Global Structural Shocks and FDI Dynamic Impact on Productive Capacities: An Application of CS-ARDL Estimation

Abstract

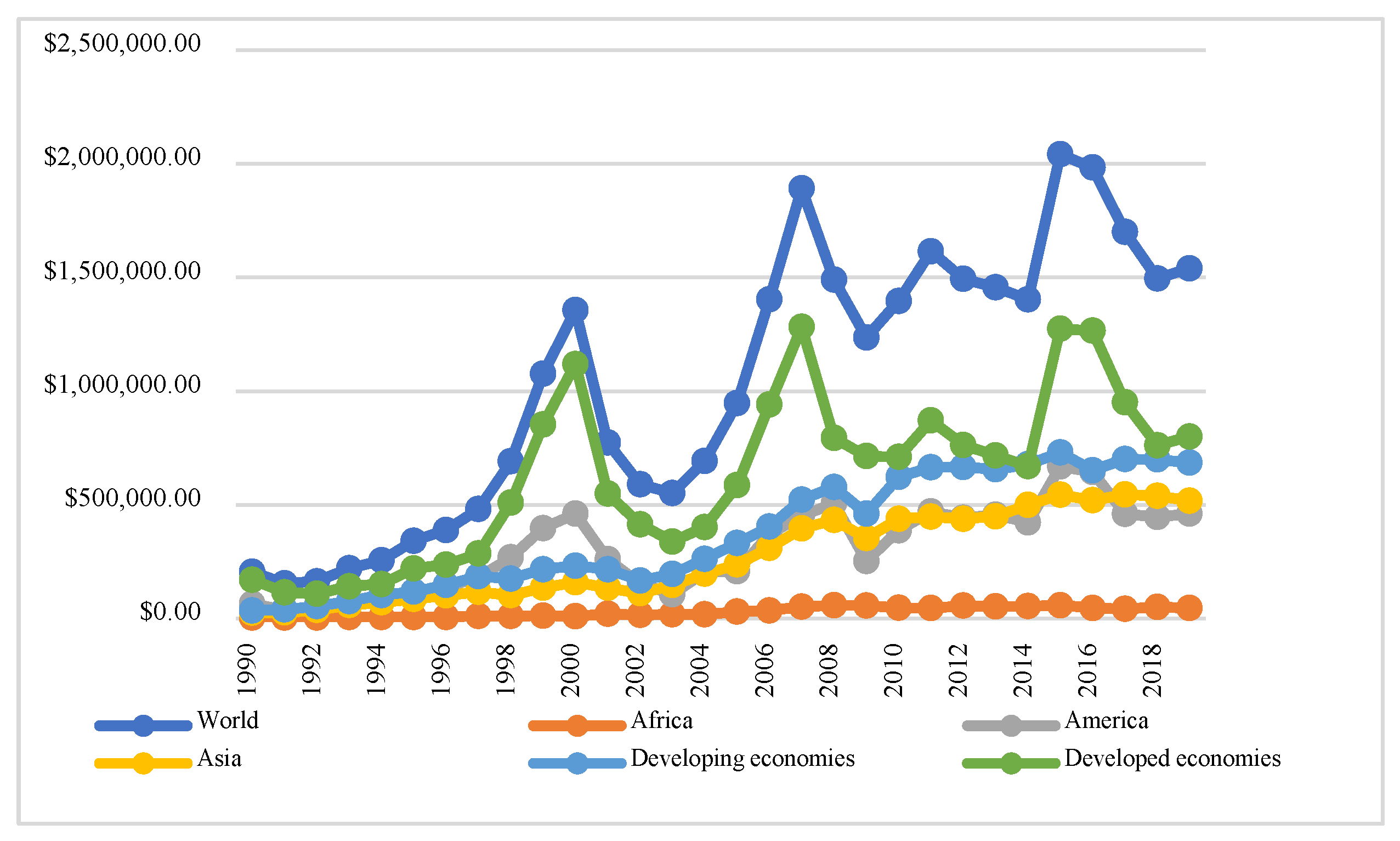

1. Introduction

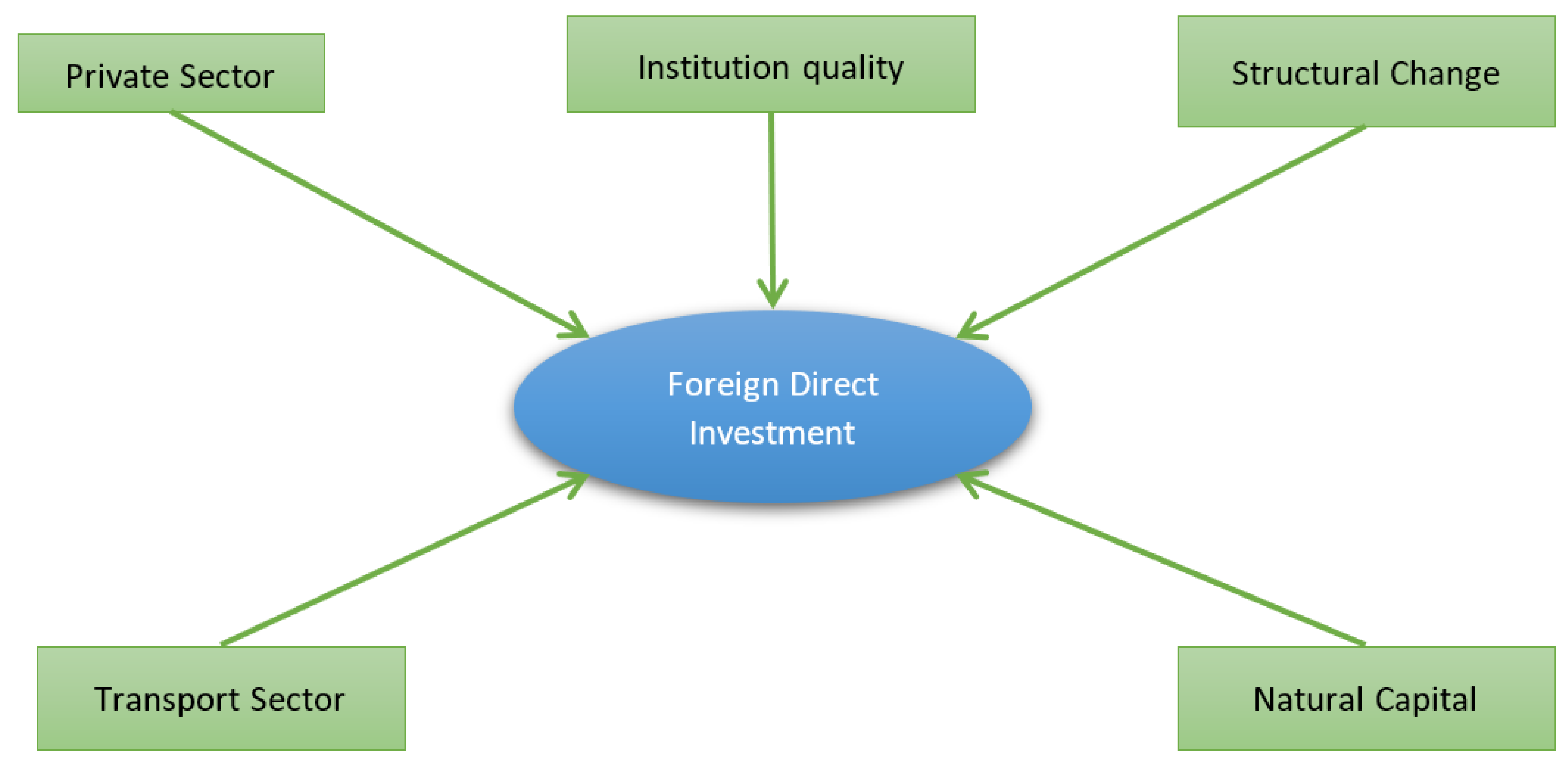

2. Literature Review

2.1. Foreign Direct Investment and Institutional Quality

2.2. Foreign Direct Investment and Structural Change

2.3. Foreign Direct Investment and Private Sector

2.4. Foreign Direct Investment and Transport Quality

2.5. Foreign Direct Investment and Natural Resources

3. Methodology and Data

3.1. Model and Data Specification

3.2. Empirical Estimation Procedure

3.2.1. Pre-Estimation Analysis Technique

3.2.2. Cross-Section Dependency Estimation (CD)

3.2.3. Panel Unit Root Estimation Test

3.2.4. Cross-Sectional Autoregressive Distributed Lag Estimation (CS-ARDL)

the mean.

the mean. 4. Empirical Results and Discussion

Robustness Check

5. Conclusion and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- UNCTAD. Trade and Development Report 2021. 2021. Available online: https://unctad.org/system/files/official-document/tdr2021overview_en.pdf (accessed on 1 June 2021).

