The Environmental Cost of Attracting FDI: An Empirical Investigation in Brazil

Abstract

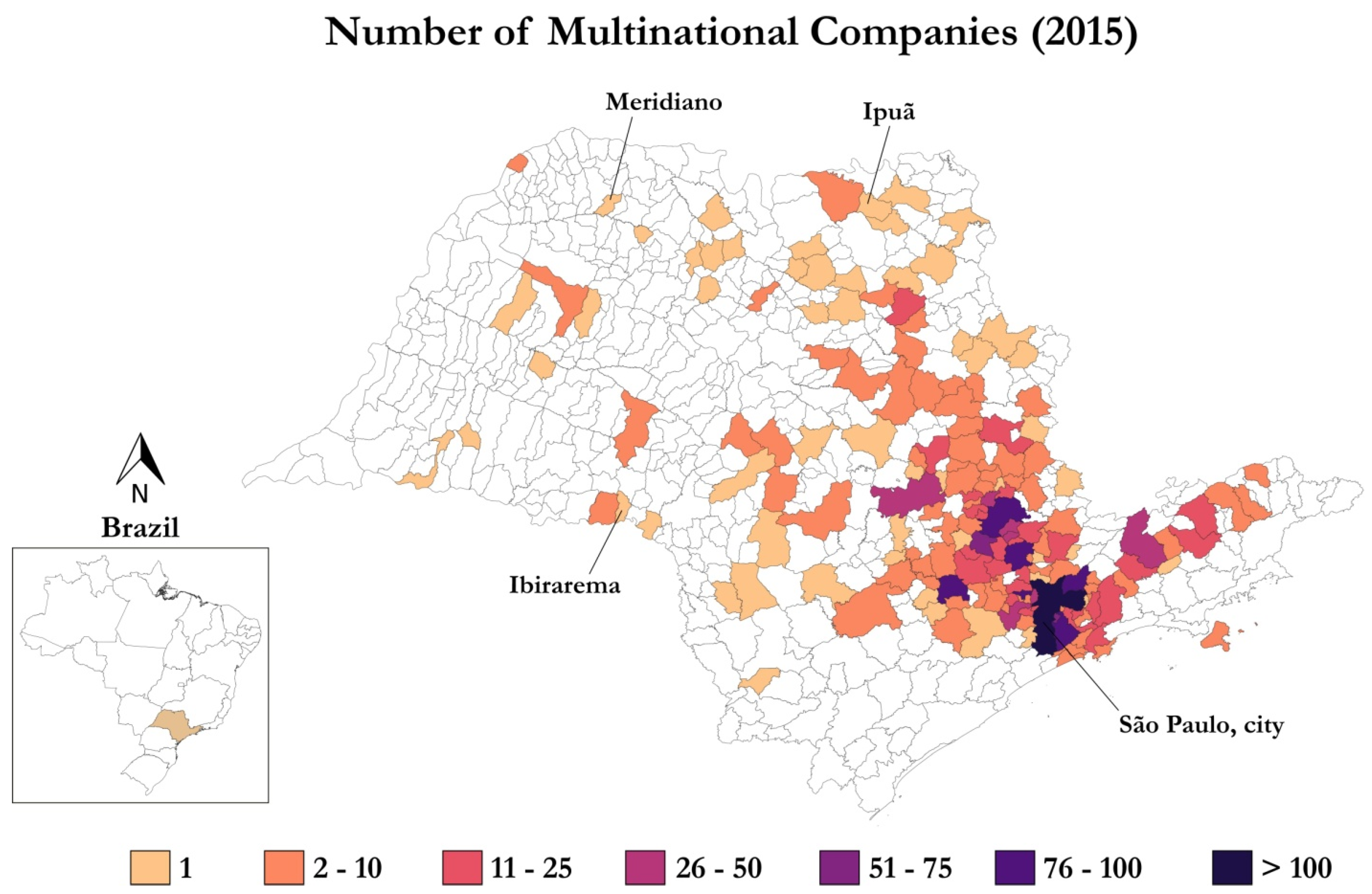

:1. Introduction

2. Data and Method

2.1. The FDI Model

2.2. The FDI Attractiveness Index (FAI)

2.3. The Low-Attractiveness-High-Intensity Index (LAHI)

2.4. The Environmental Model

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Description | Source |

|---|---|---|

| IFDI | Intensity of FDI | Calculated with data from the Atlas of FDI in the State of São Paulo |

