Corporate Social Responsibility and Green Technology Innovation: The Moderating Role of Stakeholders

Abstract

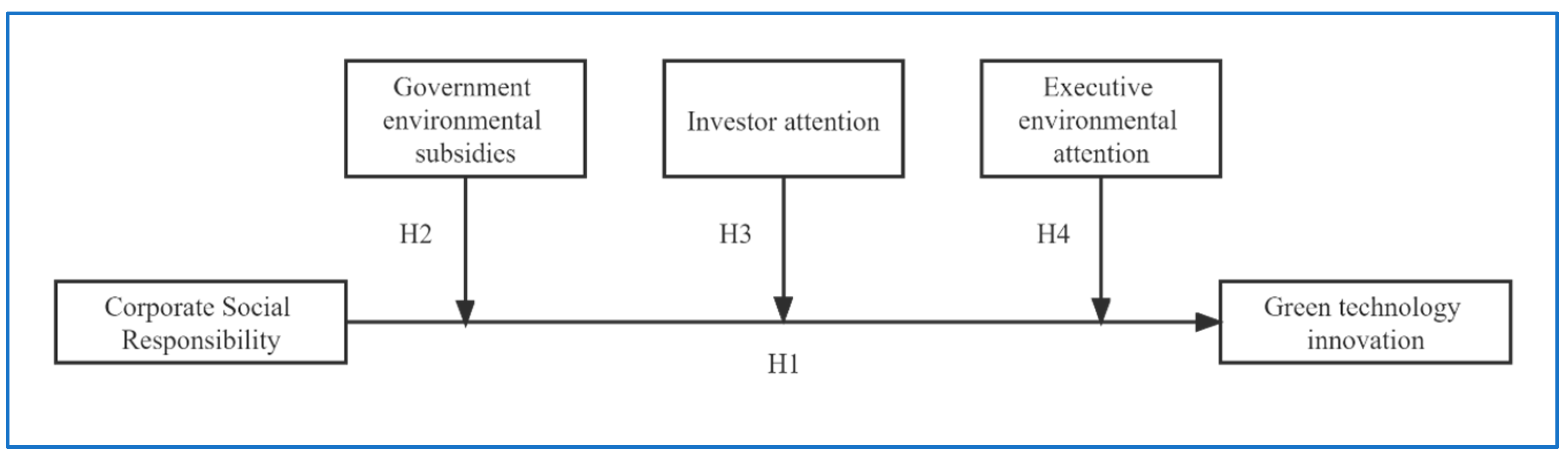

1. Introduction

2. Theoretical Background and Hypothesis

2.1. Influence of CSR on Enterprises’ GTI Capabilities

2.2. The Regulating Role of Government Environmental Protection Subsidies

2.3. Moderating Effect of Investor Attention

2.4. The Moderating Role of Environmental Attention in Top Management Teams

3. Data and Research Methods

3.1. Sample Selection and Data Sources

3.2. Definition of Variables

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Regulating Variables

Government Environmental Protection Subsidies

Investor Attention

The Executive Team’s Environmental Focus

3.2.4. Control Variables

3.3. Research Model

4. Results of Empirical Analysis

4.1. Descriptive Statistics and Correlation Analysis

4.2. Correlation Analysis

4.3. Analysis of Regression Results

4.4. Robustness Tests

4.4.1. Substitution of Independent Variables

4.4.2. Replacement Sample Interval

4.4.3. Two-Stage Least Squares (2SLS) Test

5. Discussion

6. Conclusions and Implications

6.1. Conclusions

6.2. Implications

6.2.1. Theoretical Implications

6.2.2. Managerial Implications

6.3. Limitations and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Roh, T.; Noh, J.; Oh, Y.; Park, K.S. Structural relationships of a firm’s green strategies for environmental performance: The roles of green supply chain management and green marketing innovation. J. Clean. Prod. 2022, 356, 131877. [Google Scholar] [CrossRef]

- Roh, T.; Lee, K.; Yang, J.Y. How do intellectual property rights and government support drive a firm’s green innovation? The mediating role of open innovation. J. Clean. Prod. 2021, 317, 128422. [Google Scholar] [CrossRef]

- Lee, M.J.; Roh, T. Unpacking the sustainable performance in the business ecosystem: Coopetition strategy, open innovation, and digitalization capability. J. Clean. Prod. 2023, 412, 137433. [Google Scholar] [CrossRef]

- Pan, D.; Hong, W. Benefits and costs of campaign-style environmental implementation: Evidence from China’s central environmental protection inspection system. Environ. Sci. Pollut. Res. 2022, 29, 45230–45247. [Google Scholar] [CrossRef]

- Pu, X.; Zeng, M.; Zhang, W. Corporate sustainable development driven by high-quality innovation: Does fiscal decentralization really matter? Econ. Anal. Policy 2023, 78, 273–289. [Google Scholar] [CrossRef]

