1. Introduction

Many countries worldwide deal with problems such as pollution, poverty, wars, unemployment, and child labor, among others [

1]. Social enterprises (SEs), defined as private organizations that aim for profit and a social mission, can address many of these problematic issues. Social entrepreneurship is a new form of business that has grown in recent years, mainly with the increasing incidence of economic, environmental, and social problems. The proof of the importance of social entrepreneurship is that journals have published more and more studies on the subject in the last decade [

2].

There is a relationship between social entrepreneurship and sustainability because social entrepreneurship is essential for sustainable development [

3]. This relationship also exists because social entrepreneurship is a construct focused on sustainability and shaped by environmental dynamics [

4], thus serving as a response of public and private value to social, economic, and environmental challenges discussed in the business and sustainability literature [

5]. Furthermore, the sustainability orientation—necessary for the long-term survival and economic viability of social enterprises (SEs)—is one of the dimensions of the social entrepreneurship orientation [

6]. Sustainability is also present in the mission of SEs, which is to solve social and environmental problems through sustainable solutions [

4]. In addition, the goals of SEs are similar to the UN Sustainable Development Goals (SDGs). The SDGs are a global call for developed and developing countries to commit to 17 goals related to poverty, health, education, and hunger [

7].

SEs are also the primary beneficiaries of social impact investors, who are investors who expect to achieve social and economic/financial results. They have great potential to solve several problems present in the world today [

8,

9] as they are an essential source of funding for social enterprises (SEs) [

10] and because both have a financial and social development logic at the same time [

11]. Impact investing is an excellent stimulator for the growth of SMEs [

12]. Both impact investing and sustainable investing are ways to incorporate environmental, social, and governance (ESG) criteria into investment decisions [

13].

We formulate our research problem on the importance of investment for social enterprises to grow and generate social impact and the lack of knowledge about what influences this funding. Access to financial resources is one of the biggest obstacles entrepreneurs face [

14], including those in social areas. Social impact investing is considered a way to solve this challenge [

12]. As much as social investing is in evidence, research has not kept pace with this growth [

15]. Even so, most works treat social investment as isolated and do not study contextual factors that foster investment [

8]. The social investment process and the criteria investors use to select SEs are unclear. Filling this gap is essential because entrepreneurs need knowledge about the most critical criteria to capture more investment [

16,

17]. The investment raised is essential for SEs to improve the social impact generated [

18]. We choose as a research context Brazil, one of the largest emerging economies in the world, bringing great opportunities for investors who care about social and environmental issues [

19]. However, understanding the conditions that foster impact investing in these contexts is lacking.

Our work aims to identify the determining factors of access to finance for social enterprises (SEs) in Brazil’s emerging economy. Therefore, the research question is as follows: “What are the determining factors for access to financing for social enterprises in Brazil?” For this, a quantitative approach was used with a large sample (N = 601 SEs), which researchers rarely use [

15]. This approach reduces uncertainties regarding the results [

20]. Social entrepreneurship research over the past two decades calls for more quantitative papers [

21].

Among the main findings, we found that business model, impact sector, development stage, technology adoption, and acceleration/incubation had a significant effect on access to finance by SEs. In addition, social impact measurement methodologies, dividend distribution, and market orientation were insignificant. We contribute to developing knowledge about entrepreneurial finance, social entrepreneurship, social impact investment, and entrepreneurship in emerging economies. As a practical contribution, we favor social entrepreneurs who want to drive their decisions more assertively by finding the factors that foster access to finance. We also help SEs to generate a more positive impact on society, given that social investment aims precisely at this return.

The novelty of this study lies in the fact that it is a pioneer in finding the factors that influence access to finance for social enterprises in an emerging economy. The past literature is all focused on the traditional enterprise. From a methodological point of view, the novelty of this paper lies in the quantitative approach used, which, as previously stated, is still rare in social entrepreneurship and leads to more precise results. We are also pioneers in terms of variables as the variables in this study involve strategic, technological, entrepreneurial, financial, social, product, and business factors.

3. Research Method

3.1. Research Classification

We classify our study from an ontological point of view as being objective. This work can be classified as being from the positivist paradigm regarding epistemology. Regarding the methodology, we classify our work as being hypothetical-deductive. Regarding the techniques used, this work uses a quantitative approach due to the collected data type. This work also analyzes secondary data. We also used statistical tests because we calculated the p-value to verify the significance of the analyzed variables.

