The Path of Housing Prices in Promoting the Upgrading of Industrial Structure: Bank Credit Funds, Land Finance, and Consumer Demand

Abstract

:1. Introduction

1.1. Problems Propose

1.2. Theoretical Hypotheses

1.2.1. Hypotheses 1: Bank Credit Funds

1.2.2. Hypotheses 2: Land Finance

1.2.3. Hypotheses 3: Consumer Demand

2. Materials and Methods

2.1. Variable Measure

2.1.1. Explained Variable

2.1.2. Explanatory Variable: Housing Price Level (HP)

2.1.3. Mediating Variable

- (1)

- Congestion degree of financial resources (MON). Including the crowding out of three types of funds: in terms of investment, real estate development investment accounts for a large proportion of fixed asset investment in the whole society, and excessive investment in real estate will replace other non-real estate investments, thus affecting the upgrading of industrial structure; in terms of financing, China’s huge real estate market financing mainly relies on bank credit, followed by the use of foreign capital, self-raised funds, etc. More real estate development financing, under the condition of a certain amount of financial resources, will lead to a decrease in the financing funds of other industries, which in turn will reduce the amount of financing available for other industries. Industrial upgrading has an impact. In view of this, this paper adopts the ratio of real estate investment to the total social fixed asset investment (MFR), the ratio of real estate loans to the balance of loans of banking financial institutions (CRE), and the ratio of foreign investment in real estate investment to total foreign investment (FOR), respectively., as well as the real estate industry’s occupation of fixed investment funds, bank credit funds, and foreign investment funds.

- (2)

- Land financial dependence (FIN). Many scholars directly use the ratio of land transfer fee to general budgetary revenue to measure land financial revenue but, in fact, real estate tax also occupies a considerable proportion in land finance, which cannot be ignored. Therefore, this paper draws on Wu and Li [27] who use land transfer fees to measure land finance, taking real estate taxes into account. The constructed indicator is the ratio of the sum of land transfer fees and real estate taxes to general budgetary revenue, so as to measure a region’s land financial dependence. At the same time, the ratio of land transfer fee to general budget revenue is used as another indicator to measure land financial dependence (LAND) for comparative analysis.

- (3)

- Resident consumption upgrade (EXP). The analysis is carried out from two aspects: the upgrading of residents’ consumption level and the upgrading of residents’ consumption structure. With the development of China’s social economy, the per capita consumption expenditure of residents has gradually increased, which can be used to measure the upgrading of residents’ consumption level (CON). For the upgrading of consumption structure, some scholars directly measure the ratio of residents’ non-food consumption expenditure to total consumption expenditure, but nowadays people’s living standards are gradually improving, and they have already begun to pursue more diversified consumption. It is impossible to generalize consumption expenditures other than non-food items. In view of this, this article is based on the availability of data and according to the consumption to meet the living level of residents. The structure is divided into: subsistence consumption (including food consumption expenditure, clothing consumption expenditure, and housing consumption expenditure, etc.), development consumption (including transportation and communication consumption expenditure, medical care consumption expenditure, equipment consumption expenditure, etc.), enjoyment consumption (including cultural and entertainment consumption expenditure, other supplies and services consumption expenditure, etc.); the ratio of the three types of consumption to the per capita consumption expenditure of residents is used as the measurement index for the upgrading of the consumption structure of residents, which is expressed by SUR, DEV, and ENJ, respectively.

