Impact of Epidemics on Enterprise Innovation: An Analysis of COVID-19 and SARS

Abstract

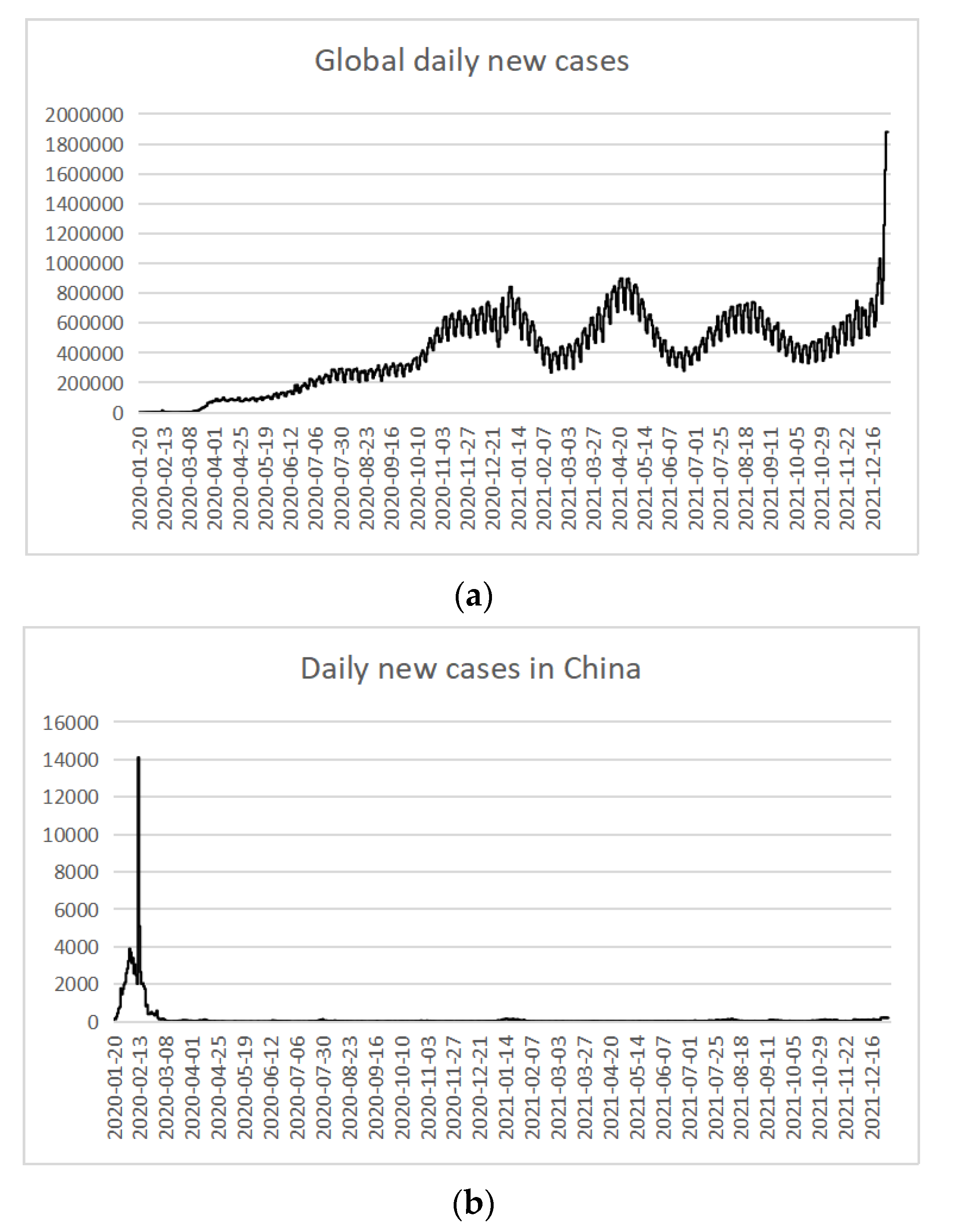

:1. Introduction

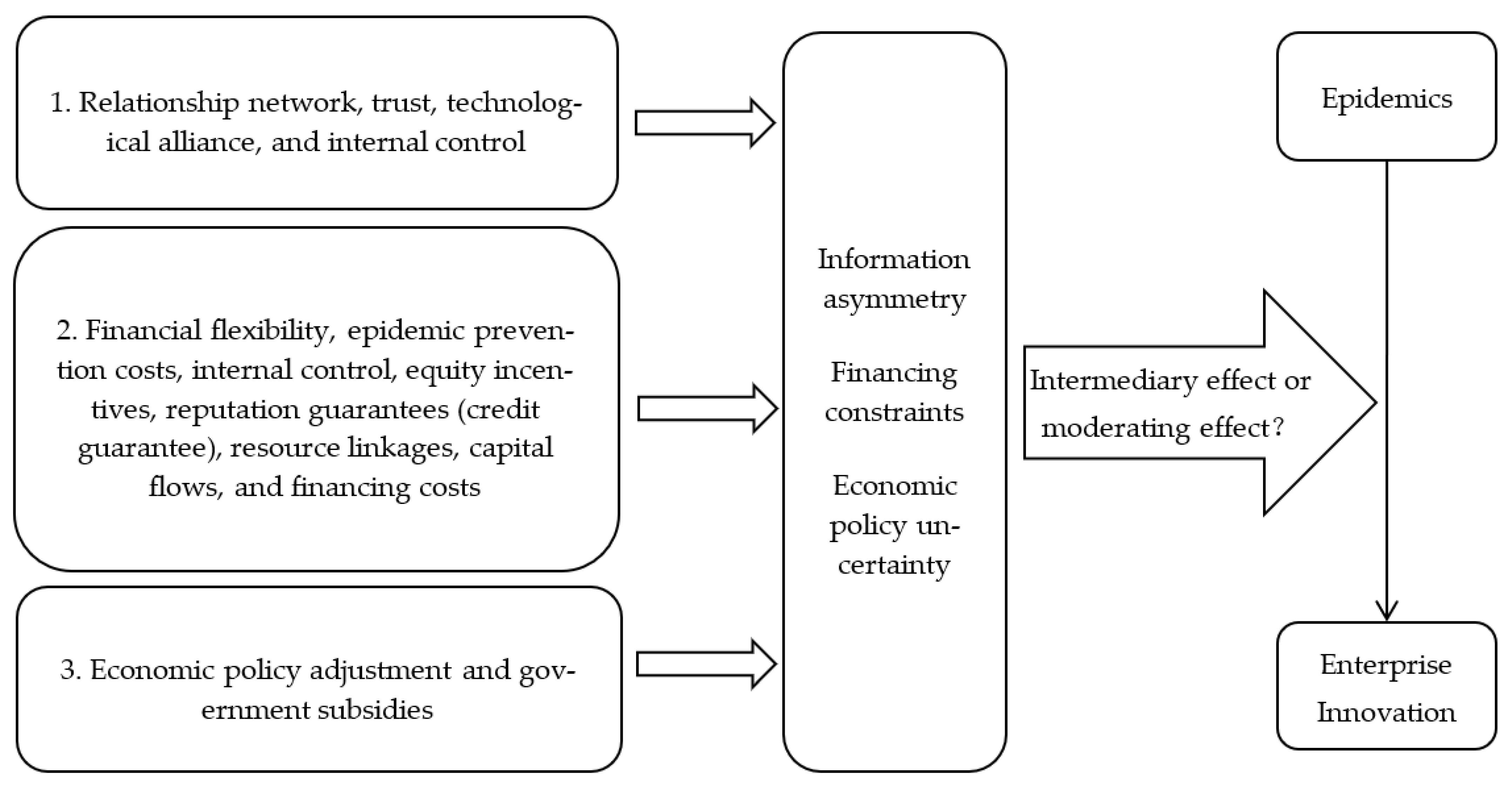

2. Theoretical Analysis and Hypotheses

2.1. Epidemic Shocks and Enterprise Innovation

2.2. Analysis of Mechanisms

2.2.1. Epidemic Shocks, Information Asymmetry, and Enterprise Innovation

2.2.2. Epidemic Shocks, Financing Constraints, and Enterprise Innovation

2.2.3. Epidemic Shocks, Economic Policy Uncertainty, and Enterprise Innovation

3. Research Design

3.1. Variable Construction

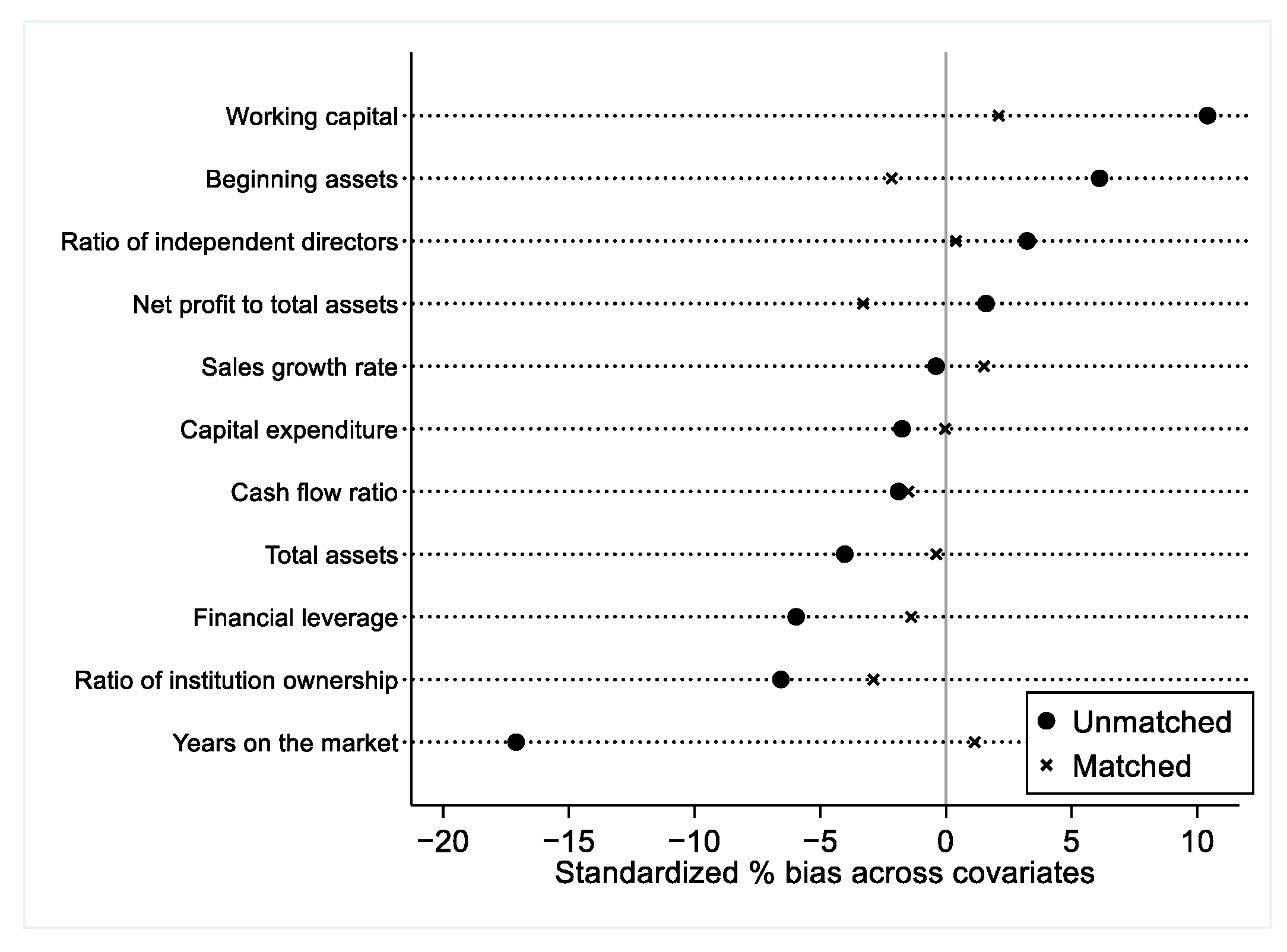

3.2. Model, Sample Selection, and Data Sources

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Regression Analysis

