International Trade and Carbon Emissions: Evaluating the Role of Trade Rule Uncertainty

Abstract

:1. Introduction

2. Literature Review

2.1. Uncertainty Measuring Theory Based on Textual Data Mining

2.2. Carbon Emission Trading Mechanism

2.3. International Trade and Carbon Emissions

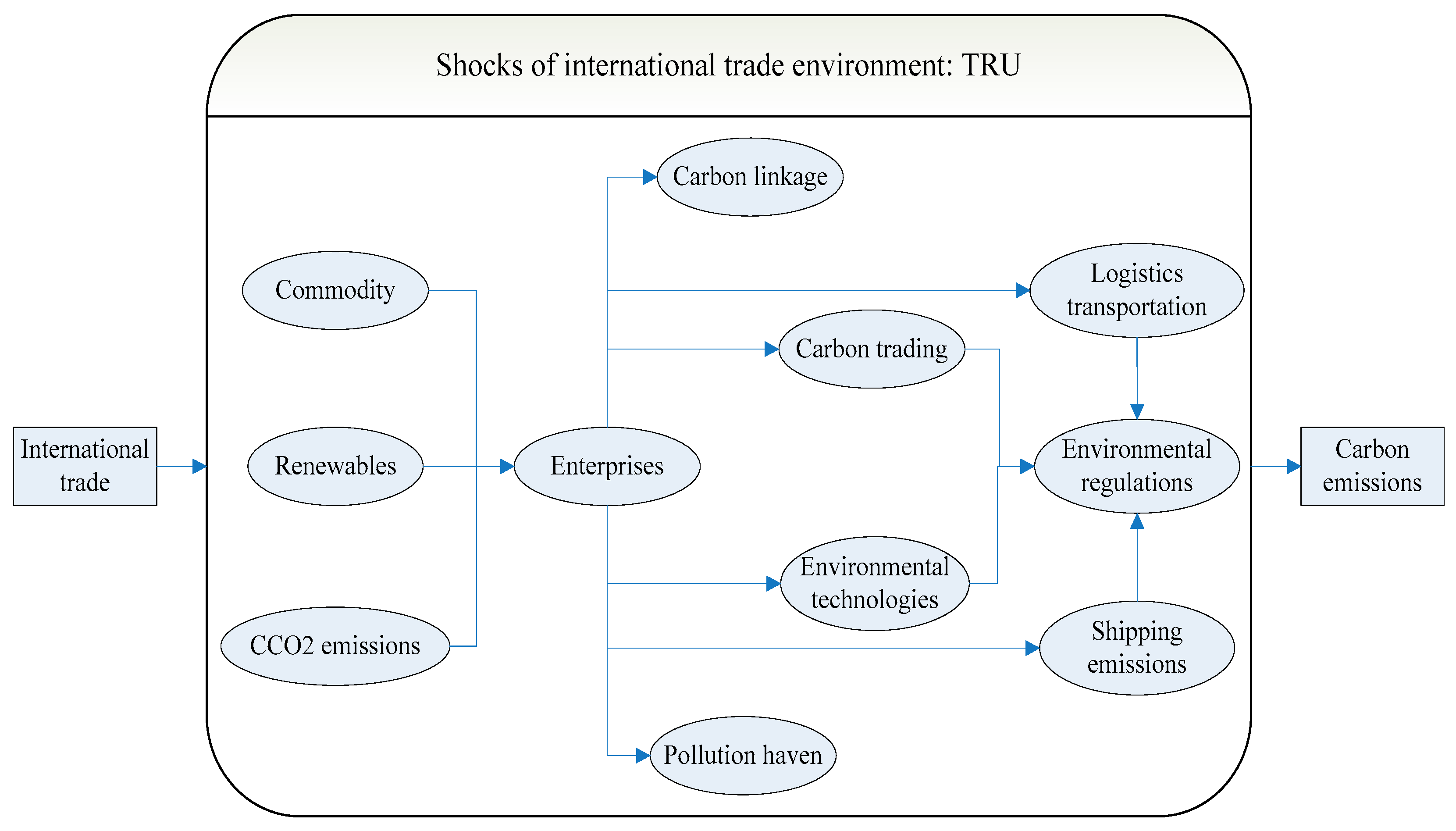

3. Methodology and Data

3.1. Mediating Effect Model

3.2. Variables and Data

4. Empirical Findings

4.1. The Relationship between CO2 Emissions, International Trade, and TRU

4.2. Robustness

5. Discussion and Conclusions

5.1. Conclusions

- (1)

- Increasing trade volume in developing countries contributes to the rise of trade rule uncertainty, which in turn triggers trade conflicts and even trade wars between countries. The empirical results show that growing imports and exports can lead to an increase in trade rule uncertainty and carbon dioxide emissions. Energy consumption and renewable consumption are positively and negatively correlated with CO2 emissions, respectively.

