Analysis of the Impact of Carbon Emission Control on Urban Economic Indicators based on the Concept of Green Economy under Sustainable Development

Abstract

1. Introduction

2. Theory and Model Analysis

2.1. Related Theoretical Basis Analysis

2.1.1. Sustainable Development Theory

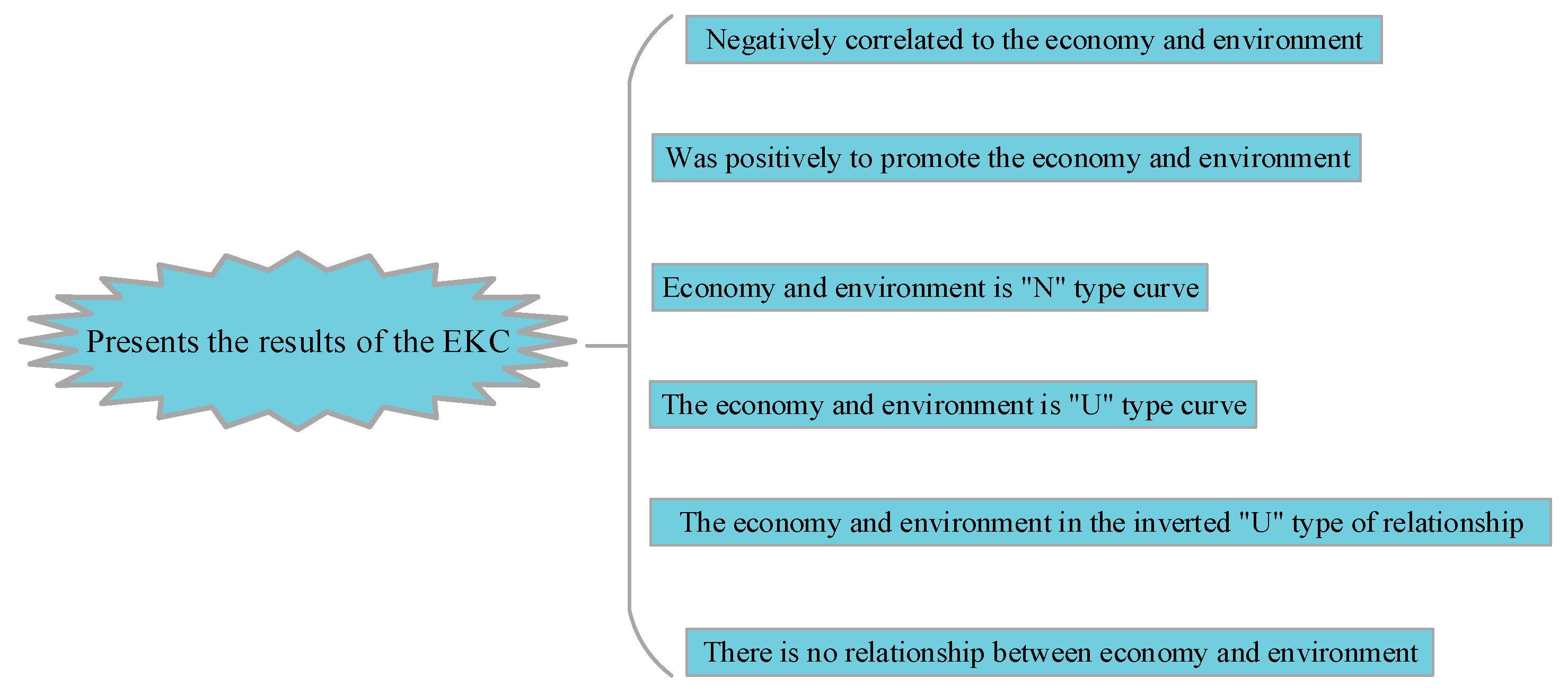

2.1.2. Kuznets Curve

2.2. Model-Building

2.2.1. Accounting Equation of Potential Growth

2.2.2. State-Space Model

2.3. Index Selection and Data Description

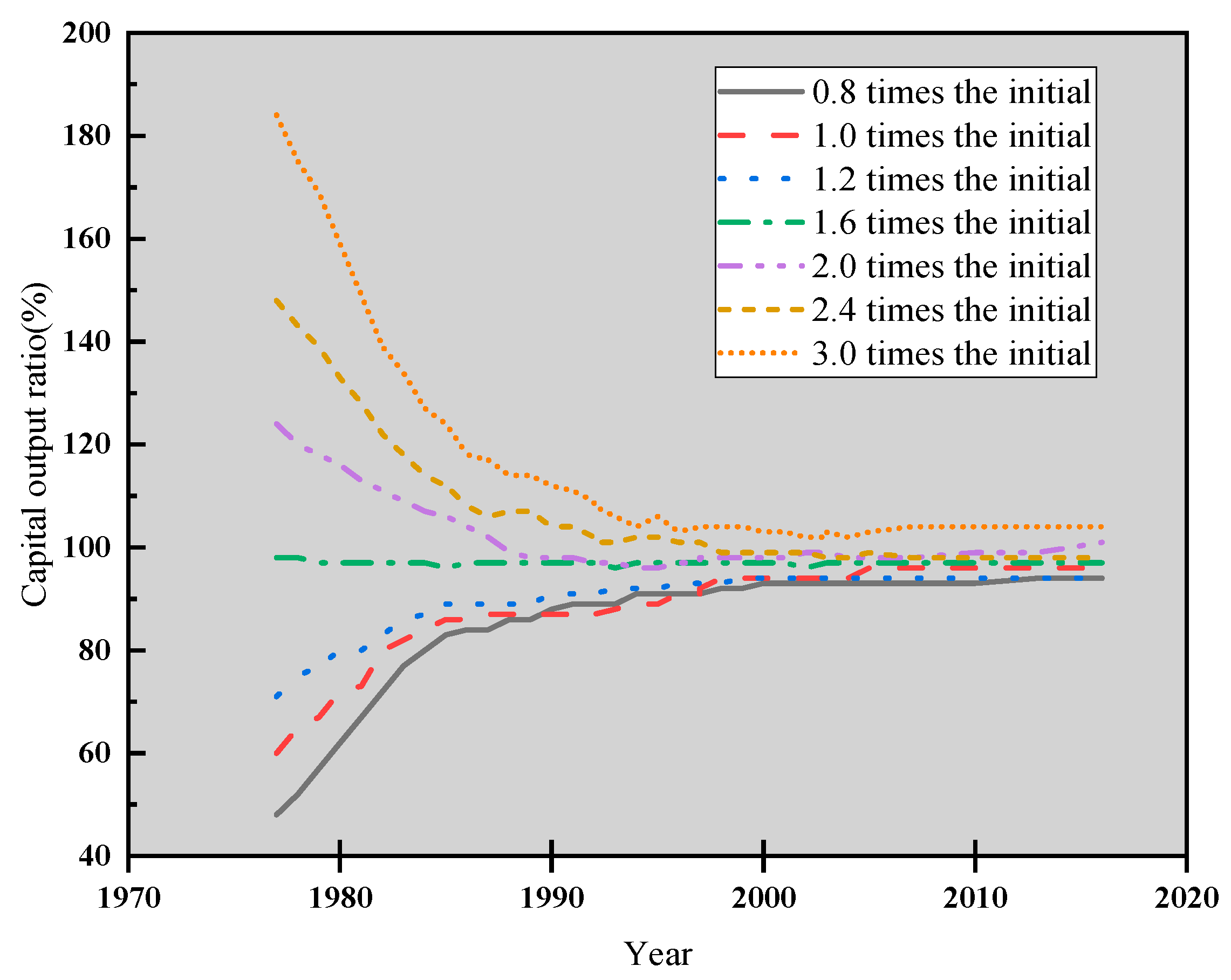

