1. Introduction

In recent years, renewable energy (RE) has developed rapidly in China due to the intensive policy incentives enacted there. However, the country faces severe RE curtailment and heavy subsidies of Feed in Tariff (FIT) [

1], due to the aggressive RE installation. In order to improve the consumption of RE, in 2016, China became the first country to adopt the policies of FIT and Renewable Portfolio Standard (RPS) [

2]; RPS and trade of green certificate (TGC) have been built in 31 provinces [

3]. In addition, in May 2019, National Energy Administration (NEA) adopted the weight of consumption responsibility to replace the quota index and updated the target of RE in the energy consumption mix [

4]. On 21 May 2021, NEA announced that the weight of RE consumption responsibility of each province would be released annually in succession and would be evaluated as an obligatory target [

5].

With these policies in place, both green power plants (mainly wind power plants and photovoltaic plants) and power sales companies are eager to maximize their profits. It is necessary to analyze their tradable strategies and behavioral decisions under the mechanism of RE consumption responsibility weight. This issue is not only a scientific question but also a focus of political and economic development. Recent studies have aimed to demonstrate the social acceptance of RPS [

6,

7,

8], the comparison between RPS and other incentives [

9,

10], the quota and mechanism [

11,

12] of RPS allocation [

13,

14], and improvement on the RE of RPS [

15,

16,

17], while some work has focused on the behavioral decisions and stability strategies of the policy executor.

A game model is typically employed to analyze the behavior decisions and stability strategies for electricity producers. Zhou and Liu [

18] and Ghaffari et al. [

19] simulated the relationship between green and thermal power producers with Nash game model, and they concluded that when TGC prices increased, the green power output increased and the total profit first decreased, then increased. Zhao and Zhou [

20] concluded that RPS became effective when one unit fine was two times the price of TGC using subjective game.

Evolutionary games are used more in the analysis of RPS, with a predominance of two-sided and three-sided games. The two-sided game are mainly the game between thermal power plants (mainly coal-fired and gas-fired power plants) and green power plants. Wan [

21] and Zuo et al. [

22] found that high-level fines can increase the transaction of TGC. Zhao et al. [

23,

24] concluded that an optimal quota, high unit fine, lower transaction cost and marginal cost difference of green and thermal power contributed to improving the effectiveness of RPS. A dynamic system of rewards and fines helps the system to reach equilibrium more than a static one [

25,

26], and a higher ceiling on unit fines can facilitate the completion of quota targets by power producers. When considering government regulation as an influencing factor in the third-party games, Cheng et al. [

27] revealed that effective government supervision can promote new energy accommodation. However, strict regulation by the central government has a more significant effect only in scenarios where high excess quotas are achieved [

28]; meanwhile, thermal power generators will adopt the low-price strategy to ensure the profit space [

29]. Zhu et al. [

30] found that increased penalties can force high-cost power sellers to comply with quota obligations and help regulators avoid unnecessary regulation. To essentially ensure all the power sales companies comply with quota obligation, TGC price should be maintained at desired levels, and incentive and punishment should be within a reasonable range [

31,

32]. A detailed comparison of the evolutionary game literature is shown in

Table 1.

In the above studies, the focus has been on the behavioral strategies between green power and thermal power producers, at the same time, the transactions are mainly for TGC, while less attention has been given to examining the behavioral decisions of power sales companies and green power trade behavior.

With the deepening reform in electric power systems, there is a game between buyers and sellers of green power and TGC. Evolutionary game theory can provide a scientific analysis paradigm for this study. In addition, power sales companies are the first responsible subjects under the mechanism of the RE consumption guarantee [

4,

5,

33]. Therefore, in this paper, the tradable strategies and behavioral decisions between green power plants and power sales companies are analyzed based on the evolutionary game model. The analyzed results are then compared to select several stable strategies for achieving the goal of revenue maximization. In addition, some possible stable situations are also investigated to obtain a range of policy parameters concerning the general stable equilibrium points.

This paper is organized as follows.

Section 2 gives a brief introduction to the evolutionary game model and System Dynamics (SD) simulation.

Section 3 establishes a game model according to the behavior strategies of green power plants and power sales companies.

