Abstract

Life Cycle Costing (LCC) is universally accepted as the method of choice for economic assessment in Life Cycle Sustainability Assessment (LCSA) but the singular focus on costs is ineffective in representing the multiple facets of economic sustainability. This review intends to identify other economic indicators to potentially complement the use of LCC in LCSA. Papers for the review were identified in the Web of Science Core Collection database for the years 2010–2021. The shortlisted indicators were analyzed using 18 criteria. The 21 indicators analyzed performed well with respect to the review criteria for indicator methodology and use but most are unsuitable for direct integration into the LCC/LCSA framework due to the inability to aggregate across life cycles and a lack of correspondingly granular data. The indicators were grouped into six economic impact categories—profitability, productivity, innovation, stability, customers, and autonomy—each of which represents a significant aspect of economic sustainability. On this basis, a conceptual framework is proposed that could maintain the utility of LCC while integrating additional indicators to enable more holistic economic assessments in LCSA. Considering additional economic indicators in LCSA ensures that the positive aspects of LCC are preserved while also improving economic assessment in LCSA.

1. Introduction

Sustainable development as a concept is based on the idea of balancing the requirements of development (within ecological limits), needs (redistribution of resources and quality of life), and future generations. It represents an effort to balance the potentially counter-productive acts of development and sustainability, given the prevalent understanding of development to mean economic development as defined in neoclassical economics [1]. Sustainability is increasingly a cornerstone consideration in policy making and management worldwide [2,3,4,5] due to its objectives of delivering global environmental protection, social and economic equality, and maintaining cultural diversity and ecological integrity [1], as reflected in the shared global vision of the United Nations (UN) 2030 Agenda for Sustainable Development. Sustainability requires addressing complex issues associated with a diverse range of dynamic and interdependent systems [6,7] and the study of sustainable development is a continuously evolving discipline [8]. Concepts such as interconnectedness, emergence, resilience/adaptive capacity, self-organization, and feedbacks are therefore central in efforts towards global sustainability [9]. As a result, systems-based sustainability measurement, management, and decision-support frameworks are essential for the transformation towards more sustainable production and consumption.

Life Cycle Thinking (LCT) is a systems-based sustainability management approach that considers all of the relevant interactions in the supply chains associated with industrial product systems [10]. This approach enables comparison of alternatives by considering the impacts along the whole life cycle of the system under consideration [11] taking into account multiple sustainability indicators, which facilitates identifying trade-offs and avoiding unintentional burden shifting [12]. The relevance of LCT-based methods in the context of sustainability is well-established [12,13,14,15,16,17].

In an editorial written for the International Journal of Life Cycle Assessment (IJLCA), Klopffer (2003)provided the first conceptual framework for moving LCT from a purely environmental focus (i.e., environmental Life Cycle Assessment (LCA)), towards more holistic assessments of sustainability [18]. This approach was subsequently termed Life Cycle Sustainability Assessment (LCSA) and formalized in Kloepffer (2008) as a method that combines traditional environmental LCA with Life Cycle Costing (LCC) and Social Life Cycle Assessment (SLCA) for economic and social assessment [19]. Though some efforts have been made towards more integrated LCSAs [20], the prevalent approach is the “LCSA = LCA + LCC + SLCA” model, without any direct integration, substitutions or compensations between the three dimensions [21]. This approach to LCSA is the approach to which the current analysis primarily refers, but the findings can likely be applied to other LCSA approaches in which LCC is used to assess the economic dimension.

Among the three methods, LCA is a well-established, standardized method [22]. SLCA is conceptually relatively new and significant methodological development is on-going. LCC is the oldest of the three, with a history dating back to 1933 [23]. The use of LCC is characterized by sector-specific applications, rather than any one encompassing framework or methodology [24]. Historically, LCC has often been used to only reflect the internal costs incurred by a single market actor, though it can also be used to assess the internal costs of more than one actor in the value chain. The need to account for all perspectives and consider costs alongside other dimensions of sustainability across the life cycle of a product led to the development of more inclusive LCC methods [25]. Based on a survey of studies, Ciroth et al. (2008) identified three different types of LCC. Conventional LCC (LCC) is a purely economic assessment which incorporates only internal costs and benefits (of one or more market actors in the life cycle of the product) [26]. Environmental LCC (En-LCC) is the assessment of all internal and external costs associated with the life cycle of a product, with complementary inclusion of monetized externalities [27]. Societal LCC (S-LCC) accounts for all private and external costs relevant to the whole society, both in the present and the future. It also monetizes all externalities (including environmental and social impacts).

Among these three LCC approaches, En-LCC is the most suitable method for Life Cycle Sustainability Assessment as unlike conventional LCC, it accounts for all life cycle stages due to using the same physical product life cycle used in the requisite, parallel LCA. The distinguishing feature of En-LCC is the internalisation of external costs that are expected to accrue in the decision-relevant future, as well as externalities that are already monetized. Complemented by an accompanying LCA, there is no conversion of measures and impacts from environmental to economic terms and double counting of any environmental impacts or externalities is avoided. On the other hand, unlike Societal-LCC, En-LCC is also not intended to be a substitute for sustainability assessment that uses a macroeconomic system encompassing all societal actors and monetising all externalities [25]. From here on, LCC refers to En-LCC.

The Use of Life Cycle Costing to Represent the Economic Dimension of LCSA

Though a well-established framework, the reasons for the use of LCC in LCSA are very rarely explained. LCC, in its conventional form, was not developed for use in the context of sustainability assessment. In introducing the Life Cycle Initiative’s guidelines for product sustainability assessment, Kloepffer (2008) states “Life Cycle Costing (LCC) is the logical counterpart of LCA for the economic assessment. LCC surpasses the purely economic cost calculation by taking into account the use-and end-of-life phases and hidden costs” (p. 89, [19]).

In line with this statement, the use of LCC for economic assessment has consistently been justified only by the similarities between LCA and LCC such as the use of a systems approach, consideration of the product’s life cycle, and steady-state modelling. However, it is important to emphasize that LCC should not be considered the default methodology for economic assessment in Life Cycle Sustainability Assessment simply because of the presence of the words ‘life cycle’.

Analyzing the use of LCC in LCSA requires a discussion on the meaning of sustainability in the context of Life Cycle Sustainability Assessment. Despite continuous evolution of the concept since it was introduced into global policy making [1], the widely accepted goal of sustainability is the provision and improvement of human well-being [28,29]. The three dimensions (environment, society, and economy) that influence human well-being are best represented in the ecological economics interpretation of sustainability popularized by Herman Daly [30]. Achieving sustainability requires the adherence to three hierarchical principles—operating within the biophysical limits of the earth, distributive justice, and efficient allocation of resources [30].

Mori and Yamashita (2015) argue that effective sustainability requires the use of both constraining and maximizing factors [31]. This is reflective of the three principles of Daly (1992) where biocapacity and distributive justice are constraining principles, and efficient allocation of resources is to be maximized [30]. When LCC and several other financial accounting tools are used independently without constraints, then there are several problems such as decision-making under uncertainty, assumptions of capital substitutability, simplification of multi-dimensional sustainability problems into one-dimensional monetary units, unconstrained growth, etc. [32].

In LCSA, however, LCA and SLCA represent the assessment of environmental and social constraints, with LCC representing the innermost economic sphere that can be maximized within those constraints. There is a clear delineation between the three dimensions in LCSA—the economic dimension is only focused on the economic viability and efficiencies of product systems [33]. Thus, the foundations of LCC that emphasize a principle of maximization (in this case, minimization of costs) are themselves not a roadblock to using LCC in LCSA.

The problems with LCC in LCSA arise rather from its inability to effectively represent the economic dimension in all its facets. Cost as a standalone indicator is incapable of representing the complexities and nuances of economic performance. While LCA and LCC might have conceptual similarities, they are also different in critical respects. Unlike LCA, LCC discounts future impacts (costs). In contrast to LCAs representation of environmental impacts relative to a larger ecosystem, LCC restricts the analysis to within the product system itself. The imperative in LCC is on minimization of costs. However, society at large demands maximization of value creation from economic systems [34].

Another significant problem with LCC is the absence of delineation between inventory and impact assessment phases. Heijungs et al. (2013) argue that merely aggregating costs is similar to focusing on only one environmental impact in LCA [35]. According to ISO 14044, impact assessments should have impact categories, category indicators and characterization models (which are required to follow relevant mechanisms). Aggregation of costs is not a representation of any economic causality. It is fundamentally a method of inventory aggregation [36].