- (2)

- There are significant correlations between international trade and carbon emissions; international trade impacts carbon emissions in both direct and indirect ways. Empirical results about the relationship between TRU and international trade imply that they are positively correlated in China, Japan, Brazil, and Australia, which reveals that the largest international trade developing countries contribute to the greatest increase in trade rule uncertainty.

- (3)

- Trade rule uncertainty plays a mediating role in the relationship between international trade and carbon emissions. According to the mediating effect test results, we find that TRU plays an essential role between international trade and carbon emissions. The mediating effect of TRU on international trade and carbon emissions is significant at the national level.

- (4)

- TRU significantly impacts carbon emissions in most developed and developing countries, but the impact is not significant in the USA. The empirical results show that TRU impacts CO2 emissions positively and significantly in China, the UK, Japan, Brazil, and Australia, but cannot significantly impact USA carbon emissions.

5.2. Discussions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, H.; Ang, B.W. Assessing the role of international trade in global CO2 emissions: An index decomposition analysis approach. Appl. Energy 2018, 218, 146–158. [Google Scholar] [CrossRef]

- Padhan, L.; Bhat, S. Interrelationship between trade and environment: A bibliometric analysis of published articles from the last two decades. Environ. Sci. Pollut. Res. 2023, 30, 17051–17075. [Google Scholar] [CrossRef] [PubMed]

- Richard, K.W.; Piergiuseppe, F. International trade and carbon emissions. Eur. J. Dev. Res. 2012, 24, 509–529. [Google Scholar]

- Shen, Y.; Liu, J.; Tian, W. Interaction between international trade and logistics carbon emissions. Energy Rep. 2022, 8, 10334–10345. [Google Scholar] [CrossRef]

- Wu, R.; Ma, T.; Chen, D.; Zhang, W. International trade, CO2 emissions, and re-examination of “Pollution Haven Hypothesis” in China. Environ. Sci. Pollut. Res. 2022, 29, 4375–4389. [Google Scholar] [CrossRef] [PubMed]

- Wang, X.; Liu, H.; Lv, Z.; Deng, F.; Xu, H.; Qi, L.; Shi, M.; Zhao, J.; Zheng, S.; Man, H.; et al. Trade-linked shipping CO2 emissions. Nat. Clim. Change 2021, 11, 945–951. [Google Scholar] [CrossRef]

- Iorember, P.T.; Gbaka, S.; Jelilov, G.; Alymkulova, N.; Usman, O. Impact of international trade, energy consumption and income on environmental degradation in Africa’s OPEC member countries. Afr. Dev. Rev. 2022, 34, 175–187. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Awosusi, A.A.; Rjoub, H.; Panait, M.; Popescu, C. Asymmetric impact of international trade on consumption-based carbon emissions in MINT Nations. Energies 2021, 14, 6581. [Google Scholar] [CrossRef]

- Jiang, S.; Chishti, M.Z.; Rjoub, H.; Rahim, S. Environmental R&D and trade-adjusted carbon emissions: Evaluating the role of international trade. Environ. Sci. Pollut. Res. 2022, 29, 63155–63170. [Google Scholar]

- Liddle, B. Consumption-based accounting and the trade-carbon emissions nexus. Energy Econ. 2018, 69, 71–78. [Google Scholar] [CrossRef]

- Ding, Q.; Khattak, S.I.; Ahmad, M. Towards sustainable production and consumption: Assessing the impact of energy productivity and eco-innovation on consumption-based carbon dioxide emissions (CCO2) in G-7 nations. Sustain. Prod. Consum. 2021, 27, 254–268. [Google Scholar] [CrossRef]

- Mahmood, H.; Alkhateeb, T.; Furqan, M. Exports, imports, foreign direct investment and CO2 emissions in North Africa: Spatial analysis. Energy Rep. 2020, 6, 2403–2409. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, M.; Jinyu, L.; Shahbaz, M.; Siqun, Y. Consumption-based carbon emissions and trade nexus: Evidence from nine oil exporting countries. Energy Econ. 2020, 89, 104806. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, S.; Umar, M.; Kirikkaleli, D.; Jiao, Z. Consumption-based carbon emissions and international trade in G7 countries: The role of environmental innovation and renewable energy. Sci. Total Environ. 2020, 730, 138945. [Google Scholar] [CrossRef]

- Hasanov, F.J.; Liddle, B.; Mikayilov, J.I. The impact of international trade on CO2 emissions in oil exporting countries: Territory vs consumption emissions accounting. Energy Econ. 2018, 74, 343–350. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Sheau-Ting, L. Econometric analysis of trade, exports, imports, energy consumption and CO2 emission in six regions. Renew. Sustain. Energy Rev. 2014, 33, 484–498. [Google Scholar] [CrossRef]

- Rana, R.; Sharma, M. Dynamic causality testing for EKC hypothesis, pollution haven hypothesis and international trade in India. J. Int. Trade Econ. Dev. 2019, 28, 348–364. [Google Scholar] [CrossRef]

