The Role of Environment, Social, and Governance Performance in Shaping Corporate Current and Future Value: The Case of Global Tech Leaders

Abstract

:1. Introduction

Contribution of the Study

2. Theoretical Underpinning, Literature Review, and Hypothesis Development

2.1. Theoretical Underpinning

2.2. Literature Review and Hypothesis Development

3. Research Framework

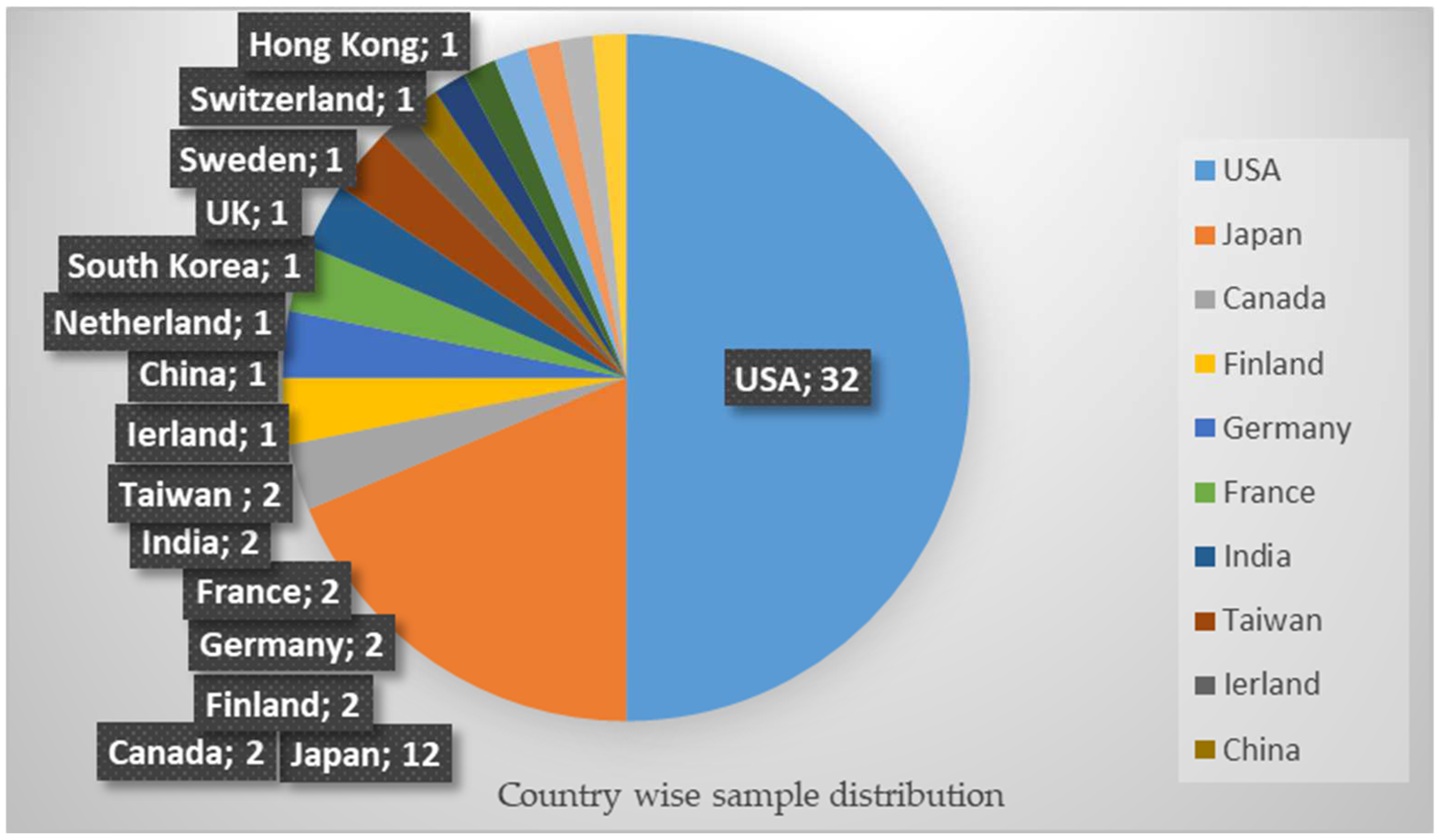

3.1. Sample

3.2. Data Collection

3.3. Variable Measurements

3.4. Estimation of Models

- L.FVit = natural log of firm value (Either EPS or PE ratio) for i firm in period t;

- L.ESGit−1 = natural log of ESG scores for i firm in t−1 period;

- L.Eit−1 = natural log of environmental scores for i firm in t−1 period;

- L.Sit−1 = natural log of social scores for i firm in t−1 period;

- L.Git−1 = natural log of governance scores for i firm in t−1 period;

- L.SIZEit = natural log of total Assets for i firm in t period;

- L.NPMit = natural log of net profit margin for i firm in period t;

- L.FSit = natural log of financial sustainability for i firm in period t;

- L.LEVit = natural log of leverage for i firm in period t;

- µ = error term.

