The Impact of Ethical Leadership on Financial Performance: The Mediating Role of Environmentally Proactive Strategy and the Moderating Role of Institutional Pressure

Abstract

1. Introduction

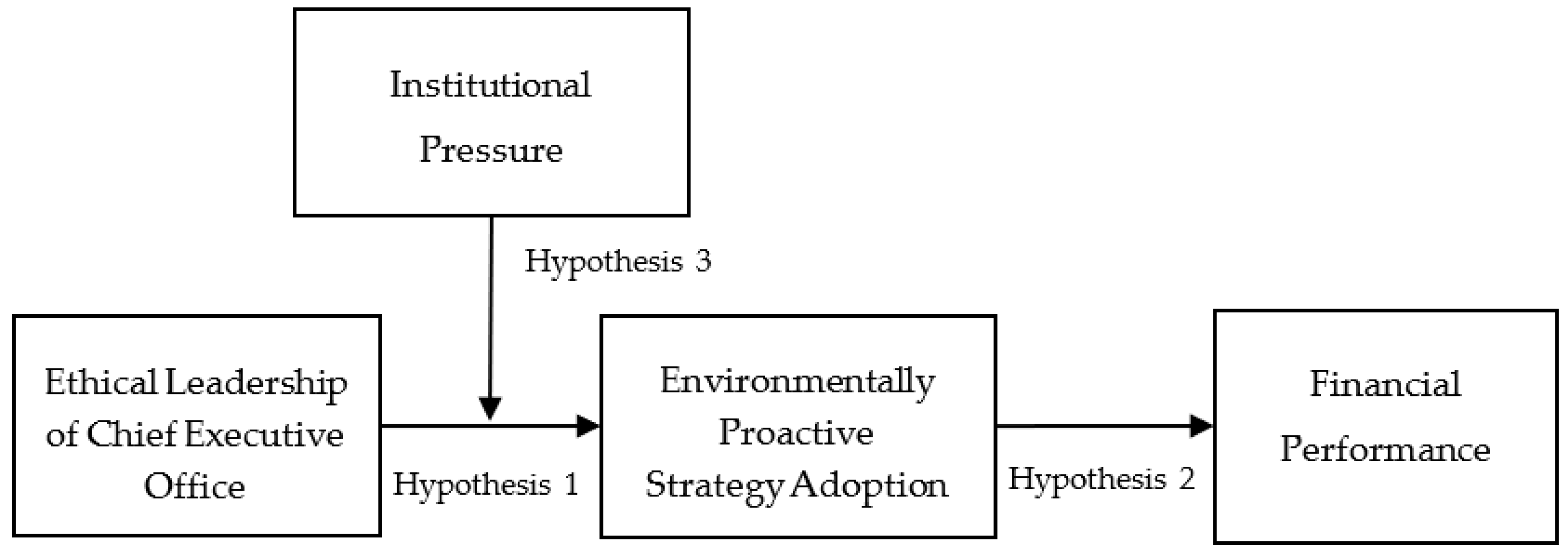

- Research question: How does the ethical leadership of the chief executive officer affect financial performance through the environmentally proactive strategy adoption, which is moderated by institutional pressures?

2. Literature Reviewing

2.1. Leadership Development

2.2. Financial Performance

2.3. Ethical Leadership and the Environmentally Proactive Strategy Adoption

2.4. The Environmentally Proactive Strategy Adoption and Financial Performance

2.5. Moderating Effect of Institutional Pressure

3. Methodology

3.1. Subjects and Procedures

3.2. Measure

4. Results

Analysis Results

5. Discussion

5.1. Academic Contribution

5.2. Practice Contribution

5.3. Limitations and Further Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Caffaro, F.; Roccato, M.; Micheletti Cremasco, M.; Cavallo, E. An ergonomic approach to sustainable development: The role of information environment and social-psychological variables in the adoption of agri-environmental innovations. Sustain. Dev. 2019, 27, 1049–1062. [Google Scholar] [CrossRef]

- Liu, D.; Fisher, G.; Chen, G.L. CEO attributes and firm performance: A sequential mediation process model. Acad. Manag. Ann. 2018, 12, 789–816. [Google Scholar] [CrossRef]

- Elalfy, A.; Weber, O.; Geobey, S. The Sustainable Development Goals (SDGs): A rising tide lifts all boats? Global reporting implications in a post SDGs world. J. Appl. Account. Res. 2021, 22, 557–575. [Google Scholar] [CrossRef]

