How High Is High Enough? Assessing Financial Risk for Vertical Farms Using Imprecise Probability

Abstract

:1. Introduction

- How can farm economics be modelled with an absence of available production, risk and financial data to conduct economic viability and risk assessment?

- What is the risk profile for two case study farms, one of which benefits from a synergistic partnership with a landlord and cost deductions?

- How might a risk assessment tool be used to inform a profitable business model?

- The article is structured as follows:

- In Section 2, related works and their inability to accurately assess the economic viability of VF projects are discussed alongside potential risks;

- In Section 3, the model is proposed alongside the risk and uncertainty quantification methods, as well as the two case study farms;

- In Section 4, the results from the analysis are presented for financial metrics;

- In Section 5, the results are discussed alongside possible interventions to de-risk one case study, the implications of using the methods proposed in the broader industry, and the limitations of the analysis are discussed; and

- In Section 6, the conclusions are presented.

2. Related Works

2.1. Economic Analyses

- Cost Analyses and Scenario Simulation

- Economic Estimation Software

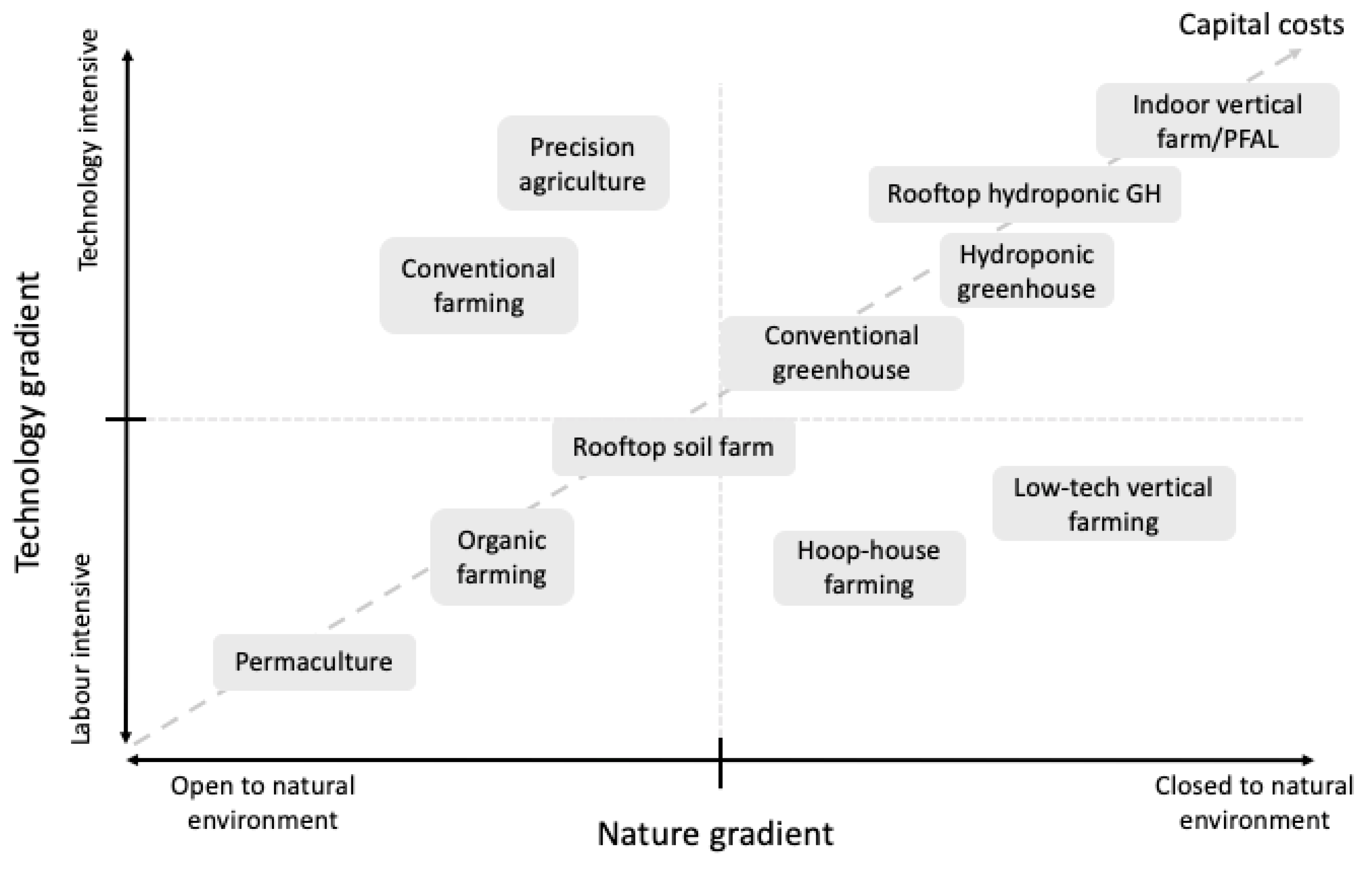

- Greenhouses vs. Vertical Farms

- Industry Surveys and Reports

2.1.1. Cost Components

2.1.2. Uncertainty

2.1.3. Limitations

2.2. Risks and Opportunities

3. Methodology

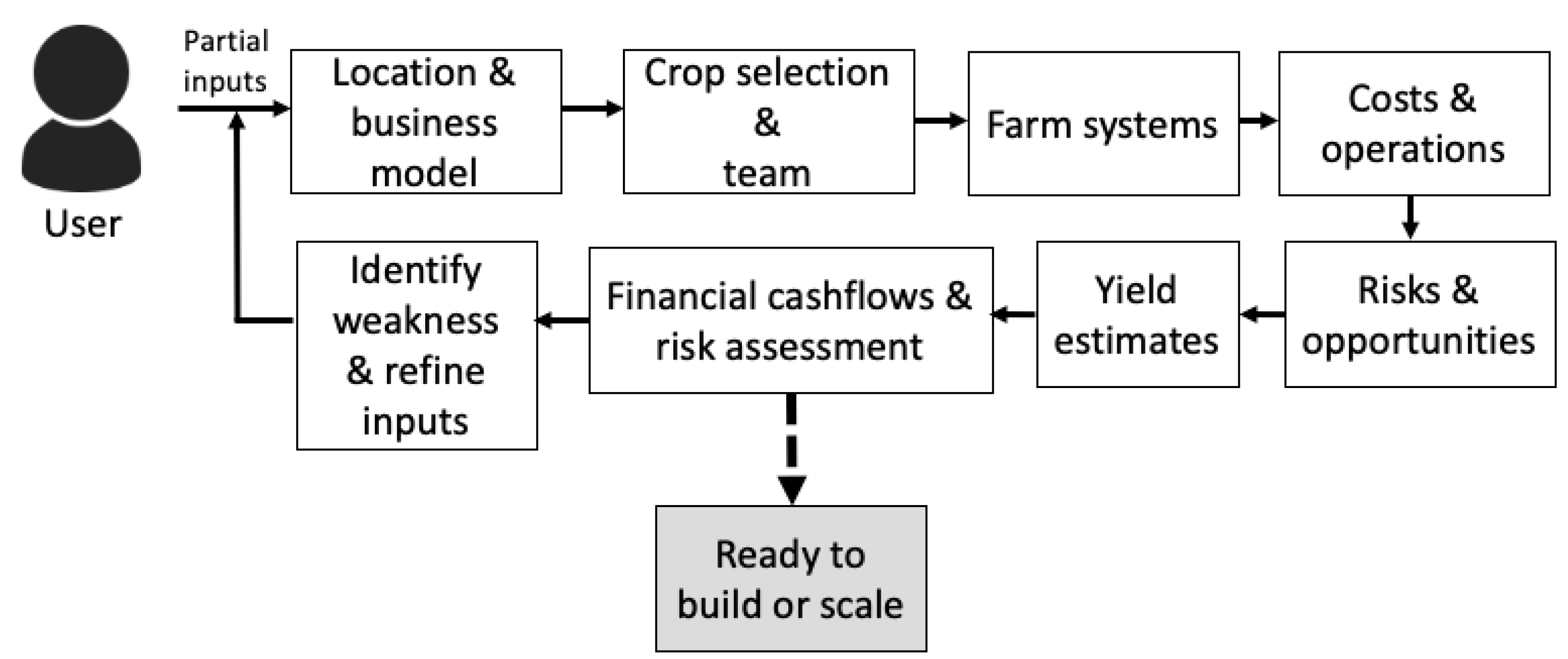

- The economic model containing its framework and assumptions to calculate cashflow forecasts and return on investment (ROI);

- The risk and uncertainty analysis, which describes the methods used, why they were used, the risk profiling results and the risks that will be considered within this analysis;

- The case studies and associated data for a real-life and hypothetical farm.

