Multidimensional Evaluation of Consumers’ Shopping Risks under Live-Streaming Commerce

Abstract

:1. Introduction

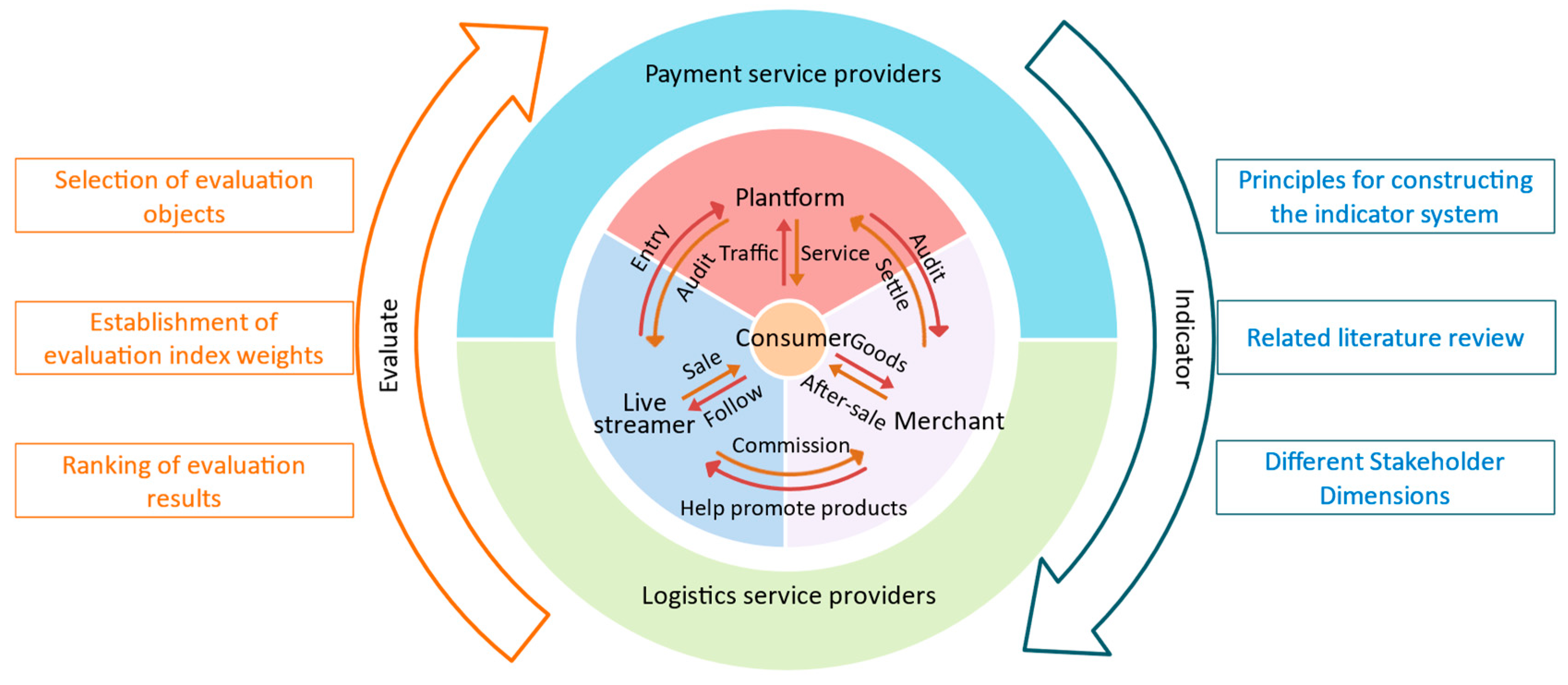

2. Background

3. Index System for Consumers’ Shopping Risk Evaluation

4. Multidimensional Risk Evaluation Based on IFAHP and Cloud Model

- They had shopping experience on the above four live-streaming commerce platforms;

- They had at least two years of online shopping experience on these platforms;

- They watched live streaming on these platforms for at least 3 h per week;

- They shopped on these platforms at least three times per month;

- They bought no less than three kinds of goods online every month.

