Research on E-Commerce Platforms’ Return Policies Considering Consumers Abusing Return Policies

Abstract

:1. Introduction

2. Literature Review

2.1. Research on Cross-Network Externality

2.2. Research on Return Policies

2.3. Research on Consumer Abuse of Return Policies

3. Basic Model

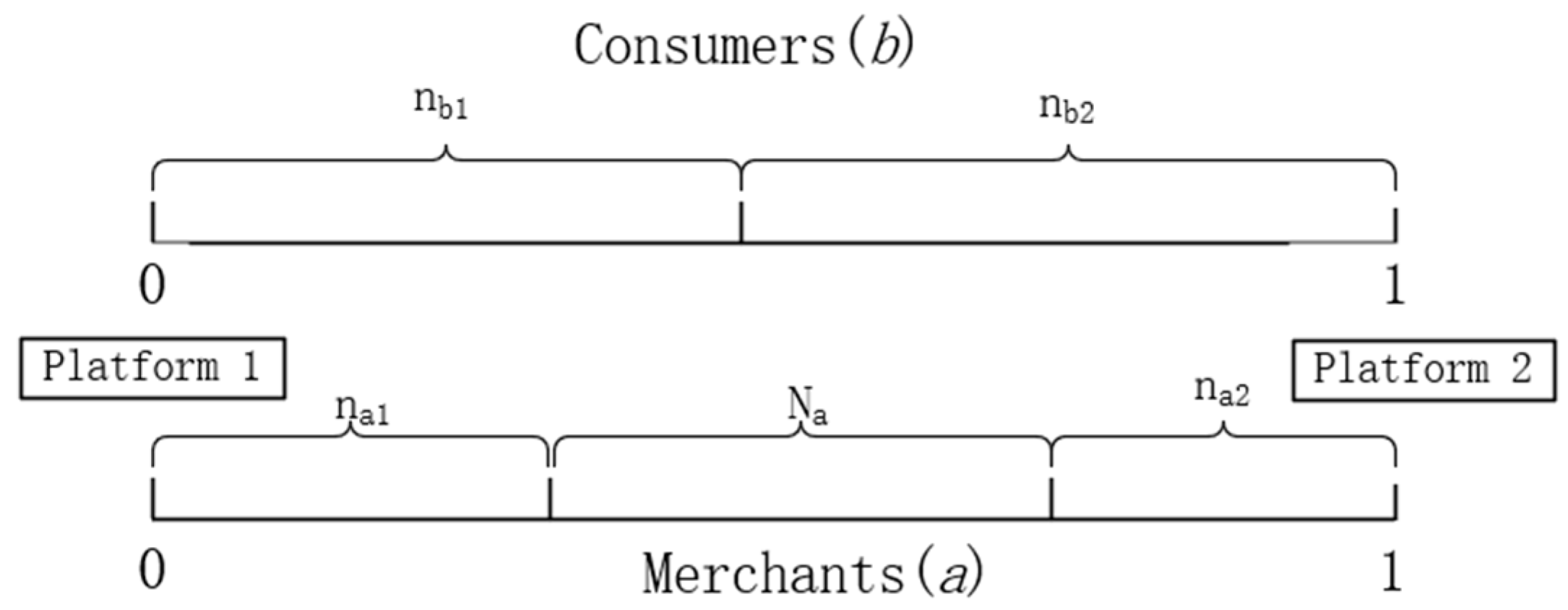

3.1. Players

3.2. User Utility and Platform Profit

3.3. Analysis of Platform Competition

Equilibrium Analysis

4. Analysis

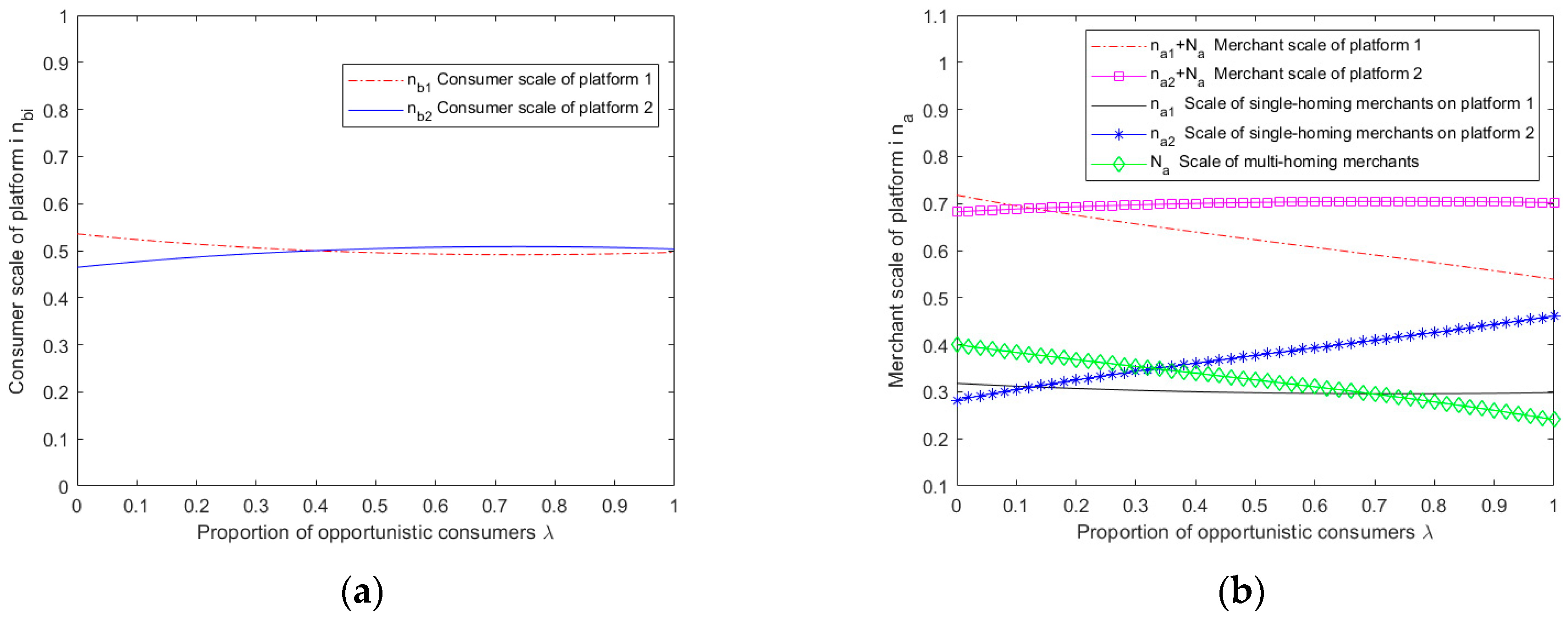

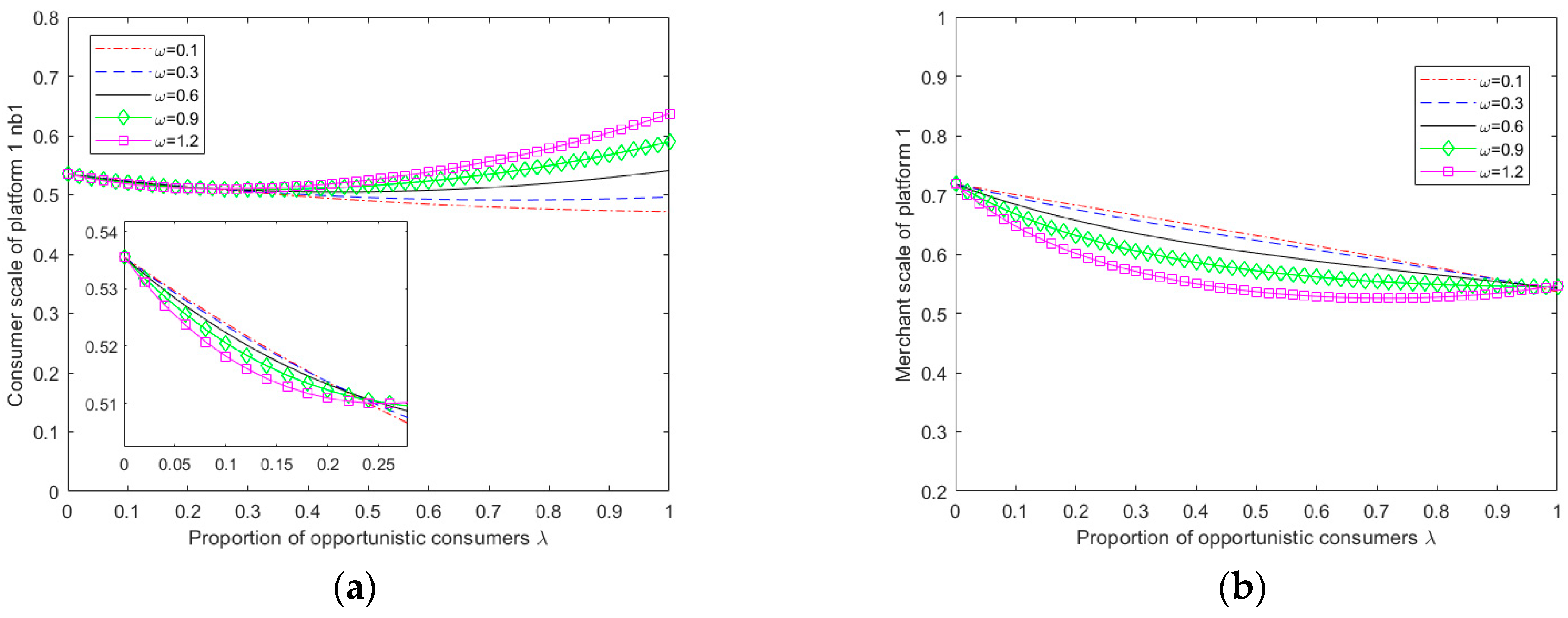

4.1. The Impact of the Proportion of Opportunistic Consumers on the Equilibrium of Platform Competition

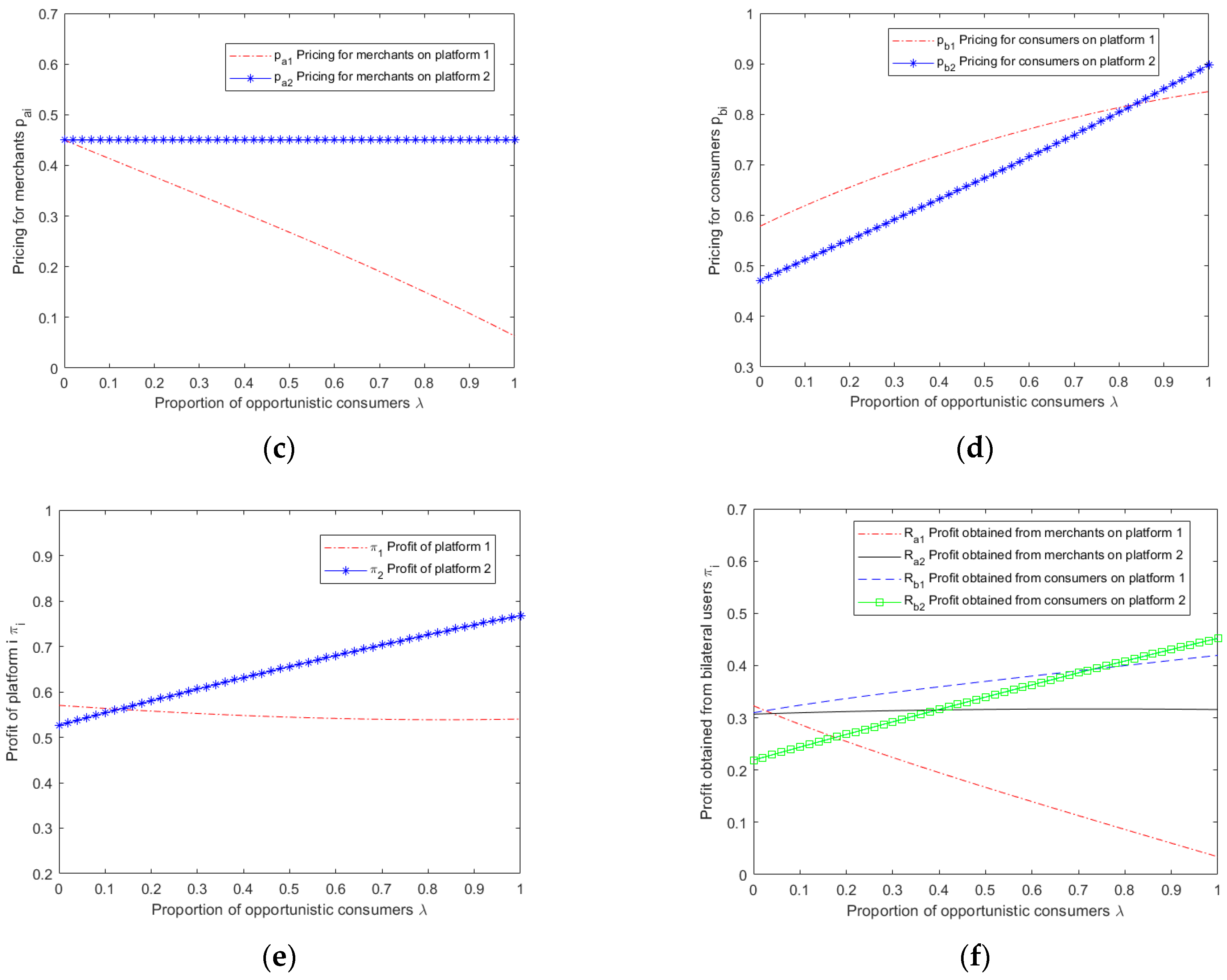

4.2. The Impact of Cross-Network Effect

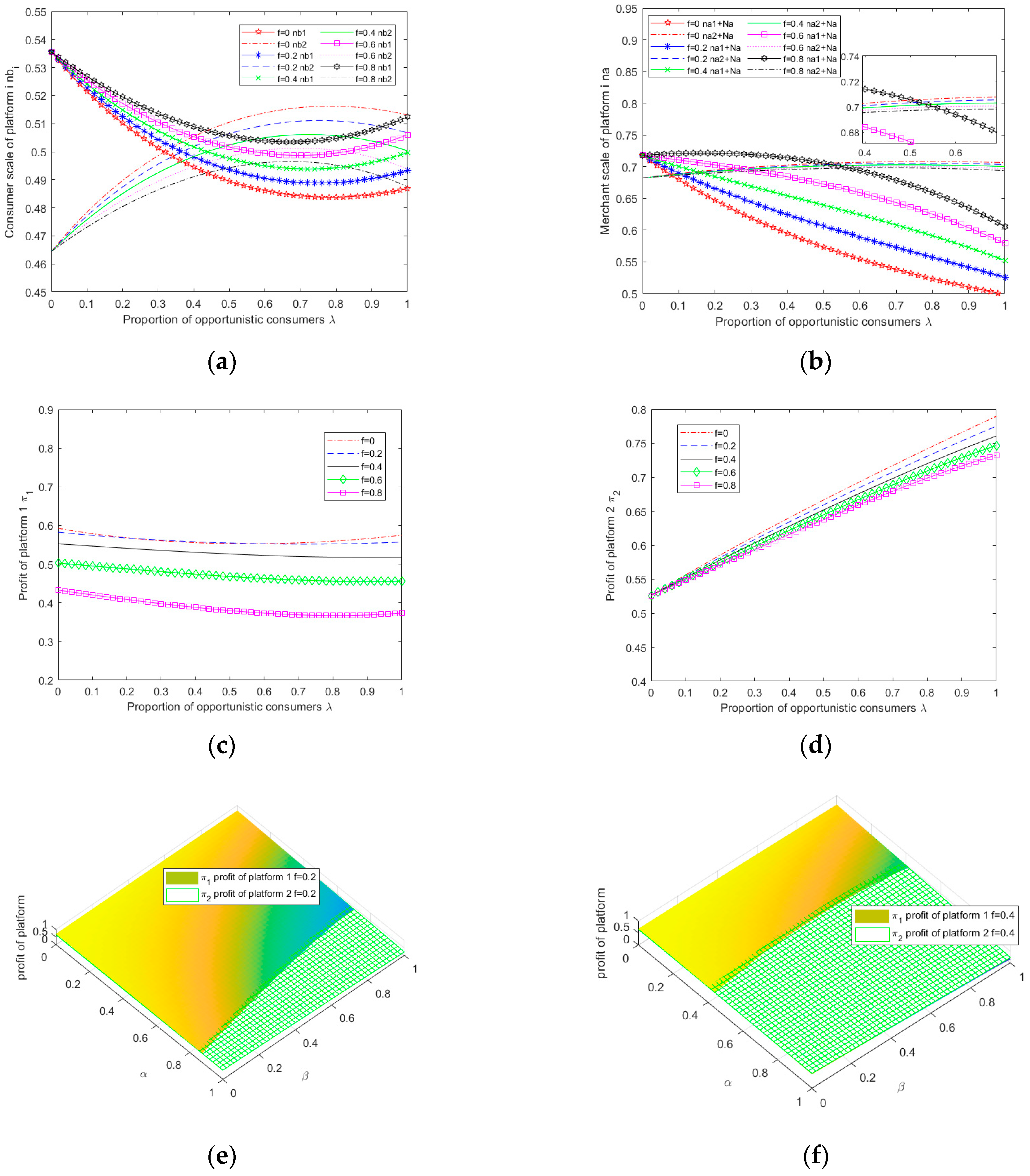

4.3. The Effect of Penalty

