1. Introduction

Driven by non-financial motives such as operational efficiency and market competition, or financial motives such as alleviating financing constraints, sustainable trade credit (TC) has been one of the most important decisions with respect to short-term financing behaviors in the supply chain [

1,

2,

3]. It is a commercial contract that favors supply chain partners and is offered by large enterprises, as well as an act of capital reallocation and risk sharing [

4,

5]. Particularly in countries with strict regulation and conservative mode in financial development, due to severe information asymmetry, SMEs have difficulty accessing adequate bank credit [

3]. Therefore, most SMEs are heavily dependent on TC. In supply chain systems, to cope with the uncertainty of financing links external and operating conditions internal, there is often a prominent demand for TC financing—that is, a need for sustainable and high-quality TC provision. There is no doubt that enterprises with outstanding capabilities can provide more TC for their collaborators. However, the TC competitiveness hypothesis and the buyer-market theory suggest that enterprises with market competitive advantages tend to obtain TC rather than provide TC [

6,

7]. Therefore, how to motivate excellent enterprises to provide sustainable TC is a challenge faced by researchers.

Sustainable TC provision originated from scholars’ assumptions of the “signaling effect”, which helped firms to quickly establish reputation [

8,

9]. Under these circumstances, some scholars investigated the motives and determinants of enterprises to provide sustainable TC from various perspectives. Some studies suggested that sustainable TC provision was a signal of product quality assurance. Along with their ideas, it could be motivated via transaction motives, such as market-environment changes, reducing transaction costs and maintaining customer relationships [

1,

10,

11]. These motives are associated with the operational and transaction needs of firms. In addition, other studies indicated that sustainable TC provision reflected the role of financial allocation played by firms with high liquidity, especially in contexts with information asymmetry and severe credit constraints [

2,

10,

12,

13]. Therefore, these motives are also called financial motives. Although it is commonly assumed that firms with low financing costs and large firms are more likely to provide TC, the opposite situation also occurs. This may be due to customers’ positions in a buyer’s market or market competition motives such as the nature of the product, long-term relationship, etc. [

6,

7]. Furthermore, sustainable TC provision could be influenced by other factors such as the economic crisis and monetary policy tightening at the level of macro [

14,

15], the market competition and the differentiation degree at the level of industry [

16,

17] and bargaining power and financial constraints at the level of firm [

18,

19]. Meanwhile, in recent years, given the application and transformation of digital technology in enterprises’ behavior, relationship and welfare [

20], scholars have also focused on the role of digital technology application in the development mode of sustainable TC provision and considered it as an approach to address the current challenges of TC [

21,

22]. Specifically, the latest research also attended to the potential impact of the digital supply chain (DSC) on TC [

23]. However, the exploration of this perspective has been simplistic, and it lacks empirical evidence support.

The notion of DSC originated from the idea of intelligent supply chain, which was IT-enabled organization, as proposed by Rai et al. [

24]. Subsequently, most scholars agreed that a key trend was the integration between digital technology and supply chain management [

21,

25]. Enterprises and their partners of in the supply chain enhance the exchange of digital applications in systems of logistics, production, information and capital, and they improve the supply chain resilience [

26,

27]. In the process, they leverage digital technology to restructure the processes, coordination, organization and value of business in both the external and internal organization of supply chains, which is what DSC means [

28]. Based on the theories of resource-based and dynamic capabilities [

29,

30], and applying various methods, which have included case studies, QCA, DID and questionnaire survey, scholars found the partial effects of DSC on enterprises, such as competitive advantage [

31,

32], supply chain management modeling and supply chain efficiency [

25,

33]. Due to the lack of empirical measurements for DSC, few studies could offer empirical evidence for the effects of DSC [

34,

35]. TC is the reflection of the collaboration relationship between enterprises and their partners [

5,

36]. Some studies found that digital transformation may influence the sustainability of TC provision, adopting the lens of bank credit substitution [

23,

37]. In conclusion, numerous surveys demonstrated that DSC enhanced the competitive advantage of firms, but they overlooked the phenomenon that both competitive advantage and TC provision increased along with the development of DSC. This clearly diverged from the existing theoretical explanations. Some studies observed this phenomenon from the viewpoint of bank credit substituting TC financing [

38]. However, they could only indicate that firms had the ability to forgo occupying TC, and they could not connect the supply chain perspective and the relevant theory of TC to address the phenomenon from the perspective of the motives and capabilities. Therefore, we believe there are still gaps in the systematic research on the relationship between DSC and sustainable TC provision.