4.1. Determining Indicator Weights Based on IFAHP

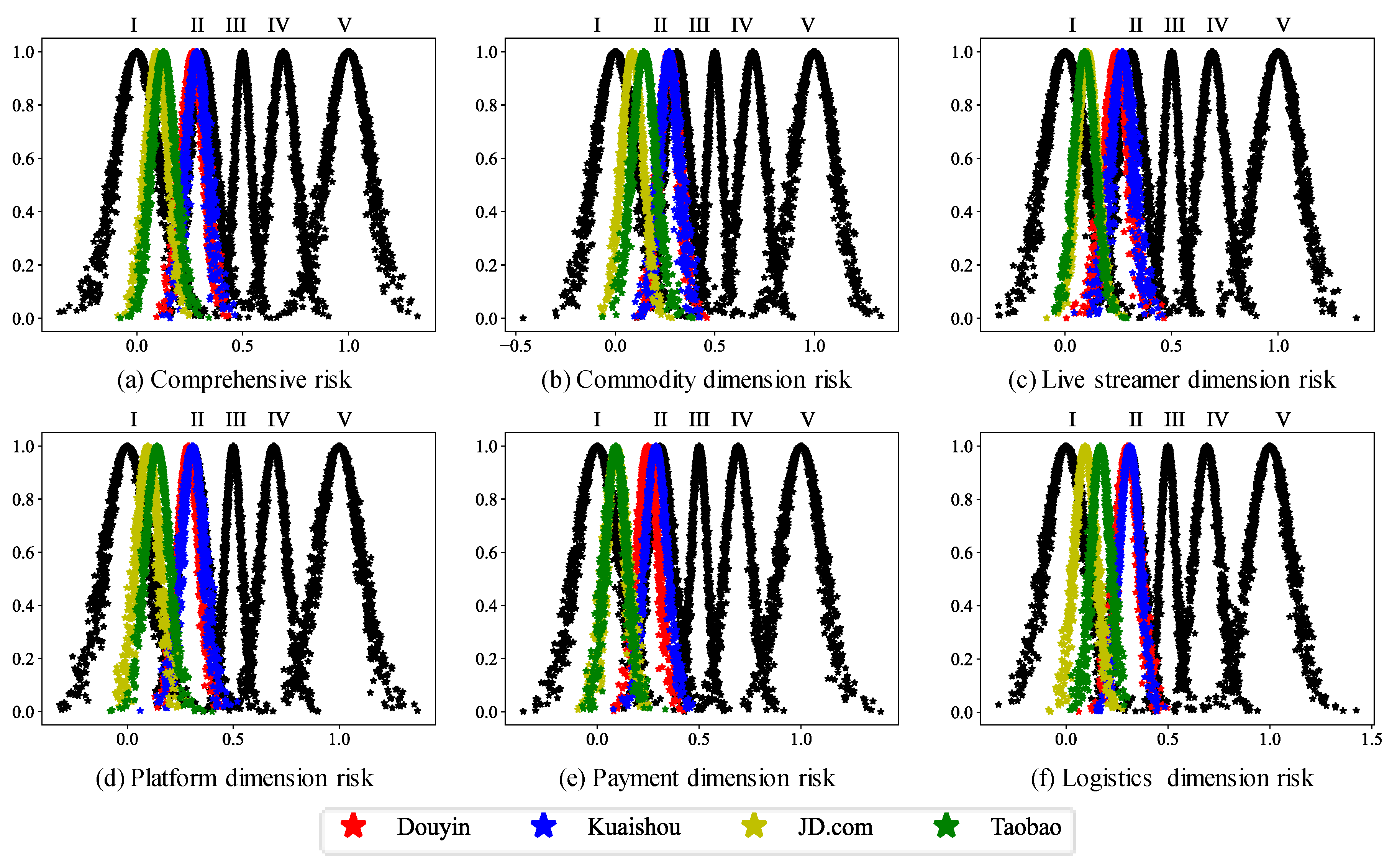

4.2. Quantifying Shopping Risks Based on Cloud Model

5. Discussion

5.1. Theoretical Implications

5.2. Managerial Implications

6. Conclusions and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- CNNIC (China Internet Network Information Center). Available online: https://cnnic.cn/n4/2023/0303/c88-10757.html (accessed on 6 June 2023).

- TechNode Feed. Available online: https://technode.com/2022/10/25/chinese-influencer-li-jiaqi-leads-singles-day-livestream-pre-sales/ (accessed on 6 June 2023).