While some like Jørgensen et al. (2010) have questioned its relevance [37], LCC does have its strengths. However, the problems identified here clearly indicate that life cycle cost is not, in itself, a sufficient indicator for the economic dimension in sustainability assessments. In the same way that carbon footprints need to be complemented with the assessment of other impacts in considering environmental sustainability, LCC and aggregation of costs require complementary indicators to provide a more comprehensive assessment of economic sustainability in LCSA, including identification of potential trade-offs.

With the exception of the works of Wood and Hertwich (2013) and Neugebauer et al. (2016), there have been few efforts to investigate whether LCC requires re-structuring for sustainability assessment [34,36]. Both of these papers identified possible economic impact categories to consider in addition to LCC but did not explore in detail the various indicators available to represent these impacts, and their potential for integration into LCSA. This review paper hence intends to complement and add to this body of work by identifying relevant economic indicators for use in LCSA.

Specifically, the following questions are addressed:

- What currently available economic indicators can be used in the assessment of the economic sustainability of products and services? (RQ1)

- Do these indicators have the required characteristics of sustainability indicators? (RQ2)

- Are the indicators suitable for use in Life Cycle Sustainability Assessment? (RQ3)

- Can these indicators be integrated into the existing LCC framework to expand the scope of its economic assessment in LCSA? (RQ4)

The results of this review will provide practitioners of life cycle-based sustainability assessments with a comprehensive catalogue of economic indicators that can be used to represent economic impacts. While the selection of indicators will always be case-specific, the current analysis intends to provide information on the indicators’ characteristics and suitability for use in LCSA that can aide in the selection process. It is neither the intention of this paper nor within its scope to provide a definitive solution to representing the economic impacts in an LCSA. Supporting the growing body of literature on the methodological development and application of LCSA, this work will provide valuable guidance to researchers on the likely existence of a multitude of economic impact categories and indicators to represent those impacts and encourage much needed discussion and investment of time and resources into developing multi-criterial assessment frameworks for the economic dimension of sustainability.

2. Methods

2.1. Search Strategy

The search parameter “(ALL = (“economic indicator” OR “economic indicators”) AND ALL = (“sustainability”))” was used to search for literature in the Web of Science (WoS) Core Collection database using the WoS interface in January 2022. The keyword “sustainability” was used to ensure economic indicators that were used in the context of sustainability were identified. The following qualification criteria were used to identify relevant literature for this review.

- Only literature published in the last decade (2010–2021) was considered to ensure relevance of economic indicators to current sustainability assessment practices.

- Literature focusing on the assessment of nations, regions, cities, etc. was not considered. Only sustainability assessments of products and services (at both micro and macroeconomic levels) were included—reflecting the intended scope of LCSA.

- Only literature in English was considered.

- Review papers and conference proceedings were not shortlisted for review.

Once the relevant literature was identified, a process of title and abstract screening was employed. Wherever this indicated the presence of an economic assessment, the paper was shortlisted for identifying the economic indicators employed. If not, the paper was excluded from the review. If the title and abstract did not provide clarity on whether economic indicators were used, the next step was to screen the text using the following keywords: “economic”, “economic indicator”, “economic assessment”, “indicator”, and “sustainability indicator”. If the use of any of these keywords showed that economic indicators were used, the paper was shortlisted for review. If not, the paper was excluded.

2.2. Review Question 1 (RQ1)

The papers shortlisted were then reviewed to identify the economic indicators used. The following criteria were employed in the identification of indicators.

- In this review, economic indicators are any representation of the past, present or potential future performance of an economic activity. This reflects the economic dimension in LCSA representing economic viability and the prosperity of systems.

- All indicators specified as economic indicators in the literature were considered. If the indicators in a paper were not grouped under distinct dimensions, common characteristics of economic indicators (such as the use of monetary information) were used to identify and shortlist indicators.

- Indictors of cost aggregation and cost breakdown were not considered. The indicator “Total Value Added” was also not considered. These indicators are already used in LCC [38], whereas the goal of this paper is to identify new indicators that can complement LCC in LCSA.

- Indicators specific to the application case were also not considered. For example, an indicator like “reduction in health risk” used in the economic assessment of contaminated soil remediation activities cannot be directly used in the assessment of other economic activities.

- Indicators specified as economic indicators that are likely to be included in environmental LCA or SLCA were also not considered. For example, “Number of local people employed” or “Number of local suppliers” are indicators in SLCA under the “Local Community” sub-category, and resource-efficiency indicators are used in LCA. This is to avoid indicators that can result in a possible double counting of impacts.

- Indicators at the intersection of two or more dimensions of sustainability (such as eco-efficiency) were also not considered in this review. This ensures consistency with the avoidance of integration between different dimensions of sustainability in LCSA.

To streamline the number of indicators for analysis, a frequency criterion was added to the selection of indicators. From the initial list of indicators, only those which were used in two or more papers were shortlisted for further analysis. Once the relevant economic indicators were identified, the second and third review questions were addressed.

2.3. Review Question 2 (RQ2)

The second review question focuses on the characteristics of indicators. Several authors have discussed the desired features of a sustainability indicator and/or criteria for selection of indicators (see Table 1). Indicators can be application-specific, and it would be generally impossible to characterize the identified indicators. Hence, a shortlist of characteristics was considered from the sources listed in Table 1 to evaluate the indicators in the absence of contextual information. However, assessing the indicators for the selected criteria is still subjective, and should only be considered as a placeholder to case-specific evaluations.

Table 1.

Sources for indicator characteristics used as review criteria.

The criteria for evaluating indicators in this paper are divided into three groups: general information, indicator measurement, and indicator usability.

2.3.1. General Information

This group comprises three criteria (I1–I3) that provide basic information about the indicator. “Number of occurrences (I1)” reflects the number of times the indicator was used in the papers reviewed. “Scale (I2)” specifies whether the indicator is a micro-economic indicator or macro-economic indicator. Here, micro-economic refers to product- or firm-level application, while macro-economic refers to sector-level application. “Type (I3)” specifies whether the indicator is a leading indicator, a lagging indicator, or both. Leading indicators are reflective of future performance, but with higher inaccuracy and uncertainty. Leading indicators provide information on “what could” happen rather than “what will” occur. Lagging indicators, on the other hand, reflect past performance, and hence have higher accuracy. Both types of indicators are used for assessments of economic performance. Some indicators can be used as both a leading and lagging indicator.

2.3.2. Indicator Measurement

This group comprises six criteria (M1–M6) that provide information on the measurement of the indicator. “Quantification (M1)” specifies whether an indicator is quantitative or qualitative. “Variables (M2)” describes the minimum number of data points required for calculating the indicator. “Method (M3)” provides the underlying formulaic representation of the indicator’s calculation. “Complexity (M4)” represents a subjective evaluation of the complexity of the methodology for obtaining the indicator result. This is done using a three-point scale (+, =, −). This three-point scale is used for several other criteria where “+” always represents the desired quality in an indicator (e.g., low complexity), “−” the least desirable quality (e.g., highly complex), and “=” an intermediate characterization (e.g., partially complex). “Reliability (M5)” is used to characterize the theoretical and scientific foundations of indicators (+, =, −). “Data availability (M6)” also used the three-point scale (+, =, −) to characterize whether the data required for the indicator is likely to be available in the basic economic/financial data of firms.

2.3.3. Indicator Usability

This group comprises four criteria (U1–U4) that describe the usability of the indicator. “Comprehensibility (U1)” refers to the ease of understanding and interpreting (+, =, −) the information provided by the indicator. “Reproducibility (U2)” reflects whether the indicator calculation can be reproduced to obtain consistent results. This criterion uses a simple “Yes” or “No” characterization. “Comparison (U3)” refers to the ability of the indicator to be used for comparison across multiple assessments (Yes/No). Finally, “Trend (U4)” describes whether the indicator is capable of showing trends if measured over a long time-period (Yes/No).

