A Monitoring Method for Corporate Environmental Performance Based on Data Fusion in China under the Double Carbon Target

Abstract

1. Introduction

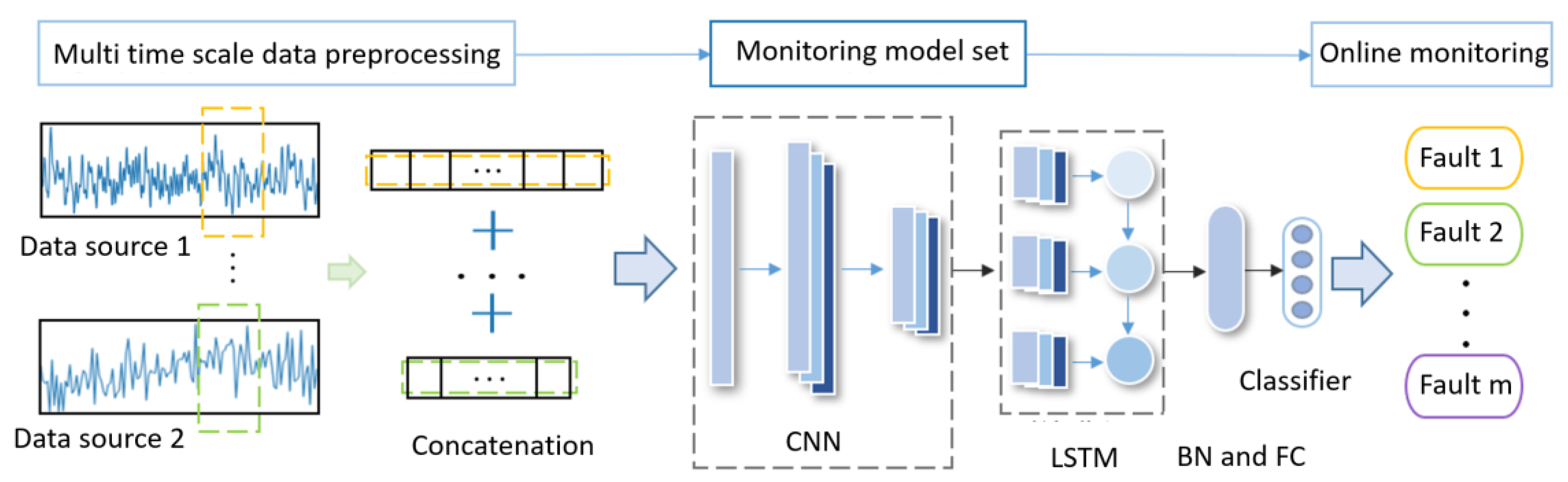

- (1)

- The proposed CNN-LSTM model uniformly vectorizes and fuses the multi-time scale corporate environmental performance data at the data level to avoid additional resampling.

- (2)

- By constructing an end-to-end integrated monitoring model, this proposed method can achieve the simultaneous optimization of feature extraction and monitoring of corporate environmental performance indicators. Additionally, the utilization of deep networks allows for automatic feature learning, eliminating the need for manual feature extraction.

- (3)

- This article innovatively combines empirical data from listed companies with multi-scale measurement data to monitor corporate environmental performance indicators. The study bridges the gap between corporate data and monitoring indicators and provides an efficient online method for ecological monitoring of corporate environmental performance.

