Abstract

How does the asymmetrical adoption of advanced communication technology affect economic and social sustainability? We examined the impact of Industry 4.0 on these two pillars of sustainability, focusing on the productivity divide arising from the asymmetric adoption of advanced technologies. We used a theoretical, general equilibrium model to describe a population within a knowledge economy with complete markets who gets exposed to a generally available advanced technology. Our main assumption was that only the more-knowledgeable individuals are able to adopt or fully benefit from the technology, leaving the unskilled ones behind. We demonstrate that this asymmetry prevents the property of positive sorting to apply, leading to a failure to sustain an equilibrium. The divide between knowledgeable and less-skilled individuals poses challenges for workers situated around the boundary, who face penalties in terms of employability and cost-effectiveness. Bridging this skill gap is crucial for inclusive growth. Policy recommendations include retraining programs, accessible education, and targeted policies promoting technology diffusion. As a possible extension, the model could be adapted to analyze collective bargaining agreements.

1. Introduction

The Fourth Industrial Revolution, or Industry 4.0, has ushered in an era of unprecedented technological change and innovation, which has significantly impacted the global economy with far-reaching implications for firms, workers, and society as a whole. However, these changes are not without their challenges for economic, social, and environmental sustainability. In this article, we address the following question: How does the asymmetrical adoption of advanced communication technology, favoring individuals with higher knowledge and skills, impact sustainability? We argue that, when technology leverages workers’ knowledge in uneven ways, it may generate a severe market failure that undermines the prospects of achieving economic and social well-being. Identifying the root cause of the market failure is essential for informing policy interventions that aim to achieve an enduring state of equilibrium, encompassing both economic and social aspects.

The concept of sustainability has been widely discussed in various fields of study [1], but most of the attention has been given to the environmental aspect and the efficient allocation of scarce resources. In this article, we focus on a scenario where the environmental dimension is not a binding constraint. This allows us to isolate the effects of a new potential issue on the economic and social dimensions of sustainability. We can define socio-economic sustainability as the practice of using resources in a way that ensures long-term and stable growth without increasing inequalities across society.

Technological innovations are often considered to be the main driver of economic growth [2,3] and a key ingredient for sustainable production processes [4,5]. Moreover, knowledge is sometimes seen as an imperishable asset that can be the fuel of unlimited growth for humanity and a crucial factor in preventing stagnation [6]. However, we show that, if technology affects knowledge unequally across the population, favoring those who have a higher endowment, the market might fail to achieve an efficient allocation of its workers. In fact, when the technology adoption gap between adopters and non-adopters is too large, the market cannot determine a fair wage for the intermediate workers. These workers would be overpriced for their productivity, and firms would prefer to replace them with combinations of low-skilled, inexpensive labor and high-skilled, expensive labor. Under such conditions, a competitive equilibrium cannot exist because, by definition, an equilibrium requires market clearing.

Although our work is based on abstract theoretical deductions, it resonates with practical instances where mid-level workers are hurt by persistent flows of innovations. Agriculture, for example, has embraced precision technology, including satellite imagery, drones, and sensor-equipped machinery, to optimize planting, irrigation, and crop management. Skilled farmers can leverage these tools to enhance productivity. However, those with intermediate technical skills might struggle to fully embrace precision agriculture, affecting their ability to remain competitive. Conversely, agricultural practitioners with minimal technical expertise primarily engaged in small-scale, subsistence farming employing traditional methods tend not to be affected by innovations. Because their practices are simple and focus on growing basic crops for local consumption, they are not heavily reliant on advanced tools. Hence, the lack of technical expertise does not hinder their ability to continue farming as usual.

In the financial technology sector, professionals skilled in programming and finance can develop and implement intricate trading strategies and investment algorithms, giving them a competitive edge. On the contrary, those with intermediate skills might not possess the expertise required to create and use such advanced opportunities. However, individuals with minimal technical knowledge might not be directly engaged in these advanced financial technology activities, dealing with more-traditional aspects of finance, such as teller services or basic transactions, making them less susceptible to disruptions caused by technological advancements.

In the realm of digital design and 3D printing, highly skilled designers proficient in Computer-Aided Design (CAD) and 3D modeling can bring sophisticated ideas to life. However, individuals with intermediate technical skills might find it challenging to keep up with the evolving design software and techniques, struggling to produce designs of a comparable level. On the other hand, individuals with minimal technical knowledge might not be affected as they are less reliant on such tools to begin with, often focusing on more-traditional handcrafted artwork.

To the best of our knowledge, this article is the first to model the economic implications of the asymmetrical adoption of technological innovations based on individual skill levels. While existing economic models often concentrate on technology diffusion across entire markets or uneven adoption across nations and firms [7], we consider this aspect of Industry 4.0 to be highly relevant for future research.

To properly define Industry 4.0, one needs to understand the previous stages through which industry evolved in the past two centuries. The First Industrial Revolution harnessed steam to power machinery in factories. The Second Industrial Revolution was characterized by the use of electricity to enable mass production. On the other hand, Industry 3.0 employed electronics to automate production. By Industry 4.0, people refer to the digital revolution that started in the middle of the 20th Century and was marked by greater integration of information and communication into automated production processes [8]. We posit that the evolution of the industry has been accompanied over time by a greater knowledge divide in the ability to adopt the new dominant technology.

This article focuses on a specific aspect of Industry 4.0, the knowledge economy, which refers to a system that relies mainly on knowledge-intensive activities that foster rapid technological and scientific progress. The main elements of a knowledge economy include: a higher dependence on intangible assets, human capital, information and communication technology, knowledge sharing and collaboration, research and development, and creativity, along with efforts to incorporate improvements in every stage of the production process [9,10,11,12].

The implications of the knowledge economy on economic and social sustainability are profound. As this system centers on knowledge-intensive activities and intellectual capabilities, it encourages innovation, technological advancement, and scientific progress, leading to increased productivity and efficiency in various sectors. This heightened efficiency could translate into economic growth and competitiveness on a global scale, as long as individuals are equipped with the skills to adopt the new paradigm effectively. Since these economies rely on intangible assets, such as human capital and intellectual property, societies’ objective should be to encourage investment in education, research, and development, which ultimately contribute to the continuous improvement in well-being. Access to knowledge and information becomes a critical driver for sustainability.