3.1. Economic Model

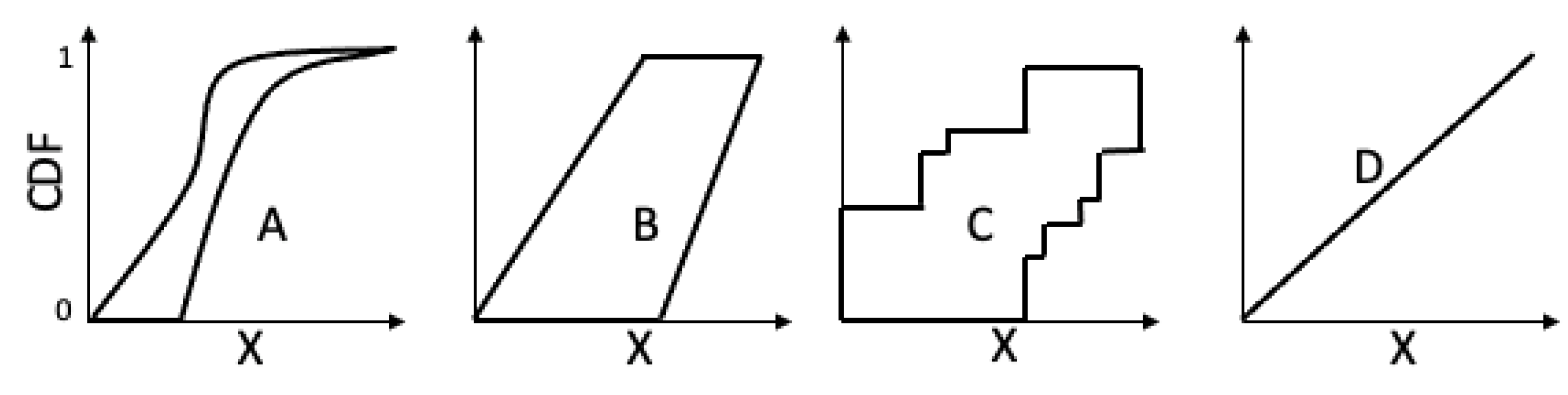

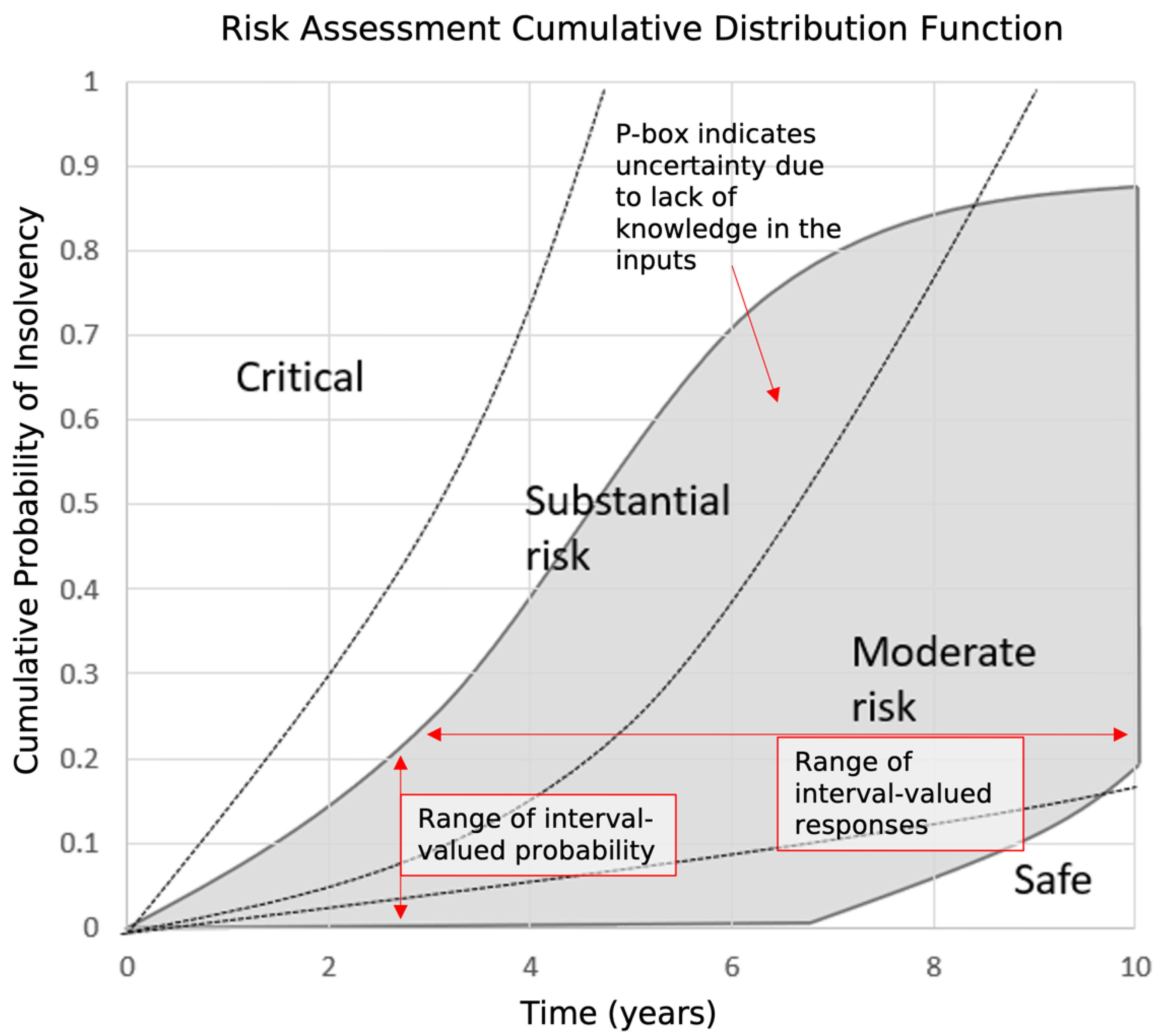

3.2. Risk and Uncertainty Analysis

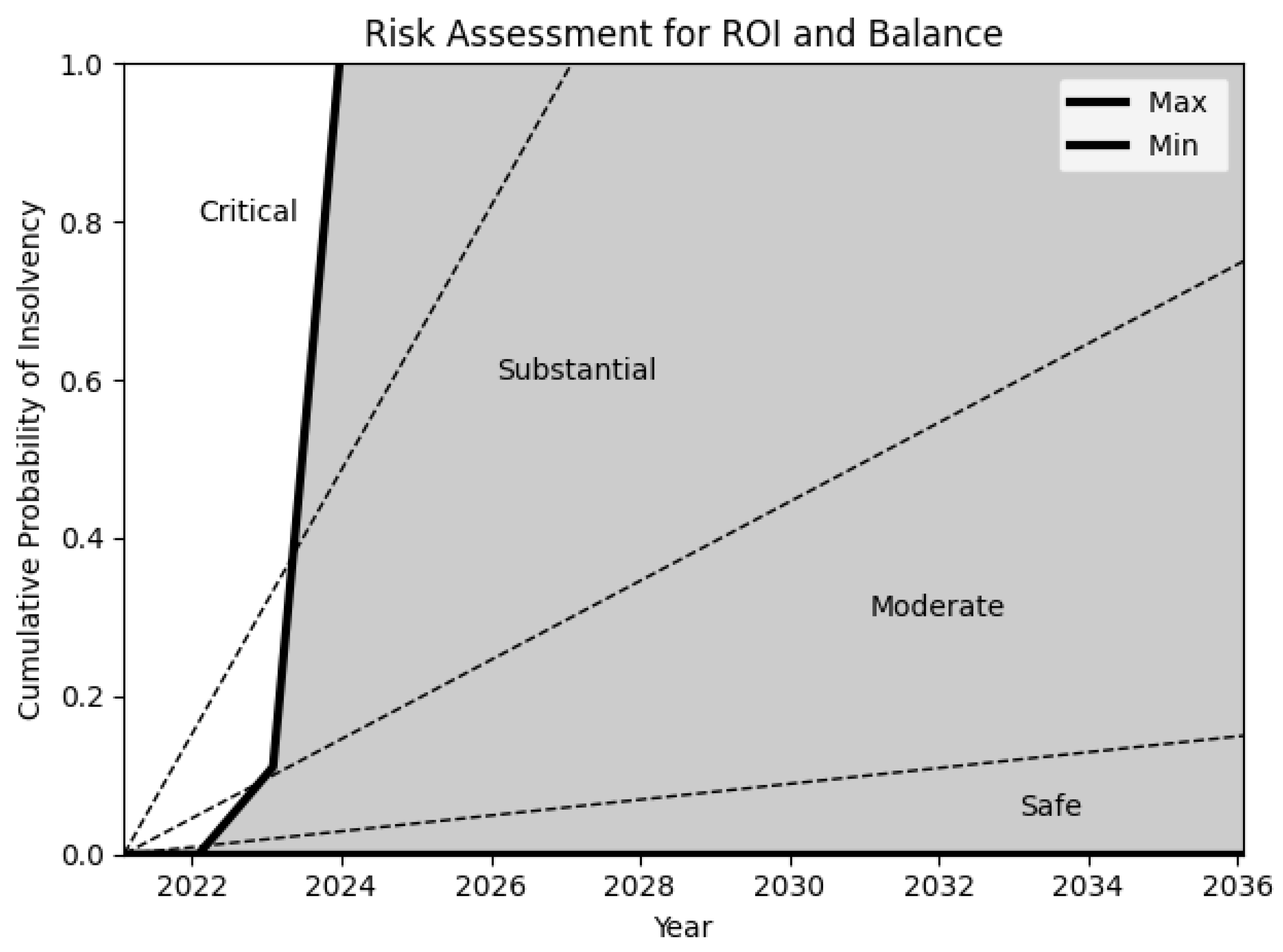

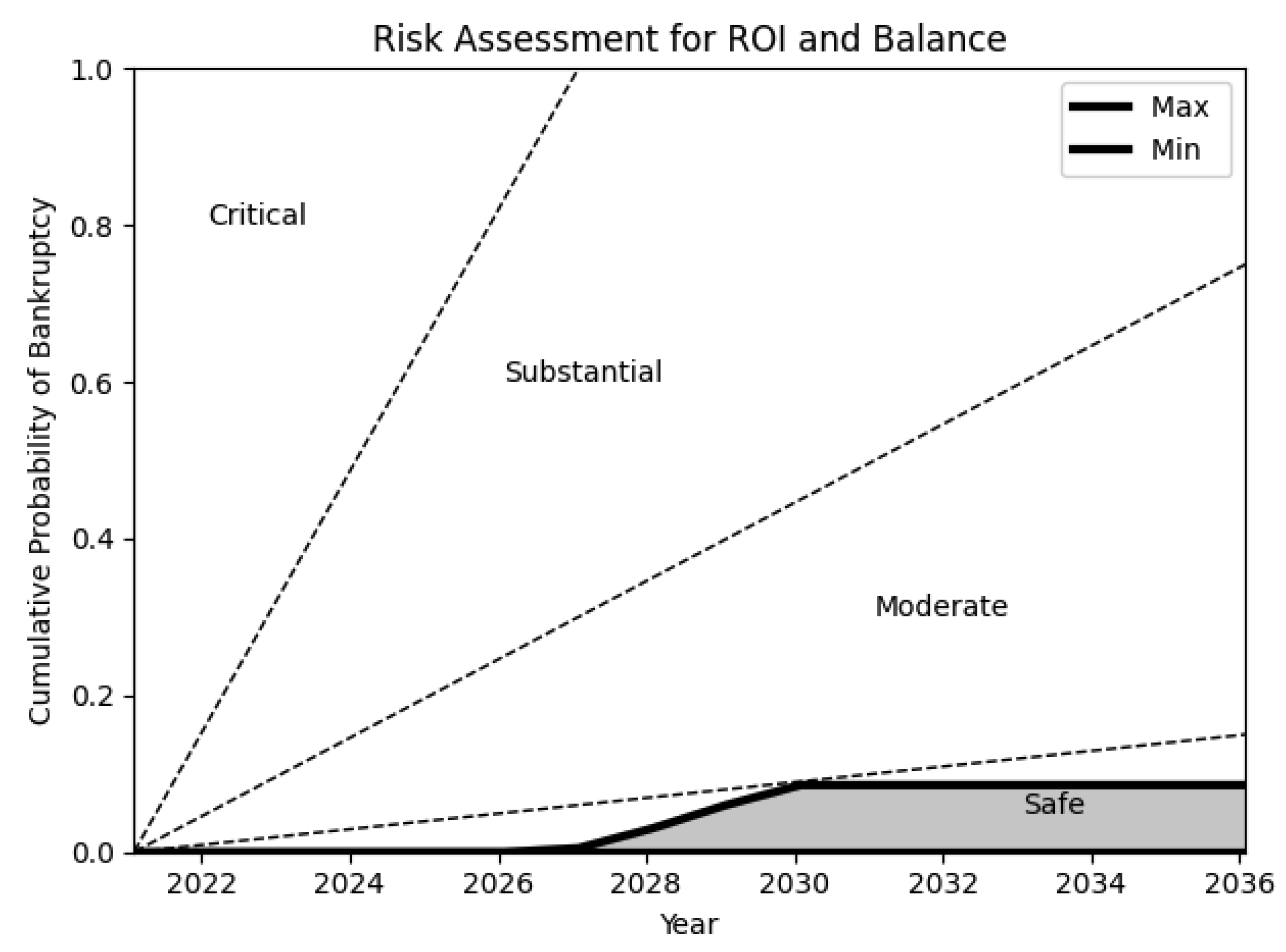

- Critical: 50% probability of insolvency within 3 years

- Substantial risk: 25% probability of insolvency within 5 years

- Moderate risk: 10% probability of insolvency within 10 years

- Safe: Less than 10% probability of insolvency within 10 years

3.3. Farm Case Study Inputs and Assumptions

4. Results

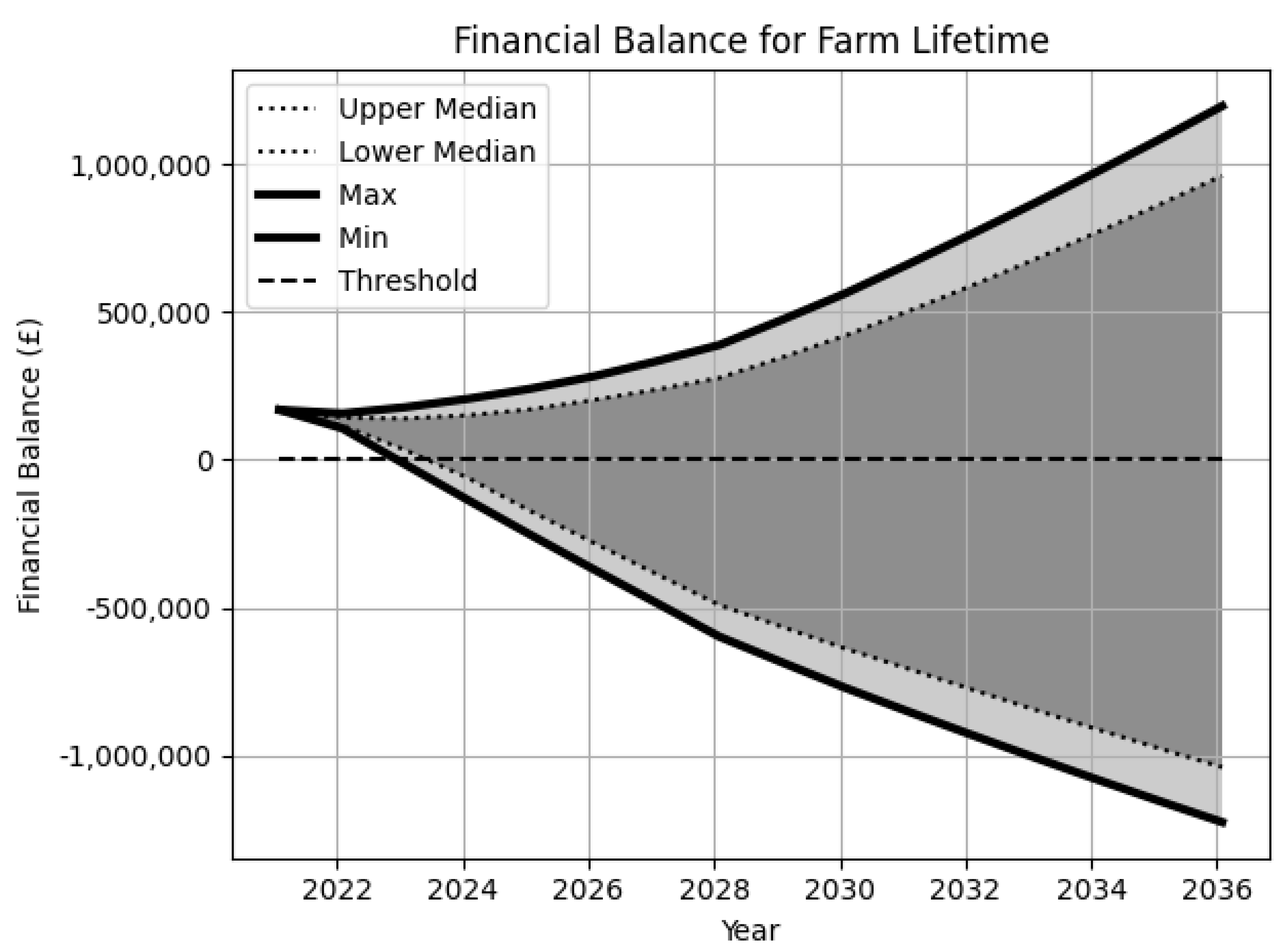

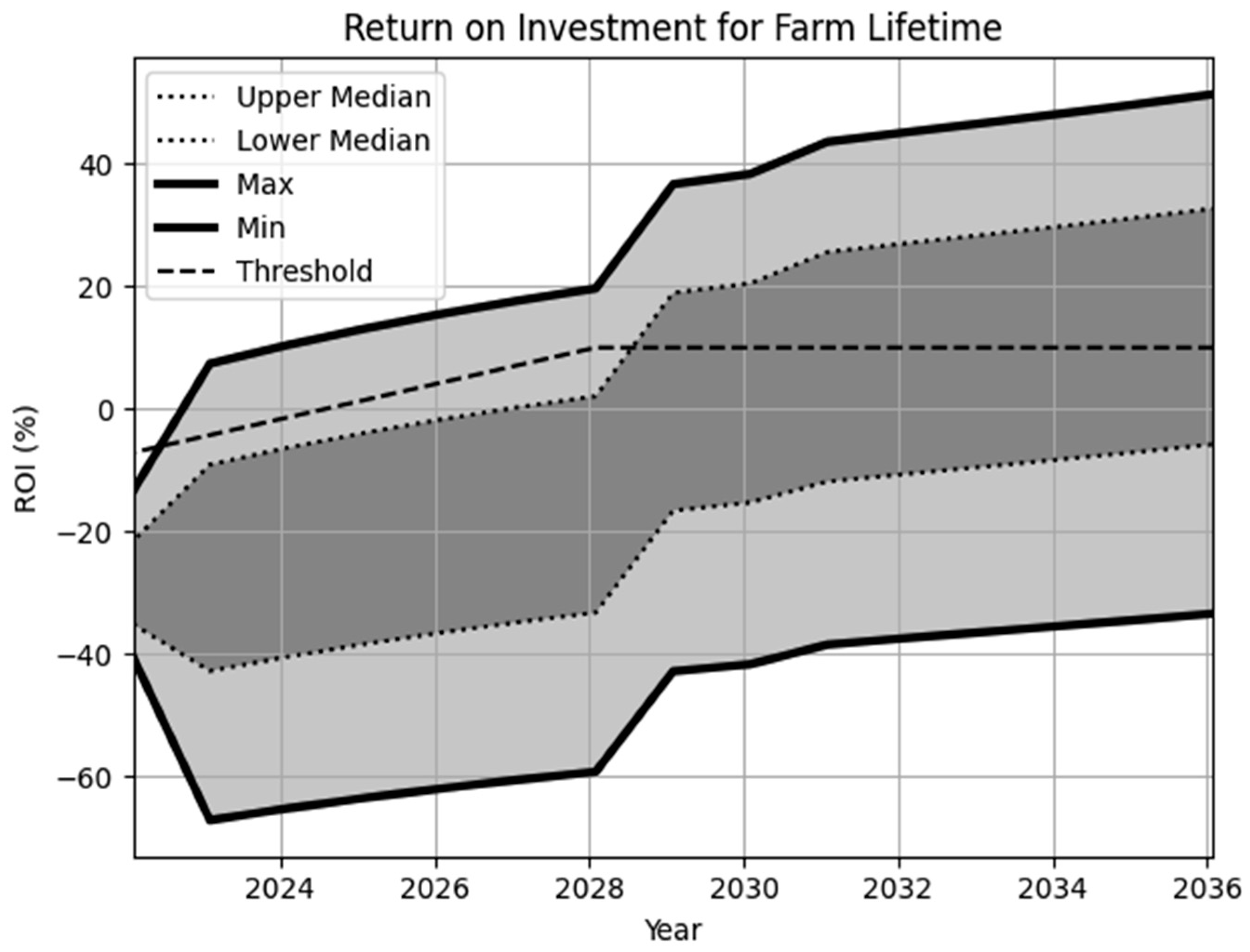

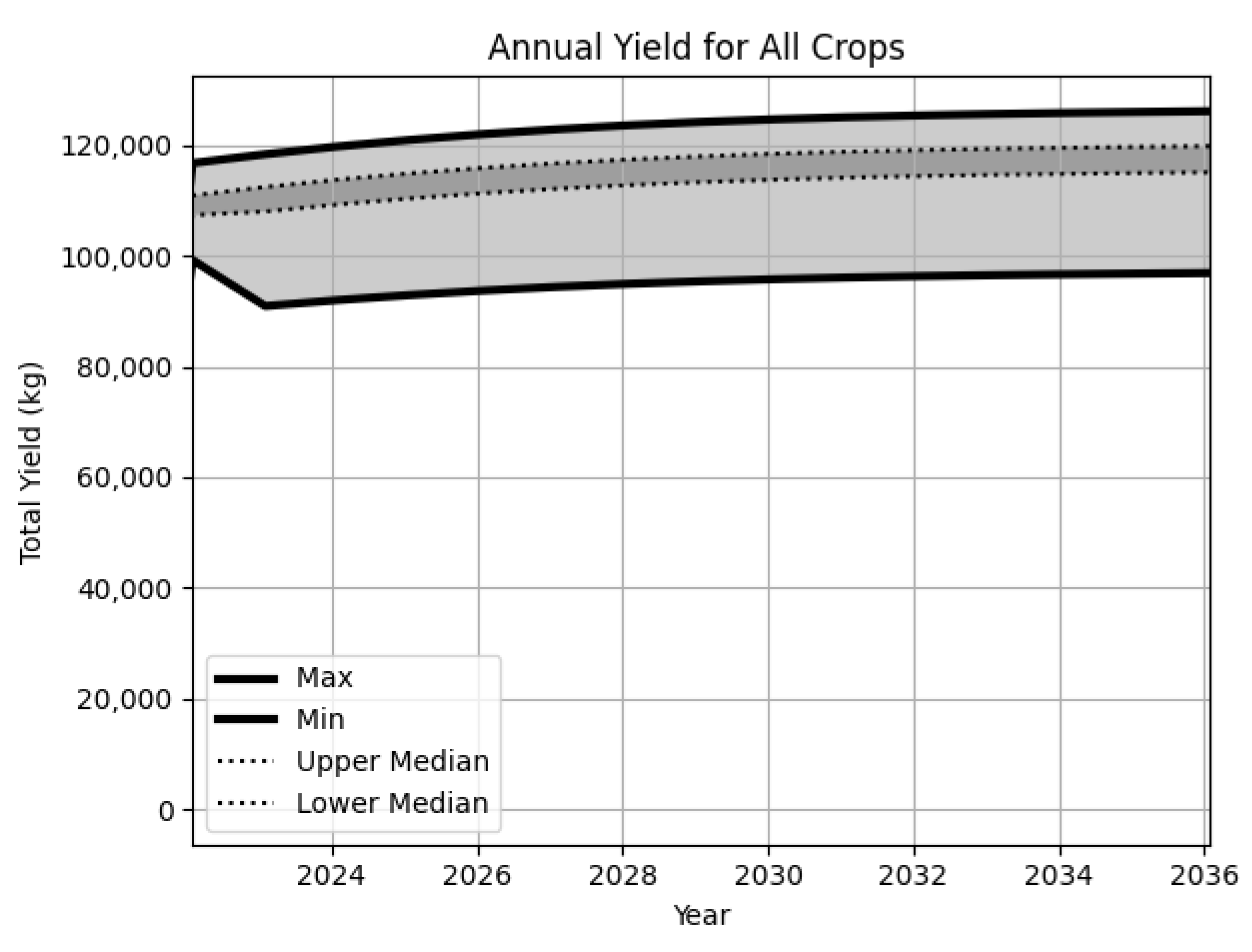

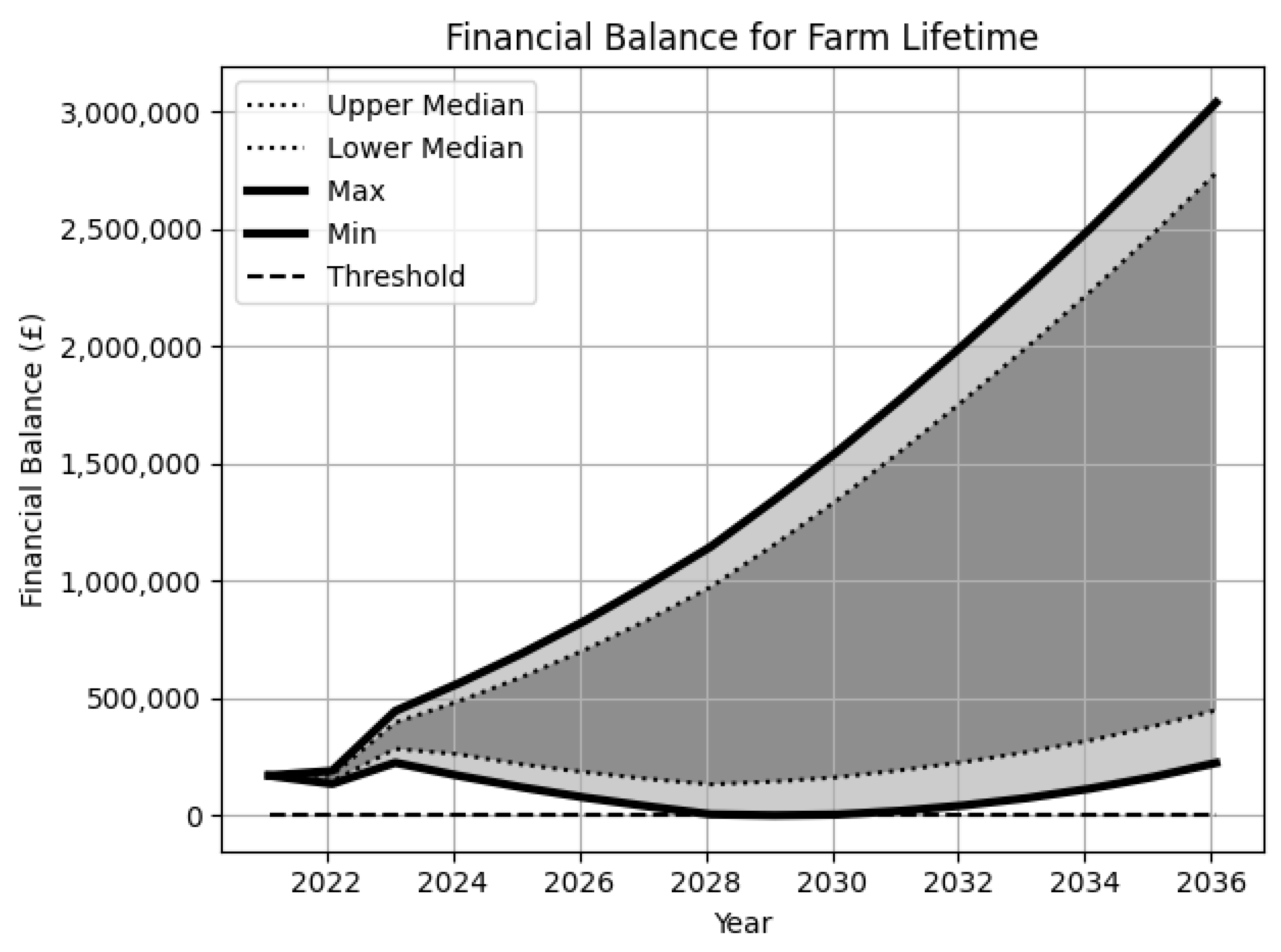

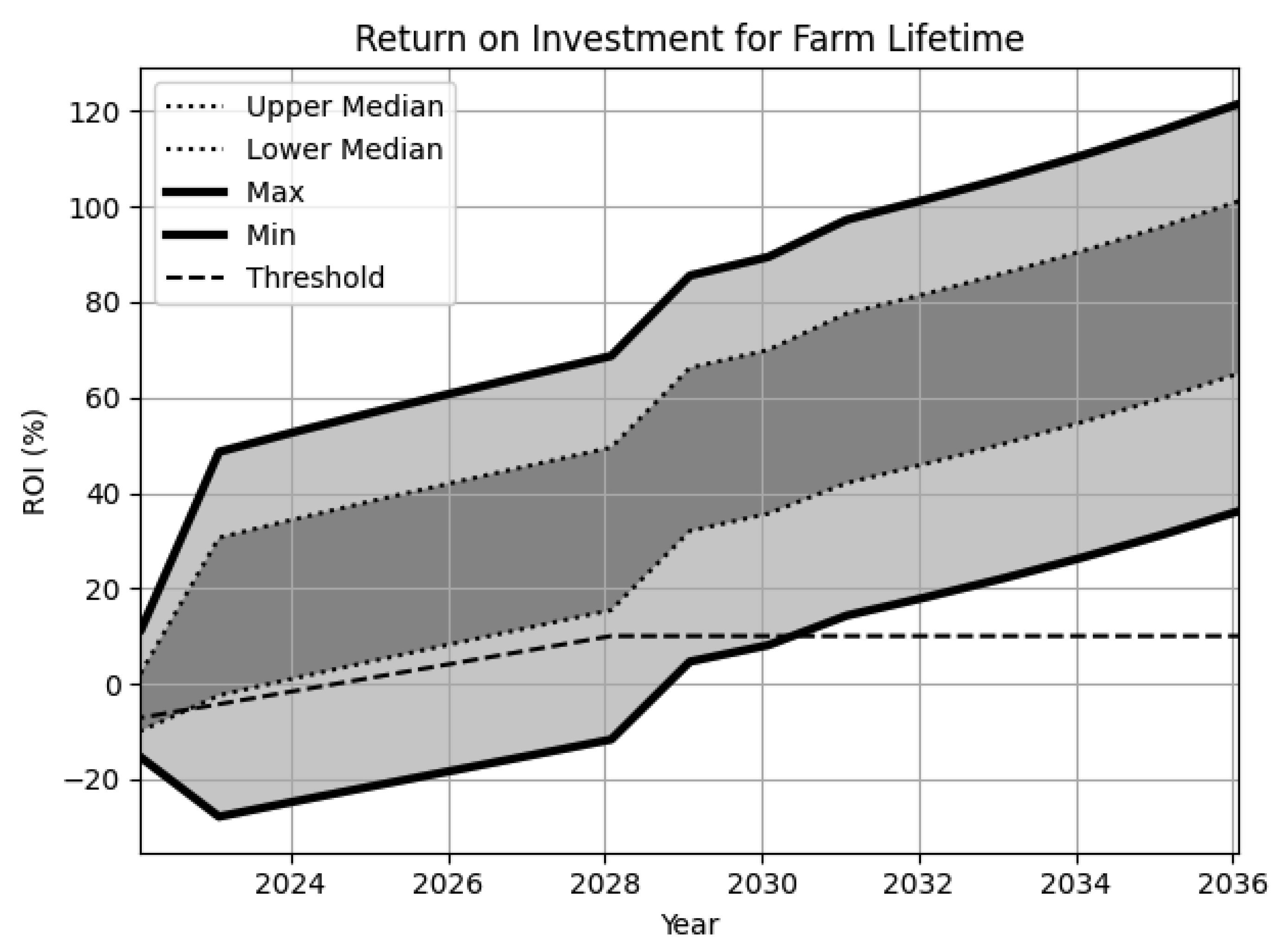

4.1. UK Vertical Farm

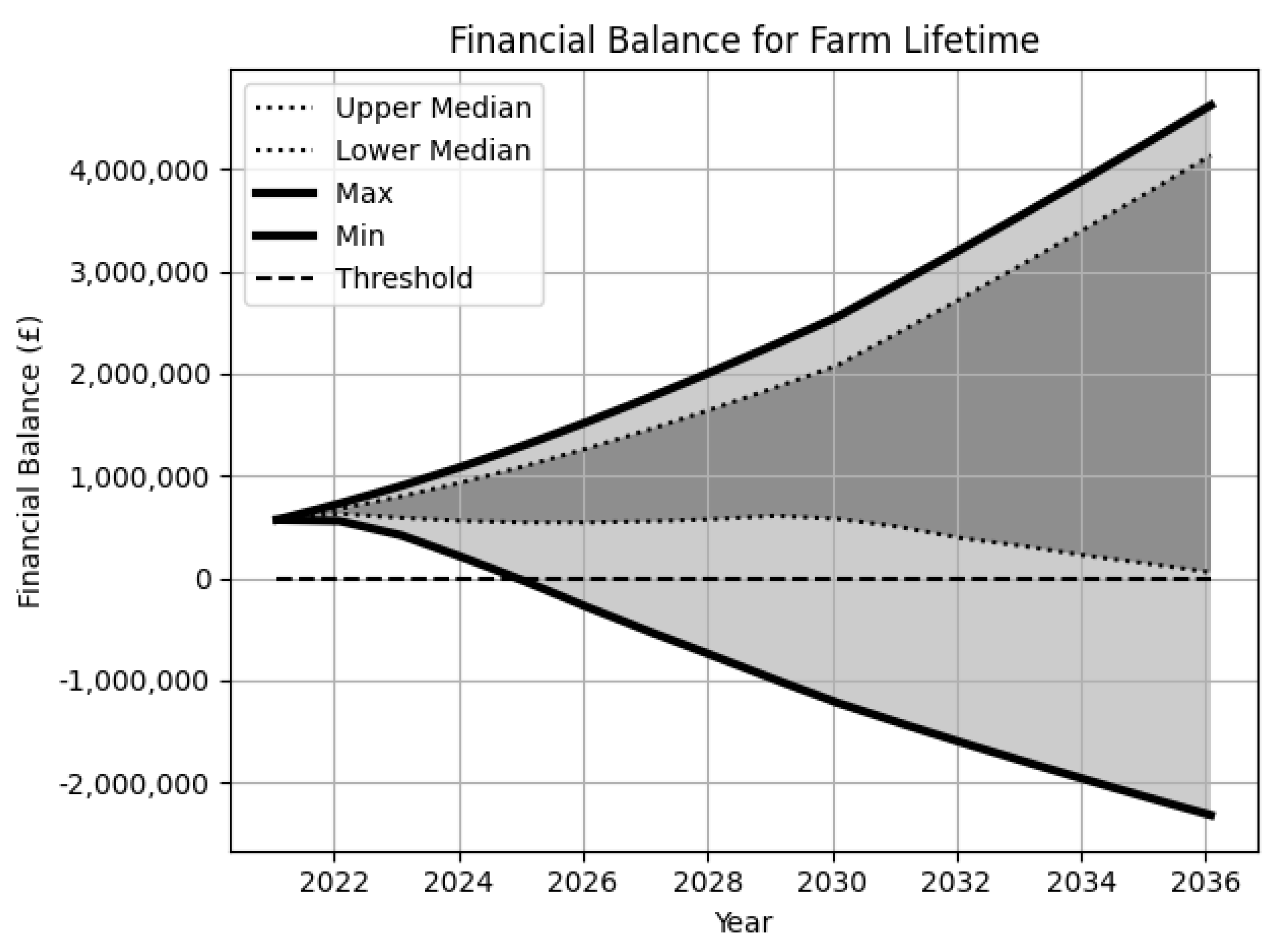

4.2. Japanese Vertical Farm

5. Discussion

5.1. UK Farm

5.2. Japanese Farm

5.3. Interventions to the UK Case Study

5.4. Implications

5.5. Limitations

- The model evaluates risk assuming the condition of perfect markets (competitive prices exist for all goods in all possible contingencies). Although there exists methods to model imperfect markets [57], these have been omitted from the analysis to avoid excessive uncertainty that reduces the ability to draw any concrete conclusions.

- The model is able to compute yield without the precise user input based on Equation (S6) within the method statement. The relationship between environmental controls and yield is nuanced and this equation adapted from existing research [28] is a simplification of a crop’s limiting factor [81]. As this relationship is further understood in the academic literature, this can be expanded to incorporate the limiting factor and provide a more accurate yield estimation.

