Can Digital Technologies Increase Consumer Acceptance of Circular Business Models? The Case of Second Hand Fashion

Abstract

:1. Introduction

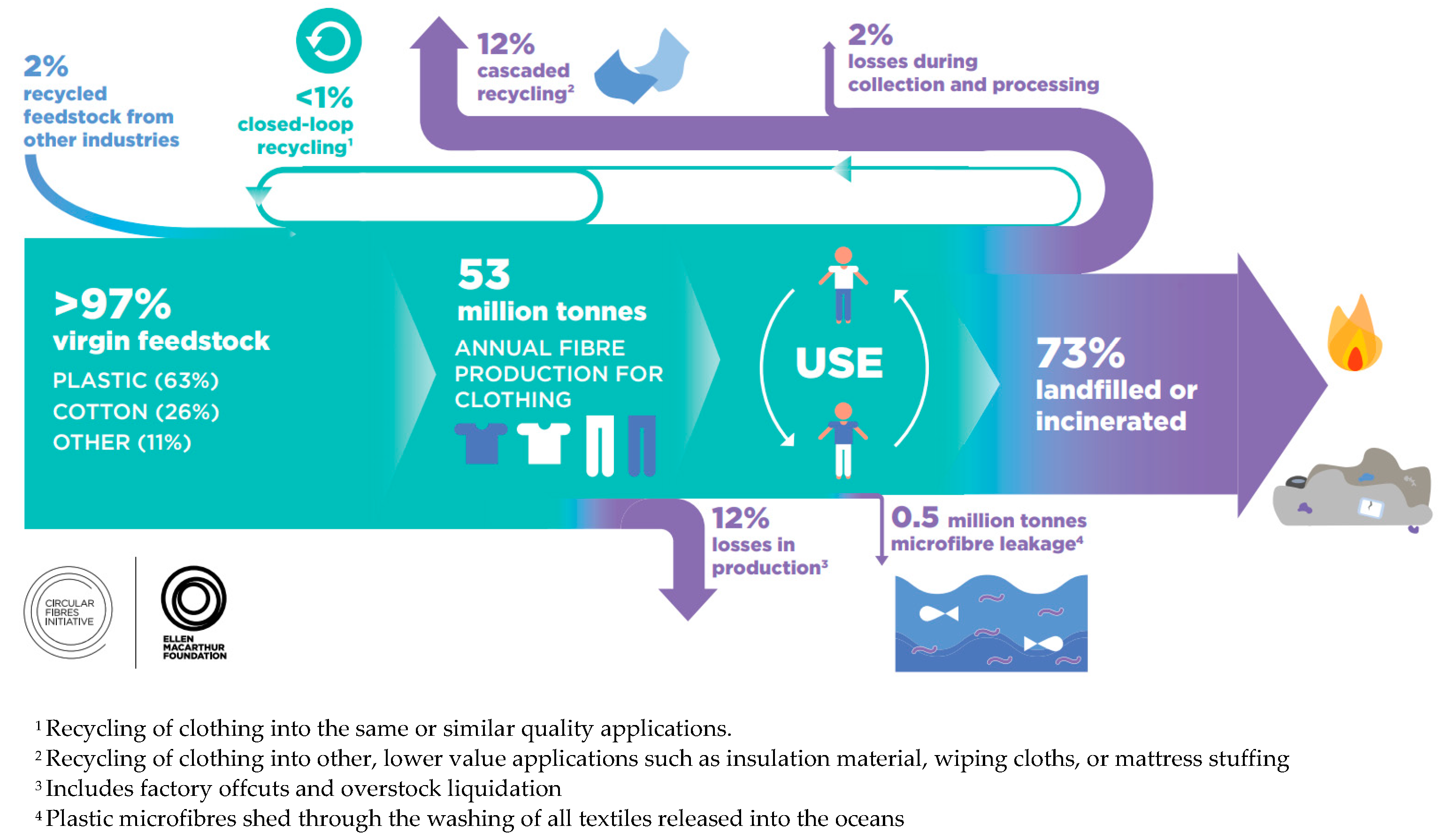

- Reusing clothes has environmental benefits;

- Reusing clothes is more beneficial than recycling;

- Life cycle analysis (LCA) shows that one also has to consider potential negative side effects, mainly from increased transportation and logistics to hand over garments from one person to another.

