Financial Inclusion through Digitalization: Improving Emerging Drivers of Industrial Pollution—Evidence from China

Abstract

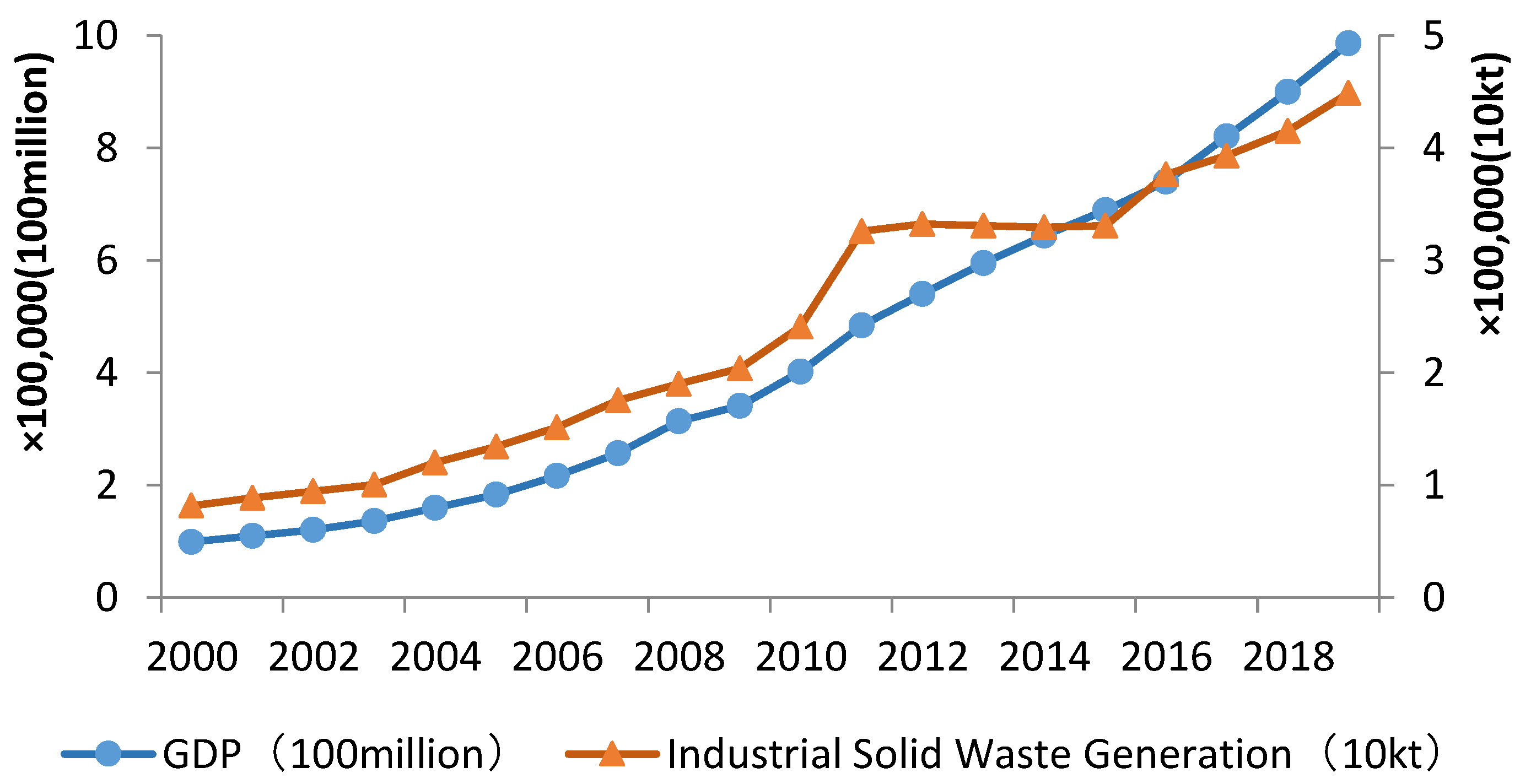

1. Introduction

2. Literature Review and Research Hypothesis

3. Data and Empirical Model

3.1. Data Sources

3.2. Variable Measurement

3.3. Model Specification

4. Empirical Results and Analysis

4.1. Effect of DIF on Industrial Pollution Discharges

4.2. Impact of DIF Sub-Indicators on Industrial Pollution Emissions

4.3. Mediation Effect Analysis

4.4. Robustness Test

4.5. Heterogeneity Analysis

4.5.1. Regional Heterogeneity Test

4.5.2. Heterogeneity of Pollutants

4.6. Threshold Effect Test

5. Research Conclusions and Recommendations

Current Limitations and Future Directions of Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Islam, N.; Yokota, K. Lewis growth model and China’s industrialization. Asian Econ. J. 2008, 22, 359–396. [Google Scholar] [CrossRef]

