An Analysis of Residual Financial Contagion in Romania’s Banking Market for Mortgage Loans

Abstract

:1. Introduction

2. The Stage of Knowledge in the Field

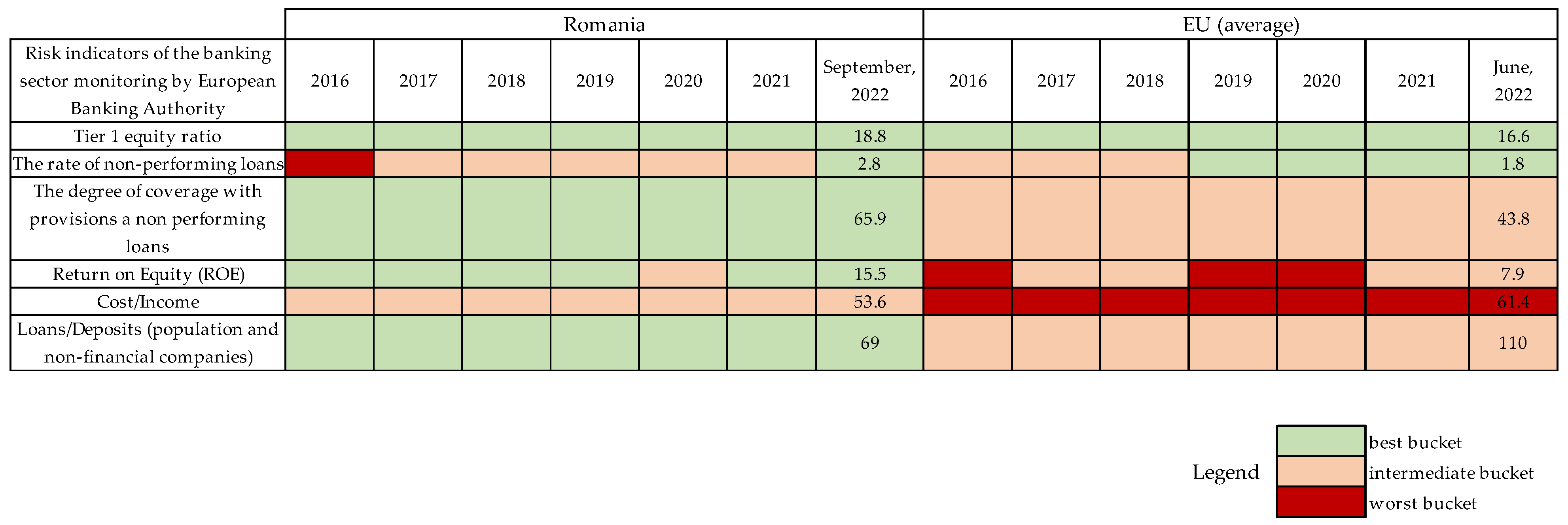

3. The Level of Financial Stability Banking in Romania

4. Methodology

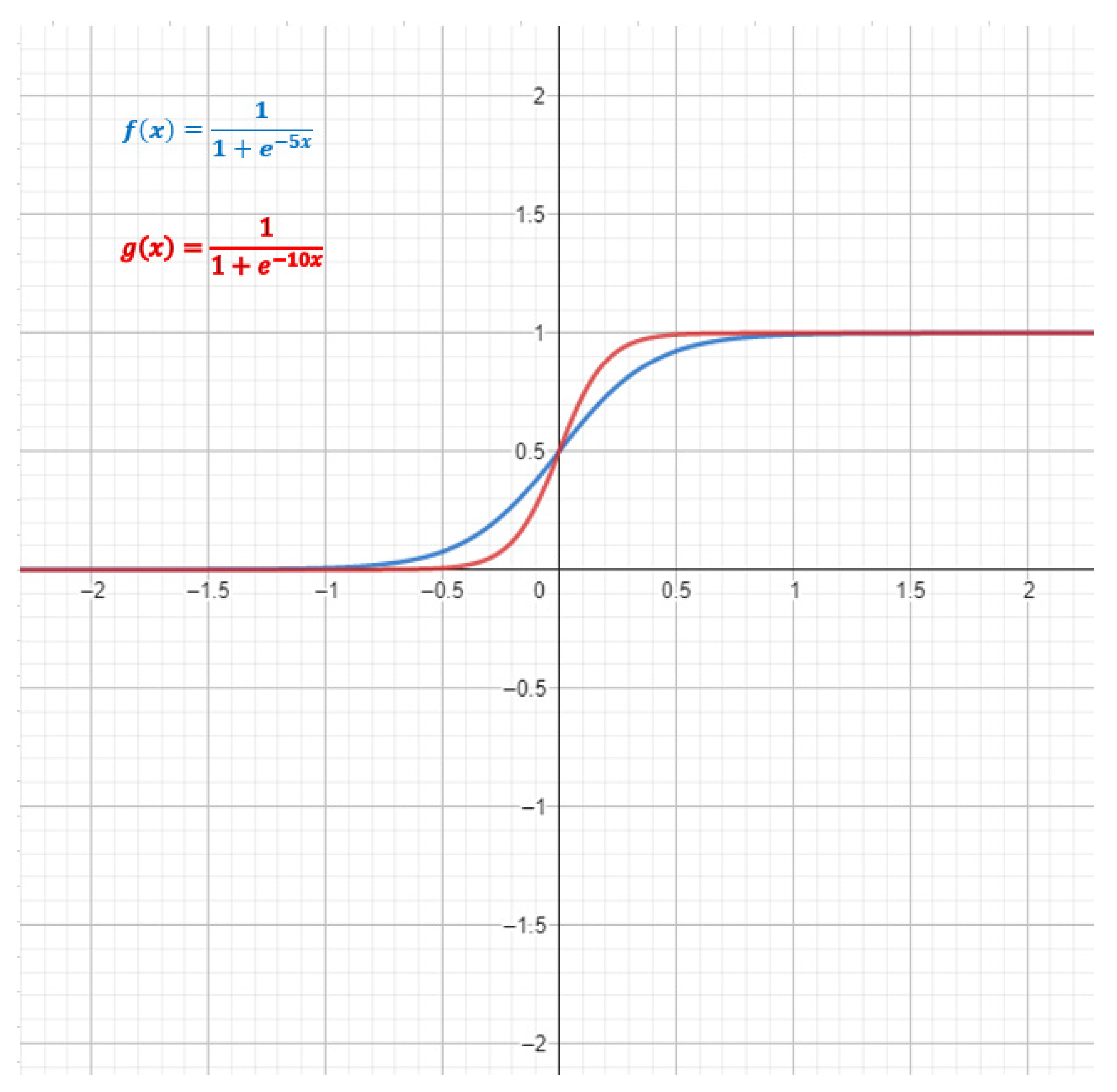

4.1. Conceptual Dimensions of Machine Learning Algorithms

4.2. Agent-Based Modeling

- ➢

- The total assets of each bank in the network are made up of interbank assets and illiquid external assets such as mortgages;

- ➢

- The total positions of the interbank assets of each bank in the network are uniformly distributed, following a normal Gaussian distribution, and are independent of the number of links that a bank has in the network;

- ➢

- Interbank liabilities are determined endogenously;

- ➢

- The only component of a bank’s liabilities are exogenous data of customer deposits.

- represents the interbank assets;

- represents the illiquid assets;

- represents the interbank liabilities;

- represents deposits;

- θ represents the proportion of banks that have defaulted on their obligations to bank;

- q denotes the price at which the illiquid asset can be resold.

- represents bank size;

- c represents the constant that is set with a value between 0 and 1;

- represents the number of outgoing links.