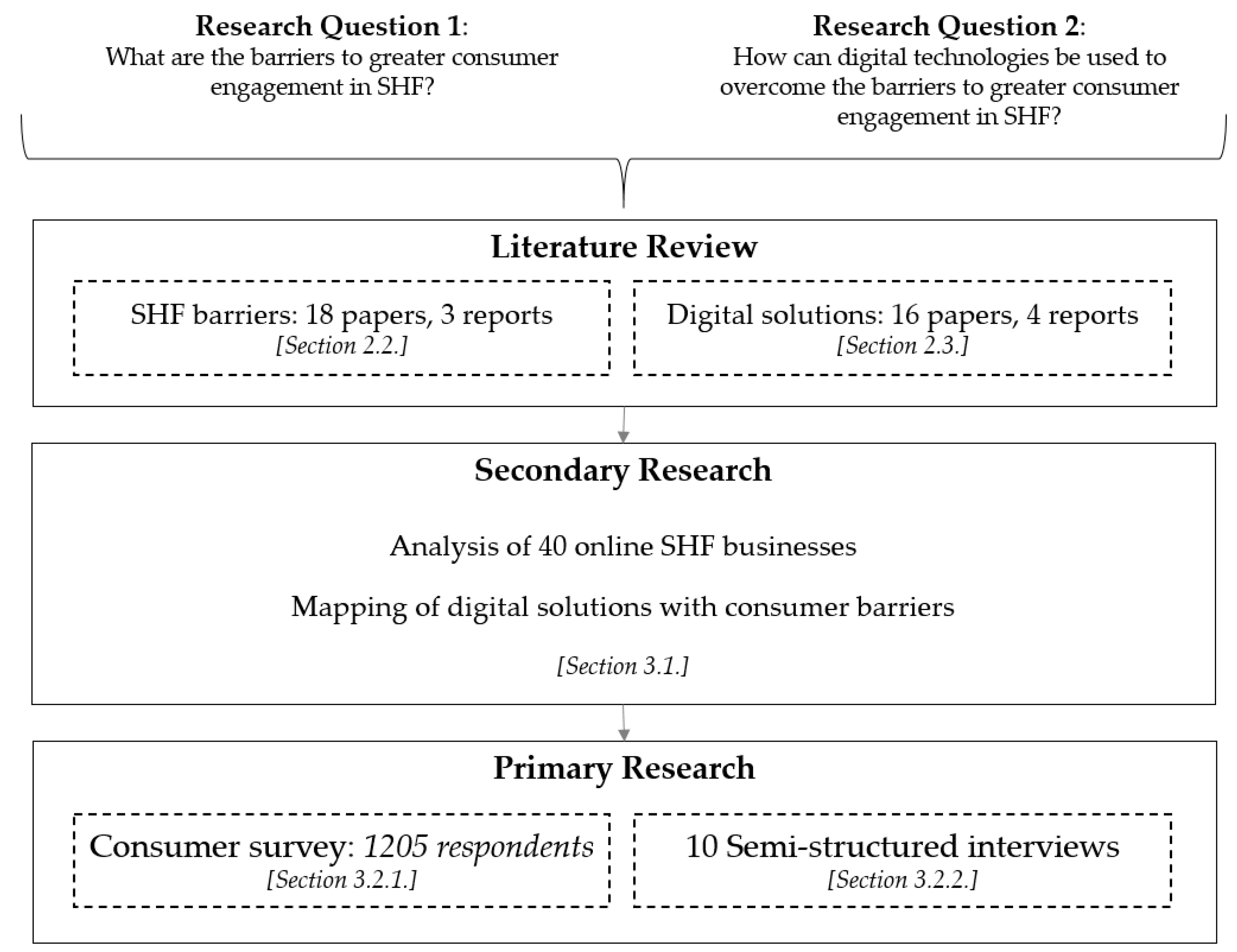

- Identify the key consumer barriers associated with SHF;

- Identify business models that facilitate fashion reuse;

- Assess the use of digital technologies within identified business models; and

- Assess how these digital technologies address consumer barriers and enable a greater engagement in SHF.

2. Literature Review

2.1. Overview of Recent Trend and New Concepts in Research

2.2. Analysis of Barriers to Consumer Engagement

- Inconvenience;

- Concerns about hygiene;

- Lack of trust; and

- Lack of transparency around pricing.