- Sachs, J.D. The Age of Sustainable Development; Columbia University Press: New York, NY, USA, 2015. [Google Scholar]

- Cameira, M.D.R.; Mota, M. Nitrogen Related Diffuse Pollution from Horticulture Production—Mitigation Practices and Assessment Strategies. Horticulturae 2017, 3, 25. [Google Scholar] [CrossRef]

- Kuntosch, A.; König, B.; Bokelmann, W.; Doernberg, A.; Siebert, R.; Schwerdtner, W.; Busse, M. Identifying System-Related Barriers for the Development and Implementation of Eco-Innovation in the German Horticultural Sector. Horticulturae 2020, 6, 33. [Google Scholar] [CrossRef]

- Valenzuela, H. Agroecology: A Global Paradigm to Challenge Mainstream Industrial Agriculture. Horticulturae 2016, 2, 2. [Google Scholar] [CrossRef]

- Wang, R.; Wang, Q.; Dong, L.; Zhang, J. Cleaner agricultural production in drinking-water source areas for the control of non-point source pollution in China. J. Environ. Manag. 2021, 285, 112096. [Google Scholar] [CrossRef]

- Latini, A.; Giagnacovo, G.; Campiotti, C.A.; Bibbiani, C.; Mariani, S. A Narrative Review of the Facts and Perspectives on Agricultural Fertilization in Europe, with a Focus on Italy. Horticulturae 2021, 7, 158. [Google Scholar] [CrossRef]

- Li, Z.; Wu, Y.; Xing, D.; Zhang, K.; Xie, J.; Yu, R.; Chen, T.; Duan, R. Effects of Foliage Spraying with Sodium Bisulfite on the Photosynthesis of Orychophragmus violaceus. Horticulturae 2021, 7, 137. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations; Sage: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Huang, S.Y.B.; Li, M.-W.; Lee, Y.-S. Why Do Medium-Sized Technology Farms Adopt Environmental Innovation? The Mediating Role of Pro-Environmental Behaviors. Horticulturae 2021, 7, 318. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Lee, S.-C.; Lee, Y.-S. Why Can Green Social Responsibility Drive Agricultural Technology Manufacturing Company to Do Good Things? A Novel Adoption Model of Environmental Strategy. Agronomy 2021, 11, 1673. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Lee, S.-C.; Lee, Y.-S. Constructing an Adoption Model of Proactive Environmental Strategy: A Novel Quantitative Method of the Multi-Level Growth Curve Model. Mathematics 2021, 9, 1962. [Google Scholar] [CrossRef]

- Buysse, K.; Verbeke, A. Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 2023, 24, 453–470. [Google Scholar] [CrossRef]

- Madime, E.; Gonçalves, T.C. Consequences of Social and Environmental Corporate Responsibility Practices: Managers’ Perception in Mozambique. Int. J. Financ. Stud. 2022, 10, 4. [Google Scholar] [CrossRef]

- Wagner, M.; Schaltegger, S. The effect of corporate environmental strategy choice and environmental performance on competitiveness and economic performance: An empirical study of EU manufacturing. Eur. Manag. J. 2004, 22, 557–572. [Google Scholar] [CrossRef]

- Lee, C.J.; Huang, S.Y. Can ethical leadership hinder sales performance? A limited resource perspective of job embeddedness. Chin. Manag. Stud. 2019, 13, 985–1002. [Google Scholar] [CrossRef]

- Lee, C.-J.; Huang, S.Y.B. A moderated mediation examination of Kahn’s theory in the development of new product performance: Cross-level moderating role of open discussion of conflict. Chin. Manag. Stud. 2019, 13, 603–615. [Google Scholar] [CrossRef]

- Lee, C.J.; Huang, S.Y. Double-edged effects of ethical leadership in the development of Greater China salespeople’s emotional exhaustion and long-term customer relationships. Chin. Manag. Stud. 2020, 14, 29–49. [Google Scholar] [CrossRef]

- Hu, L.; Huang, S.Y.B.; Li, H.-X.; Lee, S.-C. To help others or not: A moderated mediation model of emotional dissonance. Front. Hum. Neurosci. 2022, 16, 893623. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Li, M.-W.; Chang, T.-W. Transformational Leadership, Ethical Leadership, and Participative Leadership in Predicting Counterproductive Work Behaviors: Evidence from Financial Technology Firms. Front. Psychol. 2021, 12, 658727. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Huang, C.-H.; Chang, T.-W. A New Concept of Work Engagement Theory in Cognitive Engagement, Emotional Engagement, and Physical Engagement. Front. Psychol. 2022, 12, 663440. [Google Scholar] [CrossRef] [PubMed]