| EE | Energy-related CO2 emissions per capita | Calculated with data from the Ministry of Science, Technology, Innovation, and Communications (MCTIC), the National Agency for Petroleum, Natural Gas and Biofuels (ANP), and the Brazilian Energy Research Office (EPE). |

| FAI | FDI Attractiveness Index | Calculated with Data Envelopment Analysis (DEA) |

| LAHI | Low-Attractiveness-High-Intensity Index | Calculated with Data Envelopment Analysis (DEA) |

| DEN | Population density (inhabitants per square kilometer) | Brazilian Institute of Geography and Statistics (IBGE) |

| GDPPC | Real GDP per capita | IBGE |

| IND | Industry’s share of GDP (%) | IBGE |

| SERV | Services’ share of GDP (%) | IBGE |

| PROD | Manufacturing labor productivity (value added by manufacturing/total jobs in manufacturing) | Calculated with data from IBGE and the Annual Social Information Report (RAIS) |

| CONSTR | Jobs in the construction sector (% of total jobs) | RAIS |

| TRANSP | Jobs in the transport sector (% of total jobs) | RAIS |

| URB | Urbanization rate (%) | IBGE |

| POPGROWTH | Population growth (%) | IBGE |

| EMPLOY | Employment rate (%) | RAIS |

Appendix B

| Variable | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|

| IFDI | 0.047 | 0.144 | 0.000 | 1.000 |

| EE * | 2.127 | 2.587 | 0.105 | 34.413 |

| FAI | 0.672 | 0.138 | 0.265 | 1.000 |

| LAHI | 0.841 | 0.054 | 0.630 | 1.000 |

| DENS * | 4.118 | 1.446 | 1.650 | 9.470 |

| GDPPC * | 2.861 | 0.546 | 1.580 | 5.691 |

| IND * | 2.739 | 0.725 | 0.992 | 4.454 |

| SERV * | 4.010 | 0.257 | 2.460 | 4.479 |

| EDU * | 2.516 | 0.337 | 1.015 | 4.120 |

| PROD * | 4.372 | 1.045 | 0.486 | 13.645 |

| CONSTR | 2.883 | 4.167 | 0.000 | 75.934 |

| TRANSP | 3.554 | 3.388 | 0.000 | 30.048 |

| POPGROWTH | 1.024 | 2.605 | −23.724 | 31.754 |

| URB * | 4.438 | 0.196 | 3.216 | 4.605 |

| EMPLOY * | 3.020 | 0.473 | 1.685 | 5.395 |

References

- Gherghina, Ș.C.; Simionescu, L.N.; Hudea, O.S. Exploring Foreign Direct Investment—Economic Growth Nexus—Empirical Evidence from Central and Eastern European Countries. Sustainability 2019, 11, 5421. [Google Scholar] [CrossRef] [Green Version]

- Yue, S.; Yang, Y.; Hu, Y. Does Foreign Direct Investment Affect Green Growth? Evidence from China’s Experience. Sustainability 2016, 8, 158. [Google Scholar] [CrossRef] [Green Version]

- Gönel, F.; Aksoy, T. Revisiting FDI-led growth hypothesis: The role of sector characteristics. J. Int. Trade Econ. Dev. 2016, 25, 1144–1166. [Google Scholar] [CrossRef]

- World Bank. World Bank Open Data. Available online: https://data.worldbank.org/ (accessed on 15 January 2022).

