Abstract

Climate change mitigation and the imperative to reduce carbon dioxide (CO2) remain significant challenges. The primary source of this problem and a crucial aspect of its resolution lie in carbon-intensive companies responsible for emitting substantial quantities of anthropogenic carbon dioxide. Many polluting companies, such as energy producers, have been forced to take actions to adopt effective strategies and achieve better performance to mitigate emissions. This is also a result of pressure from stakeholders that is exerted on companies to decrease their carbon dioxide pollution. Therefore, this study focuses on two research questions: How does stakeholder pressure impact CO2-related performance? Do decarbonization strategies mediate and moderate the relationship between stakeholder pressure and CO2-related performance in companies? Thus, the aim of this study is to investigate the relationship between stakeholder pressure for reducing carbon dioxide emissions and corporate CO2-related performance, and to test the impact of adopting decarbonization strategies on corporate CO2-related performance. Additionally, we examine the mediating and moderating effects of decarbonization strategy adoption on the relationship between stakeholder pressure and corporate CO2-related performance. This study was conducted on a sample of 122 energy producers in Poland. To test the hypotheses, linear multiple regression analysis was employed. The findings reveal a positive relationship between stakeholder pressure and the adoption of decarbonization strategies, as well as CO2-related performance. Furthermore, the results confirm the mediating effect of decarbonization strategy, while the moderating effect of decarbonization strategies remains unproven. The results have important practical implications for managers, who are required to identify stakeholders’ demands related to CO2 emissions. Based on this, they should implement active strategies to achieve better CO2-related performance and minimize their carbon footprint.

1. Introduction

Greenhouse gas (GHG) emissions, including carbon dioxide (CO2) emissions resulting from combustion of fossil fuels, are the primary cause of climate change. Carbon dioxide is responsible for trapping heat and contributing to global warming [1]. To mitigate climate change, significant reductions in the amount of CO2 released into the atmosphere are required through the process of decarbonization [2]. Many corporations have been significant contributors to the process of climate change as major producers of carbon dioxide emissions. Hence, addressing climate change and achieving decarbonization represent paramount dilemmas faced by contemporary businesses [3]. Thus, companies operating in sectors that utilize fossil fuels, such as the energy sector, face a tremendous challenge of reducing CO2 emissions according to the Paris Agreement and the Regulation of the European Union 2021/1119 [4]. This regulation establishes the framework for achieving climate neutrality by the year 2050 compared with 2005 and the reduction of carbon dioxide emission by 82%. The strategic challenge posed by decarbonization was not frequently addressed by managers until long after the legally binding 1997 Kyoto Protocol, which came into force in 2005. The initial focus of scholars was centered on the advantages of a green strategy, which was shaped by the prevailing win-win approach [5,6]. Then, scholars’ attention has been directed towards corporate strategies related to climate change, around which interest has been growing in different management areas [7,8,9,10]. Currently, managers of carbon-intensive corporations are forced to formulate decarbonization strategies aimed at reducing their ecological footprint to achieve better CO2-related performance [3,11]. What is more, carbon-intensive companies not only face the most stringent regulations but also are under pressure from many other stakeholders to undertake measures aimed at decarbonizing their business [12], which means minimizing resource consumption to reduce CO2 emissions and achieve satisfactory environmental performance [13]. Therefore, pressures exerted from stakeholders are arguably an important driver of decarbonization strategies [11,14,15]. Thus, managers in carbon-intensive companies make significant efforts to respond to these pressures by implementing business strategies that consider both economic factors and environmental factors related to carbon dioxide reduction [15,16]. Paradoxically, despite the substantial endeavors made by companies to combat climate change [7,15], there has been an ongoing rise in global CO2 emissions from the energy sector and other industrial processes in EU countries [17]. In the year 2021, emissions of CO2 resulting from energy combustion and industrial activities represented nearly 89% of the total greenhouse gas emissions originating from the energy sector and industrial operations [18]. For this reason, decarbonizing the energy sector has become a major focus in the global effort to reduce carbon dioxide emissions and mitigate the impact of climate change [2]. Unfortunately, the extant academic literature has paid less attention to investigating whether stakeholder pressure may enhance CO2-related performance, and whether advanced decarbonization strategies may mediate or moderate the relationship between stakeholder pressure and the CO2-related performance of companies. Thus, this paper aims to fill this research gap. The aim of the paper is to examine the influence of stakeholder pressure and the effects of decarbonization strategies on a firm’s CO2-related performance among energy producers. Furthermore, the paper investigates the moderating and mediating effects of decarbonization strategies on CO2-related performance. These aims reflect the specific objectives of the research study, which focuses on understanding the relationships and mechanisms involved in the influence of stakeholder pressures on CO2-performance, considering the role of decarbonization strategy adoption as both a mediator and a moderator.

This study presents as specific and unique to the existing literature in the stakeholder theory because to the author’s knowledge, this is one of the first studies that examines the link between perceived pressures for reducing carbon dioxide emissions from various stakeholder groups and the potential adoption of various decarbonization strategies in companies. The novelty of the research is exploring the mediating and moderating role of decarbonization strategy adoption between stakeholder pressure and CO2-related performance.

The structure of this article is as follows: firstly, the theoretical background is presented. This section initially discusses corporate strategies to mitigate climate change, followed by a description of corporate decarbonization strategies. The subsequent subsections elaborate on how stakeholder pressure impacts decarbonization strategies and the potential outcomes of reducing carbon emissions. The article then delves into the relationship between the decarbonization strategy and CO2-related performance, highlighting both the mediating and moderating roles of the decarbonization strategy. In the next section, the methodology and research design are thoroughly described. Following that, the results of the analyses are explained. Lastly, the discussion and conclusions provide implications, propose research limitations, and suggest potential future research.

2. Literature Review and Hypothesis Formulation

2.1. Corporate Strategies to Mitigate Climate Change

Many authors define climate mitigation strategies from a comprehensive perspective ‘as a pattern of corporate actions aimed at addressing various aspects of climate change’, regardless of their direct impact on actual greenhouse gas emissions’ [10,19]. This broad approach to the climate change strategy is often weaker in its connection to carbon dioxide reduction practices but focuses more on diminishing adverse environmental consequences and encouraging sustainable practices. The scope of this strategy also includes stakeholder management [20], GHG data reporting [21], and emissions trading [22]. Other authors define a climate change mitigation strategy from a narrow perspective as ‘a set of actions adopted by a company to reduce its CO2 emissions’ [14,23]. These strategies encompass a variety of measures, such as minimizing the release of greenhouse gas emissions, embracing renewable energy alternatives, enhancing energy efficiency, reducing waste, promoting recycling initiatives, and implementing eco-friendly technologies and practices. Previous research focusing on climate change strategies is diverse and encompasses various approaches. For instance, it includes theoretical conceptualizations of these strategies [5,24], explorations of the determinants of such strategies [10,25,26,27]. Researchers focused the most attention on empirical investigations of carbon reduction and other climate change practices in companies [7,20,22,28,29,30,31], the implications of climate change strategies for firms’ economic performance [32,33], and GHG or CO2-related emissions performance [15,34]. Notwithstanding the growing interest in corporate climate change strategies [10], there is only limited consensus regarding the scope of a corporate decarbonization strategy [14].