- Boiral, O.; Baron, C.; Gunnlaugson, O. Environmental leadership and consciousness development: A case study among Canadian SMEs. J. Bus. Ethics 2014, 123, 363–383. [Google Scholar] [CrossRef]

- Iqbal, Q.; Ahmad, N.H.; Li, Z.; Li, Y. To walk in beauty: Sustainable leadership, frugal innovation and environmental performance. Manag. Decis. Econ. 2021, 43, 738–750. [Google Scholar] [CrossRef]

- Sulasmi, E.; Agussani Tanjung, H. Bridging the way towards sustainability performance through safety, empowerment and learning: Using sustainable leadership as driving force. J. Secur. Sustain. Issues 2020, 10, 93–107. [Google Scholar] [CrossRef]

- Chen, L.; Zhai, L.; Zhu, W.; Luo, G.; Zhang, J.; Zhang, Y. Financial Performance Under the Influence of the Coronavirus Disease 2019: Effects of Strategic Flexibility and Environmental Dynamics in Big Data Capability. Front. Psychol. 2021, 12, 798115. [Google Scholar] [CrossRef] [PubMed]

- Dang, V.C.; Nguyen, Q.K.; Tran, X.H. Corruption, institutional quality and shadow economy in Asian countries. Appl. Econ. Lett. 2022, 1–6. [Google Scholar] [CrossRef]

- Nguyen, Q.K.; Dang, V.C. Does the country’s institutional quality enhance the role of risk governance in preventing bank risk? Appl. Econ. Lett. 2023, 30, 850–853. [Google Scholar] [CrossRef]

- Tan, S.H.; Habibullah, M.S.; Tan, S.K.; Choon, S.W. The impact of the dimensions of environmental performance on firm performance in travel and tourism industry. J. Environ. Manag. 2017, 203, 603–611. [Google Scholar] [CrossRef]

- Andries, P.; Stephan, U. Environmental innovation and firm performance: How firm size and motives matter. Sustainability 2019, 11, 3585. [Google Scholar] [CrossRef]

- Huang, S.Y.; Lee, S.C.; Chen, Y.F. How do the attributes and changes of senior management affect the company’s abnormal rate of return? Evidence from China. Corp. Manag. Rev. 2022, 42, 37–69. [Google Scholar]

- Chandren, S.; Qaderi, S.A.; Ghaleb, B.A.A. The influence of the chairman and CEO effectiveness on operating performance: Evidence from Malaysia. Cogent Bus. 2021, 8, 1935189. [Google Scholar] [CrossRef]

- Kabbani, S.; Karkoulian, S.; Balozian, P.; Rizk, S. The Impact of Ethical Leadership, Commitment and Healthy/Safe Workplace Practices toward Employee Attitude to COVID-19 Vaccination/Implantation in the Banking Sector in Lebanon. Vaccines 2022, 10, 416. [Google Scholar] [CrossRef]

- Shin, Y. CEO ethical leadership, ethical climate, climate strength, and collective organizational citizenship behavior. J. Bus. Ethics 2012, 108, 299–312. [Google Scholar] [CrossRef]

- Dhar, R.L. Ethical leadership and its impact on service innovative behavior: The role of LMX and job autonomy. Tour. Manag. 2016, 57, 139–148. [Google Scholar] [CrossRef]

- Lisbona, A.; Las Hayas, A.; Palací, F.J.; Frese, M. Initiative in Work Teams: Lever between Authentic Leadership and Results. Int. J. Environ. Res. Public Health 2021, 18, 4947. [Google Scholar] [CrossRef]

- Menguc, B.; Auh, S.; Ozanne, L. The interactive effect of internal and external factors on a proactive environmental strategy and its influence on a firm’s performance. J. Bus. Ethics 2010, 94, 279–298. [Google Scholar] [CrossRef]

- Lee, S.C.; Huang, S.Y. The effect of Chinese-specific environmentally responsible leadership on the adoption of green innovation strategy. Energy Environ. 2023, 0958305X231177731. [Google Scholar] [CrossRef]

- Yang, C.; Zhang, L. CEO environmentally specific transformational leadership and firm proactive environmental strategy: Roles of TMT green commitment and regulative pressure. Pers. Rev. 2022. [Google Scholar] [CrossRef]

