Green Corporate Governance, Green Finance, and Sustainable Performance Nexus in Chinese SMES: A Mediation Moderation Model

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

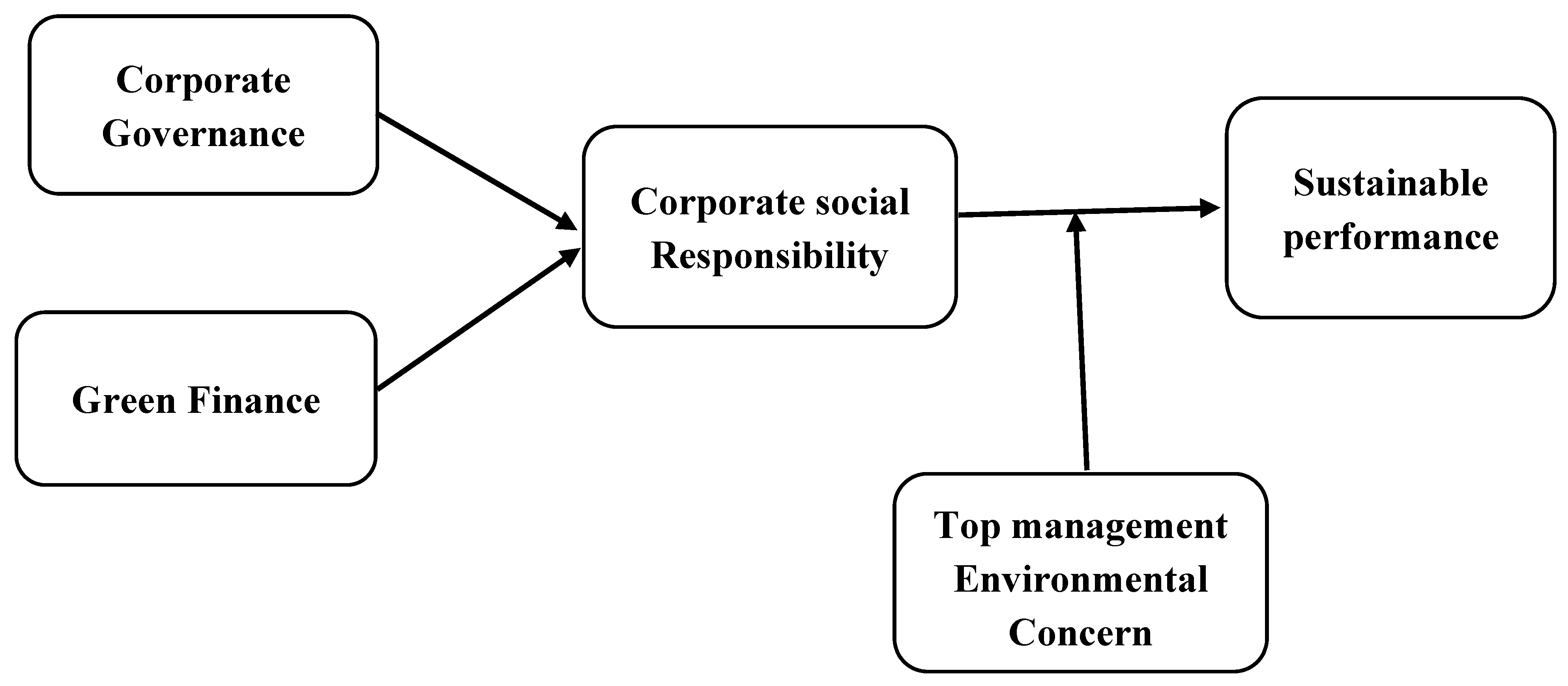

2.1. Corporate Governance and Corporate Social Responsibility

2.2. Mediating Role of Corporate Social Responsibility between Green Finance and Sustainability

2.3. Green Finance and Corporate Social Responsibility

2.4. Corporate Social Responsibility Mediates the Relationship between Corporate Governance and Sustainable Performance

2.5. Moderating Role of Top Management Commitment

3. Methodology

4. Data Analysis

4.1. Measurement Model

4.2. Predictive Accuracy