2.1.4. Control Variables

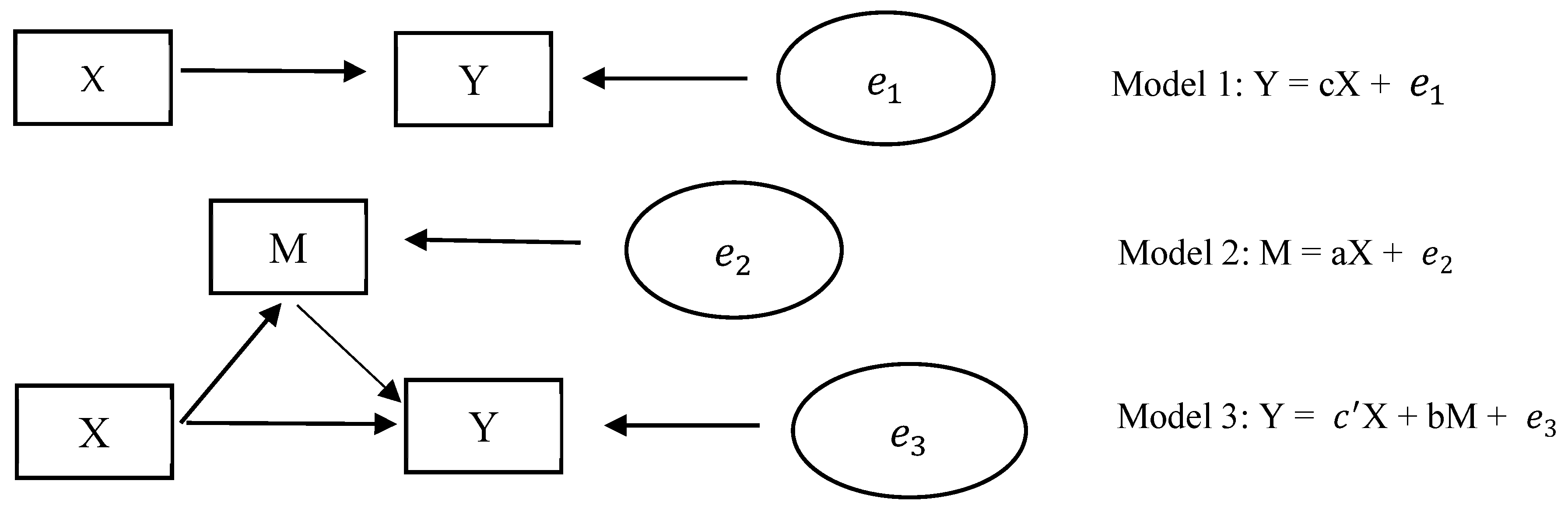

2.2. Model Building

2.3. Data Sources

3. Results

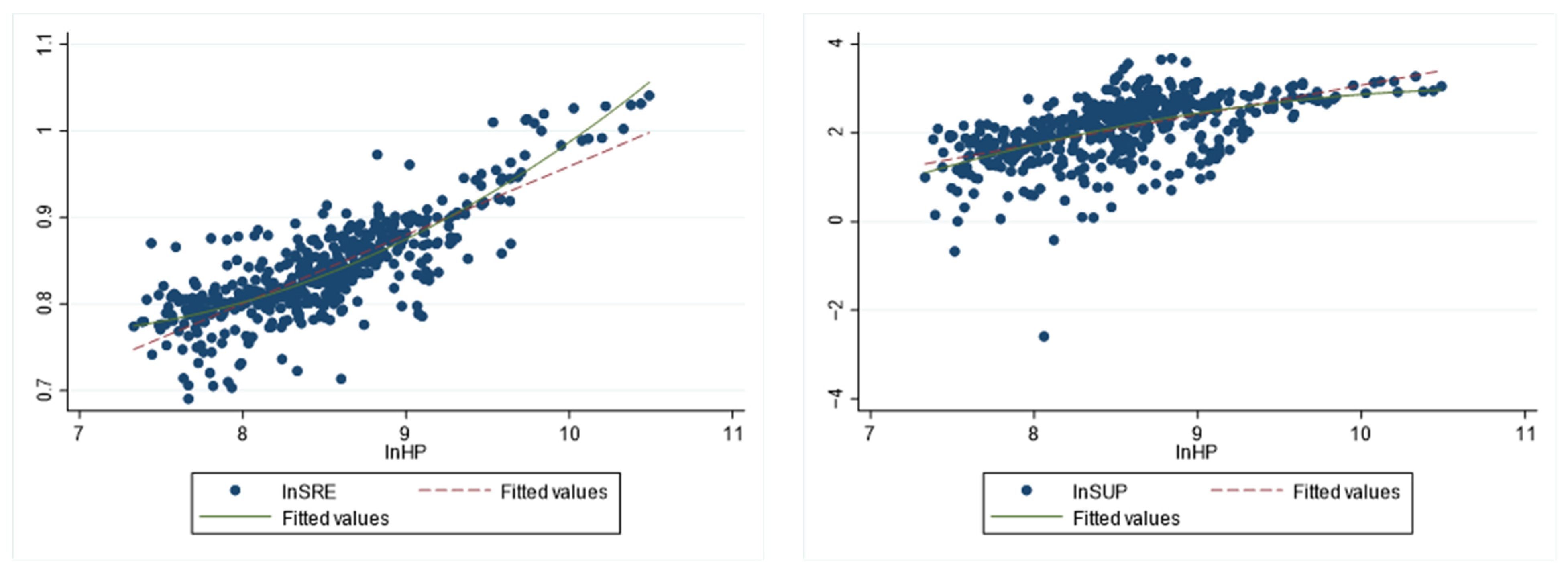

3.1. Unit Root and Cointegration Test

3.2. Direct Impact of Housing Prices on the Upgrading of Industrial Structure

3.3. Mediating Effect of the Impact of Housing Prices on the Upgrading of Industrial Structure

3.3.1. Crowding Out of Bank Credit Funds

3.3.2. Land Financial Dependence

- National level

- Areas with different house prices

3.3.3. Consumption Upgrade

4. Discussion

4.1. Main Conclusions and Discussion

4.2. Policy Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Xu, X.; Yang, H.; Li, C. Theoretical Model and Actual Characteristics of Air Pollution Affecting Health Cost: A Review. Int. J. Environ. Res. Public Health 2022, 19, 3532. [Google Scholar] [CrossRef] [PubMed]