- Risks and opportunities have been modelled based on anecdotal reports [14]. Meaningful distributions would require longitudinal data of adequate risk reporting (frequency and impacts). A lack of track records means that such data do not currently exist [22]. This is a primary reason for choosing probability bounds analysis, which does not require overly precise estimations. For the time being, risks and opportunities are based on default settings; however, users are welcome to add or modify risks from their own experience and operational history.

- Two case studies have been analysed and juxtaposed to show different systems, markets, climates and scales. Further case studies are required to generate meaningful conclusions about the industry and typical risk profiles. A comparison to a state-of-the-art greenhouse with adjusted risks would give further insight into the risk profile of other production methods. However, this was out of the scope of this article.

- Evaluation of economies of scale would require a deeper analysis of variable costs and how they vary with production quantity across multiple farms.

- The model can compute estimated yields for various crops. However, the analysis presented only examines lettuce farms. Investigating other case studies for other crop types (micro-herbs, mushrooms, berries) may reveal different characteristics, risks and opportunities.

- Other financial indicators such as current ratio, liabilities/total assets ratio, equity/total assets ratio and cash ratio should be included in future iterations of this model.

- Currently the model predicts bankruptcy with the same method regardless of location; however, there is a dependence between explanatory variables and the country, which should be considered in future works [74].

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kozai, T.; Niu, G. Introduction. In Plant Factory: An Indoor Vertical Farming System for Efficient Quality Food Production, 2nd ed.; Elsevier Inc.: Amsterdam, The Netherlands, 2019; pp. 3–6. [Google Scholar]

- van Delden, S.H.; SharathKumar, M.; Butturini, M.; Graamans, L.J.A.; Heuvelink, E.; Kacira, M.; Kaiser, E.; Klamer, R.S.; Klerkx, L.; Kootstra, G.; et al. Current status and future challenges in implementing and upscaling vertical farming systems. Nat. Food 2021, 2, 944–956. [Google Scholar] [CrossRef]

- Al-Kodmany, K. The Vertical Farm: Exploring Applications for Peri-Urban Areas; Springer International Publishing: Berlin/Heidelberg, Germany, 2020; Volume 17. [Google Scholar]

- Benton, J. Hydroponics: A Practical Guide for the Soilless Grower, 2nd ed.; Taylor& Francis: Boca Raton, FL, USA, 2004. [Google Scholar]

- Kovacova, M.; Lewis, E. Smart factory performance, cognitive automation, and industrial big data analytics in sustainable manufacturing internet of things. J. Self-Gov. Manag. Econ. 2021, 9, 9–21. [Google Scholar]

- Peterson, C.; Valle de Souza, S. Indoor Ag Sci Cafe #8—Perspectives on Business Strategy and Economics of Vertical Agriculture. Indoor Ag Science Cafe Youtube Channel. 2019. Available online: https://www.youtube.com/watch?v=BplCibZ3vbA (accessed on 6 February 2022).

- Brodwin, E. A futuristic farming startup raised $260 million from Jeff Bezos and SoftBank on the promise of upending agriculture. Insiders are raising questions. Int. J. Decis. Support Syst. Technol. 2021, 13, 34–66. Available online: https://www.businessinsider.com/bezos-softbank-farming-startup-plenty-insiders-2019-10?r=US&IR=T (accessed on 2 October 2021).