2.3.1. Estimation of Capital Stock

2.3.2. Y (Actual Output)

2.3.3. L (Labor)

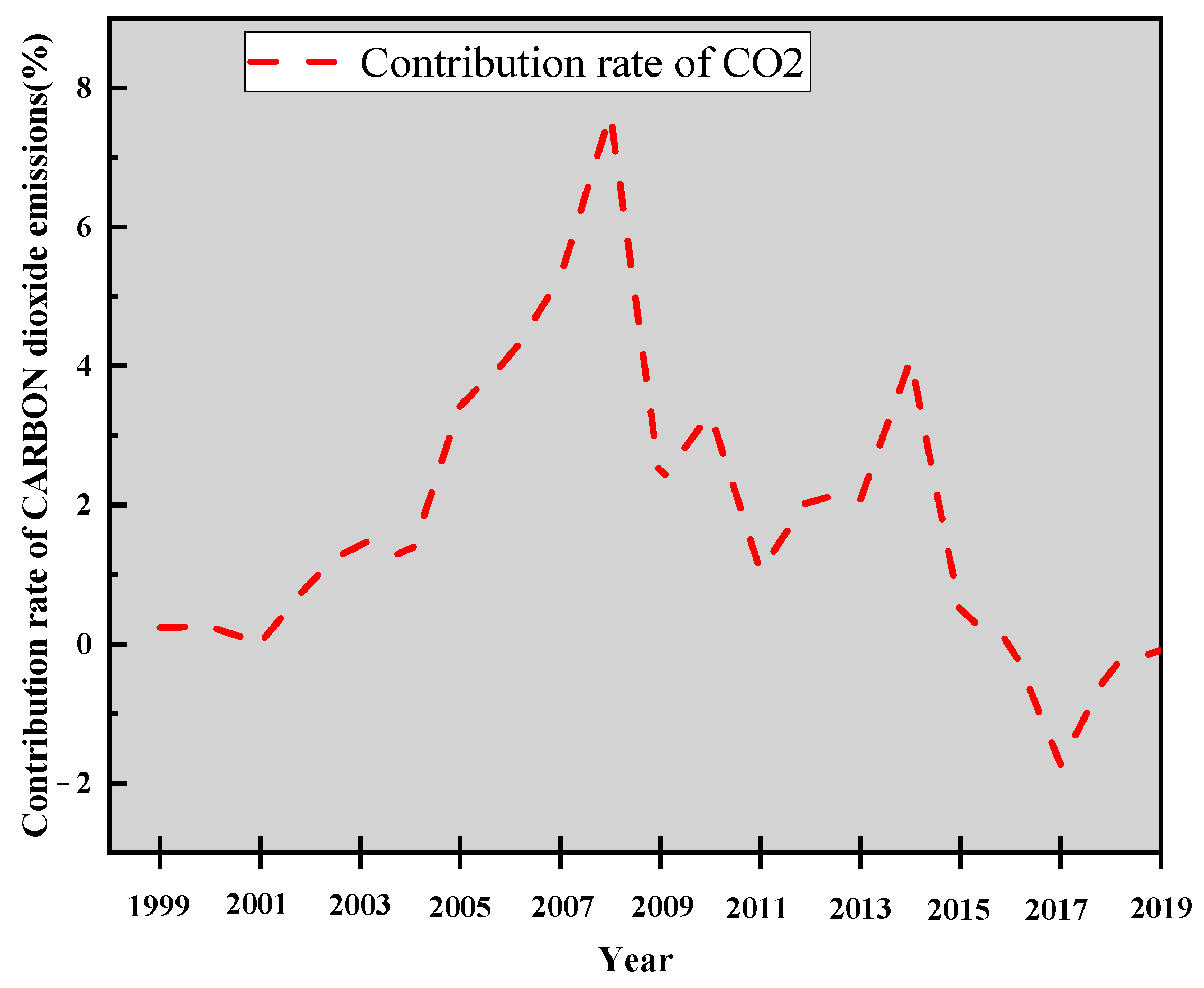

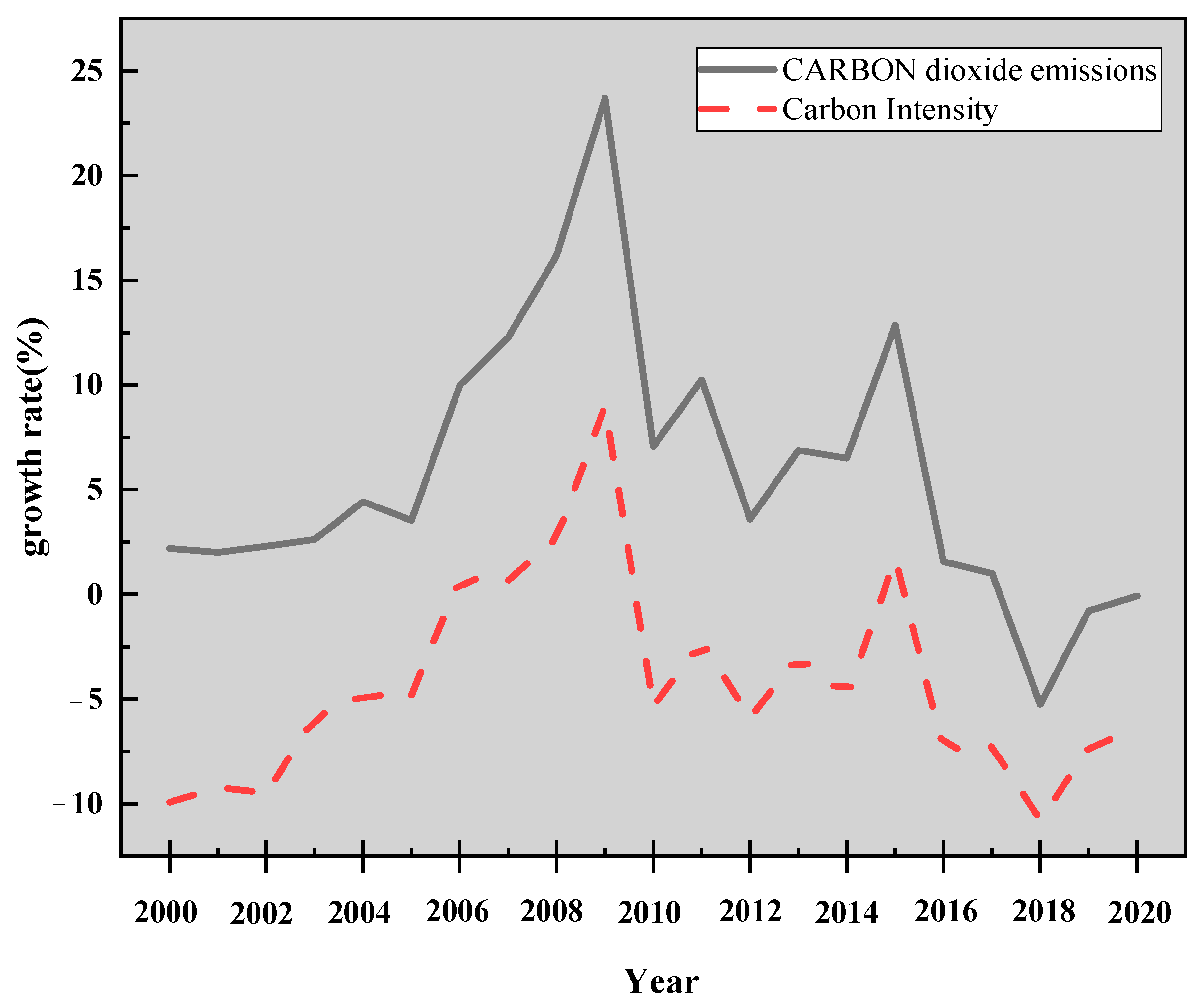

2.3.4. CO2 Emissions

2.4. Impact of Low Carbon Transformation on Economic Growth under the Endogenous Growth Model

3. Calculation of Potential Output and Economic Growth Rate of Hebei Province under Carbon Emission Control

3.1. Model Solution of the Impact of Carbon Emission Control on Economic Growth

3.1.1. Calculation Results of the Endogenous Growth Model