- Cao, Z.; Li, S. On the Strategic Position of Real Estate Industry in China’s Industrial Structure Adjustment. Nankai Econ. Res. 1995, 6, 3–9. [Google Scholar]

- Xia, M. Looking at the impact of real estate development on China’s economy from input-output data. Econ. Dyn. 2009, 11, 11–15. [Google Scholar]

- Lu, W.; Ji, X. Urban housing prices, financial development and industrial structure upgrading: An empirical study based on panel data of prefecture-level cities in China. Sankei Rev. 2017, 8, 81–94. [Google Scholar]

- Gu, Q.; Shi, W.; Wang, H. An Empirical Study on the Impact of Industrial Structure on Real Estate Prices. Bus. Res. 2015, 2, 44–52. [Google Scholar]

- Lin, Y.; Lv, P. Research on the mechanism of housing price differences affecting the advanced industrial structure—Analysis framework based on the core-periphery model. Mod. Manag. Sci. 2017, 12, 24–26. [Google Scholar]

- Guo, W.; Li, J. Analysis on the mechanism and effect of housing price fluctuation on industrial structure upgrading. J. Guangdong Univ. Financ. Econ. 2019, 3, 14–25. [Google Scholar]

- Zhang, Y.; Zhang, W. Analysis of China’s real estate market from the perspective of resource allocation. Int. Financ. 2011, 8, 63–70. [Google Scholar]

- Chen, T.; Liu, L.; Zhou, L. The Crowding-Out Effects of Real Estate Shocks: Evidence from China. 2015. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2584302 (accessed on 8 May 2021).

- Chen, T.; He, Y.; Xie, J.; China Management Modernization Research Association. Simulative Study on Crowding-out Effect of Investment in City Real Estate Based on Systems Dynamics. In Proceedings of the 3rd (2008) Annual Conference of China Management Studies—Proceedings of Entrepreneurship and Small and Medium Enterprise Management, Changsha, China, 1–2 November 2008; Volume 7. Available online: https://www.aconf.cn/conf_5180.html (accessed on 16 November 2021).

- Liu, C.; Wang, R. Will rising housing prices inhibit the upgrading of regional industrial structure? Ind. Econ. Res. 2019, 2, 102–113. [Google Scholar]

- Lin, G.C.; Ho, S.P. The State, Land System, and Land Development Processes in Contemporary China. Ann. Am. Assoc. Geogr. 2008, 95, 411–436. [Google Scholar] [CrossRef]

- Wang, X.; Wu, L. Land finance, housing price rise and industrial structure upgrade: Analysis based on panel data simultaneous equation model. Econ. Probl. Explor. 2019, 3, 32–39. [Google Scholar]

- Song, D.; Tao, X. Does Land Finance Affect Industrial Upgrading: A Test Based on the Mediation Effect of Infrastructure and Housing Prices. Financ. Account. Mon. 2019, 20, 103–112. [Google Scholar]

- Jiang, S.; Liu, S.; Li, Q. Land System Reform and National Economic Growth. Manag. World 2007, 9, 1–9. [Google Scholar]

- Yang, W.; Kong, X.; Zhu, S. Research on the Influence of Land Finance on Industrial Structure Upgrade. Financ. Dev. Res. 2018, 5, 44–49. [Google Scholar]

- Li, J. Has the “house slave effect” led to a downturn in residents’ consumption? Econ. Q. 2018, 17, 405–430. [Google Scholar]

- Tabuchi, T. Urban Agglomeration and Dispersion: A Synthesis of Alonso and Krugman. J. Urban Econ. 1998, 44, 333–351. [Google Scholar] [CrossRef] [Green Version]

- Xu, X.; Wang, Q.; Li, C. The impact of dependency burden on urban household health expenditure and its regional heterogeneity in China: Based on quantile regression method. Front. Public Health 2022, 10, 876088. [Google Scholar] [CrossRef]

- Aoki, K.; Proudman, J.; Vlieghe, G. House prices, consumption, and monetary policy: A financial accelerator approach. J. Financ. Int. 2004, 13, 414–435. [Google Scholar] [CrossRef]

- Iacoviello, M.; Neri, S. Housing Market Spillovers: Evidence from an Estimated DSGE Model. Am. Econ. J. Macroecon. 2010, 2, 125–164. [Google Scholar] [CrossRef] [Green Version]

- Du, L.; Luo, J. How rising housing prices affect the consumption propensity of urban residents in China: A study based on the two-stage optimal consumption model of households. Financ. Trade Econ. 2017, 38, 67–82. [Google Scholar]

- Wang, K.; Pang, Z. The impact of rising house prices on household consumption in China: Wealth effect or crowding out effect? East China Econ. Manag. 2019, 33, 102–107. [Google Scholar]

- Zhang, Y. The overall and regional test of the impact of residents’ consumption capacity on the upgrading of China’s industrial structure. Bus. Econ. Res. 2021, 4, 48–51. [Google Scholar]