4.3. Structural Model Evaluation

4.3.1. Direct Effect

4.3.2. Mediation Analysis

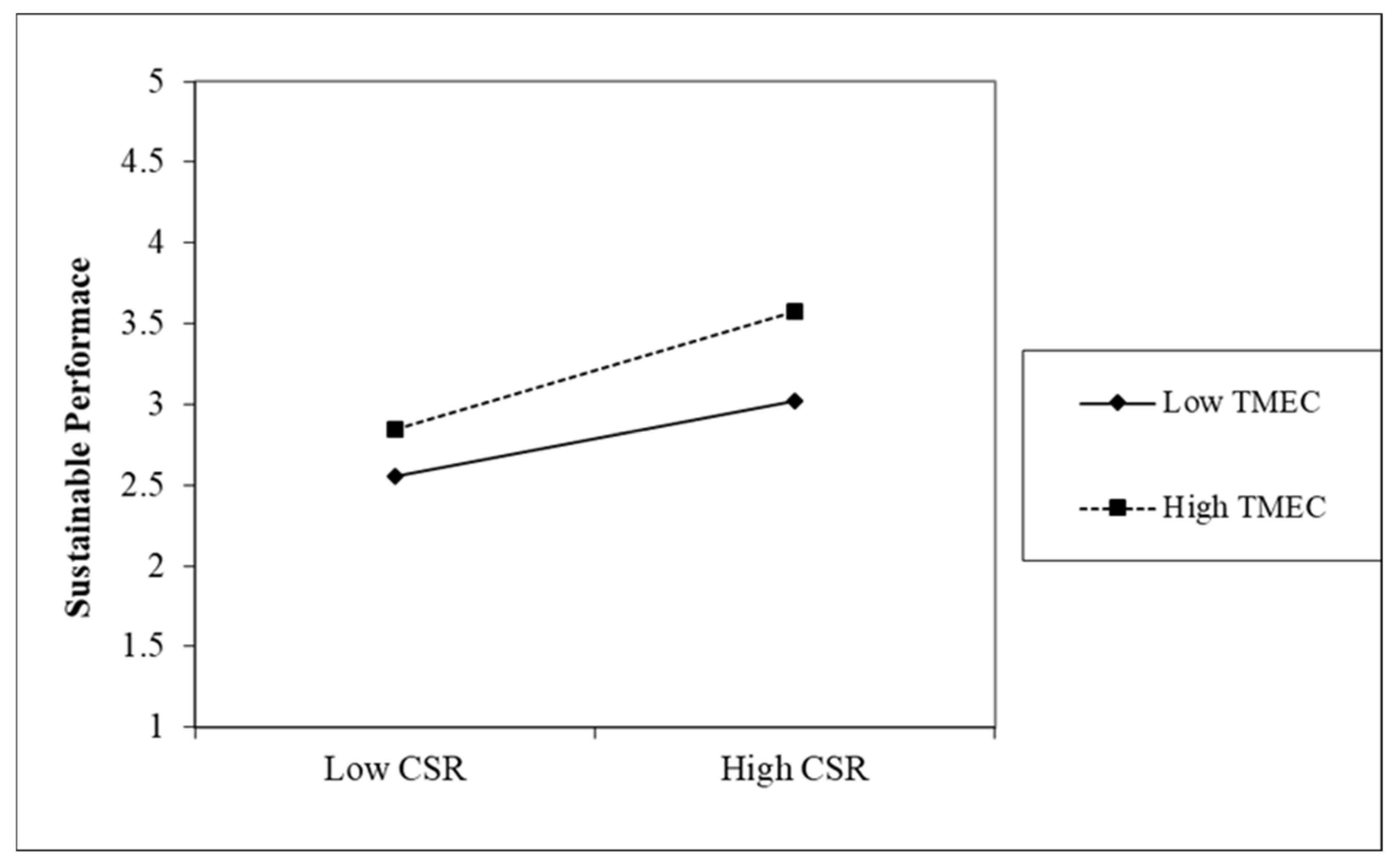

4.3.3. Moderation

5. Discussion

6. Conclusions

7. Practical and Theoretical Implications

8. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aguilera, R.V.; Marano, V.; Haxhi, I. International corporate governance: A review and opportunities for future research. J. Int. Bus. Stud. 2019, 50, 457–498. [Google Scholar] [CrossRef]

- Chandrakant, R.; Rajesh, R. Social sustainability, corporate governance, and sustainability performances: An empirical study of the effects. J. Ambient. Intell. Humaniz. Comput. 2022, 14, 9131–9143. [Google Scholar] [CrossRef]

