Abstract

Feature creep captures the phenomenon that additional features result in product complexity and even decrease the usability of products. According to consumers’ heterogeneous tastes for products’ sophisticated features, we divide them into the low-end segment and the high-end segment. The proportions of the two segments are uninformed as to the manufacturer, but known to the platform. We take into account feature creep, and consider a supply chain consisting of a manufacturer and a platform. The manufacturer decides whether to adopt customization strategy, and the platform decides whether to share its private information. By formulating several sequential game models, we explore both firms’ optimal strategies and then examine the impacts of customization production and information sharing on environmental performance. Our findings reveal that adopting customization strategy can drive the manufacturer to improve its innovation efforts and raise the wholesale price. Additionally, if the low-end consumers’ proportion exceeds the manufacturer’s expectations, this improvement can be enhanced when the platform shares its private information, and vice versa. Furthermore, if the cost that the manufacturer takes to embed various functions in the product is quite small, it is environmentally friendly for the manufacturer to adopt customization strategy. While, if the cost is relatively large, taking customization strategy causes even greater negative effects on the environment. In addition to generating higher profits for both parties, the platform sharing its private information also contributes to lowering the environmental performance in certain conditions.

1. Introduction

In general terms, ’feature’ is defined as a characteristic of a product that supplements its function and enriches the basic application [1]. Following the technological revolution resulting from the diffusion of digital technologies, firms continuously enhance innovation efforts as often as they can in order to design and produce feature-rich products to satisfy consumers’ new and sophisticated needs. For instance, the major handset makers, Samsung and Apple, try their best to embed sophisticated features in flagship smartphones, which allow consumers to take photos, check emails, track appointments, and perform hundreds of other functions [2]. Appliance manufacturers, such as Media, Haier, and Samsung, also equip their refrigerators with large touchscreens, which are used to manage the family calendar, set up photos, monitor refrigerator contents, listen to music and the radio, watch TV, manage a to-do list, and so on [3]. The complex design of refrigerators is moving far away from simply keeping food fresh. Although feature-rich products often seem very appealing and attractive during the purchasing phase, quite a few consumers reflect that sophisticated features might render the product difficult to use during consumption, and even generate frustration and regret for them [3].

The phenomenon that additional features decrease the usability of products is often referred to as feature creep, which has become much more widespread in many industries [4]. In 2021, Auto Pacific conducted a survey about the most practical features in autos, and nearly 90,000 car buyers were involved in this inquiry. The results showed that among 100 alternative features, only ten of them have more than 50 percent support. Specifically, the BMW745’s dashboard has more than 700 features, but it has been shown that no more than five of them are generally used. Similarly, the feature creep issue also occurs in office software. Microsoft Office has hundreds of features, and the number of features keeps on increasing with new versions. Along with the upgrades of version, manuals and instructions that are hundreds of pages in length are offered, which results in difficulty of use and leads to lower satisfaction for some consumers. In addition to results in dissatisfaction for consumers, feature creep also implies higher innovation cost and production cost for firms. Accordingly, researchers suggest that firms should attach great significance to the overloading of product features [5]. Furthermore, several studies even warn against the tendency for firms to design and produce feature-rich products [4,5,6].

Although feature creep may hurt their profits, manufacturers still tend to embed more features in products. That is because offering feature-rich products makes the firm more competitive in market demand. Additionally, there is a large fraction of consumers that pursue feature-rich items, whom we refer to, in this paper, as high-end segment consumers. On the contrary, there are also some consumers who only need the basic functions, whom we refer to as low-end segment consumers. Among the low-end segment consumers, typical examples are elderly consumers. For them, if more additional features are embedded in products, such as smartphones and smart appliances, it will result in significant difficulty to use. In order to meet the various preferences of heterogeneous consumers, firms have adopted customization production strategy and produce customized products. Particularly, in addition to offering standard feature-rich products for high-end consumers, firms also design and produce items that exactly meet the low-end segment consumers’ needs, which we refer to as feature-fit products in this paper. For example, Samsung has created groups of handsets for older users, Jitterbugs, which have big buttons and necessary functions. Furthermore, some home appliance enterprises in China also tend to attach great significance to elderly users’ needs. By reducing the remote control with dozens of keys to only several keys, Xiaomi simplifies the operation of intelligent home appliances and makes it easier for elderly consumers to use. Since feature-fit products are endowed with fewer features than feature-rich items, the production cost of a customized product is usually lower than that of a feature-rich one. Therefore, it seems always profitable for manufacturers to take customization production strategy rather than standardization production strategy. In view of this, one purpose of our research is to explore the impact of customization production on the manufacturer’s profit. The same issue has been widely studied by scholars [7,8,9], and most of them have demonstrated that adopting customization production strategy can benefit firms in certain conditions.

In line with the reality that firms offer simpler products for consumers, we regard customization production as a measure to alleviate the negative effect of feature creep. More specifically, the manufacturer can produce feature-fit products for low-end consumers, and feature-rich products for high-end consumers. Owing to staying away from markets, manufacturers usually cannot precisely perceive the amount of low-end consumers and know only the proportion’s prior distribution and expectations. That means it is difficult for firms to offer correct amounts of customized products that exactly meet low-end consumers’ need. Thus, if manufacturers produce customized products according to their prior expectations, there may exist a potential risk that is the oversupply of customized products. This potential risk might cause negative effects on firms’ returns, because only low-end consumers prefer customized products, but high-end consumers will never purchase them, so the oversupplied items will not generate any payoffs for manufacturers. That is to say, though they can save production costs, taking customization strategy does not always generate higher profits for manufacturers. Taking into consideration the oversupply of customized products, we formulate a supply chain consisting of a manufacturer and a retail platform to certify the conditions wherein customization strategy can benefit the manufacturer. Such consideration is quite different from what has been studied in the previous research about customization.

Practically, with the remarkable development of e-commerce, products produced by manufacturers are often sold to consumers through an e-commerce platform (e.g., Amazon, JD.com, and Suning.com), which also acts as a retailer [10]. Because of their advanced information technology and data analytics tools, platforms can also accurately and privately perceive information about consumers’ preferences and potential demands. Meanwhile, because manufacturers usually stay far away from the market, accurate information is not available for them. In view of this, we assume that the platform privately owns the information about the real proportion of low-end consumers, whereas the manufacturer knows only the proportion’s prior distribution and expectation. As a matter of fact, the potential risk related to the oversupply of customized products is caused by the asymmetrical information between the manufacturer and the platform. If the platform shares its private information with the manufacturer, the potential risk can be prevented exactly. Thereby, the manufacturer can produce exact amounts of products that exactly meet consumers’ needs. Accordingly, we take into account the platform’s information sharing strategy, and investigate how information sharing affects both parties’ profits.

Additionally, we also pay attention to the impacts of the manufacture’s production process on environmental performance. With increasing awareness of environmental protection and sustainable development, firms tend to attach significant attention to their environmental responsibility and try their best to reduce the environmental impacts of products [11]. To achieve a high level of eco-efficiency, various actions have been taken by firms not only from the perspective of the production process but also from the perspective of the design process [12,13]. Feature-fit products usually consume fewer production resources than feature-rich ones. As a result, along with saving production resources, designing and producing customized products for low-end consumers can be seen as an environmentally friendly action. As mentioned earlier, though feature creep generates frustration for low-end consumers, firms still enhance their innovation efforts to enrich their product’s functions. That results in more production resources being consumed and greater environmental impacts being caused. Therefore, if the production cost saved by producing feature-fit products is transferred into the innovation investment, it may even intensify the negative effects of feature creep. In this context, we take into consideration the environmental impacts of the production process, and then explore the impacts of the manufacture’s customization production on environmental performance. Regarding environmental and sustainable operation management in the supply chain, a large amount of the Literature has focused on the manufacturer’s production process [14,15,16,17,18]. Similarly, we also aim at the production process and investigate the impacts of strategic customization production on environmental performance in the presence of feature creep.