5. Conclusions and Management’s Insights

5.1. Platform Strategy

- (1)

- As the proportion of opportunistic consumers in the market increases, the scale of single-homing merchants remains stable. However, multi-homing merchants tend to exit platforms that offer lenient return policies and become single-homing on rival platforms. This results in a reduction in the scale of the platform’s consumer base and lower profits compared to its competitors. This outcome implies that if a platform intends to implement a lenient return policy, it is of paramount importance to take measures to prevent dishonest returns and protect the interests of merchants who tend to be multi-homing.

- (2)

- The success of a lenient return policy also depends on the network benefit parameters, especially on the consumer side. If consumers are highly sensitive to their interactions with merchants, implying that the merchant side is the bottleneck in a two-sided platform, such a lenient return policy is prone to failure in a market characterized by high opportunism. In addition, negative network effects due to opportunistic consumers can exacerbate the situation for merchants. Therefore, platforms that offer lenient return policies should set limits on how much consumers can avail themselves of these services. This will help mitigate the adverse impact of dishonest returns on platform profits.

- (3)

- Will it be effective if platforms wish to implement regulations that support lenient return policies in the presence of opportunistic consumers? Yes, it can be effective if the proportion of such consumers is relatively small and the penalties are at a moderate level. Otherwise, merchants may choose to stay, but consumers may opt out, and the competitor wins.

5.2. Research Limitations and Recommendations

- (1)

- Since this study assumes that consumers independently decide whether to abuse the platform’s return policy and does not consider the impact of platform punishment, future research should incorporate the influence of platform punishment on the proportion of consumers abusing return policies into the model and examine its implications for platform service selection.

- (2)

- Moreover, the current model solution does not account for dynamic game theory. Future research could explore the derivation of the model from the perspective of dynamic game theory.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Rysman, M. Competition between Networks: A Study of the Market for Yellow Pages. Rev. Econ. Stud. 2004, 71, 483–512. [Google Scholar] [CrossRef]

- Radhi, M. Service Decisions in a Two-Echelon Retailing System with Customer Returns. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1219–1242. [Google Scholar] [CrossRef]

- Chang, H.H.; Guo, Y.Y. Online Fraudulent Returns in Taiwan: The Impacts of E-retailers’ Transaction Ethics and Consumer Personality. J. Retail. Consum. Serv. 2021, 61, 102529. [Google Scholar] [CrossRef]

- Safda, K. How Your Returns are Used against You at Best Buy, Other Retailers. Wall Str. J. 2018. Available online: https://www.bespacific.com/how-your-returns-are-used-against-you-at-best-buy-other-retailers (accessed on 15 August 2023).