2.2. Corporate Decarbonization Strategies

The issue of strategies and pathways to achieve decarbonization currently stands as one of the most intellectually stimulating subjects in the literature on energy, climate change, and business strategies [19,35,36,37]. The first generic typologies of carbon strategies were proposed by Kolk and Pinkse (2005), who identified six strategic choices in response to climate change as follows: cautious planner, emerging planner, internal explorer, vertical explorer, horizontal explorer, emissions trader [38]. Jeswani et al. (2008) identified four carbon strategy types: ‘indifferent’, ‘beginner’, ‘emerging’, ‘active’ [7]. This strategy typology is based on the degree of a firm’s proactivity in response to carbon reduction requirements. The passive strategy is represented by the ‘indifferent’ strategy, while the highest level of proactivity is embodied by the ‘active’ strategy. Weinhofer and Hoffmann (2010) identified six types of CO2 strategies: ‘all-rounder’, ‘compensator’, ‘substituting compensator’, ‘reducer’, ‘substituting reducer’, ‘preserver’, which focus on either a single objective or a combination of several strategic goals, emphasizing different time horizons for strategic decisions as CO2 compensation, CO2 reduction, and carbon independence [14]. CO2 compensation involves actions a company takes to offset or balance its CO2 emissions, such as purchasing CO2 credits or enhancing carbon sinks. This approach helps alleviate immediate emissions pressure but does not address the root cause. CO2 reduction, on the other hand, focuses on the longer-term goal of emission decrease. Through this strategic goal, companies alter production processes and products to reduce CO2 emissions. Carbon independence, with an even longer horizon, entails measures that transition business operations away from fossil fuels, replacing them with non-carbon resources like renewables [14]. A company’s CO2 strategy can be seen as concentrating on one or a combination of these CO2 strategy types. A similar typology was identified by Yunus et al. (2020), who categorized three carbon management strategies as compensation, reduction, and innovation strategies. This typology was based on carbon management practices, and the innovation strategy is the most advanced strategy [11]. Lee (2012) proposed six types of corporate carbon strategies: ‘wait-and-see observer’, ‘cautious reducer’, ‘product enhancer’, ‘all-round enhancer’, ‘emergent explorer’ and ‘all-round explorer’ [22]. This typology framework for corporate carbon strategy emphasizes the firm’s strategic choice, and employs a continuum approach to distinguish between lower and more advanced levels of engagement by the firm for each of the six carbon management activities. These configurations include the following scopes of carbon management activities as emission reduction commitment, process and supply improvement, product improvement, new market and business development, organizational involvement. As a result, the configuration of various carbon management activities indicates a specific carbon strategy [22]. Furthermore, in pursuit of the decarbonization objective, also several alternative paths are accessible. Cadez and Czerny (2016) categorized decarbonization objectives into three primary strategic priorities: internal carbon reduction, external carbon reduction, and carbon compensation [23]. The ‘internal carbon reduction’ priority pertains to the actions taken within a firm to decrease carbon emissions, and the effectiveness of this strategy largely depends on the nature of a firm’s CO2 emissions. The possible strategic options may concentrate on combustion emissions and process emissions because carbon-intensive firms generate two main types of CO2 emissions: combustion emissions and process emissions. Combustion emissions arise from burning fossil fuels [39] and occur in both the energy sector, such as coal-fired power plants, and the manufacturing sector. Another possible strategic option for reducing firms’ CO2 emissions within this priority is the ‘reducing product output’ strategy. The ‘external carbon reduction’ priority refers to actions taken outside a company that reduce carbon emissions; for example, within the supply chain, both forward and backward of it. The ‘carbon compensation’ strategic priority involves actions taken by a company to balance or offset its emissions, such as buying allowances or enhancing carbon sinks [23]. Damert et al. (2017), building upon existing strategies and their goals, proposed three main strategic goals: carbon governance, carbon reduction, and carbon competitiveness [40]. When examining the integration of climate change into corporate strategy, various terms are commonly employed. These terms, while conveying nuanced distinctions, have been utilized across diverse contexts. The typologies and definitions of carbon reduction strategies are presented in Table 1.

Table 1.

Typologies of carbon reduction strategies.

2.3. Stakeholder Pressure and Decarbonization Strategy Adoption

As climate awareness grows, stakeholders increasingly demand transparent and tangible efforts to curb carbon emissions [41]. Many scholars confirm that a large number of stakeholders including regulators, competitors, clients, consumers, suppliers, NGOs, media, top management, shareholders, employees, and others may exert pressure on enterprises to reduce their carbon emissions [7,8,11]. Hence, managers should respond to various stakeholder pressures, as it has become a pivotal driver of the adoption of advanced carbon strategies such as active or proactive carbon strategies [11,29,42]. While the influence of stakeholder pressure on climate change mitigation strategies has been well-researched [15,29], there is believed to be a gap in understanding the impact of stakeholder pressure on decarbonization strategies aimed at reducing carbon dioxide emissions. According to the author’s knowledge, only a few articles have been dedicated to exploring this relationship [43]. Furthermore, the complex relationship between stakeholder pressure and corporate decarbonization strategies lies at the heart of businesses’ efforts to address environmental concerns and to reduce their carbon footprint. Such pressure acts as a catalyst for organizations to consider adopting decarbonization strategies, as failing to do so could lead to reputational risks, legal scrutiny, and market share erosion [44,45]. Thus, it is worth investigating the relationship between stakeholder pressure and decarbonization strategies which present a promising avenue for achieving meaningful carbon dioxide reduction while redefining the role of businesses in addressing global environmental challenges. This leads to the following hypothesis:

Hypothesis (H1a).

Stakeholder pressure is positively associated with the adoption of a decarbonization strategy.

2.4. Stakeholder Pressures and CO2—Related Performance

Climate change consequences resulting from CO2 emissions [46] have engendered a mounting demand from stakeholders to curtail both total CO2 emissions and other greenhouse gas emissions [47,48,49]. In the first phase of management research, several studies have examined the origins of stakeholder pressure and the corresponding green corporate reactions [50,51,52]. The primary focus of these studies lies in scrutinizing the impact of stakeholder demands on firms’ environmental strategies and environmental performance. In light of stakeholder theory, a new trend of studies is emerging. Nowadays, an interest of researchers is focused on investigating how stakeholder pressure might impact the reduction of carbon emissions in order to mitigate climate change [11,15,29,41]. However, there is still a limited number of studies that specifically focus on stakeholder pressure and its impact on environmental performance concerning the reduction of carbon dioxide emissions [15]. Thus, the following research hypothesis is formulated:

Hypothesis (H1b).

Stakeholder pressure on reducing carbon dioxide emissions is positively associated with corporate CO2-related performance.

2.5. Decarbonization Strategies and CO2-Related Performance

While there is a growing awareness of the importance of integrating CO2 objectives into business practices due to heightened climate awareness [26], it may be worthwhile to reconsider the connection between competitive strategies aimed at carbon dioxide emissions reduction and CO2-related performance. As Cadez and Czerny (2010) argue, the most widely used carbon reduction practices are improvement in general end-use energy efficiency and the optimization of existing processes. The potential results of greenhouse gas reduction strategies can be categorized into two aspects: economic and environmental or overall business performance [53]. Previous researchers’ studies have been focused on assessing the impact of carbon reduction strategies on economic, financial, or overall business performance [3,54,55]. However, little attention has been given to examining the relationship between decarbonization strategies and the environmental outcomes of companies, specifically related to CO2 emissions reduction. Based on our understanding, a few studies have examined the relationship between decarbonization strategies and GHG-related performance [15]. Thus, we postulate that a research gap exists. Therefore, the following hypothesis is proposed:

Hypothesis (H2).