- Karoui, K. Security novel risk assessment framework based on reversible metrics: A case study of DDoS attacks on an E-commerce web server. Int. J. Netw. Manag. 2016, 26, 553–578. [Google Scholar] [CrossRef]

- Zhang, Y.; Deng, X.; Wei, D.; Deng, Y. Assessment of E-Commerce security using AHP and evidential reasoning. Expert Syst. Appl. 2012, 39, 3611–3623. [Google Scholar] [CrossRef]

- Dinev, T.; Hart, P. An extended privacy calculus model for e-commerce transactions. Inf. Syst. Res. 2006, 17, 61–80. [Google Scholar] [CrossRef]

- Song, B.; Yan, W.; Zhang, T. Cross-border e-commerce commodity risk assessment using text mining and fuzzy rule-based reasoning. Adv. Eng. Inform. 2019, 40, 69–80. [Google Scholar] [CrossRef]

- Liu, Y.; Lu, J.; Mao, F.; Tong, K. The product quality risk assessment of e-commerce by machine learning algorithm on spark in big data environment. J. Intell. Fuzzy Syst. 2019, 37, 4705–4715. [Google Scholar] [CrossRef]

- Mou, J.; Cui, Y.; Kurcz, K. Trust, risk and alternative website quality in B-buyer acceptance of cross-border E-commerce. J. Glob. Inf. Manag. 2020, 28, 167–188. [Google Scholar] [CrossRef]

- Anastasiei, B.; Dospinescu, N.; Dospinescu, O. Word-of-Mouth Engagement in Online Social Networks: Influence of Network Centrality and Density. Electronics 2023, 12, 2857. [Google Scholar] [CrossRef]

- Al Naim, A.F.; Sobaih, A.E.E.; Elshaer, I.A. Enhancing Green Electronic Word-of-Mouth in the Saudi Tourism Industry: An Integration of the Ability, Motivation, and Opportunity and Planned Behaviour Theories. Sustainability 2023, 15, 9085. [Google Scholar] [CrossRef]

- Khasawneh, M.H.A.; Rabata, A. The impact of augmented reality on behavioural intention and E-WOM. Int. J. Electron. Bus. 2023, 18, 194–225. [Google Scholar] [CrossRef]

- Cheng, G.; Cherian, J.; Sial, M.S.; Mentel, G.; Wan, P.; Álvarez-Otero, S.; Saleem, U. The relationship between csr communication on social media, purchase intention, and e-wom in the banking sector of an emerging economy. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1025–1041. [Google Scholar] [CrossRef]

- Dong, X.; Zhao, H.; Li, T. The role of live-streaming e-commerce on consumers’ purchasing intention regarding green agricultural products. Sustainability 2022, 14, 4374. [Google Scholar] [CrossRef]

- Lu, B.; Chen, Z. Live streaming commerce and consumers’ purchase intention: An uncertainty reduction perspective. Inf. Manag. 2021, 58, 103509. [Google Scholar] [CrossRef]

- Sun, Y.; Shao, X.; Li, X.; Guo, Y.; Nie, K. How live streaming influences purchase intentions in social commerce: An IT affordance perspective. Electron. Commer. Res. Appl. 2019, 37, 100886. [Google Scholar] [CrossRef]

- Ma, X.; Zou, X.; Lv, J. Why do consumers hesitate to purchase in live streaming? A perspective of interaction between participants. Electron. Commer. Res. Appl. 2022, 55, 101193. [Google Scholar] [CrossRef]

- He, Y.; Li, W.; Xue, J. What and how driving consumer engagement and purchase intention in officer live streaming? A two-factor theory perspective. Electron. Commer. Res. Appl. 2022, 56, 101223. [Google Scholar] [CrossRef]

- Wang, D.; Luo, X.R.; Hua, Y.; Benitez, J. Customers’ help-seeking propensity and decisions in brands’ self-built live streaming E-Commerce: A mixed-methods and fsQCA investigation from a dual-process perspective. J. Bus. Res. 2023, 156, 113540. [Google Scholar] [CrossRef]

- Gong, H.; Zhao, M.; Ren, J.; Hao, Z. Live streaming strategy under multi-channel sales of the online retailer. Electron. Commer. Res. Appl. 2022, 55, 101184. [Google Scholar] [CrossRef]

- Wongkitrungrueng, A.; Assarut, N. The role of live streaming in building consumer trust and engagement with social commerce sellers. J. Bus. Res. 2020, 117, 543–556. [Google Scholar] [CrossRef]

- Zhang, T.; Tang, Z.; Han, Z. Optimal online channel structure for multinational firms considering live streaming shopping. Electron. Commer. Res. Appl. 2022, 56, 101198. [Google Scholar] [CrossRef]

- Naiyi, Y.E. Dimensions of consumer’s perceived risk in online shopping. J. Electron. Sci. Technol. 2004, 2, 177–182. [Google Scholar]

