Abstract

This article discusses developing methods for assessing environmental and socio-economic sustainability, using examples of mineral and raw materials sector companies in Northern Asia (Russia). We identified a sustainability criteria system and proposed an indicator system. These indicators represent a mechanism that orders the complex of existing indicators following the goals and strategy of sustainable development at the micro level. The proposed methodology for constructing a generalized index is based on aggregating three indicator blocks that characterize the environmental and socio-economic aspects of company development. The Sustainable Development Generalized Index (SDGI) allowed us to integrate the complex environmental and socio-economic development processes of mineral and raw materials sector companies and assess their sustainability. Its main feature is the reflection of the environmental specificity of companies. The indicator system adapted to the peculiarities of the mineral and raw materials sector development is a tool for identifying the main trends in the extractive industry development and determining the factors that positively or negatively affect the sustainable development of production companies. The obtained results have information significance for state structures in ensuring the regulation, planning, and control of the consequences of decisions made in the greening production activities at the micro level.

1. Introduction

Countries with mineral-rich economies often face economic underperformance, political instability, environmental degradation, and social inequality. In such economies, it is essential to balance economic growth with social and environmental considerations to overcome the negative impacts of resource abundance and achieve long-term sustainability [1,2]. Sustainable development (sustainability) [3] is the development that seeks to meet the needs of the present without compromising the ability of future generations to meet their own needs [4,5], considering socio-economic and environmental aspects (maintenance of the productive base of an economy relative to its population [6] and environmental quality [7]). The mineral resource sector greatly contributes to the Russian economy (12.8% in GDP structure in 2021) [8], creating jobs and ensuring economic stability in Northern Asia at the same time. Mining can cause severe environmental damage, such as water, soil, and air pollution, and land degradation, which negatively affects the quality of human life and ecosystems [9]. Many of the global challenges are related to the sustainability of industrial mining and water quality [10]. Some environmental damage from exploiting mineral resources, such as groundwater and heavy metal pollution, is challenging to eliminate once they occur. Studies on the multifaceted environmental impacts of mineral resource extraction have used various conceptual and methodological approaches [11,12]. The degree to which extractive industries affect regional ecosystems is highly variable, with various factors influencing the intensity of mining disturbances, including the type of ore extracted, the scale of production, the mining technique used, and the output duration [13]. Despite production volumes remaining unchanged, there exists a technological gap, a lack of effective environmental regulations and monitoring [14], and a dearth of development that, together with the absence of sustainability principles (social equity, resource and energy efficiency, use of integrated decision making, low carbon and low emissions, and maintaining economic growth) [15], implies that the pursuit of sustainable and environmentally friendly mining in Russia remains nascent [16,17].

Researchers use quantitative indicators and aggregate them into generalized indices to assess sustainability [18] and rational use of natural resources, measure the effectiveness of environmental protection activities, and plan and determine goals and priorities in the economy of regions [19]. Modern scientific research and publications dedicated to the development issues of the mining industry in Russia [20,21,22,23,24] consider the problems of the Siberian and Northern Asian regions and demonstrate the need to take into account regional features in the formation of state policies in the mineral resources sector. An increasing number of studies aim to green the mineral resource sector. Several studies [23,25,26,27,28,29,30,31,32,33] proposed different methods for assessing the sustainable development of production companies in the mineral resource sector by applying quantitative assessments and constructing generalized indices. The existing literature on sustainable indicators in the mineral resource sector has provided extensive information [34,35,36,37,38]; however, the abundance of indicators and varying descriptions have created a need for more clarity among practitioners, hindering their ability to make informed decisions and implement sustainability practices in mining operations. Nonetheless, there is still a need to investigate the assessment of sustainability in companies operating in the mineral resource sector of Northern Asia. Further development of established frameworks and methodologies is necessary to evaluate corporate sustainability in this context, considering the complexity arising from the lack of a universally embraced approach applicable to diverse contexts.

We aimed to assess the socio-economic and environmental sustainability of territorial subsoil users. International organizations such as the United Nations (including Sustainable Development Goals, which provide a framework for countries and organizations to work towards a more sustainable and equitable future for all), World Bank, IMF, G20, OECD, European Commission, and Asian Development Bank have developed approaches to analyze environmentally sustainable development at various levels of governance [39,40,41,42]. Following these approaches, in this study, we developed a novel methodology for diagnosing and evaluating the environmental and socio-economic sustainability of mineral resource sector companies in Northern Asia (Russia) based on calculating a single generalized index and integral assessments. The constructed Sustainable Development Generalized Index (SDGI) is a key tool that has allowed us to identify current trends and diagnose the pace of greening in the mining industry. The Northern Asian regions possess a rich mineral resource base. Based on the criteria system, we developed a set of indicators to organize the existing complex of indicators following the goals and strategy of sustainable development at the micro level. The adopted indicator system for the mineral resource sector is a tool for identifying major trends and determining the factors that positively or negatively impact the sustainable development of production companies. The proposed indicator system effectively assesses environmental production and develops an environmental strategy for mineral resource sector companies. We attempted to fill the existing gap in a comprehensive assessment of the sustainability of mineral resource sector companies. The theoretical contribution of this study is that by integrating sustainability principles into mining practices, the sector can contribute to the conservation of natural resources, the protection of ecosystems, and the improvement of social well-being to shape the development of mining in the future [43]. Thus, the scientific novelty of this research lies in the following directions: It is the first study that examines companies’ sustainability in Northern Asia’s mineral resource sector (Russia). In addition, we have developed a system of sustainability criteria for company development and proposed a set of indicators based on these criteria. The adapted indicator system, tailored to the specific characteristics of the mineral resource sector, serves as a tool for identifying key trends in achieving sustainable development goals. Finally, we have proposed a methodology for constructing the Sustainable Development Goals Index (SDGI) for companies, which enables the diagnosis and assessment of sustainable development achievements by calculating specific integrated indicators. SDGI for assessing company sustainability will allow for evaluating the degree of achievement of strategic goals in company development and can serve as a basis for planning and adjusting activities in areas that require specific development in this field. A particular set of indicators can be refined and supplemented depending on the research objectives and priorities of individual companies at each stage. The proposed approach can be further specified and interpreted by considering the distinctive objective features of the operating conditions in the mineral resource sector, such as natural climatic factors, transportation accessibility, geological conditions of mineral deposits, and their distribution. The obtained results have significant information for state structures in ensuring the regulation, planning, and control of the consequences of decisions made in greening production activities at the micro level. Initial data for this study were obtained from official data from annual reports, environmental reports, and reports on the sustainable development of leading subsoil users in the mineral resource sector of Northern Asia (Russia) for the period 2016–2021 [44,45,46,47,48,49,50].