- Halkos, G.; Nomikos, S. Corporate social responsibility: Trends in global reporting initiative standards. Econ. Anal. Policy 2021, 69, 106–117. [Google Scholar] [CrossRef]

- Bai, Y.A. Corporate social responsibility and corporate innovation output: Empirical evidence based on Chinese listed companies. Manag. Decis. Econ. 2022, 43, 3534–3547. [Google Scholar] [CrossRef]

- Hao, J.; He, F. Corporate social responsibility (CSR) performance and green innovation: Evidence from China. Financ. Res. Lett. 2022, 48, 102889. [Google Scholar] [CrossRef]

- Yuan, B.; Cao, X. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- García-Piqueres, G.; García-Ramos, R. Complementarity between CSR dimensions and innovation: Be-haviour, objective or both? Eur. Manag. J. 2022, 40, 475–489. [Google Scholar] [CrossRef]

- Yang, H.; Shi, X.; Wang, S. Moderating effect of chief executive officer narcissism in the relationship be-tween corporate social responsibility and green technology innovation. Front. Psychol. 2021, 12, 717491. [Google Scholar] [CrossRef]

- Li, C.; Wang, Z.; Wang, L. Factors affecting firms’ green technology innovation: An evolutionary game based on prospect theory. Environ. Monit. Assess. 2023, 195, 227. [Google Scholar] [CrossRef] [PubMed]

- Halkos, G.; Skouloudis, A. Corporate social responsibility and innovative capacity: Intersection in a mac-ro-level perspective. J. Clean. Prod. 2018, 182, 291–300. [Google Scholar] [CrossRef]

- Xie, Y.; Gao, S.; Jiang, X.; Fey, C.F. Social ties and indigenous innovation in China’s transition economy: The moderating effects of learning intent. Ind. Innov. 2015, 22, 79–101. [Google Scholar] [CrossRef]

- Seroka-Stolka, O.; Fijorek, K. Linking stakeholder pressure and corporate environmental competitiveness: The moderating effect of ISO 14001 adoption. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1663–1675. [Google Scholar] [CrossRef]

- Jayaraman, K.; Jayashree, S.; Dorasamy, M. The effects of green innovations in organizations: Influence of stakeholders. Sustainability 2023, 15, 1133. [Google Scholar] [CrossRef]

- Sheldon, O. The social responsibility of management. Philos. Manag. 1924, 70–99. [Google Scholar]

- Aguinis, H. Organizational responsibility: Doing good and doing well. In APA Handbook of Industrial and Organizational Psychology, Vol. 3. Maintaining, Expanding, and Contracting the Organization; Zedeck, S., Ed.; American Psychological Association: Washington, DC, USA, 2011; pp. 855–879. [Google Scholar] [CrossRef]

- Wang, Y.; Yang, Y.; Fu, C.; Fan, Z.; Zhou, X. Environmental regulation, environmental responsibility, and green technology innovation: Empirical research from China. PLoS ONE 2021, 16, e0257670. [Google Scholar] [CrossRef]

- Bahta, D.; Yun, J.; Islam, M.R.; Ashfaq, M. Corporate social responsibility, innovation capability and firm performance: Evidence from SME. Soc. Responsib. J. 2021, 17, 840–860. [Google Scholar] [CrossRef]

- Xue, Y.; Jiang, C.; Guo, Y.; Liu, J.; Wu, H.; Hao, Y. Corporate social responsibility and high-quality development: Do green innovation, environmental investment and corporate governance matter? Emerg. Mark. Financ. Trade 2022, 58, 3191–3214. [Google Scholar] [CrossRef]

- Farmaki, A. Corporate social responsibility in hotels: A stakeholder approach. Int. J. Contemp. Hosp. Manag. 2019, 31, 2297–2320. [Google Scholar] [CrossRef]

- Pekovic, S.; Vogt, S. The fit between corporate social responsibility and corporate governance: The impact on a firm’s financial performance. Rev. Manag. Sci. 2021, 15, 1095–1125. [Google Scholar] [CrossRef]

- Paruzel, A.; Klug, H.J.; Maier, G.W. The relationship between perceived corporate social responsibility and employee-related outcomes: A meta-analysis. Front. Psychol. 2021, 12, 607108. [Google Scholar] [CrossRef] [PubMed]

- Flores-Hernández, J.A.; Cambra-Fierro, J.J.; Vázquez-Carrasco, R. Sustainability, brand image, reputation and financial value: Manager perceptions in an emerging economy context. Sustain. Dev. 2020, 28, 935–945. [Google Scholar] [CrossRef]

- Chun, R. Corporate reputation: Meaning and measurement. Int. J. Manag. Rev. 2005, 7, 91–109. [Google Scholar] [CrossRef]