2.4. Review Question 3 (RQ3)

The final review question addresses the suitability of the identified indicators for use in a LCSA. Based on the defining characteristics of the use of LCC in LCSA, five criteria were identified (L1–L5). “Data (L1)” uses the three-point scale (+, =, −) to show whether the information required for the indicator can be obtained from the data already collected for the three parallel assessments in a LCSA. “Functional unit (L2)” answers the feasibility of representing the indicator relative to the functional unit used in an LCSA (Yes/No). “Application (L3)” represents the ability to apply the indicator across the life cycle of a product/service being assessed (Yes/No). The specific focus here is on whether the indicator results are easily aggregated (like costs in LCC) when applied across multiple unit processes. “Specificity (L4)” shows whether it is possible (Yes/No) to employ the indicator at the levels of higher specificity (level 3 and level 4) mentioned in Huppes et al. (2008) [47]. Level 3 represents specific activities in a unit process and level 4 represents each flow related to the process.

“Impact category (L5)” describes to which economic impact category (mid-point) this indicator is likely applicable. To identify economic impact categories, the classification of economic impacts in the indicator sources for this review were compared against the relevant economic impact categories for LCSA identified by Neugebauer et al. (2016) and Wood and Hertwich (2013) [34,36]. The following six economic impact categories were deemed applicable: profitability, productivity, stability, autonomy (self-sufficiency), customers, and innovation. While these impact categories are largely self-explanatory, they are discussed in more detail in Section 3.3.

All the criteria used across RQ2 and RQ3 for characterizing indicators are summarized in Table 2. All subjective evaluation of indicators for the criteria considered was done by the first author.

Table 2.

Criteria and characterization used to evaluate indicators identified.

2.5. Review Question 4

The information derived from RQ1-RQ3 was compiled to provide a basic solution for integrating the identified economic indicators into the existing framework of LCC. On this basis, a new conceptual framework that uses both LCC and other economic indicators is proposed for assessing the economic dimension within the LCSA = LCA + LCC + SLCA approach. In addition, as mentioned previously, the proposed framework with multiple economic impact categories is also applicable to other LCSA approaches that use cost (LCC) as the only impact category.

It is important to reiterate that the framework presented here is not intended as a definitive solution to achieving multi-criterial economic assessments in LCSA. This framework has not been applied and tested with any case-study. The intention of presenting this modified framework is rather to reinforce the message contained in the fundamental objectives of this review: Like the environmental and social dimensions in LCSA, the economic dimension also needs to account for a diverse range of economic impact categories.

3. Results and Discussion

3.1. Review Question 1

The key word search produced a total of 645 results. Applying the screening process resulted in a shortlist of 229 papers. Excluding publications that only used “cost” or “value-added” indicators, application-specific indicators, and/or indicators used in LCA or SLCA resulted in a final list of 82 publications—from which 44 indicators were identified to form the initial list. Twenty-one of these 44 indicators occurred more than once and were thus selected for the final review. Table 3 provides the initial list of 44 indicators and identifies the 21 indicators shortlisted for analysis. Any of these indicators (including those not analyzed further in this review) can be a suitable indicator in the right context. The references for the 82 papers from which indicators were identified for this study can be found in the Supplementary Materials.

Table 3.

Initial list of indicators identified and final subset of 21 indicators selected.

A brief description for each of the 21 shortlisted indicators is provided in the Supplementary Materials Section S2. The descriptions reflect how the indicator was defined and used in the literature from which indicators were identified. In the absence of such information, generic definitions are provided.

3.2. Review Question 2

3.2.1. General Information

The results for the indicator I1–I3 are presented in Table 4. The three most used indicators in the reviewed literature were gross margin/net profit, Net Present Value (NPV), and labor productivity. The other indicators that were used widely were internal rate of return (IRR), payback period, subsidies (11), and innovation (11)—each used 10 times or more. The three least frequently used indicators (among the 21 reviewed) were Investment Capital Generated in Activity (ICGA), gross operating surplus, and employee satisfaction- each used twice.

Table 4.

General characteristics of the reviewed indicators.

In terms of Scale (I2), 19 of the 21 indicators are microeconomic indicators applicable at the product system or firm level. Only contribution to GDP/GNP and trade balances (reliance on imports, contribution to exports) were macroeconomic (sector-level) indicators. Indicators were classified as macro- or microeconomic based on their application in the studies reviewed so depending on the assessment scale, many of the microeconomic indicators can also be applied at the macroeconomic scale.

Ten of the 21 indicators were classified as lagging indicators and another ten as leading indicators (I3). Only ICGA was classified as both. Indicators were considered leading if they were used as an indicator of future economic performance. The leading indicators themselves can be divided into two groups—indicators that assess investments (NPV, IRR, payback period), and indicators that are not investment-focused. Despite NPV, IRR, and payback period addressing future performance, they are only estimations and hence should be used with caution.

3.2.2. Indicator Methodology

In terms of quantification (M1), sixteen indicators were considered quantitative, with five indicators classified as quantitative/qualitative. Customer and employee satisfaction indicators were given this classification to represent the qualitative nature of surveys, which are then converted into quantitative information. Innovation, diversification and risk aspects were considered as quantitative/qualitative due to the possibility of the indicators being descriptive in nature. All of these five indicators can, however, be used in a purely quantitative manner.

All of the quantitative indicators identified only directly require between one and three input variables (M2). However, this can possibly be misleading if data for the variables are not directly available. For example, net profit is the ratio between net income and revenues. If net income data are not available, then its calculation will require data on operating expenses, other expenses, taxes, and interest paid. However, overall, except in the surveys for customer and employee satisfaction, the indicators identified require minimal data.

In terms of how the indicators are measured (M3), seven of the 21 indicators are represented as percentage values and six are ratios. Table 5 provides the underlying calculation methodology for each of the 21 indicators. The basic measurements of 17 of the 21 indicators are also low in complexity (+), with only four indicators assigned medium complexity (M4). The estimation of NPV and IRR can be complicated due to the use of discount rates, while the conversion of qualitative information from customer and employee satisfaction surveys can also possibly be complicated.

Table 5.

Review of identified indicators for criteria related to indicator measurement.

Only one indicator was found to have poor reliability (M5). ICGA was used as an indicator in Gerdessen and Pascucci (2013) and Valenti et al. (2018) [48,49], but it was difficult to find any literature on this indicator. All the other indicators have mostly strong theoretical foundations for use in economic assessments. All the data required (M6) for 16 of the 21 indicators are also likely to be found in a firm’s economic data (with some indicators like NPV requiring informed estimations). The surveys for customer and employee satisfaction can often be unavailable. For example, Cohen et al. (2012) found that only 4% of corporate reporting had data on employee satisfaction [50]. Hence these were given “−”. Some of the data on risks, contributions to GDP, and dependency on imports/contribution to exports are also unlikely to be universally available to firms (=).

3.2.3. Indicator Usability

All 21 indicators are easy to comprehend, but some might require additional information to ensure accurate interpretation. Labor and capital productivity need to be measured over time or compared against similar firms to support their interpretation. While gross operating surplus needs to be higher, the reasons for excluding so many costs in its estimation are not intuitively easy to understand (Gross Operating Surplus can be obtained by subtracting the labor costs, taxes on production and subsidies from the total value added). All 21 indicators are also reproducible, though some might produce inconsistent results due to methodological or data choices. For example, NPV results depend on the discount rate chosen and risks need to be analyzed through structured risk assessment methodologies to produce consistent results. All of the 21 indicators also clearly support the comparison of multiple assessments (U3) and monitoring of trends over time (U4) (Table 6).

Table 6.

Review of identified indicators for criteria related to indicator usability.

3.3. Review Question 3

This set of criteria analyses whether the indicators identified are suitable for inclusion in an LCSA. Only two indicators (cost efficiency, labor productivity) are likely to be fully supportable based on the information available in the LCA, LCC and SLCA inventories (L1). However, the missing data for many indicators is revenues. If the LCC inventories included revenue data for all life cycle stages, 11 more indicators would have full data compatibility with LCSA. The only indicator for which any relevant data is likely not available from the three inventories is risk aspects.

Eight of the 21 indicators are easily measurable relative to a typical functional unit in an LCSA (L2). With thirteen indicators represented as either ratios or percentages, the weak performance for this criterion is understandable. Absolute values such as NPV and Return on Investment (ROI) are best suited among the identified indicators to be presented against a functional unit of a product system. Fourteen indicators can be applied across a product system and aggregated (L3). Six of the seven indicators that cannot be aggregated across multiple unit processes are proportional values, with the other one being payback period.