- Siddique, H.M.A. Industrialization, energy consumption, and environmental pollution: Evidence from South Asia. Environ. Sci. Pollut. Res. 2022, 30, 4103. [Google Scholar] [CrossRef]

- Zhou, Y.; Liu, Z.; Liu, S.; Chen, M.; Zhang, X.; Wang, Y. Analysis of industrial eco-efficiency and its influencing factors in China. Clean Technol. Environ. Policy 2020, 22, 2023–2038. [Google Scholar] [CrossRef]

- Nasrollahi, Z.; Hashemi, M.S.; Bameri, S.; Mohamad Taghvaee, V. Environmental pollution, economic growth, population, industrialization, and technology in weak and strong sustainability: Using STIRPAT model. Environ. Dev. Sustain. 2020, 22, 1105–1122. [Google Scholar] [CrossRef]

- Han, C.; Hua, D.; Li, J. A View of Industrial Agglomeration, Air Pollution and Economic Sustainability from Spatial Econometric Analysis of 273 Cities in China. Sustainability 2023, 15, 7091. [Google Scholar] [CrossRef]

- Triki, R.; Kahouli, B.; Tissaoui, K.; Tlili, H. Assessing the Link between Environmental Quality, Green Finance, Health Expenditure, Renewable Energy, and Technology Innovation. Sustainability 2023, 15, 4286. [Google Scholar] [CrossRef]

- Caplan, M.A.; Birkenmaier, J.; Bae, J. Financial exclusion in OECD countries: A scoping review. Int. J. Soc. Welf. 2021, 30, 58–71. [Google Scholar] [CrossRef]

- Hasan, M.M.; Yajuan, L.; Khan, S. Promoting China’s inclusive finance through digital financial services. Glob. Bus. Rev. 2022, 23, 984–1006. [Google Scholar] [CrossRef]

- Sun, Y.; Tang, X. The impact of digital inclusive finance on sustainable economic growth in China. Financ. Res. Lett. 2022, 50, 103234. [Google Scholar] [CrossRef]

- Chopra, S.; Dwivedi, R.; Sherry, A.M. Leveraging technology options for financial inclusion in India. Int. J. Asian Bus. Inf. Manag. 2013, 4, 10–20. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; NBER: Cambridge, UK, 1991. [Google Scholar]

- Shafik, N.; Bandyopadhyay, S. Economic Growth and Environmental Quality: Time Series and Cross Country Evidence; Background Paper for the World Development Report; The World Bank: Washington DC, USA, 1992. [Google Scholar]

- Yang, R.; Wong, C.W.; Miao, X. Evaluation of the coordinated development of economic, urbanization and environmental systems: A case study of China. Clean Technol. Environ. Policy 2021, 23, 685–708. [Google Scholar] [CrossRef]

- Panayotou, T. The economics of environments in transition. Environ. Dev. Econ. 1999, 4, 401–412. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Hu, Y.; Dai, X.; Zhao, L. Digital finance, environmental regulation, and green technology innovation: An Empirical Study of 278 Cities in China. Sustainability 2022, 14, 8652. [Google Scholar] [CrossRef]

- Gu, B.; Chen, F.; Zhang, K. The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: Analysis from the perspective of government regulation and public environmental demands. Environ. Sci. Pollut. Res. 2021, 28, 47474–47491. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J. FDI and the capital intensity of “dirty” sectors: A missing piece of the pollution haven puzzle. Rev. Dev. Econ. 2005, 9, 530–548. [Google Scholar] [CrossRef]

- Shahbaz, M.; Solarin, S.A.; Mahmood, H.; Arouri, M. Does financial development rEDUce CO2 emissions in Malaysian economy? A time series analysis. Econ. Model. 2013, 35, 145–152. [Google Scholar] [CrossRef]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Charfeddine, L.; Khediri, K.B. Financial development and environmental quality in UAE: Cointegration with structural breaks. Renew. Sustain. Energy Rev. 2016, 55, 1322–1335. [Google Scholar] [CrossRef]