- Al-Jalahma, A.; Al-Fadhel, H.; Al-Muhanadi, M.; Al-Zaimoor, N. Environmental, social, and governance (ESG) disclosure and firm performance: Evidence from GCC banking sector. In Proceedings of the 2020 International Conference on Decision Aid Sciences and Application (DASA), Sakheer, Bahrain, 8–9 November 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 54–58. [Google Scholar]

- Merida, P.D. Environtmental Management Accounting, Competitive Advantage, Firm Perfomance: Indonesia’s Manufacturing Sector. J. Ris. Akunt. Aksioma 2021, 20, 144–156. [Google Scholar]

- Thanh, T.L.; Huan, N.Q.; Hong, T.T.T. Effects of corporate social responsibility on SMEs’ performance in emerging market. Cogent Bus. Manag. 2021, 8, 1878978. [Google Scholar] [CrossRef]

- Huang, S.Y. How can corporate social responsibility predict voluntary pro-environmental behaviors? Energy Environ. 2023, 0958305X231167473. [Google Scholar] [CrossRef]

- Huang, S.Y.; Yu, C.C.; Lee, Y.S. How to Promote the Agricultural Company Through Environmental Social Responsibility to Achieve Sustainable Production? Front. Environ. Sci. 2022, 9, 521. [Google Scholar] [CrossRef]

- Huang, S.Y.; Chen, K.H.; Lee, Y.S. How to Promote Medium-Sized Farms to Adopt Environmental Strategy to Achieve Sustainable Production during the COVID-19 Pandemic? Agriculture 2021, 11, 1052. [Google Scholar] [CrossRef]

- Gök, O.; Peker, S. Understanding the links among innovation performance, market performance and financial perfor-373 mance. Rev. Manag. Sci. 2017, 11, 605–631. [Google Scholar] [CrossRef]

- Aldieri, L.; Kotsemir, M.; Vinci, C.P. Environmental innovations and productivity: Empirical evidence from Russian regions. Resour. Policy 2019, 74, 101444. [Google Scholar] [CrossRef]

- Yu, X.; Xu, Y.; Zhang, J.; Sun, Y. The Synergy Green Innovation Effect of Green Innovation Subsidies and Carbon Taxes. Sustainability 2022, 14, 3453. [Google Scholar] [CrossRef]

- Marshall, M.E.; Mayer, D.W. Environmental training: It’s good business. Bus. Horiz. 1992, 35, 54–58. [Google Scholar] [CrossRef]

- Fraj-Andrés, E.; Martinez-Salinas, E.; Matute-Vallejo, J. A multidimensional approach to the influence of environmental marketing and orientation on the firm’s organizational performance. J. Bus. Ethics 2009, 88, 263–286. [Google Scholar] [CrossRef]

- Galleli, B.; Semprebon, E.; Santos, J.A.R.d.; Teles, N.E.B.; Freitas-Martins, M.S.d.; Onevetch, R.T.d.S. Institutional Pressures, Sustainable Development Goals and COVID-19: How Are Organisations Engaging? Sustainability 2021, 13, 12330. [Google Scholar] [CrossRef]

- Tang, Y.; Zhu, J.; Ma, W.; Zhao, M. A Study on the Impact of Institutional Pressure on Carbon Information Disclosure: The Mediating Effect of Enterprise Peer Influence. Int. J. Environ. Res. Public Health 2022, 19, 4174. [Google Scholar] [CrossRef]

- Liu, Y.; Kim, C.Y.; Lee, E.H.; Yoo, J.W. Relationship between Sustainable Management Activities and Financial Performance: Mediating Effects of Non-Financial Performance and Moderating Effects of Institutional Environment. Sustainability 2022, 14, 1168. [Google Scholar] [CrossRef]

- Zeng, S.; Qin, Y.; Zeng, G. Impact of Corporate Environmental Responsibility on Investment Efficiency: The Moderating Roles of the Institutional Environment and Consumer Environmental Awareness. Sustainability 2019, 11, 4512. [Google Scholar] [CrossRef]

- Bir, C.; Olynk Widmar, N.; Croney, C. Exploring Social Desirability Bias in Perceptions of Dog Adoption: All’s Well that Ends Well? Or Does the Method of Adoption Matter? Animals 2018, 8, 154. [Google Scholar] [CrossRef]

- Kowalkowska, J.; Poínhos, R. Eating Behaviour among University Students: Relationships with Age, Socioeconomic Status, Physical Activity, Body Mass Index, Waist-to-Height Ratio and Social Desirability. Nutrients 2021, 13, 3622. [Google Scholar] [CrossRef]