3.2. Research Context

We chose Brazil as the context of our study due to its economic importance, which attracts researchers’ interest in issues such as the solidarity economy [

82] and innovation ecosystems [

83]. Brazil has several social and environmental problems, such as deforestation, lack of water and energy, vulnerability to climate change, land concentration, and other social empowerment problems [

84]. Past studies show that SEs can help people who live in this context [

83], which explains the growth of social entrepreneurship in Brazil [

85]. In 2011, Brazil had the most Ashoka social entrepreneurship scholarship fellows [

86]. Despite this, Brazil is a country that presents many barriers to social impact investing. Among these barriers, poor financial education, institutional weakness, socio-economic inequality, and low levels of schooling stand out [

87], thus justifying the objective of this work to find the determinants of access to finance in the context of an emerging economy.

3.3. Data Collection

A secondary dataset developed by PIPE Social (Innovative Research in Small Businesses) frequently collects information about SEs and maps the innovation ecosystem. To form this dataset, PIPE Social makes an online call where SE managers respond to a questionnaire voluntarily. In order to verify whether the organization registered on the platform is an SE, PIPE analyzes several aspects. In the first place, the self-declaration, i.e., the enterprise considering itself social. Even so, PIPE checks social networks, websites, and the enterprise’s mission to verify if they fall within some aspects that characterize it as an SE, such as the intention to solve a social problem (the business’s principal activity) and the search for a financial return. The sample analyzed in this study was collected in 2019 and contained information on 601 SEs. Thus, SE is the unit of analysis of our work. Our results only apply to SEs and cannot be expanded to another type of enterprise.

In order to assess the credibility of the secondary sample, researchers should observe issues such as specifications, errors, frequency, objectives, the type of variables, and the methodology [

88]. These aspects are shown in

Table 4.

These criteria are in the marketing literature but in a chapter that deals with secondary samples so that they can be used in our work [

88]. A SEBRAE survey with the United Nations Development Program (UNDP) counted around 800 SEs in Brazil, with this number thus indicating the country’s total population of social enterprises. The PIPE database analyzed in this work covered about 75% of the total SEs and is thus representative.