- Lin, M.J.; Wang, W.T. Examining e-commerce customer satisfaction and loyalty: An integrated quality-risk-value perspective. J. Organ. Comput. Electron. Commer. 2015, 25, 379–401. [Google Scholar] [CrossRef]

- Pappas, N. Marketing strategies, perceived risks, and consumer trust in online buying behaviour. J. Retail. Consum. Serv. 2016, 29, 92–103. [Google Scholar] [CrossRef]

- Peng, H. Construction basis of C2C e-commerce credit evaluation index. J. Electron. Commer. Organ. 2017, 15, 11–23. [Google Scholar] [CrossRef]

- Ramanathan, R. The moderating roles of risk and efficiency on the relationship between logistics performance and customer loyalty in e-commerce. Transp. Res. Part E Logist. Transp. Rev. 2010, 46, 950–962. [Google Scholar] [CrossRef]

- Ramanathan, R. An empirical analysis on the influence of risk on relationships between handling of product returns and customer loyalty in E-commerce. Int. J. Prod. Econ. 2011, 130, 255–261. [Google Scholar] [CrossRef]

- Dimoka, A.; Hong, Y.; Pavlou, P.A. On product uncertainty in online markets: Theory and evidence. MIS Q. 2012, 36, 395–426. [Google Scholar] [CrossRef]

- Xing, Q.; Ren, T.; Deng, F. Analysis of the transaction behavior of live broadcasters with goods based on the multi-stage game under dynamic credit index. Sustainability 2023, 15, 4233. [Google Scholar] [CrossRef]

- Hasan, L.; Morris, A.; Probets, S. A comparison of usability evaluation methods for evaluating e-commerce websites. Behav. Inf. Technol. 2012, 31, 707–737. [Google Scholar] [CrossRef]

- Venkatesh, V.; Agarwal, R. Turning visitors into customers: A usability-centric perspective on purchase behavior in electronic channels. Manag. Sci. 2006, 52, 367–382. [Google Scholar] [CrossRef]

- Hausman, A.V.; Siekpe, J.S. The effect of web interface features on consumer online purchase intentions. J. Bus. Res. 2009, 62, 5–13. [Google Scholar] [CrossRef]

- Ong, C.E.; Teh, D. Redress procedures expected by consumers during a business-to-consumer e-commerce dispute. Electron. Commer. Res. Appl. 2016, 17, 150–160. [Google Scholar] [CrossRef]

- See-To, E.W.; Ho, K.K. A study on the impact of design attributes on E-payment service utility. Inf. Manag. 2016, 53, 668–681. [Google Scholar] [CrossRef]

- Kim, C.; Tao, W.; Shin, N.; Kim, K.S. An empirical study of customers’ perceptions of security and trust in e-payment systems. Electron. Commer. Res. Appl. 2010, 9, 84–95. [Google Scholar] [CrossRef]

- Cui, R.; Li, M.; Li, Q. Value of high-quality logistics: Evidence from a clash between SF Express and Alibaba. Manag. Sci. 2020, 66, 3879–3902. [Google Scholar] [CrossRef]

- Xiao, T.; Qi, X. A two-stage supply chain with demand sensitive to price, delivery time, and reliability of delivery. Ann. Oper. Res. 2016, 241, 475–496. [Google Scholar] [CrossRef]

- CCA (China Consumers Association). Available online: http://www.cca.org.cn/jmxf/detail/29533.html (accessed on 6 June 2023).

- Xu, Z.; Liao, H. Intuitionistic fuzzy analytic hierarchy process. IEEE Trans. Fuzzy Syst. 2013, 22, 749–761. [Google Scholar] [CrossRef]

- Li, D.; Liu, C.; Gan, W. A new cognitive model: Cloud model. Int. J. Intell. Syst. 2009, 24, 357–375. [Google Scholar] [CrossRef]

- Liu, H.C.; Wang, L.E.; Li, Z.; Hu, Y.P. Improving risk evaluation in FMEA with cloud model and hierarchical TOPSIS method. IEEE Trans. Fuzzy Syst. 2018, 27, 84–95. [Google Scholar] [CrossRef]

- Tumsekcali, E.; Ayyildiz, E.; Taskin, A. Interval valued intuitionistic fuzzy AHP-WASPAS based public transportation service quality evaluation by a new extension of SERVQUAL Model: P-SERVQUAL 4.0. Expert Syst. Appl. 2021, 186, 115757. [Google Scholar] [CrossRef]

