Incentive Mechanism of Utility Tunnel PPP Projects with User Involvement

Abstract

1. Introduction

2. Literature Review

2.1. Users and Sustainability of PPP Projects

2.2. Information Asymmetry of PPP Projects

2.3. Research Gap

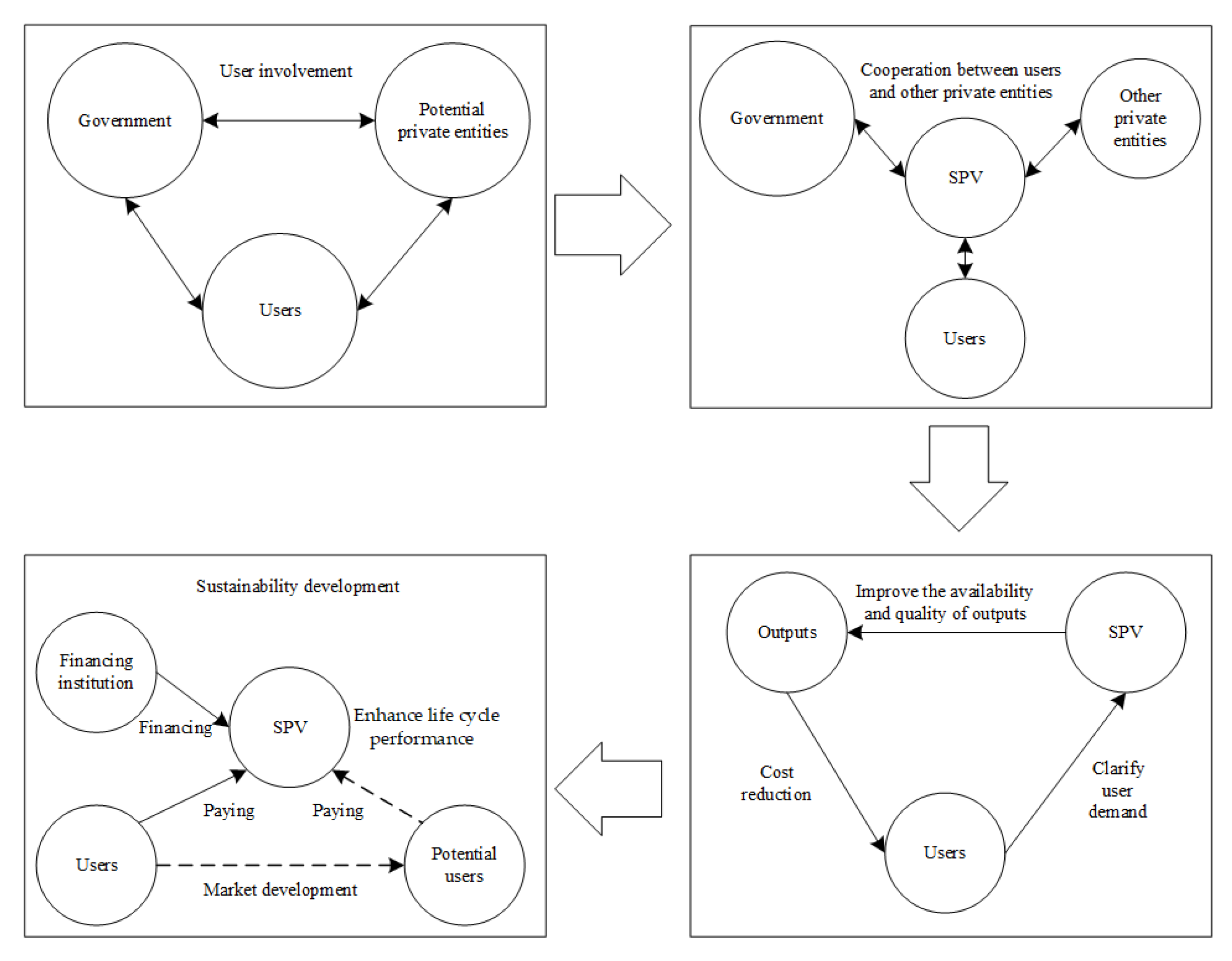

3. Incentive Model of Tunnel PPP Projects with User Involvement under Dual Information Asymmetry

3.1. Model Hypotheses

3.1.1. Game Subjects

3.1.2. Game Incomes

- (1)

- Without user involvement

- (2)

- User involvement

- (3)