- Ramayah, T.; Falahat, M.; Soto-Acosta, P. Effects of corporate social responsibility on employee commitment and corporate reputation: Evidence from a transitional economy. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 2006–2015. [Google Scholar] [CrossRef]

- Padilla-Lozano, C.P.; Collazzo, P. Corporate social responsibility, green innovation and competitiveness–causality in manufacturing. Compet. Rev. Int. Bus. J. 2022, 32, 21–39. [Google Scholar] [CrossRef]

- Malen, J.; Marcus, A.A. Environmental externalities and weak appropriability: Influences on firm pollution reduction technology development. Bus. Soc. 2019, 58, 1599–1633. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M. Who is financing corporate green innovation? Int. Rev. Econ. Financ. 2022, 78, 321–337. [Google Scholar] [CrossRef]

- Wu, Z.; Fan, X.; Zhu, B.; Xia, J.; Zhang, L.; Wang, P. Do government subsidies improve innovation investment for new energy firms: A quasi-natural experiment of China’s listed companies. Technol. Forecast. Soc. Chang. 2022, 175, 121418. [Google Scholar] [CrossRef]

- Dong, Q.; Wu, Y.; Lin, H.; Sun, Z.; Liang, R. Fostering green innovation for corporate competitive advantages in big data era: The role of institutional benefits. Technol. Anal. Strateg. Manag. 2022, 34, 1–14. [Google Scholar] [CrossRef]

- Wenqi, D.; Khurshid, A.; Rauf, A.; Calin, A.C. Government subsidies’ influence on corporate social responsibility of private firms in a competitive environment. J. Innov. Knowl. 2022, 7, 100189. [Google Scholar] [CrossRef]

- Ren, S.; Sun, H.; Zhang, T. Do environmental subsidies spur environmental innovation? Empirical evidence from Chinese listed firms. Technol. Forecast. Soc. Chang. 2021, 173, 121123. [Google Scholar] [CrossRef]

- Zhang, W.; Luo, Q.; Liu, S. Is government regulation a push for corporate environmental performance? Evidence from China. Econ. Anal. Policy 2022, 74, 105–121. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, Y. Do state subsidies increase corporate environmental spending? Int. Rev. Financ. Anal. 2020, 72, 101592. [Google Scholar] [CrossRef]

- Ding, L.; Xu, Y. Government subsidies and corporate environmental investments: A resource-based perspective. Kybernetes 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Zhong, Z.; Peng, B. Can environmental regulation promote green innovation in heavily polluting enterprises? Empirical evidence from a quasi-natural experiment in China. Sustain. Prod. Consum. 2022, 30, 815–828. [Google Scholar] [CrossRef]

- Qi, Y.; Chai, Y.; Jiang, Y. Threshold effect of government subsidy, corporate social responsibility and brand value using the data of China’s top 500 most valuable brands. PLoS ONE 2021, 16, e0251927. [Google Scholar] [CrossRef]

- Nekrasov, A.; Teoh, S.H.; Wu, S. Visuals and attention to earnings news on Twitter. Rev. Account. Stud. 2022, 27, 1233–1275. [Google Scholar] [CrossRef]

- Hao, J.; Xiong, X. Retail investor attention and firms’ idiosyncratic risk: Evidence from China. Int. Rev. Financ. Anal. 2021, 74, 101675. [Google Scholar] [CrossRef]

- Gilal, F.G.; Channa, N.A.; Gilal, N.G.; Gilal, R.G.; Gong, Z.; Zhang, N. Corporate social responsibility and brand passion among consumers: Theory and evidence. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2275–2285. [Google Scholar] [CrossRef]

- Biktimirov, E.N.; Afego, P.N. Do investors value environmental sustainability? Evidence from the FTSE Environmental Opportunities 100 index. Financ. Res. Lett. 2022, 44, 102112. [Google Scholar] [CrossRef]

- Kordsachia, O.; Focke, M.; Velte, P. Do sustainable institutional investors contribute to firms’ environmental performance? Empirical evidence from Europe. Rev. Manag. Sci. 2021, 16, 1409–1436. [Google Scholar] [CrossRef]

- Yoshino, N.; Taghizadeh-Hesary, F.; Otsuka, M. COVID-19 and optimal portfolio selection for investment in sustainable development goals. Financ. Res. Lett. 2021, 38, 101695. [Google Scholar] [CrossRef]

- Martínez, M.D.C.V.; Román, R.S.; Mart, P.A. Should risk-averse investors target the portfolios of socially responsible companies? Oecon. Copernic. 2022, 13, 439–474. [Google Scholar] [CrossRef]

- Dyck, A.; Lins, K.V.; Roth, L.; Wagner, H.F. Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 2019, 131, 693–714. [Google Scholar] [CrossRef]

- Kyaw, K.; Olugbode, M.; Petracci, B. Stakeholder engagement: Investors’ environmental risk aversion and corporate earnings. Bus. Strategy Environ. 2022, 31, 1220–1231. [Google Scholar] [CrossRef]