- Sohail, H.M.; Zatullah, M.; Li, Z. Effect of foreign direct investment on bilateral trade: Experience from Asian emerging economies. SAGE Open 2021, 11, 21582440211054487. [Google Scholar] [CrossRef]

- Wooster, R.B.; Diebel, D.S. Productivity spillovers from foreign direct investment in developing countries: A meta-regression analysis. Rev. Dev. Econ. 2010, 14, 640–655. [Google Scholar] [CrossRef]

- Gunby, P.; Jin, Y.; Reed, W.R. Did FDI really cause Chinese economic growth? A meta-analysis. World Dev. 2017, 90, 242–255. [Google Scholar] [CrossRef]

- Preis, T.; Moat, H.S.; Stanley, H.E. Quantifying trading behavior in financial markets using Google Trends. Sci. Rep. 2013, 3, 1684. [Google Scholar] [CrossRef] [PubMed]

- Getzner, M.; Moroz, S. Regional development and foreign direct investment in transition countries: A case study for regions in Ukraine. Post-Communist Econ. 2020, 32, 813–832. [Google Scholar] [CrossRef]

- Saini, N.; Singhania, M. Determinants of FDI in developed and developing countries: A quantitative analysis using GMM. J. Econ. Stud. 2018, 45, 348–382. [Google Scholar] [CrossRef]

