Research on the Impact of Financial Deepening on Digital Economy Development: An Empirical Analysis from China

Abstract

1. Introduction

2. Literature Review and Research Hypothesis

2.1. Literature Review

2.1.1. Financial Deepening

2.1.2. Financial Deepening and Technological Innovation

2.1.3. Technological Innovation and Digital Economy Development

2.2. Research Hypothesis

2.2.1. Financial Deepening and Digital Economy Development

2.2.2. Financial Deepening, Technological Innovation, and Digital Economy Development

3. Methodology and Data

3.1. Models

3.1.1. Basic Model

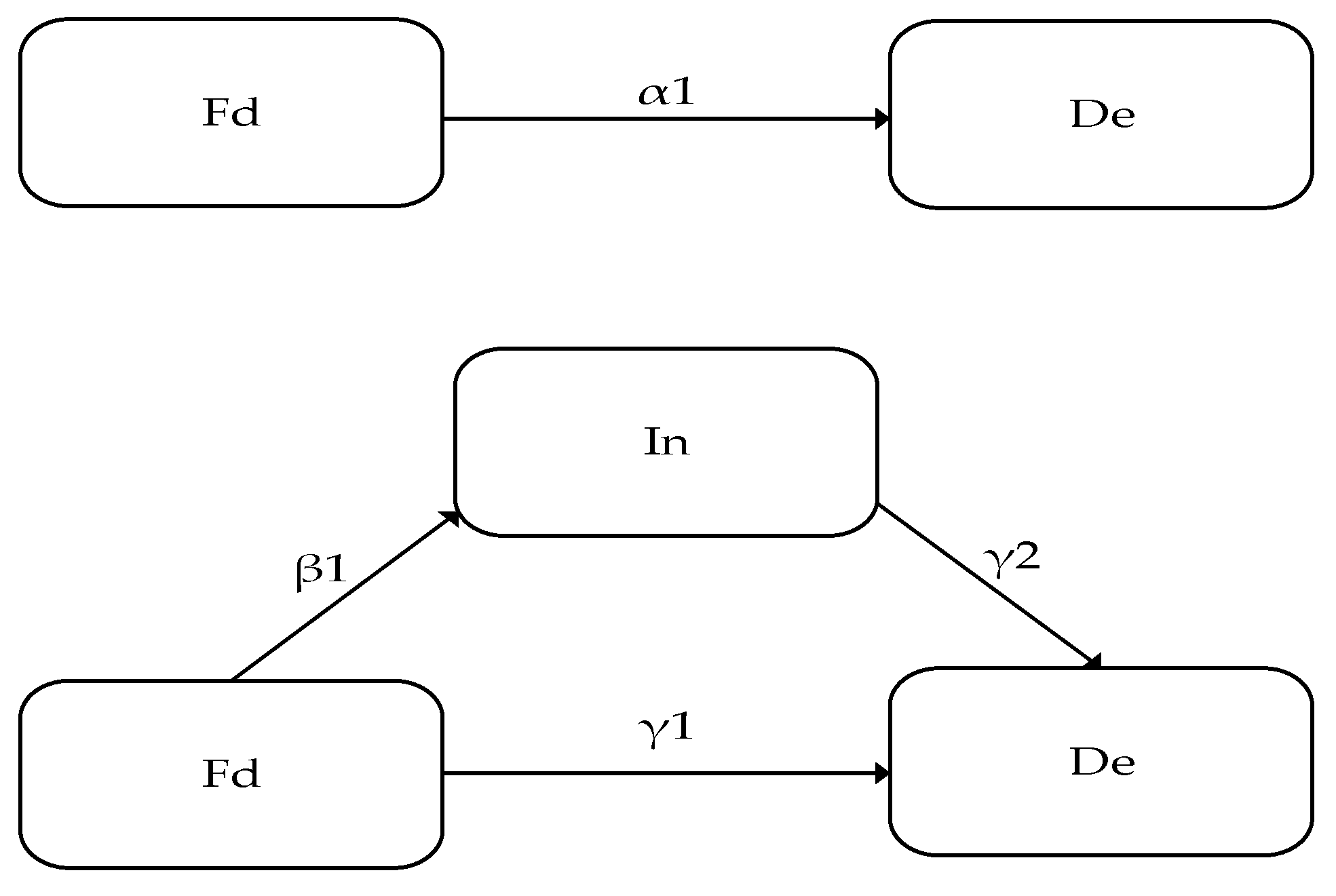

3.1.2. Mediating Effect Model

3.2. Description of the Data

3.2.1. Dependent Variables

3.2.2. Independent Variable

3.2.3. Mediating Variable

3.2.4. Control Variables

3.3. Data Source

3.4. Descriptive Statistics

3.5. Correlation Matrix

4. Empirical Results and Analysis

4.1. Regression Results

4.1.1. Benchmark Regression Results

4.1.2. Robust Regression Results

- (1)

- Replacing the indicators of the independent variable. In column (1) of Table 6, the regression outcomes are displayed using the financial depth index (Depth) released by Peking University to represent the level of financial deepening. The regression coefficient of the new indicators of financial deepening is significantly positive, indicating robustness of benchmark regression results;

- (2)

- Excluding the sample of centrally governed municipalities. The data from four municipalities governed by the central government, Beijing, Shanghai, Tianjin, and Chongqing, are not included in the sample. The regression results for the remaining 26 provinces are shown in column (2) of Table 6; the regression coefficient of financial deepening is significantly positive, ensuring the reliability of benchmark regression results;

- (3)

- Referring to Hu et al. [70] concerning possible causality issues between financial deepening and the digital economy development, this paper lags the explanatory variable and control variables by one period. The regression results are shown in column (3) of Table 6. Financial deepening with one-period lagged continues to have a significant positive effect on the digital economy development, which is consistent with the benchmark regression results.

4.2. Heterogeneity Results