A seminal literature [13,14,15] has explored how technology influences the distribution of workforce skills, the knowledge transfer within and across organizational levels, and the characteristics of work itself. These studies have derived important implications for social wealth and inequality. In this context, knowledge is a crucial factor of growth that could foster sustainable development if managed appropriately. In contrast to these models, which emphasize the distributional properties in the state of equilibrium, we show that a slight asymmetry in the impact of technology can induce market failure.

More generally, the impact of Industry 4.0 on social sustainability outcomes (such as working conditions, working hours, skills, health, and safety) has been mixed [16]. On the one hand, new technologies can enhance working conditions by automating hazardous or monotonous tasks. On the other hand, there are also worries about job loss [17] and the need for workers to acquire new skills to adapt to technological changes [18,19]. However, we demonstrate that asymmetrical technology adoption threatens sustainable growth even when technology does not displace workers, but only complements their activities.

A seminal study on technological diffusion [20] warns that, in order to maintain the well-being of any social system, it is essential to recognize its complexity and to uphold certain structural qualities, regardless of the changes brought by technological innovations. However, some examples show that technological diffusion can have negative impacts on the social system if it is not well adapted. For example, the Skolt Lapps, a reindeer herder tribe in Finland, faced a social collapse within five years of adopting ski-mobiles, resulting in debt, unemployment, and dependency on government programs [21]. Similarly, the Yir Yoront, an Australian aboriginal group, experienced social chaos after they switched from stone-axes to the most-efficient steel-axes, leading to family disintegration and prostitution [22]. These cases illustrate the challenges and risks of technological diffusion for different social groups. The initial adopters of an innovation play a crucial role in shaping the adaptation process of the social system. Some authors [20] argued that failures often occur when the new technology is first introduced to the socio-economic elites and that more-equitable outcomes would be achieved if the less-educated individuals had the opportunity to catch up first.

One of the challenges of sustainable growth is to ensure that technological innovations are accessible and beneficial to all segments of society. However, technological innovations tend to be understood and utilized more effectively by individuals with higher levels of knowledge and expertise. Those who lack the necessary knowledge and capabilities to access, understand, and apply these innovations might fail to adopt them and benefit from them. For instance, electronic spreadsheets have been a revolutionary tool for employees since their introduction. However, most users do not take advantage of their most-advanced features, such as macros or power-queries. These tools are typically used only by people who have received specific training. This might create an asymmetry that increases the gap between the skilled advantaged and the skilled disadvantaged when certain technology innovations can only be adopted by people who are already more knowledgeable. With its high degree of cutting-edge developments, Industry 4.0 could contribute to creating a vicious cycle of inequality and exclusion, as those who are already more knowledgeable can take advantage of technology innovations to enhance their productivity, income, and well-being, while those who are comparatively less knowledgeable are left behind or even harmed by the negative impacts of technology innovations.

Therefore, it is essential for sustainable growth to address the knowledge asymmetry and ensure that technological innovations are accessible, affordable, appropriate, and adaptable to the needs and preferences of diverse groups of people. This requires a collaborative and participatory approach that involves multiple stakeholders in the co-creation and diffusion of technological innovations.

This article is organized as follows. Section 2 presents a literature review. In Section 3, we introduce the basic model with a novel approach to solving for the equilibrium wages. In Section 4, we modify the model to induce a simple asymmetry in the adoption of the technological innovation. In Section 5, we discuss our results and the limitations of the model. Finally, in Section 6, we present our conclusions.

2. Literature Review

The literature on Industry 4.0 [23,24] has identified a significant leap from the previous industrial stages. The new paradigm of production embraces automation and data exchange in a more-comprehensive and -interconnected manner [25,26]. At its core, Industry 4.0 leverages cyber systems, the Internet of Things, industrial design, cloud computing, and artificial intelligence to create a dynamic and highly automated industrial ecosystem [27,28]. This integration of technologies enables immediate communication and cooperation between machines, processes, and humans, leading to unprecedented levels of efficiency, productivity, and adaptability [29,30]. Industry 4.0’s incorporation of advanced technologies plays a crucial role in shaping the current world economic landscape. By harnessing the power of data analytics and real-time information exchange, businesses can optimize their operations and reduce production costs, promoting growth and overall sustainability [31,32].

According to [1], overall sustainability is represented by the intersection of three dimensions, which are the social, economic, and environmental pillars of sustainability.

A large literature has emphasized the third aspect, with some authors proposing an approach to place environmental sustainability considerations at the center of product design [4]. Recent studies argued that the impact of Industry 4.0 on economic and social sustainability is characterized by a temporal sequence, with the initial economics favoring later socio-environmental improvements [33]. The successful implementation of Industry 4.0 hinges on identifying and capitalizing on strategic, operational, and environmental opportunities while addressing challenges related to competitiveness and organizational fit [34]. Furthermore, considering different company characteristics and tailoring Industry 4.0 initiatives accordingly can enhance the positive impact on both the economic and social dimensions of sustainability [35]. However, more efforts are needed to strengthen the association between Industry 4.0 and environmental sustainability, highlighting the need for ongoing research and targeted interventions to fully harness the potential of Industry 4.0 for sustainable development.

On the other hand, social sustainability involves ensuring that all individuals’ basic needs are met and that they are provided with equal opportunities to improve their conditions [36]. Finally, economic sustainability can be informally defined as the ability to maintain a level of economic activity that does not compromise the well-being of future generations or degrade the natural and financial resources that support it [37]. This definition does not address several issues, such as inequality or unemployment, that are relevant for the social pillar.

As we navigate the complex challenges for promoting overall sustainability, it is imperative to address the interplay between economic and social sustainability because inequality can cause market failures, which pose a serious challenge to both the efficiency of the economic system and the stability of society [38]. Concerns about the sustainability of knowledge economies have been voiced recently by [39], who documented unexpected lower growth and higher material footprint consumption than in standard economies.

The presence of asymmetrical technological adoption caused by differential skill levels has not received much attention so far in the literature. The knowledge gap literature [40] focuses on knowledge divides caused by education and mass media information, with seminal studies suggesting that technology adoption is a complex, social process where perceptions of technology influence adoption choices [41]. Economic general equilibrium models of technological adoption tend to relate the choice of adoption with its cost [42]. In our model, technology is freely available, such as access to the Internet, information, and digital media, but people differ in their ability to learn how to use it.

A recent study [43] used as an input of their analysis similar non-convexities of the wage function that our model generates endogenously. Within a monopsony setting analyzed through mechanism design, they argued that unemployment is the consequence of non-convexities and that minimum wages could help restore market efficiency.

