Economic Potentials of Ecologically Attractive Multi-Life Products—The Example of Lithium-Ion Batteries

Abstract

1. Introduction

2. Literature Review

2.1. Development of the Market for Lithium-Ion Batteries

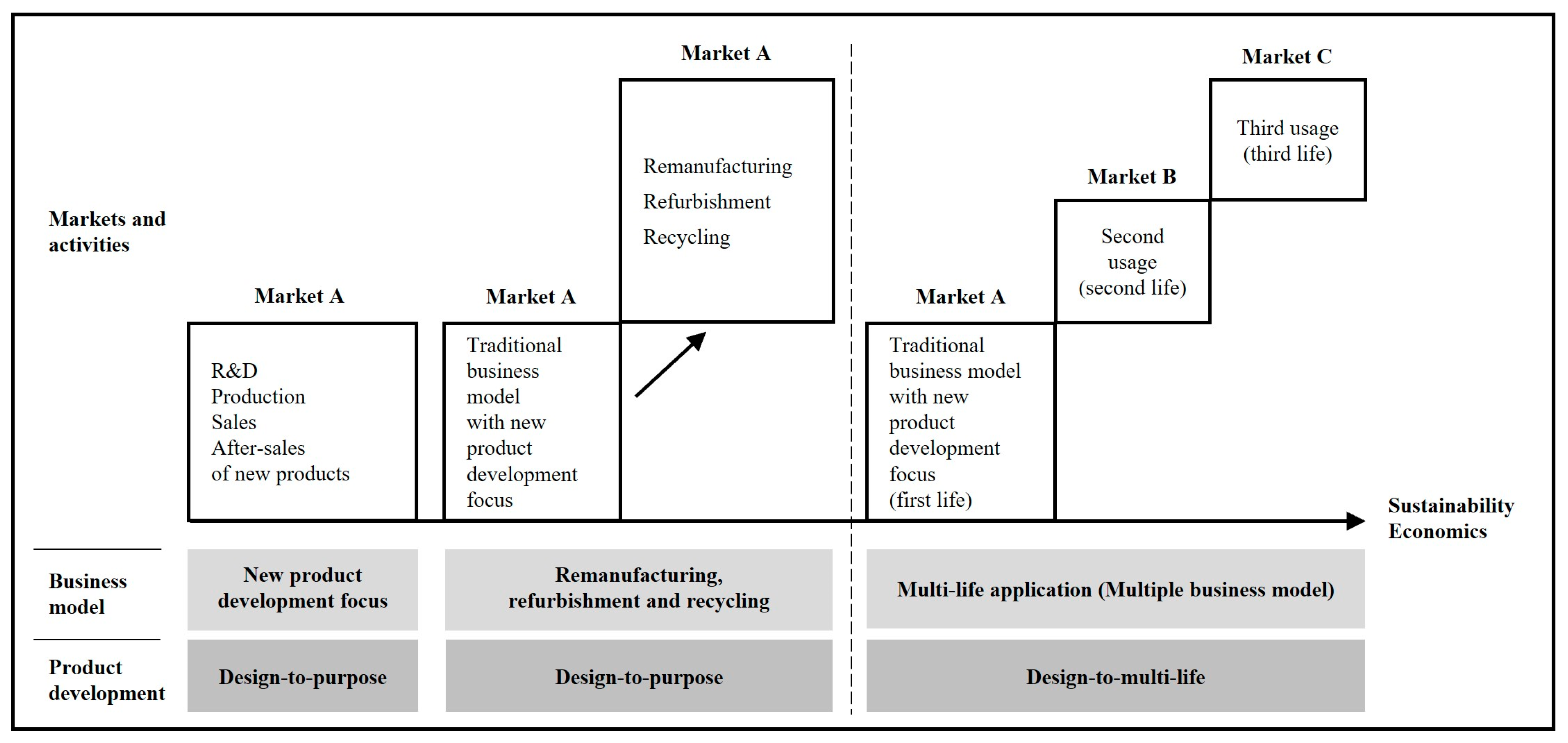

2.2. Product Life Cycle Extension and Its Economic Importance

2.3. Previous Explanations for Estimating the Economic Potential of Ecologically Attractive Multi-Life Products

3. A Model for Estimating the Economic Potentials of Ecologically Attractive Multi-Life Products