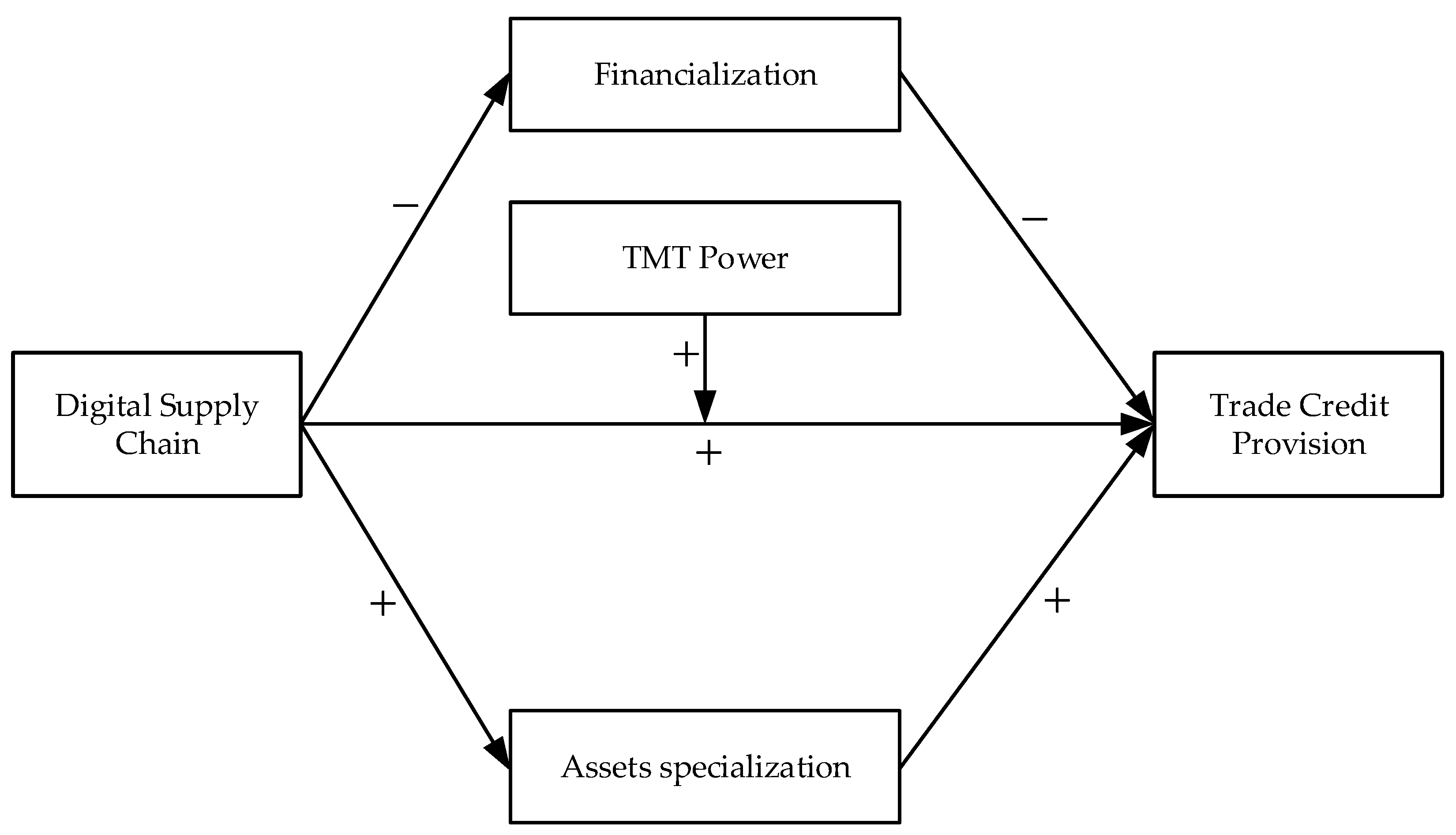

Meanwhile, based on the principal-agent problem, upper echelons theory argued that top management team (TMT) power was a crucial factor influencing the strategic orientation of enterprises [

39]. Scholars suggested that TMT power ensured that enterprises were consistent in their strategic formulation and execution [

40,

41]. However, scholars focused on how TMT power resulted in related-party transactions that harm shareholders’ interests [

42], which represented a significant challenge. In practice, TMT is the initiator and implementer of DSC strategy, as well as the key to whether firms provide sustainable TC. Therefore, TMT power may play a significant role in our research. We did not, however, find that this issue had been adequately addressed in the existing studies, which are still essential to discuss.