- BCB. Foreign Direct Investment in Brazil Report—2018; Banco Central do Brasil: Brasilia, Brasil, 2018. [Google Scholar]

- Rafique, M.Z.; Fareed, Z.; Ferraz, D.; Ikram, M.; Huang, S. Exploring the heterogenous impacts of environmental taxes on environmental footprints: An empirical assessment from developed economies. Energy 2022, 238, 121753. [Google Scholar] [CrossRef]

- Aleksynska, M.; Havrylchyk, O. FDI from the south: The role of institutional distance and natural resources. Eur. J. Political Econ. 2013, 29, 38–53. [Google Scholar] [CrossRef] [Green Version]

- Feng, Y.; Gao, Z.; Jiang, W. What attracts China’s contracts to Latin America and the Caribbean? An empirical study of the determinants of Chinese contracts. Econ. Polit. Stud. 2018, 6, 91–117. [Google Scholar] [CrossRef]

- Veltmeyer, H. The political economy of natural resource extraction: A new model or extractive imperialism? Can. J. Dev. Stud. 2013, 34, 79–95. [Google Scholar] [CrossRef]

- Li, X.; Quan, R.; Stoian, M.-C.; Azar, G. Do MNEs from developed and emerging economies differ in their location choice of FDI? A 36-year review. Int. Bus. Rev. 2018, 27, 1089–1103. [Google Scholar] [CrossRef]

- Polloni-Silva, E.; Moralles, H.F.; Rebelatto, D.A.d.N.; Hartmann, D. Are foreign companies a blessing or a curse for local development in Brazil? It depends on the home country and host region’s institutions. Growth Change 2021, 52, 933–962. [Google Scholar] [CrossRef]

- Villaverde, J.; Maza, A. Foreign direct investment in Spain: Regional distribution and determinants. Int. Bus. Rev. 2012, 21, 722–733. [Google Scholar] [CrossRef]

- De Beule, F.; Somers, D.; Zhang, H. Who Follows Whom? A Location Study of Chinese Private and State-Owned Companies in the European Union. MIR Manag. Int. Rev. 2018, 58, 43–84. [Google Scholar] [CrossRef]

- Hoang, H.H.; Huynh, C.M.; Duong, N.M.H.; Chau, N.H. Determinants of foreign direct investment in Southern Central Coast of Vietnam: A spatial econometric analysis. Econ. Change Restruct. 2021, 55, 285–310. [Google Scholar] [CrossRef]

- Hafeez, M.; Yuan, C.; Yuan, Q.; Zhuo, Z.; Stromaier, D.; Musaad, O.A.S. A global prospective of environmental degradations: Economy and finance. Environ. Sci. Pollut. Res. 2019, 26, 25898–25915. [Google Scholar] [CrossRef] [PubMed]

- Bakhsh, K.; Rose, S.; Ali, M.F.; Ahmad, N.; Shahbaz, M. Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: New evidences from 3SLS. J. Environ. Manag. 2017, 196, 627–632. [Google Scholar] [CrossRef]

- Zafar, M.W.; Zaidi, S.A.H.; Khan, N.R.; Mirza, F.M.; Hou, F.; Kirmani, S.A.A. The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: The case of the United States. Resour. Policy 2019, 63, 101428. [Google Scholar] [CrossRef]

- Ferraz, D.; Costa, N.J.d.; Fernandes, B.; Silva, E.P.; Marques, P.H.M.; Moralles, H.F.; Rebelatto, D. Analysis of absorptive capacity and foreign direct investment in the productivity of Brazilian municipalities. Production 2018, 28. [Google Scholar] [CrossRef] [Green Version]

- Polloni-Silva, E.; Ferraz, D.; Camioto, F.d.C.; Rebelatto, D.A.d.N.; Moralles, H.F. Environmental Kuznets Curve and the Pollution-Halo/Haven Hypotheses: An Investigation in Brazilian Municipalities. Sustainibility 2021, 13, 4114. [Google Scholar] [CrossRef]

- Abor, J.; Harvey, S.K. Foreign direct investment and employment: Host country experience. Macroecon. Financ. Emerg. Mark. Econ. 2008, 1, 213–225. [Google Scholar] [CrossRef]

- Moralles, H.F.; Moreno, R. FDI productivity spillovers and absorptive capacity in Brazilian firms: A threshold regression analysis. Int. Rev. Econ. Financ. 2020, 70, 257–272. [Google Scholar] [CrossRef]

- Haleem, F.; Farooq, S.; Boer, H. The impact of country of origin and operation on sustainability practices and performance. J. Clean. Prod. 2021, 304, 127097. [Google Scholar] [CrossRef]

- Hsu, M.; Lee, J.; Leon-Gonzalez, R.; Zhao, Y. Tax incentives and foreign direct investment in China. Appl. Econ. Lett. 2019, 26, 777–780. [Google Scholar] [CrossRef]