- Abbasi, F.; Riaz, K. CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 2016, 90, 102–114. [Google Scholar] [CrossRef]

- Lv, J.; Wang, N.; Ju, H.; Cui, X. Influence of green technology, tourism, and inclusive financial development on ecological sustainability: Exploring the path toward green revolution. Econ. Res. 2022, 36, 1–23. [Google Scholar] [CrossRef]

- Jiang, S.; Qiu, S.; Zhou, J. Re-Examination of the Relationship between Agricultural Economic Growth and Non-Point Source Pollution in China: Evidence from the Threshold Model of Financial Development. Water 2020, 12, 2609. [Google Scholar] [CrossRef]

- Risman, A.; Mulyana, B.; Silvatika, B.; Sulaeman, A. The effect of digital Finance on financial stability. Manag. Sci. Lett. 2021, 11, 1979–1984. [Google Scholar] [CrossRef]

- Dwivedi, R.; Alrasheedi, M.; Dwivedi, P.; Starešinić, B. Leveraging financial inclusion through technology-enabled services innovation: A case of economic development in India. Int. J. E-Serv. Mob. Appl. 2022, 14, 1–13. [Google Scholar] [CrossRef]

- Li, G.; Fang, X.; Liu, M. Will Digital Inclusive Finance Make Economic Development Greener? Evidence From China. Front. Environ. Sci. 2021, 9, 452. [Google Scholar] [CrossRef]

- Shi, F.; Ding, R.; Li, H.; Hao, S. Environmental Regulation, Digital Financial Inclusion, and Environmental Pollution: An Empirical Study Based on the Spatial Spillover Effect and Panel Threshold Effect. Sustainability 2022, 14, 6869. [Google Scholar] [CrossRef]

- Wen, H.; Yue, J.; Li, J.; Xiu, X.; Zhong, S. Can digital Finance rEDUce industrial pollution? New evidence from 260 cities in China. PLoS ONE 2022, 17, e0266564. [Google Scholar] [CrossRef] [PubMed]

- Xue, L.; Zhang, X. Can Digital Financial Inclusion Promote Green Innovation in Heavily Polluting Companies? Int. J. Environ. Res. Public Health 2022, 19, 7323. [Google Scholar] [CrossRef] [PubMed]

- Chang, J. The role of digital finance in reducing agricultural carbon emissions: Evidence from China’s provincial panel data. Environ. Sci. Pollut. Res. 2022, 29, 87730–87745. [Google Scholar] [CrossRef] [PubMed]

- Li, F.; Wu, Y.; Liu, J.; Zhong, S. Does digital inclusive finance promote industrial transformation? New evidence from 115 resource-based cities in China. PLoS ONE 2022, 17, e0273680. [Google Scholar] [CrossRef] [PubMed]

- Lin, B.; Ma, R. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef]

- Wang, X.; Zhu, Y.; Ren, X.; Gozgor, G. The impact of digital inclusive finance on the spatial convergence of the green total factor productivity in the Chinese cities. Appl. Econ. 2022, 35, 1–19. [Google Scholar] [CrossRef]

- Xiaoyu, L.; Jun, Y.; Pengfei, S. Structure and application of a new comprehensive environmental pollution index. Energy Procedia 2011, 5, 1049–1054. [Google Scholar] [CrossRef]

- Dong, F.; Pan, Y.; Li, Y.; Zhang, S. How public and government matter in industrial pollution mitigation performance: Evidence from China. J. Clean. Prod. 2021, 306, 127099. [Google Scholar] [CrossRef]

- Xue, L.; Li, H.; Xu, C.; Zhao, X.; Zheng, Z.; Li, Y.; Liu, W. Impacts of industrial structure adjustment, upgrade and coordination on energy efficiency: Empirical research based on the extended STIRPAT model. Energy Strategy Rev. 2022, 43, 100911. [Google Scholar] [CrossRef]

- Wu, N.; Liu, Z. Higher education development, technological innovation and industrial structure upgrade. Technol. Forecast. Soc. Change 2021, 162, 120400. [Google Scholar] [CrossRef]

