Research on an Investment Decision Model of Waste Incineration Power under Demand Guarantee Policies

Abstract

:1. Introduction

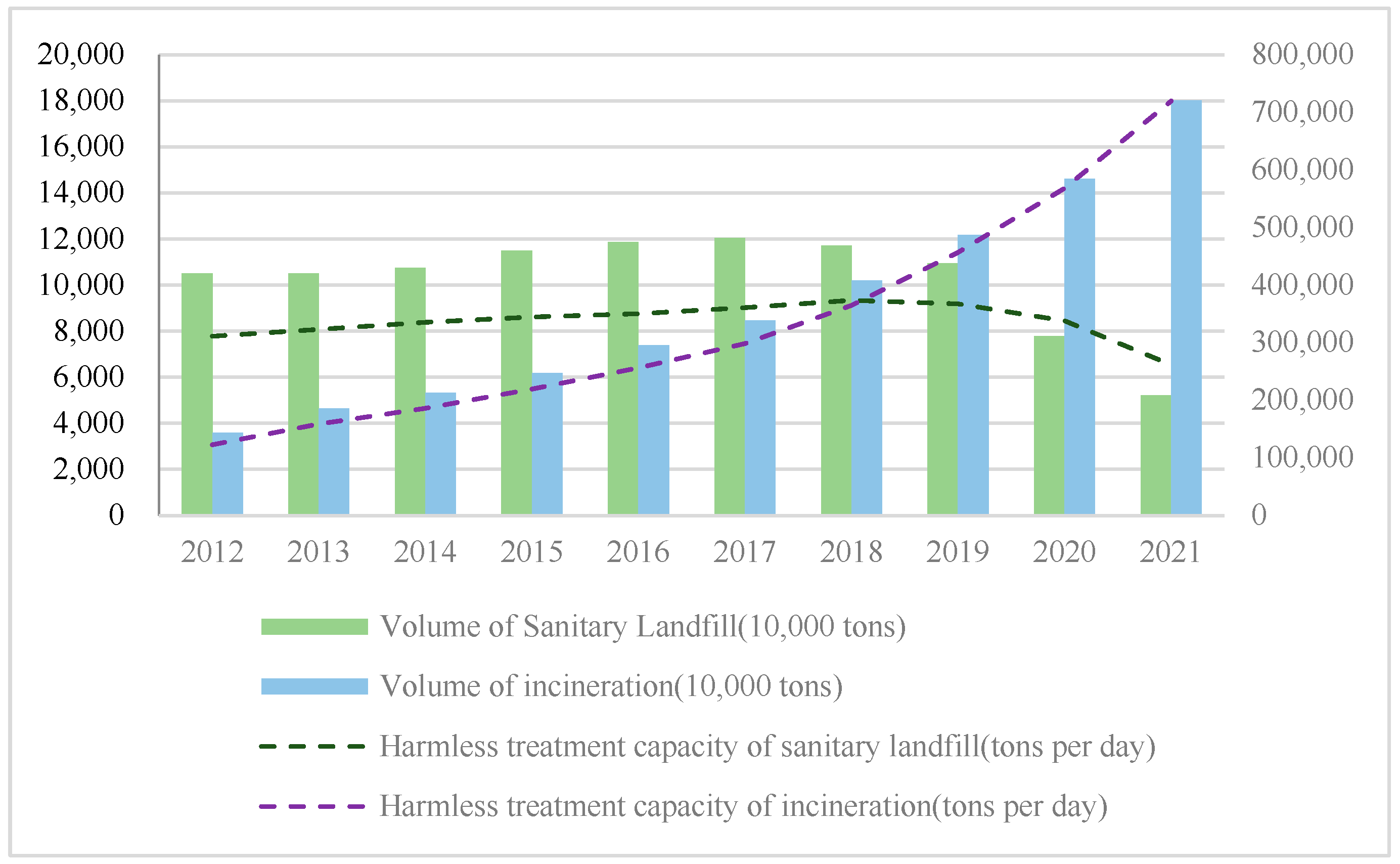

1.1. Background and Motivation

- Lower demand guarantee policy: When the actual capacity of waste incineration is lower than the set value, relevant departments compensate the project company or allow price adjustments.

- Upper demand guarantee policy: When the actual capacity of waste incineration exceeds the set value, relevant departments share the excess profit.