- Vanlaer, W.; Picarelli, M.; Marneffe, W. Debt and Private Investment: Does the EU Suffer from a Debt Overhang? Open Econ. Rev. 2021, 32, 789–820. [Google Scholar] [CrossRef]

- Wei, S.-J. How taxing is corruption on international investors? Rev. Econ. Stat. 2000, 82, 1–11. [Google Scholar] [CrossRef]

- Čermáková, K.; Procházka, P.; Kureková, L.; Rotschedl, J. Do Institutions Influence Economic Growth? Prague Econ. Pap. 2020, 2020, 672–687. [Google Scholar] [CrossRef]

- Khan, S.; Ullah, M.; Shahzad, M.R.; Khan, U.A.; Khan, U.; Eldin, S.M.; Alotaibi, A.M. Spillover Connectedness among Global Uncertainties and Sectorial Indices of Pakistan: Evidence from Quantile Connectedness Approach. Sustainability 2022, 14, 15908. [Google Scholar] [CrossRef]

- Gani, A. Governance and foreign direct investment links: Evidence from panel data estimations. Appl. Econ. Lett. 2007, 14, 753–756. [Google Scholar] [CrossRef]

- Daude, C.; Stein, E. The quality of institutions and foreign direct investment. Econ. Politics 2007, 19, 317–344. [Google Scholar] [CrossRef]