- Income structure

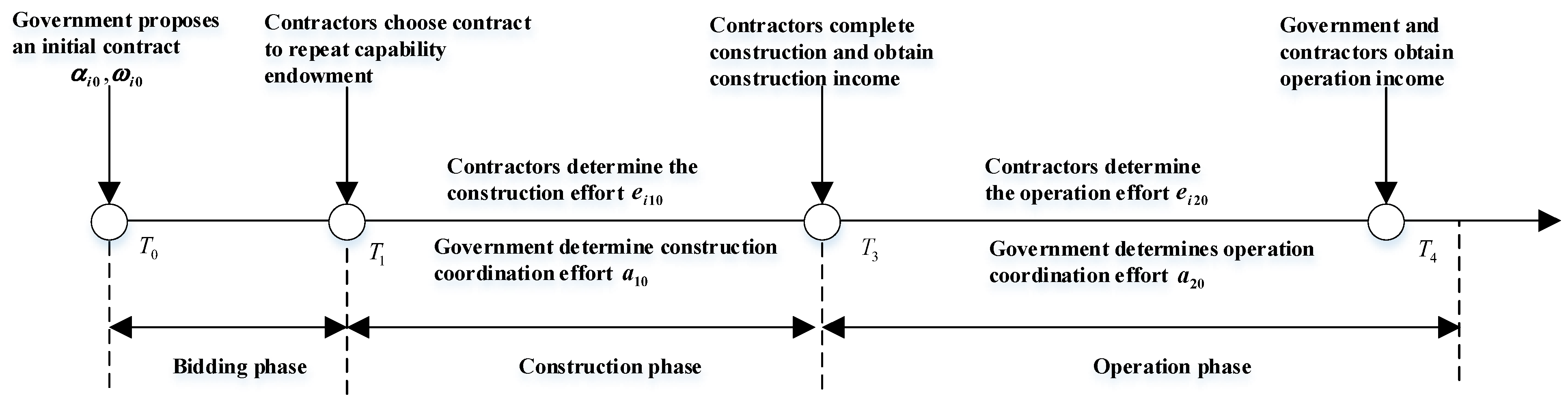

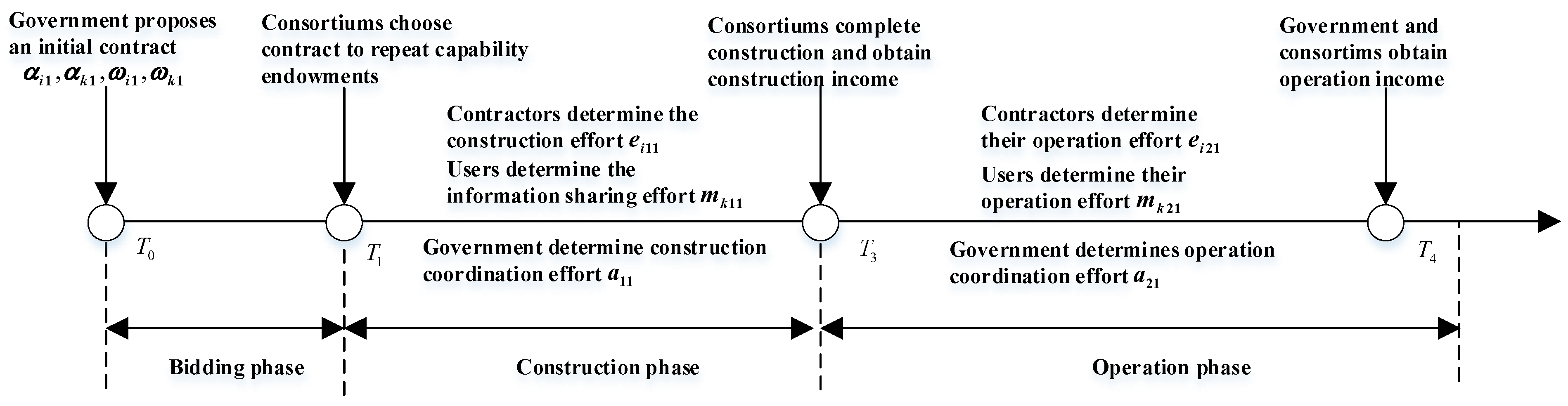

3.1.3. Game Sequences

- (1)

- Without user involvement

- (2)

- With user involvement

3.2. Construction, Solution, and Discussion of Basic Incentive Mechanism

3.2.1. Construction of Basic Incentive Mechanism

- (1)

- Contractors truthfully report their capability endowments

- (2)

- Contractors falsely report their capability endowments

- (3)

- Inventive mechanism without user involvement

3.2.2. Solution of Basic Incentive Model

3.2.3. Discussion of Basic Incentive Model

3.3. Construction, Solution, and Discussion of Incentive Model with User Involvement

3.3.1. Construction of Incentive Model with User Involvement

- (1)

- Consortiums truthfully report their capability endowments

- (2)

- Consortiums falsely report their capability endowments

- (3)