- Hu, G.G. Is knowledge spillover from human capital investment a catalyst for technological innovation? The curious case of fourth industrial revolution in BRICS economies. Technol. Forecast. Soc. Change 2021, 162, 120327. [Google Scholar] [CrossRef]

- Sánchez-Sellero, P.; Bataineh, M.J. How R&D cooperation, R&D expenditures, public funds and R&D intensity affect green innovation? Technol. Anal. Strateg. Manag. 2022, 34, 1095–1108. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Zhong, S.; Xin, C.; Shen, H.; Chen, X. Effects of land urbanization and internet penetration on environmental sustainability: A cross-regional study of China. Environ. Sci. Pollut. Res. 2021, 28, 66751–66771. [Google Scholar] [CrossRef]

| First-Level Indexes | Second-Level Indexes | Indicator Definition | Attribute |

|---|---|---|---|

| Industry exhaust | SO2 | Industrial sulphur dioxide emissions (tons) | + |

| S&D | Industrial smoke and dust emissions (tons) | + | |

| Industrial wastewater | COD | Industrial Chemical Oxygen Demand Emissions (tons) | + |

| NH3-N | Industrial ammonia nitrogen emissions (tons) | + | |

| Industrial solid waste | Solid Waste | Industrial general solid waste discharge (10,000 tons) | + |

| Variable | Mean | Standard Deviation | Min | Max | Sample Size | |

|---|---|---|---|---|---|---|

| Dependent variable | IP | 0.239 | 0.161 | 0.00119 | 0.770 | 270 |

| Explanatory variables | DIF | 5.151 | 0.670 | 2.909 | 6.017 | 270 |

| DIF_B | 4.995 | 0.827 | 0.673 | 5.952 | 270 | |

| DIF_D | 5.133 | 0.646 | 1.911 | 6.087 | 270 | |

| DIG | 5.458 | 0.716 | 2.026 | 6.136 | 270 | |

| Mediating variables | IS | 1.292 | 0.712 | 0.527 | 5.234 | 270 |

| RD | 1.592 | 1.130 | 0.190 | 6.315 | 270 | |

| Control variables | EDU | 9.194 | 0.888 | 7.514 | 12.80 | 270 |

| GS | 0.0300 | 0.00963 | 0.0118 | 0.0681 | 270 | |

| FDI | 2.122 | 1.913 | 0 | 12.10 | 270 | |

| Finance | 3.251 | 0.993 | 1.678 | 7.035 | 270 | |

| Market | 0.574 | 0.151 | 0.244 | 0.866 | 270 | |

| IP | LnDUF | EDU | GS | FDI | Finance | Market | |

|---|---|---|---|---|---|---|---|

| IP | 1 | ||||||

| LnDUF | −0.359 *** | 1 | |||||

| EDU | −0.299 *** | 0.0790 | 1 | ||||

| GS | −0.125 ** | 0.0590 | 0.0360 | 1 | |||

| FDI | 0.417 *** | −0.0360 | −0.108 * | −0.223 *** | 1 | ||

| Finance | −0.26 2*** | 0.314 *** | −0.0230 | 0.269 *** | 0.155 ** | 1 | |

| Market | −0.180 *** | 0.257 *** | 0.499 *** | −0.0330 | −0.0990 | 0.0420 | 1 |

| Variables | OLS | RE | FE | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnDIF | −0.086 *** | −0.062 *** | −0.100 *** | −0.065 *** | −0.101 *** | −0.062 *** |

| (−6.30) | (−5.03) | (−12.79) | (−5.61) | (−12.94) | (−4.05) | |

| EDU | −0.05 1*** | −0.073 *** | −0.085 *** | |||

| (−5.17) | (−3.77) | (−2.83) | ||||

| GS | 1.307 | −0.839 | −1.165 | |||

| (1.52) | (−1.13) | (−1.50) | ||||

| FDI | 0.038 *** | 0.029 *** | 0.027 *** | |||

| (8.88) | (7.06) | (6.26) | ||||

| Finance | −0.046 *** | −0.055 *** | −0.069 *** | |||

| (−5.27) | (−3.52) | (−3.16) | ||||

| Market | 0.093 | 0.200 * | 0.266 * | |||

| (1.55) | (1.88) | (1.86) | ||||

| Constant | 0.683 *** | 1.009 *** | 0.754 *** | 1.269 *** | 0.758 *** | 1.390 *** |