2. Preliminaries

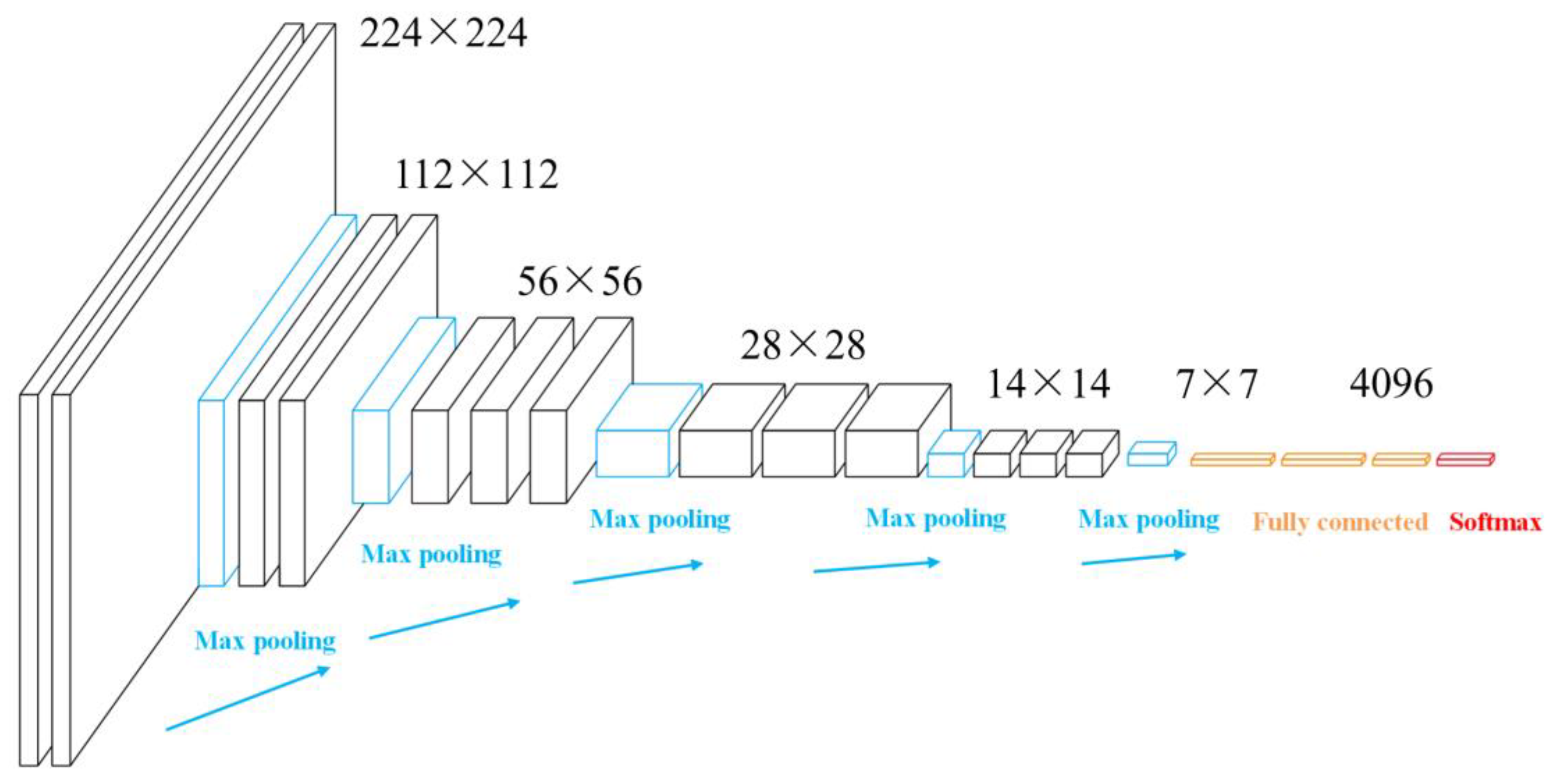

2.1. Convolutional Neural Networks

2.2. The Principles of Long Short-Term Memory Networks

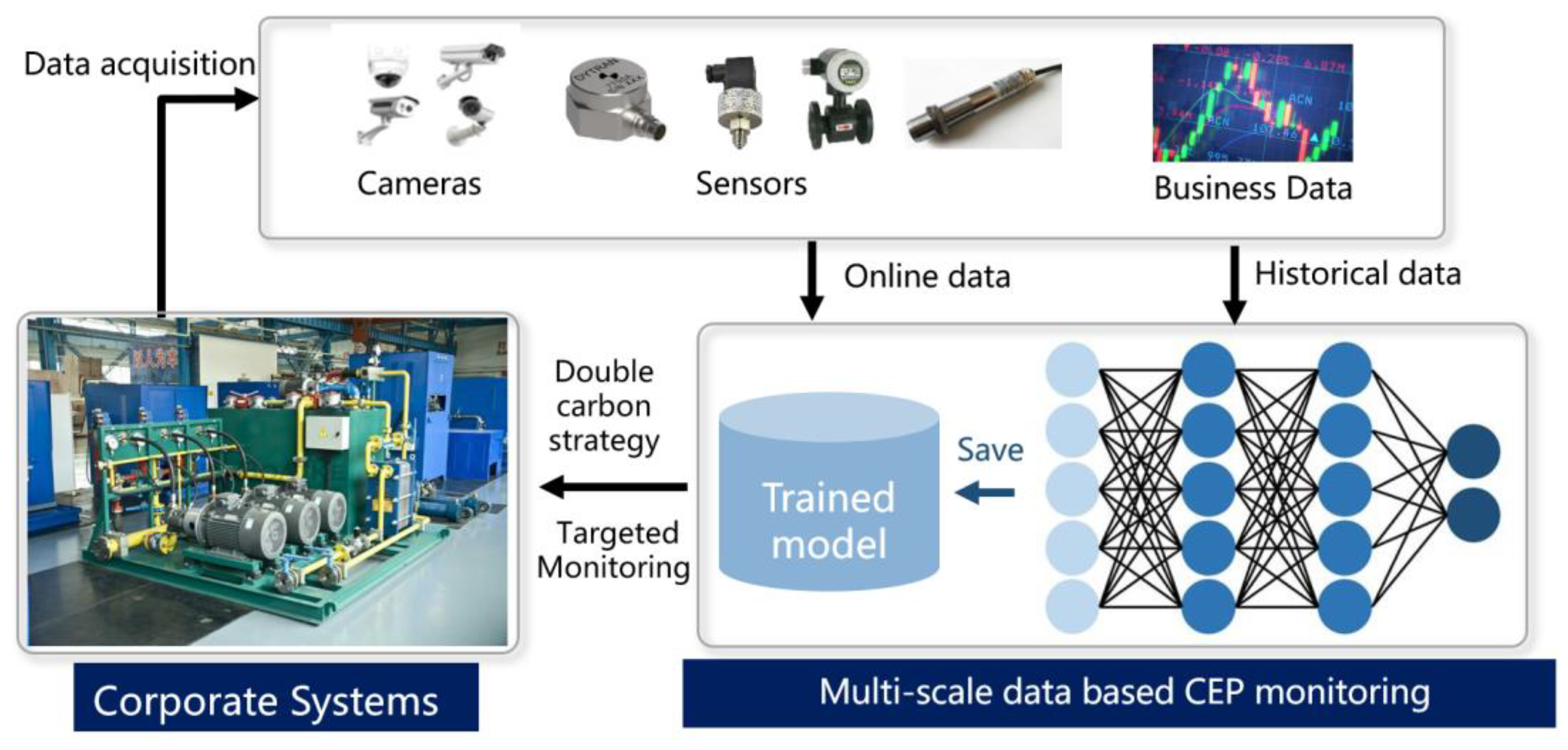

3. Corporate Environmental Performance Multi-Time Scale Monitoring Based on Improved CNN-LSTM

Algorithm Design

| Algorithm1: CNN-LSTM Monitoring Model Based on Data Hierarchy Fusion |

| Step 1: Data preprocessing: |

| Step 2: Preliminary extraction of feature R through a CNN portion with multiple convolutional layers and maximum pooling layers through (1–2). |

| Step 3: Construct the temporal correlation in feature R extracted by LSTM using Formula (8): |

| Step 4: Map H using fully connected layers: |

| Step 5: Batch standardization processing: , Step 6: Using a classifier to determine the monitoring categories of corporate environmental performance conditions: Sigmoid: Softmax: |