- Husted, B.W.; de Sousa-Filho, J.M. Board structure and environmental, social, and governance disclosure in Latin America. J. Bus. Res. 2019, 102, 220–227. [Google Scholar] [CrossRef]

- Lu, Y.; Wu, J.; Peng, J.; Lu, L. The perceived impact of the Covid-19 epidemic: Evidence from a sample of 4807 SMEs in Sichuan Province, China. Environ. Hazards 2020, 19, 323–340. [Google Scholar] [CrossRef]

- ElAlfy, A.; Palaschuk, N.; El-Bassiouny, D.; Wilson, J.; Weber, O. Scoping the Evolution of Corporate Social Responsibility (CSR) Research in the Sustainable Development Goals (SDGs) Era. Sustainability 2020, 12, 5544. [Google Scholar] [CrossRef]

- Zhang, Q.; Oo, B.L.; Lim, B.T.H. Drivers, motivations, and barriers to the implementation of corporate social responsibility practices by construction enterprises: A review. J. Clean. Prod. 2019, 210, 563–584. [Google Scholar] [CrossRef]

- Babiak, K.; Trendafilova, S. CSR and environmental responsibility: Motives and pressures to adopt green management practices. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 11–24. [Google Scholar] [CrossRef]

- Mahmood, Z.; Kouser, R.; Ali, W.; Ahmad, Z.; Salman, T. Does Corporate Governance Affect Sustainability Disclosure? A Mixed Methods Study. Sustainability 2018, 10, 207. [Google Scholar] [CrossRef]

- Wang, Y.; Chang, X.; Wang, T.; Wang, S. Female directors and environmental innovation: Is stakeholder orientation a missing link? Gend. Manag. Int. J. 2022, 37, 587–602. [Google Scholar] [CrossRef]

- Zaman, R.; Jain, T.; Samara, G.; Jamali, D. Corporate Governance Meets Corporate Social Responsibility: Mapping the Interface. Bus. Soc. 2020, 61, 690–752. [Google Scholar] [CrossRef]

- Sharma, M.; Choubey, A. Green banking initiatives: A qualitative study on Indian banking sector. Environ. Dev. Sustain. 2022, 24, 293–319. [Google Scholar] [CrossRef] [PubMed]

- Mavroulidis, M.; Vouros, P.; Fotiadis, S.; Konstantakopoulou, F.; Fountoulakis, G.; Nikolaou, I.; Evangelinos, K. Occupational health and safety of multinational construction companies through evaluation of corporate social responsibility reports. J. Saf. Res. 2022, 81, 45–54. [Google Scholar] [CrossRef]

- Rehman, S.U.; Kraus, S.; Shah, S.A.; Khanin, D.; Mahto, R.V. Analyzing the relationship between green innovation and environmental performance in large manufacturing firms. Technol. Forecast. Soc. Change 2021, 163, 120481. [Google Scholar] [CrossRef]

- Aslam, W.; Jawaid, S.T. Green banking adoption practices: Improving environmental, financial, and operational performance. Int. J. Ethic. Syst. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Chen, J.; Siddik, A.B.; Zheng, G.-W.; Masukujjaman, M.; Bekhzod, S. The Effect of Green Banking Practices on Banks’ Environmental Performance and Green Financing: An Empirical Study. Energies 2022, 15, 1292. [Google Scholar] [CrossRef]

- Ullah, H.; Wang, Z.; Mohsin, M.; Jiang, W.; Abbas, H. Multidimensional perspective of green financial innovation between green intellectual capital on sustainable business: The case of Pakistan. Environ. Sci. Pollut. Res. 2022, 29, 5552–5568. [Google Scholar] [CrossRef]

- Graafland, J.; Bovenberg, L. Government regulation, business leaders’ motivations and environmental performance of SMEs. J. Environ. Plan. Manag. 2020, 63, 1335–1355. [Google Scholar] [CrossRef]

- Wang, K.; Tsai, S.-B.; Du, X.; Bi, D. Internet finance, green finance, and sustainability. Sustainability 2019, 11, 3856. [Google Scholar] [CrossRef]

- Zhang, Z.; Chen, H. Media coverage and impression management in corporate social responsibility reports: Evidence from China. Sustain. Account. Manag. Policy J. 2020, 11, 863–886. [Google Scholar] [CrossRef]