| (9.61) | (9.90) | (16.29) | (8.02) | (18.74) | (5.71) | |

| Observations | 270 | 270 | 270 | 270 | 270 | 270 |

| R-squared | 0.129 | 0.413 | 0.412 | 0.561 | ||

| F | 39.75 | 30.84 | 167.4 | 49.90 | ||

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| IP | IP | IP | |

| LnDIF_B | −0.026 ** | ||

| (−2.19) | |||

| LnDIF_D | −0.069 *** | ||

| (−4.87) | |||

| LnDIG | −0.018 | ||

| (−1.59) | |||

| EDU | −0.103 *** | −0.068 ** | −0.119 *** |

| (−3.35) | (−2.24) | (−3.99) | |

| GS | −1.081 | −1.119 | −0.885 |

| (−1.36) | (−1.47) | (−1.11) | |

| FDI | 0.028 *** | 0.026 *** | 0.028 *** |

| (6.37) | (6.22) | (6.23) | |

| Finance | −0.089 *** | −0.068 *** | −0.099 *** |

| (−4.10) | (−3.27) | (−4.73) | |

| Market | 0.073 | 0.201 | 0.021 |

| (0.52) | (1.62) | (0.15) | |

| Constant | 1.538 *** | 1.304 *** | 1.706 *** |

| (6.11) | (5.40) | (7.27) | |

| Observations | 270 | 270 | 270 |

| R-squared | 0.540 | 0.574 | 0.536 |

| F | 45.77 | 52.51 | 44.97 |

| Variables | Industrial Structure Upgrading | Level of Technological Innovation | ||||

|---|---|---|---|---|---|---|

| IP(1) | IS(2) | IP(3) | IP(4) | RD(5) | IP(6) | |

| LnDIF | −0.062 *** | 0.086 *** | −0.047 *** | −0.062 *** | 0.147 *** | −0.047 *** |

| (−4.05) | (3.09) | (-3.17) | (−4.05) | (4.91) | (−2.98) | |

| IS | −0.171 *** | |||||

| (−5.03) | ||||||

| RD | −0.101 *** | |||||

| (−3.11) | ||||||

| EDU | −0.085 *** | 0.275 *** | −0.038 | −0.085 *** | 0.023 | −0.083 *** |

| (−2.83) | (4.98) | (−1.27) | (−2.83) | (0.38) | (−2.80) | |

| GS | −1.165 | 8.226 *** | 0.242 | −1.165 | 6.708 *** | −0.486 |

| (−1.50) | (5.80) | (0.31) | (−1.50) | (4.39) | (−0.61) | |

| FDI | 0.027 *** | −0.021 *** | 0.023 *** | 0.027 *** | 0.006 | 0.028 *** |

| (6.26) | (−2.65) | (5.63) | (6.26) | (0.74) | (6.52) | |

| Finance | −0.069 *** | 0.276 *** | −0.021 | −0.069 *** | −0.015 | −0.070 *** |

| (−3.16) | (6.97) | (−0.94) | (−3.16) | (−0.34) | (−3.29) | |

| Market | 0.266 * | −0.306 | 0.214 | 0.266 * | 0.184 | 0.285 ** |

| (1.86) | (−1.17) | (1.57) | (1.86) | (0.65) | (2.03) | |

| Constant | 1.390 *** | −2.609 *** | 0.944 *** | 1.390 *** | 0.384 | 1.426 *** |

| (5.71) | (−5.86) | (3.80) | (5.71) | (0.77) | (5.95) | |

| Observations | 270 | 270 | 270 | 270 | 270 | 270 |

| R-squared | 0.561 | 0.705 | 0.604 | 0.561 | 0.395 | 0.577 |

| F | 49.90 | 93.31 | 50.82 | 49.90 | 25.42 | 45.45 |

| Sobel test | −0.0147 *** (z = −2.635) | −0.015 *** (z = −2.625) | ||||

| Intermediary effects | 23.9% | 24.17% | ||||

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| IP | PM2.5 | IP | LnDIF | IP | |