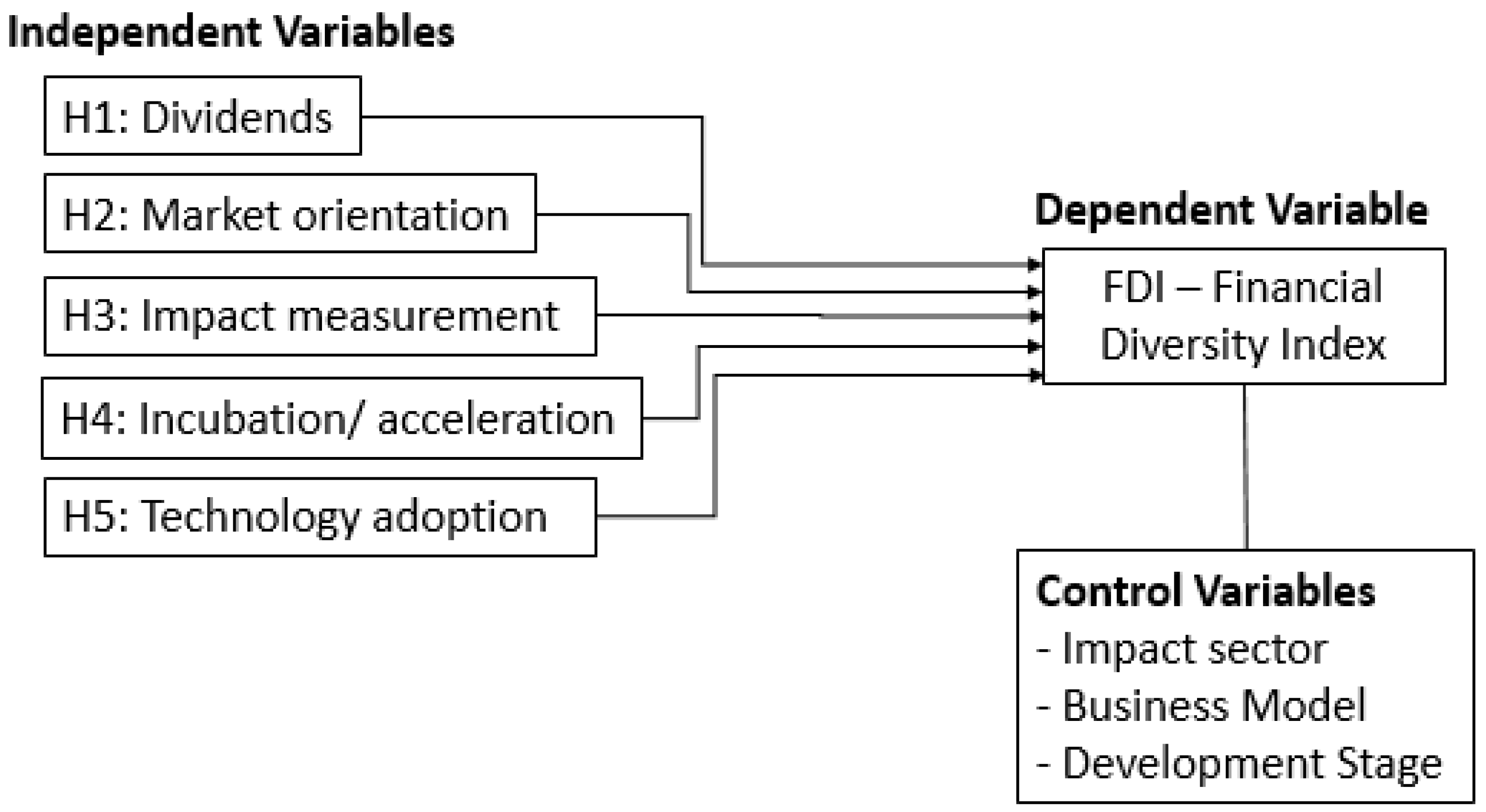

3.4. Variables

As a dependent variable, we selected the Financial Diversity Index (FDI) given by the sum of all external sources of funding through which SEs had access. We want to identify the factors that influence access to finance, and the literature considers the FDI the official measure for this type of study [

29,

89]. We chose five independent variables, indicated in

Table 5, each corresponding to a previously described hypothesis.

In addition to the independent variables, we also selected three control variables. The first one is the SE impact sector; according to

Table 1, that is a binary variable, and each SE can have more than one impact sector. The second control variable is the business model the SE adopts, which can be B2B, B2C, B2B2C, C2C, B2G, or a simultaneous combination. We first selected the impact sector and the business model of the SE because these are variables linked to the characteristics of the enterprise and, according to [

30], can influence access to finance. The last control variable is the stage of SE development according to

Table 2. In this variable, the development stage was ordered from 1 to 9, thus forming an ordinal variable. A previous study already used the development stage as an ordinal variable [

90]. This variable is commonly used as a control variable, as was the case in [

69]. One of the differentials of our work is that we selected enterprises from all stages of development, as recommended by the literature [

91], while most studies analyze only the most advanced stages [

29]. We selected the development stage because the cycle theory states that as an organization grows and evolves, its performance improves [

60].

3.5. Analysis

Figure 1 shows the relationship between this work’s independent and dependent variables. As the dependent variable in this work is ordinal, we chose to use ordinal logistic regression as an analysis method to relate the independent variables with the FDI. Regression is widely used in traditional organizational research, including research on entrepreneurship, to identify success factors or key performance indicators [

92]. The regression method provides each variable’s coefficient (effect) and significance. When the significance is less than a specific α value, the coefficient has explanatory statistical power with probability 1 − α [

93]. In our work, we checked the significance through the

p-value. Using secondary samples to identify determining factors through regression is expected [

94].

The assumptions for using ordinal logistic regression are as follows:

- -

The dependent variable must be ordinal (as in the case of the FDI in our work);

- -

At least one of the input variables must be categorical, continuous, or ordinal, as shown in

Table 5 and

Table 6;

- -

The correlation between the variables must be low (<0.6), thus implying low multicollinearity. In

Table 7, we show that all the correlations between the variables in our study are low, thus not exhibiting multicollinearity or any relationship between the variables.