4. Variables

4.1. Corporate Environmental Performance

4.2. Monitoring Variables

5. Experiments

5.1. Data Resources

5.2. CNN-LSTM Model Parameter Setting and Discussion

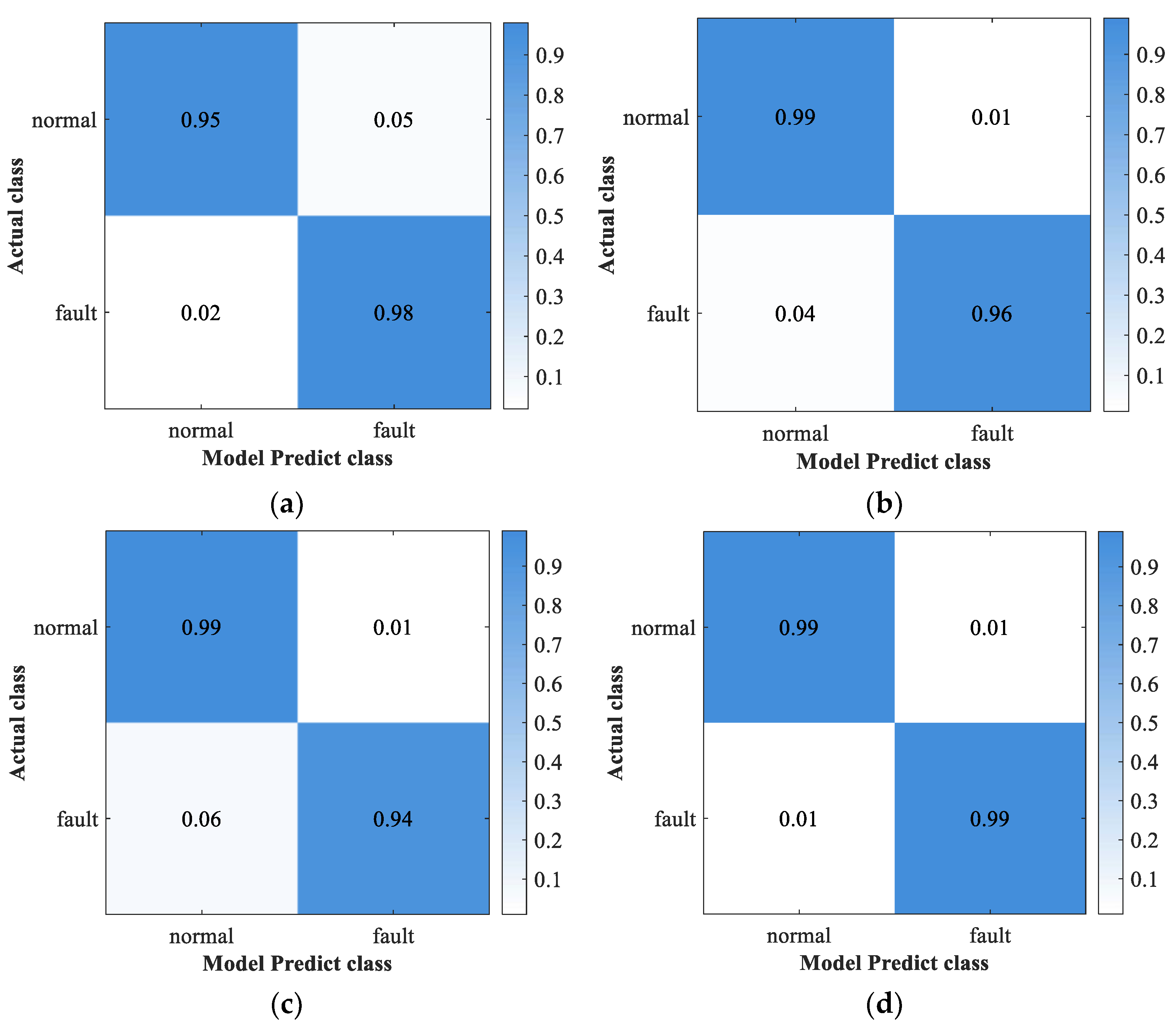

5.3. Experimental Results and Analysis

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Yasmeen, R.; Cui, Z.; Shah, W.; Kamal, M.; Khan, A. Exploring the role of biomass energy consumption, ecological footprint through FDI and technological innovation in B&R economies: A simultaneous equation approach. Energy 2022, 2, 244. [Google Scholar]

- Lu, H.; Diaz, D.; Czarnecki, N.; Zhu, C.; Kim, W. Machine learning-aided engineering of hydrolases for PET depolymerization. Nature 2022, 4, 604. [Google Scholar] [CrossRef]

- Huang, L.; Lei, Z. How Environmental Regulation Affect Corporate Green Investment: Evidence from China. J. Clean. Prod. 2021, 279, 123560. [Google Scholar] [CrossRef]

- Carpentier, C.; Suret, J.-M. Stock market and deterrence effect: A mid-run analysis of major environmental and non-environmental accidents. J. Environ. Econ. Manag. 2015, 71, 1–18. [Google Scholar] [CrossRef]

- Kim, O.S. Does Political Uncertainty Increase External Financing Costs? Measuring the Electoral Premium in Syndicated Lending. J. Financ. Quant. Anal. 2019, 54, 2141–2178. [Google Scholar] [CrossRef]

- Simmou, W.; Govindan, K.; Sameer, I.; Hussainey, K.; Simmou, S. Doing good to be green and live clean!—Linking corporate social responsibility strategy, green innovation, and environmental performance: Evidence from Maldivian and Moroccan small and medium-sized enterprises. J. Clean. Prod. 2023, 384, 135265. [Google Scholar] [CrossRef]

