1. Introduction

As an important segment of local economic development, industrial parks contain many forms of energy use. There are many types and large quantities of energy used in industrial parks, and there is a wide scope for energy saving. Demand-side response resources are used for multiple types of loads in industrial parks combined with game theory to form a flexible electricity pricing strategy and a suitable pricing strategy. It is of great significance for flexible power consumption, efficient resource allocation, energy saving and carbon reductions in the park.

Demand-side response mechanisms improve the operating efficiency of the electricity market, and enhance the resource allocation efficiency and elasticity of electricity users. Therefore, a series of studies on demand-side response have been conducted by domestic and foreign scholars in recent years. Ref. [

1] aims to quantitatively assess the level of flexibility of a suite of demand–response (DR) programs in a grid with significant wind generation. These metrics allow for the assessment of the impact of these programs on the technical constraints of conventional generation equipment. Applicable guidelines are provided for the design and implementation of suitable demand–response programs for wind-integrated grids from both flexibility and economic perspectives. Ref. [

2] presents a novel linear framework for optimizing demand–response (DR) programs in the grid. Factors such as the location, type and penetration of demand–response programs are considered, and the applicability and effectiveness of the framework is demonstrated through a case study Ref. [

3] examines the effectiveness of demand–response in optimal resource scheduling using multi-objective optimization and consumer fairness principles under renewable generation uncertainty. Ref. [

4] proposes a dynamic pricing strategy for microgrid loads based on the load characteristics of microgrids. Ref. [

5] introduces a priority-based load-shifting demand–response strategy to balance demand and supply with increased renewables. It provides insights into residential load-shifting and curtailments, emphasizing the potential of an automated demand response in residential settings. In Ref. [

6], a combined approach to renewable energy-planning methods and incentives is presented in this paper. The aim is to demonstrate the economic feasibility of hybrid renewable energy systems for professional consumers. In Ref. [

7], a decentralized framework is proposed in this paper for demand response in small or rural decentralized community power systems in order to maintain the continuity of electric services during demand-side events. In Ref. [

8], the proposed model combines the advantages of block bidding and hourly bidding. It solves the optimization problem of the whole market through a distributed iterative algorithm, showing improvements in social welfare and reductions in total generation costs. Ref. [

9] presents a low-carbon economic dispatch model for multi-energy microgrids, utilizing integrated demand–response and multistep carbon trading to minimize operation costs. Through adjusting various loads and implementing carbon trading, the model effectively reduces both costs and emissions. Refs. [

10,

11,

12] determine the electricity price in the electricity market by dynamically adjusting the electricity market for electricity markets with different degrees of flexibility. Ref. [

13] explores demand–response solutions and the factors that influence consumer participation in such programs and aims to bridge the gap between technical studies and practical implementations. Ref. [

14] analyzes the individual characteristics of users, classified users, and recommended pricing plans to guide users’ demand response. Refs. [

15,

16] construct a mathematical model based on time-of-use pricing that reflects the elasticity of electricity consumption by electricity consumers regarding the price of electricity demand. Ref. [

17] examines a grid-connected microgrid with diverse renewable energy sources and evaluates scheduling using incentive-based demand–response techniques. It aims to optimize the generation of scheduling and minimize costs by considering user preferences and exploring various pricing-based techniques for shiftable residential appliances. Most of this literature lacks an integrated approach to consider multiple factors and has limited application. There is a lack of practical guidance, insufficient research on user participation factors, and lack of integrated economic analysis. The further exploration and refinement of these aspects will help promote the development and widespread application of demand–response technologies. An emphasis on practical guidance to promote the practical application of demand–response technology and user participation, an in-depth study of user behavior to motivate users to participate in demand–response programs, and an economic analysis to assess the cost-effectiveness and social welfare of different electricity pricing strategies are the directions and ideas being suggested to solve the current problems.