- Dai, X.; Siddik, A.B.; Tian, H. Corporate Social Responsibility, Green Finance and Environmental Performance: Does Green Innovation Matter? Sustainability 2022, 14, 13607. [Google Scholar] [CrossRef]

- Kolk, A.; Pinkse, J. The integration of corporate governance in corporate social responsibility disclosures. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 15–26. [Google Scholar] [CrossRef]

- Jain, T.; Jamali, D. Looking Inside the Black Box: The Effect of Corporate Governance on Corporate Social Responsibility. Corp. Gov. Int. Rev. 2016, 24, 253–273. [Google Scholar] [CrossRef]

- Hamidu, A.; Haron, M.; Amran, A. Corporate social responsibility: A review on definitions, core characteristics and theoretical perspectives. Mediterr. J. Soc. Sci. 2015, 6, 83–95. [Google Scholar] [CrossRef]

- Gerged, A.M. Factors affecting corporate environmental disclosure in emerging markets: The role of corporate governance structures. Bus. Strat. Environ. 2021, 30, 609–629. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Javed, S.A.; Zafar, A.U.; Rehman, S.U. Relation of environment sustainability to CSR and green innovation: A case of Pakistani manufacturing industry. J. Clean. Prod. 2020, 253, 119938. [Google Scholar] [CrossRef]

- Prasad, M.; Mishra, T.; Bapat, V. Corporate social responsibility and environmental sustainability: Evidence from India using energy intensity as an indicator of environmental sustainability. IIMB Manag. Rev. 2019, 31, 374–384. [Google Scholar] [CrossRef]

- Suganthi, L. Investigating the relationship between corporate social responsibility and market, cost and environmental performance for sustainable business. S. Afr. J. Bus. Manag. 2020, 51, 1–13. [Google Scholar] [CrossRef]

- Lee, J.W. Green Finance and Sustainable Development Goals: The Case of China, Lee, Jung Wan (2020). Green Financ. Sustain. Dev. Goals Case China. J. Asian Finance Econ. Bus. 2020, 7, 577–586. [Google Scholar] [CrossRef]

- Madaleno, M.; Dogan, E.; Taskin, D. A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 2022, 109, 105945. [Google Scholar] [CrossRef]

- Awawdeh, A.E.; Ananzeh, M.; El-Khateeb, A.I.; Aljumah, A. Role of green financing and corporate social responsibility (CSR) in technological innovation and corporate environmental performance: A COVID-19 perspective. China Financ. Rev. Int. 2021, 12, 297–316. [Google Scholar] [CrossRef]

- Sadiq, M.; Nonthapot, S.; Mohamad, S.; Keong, O.C.; Ehsanullah, S.; Iqbal, N. Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? China Financ. Rev. Int. 2022, 12, 317–333. [Google Scholar] [CrossRef]

- Indriastuti, M.; Chariri, A. The role of green investment and corporate social responsibility investment on sustainable performance. Cogent Bus. Manag. 2021, 8, 1960120. [Google Scholar] [CrossRef]

- Hao, J.; He, F. Corporate social responsibility (CSR) performance and green innovation: Evidence from China. Financ. Res. Lett. 2022, 48, 102889. [Google Scholar] [CrossRef]

- Harun, M.S.; Hussainey, K.; Kharuddin, K.A.M.; Al Farooque, O. CSR Disclosure, Corporate Governance and Firm Value: A study on GCC Islamic Banks. Int. J. Account. Inf. Manag. 2020, 28, 607–638. [Google Scholar] [CrossRef]

- Kamal, Y. Stakeholders expectations for CSR-related corporate governance disclosure: Evidence from a developing country. Asian Rev. Account. 2021, 29, 97–127. [Google Scholar] [CrossRef]

- Firmansyah, A.; Husna, M.C.; Putri, M.A. Corporate social responsibility disclosure, corporate governance disclosures, and firm value in Indonesia chemical, plastic, and packaging sub-sector companies. Account. Anal. J. 2021, 10, 9–17. [Google Scholar] [CrossRef]

- Yang, J.; Basile, K. Communicating corporate social responsibility: External stakeholder involvement, productivity and firm performance. J. Bus. Ethics 2021, 178, 501–517. [Google Scholar] [CrossRef]