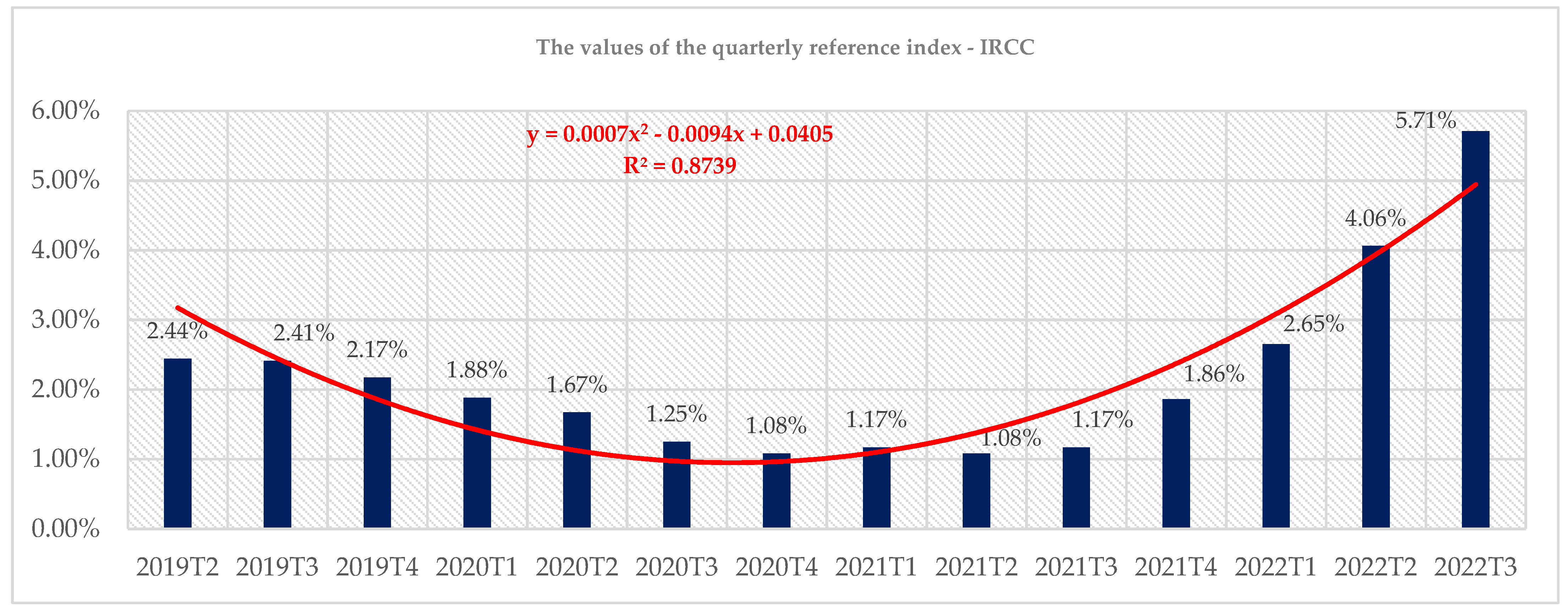

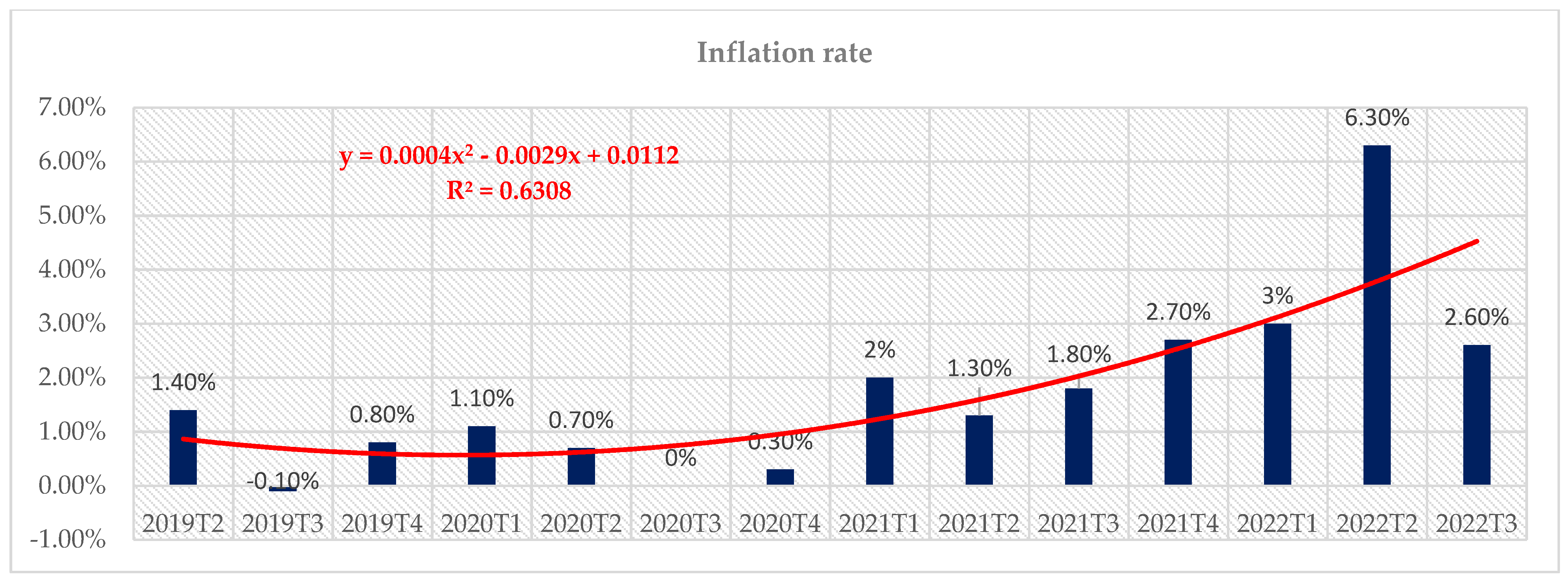

5. Case Study: The Analysis of Banking Financial Contagion from a Cybernetic Approach

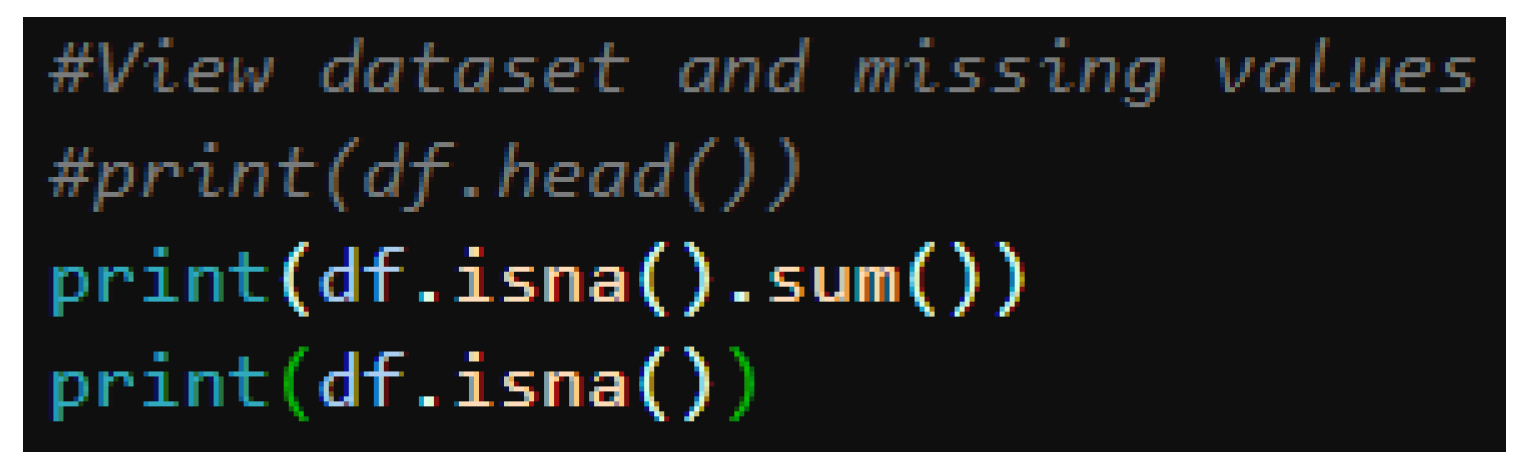

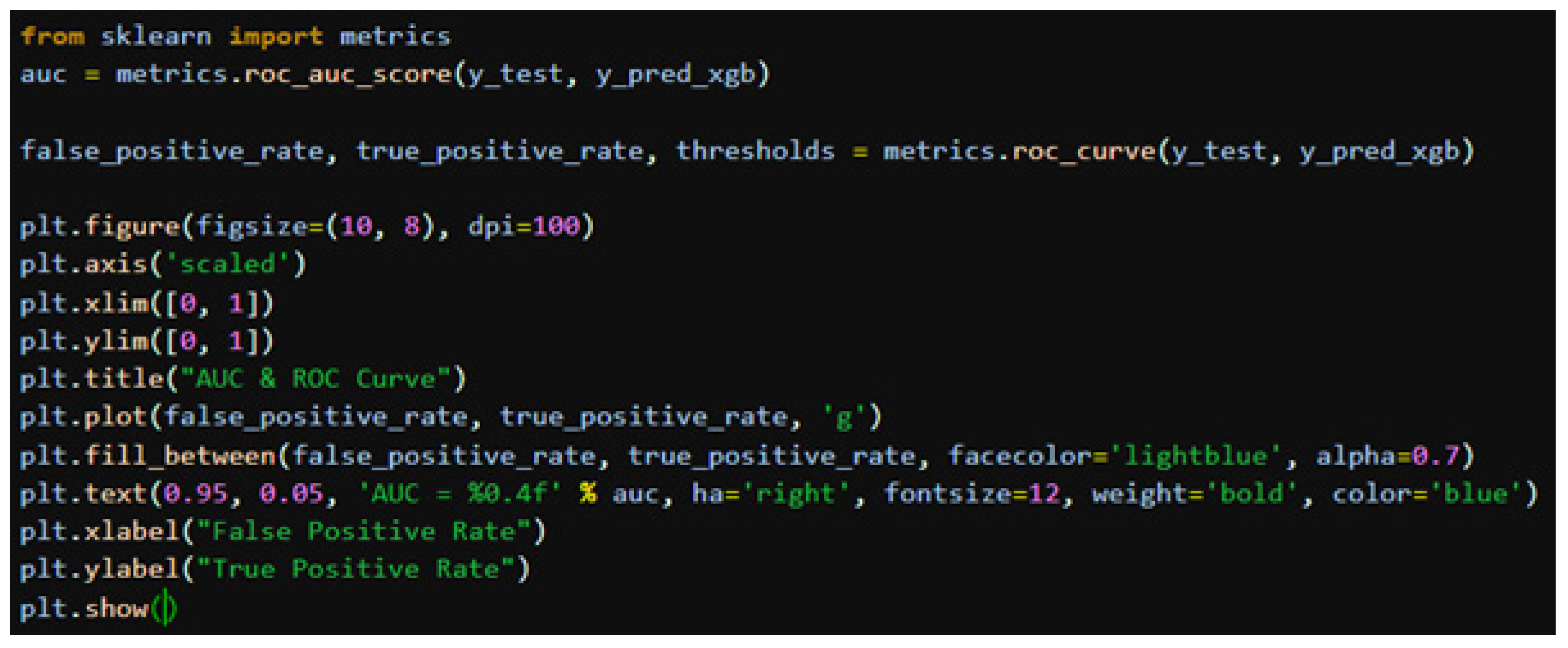

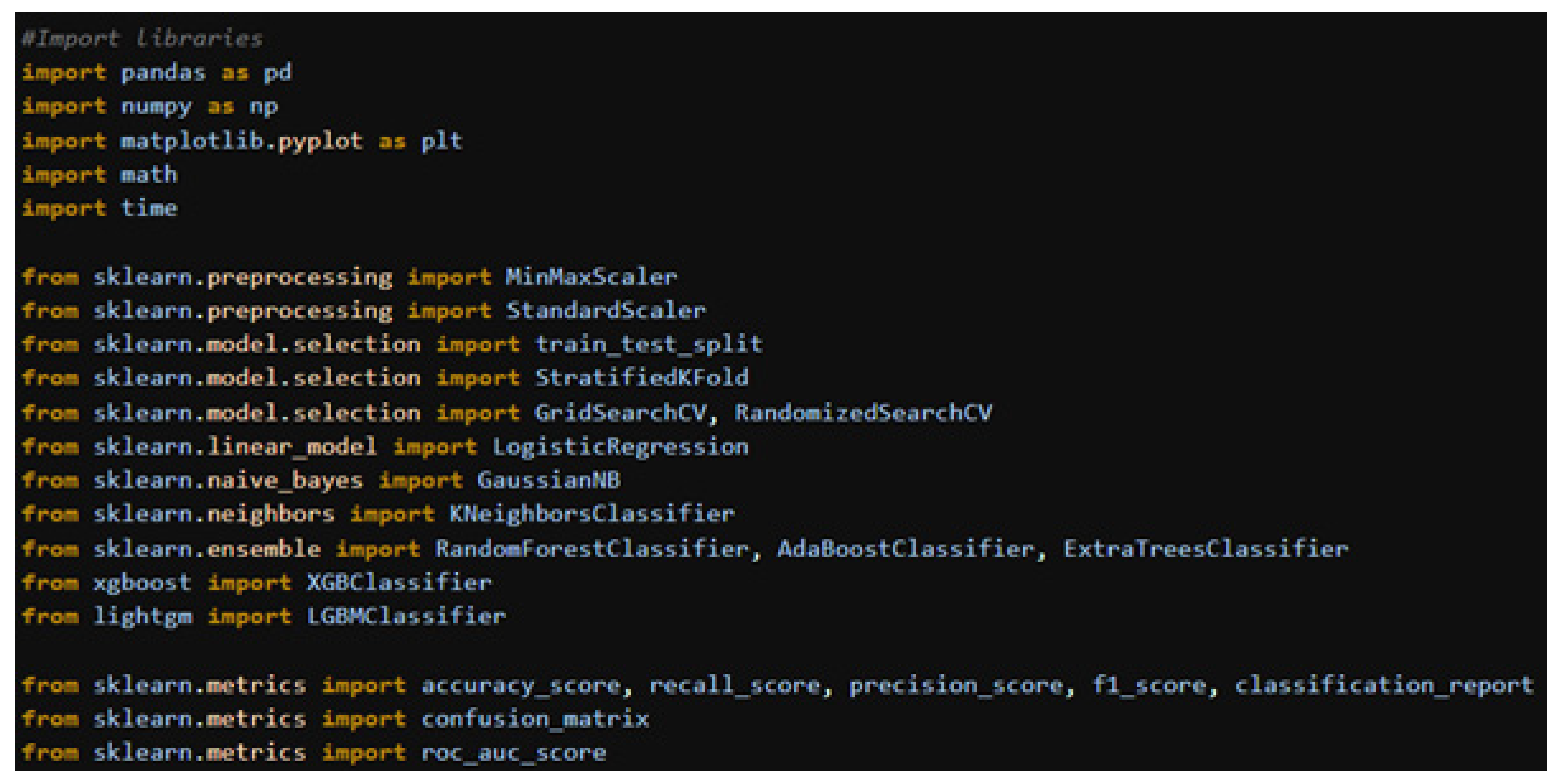

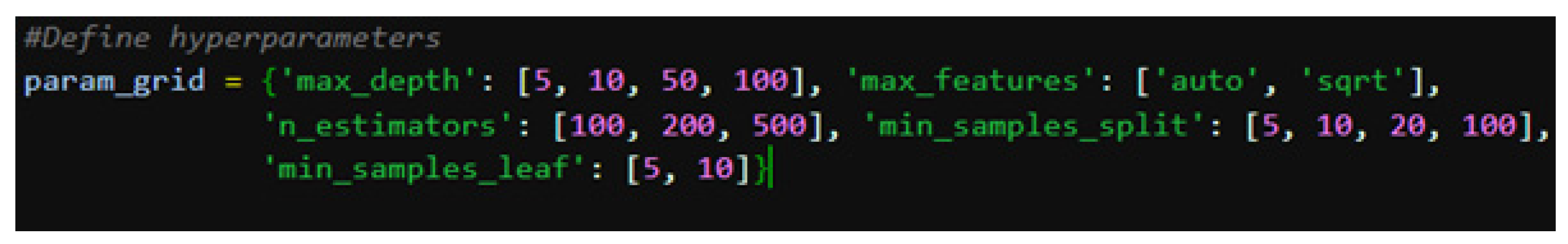

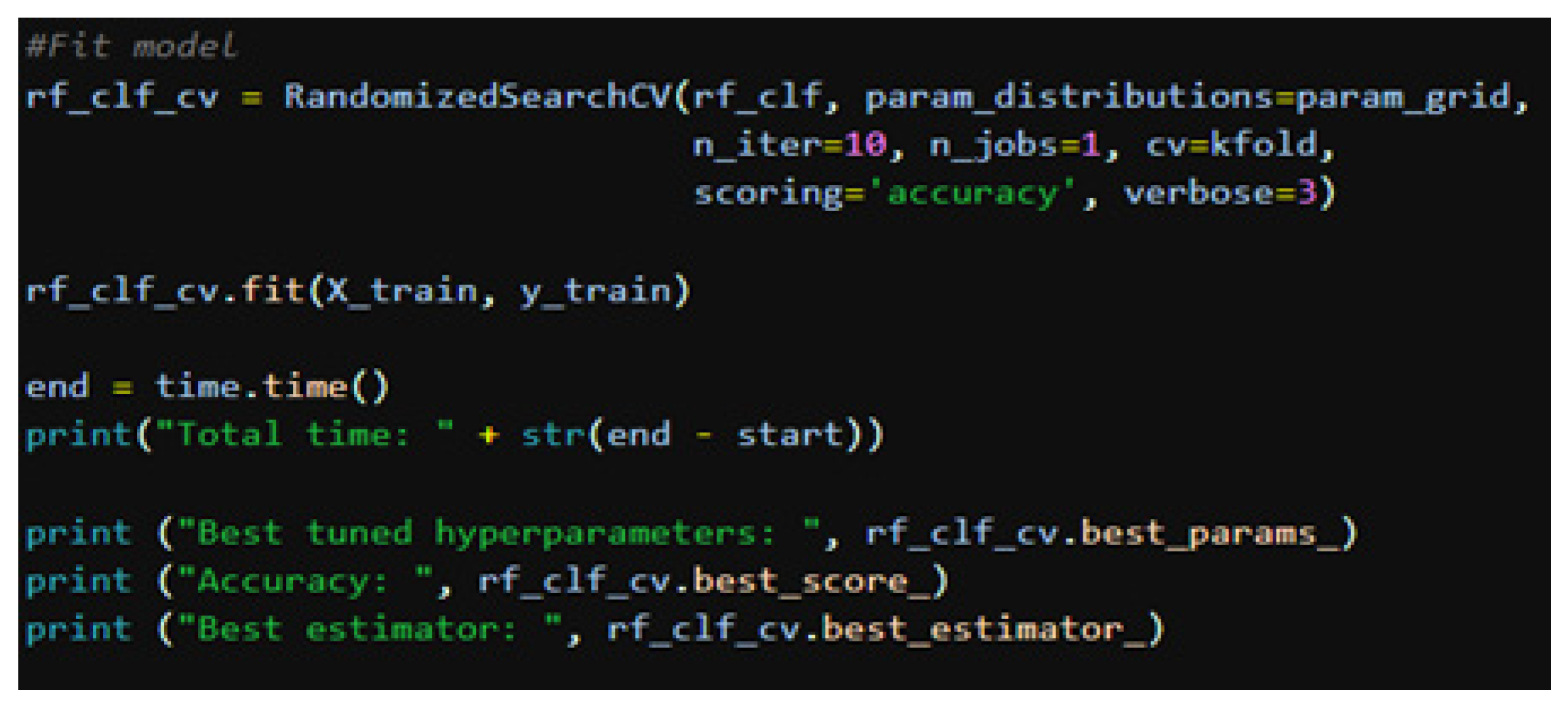

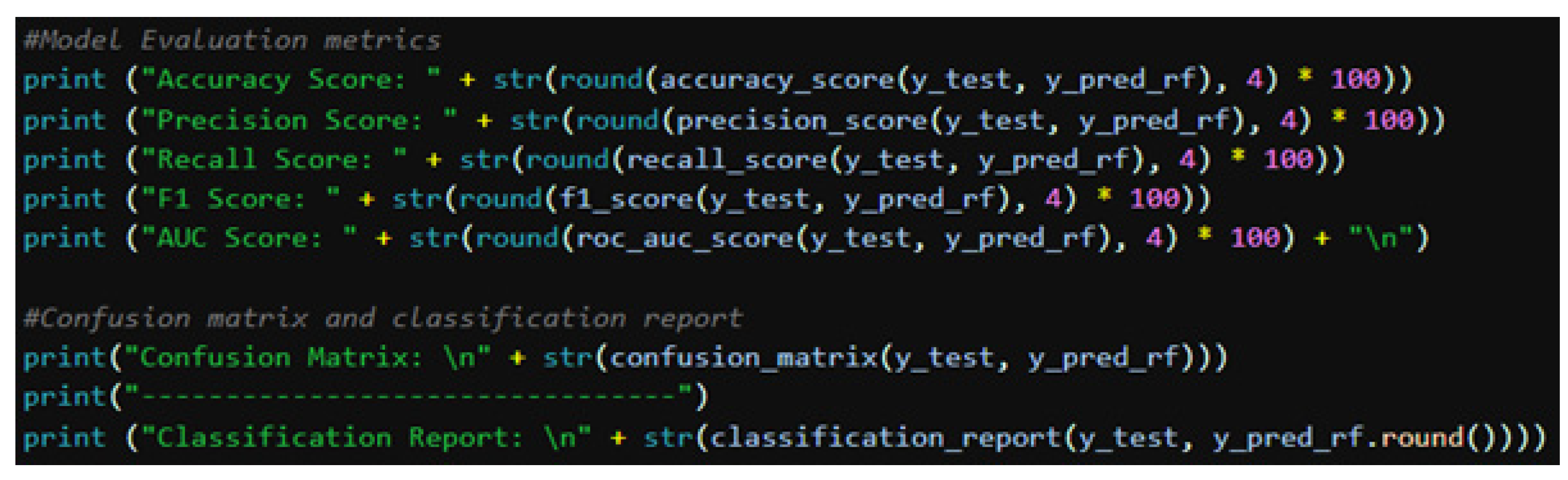

5.1. Application of Machine Learning

- -

- An increase in the production costs of companies, which will have the effect of decreasing profit margins and, possibly, increasing consumer prices. Thus, other effects can be generalized with an impact on the occurrence of potential systemic events of residual contagion. For example, this increase in costs makes it difficult for companies to repay loans. This can lead to the imbalance of the credit risk model that is the basis of the granting of loans by the bank. It is enough to have calculation residues at a sufficiently large bank and with a high degree of connectivity in the financial economic network, due to which the rate of non-performing loans will increase.