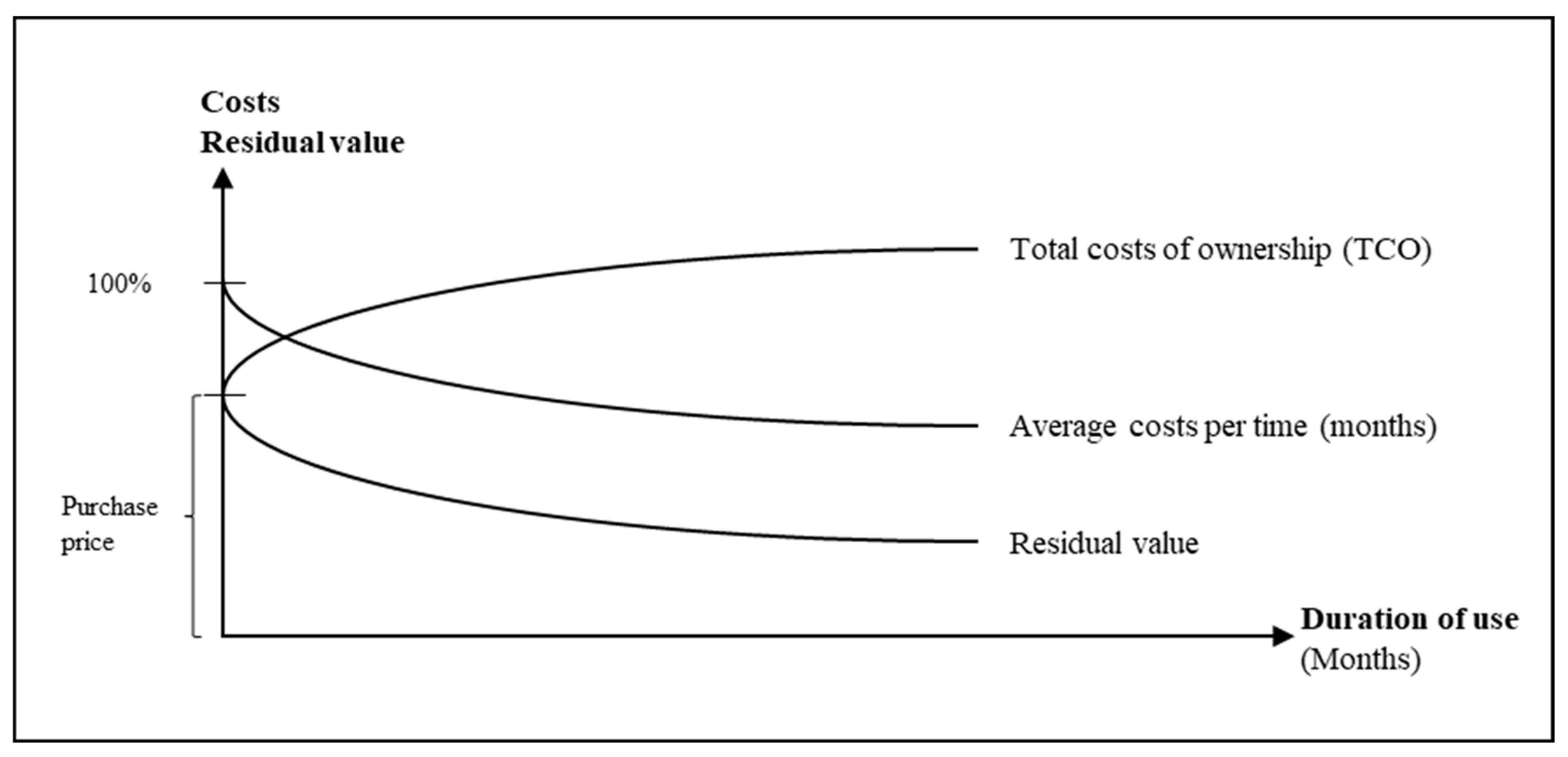

3.1. Justification of the Economically Viable Core of a Multi-Life Product with the Help of a TCO-Model

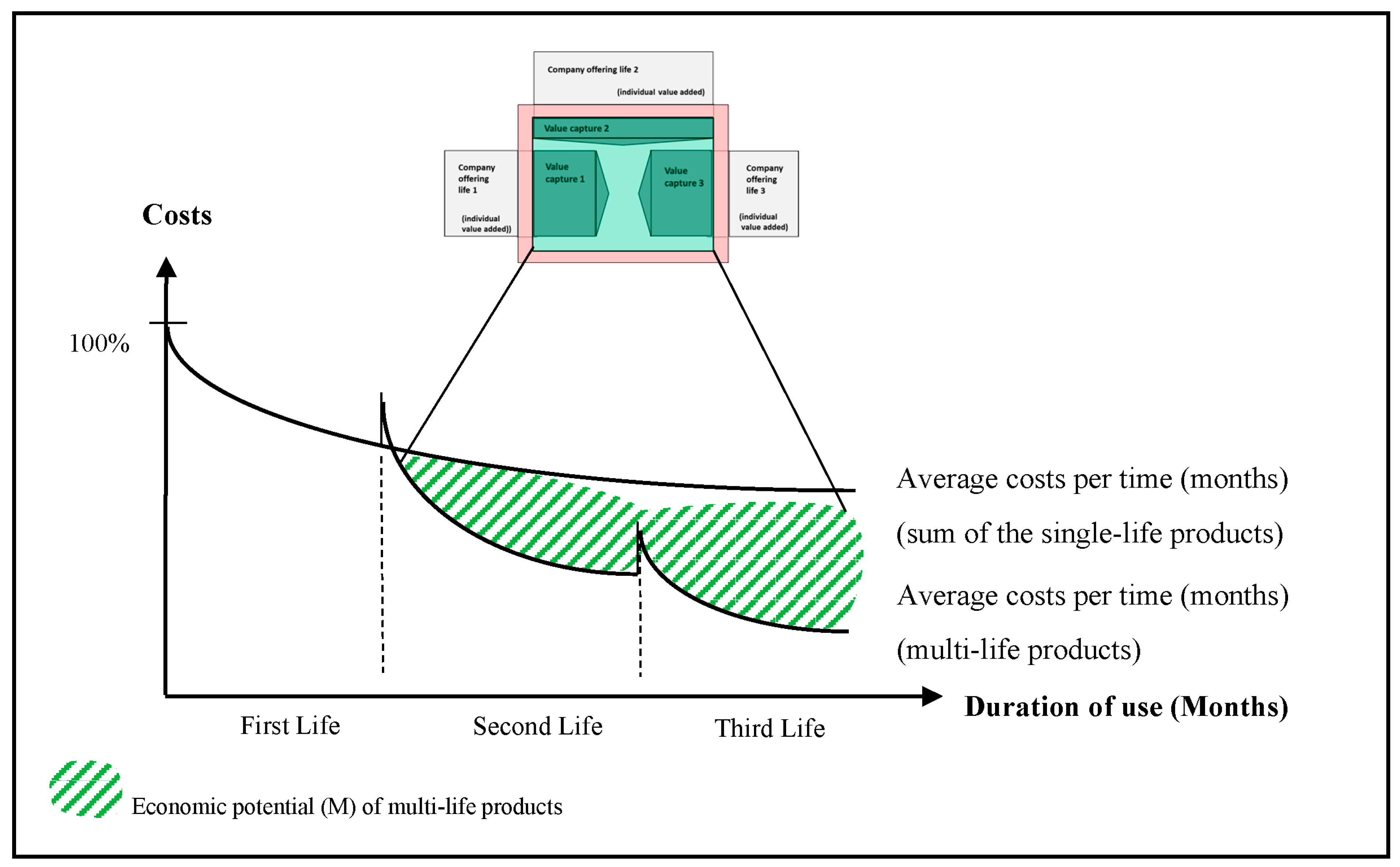

3.2. Extending the TCO Model by Considering Multi-Life Applications

3.3. Modelling Economic Potentials of Ecologically Attractive Multi-Life Products

- the total cost of ownership (TCO) over several life cycles (multi-life) minus the residual value at the end of these