- Sorroche-del-Rey, Y.; Piedra-Muñoz, L.; Galdeano-Gómez, E. Interrelationship between international trade and environmental performance: Theoretical approaches and indicators for sustainable development. Bus. Strateg. Environ. 2022, 1–17. [Google Scholar] [CrossRef]

- Ren, S.; Yuan, B.; Ma, X.; Chen, X. The impact of international trade on China’s industrial carbon emissions since its entry into WTO. Energy Policy 2014, 69, 624–634. [Google Scholar] [CrossRef]

- Zhu, Y.; Shi, Y.; Wu, J.; Wu, L.; Xiong, W. Exploring the characteristics of CO2 emissions embodied in international trade and the fair share of responsibility. Ecol. Econ. 2018, 146, 574–587. [Google Scholar] [CrossRef]

- Andersson, F.N.G. International trade and carbon emissions: The role of Chinese institutional and policy reforms. J. Environ. Manag. 2018, 205, 29–39. [Google Scholar] [CrossRef] [PubMed]

- Li, X.; Li, Z.; Su, C.; Umar, M.; Shao, X. Exploring the asymmetric impact of economic policy uncertainty on China’s carbon emissions trading market price: Do different types of uncertainty matter? Technol. Forecast. Soc. 2022, 178, 121601. [Google Scholar] [CrossRef]

- Wang, K.; Liu, L.; Zhong, Y.; Lobont, Q. Economic policy uncertainty and carbon emission trading market: A China’s perspective. Energy Econ. 2022, 115, 106342. [Google Scholar] [CrossRef]

- Adedoyin, F.; Zakari, A. Energy consumption, economic expansion, and CO2 emission in the UK: The role of economic policy uncertainty. Sci. Total Environ. 2020, 738, 140014. [Google Scholar] [CrossRef]

- Ahmed, M.; Sarkodie, S. COVID-19 pandemic and economic policy uncertainty regimes affect commodity market volatility. Resour. Policy 2021, 74, 102303. [Google Scholar] [CrossRef]

- Shams, S.; Gunasekarage, A.; Velayutham, E. Economic policy uncertainty and acquisition performance: Australian evidence. Int. Rev. Econ. Finance 2022, 78, 286–308. [Google Scholar] [CrossRef]

- Su, C.; Pang, L.; Umar, M.; Lobont, O. Will gold always shine amid world uncertainty? Emerg. Mark. Finance Trade 2022, 58, 3425–3438. [Google Scholar] [CrossRef]

- Yao, S.; Yu, X.; Yan, S.; Wen, S. Heterogeneous emission trading schemes and green innovation. Energy Policy 2021, 155, 112367. [Google Scholar] [CrossRef]

- Lin, B.; Huang, C. Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consum. 2022, 33, 28–37. [Google Scholar] [CrossRef]

- Wang, M.; Zhou, P. A two-step auction-refund allocation rule of CO2 emission permits. Energy Econ. 2022, 113, 106179. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, Z.; Du, X. Lessons learned from China’s regional carbon market pilots. Econ. Energy Environ. Policy 2017, 6, 19–38. [Google Scholar] [CrossRef]

- Peng, H.; Qi, S.; Cui, J. The environmental and economic effects of the carbon emissions trading scheme in China: The role of alternative allowance allocation. Sustain. Prod. Consum. 2021, 28, 105–115. [Google Scholar] [CrossRef]

- Pizer, W.A.; Zhang, X. China’s new national carbon market. AEA Pap. Proc. 2018, 108, 463–467. [Google Scholar] [CrossRef]

- Hassan, T.; Song, H.; Kirikkaleli, D. International trade and consumption-based carbon emissions: Evaluating the role of composite risk for RCEP economies. Environ. Sci. Pollut. Res. 2022, 29, 3417–3437. [Google Scholar] [CrossRef]

- Crowley, M.; Meng, N.; Song, H. Tariff scares: Trade policy uncertainty and foreign market entry by Chinese firms. J. Int. Econ. 2018, 114, 96–115. [Google Scholar] [CrossRef] [Green Version]

- Bewley, T.F. Knightian decision theory. Part I. Decis. Econ. Finance 2002, 25, 79–110. [Google Scholar] [CrossRef]

- Zhu, S.; Li, D.; Wang, S. Robust portfolio selection under downside risk measures. Quant. Finance 2009, 9, 869–885. [Google Scholar] [CrossRef]

- Mousavi, S.; Gigerenzer, G. Risk, uncertainty, and heuristics. J. Bus. Res. 2014, 67, 1671–1678. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Huang, Y.; Luk, P. Measuring economic policy uncertainty in China. China Econ. Rev. 2020, 59, 101367. [Google Scholar] [CrossRef]

- Shoag, D.; Veuger, S. Uncertainty and the Geography of the Great Recession. J. Monet. Econ. 2016, 84, 84–93. [Google Scholar] [CrossRef] [Green Version]