4.3. Robustness Analysis

5. Discussion: Long-Term Effects of Epidemics on Enterprise Innovation

5.1. Basic Regression Results

5.2. Long-Term Effects of Epidemics

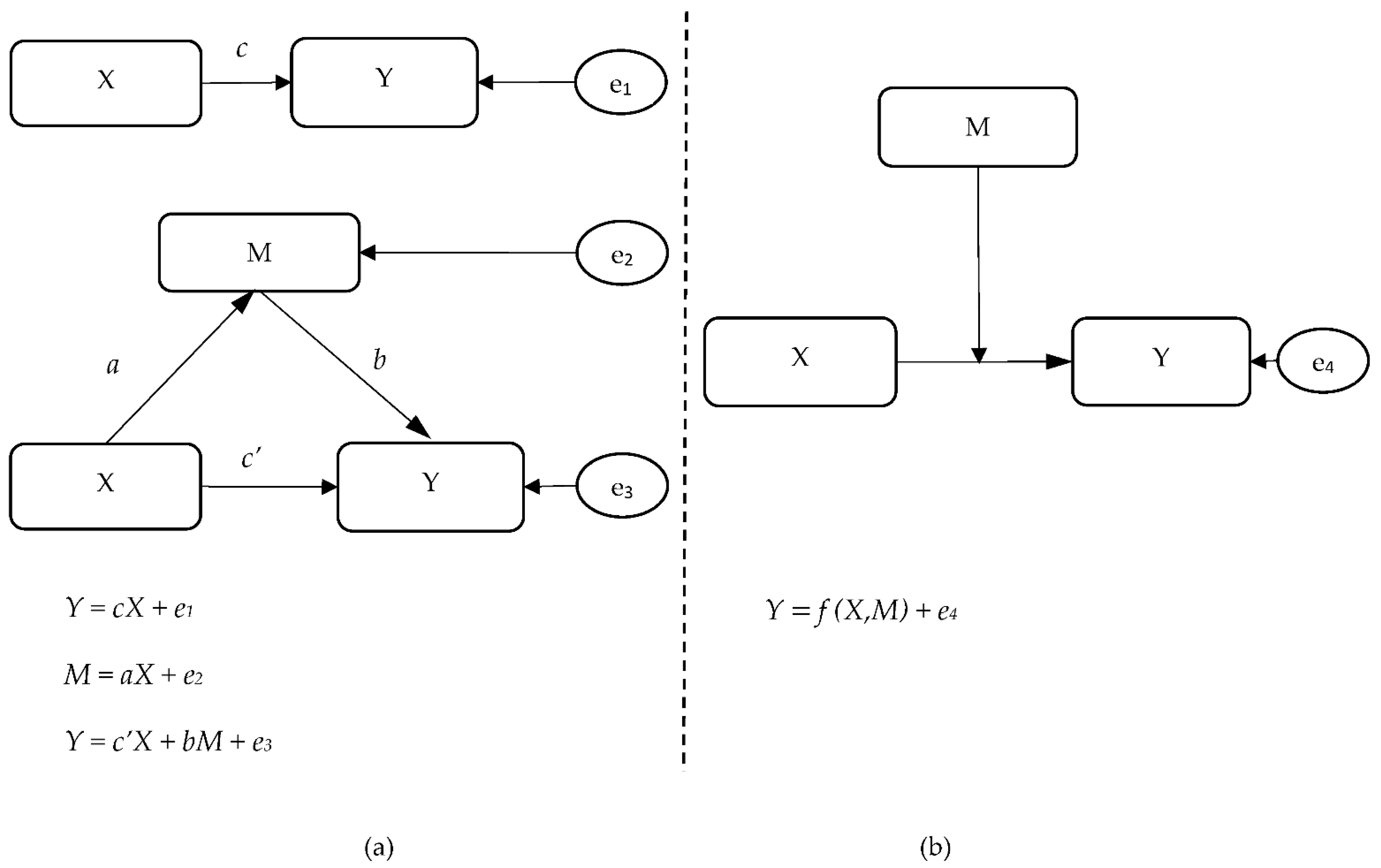

6. Analysis of Mediators

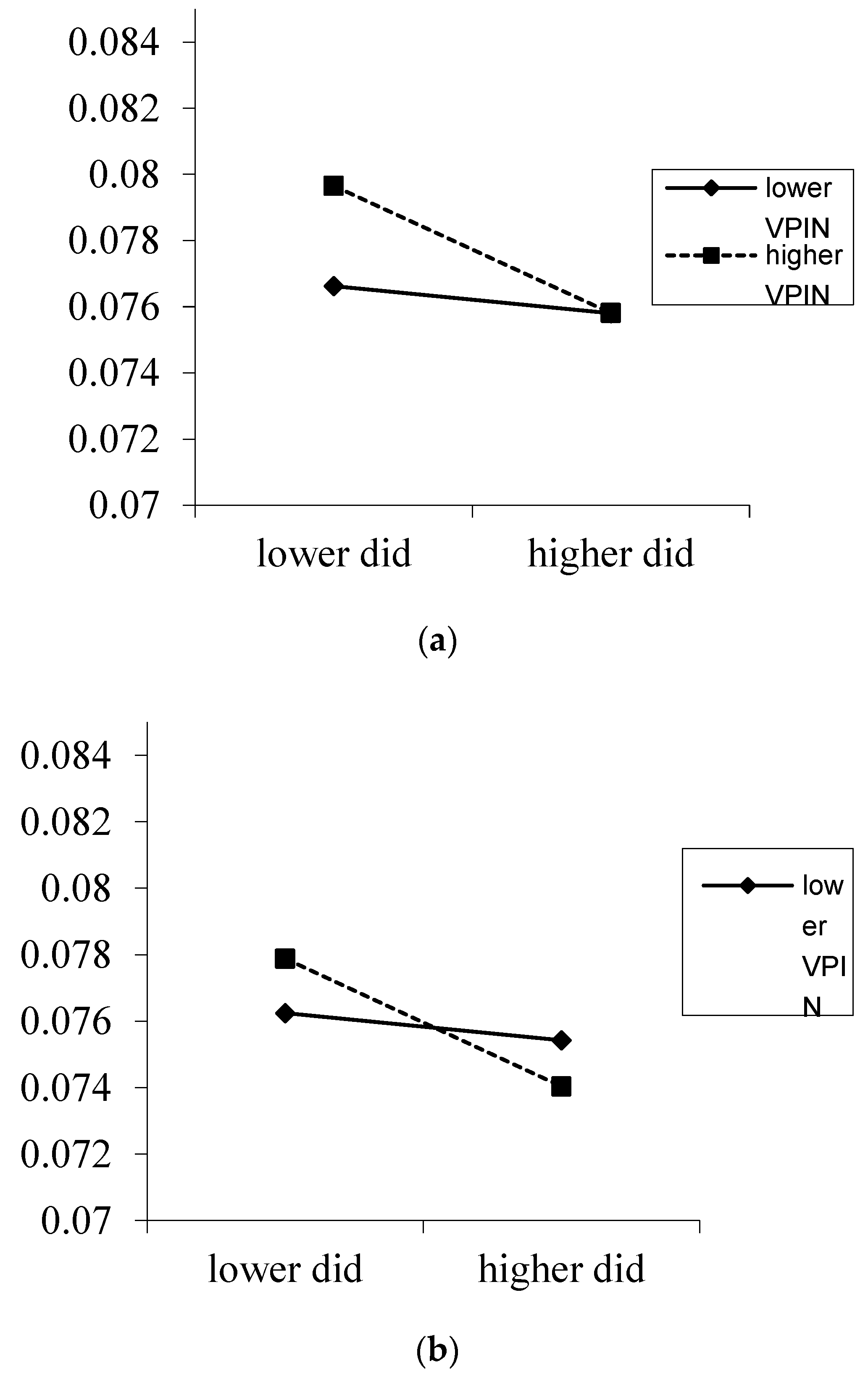

6.1. Epidemic Shocks, Information Asymmetry, and Enterprise Innovation

6.2. Epidemic Shocks, Financing Constraints, and Enterprise Innovation

6.3. Epidemic Shocks, Economic Policy Uncertainty, and Enterprise Innovation

7. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Li, X.R.; Niu, M.L. Research progress on the relation between public emergency and finance. Econ. Perspect. 2020, 61, 129–144. (In Chinese) [Google Scholar]