- -

- A decrease in purchasing power can negatively affect the sales and profits of the companies.

- -

- An increase in the interest rate is a normal reaction of the central banks, as a rule, to combat the increase in inflation. This can have the effect of decreasing investments and consumption because loans become more difficult for consumers to access.

- -

- An increase in the interest rate can also lead to a decrease in the value of financial assets, leading to significant losses for investors, which favors triggering a financial contagion effect by affecting other financial institutions or even the financial market in which it operates.

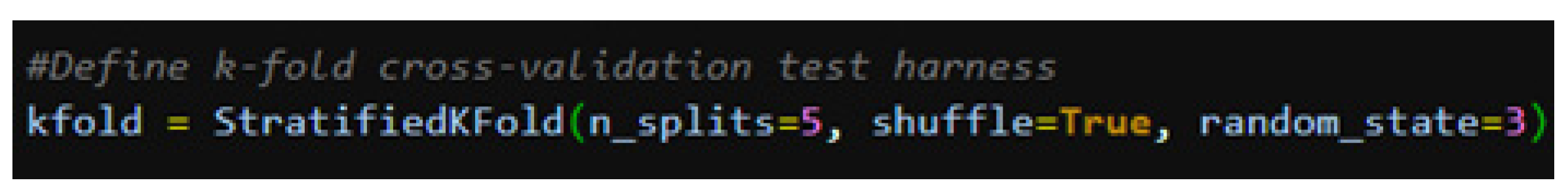

- Database processing: Cleaning, processing, and preparing the data set used in the analysis and subsequent modeling, as well as splitting it into a training set and testing set, respectively.

- Dimensioning the variables: Splitting the data set into a training set (80%) and testing set (20%), respectively.

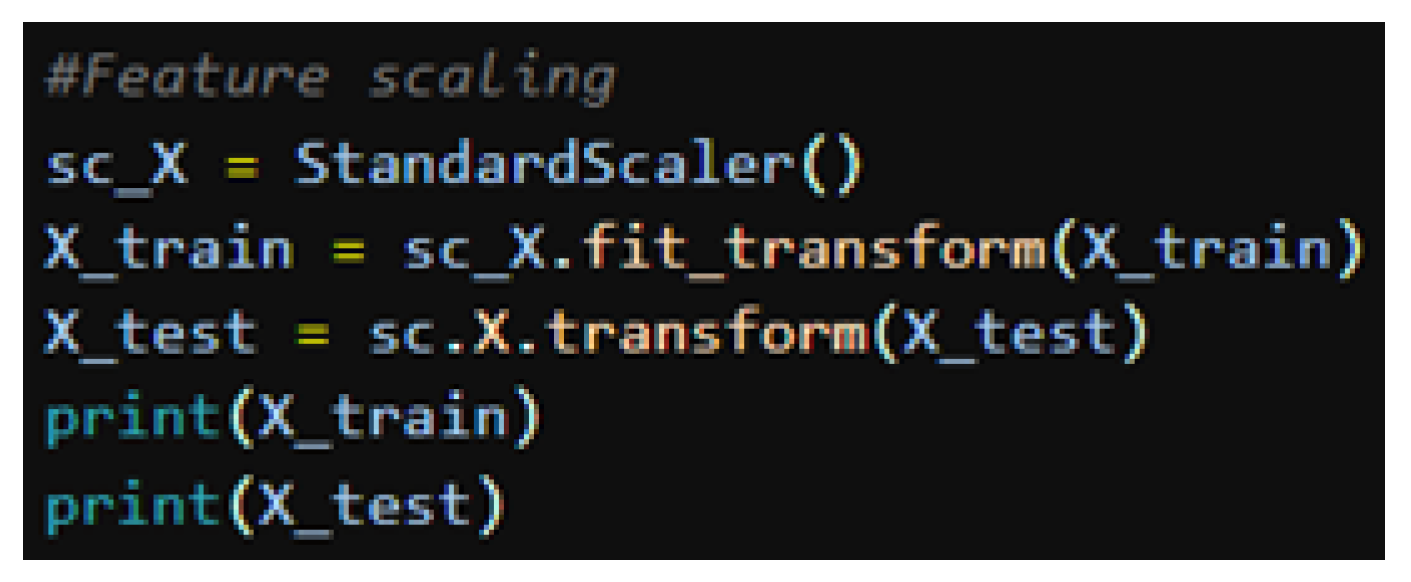

- Standardizing the predictor variables by eliminating the maximum differences between the variables.

- Defining the k-fold cross-validation methodology to test the performance of the model for the testing set.

- Estimating the models on the training set and testing the accuracy and performance of the model on the testing set.

- μ represents the mean of the data distribution;

- σ represents the standard deviation of the data distribution;

- z represents the standard score.

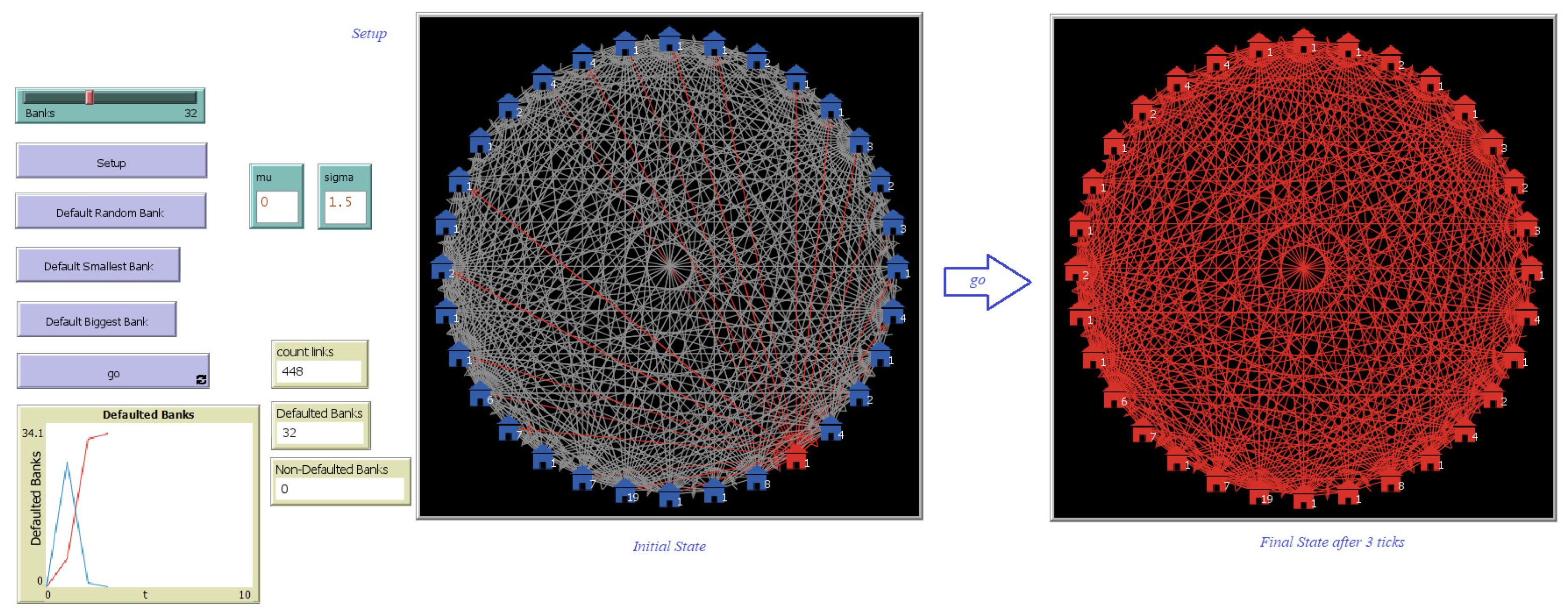

5.2. Application of Agent-Based Modeling

- ➢

- The establishment of the Financial Supervision Authority in 2013 with the aim of improving the supervision of financial institutions in Romania.

- ➢

- The elaboration and introduction of stricter rules and regulations for financial institutions, such as increasing capital requirements and liquidity requirements for banks.

- ➢

- Improving transparency by disseminating relevant information for the financial market and introducing periodic reports communicated by the press.

- ➢

- Developing stress tests and increasing the frequency of audits or inspections that financial institutions are subject to in order to identify risks and take preventive measures.

- ➢

- The agents (banks) were initialized;

- ➢

- The interdependencies between the agencies are built randomly, with each bank having a certain size;

- ➢

- The simulation is based on the scenario that one of the banks with the smallest size goes into default.

- ➢

- The size of the bank is an important element that influences the transmission of the contagion effect.

- ➢

- The degree of connectivity given by banking transactions carried out in the network has a significant impact on the transmission of the systemic default shock and favors the propagation of the contagion effect.

- ➢

- The level of deposits is again an important element compared to the level of liabilities (interbank loans). In general, according to the simulations, if the level of deposits is higher than the interbank loans, the contagion effect is blurred.

- ➢

- We noticed that in about 1 week (2 ticks), the contagion effect can spread and be installed in the entire banking network.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

References

- Wamba-Taguimdje, S.L.; Wamba, S.F.; Kamdjoug, J.R.K.; Wanko, C.E.T. Influence of Artificial Intelligence (AI) on Firm Performance: The Business Value of AI-based Transformation Projects. Bus. Process. Manag. J. 2020, 26, 1893–1924. [Google Scholar] [CrossRef]

- Yigitcanlar, T.; Degirmenci, K.; Inkinen, T. Drivers behind the public perception of artificial intelligence: Insights from major Australian cities. AI Soc. 2022. [Google Scholar] [CrossRef]

- ITUTrends. Assessing the Economic Impact of Artificial Intelligence. Available online: https://www.itu.int/dms_pub/itu-s/opb/gen/S-GEN-ISSUEPAPER-2018-1-PDF-E.pdf (accessed on 10 February 2023).