2. Materials and Methods

2.1. Study Area

Northern Asia (Russia), or the Asian part of Russia, includes the Ural region, Siberia, the Russian Far East, and the Russian Arctic. It is renowned for its abundant natural resources, such as coal, oil, natural gas, gold, diamonds, and metals. The region also features extensive timber resources in the world’s largest coniferous forest, the taiga. These resources significantly affect regional development and a nation’s economic trajectory.

Mining industry enterprises differ significantly in terms of development conditions, factors, placement, and operational characteristics. Therefore, to assess the differentiation and ranking of sustainability indicators for mineral extraction in model regions of North Asia, we conducted a dynamic comparative analysis based on developed criteria and indicator systems. In this study, we selected benchmark companies from the mineral resources sector in Northern Asia based on several factors to assess the sustainability of the region’s mineral and raw materials sector over the analyzed period. These factors include:

- Types of mineral extraction, including hydrocarbon raw materials, coal, natural uranium, precious metals, and non-ferrous metals, with explored balance reserves according to categories A, B, and C2;

- Open publication of annual reports by companies;

- Open publication of annual environmental and sustainable development reports by companies for the analyzed period;

- Vertically integrated companies that are key to the development of the mineral resources sector in the model regions of North Asia;

- Companies with head offices located in the model regions of Northern Asia;

- Comparability of the indicators related to the environmental, social, and economic sustainability of the companies.

Thus, the leading subsoil users in Northern Asia, which are crucial for the development of the mining industry, were identified. These include PJSC Rosneft Oil Company and PJSC Surgutneftegas—oil industry; OJSC Severneftegazprom—a leading gas industry enterprise; JSC SUEK—coal industry; JSC Khiagda—uranium mining, PJSC Norilsk Nickel; PJSC Alrosa and PJSC Polymetal—precious metals; and PJSC Polyus—gold.

2.2. Research Methodology

We developed a methodology for assessing companies’ environmental and socio-economic sustainability in the mineral resource sector. Establishing a criteria system is essential to evaluate companies’ environmental and socio-economic sustainability. The methods to develop such a criteria system should incorporate parameters that are constrained within specified limits. A comprehensive representation of the necessary parameters can be achieved through a methodical approach to form indicators that accurately reflect the impact of mining activities on the environment.

The proposed methodology for developing sustainable development indicators is based on the identification of sustainability criteria and includes the following main stages:

- Justification, selection, and definition of individual development indicators for companies in the mineral and raw materials sector, considering their specificity;

- Ranking of individual indicators according to the qualitative criteria of the impact direction of companies on the environment;

- Analysis and evaluation of indicators from the perspective of confirming the accuracy and completeness of reproducing the sustainable development process of companies;

- Comprehensive evaluation of companies’ sustainability using developed indicators.

- Visualization of the obtained results.

Using these approaches to analyze environmentally sustainable development at various levels of governance proposed by international organizations, we developed a system of sustainability criteria for the mineral and raw material sector. Based on this criteria system, we developed a set of indicators to organize the existing complex of indicators in line with the goals and strategies of sustainable development at the micro level. The adopted indicator system is a tool for identifying key trends and determining factors that positively or negatively affect the sustainability of production companies in the mineral and raw materials sectors. All companies selected for assessment in the mineral and raw materials sectors are the largest integrated companies in Russia. They align their economic, environmental, and social priorities with the United Nations Sustainable Development Goals (UN SDGs). Therefore, the proposed indicator system is an effective tool for evaluating the greening of production and developing environmental strategies for such companies, incorporating priority qualitative criteria in line with their ecological and social policies to achieve the UN SDGs and their tangible contributions. Table 1 shows the qualitative criteria for the sustainability of companies in the mineral resource sector.

Table 1.

Qualitative criteria for the sustainability of companies in the mineral resource sector.

We provide some explanations regarding the definition of qualitative sustainability criteria for companies operating in the mineral resource sector of the economy. The criteria for economic sustainability include indicators that reflect investments directed toward environmental objectives. These indicators reflect economic sustainability as they are key factors in the development of companies. Investment in capital assets allows for the renewal of core production facilities and the financing and modernization of environmental protection facilities, ultimately enhancing long-term production efficiency.

We included indicators such as “level of waste utilization and disposal in own production” and “Specific emissions of greenhouse gases into the atmosphere per unit of extracted hydrocarbon raw materials” in the social sustainability assessment because, among the various influencing factors, environmental factors play a crucial role in shaping the quality of life and its fundamental component, health. In actual conditions, the adverse quality of the environment affects the population not in isolation but usually through the combined impact of key factors, such as chemical pollution of air, water, and industrial waste. The positive dynamics of these indicators, overall, aim to improve the level of societal well-being.