life cycles divided by the duration of use in months (average cost per time, cf. Figure 3) by

- the average cost per time of the sum of the single-life products,

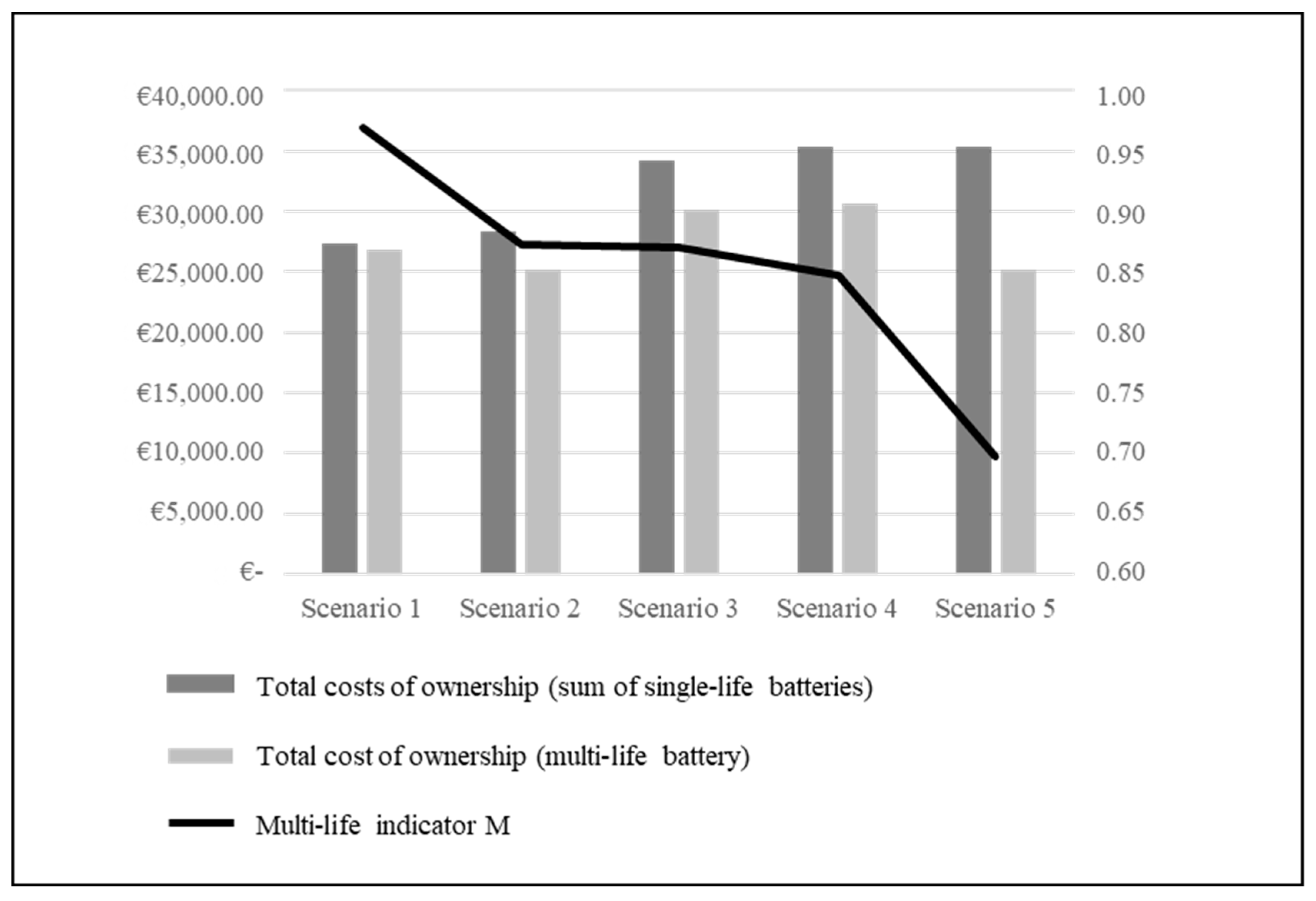

4. Empirical Examination: Potential Assessment

4.1. Methodology

4.2. Results

5. Management Implications

6. Conclusions

- Innovation ecosystems to create new complementary products and services on innovation platforms [17], e.g., through value-added use of exchanged data and/or