In this paper, we formulate a supply chain consisting of a manufacturer and a retail platform to investigate the impacts of customization and information sharing on environmental performance in the presence of feature creep. The following fundamental research questions are addressed:

- (1)

- What are the impacts of customization production and information sharing on the manufacturer’s innovation efforts, product’s retail price, and consumers’ demand?

- (2)

- Under what conditions can customization benefit the manufacturer, and under what conditions should the platform share the information?

- (3)

- How does customization and information sharing affect environmental performance?

- (4)

- What is the equilibrium strategy between the manufacturer and the platform?

To answer the above four questions, we formulate three sequential models for the following conditions, respectively: when the manufacturer only produces standard feature-rich products (mode NN), when the manufacturer takes customization production strategy with uninformed information (mode NC), and when the manufacturer takes customization production strategy with information sharing (mode SC). Furthermore, we compare the equilibrium outcomes under these three models and conclude the following main results: first, the manufacturer taking customization strategy always leads to the enhancement of innovation efforts and the rise of wholesale price; secondly, the impacts of customization production and information sharing on the product’s retail price and demand are related to the proportion of low-end consumers; and thirdly, information sharing always generates higher profits for both the manufacturer and the platform. Additionally, the equilibrium strategy between two parties is that the platform shares the real information with the manufacturer, and the latter takes customization strategy and produces feature-fit products according to the real proportion. Finally, customization contributes to the reduction in negative impacts on the environment, and the information sharing can enhance the reduction in certain conditions.

The structures and organizations of this article are designed as follows. After reviewing the related studies in Section 2, we lay out the assumptions and modeling in Section 3. In Section 4, we formulate sequential models and derive solutions. In Section 5, we compare the results and analyze the impacts of customization and information sharing. In Section 6, we present the impacts of customization and information sharing on environmental performance. In Section 7, we demonstrate both parties’ optimal strategy. Finally, we discuss the conclusions and outlook in Section 8, where Section 8.1 concludes the conclusions and managerial insights, Section 8.2 presents the main contributions of our work, and Section 8.3 gives several directions for future work.

2. Literature Review

Our research is related to four streams of research: feature creep, customization production strategy, firm’s information sharing, and environmental operation management in supply chain.

2.1. Feature Creep

As it is becoming an increasingly common phenomenon in many industries, feature creep has been widely studied. Though numerous scholars have various definitions for feature creep, there is a common consensus among them, which is the feature creep always generates consumers’ dissatisfaction, and the dissatisfaction is often induced by excessive product complexity. Thompson et al. [5] thinks feature creep captures the fact that additional features decrease the usability of products and even result in dissatisfaction and frustration for consumers. Rust et al. [6] define it as the overloading of additional features on top of basic features. Elliott [4] refers to the fact that the number of features keeps on increasing with new versions as feature creep. Jain [2] defines feature creep as the product impracticality induced by excessive product complexity and useless functionalities. Similarly, De Giovannai [19] also defines feature creep from the perspective of feature-heavy products’ complexity and impracticality. Additionally, researchers’ attention is drawn to the question of how to mitigate the bad effects of feature creep. Sara et al. [3] suggest that under certain conditions, offering after-sale service can alleviate the negative effects of feature creep effectively. Thompson et al. [5] argue that feature creep may hurt firms’ profits, and that they would attach much significance to the product’s main features. Jiang and Yang [20] also focus on this issue, but do not present feasible methods. Most of the above articles demonstrate the nature of feature creep or feature fatigue; outside of the work of Sara et al. [3], few of them explore how to counteract that. Different from the existing study, we initially regard customization production as a measure to mitigate the negative effect of feature creep. More specifically, firms can produce feature-fit products for the low-end consumers, but feature-rich products for the high-end consumers.

2.2. Customization Production

Our work is also related to the studies on customization production strategy. In order to meet the low-end consumers’ individual preferences, the manufacturer can design and produce customized feature-fit products for them. Actually, extensive research has examined the profitability of firms’ customization strategy (e.g., [8,9,21]). Syam and Kumar [21] examine firms’ incentives to produce customized products instead of standard ones in a competitive circumstance. Shao [7] explores the retailer’s choice between standardization and mass customization strategy, and then studies its corresponding pricing decision under each scheme. Alptekinoglu and Ramachandra [22] develop a model to address the firm’s customization production strategy and investigate how to satisfy consumers’ preferences. Zhang and Zheng [9] and Shao [7] also explore this issue of how to meet consumers’ personal needs. Their studies have reached an agreement that firms can enhance their technological efforts to offer a broader variety of products, and that always benefits firms. Similarly, Dobson and Yano [23] and Jiang et al. [24] regard offering a broader variety of products as an action to satisfy consumers’ needs and investigate the trade-off between development costs and increased market share associated with the expanded product variety. In line with the studies of Dobson and Yano [23] and Jiang et al. [24], we also address the manufacturers’ decisions regarding innovation efforts, and investigate the trade-off between innovation costs and increased market demand. Furthermore, we put forward a special customization production strategy, with which the manufacturer can design and produce customized simpler products to satisfy low-end consumers’ tastes, and feature-rich products to meet high-end consumers’ needs. To the best of our knowledge, this special customization strategy is quite different from the existing research on customization.

2.3. Information Sharing in Supply Chain

The third research stream is the information sharing strategy in supply chain. The issue of information sharing has spurred considerable research in academia (e.g., [25,26,27,28,29,30,31,32,33]). Most of the existing research has demonstrated that information sharing can reduce the operation costs of supply chain, lowering the mismatching of demand and supply. Cao and Chen [25] consider the impact of production cost reduction to study demand information sharing in a two-echelon supply chain. Ha et al. [26] develop a game model to study the retail platform’s demand information sharing decision. Similarly, Ha et al. [27] also examine the impacts of production cost reduction efforts on the incentive for a retailer to share demand information with a manufacturer. Li and Zhang [28] explore the retailer’s information sharing strategy when the market demand is uncertain. Wang et al. [29] examine the conditions when an intermediary platform has an incentive to share demand information, and find that the intermediary platform always inclines to share the information with others. With the consideration that information sharing can lower the mismatching of demand and supply, we investigate the impacts of the retail platforms’ information sharing on firms’ strategies. Different from the aforementioned research, we examine the strategic interaction between a retail platform who decides whether to share its private information and a manufacturer who determines whether to adopt customization strategy. Similar to Wang et al. [29], our work also shows that the platform always tends to share its private information with the manufacturer.

2.4. Sustainable Operation Management

The last research stream focuses on sustainable operation management in supply chain. Recently, in addition to profitability, the impacts of firms’ designs and production on environmental performance has also been widely discussed [14,16,17,34,35,36]. Cai et al. [16] build a stylized analytical model to examine three forms of environmental taxes and then evaluate how they affect the producer’s optimal design on an environmental level. Agrawal and Lee [34] analyze how a manufacturer can use sourcing policies to influence the supplier to adopt sustainable processes to achieve a high level of eco-efficiency. Maruli et al. [36] develop a framework for studying the impact of mandatory environmental regulation on green product development. Yao et al. [37] explore the impacts of consumers’ environmental concern on the optimal decisions of a manufacturer with an environmental reputation. Örsdemir et al. [38] and Kanatli and Karaer [35] compare servitization with traditional selling for a monopolist durable goods manufacturer from both an economic and environmental perspective. They find that servitization might be environmentally superior to conventional selling. Our work focuses on the environmental impacts caused by production processes, and shows that in certain conditions producing customized products is an environmentally friendly strategy.