- Mukhtaruddin, M.; Ubaidillah, U.; Dewi, K.; Hakiki, A.; Nopriyanto, N. Good Corporate Governance, Corporate Social Responsibility, Firm Value, and Financial Performance as Moderating Variable. Indones. J. Sustain. Account. Manag. 2019, 3, 55–64. [Google Scholar] [CrossRef]

- Wijethilake, C.; Lama, T. Sustainability core values and sustainability risk management: Moderating effects of top management commitment and stakeholder pressure. Bus. Strat. Environ. 2019, 28, 143–154. [Google Scholar] [CrossRef]

- Tandoh, I.; Duffour, K.A.; Essandoh, M.; Amoako, R.N. Corporate Governance, Corporate Social Responsibility, and Corporate Sustainability: The Moderating Role of Top Management Commitment. Int. J. Prof. Bus. Rev. 2022, 7, e0309. [Google Scholar] [CrossRef]

- Greiner, M.; Sun, J. How corporate social responsibility can incentivize top managers: A commitment to sustainability as an agency intervention. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1360–1375. [Google Scholar] [CrossRef]

- Chatterjee, S.; Chaudhuri, R.; Vrontis, D. Investigating the impacts of microlevel CSR activities on firm sustainability: Mediating role of CSR performance and moderating role of top management support. Cross Cult. Strat. Manag. 2023, 30, 123–141. [Google Scholar] [CrossRef]

- Yusliza, M.-Y.; Norazmi, N.A.; Jabbour, C.J.C.; Fernando, Y.; Fawehinmi, O.; Seles, B.M.R.P. Top management commitment, corporate social responsibility and green human resource management: A Malaysian study. Benchmarking Int. J. 2019, 26, 2051–2078. [Google Scholar] [CrossRef]

- Mandip, G. Green HRM: People management commitment to environmental sustainability. Res. J. Recent Sci. 2012, 2277, 2502. [Google Scholar]

- Babbie, E.R. The Practice of Social Research; Cengage Learning: Boston, MA, USA, 2020. [Google Scholar]

- Amjad, F.; Abbas, W.; Zia-Ur-Rehman, M.; Baig, S.A.; Hashim, M.; Khan, A.; Rehman, H.-U. Effect of green human resource management practices on organizational sustainability: The mediating role of environmental and employee performance. Environ. Sci. Pollut. Res. 2021, 28, 28191–28206. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Sanchez-Hernandez, M.I. Measuring Corporate Social Responsibility for competitive success at a regional level. J. Clean. Prod. 2014, 72, 14–22. [Google Scholar] [CrossRef]

- Song, W.; Yu, H.; Xu, H. Effects of green human resource management and managerial environmental concern on green innovation. Eur. J. Innov. Manag. 2021, 24, 951–967. [Google Scholar] [CrossRef]

- Zheng, G.-W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N.; Alam, S.S. Green Finance Development in Bangladesh: The Role of Private Commercial Banks (PCBs). Sustainability 2021, 13, 795. [Google Scholar] [CrossRef]

- de Groot, J.I.M.; Steg, L. Mean or green: Which values can promote stable pro-environmental behavior? Conserv. Lett. 2009, 2, 61–66. [Google Scholar] [CrossRef]

- Nam, S.-W.; Nam, I.C. Corporate Governance in Asia: Recent Evidence from INDONESIA, Republic of Korea, Malaysia, and Thailand; Asian Development Bank Institute: Tokyo, Japan, 2004. [Google Scholar]

- Ringle, C.; Da Silva, D.; Bido, D. Structural equation modeling with the SmartPLS. Braz. J. Mark. 2015, 13, 2015. [Google Scholar]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Change 2020, 160, 120262. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav. Res. Methods Instrum. Comput. 2004, 36, 717–731. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM) An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- JAnderson, C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411. [Google Scholar] [CrossRef]

- Aftab, J.; Abid, N.; Cucari, N.; Savastano, M. Green human resource management and environmental performance: The role of green innovation and environmental strategy in a developing country. Bus. Strat. Environ. 2022, 32, 1782–1798. [Google Scholar] [CrossRef]

- Byrne, B.M. A Primer of LISREL: Basic Applications and Programming for Confirmatory Factor Analytic Models; Springer Science & Business Media: Berlin, Germany, 2012. [Google Scholar]