4. Empirical Findings

4.1. Descriptive Statistics

4.2. Regression Results

5. Conclusions and Discussion

Research Limitations and Future Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Khosravi, A.A.; Poushaneh, K.; Roozegar, A.; Sohrabifard, N. Determination of factors affecting student satisfaction of Islamic Azad University. Procedia-Soc. Behav. Sci. 2013, 84, 579–583. [Google Scholar] [CrossRef]

- Gazman, V.D. A New Criterion for the ESG Model. Green Low-Carbon Econ. 2023, 1, 22–27. [Google Scholar] [CrossRef]

- Derwall, J. The Economic Virtues of SRI and CSR; Erasmus University Rotterdam: Rotterdam, The Netherlands, 2007. [Google Scholar]

- Barkemeyer, R.; Holt, D.; Preuss, L.; Tsang, S. What happened to the ‘development’ in sustainable development? Business guidelines two decades after Brundtland. Sustain. Dev. 2014, 22, 15–32. [Google Scholar] [CrossRef]

- Galbreath, J. ESG in focus: The Australian evidence. J. Bus. Ethics 2013, 118, 529–541. [Google Scholar] [CrossRef]

- Gates, S.; Very, P. Measuring performance during M&A integration. Long Range Plan. 2003, 36, 167–185. [Google Scholar]

- Maltz, A.C.; Shenhar, A.J.; Reilly, R.R. Beyond the balanced scorecard: Refining the search for organizational success measures. Long Range Plan. 2003, 36, 187–204. [Google Scholar] [CrossRef]

- Carroll, A.B.; Shabana, K.M. The business case for corporate social responsibility: A review of concepts, research and practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Wang, H.; Lu, W.; Ye, M.; Chau, K.; Zhang, X. The curvilinear relationship between corporate social performance and corporate financial performance: Evidence from the international construction industry. J. Clean. Prod. 2016, 137, 1313–1322. [Google Scholar] [CrossRef]

- Bhagat, S.; Bolton, B. Corporate governance and firm performance. J. Corp. Financ. 2008, 14, 257–273. [Google Scholar] [CrossRef]

- Bauer, R.; Derwall, J.; Otten, R. The ethical mutual fund performance debate: New evidence from Canada. J. Bus. Ethics 2007, 70, 111–124. [Google Scholar] [CrossRef]

- Ng, A.C.; Rezaee, Z. Business sustainability performance and cost of equity capital. J. Corp. Financ. 2015, 34, 128–149. [Google Scholar] [CrossRef]

- Khan, M.K.; He, Y.; Akram, U.; Zulfiqar, S.; Usman, M. Firms’ technology innovation activity: Does financial structure matter? Asia-Pac. J. Financ. Stud. 2018, 47, 329–353. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance–financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Preston, L.E.; O’bannon, D.P. The corporate social-financial performance relationship: A typology and analysis. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- Peng, L.S.; Isa, M. Environmental, social and governance (ESG) practices and performance in Shariah firms: Agency or stakeholder theory? Asian Acad. Manag. J. Account. Financ. 2020, 16, 1–34. [Google Scholar]

- Freeman, R.E. The politics of stakeholder theory: Some future directions. Bus. Ethics Q. 1994, 4, 409–421. [Google Scholar] [CrossRef]

- Harrison, J.S.; Wicks, A.C. Stakeholder theory, value, and firm performance. Bus. Ethics Q. 2013, 23, 97–124. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Lee, J.H. Stakeholder identification and its importance in the value creating system of stakeholder work. Camb. Handb. Stakehold. Theory 2019, 1, 53–73. [Google Scholar]

- Pachot, A.; Patissier, C. Towards Sustainable Artificial Intelligence: An Overview of Environmental Protection Uses and Issues. arXiv 2022, arXiv:2212.11738. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. The causal effect of corporate governance on corporate social responsibility. J. Bus. Ethics 2012, 106, 53–72. [Google Scholar] [CrossRef]