3.1.2. Determination of Capital Stock and CO2 in the Base Period

3.1.3. Analysis of Model Results

3.2. Budget of Potential Output in Hebei Province from 1999 to 2020

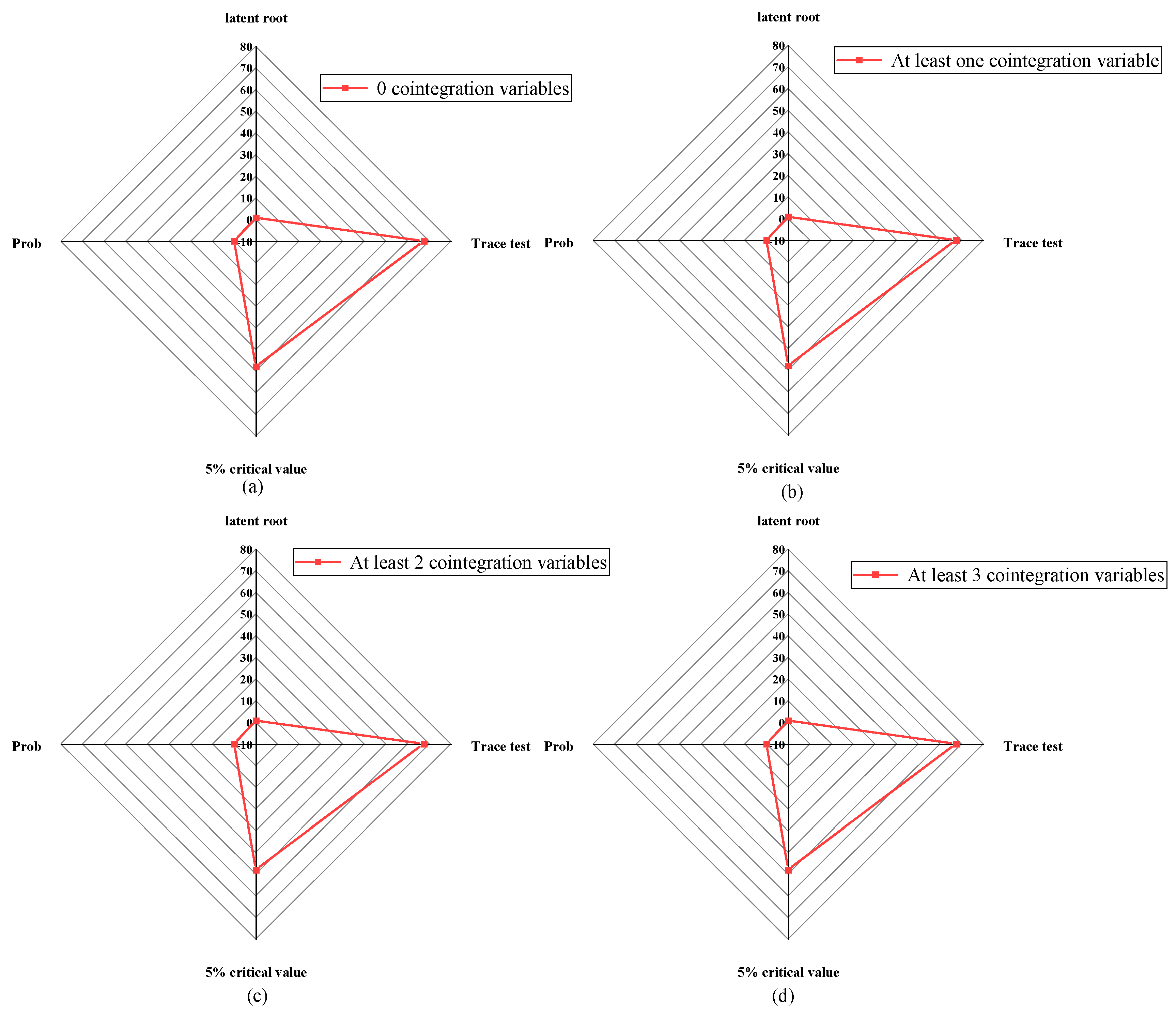

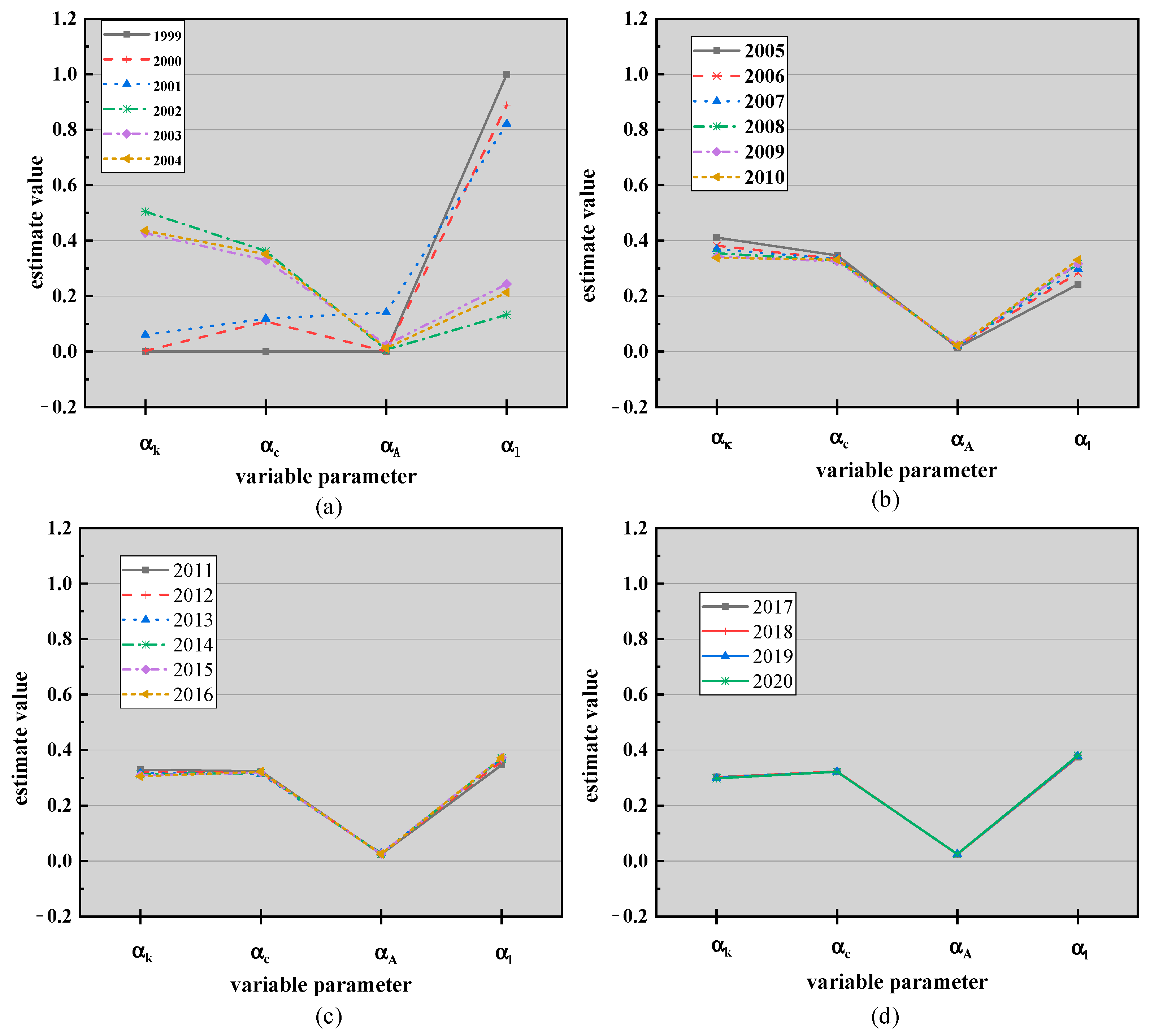

3.2.1. Estimation of Output Elasticity of Each Factor

3.2.2. Estimation of Potential Outputs

3.3. Prediction of Potential Economic Growth Rate in Hebei Province under the Control of Low-Carbon Transformation