2.2.1. Inconvenience

2.2.2. Concerns about Hygiene

2.2.3. Lack of Trust

2.2.4. Lack of Transparency around Pricing

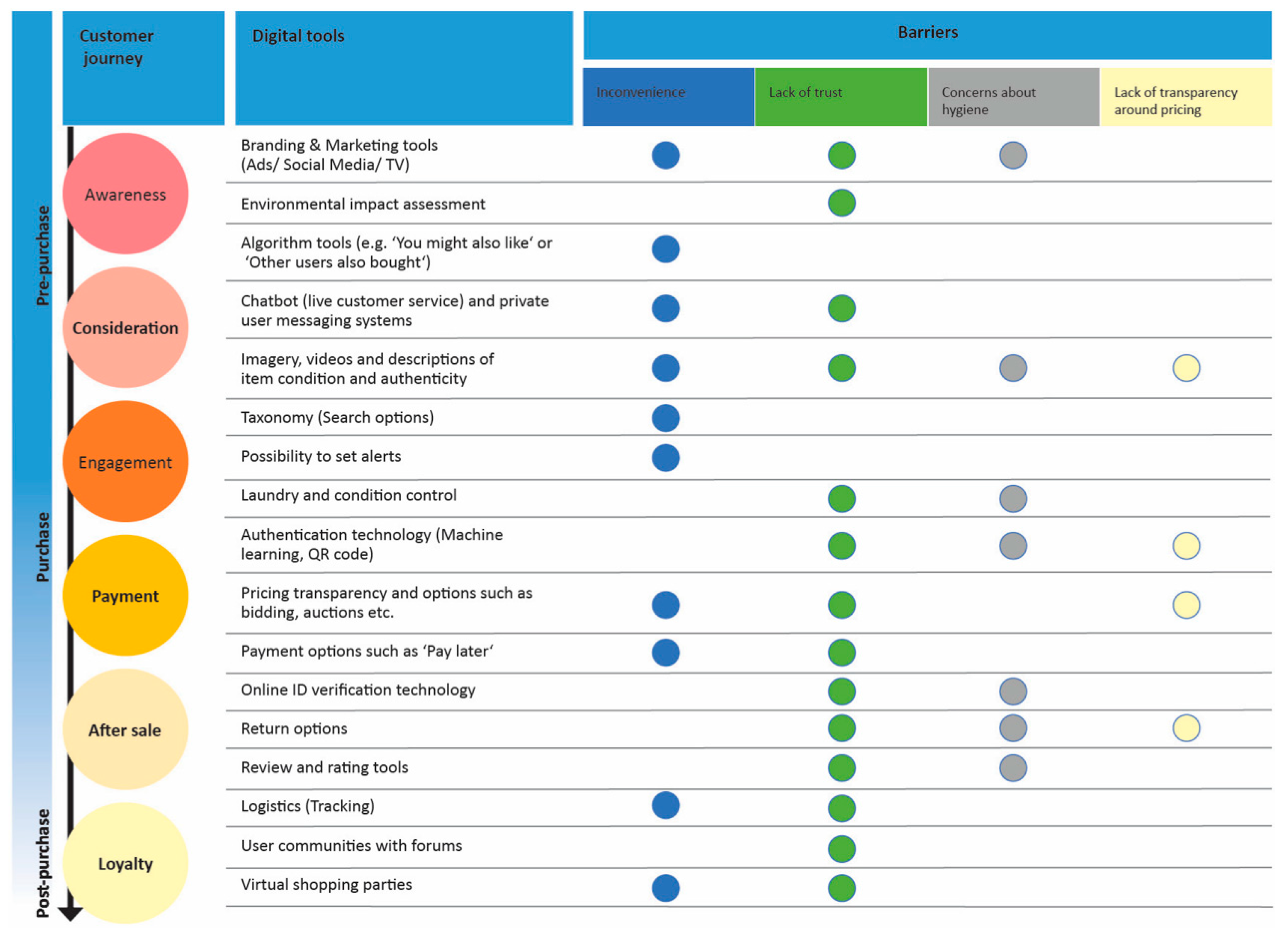

2.3. Analysis of Digital Solutions to Overcome Barriers to Consumer Engagement

3. Materials and Methods

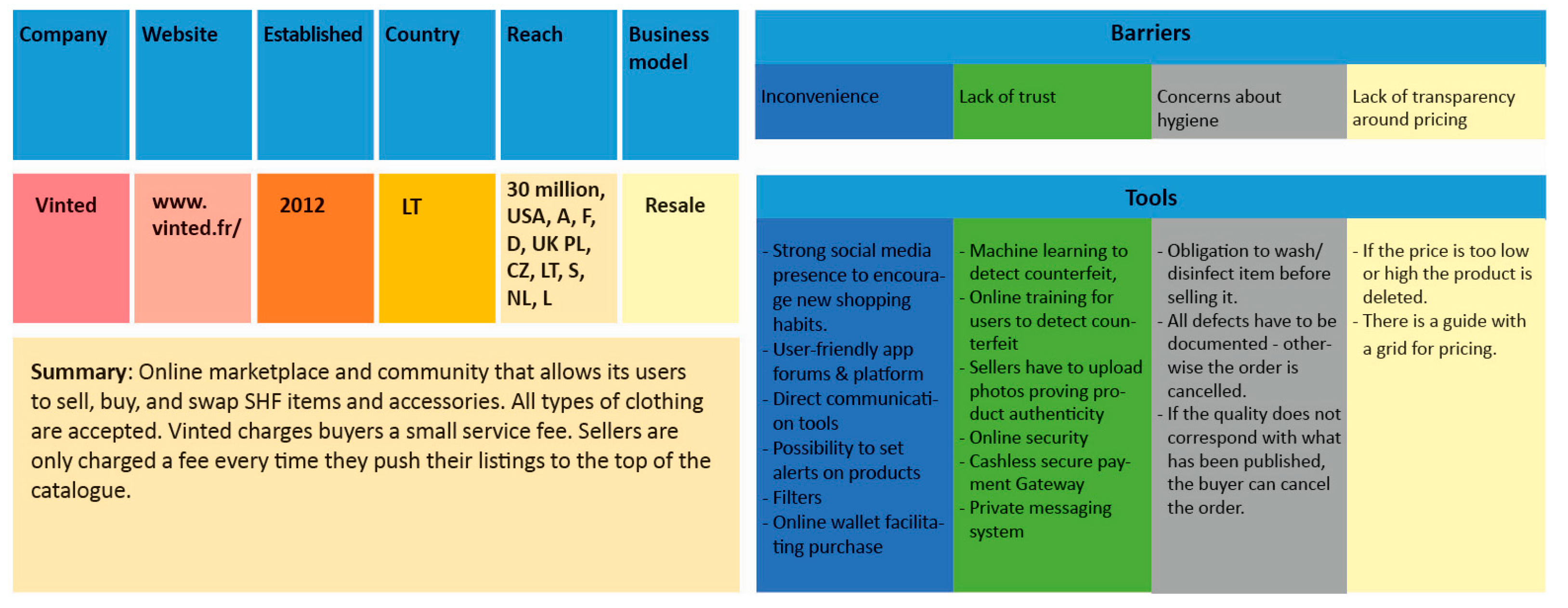

3.1. Secondary Research

- The selected companies’ approaches to CE solutions (i.e., the digital solutions in use), versus

- The consumer barriers (as per Section 2.2) being addressed by such an approach; whilst also aligning with

- The customer journey on a SHF platform, with six individual phases that a customer goes through from pre- to postpurchase [47].