4.3. Mechanism Results

4.3.1. Mediating Effect Results

4.3.2. Bootstrap Mediating Effect Test

5. Discussion

6. Conclusions and Policy Recommendations

6.1. Conclusions and Policy Recommendations

6.2. Research Deficiencies and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- China Banking and Insurance Regulatory Commission. Notice on Further Promoting the High-Quality Development of Financial Services in the Manufacturing Industry; China Banking and Insurance Regulatory Commission: Beijing, China, 2022. [Google Scholar]

- Liu, L.G. Financial support for digital economic development, creating a new engine for economic growth. Tsinghua Finance Rev. 2022, 5, 69–71. [Google Scholar]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1911; pp. 75–120. [Google Scholar]

- Goldsmith, R. Financial Structure and Development; Yale University Press: New Have, CT, USA, 1969; pp. 155–213. [Google Scholar]

- Shaw, E.S. Financial Deepening in Economic Development; Oxford University Press: Oxford, UK, 1973; pp. 211–278. [Google Scholar]

- Mckinnon, R.I. Money, Capital in Economic Development; Brookings Institution: Washington, DC, USA, 1973; pp. 121–145. [Google Scholar]

- Robert, G.K.; Ross, L. Finance and growth: Schumpeter might be right. QJE 1993, 153, 717–738. [Google Scholar] [CrossRef]

- Marco, D.R.; Thomas, H. Banks as catalysts for industrialization. J. Finance Intermed. 2002, 11, 366–397. [Google Scholar] [CrossRef]

- Nader, N. Deregulation, financial deepening and economic growth: The case of Latin America. J. Q. Rev. Econ. Finance 2004, 45, 447–459. [Google Scholar] [CrossRef]

- Michael, G.; Alexander, K. What determines the finance-growth nexus? Empirical evidence for threshold models. J. Econ. 2006, 87, 127–157. [Google Scholar] [CrossRef]

- Osuka, B.O.; Ihejirika, P.O.; Chinweze, R.M. Human capital development in Nigeria: Does financial deepening matter? J. Resour. Dev. Manag. 2018, 43, 48–56. [Google Scholar]

- Sugiyanto, C.; Yolanda, Z. The effect of financial deepening on economic growth, inequality, and poverty: Evidence from 73 countries. SEEJEB 2020, 15, 15–27. [Google Scholar] [CrossRef]

- Xu, Z.H.; Pal, S. The effects of financial liberalization on productivity: Evidence from India’s manufacturing sector. JMSE 2022, 7, 578–588. [Google Scholar] [CrossRef]