| L.LnDIF | −0.088 *** | ||||

| (−5.73) | |||||

| rate_inter | 0.054 *** | ||||

| (15.64) | |||||

| LnDIF | −0.065 *** | −4.520 *** | −0.083 *** | ||

| (−3.93) | (−4.23) | (−4.67) | |||

| EDU | −0.071 ** | −5.179 ** | −0.085 *** | 0.021 | −0.052 *** |

| (−2.15) | (−2.44) | (−2.81) | (0.58) | (−5.29) | |

| GS | −1.625 | −281.551 *** | −0.872 | −3.443 | 1.259 |

| (−1.58) | (−5.17) | (−1.07) | (−1.12) | (1.48) | |

| FDI | 0.036 *** | 0.729 ** | 0.026 *** | −0.007 | 0.037 *** |

| (6.23) | (2.41) | (5.72) | (−0.45) | (8.80) | |

| Finance | −0.072 *** | −1.638 | −0.045 * | 0.078 ** | −0.041 *** |

| (−2.90) | (−1.08) | (−1.84) | (2.55) | (−4.56) | |

| Market | 0.298 * | 18.119 * | 0.575 *** | 0.709 *** | 0.117 * |

| (1.93) | (1.81) | (3.34) | (3.35) | (1.89) | |

| Constant | 1.251 *** | 112.646 *** | 1.241 *** | 3.373 *** | 1.095 *** |

| (4.69) | (6.60) | (4.73) | (10.65) | (9.54) | |

| Observations | 234 | 270 | 240 | 270 | 270 |

| R-squared | 0.561 | 0.456 | 0.579 | 0.567 | 0.407 |

| F | 43.06 | 32.68 | 46.68 | 57.46 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| Eastern Part | Middle Part | Western Part | Wastegas | Wastewater | Solid Waste | Solid Waste | |

| LnDIF | −0.074 *** | −0.082 *** | −0.067 *** | −0.065 *** | −0.092 *** | 0.052 *** | −0.336 *** |

| (−3.34) | (−3.59) | (−3.01) | (−3.35) | (−3.66) | (3.32) | (−3.99) | |

| LnDIF2 | 0.045 *** | ||||||

| (4.68) | |||||||

| EDU | −0.126 *** | −0.139 ** | −0.020 | −0.075 * | −0.141 *** | 0.071 ** | 0.027 |

| (−3.26) | (−2.22) | (−0.42) | (−1.94) | (−2.82) | (2.29) | (0.87) | |

| GS | −0.014 | 0.328 | −3.133 * | −3.366 *** | −1.468 | −0.093 | −1.223 |

| (−0.02) | (0.17) | (−1.88) | (−3.42) | (−1.15) | (−0.12) | (−1.53) | |

| FDI | 0.026 *** | 0.063 *** | 0.027 | 0.005 | −0.000 | −0.000 | 0.004 |

| (6.88) | (2.80) | (1.43) | (0.90) | (−0.03) | (−0.08) | (0.87) | |

| Finance | −0.083 *** | −0.165 *** | 0.021 | −0.058 ** | −0.126 *** | −0.037 * | −0.055 ** |

| (−2.83) | (−3.38) | (0.68) | (−2.12) | (−3.52) | (−1.68) | (−2.55) | |

| Market | 0.506 *** | 0.650 * | 0.170 | 0.240 | 0.119 | −0.108 | −0.228 |

| (2.73) | (1.83) | (0.84) | (1.32) | (0.51) | (−0.74) | (−1.60) | |

| Constant | 1.716 *** | 1.912 *** | 0.571 | 1.414 *** | 2.387 *** | 3.168 *** | 4.513 *** |

| (5.83) | (3.70) | (1.42) | (4.57) | (5.95) | (12.74) | (12.09) | |

| Observations | 108 | 81 | 81 | 270 | 270 | 270 | 270 |

| R-squared | 0.752 | 0.657 | 0.387 | 0.384 | 0.509 | 0.180 | 0.251 |

| F | 45.52 | 21.04 | 6.953 | 24.28 | 40.45 | 8.569 | 11.13 |

| Threshold Variables | Models | F-Value | p-Value | Number of BS | 1% Threshold | 5% Threshold | 10% Threshold |

|---|---|---|---|---|---|---|---|

| DIF | Single threshold | 106.78 *** | 0.000 | 500 | 19.798 | 15.379 | 13.819 |

| double threshold | 29.08 *** | 0.000 | 500 | 17.222 | 11.565 | 9.867 | |

| three threshold | 14.22 | 0.326 | 500 | 38.087 | 28.764 | 24.032 | |

| DIF_B | Single threshold | 127.48 *** | 0.000 | 500 | 17.371 | 13.526 | 11.834 |