- Wu, X. Heterogeneity and influencing factors of inter-provincial industrial structure upgrading: Based on the spatial panel econometric analysis of 28 provinces from 1998 to 2010. Econ. Jingwei 2014, 31, 90–95. [Google Scholar]

- Fu, L. An Empirical Study on the Relationship between the Advanced Industrial Structure and Economic Growth in China. Stat. Res. 2010, 27, 79–81. [Google Scholar]

- Wu, Q.; Li, Y. Fiscal decentralization, local government competition and land finance. Financ. Trade Econ. 2010, 7, 51–59. [Google Scholar]

- Gao, G. Enhancing the comprehensive carrying capacity of urban agglomeration and fostering the growth pole and power source of high-quality development. Macroecon. Manag. 2021, 11, 15–20. [Google Scholar]

- Chen, X. Research on the Interaction path between Housing price and bank credit in China. Shanghai Commer. 2021, 1, 50–53. [Google Scholar]

- Zhou, Y.; Liu, C. Research on the Influence of China’s Virtual Economy Development on the Expansion Effect of Real Economy Investment. J. Shanxi Univ. Financ. Econ. 2014, 36, 21–32. [Google Scholar]

- Chaney, T.; Sraer, D.; Thesmar, D. The Collateral Channel: How Real Estate Shocks Affect Corporate Investment. Am. Econ. Rev. 2012, 102, 2381–2409. [Google Scholar] [CrossRef] [Green Version]

- Jiang, H.; Jiang, P. Research on the effect of digital inclusive finance on the improvement of household consumption level and structural optimization. Mod. Financ. Econ.—J. Tianjin Univ. Financ. Econ. 2020, 40, 18–32. [Google Scholar]

- Wang, W.; Liu, Z.; Gong, F. The impact of high housing prices on the upgrading of consumption structure: An empirical study based on 35 large and medium-sized cities. Acad. Res. 2017, 8, 87–94, 177–178. [Google Scholar]

| Countries | Tax | The Tax Base | Rate | |

|---|---|---|---|---|

| China (naming only the five most common types) | Property tax | (Holder) Original value of real Estate × (70~90%) | 1.2% | |

| Lease rent | 4% | |||

| Urban land use tax | 2~20 YUAN/m2/year × actual occupied land area | |||

| Land value added tax | Individual sales of housing are exempt | |||

| Farmland occupation tax | Tax shall be calculated on the basis of the area of cultivated land actually occupied by the taxpayer and at the applicable fixed tax rate | |||

| Deed tax | Transfer turnover | 1~3% | ||

| America | Real estate tax | Based on a certain proportion of the assessed value of real estate, the nominal tax rate is 0.3–3%, and the actual tax rate is 0.27–2.4% | ||

| Rental income tax | Federal tax rates range from 10% to 37%, and state top marginal tax rates range from 2.9% to 13.3% | |||

| Real estate transfer tax | Real estate transfer tax: the transaction value of real estate is the tax base, and the state tax rate is 0.01~3% | |||

| Record taxes/fees: the transaction value of real estate is the tax base, and the state tax rate is 0.3~1.45% | ||||

| Mortgage tax: The mortgage amount is the tax base, with state tax rates ranging from 0.02% to 1.05% | ||||

| Capital gains tax | Transfer after less than 1 year of ownership: federal tax rates from 10% to 37%, state top marginal tax rates from 2.9% to 13.3% | |||

| Transfer after more than 1 year of ownership: Federal tax rates 0 to 20%, the highest combined federal and state tax rates 20 to 40% for each state in 2018 | ||||

| Britain | Land stamp duty | Real estate value | First house or change of house:0~12% (over progressive), the tax rate of the second house and above will be increased by 3 or 4 percentage points | |

| Capital gains tax | Housing value minus acquisition and transaction costs | The basic tax rate is 18%, and the high salary and additional tax rate is 28% | ||

| Inheritance tax | Gift and posthumous estate within 7 years prior to death | Inheritance tax rate of 40%, 8~40% gift before death | ||

| Municipal tax | 8 classes by 1991 house prices (Wales: 9 classes by 2003 house prices) | The tax multiplier is 6/9~21/9 | ||

| Individual income tax | Rent Net income after maintenance, etc. | Included in the scope of individual income tax collection, the implementation of four levels of excess progressive tax rates: 0, 20%, 40%, and 45% | ||

| Singapore | Stamp duty | Buyer’s stamp duty | Contract price or market price (higher) | 1~4% (grade 4 progressive) |

| Seller’s stamp duty | 0~16% (five progressive levels) | |||

| Additional stamp duty | 0~30% (subject by subject) | |||

| Stamp duty on leasing | Actual or market rent (higher) | 0.4% | ||

| Income tax | Sell | Profits | Include personal income, comprehensive tax (0~20%) | |

| Rent | The balance of rent after deducting mortgage, property taxes, maintenance, etc. | |||

| Property tax | Annual housing value (annual rent) | 0~20% (progressive, distinguish between owner-occupiers and non-owner-occupiers) | ||

