The Impact of Green Investment and Green Marketing on Business Performance: The Mediation Role of Corporate Social Responsibility in Ethiopia’s Chinese Textile Companies

Abstract

:1. Introduction

2. Literature Review and Forming Hypotheses

2.1. Green Investment

2.2. Green Marketing

2.3. Business Performance in the Environmental Perspective

2.4. Corporate Social Responsibility (CSR)

2.5. The Impact of Green Investment and Green Marketing on Business Performance

2.5.1. Green Investment and Business Performance

2.5.2. Green Marketing and Business Performance

2.6. The Mediation Role of CSR on Green Investment, Green Marketing, and Business Performance Relationships

2.6.1. The Effect of Green Investment on Business Performance Mediated by CSR

2.6.2. The Impact of Green Marketing on Business Performance Mediating by CSR

2.6.3. Corporate Social Responsibility and Business Performance

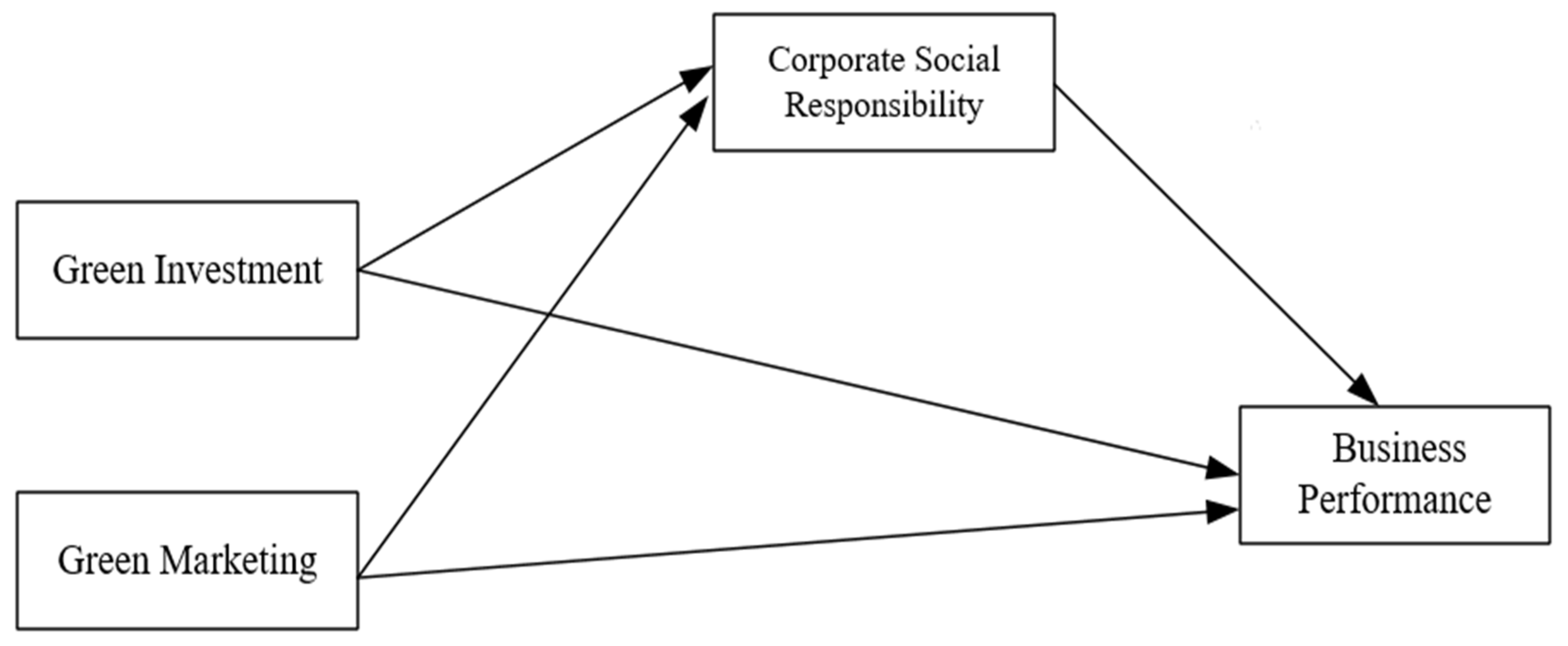

2.7. The Study’s Conceptual Model

3. Data and Methods

3.1. Design of the Study

3.2. Sample Selection and Sampling Techniques

3.3. Data Analysis Method

3.4. Measurement Items

3.4.1. Dependent Variable

3.4.2. Independent Variables

3.4.3. Measurements of Mediator Variable

4. Results and Analysis

4.1. Demographic Data Analyses

4.2. Reliability and Discriminant Validity Test

4.3. Correlation Matrix and Discriminant Validity

4.4. Weighted Multiple Regression Analysis

4.5. The Structural Equation Model and Growth Path Modeling Result Analysis

4.5.1. Structural Equation Model Goodness-of-Fit Indices

4.5.2. Coefficient Estimates and Structural Path Modeling Analysis

4.6. Hypothesis Test Analysis and Decision

4.7. Analysis of Mediating Effect Role of Corporate Social Responsibility

5. Discussion

6. Conclusions, Limitations and Future Directions

6.1. Conclusions

6.2. Implications

6.2.1. Theoretical Implications

6.2.2. Practical Implications

6.3. Limitations and Directions for Further Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Items | Source |

|---|---|---|

| (1) Revenue growth rate maintains stable growth. | ||

| (2) Our company’s sales tend to increase. | ||

| Business Performance | (3) Our company’s market share meets company goals | [38] |

| (4) Our company’s profit tends to increase. | ||