- Ghoul, S.E.; Guedhami, O.; Kim, Y. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Bus. Stud. 2017, 48, 360–385. [Google Scholar] [CrossRef]

- Thanh, T.T.T.; Phuong, A.N.T.; Thu, H.N. Advancing the Circular Business Models in Developing Countries: Lessons from China. Green Low-Carbon Econ. 2022. [Google Scholar] [CrossRef]

- Gutiérrez-Ponce, H.; Wibowo, S.A. Do Sustainability Activities Affect the Financial Performance of Banks? The Case of Indonesian Banks. Sustainability 2023, 15, 6892. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Sahut, J.-M.; Pasquini-Descomps, H. ESG impact on market performance of firms: International evidence. Manag. Int. 2015, 19, 40–63. [Google Scholar] [CrossRef]

- Zheng, J.; Khurram, M.U.; Chen, L. Can green innovation affect ESG ratings and financial performance? evidence from Chinese GEM listed companies. Sustainability 2022, 14, 8677. [Google Scholar] [CrossRef]

- Akbar, A.; Jiang, X.; Qureshi, M.A.; Akbar, M. Does corporate environmental investment impede financial performance of Chinese enterprises? The moderating role of financial constraints. Environ. Sci. Pollut. Res. 2021, 28, 58007–58017. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Yoon, B.; Lee, J.H.; Byun, R. Does ESG performance enhance firm value? Evidence from Korea. Sustainability 2018, 10, 3635. [Google Scholar] [CrossRef]

- Wong, W.C.; Batten, J.A.; Mohamed-Arshad, S.B.; Nordin, S.; Adzis, A.A. Does ESG certification add firm value? Financ. Res. Lett. 2021, 39, 101593. [Google Scholar] [CrossRef]

- Nazir, M.; Akbar, M.; Akbar, A.; Poulovo, P.; Hussain, A.; Qureshi, M.A. The nexus between corporate environment, social, and governance performance and cost of capital: Evidence from top global tech leaders. Environ. Sci. Pollut. Res. 2022, 29, 22623–22636. [Google Scholar] [CrossRef] [PubMed]

- Xu, X.; Liu, Z. ESG, Cultural Distance and Corporate Profitability: Evidence from Chinese Multinationals. Sustainability 2023, 15, 6771. [Google Scholar] [CrossRef]

- Francis, J.; Nanda, D.; Olsson, P. Voluntary disclosure, earnings quality, and cost of capital. J. Account. Res. 2008, 46, 53–99. [Google Scholar] [CrossRef]

- Reverte, C. The impact of better corporate social responsibility disclosure on the cost of equity capital. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 253–272. [Google Scholar] [CrossRef]

- Vanwalleghem, D. The real effects of socially responsible investing: Disagreement on the doing well while doing good hypothesis and the cost of capital. J. Bus. Ethics 2013, 7, 1–36. [Google Scholar]

- Ersoy, E.; Swiecka, B.; Grima, S.; Özen, E.; Romanova, I. The Impact of ESG Scores on Bank Market Value? Evidence from the US Banking Industry. Sustainability 2022, 14, 9527. [Google Scholar] [CrossRef]

- Jin, X.; Lei, X. A Study on the Mechanism of ESG’s Impact on Corporate Value under the Concept of Sustainable Development. Sustainability 2023, 15, 8442. [Google Scholar] [CrossRef]

- Dempere, J.; Abdalla, S. The Impact of Women’s Empowerment on the Corporate Environmental, Social, and Governance (ESG) Disclosure. Sustainability 2023, 15, 8173. [Google Scholar] [CrossRef]

- Yang, O.-S.; Han, J.-H. Assessing the effect of corporate esg management on corporate financial & market performance and export. Sustainability 2023, 15, 2316. [Google Scholar]

- Clinch, G.; Verrecchia, R.E. Voluntary disclosure and the cost of capital. Aust. J. Manag. 2015, 40, 201–223. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 2021, 79, 102097. [Google Scholar] [CrossRef]

- Yu, X.; Xiao, K. Does ESG Performance Affect Firm Value? Evidence from a New ESG-Scoring Approach for Chinese Enterprises. Sustainability 2022, 14, 16940. [Google Scholar] [CrossRef]

- Qureshi, M.A.; Akbar, M.; Akbar, A.; Poulova, P. Do ESG endeavors assist firms in achieving superior financial performance? A case of 100 best corporate citizens. Sage Open 2021, 11, 21582440211021598. [Google Scholar] [CrossRef]