- Ahir, H.; Bloom, N.; Furceri, D. The World Uncertainty Index; National Bureau of Economic Research: Cambridge, MA, USA, 2022. [Google Scholar]

- Caldara, D.; Iacoviello, M. Measuring geopolitical risk. Am. Econ. Rev. 2022, 112, 1194–1225. [Google Scholar] [CrossRef]

- Zhao, X.; Mi, X.; Ma, C.; Peng, G. Measuring Trade Rule Uncertainty and Its Impacts on the Commodity Market. Finance Res. Lett. 2023, 53, 103384. [Google Scholar] [CrossRef]

- Davis, S.J.; Liu, D.; Sheng, X.S. Economic policy uncertainty in China since 1949: The view from mainland newspapers. In Proceedings of the Fourth Annual IMF-Atlanta Fed Research Workshop on China’s Economy Atlanta, Atlanta, GA, USA, 19–20 September 2019; Volume 19, pp. 1–37. [Google Scholar]

- Fontaine, I.; Razafindravaosolonirina, J.; Didier, L. Chinese policy uncertainty shocks and the world macroeconomy: Evidence from STVAR. China Econ. Rev. 2018, 51, 1–19. [Google Scholar] [CrossRef]

- Tan, F.; Wan, H.; Jiang, X.; Niu, Z. The impact of outward foreign direct investment on carbon emission toward china’s sustainable development. Sustainability 2021, 13, 11605. [Google Scholar] [CrossRef]

- Zhang, G.; Han, J.; Pan, Z.; Huang, H. Economic policy uncertainty and capital structure choice: Evidence from China. Econ. Syst. 2015, 39, 439–457. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Chen, C.; Huang, Y. Economic policy uncertainty and corporate investment: Evidence from China. Pacific-Basin Finance J. 2014, 26, 227–243. [Google Scholar] [CrossRef]

- Caggiano, G.; Castelnuovo, E.; Figueres, J. Economic policy uncertainty and unemployment in the United States: A nonlinear approach. Econ. Lett. 2017, 151, 31–34. [Google Scholar] [CrossRef] [Green Version]

- Chi, Q.; Li, W. Economic policy uncertainty, credit risks and banks’ lending decisions: Evidence from Chinese commercial banks. China J. Account. Res. 2017, 10, 33–50. [Google Scholar] [CrossRef]

- Handley, K. Exporting under trade policy uncertainty: Theory and evidence. J. Int. Econ. 2014, 94, 50–66. [Google Scholar] [CrossRef] [Green Version]

- Imbruno, M. Importing under trade policy uncertainty: Evidence from China. J. Comp. Econ. 2019, 47, 806–826. [Google Scholar] [CrossRef]

- Bekiros, S.; Gupta, R.; Paccagnini, A. Oil price forecastability and economic uncertainty. Econ. Lett. 2015, 132, 125–128. [Google Scholar] [CrossRef] [Green Version]

- Aloui, R.; Gupta, R.; Miller, S. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef] [Green Version]

- Huang, W.; Lin, W.; Ning, S. The effect of economic policy uncertainty on China’s housing market. N. Am. J. Econ. Finance 2020, 54, 100850. [Google Scholar] [CrossRef]

- Handley, K.; Limão, N. Policy uncertainty, trade, and welfare: Theory and evidence for China and the United States. Am. Econ. Rev. 2017, 107, 2731–2783. [Google Scholar] [CrossRef] [Green Version]

- Erdogan, B.; Çemberci, M. The Effect of Trust and Uncertainty in the Supply Chain on Firm Performance. J. Int. Trade. Logist. Law 2018, 4, 53–62. [Google Scholar]

- Adekoya, O.B.; Oliyide, J.A.; Noman, A. The volatility connectedness of the EU carbon market with commodity and financial markets in time-and frequency-domain: The role of the US economic policy uncertainty. Resour. Policy 2021, 74, 102252. [Google Scholar] [CrossRef]

- Zhou, X.; Jia, M.; Altuntaş, M.; Kirikkaleli, D.; Hussain, M. Transition to renewable energy and environmental technologies: The role of economic policy uncertainty in top five polluted economies. J. Environ. Manag. 2022, 313, 115019. [Google Scholar] [CrossRef] [PubMed]

- Garcia, B.; Foerster, A.; Lin, J. Net zero for the international shipping sector? An Analysis of the Implementation and Regulatory Challenges of the IMO Strategy on Reduction of GHG Emissions. J. Environ. Law 2021, 33, 85–112. [Google Scholar] [CrossRef]

- Zhou, P.; Wang, M. Carbon dioxide emissions allocation: A review. Ecol. Econ. 2016, 125, 47–59. [Google Scholar] [CrossRef]

- Zetterberg, L.; Wråke, M.; Sterner, T.; Fischer, C.; Burtraw, D. Short-run allocation of emissions allowances and long-term goals for climate policy. Ambio 2012, 41, 23–32. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Zhang, Y.; Wang, A.; Tan, W. The impact of China’s carbon allowance allocation rules on the product prices and emission reduction behaviors of ETS-covered enterprises. Energy Policy 2015, 86, 176–185. [Google Scholar] [CrossRef]