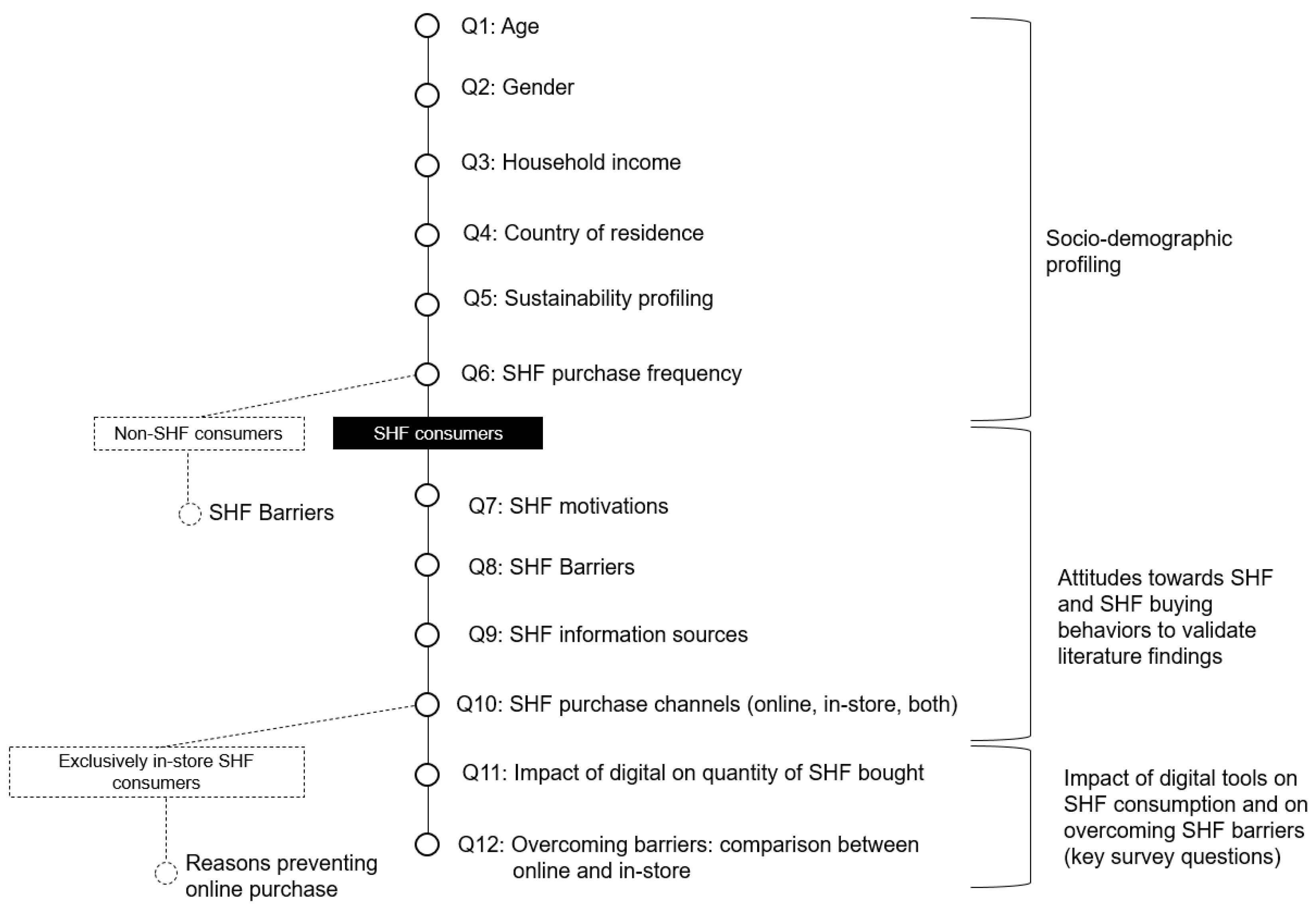

3.2. Primary Research

3.2.1. Survey

3.2.2. Interviews

- CE business models in use and the type of CE business strategy;

- Target markets, main customers, and any target consumers that are hard to reach;

- Typical barriers observed among consumers;

- Current and emerging digital solutions in the fashion industry; and

- Importance of sustainability to consumers and if/how organisations are measuring and marketing their environmental impact.