2.5. Research Gap and Conclusion

We collate most of the related Literature mentioned in this section and compare their contributions with our research, and then we summarize the key differences in Table 1.

Table 1.

Key difference between our work and the existing research.

In summary, most of the existing studies demonstrate the nature of feature creep or feature fatigue from the usability of products. Outside of the work of Sara et al. [3], few of them explore the impacts of feature creep on firms’ production costs and profits in the field of operational research. Different from the existing study, we initially regard customization production as a measure to mitigate the negative effect of feature creep, and explore how to counteract that. Moreover, most of these previous papers regard customization as a production strategy to manufacture sophisticated items to satisfy customers’ preferences and specific needs. On the contrary, we consider customization strategy as a method which is adopted to design and produce customized simpler products to satisfy low-end consumers’ tastes, but feature-rich products to meet high-end consumers’ needs. That is quite different from the previous research. Additionally, there are few studies that comprehensively take in account both feature creep and environmental performance in the operational research field. In terms of this view, our work fills this gap. By taking into account the manufacturer’s customization production strategy and the platform’s information sharing strategy, we explore the impacts of production process on environment performance in the presence of feature creep. The key point which distinguishes our study from existing research is that we consider customization production as an action for manufacturer to alleviate the negative effects of feature creep. Furthermore, we take into account the information asymmetry between the manufacturer and the platform and then examine the information sharing on both parties’ profits.

3. Problem Formulation and Notations

3.1. Consumer’s Utility and Demand

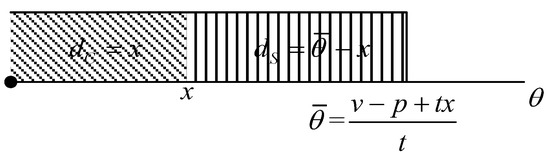

We model a supply chain where a flexible manufacturer () designs and produces items with complex features, such as smartphones and intelligent appliances, and then wholesales them to a downstream retail platform (). Referring to the research of Alptekinoglu and Ramachandra [22], Sun and Tyagi [39], and Huang et al. [40], we use the horizontal product differentiation model to depict the potential market. Specifically, consumers with heterogeneous tastes for products’ functional properties (features) are uniformly distributed on . This model is widely adopted to describe the phenomenon of a market where consumers have heterogeneous preferences for products with horizontal attributes. Generally, the more features products are equipped with, the more appealing they are. In order to expand the demand, the manufacturer tries its best to enrich products’ features by raising innovation efforts. Accordingly, we assume the products’ functional properties are proportional to the manufacturer’s innovation efforts . For simplicity, we assume that a manufacturer with innovation efforts can design and produce products with functional properties . Thus, a consumer located at who purchases a product endowed with functional properties at a price gains a net utility [39,40], where means the product’s value, and is the mismatch cost, which measures the preference-mismatch disutility between the product and the consumers’ taste. Consumers only make purchase decisions if the utility is nonnegative, i.e., . Accordingly, we derive the market demand as . It is clear that the market demand comes from two parts, as shown in Figure 1 (which is created by using Visio 2016): the consumers whose feature tastes are below the manufacturer’s innovation efforts , and the proportion of this part equals to ; and the consumers whose functional tastes are beyond the manufacturer’s innovation efforts , and the proportion of this part is .

Figure 1.

Two parts of consumers’ demand (Visualized by Visio 2016).

3.2. Information on Consumer’s Demand and Customization

As a common setting in the Literature [41,42,43,44,45], we consider two consumer segments: , where is the high-end segment, and is the low-end segment. High-end consumers have a higher preference for fashionable features though they are not usable. For example, young consumers desire phones with high pixels, fast operation, and various sophisticated features. While, for low-end consumers, these additional features even decrease the usability of products, and then lead to frustration and even lower satisfaction. To keep the analysis simple, we assume the proportion of low-end consumers is , which can be either above or below and follows a bivariate distribution with equal probability (i.e., ). With deference to the research of Li et al. [46] and Zhong et al. [47], we assume the platform can obtain private information about the real according to their advanced information technology and data analytics tools, but the manufacturer only knows the distribution and expectation of , which is , since the platform is much closer to the market than the manufacturer. This assumption has also been adopted by Sun and Tyagi [39], Feng et al. [48], Yuan et al. [49] and so on, and can simplify our work but does not change our main findings. To better focus on the impacts of information sharing on environmental performance, in line with the research of Li et al. [46], Yuan et al. [49] and Li et al. [50], we assume the cost for the platform to obtain demand information is zero. The reasons why we make this assumption can be explained with two aspects: first, the platform is much closer to the market and has advanced data analytics tools, so it can obtain the private information easily; second, our work focuses on whether the platform tends to share its private information with the manufacturer voluntarily, but not whether the platform can benefit from collecting demand information. For these two reasons, we do not take into account the cost collecting demand information. Before production, the platform determines whether to share the private information with the manufacturer. If yes, the manufacturer produces according to the real . If not, the manufacturer produces based on the expectation of .

To satisfy consumers’ personalized preferences and avoid feature creep, the manufacturer can adopt customization strategy to produce customized feature-fit products for low-end consumers in addition to producing standard full-feature products. The feature-fit products produced for low-end consumers located at are only embedded with functions , which does not exceed the manufacturer’s innovation efforts . Meanwhile, the standard full-feature products are embedded with full functions . Producing feature-fit products can be regarded as a simplified version of full-feature products. Therefore, there is no need for firms to introduce advanced equipment or improve the production process when firms produce customized feature-fit products for low-end consumers. In view of this, we assume the customization cost is zero. This assumption allows us to focus on the gross impact of customization strategy on environmental performance. Additionally, in Section 7.2, we relax this restriction and assume the cost for the manufacturer taking customization strategy is a constant term, . As for consumers, the high-end consumers only purchase the full-feature products, while the low-end ones prefer feature-fit products and may choose standard full-feature ones if customized products are sold out. Since the manufacturer cannot perceive the real scale of low-end consumers without a platform’s information sharing, there is a potential risk if the manufacturer produces customized products according to its expectation, that risk is the oversupply of feature-fit products.

3.3. Production Cost and Environmental Performance

Generally, the more features a product has, the higher production cost it takes. Accordingly, we assume the unit production cost is proportional to the products’ features , i.e., , where depicts the cost that the manufacturer takes to embed various functions in the product, including raw materials, labor, and other productive resources. Additionally, can be seen as the unit procurement cost that the manufacturer pays the supplier for its core component. For example, the major handset makers, Samsung and Apple, need to purchase mobile phone chips from TSMC. depicts the unit procurement cost for one chip. In our model, we pay much more attention to the impacts of a manufacturer’s production process on the environment and neglect the influence of the supplier’s production process. Thus, has no effects on environmental performance. Actually, the procurement cost may influence the manufacturer’s profits. Since the procurement cost can be added to the wholesale price , and then the manufacturer charges a higher wholesale price, the platform charges a greater retail price. A higher retail price indicates lower demand. That may indirectly affect the firms’ profits and environmental performance. We do not focus on the relationship between procurement cost and environmental performance. Thus, for simplicity, we let . In most of the existing studies, such as Li and Zhang [28], Li et al. [50], Li et al. [51] and so on, which focus on the operations research by formulating a supply chain composed of a manufacturer and a retailer, the manufacturer’s procurement cost is always assumed as zero. Consistent with the classical modeling of effort cost, we adopt the quadratic function to depict the manufacturer’s innovation cost with innovation efforts , where is the coefficient of innovation cost. This cost function is widely adopted by various research, such as Ha et al. [27], Li and Zhang [28], Li et al. [50], and Zhang et al. [30]. Since it is impossible for firms to cover the whole market, we assume , which ensures the total demand under each mode does not exceed one. Furthermore, to avoid trivial results, we let , which means . We focus on the impacts of production on the environment and name it as environmental performance. Specifically, we assume the environmental performance of each unit product is proportional to the production cost and denote it as , where depicts the unit impacts of unit production cost on the environment. Thus, for a manufacturer with innovation efforts , the production cost of a standard full-feature product is , and the production cost of a customized feature-fit product is , where means the consumer’s ideal taste. Accordingly, if the manufacturer only produces standard full-feature products, the total production cost is , and the related environmental performance is . Meanwhile, if the manufacturer takes customization production strategy with symmetric information, the total production cost is .