7. Limitation and Outlook

- Refine the present TCO model, including through a design -to-multi-life in product development,

- Support the offering of multi-life products through multiple business models and

- Drive the further development of the interaction of partners via platforms to an interaction in ecosystems, in order to be able to develop further economic potential.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Fischhaber, S.; Regett, A.; Schuster, S.F.; Hesse, H. Studie: Second-Life-Konzepte für Lithium-Ionen-Batterien aus Elektrofahrzeugen; Deutsches Dialog Institut GmbH: Frankfurt, Germany, 2016. [Google Scholar]

- Olsson, L.; Fallahi, S.; Schnurr, M.; Diener, D.; Van Loon, P. Circular business models for extended EV battery life. Batteries 2018, 4, 57. [Google Scholar] [CrossRef]

- Endres, A. Environmental Economics: Theory and Policy; Cambridge University Press: Cambridge, UK, 2011. [Google Scholar]

- European Commission. The European Green Deal; COM (2019) 640 Final; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Jiao, N.; Evans, S. Business Models for Sustainability: The Case of Second-life Electric Vehicle Batteries. Proc. CIRP 2016, 40, 250–255. [Google Scholar] [CrossRef]

- Hansen, E.G.; Revellio, F. Circular value creation architectures: Make alley, buy, or lasses-faire. J. Ind. Ecol. 2020, 24, 1250–1273. [Google Scholar] [CrossRef]

- Toffel, M.W. The growing strategic importance of end-of-life product management. Calif. Manag. Rev. 2003, 45, 102–129. [Google Scholar] [CrossRef]

- Atasu, A.; Guide, V.D.R.; van Wassenhofe, L.N.V. So what if remanufacturing cannibalizes my new product sales. Calif. Manag. Rev. 2010, 52, 56–76. [Google Scholar] [CrossRef]

- Gaur, J.; Amini, M.; Rao, A.K. Closed-loop supply chain configuration for new and reconditioned products: An integrated optimization model. Omega 2017, 66, 212–223. [Google Scholar] [CrossRef]

- Takacs, F.; Frankenberger, C.; Stechow, R. Business Model Innovation for Circular Ecosystems; White Paper; Institute of Management and Strategy: St. Gallen, Switzerland, 2020. [Google Scholar]

- Zhang, X.; Dong, F. Why Do Consumers Make Green Purchase Decisions? Insights from a Systematic Review. Int. J. Environ. Res. Public Health 2020, 17, 6607. [Google Scholar] [CrossRef]

- Faessler, B. Stationary, second use battery engergy storage systems and their applications: A research review. Energies 2021, 14, 2335. [Google Scholar] [CrossRef]

- Alaswad, A.; Baroutaji, A.; Achour, H.; Carton, J.; Al Makky, A.; Olabi, A.G. Developments in Fuel Cell Technologies in the Transport Sector. Int. J. Hydrogen Energy 2016, 41, 16499–16508. [Google Scholar] [CrossRef]

- Ausfelder, F.; Drake, F.-D.; Erlach, B.; Fischedick, M.; Henning, H.M.; Kost, C.P. Sektorkopplung—Untersuchungen und Überlegungen zur Entwicklung Eines Integrierten Energiesystems; Schriftenreihe Energiesysteme der Zukunft; Acetech—Deutsche Akademie der Technikwissenschaften e.V.; Deutsche Akademie der Naturforscher Leopoldina e.V.—Nationale Akademie der Wissenschaften; Union der Deutschen Akademien der Wissenschaften e.V.: Berlin, Germany, 2017. [Google Scholar]

- Suhariyanto, T.; Wahab, D.; Rahman, M.A. Multi-Life Cycle Assessment for sustainable products: A systematic review. J. Clean. Prod. 2017, 165, 677–696. [Google Scholar] [CrossRef]

- OECD. Business Models for the Circular Economy: Opportunities and Challenges from a Policy Perspective; OECD Publishing: Paris, France, 2018. [Google Scholar]

- Cusumano, M.A.; Gawer, A.; Yoffie, D.B. The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power; HarperCollins: New York, NY, USA, 2019. [Google Scholar]

- Sommer, S.; Proff, H.; Proff, H. Digital transformation in the global automotive industry. Int. J. Automot. Technol. Manag. 2021, 21, 295–321. [Google Scholar] [CrossRef]

- Kastanaki, E.; Giannis, A. Dynamic estimation of end-of-life electric vehicle batteries in the EU-27 considering reuse, remanufacturing and recycling options. J. Clean. Prod. 2023, 393, 136349. [Google Scholar] [CrossRef]