The regression method is adequate, and the samples are representative when the sample size is at least five times greater than the number of variables [

95]. We used the SPSS Statistics 20 software to apply the logistic regression method.

In order to evaluate the model, model fitting information was calculated, such as −2 Log Likelihood, Chi-square, and its significance. This statistic tests the hypothesis that all coefficients of the independent variables are equal to zero versus the hypothesis that at least one coefficient is not zero. If significance is lower than 5%, we can say that at least one coefficient differs from zero. Pearson’s goodness of fit was also calculated using the Chi-square test, where if the significance value was lower than 5% we rejected the null hypothesis that the model fits the data adequately. Finally, we calculate the Negelkerke, McFadden, and Cox–Snell pseudo-R2 values.

4. Results

Figure 2 shows the characterization of the dependent variable FDI, which expresses access to finance in SEs. As observed by the average of 0.835, most SEs in Brazil may have difficulty accessing some financing. In addition, the high standard deviation shows a significant disparity between SEs, some having access to different sources while others rely only on their investment.

In order to characterize the sample,

Table 7 shows a summary of the variables analyzed in this work. First, there is no pair of variables with high correlation, so there are no multicollinearity problems in the sample and no associations or relationships between the variables.

More than half of the SEs consider themselves to be Green techs.showing the environmental awareness of the entrepreneurs. The vast majority of SEs also have a B2B business model, that is, they have another business as a customer that seeks to solve social or environmental problems. Most SEs have the bottom of the pyramid as a market orientation, seeking to solve the problems of the most vulnerable and low-income members of the population. Most enterprises do not measure their social impact, showing difficulty accessing and using these methodologies. Finally, most SEs distribute their dividends, showing good financial conditions.

Table 8 presents the regression results, where we highlight the significant variables in green. In

Table 8, we present the different control and independent variables, all separated by the border.

The green technology impact sector, B2B2C business models, the stage of development, the incubation/acceleration process, and the adoption of technologies had a significant effect (p < 0.1). Only the smart cities impact sector had a significant negative effect (p < 0.1).

Based on the obtained results, we can consider that hypotheses H1 (dividend distribution), H2 (BOP market orientation), and H3 (social impact measurement) could not be confirmed, as their respective variables did not have significant effects on access to financing. On the other hand, we confirm hypotheses H4 and H5 and that their respective variables (incubation/acceleration process and technology adoption) positively and significantly affect SE funding. In

Table 9, we present a summary of the hypotheses.

We did not confirm hypotheses H1, H2, or H3 because the

p-value of the respective variables was greater than 10%. Therefore, they have no significant effect. We confirm hypotheses H4 and H5 because the

p-value statistics of the respective independent variables were less than 10%. Furthermore, the regression coefficients were positive.

Table 10 presents the measures of goodness of fit from the regression model.

The 2-loglikelihood significance value from the Chi-square test was less than 5%, demonstrating enough evidence to state that at least one coefficient of the independent variables is different from zero. In Pearson’s Chi-square test for goodness of fit, we obtained a significance of 75.5%. As this value was larger than the 5% selected for this work, we can say that there is not enough evidence to say that the model does not adequately fit the data. Pseudo-R2 values indicate that we can add new variables in future work.

5. Discussion

According to

Table 8, it is possible to answer the research question of our work by observing the coefficients and significance. The determining factors for access to finance for social enterprises in an emerging economy are (i) incubation/acceleration; (ii) technology adoption; (iii) development stage; (iv) the B2B2C business model; and (v) the green technology impact sector. These were the significant factors with a positive effect, and we ordered them in descending order according to the regression coefficient. In addition, the smart cities impact sector had a significant and negative effect.

The impact sector’s significant effect shows that investors care about the sectors in which entrepreneurs plan to have an impact. Green technology’s significant positive effect demonstrates greater environmental awareness by investors. On the other hand, the smart cities sector does not seem attractive to investors. The government is essential in promoting smart cities by allocating resources and creating market policies [

96]. Thus, a lack of government investment means that SEs focused on solutions for smart cities do not develop and do not attract investors.