- Cui, L.; Weng, S.; Nadeem, A.M.; Rafique, M.Z.; Shahzad, U. Exploring the role of renewable energy, urbanization and structural change for environmental sustainability: Comparative analysis for practical implications. Renew. Energy 2022, 184, 215–224. [Google Scholar] [CrossRef]

- Murshed, M.; Elheddad, M.; Ahmed, R.; Bassim, M.; Than, E.T. Foreign direct investments, renewable electricity output, and ecological footprints: Do financial globalization facilitate renewable energy transition and environmental welfare in Bangladesh? Asia Pac. Financ. Mark. 2022, 29, 33–78. [Google Scholar] [CrossRef]

- Dang, Q.T.; Jasovska, P.; Rammal, H.G. International business-government relations: The risk management strategies of MNEs in emerging economies. J. World Bus. 2020, 55, 101042. [Google Scholar] [CrossRef]

- Pineli, A.; Narula, R.; Belderbos, R. FDI, Multinationals and Structural Change in Developing Countries; Working Paper 4; UNU-MERIT: Maastricht, The Netherlands, 2019. [Google Scholar]

- Barua, S.; Naym, J. Economic Climate, Infrastructure and FDI: Global Evidence with New Dimensions. Int. J. Bus. Econ. 2017, 16, 31. [Google Scholar]

- Dussel Peters, E. Características de las actividades generadoras de empleo en la economía mexicana (1988–2000). Investig. Econ. 2003, 63, 123–154. [Google Scholar]

- Bensusán, G.; Carrillo, J.; Micheli, J.; Carrillo, J.; Bensusán, G.; Micheli, J. ¿Está Realmente la Innovación Asociada con la Mejora Social? ¿Qué Podemos Aprender de los Estudios de Caso? In Es Posible Innovar y Mejorar Laboralmente; Carrillo, J., Bensusán, G., Micheli, J., Eds.; Metropolitan Autonomous University: Mexico City, Mexico, 2017; pp. 627–690. [Google Scholar]

- Mahbub, T.; Ahammad, M.F.; Tarba, S.Y.; Mallick, S.M.Y. Factors encouraging foreign direct investment (FDI) in the wind and solar energy sector in an emerging country. Energy Strategy Rev. 2022, 41, 100865. [Google Scholar] [CrossRef]

- Fahad, S.; Bai, D.; Liu, L.; Baloch, Z.A. Heterogeneous impacts of environmental regulation on foreign direct investment: Do environmental regulation affect FDI decisions? Environ. Sci. Pollut. Res. 2022, 29, 5092–5104. [Google Scholar] [CrossRef]

- Azman-Saini, W.N.W.; Law, S.H. FDI and economic growth: New evidence on the role of financial markets. Econ. Lett. 2010, 107, 211–213. [Google Scholar] [CrossRef]

- Latif, Y.; Ge, S.; Qamri, G.M.; Ali, S. The Determinants of Trade Openness in Two Emerging Economies; China-Pakistan Economic Corridor Perspective. IEEE Trans. Eng. Manag. 2022, 3, 1–9. [Google Scholar] [CrossRef]

- Akinlo, A.E. Foreign direct investment and growth in Nigeria: An empirical investigation. J. Policy Model. 2004, 26, 627–639. [Google Scholar] [CrossRef]

- Kocsis, B.; Vida, G.; Szalay, Z.; Ágoston, G. Novel approaches to evaluate the ability of vehicles for secured transportation. Period. Polytech. Transp. Eng. 2019, 49, 80–88. [Google Scholar] [CrossRef]

- Shahbaz, M.; Mateev, M.; Abosedra, S.; Nasir, M.A.; Jiao, Z. Determinants of FDI in France: Role of transport infrastructure, education, financial development and energy consumption. Int. J. Financ. Econ. 2021, 26, 1351–1374. [Google Scholar] [CrossRef]

- Hoang, H.H.; Huynh, C.M.; Duong, N.M.H.; Chau, N.H. Determinants of foreign direct investment in Southern Central Coast of Vietnam: A spatial econometric analysis. Econ. Chang. Restruct. 2022, 55, 285–310. [Google Scholar] [CrossRef]