Only three indicators can reliably be assigned to specific activities or flows (L4). Risks and reliance on imports can be related to specific flows, while labor productivity can be related to specific activities in a process. It is also possible to link customer and employee satisfaction indicators to specific activities in the system depending on the data that is collected. However, in the case of all the indicators involving revenue variables, it is difficult to use them at higher specificities. Overall, the indicators reviewed performed relatively poorly for the characteristics defined in RQ3 as compared to the characteristics evaluated in RQ2.

Finally, indicator impact category (L5) shows the economic impact category to which the indicator belongs. The 21 indicators identified were grouped into six economic impact categories under criterion L5—profitability, stability, autonomy, productivity, customers, and innovation (Table 7). Impact categories are crucial because they represent the potential scope of economic impacts that any LCSA should include. Thus, the remainder of Section 3.3 is structured around these six economic impact categories, their corresponding indicators, and their relevance for economic assessment in LCSA.

Table 7.

Review of identified indicators for criteria related to integration with LCSA.

3.3.1. Profitability

Profitability indicators are the most widely used economic indicators in the reviewed literature. This is reflective of the priority given to profitability by organizations in a growth-oriented market system. Profitability indicators are generally quantitative, lagging indicators, with any indications of future performance the result of estimating future revenues (NPV, IRR, etc.).

All of the eight indicators of profitability are relatively suitable for inclusion in LCSA compared to the other impact categories. They all require cost data, which is collected in the inventory stage of an LCC. The additional data requirements mostly concern revenues (either real or predicted). While the availability of this data is unlikely to be an issue, unwillingness of firms to provide this data for assessment (especially in cases intended for public disclosure) could create data gaps. Still, there are opportunities to use substitutes (market prices) to obtain reasonably confident estimates of revenues for assessment.

Except for IRR (%) and the payback period (unit of time), the profitability indicators are also suitable for application and aggregation across the life cycle of a product. The usefulness of aggregating profitability indicators can be questionable, especially if unit processes/life cycle stages are managed by multiple stakeholders. However, without aggregation, this data can prove useful in identifying parts of the supply chain that are not profitable.

Another important aspect of profitability indicators is the ability to consider the impact of long-term investments such as infrastructure, machinery, etc. Such flows are generally amortized and hence avoided in LCA calculations for a unit of production. However, they represent significant aspects of economic sustainability for firms both in the short- and long-term. Indicators that can provide information on the profitability of such investments can be very useful in decision-making. When projects for sustainability improvements are evaluated, an indicator like cost-effectiveness provides more value than does comparison of costs.

The biggest weakness with using profitability indicators remains the inability to distribute revenues to specific activities within a production process or to specific flows. Even “value-added”, which has been used in LCC [38], is only useful at the level of the unit process. The ability to use costs at the same specificity of environmental LCA has been one of the major contributing factors to the popularity of LCC.

3.3.2. Stability

Stability broadly refers to the ability of a firm to stay in business. The indicators risk aspects, diversification, contribution to GDP, and employee satisfaction are classified under “Stability”. Neugebauer et al. (2016) identified diversification as an impact category to consider in LCSA [36] but this review shows that it is an indicator of stability, which can also be reflected by other indicators.

Risks in this context are generally economic risks. These include investment risks (interest rates, etc.), risks associated with government regulation (taxes, wage policies, etc.), and market risks (supply-consumption balances, consumer behavior, etc.). However, it is not just economic risks that firms face. They are exposed to technical risks such as changes in technology, safety and access to resources. The diversity of the possible risks to any economic activity means it is impossible to avoid them. As a result, the emphasis is on identifying as many risk elements as possible using structured risk assessment methods and managing them. The nature of risks mean uncertainties are always involved and, hence, decisions should be risk-informed, not risk-based [51]. It is important to note that impacts assessed in LCAs or SLCAs can be interpreted as risks from an economic perspective, and it would be prudent for practitioners to explore best practices in LCSA when encountering such cases to avoid unnecessary double counting of impacts.

There are established links between effective risk identification/management and economic performance [52,53], and between risk management and broader sustainability objectives [54,55,56,57]. Risk management—both economic and technical—is a well-established discipline but it is beyond the scope of this paper to discuss the frameworks and methods involved in this practice.

One of the common strategies for tackling risks is diversification. This includes diversifying outputs, diversifying income streams, diversifying market access, and diversifying technologies used. Diversification limits the exposure to the risks associated with any one aspect of the system, enabling greater stability and performance. Though diversification can lead to economic stability, its usefulness is not guaranteed and depends on factors such as the structure of diversification, assessment of risks and markets, size of firms, characteristics of the sector, etc.

The remaining two indicators of stability considered are contribution to GDP/GNP and employee satisfaction. Monitoring contribution to GDP was seen as a measure of stable performance, while employee satisfaction is linked to greater employee retention and productivity. Employee satisfaction, in particular, has been strongly related to economic performance and sustainability [58,59,60].

While profitability indicators only reflect past performance in most cases, stability indicators are often leading economic indicators. However, unlike the indicators of profitability, stability indicators are less compatible with the methodological framework of LCSA. The data requirements of diversification and contributions to GDP can be partially derived from LCA inventories, while employee satisfaction can be linked to the SLCA “Workers” impact category. Data on risks are, however, not commonly found in life cycle inventories and will require additional data collection. Methods such as supply chain risk management [61], which adopts a life-cycle perspective, can provide useful information to support the use of risks as an indicator in LCSA. None of these four indicators can be reported relative to a functional unit, and only risk aspects are (indirectly) relatable to specific flows or activities in a unit process.

3.3.3. Autonomy

Autonomy refers to the self-reliance of economic systems with respect to both physical (resources, goods) and monetary flows. The four indicators in this category were reliance on imports, subsidies, external finance, and Invested Capital Generated in the Activity (ICGA).

The reliance on imports (or trade-balance when used with export contributions) indicator, which refers to the inputs to the production activity that are obtained through imports, was only used on a sectoral scale. Imports are seen as not contributing to the growth, strength and diversification of the domestic supply chain, with increased self-reliance preferred as an indicator of autonomy. A more effective indicator, however, for resource or technological autonomy appears to be the “linkages” indicator proposed by Wood and Hertwich (2013). However, this indicator was excluded from the analysis as it appeared only once. Forward linkages represent the relative importance of a product system, and backward linkages represent the contribution of other product systems. The strength of the linkages as represented using coefficients can help identify the self-reliance of a product system at both microeconomic and macroeconomic scales [34].

The other three indicators relate to economic self-reliance. ICGA was the only indicator of the 21 reviewed that was found to have weak theoretical foundations. The adverse effect of unmanageable debts and external finances to economic performance has been empirically proven [62], but there is also evidence that moderate debt levels can in fact improve economic performance [63].

Subsidies and their impact on both economic performance and sustainability is a contested subject. Subsidies have been strongly associated with resource depletion in the fishing industry [64,65], economic unsustainability of dairy farms [66], and disappearance of traditional agricultural practices [67], to name a few. On the other hand, subsidies are considered integral to the promotion of sustainable practices [68], innovation [69], and technological autonomy [70]. Consideration should also be given to long-term versus short-term subsidies. Overall, the reliance on subsidies is considered an indicator of poor economic performance in the literature reviewed.

The autonomy indicators are generally leading indicators but have relatively poorer reliability (M5) than the other categories. In terms of applicability to LCSA, this category of indicators is comparable to the profitability indicators. Import/Export data can be partly compiled from life cycle inventories while economic data needed for external finance, subsidies, and ICGA will require revenue information. Except for reliance on imports (expressed as %), the other three indicators are measurable against a functional unit and applicable across a product system. These indicators are, however, only applicable at the unit-process level, with further division largely impossible.

3.3.4. Productivity

Two productivity indicators were identified—capital productivity and labor productivity. Although capital productivity can refer to the productivity of multiple types of capital (human, natural, social capital etc.), in the literature reviewed, the term consistently refers to fixed capital—infrastructure, machinery, etc.

Capital productivity is an important factor in economic performance at different economic levels and is influenced by factors such as technological changes and maintenance. The link between labor productivity and economic performance is also extremely reliable and is dependent on factors such as employee satisfaction, autonomy, and investments in technological and knowledge growth. Labor productivity has already been used as a complementary indicator to LCA [71], and extensively discussed in Neugebauer et al. (2016) as the indicator for the productivity impact category in LCSA [36].