- del Rio-Chanona, R.M.; Mealy, P.; Pichler, A.; Lafond, F.; Farmer, J.D. Supply and demand shocks in the COVID-19 pandemic: An industry and occupation perspective. Oxf. Rev. Econ. Policy 2020, 36, 94–137. [Google Scholar] [CrossRef]

- De Vito, A.; Gómez, J.P. Estimating the COVID-19 cash crunch: Global evidence and policy. J. Account. Public Policy 2020, 39, 106741. [Google Scholar] [CrossRef]

- Barako, D.G.; Taplin, R.; Brown, A. HIV/AIDS information by African companies: An empirical analysis. J. Asian Afr. Stud. 2010, 45, 387–405. [Google Scholar] [CrossRef]

- Coibion, O.; Gorodnichenko, Y.; Weber, M.; Weber, M. Labor Markets during the COVID-19 Crisis: A Preliminary View; NBER Working Papers, No. 8238; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Mckibbin, W.; Fernando, R. The global macroeconomic impacts of COVID-19: Seven scenarios. Asian Econ. Pap. 2021, 20, 1–30. [Google Scholar] [CrossRef]

- Bartik, A.W.; Bertrand, M.; Cullen, Z.B.; Glaeser, E.L.; Luca, M.; Stanton, C.T. How Are Small Businesses Adjusting to COVID-19? Early Evidence from a Survey; NBER Working Papers, No. 42; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- du Bruyn, R. A proposed reporting framework for HIV/Aids disclosure by listed South African companies. Meditari Account. Res. 2008, 16, 59–78. [Google Scholar] [CrossRef] [Green Version]

- International Labour Office. An ILO Code of Practice on HIV AIDS and the World of Work. Volume 2001. Available online: www.ilo.org (accessed on 1 July 2020).