- Ahmad, N.A.; Ismail, N.W.; Nordin, N. The impact of infrastructure on foreign direct investment in Malaysia. Int. J. Manag. Excell. 2015, 5, 584–590. [Google Scholar] [CrossRef]

- Buera, F.J.; Kaboski, J.P. Can traditional theories of structural change fit the data? J. Eur. Econ. Assoc. 2009, 7, 469–477. [Google Scholar] [CrossRef]

- Haque, M.M.; Chowdhury, M.A.F.; Shakil, M.H.; Masih, M. Infrastructure-FDI nexus in Nigeria: Insights from non-linear threshold regression model. Afro Asian J. Financ. Account. 2021, 11, 20–34. [Google Scholar] [CrossRef]

- Iqbal, S.; Wang, Y.; Shaikh, P.A.; Maqbool, A.; Hayat, K. Exploring the asymmetric effects of renewable energy production, natural resources, and economic progress on CO2 emissions: Fresh evidence from Pakistan. Environ. Sci. Pollut. Res. 2022, 29, 7067–7078. [Google Scholar] [CrossRef]

- Ekananda, M. Role of macroeconomic determinants on the natural resource commodity prices: Indonesia futures volatility. Resour. Policy 2022, 78, 102815. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A. Economic Convergence and Economic Policies; National Bureau of Economic Research: Cambridge, MA, USA, 1995. [Google Scholar]

- Botta, A.; Yajima, G.T.; Porcile, G. Structural Change, Productive Development, and Capital Flows: Does Financial “Bonanza” Cause Premature Deindustrialization? Working Papers Series; Levy Economics Institute: Annandale-On-Hudson, NY, USA, 2022. [Google Scholar]

- Ali, M.; Kirikkaleli, D.; Sharma, R.; Altuntaş, M. The nexus between remittances, natural resources, technological innovation, economic growth, and environmental sustainability in Pakistan. Environ. Sci. Pollut. Res. 2022, 29, 75822–75840. [Google Scholar] [CrossRef] [PubMed]

- Lederman, D.; Maloney, W. Open Questions About the Link between Natural Resources and Economic Growth: Sachs and Warner Revisited; Banco Central de Chile: Santiago, Chile, 2002; Volume 141. [Google Scholar]

- Xie, Z.-J. The Non-Linear Effect of Institutional Distance on the Location Selection of China’s Outward Foreign Direct Investment. In Proceedings of the 5th Annual International Conference on Management, Economics and Social Development (ICMESD 2019), Suzhou, China, 21–22 June 2019. [Google Scholar]

- Baltagi, B.H.; Hashem Pesaran, M. Heterogeneity and Cross-Section Dependence in Panel Data Models: Theory and Applications Introduction; Wiley Online Library: Hoboken, NJ, USA, 2007; Volume 22, pp. 229–232. [Google Scholar]

- Le, H.P.; Sarkodie, S.A. Dynamic linkage between renewable and conventional energy use, environmental quality and economic growth: Evidence from Emerging Market and Developing Economies. Energy Rep. 2020, 6, 965–973. [Google Scholar] [CrossRef]

- Chudik, A.; Pesaran, M.H. Large Panel Data Models with Cross-Sectional Dependence: A Survey. 2013. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwigh7KAkOn7AhW8sVYBHSw4BAIQFnoECBAQAQ&url=https%3A%2F%2Fwww.econ.cam.ac.uk%2Fpeople-files%2Femeritus%2Fmhp1%2Fwp13%2FChudik-Pesaran-Surevy-CSD-13-August-2013.pdf&usg=AOvVaw1otdd5r8XNsnW4jdp7a1BQ (accessed on 30 October 2022).

