Sustainability Management through Corporate Social Responsibility Activities in the Life Insurance Industry: Lessons from the Success Story of Kyobo Life Insurance in Korea †

Abstract

:1. Introduction

2. The Theoretical Background

3. Sustainability Management through Kyobo Life’s CSR Activities

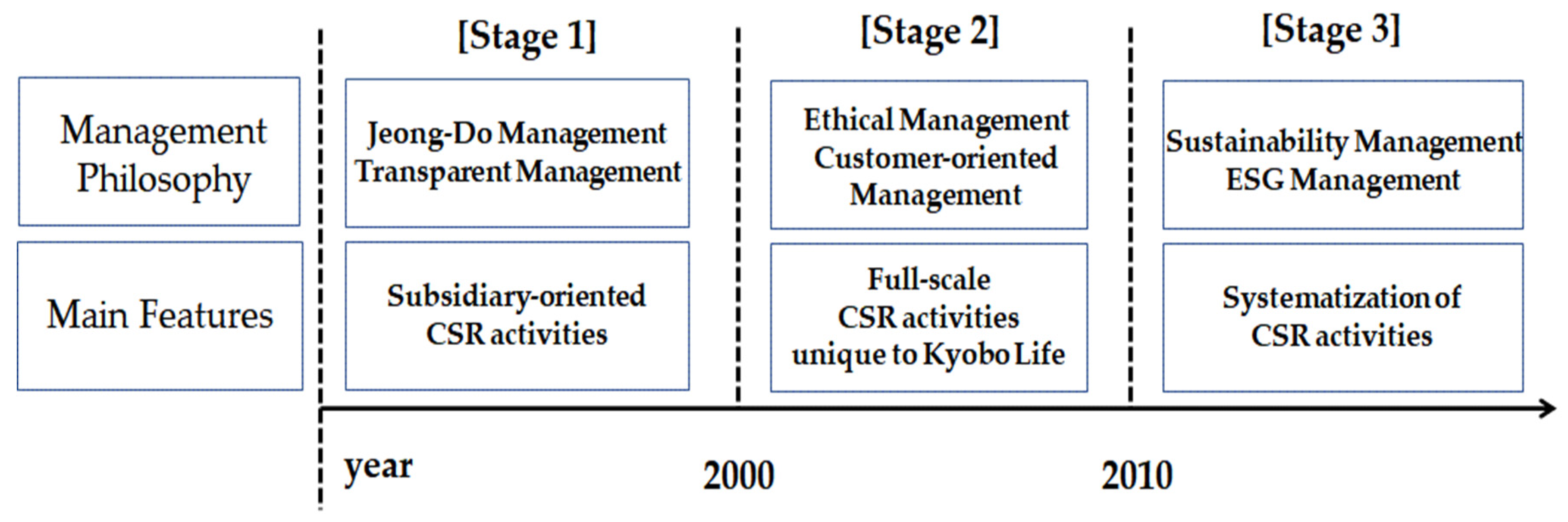

3.1. Kyobo Life’s CSR History

3.2. Kyobo Life’s CSR Activities Categorized from the TBL Perspective

3.2.1. Social Aspect

3.2.2. Environmental Aspect

3.2.3. Economic Aspect

4. Conclusions

4.1. Analysis Results and Implications

4.2. Limitations and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

References

- Brown, M.E.; Trevino, L.K. Ethical leadership: A review and future directions. Leadersh. Q. 2006, 17, 595–616. [Google Scholar] [CrossRef]

- Brown, M.E.; Trevino, L.K.; Harrison, D.A. Ethical leadership: A social learning perspective for construct development and testing. Organ. Behav. Hum. Decis. Process. 2005, 97, 117–134. [Google Scholar] [CrossRef]

- Gardner, W.L.; Avolio, B.J.; Luthans, F.; May, D.R.; Walumbwa, F. “Can you see the real me?” A self-based model of authentic leader and follower development. Leadersh. Q. 2005, 16, 343–372. [Google Scholar] [CrossRef] [Green Version]

- VanSadnt, C.V.; Neck, C.P. Bridging Ethics and Self leadership: Overcoming ethical discrepancies between employee and organizational standards. J. Bus. Ethics 2003, 43, 363–387. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate social responsibility evolution of a definitional construct. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Carroll, A.B. (Ed.) A Three-Dimensional Conceptual Model of Corporate Social Performance. In Academy of Management Review; Managing Corporate Social Responsibility, Little, Brown and Co.: Boston, MA, USA, 1979; Volume 4, pp. 497–505. [Google Scholar]