- McKinsey Company. Notes from the AI Frontier. Modeling the Impact of AI on the World Economy. Available online: https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/Artificial%20Intelligence/Notes%20from%20the%20frontier%20Modeling%20the%20impact%20of%20AI%20on%20the%20world%20economy/MGI-Notes-from-the-AI-frontier-Modeling-the-impact-of-AI-on-the-world-economy-September-2018.ashx (accessed on 10 February 2023).

- Moreira, M.A.L.; de Souza Rocha Junior, C.; de Lima Silva, D.F.; de Castro Junior, M.A.P.; de Araujo Costa, I.P.; Gomes, C.F.S.; dos Santos, M. Exploratory analysis and implementation of machine learning techniques for predictive assessment of fraud in banking systems. Procedia Comput. Sci. 2022, 214, 117–124. [Google Scholar] [CrossRef]

- Nazareth, N.; Reddy, Y.V.R. Financial applications of machine learning: A literature review. Expert Syst. Appl. 2023, 219, 119640. [Google Scholar] [CrossRef]

- Mahalakshmi, V.; Kulkarni, N.; Kumar, K.V.P.; Kumar, K.S.; Sree, D.N.; Durga, S. The role of implementing Artificial Intelligence and Machine Learning Technologies in the financial services Industry for creating Competitive Intelligence. Mater. Proc. 2022, 56 Pt 4, 2252–2255. [Google Scholar] [CrossRef]

- Startupcafe. Transilvania Bank’s Statement Regarding the Use of Artificial Intelligence in Several Departments. Available online: https://www.startupcafe.ro/smart-tech/inteligenta-artificiala-romania-startup-banci-functionari-publici.htm (accessed on 10 February 2023).

- Microsoft. Announcement Regarding the Partnership between Microsoft and Banca Transilvania Regarding the Creation of Two Chatbots. Available online: https://customers.microsoft.com/en-us/story/760664-banca-transilvania-banking-azure-ro-romania (accessed on 10 February 2023).

- ING Bank. Press Release Regarding the Use of Artificial Intelligence by Cyber Attackers. Available online: https://ing.ro/informatii-utile/ING-Bank-si-DNSC-fac-apel-la-vigilenta (accessed on 10 February 2023).

- Costanzino, N.; Curran, M. A Simple Traffic Light Approach to Backtesting Expected Shortfall. Risks 2018, 6, 2. [Google Scholar] [CrossRef] [Green Version]

- Fang, M.; Yang, S.; Lei, Y. Residual contagion in emerging markets: ‘herd’ and ‘alarm’ effects in informatization. Electron. Commer. Res. 2021, 21, 787–807. [Google Scholar] [CrossRef] [Green Version]

- Scarlat, E.; Chirita, N. Cibernetica Sistemelor Economice—Editia a Treia; Editura Economică: Bucharest, Romania, 2019. [Google Scholar]

- Al-Dosari, K.; Fetais, N.; Kucukvar, M. Artificial Intelligence and Cyber Defense System for Banking Industry: A qualitative study of AI applications and challenges. Cybern. Syst. J. 2022. [Google Scholar] [CrossRef]

- Ranjan, P.; Santhosh, K.; Kumar, A.; Kumar, S. Fraud Detection on Bank Payments using Machine Learning. In Proceedings of the 2022 International Conference for Advancement in Technology (ICONAT), Goa, India, 21–22 January 2022. [Google Scholar] [CrossRef]

- Ali, A.; Abd Razak, S.; Othman, S.H.; Eisa, T.A.E.; Al-Dhaqm, A.; Nasser, M.; Elhassan, T.; Elshafie, H.; Saif, A. Financial Fraud Detection Based on Machine Learning: A Systematic Literature Review. Appl. Sci. 2022, 12, 9637. [Google Scholar] [CrossRef]

- Sargent, H. Algorithmic decision-making in financial services: Economic and normative outcomes in consumer credit. AI Ethics 2022. [Google Scholar] [CrossRef]

- OECD. Artificial Intelligence, Machine Learning and Big Data in Finance. Opportunities, Challenges and Implications for Policy Makers. 2021. Available online: https://www.oecd.org/finance/artificial-intelligence-machine-learningbig-data-in-finance.htm (accessed on 10 February 2023).

- Herrmann, H.; Masawi, B. Three and a half decades of artificial intelligence in banking, financial services, and insurance: A systematic evolutionary review. Strat. Chang. 2022, 31, 549–569. [Google Scholar] [CrossRef]

- Goldstein, I. Chapter 36—Empirical Literature on Financial Crises: Fundamentals vs. Panic. In The Evidence and Impact of Financial Globalization; Elsevier: Amsterdam, The Netherlands, 2013; pp. 523–534. [Google Scholar]

- National Bank of Romania. Financial Stability Report. Available online: https://www.bnr.ro/Regular-publications-2504.aspx (accessed on 10 February 2023).

- Bancherul. Transilvania Bank Implements an Artificial Intelligence Solution. Available online: https://www.bancherul.ro/stire.php?id_stire=20618&titlu=banca-transilvania-implementeaza-o-solutie-de-inteligenta-artificiala (accessed on 10 February 2023).

- Ziarul Financiar. The Need for Artificial Intelligence in Combating the Risks of Bank Fraud. Available online: https://www.zf.ro/info/p-necesitatea-inteligentei-artificiale-in-combaterea-riscurilor-20326047 (accessed on 10 February 2023).

- NOCASH. Artificial Intelligence is Making Its Way into Romanian Banks—Banca Transilvania Signs a Partnership with an Israeli Fintech. Available online: https://nocash.ro/inteligenta-artificiala-isi-face-loc-in-bancile-din-romania-banca-transilvania-semneaza-un-parteneriat-cu-un-fintech-israelian/ (accessed on 10 February 2023).

- Merriam-Webster. Available online: https://www.merriamwebster.com/dictionary/contagion (accessed on 10 February 2023).

- Cambridge Dictionary. Available online: https://dictionary.cambridge.org/dictionary/english/contagion (accessed on 10 February 2023).

- Oxford Dictionary. Available online: https://www.oxfordlearnersdictionaries.com/definition/american_english/contagion (accessed on 10 February 2023).

- Zheng, C. An innovative MS-VAR model with integrated financial knowledge for measuring the impact of stock market bubbles in financial security. J. Innov. Knowl. 2022, 7, 100207. [Google Scholar] [CrossRef]

- Puneet, M. Machine Learning Applications Using Python; Apress: Berkeley, CA, USA, 2018. [Google Scholar]

- Fares, O.; Butt, I.; Lee, S.H.M. Utilization of Artificial Intelligence in the banking sector: A systematic literature review. J. Financial Serv. Mark. 2022. [Google Scholar] [CrossRef]

- Ris, K.; Stankovic, Z.; Avramovic, Z. Implications of Implementation of Artificial Intelligence in the Banking Business with Correlation to the Human Factor. J. Comput. Commun. 2020, 08, 130–144. [Google Scholar] [CrossRef]

- Sadok, H.; Sakka, F.; El Maknouzi, M. Artificial intelligence and bank credit analysis. A review. Cogent Econ. Finance 2022, 10, 2023262. [Google Scholar] [CrossRef]

- Trenca, I.; Dezsi, E. Financial contagion on the Romanian stock market. In Finante—Provocarile Viitorului (Finance—Challenges of the Future); University of Craiova, Faculty of Economics and Business Administration: Craiova, Romania, 2012; Volume 1, pp. 27–36. [Google Scholar]

- Carausu, D.N. Fianncial Contagion in the Recent Fiancial Crisis: Evidence form the Romanian Capital Market. In Ovidius University Annals, Economic Sciences Series; Ovidius University of Constantza, Faculty of Economic Sciences: Constanța, Romania, 2017; Volume XVII, Issue 2. [Google Scholar]

- Țilică, E.V. Financial Contagion Patterns in Individual Economic Sectors. The Day-of-the-Week Effect from the Polish, Russian and Romanian Markets. J. Risk Financ. Manag. 2021, 14, 442. [Google Scholar] [CrossRef]

- Bookstaber, R. Agent-Based Models for Financial Crises. Annu. Rev. Financ. Econ. 2017, 9, 85–100. [Google Scholar] [CrossRef]

- Silva, T.C.; da Silva, M.A.; Tabak, B.M. Systemic risk in financial systems: A feedback approach. J. Econ. Behav. Organ. 2017, 144, 97–120. [Google Scholar] [CrossRef]

- Gajurel, D.; Dungey, M. Systematic Contagion Effects of the Global Finance Crisis: Evidence from the World’s Largest Advanced and Emerging Equity Markets. J. Risk Financ. Manag. 2023, 16, 182. [Google Scholar] [CrossRef]

- Zhang, B.; Xie, X.; Li, C. How Connected Is China’s Systemic Financial Risk Contagion Network?—A Dynamic Network Perspective Analysis. Mathematics 2023, 11, 2267. [Google Scholar] [CrossRef]

- Tsagkanos, A.; Sharma, A.; Ghosh, B. Green Bonds and Commodities: A New Asymmetric Sustainable Relationship. Sustainability 2022, 14, 6852. [Google Scholar] [CrossRef]

- Naeem, M.A.; Karim, S.; Yarovaya, L.; Lucey, B.M. Systemic risk contagion of green and Islamic markets with conventional markets. Ann. Oper. Res. 2023. [Google Scholar] [CrossRef]

- Lian, Y.; Gao, J.; Ye, T. How does green credit affect the financial performance of commercial banks?—Evidence from China. J. Clean. Prod. 2022, 344, 131069. [Google Scholar] [CrossRef]

- National Bank of Romania. Financial Stability Report. Available online: https://www.bnr.ro/PublicationDocuments.aspx?icid=19968 (accessed on 14 February 2023).

- The Government of Romania. Emergency Ordinance No. 37 of March 30. 2020. Available online: https://legislatie.just.ro/Public/DetaliiDocument/224489 (accessed on 14 February 2023).