- Lajunen, T.; Gaygısız, E. Can We Rely on Self-Assessments of Sense of Coherence? The Effects of Socially Desirable Responding on the Orientation to Life Questionnaire (OLQ) Responses. Soc. Sci. 2019, 8, 278. [Google Scholar] [CrossRef]

- Pimentel, J. Some biases in Likert scaling, usage and its corrections. Int. J. Sci. Basic Appl. Res. 2019, 45, 183–191. [Google Scholar]

- Brown, M.E.; Trevino, L.K.; Harrison, D.A. Ethical leadership: A social learning perspective for construct development and testing. Organ. Behav. Hum. Decis. Process. 2005, 97, 117–134. [Google Scholar] [CrossRef]

- Dai, J.; Chan, H.K.; Yee, R.W.Y. Examining moderating effect of organizational culture on the relationship between market pressure and corporate environmental strategy. Ind. Mark. Manag. 2018, 74, 227–236. [Google Scholar] [CrossRef]

- Latif, B.; Mahmood, Z.; Tze San, O.; Mohd Said, R.; Bakhsh, A. Coercive, Normative and Mimetic Pressures as Drivers of Environmental Management Accounting Adoption. Sustainability 2020, 12, 4506. [Google Scholar] [CrossRef]

- Fornell, C.; Lacker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Li, M.W.; Lee, Y.S. Transforming the Emotional Intelligence of the Feeders in Agribusinesses into the Development of Task Performance and Counterproductive Work Behaviors during the COVID-19 Pandemic. Animals 2021, 11, 3124. [Google Scholar] [CrossRef] [PubMed]

- Chen, Y.S.; Huang, S.Y.B. A conservation of resources view of personal engagement in the development of innovative behavior and work-family conflict. J. Organ. Chang. Manag. 2016, 29, 1030–1040. [Google Scholar] [CrossRef]

- Ma, L.; Song, W.; Zhou, Y. Modeling Enablers of Environmentally Conscious Manufacturing Strategy: An Integrated Method. Sustainability 2018, 10, 2284. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Ting, C.-W.; Fei, Y.-M. A Multilevel Model of Environmentally Specific Social Identity in Predicting Environmental Strategies: Evidence from Technology Manufacturing Businesses. Sustainability 2021, 13, 4567. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Ting, C.-W.; Li, M.-W. The Effects of Green Transformational Leadership on Adoption of Environmentally Proactive Strategies: The Mediating Role of Green Engagement. Sustainability 2021, 13, 3366. [Google Scholar] [CrossRef]

- Li, Z.F.; Lu, X.; Wang, J. Corporate Social Responsibility and Goodwill Impairment: Charitable Donations of Chinese Listed Companies. SSRN 2023. [Google Scholar] [CrossRef]

| Constructs | Items | λ | Cronbach’s α | Composite Reliability | Average Variation Extracted |