- Wang, J.G. Financial liberalization and financial deepening. J. Finance Res. 1998, 9, 34–37. [Google Scholar]

- Yang, S.G.; Zhu, H. Central collapse, financial weakening and financial support for the rise of central China. ERJ 2007, 5, 55–67+77. [Google Scholar]

- Shen, K.R.; Zhang, C. Financial development and economic growth in China—An empirical study based on cross-regional dynamic data. J. Manag. World 2004, 7, 15–21. [Google Scholar] [CrossRef]

- Zhan, M.H. The macroeconomic environment of financial deepening in China from the perspective of government revenue structure. J. Manag. World 2002, 10, 12–17+156. [Google Scholar] [CrossRef]

- Xiong, P.; Wang, F. A study on the endogenous transmission channel of financial deepening on economic growth in China—An empirical comparison based on endogenous growth theory. JFE 2008, 12, 68–76. [Google Scholar] [CrossRef]

- Tian, J.Y.; Huang, C.X. An empirical study on the financial deepening of private capital and rural economic development—Based on microfinance companies in Zhejiang Province. J. Manag. World 2013, 8, 167–168. [Google Scholar] [CrossRef]

- Hu, R.F. Research on financial deepening, industrial integration and poverty reduction effects from the perspective of regional development—An empirical analysis based on the spatial Durbin model. NFJ 2022, 5, 35–38. [Google Scholar] [CrossRef]

- Liao, L. Accelerating the construction of digital finance to support the development of the digital economy. Mod. Finance Guide 2022, 12, 4–5. [Google Scholar]

- Yang, W.Z.; Yu, J.; Li, K. Financial resource allocation, technological progress and economic development. J. Fin. Res. 2020, 12, 75–94. [Google Scholar]

- Zhang, K.; Huang, L.Y. How does financial development affect the quality of regional innovation?—An explanation from China’s foreign trade. Stud. Int. Fin. 2019, 9, 32–42. [Google Scholar] [CrossRef]

- Xu, Y.; Liu, W.C.; Zhang, S.Y.; Yuan, Z.J. Exploring the relationship between financial structure and economic growth under the difference of technological progress—An empirical analysis based on 121 countries and regions. Shangai Finance 2021, 4, 13–23+47. [Google Scholar] [CrossRef]

- Li, A.Z.; Su, Z.; Fu, H.Y. An empirical study on the relationship between financial development, technological innovation and industrial upgrading—Based on panel data of 277 prefecture-level cities in China. Econ. Rev. 2022, 5, 39–51. [Google Scholar] [CrossRef]

- Liu, G.; Zhang, W.X. Financial deepening and total labor productivity—A study based on input-output tables in 30 provinces and cities. Explor. Fin. Theory 2023, 2, 3–14. [Google Scholar] [CrossRef]

- Yuan, J.C. Research on the development of high-tech industries and financial support system—A review of the social science literature press’ research on China’s financial support system for high-tech industries. Price Theory Pract. 2020, 7, 182. [Google Scholar]

- Hu, M.M.; Xu, S.J.; Meng, C.X. Research on the innovation and development of science and technology financial services in the digital economy era. Jiangsu Sci. Technol. Inf. 2023, 11, 53–56. [Google Scholar]

- Liu, M.; Liu, Y. Research on the improvement of technological innovation efficiency and financial support from the perspective of innovation value Chain. Hebei Finance 2023, 3, 40–44. [Google Scholar]

- Pei, W.Y. Research on the impact of financial support on innovation efficiency of technology-based enterprises: A case study of technology innovation enterprises in Tianjin. Ent. Ref. Manag. 2022, 21, 174–176. [Google Scholar]

- Dong, Q.; Li, W.L.; Yang, H.; Zhao, F.; Qiu, Y.B. Research on the path of financial support for technological innovation: Empirical evidence from listed companies. West Finance 2022, 6, 3–9+87. [Google Scholar]

- Li, L. Research on financial supply-side support for technological innovation from the perspective of dynamic evolution. Sci. Manag. Res. 2022, 2, 147–154. [Google Scholar]