- Incentive mechanism with user involvement

3.3.2. Solution of Incentive Model with User Involvement

3.3.3. Discussion of Incentive Model with User Involvement

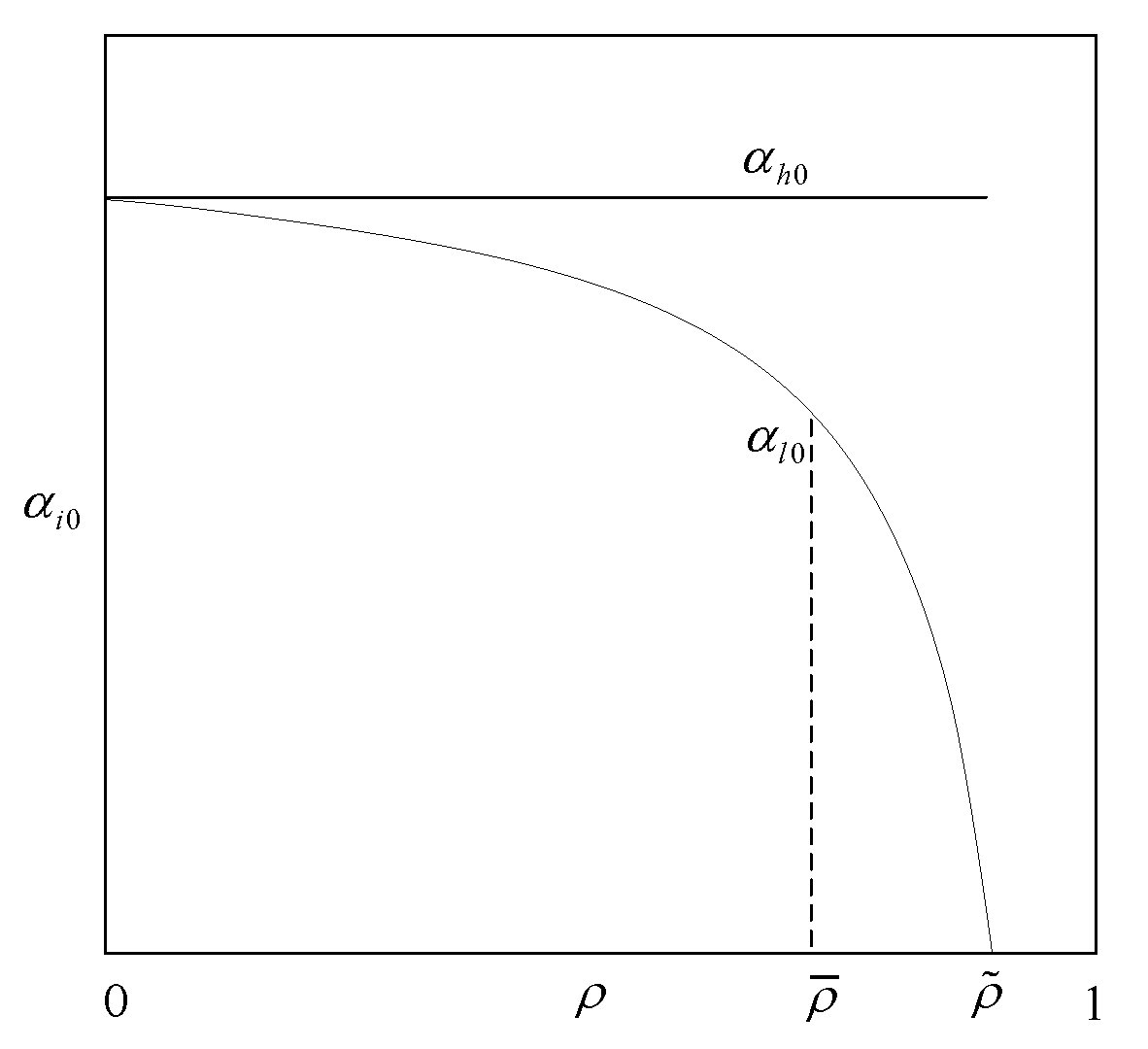

4. Comparative Analyses of Models

4.1. Theoretical Contrastive Analysis

4.2. Numerical Comparative Analysis

4.2.1. Parameter Assignment

- Variable cost coefficient for high-capability contractors: ;

- Variable cost coefficient for low-capability contractors: ;

- Variable cost coefficient for high-capability users: ;

- Variable cost coefficient for low-capability users: ;

- Fixed cost coefficient: ;

- Operation contribution coefficient for contractors: ;

- Operation contribution coefficient for users: ;

- Operation contribution coefficient for users: ;

- Government belief: ;

- Construction duration of the tunnel PPP project: ;

- Operation duration of the tunnel PPP project: .