Productivity indicators are lagging indicators but perform strongly with respect to all of the criteria used in assessing indicator measurement and use. The two indicators of productivity, however, have a mixed performance with respect to the criteria for LCSA. All the data for measuring labor productivity is likely to be available from the inventories of LCA, LCC, and SLCA, while capital productivity will require additional data collection. Both the indicators are ratios and hence not useful relative to a functional unit. They can both be applied across the product system, but only labor productivity is measurable at higher specifications.

3.3.5. Customers

All business entities have customers and they are hence a crucial part of economic decision-making. Apart from increasing profitability, satisfied customers are considered increasingly loyal—improving future profitability and stability. The effect of dissatisfied customers or customers perceiving a shortfall in product quality can be more impactful than that of firms exceeding customer expectations [72,73]. Methods of assessing customer satisfaction can, however, have significant bias if done internally [74].

Two indicators are identified for this category: customer satisfaction and market share. While market share is a straightforward indicator, measurement of customer satisfaction offers several viable options. Neugebauer et al. (2016) specified willingness-to-pay (WTP) as the quantitative indicator for the customers midpoint impact category in LCSA [36]. However, WTP, while a popular method, is also sometimes associated with a lack of realization of stated values. In the reviewed literature, customer satisfaction is measured through surveys or the use of number of complaints and product returns data as acceptable proxies. Market share is not used as an absolute measure, but changes in market share are considered reflective of changes in customer satisfaction.

Customer satisfaction is an important leading indicator but is not always easy to measure. The customer indicators are also not suitable for application in LCSA. While there is some data overlap with the ‘consumers’ impact category from SLCA, the two indicators are not suitable for representation relative to a functional unit, aggregation across the product system, and application at higher specifications.

3.3.6. Innovation

Wood and Hertwich (2013) define two types of innovation: (1) innovation that leads to an increase in the productive output of a process for the same inputs (process innovation) and (2) development of new products (product innovation) [34]. Both of these types of innovations can lead to improved economic performance. This impact category does not have a clearly defined indicator but has been widely referenced in the literature reviewed. The indicator for innovation largely seems to be a number (number of patents, etc.) representing the innovative practices implemented/developed by the organization.

The most interesting aspect of innovation is its connections to the other economic impacts defined here. Innovation can lead to growth in customer satisfaction and increased market share. Innovation can result in diversification of products and markets which, in turn, leads to greater economic resilience. It is also an established driver of productivity—both at microeconomic and macroeconomic levels [75,76,77,78]. Innovation can also lead to increased employee satisfaction due to knowledge creation and technological changes in workplaces.

As a result, despite the lack of a defined indicator, innovation represents one of the most important economic impact categories (and is a leading indicator). If the number of innovations/innovative practices is used as the indicator, it can be applied across the life cycle and applied at the level of specific activities or flows in a unit process. The only disadvantage in using this indicator in LCSA is the inability to represent innovation relative to a functional unit.

3.4. Review Question 4

In previous attempts, Wood and Hertwich (2013) proposed factors to link LCC analysis to the macro-economic scale [34] while Neugebauer et al. (2016) developed a conceptual impact pathway framework for multiple economic impacts [36] (a modified version of this impact pathway framework integrating the identified economic indicators is provided in Supplementary Materials Section S3).

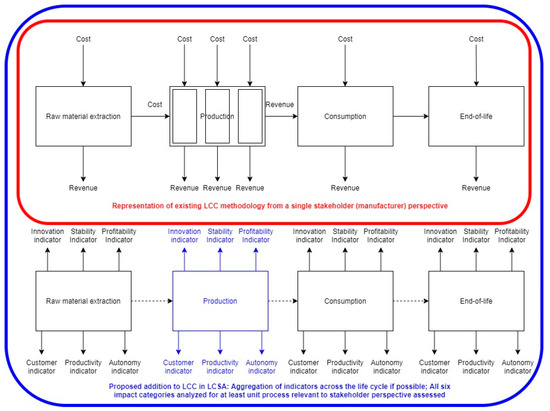

This review clearly shows the limitation of using LCC to represent economic impacts in LCSA. RQ1 showed that there exists a broad range of economic indicators at the disposal of LCSA practitioners when considering economic aspects beyond costs. RQ2 showed that 21 of these frequently used economic indicators mostly possess the suitable characteristics required in sustainability indicators. However, RQ3 identified considerable barriers to integrating these indicators with LCC and LCSA. Indicators for the six economic impact categories identified perform variably with respect to application and aggregation across the life cycle, measurement relative to a functional unit, and use at higher specificities. As a result, LCC (total cost) remains the economic assessment methodology that is the most compatible with the requirements of the LCSA framework. Hence, its rightful place within the LCSA framework cannot be questioned. However, it can be suggested that economic assessment in LCSA can potentially be based on both LCC and an analysis accounting for the six economic impact categories identified in this review at the unit-process/life cycle stage-level. A preliminary, conceptual approach to the proposed integration of these six economic impact categories is presented as a modified LCC framework in Figure 1. Figure 1 (along with Figure S1 in the Supplementary Materials) can be considered by practitioners going forward as the first step towards developing multicriterial economic assessments in LCSA with the indicators and impact categories identified in this paper constituting assessment at the mid-point level.

Figure 1.

Proposed economic assessment framework for LCSA (from the perspective of “producer” stakeholder). Existing LCC representation is recreated from [27] Figure 1 to be printed in color.

Where possible, at least one indicator for each of the six impact categories should be applied to all of the significant life cycle stages. If this is not possible, the identified economic impact categories should be assessed at least at the life cycle stage/unit process that is immediately relevant to the selected stakeholder perspective. This will provide decision-makers with a more comprehensive picture of the economic sustainability of product systems. Table 3 provides additional indicators to the 21 reviewed for practitioners to consider. The indicator characteristics used in this review (or from the Supplementary Materials) can be used to identify indicators suitable for a given context. If possible, a mixture of leading and lagging indicators should be chosen. Representation relative to the functional unit of assessment and aggregation across the life cycle should be done where possible. However, as noted by Hunkeler et al. (2008), practitioners should ensure that their choice of impact categories for economic assessment in LCSA does not overlap with impacts considered in the parallel LCA or SLCA [25].

The challenges in aggregation and quantification of economic impacts are similar to the challenges referenced in the Guidelines for SLCA [79]. A broad range of economic indicators have not been considered for application in LCSA and thus minimal experience or research exists with respect to the aggregation of economic impacts across a life cycle (except for costs and value-added). As in SLCA, economic impact pathways have also not been widely researched within the life cycle community, and hence, will not have the same robustness of impact pathways as in LCA. The economic impact pathways conceptualized by Neugebauer et al. (2016) show that end-point impact categories and Areas of Protection (AoPs)—and the associated impact pathways—can be defined for economic assessments in LCSA [36]. Only research and practice will help in better defining these impact pathways, in addition to developing methods for aggregating a wide range of indicators. This review clearly identifies that multiple economic impact categories exist and each of those impact categories can be linked to at least one of the two goals of economic sustainability: economic prosperity and economic resilience. The framework presented in Figure 1 hence represents a simple, yet valuable, starting point for the LCSA community to consider methodological development that delivers the ability to apply multicriterial analysis systematically and consistently to the economic dimension—as achieved through LCA and SLCA in the environmental and social dimensions respectively.

4. Conclusions, Implications, Future Directions, and Limitations

The use of systems-based analytical methods—such as Life Cycle Thinking and its associated methods—is vital to addressing global sustainability challenges. Life Cycle Sustainability Assessment (LCSA) is an increasingly popular framework to determine the sustainability of economic systems and products. Despite its similarities to environmental Life Cycle Assessment (LCA), LCC (an integral component of LCSA) has several weaknesses such as isolation from the larger economic system and lack of clear impact assessment pathways. Most importantly, LCC does not have the scope to provide an accurate representation of the various factors related to both the prosperity and resilience of economic systems.

To showcase the possibility for a diverse and multicriterial representation of the economic dimension of sustainability in LCSA, a literature review of economic indicators used in sustainability assessments was undertaken. Twenty-one indicators were identified for detailed review. The criteria for review were based on general characteristics of indicators, characteristics of measurement, characteristics of usability, and compatibility with LCSA.