- Bidirectional demand guarantee policy: When the actual capacity of waste incineration is lower than the set value, relevant departments compensate the project company or allow price adjustments; when it exceeds a certain set value, relevant departments share the excess profit.

1.2. Literature Review

1.3. Contribution and Innovation

- (1)

- Most research only paid attention to the decision making of waste incineration power generation projects and conveniently considered guarantee policies decision conditions without offering accurate guarantee level, leading to long-term economic pressures for social capital or relevant departments. Thus, this paper considers and compares three typical demand guarantee policies in the investment decision model and points out the respective advantages of policies to assist policy-makers in formulating relevant policies for long-term development.

- (2)

- The artificially set guarantee quantity indicators in traditional methods will have a subtle long-term economic impact on social capital or relevant departments. In order to analyze demand guarantee policies comprehensively, this paper does not treat policies as variables or parameters like other literature does, but rather as the research object of the Real Option model to obtain the optimal demand guarantee level.

2. Methodology

2.1. Assumption

2.2. Real Option Model under Lower Demand Guarantee Policy

2.3. Real Option Model under the Upper Demand Guarantee Policy

2.4. Real Option Model under the Bidirectional Demand Guarantee Policy

2.5. Real Option Value

3. Case Study

3.1. Parameter Settings

3.1.1. Estimation of Parameters Related to Waste Incineration Volume

3.1.2. Estimation of Other Parameters

3.2. Analysis on Different Demand Guarantee Policies

3.2.1. Investment Analysis under the Lower Demand Guarantee Policy

3.2.2. Comparative Analysis under Different Policies

3.3. Sensitivity Analysis

3.3.1. Sensitivity Analysis of Electricity Prices

3.3.2. Sensitivity Analysis of Subsidy

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- The Guiding Opinions on Accelerating the Construction of Urban Environmental Infrastructure. 2022. Available online: http://www.gov.cn/zhengce/2022-02/23/content_5675123.htm (accessed on 27 April 2023).

- Gomez-Brandon, M.; Podrnirseg, S.M. Biological waste treatment. Waste Manag. Res. 2013, 31, 773–774. [Google Scholar] [CrossRef] [PubMed]

- Wang, L.; Shrestha, A.; Zhang, W.; Wang, G. Government Guarantee Decisions in PPP Wastewater Treatment Expansion Projects. Water 2020, 12, 3352. [Google Scholar] [CrossRef]

- Levin, Y.; Mcgill, J.; Nediak, M. Price guarantees in dynamic pricing and revenue management. Oper. Res. 2007, 55, 75–97. [Google Scholar] [CrossRef] [Green Version]

- Barbosa, L.; Rodrigues, A.; Sardinha, A. Optimal price subsidies under uncertainty. Eur. J. Oper. Res. 2022, 303, 471–479. [Google Scholar] [CrossRef]

- Barbosa, L.; Ferrao, P.; Rodrigues, A.; Sardinha, A. Feed-in tariffs with minimum price guarantees and regulatory uncertainty. Energy Econ. 2018, 72, 517–541. [Google Scholar] [CrossRef]

- Yun, L.; Zhao, X.G.; Li, Y.B.; Li, X.Y. Waste incineration industry and development policies in China. Waste Manag. 2015, 46, 234–241. [Google Scholar] [CrossRef]

- Sheppard, G.; Beck, M. The evolution of public-private partnership in Ireland: A sustainable pathway? Int. Rev. Adm. Sci. 2018, 84, 0020852316641494. [Google Scholar] [CrossRef] [Green Version]

- Oxley, M. Supply-side subsidies for affordable rental housing. Int. Encycl. Hous. Hom. 2012, 81, 75–80. [Google Scholar] [CrossRef]

- Wu, X.L.; Zhou, J.; Peng, Y.C.; Duan, Q.K. Government’s Compensation Mechanism for PPP Project Based on Game between Public and Private Sector. Chin. J. Manag. Sci. 2013, 21, 198–204. [Google Scholar] [CrossRef]

- Du, Y.; Feng, J.C. Government’s Compensation Mechanism for PPP Project Based on Risk Preference. Oper. Res. Manag. Sci. 2017, 26, 190–199. [Google Scholar] [CrossRef]

- Wang, X.Q.; Kan, M.Y.; Zhang, Y.H. The Minimum Revenue Guarantee Level of PPP Projects Based on Real Option. Chin. J. Manage. Sci. 2018, 26, 1–13. [Google Scholar] [CrossRef]