- Xu, J.; Zeng, S.; Qi, S.; Cui, J. Do institutional investors facilitate corporate environmental innovation? Energy Econ. 2023, 117, 106472. [Google Scholar] [CrossRef]

- Chen, W.; Zhu, Y.; Wang, C. Executives’ overseas background and corporate green innovation. Corp. Soc. Responsib. Environ. Manag. 2022, 30, 165–179. [Google Scholar] [CrossRef]

- Javed, M.; Wang, F.; Usman, M.; Gull, A.A.; Zaman, Q.U. Female CEOs and green innovation. J. Bus. Res. 2023, 157, 113515. [Google Scholar] [CrossRef]

- Ju, X.; Jiang, S.; Zhao, Q. Innovation effects of academic executives: Evidence from China. Res. Policy 2023, 52, 104711. [Google Scholar] [CrossRef]

- Wu, J.; Richard, O.C.; Triana, M.D.C.; Zhang, X. The performance impact of gender diversity in the top management team and board of directors: A multiteam systems approach. Hum. Resour. Manag. 2022, 61, 157–180. [Google Scholar] [CrossRef]

- Yi, Y.; Chen, Y.; He, X. CEO leadership, strategic decision comprehensiveness, and firm performance: The moderating role of TMT cognitive conflict. Manag. Organ. Rev. 2022, 18, 131–166. [Google Scholar] [CrossRef]

- Hambrick, D.C. Upper echelons theory: An update. Acad. Manag. Rev. 2007, 32, 334–343. [Google Scholar] [CrossRef]

- Ocasio, W. Attention to attention. Organ. Sci. 2011, 22, 1286–1296. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, J.; Liu, S. Executive Team Functional Background and Enterprise Green Technology Innovation. In Proceedings of the 2022 2nd International Conference on Business Administration and Data Science (BADS 2022), Kashgar, China, 28–30 October 2022; Atlantis Press: Paris, France, 2023; pp. 109–116. [Google Scholar] [CrossRef]

- Wang, L.; Zeng, T.; Li, C. Behavior decision of top management team and enterprise green technology innovation. J. Clean. Prod. 2022, 367, 133120. [Google Scholar] [CrossRef]

- Gao, K.; Wang, L.; Liu, T.; Zhao, H. Management executive power and corporate green innovation: Empirical evidence from China’s state-owned manufacturing sector. Technol. Soc. 2022, 70, 102043. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M.; Larsen, B.; Rosenbaum, P. CEO education and corporate environmental footprint. J. Environ. Econ. Manag. 2019, 94, 254–273. [Google Scholar] [CrossRef]

- Zhu, X.; Zuo, X.; Li, H. The dual effects of heterogeneous environmental regulation on the technological innovation of Chinese steel enterprises: Based on a high-dimensional fixed effects model. Ecol. Econ. 2021, 188, 107113. [Google Scholar] [CrossRef]

- Li, J.; Lian, G.; Xu, A. How do ESG affect the spillover of green innovation among peer firms? Mechanism discussion and performance study. J. Bus. Res. 2023, 158, 113648. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Samad, S.; Nilashi, M.; Almulihi, A.; Alrizq, M.; Alghamdi, A.; Mohd, S.; Azhar, S.N.F.S. Green supply chain management practices and impact on firm performance: The moderating effect of collaborative capability. Technol. Soc. 2021, 67, 101766. [Google Scholar] [CrossRef]

- Cao, C.; Tong, X.; Chen, Y.; Zhang, Y. How top management’s environmental awareness affect corporate green competitive advantage: Evidence from China. Kybernetes 2022, 51, 1250–1279. [Google Scholar] [CrossRef]

- Aftab, J.; Abid, N.; Sarwar, H.; Veneziani, M. Environmental ethics, green innovation, and sustainable performance: Exploring the role of environmental leadership and environmental strategy. J. Clean. Prod. 2022, 378, 134639. [Google Scholar] [CrossRef]

- Velte, P.; Stawinoga, M. Do chief sustainability officers and CSR committees influence CSR-related outcomes? A structured literature review based on empirical-quantitative research findings. J. Manag. Control 2020, 31, 333–377. [Google Scholar] [CrossRef]

- Wei, X.; Wu, H.; Yang, Z.; Han, C.; Xu, B. Simulation of Manufacturing Scenarios’ Ambidexterity Green Technological Innovation Driven by Inter-Firm Social Networks: Based on a Multi-Objective Model. Systems 2023, 11, 39. [Google Scholar] [CrossRef]

- Zhang, C.; Jin, S. What drives sustainable development of enterprises? Focusing on ESG management and green technology innovation. Sustainability 2022, 14, 11695. [Google Scholar] [CrossRef]