- Schulz-Mönninghoff, M.; Bey, N.; Nørregaard, P.U.; Niero, M. Integration of energy flow modelling in life cycle assessment of electric vehicle battery repurposing: Evaluation of multi-use cases and comparison of circular business models. Resour. Conserv. Recycl. 2021, 174, 105773. [Google Scholar] [CrossRef]

- Boyer, R.H.W.; Hunka, A.D.; Whalen, K.A. Consumer Demand for Circular Products: Identifying Customer Segments in the Circular Economy. Sustainability 2021, 13, 12348. [Google Scholar] [CrossRef]

- Díaz-Ramírez, M.C.; Blecua-de-Pedro, M.; Arnal, A.J.; Post, J. Acid/base flow battery environmental and economic performance based on its potential service to renewables support. J. Clean. Prod. 2022, 330, 129529. [Google Scholar] [CrossRef]

- Franco, M.A.; Groesser, S.N. A Systematic Literature Review of the Solar Photovoltaic Value Chain for a Circular Economy. Sustainability 2021, 13, 9615. [Google Scholar] [CrossRef]

- Liu, M.; Zhang, K.; Liang, Y.; Yang, Y.; Chen, Z.; Liu, W. Life cycle environmental and economic assessment of electric bicycles with different batteries in China. J. Clean. Prod. 2023, 385, 135715. [Google Scholar] [CrossRef]

- Reinhart, L.; Vrucak, D.; Woeste, R.; Lucas, H.; Rombach, E.; Friedrich, B.; Letmathe, P. Pyrometallurgical recycling of different lithium-ion battery cell systems: Economic and technical analysis. J. Clean. Prod. 2023, 416, 137834. [Google Scholar] [CrossRef]

- Song, A.; Zhou, Y. Advanced cycling ageing-driven circular economy with E-mobility-based energy sharing and lithium battery cascade utilisation in a district community. J. Clean. Prod. 2023, 415, 137797. [Google Scholar] [CrossRef]

- Sopha, B.M.; Purnamasari, D.M.; Ma’mun, S. Barriers and Enablers of Circular Economy Implementation for Electric-Vehicle Batteries: From Systematic Literature Review to Conceptual Framework. Sustainability 2022, 14, 6359. [Google Scholar] [CrossRef]

- Chen, H.; Yu, J.; Liu, X. Development Strategies and Policy Trends of the Next-Generation Vehicles Battery: Focusing on the International Comparison of China, Japan and South Korea. Sustainability 2022, 14, 12087. [Google Scholar] [CrossRef]

- Tang, Y.; Tao, Y.; Li, Y. Collection policy analysis for retired electric vehicle batteries through agent-based simulation. J. Clean. Prod. 2023, 382, 135269. [Google Scholar] [CrossRef]

- Wang, E.; Nie, J.; Wang, Y. Government Subsidy Strategies for the New Energy Vehicle Power Battery Recycling Industry. Sustainability 2023, 15, 2090. [Google Scholar] [CrossRef]

- Zhang, M.; Wu, W.; Song, Y. Study on the impact of government policies on power battery recycling under different recycling models. J. Clean. Prod. 2023, 413, 137492. [Google Scholar] [CrossRef]

- Dattée, B.; Alexy, O.; Autio, E. Maneuvering in poor visibility: How firms play the ecosystem game when uncertainty is high. Acad. Manag. J. 2018, 6, 466–498. [Google Scholar] [CrossRef]

- Brandenburger, A.M.; Stuart, H.W. Biform games. Manag. Sci. 2007, 53, 537–549. [Google Scholar] [CrossRef]

- Gans, J.; Ryall, M.D. Value capture theory: A strategic management review. Strateg. Manag. J. 2017, 38, 17–41. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H.; Hesterly, W.S. The relational view revisited: A dynamic perspective on value creation and value capture. Strateg. Manag. J. 2018, 39, 3140–3162. [Google Scholar] [CrossRef]

- Adner, R. Winning the Right Game: How to Disrupt, Defend, and Deliver in a Changing World; The MIT Press: Cambridge, MA, USA, 2021. [Google Scholar]

- Eckert, R. Geschäftsmodelldiversifizierung und multiple Geschäftsmodelle in intelligenten Echtzeitunternehmen. In Intelligente Echtzeitunternehmen im Digitalen Hyperwettbewerb; Eckert, R., Ed.; Springer-Gabler: Wiesbaden, Germany, 2018; pp. 119–127. [Google Scholar]

- German Federal Government. Koalitionsvertrag Zwischen SPD, Bündnis 90/Die Grünen und FDP, 2021. Bundesregierung. Available online: https://www.bundesregierung.de/breg-de/service/gesetzesvorhaben/koalitionsvertrag-2021-1990800 (accessed on 31 May 2023).

- Deloitte. E-Mobility Forecast; Deloitte: Düsseldorf, Germany, 2022. [Google Scholar]

- Berger, R. Rising Opportunities for Battery Equipment Manufacturers; Roland Berger Report; Roland Berger: München, Germany, 2020. [Google Scholar]

- Rystad. Powering Up: Global Battery Demand to Surge by 2030, Supply Headaches on the Horizon; RystadEnergy. 2022. Available online: https://www.rystadenergy.com/newsevents/news/press-releases/powering-up-global-battery-demand-to-surge-by-2030-supply-headaches-on-the-horizon (accessed on 13 May 2022).