- Wu, J.; Li, X.; Jin, R. The response of the industrial system to the interrelationship approaching to carbon neutrality of carbon sources and sinks from carbon metabolism: Coal chemical case study. Energy 2022, 15, 261. [Google Scholar] [CrossRef]

- Han, M.; Chen, W. Determinants of eco-innovation adoption of small and medium enterprises: An empirical analysis in Myanmar. Technol. Forecast. Soc. Change 2021, 9, 173. [Google Scholar] [CrossRef]

- Li, C.; Firdousi, S.; Afzal, A. China’s Jinshan Yinshan sustainability evolutionary game equilibrium research under government and enterprises resource constraint dilemma. Environ. Sci. Pollut. Res. 2022, 27, 29. [Google Scholar] [CrossRef]

- Zhang, K.; The, J.; Xie, G.; Yu, H. Multi-step ahead forecasting of regional air quality using spatial-temporal deep neural networks: A case study of Huaihai Economic Zone. J. Clean. Prod. 2020, 11, 277. [Google Scholar] [CrossRef]

- Masmoudi, S.; Elghazel, H.; Taieb, D.; Yazar, O.; Kallel, A. A machine-learning framework for predicting multiple air pollutants’ concentrations via multi-target regression and feature selection. Sci. Total Environ. 2020, 5, 715. [Google Scholar] [CrossRef]

- Ban, M.; Lee, D.; Shin, S.; Kim, K.; Kim, S. Identifying the acute toxicity of contaminated sediments using machine learning models. Environ. Pollut. 2022, 9, 312. [Google Scholar] [CrossRef]

- Lin, N.; Jiang, R.; Li, G.; Yang, Q.; Li, D.; Yang, X. Estimating the heavy metal contents in farmland soil from hyperspectral images based on Stacked AdaBoost ensemble learning. Ecol. Indic. 2022, 8, 143. [Google Scholar] [CrossRef]