Section 4 analyzes the stability of evolutionary game.

Section 5 discusses the general equilibrium conditions.

Section 6 takes Ningxia Hui Autonomous Region as an example to analyze the sensitivity for both sides with different fines. Finally,

Section 7 presents the conclusions of this study.

3. Behavioral Strategies of Green Power Plants and Power Sales Companies

Against the background of the RE consumption guarantee mechanism, green power plants are typically the sellers, while power sales companies are the buyers. The buyers have the obligation to integrate a specified percentage of RE in a consumption market. If buyers cannot complete the consumption obligation, then they must pay a certain number of fines or purchase TGC to offset the difference.

The income of sellers is divided into two parts: gaining profit by selling green power, and selling excess consumption with TGC in the market. If sellers sell TGC, then they will no longer enjoy subsidies for this portion of electricity.

Both players of the game can choose whether or not to participate in the transaction, and they may adjust their strategies based on the revenue maximization. Only when both sides adopt the trading strategy can they make a match to trade successfully.

In the total number of green power plants, the proportion of individuals participating in the transaction is assumed as x so that the proportion of individuals who choose not to participate is 1 − x. In the total number of power sales companies, the proportion of individuals participating in the transaction is y, thus the proportion of individuals who choose not to participate is 1 − y. Therefore, x and y denote the probability of participating in the transaction for green power plants and power sales companies, respectively. Similarly, 1 − x and 1 − y denote the probability of not participating in the transaction for both sides, respectively, and there are four combined behavioral strategies.

Under these four different combinations of behavioral strategies, their revenue matrix of tradable strategies is shown in

Table 2.

The four elements of this revenue matrix have the following meanings:

- (1)

signifies that both sides choose the transaction of green power, where is the revenue for selling green power, and is the opposite of the payment for buying green power; namely, is the revenue of participating in the transaction for power sales companies.

- (2)

signifies that both sides do not choose the transaction of green power, where is the revenue for not selling green power, and is the revenue for not buying green power. Namely, green power plants do not gain incomes, and power sales companies pay fines.

- (3)

signifies that one side chooses the transaction, and the other does not choose, where is the revenue for selling green power, and is the revenue for not buying green power. This means that green power plants will convert green electricity into TGC to gain profits in the consumption market, and power sales companies will pay fines.

- (4)

also signifies that one side chooses the transaction, and the other does not choose, where is the revenue for not selling green power, and is the revenue for still buying green power. This means that green power plants will have no income, and power sales companies can only buy TGC from the consumption market.

Next, based on the four combined tradable strategies, the revenue matrix of green power plants and power sales companies can be represented as Equation (1):

The meanings and units of the parameters in Equation (1) are shown in

Table 3.

5. Discussion for General Equilibrium Conditions

According to the Lyapunov stability theory [

22,

33], the types of equilibrium points can be determined by calculating the determinant det(J) and trace tr(J) of the Jacobian matrix. The equilibrium point is an ESS when det(J) > 0 and tr(J) < 0. It is an unstable point when det(J) > 0 and tr(J) > 0, and it is a saddle point when det(J) < 0 [

33]. Due to the fact that the trace of

equals 0, only the first four possible equilibrium points will be analyzed.

In order to facilitate the calculation,

,

,

and

are respectively defined as the following equations:

Then, the determinant det(J) and trace tr(J) of the first four possible equilibrium points are as shown in

Table 5.

According to the positive and negative symbols of

A,

B,

E and

D, there are 16 cases for the stability analysis, and the determinant det(J) and trace tr(J) can be calculated. However, the trading is only possible when A is greater than 0. Therefore, there are a total of eight tradable cases, and their ESS are shown in

Table 6.

Unstable points are the beginning of the evolutionary process, and saddle points are transition points in the evolutionary process. Case 1 has no points of ESS, while Case 2 has two saddle points and one ESS point, Case 4 has two points of ESS, and Cases 3 and 7 have one point of ESS and two saddle points. Taking the above cases as an example, their dynamics evolution schematic diagrams are shown in

Figure 1, which represent the evolutionary process of each case. Evidently, the diagram of Case 1 is a closed circle; thus, there is no ESS point for this case.