Our work has shown that the business model that an SE applies influences access to finance, demonstrating that investors are concerned with how the entrepreneur provides value to their clients. The B2B2C business model was the only one considered significant, and its positive coefficient demonstrates its attractiveness to investors. The SE can derive several benefits from the intermediary company, such as greater logistics possibilities, more customers, visibility, and less credit risk. The reality of the significance of the impact sector and business model corroborates with another study that states that the organization’s characteristics are determining factors for financing issues [

90]. We already knew that the attractiveness of business models influences the investment received through crowdfunding for enterprises in Germany [

35], and now our study shows its importance for social enterprises in Brazil.

The fact that the distribution of dividends has no significance shows that investors do not care whether or not the SEs are returning dividends to shareholders. As the distribution of dividends is one of the best indicators of financial performance [

42], its non-significance shows that social investors are not concerned with the financial situation of the SEs they invest in. Social investors are indeed “social”; they are very concerned with the social return they bring, not just the financial issue.

Market orientation had no significant effect on access to finance, which shows that BOP- or TOP-focused SEs receive the same interest from investors. This highlights that investors want the enterprise to have a mission with a social impact, no matter which layer of society this impact is in. The fact that the development stage has a significant positive coefficient in terms of access to finance shows the difficulty SEs have in raising funds at the beginning of their entrepreneurial journey. It also indicates that these raised funds increase when the initial idea takes shape and becomes a viable product. The life cycle theory states that the performance of an organization tends to increase with its maturity (life cycle) due to the knowledge acquired in this process [

60]. Our work contributes to the knowledge stating that as an SE evolves, it becomes more attractive to investors, thus having more access to financing. One of our differentials is that the vast majority of works study only the most advanced stages of the startup cycle, while in our work we analyzed from the initial stages [

29].

The impact measurement was not significant for the investment received. As much as social investors are interested in the social impact generated by SEs, the subjectivity, high cost, and lack of consensus about the best measurement methodology for social impact [

59,

60] make the reliability of social results difficult, thus leading to them having little relevance for investors. It does not mean investors are not interested in the social impact generated, as the social mission of an SE already contains information about its social purpose. Thus, we can conclude that the impact investor is interested in the enterprise’s social mission, not necessarily the social impact metric. Another reason is the lack of publicity and knowledge about social impact measurement methods (as opposed to financial impact).

The fact that incubation and acceleration have a positive and significant coefficient on the investment received shows the importance of this type of support in bringing more resources to new SEs, confirming the results found in [

97]. It shows that incubators and accelerators can potentially connect tenants with investors. In addition, incubators and accelerators usually help with product development and provide consultancy in communication, marketing, and finance, thus making their tenants more attractive to investors. Research has already identified the influence of incubation on the financial resources raised by traditional enterprises [

71]; however, the literature on incubation is still evolving, and there is a need for further studies, especially regarding the impact of incubators on tenants [

68]. Our work then demonstrates an impact on access to finance, specifically in social enterprises which may have different needs in terms of incubators and may thus experience a different influence from them.

Adopting technology exhibited a positive and significant coefficient in terms of access to finance. We conclude that emerging technologies make SEs more attractive to social impact investors. These emerging technologies, often called ICT (information and communication technology), have their importance proven in Industry 4.0 and traditional enterprises. For example, ICT is an essential component for the financial inclusion of innovative enterprises. However, study of its effect on SEs is lacking [

98], so much so that there is a need for empirical studies on the benefits of technology for SEs [

78]. Thus, we advance knowledge by demonstrating that one of the benefits that emerging technologies bring to SEs concerns access to finance. It also shows that investors are more interested in enterprises with some technology embedded in their products or services. Technology facilitates partnership and collaboration with other actors in the ecosystem, mainly through digital platforms [

99].

5.1. Practical Implications

Our results mainly affect social entrepreneurs who can take specific practical actions to maximize the social investments raised. The fact that the “green” impact sector positively affects access to finance shows that the entrepreneur should consider including the environmental issue in their products or into the SE’s mission. Instead of waiting for governments to be more open to innovations, entrepreneurs interested in solving urban problems (smart cities) could organize themselves into groups and better disseminate their proposals to the population. Thus, they could also sensitize the authorities to the importance and general gains in implementing solutions in urban areas.

Regarding the business model, we saw that SEs with B2B2C business models have more access to funding. In practical terms, entrepreneurs should partner with another organization to reach their final consumer. The significant and positive impact of the development stage shows that the entrepreneur must focus on validating their idea as soon as possible and then put it on the market to attract more investors.