There is a rich literature on macro, micro, and labor economics about the determinants of sorting between workers and firms [44,45,46], providing a full characterization of general properties for positive or negative sorting [47]. Within this family, we used the knowledge economy models mentioned above.

3. The Basic Model

The methodology that we employed is deductive and theoretical. We describe an economy with heterogeneous agents who can benefit differently from the introduction of a new technology. Because the asymmetries in the economy are central to our results, we need a model where this heterogeneity drives the emergence of the production economy and determines all income functions. For this reason, we adopted the framework of the knowledge economy [13,14,15] to describe an economy where the main resource is knowledge, which refers to the ability to solve problems of various levels of difficulty in this context. In this section, we introduce the basic model. Our formulation differs from the literature presented above in that we explicitly assumed the presence of complete markets and analytically solved for the wage function. In the next section, we introduce asymmetries in technology adoption and demonstrate how the equilibrium of the economy fails.

We considered a population of workers who only differ in their knowledge levels, labeled as . For simplicity, we assumed that the population distribution of k is uniform. This simplification allowed us to obtain clear analytical solutions. Workers face problems that have different difficulty levels, defined by the uniformly distributed random variable with . Although it is not necessary, we assumed that there are always problems in excess of human ability to solve them. Finally, in order to avoid confusion, we labeled the cumulative distribution of k as F and the one of d as G. As explained earlier, both are uniform.

Each agent receives one problem per period. The agents can solve the problem if their knowledge level is equal to or higher than the difficulty level. For example, an agent with knowledge k can solve all problems with , but not harder ones. The agent can pass unsolvable problems to more-knowledgeable and -specialized agents in the organizational hierarchy. This process resembles several productive structures in modern economies. For example, less-experienced employees handle routine tasks, which are easy, but also tedious and time-consuming, while managers deal with the most-difficult problems. The organization should optimize the use of its workers’ time by assigning problems across its layers efficiently. The time of the agents is the most-valuable resource in this model economy. We assumed that each person is endowed with one unit of time and that each worker in the lowest layer of the firm can only handle one problem per day. The workers do not know the difficulty of each task in advance, so they have to attempt to solve it before asking for help. More formally, a worker with knowledge k can solve the random variable d with probability or pass the problem with remaining probability .

We ignored the time it takes to complete or solve a task. However, communications take time and are especially expensive for managers, who have to coordinate and support the activities of all their subordinates. Let be the time-cost of each communication between a manager and one of his/her subordinates. This means that, every time a worker needs help from a manager, the manager has to spend some time assisting with the problem, and this happens with probability .

The steps that we take throughout this section are the following. First, we derived the production function from the micro-foundation of the production process, which depends on the skills of the participants. We show that this production function exhibits skill complementarity, implying positive assortative matching in the economy. This means that there is a marginal agent who is indifferent between being a worker or a manager, and the rest of the agents are divided accordingly. Second, we solved the firm’s problem. A manager has to take into account the production function and the wage schedule to select the optimal workers to hire. This problem imposes some restrictions on the wage schedule that are crucial for our results. Third, we imposed market clearing conditions. That is, we ensured that the demand and supply of workers with different skills are equalized. These conditions allowed us to determine all the equilibrium variables and to characterize the equilibrium wage schedule, which we used to confirm that our conjecture of positive sorting is justified.

The key result of the next section will be to prove that positive sorting cannot be sustained when there is asymmetrical technology adoption.

As we demonstrated that workers’ and managers’ skills are complementary, we can apply the positive sorting property [44] and obtain that every manager employs a team of uniformly skilled workers. This result considerably simplifies the analysis and sustains the equilibrium of the model. If a manager leads a team of size n of workers, all with a knowledge level , then we can write the time constraint as

We further simplified the structure of the firms and assumed that individuals are either workers or managers in only two possible layers within any organization. Each firm can have as many workers as it can manage, but we assumed that there is only one top manager per organization, its CEO. The model could include multiple endogenous layers, but this is not necessary. The qualitative results do not change. However, the technical difficulties would increase significantly, making the results harder to understand.

The output of each firm depends on the quantity and quality of the tasks that it can solve. This is given by the problems cracked directly by the workers and by the ones that they could not decode, but that their manager could. If a firm employs n workers with ability and a manager with ability , where , then the total output is

The managers’ ability is the key factor of this economy’s output, but their output can be enhanced by the number of subordinates that work under them. Because their time is limited, managers would benefit from more skilled employees. More knowledgeable subordinates can solve a larger proportion of tasks at the lower level of the hierarchy, so that fewer tasks need to be escalated to the manager, saving precious time in the process. This effect is reflected in the time constraint equation, which shows the maximum size of a team with knowledge :

If we plug this result into the production function, we obtain

Proposition 1.

There is positive complementarity between and .

To prove this, we computed the cross partial derivative and verified that it is positive. This means that being paired with an agent with higher skill reinforces one’s own marginal productivity. Complementarity justifies the application of the positive sorting property of Becker [44], which implies that there is a one-to-one mapping between workers and managers in equilibrium, so that higher-ability workers are employed by higher-ability managers. Thanks to complementarity, in fact, an economy that pairs the best with the best and the worst with the worst is more productive than any other economy (notice that the case of negative complementarity, or substitution, would imply the opposite outcome, namely that of negative sorting.). To apply this property, we must ask the wage function to be convex. If that was not the case, the firms’ profit functions might fail to be concave and to deliver a unique optimum. Convexity in the wage function plays a crucial role in incentivizing positive sorting. Without convexity, there are no inherent increasing returns to knowledge, and individuals with higher ability may not receive higher wages relative to those with lower abilities, weakening the incentives for positive sorting to occur.

Assumption 1.

The parameter restriction of Assumption 1 simplifies the analysis and guarantees the convexity of the wage function. Notice that we could extend the range of h to fall below , but we would need to add further restrictions on a. For illustrative purposes, we ignored this case. We show in the next section that this condition does not hold when realistic market asymmetries are introduced, resulting in a market failure that prevents the equilibrium from being maintained.

In general equilibrium models, we can normalize one of the prices by choosing a good as the numeraire. Since we are interested in the wage distribution, we set the price of the output of the production function to 1. This output is homogeneous across firms; only their quantity varies. We use to denote the wage of a worker with ability k. Let the profit of a firm with a manager of ability and employees with knowledge be

Definition 1.