- Kim, S.W.; Kim, H.Y. Consumer Expectation-Discontinuation toward Finance Corporate Social Responsibility. Financ. Plan. Rev. 2012, 5, 1–33. [Google Scholar]

- Chung, D.H.; Sung, J.H. A Study on CSR Types of Cosmetic Companies to Gain Customer Loyalty of Product Brand. J. Korea Contents Assoc. 2019, 19, 184–192. [Google Scholar]

- Maignan, I.; Ferrell, O.C. Corporate Social Responsibility and Marketing: An Integrative Framework. J. Acad. Mark. Sci. 2004, 32, 3–19. [Google Scholar] [CrossRef]

- Lee, S.Y.; Hong, M.G. Corporate Social Responsibility, Irresponsibility, and Firm Performance: Empirical Investigation of Validity of Theories and Measurement. Korean Manag. Rev. 2015, 44, 677–711. [Google Scholar] [CrossRef]

- Lee, M.S.; Kim, Y. An Empirical Study on the Effect of Corporate Social Responsibility Activity on Firm Value: Comparative Analysis on Integrated Index (ESG and KEJI). J. Bus. Educ. 2015, 29, 345–374. [Google Scholar]

- Cochran, P.L.; Wood, R.A.; Jones, T.B. The Composition of Boards of Directors and Incident of Golden Parachutes. Acad. Manag. J. 1985, 28, 663–671. [Google Scholar] [CrossRef]

- David, P.; Kline, S.; Dai, Y. Corporate Social Responsibility, Practices, Corporate Identity and Purchase Intention: A Dual Process Model. J. Public Relat. Res. 2006, 17, 291–313. [Google Scholar] [CrossRef]

- Posnikoff, J. Disinvestment from South Africa: They did Well by doing Good. Contemp. Econ. Policy 1997, 15, 76–86. [Google Scholar] [CrossRef]

- Schwart, R. Corporate Philanthropic Contributions. J. Financ. 1968, 23, 479–497. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate Social Responsibility as a Conflict between Owners, Social Performance Metrics Conference; Haas Center for Responsible Business: Berkeley, CA, USA, 2005. [Google Scholar]

- Blomstrom, R.L.; Davis, K. Business and Society: Environment and Responsibility; McGraw-Hill: Singapore, 1975. [Google Scholar]

- Vance, S.C. Are Socially Responsible Corporations Good Investment Risks? Manag. Rev. 1975, 64, 19–24. [Google Scholar]

- Min, J.H.; Ha, S.; Kim, B.S. The Impact of Firms’ Sustainability Management Activities on Their Short-term and Long-term Values. Korean Manag. Rev. 2015, 44, 713–735. [Google Scholar] [CrossRef]

- World Commission on Environment and Development (WCED). Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Hong, S.T.; Ahn, C.Y.; Lee, H.S. Corporate Sustainable Management and its Impact on Corporate Reputation. J. Aviat. Manag. Soc. Korea 2012, 10, 187–205. [Google Scholar]

- Bell, S.; Morse, S. Sustainability Indicators: Measuring the Immeasurable; Earthscan: London, UK, 2008. [Google Scholar]

- Dunphy, D.; Benveniste, J.; Griffiths, A.; Sutton, P. (Eds.) Sustainability: The Corporate Challenge of the 21st Century; Allen & Unwin: St. Leonards, Australia, 2000. [Google Scholar]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; New Society: Gabriola Island, BC, Canada, 1998. [Google Scholar]

- Laszlo, C. The Sustainable Company: How to Create Lasting Value through Social and Environmental Performance; Island Press: Washington, DC, USA, 2003. [Google Scholar]

- Stead, W.E.; Stead, J.G. Sustainable Strategic Management; M.E. Sharpe: Armonk, NY, USA, 2004. [Google Scholar]

- Starik, M.; Kanashiro, P. Toward a theory of sustainability management: Uncovering and integrating the nearly obvious. Organ. Environ. 2013, 26, 7–30. [Google Scholar] [CrossRef]

- Baumgartner, R.J. Managing corporate sustainability and CSR: A conceptual framework combining values, strategies and instruments contributing to sustainable development. Corp. Soc. Responsib. Environ. Manag. 2014, 21, 258–271. [Google Scholar] [CrossRef]

- Baumgartner, R.J.; Rauter, R. Strategic perspectives of corporate sustainability management to develop a sustainable organization. J. Clean. Prod. 2017, 140, 81–92. [Google Scholar] [CrossRef]

- Jung, S.C.; Seon, H.K. The Strategies for the Sustainable Management of Insurance Companies. Commun. Stat. Appl. Methods 2011, 18, 119–130. [Google Scholar]

- UNEP. Financial Initiative, Insuring for Sustainability. Why and How the Leaders are doing it. Geneve, Switzerland. 2007. Available online: www.unepfi.org/publications/insurance/date (accessed on 20 June 2023).