The majority of the indicators were micro-economic indicators with a mostly even distribution between leading and lagging indicators. The quantitative indicators identified only require between one and three data variables for calculation, with the required data likely to be available in a firm’s economic data. None of the indicators are highly complex to calculate, with only one indicator (Invested Capital Generated in Activity) having low reliability (due to lack of theoretical foundations).

All 21 indicators had strong performance for the four usability criteria—comprehensibility, reproducibility, comparison, and trends. Overall, the identified indicators have the required characteristics needed in sustainability indicators. Thus, the important aspect of the review is the analysis of the indicators’ compatibility with the LCSA framework. The most significant barrier in terms of data requirements is revenue data for unit processes across the life cycle. Only the indicator “risk aspects” is unlikely to have any data in common with the inventories of LCA, LCC and SLCA. With 13 indicators measured as either a ratio or percentage, only eight indicators are suitable for use relative to a typical functional unit. On the other hand, 13 indicators can be aggregated across the life cycle. The weakest aspect of the indicators identified is the inability to use them at specificities higher than the unit process level. Only three indicators in their current form can be reliably measured for specific flows or activities within a unit process. Based on how the indicators were used in the literature reviewed, they were classified into six economic impact categories: profitability, stability, autonomy, productivity, customers, and innovation.

Each of these impact categories have a strong influence on a firm’s economic sustainability. Profitability represents the immediate objective of most economic activities. Stability covers the management of risks, diversification strategies, and employee satisfaction, each of which are vital to the long-term future of businesses. Autonomy addresses the ability of firms to function independently. Increased reliance on external sources to be profitable can represent a possible future issue. Productivity is directly linked to the profitability of firms. Satisfied customers are loyal customers, and this can reflect both good past performance and future potential. Unsatisfied customers can quickly become detrimental to a firm’s economic performance. Innovation can be linked to all the other impact categories on how it influences a firm’s economic sustainability.

What the review clearly shows is the existence of a broad range of economic impact categories and associated indicators (other than cost) that have traditionally been ignored in the application of LCSA due to the singular focus on LCC. These indicators are well suited to the sustainability context and the relevance of the six defined economic impact categories is well established. In trying to answer the question of whether these impact categories and associated indicators can be integrated into an expanded LCC for LCSA, a simple, preliminary, conceptual framework is presented as merely a required starting point for future methodological development towards achieving multicriterial economic assessments in LCSA. Based on this conceptual framework, some suggestions for economic assessments in LCSA are made.

- Life Cycle Costing, with cost as the only indicator, should not be considered as an acceptable framework for representing the economic dimension of sustainability.

- LCC should be used for economic assessments in LCSA along with an assessment of the six economic impact categories defined in this literature review.

- Depending on data availability for the objectives of the study, the assessment of all six economic impact categories should be applied to all relevant life cycle stages. If this is not possible, at least the life cycle stage that is immediately relevant to the stakeholder perspective selected in LCC should be assessed.

- Indicators should be evaluated using the assessment criteria defined in the study and at least one indicator for each of the six impact categories should be included in the LCSA.

- Given the inability of many of these indicators to be used relative to a functional unit, aggregated across the life cycle, and used at higher specificities, the proposed framework does not mandate aggregation of indicators across the life cycle.

- The indicators should be measured at the unit-process level for all relevant processes in the product system. If this is not possible, the six impact categories should be considered for at least the unit process relevant to the stakeholder perspective under consideration. The choice of indicators for each category is left to the practitioner.

This study is not without its limitations. To begin with, some might consider the narrow scope of the objectives of this review as a limitation. This review paper does not claim to have all the answers to defining and operationalizing a multicriterial assessment framework of the economic dimension in compliance with the fundamental principles of life cycle-based assessment. For the findings of this literature to be validated, future research will be required in developing impact assessment methods relevant to each of the impact categories identified and there should be extensive testing of those methods though case-studies in different application contexts. With respect to the methods, using only the Web of Science Core Collection for the literature search has potentially limited the study with respect to identifying additional relevant indicators. Further, selecting only indicators that were identified at least twice in the reviewed literature has eliminated further evaluation of potentially useful indicators. However, these were necessary steps in ensuring that the scope of the study remained manageable. Moreover, as stated previously, the performance of indicators is context-specific and hence the evaluation of indicators provided in this review paper should only be considered as temporary placeholders before any case-specific evaluation and selection of indicators.

The framework developed shows that the positive aspects of LCC can be preserved while also improving the scope of economic assessment in LCSA. The purpose of this framework is not necessarily to provide a solution, but to reinforce the message of needing to adequately represent the diversity of potential economic impacts in any sustainability assessment. With the environmental and social dimensions of a system being constraining factors, the economic dimension requires a maximization profile (maximum efficiency, minimum cost, etc.). If only cost is used in LCSA for economic assessment, it will be providing decision-makers with a fundamentally incomplete representation of economic performance, leading to possibly flawed decision-making. This review paper is hopefully a promising first step towards eliminating this problem in Life Cycle Sustainability Assessment.

Supplementary Materials

The following supporting information can be downloaded at https://www.mdpi.com/article/10.3390/su15010013/s1: Sources of indicators identified [34,39,42,44,48,49,50,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97,98,99,100,101,102,103,104,105,106,107,108,109,110,111,112,113,114,115,116,117,118,119,120,121,122,123,124,125,126,127,128,129,130,131,132,133,134,135,136,137,138,139,140,141,142,143,144,145,146,147,148,149,150,151,152,153,154], Definition of indicators reviewed in this study [155,156,157,158,159,160], and Figure S1: A modified version of the Neugebauer et al. (2016) economic impact pathway model [36].

Author Contributions

Conceptualization: V.A., E.P.H.L. and N.P.; methodology: V.A.; literature search and data analysis: V.A.; writing—original draft preparation: V.A.; writing—review and editing: M.D.H., M.D., E.P.H.L. and N.P.; funding acquisition: N.P.; supervision: N.P. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by funding from the Natural Sciences and Engineering Research Council of Canada (NSERC) and Egg Farmers of Canada (EFC) through the NSERC/EFC Industrial Research Chair in Sustainability.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Abbreviations

| LCT | Life Cycle Thinking |

| LCA | Life Cycle Assessment |

| LCC | Life Cycle Costing |

| SLCA | Social Life Cycle Assessment |

| LCSA | Life Cycle Sustainability Assessment |

| NPV | Net Present Value |

| IRR | Internal Rate of Return |

| PP | Payback Period |

| ROI | Return on Investment |

| ICGA | Invested Capital Generated in the Activity |

References

- Tomislav, K. The concept of sustainable development: From its beginning to the contemporary issues. Zagreb Int. Rev. Econ. Bus. 2018, 21, 67–94. [Google Scholar]

- CCA. Climate Change Act 2008. Available online: https://www.legislation.gov.uk/ukpga/2008/27/contents (accessed on 7 October 2020).

- ECCC. Achieving a Sustainable Future; ECCC: Gatineau, QC, Canada, 2019. [Google Scholar]

- EC Sustainable Development—Environment—European Commission. Available online: https://ec.europa.eu/environment/sustainable-development/index_en.htm (accessed on 7 October 2020).