| Variable Category | Symbol | Variable Name | Calculation Method |

|---|---|---|---|

| Explained variable | SRE | Rationalization of industrial structure | The proportion of the output value of each industry is multiplied by its respective weight and then summed |

| SUP | Advanced industrial structure | It is derived from the Moore structure value calculation formula | |

| Explanatory variables | HP | House price | Commercial housing sales/Commercial housing sales area |

| Mediating variable | MFR | Fixed investment capital squeeze | Real estate investment/Fixed asset investment in the whole society |

| CRE | Bank credit capital squeeze | Real estate loan/Loan balance of banking financial institutions | |

| FOR | Crowding of foreign investment funds | Real estate utilizes foreign capital/Total foreign investment | |

| LAND | Land financial dependence (1) | Land transfer fee/General budget revenue | |

| FIN | Land financial dependence (2) | (land transfer fee + real estate tax)/General budget revenue | |

| CON | Resident consumption level | Per capita consumption expenditure of local residents | |

| SUR | Proportion of subsistence consumption | (Per capita food consumption expenditure + Per capita clothing consumption expenditure + Per capita housing consumption expenditure)/Total per capita consumption expenditure of residents | |

| DEV | Proportion of developmental consumption | (Per capita transportation and communication consumption expenditure + Health care consumption expenditure per capita + Consumption of equipment, supplies and services)/Total per capita consumption expenditure of residents | |

| ENJ | The proportion of enjoyment consumption | (Per capita expenditure on education, culture and entertainment + Other Goods and Services Consumption Expenditure)/Total per capita consumption expenditure of residents | |

| Control variable | TEC | Technological innovation | Number of granted invention patent applications |

| TRA | Level of opening | Total import and export/Regional GDP | |

| FIS | Financial expenditure | local government spending | |

| HC | Human capital | Number of students in regular institutions of higher learning per 100,000 people | |

| URB | Urbanization rate | urban population/Total population |

| Variable. | Max | Min | Mean | Std.dev. | Number |

|---|---|---|---|---|---|

| LnSRE | 1.0410 | 0.6905 | 0.8403 | 0.0577 | 465 |

| LnSUP | 3.6849 | −2.5935 | 2.0810 | 0.7164 | 465 |

| LnHP | 10.4886 | 7.3322 | 8.5013 | 0.5875 | 465 |

| LnMFR | −0.5848 | −4.6108 | −1.8323 | 0.5730 | 465 |

| LnCRE | −2.5737 | −8.2570 | −4.1368 | 0.7690 | 465 |

| LnFOR | −1.4247 | −12.9914 | −5.5409 | 2.2256 | 465 |

| LnFIN | 17.2220 | 6.5890 | 14.0417 | 1.5381 | 465 |

| LnCON | 10.7278 | 7.9338 | 9.2497 | 0.5846 | 465 |

| LnSUR | −0.2637 | −0.8534 | −0.5201 | 0.0755 | 465 |

| LnDEV | −1.0675 | −1.8330 | −1.3483 | 0.1187 | 465 |

| LnENJ | −1.5674 | −2.7592 | −1.9793 | 0.1770 | 465 |

| LnTEC | 10.9978 | 1.3863 | 7.2630 | 1.7993 | 465 |

| LnTRA | −1.4088 | −6.2997 | −3.6631 | 0.9836 | 465 |

| LnFIS | 9.7583 | 5.0189 | 7.8080 | 0.9005 | 465 |

| LnHC | 5.5081 | −1.9601 | 1.4650 | 1.4233 | 465 |

| LnURB | −0.1098 | −1.5678 | −0.6699 | 0.2798 | 465 |

| − | lnSRE | lnSUP | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| lnHP | 0.0843 *** (0.0035) | 0.0637 *** (0.0081) | −0.215 *** (0.0608) | −0.237 *** (0.0537) | 0.131 ** (0.0537) | 0.350 *** (0.123) | −3.671 *** (0.946) | −2.674 *** (1.022) |

| lnHP 2 | 0.0169 *** (0.0034) | 0.0151 *** (0.0030) | 0.215 *** (0.0534) | 0.167 *** (0.0562) | ||||

| lnTEC | −0.0466 *** (0.0037) | −0.0462 *** (0.0036) | −0.0795 (0.0698) | −0.0751 (0.0692) | ||||

| lnTRA | 0.0031 (0.0026) | 0.0058 ** (0.0026) | −0.155 *** (0.0482) | −0.126 ** (0.0488) | ||||

| lnFIS | 0.0538 *** (0.0059) | 0.0539 *** (0.0058) | 0.0706 (0.110) | 0.0721 (0.110) | ||||

| lnHC | 0.0664 *** (0.0044) | 0.0642 *** (0.0043) | 0.138 * (0.0828) | 0.114 (0.0825) | ||||

| lnURB | −0.0436 *** (0.0086) | −0.0343 *** (0.0086) | −0.169 (0.161) | −0.0664 (0.163) | ||||