The adoption of a decarbonization strategy is positively associated with corporate CO2-related performance.

2.6. The Mediating and Moderating Role of Corporate Decarbonization Strategies

However, the relationship between stakeholder pressure and carbon reduction performance is not solely direct. Corporate decarbonization strategies may play a pivotal mediating role in this relation. Buysse and Verbeke (2003) and Cadez et al. (2019) highlight that environmental strategy (integrated within the broader business strategy) embodies a managerial interpretation of stakeholder requirements [15,51]. Firms facing significant stakeholder pressures are more likely to implement advanced decarbonization strategies, which encompass various operational, technological, and managerial initiatives. These strategies act as a bridge between stakeholder pressures and actual CO2-related outcomes. Furthermore, the extent to which stakeholder pressures directly translate into carbon reduction performance is also influenced by the nature and effectiveness of a company’s decarbonization strategies [25,55]. On the one hand, firms adopting active strategies are under stronger pressure from stakeholders, which may result in their better carbon reduction achievements [29,56,57]. On the other hand, companies with less effective strategies might not fully capitalize on stakeholder pressures to drive significant CO2-related improvements [56,57]. Therefore, it is argued that the decarbonization strategy may play a role as a mediator and moderator. Based on the above arguments, the following hypotheses are proposed:

Hypothesis (H3).

The adoption of a decarbonization strategy positively moderates the influence of stakeholder pressure on corporate CO2-related performance, so that the moderating effect is stronger for more advanced strategies compared to less advanced strategies. Specifically, the relationship is stronger when the decarbonization strategy is more advanced and weaker when the decarbonization strategy is less advanced.

Hypothesis (H4).

The adoption of a decarbonization strategy positively mediates the influence of stakeholder pressure related to reducing emissions on corporate CO2-related performance.

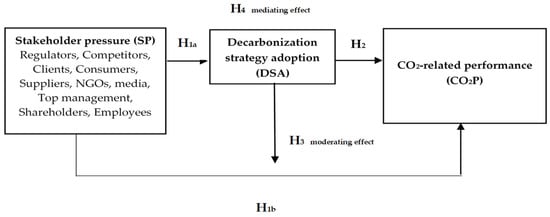

Figure 1 presents the research framework.

Figure 1.

Research framework.

3. Materials and Methods

3.1. Data Collection and Sample

The hypotheses were tested using data obtained from the EU registry, an online database managed by the European Commission [58]. This registry serves as a repository for carbon-intensive companies participating in the EU Emissions Trading Scheme (EU ETS), which is a key policy tool implemented by the European Union to combat climate change [59,60]. The ETS system is one of the three flexible mechanisms commonly known as the ‘Kyoto mechanisms’. The registry encompasses comprehensive information on firms from various countries, including those operating within energy-intensive industry sectors, as outlined in Regulation (EU) 2021/1119 of the European Parliament. Furthermore, this regulation provides a comprehensive framework for decarbonization and sets out binding targets for the reduction of greenhouse gas emissions. Additionally, it establishes the overarching operational and maintenance guidelines for the EU registry, specifically pertaining to phase IV of the EU ETS, spanning from 2021 to 2030. Firstly, a list of Polish companies was extracted from the registry. Subsequently, the initial sample was created by selecting the companies operating in the energy sector, which belonged to energy producers. Finally, a sample consisting of 500 energy producers was created. The selected energy producers were emailed individual invitations to participate in the survey.

To collect data, the questionnaire was prepared, and was divided into three parts. The first part included descriptions of decarbonization strategies. The second part of the questionnaire contained items related to the stakeholder pressure perceived by companies in relation to CO2 emissions. The third part included items that measure CO2-related performance. The questionnaire underwent a pilot test in 10 companies by practitioners engaged in carbon management. The feedback provided by these individuals was considered during the development of the final version of the questionnaire. The questionnaires were emailed to 500 companies with the required instructions for completing them. Reminder emails were sent to each nonresponding company, and if those emails were unsuccessful, telephone reminders were then used. The questionnaires were completed by individuals responsible for carbon management, environmental or production management, or those who possessed comprehensive knowledge in these areas. Out of 132 questionnaires received, 10 were incomplete. As a result, the received response rate reached 24.4%. The data collection period for the survey spanned from January to June 2023.

Thus, the final sample consisted of 122 energy producers in Poland. These companies generated electricity from various sources, including coal, natural gas, hydro, and wind. In terms of size, the sample primarily identified only large enterprises, as many energy producers are classified as large corporations due to the significance and scale of their operations, as well as investments in energy infrastructure.

Polish energy producers were chosen firstly because Poland is one of the most significant economies within the European Union and heavily relies on fossil fuels. Secondly, the European Union is the most restricted and regulated market when it comes to climate policy [60]. Thirdly, Poland is also the largest producer of hard coal in the European Union, with approximately 90% of the country’s electricity generation relying on this fossil fuel [61]. Thus, the Polish energy sector depends heavily on coal [62]. Furthermore, coal, natural gas, and oil are still the primary sources of energy for Poland’s power sector. A high demand for coal contributes to the production of enormous emissions of chemical compounds into the atmosphere, of which CO2 may account for about 92% [63]. The energy sector faces significant pressure to reduce CO2 emissions due to its heavy reliance on carbon resources as primary input materials [63]. Consequently, it stands as a significant contributor to CO2 emissions. Despite being slow to adopt renewable energy, Poland has started implementing decarbonization strategies to transition towards a climate-neutral economy.

3.2. Variable Descriptions

3.2.1. Stakeholder Pressure (SP)

To assess stakeholder pressures, respondents were requested to evaluate the level of pressure exerted by different stakeholder groups on CO2 reduction emissions faced by firms. We used a slightly modified instrument adopted by Murillo-Luna et al. (2008) [64], following the question “Please indicate, to what extent your organization has been exposed to individual stakeholder pressures with regards to CO2 emission reduction, directly or indirectly. The measurement of the stakeholder pressure encompassed 10 distinct groups: regulators, competitors, clients, consumers, suppliers, NGOs, media, top management, shareholders, and employees. The power of pressure exerted by each stakeholder group was measured on a 5-point Likert scale, ranging from 1 (lack of pressure) to 5 (strong pressure). The aggregate impact of stakeholders’ power was assessed using an arithmetic average.