According to

Table 6, in Cases 3 and 7, two ESS points can be traded successfully. They share a common condition (

). Therefore, there are three general conditions for a successful transaction between green power plants and power sales companies:

, , the price for TGC is higher than the unit transaction cost for green power plants;

,, the real transaction price of RE is higher than the cost of unit transaction for green power plants;

, , the unit fine is higher than the sum of FIT and the unit transaction cost for power sales companies.

Table 7 compares our results with those of previous studies. Based on game theory, other three studies have focused on the behavior strategies between green power plants and thermal power plants. In comparison with the other three literatures, the present study obtains the range of three important policy parameters and reveals the relationship between these three parameters and their unit transaction costs of both sides.

Based on the above model, these ranges reflect the magnitude between fines and the cost of renewable energy generation, subsidies and FIT. When equals 0, then . When both sides share the transaction costs equally (), then . In addition, if , then the range of unit fine is consistent with the conclusions of the first two articles. In order to trade successfully, the ranges of RE and TGC price are also reasonable according to the market-based price mechanism. Then, green power plants are willing to participate in the trade to reduce the burden of renewable energy subsidies for the government.

6. Example

In this section, we take Ningxia Hui Autonomous Region, which is China’s first new energy demonstration area, as an example to analyze the unit fine and the price of TGC, using the scenario analysis method.