- Chen, X.; Teng, L.; Chen, W. How does FinTech affect the development of the digital economy? Evidence from China. N. Am. J. Econ. Finance 2022, 61, 101697. [Google Scholar] [CrossRef]

- Yuan, S.J.; Musibau, H.O.; Genç, S.Y.; Shaheen, R.; Ameen, A.; Tan, Z.X. Digitalization of economy is the key factor behind fourth industrial revolution: How G7 countries are overcoming with the financing issues? Technol. Forecast. Soc. Change 2021, 165, 120533. [Google Scholar] [CrossRef]

- Wu, X.H.; Pei, P. Fintech, total factor productivity and digital economy growth. Res. Econ. Manag. 2022, 7, 16–36. [Google Scholar] [CrossRef]

- Xue, Y.; Zhang, X.Z. Research on the mechanism of financial technology to promote the development of financial industry in the digital economy. J. Beijing Normal Univ. Soc. Sci. 2022, 3, 104–112. [Google Scholar]

- Liu, S.F.; Zhang, R.G.; Deng, J.C. Science and technology finance, high-tech industry and industrial structure upgrading. Stat. Decis. 2021, 2, 145–149. [Google Scholar] [CrossRef]

- Li, W.; Tan, S.Y.; Wu, F. Fintech development and digital transformation of enterprises—Intermediary transmission based on alleviating financing constraints and promoting innovation. Sci. Technol. Manag. Res. 2022, 20, 28–38. [Google Scholar]

- Qi, Y. Creating a new era of digital scene finance. China Finance 2022, 17, 36–37. [Google Scholar]

- Li, D. Financial technology empowering high-quality development of digital economy—A Record of the 9th Zhongguancun financial technology forum annual meeting. China Finance J. 2022, 4, 21–23. [Google Scholar] [CrossRef]

- Zhou, L.; Xu, J.; Finnula, E.A. Research progress and prospects on financial technology servicing the high-quality development of the real economy in the digital economy era. Finance Theory Pract. 2023, 3, 69–80. [Google Scholar] [CrossRef]

- Lei, L. Regulatory challenges and responses for financial support in the innovative development of Shaanxi’s digital economy. China Foreign Inv. 2022, 20, 99–101. [Google Scholar]

- Zhou, Y.R.; Chen, M.G. Theoretical approaches and practical evaluation of measuring digital economy. Chin. Soc. Sci. Eval. 2023, 1, 73–84+159. [Google Scholar]

- Wang, Y. A measure of China’s financial deepening process using financial stock indicators. J. Finance Res. 2002, 1, 82–92. [Google Scholar]

- Lu, J.W. Research on the Impact of finance on high-quality development of manufacturing industry under the background of digital economy. China Ind. Econ. 2023, 1, 138–140. [Google Scholar]

- Chen, D.Q.; Wei, G.; Xiao, Z.Z. Legal institutional efficiency, financial deepening and family control preferences. Econ. Res. J. 2013, 10, 55–68. [Google Scholar]

- Qian, H.X.; An, T.L. A study on the mechanism of financial deepening’s impact on corporate technological innovation in China. Nanjing Soc. Sci. 2022, 7, 50–60. [Google Scholar] [CrossRef]

- Yang, L.; Yang, L.X.; Zhang, Z.T. Financial support, technological innovation, and industrial structure upgrading. Acc. Econ. Res. 2022, 5, 89–104. [Google Scholar]

- Chen, H.; Shen, Y. New ideas of green finance to boost the development of digital economy. Gansu Soc. Sci. 2022, 2, 218–225. [Google Scholar] [CrossRef]

- Cheng, X.M.; Zou, Y.F. Measurement of China’s digital economy development level and spatial spillover effects. Bus. Econ. Res. 2022, 23, 189–192. [Google Scholar]

- Fang, X.M.; Guo, M.S.; Xia, W.H. Research on science and technology financial support for innovation and development of high-tech industries in the yangtze river economic belt in the era of digital economy. J. Hohai Univ. 2023, 2, 108–117. [Google Scholar]

- Du, N.Y.; Zhao, J. Can digital finance promote innovation and entrepreneurship? Evidence from 280 prefecture-level cities. New Finance 2023, 3, 50–56. [Google Scholar]