- Yu, X.; Zheng, D.; Zhou, L. Credit risk analysis of electricity retailers based on cloud model and intuitionistic fuzzy analytic hierarchy process. Int. J. Energy Res. 2021, 45, 4285–4302. [Google Scholar] [CrossRef]

| First-Level Indicator | Weight | Second-Level Indicator | Weight |

|---|---|---|---|

| Commodity dimension risk (A1) | 0.332 | Counterfeiting and inferior (B1) | 0.391 |

| Unreasonable price (B2) | 0.275 | ||

| No goods received (B3) | 0.196 | ||

| Refusing to be returned or exchanged (B4) | 0.138 | ||

| Live-streamer dimension risk (A2) | 0.256 | Poor professional ability (B5) | 0.486 |

| Lack of credit (B6) | 0.310 | ||

| Shirking responsibility after sales (B7) | 0.204 | ||

| Platform dimension risk (A3) | 0.182 | Unfriendly interface design (B8) | 0.387 |

| Unreasonable function settings (B9) | 0.258 | ||

| Poor service feedback (B10) | 0.199 | ||

| Weak personal privacy protection (B11) | 0.156 | ||

| Payment dimension risk (A4) | 0.135 | Private payment method (B12) | 0.388 |

| Financial loss caused by payment (B13) | 0.147 | ||

| Payment interruption or cancellation (B14) | 0.269 | ||

| Payment data tampering or theft (B15) | 0.196 | ||

| Logistics dimension risk (A5) | 0.095 | Slow delivery speed (B16) | 0.481 |

| Damage and loss of goods (B17) | 0.314 | ||

| High logistics service costs (B18) | 0.205 |

| Risk Dimension | Platform | |||

|---|---|---|---|---|

| Comprehensive | Taobao | 0.1248 | 0.0563 | 0.0065 |

| Douyin | 0.2664 | 0.0543 | 0.0087 | |

| Kuaishou | 0.2828 | 0.0516 | 0.0103 | |

| JD.com | 0.0942 | 0.0527 | 0.0062 | |

| Commodity | Taobao | 0.1430 | 0.0598 | 0.0074 |

| Douyin | 0.2695 | 0.0529 | 0.0088 | |

| Kuaishou | 0.2697 | 0.0493 | 0.0116 | |

| JD.com | 0.0848 | 0.0550 | 0.0058 | |

| Live streamer | Taobao | 0.0911 | 0.0525 | 0.0053 |

| Douyin | 0.2431 | 0.0585 | 0.0100 | |

| Kuaishou | 0.2688 | 0.0523 | 0.0114 | |

| JD.com | 0.1054 | 0.0482 | 0.0040 | |

| Platform | Taobao | 0.1406 | 0.0565 | 0.0061 |

| Douyin | 0.2879 | 0.0507 | 0.0055 | |

| Kuaishou | 0.3077 | 0.0562 | 0.0101 | |

| JD.com | 0.0971 | 0.0541 | 0.0096 | |

| Payment | Taobao | 0.0914 | 0.0532 | 0.0092 |

| Douyin | 0.2487 | 0.0531 | 0.0076 | |

| Kuaishou | 0.2876 | 0.0549 | 0.0064 | |

| JD.com | 0.0927 | 0.0521 | 0.0101 | |

| Logistics | Taobao | 0.1689 | 0.0480 | 0.0085 |

| Douyin | 0.3023 | 0.0563 | 0.0101 | |

| Kuaishou | 0.3119 | 0.0508 | 0.0060 | |

| JD.com | 0.0938 | 0.0534 | 0.0085 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, H.; Wang, Z.; Yuan, Z.; Yan, X. Multidimensional Evaluation of Consumers’ Shopping Risks under Live-Streaming Commerce. Sustainability 2023, 15, 14060. https://doi.org/10.3390/su151914060

Li H, Wang Z, Yuan Z, Yan X. Multidimensional Evaluation of Consumers’ Shopping Risks under Live-Streaming Commerce. Sustainability. 2023; 15(19):14060. https://doi.org/10.3390/su151914060

Chicago/Turabian StyleLi, Hongbo, Zhenzhen Wang, Zhijie Yuan, and Xin Yan. 2023. "Multidimensional Evaluation of Consumers’ Shopping Risks under Live-Streaming Commerce" Sustainability 15, no. 19: 14060. https://doi.org/10.3390/su151914060

APA StyleLi, H., Wang, Z., Yuan, Z., & Yan, X. (2023). Multidimensional Evaluation of Consumers’ Shopping Risks under Live-Streaming Commerce. Sustainability, 15(19), 14060. https://doi.org/10.3390/su151914060