- National Bank of Romania. Financial Stability Report. Available online: https://www.bnr.ro/Raportul-asupra-stabilita%c8%9bii-financiare---decembrie-2022-25453.aspx (accessed on 14 February 2023).

- Federal Reserve History. Asian Financial Crisis. Available online: https://www.federalreservehistory.org/essays/asian-financial-crisis (accessed on 14 February 2023).

- Hoppit, J. The myths of the South Sea Bubble. Trans. R. Hist. Soc. 2002, 12, 141–165. [Google Scholar] [CrossRef] [Green Version]

- Bruner, R.F.; Miller, S.C. The first modern financial crises: The South Sea and Mississippi Bubbles in Historical Perspective. J. Appl. Corp. Financ. 2020, 32, 17–33. [Google Scholar] [CrossRef]

- Thakor, A. The Financial Crisis of 2007–2009: Why did it happen and what did we learn? Rev. Corp. Financ. Stud. Rev. Corp. Finance Stud. 2015, 4, 155–205. [Google Scholar] [CrossRef] [Green Version]

- National Bank of Romania. The Role of the NBR in Maintaining Financial Stability. Available online: https://www.bnr.ro/Stabilitate-financiara---Rolul-BNR-3114-Mobile.aspx (accessed on 14 February 2023).

- Acharya, V.V.; Pedersen, L.H.; Philippon, T.; Richardson, M. Measuring Systemic Risk. Rev. Financ. Stud. 2017, 30, 2–47. [Google Scholar] [CrossRef] [Green Version]

- Sarker, I.H. Machine Learning: Algorithms, Real-World Applications and Research Directions. SN Comput. Sci. 2021, 2, 160. [Google Scholar] [CrossRef]

- Edgar, T.; Manz, D.O. Chapter 6—Machine Learning. In Research Methods for Cyber Security; Syngress: Oxford, UK, 2017; pp. 153–173. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, Y.; Lu, Y.; Yu, X. A comparative assessment of Credit Risk Model Based on Machine Learning—A case study of bank loan data. Procedia Comput. Sci. 2020, 174, 141–149. [Google Scholar] [CrossRef]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef] [Green Version]

- Towardsdatascience. Random Forest in Phyton. Available online: https://towardsdatascience.com/random-forest-in-python-24d0893d51c0 (accessed on 14 February 2023).

- IBM. K-Nearest Neighbors Algorithm. Available online: https://www.ibm.com/topics/knn (accessed on 15 February 2023).

- Analytics Vidhaya. Understanding Distance Metrics Used in Machine Learning. Available online: https://www.analyticsvidhya.com/blog/2020/02/4-types-of-distance-metrics-in-machine-learning/ (accessed on 15 February 2023).

- Towardsdatascience. Building a Logistic Regression in Python, Step by Step. Available online: https://towardsdatascience.com/building-a-logistic-regression-in-python-step-by-step-becd4d56c9c8 (accessed on 15 February 2023).

- Liew, B.; Kovacs, F.; Rugamer, D.; Royuela, A. Machine learning versus logistic regression for prognostic modelling in individuals with non-specific neck pain. Eur. Spine J. 2022, 31, 2082–2091. [Google Scholar] [CrossRef] [PubMed]

- Analytics Vidhya. The Math Behind Logistic Regression. Available online: https://medium.com/analytics-vidhya/the-math-behind-logistic-regression-c2f04ca27bca (accessed on 15 February 2023).

- Towards AI. Logistic Regression with Mathematics. Available online: https://towardsai.net/p/machine-learning/logistic-regression-with-mathematics (accessed on 15 February 2023).

- Addo, P.M.; Guegan, D.; Hassani, B. Credit Risk Analysis Using Machine and Deep Learning Models. Risks 2018, 6, 38. [Google Scholar] [CrossRef] [Green Version]

- Yu, Y.; Nguyen, T.; Li, J.; Sanchez, L.; Nguyen, A. Predicting elastic modulus degradation of alkali silica reaction affected concrete using soft computing techniques: A comparative study. Constr. Build. Mater. 2020, 274, 122024. [Google Scholar] [CrossRef]

- Aggarwal, C.C. Neural Networks and Deep Learning; Springer International Publishing AG: Cham, Switzerland, 2018. [Google Scholar]

- Ibrahem Ahmed Osman, A.; Najah, A.A.; Chow, M.; Feng, H.Y.; El-Shafie, A. Extreme gradient boosting (Xgboost) model to predict thegroundwater levels in Selangor Malaysia. Ain Shams Eng. J. 2021, 12, 1545–1556. [Google Scholar] [CrossRef]

- Dhieb, N.; Ghazzai, H.; Besbes, H.; Massoud, Y. Extreme Gradient Boosting Machine Learning Algorithm for Safe Auto Insurance Operations. In Proceedings of the 2019 IEEE International Conference on Vehicular Electronics and Safety, Cairo, Egypt, 4–6 September 2019. [Google Scholar]

- Probst, P.; Wright, M.; Boulesteix, A.-L. Hyperparameters and Tuning Strategies for Random Forest. Wiley Interdiscip. Rev. Data Min. Knowl. Discov. 2019, 9, e1301. [Google Scholar] [CrossRef] [Green Version]

- Haghighi, S.; Jasemi, M.; Hessabi, S.; Zolanvari, A. PyCM: Multiclass confusion matrix library in Python. J. Open Source Softw. 2018, 3, 729. [Google Scholar] [CrossRef] [Green Version]

- Nica, I.; Alexandru, D.B.; Crăciunescu, S.L.P.; Ionescu, Ș. Automated Valuation Modelling: Analysing Mortgage Behavioural Life Profile Models Using Machine Learning Techniques. Sustainability 2021, 13, 5162. [Google Scholar] [CrossRef]

- Economic Times. What Is Commercial Bank. Available online: https://economictimes.indiatimes.com/definition/commercial-bank (accessed on 16 February 2023).

- Miller, J.H.; Scott, E.P. Complex Adaptive Systems: An Introduction to Computational Models of Social Life; Princeton University Press: Princeton, NJ, USA, 2007. [Google Scholar]

- Rand, W.; Rust, R.T. Agent-based modeling in marketing: Guidelines for rigor. Int. J. Res. Mark. 2011, 28, 181–193. [Google Scholar] [CrossRef]

- Delcea, C.; Cotfas, L.-A.; Salari, M.; Milne, R.J. Investigating the Random Seat Boarding Method without Seat Assignments with Common Boarding Practices Using an Agent-Based Modeling. Sustainability 2018, 10, 4623. [Google Scholar] [CrossRef] [Green Version]

- DeAngelis, D.L.; Diaz, S.G. Decision-Making in Agent-Based Modeling: A current review and future prospectus. Front. Ecol. Evol. Sec. Behav. Evol. Ecol. 2018, 6. [Google Scholar] [CrossRef] [Green Version]

- Pan, X.; Han, C.S.; Law, K.H. A multi-agent based simulation framework for the study of human and social behavior in egress analysis. In Proceedings of the International Conference on Computing in Civil Engineering, Cancun, Mexico, 12–15 July 2005. [Google Scholar]

- Ionescu, S.; Nica, I.; Chirita, N. Cybernetics Approach Using Agent-Based Modeling in the Process of Evacuating Educational Institutions in Case of Disasters. Sustainability 2021, 13, 10277. [Google Scholar] [CrossRef]

- Delcea, C.; Bradea, I.A. Economic Cybernetics. An Equation-Based Modeling and Agent-Based Modeling Approach. Universitara Printinghouse: Bucharest, Romania, 2017; ISBN 978-606-28-0629-3. [Google Scholar]

- Railsback, S.; Grimm, V. Agent-Based and Individual-Based Modeling: A Practical Introduction, 2nd ed.; Princeton University Press: Princeton, NJ, USA, 2019. [Google Scholar]

- Chan-Lau, J.A. ABBA: An Agent-Based Model of Banking System; IMF Working Paper/17/136; International Monetary Fund: Bretton Woods, NH, USA, 2017. [Google Scholar]

- Simudyne. A Complete Guide to Agent-Based Modeling for Financial Services. Available online: https://simudyne.com/wp-content/uploads/2019/08/A4-Guide-to-ABM-FINAL-5.pdf (accessed on 16 February 2023).

- Steinbacher, M.; Raddant, M.; Karimi, F.; Cuena, E.C.; Alfarano, S.; Iori, G.; Lux, T. Advances in the agent-based modeling of economic and social behavior. SN Bus. Econ. 2021, 1, 99. [Google Scholar] [CrossRef] [PubMed]

- Chakraborty, S. Developing Agent-Based Models to Study Financial Markets. Digital Commons @ University of South Florida. Available online: https://digitalcommons.usf.edu/cgi/viewcontent.cgi?article=10119&context=etd (accessed on 16 February 2023).