4. Results

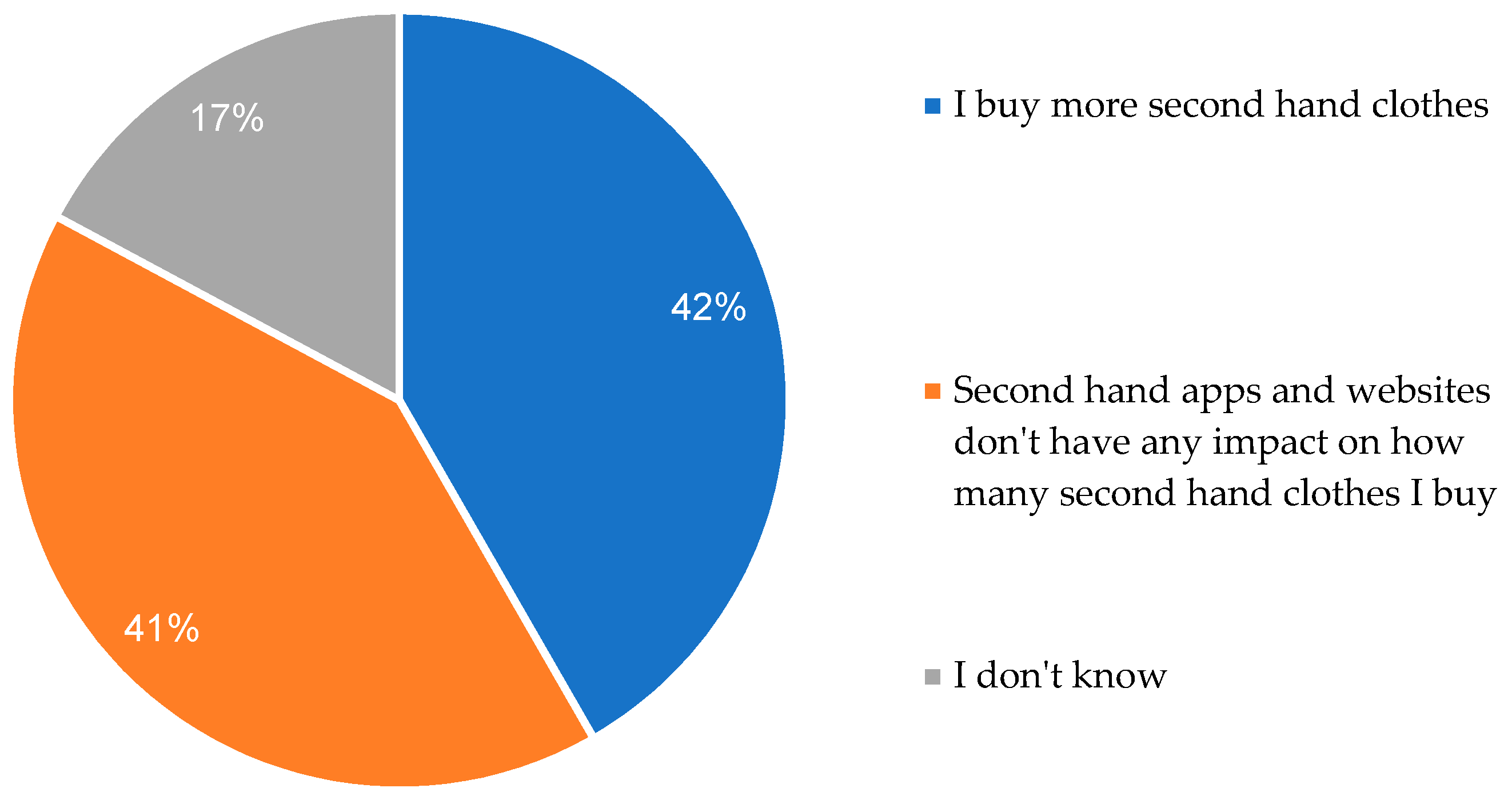

4.1. Survey Results

4.2. Interview Results

4.2.1. CE Business Models

4.2.2. Identified Barriers

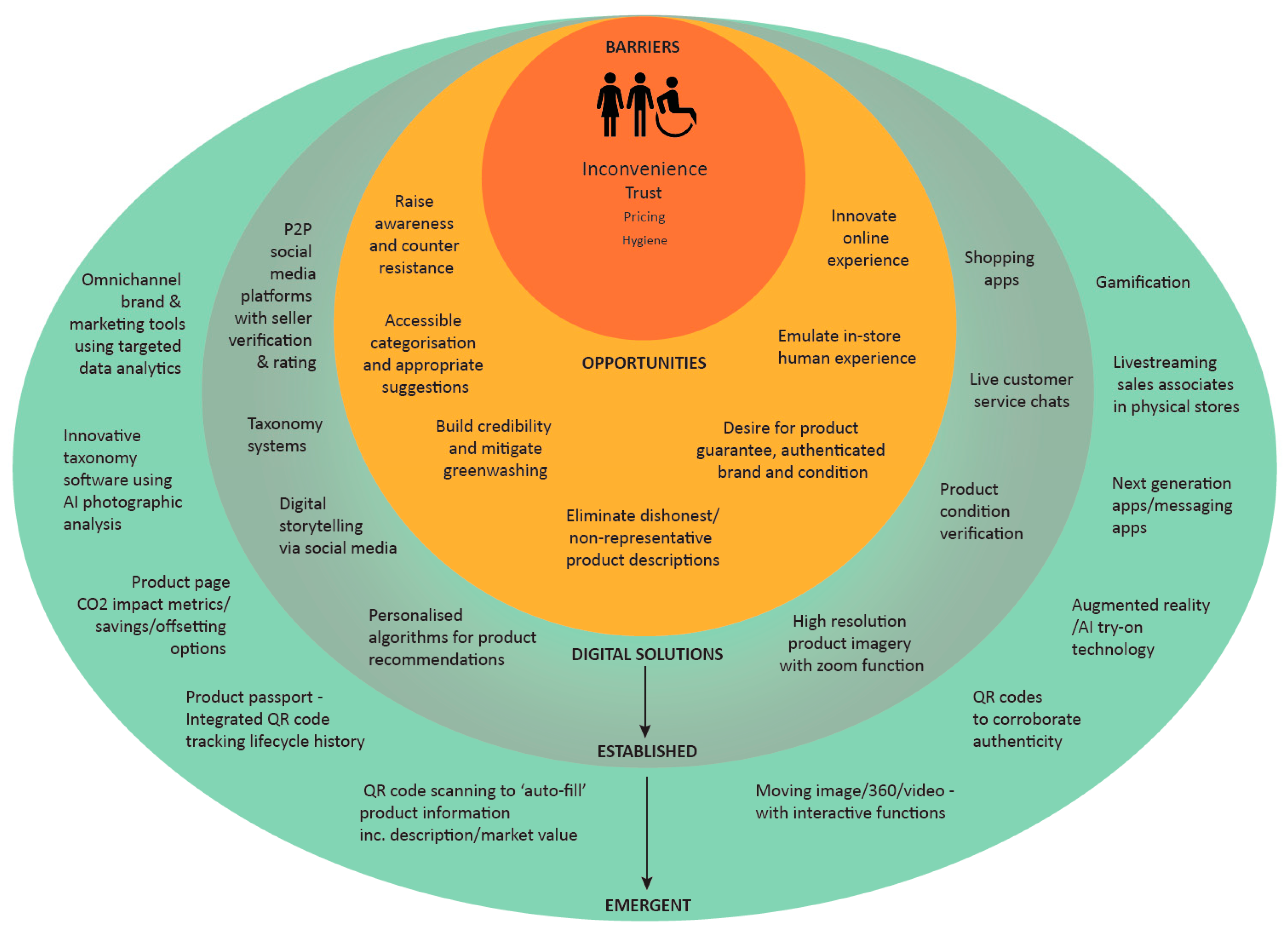

5. Discussion and Conclusions

5.1. The Key Engagement Barriers and Digital Solutions

5.2. Opportunities for SHF Businesses

5.3. Limitations and Future Research Areas

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

Appendix C

- Introduction:

- -

- We are interviewing X companies;

- -

- Interviewees are anonymous and will not be named in the report, unless you ask us to list your name/company name;

- -

- We would be pleased to share with you a copy of the report/research findings; and

- -

- To make best use of the time we have today, we plan to record the interview audio as this will help to ensure we capture things accurately and make the best use of our time today.

- Interview:

- -

- Company name:

- -

- Interviewee’s role, length of service, etc.

- What is your business model type?

- 2.

- Who is your main customer for this model?

- 3.

- What are the customer barriers you experience and how do you counter these?

- 4.

- What digital solutions/digital tools do you think are paramount to your investment in this strategy?

- 5.

- What current digital projects or initiatives on customer engagement are you working on?

- 6.

- How do you measure the environmental impact of your model?

- 7.

- How important is this/sustainability to your customers?

References

- Shahbandeh, M. Global Apparel Market—Statistics & Facts. Statista. 2021. Available online: https://www.statista.com/topics/5091/apparel-market-worldwide/#dossierKeyfigures (accessed on 30 March 2022).

- Ellen MacArthur Foundation. Circular Fashion—A New Textiles Economy: Redesigning Fashion’s Future; Ellen MacArthur Foundation: Cowes, UK, 2017. [Google Scholar]

- Global Fashion Agenda. Pulse of the Fashion Industry. Global Fashion Agenda & The Boston Consulting Group. 2017. Available online: https://www.globalfashionagenda.com/publications-and-policy/pulse-of-the-industry/ (accessed on 21 July 2021).