- Schmidt, R.C.; Heitzig, J. Carbon leakage: Grandfathering as an incentive device to avert firm relocation. J. Environ. Econ. Manag. 2014, 67, 209–223. [Google Scholar] [CrossRef] [Green Version]

- Hintermann, B. Pass-through of CO2 emission costs to hourly electricity prices in Germany. J. Assoc. Environ. Resour. 2016, 3, 857–891. [Google Scholar] [CrossRef] [Green Version]

- Jotzo, F.; Karplus, V.; Grubb, M.; Löschel, A.; Neuhoff, K.; Wu, L.; Teng, F. China’s emissions trading takes steps towards big ambitions. Nat. Clim. Change 2018, 8, 265–267. [Google Scholar] [CrossRef]

- Wang, M.; Zhou, P. Does emission permit allocation affect CO2 cost pass-through? A theoretical analysis. Energy Econ. 2017, 66, 140–146. [Google Scholar] [CrossRef]

- Wu, M.; Li, K.; Xiao, Y.; Yuen, K. Carbon Emission Trading Scheme in the shipping sector: Drivers, challenges, and impacts. Mar. Policy 2022, 138, 104989. [Google Scholar] [CrossRef]

- Shao, Q.; Zhang, Z. Carbon mitigation and energy conservation effects of emissions trading policy in China considering regional disparities. Energy Clim. Change 2022, 3, 100079. [Google Scholar] [CrossRef]

- Peng, H.; Cui, J.; Zhang, X. Does China emission trading scheme reduce marginal abatement cost? A perspective of allowance allocation alternatives. Sustain. Prod. Consum. 2022, 32, 690–699. [Google Scholar] [CrossRef]

- Chen, Y.; Xu, Z.; Zhang, Z.; Ye, W.; Yang, Y.; Gong, Z. Does the carbon emission trading scheme boost corporate environmental and financial performance in China? J. Clean. Prod. 2022, 368, 133151. [Google Scholar] [CrossRef]

- Wang, Y.; Hang, Y.; Wang, Q. Joint or separate? An economic-environmental comparison of energy-consuming and carbon emissions permits trading in China. Energy Econ. 2022, 109, 105949. [Google Scholar] [CrossRef]

- Li, S.; Liu, J.; Wu, J.; Hu, X. Spatial spillover effect of carbon emission trading policy on carbon emission reduction: Empirical data from transport industry in China. J. Clean. Prod. 2022, 371, 133529. [Google Scholar] [CrossRef]

- Lu, Y.; Li, Y.; Tang, X.; Cai, B.; Wang, H.; Liu, L.; Wan, S.; Yu, K. STRICTs: A Blockchain-enabled Smart Emission Cap Restrictive and Carbon Permit Trading System. Appl. Energy 2022, 313, 118787. [Google Scholar] [CrossRef]

- Chi, Y.; Zhao, H.; Hu, Y.; Yuan, Y.; Pang, Y. The impact of allocation methods on carbon emission trading under electricity marketization reform in China: A system dynamics analysis. Energy 2022, 259, 125034. [Google Scholar] [CrossRef]

- Chen, Z.; Su, Y.; Wang, X.; Wu, Y. The price discrimination and environmental effectiveness in carbon emission trading schemes: A theoretical approach. J. Clean. Prod. 2021, 283, 125196. [Google Scholar] [CrossRef]

- Kim, T.J.; Tromp, N. Analysis of carbon emissions embodied in South Korea’s international trade: Production-based and consumption-based perspectives. J. Clean. Prod. 2021, 320, 128839. [Google Scholar] [CrossRef]

- Jijian, Z.; Twum, A.K.; Agyemang, A.O.; Edziah, B.; Ayamba, E.C. Empirical study on the impact of international trade and foreign direct investment on carbon emission for belt and road countries. Energy Rep. 2021, 7, 7591–7600. [Google Scholar] [CrossRef]

- Muhammad, S.; Long, X.; Salman, M.; Dauda, L. Effect of urbanization and international trade on CO2 emissions across 65 belt and road initiative countries. Energy 2020, 196, 117102. [Google Scholar] [CrossRef]

- Valodka, I.; Snieška, V.; Mihi-Ramirez, A. Impact of the international trade on the EU clothing industry carbon emissions. Inz. Ekon. 2020, 31, 314–322. [Google Scholar] [CrossRef]

- Gao, J.; Gao, F.; Yin, B.; Zhang, M. International trade as a double-edged sword: The perspective of carbon emissions. Front. Energy Res. 2021, 9, 764914. [Google Scholar] [CrossRef]