2.3. SDGI Calculating Methods

The stage of forming an indicator system for the studied objects in constructing the SDGI is one of the keys, and it is necessary to identify individual development indicators of mineral resource companies that can be controlled and managed. When selecting factor indicators, we took the following into account: the indicator should reflect the considered factor; be available in official statistics; have numerical values in one of the information bases; be easy to measure characteristics and provide the possibility of comparison; provide multidimensionality of measurement and take into account the structural features of the studied object; provide the possibility of constructing and interpreting integrated and summary indicators, characterizing the achievement of the goal. In addition, the SDGI reflects circular economy principles, as companies in their production practices employ technologies based on water recycling systems, secondary raw material processing, and a transition to renewable energy sources.

In the conducted research, constructing composite indices included procedures such as normalization and aggregation.

The transformation of individual indicators was carried out using normalized coefficients for each indicator within the block of indicators:

where Ki is the normalized coefficient of the ith indicator; maxi is the maximum value of the ith indicator; mini is the minimum value of the ith indicator (for the integral formula).

The described approach for calculating the composite indices allows for an independent assessment of the indicators in the sense that no weighting coefficients are established for the indicators; each indicator is evaluated separately, whereas the composite index equally considers the change of each indicator.

where —the normalized value of the ith indicator; xi—the indicator;

i = 1, …n—the number of features.

To determine the composite level of economic, eco-resource, and social sustainability, we calculated the geometric mean considering each indicator’s influence on the composite assessment.

where Icomposite—the composite index of the block; n—the total number of indicators; —the normalized value of the ith indicator.

SDGI was calculated as the arithmetic mean of the composite indices:

where Igeneral—SDGI of the company; m—the number of indicator blocks; Icomposite—the composite indicator of the block.

The level of sustainable development of companies in the mineral and raw materials sector in model regions of North Asia, determined by the expert method, was measured on a scale ranging from 0 to 5, with fixed upper and lower limits to position the research object in external and internal environments.

3. Results

3.1. Determining Composite Indicators of Company Sustainability and Constructing SDGI

Table 2 shows the sustainability performance over the past six years of enterprises operating in the mineral resources industry across Northern Asia, as measured by three composite indicators: economic, environmental and resource, and social sustainability. The data also include the company’s overall performance as measured by the Sustainable Development Generalized Index (SDGI).

Table 2.

Dynamics of composite and generalized sustainability indices of companies in the mineral resources sector in Northern Asia.

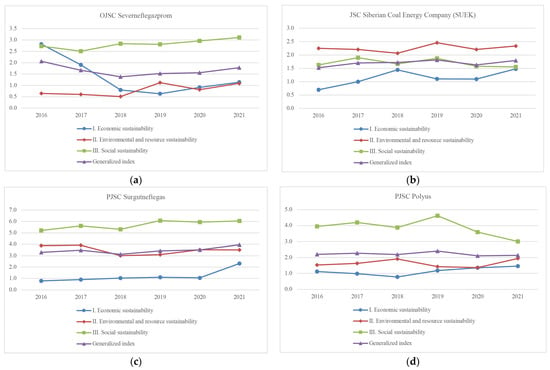

The results showed that eight out of nine companies demonstrated economic sustainability growth from 2016 to 2021, with the sharpest growth demonstrated by PJSC Surgutneftegas, which increased by almost three times. However, OJSC Severneftegazprom showed a significant decline in its economic sustainability, with a decrease of 59.4% during the same period. Also, companies observed an improvement in environmental and resource sustainability, with PJSC Norilsk Nickel demonstrating the most significant increase of more than two times, and PJSC Alrosa showing the lowest decline of 44.1%. Regarding social sustainability, more than half of the companies showed a decline, the sharpest being JSC Khiagda’s 32% decline in the 2016–2021 period, and PJSC Polymetal showed the highest increase (42.9%). This study calculated the Sustainable Development Generalized Index (SDGI), which combines three composite sustainability indices. The results indicated that OJSC Severneftegazprom had the lowest SDGI growth among the companies, with a 13.8% decline from 2016 to 2018. In contrast, PJSC Polymetal demonstrated the highest increase in the SDGI, with a 71.8% rise over the same period.

Figure 1 shows the dynamics of composite indices of environmental and socio-economic sustainability and the SDGI of companies in the mineral resource sector of the model regions of Northern Asia.

Figure 1.

Composite indices of environmental and socio-economic sustainability and SDGI of companies in the mineral resource sector.

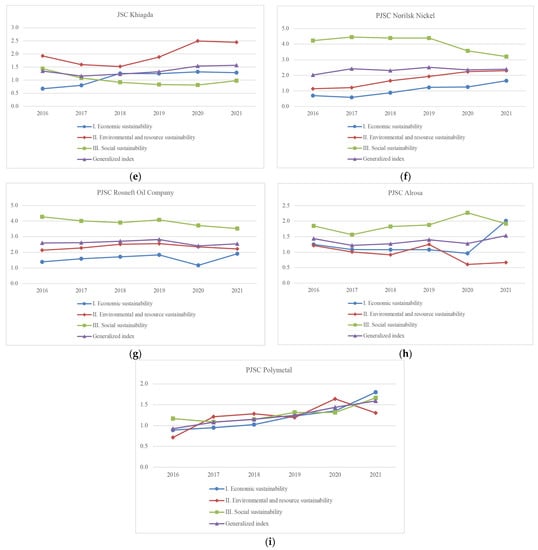

Figure 2 shows the SDGI dynamics of mineral resource sector companies from 2016 to 2021.