- Zamani, B.; Sandin, G.; Peters, G.M. Life cycle assessment of clothing libraries: Can collaborative consumption reduce the environmental impact of fast fashion? J. Clean Prod. 2017, 162, 1368–1375. [Google Scholar] [CrossRef]

- Sandin, G.; Peters, G.M. Environmental impact of textile reuse and recycling—A review. J. Clean Prod. 2018, 184, 353–365. [Google Scholar] [CrossRef]

- Farrant, L.; Olsen, S.I.; Wangel, A. Environmental benefits from reusing clothes. Int. J. Life Cycle Assess. 2010, 15, 726–736. [Google Scholar] [CrossRef]

- Kirchherr, J.; Piscicelli, L.; Bour, R.; Kostense-Smit, E.; Muller, J.; Huibrechtse-Truijens, A.; Hekkert, M. Barriers to the Circular Economy: Evidence From the European Union (EU). Ecol. Econ. 2018, 150, 264–272. [Google Scholar] [CrossRef] [Green Version]

- Sijtsema, S.J.; Snoek, H.M.; van Haaster-de Winter, M.A.; Dagevos, H. Let’s Talk about Circular Economy: A Qualitative Exploration of Consumer Perceptions. Sustainability 2020, 12, 286. [Google Scholar] [CrossRef] [Green Version]

- Lacy, P.; Rutqvist, J. Waste to Wealth: The Circular Economy Advantage; Palgrave Macmillan: New York, NY, USA, 2015. [Google Scholar]

- Di Silvestre, M.L.; Favuzza, S.; Riva Sanseverino, E.; Zizzo, G. How Decarbonization, Digitalization and Decentralization are changing key power infrastructures. Renew. Sustain. Energy Rev. 2018, 93, 483–498. [Google Scholar] [CrossRef]

- Thredup. 2021 Fashion Resale Market and Trend Report. Available online: https://www.thredup.com/resale/ (accessed on 10 July 2021).

- Anon. Research and Markets Adds Report: Global Online Clothing Rental Market (2018–2023); Netscribes (India) Pvt Ltd.: Mumbai, India, 2019. [Google Scholar]

- PricewaterhouseCoopers. Renting or Buying Second-Hand Clothing as a Sustainable Option 2020. Available online: https://www.pwc.nl/en/insights-and-publications/services-and-industries/retail-and-consumer-goods/renting-or-buying-second-hand-clothing-as-a-sustainable-option.html (accessed on 10 July 2020).