- Khan, Y.A.; Ahmad, M. Investigating the impact of renewable energy, international trade, tourism, and foreign direct investment on carbon emission in developing as well as developed countries. Environ. Sci. Pollut. Res. 2021, 28, 31246–31255. [Google Scholar] [CrossRef] [PubMed]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Hayes, A.F. Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Commun. Monogr. 2009, 76, 408–420. [Google Scholar] [CrossRef]

- Yan, W.J.; Guo, S.L. How does environmental regulation affect employment—An empirical research based on mediating effect model. Collect. Essays Finance Econ. 2016, 10, 105–112. [Google Scholar]

- Cao, W.; Wang, H.; Ying, H. The effect of environmental regulation on employment in resource-based areas of China—An empirical research based on the mediating effect model. Int. J. Environ. Res. Pub. Health 2017, 14, 1598. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Stojanović, Đ.; Ivetić, J.; Veličković, M. Assessment of international trade-related transport CO2 emissions—A logistics responsibility perspective. Sustainability 2021, 13, 1138. [Google Scholar] [CrossRef]

- Chen, F.; Jiang, G.; Kitila, G.M. Trade openness and CO2 emissions: The heterogeneous and mediating effects for the belt and road countries. Sustainability 2021, 13, 1958. [Google Scholar] [CrossRef]

- Jiang, B.; He, Z.; Xue, W.; Yang, C.; Zhu, H.; Hua, Y.; Lu, B. China’s Low-Carbon Cities Pilot Promotes Sustainable Carbon Emission Reduction: Evidence from Quasi-Natural Experiments. Sustainability 2022, 14, 8996. [Google Scholar] [CrossRef]

- Liu, P.Z.; Narayan, S.; Ren, Y.; Jiang, Y.; Baltas, K.; Sharp, B. Re-Examining the Income–CO2 Emissions Nexus Using the New Kink Regression Model: Does the Kuznets Curve Exist in G7 Countries? Sustainability 2022, 14, 3955. [Google Scholar] [CrossRef]

| Category | Keywords |

|---|---|

| Trade Rule | trade rules; trading rules; WTO rules; WTO principles; economy principles |

| Economy | economic; economy; political; politics; legislation; law |

| Uncertainty | uncertainty; uncertain; conflict; violate; challenge |

| Variables | Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | Jarque–Bera |

|---|---|---|---|---|---|---|---|---|

| CO2 | 2712.3428 | 830.9762 | 12,039.7811 | 296.1190 | 3235.6667 | 1.3095 | 0.5684 | 45.43 *** |

| Trade | 1.3729 × 106 | 8.9870 × 105 | 6.0501 × 106 | 98,205.4497 | 1.3266 × 106 | 1.3185 | 0.7707 | 47.59 *** |

| TRU | 93.4084 | 82.4744 | 311.4153 | 41.5876 | 50.0713 | 3.1175 | 11.4159 | 1036.49 *** |

| RC | 1.1888 | 0.4046 | 11.3163 | 0.0112 | 1.8586 | 2.7351 | 8.3199 | 608.57 *** |

| EC | 70.3126 | 14.9308 | 338.8127 | 4.2773 | 109.7597 | 1.6685 | 1.0540 | 77.27 *** |

| GDP | 5.7316 × 106 | 3.1371 × 106 | 2.0137 × 107 | 8.1646× 105 | 5.4578× 106 | 1.3008 | 0.2645 | 43.46 *** |

| Model | Intercept | Trade | TRU | EC | RC | GDP | Y(−1) | Y(−2) | R2 |

|---|---|---|---|---|---|---|---|---|---|

| Model (1) | −1.205 × 104 *** (0.0000) | 0.0022 *** (0.0000) | - | 21.4790 *** (0.0000) | −448.1041 *** (0.0021) | −0.0009 *** (0.0000) | 1866.0114 *** (0.0000) | 218.1066 (0.2252) | 0.932 |

| Model (2) | 57.3836 (0.1400) | 1.1023 × 10−5 * (0.0991) | - | 0.1241 (0.3890) | 17.5382 *** (0.0000) | −7.9740 × 10−6 * (0.0941) | 9.6148 (0.1293) | −1.0533 (0.8272) | 0.275 |

| Model (3) | −1.113 × 104 *** (0.0000) | 0.0024 *** (0.0000) | 5.4377 *** (0.0000) | 22.4221 *** (0.0000) | −531.7134 *** (0.0000) | −0.0010 *** (0.0000) | 1823.7349 *** (0.0000) | 194.6867 (0.1333) | 0.936 |

| Model (1) | China | USA | UK | Japan | Brazil | Australia |

|---|---|---|---|---|---|---|

| Intercept | 9836.7403 *** (0.0042) | 1.482 × 104 ** (0.0214) | −293.0280 * (0.0843) | 798.4860 (0.6141) | −1250.1459 *** (0.0000) | −519.9385 *** (0.0000) |

| Trade | 9.9241 × 10−5 *** (0.0062) | 5.6223 × 10−5 (0.1511) | 6.6173 × 10−5 *** (0.0000) | −1.1942 × 10−5 (0.6763) | 0.0003 ** (0.0482) | −2.9754 × 10−5 *** (0.0031) |