| (5) Our company has high customer satisfaction | ||

| (1) Our company increasing turnover and profits through the use of environmental aspects in the marketing activity | ||

| (2) Our company taking the environment as the premise for all marketing efforts. | ||

| Green Marketing | (3) Our company use as much natural products as possible and void wasting energy and materials. | [87,88] |

| (4) Use recyclable, reusable packaging materials. | ||

| (5) Our company conduct safety measures always | ||

| (1) Our company takes environmental protection into account for our green investment dictions. | ||

| (2) In our company green investment is a daily practice | ||

| Green Investment | (3) Our company’s reason to invest green is to take responsibility for the planet or society | [70,86] |

| (4) Our company financial performance of green investment is attractive | ||

| (5) To save costs, our company is reducing its green investment. | ||

| (1) Our company contributes to campaigns and projects that promote the safety of society. | ||

| (2) Our company targets sustainable growth that considers future generations. | ||

| Corporate Social Responsibility | (3) Our company supports the non-governmental organizations working in the problematic areas. | [89,90] |

| (4) Our company protects consumer rights beyond the legal requirements | ||

| (5) Our company complies with the legal regulations completely and promptly. |

References

- Pavlyk, V. Assessment of green investment impact on the energy efficiency gap of the national economy. J. Financ. Mark. Inst. Risks 2020, 4, 117–123. [Google Scholar]

- O’Neill, B.C.; Carter, T.R.; Ebi, K.; Harrison, P.A.; Kemp-Benedict, E.; Kok, K.; Kriegler, E.; Preston, B.L.; Riahi, K.; Sillmann, J.; et al. Achievements and needs for the climate change scenario framework. Nat. Clim. Chang. 2020, 10, 1074–1084. [Google Scholar]

- Zhang, H.; Razzaq, A.; Pelit, I.; Irmak, E. Does freight and passenger transportation industries are sustainable in BRICS countries? Evidence from advance panel estimations. Econ. Res.-Ekon. Istraz. 2021, 8, 1–21. [Google Scholar]

- Sachs, J.D.; Schmidt-Traub, G.; Mazzucato, M.; Messner, D.; Nakicenovic, N.; Rockström, J. Six transformations to achieve the sustainable development goals. J. Nat. Sustain. 2019, 2, 805–814. [Google Scholar]