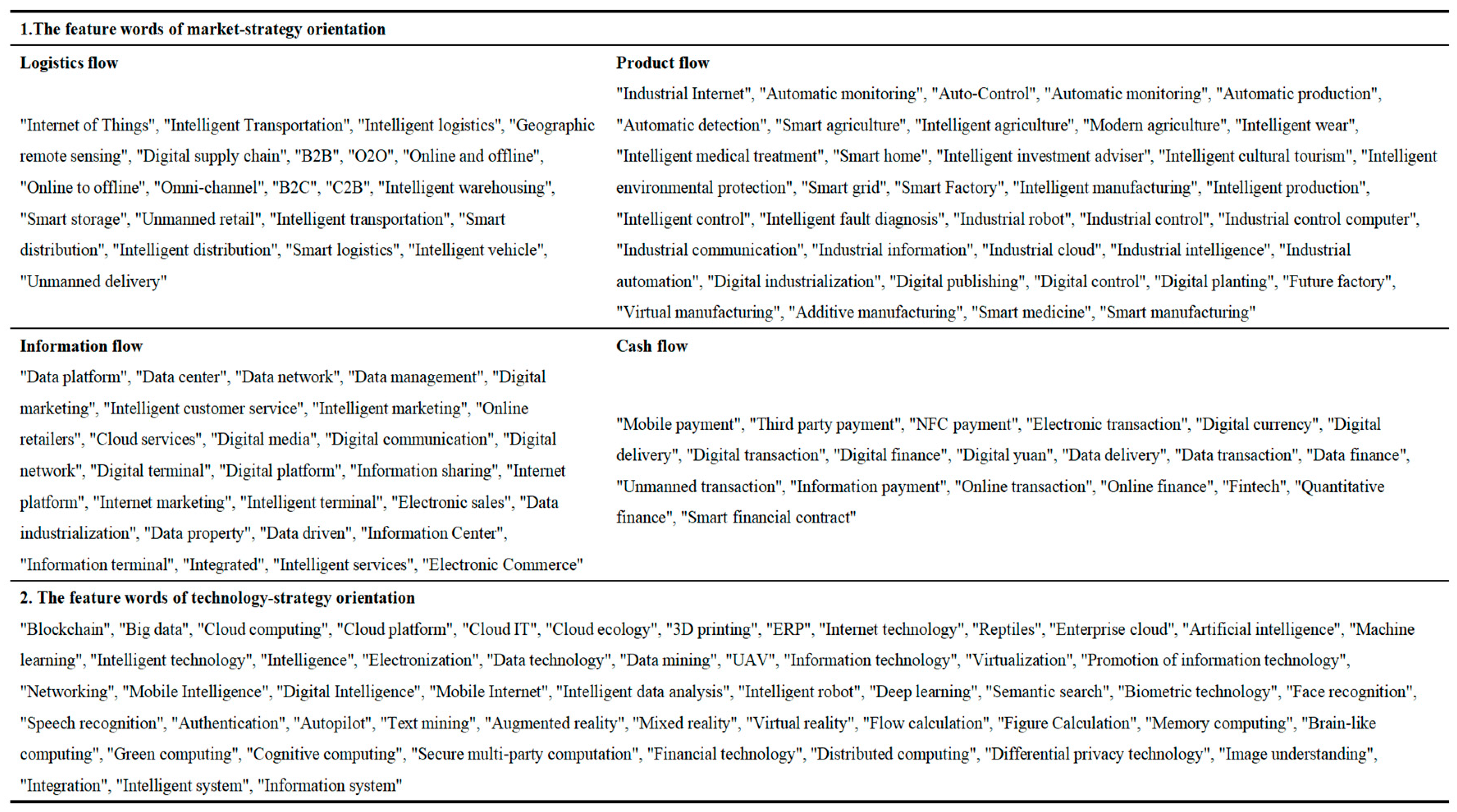

To investigate the relationship between DSC and sustainable TC provision, we gathered the financial data and reports of Chinese listed firms from 2008 to 2020. We utilized Python to create a feature-word corpus based on market-strategy and technology-strategy orientations and to assess the degree of DSC with the TF-IDF method. To ensure the robustness of our study, we used five methods to verify the outcomes of our baseline regression, including alternative measures of variables, alternative measures of models and alternative measures of samples. We also tackled the endogenous issue by using the IV method.