3.2.2. Corporate Decarbonization Strategies

This investigation also aims to assess whether large carbon dioxide polluters adopt decarbonization strategies and, if so, which specific types they implement. The decarbonization strategies were adopted from Jeswani et al. (2008), who identified four types of strategies: indifferent, beginner, emerging, and active. This typology is based on the degree of a firm’s proactivity in response to carbon dioxide reduction requirements [7]. The typology was enhanced by incorporating additional items from Damert et al. (2017) [40], which are related to significant carbon-related activities discussed in the literature, such as stakeholder engagement (Appendix A). The surveyed companies were asked to select the most suitable decarbonization strategy, provided that at least three items included in the strategic descriptions were the most fitting for the investigated enterprise. Respondents were not informed about the names of the strategies. The final sample consisted of 23 companies with the ‘Beginner’ strategy, 35 companies with the ‘Emerging’ strategy, and 64 companies with the ‘Active’ strategy. Since no company indicated the ‘Indifferent’ strategy, the strategic options were coded as follows: 1—‘Beginner’, 2—‘Emerging’, 3—‘Active’.

3.2.3. CO2-Related Performance

CO2-related performance was adopted from Cadez et al. (2019) [15]. The instrument measuring overall environmental performance was slightly modified to capture CO2-related environmental performance over the period 2021–2023, related to the beginning of the phase IV of the UE ETS scheme. Using a Likert scale ranging from “1” (no contribution) to “5” (very large contribution), respondents were asked to indicate the extent to which the CO2 practices had led to the following benefits in their companies: of CO2 (1) reduction of relative CO2 emissions; (2) reduction in materials, energy/fuel costs; (3) reduction of process/production costs; (4) reduction of costs associated with regulatory compliance; and (5) increased efficiency of processes and production.

3.3. Statistical Methods of Data Analysis

Linear multiple regression analysis was employed as a data analysis method in this study because the dependent variable (CO2-related performance) was measured quantitatively. The use of regression analysis was justified due to the limited number of variables involved. The primary objective of the regression analysis was to examine the relationships between the dependent variable (CO2-related performance) and the independent variables (stakeholder pressure). The statistical tests performed on the regression model were used to validate the research hypotheses H1–H4. Additionally, individual regression coefficients were tested for significance using t-tests. To evaluate the adequacy of the linear regression model in fitting the data, the coefficient of determination (R-squared) was utilized as a measure of goodness-of-fit. The overall significance of the results was determined by applying the F-test. To examine the moderating and mediating effects, the PROCESS macro (version V4.2 beta) in SPSS was used, employing moderation (model 1) and mediation (model 4) [65]. According to Hayes’ technique, in moderation model 1, the assumption is made that there is one predictor variable X (decarbonization strategy), one moderator variable W (SP), and one outcome variable Y (CO2-related performance). In mediation model 4, it is assumed that there is one predictor variable X, one mediator variable M, and one outcome variable Y. These variables are also assumed to be continuous. To assess the moderating and mediating effects, 5000 bootstrapping samples were used [65]. Bootstrapping involves resampling a large number of small samples (e.g., 5000 or 10,000 samples) with replacement from the original sample. This technique provides estimates of the standard error and generates confidence intervals [65]. StatsToolPackage was utilized to generate the graph in this study [66]. To present the reliability and validity of the results, factor analysis, Cronbach’s alpha, composite reliability (CR), and average variance extracted (AVE) were also employed. The details of these procedures are presented in the following sections.

3.4. Data Reliability and Validity

In order to assess construct validity, the factor loadings of each construct were calculated [67]. Cronbach’s alpha, composite reliability (CR), and average variance extracted (AVE) were employed as measures of measurement reliability (Table 2). The factor loadings for items of two constructs surpassed the recommended threshold of 0.50 [68]. Moreover, the square root of AVE for both CO2-related performance and SP significantly exceeded the threshold of 0.5, with values of 0.753 and 0.964, respectively. The reliability scores (Cronbach’s alpha) for CO2-related performance and stakeholder pressure constructs ranged from 0.815 to 0.864, all surpassing 0.7. The CR scores for the two constructs fell between 0.867 and 0.896, all exceeding the recommended threshold of 0.7. To summarize, the results indicate that the Cronbach’s alpha values for composite reliability exceed the recommended threshold of 0.7 [69], indicating a satisfactory level of reliability. Furthermore, the AVE values for the two constructs surpass the minimum required threshold of 0.5 [69], which is also considered satisfactory. These findings collectively demonstrate satisfactory levels of both reliability and validity [69]. Factor loadings, composite reliability, and average variance extracted for the constructs are presented in Table 2.

Table 2.

Factor loadings, AVE, and CR for stakeholders’ pressure and CO2-related performance.

3.5. Common Method Bias (CMB)

Since the survey data were obtained from a single respondent, it was necessary to determine the presence of common method bias (CMB) [70]. To address this, Harmon’s one-factor test was selected and conducted using exploratory factor analysis (EFA). Before proceeding with factor analysis, the construct validity and adequacy of sampling were assessed using the Kaiser-Meyer-Olkin (KMO) test. The KMO test yielded a value of 0.821 (p < 0.001), indicating a satisfactory level of sampling adequacy [71]. The closer the p value in the KMO test is to 1.00, the more suitable it is to apply factor analysis to the sample group. The Bartlett’s test of sphericity was found to be significant (p = 0.000) [72] Subsequently, Harmon’s one-factor test was conducted using principal component analysis (PCA) to determine the number of orthogonal components with eigenvalues exceeding 1.0. The findings revealed that the initial component explained 28.954% of the variance, which is significantly lower than the 50% threshold. This outcome indicates that there is no significant concern regarding common method bias (CMB) [70].

4. Results

In this study, multiple linear regression analysis and the PROCESS Macro technique by Hayes are used to test the hypotheses H1–H4. Model 1 presents the results of regression analysis with one variable. It shows the impact of stakeholder pressure on the adoption of a decarbonization strategy. Model 1 reveals that stakeholder pressure has a positive and significant impact on the adoption of the decarbonization strategy. The value of regression coefficient is quite good and for this impact amounted to b = 0.517, t = 7.930, p = 0.000. In turn, the value of the coefficient of determination (R2) for this model amounted to R2 = 0.261. On this basis, it can be concluded that the M1 with one independent variable—stakeholder pressure—explains 26% of the volatility of the decarbonization strategy. Model 1 supports hypothesis H1a.

Model 2 presents the impact of stakeholder pressure on CO2-related performance. The model reveals that stakeholder pressure has a positive and significant impact on CO2-related performance. The value of regression coefficient amounted to b = 0.399, t = 6.758, p = 0.000. The value of the coefficient of determination (R2) for model 2 amounted to R2 = 0.204. The model explains 20.4% of the variance in CO2-related performance. Model 2 supports hypothesis H1b. The decarbonization strategy variable was also tested both as a moderator and a mediator. Thus, this study used PROCESS Macro procedure to test the mediating and moderating effects, which are presented in model 3 and model 4. Model 3 assesses the mediating effect of decarbonization strategies on the relationship between stakeholder pressure and CO2-related performance. Model 4 presents the effect of independent and moderating variables. Model 3, with two independent variables and the mediating variable, shows that stakeholder pressure has a positive significant direct impact on CO2-related performance (b = 0.344, t = 5.033, p = 0.0000; LLCI = 0.2095, ULCI = 0.4797). It also proves that the adoption of the ‘active’ decarbonization strategy has a positive significant impact on CO2-related performance (b = 0.390, t = 5.6271, p = 0.009; LLCI = 0.077, ULCI = 0.2388). The coefficient of determination (R2) for this model amounted to R2 = 0.215. On this basis, it can be concluded that model 3, with two independent variables, explains 21.5% of the volatility of CO2-related performance. These findings indicate that higher levels of stakeholder pressure are associated with increased CO2-related performance, and the adoption of the ‘active’ decarbonization strategy is related to better CO2-related performance. The bootstrapping analysis was also used to evaluate the indirect effect of stakeholder pressure on CO2-related performance through the adoption of decarbonization strategies. The analyses were conducted with a 95% confidence level. The results show a significant positive but weak indirect effect of stakeholder pressure through the adoption of decarbonization strategies on CO2-related performance (b = 0.202, LLCI = 0.0092, ULCI = 0.1171). Moreover, the direct effect of stakeholder pressure on CO2-related performance in the presence of the mediator is also significant (b = 0.3446, t = 5.033, p = 0.0000; LLCI = 0.2095, ULCI = 0.4797). Thus, the adoption of decarbonization strategies partially mediates the relationship between stakeholder pressure and corporate CO2-related performance. Notably, the results also indicate the mediation is complimentary, as the sign of direct and indirect effect is same. The results of the mediation analysis are presented in Table 3, supporting hypothesis H2 and H4. The results are presented in Table 4.