- Ding, X.; Qu, Y.; Shahzad, M. The impact of environmental administrative penalties on the disclosure of environmental information. Sustainability 2019, 11, 5820. [Google Scholar]

- Khan, S.A.R.; Razzaq, A.; Yu, Z.; Miller, S. Industry 4.0 and circular economy practices: A new era business strategies for environmental sustainability. J. Bus. Strategy Environ. 2021, 30, 4001–4014. [Google Scholar]

- Chițimiea, A.; Minciu, M.; Manta, A.M.; Ciocoiu, C.N.; Veith, C. The Drivers of Green Investment: A Bibliometric and Systematic Review. Sustainability 2021, 13, 3507. [Google Scholar]

- Shuai, S.; Fan, Z. Modeling the role of environmental regulations in regional green economy efficiency of China: Empirical evidence from super efficiency DEA-Tobit model. J. Environ. Manag. 2020, 261, 110227. [Google Scholar]

- Su, X. Can green investment win the favor of investors in China? Evidence from the return performance of green investment stocks. J. Emerg. Mark. Financ. Trade 2021, 57, 3120–3138. [Google Scholar]

- Chien, F.; Sadiq, M.; Nawaz, M.A.; Hussain, M.S.; Tran, T.D.; Le Thanh, T. A step toward reducing air pollution in top Asian economies: The role of green energy, eco-innovation, and environmental taxes. J. Environ. Manag. 2021, 297, 113–420. [Google Scholar]

- Mirzoieva, T.; Tomashevska, O. Economic assessment of concentration and monopolization of the market of spices and essential oil plants in Ukraine. Mod. Manag. Rev. 2020, 25, 59–72. [Google Scholar]

- Shahzad, M.; Qu, Y.; Zafar, A.U.; Appolloni, A. Does the interaction between the knowledge management process and sustainable development practices boost corporate green innovation? J. Bus. Strategy Environ. 2021, 30, 4206–4222. [Google Scholar]

- Ali, W.; Frynas, J.G.; Mahmood, Z. Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: Literature review. J. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 273–294. [Google Scholar]

- Tamvada, M. Corporate social responsibility and accountability: A new theoretical foundation for regulating CSR. Int. J. Corp. Soc. Responsib. 2020, 5, 1–14. [Google Scholar]

- Ozkaya, H.E.; Droge, C.; Hult, G.T.M.; Calantone, R.; Ozkaya, E. Market orientation, knowledge competence, and innovation. Int. J. Res. Mark. 2015, 32, 309–318. [Google Scholar]

- Kahlenborn, W. Transparency and the Green Investment Market. In Sustainable Banking; Routledge: London, UK, 2017; pp. 173–186. [Google Scholar]

- Bukhari, A.; Rana, R.A.; Bhatti, U.T. Factors influencing consumer’s green product purchase decision by mediation of green brand image. Int. J. Res. 2017, 4, 1620–1632. [Google Scholar]

- Mukonza, C.; Swarts, I. The influence of green marketing strategies on business performance and corporate image in the retail sector. J. Bus. Strategy Environ. 2020, 29, 838–845. [Google Scholar]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar]

- Shahzad, M.; Qu, Y.; Javed, S.A.; Zafar, A.U.; Rehman, S.U. Relation of environment sustainability to CSR and green innovation: A case of Pakistani manufacturing industry. J. Clean. Prod. 2020, 253, 119938. [Google Scholar]

- Jinru, L.; Changbiao, Z.; Ahmad, B.; Irfan, M.; Nazir, R. How do green financing and green logistics affect the circular economy in the pandemic situation: Key mediating role of sustainable production. J. Econ. Res.-Ekon. Istraz. 2021, 3, 1–21. [Google Scholar]

- Chakrabarty, M. Ethiopia–China economic relations: A classic win–win situation? J. World Rev. Political Econ. 2016, 7, 226–248. [Google Scholar]