- Gu, J.; Renwick, N.; Xue, L. The BRICS and Africa’s search for green growth, clean energy and sustainable development. Energy Policy 2018, 120, 675–683. [Google Scholar] [CrossRef]

- Boardman, J.; Sauser, B. Systems Thinking, 1st ed.; CRC Press: Boca Raton, FL, USA, 2008; ISBN 9780429146404. [Google Scholar]

- Sanneh, E.S. Systems Thinking for Sustainable Development: Climate Change and the Environment; Springer International Publishing: Madison, WI, USA, 2018; ISBN 9783319705859. [Google Scholar]

- Manioudis, M.; Meramveliotakis, G. Broad strokes towards a grand theory in the analysis of sustainable development: A return to the classical political economy. New Political Econ. 2022, 27, 866–878. [Google Scholar] [CrossRef]

- Williams, A.; Kennedy, S.; Philipp, F.; Whiteman, G. Systems thinking: A review of sustainability management research. J. Clean. Prod. 2017, 148, 866–881. [Google Scholar] [CrossRef]

- Pelletier, N. Life Cycle Thinking, Measurement and Management for Food System Sustainability. Environ. Sci. Technol. 2015, 49, 7515–7519. [Google Scholar] [CrossRef]

- Bauer, C.; Buchgeister, J.; Hischier, R.; Poganietz, W.R.; Schebek, L.; Warsen, J. Towards a framework for life cycle thinking in the assessment of nanotechnology. J. Clean. Prod. 2008, 16, 910–926. [Google Scholar] [CrossRef]

- Pelletier, N.; Ustaoglu, E.; Benoit, C.; Norris, G.; Rosenbaum, E.; Vasta, A.; Sala, S. Social sustainability in trade and development policy. Int. J. Life Cycle Assess. 2018, 23, 629–639. [Google Scholar] [CrossRef]

- Petit-Boix, A.; Llorach-Massana, P.; Sanjuan-Delmás, D.; Sierra-Pérez, J.; Vinyes, E.; Gabarrell, X.; Rieradevall, J.; Sanyé-Mengual, E. Application of life cycle thinking towards sustainable cities: A review. J. Clean. Prod. 2017, 166, 939–951. [Google Scholar] [CrossRef]

- Hughes, R. The EU Circular Economy Package—Life Cycle Thinking to Life Cycle Law. In Procedia CIRP; Elsevier B.V.: Amsterdam, The Netherlands, 2017; Volume 61, pp. 10–16. [Google Scholar]

- Soratana, K.; Harden, C.L.; Zaimes, G.G.; Rasutis, D.; Antaya, C.L.; Khanna, V.; Landis, A.E. The role of sustainability and life cycle thinking in U.S. biofuels policies. Energy Policy 2014, 75, 316–326. [Google Scholar] [CrossRef]

- Lazarevic, D.; Buclet, N.; Brandt, N. The application of life cycle thinking in the context of European waste policy. J. Clean. Prod. 2012, 29–30, 199–207. [Google Scholar] [CrossRef]

- Sonnemann, G.; Gemechu, E.D.; Sala, S.; Schau, E.M.; Allacker, K.; Pant, R.; Adibi, N.; Valdivia, S. Life cycle thinking and the use of LCA in policies around the world. In Life Cycle Assessment: Theory and Practice; Springer International Publishing: Cham, Switzerland, 2017; pp. 429–463. ISBN 9783319564753. [Google Scholar]

- Klopffer, W. Life-Cycle Based Methods for Sustainable Product Development. Int. J. Life Cycle Assess. 2003, 8, 157–159. [Google Scholar] [CrossRef]

- Kloepffer, W. Life cycle sustainability assessment of products (with Comments by Helias A. Udo de Haes, p. 95). Int. J. Life Cycle Assess. 2008, 13, 89–95. [Google Scholar] [CrossRef]

- Guinée, J.B.; Heijungs, R.; Huppes, G.; Zamagni, A.; Masoni, P.; Buonamici, R.; Ekvall, T.; Rydberg, T. Life cycle assessment: Past, present, and future. Environ. Sci. Technol. 2011, 45, 90–96. [Google Scholar] [CrossRef] [PubMed]

- Costa, D.; Quinteiro, P.; Dias, A.C. A systematic review of life cycle sustainability assessment: Current state, methodological challenges, and implementation issues. Sci. Total Environ. 2019, 686, 774–787. [Google Scholar] [CrossRef] [PubMed]

- ISO 14044; Environmental Management—Life Cycle Assessment—Requirements and Guilelines. ISO: Geneva, Switzerland, 2006.

- Lichtenvort, K.; Rebitzer, G.; Huppes, G.; Ciroth, A.; Seuring, S.; Schmidt, W.-P.; Günther, E.; Hoppe, H.; Swarr, T.; Hunkeler, D. Introduction: History of Life Cycle Costing, Its Categorization, and Its Basic Framework. In Environmental Life Cycle Costing; Hunkeler, D., Lichtenvort, K., Rebitzer, G., Eds.; SETAC: Jacksonville, FL, USA, 2008; p. 234. ISBN 978-1-58488-661-7. [Google Scholar]

- Sherif, Y.S.; Kolarik, W.J. Life cycle costing: Concept and practice. Omega 1981, 9, 287–296. [Google Scholar] [CrossRef]

- Hunkeler, D.; Lichtenvort, K.; Rebitzer, G. Environmental Life Cycle Costing; CRC Press: Boca Raton, FL, USA, 2008; ISBN 9781420054736. [Google Scholar]

- Ciroth, A.; Verghese, K.; Trescher, C. A Survey of Current Life Cycle Costing Studies. In Environmental Life Cycle Costing; Hunkeler, D., Lichtenvort, K., Rebitzer, G., Eds.; SETAC: Jacksonville, FL, USA, 2008; p. 234. ISBN 978-1-58488-661-7. [Google Scholar]

- Rebitzer, G.; Hunkeler, D. Life cycle costing in LCM: Ambitions, opportunities, and limitations: Discussing a framework. Int. J. Life Cycle Assess. 2003, 8, 253–256. [Google Scholar] [CrossRef]

- UN. A/RES/70/1 Resolution Adopted by the General Assembly on 25 September 2015; United Nations: New York, NY, USA, 2015.

- WCED. Our Common Future; Oxford University Press: New York, NY, USA, 1987. [Google Scholar]

- Daly, H.E. Allocation, distribution, and scale: Towards an economics that is efficient, just, and sustainable. Ecol. Econ. 1992, 6, 185–193. [Google Scholar] [CrossRef]

- Mori, K.; Yamashita, T. Methodological framework of sustainability assessment in City Sustainability Index (CSI): A concept of constraint and maximisation indicators. Habitat Int. 2015, 45, 10–14. [Google Scholar] [CrossRef]

- Gluch, P.; Baumann, H. The life cycle costing (LCC) approach: A conceptual discussion of its usefulness for environmental decision-making. Build. Environ. 2004, 39, 571–580. [Google Scholar] [CrossRef]

- Latruffe, L.; Diazabakana, A.; Bockstaller, C.; Desjeux, Y.; Finn, J.; Kelly, E.; Ryan, M.; Uthes, S. Measurement of sustainability in agriculture: A review of indicators. Stud. Agric. Econ. 2016, 118, 123–130. [Google Scholar] [CrossRef]

- Wood, R.; Hertwich, E.G. Economic modelling and indicators in life cycle sustainability assessment. Int. J. Life Cycle Assess. 2013, 18, 1710–1721. [Google Scholar] [CrossRef]

- Heijungs, R.; Settanni, E.; Guinée, J. Toward a computational structure for life cycle sustainability analysis: Unifying LCA and LCC. Int. J. Life Cycle Assess. 2013, 18, 1722–1733. [Google Scholar] [CrossRef]

- Neugebauer, S.; Forin, S.; Finkbeiner, M. From Life Cycle Costing to Economic Life Cycle Assessment—Introducing an Economic Impact Pathway. Sustainability 2016, 8, 428. [Google Scholar] [CrossRef]

- Jørgensen, A.; Hermann, I.T.; Mortensen, J.B. Is LCC relevant in a sustainability assessment? Int. J. Life Cycle Assess. 2010, 15, 531–532. [Google Scholar] [CrossRef]

- Moreau, V.; Weidema, B.P. The computational structure of environmental life cycle costing. Int. J. Life Cycle Assess. 2015, 20, 1359–1363. [Google Scholar] [CrossRef]

- Kielenniva, N.; Antikainen, R.; Sorvari, J. Measuring eco-efficiency of contaminated soil management at the regional level. J. Environ. Manag. 2012, 109, 179–188. [Google Scholar] [CrossRef]

- Feil, A.A.; de Quevedo, D.M.; Schreiber, D. Selection and identification of the indicators for quickly measuring sustainability in micro and small furniture industries. Sustain. Prod. Consum. 2015, 3, 34–44. [Google Scholar] [CrossRef]

- Shortall, R.; Davidsdottir, B.; Axelsson, G. Development of a sustainability assessment framework for geothermal energy projects. Energy Sustain. Dev. 2015, 27, 28–45. [Google Scholar] [CrossRef]

- Rasmussen, L.V.; Bierbaum, R.; Oldekop, J.A.; Agrawal, A. Bridging the practitioner-researcher divide: Indicators to track environmental, economic, and sociocultural sustainability of agricultural commodity production. Glob. Environ. Chang. 2017, 42, 33–46. [Google Scholar] [CrossRef]