Table 3.

The mediation summary. Total, direct, and indirect effects.

Table 4.

Results of regression analysis with moderation and mediation effects of decarbonization strategy adoption.

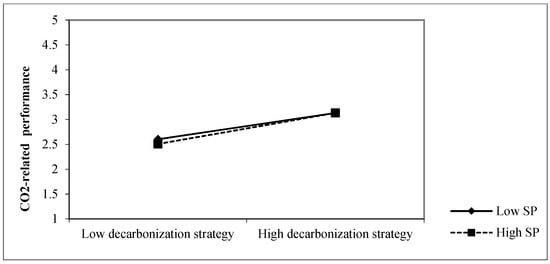

A moderation analysis was conducted to examine the influence of the predictor variable, stakeholder pressure, on the outcome variable, CO2-related performance, while considering the moderating effect of the categorical variable-decarbonization strategy (model 4). The results indicate that the overall model is statistically significant and accounts for 21.6% of the variance in CO2-related performance. The predictor variable, stakeholder pressure, shows a non-significant direct effect on CO2-related performance (b = 0.264, t = 1.591, p = 0.113; LLCI = −0.0635, ULCI = 0.5919), indicating that stakeholder pressure alone does not have a significant impact on CO2-related performance. Furthermore, the interaction effect between stakeholder pressure and decarbonization strategies (SP × DSA) was also included in the model. The analysis reveals that this interaction is not statistically significant (b = 0.0487, p = 0.5956; LLCI = −0.1321, ULCI = 0.2296), suggesting that the moderator variable, decarbonization strategy, does not significantly moderate the relationship between stakeholder pressure and CO2-related performance. In summary, the results of this moderation analysis indicate that decarbonization strategies do not have a significant moderating effect on the relationship between stakeholder pressure and CO2-related performance. The model accounted for a significant portion of the variance in CO2-related performance, but the direct effect of stakeholder pressure was not significant, not supporting hypothesis H3. These findings contribute to our understanding of the factors influencing CO2-related performance in the context of the studied variables. A graphical presentation of the moderation analysis is presented in Figure 2. The results of the regression analysis are presented in Table 4.

Figure 2.

Moderation analysis results.

5. Discussion and Conclusions

5.1. Discussion

In recent years, the escalating concerns about climate change and its profound impact on the environment have prompted businesses to reassess their strategies and practices. This shifting landscape has led to an exploration of the relationship between stakeholder pressure, the choice of the decarbonization strategies, and corporate performance in terms of carbon dioxide (CO2) reduction. This study explores the intricate interplay among these factors to show how they collectively influence a company’s CO2-related performance [73]. The results of the conducted study indicate that stakeholders, considered as an aggregated variable, exert a positive impact on the most advanced decarbonization strategy, known as the ‘active’ strategy. It means that the stronger the pressure is, the more advanced the decarbonization strategy adopted, which usually follows a pattern of more developed carbon dioxide emission reduction activities. Similar results to those obtained in this study were obtained by Sprengel and Busch (2011) [29], Damert et al. [40], Paul (2018) [74], Cadez et al. (2019) [15], and Yunus et al. (2020) [11]. Yunus et al. (2020) proved that there is a relationship between stakeholder pressures and carbon management strategy, but it depends on the specific type of carbon management strategy that a company chooses. Their findings further revealed that the adoption of carbon management strategies and a company’s likelihood to adopt ‘compensation’ and ‘reduction’ strategies are significantly associated with perceived pressures from regulatory bodies, media, and creditors. While regulatory pressures impact a company’s propensity to adopt innovation strategies—an advanced form of carbon management strategy—potential pressures from media and creditors do not exhibit a significant association [11]. Similar findings were obtained by Paul (2018), who confirmed a positive correlation between carbon pressures and a strategic orientation toward carbon reductions [74]. This discovery aligns with the author’s initial prediction that increased stakeholder pressures would strengthen efforts to reduce carbon dioxide emissions within organizations. Damert et al. (2017) also demonstrated that stakeholder pressure has a positive effect on emission reduction activities, considering various types of stakeholder pressures [40]. Cadez et al. (2019) argued that market pressures for reducing GHG emissions are important determinants of corporate GHG reduction strategies [15]. In a similar study, Kumarasiri (2017) investigated the implications of stakeholder pressure on corporate actions regarding climate change. Her results indicated that while the government emerges as the most impactful stakeholder for companies operating in high-emission-intensive industries, its influence is less pronounced for companies with lower emission levels [41]. In contrast, Sprengel and Busch (2011) revealed that corporate strategic responses are not contingent upon specific stakeholder groups. Instead, the level of pollution demonstrated by the organization, measured as its greenhouse gas intensity, emerges as a determining factor that influences the formulation of its environmental strategy [29]. This research study confirms that stakeholder pressure has a positive impact on CO2-related performance. In a similar study, Jeswani et al. (2008) investigated the impact of various stakeholder pressures on carbon strategic options. They revealed that companies adopting the ‘indifferent’ carbon strategy—which is the least advanced type of carbon strategy—perceive very little pressure from owners/top management and regulatory agencies to enhance their performance. In contrast, companies adopting ‘active’ and ‘emerging’ strategies are under stronger pressure from stakeholders. Top management and corporate owners exert the most powerful influence among stakeholders in companies that adopt the ‘beginner’ type of carbon strategy, but they do not perceive the same level of pressure from regulatory agencies [7]. The results of our study also revealed that ‘active’ strategies may stimulate better CO2-related performance. These results are consistent with previous research findings in the field of decarbonization and climate change [7,15,75]. Cadez et al. (2019) confirmed that a greater implementation of GHG reduction strategies has a positive effect on GHG-related performance. This includes not only the reduction of GHG emissions but also the reduction of GHG-related costs. Their research results showed that GHG reduction strategies explain almost 27% of the total variance in GHG performance [15]. Konadu et al. (2022) discovered also the evidence that the moderating effect of environmental innovation, which is associated with advanced strategies, is more pronounced for carbon-intensive firms that typically adopt proactive carbon strategies than for non-carbon-intensive firms [75]. However, it is argued that companies implementing good practices of carbon management will also have to go further along the continuum to be more proactive and innovative, setting appropriate and clear goals to decarbonize their strategies [7]. On the contrary, Lee (2012) did not confirm a significant relationship between a firm’s carbon strategy and firm performance. However, his results confirmed that decarbonization strategies partially mediated the relationship between stakeholder pressure and CO2-related performance. These findings suggest that stakeholder pressure has both direct and indirect effects on CO2-related performance [22]. The results of our study did not support the hypothesis that the adoption of decarbonization strategies positively moderates the influence of stakeholder pressure on corporate CO2-related performance. Nonetheless, there is evidence in the literature that aligns similarly with this correlation. For example, Franca et al. (2023) suggest that the scope of decarbonization efforts goes beyond just implementing technologies and organizational initiatives to reduce carbon dioxide emissions. It may help to achieve cost savings and market benefits. These factors could potentially moderate the relationship between corporate competitive carbon strategies and performance [3].