The equilibrium of the model is:

- A set of workers and a set of managers ;

- A wage function ;

- An assignment function that matches each worker with one manager .

This is such that:

- 1.

- Each person chooses the occupation (worker or manager) that maximizes income;

- 2.

- Each manager optimally chooses the skill level and the number of workers to maximize the company’s profit;

- 3.

- The labor market clears. The mass of workers employed in each measurable interval equates to the supply.

In the competitive equilibrium that we are considering, firms must take prices and wages as given. Managers can only optimize the firm’s profit by selecting the quality k of their subordinates. Thus, the problem of a firm with a manager of ability is:

The FOC produces an ordinary differential equation:

Our methodology differs from the one of the literature introduced above [13,14,15], as we address directly the differential equation and provide a closed-form solution to it. This type of equation takes the name of Clairaut’s Equation in Mathematics, and it possesses an analytical solution. If we assume that markets are complete, then Equation (8) must hold for every and k. This implies that a manager must be able to compare potential wages that each candidate worker would receive if employed. The opposite would mean that wages exist only for optimal matches: however, there is no reason to believe that agents know what the optimal match would be before observing the wages. Market completeness is the most-commonly adopted assumption in general equilibrium models. If we accept this, then the differential equation has a simple solution.

Theorem 1.

If markets are complete, the equilibrium wage function for a worker of knowledge k, employed by a manager of ability, must be

where is the wage assigned to workers of ability zero. Notice that, if , then the wage function is increasing in ability.

Proof of Theorem 1.

We collect common terms on each side and rewrite Equation (8) as

Both sides can be expressed as derivatives of logarithmic forms:

Changing sign and integrating from zero to k give

After removing the logarithms and with a bit of algebra, we obtain Equation (9). □

Unlike the literature, our solution does not impose specific functional restrictions. Therefore, our result is more general and robust. Note that the wage function is independent of the communication costs, h. However, these costs affect the sorting of workers and the size of the firms, as we illustrate next. By plugging the wage function back into the profit, we obtain a useful simplification. The next equation represents the expression for the equilibrium profit after we introduce the equilibrium wage function:

To close the model, we need to ensure that the matching function correctly equates demand and supply for workers, so that there is no unemployment. If we consider a worker of ability , denotes the optimal manager that is assigned to . That is, . Because of positive sorting, this assignment function is increasing: more-skilled workers are employed by more-skilled managers. Therefore, there must exist a marginal agent, , who is indifferent between working and being a manager: this agent is the best worker available in the market, or the least skilled manager who still operates a company. Then, every agent for which is going to be a manager (worker). In equilibrium, the demand for the mass of workers in a neighborhood of (this demand is represented by the number of workers employed, ) must equate to its supply (defined by the distribution of knowledge). Following the literature [13,14,15], the market-clearing condition can be written as

The left-hand side represents the demand for workers and the right-hand side their supply. If the equality between the two sides holds for every k in the interval, then their derivatives must also be equal. Therefore, a necessary condition for the market to clear is

which simplifies to , or

with boundary conditions and (notice that the most-skilled worker has ability 1, which is lower than the most-difficult task, a). The least-skilled worker is assigned to the least-skilled manager. Similar reasoning holds for the best-skilled worker and the best-skilled manager. Integrating Equation (16) from zero to any k allows us to identify the identify of the manager optimally matched with k:

Using the boundary conditions and , it is possible to solve for the marginal agent:

We need to define the payoff functions of managers and workers to complete the equilibrium of the model. This ensures that individuals choose their occupations based on their monetary incentives. Individuals have linear utilities and aim to maximize their income. They will select the occupation that gives them the highest income. We used a modified version of the Roy model [48] to model this choice. An individual with ability k can choose either of these two options: (1) be a worker and earn ; (2) be a manager and obtain the profit . In equilibrium, agents with the lowest ability must choose to work as employees at firms for a fixed salary. Conversely, agents with a high ability must prefer to become managers and earn rents that exceed the salaries they would receive as employees. At the threshold , the two types of jobs are equally attractive. Therefore, two conditions must hold at :

and

The first condition ensures that the agent at the margin is equally satisfied with either occupation. The second one prevents agents from a left (right) neighborhood of from self-selecting into managerial (subordinate) positions, which would violate the equilibrium. For example, if we consider a left neighborhood of , a violation of this inequality means that agents in this range could make more profits as managers than the wages they would obtain as employees. This would disrupt the equilibrium assignment. Note that this step relies on the implicit assumption of complete markets, which supports our approach.

If we solve Equation (19), , we obtain

Comparing this with the previous expression for from Equation (25) gives the baseline wage that sustains the equilibrium:

Notice that this is a novel feature of our model, which we can easily rationalize. Even workers with no skills can contribute to the knowledge economy by processing problems for their superiors, which helps them work more efficiently.

To verify that Inequality (20) is satisfied, one can take the derivatives of the wage and profit functions at :

It is easy to see that the inequality is satisfied whenever and .

Finally, we can check that the wage function is convex. After we plug into the wage equation the expressions for and , we take a second derivative and obtain

For this value to be positive at any , we impose the conservative restriction that . This means that

which holds under the conditions specified by Assumption 1. This convexity implies that there are increasing returns to skills.

Once the equilibrium is characterized, it is possible to examine how the main variables respond to changes in the exogenous parameters, such as h. In this article, we addressed a different problem, which we present in the next section.

4. Asymmetric Technological Adoption

We now turn to the main aim of our study, which is to examine the economic implications of introducing an innovation in information technology or in AI that could have a significant impact on the production process. This is a well-known topic in economics, but in this article, we explored what happens if technology requires a high level of skills that only a fraction of the population possesses. To benefit from AI and increase personal productivity, it is necessary to have advanced skills. In this scenario, the technology creates a gap in the distribution of knowledge, exacerbating skill inequality in the population.

We considered a scenario where only the people with knowledge level k above a certain threshold , with , can use the technology; hence, their base ability is enhanced. Conversely, lower-skilled workers cannot use the technology and their production remains unchanged. Specifically, any agent with knowledge can operate as if having an effective knowledge of

This formula implies that the effective knowledge is scaled such that: (i) worker has her/his ability unaffected; (ii) worker expands her/his knowledge to ; (iii) any value in between is simply stretched in a uniform way so that the mass of high-skilled agents is constant and equal to .