- Luo, Y.; Li, Y.; Sharma, P.; Shou, W.; Wu, K. Learning human-environment interactions using conformal tactile textiles. Nat. Electron. 2021, 4, 193. [Google Scholar] [CrossRef]

- Chen, H.; Chen, A.; Xu, L.; Xie, H.; Qiao, H. A deep learning CNN architecture applied in smart near-infrared analysis of water pollution for agricultural irrigation resources. Agric. Water Manag. 2020, 240, 106303. [Google Scholar] [CrossRef]

- Ma, X.; Xu, J.; Pan, J.; Yang, J.; Wu, P.; Meng, X. Detection of marine oil spills from radar satellite images for the coastal risk assessment. J. Environ. Manag. 2022, 325, 116637. [Google Scholar] [CrossRef]

- Glaviano, F.; Esposito, R.; Cosmo, A.D.; Esposito, F.; Gerevini, L.; Ria, A.; Molinara, M.; Bruschi, P.; Costantini, M.; Zupo, V. Management and Sustainable Exploitation of Marine Environments through Smart Monitoring and Automation. J. Mar. Sci. Eng. 2022, 10, 297. [Google Scholar] [CrossRef]

- Geng, H.; Liang, Y.; Yang, F. Model-reduced fault detection for multi-rate sensor fusion with unknown inputs. Inf. Fusion 2017, 33, 14. [Google Scholar] [CrossRef]

- Chen, Z.; Deng, S.; Chen, X. Deep neural networks-based rolling bearing fault diagnosis. Microelectron. Reliab. 2017, 75, 327–333. [Google Scholar] [CrossRef]

- Wu, D.; Jiang, Z.; Xie, X. LSTM Learning With Bayesian and Gaussian Processing for Anomaly Detection in Industrial IoT. IEEE Trans. Ind. Inform. 2020, 16, 5244. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, Y.; Wang, J. Unsupervised Deep Anomaly Detection for Multi-Sensor Time-Series Signals. IEEE Trans. Knowl. Data Eng. 2021, 1, 1. [Google Scholar] [CrossRef]

- Masuda, Y.; Kaneko, H.; Funatsu, K. Multivariate Statistical Process Control Method Including Soft Sensors for Both Early and Accurate Fault Detection. Ind. Eng. Chem. Res. 2014, 53, 8553. [Google Scholar] [CrossRef]

- Feng, J.; Li, K. MRS-kNN fault detection method for multirate sampling process based variable grouping threshold. J. Process Control 2020, 85, 149–158. [Google Scholar] [CrossRef]

- Chen, D.; Yang, S.; Zhou, F. Transfer Learning Based Fault Diagnosis with Missing Data Due to Multi-Rate Sampling. Sensors 2019, 19, 1826. [Google Scholar] [CrossRef]

- Xu, R.J.; Xu, B. Exploring the effective way of reducing carbon intensity in the heavy industry using a semiparametric econometric approach. Energy 2022, 243, 123066. [Google Scholar] [CrossRef]

- Xu, B.; Luo, Y.; Xu, R.; Chen, J. Exploring the driving forces of distributed energy resources in China: Using a semiparametric regression model. Energy 2021, 236, 121452. [Google Scholar] [CrossRef]

- Xu, B.; Chen, J.B. How to achieve a low-carbon transition in the heavy industry? A nonlinear perspective. Renew. Sustain. Energy Rev. 2021, 140, 110708. [Google Scholar] [CrossRef]

- Xu, B.; Xu, R.J. Assessing the role of environmental regulations in improving energy efficiency and reducing CO2 emissions: Evidence from the logistics industry. Environ. Impact Assess. Rev. 2022, 96, 106831. [Google Scholar] [CrossRef]

- Krizhevsky, A.; Sutskever, I.; Hinton, G. ImageNet classification with deep convolutional neural networks. Commun. ACM 2017, 60, 84–90. [Google Scholar] [CrossRef]