- Dmytriyev, S.D.; Freeman, R.E.; Hörisch, J. The relationship between stakeholder theory and corporate social responsibility: Differences, similarities, and implications for social issues in management. J. Manag. Stud. 2021, 58, 1441–1470. [Google Scholar] [CrossRef]

- Javeed, S.A.; Teh, B.H.; Ong, T.S.; Chong, L.L.; Abd Rahim, M.F.B.; Latief, R. How does green innovation strategy influence corporate financing? Corporate social responsibility and gender diversity play a moderating role. Int. J. Environ. Res. Public Health 2022, 19, 8724. [Google Scholar] [CrossRef]

- Fu, L.; Pan, L.; Zhao, J. Can Passive Investors Improve Corporate Social Responsibility? Evidence from Chinese Listed Firms. Emerg. Mark. Financ. Trade 2023, 59, 404–419. [Google Scholar] [CrossRef]

- Jiang, Z.; Xu, C.; Zhou, J. Government environmental protection subsidies, environmental tax collection, and green innovation: Evidence from listed enterprises in China. Environ. Sci. Pollut. Res. 2023, 30, 4627–4641. [Google Scholar] [CrossRef] [PubMed]

- Sun, X.; Tang, J.; Li, S. Promote green innovation in manufacturing enterprises in the aspect of government subsidies in China. Int. J. Environ. Res. Public Health 2022, 19, 7864. [Google Scholar] [CrossRef] [PubMed]

- Baker, M.; Wurgler, J. Investor sentiment in the stock market. J. Econ. Perspect. 2007, 21, 129–151. [Google Scholar] [CrossRef]

- Zhang, G.; Fang, C.; Zhang, W.; Wang, Q.; Hu, D. How does the implementation of the new Environmental Protection Law affect the stock price of heavily polluting enterprises? Evidence from China’s capital market. Emerg. Mark. Financ. Trade 2019, 55, 3513–3538. [Google Scholar] [CrossRef]

- Pham, L.; Cepni, O. Extreme directional spillovers between investor attention and green bond markets. Int. Rev. Econ. Financ. 2022, 80, 186–210. [Google Scholar] [CrossRef]

- Hao, J. Retail investor attention and corporate innovation in the big data era. Int. Rev. Financ. Anal. 2023, 86, 102486. [Google Scholar] [CrossRef]

- Sapir, E. Grading, a study in semantics. Philos. Sci. 1944, 11, 93–116. [Google Scholar] [CrossRef]

- Duriau, V.J.; Reger, R.K.; Pfarrer, M.D. A content analysis of the content analysis literature in organization studies: Research themes, data sources, and methodological refinements. Organ. Res. Methods 2007, 10, 5–34. [Google Scholar] [CrossRef]

- Zhang, C.; Jin, S. How does an environmental information disclosure of a buyer’s enterprise affect green technological innovations of sellers’ enterprise? Int. J. Environ. Res. Public Health 2022, 19, 14715. [Google Scholar] [CrossRef]

- Gao, Y.; Jin, S. Corporate nature, financial technology, and corporate innovation in China. Sustainability 2022, 14, 7162. [Google Scholar] [CrossRef]

- Zheng, Y.; Rashid, M.H.U.; Siddik, A.B.; Wei, W.; Hossain, S.Z. Corporate social responsibility disclosure and firm’s productivity: Evidence from the banking industry in Bangladesh. Sustainability 2022, 14, 6237. [Google Scholar] [CrossRef]

- Ang, R.; Shao, Z.; Liu, C.; Yang, C.; Zheng, Q. The relationship between CSR and financial performance and the moderating effect of ownership structure: Evidence from Chinese heavily polluting listed enterprises. Sustain. Prod. Consum. 2022, 30, 117–129. [Google Scholar] [CrossRef]

- Lin, Y.E.; Li, Y.W.; Cheng, T.Y.; Lam, K. Corporate social responsibility and investment efficiency: Does business strategy matter? Int. Rev. Financ. Anal. 2021, 73, 101585. [Google Scholar] [CrossRef]

- Sarwar, H.; Aftab, J.; Ishaq, M.I.; Atif, M. Achieving business competitiveness through corporate social responsibility and dynamic capabilities: An empirical evidence from emerging economy. J. Clean. Prod. 2023, 386, 135820. [Google Scholar] [CrossRef]

- Chkir, I.; Hassan, B.E.H.; Rjiba, H.; Saadi, S. Does corporate social responsibility influence corporate innovation? International evidence. Emerg. Mark. Rev. 2021, 46, 100746. [Google Scholar] [CrossRef]

- Mbanyele, W.; Huang, H.; Li, Y.; Muchenje, L.T.; Wang, F. Corporate social responsibility and green innovation: Evidence from mandatory CSR disclosure laws. Econ. Lett. 2022, 212, 110322. [Google Scholar] [CrossRef]