- Dal Maso, L.; Liberatore, G.; Mazzi, F. Value relevance of stakeholder engagement: The influence of national culture. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 44–56. [Google Scholar] [CrossRef]

- Wang, H.-M.D.; Sengupta, S. Stakeholder relationships, brand equity, firm performance: A resource-based perspective. J. Bus. Res. 2016, 69, 5561–5568. [Google Scholar] [CrossRef]

- Zhao, X.; Shao, F.; Wu, C. Do stakeholder relationships matter? An empirical study of exploration, exploitation and firm performance. Manag. Decis. 2021, 59, 764–786. [Google Scholar] [CrossRef]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Manag. Environ. Qual. Int. J. 2018, 29, 182–194. [Google Scholar] [CrossRef]

- Saleh, M.; Zulkifli, N.; Muhamad, R. Looking for evidence of the relationship between corporate social responsibility and corporate financial performance in an emerging market. Asia-Pac. J. Bus. Adm. 2011, 3, 165–190. [Google Scholar] [CrossRef]

- Gentry, R.J.; Shen, W. The relationship between accounting and market measures of firm financial performance: How strong is it? J. Manag. Issues 2010, 22, 514–530. [Google Scholar]

- Husted, B.W.; Allen, D.B. Strategic corporate social responsibility and value creation among large firms: Lessons from the Spanish experience. Long Range Plan. 2007, 40, 594–610. [Google Scholar] [CrossRef]

- Grougiou, V.; Leventis, S.; Dedoulis, E.; Owusu-Ansah, S. Corporate social responsibility and earnings management in US banks. Account. Forum 2014, 38, 155–169. [Google Scholar] [CrossRef]

- Huang, J.; Duan, Z.; Zhu, G. Does corporate social responsibility affect the cost of bank loans? Evidence from China. Emerg. Mark. Financ. Trade 2017, 53, 1589–1602. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Ford, J.K.; Quiñones, M.A.; Sego, D.J.; Sorra, J.S. Factors affecting the opportunity to perform trained tasks on the job. Pers. Psychol. 1992, 45, 511–527. [Google Scholar] [CrossRef]

- Kotsantonis, S.; Pinney, C.; Serafeim, G. ESG integration in investment management: Myths and realities. J. Appl. Corp. Financ. 2016, 28, 10–16. [Google Scholar]

- Khan, M.A. ESG disclosure and firm performance: A bibliometric and meta analysis. Res. Int. Bus. Financ. 2022, 61, 101668. [Google Scholar] [CrossRef]

- Behl, A.; Kumari, P.R.; Makhija, H.; Sharma, D. Exploring the relationship of ESG score and firm value using cross-lagged panel analyses: Case of the Indian energy sector. Ann. Oper. Res. 2022, 313, 231–256. [Google Scholar] [CrossRef]

- Akbar, M.; Akbar, A.; Maresova, P.; Yang, M.; Arshad, H.M. Unraveling the bankruptcy risk-return paradox across the corporate life cycle. Sustainability 2020, 12, 3547. [Google Scholar] [CrossRef]

- Wang, Z.; Akbar, M.; Akbar, A. The interplay between working capital management and a firm’s financial performance across the corporate life cycle. Sustainability 2020, 12, 1661. [Google Scholar] [CrossRef]

| Variable | Mean | Std. Dev | Minimum | Maximum | 95% Confidence Interval | |

|---|---|---|---|---|---|---|

| L.EPS | 0.6638 | 1.0425 | −2.3667 | 4.5485 | 0.5644 | 0.7632 |

| L.PE ratio | 0.5547 | 1.2680 | −4.3701 | 4.8793 | 0.4336 | 0.6759 |

| L.ESG | 1.7378 | 0.1325 | 1.2381 | 1.9763 | 1.7252 | 1.7503 |

| L.E | 1.5672 | 0.7015 | 0.0000 | 1.9921 | 1.5063 | 1.6281 |

| L.S | 1.2822 | 0.8556 | 0.0000 | 1.9936 | 1.2079 | 1.3565 |

| L.G | 0.8917 | 0.8881 | 0.0000 | 1.9914 | 0.8146 | 0.9689 |

| L.SIZE | 10.7626 | 2.4440 | 6.5989 | 19.5251 | 10.5468 | 10.9785 |

| L.NPM | −1.1225 | 0.4887 | −3.3403 | −0.0908 | −1.1686 | −1.0764 |

| L.FS | 0.0828 | 0.1806 | −0.1228 | 1.3281 | 0.0669 | 0.0987 |

| L.LEV | −0.9305 | 0.6725 | −5.2436 | −0.1381 | −0.9932 | −0.8678 |

| Variable | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | L.EPS | 1.00 | |||||||||