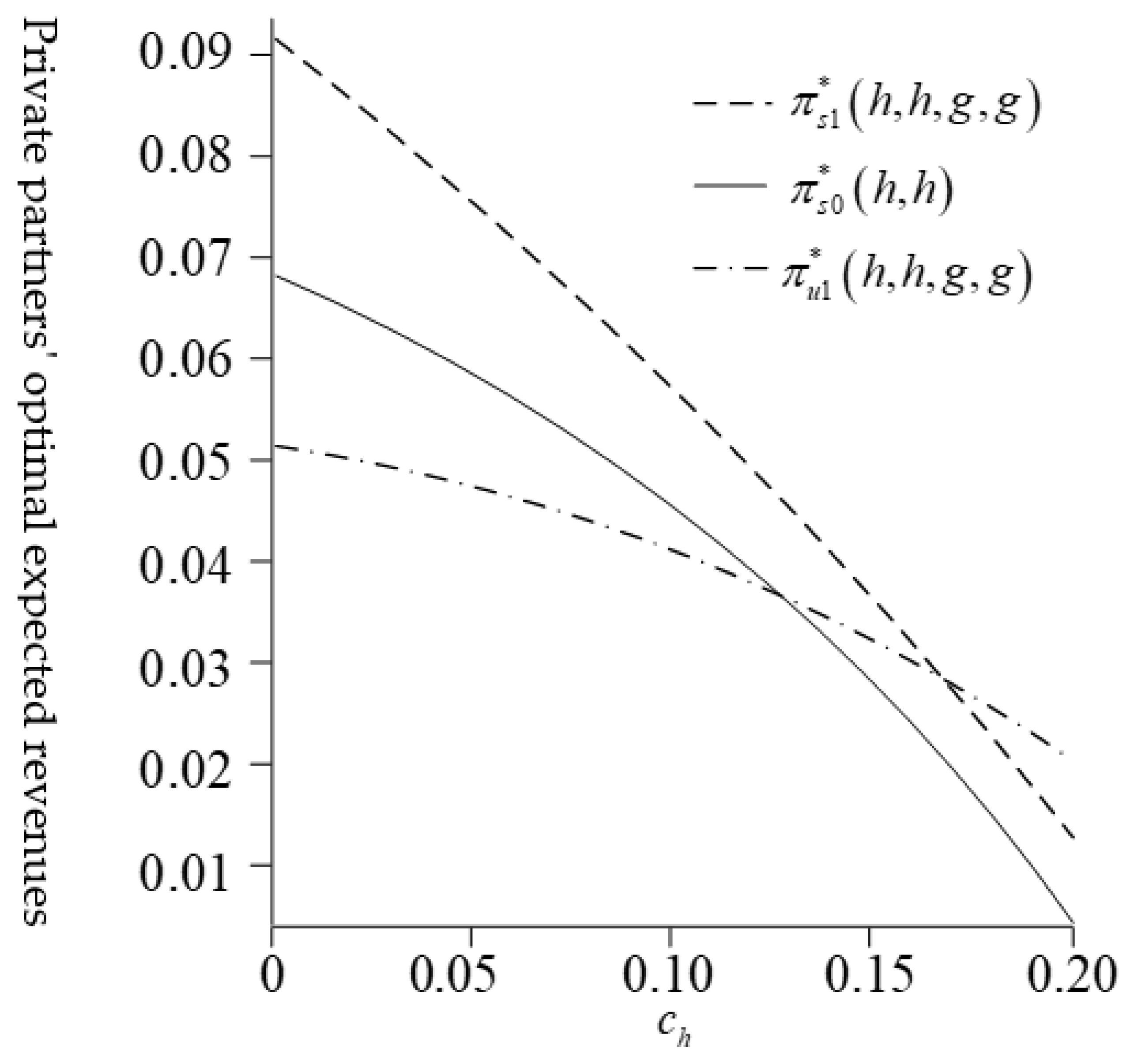

4.2.2. Private Partners’ Optimal Expected Revenues

- (1)

- Increasing the variable cost coefficients of the high-capability contractor leads to lower optimal expected revenues for both the high-capability contractor and the high-capability consortium in both the basic incentive model and the incentive model with user involvement.

- (2)

- Irrespective of the variable cost coefficient of the high-capability contractor, the incentive model with user involvement, when combined with high-capability users in implementing the tunnel PPP project, ensures higher returns for the high-capability contractor compared to the independent implementation of the PPP project.

- (3)

- The optimal expected revenues of high-capability users are negatively correlated with the variable cost coefficients of high-capability contractors, regardless of whether the basic incentive model or the incentive model with user involvement is considered.

- (4)

- In both the basic incentive model and the incentive model with user involvement, private partners with strong capabilities achieve greater optimal expected returns compared to partners with low capabilities, indicating the presence of a “capability premium” for highly capable partners.

- (5)

- The incentive mechanism provides a larger “capability premium” to high-capability private partners as their capabilities strengthen, and conversely, the “capability premium” decreases for partners with lower capabilities.