5.2. Conclusions

Nowadays, climate change is one of the most important environmental concerns. Consequently, an increasing number of companies face pressure from various stakeholders to reduce their CO2 emissions, and to mitigate climate change. Many stakeholders expect companies to integrate carbon dioxide management policies into their operations and strategies. Therefore, stakeholders may motivate companies to adopt active decarbonization strategies that may enhance the effects of these pressures on CO2-related outcomes, contributing to the reduction of carbon dioxide emissions. As a result, effectively managing CO2 emissions and formulating appropriate decarbonization strategies have become top priorities for these companies. However, the relationship between stakeholder pressure and companies’ carbon dioxide reduction performance is intricate and multifaceted, which prompted the author to search a research gap.

This study’s results also confirm the mediating effect of the adoption of decarbonization strategies on the relationship between stakeholder pressure and CO2-related performance. This research study highlights the importance of integrating climate change efforts into business strategies for improved carbon dioxide reduction outcomes. Although the moderating role of decarbonization strategies was not confirmed, this result indicates that companies cannot solely rely on the choice of the decarbonization strategy to moderate the relationship between stakeholder pressure and CO2-related outcomes in the absence of other tested variables. It means that other factors might also play a significant role in shaping this interaction.

This study has practical implications. A managerial implication is that advancing the decarbonization strategy towards the ‘active’ strategy is important for improving CO2-related performance when stakeholder pressures are on the rise. It highlights the significant role of the ‘active’ decarbonization strategy in improving CO2-related performance, which focuses on integrating carbon dioxide management policies with other business strategies. Therefore, firms should consider implementing such strategies that effectively reduce their carbon dioxide emissions. Furthermore, carbon-intensive firms should recognize key stakeholders that exert pressure on their decarbonization strategies and CO2-related performance. This emphasizes the need for the implementation of innovative business decarbonization strategies that align with stakeholder expectations.

The conducted study also has some limitations. Firstly, the research was conducted among large, carbon-intensive firms, exclusively within the energy industry. Secondly, the surveyed companies operate in Poland. It is worth noting that companies might respond differently to stakeholder pressure, and the choice of decarbonization strategies could be influenced by factors such as company size [76], industry sector [77], or country of operation [45], which were not tested as control variables.

Future research may focus on investigating the impact of stakeholder pressure on decarbonization strategic options and CO2-related performance from the perspectives of various stakeholder groups, analyzed separately. Additionally, future research may explore the mediating role of decarbonization strategies in small and medium-sized companies, as they are often more sensitive to stakeholder pressure than large companies.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The author declare no conflict of interest.

Appendix A

Decarbonization strategy options.

Appendix A.1. Indifferent

- Our company currently does not have a formal policy in place to address climate change issues.

- Our company has not conducted an inventory of its carbon dioxide emissions.

- Our company is not engaged in any external activities related to carbon dioxide management.

- Our company has carried out very few internal carbon dioxide management activities, mostly for cost reduction, and does not have a formal carbon management system, certified, or verified.

- Our company does not mention or does not plan to engage in voluntary initiatives related to climate change mitigation in cooperation with stakeholders.

Appendix A.2. Beginner

- Our company has initiated some operational activities related to carbon dioxide management.

- Our company allocates minimal resources for carbon dioxide management programs.

- Our company focuses on low-cost activities such as energy efficiency projects.

- Our company is in the early stages of setting up its carbon dioxide management programs.

- Our company has general intentions and/or plans for engaging in voluntary initiatives related to climate change mitigation in cooperation with stakeholders.

Appendix A.3. Emerging

- Our company has established a carbon dioxide management policy.

- We have prepared a greenhouse carbon dioxide inventory for our company’s emissions.

- Our company’s actions in carbon dioxide management are primarily driven by legal requirements.

- Our company engages in external activities such as regulatory compliance, emission trading, and emissions disclosure.

- Our company has concrete intentions and/or detailed plans for engaging in voluntary initiatives related to climate change mitigation in cooperation with stakeholders.

Appendix A.4. Active

- Our company has fully developed and integrated a carbon dioxide management policy with other business strategies.

- Our company actively shifts from fossil fuels to renewable sources like wind, solar, and biomass and etc.

- We have completed comprehensive carbon dioxide inventories and assessments to identify improvement opportunities.

- Our company undergoes external verification and disclosure of emissions, demonstrating a high level of commitment to carbon dioxide management.

- Our company engages in voluntary business/sector initiatives or initiatives in cooperation with NGOs, research institutes, governments, or civil society that are related to climate change mitigation.

Notes: In this paper, we employ the overarching term “carbon” interchangeably with greenhouse gas (GHG) emissions. Nonetheless, the term ‘decarbonization’ specifically pertains to the reduction of CO2 emissions exclusively.

References

- Hafner, S.; Speich, M.; Bischofberger, P.; Ulli-Beer, S. Governing industry decarbonisation: Policy implications from a firm perspective. J. Clean. Prod. 2022, 375, 133884. [Google Scholar] [CrossRef]

- Beccarello, M.; Di Foggia, G. Review and Perspectives of Key Decarbonization Drivers to 2030. Energies 2023, 16, 1345. [Google Scholar] [CrossRef]

- França, A.; López-Manuel, L.; Sartal, A.; Vázquez, X.H. Adapting corporations to climate change: How decarbonization impacts the business strategy–performance nexus. Bus. Strategy Environ. 2023, 1–18. [Google Scholar] [CrossRef]

- Delbeke, J.; Runge-Metzger, A.; Slingenberg, Y.; Werksman, J. The Paris agreement. In Towards a Climate-Neutral Europe; Routledge: London, UK, 2019; pp. 24–45. [Google Scholar]

- Boiral, O. Global warming: Should companies adopt a proactive strategy? Long Range Plan. 2006, 39, 315–330. [Google Scholar] [CrossRef]

- Porter, M.; Van der Linde, C. Green and competitive: Ending the stalemate. The Dynamics of the eco-efficient economy: Environmental regulation and competitive advantage. Harv. Bus. Rev. 1995, 33, 120–134. [Google Scholar]

- Jeswani, H.K.; Wehrmeyer, W.; Mulugetta, Y. How warm is the corporate response to climate change? Evidence from Pakistan and the UK. Bus. Strategy Environ. 2008, 17, 46–60. [Google Scholar] [CrossRef]