- Goel, P. Triple bottom line reporting: An analytical approach for corporate sustainability. J. Financ. Account. Manag. 2010, 1, 27–42. [Google Scholar]

- Ebner, D.; Baumgartner, R.J. The relationship between sustainable development and corporate social responsibility. In Corporate Responsibility Research Conference; Queens University: Belfast, UK, 2006; Volume 4, p. 2006. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman Publishing: Boston, MA, USA, 1984. [Google Scholar]

- Simionescu, L.N. The Relationship between Corporate Social Responsibility (CSR) and Sustainable Development (SD). Intern. Audit. Risk Manag. 2015, 10, 179–190. [Google Scholar]

- Ait Sidhoum, A.; Serra, T. Corporate sustainable development. Revisiting the relationship between corporate social responsibility dimensions. Sustain. Dev. 2018, 26, 365–378. [Google Scholar] [CrossRef] [Green Version]

- Kim, Y.-H. The Effects of the Corporate Social Responsibility (CSR) on Customer Loyalty and Intention to Pay the Premium Price: Focusing on the Moderating Impact of CSR Genuineness; Dept. of Business Administration Graduate School, Dong-A University: Busan, Republic of Korea, 2012. [Google Scholar]

- Kim, J.Y.; Kim, H. A Study on the Impact of CSR Activities and Risk Management on the Corporate Image and Sustainability of Financial Services Companies. J. Korea Contents Assoc. 2020, 20, 403–416. [Google Scholar]

- Kim, J.H.; Cao, J. Effects of Corporate Social Responsibility on Corporate Image and Purchase Intent: An Empirical Investigation of Korean Food Companies in China. Int. Bus. Rev. 2011, 15, 1–23. [Google Scholar] [CrossRef]

- Hirsch, P.M.; Levin, D.Z. Umbrella advocates versus validity police: A life-cycle model. Organ. Sci. 1999, 10, 199–212. [Google Scholar] [CrossRef] [Green Version]

- Donaldson, T.; Preston, L. (Eds.) The Stakeholder Theory of the Corporation: Concepts, Evidence and Implications, in Clarkson; The Corporation and its Stakeholders, University of Toronto Press: Toronto, ON, USA, 1997. [Google Scholar]

- Kim, D.-J. Effects of External Activities of Corporate Social Responsibility on Benefits of Employees and Shareholders—Mainly from Stakeholders’ Perspective. J. Hum. Resour. Manag. Res. (JHRMR) 2009, 16, 29–48. [Google Scholar]

- Jonker, J.; Foster, D. Stakeholder Excellence: Framing the Evolution and Complexity of a Stakeholder Perspective of the Firm. Corp. Soc. Responsib. Environ. Manag. 2002, 9, 187–195. [Google Scholar] [CrossRef]

- Jamali, D. A stakeholder approach to corporate social responsibility: A fresh perspective into theory and practice. J. Bus. Ethics 2008, 82, 213–231. [Google Scholar] [CrossRef]

- Wood, D.J. Corporate social performance revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar] [CrossRef]

- Clarkson, M. A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar] [CrossRef]

- Maignan, I.; Ferrell, O.; Ferrell, L. A Stakeholder Model for Implementing Social Responsibility in Marketing. Eur. J. Mark. 2005, 29, 956–977. [Google Scholar] [CrossRef] [Green Version]

- Jones, T.; Wicks, A. Convergent stakeholder theory. Acad. Manag. Rev. 1999, 24, 206–221. [Google Scholar] [CrossRef]

- Available online: https://www.ksa.or.kr/ksi/index.do (accessed on 20 June 2023.).

- ISO 26000; Guidance on Social Responsibility. International Organization for Standardization ISO: Geneva, Switzerland, 2010.