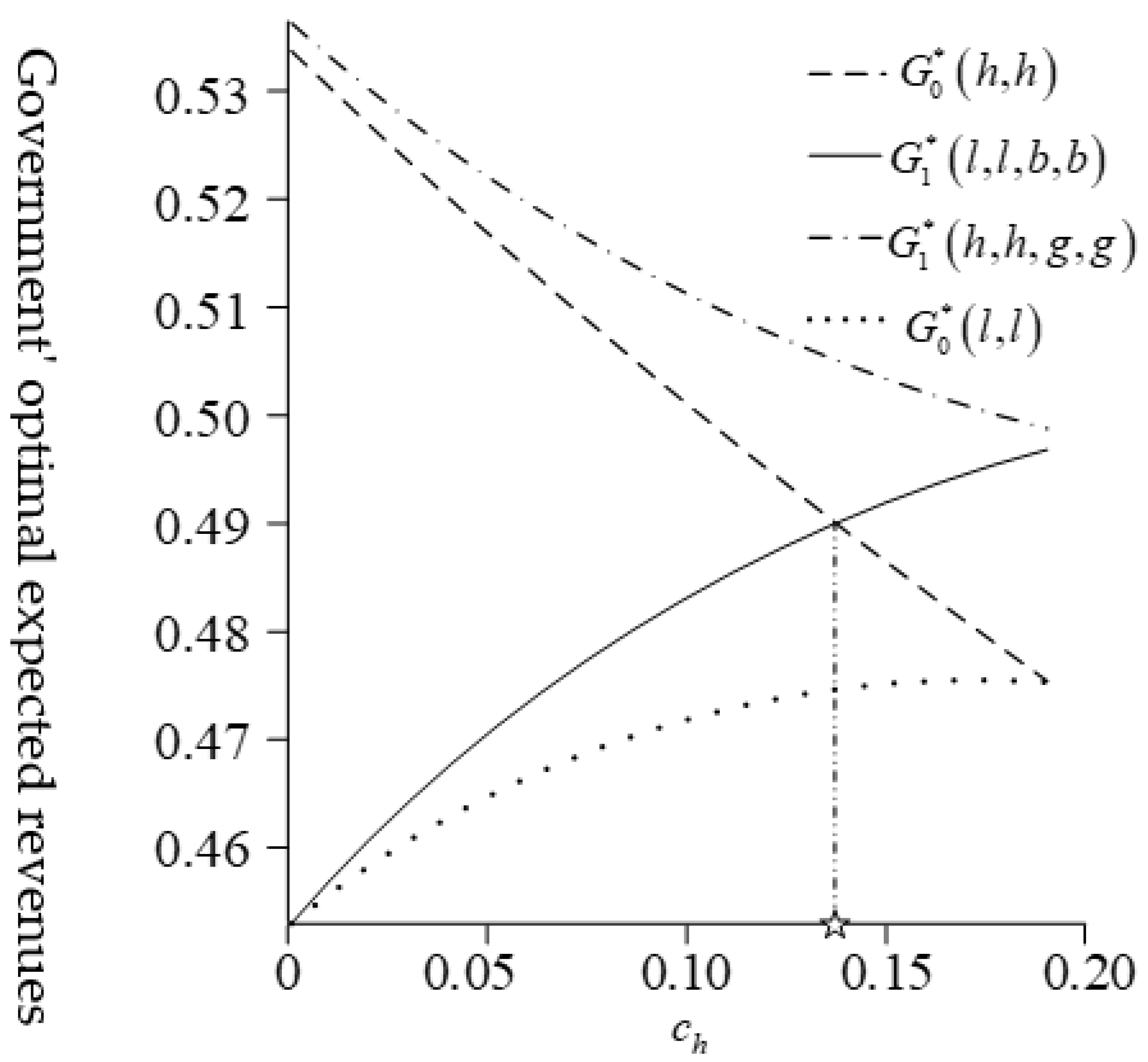

4.2.3. Government’s Optimal Expected Revenue

- (1)

- Irrespective of whether the basic incentive mechanism or the incentive mechanism with user involvement is employed, the government’s optimal expected revenues from collaborating with high-capability private partners exhibit a negative correlation with the variable cost coefficients of the high-capability contractor. Conversely, the government’s optimal expected revenues from collaborating with low-capability private partners show a positive correlation with the variable cost coefficients of the high-capability contractor.

- (2)

- When the high-capability contractor possesses a significantly strong ability, denoted as under different incentive mechanisms, the relationship among the government’s optimal expected revenues from cooperating with private partners of varying capabilities satisfies .

- (3)

- Under different incentive mechanisms, when the high-capability contractor demonstrates relatively strong ability, represented as , the relationship among the government’s optimal expected revenues from cooperating with private partners with different capabilities complies with .

- (4)

- Due to the competition mechanism established by the incentive mechanism with user involvement between the contractor and user, there is an improvement in the effort levels of private partners. Consequently, when the high-capability contractor’s ability in the PPP market is exceptionally strong ( ), low-capability private partners significantly enhance their effort levels under the guidance of the benchmark. As a result, even if the government collaborates with a low-capability consortium, it can obtain greater benefits compared to collaborating solely with a high-capability contractor.