With the development of the electricity market, the participation of different types of customers has led to a relationship of mutual influence and constraint between different interest players. Game theory has proposed solutions to these problems, and scholars at home and abroad have carried out a series of studies on this. Ref. [

18] explores the Pirate Game, a multi-player variation of the Ultimatum Game, to examine whether human choices differ from Game Theory expectations. Using an online questionnaire, the study discovers that the choice patterns in this context also deviate from Game Theory predictions. In Ref. [

19], a non-cooperative game model with one master and many slaves is constructed. The model combines game theory in the transaction model and a mathematical model of the integrated source system. It greatly improves the utilization of system and user consumption surplus. In Ref. [

20], a two-tier optimization model is developed based on demand-side response combined with coalition games. The same distribute algorithm is used to solve the system, which makes the system much more economical and resilient. In Ref. [

21], the operational characteristics of the integrated energy sub-regional and hierarchical synergy are addressed. The information interaction between regions and between users and energy suppliers is considered. The integrated energy system is collaboratively optimized. Ref. [

22] presents an equilibrium model for electricity retailers, using mean-variance utility theory to account for their risk preferences. Through theoretical analysis and the Levenberg–Marquardt algorithm, the paper investigates the effects of wholesale price uncertainty and risk preferences on bidding strategies and Nash equilibrium outcomes. Game theory has made progress in electricity market research, but still needs to address issues such as deviations from actual behavior, lack of a comprehensive framework, and failure to consider market dynamics and uncertainty.

However, there are several problems with these studies. Most of them propose tariff decisions and pricing schemes by targeting the internal structure of customer loads and using price elasticity matrices, lacking specific studies on the external characteristics of demand-side response. The existing static pricing strategy applied to industrial park pricing is not flexible enough. There has been insufficient study different types of tariff strategies. Their effectiveness, feasibility and impact in the power system have not been fully studied.

This paper proposes three innovative contributions:

- (a)