- Ülkü, M.A.; Gürler, Ü. The Impact of Abusing Return Policies: A Newsvendor Model with Opportunistic Consumers. Int. J. Prod. Econ. 2018, 203, 124–133. [Google Scholar] [CrossRef]

- Yan, R.L.; Pei, Z. Return Policies and O2O Coordination in the E-tailing Age. J. Retail. Consum. Serv. 2019, 50, 314–321. [Google Scholar] [CrossRef]

- Shang, G.Z.; Ghosh, B.P.; Galbreth, M.R. Optimal Retail Return Policies with Wardrobing. Prod. Oper. Manag. 2017, 26, 1315–1332. [Google Scholar] [CrossRef]

- Khouja, M.; Hammami, R. Optimizing Price, Order Quantity, and Return Policy in the Presence of Consumer Opportunistic Behavior for Online Retailers. Eur. J. Oper. Res. 2023, 309, 683–703. [Google Scholar] [CrossRef]

- Altug, M.S.; Aydinliyim, T.; Jain, A. Managing Opportunistic Consumer Returns in Retail Operations. Manag. Sci. 2021, 67, 5660–5678. [Google Scholar] [CrossRef]

- Hagiu, A. Pricing and commitment by two-sided platforms. RAND J. Econ. 2006, 37, 720–737. [Google Scholar] [CrossRef]

- Song, P.J.; Xue, L.; Rai, A. The Ecosystem of Software Platform: A Study of Asymmetric Cross-side Network Effects and Platform Governance. MIS Q. 2018, 42, 121–142. [Google Scholar] [CrossRef]

- Caillaud, B.; Jullien, B. Chicken & Egg: Competition among Intermediation Service Providers. RAND J. Econ. 2003, 34, 309–328. [Google Scholar] [CrossRef]

- Hagiu, A.; Hałaburda, H. Information and Two-sided Platform Profits. Int. J. Ind. Organ. 2014, 34, 25–35. [Google Scholar] [CrossRef]

- Cachon, G.P.; Daniels, K.M.; Lobel, R. The Role of Surge Pricing on a Service Platform with Self-Scheduling Capacity. Manuf. Serv. Oper. Manag. 2017, 19, 368–384. [Google Scholar] [CrossRef]

- Rochet, J.C.; Tirole, J. Two-sided Markets: A Progress Report. RAND J. Econ. 2006, 37, 645–667. [Google Scholar] [CrossRef]

- Athey, S.; Calvano, E.; Gans, J.S. The Impact of Consumer Multi-homing on Advertising Markets and Media Competition. Manag. Sci. 2018, 64, 1574–1590. [Google Scholar] [CrossRef]

- Bakos, Y.; Halaburda, H. Platform Competition with Multihoming on Both Sides: Subsidize or Not? Manag. Sci. 2020, 66, 5599–5607. [Google Scholar] [CrossRef]

- Dou, G.W.; He, P. Value-added Service Investing and Pricing Strategies for a Two-sided Platform under Investing Resource Constraint. J. Syst. Sci. Syst. Eng. 2017, 26, 609–627. [Google Scholar] [CrossRef]

- Liu, W.H.; Yan, X.Y.; Wei, W.Y. Pricing Decisions for Service Platform with Provider’s Threshold Participating Quantity, Value-added Service and Matching Ability. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 410–432. [Google Scholar] [CrossRef]

- Basu, A.; Bhaskaran, S.; Mukherjee, R. An Analysis of Search and Authentication Strategies for Online Matching Platforms. Manag. Sci. 2019, 65, 2412–2431. [Google Scholar] [CrossRef]

- Armstrong, M. Competition in Two-sided Markets. RAND J. Econ. 2006, 37, 668–691. [Google Scholar] [CrossRef]

- Aloui, C.; Jebsi, K. Optimal Pricing of a Two-sided Monopoly Platform with a One-sided Congestion Effect. Int. Rev. Econ. 2010, 57, 423–439. [Google Scholar] [CrossRef]