Figure 2.

SDGI dynamics of mineral resource sector companies.

3.2. Dynamics of Companies by SDGI Compared to Its Average Value

We identified companies with higher values of SDGI than the average values among the presented mining industry companies and obtained the following results (Table 3).

Table 3.

Deviation of the SDGI from its average value of companies in the mineral and raw materials sector for 2016–2021.

The analysis showed the greatest excess over the average value of the sustainable development generalized index demonstrated by PJSC Surgutneftegas; for example, in 2021, its value amounted to 1.812. PJSC Alrosa showed a sharp decrease to 0.610 in the average generalized index.

3.3. Determining the Position of Companies on the SDGI Scale

We developed an evaluation scale of threshold values for the sustainable development generalized index to monitor individual stages on the path to achieving (deviations in a negative or positive direction) sustainable development. Since we conducted the normalization of indicators based on the maximum and minimum values of the series, the constraints were already incorporated during the normalization stage. The methodological approach underlying the determination of the scale is based on a criterion-oriented method, in which the choice of scale depends on its purpose. Therefore, we defined whether a value was high or low relative to the average values of the obtained indicators. Without additional information about their representativeness, we assumed that higher values of the composite sustainability indices, compared to their average values determined by the expert method, were measured on a scale ranging from 0 to 5 (Table 4), with fixed upper and lower limits for positioning the research object in the external and internal environments.

Table 4.

Measurement scale of the mineral resource sector companies’ SDGI.

Based on the developed measurement scale of the sustainable development generalized index, we adopted the following typology of companies in the mineral and raw materials sector (Table 5).

Table 5.

Typology of companies in the mineral resource sector following the developed scale of assessments of SDGI.

The analysis shows that PJSC Surgutneftegas achieved a high level of environmental and socio-economic development, which corresponds well with sustainability goals. We also positively evaluated the sustainability of the development of PJSC Polyus, PJSC Norilsk Nickel, and PJSC Rosneft Oil Company. At the same time, this study shows that OJSC Severneftegazprom, JSC SUEK, JSC Khiagda, PJSC Alrosa, and PJSC Polymetal had the lowest values of the sustainable development generalized indices.

4. Discussion

1. The analysis and assessment of the environmental and socio-economic sustainability of the development of mineral resource companies showed the following. We found that the lowest value of the integrated indicator of the assessment of the level of economic development over the past period is in OJSC Severneftegazprom, which was influenced by external factors related to the decline in external and internal demand for petroleum products in the context of the global coronavirus pandemic, as well as due to Russia’s obligations to maintain national oil production at the level of quotas established within the framework of the agreement with the “OPEC+” countries. The decline in the composite economic sustainability index over the past period was 59.4%. This factor had the greatest impact on the decrease in the SDGI value of 13.8%.

Regarding the environmental and resource components of the SDGI, the highest composite index in 2019 was recorded for PJSC Surgutneftegas, which was 3.509, but this value decreased by 9.8% compared to 2016. We observed positive dynamics in PJSC Norilsk Nickel, where environmental and resource sustainability increased more than two times over the past period. The company implements programs in ecology and climate change, reducing emissions of SO2 and other specific indicators as follows: energy and water consumption, emissions of pollutants into the atmosphere, specific water consumption per unit of raw materials produced, and specific waste utilization.

The two leading Russian gold mining companies, PJSC Polyus and PJSC Polymetal, which are central enterprises located in Northern Asia, are dynamically developing. The analysis showed that they have high values for the composite economic sustainability index. The values for the composite environmental and resource sustainability index also tended to increase; for example, their growth from 2016 to 2021 was 127.1% and 181.7%, respectively. There is a continued increase in funding for gold exploration, which is due to, on the one hand, the depletion of deposits (no new deposits discovered in the last 30 years) and, on the other hand, the high price of gold. Investments in geological exploration have been carried out for solid minerals, including gold. Russia is among the top three leaders in terms of production volumes of this precious metal and among the top ten in terms of reserves. As uncertainty grows around the world, demand for gold is increasing. As a result, gold mining companies in Russia are increasing their gold production every year.

COVID-19-related restrictions have triggered lockdowns, an economic crisis, and decreased demand in the global diamond market. However, despite the difficult economic conditions, PJSC Alrosa has consistently reduced the burden on the environment and implemented new innovative developments and technologies. As a result, the company’s composite social sustainability index increased by 3.8%, primarily due to the growth in environmental protection costs, which amounted to 119.7%.

JSC SUEK is one of the largest coal producers. Coal mining and coal-fired power generation are associated with greenhouse gas emissions, so environmental problems must be addressed with a comprehensive scientific approach to ensure sustainable development. As a result, specific greenhouse gas emissions per unit of extracted raw material decreased by 39.5%, and there was an increase in environmental protection costs by 136.6% by 2019.

Overall, in the mineral and raw materials sector, the companies with the highest increase in environmental protection costs in % from 2015 to 2019 were the following: JSC Khiagda in 2016, JSC SUEK 2.3 times in 2017, JSC Khiagda 149.7% in 2018, PJSC Surgutneftegas 155.3% in 2019, and JSC Khiagda 3.0 times in 2020.

Uranium mining poses a radiation hazard primarily associated with airborne radionuclides. Sharp changes in specific greenhouse gas emissions per unit of extracted raw material were not observed for all the benchmark companies. JSC Khiagda, a prospective enterprise of the Uranium Holding “Atomredmetzoloto”, takes great responsibility for preserving the environment. The environmental policy is based on the principles of rational use of natural resources, conservation of the natural environment in areas of industrial activity, and improvement of radiation, environmental, and sanitary epidemiological control systems. At JSC Khiagda, specific greenhouse gas emissions per unit of extracted raw material decreased by 90.3% over the analyzed period, which was the best indicator among the considered companies. For example, in the summers of 2019 and 2020, fingerlings of sturgeon and char were grown on the company’s order. About 100 thousand fry were released into the Lake Baikal basin—the Selenga and Ina rivers. In addition, the enterprise carries out annual compensatory reforestation activities.