- Delmas, M.A.; Toffel, M.W. Organizational responses to environmental demands: Opening the black box. Strat. Manag. J. 2008, 29, 1027–1055. [Google Scholar] [CrossRef]

- Howard-Grenville, J.; Buckle, S.J.; Hoskins, B.J.; George, G. Climate change and management. Acad. Manag. J. 2014, 57, 615–623. [Google Scholar] [CrossRef]

- Backman, C.A.; Verbeke, A.; Schulz, R.A. The drivers of corporate climate change strategies and public policy: A new resource-based view perspective. Bus. Soc. 2017, 56, 545–575. [Google Scholar] [CrossRef]

- Yunus, S.; Elijido-Ten, E.O.; Abhayawansa, S. Impact of stakeholder pressure on the adoption of carbon management strategies: Evidence from Australia. Sustain. Account. Manag. Policy J. 2020, 11, 1189–1212. [Google Scholar] [CrossRef]

- Huisingh, D.; Zhang, Z.; Moore, J.C.; Qiao, Q.; Li, Q. Recent advances in carbon emissions reduction: Policies, technologies, monitoring, assessment and modeling. J. Clean. Prod. 2015, 103, 1–12. [Google Scholar] [CrossRef]

- Wedari, L.K.; Moradi-Motlagh, A.; Jubb, C. The moderating effect of innovation on the relationship between environmental and financial performance: Evidence from high emitters in Australia. Bus. Strategy Environ. 2023, 32, 654–672. [Google Scholar] [CrossRef]

- Weinhofer, G.; Hoffmann, V.H. Mitigating climate change–how do corporate strategies differ? Bus. Strategy Environ. 2010, 19, 77–89. [Google Scholar] [CrossRef]

- Cadez, S.; Czerny, A.; Letmathe, P. Stakeholder pressures and corporate climate change mitigation strategies. Bus. Strategy Environ. 2019, 28, 1–14. [Google Scholar] [CrossRef]

- Bundy, J.; Shropshire, C.; Buchholtz, A.K. Strategic cognition and issue salience: Toward an explanation of firm responsiveness to stakeholder concerns. Acad. Manag. Rev. 2013, 38, 352–376. [Google Scholar] [CrossRef]

- Crippa, M.; Guizzardi, D.; Muntean, M.; Schaaf, E.; Solazzo, E.; Monforti-Ferrario, F.; Olivier, J.G.J.; Vignati, E. Fossil CO2 Emissions of All World Countries-2020 Report; EUR 30358 EN; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar] [CrossRef]

- European Environment Agency (EEA). Trends and Projections in Europe 2022: Tracking Progress towards Europe’s Climate and Energy Targets. EEA Report No 10/2022. Available online: https://www.eea.europa.eu/publications/trends-and-projections-in-europe-2022 (accessed on 2 April 2023).

- Meinshausen, M.; Meinshausen, N.; Hare, W.; Raper, S.C.B.; Frieler, K.; Knutti, R.; Allen, M.R. Greenhouse-gas emission targets for limiting global warming to 2 degrees C. Nature 2009, 458, 1158–1162. [Google Scholar] [CrossRef]

- Talbot, D.; Boiral, O. Strategies for climate change and impression management: A case study among Canada’s large industrial emitters. J. Bus. Ethics 2015, 132, 329–346. [Google Scholar] [CrossRef]

- Stanny, E. Voluntary disclosures of emissions by US firms. Bus. Strategy Environ. 2013, 22, 145–158. [Google Scholar] [CrossRef]

- Lee, S.-Y. Corporate carbon strategies in responding to climate change. Bus. Strategy Environ. 2012, 21, 33–48. [Google Scholar] [CrossRef]

- Cadez, S.; Czerny, A. Climate change mitigation strategies in carbon-intensive firms. J. Clean. Prod. 2016, 112, 4132–4143. [Google Scholar] [CrossRef]

- Hoffman, A.J. Climate change strategy: The business logic behind voluntary greenhouse gas reductions. Calif. Manag. Rev. 2005, 47, 21–46. [Google Scholar] [CrossRef]

- Amran, A.; Ooi, S.K.; Wong, C.Y.; Hashim, F. Business strategy for climate change: An ASEAN perspective. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 213–227. [Google Scholar] [CrossRef]

- Liu, Y. An empirical research of awareness, behavior and barriers to enact carbon management of industrial firms in China. Sci. Total Environ. 2012, 425, 1–8. [Google Scholar] [CrossRef]

- Rickards, L.; Wiseman, J.; Kashima, Y. Barriers to effective climate change mitigation: The case of senior government and business decision makers. Wiley Interdiscip. Rev. Clim. Chang. 2014, 5, 753–773. [Google Scholar] [CrossRef]

- Hashmi, M.A.; Al-Habib, M. Sustainability and carbon management practices in the Kingdom of Saudi Arabia. J. Environ. Plan. Manag. 2013, 56, 140–157. [Google Scholar] [CrossRef]

- Sprengel, D.C.; Busch, T. Stakeholder engagement and environmental strategy–the case of climate change. Bus. Strategy Environ. 2011, 20, 351–364. [Google Scholar] [CrossRef]

- Wahyuni, D.; Ratnatunga, J. Carbon strategies and management practices in an uncertain carbonomic environment–lessons learned from the coal-face. J. Clean. Prod. 2015, 96, 397–406. [Google Scholar] [CrossRef]

- Weinhofer, G.; Busch, T. Corporate strategies for managing climate risks. Bus. Strategy Environ. 2013, 22, 121–144. [Google Scholar] [CrossRef]

- Hsu, A.W.H.; Wang, T. Does the market value corporate response to climate change? Omega 2013, 41, 195–206. [Google Scholar] [CrossRef]

- Matsumura, E.M.; Prakash, R.; Vera-Munoz, S.C. Firm-value effects of carbon emissions and carbon disclosures. Account. Rev. 2014, 89, 695–724. [Google Scholar] [CrossRef]

- Doda, B.; Gennaioli, C.; Gouldson, A.; Grover, D.; Sullivan, R. Are corporate carbon management practices reducing corporate carbon emissions? Corp. Soc. Responsib. Environ. Manag. 2016, 23, 257–270. [Google Scholar] [CrossRef]

- Papadis, E.; Tsatsaronis, G. Challenges in the decarbonization of the energy sector. Energy 2020, 205, 118025. [Google Scholar] [CrossRef]

- Slawinski, N.; Pinkse, J.; Busch, T.; Banerjee, S.B. The role of short-termism and uncertainty avoidance in organizational inaction on climate change: A multi-level framework. Bus. Soc. 2017, 56, 253–282. [Google Scholar] [CrossRef]

- Guo, Y.; Yang, Y.; Bradshaw, M.; Wang, C.; Blondeel, M. Globalization and decarbonization: Changing strategies of global oil and gas companies. Wiley Interdiscip. Rev. Clim. Chang. 2023, 849, e849. [Google Scholar] [CrossRef]

- Kolk, A.; Pinkse, J. Business responses to climate change: Identifying emergent strategies. Calif. Manag. Rev. 2005, 47, 6–20. [Google Scholar] [CrossRef]

- Bernstein, L.; Lee, A.; Crookshank, S. Carbon dioxide capture and storage: A status report. Clim. Policy 2006, 6, 241–246. [Google Scholar] [CrossRef]