- Kramer, J. What It’s Really Like Inside Bowery Farming, a Vertical Farm on the Rise. Food & Wine. 2018. Available online: https://www.foodandwine.com/news/bowery-farming (accessed on 17 November 2021).

- AeroFarms. AeroFarms. AeroFarms Blog. 2018. Available online: http://aerofarms.com/2017/11/14/welcome-worlds-largest-indoor-vertical-farm/ (accessed on 26 June 2018).

- Hardman, M.; Clark, A.; Sherriff, G. Mainstreaming Urban Agriculture: Opportunities and Barriers to Upscaling City Farming. Agronomoy 2022, 12, 601. [Google Scholar] [CrossRef]

- Kozai, T.; Niu, G. Role of the plant factory with artificial lighting (PFAL) in urban areas. In Plant Factory: An Indoor Vertical Farming System for Efficient Quality Food Production, 2nd ed.; Elsevier Inc.: Amsterdam, The Netherlands, 2019; pp. 7–34. [Google Scholar]

- de Oliveira, F.B.; Ferson, S.; Dyer, R. A Collaborative Decision Support System Framework for Vertical Farming Business Developments. Int. J. Decis. Support Syst. Technol. 2021, 13, 34–46. [Google Scholar] [CrossRef]

- Gauthier, P.; Princeton University, Princeton, NJ, USA. Personal Correspondance via Email with Researcher, 2018.

- de Oliveira, F.B. Lessons Learned from Shuttered and Operational Vertical Farms—Interview Study with 15 participants. 2022; manuscript in preparation. [Google Scholar]

- Amidi-Abraham Understanding Capital Expenses for Vertical Farms and Greenhouses. Agritecture Blog. 2021. Available online: https://www.agritecture.com/blog/2021/1/25/understanding-capital-expenses-for-vertical-farms-and-greenhouses (accessed on 6 February 2022).