The positive influence of adopting emerging technologies on access to finance shows that entrepreneurs should seek to implement some of these technologies in their solutions for the customer. Finally, we recommend that the entrepreneur seek the support of an incubator or accelerator, as these organizations can expose SEs to investors and provide access to knowledge through consultation and mentoring.

Market orientation does not affect access to finance, so the entrepreneur can choose whichever portion of the pyramid they find most convenient. The same occurs with the distribution of dividends. The entrepreneur may or may not return the dividends to the company, depending on their needs. Even without a significant effect, the entrepreneur should adopt some social impact measurement methodology suitable for the business since it can influence other issues like financial and environmental performance.

5.2. Theoretical Implications

This article first contributes to the social entrepreneurship and investment literature by filling the gap regarding the criteria and factors social investors consider when investing in an SE. We contribute to knowledge by presenting a specific profile of the social impact investor. We show that they are more sensitive to causes related to the environment, perceive the financial return to not be as relevant, and are more concerned with whether the invested enterprise has a social mission (impact sector), with the portion of society that the enterprise reaches and the measurement of its impact not as important. We also show that life cycle theory, in the case of social enterprises, also applies to access to finance. As an SE acquires maturity, it also becomes more attractive to investors. We also build on existing knowledge regarding the role and impact of technologies and incubators/accelerators by showing their influence on access to finance for SEs. We are also pioneers in the set of predictors used, thus bringing novelty. In addition, the literature on social entrepreneurship lacked quantitative works that used large databases [

100].

The article contributes to the literature on entrepreneurial finance by identifying the determinants of access to finance for SEs. The theory divides entrepreneurial finance into four levels of analysis: (i) the entrepreneurial firm; (ii) organizations that encourage and provide resources for entrepreneurial firms; (iii) the organizations that support these organizations; and (iv) the country in which the firm works [

101]. In our work, we addressed three of these four levels. We analyzed the enterprising firm, in this case SEs, which is our database’s analysis unit. One of our independent variables was precisely the incubator/accelerator, which plays the role of an organization that provides resources for entrepreneurial firms. Finally, we used the country where entrepreneurial firms are located as the context of analysis, in this case Brazil, one of the largest emerging economies in the world.

Our study also contributes to the literature on entrepreneurship in emerging economies because many characteristics of Brazil are similar to other emerging economies. The same entrepreneurial challenges stand out among these characteristics, such as the lack of financial and technological resources, weak institutions, and excessive bureaucracy [

102,

103]. Economic and socio-economic similarities include economic growth, lack of infrastructure, social inequality, high rates of informal work, and poor education and health systems [

47,

104]. Finally, political similarities are also highlighted, such as political instability and corruption [

104]. However, researchers and practitioners should take into account cultural differences.

6. Conclusions

This work aims to find the factors that determine access to financing for social enterprises in the context of an emerging economy, in this case Brazil. For this, we used a large sample with information from 601 SEs and the quantitative method of ordinal logistic regression was applied.

The determining factors were the impact sector, the business model, the development stage, the incubation and acceleration process, and the adoption of emerging technologies. The results focused on the level of importance investors placed on green technology and enterprises with a B2B2C business model. Enterprises that are already well established and have an active product or service on the market attract more attention from investors. The results prove the potential of incubators and accelerators to attract investors to their incubated enterprises. Finally, our work demonstrated the power of new technology when added directly to the product or service offered by the SE.

This study mainly affects social entrepreneurs, who can use our results in the strategic decisions of their enterprises. As the variables that had the highest regression coefficients were incubation/acceleration and technology adoption, our results highlight the great need for social entrepreneurs to seek the assistance of an incubator or accelerator and the need to insert an emerging technology in the solution they offer in order to enhance access to financing.

As a practical implication, this work can help entrepreneurs to take specific initiatives to have more access to financing. As a theoretical implication, our article contributes to research on social entrepreneurship, social investment, entrepreneurial finance, and entrepreneurship in emerging economies. As a social implication, by having more access to finance, the social entrepreneur can invest more in their venture to generate more social impact.

The limitations of this work refer mainly to the use of a secondary sample. As a result, we face restrictions regarding the selection of variables. Therefore, future work could use other variables such as size and location, which researchers can collect from primary sources through a survey.