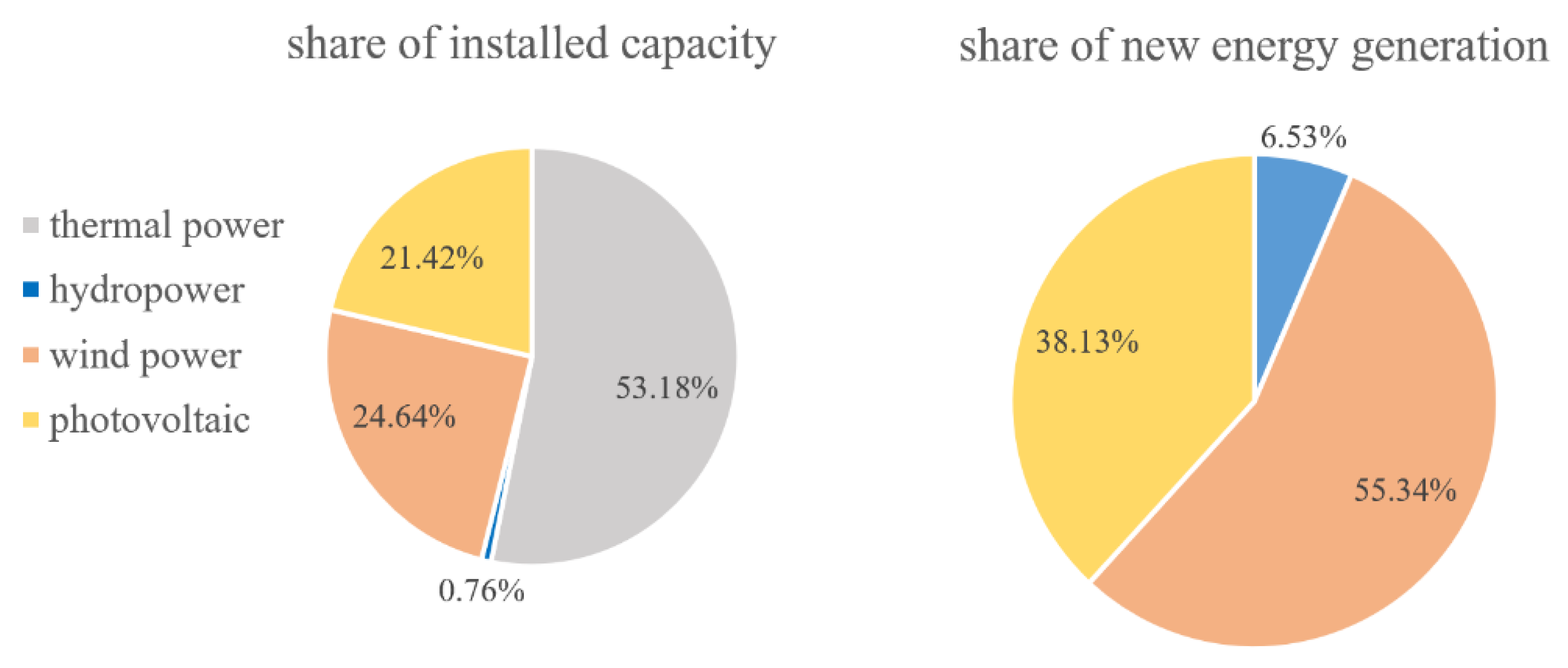

Ningxia is China’s smallest inland territory. As of the end of 2020, the total installed capacity of regulated electricity in Ningxia was 55,870 MW, among which the installed capacity of thermal power (mainly coal-fired and gas-fired power) was 29,710 MW, wind power installed capacity was 13,766 MW, and photovoltaic power installed capacity was 11,971 MW [

34]. The share of RE installed capacity was approximately 46.8%, while the proportion of RE generation was 20.2%. The new energy generation was 34.5 TWh, of which wind power accounted for 55.3% and photovoltaic power for 38.1%. The shares of installed capacity and generation power of each power source are shown in

Figure 2. Because the share of hydropower is very small in Ningxia, green power calculated in the latter analysis is mainly wind power and photovoltaic power.

To facilitate the calculation, we simplified the formula of unit fine as

, and the price of TGC as

. This is the lower boundary of the inequality in the results, the goal of which is to explore the effect of the policy with relatively conservative policy parameters. According to the model results, we collected the values of key parameters from official statistics and previous studies. The different values of each parameter at initial stage, intermediate stage and mature stage represent the three developing stages of the regional electricity market. In Ningxia, the FIT of coal power is 0.26 yuan/kWh [

35], and that of RE is in accordance with the benchmark price of coal power [

36], so the mature FIT of wind power and photovoltaic power is 0.26 yuan/kWh. The initial FIT of wind power is 0.38 yuan/kWh [

37] and that of photovoltaic power is 0.35 yuan/kWh [

38]. The cost of unit green power can be calculated by the levelized cost of electricity (LCOE) for wind power and photovoltaic power, where the LCOE of wind power for the three stages are 0.50 yuan/kWh, 0.45 yuan/kWh and 0.44 yuan/kWh [

39,

40]. In addition, the LCOE of photovoltaic power are 0.77 yuan/kWh, 0.66 yuan/kWh and 0.62 yuan/kWh [

40]. We assume that the cost coefficient for both sides is 0.5, the parameters and the corresponding values are listed in

Table 8, and the calculated fines are also shown in the last two rows of the table.

According to the generation ratios of wind power and photovoltaic power, the FIT and the cost of unit green power are respectively calculated. Based on the model results, the price of TGC and one unit fine are also calculated. At present, Ningxia only monitors and assesses the amount of consumption and has yet to set specific fines. The calculated fines in the present study are also greater than 0.5 yuan/kWh. In most cases, the effective fines increase from 0.5 yuan/kWh to 2 yuan/kWh, otherwise power sales companies will abandon RE consumption due to a heavy punishment [

26]. It appears that these calculated fines are moderate. Since 2021, China has completely eliminated RE subsidies for onshore wind power. Therefore, the two formulas for unit fines are the same in the two studies respectively performed by Zhao et al. [

23,

24]. The calculated results in the last row are generally consistent with the results of the present study.