- Feng, Y.; Akram, R.; Hieu, V.M.; Tien, N.H. The impact of corporate social responsibility on the sustainable financial performance of Italian firms: Mediating role of firm reputation. Econ. Res.-Ekon. Istraž. 2021, 35, 4740–4758. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Chang. 2020, 160, 120262. [Google Scholar] [CrossRef]

- Flammer, C.; Kacperczyk, A. The impact of stakeholder orientation on innovation: Evidence from a natural experiment. Manag. Sci. 2016, 62, 1982–2001. [Google Scholar] [CrossRef]

- Pan, Z.; Liu, L.; Bai, S.; Ma, Q. Can the social trust promote corporate green innovation? Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 52157–52173. [Google Scholar] [CrossRef] [PubMed]

| Sample Selection | |

|---|---|

| Total number of companies | 2364 |

| Excluded ST/*ST/PT companies | 565 |

| Excluded companies in the financial industries | 126 |

| Companies extracted | 1673 |

| Variable | Name | Symbol | Definition |

|---|---|---|---|

| Independent variable | Corporate social responsibility | CSR | Hexun.com Corporate Social Responsibility Score |

| Dependent variable | Green technology innovation | GTI | Ln (Number of green patent authorizations + 1) |

| Moderating variables | Government environmental protection subsidy | ESA | Ln (Environmental protection subsidies) |

| Investor attention | IA | Ln(Annual Web Search Index) | |

| Executive environmental attention | EEA | Ln (Environmental attention keyword frequency) | |

| ontrol Variables | Enterprise size | Size | Ln (Book value of total assets at the end of the year) |

| Asset–liability ratio | Lev | Total liabilities/total assets | |

| Return on assets | Roa | Net profit/average balance of total assets | |

| Investor shareholding ratio | Inst | Total number of shares held by institutional investors/outstanding share capital | |

| Cash flow ratio | Cash | Net cash flow from operating activities/total assets | |

| Duality | Dual | The chairman and general manager are the same = 1, otherwise = 0 | |

| Independent director ratio | Indep | Number of independent directors/number of boards of directors | |

| Year | Year | Annual dummy variables | |

| Industry | Industry | Industry dummy variables |

| Variable | Sd | P50 | Mean | Min | Max | Sample Size |

|---|---|---|---|---|---|---|

| GTI | 0.62 | 0 | 0.25 | 0 | 4.86 | 4941 |

| CSR | 15.09 | 21.14 | 23.1 | −11.27 | 90.87 | 4941 |

| ESA | 2.09 | 13.23 | 13.27 | 5.8 | 21.24 | 4941 |

| IA | 0.69 | 12.72 | 12.76 | 8.7 | 16.61 | 4941 |

| EEA | 1.02 | 4.34 | 4.41 | 0 | 7.67 | 4941 |

| Size | 1.2 | 22.2 | 22.36 | 19.55 | 26.4 | 4941 |

| Lev | 0.2 | 0.44 | 0.45 | 0.03 | 0.92 | 4941 |

| Roa | 0.06 | 0.03 | 0.04 | −0.4 | 0.24 | 4941 |

| Inst | 0.23 | 0.43 | 0.41 | 0 | 0.89 | 4941 |

| Cash | 0.07 | 0.05 | 0.05 | −0.2 | 0.26 | 4941 |

| Dual | 0.42 | 0 | 0.22 | 0 | 1 | 4941 |

| Indep | 0.05 | 0.33 | 0.37 | 0.3 | 0.6 | 4941 |

| Variable | GTI | CSR | ESA | CSR* ESA | IA | CSR* IA | EEA | CSR* EEA | Size | Lev | Roa | Inst | Cash | Dual | Indep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GTI | 1 | ||||||||||||||

| CSR | 0.042 *** | 1 | |||||||||||||

| ESA | 0.117 *** | 0.066 *** | 1 | ||||||||||||

| CSR*ESA | 0.067 *** | 0.197 *** | 0.062 *** | 1 | |||||||||||

| IA | 0.067 *** | 0.100 *** | 0.245 *** | 0.038 *** | 1 | ||||||||||

| CSR*IA | 0.061 *** | 0.325 *** | 0.040 *** | 0.273 *** | 0.039 *** | 1 | |||||||||

| EEA | 0.190 *** | −0.045 *** | 0.309 *** | 0.00300 | −0.037 *** | −0.00800 | 1 | ||||||||

| CSR*EEA | −0.0110 | −0.169 *** | 0.00300 | 0.230 *** | -0.00800 | −0.065 *** | 0.061 *** | 1 | |||||||

| Size | 0.112 *** | 0.240 *** | 0.423 *** | 0.088 *** | 0.399 *** | 0.107 *** | 0.331 *** | −0.054 *** | 1 | ||||||