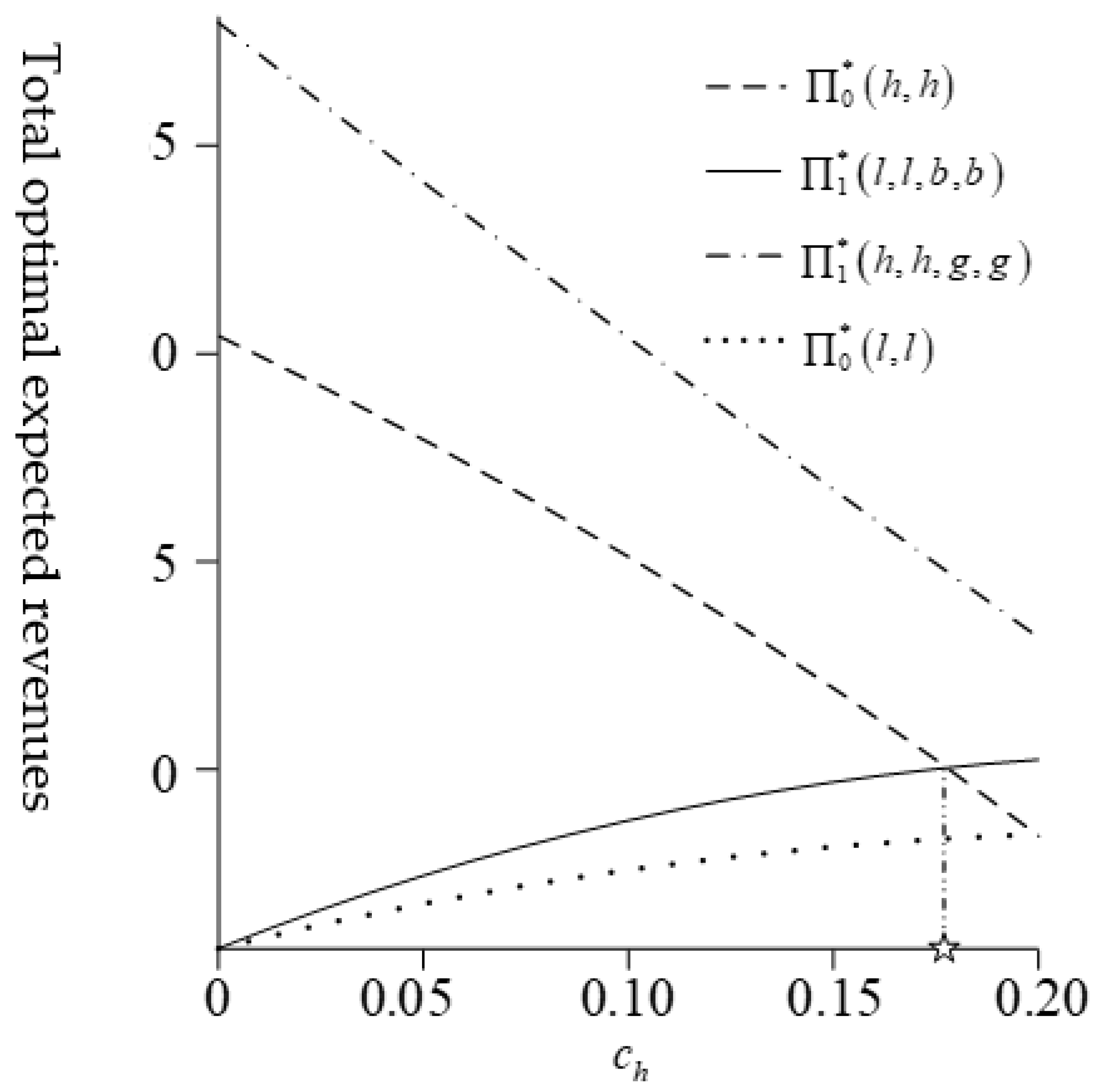

4.2.4. Total Optimal Expected Revenue

- (1)

- Under both the basic incentive mechanism and the incentive mechanism with user involvement, when the government collaborates with high-capability private partners, the total optimal expected revenues of the game subjects display a negative correlation with the variable cost coefficient of the high-capability contractor.

- (2)

- Similarly, under the basic incentive mechanism and the incentive mechanism with user involvement, when the government partners with low-capability private partners, the total optimal expected revenues of the game subjects exhibit a positive correlation with the variable cost coefficients of high-capability contractors.

- (3)

- In the case where the ability of the high-capability contractor is exceptionally strong (denoted as ), the total optimal expected revenues of the game subjects satisfy across various scenarios.

- (4)

- Furthermore, when the ability of the high-capability contractor is relatively strong (represented as ), under different incentive mechanisms, the total optimal expected revenue of the game subjects satisfies .

5. Case Study

5.1. PT Utility Tunnel PPP Project

5.2. SC utility Tunnel PPP Project

6. Conclusions and Recommendations

- (1)

- When selecting private partners, the government should prioritize users who possess significant advantages in operation, market control, and management. It is essential to design reasonable incentives, such as policy support and price concessions, to encourage user participation in PPP projects. This will enhance output availability, reduce market and financing risks, and ultimately improve project performance.