If we uniformly stretch the ability of workers in the interval to the new interval , then the new probability distribution of talent is obtained computing the area below the density, from 0 to any point k.

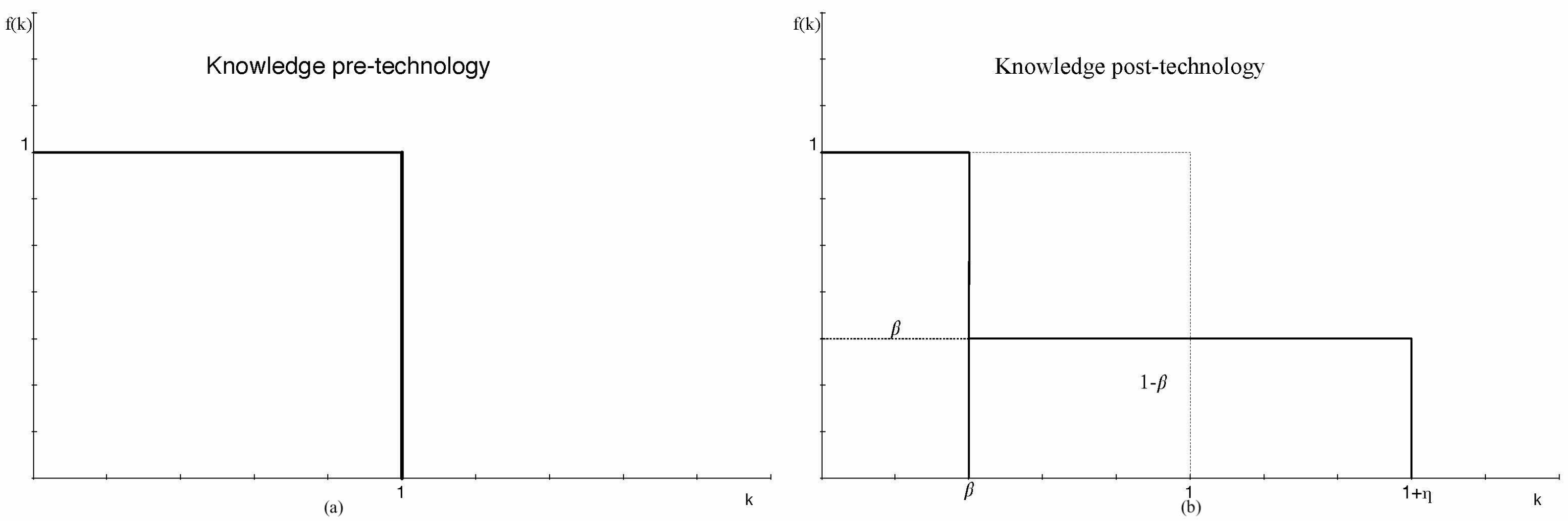

Figure 1 shows that the distribution has a piecewise uniform shape. To show that unequal technology adoption can lead to market failure, we do not need to repeat the whole model. We only need to show that the wage function is not convex near the point of asymmetry. For this, we used the assignment function to calculate the wage.

Figure 1.

Density of knowledge before (a) and after (b) asymmetric technological change. The workers with ability above have mass equal to . These workers are stretched over a larger interval: .

4.1. Assignment Function

The assignment of workers to managers must preserve the equality of demand and supply in any measurable interval, that is Equation (15) must still hold, although the distribution F is now different. Notice that, because we ask for to be sufficiently low, and .

To obtain from its derivative, we integrate separately the two components and then impose continuity at the critical point .

where . The parameter K is found by imposing continuity at : . It is possible to see that so that, for , the assignment function is .

Although we did not reproduce all the steps, it would be possible to follow a similar method as in the previous section to compute the marginal agent one we used in the previous section.

4.2. The Wage Function

The FOC of each firm produces the same wage function as in the previous section, which we report here for simplicity. As we saw earlier, it can be proven that is a constant.

When technological adoption is asymmetrical, the assignment function forces specifying the wage function for the two relevant intervals:

Notice that, at , , so the wage function is continuous.

The slopes of the wage function can be written as

Theorem 2.

The market fails to sustain the equilibrium with positive sorting.

Proof of Theorem 2.

The proof consists of demonstrating that the wage function is not convex around , invalidating one of the necessary conditions for having an assortative equilibrium. It can be seen that