- Gao, Y.; Zhang, S.B.; Feng, Z. PPP Projects: A Study of Compensation Mechanism with Unmet Demand. J. Ind. Eng. Eng. Manag. 2015, 29, 93–102. [Google Scholar] [CrossRef]

- Gao, H.; Hou, X.X.; Zhang, X.X. Government Compensation Mechanism for PPP Based on Risk Preference and Fairness Preference. Oper. Res. Manag. Sci. 2021, 30, 191–197. [Google Scholar] [CrossRef]

- Zheng, X.; Yang, C.L.; Luo, C.X.; Hu, X.; Wang, Y.L.; Chen, J.Y. Research on the Government Compensation of Public Cultural PPP Projects Based on Fairness Preference. J. Eng. Manag. 2022, 36, 90–96. [Google Scholar] [CrossRef]

- Chen, X.H.; Guo, P.H. The Model of Government Subsidies of PPP Project on Real Option Method. Soft Sci. 2016, 30, 26–29. [Google Scholar] [CrossRef]

- Shi, S.; An, Q.; Chen, K. Optimal choice of capacity, toll, and subsidy for build-operate-transfer roads with a paid minimum traffic guarantee. Transp. Res. Part A Policy Pract. 2020, 139, 228–254. [Google Scholar] [CrossRef]

- Song, J.B.; Song, D.R.; Tan, C.M. A Decision-Making Model of Concession Period for Refuse-Incineration Power Generation BOT Projects. Chin. J. Manag. Sci. 2013, 21, 86–93. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994; pp. 135–173. [Google Scholar]

- Pindyck, R.S. Irreversibility, Uncertainty, and Investment. J. Econ Lit. 1991, 29, 1110–1148. [Google Scholar]

- Tolis, A.; Rentizelas, A.; Aravossis, K.; Tatsiopoulos, I. Electricity and combined heat and power from municipal solid waste; theoretically optimal investment decision time and emissions trading implications. Waste Manag. Res. 2010, 28, 985–995. [Google Scholar] [CrossRef]

- Agaton, C.B.; Guno, C.S.; Villanueva, R.O. Economic analysis of waste-to-energy investment in the Philippines: A real options approach. Appl. Energy 2020, 275, 115265. [Google Scholar] [CrossRef]

- Boomsma, T.K.; Meade, N.; Fleten, S.E. Renewable energy investments under different support schemes: A real options approach. Eur. J. Oper. Res. 2012, 220, 225–237. [Google Scholar] [CrossRef]

- Marzouk, M.; Ali, M. Mitigating risks in wastewater treatment plant PPPs using minimum revenue guarantee and real options. Util. Polic. 2018, 53, 121–133. [Google Scholar] [CrossRef]

- Hu, J.; Chen, H.; Zhou, P.; Guo, P. Optimal subsidy level for waste-to-energy investment considering flexibility and uncertainty. Energy Econ 2022, 108, 105894. [Google Scholar] [CrossRef]

- Kim, B.; Lim, H.; Kim, H.; Hong, T. Determining the Value of Governmental Subsidies for the Installation of Clean Energy Systems Using Real Options. J. Constr. Div., Am. Soc. Civ. Eng. 2012, 138, 422–430. [Google Scholar] [CrossRef]

- Wang, X.; Cai, Y.; Dai, C. Evaluating China’s biomass power production investment based on a policy benefit real options model. Energy 2014, 73, 751–761. [Google Scholar] [CrossRef]

- Cheng, C.; Wang, Z.; Liu, H.H.; Zhao, G.H.; Liu, M.M.; Ren, X.H. Study on optimization of investment incentive policies for renewable energy projects—From a perspective of execution time. Chin. J. Manag. Sci. 2019, 27, 157–167. [Google Scholar] [CrossRef]

- Song, J.; Zhao, Y.; Jin, L.; Sun, Y. Pareto optimization of public-private partnership toll road contracts with government guarantees. Transp. Res. Policy Pract. 2018, 117, 158–175. [Google Scholar] [CrossRef]