- (2)

- The government should give priority to selecting private entities that have greater advantages in operation, market control, and management. It is important to establish reasonable incentives, such as policy support and price concessions, to encourage user participation in PPP projects. This will increase the availability of outputs, mitigate market and financing risks, and ultimately enhance project performance.

- (3)

- After involving users in PPP projects, they assume dual roles as customers and shareholders of the SPV (Special Purpose Vehicle). Conflicts of interest between users and contractors, as well as issues related to the equivalence of strengths, may give rise to new governance challenges. Therefore, it is crucial to establish an effective communication and coordination mechanism between the government, users, and contractors. This will allow for the full utilization of the advantageous resources brought about by user involvement while addressing any adverse reactions that may arise.

- (4)

- A practical and comprehensive performance appraisal plan should be developed to objectively and fairly evaluate the performance of private partners. This assessment should consider multiple factors, such as investment, effort, and contract performance. By combining the results of the government’s performance appraisal and taking a multi-dimensional approach, an internal revenue-sharing scheme for private partners can be formulated.

7. Limitations and Future Research

- (1)

- Information Asymmetry: The theoretical model in this study primarily focuses on the information asymmetry between the government and contractors, as well as between the government and the consortium comprising contractors and users. However, it does not consider the information asymmetry between contractors and users. Future research can relax the model assumptions to incorporate the information asymmetry between contractors and users, thereby expanding the existing model.

- (2)

- Output and Cost Measurement: The measurement of output and cost for both contractors and users in this study is largely symmetrical. Moreover, the study only considers the impact of synergies on costs. In future studies, it is recommended to separately measure the output and cost of contractors and users and further explore the synergistic benefits between them. This will allow for a more comprehensive analysis and expansion of the existing models.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Burkea, R.; Demirag, I. Risk transfer and stakeholder relationships in public private partnerships. Account. Forum 2017, 41, 28–43. [Google Scholar] [CrossRef]

- He, H.; Zheng, L.; Zhou, G. Linking users as private partners of utility tunnel public-private partnership projects. Tunn. Undergr. Space Technol. 2022, 119, 104249. [Google Scholar] [CrossRef]

- Bovaird, T. Beyond engagement and participation, User and community coproduction of public services. Public Adm. Rev. 2007, 67, 846–860. [Google Scholar] [CrossRef]

- Kumaraswamy, M.; Zou, W.; Zhang, J. Reinforcing relationships for resilience by embedding end user people in public private partnerships. Civ. Eng. Environ. Syst. 2015, 32, 119–129. [Google Scholar] [CrossRef]

- Kondapalli, S.; Deepak, S. Identifying end users’ expectations from public private partnerships. In Proceedings of the 6th CSCE—CRC International Construction Specialty Conference 2017, Vancouver, BC, Canada, 31 May—3 June 2017. [Google Scholar]

- Rwelamila, P.D.; Fewings, P.; Henjewele, C. Addressing the missing link in PPP projects what constitutes the public. J. Manag. Eng. 2015, 31, 4014085. [Google Scholar] [CrossRef]

- Dixon, T.; Pottinger, G.; Jordan, A. Lessons from the private finance initiative in the UK: Benefits, problems and critical success factors. J. Prop. Invest. Financ. 2005, 5, 412–423. [Google Scholar] [CrossRef]

- Babatunde, S.O.; Perera, S.; Zhou, L.; Udeaja, C. Stakeholder perceptions on critical success factors for public-private partnership projects in Nigeria. Built Environ. Proj. Asset Manag. 2016, 6, 74–91. [Google Scholar] [CrossRef]

- Majamaa, W.; Junnila, S.; Doloi, H.; Niemistö, E. End-user oriented public-private partnerships in real estate industry. Int. J. Strateg. Prop. Manag. 2008, 12, 1–17. [Google Scholar] [CrossRef]

- Jacobson, C.; Choi, S.O. Success factors, public works and public-private partnerships. Int. J. Public Sect. Manag. 2008, 21, 637–657. [Google Scholar] [CrossRef]

- Toriola-Coker, L.O.; Alaka, H.; Agbali, M.; Bello, W.A.; Pathirage, C.; Oyedele, L. Marginalization of end-user stakeholder’s in public private partnership road projects in Nigeria. Int. J. Constr. Manag. 2020, 22, 2098–2107. [Google Scholar] [CrossRef]

- Gregory, R.; Fischhoff, B.; Thorne, S.; Butte, G. A multi-channel stakeholder consultation process for transmission deregulation. Energy Policy 2003, 31, 1291–1299. [Google Scholar] [CrossRef]

- Smyth, H.; Edkins, A. Relationship management in the management of PFI/PPP projects in the UK. Int. J. Proj. Manag. 2007, 25, 232–240. [Google Scholar] [CrossRef]