In fact, after we eliminate the common terms and , the inequality simplifies to

which turns into

because and . The wage function is not convex. □

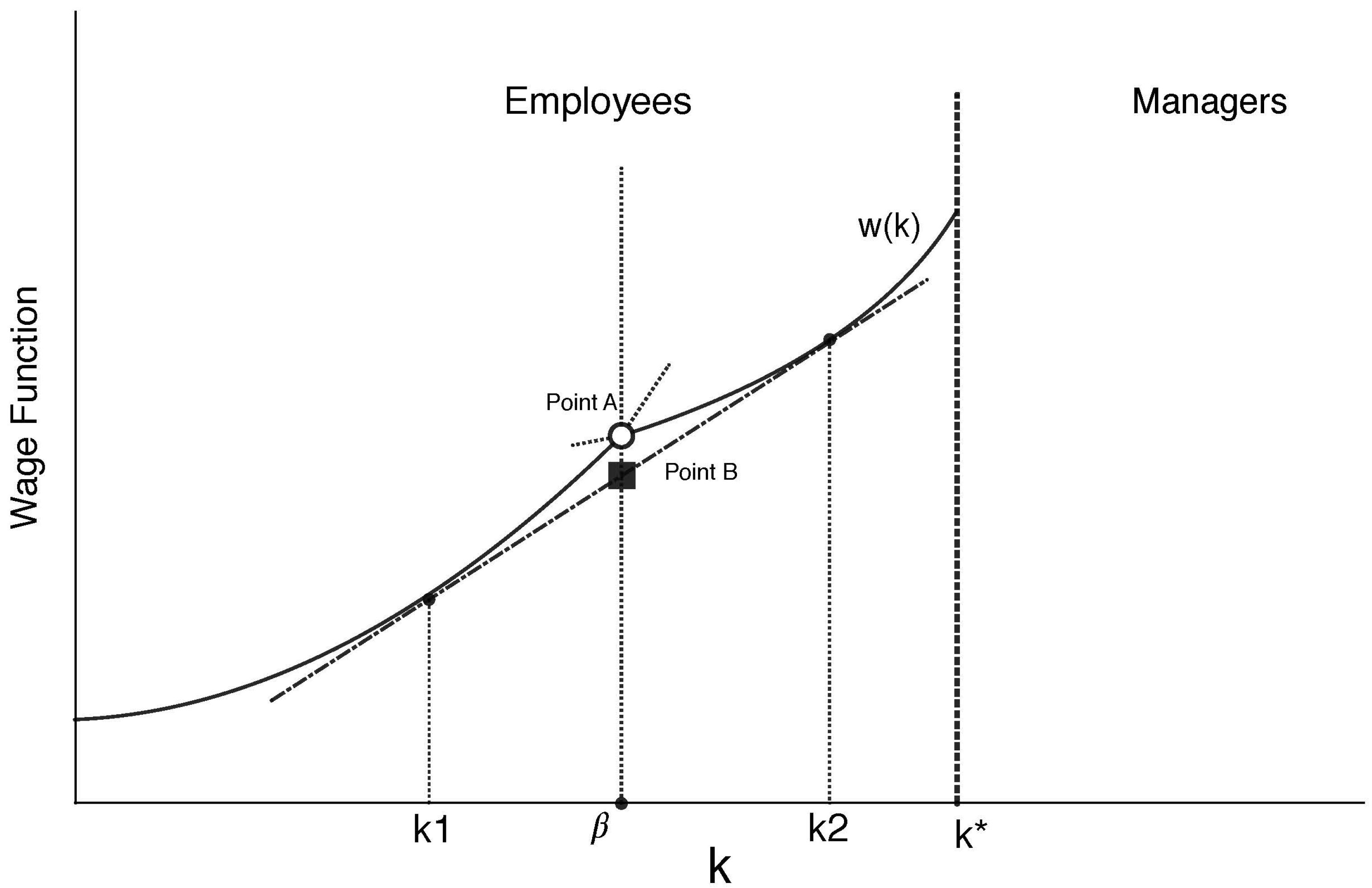

Figure 2 shows the cause of the market failure. In the interval where agents decide to work, there is a non-convexity near . This implies that a firm that wants to hire such workers would prefer a combination of people with knowledge levels and to achieve an optimal average knowledge equal to , but at a lower total wage (Point B in the graph. The coordinates and can be obtained by taking the convex-hull of the wage function.). As a result, all people within the interval cannot find suitable matches and be employed, but this contradicts the requirement for the equilibrium. Such non-convexity of the wage function fails to support the positive sorting property, where one manager is matched with one worker type of increasing skills, leaving part of the population that is caught in the middle mismatched.

Figure 2.

Non-convexity of the wage function and failure of the market equilibrium.

To correct for this inefficiency, the implementation of initiatives aimed at enhancing the competencies of agents within the critical span of becomes imperative. This strategic intervention mitigates abrupt differentials versus neighboring workers. The pursuit of a smoother, but not necessarily equal, income distribution assumes significance as a pivotal objective for socioeconomic policies.

5. Discussion

The advent of Industry 4.0 introduces a range of promising technological advancements with the potential for driving economic growth and improving sustainability. However, it is important to recognize that the adoption of these technologies tends to favor individuals with preexisting knowledge and skills, creating a significant wedge between the knowledgeable and the less-skilled within our society. This knowledge divide in the context of a knowledge economy poses several challenges, particularly for workers situated around the boundary between these two groups, who try to adopt the technology, but do not possess the necessary high skills to justify their high salary.

These workers are penalized by the market, as their skill-to-wage ratio becomes less attractive relative to the combinations of better and worse workers. Consequently, they may experience difficulty in finding employment. This not only hinders their individual prospects, but also has wider repercussions for sustainability as it puts a strain on its economic and social pillars. The growing inequality in the adoption and utilization of technological advancements threatens to exacerbate existing disparities, perpetuating a cycle of disadvantage and impeding societal progress.

The rise of automation in the automotive industry is an interesting example. With the integration of robotics, the assembly lines have gone through a revolutionary transformation. Currently, most car manufacturers have automated their paint and body shops. While this has enhanced productivity and efficiency, it has also led to significant job displacement for workers in middle-skill manufacturing roles. Occupations that were once the core of the industry, such as assembly line workers and machine operators, have gradually been replaced by machines, leaving many with limited employment opportunities. The consequences of this asymmetric technology adoption have not been uniform. A polarization of skills has emerged, with a growing demand for highly skilled workers capable of designing, programming, and maintaining the new technology. Interestingly, low-skilled positions still require human labor for tasks that go beyond the scope of automation. However, individuals with middle-level skills have found themselves trapped, facing fewer job prospects as the roles they once occupied are now automated. To address the consequences of this technological transformation, proactive policies and initiatives are required. Retraining and upskilling programs can enable displaced workers to acquire relevant skills that align with the evolving job market, opening doors to new opportunities. Supportive social policies, such as unemployment benefits and job placement services, can offer a safety net during times of transition, fostering a more-resilient workforce. Embracing collaborative robotics rather than full automation may also provide a pathway for human workers to collaborate with machines effectively.

To the best of our knowledge, this is the first article that focuses on the asymmetrical adoption of technological innovations based on individual skill levels. Most economic models focus on market-wide diffusions of technology or on asymmetrical adoption across different countries. We believe that this feature of modern economies is relevant and should drive future research. We adopted the knowledge economy model of [13,14,15], but we differed from these articles in how we derived the equilibrium wage equation. Instead of assuming and imposing a point solution to Differential Equation (8), we solved it directly by recognizing that it is a form of Clairaut’s Equation. This led to some minor differences in our results compared to those published earlier. Interestingly, we found that our solution simplifies the final results while preserving their realistic interpretability, offering a new paradigm for further research. Regardless of these technical minutiae, our work separates itself from the literature because, rather than focusing on the conditions that maintain the equilibrium, it was aimed at exploring the sources of potential disequilibrium.

We recognize that this study has several limitations. One of them is that our analytical results depend on the assumption that the workers’ skills follow a uniform distribution. This assumption allowed us to obtain non-linear relations that qualitatively match real-world patterns, but we acknowledge that it may not capture the realistic heterogeneity and complexity of the labor market. A possible direction for future research is to explore other types of distributions using numerical methods instead of analytical ones. We believe this path could deliver novel results about earning patterns and inequality. On the other hand, we think that non-uniform distributions would not change our main result. The market failure is caused by the gap between adopters and non-adopters of the technology, which does not depend on the distribution. A second limitation in our model is that it abstracts from the use of more-complex production functions that include capital or different layers of management. While including these features would enrich the model outcomes, we believe they would not affect the fact that technology tends to be adopted by more-skilled individuals.