3.3.1. Prediction Analysis on Changes of the Growth Rate of Various Factors

3.3.2. Prediction

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Hughes, T.P.; Kerry, J.T.; Álvarez-Noriega, M.; Álvarez-Romero, J.G.; Anderson, K.D.; Baird, A.H.; Babcock, R.C.; Beger, M.; Bellwood, D.R.; Berkelmans, R.; et al. Global warming and recurrent mass bleaching of corals. Nature 2017, 543, 373–377. [Google Scholar] [CrossRef]

- Donnelly, C.; Greuell, W.; Andersson, J.; Gerten, D.; Pisacane, G.; Roudier, P.; Ludwig, F. Impacts of climate change on European hydrology at 1.5, 2 and 3 degrees mean global warming above preindustrial level. Clim. Chang. 2017, 143, 13–26. [Google Scholar] [CrossRef]

- Sagna, K.; Amou, K.A.; Boroze, T.T.E.; Kassegne, D.; d’Almeida, A.; Napo, K. Environmental pollution due to the operation of gasoline engines: Exhaust gas law. Int. J. Oil Gas Coal. Eng. 2017, 5, 39–43. [Google Scholar] [CrossRef]

- Ali, E.B.; Anufriev, V.P.; Amfo, B. Green economy implementation in Ghana as a road map for a sustainable development drive: A review. Sci. Afr. 2021, 12, e00756. [Google Scholar] [CrossRef]

- Yang, Q.; Du, Q.; Razzaq, A.; Shang, Y. How volatility in green financing, clean energy, and green economic practices derive sustainable performance through ESG indicators? A sectoral study of G7 countries. Resour. Policy 2022, 75, 102526. [Google Scholar] [CrossRef]

- Falcone, P.M.; Hiete, M.; Sapio, A. Hydrogen economy and sustainable development goals: Review and policy insights. Curr. Opin. Green Sustain. Chem. 2021, 31, 100506. [Google Scholar] [CrossRef]