- Hassan, T.A.; Hollander, S.; Lent, L.; Tahoun, A. Firm-Level Exposure to Epidemic Diseases: COVID-19, SARS, and H1N1; NBER Working Paper, No. 26971; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Fahlenbrach, R.; Rageth, K.; Stulz, R.M. How valuable is financial flexibility when revenue stops? Evidence from the COVID-19 crisis. Rev. Financ. Stud. 2021, 34, 5474–5521. [Google Scholar] [CrossRef]

- Mayer, T.; Melitz, M.J.; Ottaviano, G.I.P. Market size, competition, and the product mix of exporters. Am. Econ. Rev. 2014, 104, 495–536. [Google Scholar] [CrossRef] [Green Version]

- Aghion, P.; Bergeaud, A.; Lequien, M.; Melitz, M.J. The Impact of Exports on Innovation: Theory and Evidence; National Bureau of Economic Research: New York, NY, USA, 2018. [Google Scholar] [CrossRef]

- Gupta, S.; Kumar, V.; Karam, E. New-age technologies-driven social innovation: What, how, where, and why? Ind. Market. Manag. 2020, 89, 499–516. [Google Scholar] [CrossRef]

- Drobetz, W.; El Ghoul, S.; Guedhami, O.; Janzen, M. Policy uncertainty, investment, and the cost of capital. J. Financ. Stab. 2018, 39, 28–45. [Google Scholar] [CrossRef]

- Qv, S.N.; Yang, D.H. Intelligent response to public health emergencies: Theoretical retrospection and trend analysis. Reform 2020, 36, 14–21. (In Chinese) [Google Scholar]

- Salge, T.O.; Vera, A. Benefiting from public sector innovation: The moderating role of customer and learning orientation. Public Adm. Rev. 2012, 72, 550–559. [Google Scholar] [CrossRef]

- Frankort, H.T.W. When does knowledge acquisition in R&D alliances increase new product development? The moderating roles of technological relatedness and product-market competition. Res. Policy 2016, 45, 291–302. [Google Scholar] [CrossRef] [Green Version]

- Fan, P.J.; Wong, T.J.; Zhang, T. Politically connected CEOs, corporate governance, and post-IPO performance of China’s newly partially privatized firms. J. Financ. Econ. 2006, 84, 330–357. [Google Scholar] [CrossRef]

- Benner, M.J.; Tushman, M. Process management and technological innovation: A longitudinal study of the photography and paint industries. Adm. Sci. Q. 2002, 47, 676–707. [Google Scholar] [CrossRef] [Green Version]

- Ahuja, G. Collaboration networks, structural holes, and innovation: A longitudinal study. Admin. Sci. Q. 2000, 45, 425–455. [Google Scholar] [CrossRef] [Green Version]

- Heidl, R.A.; Steensma, H.K.; Phelps, C. Divisive faultlines and the unplanned dissolutions of multipartner alliances. Organ. Sci. 2014, 25, 1351–1371. [Google Scholar] [CrossRef] [Green Version]

- Asgari, N.; Tandon, V.; Singh, K.; Mitchell, W. Creating and taming discord: How firms manage embedded competition in alliance portfolios to limit alliance termination. Strateg. Manag. J. 2018, 39, 3273–3299. [Google Scholar] [CrossRef]

- Park, J. Open innovation of small and medium-sized enterprises and innovation efficiency. Asian J. Technol. Innov. 2018, 26, 115–145. [Google Scholar] [CrossRef]

- He, J.; Mao, X.Y.; Rui, O.M.; Zha, X. Business groups in China. J. Corp. Financ. 2013, 22, 166–192. [Google Scholar] [CrossRef] [Green Version]

- Chang, J. The effects of buyer-supplier’s collaboration on knowledge and product innovation. Ind. Mark. Manag. 2017, 65, 129–143. [Google Scholar] [CrossRef]

- Hasan, I.; Hoi, C.S.; Wu, Q.; Zhang, H. Does social capital matter in corporate decisions? Evidence from corporate tax avoidance. J. Account. Res. 2017, 55, 629–668. [Google Scholar] [CrossRef] [Green Version]

- Bottazzi, L.; Da Rin, M.; Hellmann, T. The Importance of Trust for Investment: Evidence from Venture Capital. Rev. Financ. Stud. 2016, 29, 2283–2318. [Google Scholar] [CrossRef] [Green Version]

- Zuo, R.; Ma, X.J.; Li, Y.J. Corporate integrity culture, internal control and innovation efficiency. Stat. Decis. 2020, 36, 154–158. (In Chinese) [Google Scholar]

- Psillaki, M.; Eleftheriou, K. Trade credit, bank credit, and flight to quality: Evidence from French SMEs. J. Small Bus. Manag. 2015, 53, 1219–1240. [Google Scholar] [CrossRef]

- Leary, M.T.; Roberts, M.R. Do peer firms affect corporate financial policy? J. Financ. 2014, 69, 139–178. [Google Scholar] [CrossRef]

- Lu, Z.; Zhu, J.; Zhang, W. Bank discrimination, holding bank ownership, and economic consequences: Evidence from China. J. Bank Financ. 2012, 36, 341–354. [Google Scholar] [CrossRef]

- Arslan-Ayaydin, Ö.; Florackis, C.; Ozkan, A. Financial flexibility, corporate investment and performance: Evidence from financial crises. Rev. Quant. Financ. Account. 2014, 42, 211–250. [Google Scholar] [CrossRef]

- Gong, J.J.; Li, S. CEO incentives and earnings prediction. Rev. Quant. Financ. Account. 2013, 40, 647–674. [Google Scholar] [CrossRef]

- Burak Güner, A.B.; Malmendier, U.; Tate, G. Financial expertise of directors. J. Financ. Econ. 2008, 88, 323–354. [Google Scholar] [CrossRef] [Green Version]

- Sisli-Ciamarra, E. Monitoring by affiliated bankers on board of directors: Evidence from corporate financing outcomes. Financ. Manag. 2012, 41, 665–702. [Google Scholar] [CrossRef]

- Gao, Z.L.; Zhang, J.R.; Li, H.X. Top manager’s financial social network, financing constraints and capital structure. Financ. Forum 2019, 24, 69–80. (In Chinese) [Google Scholar]

- Hackbarth, D. Managerial traits and capital structure decisions. J. Financ. Quant. Anal. 2008, 43, 843–881. [Google Scholar] [CrossRef] [Green Version]

- Cai, Y.; Dhaliwal, D.S.; Kim, Y.; Pan, C. Board interlocks and the diffusion of disclosure policy. Rev. Account. Stud. 2014, 19, 1086–1119. [Google Scholar] [CrossRef]