- Schmidt, M. Rohstoffrisikobewertung—Lithium 2030—Update; Deutsche Rohstoffagentur (DERA) der Bundesanstalt für Geowissenschaften und Rohstoffe: Berlin, Germany, 2022. [Google Scholar]

- Ausfelder, F.; Wagemann, K. Power-to-Fuels: E-Fuels as an Important Option for a Climate-Friendly Mobility of the Future. Chem. Ing. Tech. 2020, 92, 21–30. [Google Scholar] [CrossRef]

- Acatech; Circular Economy Initiative; Deutschland; SYSTEMIQ (Eds.) Executive Summary and Recommendations. In Circular Business Models: Overcominig Barriers, Unleashing Potentials; World Wide Fund for Nature: München, Germany, 2020. [Google Scholar]

- Fasse, M. BMW-Chef Oliver Zipse Geht in die Offensive; Handelsblatt: Düsseldorf, Germany, 2019. [Google Scholar]

- Alcayaga, A.; Wiener, M.; Hansen, E.G. Towards a framework of smart-circular systems: An integrated literature review. J. Clean. Prod. 2019, 221, 622–634. [Google Scholar] [CrossRef]

- Nationale Plattform Zukunft der Mobilität. Batterierecyclingmarkt Europa; Bundesministerium für Verkehr und Digitale Infrastruktur (BMVI): Berlin, Germany, 2021. [Google Scholar]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Courtney, H.; Kirkland, J.; Viguerie, P. Strategy under uncertainty. Harv. Bus. Rev. 1997, 75, 67–79. [Google Scholar]

- Proff, H.; Fojcik, T.M. Business model innovations in times of log-term discontinuous technological change. Int. J. Automot. Technol. Manag. 2015, 15, 418–442. [Google Scholar] [CrossRef]

- Csaszar, F.A.; Eggers, J.P. Organizational decision making: An information aggregation view. Manag. Sci. 2013, 59, 2257–2277. [Google Scholar] [CrossRef]

- Rohlfs, W.; Madlehner, R. Investment decisions under uncertainty: CCS competing with green energy technologies. Energy Proced. 2013, 37, 7029–7038. [Google Scholar] [CrossRef]

- Chevalier-Roignant, B.; Flath, C.M.; Trigeorgis, L. Disruptive innovation, market entry and production flexibility in heterogenous oligopoly. Prod. Oper. Manag. 2019, 28, 1641–1657. [Google Scholar] [CrossRef]

- Javed, S.A.; Mahmoudi, A.; Liu, S. Grey absolute decision analysis (GADA) method for multiple criteria group-decision making under uncertainty. Int. J. Fuzzy. Syst. 2020, 22, 1073–1090. [Google Scholar] [CrossRef]

- Agawal, V.; Atasu, A.; Ülkü, S. Leasing, modularity, and the circular economy. Manag. Sci. 2021, 67, 6629–7289. [Google Scholar]

- Bohlayer, M.; Bürger, A.; Fleschutz, M.; Braun, M. Multi-period investment pathways—Modelling approaches to design distributed energy systems under uncertainty. Appl. Energy 2021, 285, 116368. [Google Scholar] [CrossRef]

- Riasanow, T.; Galic, G.; Böhm, M. Digital transformation in the automotive industry: Towards generic value networks. In Proceedings of the 25th European Conference on Information Systems (ECIS), Guimaraes, Portugal, 5–10 June 2017; pp. 3191–3201. [Google Scholar]

- Teece, D.J.; Peteraf, M.; Leih, S. Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy. Calif. Manag. Rev. 2016, 58, 13–35. [Google Scholar] [CrossRef]

- Ellram, L.M.; Siferd, S.P. Total cost of ownership: A key concept in strategic cost management decisions. J. Bus. Logist. 1998, 19, 55–84. [Google Scholar]

- Hanson, J.D. Differential method for TCO modelling: An analysis and tutorial. Int. J. Procure. Manag. 2011, 4, 627–641. [Google Scholar] [CrossRef]

- Adner, R. Ecosystem as structure. J. Manag. 2017, 43, 39–58. [Google Scholar] [CrossRef]

- Zapf, M.; Pengg, H.; Bütler, T.; Bach, C.; Weidl, C. Kosteneffiziente und Nachhaltige Automobile; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar]

- Richnák, R.; Gubová, K.; Fabianová, J. The Application of Total Cost of Ownership Method to Automotive Industry. LOGI Sci. J. Transp. Logist. 2020, 11, 102–108. [Google Scholar] [CrossRef]

- Gobbi, C. Designing the reverse supply chain: The impact of the product residual value. Int. J. Phys. Distrib. Logist. Manag. 2011, 41, 768–796. [Google Scholar] [CrossRef]

- Centrobelli, P.; Cerchione, R.; Chiaroni, D.; Del Vecchio, P.; Urbinati, A. Designing business models in circular economy: A systematic literature review and research agenda. Bus. Strateg. Environ. 2020, 28, 1734–1749. [Google Scholar] [CrossRef]

- Gawer, A. Digital platforms boundaries: The interplay of firm scope, platform size and digital interfaces. Long Range Plan. 2021, 54, 102045. [Google Scholar] [CrossRef]

- Rochet, C.-J.; Tirole, J. Platform competition in two-sided markets. J. Eur. Econ. Assoc. 2003, 1, 990–1029. [Google Scholar] [CrossRef]