Another limitation is that our key result is a negative one, in the sense that we only proved that an equilibrium with positive sorting cannot exist under certain conditions. We did not provide a positive characterization of the equilibrium or a comparative statics analysis of how different parameters affect the equilibrium. Moreover, we did not consider any dynamic aspects of the model, such as learning, innovation diffusion, or entry and exit of workers and firms. These are important directions for future research.

Despite these limitations, we believe that our work contributes to the literature on technological innovation and labor market outcomes by highlighting a potential source of market failure in the absence of positive sorting.

This class of models represents a private economy. This assumption implies that impersonal market forces determine the wage freely and that no parties have significant market power to bargain it. However, collective bargaining agreements could alter this scenario. This extension is potentially relevant and deserves a separate article. We should treat the model with mechanism design if only workers had market power. However, it is not obvious that there exists a mechanism that ensures full employment. In our view, mid-workers would face rationing, that is unemployment, as they are still dominated by combinations of slightly better and slightly worse peers.

6. Conclusions

Our research sheds light on the complexities and potential contradictions in the process of technological innovation, specifically within the context of Industry 4.0. While technology has been traditionally welcomed as a driver of economic growth, we have taken a step into analyzing its impact on socio-economic sustainability, which we intend as the process of fostering growth without exacerbating inequalities.

By examining the consequences of the asymmetrical adoption of communication technology, we identified a significant concern. Our theoretical model illustrates how an uneven adoption of technology, where the most-skilled individuals embrace the innovation while the less-skilled ones lag behind, can lead to a critical market failure. This failure produces an inefficient and incomplete allocation of some workers, which could translate into unemployment, hurting the chances of achieving sustainable growth.

Our research underscores the significance of looking beyond the conventional worries of job displacement associated with technology. While job displacement is indeed a concern, the potential market failure resulting from an uneven distribution of technology adoption represents a distinct challenge that requires targeted policy interventions.

To achieve a truly sustainable future in the era of Industry 4.0, it is necessary to ensure that the benefits of technological innovations are accessible and equitable across all segments of society. Policymakers, businesses, and educational institutions must prioritize actions that bridge the knowledge divide. Efforts should be made to ensure that the benefits of Industry 4.0 are accessible to all segments of society, regardless of their existing skills or knowledge, mitigating the negative effects of technological innovation on labor market outcomes. This can be achieved through comprehensive retraining and upskilling programs, accessible educational resources, and targeted policies that provide information and promote the diffusion of technology across various sectors and regions.

Ultimately, by prioritizing efforts to reduce the knowledge gap and facilitate the inclusion of all members of society, we can harness the transformative potential of Industry 4.0 in a way that not only promotes economic growth, but also ensures economic and social sustainability.

Author Contributions

Conceptualization, R.C.V.; methodology, P.M.; formal analysis, P.M. and R.C.V.; writing—original draft preparation, R.C.V.; writing—review and editing, P.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| FOC | First-order conditions |

| CEO | Chief executive officer |

References

- Purvis, B.; Mao, Y.; Robinson, D. Three Pillars of Sustainability: In Search of Conceptual Origins. Sustain. Sci. 2019, 14, 681–695. [Google Scholar] [CrossRef]

- Solow, R.M. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Swan, T.W. Economic Growth and Capital Accumulation. Econ. Rec. 1956, 32, 334–361. [Google Scholar] [CrossRef]

- Romli, A.; Prickett, P.; Setchi, R.; Soe, S. Integrated Eco-Design Decision-Making for Sustainable Product Development. Int. J. Prod. Res. 2015, 53, 549–571. [Google Scholar] [CrossRef]

- Lacasa, E.; Santolaya, J.L.; Biedermann, A. Obtaining Sustainable Production from the Product Design Analysis. J. Clean. Prod. 2016, 139, 706–716. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous Technological Change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Perla, J.; Tonetti, C.; Waugh, M.E. Equilibrium Technology Diffusion, Trade, and Growth. Am. Econ. Rev. 2021, 111, 73–128. [Google Scholar] [CrossRef]

- Schwab, K. The Fourth Industrial Revolution; Currency: New York, NY, USA, 2017. [Google Scholar]

- Powell, W.W.; Snellman, K. The Knowledge Economy. Annu. Rev. Sociol. 2004, 30, 199–220. [Google Scholar] [CrossRef]

- Wang, X.; Xu, Z.; Qin, Y.; Skare, M. Innovation, the Knowledge Economy, and Green Growth: Is Knowledge-Intensive Growth Really Environmentally Friendly? Energy Econ. 2022, 115, 106331. [Google Scholar] [CrossRef]

- Manesh, M.F.; Pellegrini, M.M.; Marzi, G.; Dabic, M. Knowledge Management in the Fourth Industrial Revolution: Mapping the Literature and Scoping Future Avenues. IEEE Trans. Eng. Manag. 2020, 68, 289–300. [Google Scholar] [CrossRef]

- Clauss, T.; Abebe, M.; Tangpong, C.; Hock, M. Strategic Agility, Business Model Innovation, and Firm Performance: An Empirical Investigation. IEEE Trans. Eng. Manag. 2019, 68, 767–784. [Google Scholar] [CrossRef]

- Garicano, L.; Rossi-Hansberg, E. Inequality and the Organization of Knowledge. Am. Econ. Rev. 2004, 94, 197–202. [Google Scholar] [CrossRef]

- Antràs, P.; Garicano, L.; Rossi-Hansberg, E. Offshoring in a Knowledge Economy. Q. J. Econ. 2006, 121, 31–77. [Google Scholar] [CrossRef]

- Garicano, L.; Rossi-Hansberg, E. Organization and Inequality in a Knowledge Economy. Q. J. Econ. 2006, 121, 1383–1435. [Google Scholar] [CrossRef]

- Bajic, B.; Suzic, N.; Moraca, S.; Stefanović, M.; Jovicic, M.; Rikalovic, A. Edge Computing Data Optimization for Smart Quality Management: Industry 5.0 Perspective. Sustainability 2023, 15, 6032. [Google Scholar]

- Autor, D.H. Why Are There Still So Many Jobs? The History and Future of Workplace Automation. J. Econ. Perspect. 2015, 29, 3–30. [Google Scholar] [CrossRef]