- Jiang, Y. Foreign Direct Investment, Pollution, and the Environmental Quality: A Model with Empirical Evidence from the Chinese Regions. Int. Trade J. 2015, 29, 212–227. [Google Scholar] [CrossRef]

- Opoku, E.E.O.; Boachie, M.K. The environmental impact of industrialization and foreign direct investment. Energy Policy 2020, 137, 111178. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasreen, S.; Abbas, F.; Anis, O. Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ. 2015, 51, 275–287. [Google Scholar] [CrossRef]

- Castilho, M.; Zignago, S. Foreign Direct Investment, Trade and Regional Integration in Mercosur. In Multinationals and Foreign Investment in Economic Development; Graham, E.M., Ed.; Palgrave Macmillan: London, UK, 2005; pp. 145–162. [Google Scholar]

- OEC. Observatory of Economic Complexity. Available online: https://oec.world (accessed on 15 January 2022).

- Kayam, S.S.; Yabrukov, A.; Hisarciklilar, M. What Causes the Regional Disparity of FDI in Russia? A Spatial Analysis. Transit. Stud. Rev. 2013, 20, 63–78. [Google Scholar] [CrossRef] [Green Version]

- Liu, K.; Daly, K.; Varua, M.E. Determinants of Regional Distribution of FDI Inflows across China’s Four Regions. Int. Bus. Res. 2012, 5. [Google Scholar] [CrossRef] [Green Version]

- Boermans, M.A.; Roelfsema, H.; Zhang, Y. Regional determinants of FDI in China: A factor-based approach. J. Chin. Econ. Bus. Stud. 2011, 9, 23–42. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2010. [Google Scholar]

- Greene, W.H. Econometric Analysis, 5th ed.; Pearson Education: Hoboken, NJ, USA, 2002. [Google Scholar]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; Faculty of Economics, University of Cambridge: Cambridge, UK, 2004. [Google Scholar]

- Wang, J.; Li, J. Exploring the Impact of International Trade on Carbon Emissions: New Evidence from China’s 282 Cities. Sustainability 2021, 13, 8968. [Google Scholar] [CrossRef]

- Ma, B.; Yu, Y. Industrial structure, energy-saving regulations and energy intensity: Evidence from Chinese cities. J. Clean. Prod. 2017, 141, 1539–1547. [Google Scholar] [CrossRef]

- Cherchye, L.; Moesen, W.; Rogge, N.; Puyenbroeck, T.V. An Introduction to ‘Benefit of the Doubt’ Composite Indicators. Soc. Indic. Res. 2007, 82, 111–145. [Google Scholar] [CrossRef]

- Mariano, E.B.; Ferraz, D.; Gobbo, S.C.d.O. The Human Development Index with Multiple Data Envelopment Analysis Approaches: A Comparative Evaluation Using Social Network Analysis. Soc. Indic. Res. 2021, 157, 443–500. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Gong, C.; Gong, N.; Qi, R.; Yu, S. Assessment of natural gas supply security in Asia Pacific: Composite indicators with compromise Benefit-of-the-Doubt weights. Resour. Policy 2020, 67, 101671. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef] [Green Version]

- Thompson, R.G.; Dharmapala, P.S.; Thrall, R.M. Importance for DEA of zeros in data, multipliers, and solutions. J. Product. Anal. 1993, 4, 379–390. [Google Scholar] [CrossRef]

- Wen, L.; Li, Z. Provincial-level industrial CO2 emission drivers and emission reduction strategies in China: Combining two-layer LMDI method with spectral clustering. Sci. Total Environ. 2020, 700, 134374. [Google Scholar] [CrossRef]

- IPCC. 2006 IPCC Guidelines for National Greenhouse Gas Inventories. Available online: https://www.ipcc-nggip.iges.or.jp/public/2006gl/ (accessed on 17 May 2020).