Though taking customization strategy can save production cost, it also brings an oversupply risk in the case without the platform’s information sharing. Therefore, whether the manufacturer can benefit from customization largely relies on the platform’s information sharing strategy and the trade-off between production cost reduction and oversupply risk. By constructing sequential game models between the manufacturer and the platform, we explore the impacts of the manufacturer’s customization and the platform’s information sharing strategy on their profits and environmental performance. Referencing the research of Li and Zhang [28] and Li et al. [50], we give the game sequence as follows. First, consumers’ preference information is privately observed by the platform, which should decide whether to share (superscript S) with the manufacturer or not (superscript N). Second, the manufacturer decides whether to take customization strategy (superscripts C and N). Third, in the design and production stage, the manufacturer decides both innovation efforts () and wholesale price (). Finally, the platform determines the retail price (). In line with reality, products that are not sold will be returned back to the manufacturer. Both parties are risk-neutral and maximize their expected payoffs. Backward induction is applied to derive optimal results.

For clarity, we summarize the parameters and decisions in Table 2.

Table 2.

Notations.

4. Modeling and Derivation

In this section, we construct three sequential game models and derive the equilibrium results in the condition that the manufacturer takes standardization production strategy (mode NN), when the manufacturer takes customization production strategy with uninformed information (mode NC), and when the manufacturer takes customization production strategy with information sharing (mode SC), respectively.

4.1. Mode NN

Under mode NN, the manufacturer only produces standard full-feature products based on its innovation efforts. It is clear that the marginal profit for the manufacturer to produce a product equals the wholesale price minus the unit production cost, i.e., . Additionally, the marginal profit for the platform reselling a product equals the retail price minus the wholesale price, i.e., . Accordingly, the profits of the manufacturer and the platform can be written as follows:

In line with the derivation process proposed in previous research [28,29,50], we derive the equilibrium results by backward induction, which is widely used to solve sequential game models. For any given wholesale price and innovation efforts , we first characterize the equilibrium retail price that would maximize the platform’s profit . We then determine the wholesale price and the innovation effort for the manufacturer by maximizing its individual profit. The equilibrium prices, innovation efforts, demand, profits, and environmental performance are as follows:

Proposition 1.

By exploring the impacts of production cost () on environmental performance, wehave (The proof is presented in

Appendix A): If,; While, if,.

It is straightforward to note that an increase in innovation cost factor () or an increase in production cost () would lead to an increase in the equilibrium wholesale price and retail price, but a decrease in innovation efforts, demand, and both parties’ profits. Furthermore, the environmental performance is decreasing in innovation cost factor (), but concave in production cost (). That is because, if the production cost is relatively small, the manufacturer would put more investment in innovation. That leads to an increase in innovation efforts and then generates a growth in demand. To meet the market demand, the manufacturer has to produce more products. That means more production resources are used and related environmental effects are caused. In this condition, the increase in production cost aggravates the environmental performance. On the contrary, if the production cost is large enough, the increase in production cost would result in a decrease in innovation effort and then lead to a drop in demand.

4.2. Mode NC

Under mode NC, the platform will not share low-end consumers’ information with the manufacturer, and the manufacturer takes customization production strategy to produce customized products according to its expected proportion of low-end consumers, . As assumed before, the high-end consumers will never purchase feature-fit products, but the low-end consumers can choose either standard products or customized items. Accordingly, if the manufacturer produces feature-fit products based on , there exists two potential cases: if the real proportion of low-end consumers exceeds the expected proportion, i.e., , all of the standard products and customized products can be sold out; meanwhile, if the real proportion is below the expected proportion, i.e., , a fraction () of customized feature-fit products will not be required. As demonstrated in the research of Sun and Tyagi [39], Feng et al. [48], Yuan et al. [49], because of the asymmetrical information, the manufacturer makes decisions according to the expected proportion (), but the platform decides retail price according to the real proportion (). Therefore, under mode NC, the expected profit of the manufacturer and the profit of the platform are as follows:

Similarly, we solve this game model with backward induction. As there are two potential cases, i.e., and , we derive for the equilibrium results separately. For any given wholesale price and innovation efforts , the equilibrium retail price that would maximize the platform’s profit is characterized as . Substituting that into Equation (3), we then derive for the manufacturer’s optimal decisions. In the condition that the Hesse matrix of the manufacturer’s expected profit, , is negative definite, equilibrium innovation efforts and wholesale price are solved as and . Furthermore, we derive for other equilibrium results and summarize them in Table 3, the proof is presented in Appendix A.

Table 3.

Results under mode NC.

Proposition 2.

Under mode NC, if, the profits of both the manufacturer and the platform increase in the proportion of low-end consumers, i.e.,,. Meanwhile, if, their profits are indifferent with the proportion.

Proposition 2 shows that, in the condition that the proportion of low-end consumers is below the manufacturer’s expectation, the increase in the proportion would generate increment in both parties’ profits. Nevertheless, if the fraction of low-end consumers exceeds the manufacturer’s expectation, the profits of the manufacturer and the platform are independent with the proportion. The reasons can be interpreted as follows. Because high-end consumers would never purchase feature-fit products, though it saves production cost, manufacturing customized products according to the expected proportion () results in a fraction () of feature-fit products not being required. The information asymmetry between the manufacturer and the platform leads to a mismatch between supply and demand, and then results in the oversupply of feature-fit products. As a consequence, the oversupply of feature-fit products causes reductions in both parties’ profits. That is to say, information asymmetry hurts firms’ payoffs. This has been demonstrated by Ha et al. [27], Li and Zhang [28], Zhang et al. [30] and other studies. Proposition 2 also shows that the increase in low-end consumers’ scale can mitigate the reduction in profit for both parties.

4.3. Mode SC

From Table 2 we see that there exists a gap between the manufacturer’s profit and its expected profit, which is caused by the asymmetrical information about the proportion of low-end consumers. In order to eliminate that, the manufacturer can encourage the platform to share information. Under mode SC, the platform discloses the real proportion of low-end consumers to the manufacturer. As assumed in the research of Sun and Tyagi [39], Feng et al. [48], and Yuan et al. [49], the manufacturer accesses the accurate proportion of low-end consumers after information sharing. Accordingly, the manufacturer adopts customization strategies and produces corresponding amounts of feature-fit products. Respectively, the costs for producing customized products and standard products are and , and the innovation investment is . Thus, the profits of the manufacturer and the platform under mode SC can be presented as follows:

Similar to mode NC, we solve this game model with backward induction. In the condition that is satisfied, the Hesse matrix, , is negative definite. Additionally, then the manufacturer’s optimal decisions about innovation efforts and wholesale price are obtained. Furthermore, we derive that the equilibrium prices, innovation efforts, demand, profits and environmental performance are as follows:

Under mode SC, the quantity of both full-feature and feature-fit products is closely related to the proportion of low-end consumers, which then has significant effects on environmental performance. By exploring the impacts that the proportion of low-end consumers has on environmental performance, we summarize the results in Table 4. The expressions of , and are presented in Appendix B.