- Gonzalez-Garcia, S.; Manteiga, R.; Moreira, M.T.; Feijoo, G. Assessing the sustainability of Spanish cities considering environmental and socio-economic indicators. J. Clean. Prod. 2018, 178, 599–610. [Google Scholar] [CrossRef]

- Lebacq, T.; Baret, P.V.; Stilmant, D. Sustainability indicators for livestock farming. A review. Agron. Sustain. Dev. 2013, 33, 311–327. [Google Scholar] [CrossRef]

- Niemeijer, D.; de Groot, R.S. A conceptual framework for selecting environmental indicator sets. Ecol. Indic. 2008, 8, 14–25. [Google Scholar] [CrossRef]

- Miller, C. Creating Indicators of Sustainability; International Institute for Sustainable Development: Winnipeg, MB, Canada, 2007. [Google Scholar]

- Huppes, G.; Ciroth, A.; Lichtenvort, K.; Rebitzer, G.; Schmidt, W.-P.; Seuring, S. Modeling for Life Cycle Costing. In Environmental Life Cycle Costing; Hunkeler, D., Lichtenvort, K., Rebitzer, G., Eds.; SETAC: Jacksonville, FL, USA, 2008; p. 234. [Google Scholar]

- Gerdessen, J.C.; Pascucci, S. Data envelopment analysis of sustainability indicators of european agricultural systems at regional level. Agric. Syst. 2013, 118, 78–90. [Google Scholar] [CrossRef]

- Valenti, W.C.; Kimpara, J.M.; Preto, B.D.L.; Moraes-Valenti, P. Indicators of sustainability to assess aquaculture systems. Ecol. Indic. 2018, 88, 402–413. [Google Scholar] [CrossRef]

- Cohen, J.R.; Holder-Webb, L.L.; Nath, L.; Wood, D. Corporate Reporting of Nonfinancial Leading Indicators of Economic Performance and Sustainability. Account. Horizons 2012, 26, 65–90. [Google Scholar] [CrossRef]

- Apostolakis, G.E. How useful is quantitative risk assessment? Risk Anal. 2004, 24, 515–520. [Google Scholar] [CrossRef]

- Andersen, T.J. The Performance Relationship of Effective Risk Management: Exploring the Firm-Specific Investment Rationale. Long Range Plan. 2008, 41, 155–176. [Google Scholar] [CrossRef]

- Sandøy, M.; Aven, T.; Ford, D. On Integrating Risk Perspectives in Project Management. Risk Manag. 2005, 7, 7–21. [Google Scholar] [CrossRef]

- McLellan, B.; Zhang, Q.; Farzaneh, H.; Utama, N.A.; Ishihara, K.N. Resilience, Sustainability and Risk Management: A Focus on Energy. Challenges 2012, 3, 153–182. [Google Scholar] [CrossRef]

- Gourguet, S.; Thébaud, O.; Dichmont, C.; Jennings, S.; Little, L.R.; Pascoe, S.; Deng, R.A.; Doyen, L. Risk versus economic performance in a mixed fishery. Ecol. Econ. 2014, 99, 110–120. [Google Scholar] [CrossRef]

- Plagányi, É.E.; Skewes, T.D.; Dowling, N.A.; Haddon, M. Risk management tools for sustainable fisheries management under changing climate: A sea cucumber example. Clim. Chang. 2013, 119, 181–197. [Google Scholar] [CrossRef]

- Gebreslassie, B.H.; Guillén-Gosálbez, G.; Jiménez, L.; Boer, D. Economic performance optimization of an absorption cooling system under uncertainty. Appl. Therm. Eng. 2009, 29, 3491–3500. [Google Scholar] [CrossRef]

- Epstein, M.J.; Roy, M.J. Sustainability in action: Identifying and measuring the key performance drivers. Long Range Plan. 2001, 34, 585–604. [Google Scholar] [CrossRef]

- Huang, M.; Li, P.; Meschke, F.; Guthrie, J.P. Family firms, employee satisfaction, and corporate performance. J. Corp. Financ. 2015, 34, 108–127. [Google Scholar] [CrossRef]

- Melián-González, S.; Bulchand-Gidumal, J.; González López-Valcárcel, B. New evidence of the relationship between employee satisfaction and firm economic performance. Pers. Rev. 2015, 44, 906–929. [Google Scholar] [CrossRef]

- Tang, C.S. Perspectives in supply chain risk management. Int. J. Prod. Econ. 2006, 103, 451–488. [Google Scholar] [CrossRef]

- Bergman, N.; Iyer, R.; Thakor, R. The Effect of Cash Injections: Evidence from the 1980s Farm Debt Crisis; Nagtional Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Campello, M. Debt financing: Does it boost or hurt firm performance in product markets? J. Financ. Econ. 2006, 82, 135–172. [Google Scholar] [CrossRef]

- Sumaila, U.R.; Teh, L.; Watson, R.; Tyedmers, P.; Pauly, D. Fuel price increase, subsidies, overcapacity, and resource sustainability. ICES J. Mar. Sci. 2008, 65, 832–840. [Google Scholar] [CrossRef]

- Munro, G.; Sumaila, U.R. The impact of subsidies upon fisheries management and sustainability: The case of the North Atlantic. Fish Fish. 2002, 3, 233–250. [Google Scholar] [CrossRef]

- Toro-Mujica, P.; García, A.; Aguilar, C.; Vera, R.; Perea, J.; Angón, E. Economic Sustainability of Organic Dairy Sheep Systems in Central Spain. Ital. J. Anim. Sci. 2015, 14, 3625. [Google Scholar] [CrossRef]

- Merlín-Uribe, Y.; González-Esquivel, C.E.; Contreras-Hernández, A.; Zambrano, L.; Moreno-Casasola, P.; Astier, M. Environmental and socio-economic sustainability of chinampas (raised beds) in Xochimilco, Mexico City. Int. J. Agric. Sustain. 2013, 11, 216–233. [Google Scholar] [CrossRef]

- Cucchiella, F.; D’Adamo, I. Technical and economic analysis of biomethane: A focus on the role of subsidies. Energy Convers. Manag. 2016, 119, 338–351. [Google Scholar] [CrossRef]

- Cantner, U.; Dettmann, E.; Giebler, A.; Guenther, J.; Kristalova, M. The impact of innovation and innovation subsidies on economic development in German regions. Reg. Stud. 2019, 53, 1284–1295. [Google Scholar] [CrossRef]

- Howell, A. Picking ‘winners’ in China: Do subsidies matter for indigenous innovation and firm productivity? China Econ. Rev. 2017, 44, 154–165. [Google Scholar] [CrossRef]

- Thomassen, M.A.; Dolman, M.A.; van Calker, K.J.; de Boer, I.J.M. Relating life cycle assessment indicators to gross value added for Dutch dairy farms. Ecol. Econ. 2009, 68, 2278–2284. [Google Scholar] [CrossRef]

- Isaksson, R. Economic sustainability and the cost of poor quality. Corp. Soc. Responsib. Environ. Manag. 2005, 12, 197–209. [Google Scholar] [CrossRef]

- Anderson, E.W.; Sullivan, M.W. The Antecedents and Consequences of Customer Satisfaction for Firms. Mark. Sci. 1993, 12, 125–143. [Google Scholar] [CrossRef]

- Peterson, R.A.; Wilson, W.R. Measuring customer satisfaction: Fact and artifact. J. Acad. Mark. Sci. 1992, 20, 61–71. [Google Scholar] [CrossRef]

- Pece, A.M.; Simona, O.E.O.; Salisteanu, F. Innovation and Economic Growth: An Empirical Analysis for CEE Countries. Procedia Econ. Financ. 2015, 26, 461–467. [Google Scholar] [CrossRef]

- Maradana, R.P.; Pradhan, R.P.; Dash, S.; Gaurav, K.; Jayakumar, M.; Chatterjee, D. Does innovation promote economic growth? Evidence from European countries. J. Innov. Entrep. 2017, 6, 1. [Google Scholar] [CrossRef]

- Haugh, H.; Kitson, M. The Global Hunt for Jobs. Available online: http://www.news.ucsb.edu/2018/018615/global-hunt-jobs (accessed on 27 May 2020).

- Cainelli, G.; Evangelista, R.; Savona, M. The impact of innovation on economic performance in services. Serv. Ind. J. 2004, 24, 116–130. [Google Scholar] [CrossRef]