- Duchin, R.; Ozbas, O.; Sensoy, B.A. Costly external finance, corporate investment, and the subprime mortgage credit crisis. J. Financ. Econ. 2010, 97, 418–435. [Google Scholar] [CrossRef]

- Andreasen, E.; Valenzuela, P. Financial openness, domestic financial development and credit ratings. Financ. Res. Lett. 2016, 16, 11–18. [Google Scholar] [CrossRef]

- Harrison, A.E.; Mcmillan, M.S. Does direct foreign investment affect domestic credit constraints? J. Int. Econ. 2003, 61, 73–100. [Google Scholar] [CrossRef] [Green Version]

- Buch, C.M.; Kesternich, I.; Lipponer, A.; Schnitzer, M. Financial constraints and foreign direct investment: Firm-level evidence. Rev. World Econ. 2014, 150, 393–420. [Google Scholar] [CrossRef] [Green Version]

- Xv, S.; He, X.Y.; Zhong, K. The belt and road initiative and chinese firms’ financial constraints. China Ind. Econ. 2019, 35, 155–173. (In Chinese) [Google Scholar]

- Chen, D.H.; Li, O.Z.; Fu, X. Five-year plans, China finance and their consequences. China J. Account. Res. 2017, 10, 189–230. [Google Scholar] [CrossRef]

- Knill, A.; Lee, B.S. The volatility of foreign portfolio investment and the access to finance of small listed firms. Rev. Dev. Econ. 2014, 18, 524–542. [Google Scholar] [CrossRef]

- Zhang, K.; Li, W. Financial constraint and foreign direct investment under the new situation of international trade: A panel threshold model analysis based on the data of the industry in China. J. Aud. Econ. 2019, 34, 106–115. (In Chinese) [Google Scholar]

- Svaleryd, H.; Vlachos, J. Financial markets, the pattern of industrial specialization and comparative advantage: Evidence from OECD countries. Eur. Econ. Rev. 2005, 49, 113–144. [Google Scholar] [CrossRef]

- Gu, X.M.; Chen, Y.M.; Pan, S.Y. Economic policy uncertainty and innovation: Evidence from listed companies in China. Econ. Res. J. 2018, 53, 109–123. (In Chinese) [Google Scholar]

- Hall, B.H.; Moncada-Paternò-Castello, P.; Montresor, S.; Vezzani, A. Financing constraints, R&D investments and innovative performances: New empirical evidence at the firm level for Europe. Econ. Innov. New Technol. 2016, 25, 183–196. [Google Scholar] [CrossRef]

- Bloom, N.; Bond, S.; Van Reenen, J. Uncertainty and investment dynamics. Rev. Econ. Stud. 2007, 74, 391–415. [Google Scholar] [CrossRef] [Green Version]

- Julio, B.; Yook, Y. Political uncertainty and corporate investment cycles. J. Financ. 2012, 67, 45–83. [Google Scholar] [CrossRef]

- Phan, H.V.; Nguyen, N.H.; Nguyen, H.T.; Hege, S. Policy uncertainty and firm cash holdings. J. Bus. Res. 2018, 95, 71–82. [Google Scholar] [CrossRef]

- Wu, C.P.; Tang, D. Intellectual property rights enforcement, corporate innovation and operating performance: Evidence from China’s listed companies. Econ. Res. J. 2016, 51, 125–139. (In Chinese) [Google Scholar]

- Amore, M.D.; Schneider, C.; Žaldokas, A. Credit supply and corporate innovation. J. Financ. Econ. 2013, 109, 835–855. [Google Scholar] [CrossRef]

- Qian, N. Missing women and the price of tea in China: The effect of sex-specific earnings on sex imbalance. Q. J. Econ. 2008, 123, 1251–1285. [Google Scholar] [CrossRef]

- Ju, X.S.; Dic, L.; Yu, Y.H. Financing constraints, working capital management and the persistence of firm innovation. Econ. Res. J. 2013, 48, 4–16. (In Chinese) [Google Scholar]

- Andersen, T.G.; Bondarenko, O. VPIN and the flash crash. J. Financ. Mark. 2014, 17, 1–46. [Google Scholar] [CrossRef]

- Chen, G.J.; Zhang, R.Z.; Xie, P.L.; Zhao, X.Q. Informed trading, information uncertainty and stock risk premium. J. Manag. Sci. China 2019, 22, 53–74. (In Chinese) [Google Scholar]

- Wen, Z.L.; Hau, K.T.; Chang, L. A comparison of moderator and mediator and their applications. Acta Psychol. 2005, 37, 268–274. (In Chinese) [Google Scholar]

- Thompson, R.J.; Kronenberger, W.G.; Johnson, D.F.; Whiting, K. The role of central nervous system functioning and family functioning in behavioral problems of children with myelodysplasia. J. Dev. Behav. Pediatr. 1989, 10, 242–248. [Google Scholar] [CrossRef]

- Porter, M.A. Multiple regression: Testing and interpreting interactions. J. R. Stat. Soc. Ser. D (Stat.) 1994, 43, 453. [Google Scholar] [CrossRef]

- Kemp, F. Applied multiple regression/correlation analysis for the behavioral sciences. J. R. Stat. Soc. Ser. D 2003, 52, 691. [Google Scholar] [CrossRef]

- Sapra, H.; Subramanian, A.; Subramanian, K.V. Corporate governance and innovation: Theory and evidence. J. Financ. Quant. Anal. 2014, 49, 957–1003. [Google Scholar] [CrossRef] [Green Version]