- Bengtsson, M.; Raza-Ullah, T. A systematic review of research on coopetition: Toward a multilevel understanding. Ind. Mark. Manag. 2016, 57, 23–39. [Google Scholar] [CrossRef]

- Luo, Y. A general framework of digitization risks in international business. J. Int. Bus. Stud. 2022, 53, 344–361. [Google Scholar] [CrossRef]

- Jacobides, M.G.; Cennamo, C.; Gawer, A. Towards a theory of ecosystems. Strateg. Manag. J. 2018, 39, 2255–2276. [Google Scholar] [CrossRef]

- Baldwin, C.Y.; Clark, K.B. Managing in an age of modularity. Harv. Bus. Rev. 1997, 75, 84–93. [Google Scholar]

- Williamson, O.E. Markets and Hierarchies; The Free Press: Florence, MA, USA, 1975. [Google Scholar]

- Williamson, P.J.; De Meyer, A. Ecosystem advantage: How to successfully harness the power of partners. Calif. Manag. Rev. 2012, 55, 24–46. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. Multi-sided platforms. Int. J. Ind. Organ. 2015, 43, 162–174. [Google Scholar] [CrossRef]

- Milgrom, P.; Roberts, J. The economics of modern manufacturing: Technology, strategy and organization. Am. Econ. Rev. 1990, 80, 511–528. [Google Scholar]

- Buchanan, J.M. An economic theory of clubs. Economica 1965, 32, 1–14. [Google Scholar] [CrossRef]

- Burmeister, A.; Lazarova, M.B.; Deller, J. The influence of motivation, opportunity, ability, and tacitness on Repatriate Knowledge Transfer. Acad. Manag. Proc. 2016, 2016, 10427. [Google Scholar] [CrossRef]

- Katz, M.L.; Shapiro, C. Network externalities, competition, and compatibility. Am. Econ. Rev. 1985, 75, 424–440. [Google Scholar]

- Eisenmann, T.; Parker, G.; van Alstyne, M. Strategies for two-sided markets. Harvard. Bus. Rev. 2006, 84, 92–101. [Google Scholar]

- Iansiti, M.; Lakhani, K.R. Competing in an Age of AI: Strategy and Leadership When Algorthms and Networks Run the World; Harvard Business Review Press: Brighton, MA, USA, 2020. [Google Scholar]

- Di Maria, A.; Merchán, M.; Marchand, M.; Eguizabal, D.; De Cortázar, M.G.; van Acker, K. Evaluating energy and resource efficiency for recovery of metallurgical residues using environmental and economic analysis. J. Clean. Prod. 2022, 356, 131790. [Google Scholar] [CrossRef]

- Liessmann, K. Strategisches Controlling. In Controlling Konzepte, 4th ed.; Mayer, E., Liessmann, K., Freidank, C., Eds.; Gabler-Verlag: Wiesbaden, Germany, 1999; pp. 117–210. [Google Scholar]

- Lukomnik, J.; Hawley, J.P. Moving Beyond Modern Portfolio Theory: Investing that Matters; Taylor & Francis Group: Abingdon, UK, 2021. [Google Scholar]

- World Economic Forum. A Vision for a Sustainable Battery Value Chain in 2030; The World Economic Forum: Geneva, Switzerland, 2019. [Google Scholar]

- Curtis, T.; Smith, L.; Heath, G.; Buchanan, H. A Circular Economy for Lithium-Ion Batteries Used in Mobile and Stationary Energy Storage: Drivers, Barriers, Enablers, and US Policy Considerations; National Renewable Energy Lab (NREL): Golden, CO, USA, 2021. [Google Scholar]

- Sun, B.; Su, X.; Wang, D.; Zhang, L.; Liu, Y.; Yang, Y.; Jiang, J. Economic analysis of lithium-ion batteries recycled from electric vehicles for secondary use in power load peak shaving in China. J. Clean. Prod. 2020, 276, 123327. [Google Scholar] [CrossRef]

- Gandoman, F.H.; Jaguemon, J.; Goutam, S.; Gopalakrishnan, R.; Firouz, Y.; Kalogian, T.; Omai, N.; Mierd, J.V. Concept of reliability and safety assessment of lithium-ion batteries in electric vehicles: Basics, progress, and challenges. Appl. Energy 2019, 251, 113343. [Google Scholar] [CrossRef]

- Kotak, Y.; Marchante Fernández, C.; Canals Casals, L.; Kotak, B.S.; Koch, D.; Geisbauer, C.; Trill, L.; Gómez-Núñes, A.; Schweiger, H.G. End of electric vehicle batteries: Reuse vs. recycle. Energies 2021, 14, 2217. [Google Scholar] [CrossRef]

- Bernhart, W. Recycling von Lithium-Ionen-Batterien im Kontext von Technologie-und Preisentwicklungen. ATZelektronik 2019, 14, 38–43. [Google Scholar] [CrossRef]

- Engel, H.; Hertzke, P.; Siccardo, G. Second-Life EV Batteries: The Newest Value Pool in Energy Storage; McKinsey & Company: Minato, Tokyo, 2019. [Google Scholar]

- Desarnaud, G.; Boust, M. Second Life Batteries: A Sustainable Business Opportunity, Not a Conundrum; Capgemini: Paris, France, 2019. [Google Scholar]

- Kurdve, M.; Zackrisson, M.; Johansson, M.I.; Ebin, B.; Harlin, U. Considerations when modelling EV battery circularity systems. Batteries 2019, 5, 40. [Google Scholar] [CrossRef]