2. The development of the mineral and raw materials sector is associated with positive effects, such as employment opportunities, high levels of income, and infrastructure development [51]. However, it is essential to emphasize that using mineral resources frequently results in severe environmental impacts [52]. Therefore, environmental issues must be addressed with a comprehensive scientific approach to ensure sustainable development of the regions, including social development and improving people’s lives. Resolving existing contradictions requires a systemic analysis and assessment of the rationality of subsoil use and the development of a mechanism for regulating sustainable development of the mineral and raw materials sector, which should be directed towards environmentally oriented opportunities for economic growth.

3. Regarding the formation and regulation of the organizational structure, the contemporary features of the mineral and raw materials sector in Northern Asia (Russia) include the dominant role of vertically integrated companies; the formation of service market segments; weak development of small and medium-sized, innovation-oriented, mining, and specialized geological and exploration companies; an increasing focus on environmental sustainability; expansion into new regions; technological modernization; and government regulation and policy. Companies in the sector are adopting sustainable practices [53] and investing in green technologies to address environmental concerns while expanding their operations into new regions and implementing technological modernization to improve efficiency and reduce costs. These technologies can include advanced filtering systems, automated systems, and digitalization solutions that optimize production processes and reduce waste. One key approach to reducing emissions is cogeneration, which simultaneously produces heat and electricity from a single source. This approach allows for the maximum use of energy generated, thereby reducing emissions per unit of energy produced. Companies are also exploring and reducing emissions and waste at the pre-production stage by implementing the most advanced filtering systems. The Russian government regulates the sector through policies and regulations that aim to increase state control, encourage domestic processing of raw materials, and promote sustainable mining practices.

The main measures aimed at improving the environmental situation include the following:

- Investing in the development and implementation of technologies that increase production efficiency and environmental safety;

- Maximizing the generation of heat and electricity through cogeneration to reduce emissions per unit of energy;

- Continuing to take measures to reduce emissions at the pre-production stage, including installation of the most modern filters;

- Developing intersectoral cooperation to achieve goals for reducing emissions, discharges, and waste disposal.

4. Companies also develop intersectoral cooperation to achieve sustainability goals and work with other industries, such as energy and transportation, to reduce emissions and waste across the supply chain. By collaborating with partners across different sectors, companies can share best practices and achieve common goals for reducing the environmental impact. Russia’s mineral and raw materials sector addresses environmental concerns by investing in sustainable practices, maximizing energy generation through cogeneration, reducing emissions and waste at the pre-production stage, and developing intersectoral cooperation to achieve common sustainability goals.

The government’s economic development level of the mining location and the intensity of environmental regulations in place [54] can influence the power and scale of environmental impacts from mining activities. Weak governance can lead to unsustainable mining practices, corruption, and a lack of transparency and accountability, thus undermining sustainable development efforts. Therefore, ensuring that mining activities are subject to appropriate governance, regulation, and oversight is essential to promote sustainable development.

Materials are critical components of various industries that require decarbonization, including the primary energy production sector [55]. For example, the transition to a low-carbon development trajectory within the framework of Russia and China’s cooperation until 2030 will be based on increasing the share of gas in bilateral trade and gradually reducing the share of coal and oil. For China, decarbonization means primarily reducing coal use in the energy sector, which will allow reaching the peak of greenhouse gas emissions by 2030. China plans to achieve this goal by increasing the use of “transitional” fuel—gas—in the energy sector until 2060 when it intends to complete the transition to a low-carbon development trajectory. China’s “green transition” creates additional advantages for the Russian gas industry. Here, gas acts not only as an energy source but also as a carbon balance stabilizer. Joint projects of new gas pipelines, long-term contracts for gas supplies, and China’s investments in LNG (liquefied natural gas) projects in the Asian part of Russia guarantee Russian exporters a niche in the gas market in the next decade [56].

5. Mineral and raw material companies in Northern Asia should prioritize achieving sustainable development goals for the mining industry. This will establish corporate relationships with potential investors and other prominent international companies with a positive stimulating effect. Furthermore, the consolidation of the coal and energy sectors is necessary to control the impact of production activities on the environment. The challenges for the further development of coal industry companies are related to changes in global energy markets, the international sustainable development agenda, and the proliferation of new technologies [49,50]. In this regard, prompt action is required, particularly on the part of the mining sector. First, about 85% of the energy mines consume fossil fuels. In addition, the energy demand in the mining industry is rapidly increasing as ore grades in existing deposits decline, making the mining process more energy-intensive and water-intensive. These problems exacerbate the transition to green energy, which must be mineral-intensive [57]. One effective measure for obtaining low-cost and clean energy is to maximize the implementation of renewable energy sources, such as wind, solar and geothermal power, diversifying energy sources to reduce downtime, and replacing diesel generators.