- Liu, L.Y.; He, Y.L.; Wang, Z.F. Do financial constraints affect Chinese firms’ outward FDI behavior? A theoretical and empirical analysis based on the micro perspective. J. Financ. Res. 2015, 4, 124–140. (In Chinese) [Google Scholar]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Lai, H.B.; Meng, Z. Research on the integration of traditional innovation and social innovation and innovation transformation in the context of major public health events. Sci. Technol. Prog. Pol. 2020, 37, 14–20. (In Chinese) [Google Scholar] [CrossRef]

| Type | Variable Name | Symbol | Construction |

|---|---|---|---|

| Explained variable | Enterprise innovation | intangible | R&D expenditure/total assets |

| Factor variables of continuous DID | Shock factor | treat | ln (number of cases) |

| Before or after the event | post | Dates before 30 December 2019, are defined as “before the event”, post = 0; dates after 30 December 2019, are defined as “after the event”, post = 1 | |

| Treatment effects | did* | treat × post | |

| Control variables for firm characteristics | Total firm assets | size | ln (total assets) |

| Financial leverage | debt | Total liabilities/capital | |

| Cash flow ratio | cash | Net cash flows from operating activities/total assets | |

| Capital expenditure | capital | Cash paid for fixed assets, intangible assets, and other long-term assets/beginning assets | |

| Years on the market | age | Year of data period–year of listing | |

| Ratio of institutional ownership | institutional | Ratio of institutional ownership to total equity | |

| Sales growth rate | salesgrowth | Quarter-on-quarter sales growth rate | |

| Ratio of independent directors | independent | Number of independent directors/total number of directors | |

| Return on total assets | roa | Net profit/total assets |

| Variable | N | Min | Mean | p50 | sd | Max |

|---|---|---|---|---|---|---|

| Enterprise innovation (intangible) | 22,556 | 0 | 0.0150 | 0.00900 | 0.0200 | 0.639 |

| Number of cases (treat) | 25,543 | 0 | 6.704 | 6.827 | 1.114 | 11.13 |

| Total assets (size) | 24,534 | 18.14 | 22.16 | 21.99 | 1.323 | 28.64 |

| Financial leverage (debt) | 24,533 | 0.00600 | 0.397 | 0.388 | 0.196 | 2.114 |

| Cash flow ratio (cash) | 24,534 | −0.635 | 0.0200 | 0.0160 | 0.0640 | 0.596 |

| Capital expenditure (capital) | 24,454 | −368.8 | −0.0220 | 0.00100 | 2.568 | 24 |

| Years on the market (age) | 25,543 | 0 | 9.431 | 8 | 8.262 | 30 |

| Ratio of institutional ownership (institution) | 22,693 | 0 | 0.366 | 0.367 | 0.238 | 1.136 |

| Sales growth rate (salesgrowth) | 24,573 | −413.3 | 32.51 | 3.477 | 788.4 | 62881 |

| Ratio of independent directors (independent) | 22,953 | 0.143 | 0.378 | 0.364 | 0.0560 | 0.800 |

| Return on total assets (roa) | 25,153 | −1.184 | 0.0290 | 0.0200 | 0.0550 | 0.809 |

| Variable | (1) |

|---|---|

| Enterprise Innovation | |

| did* | −0.000460 *** |

| (0.000100) | |

| Intercept item | 0.0973 *** |

| (0.0146) | |

| Sample size | 3104 |

| Firm fixed effects | YES |

| Time fixed effects | YES |

| Other control variables | YES |

| R2 | 0.515 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Enterprise Innovation | Enterprise Innovation | Enterprise Innovation (R&D Expenditure) | |

| did1 | −0.00109 *** | −0.000762 ** | −0.000312 ** |

| (0.000198) | (0.000300) | −(0.000131) | |

| Intercept item | 0.0918 *** | 0.0870 *** | −0.0508 *** |

| (0.0146) | (0.0186) | (0.00768) | |

| Sample size | 3104 | 3006 | 2562 |

| Firm fixed effects | YES | YES | YES |

| Time fixed effects | YES | YES | YES |

| Other control variables | YES | YES | YES |

| R2 | 0.516 | 0.520 | 0.407 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Enterprise Innovation | Innovation Activities (Growth Rate) | Enterprise Innovation | Enterprise Innovation | |

| did2 | −0.00844 *** | −0.0141 *** | −0.0174 * | −0.00939 *** |

| (0.00106) | (0.00204) | (0.00935) | (0.000929) | |

| Intercept item | 0.186 *** | 8.954 *** | 0.126 *** | 0.182 *** |

| (0.0102) | (0.0783) | (0.0398) | (0.0102) | |

| Sample size | 344,530 | 299,228 | 344,530 | 344,530 |

| Firm fixed effects | YES | YES | YES | YES |

| Time fixed effects | YES | YES | YES | YES |

| Other control variables | YES | YES | YES | YES |

| R2 | 0.015 | 0.141 | 0.016 | 0.015 |

| The Year of the Outbreak Is 2002 | (1) | The Year of the Outbreak Is 2003 | (2) |

|---|---|---|---|

| Enterprise Innovation | Enterprise Innovation | ||

| prez_2 | 0.00315 | prew_4 | 0.00625 * |

| (0.00232) | (0.00340) | ||

| prez_1 | 0.0223 | prew_3 | 0.00310 |

| (0.0246) | (0.00311) | ||

| currentz | 0.00106 | prew_2 | 0.0254 |

| (0.00285) | (0.0228) | ||

| postz_1 | −0.00573 * | prew_1 | 0.00417 |

| (0.00309) | (0.00290) | ||

| postz_2 | −0.00799 *** | currentw | −0.00263 |

| (0.00256) | (0.00310) | ||

| postz_3 | −0.00379 | postw_1 | −0.00488 ** |

| (0.00262) | (0.00213) | ||

| postz_4 | −0.00310 | postw_2 | −0.000688 |

| (0.00311) | (0.00161) | ||

| Intercept item | −0.443 *** | Intercept item | −0.444 *** |

| (0.158) | (0.158) | ||

| Sample size | 397,470 | Sample size | 397,470 |

| Firm fixed effects | YES | Firm fixed effect | YES |

| Time fixed effects | YES | Time fixed effect | YES |

| Other control variables | YES | Other control variables | YES |

| R2 | 0.120 | R2 | 0.115 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Enterprise Innovation | Enterprise Innovation | Enterprise Innovation | |