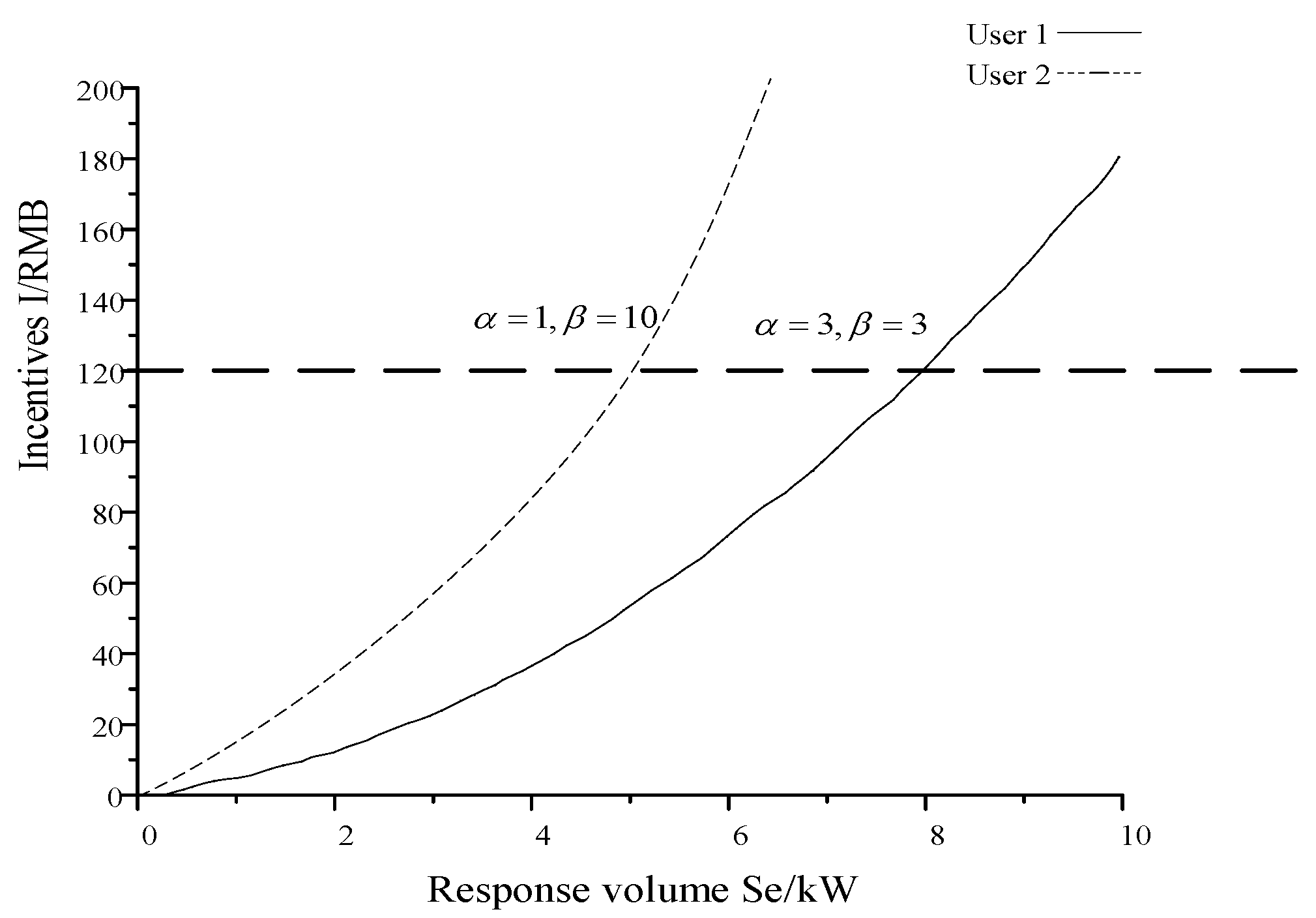

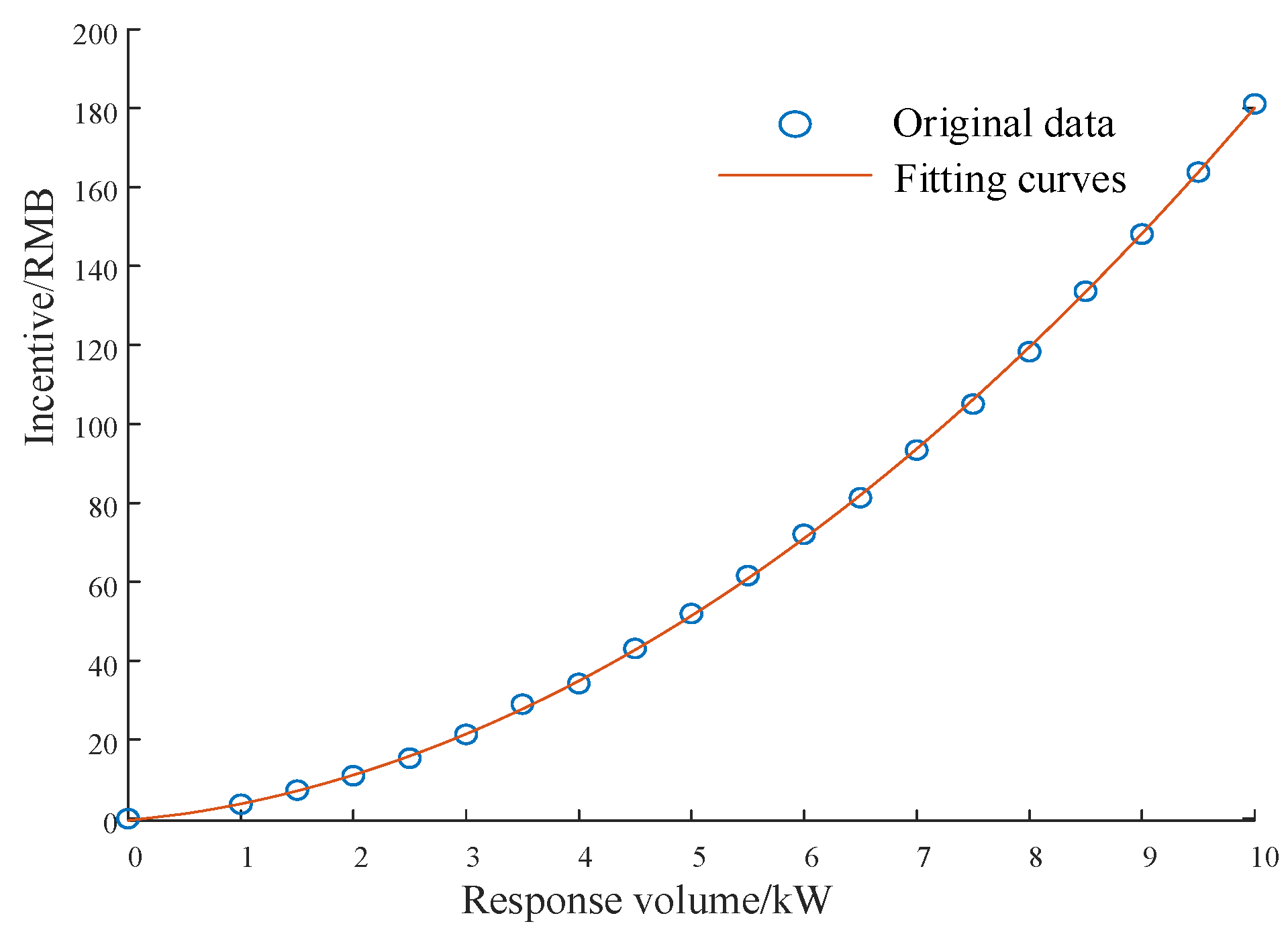

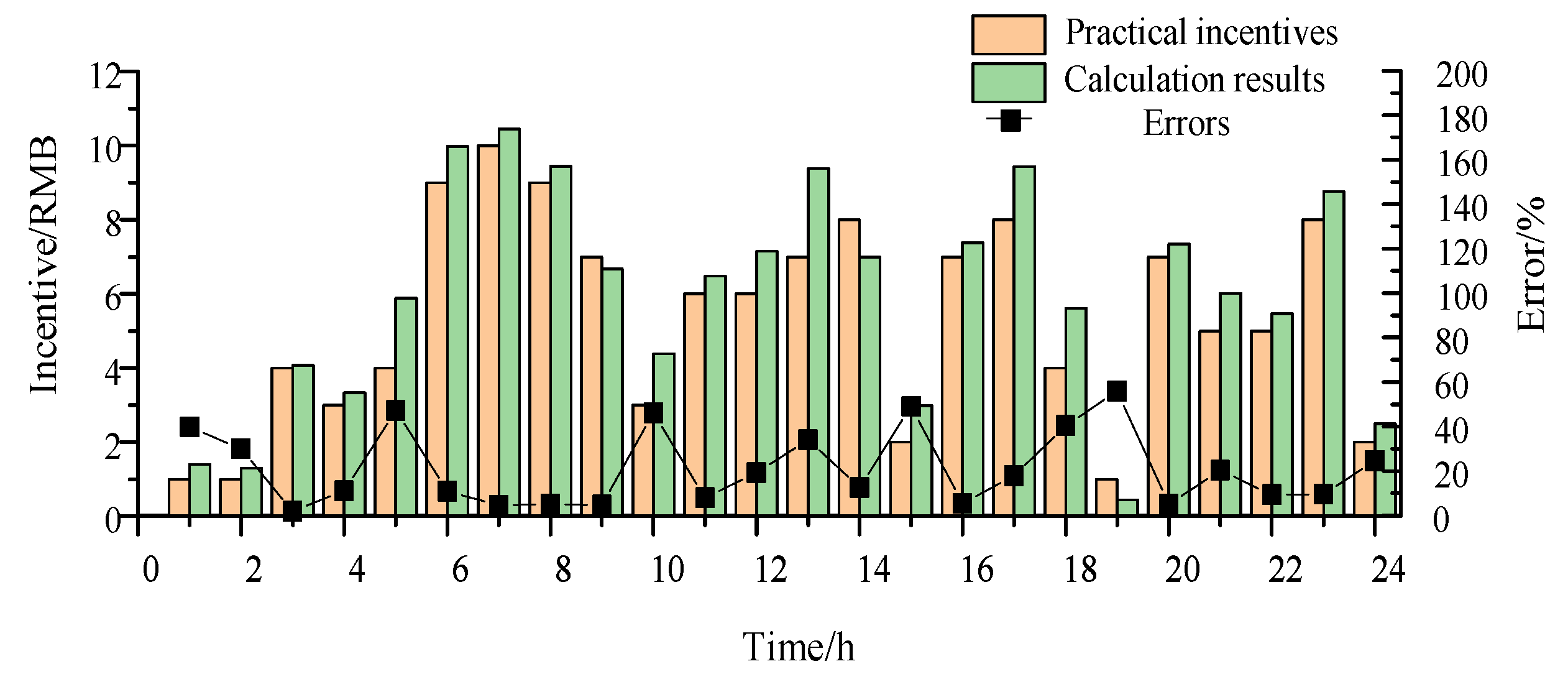

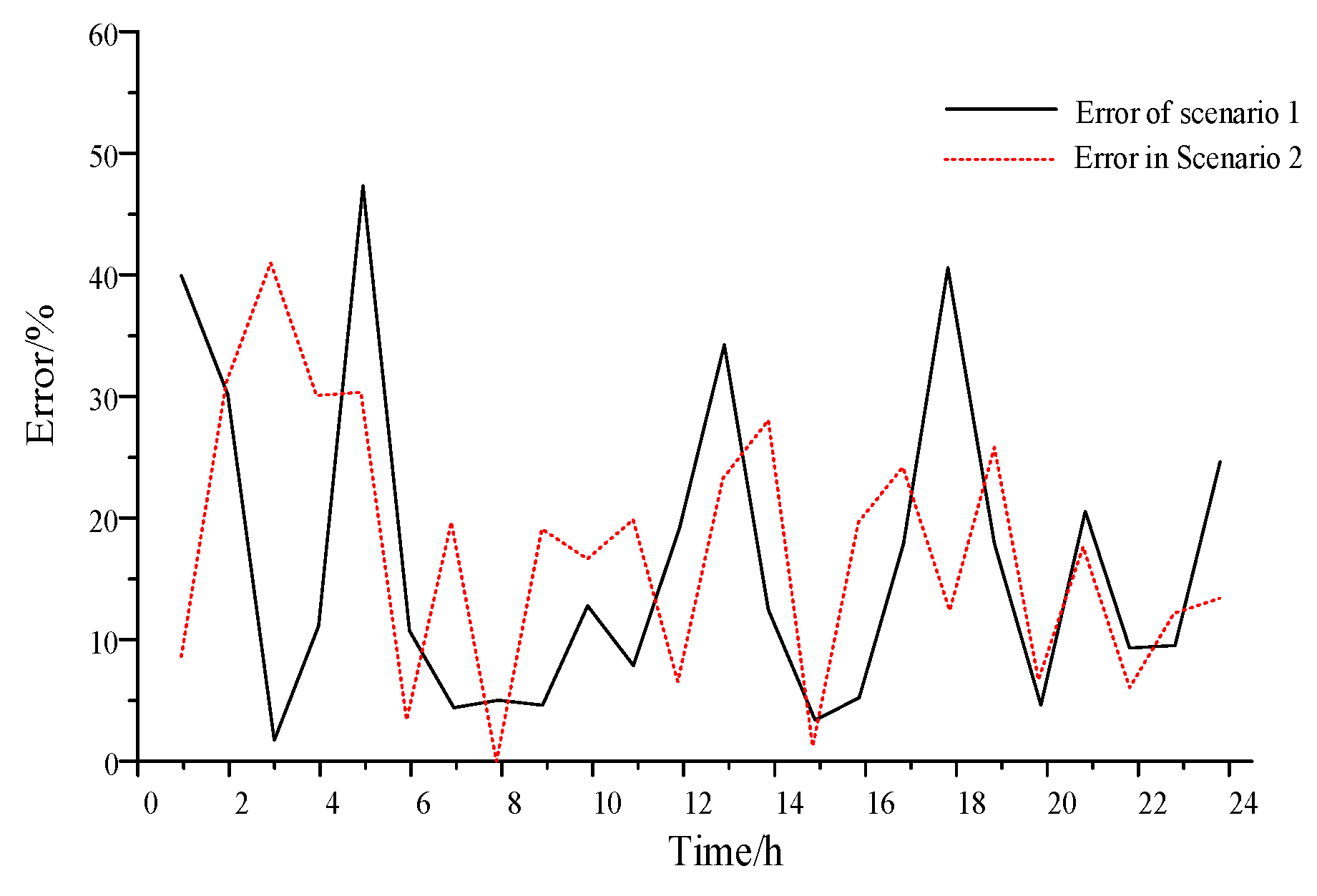

This paper fills a gap in the references by proposing an exogenous mode to consider random errors. The model obtains the demand-side response coefficient index of users in each case based on the identification and analysis of historical data. This index is used to build an exogenous model of demand-side response and incentive to characterize the demand-side response cost. It provides a clearer and more effective characterization of demand-side response costs and the relevance of traditional industrial pricing.