- Brydges, T.; Retamal, M.; Hanlon, M. Will COVID-19 support the transition to a more sustainable fashion industry? Sustain. Sci. Pract. Policy 2020, 16, 298–308. [Google Scholar] [CrossRef]

- Magyar, J. How COVID-19 Is Nudging the Fashion Industry to Go Circular. Available online: https://www.forbes.com/sites/sap/2021/01/12/how-COVID-19-is-nudging-the-fashion-industry-to-go-circular/ (accessed on 10 July 2020).

- Camacho-Otero, J.; Boks, C.; Pettersen, I.N. Consumption in the Circular Economy: A Literature Review. Sustainability 2018, 10, 2758. [Google Scholar] [CrossRef] [Green Version]

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions a New Circular Economy Action Plan for a Cleaner and More Competitive Europe; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Amed, I.; Balshandani, A.; Berg, A.; Ekeløf Jensen, J.; Rölkens, F. The State of Fashion 2021: In Search of Promise in Perilous Times; McKinsey & Company: Atlanta, GA, USA, 2020. [Google Scholar]

- Iran, S.; Schrader, U. Collaborative fashion consumption and its environmental effects. J. Fash. Mark. Manag. Int. J. 2017, 21, 468–482. [Google Scholar] [CrossRef]

- Schor, J.; Fitzmaurice, C. Collaborating and connecting: The emergence of the sharing economy. In Handbook of Research on Sustainable Consumption; Edward Elgar Publishing: Cheltenham, UK, 2015. [Google Scholar]

- Belk, R. You are what you can access: Sharing and collaborative consumption online. J. Bus. Res. 2014, 67, 1595–1600. [Google Scholar] [CrossRef]

- Bardhi, F.; Eckhardt, G. Access-based consumption: The case of car sharing. J. Consum. 2012, 39, 881–898. [Google Scholar] [CrossRef]

- Catulli, M. What uncertainty? Further insight into why consumers might be distrustful of product service systems. J. Manuf. Technol. Manag. 2012, 23, 780–793. [Google Scholar] [CrossRef] [Green Version]

- Silva, S.C.; Santos, A.; Duarte, P.; Vlačić, B. The role of social embarrassment, sustainability, familiarity and perception of hygiene in second-hand clothing purchase experience. Int. J. Retail. Distrib. Manag. 2021, 49, 717–734. [Google Scholar] [CrossRef]

- Bani, M.B.M. Rethinking the Road to the Circular Economy; ING Economics Department: Amsterdam, The Netherlands, 2020. [Google Scholar]

- Tukker, A.; Tischner, U. Product-services as a research field: Past, present and future. Reflections from a decade of research. J. Clean Prod. 2006, 14, 1552–1556. [Google Scholar] [CrossRef]

- Armstrong, C.; Niinimäki, K.; Kujala, S.; Karell, E.; Chunmin, L. Sustainable product-service systems for clothing: Exploring consumer perceptions of consumption alternatives in Finland. J. Clean Prod. 2015, 97, 30–39. [Google Scholar] [CrossRef]

- Rexfelt, O.; Hiort af Ornäs, V. Consumer acceptance of product-service systems: Designing for relative advantages and uncertainty reductions. J. Manuf. Technol. Manag. 2009, 20, 674–699. [Google Scholar] [CrossRef]

- Hirschl, B.; Konrad, W.; Scholl, G. New concepts in product use for sustainable consumption. J. Clean Prod. 2003, 11, 873–881. [Google Scholar] [CrossRef]

- Armstrong, C.M.; Niinimäki, K.; Lang, C.; Kujala, S. A Use-Oriented Clothing Economy? Preliminary Affirmation for Sustainable Clothing Consumption Alternatives. Sustain. Dev. 2016, 24, 18–31. [Google Scholar] [CrossRef]

- Roux, D. Identity and Self-Territory in Second Hand Clothing Transfers. In NA—Advances in Consumer Research; The Association for Consumer Research (ACR): Denver, CO, USA, 2010; Volume 37, pp. 65–68. [Google Scholar]

- Na’amneh, M.M.; Husban, A.K.A. Identity in old clothes: The socio-cultural dynamics of second-hand clothing in Irbid, Jordan. Soc. Identities 2012, 18, 609–621. [Google Scholar] [CrossRef]

- Perry, A.; Chung, T. Understand attitude-behavior gaps and benefit-behavior connections in Eco-Apparel. J. Fash Mark. Manag. 2016, 20, 105–119. [Google Scholar] [CrossRef]

- Fisher, B.; Turner, K.; Zylstra, M.; Brouwer, R.; de Groot, R.; Farber, S.; Ferraro, P.; Green, R.; Hadley, D.; Harlow, J.; et al. Ecosystem Services and Economic Theory: Integration for Policy-Relevant Research. Ecol. Appl. 2008, 18, 2050–2067. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hazée, S.; Delcourt, C.; Van Vaerenbergh, Y. Burdens of Access: Understanding Customer Barriers and Barrier-Attenuating Practices in Access-Based Services. J. Serv. Res. 2017, 20, 441–456. [Google Scholar] [CrossRef] [Green Version]

- Baxter, W.; Aurisicchio, M.; Mugge, R.; Childs, P.R.N. Positive and negative contamination in user interactions. In Proceedings of the 21st International Conference on Engineering Design (ICED 17), Vancouver, BC, Canada, 21–25 August 2017; Volume 8, pp. 509–518, ISBN 21-25082017. [Google Scholar]