- Grace, K.; Salvatier, J.; Dafoe, A.; Zhang, B.; Evans, O. When Will AI Exceed Human Performance? Evidence from AI Experts. J. Artif. Intell. Res. 2018, 62, 729–754. [Google Scholar] [CrossRef]

- Makridakis, S. The Forthcoming Artificial Intelligence (AI) Revolution: Its Impact on Society and Firms. Futures 2017, 90, 46–60. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Simon and Schuster: New York, NY, USA, 2010. [Google Scholar]

- Pelto, P.J. The Snowmobile Revolution: Technology and Social Change in the Arctic; Waveland Press: Long Grove, IL, USA, 1973. [Google Scholar]

- Sharp, L. Steel Axes for Stone-Age Australians. Hum. Organ. 1952, 11, 17–22. [Google Scholar] [CrossRef]

- Chou, S.Y. The Fourth Industrial Revolution. J. Int. Aff. 2018, 72, 107–120. Available online: https://www.jstor.org/stable/26588346 (accessed on 14 August 2023).

- Prisecaru, P. Challenges of the Fourth Industrial Revolution. Knowl. Horizons Econ. 2016, 8, 57. [Google Scholar]

- Xu, M.; David, J.M.; Kim, S.H. The Fourth Industrial Revolution: Opportunities and Challenges. Int. J. Financ. Res. 2018, 9, 90–95. [Google Scholar] [CrossRef]

- Davis, N. What Is the Fourth Industrial Revolution. World Economic Forum. 2016, Volume 19. Available online: https://www.weforum.org/agenda/2016/01/what-is-the-fourth-industrial-revolution/ (accessed on 14 August 2023).

- Bai, C.; Dallasega, P.; Orzes, G.; Sarkis, J. Industry 4.0 Technologies Assessment: A Sustainability Perspective. Int. J. Prod. Econ. 2020, 229, 107776. [Google Scholar] [CrossRef]

- Philbeck, T.; Davis, N. The Fourth Industrial Revolution. J. Int. Aff. 2018, 72, 17–22. [Google Scholar]

- Kamble, S.S.; Gunasekaran, A.; Gawankar, S.A. Sustainable Industry 4.0 Framework: A Systematic Literature Review Identifying the Current Trends and Future Perspectives. Process. Saf. Environ. Prot. 2018, 117, 408–425. [Google Scholar] [CrossRef]

- Culot, G.; Nassimbeni, G.; Orzes, G.; Sartor, M. Behind the Definition of Industry 4.0: Analysis and Open Questions. Int. J. Prod. Econ. 2020, 226, 107617. [Google Scholar] [CrossRef]

- Dalenogare, L.S.; Benitez, G.B.; Ayala, N.F.; Frank, A.G. The Expected Contribution of Industry 4.0 Technologies for Industrial Performance. Int. J. Prod. Econ. 2018, 204, 383–394. [Google Scholar] [CrossRef]

- Contini, G.; Peruzzini, M. Sustainability and Industry 4.0: Definition of a Set of Key Performance Indicators for Manufacturing Companies. Sustainability 2022, 14, 11004. [Google Scholar] [CrossRef]

- Ghobakhloo, M. Industry 4.0, Digitization, and Opportunities for Sustainability. J. Clean. Prod. 2020, 252, 119869. [Google Scholar] [CrossRef]

- Müller, J. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability 2018, 10, 247. [Google Scholar] [CrossRef]

- Brozzi, R. The Advantages of Industry 4.0 Applications for Sustainability: Results from a Sample of Manufacturing Companies. Sustainability 2020, 12, 3647. [Google Scholar] [CrossRef]

- Dempsey, N.; Bramley, G.; Power, S.; Brown, C. The Social Dimension of Sustainable Development: Defining Urban Social Sustainability. Sustain. Dev. 2011, 19, 289–300. [Google Scholar] [CrossRef]

- Jeronen, E. Economic Sustainability. In Encyclopedia of Sustainable Management; Springer International Publishing: Cham, Switzerland, 2020; pp. 1–6. [Google Scholar] [CrossRef]

- Akerlof, G.A. The Market for Lemons. Quality Uncertainty and the Market Mechanism. Q. J. Econ. 1970, 84, 488–500. [Google Scholar] [CrossRef]

- Rezny, L.; White, J.B.; Maresova, P. The Knowledge Economy: Key to Sustainable Development? Struct. Chang. Econ. Dyn. 2019, 51, 291–300. [Google Scholar] [CrossRef]

- Lind, F.; Boomgaarden, H.G. What We Do and Don’t Know: A Meta-Analysis of the Knowledge Gap Hypothesis. Ann. Int. Commun. Assoc. 2019, 43, 210–224. [Google Scholar] [CrossRef]

- Straub, E.T. Understanding Technology Adoption: Theory and Future Directions for Informal Learning. Rev. Educ. Res. 2009, 79, 625–649. [Google Scholar] [CrossRef]

- Shapiro, A. Digital Adoption, Automation, and Labor Markets in Developing Countries. J. Dev. Econ. 2021, 151, 102656. [Google Scholar] [CrossRef]

- Loertscher, S.; Muir, E.V. Wage Dispersion, Involuntary Unemployment and Minimum Wages under Monopsony and Oligopsony; Technical Report, Working Paper. 2022. Available online: https://ellenmuir.net/wp-content/uploads/2022/01/Loertscher.Muir_.WDMWIU-WP-2021.pdf (accessed on 14 August 2023).

- Becker, G.S. A Theory of Marriage: Part I. J. Political Econ. 1973, 81, 813–846. [Google Scholar] [CrossRef]

- Lucas, R.E., Jr. On the Size Distribution of Business Firms. Bell J. Econ. 1978, 9, 508–523. [Google Scholar] [CrossRef]

- Krusell, P.; Ohanian, L.E.; Ríos-Rull, J.V.; Violante, G.L. Capital-Skill Complementarity and Inequality: A Macroeconomic Analysis. Econometrica 2000, 68, 1029–1053. [Google Scholar] [CrossRef]

- Eeckhout, J.; Kircher, P. Assortative Matching with Large Firms. Econometrica 2018, 86, 85–132. [Google Scholar] [CrossRef]

- Roy, A.D. Some Thoughts on the Distribution of Earnings. Oxf. Econ. Pap. 1951, 3, 135–146. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).