- Girshick, R.; Donahue, J.; Darrell, T. Rich Feature Hierarchies for Accurate Object Detection and Semantic Segmentation. In Proceedings of the IEEE Conference on Computer Vision and Pattern Recognition, Columbus, OH, USA, 23–28 June 2014; pp. 580–587. [Google Scholar]

- Mikolov, T.; Karafiat, M.; Burget, L. Recurrent Neural Network Based Language Model. In Proceedings of the 11th Annual Conference of the International Speech Communication Association, Makuhari, Japan, 26–30 September 2010; p. 4. [Google Scholar]

- Sun, H.; Wang, A.; He, S. Temporal and Spatial Analysis of Alzheimer’s Disease Based on an Improved Convolutional Neural Network and a Resting-State FMRI Brain Functional Network. Int. J. Environ. Res. Public Health 2022, 19, 4508. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Pei, A.; Wang, F.; Yang, Y. An attention-based category-aware GRU model for the next POI recommendation. Int. J. Intell. Syst. 2021, 7, 36. [Google Scholar] [CrossRef]

- Wang, J.; Fu, P.; Zhang, L. Multilevel Information Fusion for Induction Motor Fault Diagnosis. IEEE/ASME Trans. Mechatron. 2019, 24, 2139. [Google Scholar] [CrossRef]

- Nhu, V.; Hoang, N.; Nguyen, H.; Ngo, P. Effectiveness assessment of Keras based deep learning with different robust optimization algorithms for shallow landslide susceptibility mapping at tropical area. Catena 2020, 5, 188. [Google Scholar] [CrossRef]

- Casalin, F.; Pang, G.; Maioli, S.; Cao, T. Inventories and the concentration of suppliers and customers: Evidence from the Chinese manufacturing sector. Int. J. Prod. Econ. 2017, 193, 148–159. [Google Scholar] [CrossRef]

- Cai, L.; Cui, J.; Jo, H. Corporate Environmental Responsibility and Firm Risk. J. Bus. Ethics 2016, 139, 563–594. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, Q.; Ge, G.; Hao, Y.; Hao, H. The impact of government intervention on corporate environmental performance: Evidence from China’s national civilized city award. Financ. Res. Lett. 2021, 39, 101624. [Google Scholar] [CrossRef]

- Zhang, R.; Fu, W. Multiple large shareholders and corporate environmental performance. Financ. Res. Lett. 2023, 51, 103487. [Google Scholar] [CrossRef]

- Borghesi, R.; Houston, J.; Naranjo, A. Corporate socially responsible investments: CEO altruism, reputation, and shareholder interests. J. Corp. Financ. 2023, 26, 164–181. [Google Scholar] [CrossRef]

- Choi, J.; Contractor, F.J. Choosing an appropriate alliance governance mode: The role of institutional, cultural and geographical distance in international research & development (R&D) collaborations. J. Int. Bus. Stud. 2016, 47, 210–232. [Google Scholar]

- Vural-Yavas, C. Economic policy uncertainty, stakeholder engagement, and environmental, social, and governance practices: The moderating effect of competition. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 82–102. [Google Scholar] [CrossRef]

- Tran, N.; Fu, L.; Boehe, D. How does urban air pollution affect corporate environmental performance? J. Clean. Prod. 2023, 383, 135443. [Google Scholar] [CrossRef]

| Variable | Definitions and Equations |

|---|---|

| Book-to-market, the book value of common equity divided by the market value Book Value of Equity/Market Value of Equity | |

| The debt-to-assets ratio Total Debt/Total Equity | |

| Log of one plus the current year minus the year in which a firm was listed Current Year—Year of Incorporation | |

| The natural logarithm of a firm’s market capitalization ln(Market Capitalization) | |

| a | Green asset ratio Green Assets/Total Assets |

| The proportion of environmentally friendly products Number of Environmentally Friendly Products/Total Number of Products | |

| The ratio of cash flow to total assets for environmental protection Cash Flow for Environmental Protection/Total Assets |