| EC | 178.7013 *** (0.0000) | 10.2971 *** (0.0000) | 63.1542 *** (0.0000) | 13.7738 * (0.0821) | 57.6451 *** (0.0023) | 87.1500 *** (0.0000) |

| RC | −58.5138 *** (0.0000) | −317.4149 *** (0.0000) | −70.2701 *** (0.0000) | −242.0630 *** (0.0000) | −44.9568 *** (0.0000) | −59.4263 *** (0.0000) |

| GDP | −0.0003 *** (0.0000) | 0.0002 *** (0.0000) | −2.869 × 10−5 (0.1031) | 0.0003 *** (0.0000) | −0.0002 *** (0.0000) | −2.845 × 10−5 * (0.0724) |

| CO2(−1) | −2424.8635 *** (0.0063) | −839.9616 ** (0.0132) | −12.5599 (0.5154) | 131.5996 (0.3792) | 128.4349 ** (0.0460) | 22.7077 (0.5520) |

| CO2(−2) | 1054.6469 ** (0.0181) | −894.9831 (0.1072) | 60.8292 (0.0784) | −287.2807 (0.1141) | 129.1869 (0.2332) | 67.2835 * (0.0544) |

| R2 | 0.999 | 0.984 | 0.997 | 0.873 | 0.980 | 0.994 |

| DW | 1.456 | 1.671 | 1.167 | 1.660 | 1.532 | 1.878 |

| Cointeg | −3.9524 *** (0.0020) | −2.5888 * (0.0951) | −2.6702 * (0.0792) | −3.8657 (0.0023) | −3.3096 ** (0.0154) | −4.3928 *** (0.0000) |

| Model (2) | China | USA | UK | Japan | Brazil | Australia |

|---|---|---|---|---|---|---|

| Intercept | 119.2707 (0.4211) | −502.8036 (0.1192) | 313.4229 (0.2700) | 265.1303 (0.1154) | 294.5387 (0.1371) | 359.7366 (0.1382) |

| Trade | 5.6394 × 10−5 ** (0.0482) | 1.6451 × 10−5 (0.5000) | −8.8080 × 10−5 (0.2163) | 0.0001 ** (0.0151) | 0.0005 ** (0.0252) | 0.0002 * (0.0900) |

| EC | −0.7700 (0.6261) | 1.6188 (0.1400) | −50.4040 (0.1883) | 22.0280 ** (0.0300) | −32.9523 ** (0.0113) | −92.1568 (0.1212) |

| RC | 23.8231 *** (0.0000) | 28.3844 ** (0.0492) | −67.5254 (0.4011) | 228.7142 *** (0.0000) | 76.4054 *** (0.0000) | 203.4501 * (0.0573) |

| GDP | −2.553 × 10−5 (0.0013) | −6.766 × 10−6 (0.5114) | 0.0001 (0.3161) | −0.0002 *** (0.0000) | −0.0001 (0.1912) | 3.975 × 10−5 (0.7403) |

| TRU(−1) | 6.2200 (0.8411) | 16.4649 (0.5243) | 12.1584 (0.6482) | 15.0552 (0.6041) | 31.5410 (0.3344) | 19.5514 (0.4581) |

| R2 | 0.751 | 0.532 | 0.441 | 0.694 | 0.649 | 0.671 |

| DW | 1.718 | 1.332 | 1.380 | 2.011 | 1.798 | 1.636 |

| Cointeg | −4.4249 *** (0.0000) | −2.8248 * (0.0551) | −1.1188 (0.7072) | −3.5514 *** (0.0071) | −3.7784 (0.0033) | −4.2113 *** (0.0000) |

| Model (3) | China | USA | UK | Japan | Brazil | Australia |

|---|---|---|---|---|---|---|

| Intercept | 1.0191 × 104 *** (0.0041) | 1.4631 × 104 ** (0.0213) | −869.2764 *** (0.0000) | 469.0504 (0.7768) | −1099.0245 *** (0.0000) | −493.5666 *** (0.0000) |

| Trade | 3.2802 × 10−5 (0.2800) | 6.8692 × 10−5 * (0.0631) | 6.4491 × 10−5 *** (0.0000) | −4.2012 × 10−5 * (0.0722) | 8.2551 × 10−5 (0.5893) | −3.2222 × 10−5 *** (0.0031) |

| TRU | 1.0182 *** (0.0000) | −0.5069 (0.1121) | 0.1098 *** (0.0000) | 0.2932 * (0.0954) | 0.1825 ** (0.0133) | 0.0404 ** (0.0251) |

| EC | 183.5197 *** (0.0000) | 11.2394 *** (0.0000) | 65.1813 *** (0.0000) | 7.8202 (0.4600) | 73.3256 *** (0.0000) | 90.5247 *** (0.0000) |