- (b)

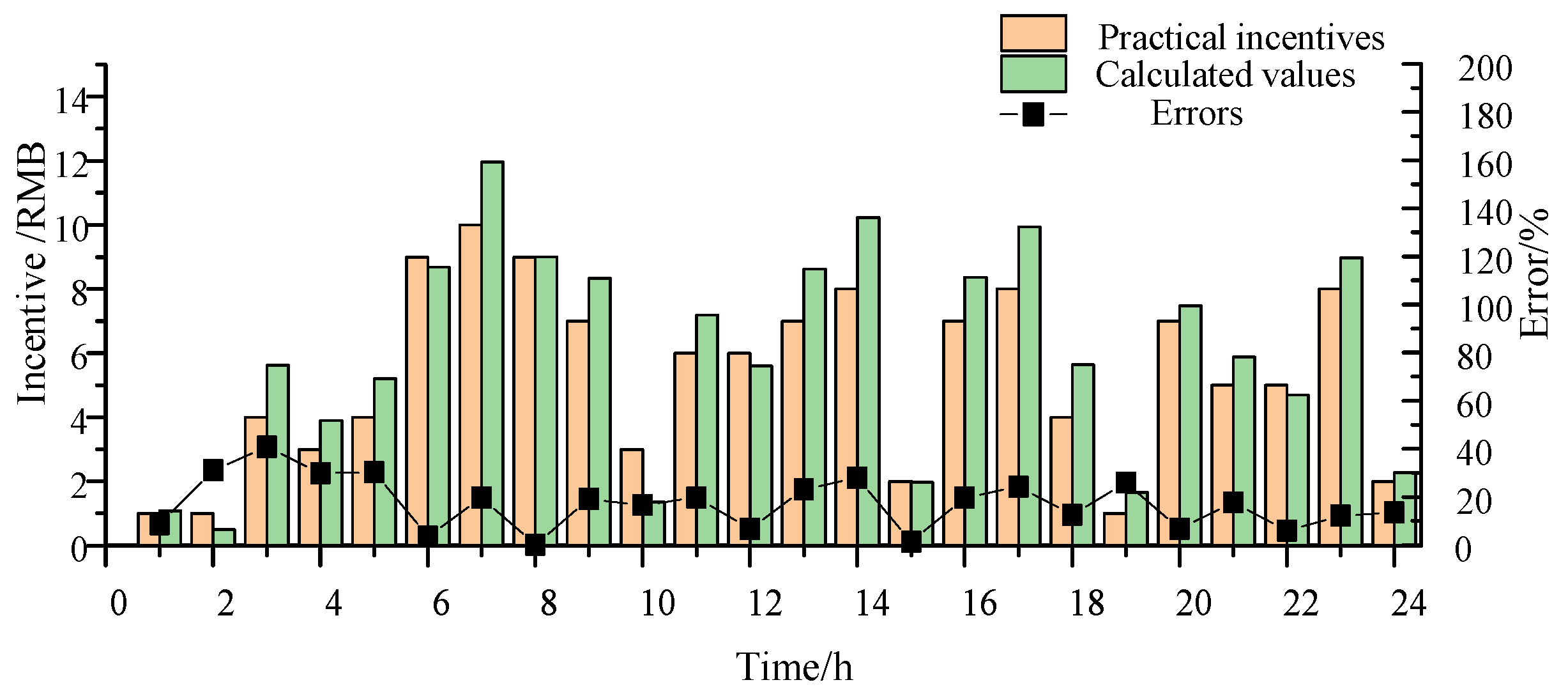

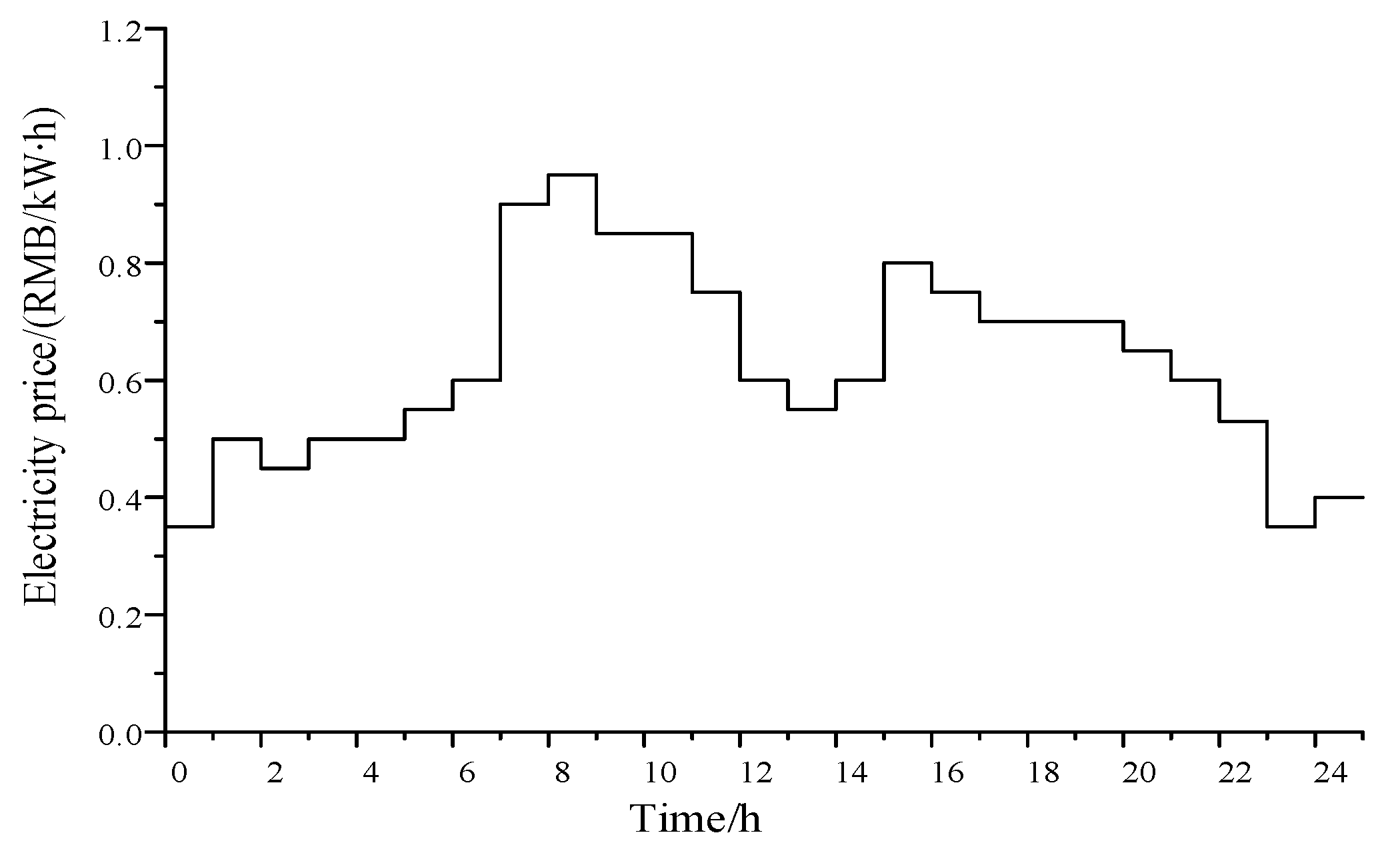

A strategy is proposed for the first time in this paper considering a two-stage master–slave game of user demand-side response. The first stage of the strategy is to form a time-of-day tariff for the day ahead and to regulate customers once. The second stage is an intraday correction of the tariff based on a model of the external characteristics of the customer’s demand-side response and the clean consumption incentive. Traditional pricing methods usually lack a specific consideration of user-demand response, and pricing strategies are too rigid to meet the flexibility needs of industrial users. Compared with traditional pricing methods, this innovative approach effectively meets the flexibility needs of industrial users and improves load regulation efficiency and cost-effectiveness. It improves the problem of traditional pricing strategies that failed to meet the flexibility needs of industrial users. The proposed pricing strategy is more economical and more effective in regulating the load.

- (c)