| did3 | −0.0172 | −0.0105 ** | −0.00750 |

| (0.0111) | (0.00467) | (0.00469) | |

| Intercept item | 0.176 *** | 0.139 *** | 0.136 *** |

| (0.0182) | (0.00482) | (0.00454) | |

| Sample size | 344,530 | 344,530 | 344,530 |

| Firm fixed effects | YES | YES | YES |

| Time fixed effects | YES | YES | YES |

| Other control variables | YES | YES | YES |

| R2 | 0.102 | 0.136 | 0.147 |

| Variable | Panel A | Panel B | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (1) | (2) | |

| Enterprise Innovation | Enterprise Innovation | Enterprise Innovation | Enterprise Innovation | VPIN (Daily) | VPIN (Quarterly) | |

| VPIN | 0.0228 *** | 0.0229 *** | 0.0333 *** | 0.0180 *** | ||

| (0.00308) | (0.00308) | (0.00365) | (0.00317) | |||

| did* | −0.000466 *** | 0.00126 *** | −0.000343 *** | −0.00158 *** | 0.000231 | |

| (0.000101) | (0.000169) | (9.88 × 10−5) | (0.000122) | (0.000308) | ||

| VPIN × did* | −0.00529 *** | −0.00529 *** | ||||

| (0.000414) | (0.000414) | |||||

| Intercept item | −0.0175 | 0.0887 *** | 0.0679 *** | 0.0770 *** | 0.297 *** | 0.186 *** |

| (0.0144) | (0.0149) | (0.0149) | (0.0150) | (0.00060) | (0.0273) | |

| Sample size | 3079 | 3079 | 3079 | 3079 | 3519 | 3264 |

| Firm fixed effects | YES | YES | YES | YES | YES | YES |

| Time fixed effects | YES | YES | YES | YES | YES | YES |

| Other control variables | YES | YES | YES | YES | YES | YES |

| R2 | 0.517 | 0.517 | 0.521 | 0.521 | 0.021 | 0.178 |

| Variable | Panel A | Panel B | |||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (1) | |

| Enterprise Innovation | Enterprise Innovation | Enterprise Innovation | Enterprise Innovation | Financing Constraints | |

| SA | 0.000349 ** | 0.000352 ** | −0.000240 | −0.000208 | |

| (0.000172) | (0.000175) | (0.000196) | (0.000194) | ||

| did* | −0.000462 *** | −0.000680 *** | −0.000459 *** | 0.00657 | |

| (0.000101) | (0.000101) | (9.82 × 10−5) | (0.00922) | ||

| SA × did* | 0.000011 *** | 0.000011 *** | |||

| (9.76 × 10−6) | (1.11 × 10−6) | ||||

| Intercept item | 0.0534 | 0.161 *** | 0.0678 * | 0.0617 | −168.8 *** |

| (0.0365) | (0.0371) | (0.0393) | (0.0429) | (7.366) | |

| Sample size | 3088 | 3088 | 3088 | 3088 | 3279 |

| Firm fixed effects | YES | YES | YES | YES | YES |

| Time fixed effects | YES | YES | YES | YES | YES |

| Other control variables | YES | YES | YES | YES | YES |

| R2 | 0.515 | 0.515 | 0.518 | 0.518 | 0.922 |

| Variable | Panel A | Panel B | |||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (3) | (1) | |

| Enterprise Innovation | Enterprise Innovation | Enterprise Innovation | Enterprise Innovation | EPU | |

| EPU | 0.00909 *** | 0.00909 *** | 0.00116 *** | −0.00834 *** | |

| (0.000206) | (0.000206) | (0.000226) | (0.000372) | ||

| did* | −0.000545 *** | −0.000470 *** | −0.0199 *** | −0.0000 *** | |

| (0.000130) | (0.000130) | (0.000471) | (0) | ||

| EPU × did* | 0.00331 *** | 0.00331 *** | |||

| (7.14 × 10−5) | (7.14 × 10−5) | ||||

| Intercept item | −0.0362 *** | −0.0362 *** | 0.0162 *** | 0.0664 *** | −0.5771 |

| (0.00119) | (0.00119) | (0.000367) | (0.00222) | (0) | |

| Firm fixed effects | YES | YES | YES | YES | YES |

| Other control variables | YES | YES | YES | YES | YES |

| Sample size | 3454 | 3454 | 3454 | 3454 | 3454 |

| R2 | 0.087 | 0.087 | 0.119 | 0.119 | 0.004 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, X.; He, X.; Zhou, L.; Xie, S. Impact of Epidemics on Enterprise Innovation: An Analysis of COVID-19 and SARS. Sustainability 2022, 14, 5223. https://doi.org/10.3390/su14095223

Li X, He X, Zhou L, Xie S. Impact of Epidemics on Enterprise Innovation: An Analysis of COVID-19 and SARS. Sustainability. 2022; 14(9):5223. https://doi.org/10.3390/su14095223

Chicago/Turabian StyleLi, Xin, Xingyuan He, Lu Zhou, and Shushu Xie. 2022. "Impact of Epidemics on Enterprise Innovation: An Analysis of COVID-19 and SARS" Sustainability 14, no. 9: 5223. https://doi.org/10.3390/su14095223

APA StyleLi, X., He, X., Zhou, L., & Xie, S. (2022). Impact of Epidemics on Enterprise Innovation: An Analysis of COVID-19 and SARS. Sustainability, 14(9), 5223. https://doi.org/10.3390/su14095223