6. The developed methodology for assessing the environmental and socio-economic sustainability of the mineral and raw materials sector companies of Northern Asia will serve as an important tool for decision makers, allowing them to control the availability of natural resources in the regions where they are extracted, and how the resource base changes and is used over time for internal consumption and export purposes. This information is also practically significant for government structures in determining the sustainability of environmental protection regulations aimed at reducing pollution levels at the micro level and ensuring the regulation, planning, and control of the consequences of decisions made. The government should take measures to develop sustainable development reports for companies, such as conducting techno-economic justifications and implementing projects in the mineral and raw materials sector. Decision-making processes based on sustainable development principles ensure better compliance with laws in the management of natural resources policies and consider a wide range of issues related to local knowledge and the interests of different segments and groups of the population. However, the knowledge and social and economic conditions regarding developing and using natural resources constantly change. As a result, natural resource development policies are more successful in terms of the long-term perspective only if they can reflect and adapt to these changes. Inflexible policies for managing natural resources mean missed opportunities in economic development sustainability, prosperity levels, and the environmental state [24].

7. One of the main prerequisites for mineral and raw material sector companies to transition to a sustainable development trajectory is to introduce the necessary flexibility into the system of state management and regulation of the processes of exploration and use of Russia’s mineral and raw material potential, considering the current conditions. In this regard, approximating decision-making centers to the places of actual economic activity is a fundamental issue. This means expanding the degree of participation in such processes by regional management bodies of subsoil use, including the involvement of resource territories, namely, federation subjects, municipalities, and companies engaged in the extraction of minerals.

5. Conclusions

The proposed SDGI and indicator assessments of sustainable development for companies in the mineral and raw materials sector of Northern Asia (Russia) allow the evaluation of the degree of strategic goals achieved in the development of new deposits of mineral resources, as well as the assessment of the effectiveness of integrating environmental, economic, and social aspects into decision-making processes at the corporate level. An evaluation based on the proposed generalized index should become an information base for regulating and timely adjusting the production activities of mining companies to achieve sustainable development. Generalized and composite indices of sustainable development for the mineral and raw materials sectors are consistent with each other and accessible for making management decisions at all levels, starting from the corporate level. The obtained SDGI indicator can be modified depending on the goals and objectives set at each stage of the sustainable development policy of companies. The proposed approach can be further refined, specified, and interpreted by considering the conditions in the mineral resource industry, such as natural climatic factors, transportation accessibility, geological conditions of mineral deposits, and their distribution. This methodology has the potential for broader applicability and can contribute to promoting sustainable development practices beyond the scope of this study. In further research, it is necessary to enhance the proposed approach to indicator development by including measures that characterize the level of worker safety and health. These measures can be identified as a separate block of indicators under the qualitative criteria of occupational safety, industrial security, and occupational injuries, strengthening the assessment of companies’ social sustainability.

Author Contributions

Conceptualization, A.B., S.D. and E.S.; methodology, E.S.; software, A.B. and E.S; validation, S.D., F.L., A.T., A.M. and V.B.; formal analysis, A.B. and E.S.; investigation, A.B. and E.S.; resources, S.D.; data curation, A.B.; writing—original draft preparation, A.B. and E.S.; writing—review and editing, S.D. and F.L.; visualization, A.B.; supervision, S.D., F.L., A.T., A.M. and V.B.; project administration, S.D.; funding acquisition, S.D. and F.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Science and Technology Fundamental Resources Investigation Program of China (2022FY101904), National Natural Science Foundation of China (NSFC-MFST32161143029), National Natural Science Foundation of China (Grant number 32161143029), Key Collaborative Research Program of the Alliance of International Science Organizations (Grant number ANSO-CR-KP-2020-02, ANSO-CR-KP-2020-06), Class A Strategic Leading Science and Technology Project of Chinese Academy of Sciences (Grant number XDA20030203), Second Tibetan Plateau Scientific Expedition and Research Program (Grant No. 2019QZKK040303), and State assignment of BINM SB RAS (Grant number AAAA-A21-121011590039-6).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Auty, R.M. Sustaining Development in Mineral Economies: The Resource Curse Thesis; Routledge: London, UK, 1993; p. 288. [Google Scholar]

- Auty, R.M.; Mikesell, R.F. Sustainable Development in Mineral Economies; Oxford University Press: Oxford, UK, 1999; ISBN 9780198294870. [Google Scholar]

- Tuazon, D.; Corder, G.; Mclellan, B. Sustainable Development: A Review of Theoretical Contributions. Int. J. Sustain. Future Hum. Secur. 2013, 1, 40–48. [Google Scholar] [CrossRef]

- World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK, 1987; p. 400. [Google Scholar]

- Ardeleanu, G.; Petrariu, R. Sustainable development strategies. In Proceedings of the Agro-Food and Rural Economy Competitiveness in Terms of Global Crisis, Institute of Agriculture Economics, Belgrade, Serbia, 23 September 2011. [Google Scholar]

- Dasgupta, P. Measuring Sustainable Development: Theory and Application. Asian Dev. Rev. 2007, 24, 1–10. [Google Scholar]

- Barrow, C.J. Sustainable development: Concept, Value and practice. Third World Plan. Rev. 1995, 17, 369–386. [Google Scholar] [CrossRef]

- Information on the Production and Use of Gross Domestic Product (GDP) in 2021. Available online: https://rosstat.gov.ru/storage/mediabank/59_08-04-2022.htm (accessed on 20 May 2023).

- Avagyan, A. Environmental building policy by the use of microalgae and decreasing of risks for Canadian oil sand sector development. Environ. Sci. Pollut. Res. 2017, 24, 20241–20253. [Google Scholar] [CrossRef]

- Harris, J.; McCartor, A. The Top Ten of the Toxic Twenty. In The World’s Worst Toxic Pollution Problems. Available online: https://www.worstpolluted.org (accessed on 8 March 2023).