| 2 | L.PE ratio | −0.63 | 1.00 | ||||||||

| 3 | L.ESG | −0.07 | 0.08 | 1.00 | |||||||

| 4 | L.E | 0.12 | −0.06 | 0.48 | 1.00 | ||||||

| 5 | L.S | 0.07 | −0.08 | 0.12 | 0.67 | 1.00 | |||||

| 6 | L.G | −0.03 | 0.01 | 0.02 | 0.44 | 0.65 | 1.00 | ||||

| 7 | L.SIZE | 0.20 | 0.33 | −0.05 | 0.11 | 0.00 | −0.09 | 1.00 | |||

| 8 | L.NPM | 0.29 | −0.38 | −0.17 | 0.04 | 0.03 | −0.01 | −0.13 | 1.00 | ||

| 9 | L.FS | −0.07 | 0.27 | 0.07 | 0.05 | 0.00 | 0.00 | 0.07 | 0.27 | 1.00 | |

| 10 | L.LEV | −0.18 | −0.05 | −0.07 | 0.01 | −0.04 | −0.10 | −0.24 | 0.03 | −0.32 | 1.00 |

| Expected Sign | EPS | EPS | |

|---|---|---|---|

| L.ESG | + | 0.2380 *** | |

| (2.70) | |||

| L.E | + | 0.0121 | |

| (0.55) | |||

| L.S | + | 0.0273 * | |

| (1.83) | |||

| L.G | + | 0.0260 | |

| (0.94) | |||

| L.SIZE | + ? | −0.045 *** | −0.0173 |

| (−3.16) | (−1.23) | ||

| L.NPM | + | 1.003 *** | 1.0030 *** |

| (28.12) | (33.07) | ||

| L.FS | + ? | −0.0368 | −0.6060 * |

| (−0.13) | (−2.51) | ||

| L.LEV | − | −0.0118 | −0.0148 |

| (−0.51) | (−0.69) | ||

| Constant | 1.945 *** | 1.9900 *** | |

| (8.77) | (13.13) | ||

| R-Square | 0.7736 | 0.7908 | |

| F-Statistics | 0.0000 | 0.0000 | |

| Hausman Prob > Chi2 | 0.0000 | 0.0000 |

| Expected Sign | PE Ratio | PE Ratio | |

|---|---|---|---|

| L.ESG | + | 0.3930 ** | |

| (2.40) | |||

| L.E | + | −0.0207 | |

| (−0.58) | |||

| L.S | + | 0.1230 *** | |

| (5.13) | |||

| L.G | + | 0.0904 ** | |

| (2.04) | |||

| L.SIZE | + | 0.343 *** | 0.335 *** |

| (13.10) | (14.83) | ||

| L.NPM | + ? | −1.0270 *** | −0.988 *** |

| (−15.74) | (−20.31) | ||

| L.FS | + | 0.4800 | 0.3420 |

| (0.91) | (0.88) | ||

| L.LEV | − | −0.0573 | −0.072 ** |

| (−1.34) | (−2.10) | ||

| Constant | −3.789 *** | −4.175 *** | |

| (−9.26) | (−17.16) | ||

| R-Square | 0.6325 | 0.6969 | |

| F-Statistics | 0.0000 | 0.0000 | |

| Hausman Prob > Chi2 | 0.0000 | 0.0000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kong, L.; Akbar, M.; Poulova, P. The Role of Environment, Social, and Governance Performance in Shaping Corporate Current and Future Value: The Case of Global Tech Leaders. Sustainability 2023, 15, 13114. https://doi.org/10.3390/su151713114

Kong L, Akbar M, Poulova P. The Role of Environment, Social, and Governance Performance in Shaping Corporate Current and Future Value: The Case of Global Tech Leaders. Sustainability. 2023; 15(17):13114. https://doi.org/10.3390/su151713114

Chicago/Turabian StyleKong, Lingfu, Minhas Akbar, and Petra Poulova. 2023. "The Role of Environment, Social, and Governance Performance in Shaping Corporate Current and Future Value: The Case of Global Tech Leaders" Sustainability 15, no. 17: 13114. https://doi.org/10.3390/su151713114

APA StyleKong, L., Akbar, M., & Poulova, P. (2023). The Role of Environment, Social, and Governance Performance in Shaping Corporate Current and Future Value: The Case of Global Tech Leaders. Sustainability, 15(17), 13114. https://doi.org/10.3390/su151713114