Table 4.

Impacts of on environmental performance under mode SC.

From Table 4 we see that the impacts of on environmental performance are related to not only the innovation cost factor () but also the production cost () that the manufacturer takes to embed various functions in the product. That is because taking customization strategy aims to save production costs, and the larger the proportion of low-end consumers is, the more production costs are saved. Furthermore, the saved costs can be transferred into innovation investment. That contributes to improving innovation efforts and then expanding market demands. As a result, environmental performance is also affected. Specifically, in the condition that the production cost () is small enough, or in the condition that both the production cost and innovation cost are quite large, the environmental performance decreases in the proportion of low-end consumers. However, in the condition that production cost is relatively large but innovation cost is moderate, the environmental performance first decreases and then increases in the proportion of low-end consumers.

5. Comparison and Analysis

In this section, we compare the equilibrium prices, innovation efforts, demands, and both parties’ profits among three modes. Furthermore, we explore the impacts of customization production strategy and information sharing on equilibrium results. All expressions of , , and in this paper are presented in Appendix B.

5.1. Innovation Effort and Wholesale Price

We first compare the manufacturer’s innovation efforts and wholesale price across the three modes. The comparative results are summarized in Proposition 3, the proof of which is presented in Appendix A.

Proposition 3.

If,,; While, if,, .

Proposition 3 shows that, whether the platform shares the information or not, taking customization strategy motivates the manufacturer to improve innovation efforts and charge a higher wholesale price. That is because producing feature-fit products saves a great deal of production resources. Additionally, the saved costs can be transferred into innovation. That leads to an improvement in innovation efforts. As a result, the product features are enriched, and then the unit cost for producing a standard full-feature product increases as well. The increment of production cost induces the manufacturer to increase its wholesale price. From Proposition 3 we also see that, if the proportion of low-end consumers exceeds the manufacturer’s expected scale, the platform sharing consumer information can motivate the manufacturer to enhance innovation efforts as well. Similar results have been demonstrated by Yuan et al. [49] and Li et al. [50]: information sharing induces the manufacturer (or the supplier) to improve its quality (or service) efforts. Otherwise, sharing consumer information would inhibit the manufacturer’s innovation investment. Therefore, the platform can encourage the manufacturer to raise innovation efforts by sharing or hiding the real proportion of low-end consumers.

5.2. Retail Price and Demand

We next proceed to examine the retail price and demand across the three modes. The comparative results of retail price are summarized in Table 5, the proof of which is presented in Appendix A. Additionally, the comparative results of demand are summarized in Proposition 4. The expressions of , , , and are presented in Appendix B.

Table 5.

Comparison of prices across three modes.

Table 5 shows that, under the condition that the fraction of low-end consumers is quite small (), the retail price under mode NN is higher than that under mode NC. Otherwise, the retail price under mode NN is below that under mode NC. The reason can be interpreted as follows: as mentioned before, by saving production cost, producing feature-fit products contributes to the enhancement of innovation efforts, which conduces to the rise of retail price. However, if the proportion of low-end consumers is quite small, a large fraction of feature-fit products will not be required. In order to increase the demand, the platform has to lower retail price. From Table 5 we see that, in most cases, the retail price under NC is lower than that under mode SC. That is because, as proved by Zhang et al. [30], Zhang and Zhang [31], and Zhang et al. [52], information sharing can reduce supply chain costs, improve the matching of supply and demand, and reduce the bullwhip effect. The platform sharing its private information avoids the oversupply of feature-fit products. Therefore, there is no need for the platform to lower the selling price to stimulate demand. However, under certain conditions (when the innovation cost is quite small but the low-end consumers’ proportion is smaller than expected), the retail price under NC is even higher than that under mode SC. This is because, under mode NC, a lower cost factor generates greater innovation efforts, higher retailer price and larger market size. Specifically, the scale of consumers whose functional tastes are perfectly satisfied is also expanded. Since most of the consumers’ preferences can be exactly satisfied, lowering the retail price does less to raise the demand or mitigate the oversupply of feature-fit products. Additionally, greater innovation efforts indicate larger production costs, which also prevents the platform from lowering the selling price. Therefore, to achieve greater returns, the platform tends to charge a much higher retail price. Table 5 also shows that, if the proportion of low-end consumers is higher than the manufacturer expected, sharing the private information will motivate the platform to charge a much higher retail price. The reason is intuitive; as mentioned before, the larger the proportion of low-end consumers is, the more the production costs are saved. Additionally, the saved costs are transferred into innovation investment, thereby generating greater innovation efforts and higher willingness-to-pay for consumers.

Comparing the demand across the three modes, we summarize the results in Proposition 4, the proof of which is presented in Appendix A.

Proposition 4.

There is a threshold, if,; but if,.

Proposition 4 presents the comparative results of demand. From that we can see, without information sharing, adopting customization strategy does not always result in a greater demand. On the contrary, under the condition that the proportion of low-end consumers is quite small, producing customized products even leads to a reduction in demand. As mentioned before, this is caused by the oversupply of feature-fit items. Proposition 4 also indicates that among the three modes, the SC mode generates the greatest demand. That is because, as demonstrated in [30,31,52], sharing information avoids the risk of oversupply. Combining Proposition 4 with Table 5, we see that, if the proportion of low-end consumers lies in certain intervals (), customizing without information sharing not only results in a reduction in demand, but also generates a lower retail price. In order to prevent that, it is advisable for the platform to share the information with the manufacturer. In other words, the platform has an incentive to share information voluntarily. Similar conclusions have been proved by Li and Zhang [28] and Liu et al. [53].

5.3. Firms’ Profits

After comparing the wholesale prices, retail prices, and demands, we now examine both parties’ profits across the three modes to explore whether customization production strategy and information sharing can benefit both firms. In this section, we neglect the cost for the manufacturer to take customization strategy and compare both firms’ profits directly. The comparative results are summarized in Proposition 5, the proof of which is presented in Appendix A.

Proposition 5.

There are two thresholdsand:

- (1)

- If,; and if,.

- (2)

- If,; and if,.

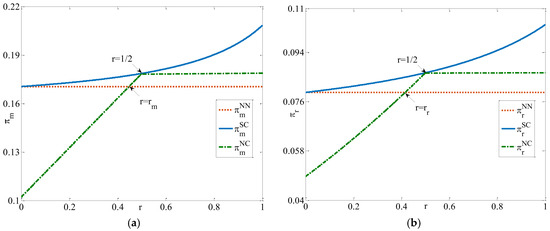

From Proposition 5 we see that, among the three modes, the SC mode generates the highest profits not only for the manufacturer but also for the platform. That is to say, sharing the low-end consumers’ fraction can always benefit both the manufacturer and the platform. However, whether customizing without information sharing can benefit both parties largely depends on the real proportion of low-end consumers. To clearly identify the conditions wherein taking customization strategy generates higher returns for both the manufacturer and the platform, we compare their profits with illustration in Figure 2. Figure 2 is displayed using Matlab 2019 software, and the needed parameters are as follows: , , , and .

Figure 2.

Impacts of on firms’ profits (visualized by Matlab 2019). (a) The manufacturer’s profit. (b) The platform’s profit.

As illustrated in Figure 2, under the condition that the proportion of low-end consumers exceeds the threshold (), NC mode will generate higher profits for both firms. While, if the proportion is below this threshold, taking customization strategy without information sharing would hurt at least one firm’s return. As mentioned before, if the proportion of low-end consumers is larger than the manufacturer expected, owing to induce the manufacturer to enhance innovation efforts and the platform to raise retail prices, customizing generates profit growth for both parties. Moreover, such growth can be further enhanced when the platform shares its private information.