- Mok, H.F.; Williamson, V.G.; Grove, J.R.; Burry, K.; Barker, S.F.; Hamilton, A.J. Strawberry fields forever? Urban agriculture in developed countries: A review. Agron. Sustain. Dev. 2014, 34, 21–43. [Google Scholar] [CrossRef] [Green Version]

- Eigenbrod, C.; Gruda, N. Urban vegetable for food security in cities. A review. Agron. Sustain. Dev. 2015, 35, 483–498. [Google Scholar] [CrossRef] [Green Version]

- de Souza, S.V.; Peterson, H.C.; Seong, J. Emerging economics and profitability of PFALs. In Plant Factory Basics, Applications and Advances; Kozai, T., Niu, G., Masabni, J., Eds.; Elsevier Inc.: Amsterdam, The Netherlands, 2021; pp. 251–270. [Google Scholar]

- van der Feltz, G.; Livingston, T.; Butturini, M.; de Oliveira, F.B. FarmTech Society at GreenTech—Cafe Talk: Benchmarking Data Initative, GreenTech 2021. Available online: https://www.youtube.com/watch?v=iEzYEkzbK_0&ab_channel=FarmtechSociety (accessed on 27 March 2022).

- Japan Plant Factory Association Research Committee on Productivity Improvements. Questionnaire on Productivity of Plant Factories with Artificial Lighting (‘PFALs’)—6 October 2019. Available online: https://jp.surveymonkey.com/r/JPFASURVEY1 (accessed on 28 March 2022).

- Osagie, R.O. Financial Inclusion: A Panacea for Attaining Sustainable Development in Developing Countries Like Nigeria. Ekon.-Manaz. Spektrum 2021, 14, 1–11. [Google Scholar] [CrossRef]

- Uraisami, K. Business Planning on Efficiency, Productivity, and Profitability. In Smart Plant Factory; Kozai, T., Ed.; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- Banerjee, C.; Adenaeuer, L. Up, Up and Away! The Economics of Vertical Farming. J. Agric. Stud. 2014, 2, 40. [Google Scholar] [CrossRef]

- Liaros, S.; Botsis, K.; Xydis, G. Technoeconomic evaluation of urban plant factories: The case of basil (Ocimum basilicum). Sci. Total Environ. 2016, 554–555, 218–227. [Google Scholar] [CrossRef]

- Zhang, H.; Asutosh, A.; Hu, W. Implementing vertical farming at university scale to promote sustainable communities: A feasibility analysis. Sustainability 2018, 10, 4429. [Google Scholar] [CrossRef] [Green Version]

- Trimbo, A. Economic Sustainability of Indoor Vertical Farming in Sao Paulo. Master’s Thesis, Escola de Administraç ão Getulio Vargas, Sao Paolo, Brazil, 2019. Available online: https://bibliotecadigital.fgv.br/dspace/bitstream/handle/10438/28986/Vertical%20Farming%20-%20Alex%20Trimbo%204.pdf (accessed on 6 February 2022).

- Sarkar, A.; Majumder, M. Economic of a six-story stacked protected farm structure. Environ. Dev. Sustain. 2019, 21, 1075–1089. [Google Scholar] [CrossRef]

- Shao, Y.; Heath, T.; Zhu, Y. Developing an Economic Estimation System for Vertical Farms. Int. J. Agric. Environ. Inf. Syst. 2016, 7, 26–51. [Google Scholar] [CrossRef]

- Agritecture. Agritecture Designer. 2020. Available online: https://www.agritecture.com/designer (accessed on 10 June 2020).

- Eaves, J.; Eaves, S. Comparing the Profitability of a Greenhouse to a Vertical Farm in Quebec. Can. J. Agric. Econ. 2018, 66, 43–45. [Google Scholar]

- Avgoustaki, D.D.; Xydis, G. Indoor vertical farming in the Urban nexus context: Business growth and resource savings. Sustainability 2020, 12, 1965. [Google Scholar] [CrossRef] [Green Version]

- Agrilyst. State of Indoor Farming 2017. 2018. Available online: https://artemisag.com/guides_reports/ (accessed on 27 March 2022).

- Agritecture and Autogrow. 2020 Global CEA Census Report. 2020. Available online: https://www.agritecture.com/census (accessed on 17 November 2021).

- Conrad, Z.; Daniel, S.; Vincent, V. Vertical Farm 2.0 Designing an Economically Feasible Vertical Farm—A Combined European Endeavor for Sustainable Urban Agriculture; Association of Vertical Farming: Munich, Germany, 2015; Available online: https://elib.dlr.de/116034/ (accessed on 6 February 2022).

- Hayashi, E.; Kozai, T. Smart Plant Factory, 1st ed.; Springer: Singapore, 2018. [Google Scholar]

- Burwood-Taylor, L. Japan’s Indoor Ag Sector is Becoming More Collaborative. AgFunder. 2018. Available online: https://agfundernews.com/japans-indoor-ag-sector-is-becoming-more-collaborative.html (accessed on 25 June 2018).

- de Oliveira, F.B. A Typology Review of Vertical Farming: Classifications, Configurations, Business Models and Economic Analyses. 2022; manuscript in preparation. [Google Scholar]

- Bartok, J.W. Energy Conservation for Commercial Greenhouses, NRAES-3; Natural Resource, Agriculture and Engineering Service: Ithaca, NY, USA, 2001. [Google Scholar]

- FreightFarms. Freight Farms Investment Calculator. FreightFarms. 2021. Available online: https://www.freightfarms.com/investment-calculator (accessed on 6 February 2022).

- Anonymous; France. Personal Correspondence via Email with Vertical Farming System Supplier, 2018.

- Hughes, S. Vertical Farming: Does the Economic Model Work? Nuffield Farming Scholarship Report. 2018. Available online: https://www.nuffieldscholar.org/reports/gb/2017/vertical-farming-does-economic-model-work (accessed on 6 February 2022).

- Liotta, M.; Hardej, P.; Nasseri, M. An Examination of Shuttered Vertical Farm Facilities. Aglanta Conference Panel. 2017. Available online: https://www.youtube.com/watch?v=1mB_8TE-t2E (accessed on 3 October 2021).

- Crumpacker, M. A Look at the Benefits and Drawbacks of Container Farms. Medium. 2019. Available online: https://medium.com/@MarkCrumpacker/a-look-at-the-benefits-and-drawbacks-of-container-farms-ea6b949e8a03 (accessed on 30 April 2021).

- Sijmonsma, A. Swedish Vertical Farming Company Plantagon International Bankrupt. Hortidaily. 22 February 2019. Available online: https://www.hortidaily.com/article/9075157/swedish-vertical-farming-company-plantagon-international-bankrupt/ (accessed on 6 February 2022).

- Agritecture. 8 Mistakes Vertical Farms Make. Agritecture Blog. 2021. Available online: https://www.agritecture.com/blog/2021/7/15/8-mistakes-vertical-farms-make (accessed on 20 July 2021).

- Kummer, C. Trouble in the High-Rise Hothouse NEO.LIFE. December 2018. Available online: https://medium.com/neodotlife/vertical-farming-paul-gauthier-76e81ace79d0 (accessed on 3 October 2021).

- McGoran, C. Things to Think about before Purchasing a Freight Farm. Medium. 2020. Available online: https://medium.com/@connormcgoran/things-to-think-about-before-purchasing-a-freight-farm-963b6d53cfa3 (accessed on 14 February 2022).

- Denis, J.S.; Greer, D. City of Vancouver Still Paying for Failed Urban Farm. 2018. Available online: https://biv.com/article/2015/05/city-vancouver-still-paying-failed-urban-farm (accessed on 29 November 2019).

- Michael, C. 9 Reasons Why Vertical Farms Fail. Upstart University—Plenty. 2017. Available online: https://university.upstartfarmers.com/blog/9-reasons-why-vertical-farms-fail (accessed on 30 August 2019).

- Agritecture. Agritecture Online Commercial Urban Farming Course. 2019. Available online: https://design.agritecture.com/learn/?utm_campaign=classes-page-button&utm_medium=agr-com&utm_source=classes (accessed on 1 January 2020).

- Asci, S.; VanSickle, J.J.; Cantliffe, D.J. Risk in investment decision making and greenhouse tomato production expansion in Florida. Int. Food Agribus. Manag. Rev. 2014, 17, 1–26. [Google Scholar]

- El-Nahhal, Y. Risk Factors among Greenhouse Farmers in Gaza Strip. Occup. Dis. Environ. Med. 2017, 5, 73469. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.J.; Deering, A.J.; Kim, H.J. The occurrence of Shiga toxin-producing E. coli in aquaponic and hydroponic systems. Horticulturae 2020, 6, 1. [Google Scholar] [CrossRef] [Green Version]

- Ishag, K.H.M.; al al Rawahy, M.S.S. Risk and Economic Analysis of Greenhouse Cucumber and Tomato Cropping Systems in Oman. Sustain. Agric. Res. 2018, 7, 115. [Google Scholar]

- Tay, A.; Lafont, F.; Balmat, J.F. Forecasting pest risk level in roses greenhouse: Adaptive neuro-fuzzy inference system vs artificial neural networks. Inf. Process. Agric. 2021, 8, 386–397. [Google Scholar] [CrossRef]

- Pessel, N.; Lhoste-drouineau, A. Fuzzy Approach to Pest Risk Assessment in a Greenhouse. In Proceedings of the 22nd International Conference on Smart Decision-Making Systems for Precision Agriculture. 2020. Available online: https://www.researchgate.net/publication/341458689_Fuzzy_Approach_to_Pest_Risk_Assessment_in_a_Greenhouse (accessed on 6 February 2022).