- Sohag, K.; Ullah, M. Response of BTC Market to Social Media Sentiment: Application of Cross-Quantilogram with Bootstrap. In Digitalization and the Future of Financial Services; Contributions to Finance and Accounting; Vukovic, D.B., Maiti, M., Grigorieva, E.M., Eds.; Springer: Cham, Switzerland, 2022. [Google Scholar]

- Herzer, D.; Nunnenkamp, P. FDI and Income Inequality: Evidence from Europe (No. 1675). Kiel Working Paper. 2011. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwiCpqG6j-n7AhXFpVYBHTdcATUQFnoECAwQAQ&url=https%3A%2F%2Fwww.econstor.eu%2Fbitstream%2F10419%2F45887%2F1%2F643791663.pdf&usg=AOvVaw2IerB2qB5libbx5RXuwu6B (accessed on 30 October 2022).

- Sohail, H.M.; Ullah, M.; Sohag, K.; Rehman, F.U. Considering the Impact of Sustainable Development Goals on Economic Boost-trip; A Case from Pakistan’s Economy; Environmental Science and Pollution Research. 2022. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwjy5cr6jun7AhWkpVYBHQV3CIQQFnoECAoQAQ&url=https%3A%2F%2Fwww.researchsquare.com%2Farticle%2Frs-1704495%2Fv1.pdf&usg=AOvVaw07hcTJowmc0r3GZTQ5EoyM (accessed on 30 October 2022).

- Kottaridi, C.; Louloudi, K.; Karkalakos, S. Human capital, skills and competencies: Varying effects on inward FDI in the EU context. Int. Bus. Rev. 2019, 28, 375–390. [Google Scholar] [CrossRef]

- Seyoum, B.; Manyak, T.G. The impact of public and private sector transparency on foreign direct investment in developing countries. Crit. Perspect. Int. Bus. 2009, 5, 187–206. [Google Scholar] [CrossRef]

- Hasli, A.; Ho, C.S.F.; Ibrahim, N.A. Determinants of FDI inflow in Asia. J. Emerg. Econ. Islam. Res. 2015, 3, 9–17. [Google Scholar] [CrossRef]

- Sabir, S.; Rafique, A.; Abbas, K. Institutions and FDI: Evidence from developed and developing countries. Financ. Innov. 2019, 5, 1–20. [Google Scholar] [CrossRef]

- Bissoon, O. Can better institutions attract more foreign direct investment (FDI)? Evidence from developing countries. Int. Res. J. Financ. Econ. 2012, 82, 142–158. [Google Scholar]

- Mat, S.H.C.; Harun, M. The impact of infrastructure on foreign direct investment: The case of Malaysia. Procedia Soc. Behav. Sci. 2012, 65, 205–211. [Google Scholar]

- Saikia, M. Foreign direct investment and institutions: A case of Indian firms. J. Int. Trade Econ. Dev. 2021, 30, 725–738. [Google Scholar] [CrossRef]

| Variable | Code | Unit | Data-Source |

|---|---|---|---|

| Foreign Direct Investment | FDI | Percentage | World Bank |

| Structural Change | STRC | 100 | UNCTAD-2021 |

| Private Business Sector | PRIVS | 100 | UNCTAD-2021 |

| Institutional Quality | INSTS | 100 | UNCTAD-2021 |

| Transportation Infrastructure Sector | TRANS | 100 | UNCTAD-2021 |

| Natural Capital | NATUC | 100 | UNCTAD-2021 |

| Variable | Obs. | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| LogFDI | 3230 | 4.071 | 7.023 | 43.583 | 131.017 |