| Constant | 0.123 *** (0.0296) | 0.346 *** (0.0697) | 1.440 *** (0.268) | 1.580 *** (0.251) | 0.967 ** (0.457) | −1.749 (1.302) | 17.68 *** (4.177) | 11.96 ** (4.778) |

| Observations | 465 | 465 | 465 | 465 | 465 | 465 | 465 | 465 |

| R−squared | 0.567 | 0.716 | 0.589 | 0.731 | 0.013 | 0.050 | 0.048 | 0.069 |

| Number of id | 15 | 31 | 15 | 15 | 15 | 31 | 15 | 15 |

| Variable | Fixed Investment Capital Squeeze | Bank Credit Capital Squeeze | Crowding of Foreign Investment Funds | ||||||

|---|---|---|---|---|---|---|---|---|---|

| lnMFR (1) | lnSRE (2) | lnSUP (3) | lnCRE (4) | lnSRE (5) | lnSUP (6) | lnFOR (7) | lnSRE (8) | lnSUP (9) | |

| lnHP | 1.027 *** (0.0840) | 0.0385 *** (0.0076) | 0.125 (0.141) | 0.868 *** (0.136) | 0.0423 *** (0.0068) | 0.431 *** (0.128) | 0.916 ** (0.407) | 0.0377 *** (0.0066) | 0.370 *** (0.126) |

| lnMFR | −0.0034 (0.0037) | 0.219 *** (0.0691) | |||||||

| lnCRE | −0.0083 *** (0.0023) | −0.0939 ** (0.0428) | |||||||

| lnFOR | −0.0036 *** (0.0008) | −0.0122 (0.0147) | |||||||

| lnTEC | 0.617 *** (0.0475) | −0.0445 *** (0.0044) | −0.214 *** (0.0812) | 0.979 *** (0.0771) | −0.0385 *** (0.0043) | 0.0125 (0.0812) | 1.962 *** (0.234) | −0.0402 *** (0.0040) | −0.0536 (0.0773) |

| lnTRA | −0.113 *** (0.0328) | 0.0028 (0.0026) | −0.130 *** (0.0484) | −0.0249 (0.0532) | 0.0029 (0.0026) | −0.157 *** (0.0480) | −0.627 *** (0.163) | 0.0014 (0.0027) | −0.169 *** (0.0508) |

| lnFIS | −0.748 *** (0.0752) | 0.0513 *** (0.0065) | 0.234 * (0.121) | −1.216 *** (0.122) | 0.0436 *** (0.0065) | −0.0436 (0.122) | −1.873 *** (0.368) | 0.0481 *** (0.0061) | 0.0507 (0.116) |

| lnHC | −0.565 *** (0.0563) | 0.0645 *** (0.0049) | 0.262 *** (0.0908) | −0.776 *** (0.0913) | 0.0599 *** (0.0047) | 0.0653 (0.0889) | −1.545 *** (0.274) | 0.0612 *** (0.0046) | 0.115 (0.0871) |

| lnURB | 0.688 *** (0.110) | −0.0413 *** (0.009) | −0.320 * (0.166) | 0.296 * (0.178) | −0.0411 *** (0.0085) | −0.142 (0.161) | 2.286 *** (0.547) | −0.0353 *** (0.0089) | −0.121 (0.171) |

| Constant | −8.329 *** (0.886) | 0.318 *** (0.0763) | 0.0712 (1.411) | −7.881 *** (1.436) | 0.281 *** (0.0710) | −2.490 * (1.339) | −11.48 *** (4.310) | 0.309 *** (0.0696) | −2.011 (1.333) |

| Observations | 465 | 465 | 465 | 465 | 465 | 465 | 465 | 465 | 465 |

| R_squared | 0.672 | 0.716 | 0.071 | 0.495 | 0.724 | 0.061 | 0.306 | 0.733 | 0.053 |

| Variable | Land Financial Dependence (1) (Only the Land Transfer Fee is Considered) | Land Financial Dependence (2) (Consider Both Land Transfer Fees and Real Estate Taxes) | |||||

|---|---|---|---|---|---|---|---|

| lnLAND (1) | lnSRE (2) | lnSUP (3) | lnHP (4) | lnFIN (5) | lnSRE (6) | lnSUP (7) | |

| lnHP | 0.262 * (0.144) | 0.0362 *** (0.0066) | 0.396 *** (0.121) | 0.304 *** (0.0880) | 0.0400 *** (0.0066) | 0.422 *** (0.123) | |

| lnLAND | −0.0044 ** (0.0022) | −0.178 *** (0.0399) | |||||

| lnFIN | 0.0860 *** (0.0249) | −0.0162 *** (0.0035) | −0.239 *** (0.0657) | ||||

| lnTEC | 1.096 *** (0.0813) | −0.0418 *** (0.0044) | 0.116 (0.0812) | −0.221 *** (0.0336) | 0.915 *** (0.0498) | −0.0317 *** (0.0049) | 0.139 (0.0914) |