| RC | −77.0547 *** (0.0000) | −303.8319 *** (0.0000) | −36.9938 ** (0.0241) | −302.7455 *** (0.0000) | −58.8179 *** (0.0000) | −68.7108 *** (0.0000) |

| GDP | −0.0002 *** (0.0000) | 0.0002 *** (0.0000) | −3.666 × 10−5 *** (0.0031) | 0.0003 *** (0.0000) | −0.0002 *** (0.0000) | −2.727 × 10−5 ** (0.0372) |

| CO2(−1) | −2716.3357 *** (0.0000) | −1127.7907 *** (0.0043) | 43.8085 ** (0.0211) | 140.8406 (0.3092) | 144.3421 ** (0.0281) | 54.8928 ** (0.0200) |

| CO2(−2) | 1274.9741 *** (0.0000) | −613.3103 (0.2721) | 93.4623 *** (0.0021) | −260.8631 (0.1543) | 58.8840 (0.5891) | 27.1825 (0.3462) |

| R2 | 0.999 | 0.985 | 0.998 | 0.882 | 0.984 | 0.995 |

| DW | 1.549 | 1.706 | 1.599 | 1.863 | 1.929 | 1.906 |

| Cointeg | −3.7689 *** (0.0031) | −3.0358 ** (0.0321) | −3.3935 ** (0.0111) | −4.2841 *** (0.0011) | −3.9790 *** (0.0023) | −4.7055 *** (8.2164 × 10−5) |

| Pearson Correlation Coefficients | CO2 | Trade | TRU | RC | EC | GDP |

|---|---|---|---|---|---|---|

| CO2 | 1.0000 | 0.8484 | 0.0796 | 0.6082 | 0.6040 | 0.7468 |

| Trade | 0.8484 | 1.0000 | 0.2894 | 0.8197 | 0.6574 | 0.8924 |

| TRU | 0.0796 | 0.2894 | 1.0000 | 0.4264 | 0.0058 | 0.1629 |

| RC | 0.6082 | 0.8197 | 0.4264 | 1.0000 | 0.4997 | 0.7594 |

| EC | 0.6040 | 0.6574 | 0.0058 | 0.4997 | 1.0000 | 0.9072 |

| GDP | 0.7468 | 0.8924 | 0.1629 | 0.7594 | 0.9072 | 1.0000 |

| Trade | TRU | EC | RC | GDP | Y(−1) | R2 | |

|---|---|---|---|---|---|---|---|

| Model (1) | 11.82 | - | 26.88 | 2.73 | 48.75 | 7.11 | 0.9695 |

| Model (2) | 10.20 | - | 17.15 | 2.88 | 46.49 | 1.19 | 0.4444 |

| Model (3) | 13.93 | 1.81 | 27.00 | 3.65 | 52.37 | 7.16 | 0.9699 |

| Modified Model (1) | 3.52 | - | 6.94 | 2.11 | - | 6.68 | 0.9681 |

| Modified Model (2) | 3.08 | - | 2.81 | 1.99 | - | 1.17 | 0.4075 |

| Modified Model (3) | 3.94 | 1.69 | 7.65 | 2.63 | - | 6.68 | 0.9690 |

| Model | Intercept | Trade | TRU | EC | RC | Y(−1) | R2 |

|---|---|---|---|---|---|---|---|

| Modified Model (1) | −1.0097 *** (0.006) | 0.1681 *** (0.000) | - | 0.1659 *** (0.000) | −0.0771 *** (0.000) | 0.7370 *** (0.000) | 0.9681 |

| Modified Model (2) | 2.5951 *** (0.000) | 0.1803 *** (0.000) | - | −0.1880) *** (0.000) | 0.1380 *** (0.000) | 0.0250 (0.720) | 0.4075 |

| Modified Model (3) | −1.3306 *** (0.001) | 0.1460 *** (0.000) | 0.1194 ** (0.039) | 0.1879 *** (0.000) | −0.0936 *** (0.000) | 0.7381 *** (0.000) | 0.9690 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, X.; Yang, X.; Peng, G.; Yue, S. International Trade and Carbon Emissions: Evaluating the Role of Trade Rule Uncertainty. Sustainability 2023, 15, 11662. https://doi.org/10.3390/su151511662

Zhao X, Yang X, Peng G, Yue S. International Trade and Carbon Emissions: Evaluating the Role of Trade Rule Uncertainty. Sustainability. 2023; 15(15):11662. https://doi.org/10.3390/su151511662

Chicago/Turabian StyleZhao, Xinwei, Xinsong Yang, Geng Peng, and Shengjie Yue. 2023. "International Trade and Carbon Emissions: Evaluating the Role of Trade Rule Uncertainty" Sustainability 15, no. 15: 11662. https://doi.org/10.3390/su151511662

APA StyleZhao, X., Yang, X., Peng, G., & Yue, S. (2023). International Trade and Carbon Emissions: Evaluating the Role of Trade Rule Uncertainty. Sustainability, 15(15), 11662. https://doi.org/10.3390/su151511662