- Zhao, Y.; Song, J.; Feng, Z.; Jin, L. Incentive contracts with demand guarantee in BOT toll road projects. Res. Transp. Econ. 2023, 98, 101272. [Google Scholar] [CrossRef]

| Parameter | Symbol | Unit | Value |

|---|---|---|---|

| Parameters related to waste incineration volume | |||

| Drift rate | - | 0.0355 | |

| Fluctuation rate | - | 0.2317 | |

| Initial capacity | 20.648 | ||

| Other parameters | |||

| Waste power grid electricity price | CNY/KWh | 0.65 | |

| Electricity generation of waste | KWh/t | 380.82 | |

| Waste treatment fee | CNY/t | 50 | |

| Subsidy coefficient | % | 0.168 | |

| Generation cost | CNY/t | 128 | |

| Discount rate | % | 3.7 | |

| Design scale | t | 1400 | |

| Investment cost | CNY | 4.17 | |

| Lower Demand Guarantee Policy | Upper Demand Guarantee Policy | Bidirectional Demand Guarantee Policy | |

|---|---|---|---|

| Option value | |||

| Lower reflection wall of operation revenue | 257,350 | - | 234,640 |

| Lower reflection wall of waste treatment capacity | 790 | - | 833 |

| Upper reflection wall of operation revenue | - | 324,010 | 264,340 |

| Upper reflection wall of waste treatment capacity | - | 1090 | 890 |

| Investment trigger of revenue | 162,000 | 196,370 | 172,120 |

| Investment trigger of capacity | 545 | 661 | 580 |

| Demand guarantee rate | 61% | 73% | 64% |

| Investment timing | 0 | 4.3856 | 0.7032 |

| Parameters | Cases | |||

|---|---|---|---|---|

| Shandong | Guizhou | Zhejiang | Ningxia | |

| Waste power grid electricity price (CNY/kWh) | 0.4949 | 0.4515 | 0.5153 | 0.3595 |

| Lower demand guarantee policy | ||||

| Investment trigger of waste treatment capacity (t) | 680 | 731 | 659 | 868 |

| Investment opportunity (year) | 5.188 | 7.225 | 4.305 | 12.060 |

| Upper demand guarantee policy | ||||

| Investment trigger of waste treatment capacity (t) | 825 | 886 | 799 | 1052 |

| Investment opportunity (year) | 10.628 | 12.638 | 9.7267 | 17.4756 |

| Bidirectional demand guarantee policy | ||||

| Investment trigger of waste treatment capacity (t) | 723 | 777 | 700 | 922 |

| Investment opportunity (year) | 6.9111 | 8.9402 | 6.005 | 13.76 |

| Parameters | Case | |||

|---|---|---|---|---|

| Waste incineration | Agroforestry Biology | Animal Manure and Straw | Biogas | |

| Subsidy (CNY/KWh) | 0.1313 | 0.25 | 0.1991 | 0.156 |

| Subsidy coefficient | 0.168 | 0.32 | 0.2548 | 0.1997 |

| Lower demand guarantee policy | ||||

| Lower reflection wall (t) | 790 | 415 | 521 | 665 |

| Investment trigger of waste treatment capacity (t) | 545 | 286 | 359 | 458 |

| Investment timing (year) | 0 | 0 | 0 | 0 |

| Upper demand guarantee policy | ||||

| Upper reflection wall (t) | 1090 | 572 | 719 | 917 |

| Investment trigger of waste treatment capacity (t) | 661 | 347 | 436 | 556 |

| Investment timing (year) | 4.3856 | 0 | 0 | 0 |

| Bidirectional demand guarantee policy | ||||

| Lower reflection wall (t) | 833 | 437 | 549 | 710 |

| Upper reflection wall (t) | 890 | 467 | 587 | 749 |

| Investment trigger of waste treatment capacity (t) | 580 | 357 | 448 | 572 |

| Investment timing (year) | 5.1839 | 0 | 0 | 0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, Y.; Zhuang, Y. Research on an Investment Decision Model of Waste Incineration Power under Demand Guarantee Policies. Sustainability 2023, 15, 11784. https://doi.org/10.3390/su151511784

Dong Y, Zhuang Y. Research on an Investment Decision Model of Waste Incineration Power under Demand Guarantee Policies. Sustainability. 2023; 15(15):11784. https://doi.org/10.3390/su151511784

Chicago/Turabian StyleDong, Yuqun, and Yaming Zhuang. 2023. "Research on an Investment Decision Model of Waste Incineration Power under Demand Guarantee Policies" Sustainability 15, no. 15: 11784. https://doi.org/10.3390/su151511784

APA StyleDong, Y., & Zhuang, Y. (2023). Research on an Investment Decision Model of Waste Incineration Power under Demand Guarantee Policies. Sustainability, 15(15), 11784. https://doi.org/10.3390/su151511784