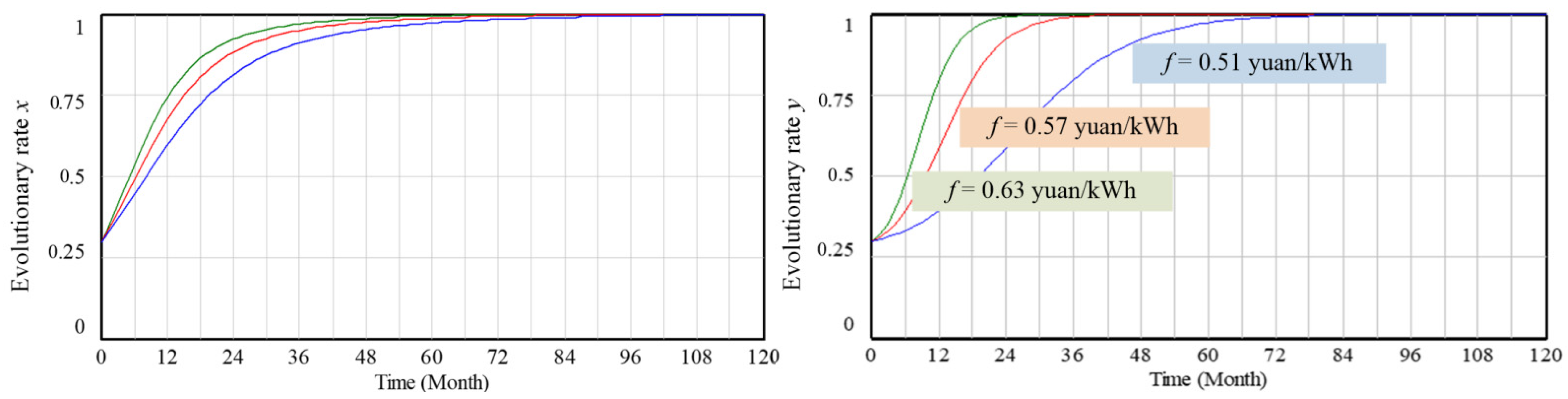

To explore the sensitivity of both sides to different fines, we establish a simple system dynamics (SD) model based on the replicator dynamics equations. We conduct the model validation from the perspective of structural validity and behavioral validity. The results of model validation show that there are no mechanical or dimensional consistency errors in the SD model. Due to the fact that the weighting of the consumption responsibility for power sales companies is 27.5% [

41], after the decomposition of the consumption task, the initial evolutionary rate is also set to 0.30 for both sides’ strategies. The simulation is carried out from 2020 to 2030, for a total of 120 months. The evolution processes of the green power plants and power sales companies with different fines are shown in

Figure 3.

As shown in

Figure 3, the unit fines indeed exert an influence on the behavioral decisions for both sides. The evolutionary rate increases with the increase in unit fines. As the unit fine is 0.63 yuan/kWh, it will take 24 months for the power sales companies to achieve full participation in RE consumption, while the green power plants will require 54 months to achieve this. Compared with green power plants, power sales companies are more sensitive to different fines. The unit cost of green power has not dropped to the benchmark price of coal power, while the RE subsidies are being phased out; thus, green power plants tend to sell more green power in order to reduce the loss of investment cost, and as a result they are not highly sensitive to the fines. For both sides, the heavier the punishment is, the larger the growth rate of the evolutionary process will be. However, an even heavier punishment does not lead to superior results, and the behaviors of power sales companies cannot be restrained by a heavy punishment. Instead, appropriate incentives should be integrated with punishment so as to facilitate the implementation of RPS [

26].

7. Conclusions

In this paper, an evolutionary game theory was developed to study the tradable strategies and behavioral decisions of green power plants and power sales companies. In addition, the stability strategies and general stability conditions of China’s RPS were discussed. These three general conditions for a successful transaction reflect the magnitude between the penalties and cost of renewable energy generation, subsidies and FIT. The analysis results indicate that the government must ensure the effectiveness of China’s RPS by means of designing scientific parameters. With different fines, power sales companies’ strategy selection becomes more sensitive than that of green power plants. With China’s electric power system reform, RE subsidies will be eliminated, and electricity price mechanisms will change from fixed price to market-based price mechanisms, while China’s RPS can be implemented provided that RE price and TGC price are higher than their transaction costs. Under such conditions, both sides will have the willingness and motivation to participate in the consumption market.

Based on the results of this paper, the future research can be further studied from the following aspects. First, future research can study more than three parties in the games under the consumption regime, such as large electricity consumers, fractional consumers, green power plants, traditional power plants, power sales companies and power grid companies. Second, future research can also explore multiple policy parameters to synergistically influence RE consumption in the regional markets of China.