| Lev | 0.051 *** | −0.081 *** | 0.280 *** | 0.0220 | 0.205 *** | -0.0150 | 0.155 *** | 0.0100 | 0.492 *** | 1 | |||||

| Roa | 0.033 ** | 0.438 *** | −0.061 *** | −0.027 * | −0.043 *** | 0.096 *** | −0.0220 | −0.087 *** | −0.00100 | -0.393 *** | 1 | ||||

| Inst | 0.00300 | 0.172 *** | 0.211 *** | 0.044 *** | 0.142 *** | 0.086 *** | 0.107 *** | −0.040 *** | 0.443 *** | 0.218 *** | 0.0160 | 1 | |||

| Cash | −0.0160 | 0.211 *** | 0.081 *** | 0.0110 | 0.036 ** | 0.039 *** | 0.074 *** | −0.049 *** | 0.080 *** | -0.160 *** | 0.402 *** | 0.081 *** | 1 | ||

| Dual | 0.00400 | −0.045 *** | −0.136 *** | −0.0120 | −0.105 *** | −0.0100 | −0.074 *** | −0.00400 | −0.178 *** | -0.113 *** | 0.047 *** | -0.160 *** | -0.00200 | 1 | |

| Indep | −0.00900 | −0.00700 | −0.028 * | 0.035 ** | -0.00400 | 0.030 ** | -0.0200 | 0.00200 | −0.0200 | −0.00300 | −0.036 ** | −0.029 ** | −0.028 * | 0.079 *** | 1 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| GTI | GTI | GTI | GTI | |

| CSR | 0.005 *** | 0.004 *** | 0.004 *** | 0.005 *** |

| (8.79) | (9.20) | (9.05) | (8.94) | |

| ESA | 0.015 *** | |||

| (4.64) | ||||

| CSR*ESA | 0.001 *** | |||

| (3.59) | ||||

| IA | 0.046 *** | |||

| (3.14) | ||||

| CSR*IA | 0.002 *** | |||

| (3.53) | ||||

| EEA | 0.027 *** | |||

| (2.84) | ||||

| CSR*EEA | 0.001 *** | |||

| (2.94) | ||||

| Size | 0.041 ** | 0.034 * | 0.039 ** | 0.039 ** |

| (2.29) | (1.92) | (2.18) | (2.18) | |

| Lev | −0.131 ** | −0.125 ** | −0.141 ** | −0.127 ** |

| (−2.22) | (−2.15) | (−2.41) | (−2.16) | |

| Roa | −0.395 *** | −0.337 *** | −0.379 *** | −0.396 *** |

| (−4.30) | (−3.84) | (−4.29) | (−4.36) | |

| Inst | −0.020 | −0.015 | −0.014 | −0.023 |

| (−0.50) | (−0.37) | (−0.36) | (−0.59) | |

| Cash | −0.125 | −0.126 | −0.137 * | −0.131 * |

| (−1.57) | (−1.61) | (−1.72) | (−1.66) | |

| Dual | −0.010 | −0.009 | −0.008 | −0.010 |

| (−0.62) | (−0.58) | (−0.55) | (−0.68) | |

| Indep | 0.053 | 0.043 | 0.041 | 0.052 |

| (0.40) | (0.32) | (0.31) | (0.39) | |

| Observations | 4, 941 | 4, 941 | 4, 941 | 4, 941 |

| R-squared | 0.0504 | 0.0588 | 0.0573 | 0.0571 |

| Industry FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Variables | (1) GTI | (2) GTI | (3) GTI | (4) GTI | (5) GTI | (6) GTI |

|---|---|---|---|---|---|---|

| CSR_R | 0.013 *** | 0.013 *** | ||||

| (7.67) | (7.73) | |||||

| CSR_S | 0.004 *** | 0.003 *** | ||||

| (3.76) | (3.32) | |||||

| CSR_E | 0.014 *** | 0.014 *** | ||||

| (7.98) | (8.03) | |||||

| Size | 0.051 *** | 0.057 *** | 0.048 *** | |||

| (2.77) | (3.00) | (2.61) | ||||

| Lev | −0.159 *** | −0.161 *** | −0.164 *** | |||

| (−2.69) | (−2.69) | (−2.77) | ||||

| ROA | 0.012 | −0.032 | 0.015 | |||

| (0.15) | (−0.39) | (0.19) | ||||

| INST | −0.019 | −0.006 | −0.022 | |||

| (−0.48) | (−0.15) | (−0.57) | ||||

| Cashflow | −0.123 | −0.112 | −0.109 | |||

| (−1.54) | (−1.40) | (−1.37) | ||||

| Dual | −0.011 | −0.012 | −0.009 | |||

| (−0.75) | (−0.78) | (−0.57) | ||||

| Indep | 0.050 | 0.063 | 0.064 | |||

| (0.37) | (0.47) | (0.48) | ||||

| Constant | 0.566 *** | 0.658 *** | 0.525 *** | −0.447 | −0.492 | −0.425 |

| (4.59) | (4.63) | (4.78) | (−1.05) | (−1.11) | (−1.01) | |

| Observations | 4, 941 | 4, 941 | 4, 941 | 4, 941 | 4, 941 | 4, 941 |

| R-squared | 0.037 | 0.015 | 0.045 | 0.043 | 0.021 | 0.050 |

| Industry FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| GTI | GTI | GTI | GTI | |