- El-Gohary, N.M.; Osman, H.; El-Diraby, T.E. Stakeholder management for public private partnerships. Int. J. Proj. Manag. 2006, 24, 595–604. [Google Scholar] [CrossRef]

- Akintoye, A.; Hardcastle, C.; Beck, M.; Chinyio, E.; Asenova, D. Achieving best value in private finance initiative project procurement. Constr. Manag. Econ. 2003, 21, 461–470. [Google Scholar] [CrossRef]

- Ahmed, S.A.; Ali, S.M. People as partners: Facilitating people’s participation in public-private partnerships for solid waste management. Habitat Int. 2006, 30, 781–796. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, J.M.W.; Wong, K.K.W. A public private people partnerships (P4) process framework for infrastructure development in Hong Kong. Cities 2013, 31, 370–381. [Google Scholar] [CrossRef]

- Torvinen, H.; Ulkuniemi, P. End-user engagement within innovative public procurement practices: A case study on public-private partnership procurement. Ind. Mark. Manag. 2016, 58, 58–68. [Google Scholar] [CrossRef]

- Wang, X.; Yuan, J.; Lin, Z.; Zhao, J.; Qin, Y. Research on incentive mechanism of PPP project under dual information asymmetry based on fair preference. Chinses J. Manag. Sci. 2021, 29, 107–120. [Google Scholar]

- Owusu-Manu, D.; Edwards, D.J.; Kukah, A.S.; Parn, E.A.; El-Gohary, H.; Hosseini, M.R. An empirical examination of moral hazards and adverse selection on PPP projects: A case study of Ghana. J. Eng. Des. Technol. 2017, 16, 910–924. [Google Scholar] [CrossRef]

- Gao, R.; Zhou, Y.; Liu, J. Adverse selection of investors in PPP projects based on prospect theory. Chinses J. Manag. Sci. 2021, 29, 36–46. [Google Scholar]

- Wang, P. Construction Experience of Urban Underground Pipe Gallery in Suzhou. Constr. Econ. 2016, 37, 113–115. [Google Scholar]

- Liu, J.; Gao, R.; Cheah, C.Y.J.; Luo, J. Evolutionary game of investors’ opportunistic behaviour during the operational period in PPP projects. Constr. Manag. Econ. 2016, 35, 137–153. [Google Scholar] [CrossRef]

- Kuronen, M.; Junnila, S.; Majamaa, W.; Niiranen, I. Public-private-people partnership as a way to reduce carbon dioxide emissions from residential development. Int. J. Strateg. Prop. Manag. 2010, 14, 200–216. [Google Scholar] [CrossRef]

- Wang, T.; Tan, L.; Xie, S.; Ma, B. Development and applications of common utility tunnels in China. Tunn. Undergr. Space Technol. 2018, 76, 92–106. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, J.; Lai, J. The incentive mechanism of PPP projects by using game theory based on the investors’ speculation. J. Ind. Eng. Eng. Manag. 2016, 30, 223–232. [Google Scholar]

- Bhaskaran, S.R.; Krishnan, V. Effort, revenue, and cost sharing mechanisms for collaborative new product development. Manag. Sci. 2009, 55, 1152–1169. [Google Scholar] [CrossRef]

- Xiao, W.; Xu, Y. The impact of royalty contract revision in a multistage strategic R&D alliance. Manag. Sci. 2012, 58, 2251–2271. [Google Scholar]

- Liu, W.; Lu, J.; Zhou, Q. Decision-making model on concession period for traffic BOT project under uncertainty. Syst. Eng. 2012, 30, 51–56. [Google Scholar]

- Zhang, Y.; Feng, J.; Zhang, K.; Yan, H. A comparative study of motivation model of PPP control rights under entirely rational and reciprocal preference: Based on the allocation of control rights among private sectors. J. Ind. Eng. Eng. Manag. 2019, 33, 151–158. [Google Scholar]

- Shi, J.; Qin, X.; Liu, J. Study on double principle-agent model of ‘investors-operators’ dual-role party’s in PPP projects. Soft Sci. 2018, 32, 124–137. [Google Scholar]

| Items | Expressions |

|---|---|

| Items | Expressions |

|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, H. Incentive Mechanism of Utility Tunnel PPP Projects with User Involvement. Sustainability 2023, 15, 10771. https://doi.org/10.3390/su151410771

He H. Incentive Mechanism of Utility Tunnel PPP Projects with User Involvement. Sustainability. 2023; 15(14):10771. https://doi.org/10.3390/su151410771

Chicago/Turabian StyleHe, Haiyan. 2023. "Incentive Mechanism of Utility Tunnel PPP Projects with User Involvement" Sustainability 15, no. 14: 10771. https://doi.org/10.3390/su151410771

APA StyleHe, H. (2023). Incentive Mechanism of Utility Tunnel PPP Projects with User Involvement. Sustainability, 15(14), 10771. https://doi.org/10.3390/su151410771