| double threshold | 12.11 ** | 0.032 | 500 | 14.769 | 11.146 | 9.505 | |

| three threshold | 11.24 | 0.382 | 500 | 26.899 | 21.572 | 18.915 | |

| DIF_D | Single threshold | 127.52 *** | 0.000 | 500 | 34.791 | 29.221 | 27.075 |

| double threshold | 18.79 ** | 0.024 | 500 | 21.047 | 16.968 | 14.526 | |

| three threshold | 19.11 | 0.674 | 500 | 56.153 | 44.055 | 38.646 |

| Threshold Variables | Models | Threshold Estimates | 95% Confidence Interval | |

|---|---|---|---|---|

| DIF | Single threshold | 5.3735 | 5.3685 | 5.3802 |

| double threshold | 5.5273 | 5.5009 | 5.5403 | |

| DIF_B | Single threshold | 5.2965 | 5.2832 | 5.3192 |

| double threshold | 5.4681 | 5.4369 | 5.4801 | |

| DIF_D | Single threshold | 2.5463 | 2.5463 | 4.1307 |

| double threshold | 5.2894 | 5.2825 | 5.3038 | |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| LnDIF (LnDIF ≤ 5.3735) | −0.022 * | ||

| (−1.73) | |||

| LnDIF (5.3735 < LnDIF ≤ 5.5273) | −0.036 ** | ||

| (−2.68) | |||

| LnDIF (5.5273 < LnDIF) | −0.048 *** | ||

| (−3.64) | |||

| LnDIF_B (LnDIF_B ≤ 5.2965) | −0.007 | ||

| (−0.59) | |||

| LnDIF_B (5.2965 < LnDIF_B ≤ 5.4681) | −0.024 * | ||

| (−1.84) | |||

| LnDIF_B (LnDIF_B > 5.4681) | −0.032 ** | ||

| (−2.61) | |||

| LnDIF_D (LnDIF_D ≤ 2.5463) | −0.137 *** | ||

| (−5.00) | |||

| LnDIF_D (2.5463 < LnDIF_D ≤ 5.2894) | −0.045 *** | ||

| (−2.49) | |||

| LnDIF_D (5.2894 < LnDIF_D) | −0.065 *** | ||

| (−4.39) | |||

| EDU | 0.019 | 0.007 | 0.003 |

| (0.44) | (0.17) | (0.07) | |

| GS | 1.025 | 0.855 | 0.470 |

| (1.03) | (0.85) | (0.53) | |

| FDI | 0.020 ** | 0.020 ** | 0.019 ** |

| (2.62) | (2.60) | (2.33) | |

| Finance | −0.045 | −0.064 * | −0.060 ** |

| (−1.43) | (−1.86) | (−2.21) | |

| Market | 0.133 | 0.031 | 0.209 |

| (0.96) | (0.21) | (1.58) | |

| Constant | 0.238 | 0.386 | 0.519 |

| (0.62) | (1.01) | (1.52) | |

| Observations | 270 | 270 | 270 |

| R-squared | 0.729 | 0.714 | 0.742 |

| F | 17.90 | 16.14 | 18.28 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiong, M.; Li, W.; Jenny, C.; Wang, P. Financial Inclusion through Digitalization: Improving Emerging Drivers of Industrial Pollution—Evidence from China. Sustainability 2023, 15, 10203. https://doi.org/10.3390/su151310203

Xiong M, Li W, Jenny C, Wang P. Financial Inclusion through Digitalization: Improving Emerging Drivers of Industrial Pollution—Evidence from China. Sustainability. 2023; 15(13):10203. https://doi.org/10.3390/su151310203

Chicago/Turabian StyleXiong, Mingzhao, Wenqi Li, Chenjie Jenny, and Peixu Wang. 2023. "Financial Inclusion through Digitalization: Improving Emerging Drivers of Industrial Pollution—Evidence from China" Sustainability 15, no. 13: 10203. https://doi.org/10.3390/su151310203

APA StyleXiong, M., Li, W., Jenny, C., & Wang, P. (2023). Financial Inclusion through Digitalization: Improving Emerging Drivers of Industrial Pollution—Evidence from China. Sustainability, 15(13), 10203. https://doi.org/10.3390/su151310203