Compared with the extant literature, our study makes three innovative contributions. First, we examined the micro-effects of DSC applications and extended the competitive hypothesis of TC and buyer-market theory. Unlike previous studies [

23,

37,

38], we adopted a risk perspective and linked existing theories with enterprise capability and motivation. We investigated the impact and mechanism of DSC and sustainable TC provision systematically, which helped us to uncover the economic benefits of DSC [

43] and, furthermore, enriched the research angle and scope of TC provision motivation. Second, we broadened the application domain of the upper echelon theory [

44]. The extant literature highlighted the role of TMT in supply chain management [

45], but its overlooked the power of TMT. We elucidated the effect of TMT power on the relationship between DSC and TC provision and offered a foundation for future research. Finally, we developed a measurement method for DSC via a methodological framework that could include both the market-strategy orientation and the technology-strategy orientation of DSC [

32,

34], and we utilized the methods of text analysis and TF-IDF to develop a comprehensive assessment for DSC, which could address the challenges in the existing research.

Then this paper remaining is as follows:

Section 2 develops the hypotheses;

Section 3 describes the data and methods;

Section 4 reports the empirical results and robustness tests;

Section 5 presents the extended analysis; and

Section 6 concludes the paper and presents it implications.

6. Conclusions and Discussion

TC provision is one of the most crucial short-term financing behaviors and strategic decisions in the supply chain. How to enhance TC provision to actively exert credit allocation function and improve collaboration within the supply chain has been a vital theoretical and practical issue. In recent years, the application of digital technology in economic activities and the transformation of economic agents have aroused widespread attention [

20]. Existing studies not only explored the mechanism of digitization on TC financing [

23,

37] and demonstrated that bank credit may substitute TC financing in the context of digitization [

38]; they also found that DSC would increase supply chain resilience and performance from multiple aspects [

33]. DSC is an essential component of facilitating enterprise cooperation. Therefore, it should be emphasized that enterprises need to undertake the transformation of DSC proactively [

21,

25], and the government must also pay attention to bridging the digital gap [

69]. This implies that DSC may also exert a significant influence on sustainable TC provision, but existing research could not address this issue. Our study complements this key content and connects the two important research streams of DSC and TC in the field of supply chain. Meanwhile, our study also offers some insights into how to advance the DSC transformation of SMEs. SMEs are constrained by the scarcity of resources and capabilities; hence, their transformations are particularly challenging, especially in the absence of sufficient sources of funding [

70]. Some scholars have suggested that large enterprises should be encouraged to provide sustainable support for SMEs’ transformation [

3]. However, they did not point out specific and feasible means. In fact, sustainable TC offered by large enterprises may be an important path to achieving this. Compared with existing studies, our study identified a positive relationship between DSC and TC provision in large enterprises. Hence, we offer the theoretical foundation that TC provided from large enterprises can be a sustainable source of funding for SMEs’ digital transformation. By developing a digital network of the supply chain involving large, medium and small enterprises, based on the enhancement of credit allocation efficiency, we can promote the comprehensive transformation of DSC and the co-creation in value of the supply chain [

5]. This broadens the significance of our study and also indicates many issues worthy of continuous attention in future research on the supply chain. At the same time, unlike existing research on DSC, our study used data from Chinese listed firms from 2008 to 2021 and adopts the methods of text analysis and TF-IDF calculation to construct the indicators of DSC. This compensates for the deficiency of empirical evidence in existing related research and can provide reference for subsequent research on DSC.