| CSR | 0.005 *** | 0.004 *** | 0.004 *** | 0.005 *** |

| (8.84) | (9.28) | (9.12) | (9.02) | |

| ESA | 0.014 *** | |||

| (4.42) | ||||

| CSR*ESA | 0.001 *** | |||

| (3.61) | ||||

| IA | 0.046 *** | |||

| (3.10) | ||||

| CSR*IA | 0.002 *** | |||

| (3.50) | ||||

| EEA | 0.028 *** | |||

| (2.88) | ||||

| CSR*EEA | 0.001 *** | |||

| (3.00) | ||||

| Size | 0.043 ** | 0.036 * | 0.040 ** | 0.041 ** |

| (2.34) | (1.96) | (2.22) | (2.24) | |

| Lev | −0.129 ** | −0.124 ** | −0.138 ** | −0.126 ** |

| (−2.16) | (−2.09) | (−2.32) | (−2.11) | |

| Roa | −0.404 *** | −0.347 *** | −0.386 *** | −0.407 *** |

| (−4.38) | (−3.93) | (−4.36) | (−4.45) | |

| Inst | −0.019 | −0.013 | −0.013 | −0.022 |

| (−0.46) | (−0.33) | (−0.33) | (−0.55) | |

| Cash | −0.124 | −0.128 | −0.135 * | −0.130 |

| (−1.55) | (−1.62) | (−1.69) | (−1.65) | |

| Dual | −0.008 | −0.007 | −0.007 | −0.009 |

| (−0.51) | (−0.47) | (−0.44) | (−0.57) | |

| Indep | 0.048 | 0.040 | 0.034 | 0.047 |

| (0.36) | (0.29) | (0.25) | (0.35) | |

| Constant | −0.350 | −0.359 | −0.855 * | −0.379 |

| (−0.82) | (−0.85) | (−1.82) | (−0.90) | |

| Observations | 4, 861 | 4, 861 | 4, 861 | 4, 861 |

| R-squared | 0.051 | 0.060 | 0.057 | 0.057 |

| Industry FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Variables | First Stage | Second Stage |

|---|---|---|

| CSR | GTI | |

| LCSR | 0.211 *** | |

| (6.024) | ||

| CSR | 0.009 *** | |

| (3.152) | ||

| Size | 1.719 * | 0.021 |

| (1.649) | (0.885) | |

| Lev | −6.291 ** | −0.085 |

| (−2.064) | (−0.986) | |

| Roa | 80.563 *** | −0.713 *** |

| (12.008) | (−2.913) | |

| Cashflow | 3.298 | −0.038 |

| (0.803) | (−0.428) | |

| Indep | −8.121 | 0.048 |

| (−1.009) | (0.263) | |

| Dual | −1.307 | 0.013 |

| (−1.321) | (0.624) | |

| Inst | 2.991 | −0.065 |

| (1.567) | (−1.300) | |

| Constant | −19.683 | −0.431 |

| (−0.830) | (−0.789) | |

| Under-identification test (Kleibergen–Paap rk LM statistic) | 26.505 (Chi-sq(1) p-val = 0.000) | |

| Weak identification test (Cragg–Donald Wald F statistic) (Kleibergen–Paap rk Wald F statistic) 10% maximal IV size | 73.220 36.209 16.380 | |

| Hausman test | 0.000 | 0.012 |

| Observations | 2, 452 | 2, 452 |

| R-squared | 0.345 | 0.027 |

| Industry FE | YES | YES |

| Year FE | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Y.; Jin, S. Corporate Social Responsibility and Green Technology Innovation: The Moderating Role of Stakeholders. Sustainability 2023, 15, 8164. https://doi.org/10.3390/su15108164

Chen Y, Jin S. Corporate Social Responsibility and Green Technology Innovation: The Moderating Role of Stakeholders. Sustainability. 2023; 15(10):8164. https://doi.org/10.3390/su15108164

Chicago/Turabian StyleChen, Yixuan, and Shanyue Jin. 2023. "Corporate Social Responsibility and Green Technology Innovation: The Moderating Role of Stakeholders" Sustainability 15, no. 10: 8164. https://doi.org/10.3390/su15108164

APA StyleChen, Y., & Jin, S. (2023). Corporate Social Responsibility and Green Technology Innovation: The Moderating Role of Stakeholders. Sustainability, 15(10), 8164. https://doi.org/10.3390/su15108164