- Ji, H.L.; Wang, X.F. Competition Model of Two-sided Markets with Platform Differentiation and Users Partially Multihoming. Syst. Eng. Theory Pract. 2014, 34, 1398–1406. [Google Scholar]

- Gui, Y.M.; Wu, Z.; Gong, B.G. Value-added Service Quality Investment Competition of Bilateral Platform in Competitive Environment. J. Syst. Sci. Math. Sci. 2022, 42, 3273–3287. [Google Scholar]

- Zhao, F.Y.; Wang, Y. Value-added Service and Pricing Strategies of Duopoly Two-sided Platforms with Sellers Partially Multihoming. Front. Sci. Technol. Eng. Manag. 2020, 39, 76–82. [Google Scholar]

- Mukhopadhyay, S.K.; Setoputro, R. Reverse Logistics in E-business: Optimal Price and Return Policy. Int. J. Phys. Distrib. Logist. Manag. 2004, 34, 70–89. [Google Scholar] [CrossRef]

- Su, X. Consumer Returns Policies and Supply Chain Performance. Manuf. Serv. Oper. Manag. 2009, 11, 595–612. [Google Scholar] [CrossRef]

- Akçay, Y.; Boyacı, T.; Zhang, D. Selling with Money-Back Guarantees: The Impact on Prices, Quantities, and Retail Profitability. Prod. Oper. Manag. 2012, 22, 777–791. [Google Scholar] [CrossRef]

- Li, Y.J.; Xu, L.; Li, D. Examining Relationships Between the Return Policy, Product Quality, and Pricing Strategy in Online Direct Selling. Int. J. Prod. Econ. 2013, 144, 451–460. [Google Scholar] [CrossRef]

- Pei, Z.; Paswan, A.; Yan, R. E-tailer’s Return Policy, Consumer’s Perception of Return Policy Fairness and Purchase Intention. J. Retail. Consum. Serv. 2014, 21, 249–257. [Google Scholar] [CrossRef]

- Batarfi, R.; Jaber, M.Y.; Aljazzar, S.M. A Profit Maximization for a Reverse Logistics Dual-channel Supply Chain with a Return Policy. Comput. Ind. Eng. 2017, 106, 58–82. [Google Scholar] [CrossRef]

- Wood, S.L. Remote Purchase Environments: The Influence of Return Policy Leniency on Two-Stage Decision Processes. J. Mark. Res. 2001, 38, 157–169. [Google Scholar] [CrossRef]

- Li, J.B.; Li, Y. Optimal Online Pricing and Compensation Strategy in MBG Returns Policy. Syst. Eng. Theory Pract. 2016, 36, 2811–2819. [Google Scholar]

- Stock, J.R.; Mulki, J.P. Product Returns Processing: An Examination of Practices of Manufacturers, Wholesalers/Distributors, and Retailers. J. Bus. Logist. 2009, 30, 33–62. [Google Scholar] [CrossRef]

- Chen, J.; Grewal, R. Competing in a Supply Chain via Full-refund and No-refund Customer Returns Policies. Int. J. Prod. Econ. 2013, 146, 246–258. [Google Scholar] [CrossRef]

- Huang, Z.S.; Nie, J.J.; Zhao, Y.X. Money-back guarantee in the presence of bounded rational consumers. Chin. J. Manag. Sci. 2016, 24, 116–123. [Google Scholar]

- Chen, B.T.; Chen, J. Compete in Price or Service? —A Study of Personalized Pricing and Money Back Guarantees. J. Retail. 2017, 93, 154–171. [Google Scholar] [CrossRef]

- Ofek, E.; Katona, Z.; Sarvary, M. “Bricks and Clicks”: The Impact of Product Returns on the Strategies of Multichannel Retailers. Market. Sci. 2011, 30, 42–60. [Google Scholar] [CrossRef]

- Chen, J.; Bell, P.C. Implementing Market Segmentation Using Full-refund and No-refund Customer Returns Policies in a Dual-channel Supply Chain Structure. Int. J. Prod. Econ. 2012, 136, 56–66. [Google Scholar] [CrossRef]