- Dou, S.; Xu, D.; Keenan, R.J. Effect of income, industry structure and environmental regulation on the ecological impacts of mining: An analysis for Guangxi Province in China. J. Clean. Prod. 2023, 400, 136654. [Google Scholar] [CrossRef]

- Boldy, R.; Santini, T.; Annandale, M.; Erskine, P.D.; Sonter, L.J. Understanding the impacts of mining on ecosystem services through a systematic review. Extr. Ind. Soc. 2021, 8, 457–466. [Google Scholar] [CrossRef]

- Werner, T.T.; Mudd, G.M.; Schipper, A.M.; Huijbregts, M.A.J.; Taneja, L.; Northey, S.A. Global-scale remote sensing of mine areas and analysis of factors explaining their extent. Glob. Environ. Chang. 2020, 60, 102007. [Google Scholar] [CrossRef]

- Bradshaw, M.J.; Connolly, R. Russia’s Natural Resources in the World Economy: History, review and reassessment. Eurasian Geogr. Econ. 2016, 57, 700–726. [Google Scholar] [CrossRef]

- Bilgaev, A.; Dong, S.; Li, F.; Cheng, H.; Tulohonov, A.; Sadykova, E.; Mikheeva, A. Baikal Region (Russia) Development Prospects Based on the Green Economy Principles. Sustainability 2021, 13, 157. [Google Scholar] [CrossRef]

- Dotsenko, E.; Ezdina, N.; Prilepskaya, A.; Pivnyk, K. Sustainable Development Strategy for Russian Mineral Resources Extracting Economy. E3S Web Conf. 2017, 21, 04014. [Google Scholar] [CrossRef]

- Tulokhonov, A.K. Political Geography of the Northern Asian States in the Globalization; EKOS: Ulan-Ude, Russia, 2014; p. 256. ISBN 978-5-905013-21-8. [Google Scholar]

- Semin, A.; Betin, O.; Namyatova, L.; Kireeva, E.; Vatutina, L.; Vorontcov, A.; Bagaeva, N. Sustainable Condition of the Agricultural Sector’s Environmental, Economic, and Social Components from the Perspective of Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 74. [Google Scholar] [CrossRef]

- Information for Sustainable Natural Resource Management: Key Considerations for Reformers in Eastern Europe, the Caucasus and Central Asia. Available online: https://www.oecd.org/env/outreach/2011_AB_Information%20for%20SRM%20in%20EECCA_ENG.pdf (accessed on 19 April 2023).

- Gladkevich, G.I. Resource consumption of industrial production in Russia as compared to foreign analogues. Vestn. Mosk. Univ. 2016, 5, 12–23. [Google Scholar]

- Zhukova, I.V. Mineral and Raw Materials Complex of the Far East: From Resources to the Industrial Base: Monograph; Far Eastern Institute of Management—Branch of RANEPA: Khabarovsk, Russia, 2019; p. 160. [Google Scholar]

- Kryukov, V.A.; Sevastyanova, A.E.; Tokarev, A.N. Mineral and Raw Materials Sector of Asian Russia: How to Ensure Socio-Economic Return; IEPP SB RAS: Novosibirsk, Russia, 2015; p. 351. [Google Scholar]

- Ponomarenko, T.V.; Pikalova, T.A.; Korotkiy, S.V. Integrated and Global Companies: Corporate Governance, Sustainable Development, Competitiveness (on the Example of Mineral and Raw Materials Complex Companies). Monograph; Publishing House of Polytechnic University: St. Petersburg, Russia, 2016; p. 302. [Google Scholar]

- Kuleshov, V.V. Resource Regions of Russia in the “New Reality”; IEPP SB RAS: Novosibirsk, Russia, 2017; p. 308. [Google Scholar]

- Basharatian, M.M. Tools and methods for analyzing the economically sustainable development of fuel and energy companies. Econ. Entrep. Law 2021, 11, 2485–2496. [Google Scholar] [CrossRef]

- Gutman, S.; Basova, A. Indicators of sustainable development of Russian Federation Arctic zone: Problems of selection and measurement. Arct. Ecol. Econ. 2017, 4, 32–48. [Google Scholar] [CrossRef]

- Gutman, S.S.; Ostapenko, A.V. Evaluation of the impact of Alrosa group on the sustainable development of the Sakha Republic (Yakutia). Sci. Bull. South. Inst. Manag. 2018, 4, 12–18. [Google Scholar] [CrossRef]

- Dudina, T.N.; Tarasova, O.S. The approaches to the development of regional frameworks of sustainable development indices and indicators. Achiev. Mod. Nat. Sci. 2022, 1, 23–29. [Google Scholar]

- Kaplan, A.V.; Tereshina, M.A. Mining enterprises social-economic sustainable development assessment. Russ. Coal J. 2018, 8, 86–90. [Google Scholar] [CrossRef]

- Klyushnikova, E.V.; Shitova, E.M. Methodological approaches to calculation the integral indicator, ranking methods. Electron. Sci.-Pract. J. InnoCenter 2016, 1, 4–18. [Google Scholar]

- Cherepovitsyn, A.E.; Tsvetkov, P.S.; Evseeva, O.O. Critical analysis of methodological approaches to assessing the sustainability of Arctic oil and gas projects. Notes Min. Inst. 2021, 249, 463–478. [Google Scholar] [CrossRef]

- Lepikhina, T.L.; Alikina, E.B.; Lepikhin, V.V. The impact of economic indicators on the environmental and social sustainability of industrial enterprises. Perm. Univ. Herald. Econ. 2014, 4, 86–92. [Google Scholar]

- Mayorova, T.V.; Ponomareva, O.S.; Pavlova, I.E. Sustainable development of metallurgical industry enterprises: Aspects, criteria, indicators. Bull. Nosov Magnitogorsk. State Tech. Univ. 2022, 20, 140–147. [Google Scholar] [CrossRef]