- Rachman, S. Fear of contamination. Behav. Res. Ther. 2004, 42, 1227–1255. [Google Scholar] [CrossRef] [PubMed]

- Rozin, P.; Fallon, A.E. A perspective on disgust. Psychol. Rev. 1987, 94, 23–41. [Google Scholar] [CrossRef] [PubMed]

- Demestichas, K.; Daskalakis, E. Information and Communication Technology Solutions for the Circular Economy. Sustainability 2020, 12, 7272. [Google Scholar] [CrossRef]

- Gillpatrick, T.; Blunck, E.; Boğa, S. Understanding the role of consumer behavior in forecasting the impact of industry 4.0 and the wave of digital disruption driving innovation in retailing. Diem. Dubrov Int. Econ. Meet 2019, 4, 165–176. [Google Scholar]

- Bongomin, O.; Gilibrays Ocen, G.; Oyondi Nganyi, E.; Musinguzi, A.; Omara, T. Exponential Disruptive Technologies and the Required Skills of Industry 4.0. J. Eng. 2020, 2020, e4280156. [Google Scholar] [CrossRef] [Green Version]

- High-Tech Fashion: Pandemic Shifts Focus from Physical Garments to Storytelling and Digital Aspiration. Financ Express 2020. Available online: https://www.financialexpress.com/lifestyle/high-tech-fashion-pandemic-shifts-focus-from-physical-garments-to-storytelling-and-digital-aspiration/2107954/ (accessed on 10 July 2021).

- Nast, C. Taxonomy Is the New Fashion-Tech Essential. Vogue Bus 2020. Available online: https://www.voguebusiness.com/technology/taxonomy-is-the-new-fashion-tech-essential-the-yes (accessed on 10 March 2021).

- Velasquez, A.; Velasquez, A. 21 Fashion Trends to Know for 2021. Available online: https://sourcingjournal.com/denim/denim-trends/21-fashion-trends-2021-resale-environmentalism-gaming-hemp-jeans-vegan-252558/ (accessed on 10 March 2021).

- Davis, G. Digital Retail Innovations 2020. Available online: https://www.retailinsider.com/wp-content/uploads/2020/11/Digital-Innovations-Report-2020.pdf (accessed on 10 March 2021).

- ForwardPMX. Luxe Trend Report: Luxury Brands Online 2020. Available online: http://m.yhvip111.com/index-195.html (accessed on 21 July 2021).

- Lemon, K.N.; Verhoef, P.C. Understanding Customer Experience Throughout the Customer Journey. J. Mark. 2016, 80, 69–96. [Google Scholar] [CrossRef]

- Bentley, F.R.; Daskalova, N.; White, B. Comparing the Reliability of Amazon Mechanical Turk and Survey Monkey to Traditional Market Research Surveys. In Proceedings of the 2017 CHI Conference Extended Abstracts on Human Factors in Computing Systems, Denver, CO, USA, 6–11 May 2017; Association for Computing Machinery: New York, NY, USA, 2017; pp. 1092–1099. [Google Scholar] [CrossRef]

- Stewart, N.; Ungemach, C.; Harris, A.J.L.; Bartels, D.M.; Newell, B.R.; Paolacci, G.; Chandler, J. The average laboratory samples a population of 7,300 Amazon Mechanical Turk workers. Judgm. Decis. Mak. 2015, 10, 479–491. [Google Scholar]

- Goodman, J.K.; Cryder, C.E.; Cheema, A. Data Collection in a Flat World: The Strengths and Weaknesses of Mechanical Turk Samples. J. Behav. Decis. Making 2013, 26, 213–224. [Google Scholar] [CrossRef]

- Buhrmester, M.; Kwang, T.; Gosling, S.D. Amazon’s Mechanical Turk: A New Source of Inexpensive, Yet High-Quality Data? American Psychological Association: Washington, DC, USA, 2016. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Charnley, F.; Knecht, F.; Muenkel, H.; Pletosu, D.; Rickard, V.; Sambonet, C.; Schneider, M.; Zhang, C. Can Digital Technologies Increase Consumer Acceptance of Circular Business Models? The Case of Second Hand Fashion. Sustainability 2022, 14, 4589. https://doi.org/10.3390/su14084589

Charnley F, Knecht F, Muenkel H, Pletosu D, Rickard V, Sambonet C, Schneider M, Zhang C. Can Digital Technologies Increase Consumer Acceptance of Circular Business Models? The Case of Second Hand Fashion. Sustainability. 2022; 14(8):4589. https://doi.org/10.3390/su14084589

Chicago/Turabian StyleCharnley, Fiona, Fabienne Knecht, Helge Muenkel, Diana Pletosu, Victoria Rickard, Chiara Sambonet, Martina Schneider, and Chunli Zhang. 2022. "Can Digital Technologies Increase Consumer Acceptance of Circular Business Models? The Case of Second Hand Fashion" Sustainability 14, no. 8: 4589. https://doi.org/10.3390/su14084589

APA StyleCharnley, F., Knecht, F., Muenkel, H., Pletosu, D., Rickard, V., Sambonet, C., Schneider, M., & Zhang, C. (2022). Can Digital Technologies Increase Consumer Acceptance of Circular Business Models? The Case of Second Hand Fashion. Sustainability, 14(8), 4589. https://doi.org/10.3390/su14084589