- Phau, I.; Akintimehin, O.O.; Shen, B. “Buy, wear, return, repeat”: Investigating Chinese Consumers’ Attitude and Intentions to Engage in Wardrobing. Strateg. Chang. 2022, 31, 345–356. [Google Scholar] [CrossRef]

- Mun, J.M.; Ju, H.W.; Johnson, K.K.P. Young Consumers and Retail Borrowing: Application of the Theory of Planned Behavior. J. Glob. Fash. Mark. 2014, 5, 60–73. [Google Scholar] [CrossRef]

- Young, M.; Piron, F. Retail Borrowing: Insights and Implications on Returning Used Merchandise. Int. J. Retail. Distrib. Manag. 2000, 28, 27–36. [Google Scholar] [CrossRef]

- Hjort, K.; Lantz, B. (R)e-tail Borrowing of Party Dresses: An Experimental Study. Int. J. Retail. Distrib. Manag. 2012, 40, 997–1012. [Google Scholar] [CrossRef]

- Harris, L.C. Fraudulent Return Proclivity: An Empirical Analysis. J. Retail. 2008, 84, 461–476. [Google Scholar] [CrossRef]

- Zhang, D.; Frei, R.; Senyo, P.K. Understanding Fraudulent Returns and Mitigation Strategies in Multichannel Retailing. J. Retail. Consum. Serv. 2023, 70, 103145. [Google Scholar] [CrossRef]

- Li, Y.J.; Xu, L.; Choi, T.M. Optimal Advance-Selling Strategy for Fashionable Products with Opportunistic Consumers Returns. IEEE Trans. Syst. Man Cybern. Syst. 2014, 44, 938–952. [Google Scholar] [CrossRef]

- Rasch, A.; Wenzel, T. Piracy in a Two-sided Software Market. J. Econ. Behav. Organ. 2013, 88, 78–89. [Google Scholar] [CrossRef]

- Dou, Y.F.; Wu, D.J. Platform Competition under Network Effects: Piggybacking and Optimal Subsidization. Inform. Syst. Res. 2021, 32, 820–835. [Google Scholar] [CrossRef]

- Belleflamme, P.; Peitz, M. Platform Competition: Who Benefits from Multihoming? Int. J. Ind. Organ. 2019, 64, 1–26. [Google Scholar] [CrossRef]

- Chen, J.; Yu, B.; Chen, B.T. Lenient vs. Stringent Returns Policies in the Presence of Fraudulent Returns: The Role of Customers’ Fairness Perceptions. Omega 2023, 117, 102843. [Google Scholar] [CrossRef]

- Sui, R.H.; Zhang, X.M.; Dan, B. Bilateral Value-added Service Investment in Platform Competition with Cross-side Network Effects under Multihoming. Eur. J. Oper. Res. 2023, 304, 952–963. [Google Scholar] [CrossRef]

- Li, J.; Zhang, Y.L. Pricing Strategy of the Platform Considering Network Effects and Business Expansion. Syst. Eng. Theory Pract. 2020, 40, 593–604. [Google Scholar]

- Zhang, C.; Tian, Y.X.; Xiao, M. Value-added Service Investing and Pricing Strategies of Multilateral Distribution Platform with Consideration of Cross-network Externalities. Syst. Eng. Theory Pract. 2019, 39, 3084–3309. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Du, F. Research on E-Commerce Platforms’ Return Policies Considering Consumers Abusing Return Policies. Sustainability 2023, 15, 13938. https://doi.org/10.3390/su151813938

Liu H, Du F. Research on E-Commerce Platforms’ Return Policies Considering Consumers Abusing Return Policies. Sustainability. 2023; 15(18):13938. https://doi.org/10.3390/su151813938

Chicago/Turabian StyleLiu, Huixin, and Feng Du. 2023. "Research on E-Commerce Platforms’ Return Policies Considering Consumers Abusing Return Policies" Sustainability 15, no. 18: 13938. https://doi.org/10.3390/su151813938

APA StyleLiu, H., & Du, F. (2023). Research on E-Commerce Platforms’ Return Policies Considering Consumers Abusing Return Policies. Sustainability, 15(18), 13938. https://doi.org/10.3390/su151813938

_Qiu.png)