| Variable | Mean | Sd | P5 | P25 | P50 | P75 | P95 |

|---|---|---|---|---|---|---|---|

| 0.350 | 0.158 | 0.125 | 0.234 | 0.328 | 0.451 | 0.645 | |

| 0.401 | 0.199 | 0.0950 | 0.240 | 0.394 | 0.552 | 0.733 | |

| 2.760 | 0.359 | 2.079 | 2.565 | 2.833 | 2.996 | 3.258 | |

| 21.97 | 1.241 | 20.30 | 21.06 | 21.78 | 22.66 | 24.40 | |

| 0.0610 | 0.0570 | −0.0190 | 0.0310 | 0.0560 | 0.0880 | 0.159 | |

| 0.356 | 0.146 | 0.142 | 0.243 | 0.340 | 0.453 | 0.621 | |

| 0.0500 | 0.0660 | −0.0580 | 0.0110 | 0.0480 | 0.0890 | 0.163 |

| Layer | Parameter |

|---|---|

| Convolutional Layer (C1) | Number of filters: 16, filter size: 20 |

| Pooling layer (P2) | Pooling size: 2 |

| Convolutional Layer (C3) | Number of cores: 32, size of cores: 20 |

| Pooling layer (P4) | Pooling size: 2 |

| Convolutional Layer (C5) | Number of cores: 64, size of cores: 15 |

| Pooling layer (P6) | Pooling size: 2 |

| LSTM Network | Number of nodes: 32 |

| Fully connected layer (FC) | Number of output nodes: 8, activation function: tanh |

| Batch standardization layer (BN) | Number of output nodes: 2, classifier: Sigmaid |

| Output layer (Output) |

| Data Length | 70 | 140 | 210 | 280 | 350 | 420 | 490 |

|---|---|---|---|---|---|---|---|

| Accuracy (%) | 94.59 | 97.06 | 98.15 | 97.56 | 98.94 | 97.12 | 98.34 |

| Running time (s) | 24.97 | 42.19 | 52.13 | 70.44 | 83.61 | 99.90 | 112.04 |

| Model | Accuracy | Precision | Recall | F1-Score |

|---|---|---|---|---|

| CNN | 97.09 ± 0.79 | 93.93 ± 2.76 | 94.63 ± 3.13 | 94.21 ± 1.61 |

| LSTM | 97.16 ± 0.27 | 93.93 ± 0.42 | 94.75 ± 1.09 | 94.33 ± 0.56 |

| The Proposed CNN-LSTM | 99.41 ± 0.12 | 99.87 ± 0.25 | 97.75 ± 0.50 | 98.80 ± 0.24 |

| CNN-LSTM without BN | 99.00 ± 0.78 | 98.76 ± 2.17 | 97.25 ± 1.16 | 97.99 ± 1.54 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mu, Y.; Duan, C.; Li, X.; Wu, Y. A Monitoring Method for Corporate Environmental Performance Based on Data Fusion in China under the Double Carbon Target. Sustainability 2023, 15, 9391. https://doi.org/10.3390/su15129391

Mu Y, Duan C, Li X, Wu Y. A Monitoring Method for Corporate Environmental Performance Based on Data Fusion in China under the Double Carbon Target. Sustainability. 2023; 15(12):9391. https://doi.org/10.3390/su15129391

Chicago/Turabian StyleMu, Youying, Chengzhuo Duan, Xin Li, and Yongbo Wu. 2023. "A Monitoring Method for Corporate Environmental Performance Based on Data Fusion in China under the Double Carbon Target" Sustainability 15, no. 12: 9391. https://doi.org/10.3390/su15129391

APA StyleMu, Y., Duan, C., Li, X., & Wu, Y. (2023). A Monitoring Method for Corporate Environmental Performance Based on Data Fusion in China under the Double Carbon Target. Sustainability, 15(12), 9391. https://doi.org/10.3390/su15129391