- Eidelwein, F.; Collatto, D.C.; Rodrigues, L.H.; Lacerda, D.P.; Piran, F.S. Internalization of environmental externalities: Development of a method for elaborating the statement of economic and environmental results. J. Clean. Prod. 2018, 170, 1316–1327. [Google Scholar] [CrossRef]

- Zhu, J.; Mathews, I.; Ren, D.; Li, W.; Cogswell, D.; Xing, B.; Sedlatschek, T.; Kantareddy, S.N.R.; Yi, M.; Gao, T.; et al. End-of-Life or Second-Life Options for Retired Electric Vehicle Batteries. Cell. Rep. 2021, 2, 100537. [Google Scholar] [CrossRef]

- den Hollander, M.C.; Bakker, C.A.; Hultink, E.J. Product Design in a Circular Economy: Development of a Typology of Key Concepts and Terms. J. Ind. Ecol. 2017, 21, 517–525. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. An e-buiness model ontology for modeling e-business. In Proceedings of the 15th Electronic Commerce Conference, Bled, Slovenia, 17–19 June 2002. [Google Scholar]

- Simões, V.; Pereira, L.; Dias, Á. Enhancing Sustainable Business Models for Green Transportation. Sustainability 2023, 15, 7272. [Google Scholar] [CrossRef]

- Yang, S.; Li, R.; Li, J. “Separation of Vehicle and Battery” of Private Electric Vehicles and Customer Delivered Value: Based on the Attempt of 2 Chinese EV Companies. Sustainability 2020, 12, 2042. [Google Scholar] [CrossRef]

- Hansen, E.; Wiedemann, P.; Fichter, K.; Lüdeke-Freund, F.; Jaeger-Erben, M.; Schomerus, T.; Alcayaga, A.; Blomsma, F.; Tischner, U.; Ahle, U.; et al. Circular Business Models: Overcoming Barriers, Unleashing Potentials; Circular Economy Initiative Deutschland, Ed.; Acatech: Munich, Germany; SYSTEMIQ: London, UK, 2020. [Google Scholar]

- Nambisan, S.; Zarah, S.A.; Luo, Y. Global platforms and ecosystems: Implications for international business theories. J. Int. Bus. Stud. 2019, 50, 1446–1486. [Google Scholar] [CrossRef]

- Campagnolo, D.; Camuffo, A. The concept of modularity in management studies: A literature review. Int. J. Manag. Rev. 2010, 12, 259–283. [Google Scholar] [CrossRef]

- Philippot, M.; Alvarez, G.; Ayerbe, E.; Van Mierlo, J.; Messagie, M. Eco-Efficiency of a Lithium-Ion Battery for Electric Vehicles: Influence of Manufacturing Country and Commodity Prices on GHG Emissions and Costs. Batteries 2019, 5, 23. [Google Scholar] [CrossRef]

| Evaluation of a single life battery (in case of isolated use) | Evaluation of a multi-life battery (with adaptations for multiple use over the duration of use) | ||

| First use in electric cars | |||

| Capacity | 60 kWh | Capacity | 60 kWh |

| Initial investment | EUR 6000 | Initial investment | EUR 7800 |

| Lifecycle | 8 years | Lifecycle 1 | 8 years |

| Operating costs p.a. | EUR 600 | Operating costs p.a. | EUR 780 |

| Residual value | EUR 2480 | Refurbishment costs | EUR 1920 |

| Second use as power storage for photovoltaic | |||

| Capacity | 48 kWh | Capacity | 48 kWh |

| Initial investment | EUR 9600 | Initial investment | - |

| Lifecycle | 10 years | Lifecycle 2 | 10 years |

| Operating costs p.a. | EUR 960 | Operating costs p.a. | EUR 780 |

| Residual value | EUR 3970 | Refurbishment costs | EUR 1920 |

| Third use in forklifts | |||

| Capacity | 30 kWh | Capacity | 30 kWh |

| Initial investment | EUR 3600 | Initial investment | - |

| Lifecycle | 2 years | Lifecycle 3 | 2 years |

| Operating costs p.a. | EUR 360 | Operating costs p.a. | EUR 780 |

| Residual value | EUR 1488 | Resale/Recycling value | EUR 390 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jeppe, A.; Proff, H.; Eickhoff, M. Economic Potentials of Ecologically Attractive Multi-Life Products—The Example of Lithium-Ion Batteries. Sustainability 2023, 15, 11184. https://doi.org/10.3390/su151411184

Jeppe A, Proff H, Eickhoff M. Economic Potentials of Ecologically Attractive Multi-Life Products—The Example of Lithium-Ion Batteries. Sustainability. 2023; 15(14):11184. https://doi.org/10.3390/su151411184

Chicago/Turabian StyleJeppe, Arne, Heike Proff, and Max Eickhoff. 2023. "Economic Potentials of Ecologically Attractive Multi-Life Products—The Example of Lithium-Ion Batteries" Sustainability 15, no. 14: 11184. https://doi.org/10.3390/su151411184

APA StyleJeppe, A., Proff, H., & Eickhoff, M. (2023). Economic Potentials of Ecologically Attractive Multi-Life Products—The Example of Lithium-Ion Batteries. Sustainability, 15(14), 11184. https://doi.org/10.3390/su151411184