- Wen, Z.L.; Zhang, L.; Hou, Q.J.; Liu, Y.H. Tesing and application of the mediating effects. Acta Psychol. Sin. 2004, 5, 614–620. [Google Scholar]

- Zhang, Y.S. Development of digital economy and technological innovation of circulation enterprises: Theoretical mechanism and empirical verification. Bus. Econ. Res. 2023, 11, 120–123. [Google Scholar]

- Ma, Y.R.; Lv, H.; Cai, J.F. Digital economy, technological innovation, and regional economic growth. Stat. Decis. 2023, 6, 98–103. [Google Scholar] [CrossRef]

- Tapscott, D. The Digital Economy: Promise and Peril in the Age of Networked Intelligence; McGraw-Hill: New York, NY, USA, 1996; pp. 18–21. [Google Scholar]

- Margherio, L. The Emerging Digital Economy; Department of Commerce: Washington, DC, USA, 1999. [Google Scholar]

- Mesenbourg, T.L. Measuring the Digital Economy; US Bureau of the Census: Suitland, MD, USA, 2001. [Google Scholar]

- Junmo, K. Infrastructure of the digital economy: Some empirical findings with the case of Korea. Technol. Forecast Soc. Change 2004, 73, 377–389. [Google Scholar] [CrossRef]

- Sung, T.K. Introduction to “The Digital Economy in Asia”. Technol. Forecast Soc. Change 2009, 76, 653. [Google Scholar] [CrossRef]

- Xie, Y.F. The effect of digital economy on regional carbon emission intensity and its mechanism of action. Contemp. Econ. Manag. 2022, 2, 68–78. [Google Scholar] [CrossRef]

- Liu, J.; Yang, Y.Y.; Zhang, S.F. Study on the measurement and drivers of China’s digital economy. Shanghai J. Econ. 2020, 6, 81–96. [Google Scholar] [CrossRef]

- China Academy of Information and Communications Technology. White Paper on the Development of China’s Digital Economy (2023); China Academy of Information and Communications Technology: Beijing, China, 2022. [Google Scholar]

- National Bureau of Statistics of China. Statistical Classification of the Digital Economy and Its Core Industries (2021); National Bureau of Statistics of China: Beijing, China, 2021. [Google Scholar]

- Zhang, G.Y. Coupling and coordinated analysis of urban digital economy and low-carbon development in China. Oper. Manag. 2023, 1–13. [Google Scholar]

- Chu, M.; Zong, J.F. Government intervention, financial deepening and economic structural transformation: An examination of the “new northeast phenomenon”. China Softw. Sci. 2018, 01, 63–76. [Google Scholar]

- Xiong, L.; Cai, X.L. The impact effect of digital economy on regional innovation capacity enhancement—An empirical study based on the Yangtze River Delta city cluster. East China Econ. Manag. 2020, 12, 1–8. [Google Scholar]

- Wang, Y.J.; Peng, D.Y.; Zhao, S.Q. The impact of digital economy development on common wealth—An empirical analysis based on spatial spillover effects. Enterp. Econ. 2023, 2, 28–39. [Google Scholar] [CrossRef]

- Zhu, J.X.; Li, J.L. Digital economy, technological innovation and urban green economic efficiency—An empirical analysis based on spatial econometric model and mediating effects. Inq. Econ. Issues 2023, 2, 65–80. [Google Scholar]

- Hu, Q.W.; Li, Z.; Zhang, G.C. A study on the effect and heterogeneity of digital inclusive finance in supporting the development of real economy. New Finance 2022, 10, 18–24. [Google Scholar]