- Hu, L.T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. Multidiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Hair, J.F.; Astrachan, C.B.; Moisescu, O.I.; Radomir, L.; Sarstedt, M.; Vaithilingam, S.; Ringle, C.M. Executing and interpreting applications of PLS-SEM: Updates for family business researchers. J. Fam. Bus. Strat. 2021, 12, 100392. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Cohen, J. Set Correlation and Contingency Tables. Appl. Psychol. Meas. 1988, 12, 425–434. [Google Scholar] [CrossRef]

- Cohen, M.A.; Eliashberg, J.; Ho, T.H. An Analysis of Several New Product Performance Metrics. Manuf. Serv. Oper. Manag. 2000, 2, 337–349. [Google Scholar] [CrossRef]

- Geisser, S. A predictive approach to the random effect model. Biometrika 1974, 61, 101–107. [Google Scholar] [CrossRef]

- Hu, L.; Bentler, P.M. Fit indices in covariance structure modeling: Sensitivity to underparameterized model misspecification. Psychol. Methods 1998, 3, 424. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate Governance and Sustainability Performance: Analysis of Triple Bottom Line Performance. J. Bus. Ethic 2019, 149, 411–432. [Google Scholar] [CrossRef]

- Jan, A.A.; Lai, F.-W.; Tahir, M. Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions. J. Clean. Prod. 2021, 315, 128099. [Google Scholar] [CrossRef]

- Maali, K.; Rakia, R.; Khaireddine, M. How corporate social responsibility mediates the relationship between corporate governance and sustainability performance in UK: A multiple mediator analysis. Soc. Bus. Rev. 2021, 16, 201–217. [Google Scholar] [CrossRef]

- Wahyudi, S.M. The Effect of Corporate Governance and Company Characteristics on Disclosure of Sustainability Report Companies. Eur. J. Bus. Manag. Res. 2021, 6, 94–99. [Google Scholar] [CrossRef]

- Zhang, Y.; Berhe, H.M. The Impact of Green Investment and Green Marketing on Business Performance: The Mediation Role of Corporate Social Responsibility in Ethiopia’s Chinese Textile Companies. Sustainability 2022, 14, 3883. [Google Scholar] [CrossRef]

- Risal, N.; Joshi, S.K. Measuring Green Banking Practices on Bank’s Environmental Performance: Empirical Evidence from Kathmandu valley. J. Bus. Soc. Sci. 2018, 2, 44–56. [Google Scholar] [CrossRef]

- Alfalah, A.A.; Muneer, S.; Hussain, M. An empirical investigation of firm performance through corporate governance and information technology investment with mediating role of corporate social responsibility: Evidence from Saudi Arabia telecommunication sector. Front. Psychol. 2022, 13, 959406. [Google Scholar] [CrossRef] [PubMed]

- Mahrani, M.; Soewarno, N. The effect of good corporate governance mechanism and corporate social responsibility on financial performance with earnings management as mediating variable. Asian J. Account. Res. 2018, 3, 41–60. [Google Scholar] [CrossRef]