6. Impacts of Customization and Information Sharing on Environmental Performance

We now proceed to compare the environmental performance across the three modes, and then explore the impacts of customization strategy and information sharing on environmental performance. All of the expressions of , , and in this paper are presented in Appendix B. In this section, we pay much more attention to the environmental performance but not to the firms’ profits, and explore how customizing and information sharing affects environmental performance.

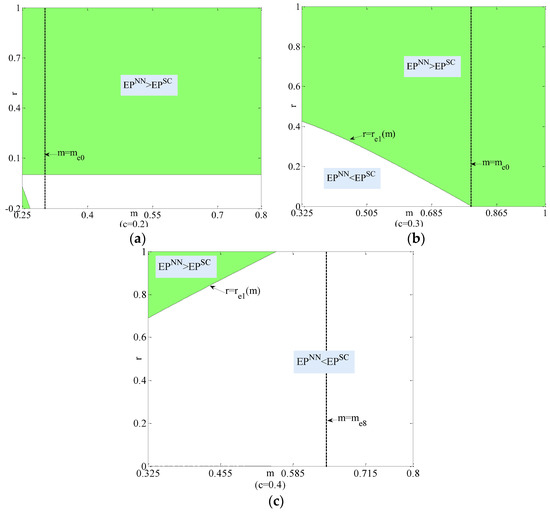

6.1. Impacts of Customization

Intuitively, because it can save production costs, it is of great environmental friendliness to take customization strategy and produce feature-fit products. Meanwhile, as mentioned before, in the condition that , adopting customization strategy may generate a greater demand. In this condition, to meet the growth in demand, many more materials have to be used to produce products. That means greater effects are caused on the environment. In other words, in certain conditions (), customizing can generate greater demands and profits for firms, but it may also result in heavier effects on the environment. Thus, the key point of the manufacturer’s strategy relies on the trade-off between environmental performance and profits. So it is meaningful to study the impacts of customization strategy on environmental performance. To certify that, we first compare the environmental performance under mode NN and mode NC; the comparative results are summarized in Table 6.

Table 6.

Comparison of environmental performance under NN and NC.

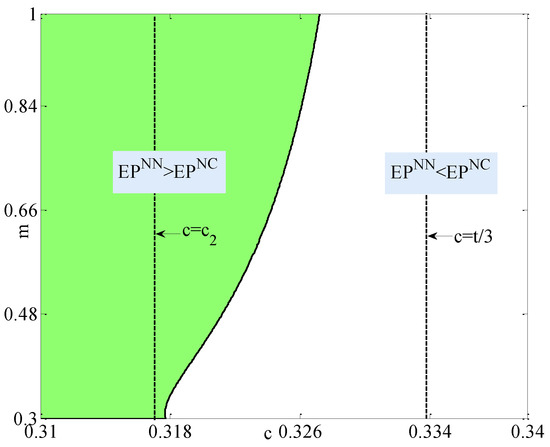

From Table 6 we see that, if the production cost is quite small, the manufacturer producing feature-fit products leads to a reduction in environmental performance. If the production is relatively large, counterintuitively, taking customization strategy causes even higher negative effects on the environment. While, if the production cost is quite moderate, the impacts of customizing on the environment is closely related to the innovation cost.

As illustrated in Figure 3, which is also displayed using Matlab 2019 software, under the conditions that the production cost is moderate but the innovation cost factor is relatively large, producing customized products also leads to a reduction in environmental performance. However, if the innovation cost factor is quite small, the manufacturer can design feature-rich products without too much innovation investment. As mentioned before, the production cost is directly proportional to the products’ features (i.e., ). Manufacturing a product that is embedded with various functions will take a great deal of materials and produce a feature-rich product. In this way, if the innovation cost factor is not too large, taking customization strategy may cause higher negative effects on the environment as well. The reason can be explained from another perspective: as mentioned in Section 5.2, the manufacturer producing feature-fit products according to its initial expected proportion saves large amounts of production costs, which are transferred into innovation investment. As a result, the innovation efforts are enhanced, and the expected demand is enlarged. That is to say, the manufacturer has to produce more products, which leads to the growth of production cost and environmental performance. Therefore, though taking customization production strategy can generate greater demands and profits for firms, it may also hurt the environment at the same time. Thus, the key point of the manufacturer’s strategy relies on the trade-off between environmental performance and profits.

Figure 3.

Comparison of environmental performance under NN and NC (Visualized by Matlab 2019).

In this section we pay much more attention to the environment and explore how customizing affects environmental performance. Whether customization can lower the negative effects of manufacturing on the environment largely relies on the trade-off between cost reduction caused by producing feature-fit products and the cost increment related to demand growth. If the production cost is too small or the innovation cost is too large, the cost saved by producing feature-fit products implies less effect on the enhancement of innovation efforts and the increases of expected demand. Therefore, under these conditions, it is environmentally friendly to adopt customization strategy. On the contrary, under the condition that the production cost is relatively large but the innovation cost is moderate, considerable costs are saved and transferred into innovation investment. Accordingly, more production resources are consumed to produce products to meet the expected demand. Therefore, in this condition, customizing causes even greater negative effects on the environment.

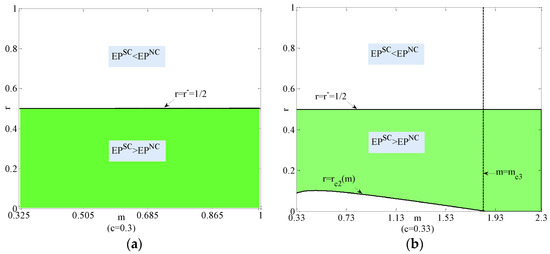

6.2. Impacts of Information Sharing

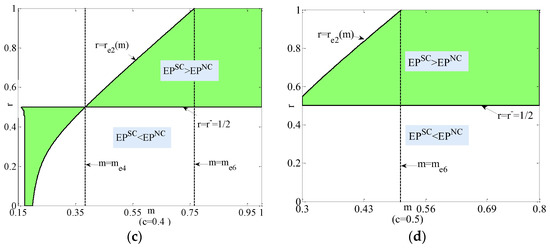

We next proceed to compare the environmental performance under NC and SC, and then explore the impacts of the platform’s information sharing strategy on environmental performance. The comparative results are summarized in Table 7.

Table 7.

Comparison of environmental performance under SC and NC.

After being shared the platform’s private information, the manufacturer can produce the exact amounts of customized products based on the real proportion of low-end consumers. That makes it possible for the manufacturer to make full use of production resources. From Table 7 we see that the impacts of information sharing on environmental performance are not only related to the production cost and innovation cost, which has been certified before, but also related to the proportion of low-end consumers. As illustrated in Figure 4a,b, under the condition that the production cost is relatively small, if the proportion of low-end consumers exceeds the manufacturer’s expectation, the platform’s information sharing contributes to lowering environmental performance. That is because, under this condition, more feature-fit products than expected are manufactured. Meanwhile, if the proportion falls short of the manufacturer’s initial expectation, information sharing may hurt the environment in most cases. With the increase in production cost, as illustrated in Figure 4c,d, if the proportion of low-end consumers is below the manufacturer’s expectation, informing the manufacturer of the real proportion generates a lower environmental performance. On the contrary, if the proportion is above the expectation, not sharing seems to be more environmentally friendly. However, hiding the information may lead to a reduction in both parties’ profits. This is because, under the condition that the proportion of low-end consumers exceeds the expectation, the platform sharing the real proportion conducts the manufacturer to produce more feature-fit products. Therefore, as mentioned before, more costs are saved and transferred into innovation investment. That yields greater innovation efforts and greater demand, which exactly indicates larger environmental performance and higher firms’ profitability. Specifically, as illustrated in Figure 4c, under the condition that the production cost is moderate but the innovation cost is relatively small (), if the proportion of low-end consumers falls short of the manufacturer’s expectation, hiding the real proportion can also be environmentally friendly. However, the reduction in environmental performance is at the cost of a serious oversupply of feature-fit products.