- Shi, Y.; Zhang, T.; Jiang, Y. Digital economy, technological innovation and urban resilience. Sustainability 2023, 15, 9250. [Google Scholar] [CrossRef]

| First-Level Indicators | Second-Level Indicators | Third-Level Indicators | Properties |

|---|---|---|---|

| Digital economy development level | Digital Infrastructure | Length of fiber optic cable line | + |

| Number of Mobile phone base stations | + | ||

| Mobile Phone Penetration Rate | + | ||

| Number of Internet broadband access ports | + | ||

| Number of Internet domain names | + | ||

| Number of ipv4 addresses | + | ||

| Digital Industrialization | Total Amount of Telecommunications Services | + | |

| Software industry revenue | + | ||

| Number of Employees in Information Services Industry | + | ||

| Output Value of Information Technology Industry | + | ||

| Industrial Digitization | E-commerce Sales Revenue | + | |

| Proportion of Enterprises with E-commerce Transactions | + | ||

| Number of Websites per Hundred Enterprises | + | ||

| Digital Services | Digital Inclusive Finance | + |

| Indicators | Weights | Indicators | Weights |

|---|---|---|---|

| Length of fiber optic cable line | 4.571% | Software industry revenue | 14.600% |

| Number of Mobile phone base stations | 4.273% | Number of Employees in Information Services Industry | 9.261% |

| Mobile Phone Penetration Rate | 2.242% | Output Value of Information Technology Industry | 15.006% |

| Number of Internet broadband access ports | 4.495% | E-commerce Sales Revenue | 10.526% |

| Number of Internet domain names | 10.038% | Proportion of Enterprises with E-commerce Transactions | 2.215% |

| Number of ipv4 addresses | 10.994% | Number of Websites per Hundred Enterprises | 0.733% |

| Total Amount of Telecommunications Services | 8.830% | Digital Inclusive Finance | 2.225% |

| Variables | Symbols | Mean | Standard Deviation | Min | Max | |

|---|---|---|---|---|---|---|

| Dependent Variables | Digital Economy | De | 0.3704 | 0.4143 | 0.0254 | 2.5897 |

| Independent Variables | Financial Deepening | Fd | 10.3072 | 0.8083 | 8.1647 | 12.3115 |

| Intermediate Variables | Technology Innovation | In | 2.1724 | 0.9971 | −0.1288 | 4.5087 |

| Control Variables | Government Support | Gov | 0.2522 | 0.1023 | 0.1066 | 0.6430 |

| Foreign Investment | FDI | 0.0188 | 0.0170 | 0.0001 | 0.1210 | |

| Openness | Open | 0.2529 | 0.2643 | 0.0076 | 1.3418 | |

| Transportation Level | Transport | 11.6327 | 0.8258 | 9.4441 | 12.8607 | |

| Human Capital | Edu | 0.1613 | 0.0257 | 0.0989 | 0.2099 |

| De | Fd | In | Gov | FDI | Open | Transport | Edu | |

|---|---|---|---|---|---|---|---|---|

| De | 1.000 | |||||||

| Fd | 0.7679 *** | 1.0000 | ||||||

| In | 0.7416 *** | 0.7870 *** | 1.0000 | |||||

| Gov | −0.4615 *** | −0.7373 *** | −0.5271 *** | 1.0000 | ||||

| FDI | 0.0966 | 0.1727 *** | 0.2813 *** | −0.3808 *** | 1.0000 | |||

| Open | 0.6599 *** | 0.5560 *** | 0.6722 *** | −0.4027 *** | 0.3538 *** | 1.0000 | ||

| Transport | −0.0687 | 0.2384 *** | −0.2122 *** | −0.1866 *** | −0.3509 *** | −0.5255 *** | 1.0000 | |

| Edu | 0.2130 *** | 0.3960 *** | 0.1257 ** | −0.4705 *** | −0.0079 | 0.0426 | 0.4062 *** | 1.0000 |

| Variables | Coefficient |

|---|---|

| De | |

| Fd | 0.5327 *** |

| (4.88) | |

| Gov | −0.5976 |

| (−1.61) | |

| FDI | −0.4554 |

| (−0.64) | |

| Open | −1.3771 *** |

| (−9.93) | |

| Transport | −0.8053 *** |

| (−7.11) | |

| Edu | 1.8827 ** |

| (1.98) | |

| Constants | 4.4564 *** |

| (2.99) | |

| Number of Observations | 270 |

| R-squared | 0.7133 |

| Province | YES |

| Year | YES |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| De | De | De | |