- Driscoll, J.C.; Kraay, A.C. Consistent Covariance Matrix Estimation with Spatially Dependent Panel Data. Rev. Econ. Stat. 1998, 80, 549–560. [Google Scholar] [CrossRef]

- Xu, C.; Zhao, W.; Zhang, M.; Cheng, B. Pollution haven or halo? The role of the energy transition in the impact of FDI on SO2 emissions. Sci. Total Environ. 2021, 763, 143002. [Google Scholar] [CrossRef]

- Gandhi, O.; Oshiro, A.H.; Costa, H.K.d.M.; Santos, E.M. Energy intensity trend explained for Sao Paulo state. Renew. Sustain. Energy Rev. 2017, 77, 1046–1054. [Google Scholar] [CrossRef]

- Geller, H.; Schaeffer, R.; Szklo, A.; Tolmasquim, M. Policies for advancing energy efficiency and renewable energy use in Brazil. Energy Policy 2004, 32, 1437–1450. [Google Scholar] [CrossRef]

- Adeel-Farooq, R.M.; Riaz, M.F.; Ali, T. Improving the environment begins at home: Revisiting the links between FDI and environment. Energy 2021, 215, 119150. [Google Scholar] [CrossRef]

- Hanafy, S.a.; Marktanner, M. Sectoral FDI, absorptive capacity and economic growth—Empirical evidence from Egyptian governorates. J. Int. Trade Econ. Dev. 2019, 28, 57–81. [Google Scholar] [CrossRef]

- Doytch, N.; Uctum, M. Globalization and the environmental impact of sectoral FDI. Econ. Syst. 2016, 40, 582–594. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 2011, 36, 685–693. [Google Scholar] [CrossRef]

- Polloni-Silva, E.; Silveira, N.; Ferraz, D.; de Mello, D.S.; Moralles, H.F. The drivers of energy-related CO2 emissions in Brazil: A regional application of the STIRPAT model. Environ. Sci. Pollut. Res. 2021, 28, 51745–51762. [Google Scholar] [CrossRef]

- Lima, M.A.; Mendes, L.F.R.; Mothé, G.A.; Linhares, F.G.; de Castro, M.P.P.; da Silva, M.G.; Sthel, M.S. Renewable energy in reducing greenhouse gas emissions: Reaching the goals of the Paris agreement in Brazil. Environ. Dev. 2020, 33, 100504. [Google Scholar] [CrossRef]

- Adom, P.K.; Opoku, E.E.O.; Yan, I.K.-M. Energy demand–FDI nexus in Africa: Do FDIs induce dichotomous paths? Energy Econ. 2019, 81, 928–941. [Google Scholar] [CrossRef]

- Li, C.; Li, M.; Zhang, L.; Li, T.; Ouyang, H.; Na, S. Has the High-Tech Industry along the Belt and Road in China Achieved Green Growth with Technological Innovation Efficiency and Environmental Sustainability? Int. J. Environ. Res. Public Health 2019, 16, 3117. [Google Scholar] [CrossRef] [Green Version]

- Gu, W.; Liu, D.; Wang, C.; Dai, S.; Zhang, D. Direct and indirect impacts of high-tech industry development on CO2 emissions: Empirical evidence from China. Environ. Sci. Pollut. Res. 2020, 27, 27093–27110. [Google Scholar] [CrossRef]