- Li, Y.; Barrueta Pinto, M.C.; Kumar, D. Analyzing sustainability indicator for Chinese mining sector. Resour. Policy 2023, 80, 103275. [Google Scholar] [CrossRef]

- Prasad, V.; Bandyopadhyay, G.; Adhikari, K.; Gupta, S.S. An Integrated Framework for Prioritizing Sustainability Indicators for the Mining Sector with a Multicriteria Decision-Making Technique. In Operations Research Forum; Springer International Publishing: Cham, Switzerland, 2022; Volume 4, pp. 1–44. [Google Scholar] [CrossRef]

- Carvalho, D.S.; Garnier, J.; Barreto, C.G.; Amorim, L.L. Sustainability Indicators and Indices in Mining: A Critical Approach. Int. J. Adv. Eng. Res. Sci. 2021, 8, 030–040. [Google Scholar] [CrossRef]

- Shaheen, M.; Shahbaz, M.; Guergachi, A.; Rehman, Z. Mining sustainability indicators to classify hydrocarbon development. Knowl. Based Syst. 2011, 24, 1159–1168. [Google Scholar] [CrossRef]

- Li, Z.; Zhao, Y.; Zhao, H. Assessment indicators and methods for developing the sustainability of mining communities. Int. J. Sustain. Dev. World Ecol. 2008, 15, 35S–43S. [Google Scholar] [CrossRef]

- United Nations Environment Programme (UNEP). The Emissions Gap Report 2016: A UNEP Synthesis Report; United Nations Environment Programme (UNEP): Nairobi, Kenya, 2016; Available online: https://www.unep.org/resources/report/emissions-gap-report-2016-unep-synthesis-report (accessed on 19 April 2023).

- The World Bank. The Economics of Adaptation to Climate Change: Synthesis Report; The International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2010; Available online: https://documents1.worldbank.org/curated/en/646291468171244256/pdf/702670ESW0P10800EACCSynthesisReport.pdf (accessed on 6 April 2023).

- World Economic Forum. The Global Risks Report 2017, 12th ed.; World Economic Forum: Geneva, Switzerland, 2017; Available online: https://www3.weforum.org/docs/GRR17_Report_web.pdf (accessed on 19 April 2023).

- Green Growth Indicators. 2017. Available online: https://www.oecd.org/environment/green-growth-indicators-2017-9789264268586-en.htm (accessed on 1 May 2023).

- Dubiński, J. Sustainable Development of Mining Mineral Resources. J. Sustain. Min. 2013, 1, 1–6. [Google Scholar] [CrossRef]

- Gold Mining Industry: Gold Prices and Growth Prospects. Available online: https://delprof.ru/press-center/open-analytics/zolotodobyvayushchaya-promyshlennost-tseny-na-zoloto-i-perspektivy-rosta/ (accessed on 21 January 2023).

- Ministry of Energy of the Russian Federation. Results of the work of Russia’s Fuel and Energy Complex 2016–2021. Available online: https://minenergo.gov.ru (accessed on 6 April 2023).

- Rosneft Annual Report 2016–2021. Available online: https://www.rosneft.com/Investors/Reports_and_presentations/Annual_reports/ (accessed on 21 January 2023).

- Surgutneftegas PJSC Annual Reports. Available online: https://www.surgutneftegas.ru/en/ (accessed on 20 January 2023).

- Nornickel Annual Reports. Available online: https://www.nornickel.com/investors/reports-and-results/annual-reports/ (accessed on 20 January 2023).

- SUEK Sustainable Development Report for 2018–2019. Available online: https://www.akm.ru/upload/akmrating/SUEK_sustainability_report_2018-2019.pdf (accessed on 20 December 2022).

- SUEK Sustainable Development Report for 2020–2021. Available online: https://www.suek.ru/upload/pdf/1674202400944472628_SUEK_2022_AnurepOUR_WWW_ver1.pdf (accessed on 20 December 2022).

- Ericsson, M.; Löf, O. Mining’s contribution to national economies between 1996 and 2016. Miner. Econ. 2019, 32, 223–250. [Google Scholar] [CrossRef]

- Sovacool, B.; Ali, S.H.; Bazilian, M.D.; Radley, B.; Nemery, B.; Okatz, J.; Mulvaney, D. Sustainable minerals and metals for a low-carbon future. Science 2020, 367, 30–33. [Google Scholar] [CrossRef]

- Ivic, A.; Saviolidis, N.M.; Jóhannsdóttir, L. Drivers of sustainability practices and contributions to sustainable development evident in sustainability reports of European mining companies. Discov. Sustain. 2021, 2, 17. [Google Scholar] [CrossRef]

- Ji, Y.; Lei, Y.; Li, L.; Zhang, A.; Wu, S.; Li, Q. Evaluation of the implementation effects and the influencing factors of resource tax in China. Resour. Policy 2021, 72, 102126. [Google Scholar] [CrossRef]

- COP 26 the Glasgow Climate Pact. Available online: https://ukcop26.org/wp-content/uploads/2021/11/COP26-Presidency-Outcomes-The-Climate-Pact.pdf (accessed on 19 April 2023).

- Kryukov, V.A.; Kryukov, Y.V. China’s and Russia’s energy sectors in the context of the transition to a low-carbon development trajectory. Spat. Econ. 2022, 18, 141–167. [Google Scholar] [CrossRef]

- Mining and the SDGs a 2020 Status Update. Available online: https://www.responsibleminingfoundation.org/app/uploads/RMF_CCSI_Mining_and_SDGs_EN_Sept2020.pdf (accessed on 15 April 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).