| Fd | 0.7119 *** | 0.3575 *** | |

| (8.31) | (2.82) | ||

| Depth | 0.4727 *** | ||

| (7.33) | |||

| Gov | −0.3423 | −0.3525 | −1.0407 *** |

| (−0.97) | (−1.19) | (−2.73) | |

| FDI | 0.5627 | −2.1270 *** | 0.1055 |

| (0.86) | (−2.87) | (0.15) | |

| Open | −1.0843 *** | −1.3750 *** | −1.2803 *** |

| (−8.62) | (−8.79) | (−9.66) | |

| Transport | −0.3962 *** | −0.6851 *** | −0.7700 *** |

| (−3.57) | (−7.16) | (−6.30) | |

| Edu | 1.0860 | −0.1615 | 0.9034 |

| (1.19) | (−0.20) | (0.96) | |

| Constants | 4.1334 *** | 1.7104 | 6.0617 *** |

| (3.11) | (1.33) | (3.75) | |

| Number of Observations | 270 | 234 | 240 |

| R-squared | 0.7439 | 0.7598 | 0.7217 |

| Province | YES | YES | YES |

| Year | YES | YES | YES |

| Variables | Eastern Region | Central and Western Regions |

|---|---|---|

| De | De | |

| Fd | 0.3367 | 0.3235 *** |

| (1.42) | (5.46) | |

| Gov | −1.6639 | −0.9222 *** |

| (−1.58) | (−5.34) | |

| FDI | 1.5259 | −3.0301 *** |

| (1.44) | (−3.68) | |

| Open | −1.1580 *** | 0.2209 |

| (−5.19) | (1.44) | |

| Transport | −1.0944 *** | −0.0869 |

| (−4.06) | (−1.39) | |

| Edu | 5.655 *** | −1.8109 *** |

| (2.91) | (−3.39) | |

| Constants | 8.9299 ** | −1.3915 * |

| (2.29) | (−1.96) | |

| Number of Observations | 90 | 180 |

| R-squared | 0.8496 | 0.8217 |

| Province | YES | YES |

| Year | YES | YES |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| De | In | De | |

| Fd | 0.4139 *** | 1.3581 *** | 0.3226 *** |

| (11.32) | (18.96) | (5.77) | |

| In | 0.0672 ** | ||

| (2.15) | |||

| Gov | 0.6701 *** | 0.8968 * | 0.6098 *** |

| (2.87) | (1.96) | (2.61) | |

| FDI | −2.8917 *** | 0.1550 | −2.9021 *** |

| (−2.86) | (0.08) | (−2.89) | |

| Open | 0.3685 *** | −0.6949 *** | 0.4152 *** |

| (3.35) | (−3.23) | (3.73) | |

| Transport | −0.0795 ** | −0.6482 *** | −0.0359 |

| (−2.43) | (−10.13) | (−0.94) | |

| Edu | 0.3935 | −1.5896 | 0.5004 |

| (0.59) | (−1.22) | (0.76) | |

| Constants | −3.2431 *** | −4.0827 *** | −2.9685 *** |

| (−8.28) | (−5.32) | (−7.25) | |

| R-squared | 0.7036 | 0.7992 | 0.7088 |

| Sobel | 0.0913 ** | ||

| Indirect effect | 0.0913 ** | ||

| Direct effect | 0.3226 *** | ||

| Total effect | 0.4139 *** | ||

| Coefficient | p-Value | |

|---|---|---|

| Indirect effect | 0.0913 | 0.005 |

| Direct effect | 0.3226 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shan, S.; Liu, C. Research on the Impact of Financial Deepening on Digital Economy Development: An Empirical Analysis from China. Sustainability 2023, 15, 11358. https://doi.org/10.3390/su151411358

Shan S, Liu C. Research on the Impact of Financial Deepening on Digital Economy Development: An Empirical Analysis from China. Sustainability. 2023; 15(14):11358. https://doi.org/10.3390/su151411358

Chicago/Turabian StyleShan, Shuai, and Chuanzhe Liu. 2023. "Research on the Impact of Financial Deepening on Digital Economy Development: An Empirical Analysis from China" Sustainability 15, no. 14: 11358. https://doi.org/10.3390/su151411358

APA StyleShan, S., & Liu, C. (2023). Research on the Impact of Financial Deepening on Digital Economy Development: An Empirical Analysis from China. Sustainability, 15(14), 11358. https://doi.org/10.3390/su151411358