|---|---|---|---|---|---|

| Ethical Leadership | EL01 | 0.83 ** | 0.87 | 0.89 | 0.63 |

| EL02 | 0.67 ** | ||||

| EL03 | 0.76 ** | ||||

| EL04 | 0.65 ** | ||||

| Environmentally Proactive Strategy | EPS01 | 0.76 ** | 085 | 0.84 | 0.57 |

| EPS05 | 0.73 ** | ||||

| EPS06 | 0.76 ** | ||||

| EPS07 | 0.81 ** | ||||

| Financial Performance | IP01 | 0.83 ** | 0.84 | 0.89 | 0.67 |

| IP03 | 0.84 ** | ||||

| IP04 | 0.82 ** | ||||

| IP05 | 0.81 ** | ||||

| Institutional pressure | IP01 | 0.88 ** | 0.86 | 0.89 | 0.68 |

| IP02 | 0.75 ** | ||||

| IP03 | 0.83 ** | ||||

| IP04 | 0.84 ** |

| Component | Total (Eigenvalue) | % of Variance | Cumulative % |

|---|---|---|---|

| Ethical Leadership | 2.1 | 0.30 | 0.30 |

| Environmentally Proactive Strategy | 1.8 | 0.28 | 0.28 |

| Financial Performance | 1.6 | 0.25 | 0.25 |

| Institutional pressure | 1.4 | 0.17 | 0.17 |

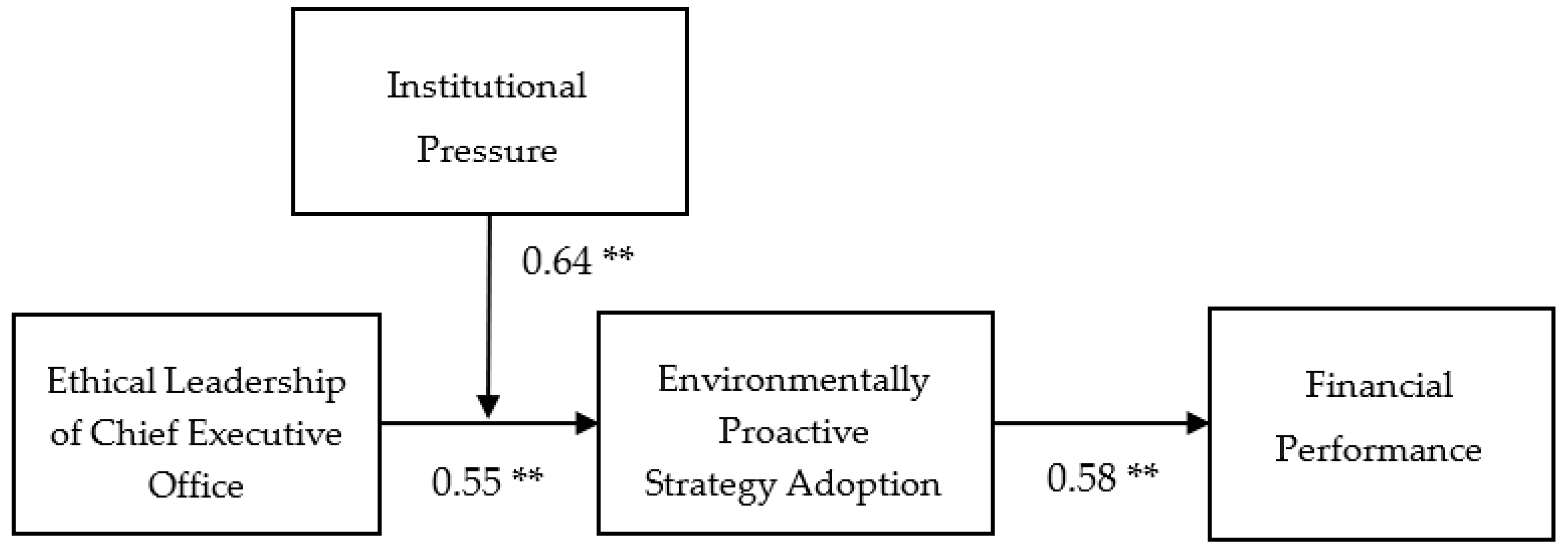

| Hypothesis | Path Relationship | Coefficient |

|---|---|---|

| H1 | Ethical Leadership -> Environmentally Proactive Strategy | 0.55 ** |

| H2 | Environmentally Proactive Strategy -> Financial Performance | 0.58 ** |

| H3 | Institutional Pressure -> Ethical Leadership and Environmentally Proactive Strategy | 0.64 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, C.-H.; Ting, C.-W.; Chang, T.-W.; Lee, Y.-S.; Yen, S.-J. The Impact of Ethical Leadership on Financial Performance: The Mediating Role of Environmentally Proactive Strategy and the Moderating Role of Institutional Pressure. Sustainability 2023, 15, 10449. https://doi.org/10.3390/su151310449

Huang C-H, Ting C-W, Chang T-W, Lee Y-S, Yen S-J. The Impact of Ethical Leadership on Financial Performance: The Mediating Role of Environmentally Proactive Strategy and the Moderating Role of Institutional Pressure. Sustainability. 2023; 15(13):10449. https://doi.org/10.3390/su151310449

Chicago/Turabian StyleHuang, Chien-Hsiang, Chih-Wen Ting, Tai-Wei Chang, Yue-Shi Lee, and Show-Jane Yen. 2023. "The Impact of Ethical Leadership on Financial Performance: The Mediating Role of Environmentally Proactive Strategy and the Moderating Role of Institutional Pressure" Sustainability 15, no. 13: 10449. https://doi.org/10.3390/su151310449

APA StyleHuang, C.-H., Ting, C.-W., Chang, T.-W., Lee, Y.-S., & Yen, S.-J. (2023). The Impact of Ethical Leadership on Financial Performance: The Mediating Role of Environmentally Proactive Strategy and the Moderating Role of Institutional Pressure. Sustainability, 15(13), 10449. https://doi.org/10.3390/su151310449