- Roberts, M.J.; Osteen, C.; Soule, M. Risk, Government Programs, and the Environment; USDA: Washington, DC, USA, 2004. [Google Scholar] [CrossRef]

- Hardaker, J.B.; Lien, G. Stochastic efficiency analysis with risk aversion bounds: A simplified approach. Aust. J. Agric. Resour. Econ. 2010, 54, 379–383. [Google Scholar] [CrossRef] [Green Version]

- Hernandez, J.E.; Kacprzyk, J. Agriculture Value Chain—Challenges and Trends in Academia and Industry, 1st ed.; Springer: Berlin/Heidelberg, Germany, 2021. [Google Scholar]

- Harwood, J.; Heifner, R.; Keith, C.; Perry, J.; Agapi, S. Managing Risk in Farming: Concepts, Research, and Analysis; US Department of Agriculture: Washington, DC, USA, 1999. [Google Scholar]

- Lane, P. Fire Risk in Vertical Farms. 2018. Available online: https://www.linkedin.com/pulse/fire-risk-vertical-farms-peter-lane/ (accessed on 27 February 2022).

- Brodwin, E. The Epstein—Funded MIT Lab Has an Ambitious Project That Purports to Revolutionize Agriculture. Insiders Say It’s Mostly Smoke and Mirrors. Business Insider. September 2019. Available online: https://www.businessinsider.com/mit-media-lab-personal-food-computers-dont-work-fake-staff-say-2019-9?r=US&IR=T (accessed on 2 October 2021).

- Avgoustaki, D.D.; Xydis, G. Energy cost reduction by shifting electricity demand in indoor vertical farms with artificial lighting. Biosyst. Eng. 2021, 211, 219–229. [Google Scholar] [CrossRef]

- Ferson, S.; Ginzburg, L.; Akçakaya, R. Whereof one cannot speak: When input distributions are unknown. Grey Room 2005, 21, 46–69. [Google Scholar]

- Ferson, S.; Moore, D.R.J.; van den Brink, P.J.; Estes, T.L.; Gallagher, K.; O’Connor, R.; Verdonck, F. Bounding Uncertainty Analyses. In Application of Uncertainty Analysis to Ecological Risks of Pesticides; No. March 2016; CRC Press: Boca Raton, FL, USA, 2010; pp. 89–122. [Google Scholar]

- Ferson, S.; Siegrist, J. Verified computation with probabilities. In Proceedings of the 10th IFIP WG2.5 Working Conference, WoCoUQ, Boulder, CO, USA; 2011. Available online: https://studylib.net/doc/17587612/verified-computation-with-probabilities-scott-ferson--app (accessed on 6 February 2022).

- Gray, N. pba Package for Python. 2021. Available online: https://pypi.org/project/pba/ (accessed on 4 May 2021).

- Gray, N.; Ferson, S.; de Angelis, M.; Gray, A.; de Oliveira, F.B. Probability Bounds Analysis for Python. Softw. Impacts 2022, 12, 100246. [Google Scholar] [CrossRef]

- Dassios, A.; Li, L. An economic bubble model and its first passage time. arXiv 2018, arXiv:1803.08160. [Google Scholar]

- Jeannin, M. On Pricing and Hedging Options and Related First-Passage Time Problems; Imperial College: London, UK, 2008. [Google Scholar]

- Redner, S.; Dorfman, J.R. A Guide to First-Passage Processes. Am. J. Phys. 2002, 70, 1166. [Google Scholar] [CrossRef]

- Goldwasser, L.; Ferson, S.; Ginzburg, L. Variability and Measurement Error in Extinction Risk Analysis: The Northern Spotted Owl on the Olympic Peninsula. In Quantitative Methods for Conservation Biology; Springer: New York, NY, USA, 2013; Volume 53, pp. 1689–1699. [Google Scholar]

- Burgman, M.A.; Ferson, S.; Akçakaya, H.R. Population and Community Biology: Risk Assessment in Conservation Biology; Chapman & Hall: London, UK, 1993. [Google Scholar]

- Kovacova, M.; Kliestik, T.; Valaskova, K.; Durana, P.; Juhaszova, Z. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oeconomia Copernic. 2019, 10, 743–772. [Google Scholar] [CrossRef] [Green Version]

- Allegaert, S.; Wubben, E.F.M.; Hagelaar, G. Where is the business? A study into prominent items of the vertical farm business framework. Eur. J. Hortic. Sci. 2020, 85, 344–353. [Google Scholar] [CrossRef]

- Storey, N.R. Vertical Aquaponic Crop Production Towers and Associated Produce Sales and Distribution Models: Design, Development and Analysis; University of Wyoming: Laramie, WY, USA, 2012. [Google Scholar]

- O’Hear, S. InFarm Wants to Put a Farm in Every Grocery Store. TechCrunch. 2017. Available online: https://techcrunch.com/2017/06/26/infarm/ (accessed on 20 March 2020).

- Farm Urban. Farm Urban Webpage. 2021. Available online: https://www.farmurban.co.uk/ (accessed on 3 October 2021).

- Swegreen. Swegreen Webpage. 2021. Available online: https://www.swegreen.com/ (accessed on 6 February 2022).

- Milanov, A. Risk Measurement and Evaluation in Rfi and Rfp Processes at Bulgarian Mobile Network Operators. Ekon—Manaz. Spektrum 2020, 14, 24–25. [Google Scholar] [CrossRef]

- Sinclair, T.R. Limits to Crop Yield. In NAS Colloquium. Plants and Population: Is There Time? Nationl Academy of Sciences: Washington, DC, USA, 1998; Available online: https://pdfroom.com/books/nas-colloquium-plants-and-population/Xn2GJRyrgxV (accessed on 6 February 2022).

- Avgoustaki, D.D. Optimization of photoperiod and quality assessment of basil plants grown in a small-scale indoor cultivation system for reduction of energy demand. Energies 2019, 12, 3980. [Google Scholar] [CrossRef] [Green Version]

- Crespo, L.G.; Kenny, S.P.; Giesy, D.P. Bounding the failure probability range of polynomial systems subject to P-box uncertainties. In Proceedings of the 11th International Probabilistic Safety Assessment and Management Conference and the Annual European Safety and Reliability Conference 2012, PSAM11 ESREL 2012, Helsinki, Finland, 25–29 June 2012; Volume 2, pp. 1213–1222. [Google Scholar]

- Elliot, C.; Lee, K. Adoption of Light-Emitting Diodes in Common Lighting Applications; U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy, 2020. Available online: https://www.energy.gov/sites/default/files/2020/09/f78/ssl-led-adoption-aug2020.pdf (accessed on 6 February 2022).

- de Oliveira, F.B.; Forbes, H.; Schaefer, D.; Milisavljevic, J. Lean Principles in Vertical Farming: A Case Study. CIRP Procedia 2020, 93, 712–717. [Google Scholar] [CrossRef]

- Sinclair, T. Inadequacy of the Liebig Limiting-Factor Paradigm for Explaining Varying Crop Yields. Argonomy J. 1993, 85, 742–746. [Google Scholar] [CrossRef]

- Siteman, J.; Lysaam, P.A.; Intravision Group, Oslo, Norway. Personal Correspondance with Intravision Group. Supplier of Controlled Environment & Lighting Systems, 2019.

- ZipGrow. ZipGrow Website, ZipGrow Website. 2021. Available online: https://zipgrow.com/zipfarm/ (accessed on 6 February 2022).

| Type | Source | Objective | Results |

|---|---|---|---|

| Cost analyses | [23] | Simulate the economics for a hypothetical 37-storey (167.5 m) vertical farm hybrid in Berlin, Germany. | Cost of production presented through probability distributions. Costs lie between €3.5–4 per kg in 44% of cases. No validation. |

| [24] | Simulate life cycle costing for a hypothetical 50 m2 apartment to study small and inexpensive VF. | Sensitivity analysis results indicate added value crops such as herbs and pharmaceutical ingredients are necessary for economic viability. No validation. | |

| [22] | Provide a business planning spreadsheet developed for a hypothetical 1000 m2 PFAL based on expert’s and industry practitioners’ insights. Most comprehensive data set in the literature. | Cashflow projections for a profitable farm with a 7.8 payback period. | |

| [25] | Conduct feasibility study using central limit theorem to assess ROI for a hypothetical 5000 m2 VF serving 24 canteens in Wuhan, China. | The breakeven on investment in this VF analysis is 11.5 years. Unviable crops are selected. | |

| [26] | Perform cost analysis for a hypothetical ZipGrow VF in São Paulo, Brazil comparing to Denver, North America, assessing its economic viability using vendor’s data. | São Paulo provides a cheaper scenario in comparison to Denver, but possesses market conditions where low costs cannot compete with traditional farming product prices. Analysis predicts Denver as 14.17% IRR compared to −19.12% in Sao Paulo. | |

| [27] | Analyse the economics of a hypothetical six-story VF in Delhi, India, with a footprint of 200 m2 and 3 stacked layers in each story. | Payback period calculated to be 64 years. Unviable crops are selected. | |

| [18] | Draw from hypothetical Japanese PFAL data [22] and substitute modern data in various scenarios (changes to scale, operations and market context). | Significant decline in capital costs, especially equipment (45%), make profitability increase substantially (ROI rose from 1.8% to 14.3%). Scale of operation is critical to profit as well and depends on the proportion of fixed costs in the operating structure. Doubling the size of the PFAL results in the enhancement of ROI from 14.3% to 22%. | |

| Software systems | [28] | A flexible system for predicting costs and return-on the investment of a VF, with results shown for several hypothetical scenarios and sensitivity analysis. | Return on investment is sensitive to price of electricity, crop price and CO2 concentrations. Software not publicly available. |

| [29] | A commercial and flexible digital platform for economic estimation of farms, greenhouses and VF. | Capital expenditure, operating costs and yield estimates alongside 15-year projection. Not peer-reviewed or academically validated. | |

| [12] | Evaluate business sustainability using imprecise data techniques using ideas from [28]. The economic modelling contained within “How High is High Enough?” builds upon the framework and executes the first passage time risk analysis on two case studies. | N/A—No results presented. | |

| Greenhouse vs. VF | [30] | Simulate a hypothetical scenario comparing profitability of growing lettuce in a semiclosed VF and semiclosed GH farm near Quebec City. | Results show that the costs to equip and run the two facilities are similar with higher gross profit for VF. |

| [31] | Simulate scenarios to compare hypothetical VF and GH facilities under various financing schemes in Denmark. | Results show that regardless of financing scheme, the VF facility was much more profitable compared to the GH, with high IRR rates and a payback period between 2–6 years. | |

| Industry surveys and reports | [32] | Present results of a self-reported survey of 56 indoor VFs (primarily in the USA). | Aggregated data for OpEx breakdowns per and profitable crops |