- Karintseva, O.; Kharchenko, M.; Boon, E.K.; Derykolenko, O.; Melnyk, V.; Kobzar, O. Environmental determinants of energy-efficient transformation of national economies for sustainable development. Int. J. Glob. Energy Issues 2021, 43, 262–274. [Google Scholar] [CrossRef]

- Suparjo Suparjo, S.D.; Kurniadin, N.; Kasuma, J.; Priyagus, P.; Darma, D.C.; Haryadi, H. Indonesia’s New SDGs Agenda for Green Growth–Emphasis in the Energy Sector. Int. J. Energy Econ. Policy 2021, 11, 395–402. [Google Scholar] [CrossRef]

- Bormann, I.; Nikel, J. How education for sustainable development is implemented in Germany: Looking through the lens of educational governance theory. Int. Rev. Educ. 2017, 63, 793–809. [Google Scholar] [CrossRef]

- Niu, Q.; Yu, L. Environment, development and sustainability a multidisciplinary approach to the theory and practice of sustainable development. Environ. Dev. Sustain. 2021, 22, 2069–2085. [Google Scholar] [CrossRef]

- Capra, F.; Jakobsen, O.D. A conceptual framework for ecological economics based on systemic principles of life. Int. J. Soc. Econ. 2017, 44, 831–844. [Google Scholar] [CrossRef]

- Bartkowski, B.; Lienhoop, N. Beyond rationality, towards reasonableness: Enriching the theoretical foundation of deliberative monetary valuation. Ecol. Econ. 2018, 143, 97–104. [Google Scholar] [CrossRef]

- Cohen, M.A.; Tubb, A. The impact of environmental regulation on firm and country competitiveness: A meta-analysis of the porter hypothesis. J. Assoc. Environ. Resour. Econ. 2018, 5, 371–399. [Google Scholar] [CrossRef]

- Leeuwen, G.; Mohnen, P. Revisiting the Porter hypothesis: An empirical analysis of green innovation for the Netherlands. Econ. Innov. New Technol. 2017, 26, 63–77. [Google Scholar] [CrossRef]

- Beşe, E.; Kalayci, S. Environmental Kuznets curve (EKC): Empirical relationship between economic growth, energy consumption, and CO2 emissions: Evidence from 3 developed countries. Panoeconomicus 2021, 68, 483–506. [Google Scholar] [CrossRef]

- Crafts, N.; Woltjer, P. Growth accounting in economic history: Findings, lessons and new directions. J. Econ. Surv. 2021, 35, 670–696. [Google Scholar] [CrossRef]

- Vospernik, S. Basal area increment models accounting for climate and mixture for Austrian tree species. For. Ecol. Manag. 2021, 480, 118725. [Google Scholar] [CrossRef]

- Harris, R.; Moffat, J. The UK productivity puzzle, 2008–2012: Evidence using plant-level estimates of total factor productivity. Oxf. Econ. Pap. 2017, 69, 529–549. [Google Scholar] [CrossRef]

- Svensson, A.; Schön, T.B. A flexible state–space model for learning nonlinear dynamical systems. Automatica 2017, 80, 189–199. [Google Scholar] [CrossRef]

- Ohkita, M.; Bando, Y.; Nakamura, E.; Itoyama, K.; Yoshii, K. Audio-Visual Beat Tracking Based on a State-Space Model for a Robot Dancer Performing with a Human Dancer. J. Robot. Mechatron. 2017, 29, 125–136. [Google Scholar] [CrossRef]

- Nowakowski, M.; Cohen, E.; Horodecki, P. Entangled histories versus the two-state-vector formalism: Towards a better understanding of quantum temporal correlations. Phys. Rev. A 2018, 98, 032312. [Google Scholar] [CrossRef]

- Delgado, M.S.; McCloud, N. Foreign direct investment and the domestic capital stock: The good–bad role of higher institutional quality. Empir. Econ. 2017, 53, 1587–1637. [Google Scholar] [CrossRef]

- Berlemann, M.; Wesselhöft, J.E. Aggregate capital stock estimations for 122 countries: An update. Rev. Econ. 2017, 68, 75–92. [Google Scholar] [CrossRef]

- Vander Donckt, M.; Chan, P.; Silvestrini, A. A new global database on agriculture investment and capital stock. Food Policy 2021, 100, 101961. [Google Scholar] [CrossRef]