| lnTRA | 0.0064 (0.0562) | 0.00316 (0.0026) | −0.154 *** (0.0472) | 0.208 *** (0.0154) | −0.0272 (0.0344) | 0.0027 (0.0025) | −0.162 *** (0.0476) |

| lnFIS | −1.289 *** (0.129) | 0.0481 *** (0.0065) | −0.159 (0.120) | 0.143 *** (0.0482) | −0.982 *** (0.0788) | 0.0378 *** (0.0067) | −0.164 (0.127) |

| lnHC | −0.969 *** (0.0964) | 0.0621 *** (0.0049) | −0.0343 (0.0898) | 0.386 *** (0.0354) | −0.971 *** (0.0590) | 0.0506 *** (0.0055) | −0.0939 (0.104) |

| lnURB | 0.431 ** (0.188) | −0.0417 *** (0.0086) | −0.0926 (0.159) | 0.0176 (0.0670) | 1.090 *** (0.115) | −0.0259 *** (0.0092) | 0.0912 (0.174) |

| Constant | −0.544 (1.516) | 0.344 *** (0.0694) | −1.846 (1.275) | 9.315 *** (0.221) | −0.852 (0.928) | 0.332 *** (0.0682) | −1.953 (1.285) |

| Observations | 465 | 465 | 465 | 465 | 465 | 465 | 465 |

| R−squared | 0.366 | 0.718 | 0.091 | 0.821 | 0.578 | 0.729 | 0.078 |

| Variable | High Housing Prices | Moderate to High Price | Medium Housing Price | Moderately Low Price | Low Housing Price | ||||

|---|---|---|---|---|---|---|---|---|---|

| LnFIN (1) | lnFIN (2) | lnSRE (3) | lnSUP (4) | lnFIN (5) | lnFIN (6) | lnFIN (7) | lnSRE (8) | lnSUP (9) | |

| lnHP | 1.261 (0.834) | 1.106 *** (0.332) | 0.0651 ** (0.0283) | 1.150 ** (0.467) | −1.999 (1.110) | 0.449 (0.631) | 0.510 ** (0.217) | 0.0333 *** (0.0134) | 0.345 (0.251) |

| lnFIN | 0.0136 (0.0120) | −0.754 *** (0.199) | −0.0211 *** (0.0039) | −0.159 ** (0.0725) | |||||

| lnTEC | 1.007 (5.812) | −0.0640 (0.250) | −0.0080 (0.0188) | 0.922 *** (0.311) | 3.835 (2.805) | 0.179 (0.316) | 0.802 *** (0.0853) | 0.0011 (0.0060) | 0.202 * (0.112) |

| lnTRA | 0.132 (1.057) | −0.161 (0.161) | −0.0305 ** (0.0122) | 1.675 *** (0.202) | 1.512 (1.363) | 0.133 (0.0859) | −0.101 ** (0.0483) | −0.00555 * (0.0030) | −0.0607 (0.0558) |

| lnFIS | 0.262 (2.146) | −0.0348 (0.316) | 0.0482 ** (0.0238) | −1.879 *** (0.393) | −3.761 * (2.020) | −0.361 (0.441) | −0.791 *** (0.136) | −0.0150 * (0.0089) | −0.287 * (0.166) |

| lnHC | −0.827 (5.231) | 0.527 * (0.271) | 0.0011 (0.0213) | −0.985 *** (0.353) | −4.425 (3.361) | −0.764 *** (0.243) | −0.777 *** (0.111) | 0.0111 (0.0074) | −0.113 (0.139) |

| lnURB | −7.689 (17.71) | −2.887 *** (0.552) | 0.224 *** (0.0541) | −3.154 *** (0.895) | 3.620 (6.449) | 1.887 *** (0.574) | 0.977 *** (0.134) | −0.0196 ** (0.0090) | 0.132 (0.169) |

| Constant | −22.80 (42.76) | −13.26 *** (2.799) | −0.0017 (0.264) | 3.270 (4.367) | 30.26 (16.91) | −0.401 (4.922) | −03.861 ** (1.824) | 0.576 *** (0.112) | −0.120 (2.106) |

| Observations | 30 | 60 | 60 | 60 | 30 | 75 | 270 | 270 | 270 |

| R_squared | 0.730 | 0.710 | 0.916 | 0.820 | 0.847 | 0.564 | 0.642 | 0.380 | 0.039 |