| LogSTRUC | 3230 | 1.471 | 1.015 | 2.452 | 2.974 |

| LogPRIVS | 3230 | 4.333 | 0.246 | 2.526 | 3.462 |

| LogINSTS | 3230 | 3.913 | 1.487 | 2.312 | 4.602 |

| LogTRANS | 3230 | 1.231 | 1.313 | 2.398 | 3.313 |

| LogNATUC | 3230 | 2.842 | 0.055 | 1.571 | 3.460 |

| Variables | LogFDI | LogSTRUC | LogPRIVS | LogINSTS | LogTRANS | LogNATUC |

|---|---|---|---|---|---|---|

| LogFDI | 1.000 | |||||

| LogSTRUC | 0.135 | 1.000 | ||||

| LogPRIVS | 0.224 | 0.525 | 1.000 | |||

| LogINSTS | 0.129 | 0.630 | 0.685 | 1.000 | ||

| LogTRANS | 0.132 | 0.489 | 0.525 | 0.588 | 1.000 | |

| LogNATUC | 0.036 | −0.343 | −0.275 | −0.323 | −0.401 | 1.000 |

| Variables | CD-SR (Model 1) | CD-LR (Model 2) | CD-SR and LR (Model 3) |

|---|---|---|---|

| Long Run Results | |||

| 0.536 ** | 0.469 ** | 0.826 ** | |

| (0.167) | (0.170) | (0.071) | |

| 0.341 ** | 0.736 * | 0.629 ** | |

| (0.160) | (0.163) | (0.156) | |

| 0.581 * | 0.254 * | 0.165 ** | |

| (0.340) | (0.133) | (0.060) | |

| 0.604 | 0.477 | 0.217 | |

| (0.880) | (0.578) | (0.348) | |

| 0.105 | 0.126 | 0.079 | |

| (0.141) | (0.178) | (0.089) | |

| 0.976 ** | 0.653 * | 0.592 ** | |

| (0.168) | (0.164) | (0.015) | |

| Short Run Results | |||

| 1.983 *** | 1.143 *** | 1.074 *** | |

| (0.466) | (0.278) | (0.208) | |

| 2.971 *** | 1.943 ** | 1.514 *** | |

| (0.259) | (0.153) | (0.039) | |

| 0.380 *** | 0.216 ** | 0.170 *** | |

| (0.018) | (0.016) | (0.019) | |

| 1.947 *** | 1.268 *** | 0.953 *** | |

| (0.861) | (0.126) | (0.065) | |

| 1.634 *** | 1.009 *** | 0.986 ** | |

| (0.006) | (0.000) | (0.000) | |

| 1.862 *** | 1.569 *** | 1.097 *** | |

| (0.526) | (0.238) | (0.176) | |

| 1.983 *** | 1.143 *** | 1.074 *** | |

| (0.466) | (0.278) | (0.208) | |

| −0.593 *** | −0.416 *** | −0.347 *** | |

| (0.095) | (0.033) | (0.041) | |

| 3230 | 3230 | 3230 | |

| 170 | 170 | 170 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ullah, M.; Sohail, H.M.; Haddad, H.; Al-Ramahi, N.M.; Khan, M.A. Global Structural Shocks and FDI Dynamic Impact on Productive Capacities: An Application of CS-ARDL Estimation. Sustainability 2023, 15, 283. https://doi.org/10.3390/su15010283

Ullah M, Sohail HM, Haddad H, Al-Ramahi NM, Khan MA. Global Structural Shocks and FDI Dynamic Impact on Productive Capacities: An Application of CS-ARDL Estimation. Sustainability. 2023; 15(1):283. https://doi.org/10.3390/su15010283

Chicago/Turabian StyleUllah, Mirzat, Hafiz M. Sohail, Hossam Haddad, Nidal Mahmoud Al-Ramahi, and Mohammed Arshad Khan. 2023. "Global Structural Shocks and FDI Dynamic Impact on Productive Capacities: An Application of CS-ARDL Estimation" Sustainability 15, no. 1: 283. https://doi.org/10.3390/su15010283

APA StyleUllah, M., Sohail, H. M., Haddad, H., Al-Ramahi, N. M., & Khan, M. A. (2023). Global Structural Shocks and FDI Dynamic Impact on Productive Capacities: An Application of CS-ARDL Estimation. Sustainability, 15(1), 283. https://doi.org/10.3390/su15010283