| Variables | Dependent: Intensity of FDI |

|---|---|

| (1) | |

| LN_DEN t-1 | 0.0628 *** |

| (0.0095) | |

| LN_GDPPC t-1 | 0.0104 ** |

| (0.0049) | |

| LN_IND t-1 | −0.0022 |

| (0.0031) | |

| LN_SERV t-1 | 0.0339 ** |

| (0.0151) | |

| LN_EDU t-1 | 0.0136 |

| (0.0090) | |

| LN_PROD t-1 | 0.0050 *** |

| (0.0009) | |

| CONSTR t-1 | 0.0001 ** |

| (7.75 × 10−5) | |

| TRANSP t-1 | −0.0001 |

| (0.0004) | |

| Constant | −0.426 *** |

| (0.0232) | |

| F | 7535.20 *** |

| Wooldridge (Autocorrelation) | 6.65 ** |

| Mod. Wald (Heteroskedasticity) | 1.60 × 109 *** |

| Pesaran CD | 322.41 *** |

| Mean VIF | 1.73 |

| Observations | 3549 |

| Number of municipalities | 592 |

| Variables | Dependent: Energy-Related CO2 Emissions per Capita | |

|---|---|---|

| (2) | (3) | |

| LN_DEN | 1.658 * | 0.982 |

| (0.893) | (1.162) | |

| LN_GDPPC | 1.250 *** | 1.181 *** |

| (0.0840) | (0.0895) | |

| LN_IND | 0.284 *** | |

| (0.0633) | ||

| LN_SERV | 1.825 *** | 1.427 *** |

| (0.180) | (0.171) | |

| LN_EDU | −0.314 *** | |

| (0.0648) | ||

| LN_PROD | −0.133 *** | −0.103 *** |

| (0.0390) | (0.0373) | |

| CONSTR | −0.0012 | 0.0020 |

| (0.0019) | (0.0019) | |

| TRANSP | 0.0415 *** | |

| (0.0102) | ||

| Constant | −5.27 *** | −10.65 ** |

| (4.182) | (4.938) | |

| F | 33.42 *** | 84.56 *** |

| Wooldridge (Autocorrelation) | 85.84 *** | 82.69 *** |

| Mod. Wald (Heteroskedasticity) | 1.00 × 107 *** | 2.30 × 107 *** |

| Pesaran CD | 94.73 *** | 159.86 *** |

| Mean VIF | 1.72 | 1.53 |

| Observations | 3927 | 3927 |

| Number of groups | 561 | 561 |

| Variables | Dependent: Energy-Related CO2 Emissions per Capita | |||

|---|---|---|---|---|

| (4) | (5) | (6) | (7) | |

| FAI | 0.910 * | 0.755 ** | ||

| (0.529) | (0.339) | |||

| LAHI | 2.446 * | 1.840 * | ||

| (1.458) | (1.073) | |||

| LN_URB | 4.822 *** | 5.069 *** | ||

| (1.827) | (1.903) | |||

| POPGROWTH | 0.0148 * | 0.0150 * | ||

| (0.0078) | (0.0079) | |||

| LN_EMPLOY | 1.192 *** | 1.171 *** | ||

| (0.163) | (0.160) | |||

| Constant | 1.506 *** | −23.44 *** | 0.0636 | −25.51 *** |

| (0.377) | (8.407) | (1.252) | (9.307) | |

| F | 2.81 * | 82.21 *** | 2.81 * | 220.16 *** |

| Wooldridge (Autocorrelation) | 75.21 *** | 82.41 *** | 75.97 *** | 82.78 *** |

| Mod. Wald (Heteroskedasticity) | 2.50 × 107 *** | 2.20 × 107 *** | 1.70 × 107 *** | 9.60 × 106 *** |

| Pesaran CD | 320.46 *** | 158.09 *** | 324.65 *** | 159.18 *** |

| Mean VIF | 1 | 1.09 | 1 | 1.07 |

| Observations | 3913 | 3913 | 3913 | 3913 |

| Number of municipalities | 559 | 559 | 559 | 559 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Polloni-Silva, E.; Roiz, G.A.; Mariano, E.B.; Moralles, H.F.; Rebelatto, D.A.N. The Environmental Cost of Attracting FDI: An Empirical Investigation in Brazil. Sustainability 2022, 14, 4490. https://doi.org/10.3390/su14084490

Polloni-Silva E, Roiz GA, Mariano EB, Moralles HF, Rebelatto DAN. The Environmental Cost of Attracting FDI: An Empirical Investigation in Brazil. Sustainability. 2022; 14(8):4490. https://doi.org/10.3390/su14084490

Chicago/Turabian StylePolloni-Silva, Eduardo, Guilherme Augusto Roiz, Enzo Barberio Mariano, Herick Fernando Moralles, and Daisy Aparecida Nascimento Rebelatto. 2022. "The Environmental Cost of Attracting FDI: An Empirical Investigation in Brazil" Sustainability 14, no. 8: 4490. https://doi.org/10.3390/su14084490

APA StylePolloni-Silva, E., Roiz, G. A., Mariano, E. B., Moralles, H. F., & Rebelatto, D. A. N. (2022). The Environmental Cost of Attracting FDI: An Empirical Investigation in Brazil. Sustainability, 14(8), 4490. https://doi.org/10.3390/su14084490