Our study also has special contributions in theoretical application. First, our study enriches the literature on DSC and TC. Taking firm risk as the entry point, we answer why DSC can simultaneously enhance competitive advantage and TC provision of firms, which complements scholars’ understanding of the TC competitive hypothesis and buyer-market theory. Second, we applied upper echelon theory to the research of DSC and TC. We confirmed the contribution of TMT power to the relation between DSC and TC provision and enriched the literature on upper echelon theory. In sum, our study addresses the problem of how to encourage excellent enterprises to provide sustainable TC, which has important significance in managerial theory.

Furthermore, our study indicates that DSC of large enterprises can mitigate the unequal distribution of credit resources along the supply chain. Liu et al. argued that offering TC was detrimental to the sustainability of enterprises [

71]. However, the rational allocation of credit resources is a vital way to address the supply chain crisis and enhance the supply chain stability [

72]. In the context of Industry 4.0, digital technology reduces the information asymmetry in the supply chain and improves collaboration efficiency among enterprises [

73]. In the domain of digital coordination between large enterprises and their partners, constrained by the insufficient funds of SMEs, there are certain ceilings and gaps in DSC of large enterprises. Therefore, a reasonable policy of sustainable TC provision can not only assist in improving the stability level of supply chain but also help to safeguard the interests of supply chain partners and augment the positive externality and sustainability [

70,

74]. Our study offers the following insights for management practice. First, for large enterprises, DSC will entail changes in financial risks and operational risks. They can enhance the flexibility of TC provision and decide credit policies that align with their operational status. Meanwhile, in this process, large enterprises should be mindful of the role of TMT. Second, for SMEs, DSC of large enterprises provides them with sustainable TC, which can not only lower financing costs but also diminish operational uncertainty and gain the opportunities of “free riding”. Third, for government, DSC enables large enterprises to take on more work of credit allocation in the supply chain, which facilitates the improvement of the allocation efficiency of financial resources. Drawing on the empirical evidence from Chinese listed companies, our study offers evidence to support relevant practitioners to optimize their management decisions.

We derived several related conclusions. First, using data from Chinese listed firms from 2008 to 2020, we found that DSC could enhance the TC provision of firms, addressing the question of whether DSC can affect TC provision. Second, for enterprises with higher-power TMT, the effect of DSC on TC provision is more pronounced. Our main conclusions remain valid after the robustness tests. Third, for both upstream and downstream partners, we found that the effects of DSC were simultaneously positive. In addition, among the sub-indicators of DSC, LFD, PFD and IFD can increase TC provision. However, the impact of CFD on TC provision is non-significant. Furthermore, from the perspectives of financial risk and operational risk, we determined the mechanisms of DSC: DSC curbs the financialization and increases the asset specialization of enterprises. Lastly, based on heterogeneous-analysis tests, we found that the effect of DSC was more pronounced for firms with higher agency cost, lower supply chain collaboration and non-state ownership, and it was also more salient in industries with higher competition and without national support.

Our study has the following limitations. First, our sample is panel data of Chinese listed firms excluding financial and real-estate industries. Based on data from other countries and specific industries on DSC, future research can further explore other potential mechanisms of DSC influencing TC provision. Second, we used the TF-IDF algorithm to replace the TF algorithm, which corrects the overestimation of common word weight and the underestimation of key feature word weight in existing research [

71]. However, we still confront the inherent drawbacks of text analysis methods [

38]; that is, the text of firms’ annual reports cannot fully capture the process of DSC, and there is no consistent disclosure standard for DSC across firms. Currently, the Chinese government is promoting the incorporation of data assets into firm balance sheets, which involves the standardization of data asset value assessment and digital process assessment. We believe that this trend may be a key measure to address the deficiencies of the annual report text. Future research on DSC can include standardized rules for data asset assessment in China as a basis from which to mitigate the lack of standardization in existing research. Third, the TF-IDF algorithm does not incorporate the position information of feature words in annual reports, and the information in the management discussion section of annual reports may be more valuable [

75]. Future research can consider the conditions of weight assignment and introduce algorithms that contain annual report position information to refine the DSC indicators we constructed. Fourth, due to the length of our paper, we focused on the effects of DSC within the organizations but neglected to assess whether DSC across organizations can affect their decisions regarding sustainable TC [

28]. Finally, there is a severe digital divide across different countries and regions [

76], and we do not discuss where the divide affects the impact of DSC. Based on our findings, future studies can examine the effects of DSC on TC decisions more holistically.