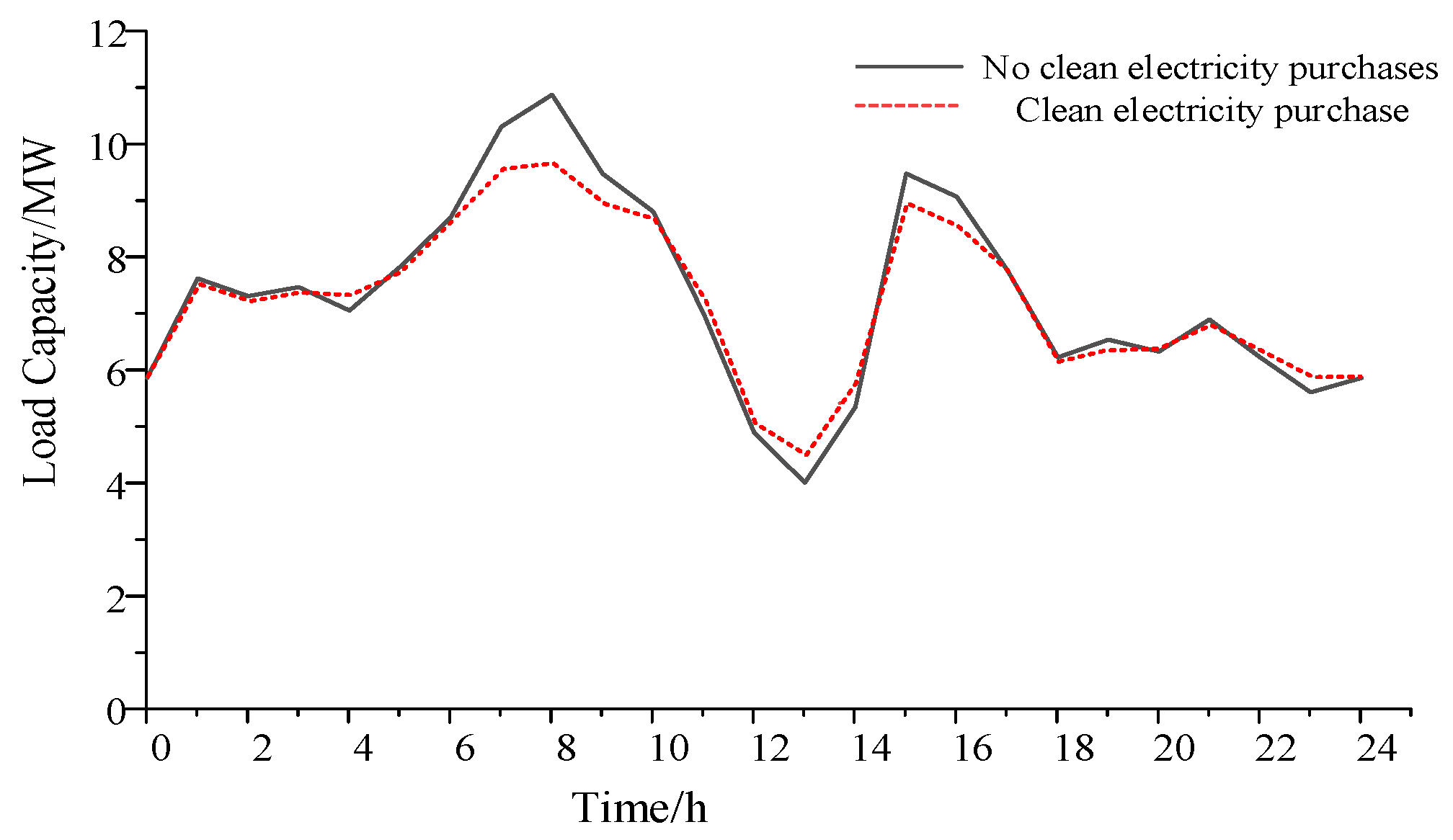

This paper proposes introducing clean consumption subsidies and environmental cost factors into the incentive model. Through the adjustment of incentive indexes in various scenarios in the model, dynamic pricing is realized in the game to promote the consumption of renewable energy. This enables industrial park users to actively consume clean electricity and makes the effect of peak shaving and valley filling more significant. Traditional methods fail to adequately consider incentives for clean energy consumption. This leads to a low utilization rate for renewable energy. This paper incorporates clean consumption incentives and environmental cost factors into the incentive model. This encourages industrial park users to actively consume clean electricity, while enhancing the peak-and-valley regulation effect, further improving the effectiveness of load regulation.

The remainder of this paper is organized as follows.

Section 2 builds an exogenous model of demand-side response and incentive to characterize the demand-side response cost. The method focuses more on describing the exogenous characteristics of user incentives and response quantities. Only the exogenous indicators and random errors in various typical scenarios need to be analyzed. The description of user demand-side response is more efficient.

Section 3 presents a master–slave game dynamic pricing strategy that considers user demand response and is tailored to industrial parks.

Section 4 analyzes a case study of industrial power users in a park in Liaoning. Finally, the paper is concluded in

Section 5.