| Variable | lnCON (1) | lnSRE (2) | lnSUP (3) |

|---|---|---|---|

| lnHP | 0.327 *** (0.0327) | 0.0461 *** (0.0110) | 0.925 *** (0.193) |

| lnCON | 0.0533 *** (0.0146) | 0.0153 (0.257) | |

| lnTEC | 0.241 ** (0.0956) | 0.120 *** (0.0292) | 0.268 (0.512) |

| lnTRA | −0.0877 *** (0.0118) | 0.00251 (0.0038) | −0.192 *** (0.0664) |

| lnFIS | 0.244 *** (0.0249) | −0.0471 *** (0.0083) | −0.0897 (0.146) |

| lnHC | −0.169 * (0.0958) | −0.111 *** (0.0291) | −0.0400 (0.511) |

| lnURB | 0.868 *** (0.0770) | 0.0425 (0.0266) | −0.360 (0.466) |

| Constant | 3.325 *** (0.461) | −0.350 ** (0.148) | −8.060 *** (2.592) |

| Observations | 465 | 465 | 465 |

| R_squared | 0.980 | 0.689 | 0.680 |

| Variable | Subsistence Consumption | Developmental Consumption | Enjoyment Consumption | ||||||

|---|---|---|---|---|---|---|---|---|---|

| lnSUR (1) | lnSRE (2) | lnSUP (3) | lnDEV (4) | lnSRE (5) | lnSUP (6) | lnENJ (7) | lnSRE (8) | lnSUP (9) | |

| lnHP | −0.0385 * (0.0217) | 0.0637 *** (0.0101) | 0.934 *** (0.174) | 0.0637 ** (0.0263) | 0.0624 *** (0.0101) | 0.936 *** (0.175) | 0.108 *** (0.0406) | 0.0611 *** (0.0101) | 0.950 *** (0.175) |

| lnSUR | 0.00589 (0.0224) | 0.0876 (0.387) | |||||||

| lnDEV | 0.0175 (0.0184) | −0.0977 (0.319) | |||||||

| lnENJ | 0.0215 * (0.0119) | −0.179 (0.206) | |||||||

| lnTEC | 0.198 *** (0.0635) | 0.132 *** (0.0298) | 0.254 (0.514) | −0.480 *** (0.0770) | 0.142 *** (0.0307) | 0.225 (0.530) | −0.103 (0.119) | 0.135 *** (0.0293) | 0.253 (0.508) |

| lnTRA | −0.0003 (0.0078) | −0.0022 (0.0036) | −0.194 *** (0.0624) | −0.0284 *** (0.0095) | −0.0017 (0.0037) | −0.196 *** (0.0631) | 0.0097 (0.0146) | −0.0024 (0.0036) | −0.192 *** (0.0624) |

| lnFIS | 0.0370 ** (0.0165) | −0.0343 *** (0.0077) | −0.0892 (0.133) | −0.0049 (0.0200) | −0.0340 *** (0.0077) | −0.0864 (0.132) | −0.223 *** (0.0309) | −0.0293 *** (0.0081) | −0.126 (0.140) |

| lnHC | −0.187 *** (0.0636) | −0.119 *** (0.0298) | −0.0262 (0.514) | 0.473 *** (0.0772) | −0.128 *** (0.0307) | 0.0037 (0.531) | 0.0884 (0.119) | −0.122 *** (0.0294) | −0.0267 (0.509) |

| lnURB | −0.422 *** (0.0511) | 0.0913 *** (0.0255) | −0.310 (0.440) | 0.565 *** (0.0620) | 0.0789 *** (0.0259) | −0.292 (0.447) | 0.833 *** (0.0957) | 0.0708 *** (0.0256) | −0.198 (0.443) |

| Constant | −1.932 *** (0.306) | −0.162 (0.148) | 0.0876 (0.387) | 1.219 *** (0.371) | −0.194 (0.143) | −7.890 *** (2.478) | 0.0521 (0.573) | −0.174 (0.141) | −8.000 *** (2.445) |

| Observations | 465 | 465 | 465 | 465 | 465 | 465 | 465 | 465 | 465 |

| R_squared | 0.311 | 0.679 | 0.680 | 0.635 | 0.680 | 0.680 | 0.331 | 0.681 | 0.681 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yin, B.; Pang, Y.; Xu, X. The Path of Housing Prices in Promoting the Upgrading of Industrial Structure: Bank Credit Funds, Land Finance, and Consumer Demand. Sustainability 2022, 14, 5731. https://doi.org/10.3390/su14095731

Yin B, Pang Y, Xu X. The Path of Housing Prices in Promoting the Upgrading of Industrial Structure: Bank Credit Funds, Land Finance, and Consumer Demand. Sustainability. 2022; 14(9):5731. https://doi.org/10.3390/su14095731

Chicago/Turabian StyleYin, Bibo, Yining Pang, and Xiaocang Xu. 2022. "The Path of Housing Prices in Promoting the Upgrading of Industrial Structure: Bank Credit Funds, Land Finance, and Consumer Demand" Sustainability 14, no. 9: 5731. https://doi.org/10.3390/su14095731

APA StyleYin, B., Pang, Y., & Xu, X. (2022). The Path of Housing Prices in Promoting the Upgrading of Industrial Structure: Bank Credit Funds, Land Finance, and Consumer Demand. Sustainability, 14(9), 5731. https://doi.org/10.3390/su14095731