Figure 4.

Comparison of environmental performance under SC and NC (Visualized by Matlab 2019). (a) . (b) . (c) . (d) .

6.3. Joint Impacts of Information Sharing and Customization

Finally, we compare the environmental performance under mode NN and mode SC to certify the joint impacts of information and customization on environmental performance. The comparative results are summarized in Table 8.

Table 8.

Comparison of environmental performance under SC and NN.

From Table 6 and Table 8, we see that, if the production cost is below a threshold ( under NC, under SC), whether the platform shares private information with the manufacturer, it is environmentally friendly to adopt customization strategy. Furthermore, the production cost threshold under mode SC is smaller than that under mode NC. That is to say, in the condition that the production cost is relatively small (i.e., below ), producing customized products always generates a reduction in environmental performance. However, such a reduction can be depressed if the platform shares its private information in certain conditions (). As illustrated in Figure 5b,c, with the increase in production cost, the joint impacts of information sharing and customization on environmental performance are related to the production cost and the innovation cost. Specifically, if the production cost is moderate but the innovation cost is considerable, producing customized products based on the shared information generates lower environmental performance. While, if both the production cost and innovation cost are quite large, producing customized products based on the shared information leads to even lower environmental performance.

Figure 5.

Comparison of environmental performance under SC and NN (Visualized by Matlab 2019). (a) . (b) . (c) .

7. Equilibrium Strategy

7.1. Equilibrium Strategy without Customizing Cost

In this section, we further examine the equilibrium strategy by considering the strategic interactions between the manufacturer and the retail platform. Using backward induction, we first deduce the platform’s information sharing strategy. From Proposition 5 we see that the platform sharing its private information with the manufacturer always generates higher profit for itself. Accordingly, we infer that the optimal strategy for the platform is to share its private information with the manufacturer. Next, we explore the manufacturer’s production strategy, i.e., standardization production or customization production. Owing to information asymmetry, the manufacturer only makes decisions based on the expected proportion and its expected profit. Thus, we have to compare the manufacturer’s expected profit to explore its optimal strategy. By neglecting the cost for the manufacturer taking customization strategy, we summarize the results and present Proposition 6.

Proposition 6.

If by comparing the manufacturer’s expected profit across the three modes, we have:and.

Proposition 6 indicates that, from the perspective of firms’ profits, mode SC always dominates mode NC and mode NN. That is to say, the equilibrium strategy for both firms can be presented as follows: the platform tends to inform the real proportion of low-end consumers with the manufacturer, and then the latter adopts customization strategy to produce corresponding amounts of feature-fit products. Combining this with Table 6 and Table 7, we infer that, in certain conditions (e.g., ), mode SC not only generates the highest profits for both firms, but also results in the lowest environmental performance.

7.2. Equilibrium Strategy with Customizing Cost

Now we take into account the cost for the manufacturer to take customization strategy, and further explore whether the manufacturer prefers to take customization strategy. Similarly, because of information asymmetry, the manufacturer only makes decisions based on the expected proportion and its expected profit. Thus, we have to compare the manufacturer’s expected profit to explore its optimal strategy. The comparative results are as follows.

Proposition 7.

Ifby comparing the manufacturer’s expected profit we have:

- (1)

- If, and;

- (2)

- If, and;

- (3)

- If, and, where,.

From Proposition 7 we see that, no matter how large the customizing cost is, the platform’s profits under mode SC are always greater than those under mode NC and mode NN. That is to say, the platform will always tend to share its private information voluntarily. This conclusion is consistent with the research of Li and Zhang [28] and Liu et al. [53]. As for the manufacturer, if the cost for the manufacturer to take customization strategy exceeds a threshold, i.e., , the manufacturer will not adopt customization strategy. Otherwise, it can benefit from producing customized products.

8. Conclusions and Outlook

8.1. Conclusions and Managerial Implications

Feature creep captures the phenomenon that additional features result in product complexity and even decrease the usability of products. The manufacturer decides whether to adopt customization strategy so as to offer customized feature-fit products for low-end consumers but full-feature products for high-end consumers. In this context, we develop three sequential game models under the condition that the manufacturer takes standardization production strategy (mode NN), takes customization production strategy without information sharing (mode NC), and takes customization production strategy with information sharing (mode SC). By comparing the equilibrium results among the three models, we explore the equilibrium strategy for both firms and demonstrate the impacts of customization and information sharing on environmental performance as well. Several interesting main findings are derived:

- (1)

- Adopting customization strategy can drive the manufacturer to improve its innovation efforts. Additionally, if the cost for the manufacturer to take customization strategy is not too great, both firms can benefit from adopting customization strategy. This result has been demonstrated by many studies, such as Shao [7], Syam and Kumar [8], and Zhang and Zheng [9]. The impacts of information sharing on innovation efforts are closely related to the proportion of low-end consumers. In certain conditions (the proportion of low-end consumers exceeds the manufacturer’s expectation), the improvement of innovation efforts can be enhanced if the platform shares its private information. Similar results have been demonstrated by Yuan et al. [49] and Li et al. [50]: information sharing induces the manufacturer (or the supplier) to improve its quality (or service) efforts. However, if the proportion exceeds the manufacturer’s expectation, the manufacturer will not tend to improve innovation efforts. This conclusion is quite different from that in previous research.

- (2)

- The oversupply of feature-fit products for low-end consumers would hurt both firms’ profits if the proportion of low-end consumers is quite small. To avoid that, it is advisable for the retail platform to share its private information with the manufacturer. The same conclusions have been drawn by Zhang et al. [30], Zhang and Zhang [31], and Zhang et al. [52]. Then the manufacturer would certainly adopt customization strategy and produce customized items for low-end consumers. That is to say, if the manufacturer produces customized products according to the platform’s private information, both firms can achieve a “win-win” situation. The role of information sharing in generating greater profits has been widely proved [30,49,51,52]. In practice, some firms such as Xiaomi not only try their best to satisfy young consumers’ sophisticated needs, but also simplify the operation of intelligent home appliances and make it easy to use for elderly consumers.

- (3)

- The impacts of customization strategy and information sharing on environmental performance is quite intricate. Specifically, though producing customized items can generate greater demands and profits for firms, it may hurt the environment at the same time. This is because more products are manufactured to meet market demands, which results in more materials being consumed and more negative effects caused on the environment. Thus, the key point relies on the trade-off between environmental performance and firms’ profits. Customizing feature-fit products for low-end consumers can expand market demand, which has been proved practically. For instance, some firms such as Hair and Xiaomi have attached great significance to elderly users’ needs by simplifying the operation of intelligent home appliances and making it easier for elderly consumers to use. This strategic policy generates greater demand for firms.

8.2. Contributions

By taking into account the manufacturer’s customization production strategy and the platform’s information sharing strategy in the presence of feature creep, we explore whether it is profitable for the platform to share its private demand information, and whether it is advisable for the manufacturer to adopt customization strategy. Furthermore, we demonstrate the impacts of production process on environmental performance. The contributions of our work are summarized as follows:

- (1)

- We extend the theoretical research related to feature creep in the field of operations management. Most of the existing studies demonstrate the nature of feature creep or feature fatigue from the usability of products. Outside of the work of Sara et al. [3], few of them explore the impacts of feature creep on firms’ production costs and profits. Moreover, we initially regard customization production as a measure to counteract feature creep. This is quite different from the previous research.