| Sr# | Construct | Items | References |

|---|---|---|---|

| 1 | Green finance | 3 | [49] |

| 2 | Corporate social responsibility | 9 | [47] |

| 3 | Organizational sustainable | 8 | [46] |

| 4 | Top management environment concern | 3 | [48,49,50] |

| 5 | Corporate governance | 7 | [51] |

| Demographic Variables | Frequency | Percentage |

|---|---|---|

| Gender | ||

| Male | 198 | 63.06 |

| Female | 118 | 37.58 |

| Age | ||

| 21–25 years | 78 | 24.84 |

| 26–30 years | 70 | 22.29 |

| 31–35 years | 122 | 28.85 |

| Above 35 | 44 | 14.01 |

| Work experience | ||

| Less than 5 years | 82 | 26.11 |

| 5 to 10 years | 110 | 35.03 |

| 10 to 15 years | 58 | 18.47 |

| 15 to 20 years | 44 | 14.01 |

| Above 20 years | 20 | 6.36 |

| Designation | ||

| Senior officer | 37 | 11.78 |

| Assistant manager | 80 | 25.48 |

| Deputy manager | 76 | 24.20 |

| Manager | 59 | 18.79 |

| General manager | 62 | 19.75 |

| Variables | Item Loading | α | CR | AVE | |

|---|---|---|---|---|---|

| Corporate governance | 0.909 | 0.919 | 0.648 | ||

| CG1 | 0.819 | ||||

| CG2 | 0.750 | ||||

| CG3 | 0.817 | ||||

| CG4 | 0.789 | ||||

| CG5 | 0.848 | ||||

| CG6 | 0.836 | ||||

| CG7 | 0.769 | ||||

| Corporate social responsibility | CSR1 | 0.689 | 0.907 | 0.913 | 0.573 |

| CSR2 | 0.717 | ||||

| CSR3 | 0.779 | ||||

| CSR4 | 0.774 | ||||

| CSR5 | 0.754 | ||||

| CSR6 | 0.766 | ||||

| CSR7 | 0.729 | ||||

| CSR8 | 0.827 | ||||

| CSR9 | 0.770 | ||||

| Green finance | GF | 0.717 | 0.789 | 0.801 | 0.613 |

| GF1 | 0.775 | ||||

| GF2 | 0.796 | ||||

| GF4 | 0.838 | ||||

| Sustainable performance | SP1 | 0.804 | 0.809 | 0.815 | 0.568 |

| SP2 | 0.683 | ||||

| SP3 | 0.782 | ||||

| SP4 | 0.750 | ||||

| SP5 | 0.744 | ||||

| Top management environmental concern | TMEC1 | 0.882 | 0.781 | 0.784 | 0.700 |

| TMEC2 | 0.742 | ||||

| TMEC3 | 0.878 | ||||

| Model Fit Indices | |||||

| CFI | 0.91 | ||||

| GFI | 0.93 | ||||

| REMESA | 0.43 | ||||

| CG | CSR | GF | SP | TMEC | |

|---|---|---|---|---|---|

| CG | 0.805 | ||||

| CSR | 0.496 | 0.757 | |||

| GF | 0.358 | 0.675 | 0.782 | ||

| SP | 0.514 | 0.642 | 0.797 | 0.754 | |

| TMEC | 0.472 | 0.585 | 0.715 | 0.729 | 0.837 |

| Construct | R-Square | R-Square Adjusted |

|---|---|---|

| CSR | 0.554 | 0.553 |

| SP | 0.558 | 0.557 |

| Hypothesis | Path Coefficient | T Statistics | p Values | Decision | |

|---|---|---|---|---|---|

| Direct Relationship | |||||

| H1 | CG→CSR | 0.263 | 7.212 | 0.000 | Accepted |

| H2 | CSR→SP | 0.800 | 17.766 | 0.000 | Accepted |

| H3 | GF→CSR | 0.619 | 19.834 | 0.000 | Accepted |

| Relationship | Indirect Effects | Total Effects | Result | |

|---|---|---|---|---|

| H4 | CG→CSR→SP | β = 0.094, t = 3.118 | β = 0.059, t = 11.453 | Partial |

| H5 | GF→CSR→SP | β = 0.495, t = 14.224 | β = 0.702, t = 18.501 | Partial |

| Hypothesis | Path Coefficient | T Statistics | p Values | Decision | |

|---|---|---|---|---|---|

| H6 | TMEC × CSR→SP | 0.067 | 2.349 | 0.019 | Accepted |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, L.; Ur Rehman, A.; Xu, Z.; Amjad, F.; Ur Rehman, S. Green Corporate Governance, Green Finance, and Sustainable Performance Nexus in Chinese SMES: A Mediation Moderation Model. Sustainability 2023, 15, 9914. https://doi.org/10.3390/su15139914

Wang L, Ur Rehman A, Xu Z, Amjad F, Ur Rehman S. Green Corporate Governance, Green Finance, and Sustainable Performance Nexus in Chinese SMES: A Mediation Moderation Model. Sustainability. 2023; 15(13):9914. https://doi.org/10.3390/su15139914

Chicago/Turabian StyleWang, Lei, Amin Ur Rehman, Zhaocheng Xu, Fiza Amjad, and Shams Ur Rehman. 2023. "Green Corporate Governance, Green Finance, and Sustainable Performance Nexus in Chinese SMES: A Mediation Moderation Model" Sustainability 15, no. 13: 9914. https://doi.org/10.3390/su15139914

APA StyleWang, L., Ur Rehman, A., Xu, Z., Amjad, F., & Ur Rehman, S. (2023). Green Corporate Governance, Green Finance, and Sustainable Performance Nexus in Chinese SMES: A Mediation Moderation Model. Sustainability, 15(13), 9914. https://doi.org/10.3390/su15139914