- Halaj, G. Agent-Based Model of System-Wide Implications of Funding Risk; Working Paper Series, No. 2121; European Central Bank: Frankfurt, Germany, 2018. [Google Scholar]

- Bruch, E.; Atwell, J. Agent-Based Models in Empirical Social Research. Sociol. Methods Res. 2013, 44, 186–221. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Gai, P.; Kapadia, S. Contagion in financial networks. Proc. R. Soc. A Math. Phys. Eng. Sci. 2010, 466, 2401–2423. [Google Scholar] [CrossRef]

- Wilensky, U.; Rand, W. An Introduction to Agent-Based Modeling: Modeling Natural, Social, and Engineered Complex Systems with NetLogo; MIT Press: Cambridge, MA, USA, 2015; ISBN 978-0-262-73189-8. [Google Scholar]

- Milne, R.J.; Delcea, C.; Cotfas, L.-A.; Ioanas, C. Evaluation of Boarding Methods Adapted for Social Distancing When Using Apron Buses. IEEE Access 2020, 8, 151650–151667. [Google Scholar] [CrossRef] [PubMed]

- Cotfas, L.-A.; Delcea, C.; Mancini, S.; Ponsiglione, C.; Vitiello, L. An Agent-Based Model for Cruise Ship Evacuation Considering the Presence of Smart Technologies on Board. Expert Syst. Appl. 2023, 214, 119124. [Google Scholar] [CrossRef]

- Cotfas, L.-A.; Delcea, C.; Iancu, L.-D.; Ioanas, C.; Ponsiglione, C. Large Event Halls Evacuation Using an Agent-Based Modeling Approach. IEEE Access 2022, 10, 49359–49384. [Google Scholar] [CrossRef]

- Milne, R.J.; Delcea, C.; Cotfas, L.-A. Airplane Boarding Methods That Reduce Risk from COVID-19. Saf. Sci. 2021, 134, 105061. [Google Scholar] [CrossRef]

- Milne, R.J.; Delcea, C.; Cotfas, L.-A.; Craciun, L.; Molanescu, A.G. Health Risks of Airplane Boarding Methods with Apron Buses When Some Passengers Disregard Safe Social Distancing. PLoS ONE 2022, 17, e0271544. [Google Scholar] [CrossRef]

- Ponsiglione, C.; Roma, V.; Zampella, F.; Zollo, G. The Fairness/Efficiency Issue Explored Through El Farol Bar Model. In Scientific Methods for the Treatment of Uncertainty in Social Sciences; Gil-Aluja, J., Terceño-Gómez, A., Ferrer-Comalat, J.C., Merigó-Lindahl, J.M., Linares-Mustarós, S., Eds.; Advances in Intelligent Systems and Computing; Springer International Publishing: Cham, Switzerland, 2015; Volume 377, pp. 309–327. ISBN 978-3-319-19703-6. [Google Scholar]

- Zhou, Y.; Shen, X.; Cao, J.; Zhang, Y. Research on Influence Factors of Prevention and Control Measures on Economy-Based on Netlogo Simulation and Big Data Computation. In Proceedings of the 2022 2nd International Conference on Social Sciences and Intelligence Management (SSIM), Taichung, Taiwan, 24–26 November 2022; IEEE: Taichung, Taiwan, 2022; pp. 79–84. [Google Scholar]

- Umlauft, M.; Schranz, M.; Elmenreich, W. SwarmFabSim: A Simulation Framework for Bottom-up Optimization in Flexible Job-Shop Scheduling Using NetLogo. In Proceedings of the 12th International Conference on Simulation and Modeling Methodologies, Technologies and Applications, Lisbon, Portugal, 14–16 July 2022; SCITEPRESS—Science and Technology Publications: Lisbon, Portugal, 2022; pp. 271–279. [Google Scholar]

- Chatterjee, A.; Cao, Q.; Sajadi, A.; Ravandi, B. Deterministic Random Walk Model in NetLogo and the Identification of Asymmetric Saturation Time in Random Graph. Appl. Netw. Sci. 2023, 8, 33. [Google Scholar] [CrossRef]

- Khan, F. Application of Agent-Based Modeling: Simulating Financial Systemic Risk and Contagion within Housing and Financial Markets. Ph.D. Dissertation, The Claremont Graduate University, Claremont, CA, USA, 2019; p. 332. Available online: https://scholarship.claremont.edu/cgu_etd/332 (accessed on 9 July 2023).

- Axtell, R.L.; Farmer, J.D. Agent-Based Modeling in Economics and Finance: Past, Present, and Future; INET Oxford Working Paper No. 2022-10; Institute for New Economic Thinking: Oxford, UK, 2022; Available online: https://www.inet.ox.ac.uk/files/JEL-v2.0.pdf (accessed on 9 July 2023).

- National Bank of Romania. Evolution of the Quarterly Reference Index—IRCC. Available online: https://www.bnr.ro/Indicele-de-referin%C8%9Ba-pentru-creditele-consumatorilor--19492-Mobile.aspx (accessed on 16 February 2023).

- National Institute of Statistics. Evolution of the Inflation Rate in Romania. Available online: https://insse.ro/cms/en/content/cpi-%E2%80%93-quarterly-data-series (accessed on 16 February 2023).

- Li, H.; Zou, H. Inflation, Growth, and Income Distribution: A Cross-Country Study. Ann. Econ. Financ. 2002, 3, 85–101. [Google Scholar]

- Khumalo, J. Inflation and Stock Prices interactions in South Africa: VAR Analysis. Int. J. Econ. Financ. Stud. 2013, 5, 23–24. [Google Scholar]

- Hsing, Y. The Stock Market and Macroeconomic Variables in BRICS Country and Policy Implications. Int. J. Econ. Financ. Issues 2011, 1, 12–18. [Google Scholar]

- De Jesus, C.; Willows, G.D.; Olivier, A.M. The influence of the market on inflation, not the other way around. Invest. Anal. J. 2020, 49, 79–91. [Google Scholar] [CrossRef]

- Sokpo, J.T.; Iorember, P.T.; Usar, T. Inflation and Stock Market returns volatility: Evidence form the Nigerian Stock Exchange 1995Q1–2016Q4: An E-GARCH Approach. MPRA Paper, no. 85656. Int. J. Econom. Financ. Manag. 2017, 2, 69–76. [Google Scholar]

- Tchereni, B.H.; Mpini, S. Monetary Policy Shocks and Stock Market volatility in emerging markets. Risk Gov. Control. Financ. Mark. Inst. 2020, 10, 50–61. [Google Scholar] [CrossRef]

- Bank of England. Available online: https://www.bankofengland.co.uk/ (accessed on 16 February 2023).

- National Bank of Romania. Banks in Romania. Available online: https://www.bnro.ro/Banks-in-Romania-1724.aspx (accessed on 16 February 2023).

| Systemic Risk Event | Risk Classification |

|---|---|

Global uncertainties in the context of the energy crisis, the war in Ukraine, and the COVID-19 pandemic. Global uncertainties in the context of the energy crisis, the war in Ukraine, and the COVID-19 pandemic. | Severe Systemic Risk |

The deterioration of internal macroeconomic balances, including deterioration as a result of geopolitical and international developments. The deterioration of internal macroeconomic balances, including deterioration as a result of geopolitical and international developments. | Severe Systemic Risk |

The delay in reforms and the absorption of European funds, especially through the National Recovery and Resilience Plan. The delay in reforms and the absorption of European funds, especially through the National Recovery and Resilience Plan. | High Systemic Risk |

The risk of non-payment of loans contracted by the non-governmental sector The risk of non-payment of loans contracted by the non-governmental sector | High Systemic Risk |

| Actual Value | |||

|---|---|---|---|

| Positive | Negative | ||

| Predicted Value | Positive | True Positive (TP) | False Positive (FP) |

| Negative | False Negative (FN) | True Negative (TN) | |

| Agent Characteristics | Description of the Property of ABM Agents |

|---|---|

| Heterogeneity | Agent-based models provide the ability to simulate each specific entity of interest, such as ants, customers, households, small businesses, large corporations, governments, and more. Additionally, these models allow for the incorporation of realistic or irrational behaviors. By utilizing a “bottom-up” approach, these models can capture the diversity of the real world, making them highly intriguing. Basically, agents are different from each other in terms of behavior, degree of connectivity, and portfolio size. |

| Emergence | One of the most important emergent properties of agents refers to the appearance of behaviors or characteristics at the system level that cannot be predicted or explained by the individual analysis of agents. This feature makes agent-based models very useful in analyzing and simulating complex systems such as financial markets. According to [81], one of the most notable instances of emergent behavior in the financial market and economics is Adam Smith’s concept of the invisible hand, which illustrates how the self-interested behaviors of individual agents in the economy can converge to generate optimal outcomes for society as a whole. |

| Complexity | By using agent-based models, we can acknowledge the interconnected and non-linear nature of financial markets. This involves modeling the bank and the market as a complex adaptive system. Rather than disregarding complexity, agent-based models actively embrace it. Although agents in agent-based models are considered autonomous entities, the complexity property helps us to program agents so that they have complex behaviors and decisions based on an input of information and variables. |

| Social Interaction | In the case of the analysis of banking systems using agent-based modeling, the social interaction property shows us that agents interact with each other through the banking network. For example, you can simulate a network of customers who have mortgages offered by the Romanian banking system. This network can be an eloquent example that highlights the described property. |

| Adoption | Agents can adopt different strategies, being autonomous agents, but these are also influenced to some extent by market circumstances and by the level of financial education that the agent has. |

| Risk and reward | Through this feature, agents evaluate their potential risk and reward to make decisions about their portfolio. For example, in the case of accessing a second mortgage, the agents can assess the risk of defaulting on the loan, but also the reward of purchasing another property. |

| Learning | In terms of learning, agents can learn from past experiences and adapt their strategies. |

| Informational asymmetry | Agents may have different or incomplete information about markets and other agents, which can influence their decisions and lead to risk propagation. |

| Interdependence | Decisions made by one agent can directly or indirectly impact other agents and the market as a whole. |

| Feedback | Agents can receive feedback from the market and adjust their strategies accordingly, which can lead to changes in market behavior and performance. |

| Adaptability | Agents may be able to adapt to changes in the economic environment and other market conditions. |

| Realistic behaviors | One of the strengths of agent-based models is their ability to generate realistic behavior by observing actual human behavior. Research in behavioral economics has shown that people frequently use heuristics rather than making fully rational decisions. Consequently, there are several models that investigate the consequences of situations where purely rational options are not viable or too costly, or when agents’ environments undergo changes over time [81] |

| Exploring the space of possibilities | A major advantage of agent-based modeling is that it allows for the simulation for each individual agent of numerous scenarios to observe the entire population of agents. |

| Variable | Type | Description |

|---|---|---|

| Bad | Quantitative | A bad customer is defined, in this case, as a customer who has payment delays or has not repaid the loan by the due date and has penalties such as garnishment of salary, court executions, etc. |

| Loan | Quantitative | The value (amount) of the requested loan. |

| Mortdue | Quantitative | The amount owed for the mortgage loan. |

| Value | Quantitative | The value of the mortgaged property. |

| Reason | Qualitative | The purpose of the loan requested. We have 2 possible options: loan consolidation (DeptCon) or home renovation (HomeImp). |