- (2)

- We enrich the theoretical research related to firms’ strategic production. Firms usually adopt customization strategy to manufacture sophisticated items to satisfy customers’ preferences and specific needs. In this context, many scholars explore the firms’ strategic production policies. On the contrary, based on the operation practice of Xiaomi and Hair, we consider customization strategy as a method which is adopted to design and produce customized simpler products to satisfy low-end consumers’ tastes. By raising this specific customization strategy, we put forward a new research direction related to firms’ strategic production policies.

- (3)

- By taking into account the manufacturer’s customization production strategy and the platform’s information sharing strategy, we formulate a supply chain consisting of a manufacturer and a retail platform, and jointly explore both firms’ equilibrium strategies. Our work extends the research on information sharing.

- (4)

- Though many studies have addressed the impacts of firms’ strategic production and environmental performance, few papers attach significance to feature creep in the field of sustainability. We initially comprehensively take into account both feature creep and environmental performance in the operational research field. By taking into account the manufacturer’s customization production strategy and the platform’s information sharing strategy, we explore the impacts of the production process on environmental performance in the presence of feature creep. In view of this, our work fills this gap, and provides useful guidance for manufacturing firms’ practices in sustainable development.

8.3. Limitations and Future Study

There are several limitations in this study, which also offer some future research openings.

- (1)

- We neglect the cost for the retail platform to collect information and assume the platform has the advantage on the demand information over the manufacturer. In this context, we further explore whether it is profitable for the platform to share its private information. In the future, work can take into account the information acquisition cost, and formulate a theoretical model where both firms are uninformed about the demand information. By comparing equilibrium results, we study whether the platform can benefit from collecting demand information.

- (2)

- In our model, we assume the procurement cost is zero and focus on the impacts of the manufacturer’s production process on the environment, and neglect the influence of the supplier’s production process. Actually, the procurement cost may influence the manufacturer’s wholesale price and the platform’s retail price, and then affect the product’s demand and firms’ profits. In the future, we can take into account the procurement cost and examine its impacts on firms’ equilibrium strategies.

- (3)

- We assume the platform charges identical retail prices for both full-feature products and the customized feature-fit products. Practically, firms often adopt a discrimination pricing strategy for customized products. Jain (2019) also shows that feature-rich products can enable better price discrimination when consumers have varying preferences for different features. Accordingly, in the future, research can take into account price discrimination and examine the retail platform’s optimal pricing strategy.

Author Contributions

Y.M.: conceptualization, methodology, writing—original draft preparation; C.L. and Y.M.: writing—reviewing and editing, supervision. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Shenyang Philosophy and Social Science Special Fund (No. SY202204ZC).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study.

Conflicts of Interest

The authors declare that they have no known competing financial interest or personal relationships that could have appeared to influence the work reported in this paper.

Appendix A

Proof of Proposition 1.

Deriving the first order derivative of with regard to , we have , where . Letting , we derive for the unique solution . Deriving the first order derivative of with regard to , we have . Thus, if , and . Accordingly, we infer that and then when . On the contrary, if , and . That means and . □

Proof of Table 3.

Deriving the first order derivative of with , we have , where . Letting , we derive for the unique solution , where . Respectively, we let and , and derive for the solutions: and . We can easily prove that when . Deriving the first order derivative of with , we have . Thus, we infer that increases in when but decreases in when . Comparing with , we have . Thus, we can easily prove that when . Comparing with , we have . Letting , we derive for the unique solution that satisfies , which is . Thus, if , we have . Because decreases in when , we can easily prove that for any that satisfies . Additionally, if , we have . Under this condition, there are two potential cases: (1), from which we infer . Accordingly, we have if and if ; (2) , from which we infer . Thus, is always satisfied for any nonnegative . Additionally, if , we see that increases in and . Under this condition, there are also two potential cases: (1), from which we can infer . Thus, we have if and if ; , from which we infer . Therefore, is always satisfied for any nonnegative . As a result, what is showed in Table 3 have been proved. □

Proof of Proposition 3.

Comparing with , we have . Since is always satisfied, we can infer that if , and if . □

Proof of Table 4.

Under the condition that : comparing the retail prices among three modes, we have and . Because , we can easily infer that and . Under the condition that , comparing and , we have . Deriving the first order derivative of with , we have . Letting and deriving for the unique solution, we have . Letting ,we obtain the solution, . We can easily infer that is always satisfied when . Under this condition, if , and if . Meanwhile, in the condition , we have . Under this condition, is always satisfied for any that satisfies . Next, we compare and , . Letting , we obtain two solutions, i.e., and . Comparing with , we find that is satisfied in the condition that . From that we can further infer that is satisfied. Meanwhile, we have when . Under this condition, if , and if . We also find that when . Under this condition, is always satisfied, that is to say, is satisfied. Comparing with , we have . Letting , we obtain and . From that we can infer is satisfied when and is satisfied when . Since , we can easily prove that if and if . In summary, what was presented in Table 4 is proved. □

Proof of Proposition 4.

Under the condition that : comparing the market demand among three models, we have and . Because , we can easily infer that and . Thus, if , is satisfied.

Under the condition that , . Deriving the first order derivative of with , we have . Letting , we solve for the unique solution . Therefore, we can infer that is satisfied when and is satisfied when . Next, we let and obtain two solutions, i.e., and . It is easy to prove that . That is to say, is always satisfied when . □

Proof of Proposition 5 (1).

We first compare the manufacturer’s profit under mode NC and mode NN. Under the condition that , . Thus, we infer that is satisfied when . Under the condition that , . Deriving the first order derivative of with , we have . Because of and , we can easily prove that , that is to say, is satisfied. Letting , we solve for the unique solution . Comparing with , we can easily infer that is satisfied, because of and . Letting , we obtain two solutions, and , where . It is clear that . If , is satisfied. Under the condition , comparing with , we have . Since , we can easily prove that . That is to say, is satisfied. Accordingly, if , ; meanwhile, if , . Next, comparing the manufacturer’s profit under mode SC and mode NN, it is easy to prove that is always satisfied. Finally, we compare the manufacturer’s profit under mode SC and mode NC. Under the condition that , . It is clear that when . When , let , we solve for two solutions: and . We can infer that is satisfied. Therefore, if , ; and if , . □

Proof of Proposition 5 (2).

We first compare the platform’s profit under mode NC and mode NN. Under the condition that , . Thus, we infer that is satisfied when . Under the condition that , letting , we obtain solutions: and . Because is always satisfied, we can easily prove that . Furthermore, we can infer that when and when . Next, we compare the platform’s profit under mode NN and mode SC, . From that, we infer that is always satisfied. Finally, we compare the platform’s profit under mode NC and mode SC. Under the condition that , . From that, we infer that is satisfied when . Meanwhile, under the condition , . Since that is satisfied, we can infer , namely, . □

Proof of Table 5.

Letting , we obtain two solutions, i.e., and , where . Because is always satisfied, we can easily prove that . Furthermore, letting , we solve for . Thus, we can infer that when and when . Accordingly, is satisfied when . Under the condition that , we let and . By solving these two equations, we obtain the unique solution that satisfies , which is . Therefore, we can infer that when . We can further infer that when and when . Meanwhile, under the condition that , we infer that . Accordingly, we can further infer that is always satisfied for any that satisfies . In summary, what was presented in Table 5 is proved. □

Proof of Table 6.