- Cho, Y.; Lee, J.; Kang, D.; Kim, M. The Entrepreneurship of LG and GS Groups: In-wha Management, Jung-Do Management and Kyeong and Eui Principles of Nammyuong. J. CEO Manag. Stud. 2019, 22, 11. [Google Scholar]

- Moneytoday. 23 November 2004 Article. Available online: https://news.mt.co.kr/mtview.php?no=2004112311065680682 (accessed on 26 October 2022.).

- Jin, M.J. Ethics management program of Kyobo life Insurance Co. Korean J. Bus. Ethics 2007, 9, 28–39. [Google Scholar]

- Kyobo Life Publishes Sustainability Report (2011 to 2021). Available online: https://www.kyobo.com/dgt/web/company-information/sustainable-management/issue-of-bonds/en-sustainability-management-report (accessed on 20 June 2023.).

- Kyobo Life Insurance’s Website. Available online: https://www.kyobo.com (accessed on 20 June 2023.).

- National Customer Satisfaction Index(by Korea Productivity Center. Available online: https://www.ncsi.or.kr/ (accessed on 20 June 2023.).

- Sisodia, R.S. Conscious Capitalism: A Better Way to Win: A Response to James O’Toole and David Vogel’s “Two and a Half Cheers for Conscious Capitalism”. Calif. Manag. Rev. 2011, 53, 60–76. [Google Scholar] [CrossRef]

- Sisodia, R.S.; Wolfe, D.B.; Sheth, J.N. Firms of Endearment: How World-Class Companies Profit from Passion and Purpose; Wharton School Publishing: Upper Saddle River, NJ, USA, 2007; pp. 12–13. [Google Scholar]

| Year | Share of SRI | Share of Social Contribution Activities Support | Total Assets (Unit: Trillion) | Net Income (unit: Billions of Dollars) | |||

|---|---|---|---|---|---|---|---|

| As a Percentage of Assets | Proportion of Eco-Friendly Investment in SRI | Proportion of Net Income | Amount of Support (Unit: 100 Million) | Proportion of Contribution Activities in the Environment Sector | |||

| 2010 | 6.7% | 1.9% | 118 | 13% | 57.9 | 6389 | |

| 2011 | 7.6% | 2.6% | 143 | 8% | 62.4 | 5455 | |

| 2012 | 8.1% | 23.6% | 3.5% | 184 | 1.5% | 75.1 | 5956 |

| 2013 | 8.6% | 26.6% | 3.2% | 125 | 0.6% | 78.6 | 3961 |

| 2014 | 8.8% | 28.5% | 2.3% | 121 | 0.3% | 85.8 | 5175 |

| 2015 | 8.5% | 36.5% | 3.3% | 202 | 0.1% | 92.0 | 6079 |

| 2016 | 8.8% | 29.8% | 4.2% | 214 | 96.7 | 5145 | |

| 2017 | 8.5% | 30.9% | 2.3% | 146 | 104.5 | 6400 | |

| 2018 | 9.1% | 33.3% | 1.9% | 103 | 108.8 | 5280 | |

| 2019 | 9.4% | 39.2% | 6.8% | 352 | 116.1 | 6282 | |

| 2020 | 9.8% | 41.6% | 1.5% | 57 | 125.7 | 4522 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahn, Y.B.; Park, H.C. Sustainability Management through Corporate Social Responsibility Activities in the Life Insurance Industry: Lessons from the Success Story of Kyobo Life Insurance in Korea. Sustainability 2023, 15, 11632. https://doi.org/10.3390/su151511632

Ahn YB, Park HC. Sustainability Management through Corporate Social Responsibility Activities in the Life Insurance Industry: Lessons from the Success Story of Kyobo Life Insurance in Korea. Sustainability. 2023; 15(15):11632. https://doi.org/10.3390/su151511632

Chicago/Turabian StyleAhn, Young Back, and Hyun Chae Park. 2023. "Sustainability Management through Corporate Social Responsibility Activities in the Life Insurance Industry: Lessons from the Success Story of Kyobo Life Insurance in Korea" Sustainability 15, no. 15: 11632. https://doi.org/10.3390/su151511632

APA StyleAhn, Y. B., & Park, H. C. (2023). Sustainability Management through Corporate Social Responsibility Activities in the Life Insurance Industry: Lessons from the Success Story of Kyobo Life Insurance in Korea. Sustainability, 15(15), 11632. https://doi.org/10.3390/su151511632