| Job | Qualitative | Scorecard for credit applicants’ occupations. |

| Yoj | Quantitative | Seniority at work. |

| Derog | Quantitative | The number of exemptions. |

| Delinq | Quantitative | The number of loans that have not been paid. |

| Clage | Quantitative | Duration of the oldest line of credit (months). |

| Ninq | Quantitative | Number of recent credit requests. |

| Clno | Quantitative | Number of lines of credit. |

| Debtinc | Quantitative | Debt-to-income ratio. |

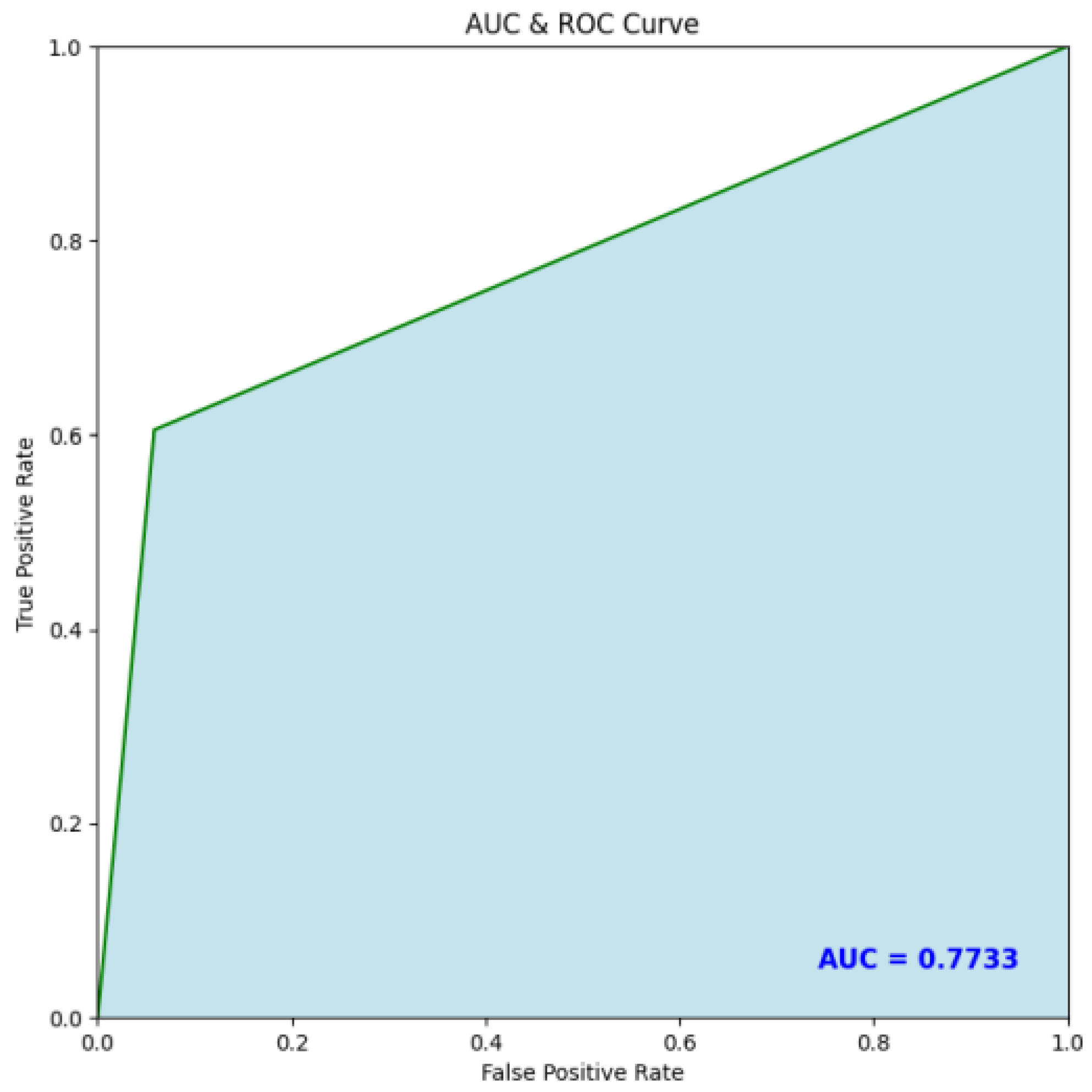

| Models | Accuracy | Precision | Recall | F1 | AUC |

|---|---|---|---|---|---|

| Random Forest | 86.66 | 78.71 | 49.19 | 60.55 | 72.85 |

| K-Nearest Neighbors | 85.99 | 76.47 | 47.18 | 58.35 | 71.67 |

| Logistic Regression | 80.36 | 88.89 | 6.45 | 12.03 | 53.12 |

| Extra Trees Classifier | 81.28 | 96.3 | 10.48 | 18.91 | 55.19 |

| Naïve Bayes | 80.87 | 73.81 | 12.5 | 21.38 | 55.66 |

| AdaBoost | 88.26 | 80 | 58.06 | 67.29 | 77.13 |

| XGBoost | 88 | 78.07 | 58.87 | 67.13 | 77.25 |

| LightGBM | 87 | 75.41 | 55.65 | 64.03 | 75.44 |

| Variables | Description |

|---|---|

| Number of agents (banks) | The agents modeled in NetLogo are the 32 banks that form the banking network in Romania. |

| Interbank assets | Represents the loans the bank has received from other banks on the interbank market. |

| Illiquid assets | Represents some form of illiquid assets on the balance sheet. |

| Interbank liabilities | Represents the obligations to other banks on the interbank market. |

| Deposits | Bank deposits. |

| Bank size | Banks have different sizes based on random normal distribution. |

| Ticks | One tick represents 3 days. |

| Setup Parameters | Meaning | Possible Values |

|---|---|---|

| Banks | The total number of banks that will be considered for the proposed analysis. | Between 1 and 80 Since we are analyzing the behavior that may occur in Romania, 32 banks were selected, since this is the total number of the banks present in the country |

| Setup | Initializes the model. | N/A |

| mu | The average value of the interbank assets. | Between 0 and INF In order to have a Gaussian distribution of the interbank assets for our analysis, mu should be 0 |

| sigma | The standard deviation of the interbank assets. | Between 0 and INF. In order to have a Gaussian distribution of the interbank assets for our analysis, sigma should be 1.5 |

| Default random bank | One random bank from their total amount is going to be in a default state. | 1 |

| Default smallest bank | One of the smallest banks is going to be in a default state. | 1 |

| Default biggest bank | One of the biggest banks is going to be in a default state. | 1 |

| go | Runs the model. | N/A |

| Count links | The total amount of links that are between all of the banks. | Between 1 and 322 |

| Defaulted banks | The number of banks in default-state at a specific moment in time. | Between 1 and 32 |

| Non-defaulted banks | The number of banks in a non-default-state at a specific moment in time. | Between 0 and 31 |

| Scenario | Statistics | Interbank Assets | Illiquid Assets | Interbank Liabilities | Deposits | Bank Size | Tick |

|---|---|---|---|---|---|---|---|

| Default Random Bank | Average Non-Contagion | 0.530662021 | 2.455400697 | 0.001776756 | 2.984286 | 2.986062718 | 360 |

| Max. Value Non-Contagion | 19.6 | 78.4 | 0.135232349 | 98 | 98 | 360 | |

| Min. Value Non-Contagion | 0 | 0.8 | 0 | 0.878655 | 1 | 360 | |

| Average Financial Contagion | 0.66056338 | 2.642253521 | 0.620101426 | 2.682715 | 3.302816901 | 2.443662 | |

| Max. Value Financial Contagion | 15 | 60 | 4.078809524 | 73.89019 | 75 | 5 | |

| Min. Value Financial Contagion | 0.2 | 0.8 | 0 | −2.99836 | 1 | 2 | |

| Default Biggest Bank | Average Non-Contagion | 5.48487 | 25.336 | 0.003419 | 30.81745 | 30.82087 | 360 |

| Max. Value Non-Contagion | 64.2 | 256.8 | 0.337621 | 321 | 321 | 360 | |

| Min. Value Non-Contagion | 0 | 2.4 | 0 | 3 | 3 | 360 | |

| Average Financial Contagion | 5.837297 | 23.40054 | 0.54245 | 28.69539 | 29.23784 | 2.462162 | |

| Max. Value Financial Contagion | 45.8 | 183.2 | 5.9 | 228.96 | 229 | 5 | |

| Min. Value Financial Contagion | 0 | 4 | 0 | 4.207451 | 5 | 2 | |

| Default Smallest Bank | Average Non-Contagion | 0.181226054 | 0.818773946 | 0.002115523 | 0.99788 | 1 | 358.6303 |

| Max. Value Non-Contagion | 0.2 | 1 | 0.316666667 | 1 | 1 | 360 | |

| Min. Value Non-Contagion | 0 | 0.8 | 0 | 0.68333 | 1 | 2 | |

| Average Financial Contagion | 0.199524941 | 0.800475059 | 0.708634049 | 0.29137 | 1 | 2.418052 | |

| Max. Value Financial Contagion | 0.2 | 1 | 12.8 | 1 | 1 | 360 | |

| Min. Value Financial Contagion | 0 | 0.8 | 0 | −6.2114 | 1 | 2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ionescu, Ș.; Chiriță, N.; Nica, I.; Delcea, C. An Analysis of Residual Financial Contagion in Romania’s Banking Market for Mortgage Loans. Sustainability 2023, 15, 12037. https://doi.org/10.3390/su151512037

Ionescu Ș, Chiriță N, Nica I, Delcea C. An Analysis of Residual Financial Contagion in Romania’s Banking Market for Mortgage Loans. Sustainability. 2023; 15(15):12037. https://doi.org/10.3390/su151512037

Chicago/Turabian StyleIonescu, Ștefan, Nora Chiriță, Ionuț Nica, and Camelia Delcea. 2023. "An Analysis of Residual Financial Contagion in Romania’s Banking Market for Mortgage Loans" Sustainability 15, no. 15: 12037. https://doi.org/10.3390/su151512037

APA StyleIonescu, Ș., Chiriță, N., Nica, I., & Delcea, C. (2023). An Analysis of Residual Financial Contagion in Romania’s Banking Market for Mortgage Loans. Sustainability, 15(15), 12037. https://doi.org/10.3390/su151512037