- Dong, Q.; Murakami, T.; Nakashima, Y. Estimating China’s agricultural capital stock from 1952 to 2012. Reg. Sect. Econ. Stud. 2018, 18, 53–70. [Google Scholar]

- Jianu, I. The share price and investment: Current footprints for future oil and gas industry performance. Energies 2018, 11, 448. [Google Scholar] [CrossRef]

- Aganbegyan, A.G. Investments in fixed assets and human capital: Two interconnected drivers of socioeconomic growth. Stud. Russ. Econ. Dev. 2017, 28, 361–363. [Google Scholar] [CrossRef]

- Hartwig, J. “Relative movements of real wages and output”—How does Keynes’s 1939 essay relate to his theory of effective demand? J. Hist. Econ. Thought 2017, 39, 257–270. [Google Scholar] [CrossRef]

- Khalil, A.; Rajab, Z.; Amhammed, M.; Asheibi, A. The benefits of the transition from fossil fuel to solar energy in Libya: A street lighting system case study. Appl. Sol. Energy 2017, 53, 138–151. [Google Scholar] [CrossRef]

- Santosa, P.I.; Pranatal, E. Study of emission quantification in catamaran fishing vessels based on fossil energy. J. Phys. 2021, 1833, 012042. [Google Scholar] [CrossRef]

- Cozzi, G. Endogenous growth, semi-endogenous growth... or both? A simple hybrid model. Econ. Lett. 2017, 154, 28–30. [Google Scholar] [CrossRef]

- Gupta, R.; Stander, L. Social Status, Inflation and Endogenous Growth in A Cash-in-Advance Economy: A Reconsideration using the Credit Channel. Manch. Sch. 2018, 86, 622–640. [Google Scholar] [CrossRef]

- Liu, Y.; Xu, R.X.; Zhang, H.D.; Yan, Y. Dissipaton equation of motion theory versus Fokker-Planck quantum master equation. Chin. J. Chem. Phys. 2018, 31, 245. [Google Scholar] [CrossRef]

- Petrescu, F.I.T. Machine motion equations at the internal combustion heat engines. Am. J. Eng. Appl. Sci. 2015, 8, 127. [Google Scholar] [CrossRef]

- Bartosik, K.; Mycielski, J. The output employment elasticity and the increased use of temporary contracts: Evidence from Poland. Acta Oecon. 2020, 70, 83–104. [Google Scholar] [CrossRef]

- Oliveira, F.N.; Petrassi, M. Do financial crises erode potential output? A cross-country analysis of industrial and emerging economies. J. Econ. Stud. 2018, 45, 247–262. [Google Scholar] [CrossRef]

- Li, B.; Zhu, X. Forecast of maize production in Henan province. Am. J. Plant Sci. 2018, 9, 2276–2286. [Google Scholar] [CrossRef]

- Teguh, M.; Bashir, A. Indonesia’s Economic Growth Forecasting. Sriwij. Int. J. Dyn. Econ. Bus. 2019, 3, 134–145. [Google Scholar] [CrossRef]

- Wang, L.; Wang, Y.; Sun, Y.; Han, K.; Chen, Y. Financial inclusion and green economic efficiency: Evidence from China. J. Environ. Plan. Manag. 2022, 65, 240–271. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, S.; Li, T.; Cao, K. Analysis of the Impact of Carbon Emission Control on Urban Economic Indicators based on the Concept of Green Economy under Sustainable Development. Sustainability 2023, 15, 10145. https://doi.org/10.3390/su151310145

Xie S, Li T, Cao K. Analysis of the Impact of Carbon Emission Control on Urban Economic Indicators based on the Concept of Green Economy under Sustainable Development. Sustainability. 2023; 15(13):10145. https://doi.org/10.3390/su151310145

Chicago/Turabian StyleXie, Si, Tianshu Li, and Ke Cao. 2023. "Analysis of the Impact of Carbon Emission Control on Urban Economic Indicators based on the Concept of Green Economy under Sustainable Development" Sustainability 15, no. 13: 10145. https://doi.org/10.3390/su151310145

APA StyleXie, S., Li, T., & Cao, K. (2023). Analysis of the Impact of Carbon Emission Control on Urban Economic Indicators based on the Concept of Green Economy under Sustainable Development. Sustainability, 15(13), 10145. https://doi.org/10.3390/su151310145