- Damert, M.; Paul, A.; Baumgartner, R.J. Exploring the determinants and long-term performance outcomes of corporate carbon strategies. J. Clean. Prod. 2017, 160, 123–138. [Google Scholar] [CrossRef]

- Kumarasiri, J. Stakeholder pressure on carbon emissions: Strategies and the use of management accounting. Australas J. Environ. Manag. 2017, 24, 339–354. [Google Scholar] [CrossRef]

- Dhanda, K.K.; Sarkis, J.; Dhavale, D.G. Institutional and stakeholder effects on carbon mitigation strategies. Bus. Strategy Environ. 2022, 31, 782–795. [Google Scholar] [CrossRef]

- Benz, L.; Block, J.H.; Sharma, P. Stakeholder Pressures and Decarbonization Strategies in Mittelstand Firms. In Academy of Management Proceedings; New York, NY, USA, 2023; Volume 2023, p. 1514. [Google Scholar] [CrossRef]

- Lee, S.Y.; Kim, Y.H. Antecedents and consequences of firms’ climate change management practices: Stakeholder and synergistic approach. Sustainability 2015, 7, 14521–14536. [Google Scholar] [CrossRef]

- González-Benito, J.; González-Benito, Ó. A study of determinant factors of stakeholder environmental pressure perceived by industrial companies. Bus. Strategy Environ. 2010, 19, 164–181. [Google Scholar] [CrossRef]

- Karl, T.R.; Trenberth, K.E. Modern global climate change. Science 2003, 302, 1719–1723. [Google Scholar] [CrossRef] [PubMed]

- AL-Amin, A.Q.; Rasiah, R.; Chenayah, S. Prioritizing climate change mitigation: An assessment using Malaysia to reduce carbon emissions in future. Environ. Sci. Policy 2015, 50, 24–33. [Google Scholar] [CrossRef]

- Okereke, C.; Russel, D. Regulatory pressure and competitive dynamics: Carbon management strategies of UK energy-intensive companies. Calif. Manag. Rev. 2010, 52, 100–124. [Google Scholar] [CrossRef]

- Reid, E.M.; Toffel, M.W. Responding to public and private politics: Corporate disclosure of climate change strategies. Strateg. Manag. J. 2009, 30, 1157–1178. [Google Scholar] [CrossRef]

- Sharma, S.; Henriques, I. Stakeholder influences on sustainability practices in the Canadian forest products industry. Strateg. Manag. J. 2005, 26, 159–180. [Google Scholar] [CrossRef]

- Buysse, K.; Verbeke, A. Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 2003, 24, 453–470. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The relationship between environmental commitment and managerial perceptions of stakeholder importance. Acad. Manag. J. 1999, 42, 87–99. [Google Scholar] [CrossRef]

- Čadež, S.; Czerny, A. Carbon management strategies in manufacturing companies: An exploratory note. J. East Eur. Manag. Stud. 2010, 15, 348–360. [Google Scholar] [CrossRef]

- Sartal, A.; Rodríguez, M.; Vázquez, X.H. From efficiency-driven to low-carbon operations management: Implications for labor productivity. J. Oper. Manag. 2020, 66, 310–325. [Google Scholar] [CrossRef]

- Russo, A.; Pogutz, S.; Misani, N. Paving the road toward eco-effectiveness: Exploring the link between greenhouse gas emissions and firm performance. Bus. Strategy Environ. 2021, 30, 3065–3078. [Google Scholar] [CrossRef]

- Roome, N. Developing environmental management strategies. Bus. Strategy Environ. 1992, 1, 11–24. [Google Scholar] [CrossRef]

- Wang, L.; Li, W.; Qi, L. Stakeholder pressures and corporate environmental strategies: A meta-analysis. Sustainability 2020, 12, 1172. [Google Scholar] [CrossRef]

- European Commission. Available online: https://www.eea.europa.eu/data-and-maps/dashboards/emissions-trading-viewer-1 (accessed on 1 December 2022).

- Watanabe, R.; Robinson, G. The European Union emissions trading scheme (EU ETS). Climate Policy 2005, 5, 10–14. [Google Scholar] [CrossRef]

- Braun, M. The evolution of emissions trading in the European Union–The role of policy networks, knowledge and policy entrepreneurs. Account. Organ. Soc. 2009, 34, 469–487. [Google Scholar] [CrossRef]

- Pietrzak, M.B.; Igliński, B.; Kujawski, W.; Iwański, P. Energy transition in Poland-Assessment of the renewable energy sector. Energies 2021, 14, 2046. [Google Scholar] [CrossRef]

- Kaszyński, P.; Kamiński, J. Coal demand and environmental regulations: A case study of the Polish power sector. Energies 2020, 13, 1521. [Google Scholar] [CrossRef]

- Dyjak, P. Analiza konkurencyjności węgla w polskim sektorze energetycznym w odniesieniu do dyrektyw Unii Europejskiej do 2050 roku. Ekon. XXI Wieku 2018, 18, 48–61. [Google Scholar] [CrossRef]

- Murillo-Luna, J.L.; Garcés-Ayerbe, C.; Rivera-Torres, P. Why do patterns of environmental response differ? A stakeholders’ pressure approach. Strateg. Manag. J. 2008, 29, 1225–1240. [Google Scholar] [CrossRef]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach, 3rd ed.; Guilford Publications: New York, NY, USA, 2022. [Google Scholar]

- Lowry, P.B.; Gaskin, J. Partial least squares (PLS) structural equation modeling (SEM) for building and testing behavioral causal theory: When to choose it and how to use it. IEEE Trans. Prof. Commun. 2014, 57, 123–146. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: New York, NY, USA, 2021. [Google Scholar] [CrossRef]

- Hulland, J. Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strateg. Manag. J. 1999, 20, 195–204. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM) An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Hutcheson, G.D.; Sofroniou, N. The Multivariate Social Scientist: An Introduction to Generalized Linear Models; Sage Publications: New York, NY, USA, 1999. [Google Scholar] [CrossRef]

- Bayram, N. Sosyal Bilimlerde SPSS ile Veri Analizi; Ezgi Kitabevi: Bursa, Turkey, 2004. [Google Scholar]

- Lopez-Manuel, L.; Vázquez, X.H.; Sartal, A. Firm, industry, and country effects on CO2 emissions levels. Bus. Strategy Environ. 2023; ahead-of-print. [Google Scholar] [CrossRef]

- Paul, A. Strategic and Ethical Dimensions of Business Responses to Climate Change. Ph.D. Thesis, University of Graz, Graz, Austria, 2018. [Google Scholar]

- Konadu, R.; Ahinful, G.S.; Boakye, D.J.; Elbardan, H. Board gender diversity, environmental innovation and corporate carbon emissions. Technol. Forecast. Soc. Chang. 2022, 174, 121279. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Adopting proactive environmental strategy: The influence of stakeholders and firm size. J. Manag. Stud. 2010, 47, 1072–1094. [Google Scholar] [CrossRef]

- Garcés-Ayerbe, C.; Rivera-Torres, P.; Murillo-Luna, J.L. Stakeholder pressure and environmental proactivity: Moderating effect of competitive advantage expectations. Manag. Decis. 2012, 50, 189–206. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).