| [11] | Present results of the government census of a number of profitable Japanese plant factories with typical production costs. | Aggregated data for production costs and percentage of profitable farms in Japan. | |

| [33] | Present results of a self-reported survey of 190 indoor VFs. | Aggregated and self-reported data on profitability and revenue. | |

| [34] | Design and cost an economically feasible next-generation VF concept. A workshop of experts design and cost five hypothetical food modules with margins to account for uncertainty. | The resulting concept is broken down into estimated capital expenditure and running costs. |

| Risk Parameters | Risk Source | Indoor Vertical Farm | Greenhouse | Field-Grown |

|---|---|---|---|---|

| Yield risk | Weather conditions | Low | Medium | High |

| Pest outbreak | Low | Medium | High | |

| Pathogen outbreak | Medium | Low | High | |

| Production risk | Environmental control (malfunctioning HVAC) | High | Medium | Low |

| Electrical outage | Medium | Low | Low | |

| Incorrect nutrient/pH dosage | Medium | Low-Medium | Low | |

| Irrigation (flooding, clogs) | High | Medium | Low | |

| Equipment failure | High | Medium | Low | |

| Cost risk | Energy expense variability | Very High | High | Low |

| Underestimated labour costs | High | Medium | Low | |

| Technology advances | High | Medium | Low | |

| Labour risk | Poaching of staff/Loss of expertise | High | Medium | Low |

| Accidental damage | High | Medium | Low | |

| Safety risk | Fire | Low | Low | Low |

| Planning risk | Zoning codes | High | Medium | Low |

| Change of lease agreement | High | Medium | Low | |

| Market risk | Market competition | Medium | Medium | Low |

| Local supply/demand situation | Low-Medium | Low | High |

| UK Vertical Farm | Japanese Vertical Farm |

|---|---|

| 1. The farm has been retro-fitted and installed into a basement rented from a school. The school subsidises rent, electricity and water costs. | 1. The farm has been constructed within a leased purpose-built facility. |

| 2. The facility is a pilot with plans to double production capacity in the next year. Therefore, the analysis considers both the pilot and full-scale plan. | 2. The facility is at full production capacity with no plan to expand. |

| 3. Vertical towers were modelled as a growing area. The farm’s imprecise yield data are used to form upper and lower bounds to compensate for the lack of robust data collection. | 3. Nutrient Film Technique (NFT) racks were modelled with the annual yield provided in the example. |

| 4. Lettuce cultivars are grown with twelve plants per tower and a growth cycle of 21 days (after 25 days in the propagation system). | 4. Lettuce heads are cultivated in four phases at different spacing: 1st seedling (8 days), 2nd seedling (10 days), transplanting 1st (8 days), transplanting 2nd (8 days). |

| 5. Alternative revenue streams (such as education) are omitted to assess the farm in isolation. | 5. No alternative revenue streams are included. |

| 6. Water consumption data are tracked on the farm for 15 months and have been characterised per month: min = 1325 L, max = 8325 L, mean = 3730 L, Standard deviation = 2039 L. Multiplied by 2 for the scaled-up plan. | 6. Water costs have been grouped with electricity costs. |

| 7. The facility has a pre-existing HVAC system that has no associated capital costs. | 7. A bespoke HVAC system was installed. |

| 8. The indirect team consists of three staff (head grower, marketer, manager). | 8. Indirect staff costs were not considered by [22]. This analysis assumes five staff members (CEO, head grower, marketer, engineer and admin). |

| 9. The farm is partly grant-funded for two years. | 9. The project is funded with zero interest rates, according to [22]. |

| 10. The farm is partially insulated within a thick-brick walled basement but is not sealed, which reduces the climate control capacity. | 10. The facility is insulated and benefits from a strictly controlled environment. |

| Characteristic | UK Farm | Japanese Farm | Unit |

|---|---|---|---|

| Real Estate | |||

| Facility size | 220 | 1000 | m2 |

| Facility height | 3 | 3.5 | m |

| Space utilisation | 45 | 36.4 | % |

| Growing space | 100 | 364 | m2 |

| Systems | |||

| Grow levels | 30 towers per rack | 6 shelves | |

| Number. of racks | 16 | 241 | |

| Stacked growing area | 392 | 2184 | m2 |

| Number of lights | 256 | 5784 | |

| Light wattage | 100 | 32 | W |

| Energy price | 0.073–0.108 | 0.090–0.100 | £/kWh |

| Annual electrical consumption | 224,255 | 1,676,052 | kWh |

| Labour | |||

| Number of direct labourers | 3 | 9 | people |

| Number of indirect staff | 3 | 5 | people |

| Direct labour hours per week | 20 | 42 | hours per person |

| Direct hourly cost | 9.50 | 7.34 | £/hour |

| Crop: Lettuce | |||

| Annual yield | 8800–10,800 | 116,640 | kg/year |

| Harvest weight | 0.1 | 0.09 | kg |

| Photoperiod | 16 | 16 | hours |

| Product weight | 0.3 | 1 | kg |

| Customer segmentation | 85 (customer 1) 15 (customer 2) | 100 | % to customers |

| Unit prices | 7.50 (customer 1) 3 (customer 2) | 8.64 | £/unit |

| Packaging cost | 0.85 | 0.05 | £/unit |

| Attributes 1 | |||

| Business model | Hybrid | Wholesale | |

| Grower experience | Medium | High | |

| Automation level | None | Medium | |

| Climate control level | Medium | High | |

| Lighting control level | Medium | High | |

| Nutrient control level | Medium | High | |

| CO2 enrichment | No | Yes | |

| Biosecurity level | Medium | High |

| Capital Costs | UK Farm | Japanese Farm | Unit |

|---|---|---|---|

| Construction | |||

| Finishing | 3850 | 114,775 | £ |

| Appliance | 4250 | 108,000 | £ |

| Management costs | 9029 | 0 | £ |

| Electrical infrastructure | 8020 | 25,200 | £ |

| Real estate | 0 | 0 | £ |

| Total construction costs | 25,149 | 247,975 | £ |

| Systems | |||

| Growing system cost | 55,071 | 747,072 | £ |

| Lighting system cost | 87,165 | 538,804 | £ |

| HVAC system cost | 2700 | 56,160 | £ |

| Miscellaneous cost | 9548 | 0 | £ |

| Total equipment cost | 154,484 | 1,342,037 | £ |

| Total capital costs | 179,633 | 1,590,012 | £ |

| Production Costs | UK Farm | Japanese Farm | Unit |

|---|---|---|---|

| Operational expenditure | |||

| Rent | 0 | 69,120 | £/year |

| Staff costs (non-direct labour) | 70,236 | 171,888 1 | £/year |

| Distribution | 31,172 | 106,691 | £/year |

| Other costs 1 | 1404–6039 | 8594 1 | £/year |

| Total OpEx | 108,998 | 356,293 | £/year |

| Cost of goods sold | |||

| Direct labour costs | 29,640 | 142,689 | £/year |

| Growing media | 5735 | 14,818 | £/year |

| Packaging | 22,977–32,078 | 2905 | £/year |

| Total electricity cost | 15,929–23,416 | 150,844 | £/year |

| Water cost | 97.59 | N/A | £/year |

| Total COGS | 104,000 | 375,192 | £/year |

| Other costs | |||

| Depreciation | 20,417 | 162,454 1 | £/year |

| Working capital | 251,504 | 2,160,000 | £ |

| Loan amount | 158,000 | 0 | £ |

| Loan tenure | 7 | 0 | years |

| Loan interest | 5 | 0 | % per year |

| Intervention | Input Change | Result |

|---|---|---|

| Tailor nutrient solution composition to specific lettuce varietal | Nutrient control: medium to high | Improved yield and produce quality by ~10% 1 |

| Provide carbon dioxide enrichment | CO2 enrichment: no to yes | Improved yield and produce quality by ~10% 1 |

| Improve climate control through HVAC system | Climate control: low to medium. Additional 5–20% energy costs | Improved yield by ~5% 1 and reduced likelihood of pathogens and pests 2 |

| Alter packaging solution with digital information rather than printed leaflets | Reduce cost from £1.00 to £0.70 per unit | Reduced unit costs |

| Adopt robust biosecurity protocol requiring more regular cleaning of the systems | Biosecurity control: medium to high | Reduced likelihood of pathogen outbreaks 2 |

| Use efficient distribution channels by focusing on bulk customers | Distribution unit costs are reduced by 50% | Reduced unit costs |

| Acquire further capital funding for proposed improvements | £100,000 grant in year 2 | £20,000–30,000 additional capex |

| Utilise load shifting to optimise electricity prices (see [63]) | From £0.073–0.108 to £0.073–0.085 | Reduced unit costs |

| Introduce tours of the farm with a dedicated tour guide | £2000 revenue per month (10% increase/year) and tour guide salary budgeted | Increased revenue and mitigate risk of crop failure severely affecting income |

| Account for higher expenses associated with CO2, nutrient solution, biosecurity and tour marketing | From 2% to 5% of salaries | Increased costs |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baumont de Oliveira, F.J.; Ferson, S.; Dyer, R.A.D.; Thomas, J.M.H.; Myers, P.D.; Gray, N.G. How High Is High Enough? Assessing Financial Risk for Vertical Farms Using Imprecise Probability. Sustainability 2022, 14, 5676. https://doi.org/10.3390/su14095676

Baumont de Oliveira FJ, Ferson S, Dyer RAD, Thomas JMH, Myers PD, Gray NG. How High Is High Enough? Assessing Financial Risk for Vertical Farms Using Imprecise Probability. Sustainability. 2022; 14(9):5676. https://doi.org/10.3390/su14095676

Chicago/Turabian StyleBaumont de Oliveira, Francis J., Scott Ferson, Ronald A. D. Dyer, Jens M. H. Thomas, Paul D. Myers, and Nicholas G. Gray. 2022. "How High Is High Enough? Assessing Financial Risk for Vertical Farms Using Imprecise Probability" Sustainability 14, no. 9: 5676. https://doi.org/10.3390/su14095676

APA StyleBaumont de Oliveira, F. J., Ferson, S., Dyer, R. A. D., Thomas, J. M. H., Myers, P. D., & Gray, N. G. (2022). How High Is High Enough? Assessing Financial Risk for Vertical Farms Using Imprecise Probability. Sustainability, 14(9), 5676. https://doi.org/10.3390/su14095676