- Nicolas, F. Chinese Investors in Ethiopia: The Perfect Match. Notes de l’ifri; French Institute of International Relations: Paris, France, 2017. [Google Scholar]

- Khan, S.A.; Al-Maimani, K.A.; Al-Yafi, W.A. Exploring corporate social responsibility in Saudi Arabia: The challenges ahead. J. Leadersh. Account. Ethics 2013, 10, 65–78. [Google Scholar]

- Tran, T.; Do, H.; Vu, T.; Do, N. The factors affecting green investment for sustainable development. J. Decis. Sci. Lett. 2020, 9, 365–386. [Google Scholar]

- Rokhmawati, A. The nexus among green investment, foreign ownership, export, greenhouse gas emissions, and competitiveness. J. Energy Strategy Rev. 2021, 37, 100679. [Google Scholar]

- Testa, F.; Gusmerottia, N.M.; Corsini, F.; Passetti, E.; Iraldo, F. Factors affecting environmental management by small and micro firms: The importance of entrepreneurs’ attitudes and environmental investment. J. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 373–385. [Google Scholar]

- Konar, S.; Cohen, M.A. Does the market value environmental performance? J. Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar]

- Mishra, P.; Sharma, P. Green marketing in India: Emerging opportunities and challenges. J. Eng. Sci. Manag. Educ. 2010, 3, 9–14. [Google Scholar]

- Chamorro, A.; Bañegil, T.M. Green marketing philosophy: A study of Spanish firms with ecolabels. Corp. Soc. Responsib. Environ. Manag. 2006, 13, 11–24. [Google Scholar]

- Soonthonsmai, V. Environmental or Green Marketing as Global Competitive Edge: Concept, Synthesis, and Implication. In Proceedings of the EABR (Business) and ETLC (Teaching) Conference, Venice, Italy, 4–7 June 2007. [Google Scholar]

- Rahman, I.; Reynolds, D.; Svaren, S. How “green” are North American hotels? An exploration of low-cost adoption practices. Int. J. Hosp. Manag. 2012, 31, 720–727. [Google Scholar]

- Katrandjiev, H. Ecological marketing, green marketing, sustainable marketing: Synonyms or an evolution of ideas. J. Econ. Alt. 2016, 1, 71–82. [Google Scholar]

- Mukonza, C.; Swarts, I. Examining the Role of Green Transformational Leadership on Promoting Green Organizational Behavior. In Contemporary Multicultural Orientations and Practices for Global Leadership; IGI Global: Hershey, PA, USA, 2019; pp. 200–224. [Google Scholar]

- Papadas, K.K.; Avlonitis, G.J.; Carrigan, M. Green marketing orientation: Conceptualization, scale development and validation. J. Bus. Res. 2017, 80, 236–246. [Google Scholar]

- Li, Y.; Ye, F.; Sheu, C.; Yang, Q. Linking green market orientation and performance: Antecedents and processes. J. Clean. Prod. 2018, 192, 924–931. [Google Scholar]

- González-Benito, J.; González-Benito, Ó. Environmental proactivity and business performance. J. OMEGA 2005, 33, 1–15. [Google Scholar]

- Kaplan, R.S.; Kaplan, R.E.; Norton, D.P.; Davenport, T.H.; Norton, D.P. Strategy Maps: Converting Intangible Assets into Tangible Outcomes; Harvard Business Press: Boston, MA, USA, 2004. [Google Scholar]

- Wang, Y.; Bhanugopan, R.; Lockhart, P. examining the quantitative determinants of organizational performance: Evidence from China. J. Meas. Bus. Excell. 2015, 19, 23–41. [Google Scholar]

- Muthuveloo, R.; Shanmugam, N.; Teoh, A.P. The impact of tacit knowledge management on organizational performance: Evidence from Malaysia. Asia Pac. Manag. Rev. 2017, 22, 192–201. [Google Scholar]

- Leonidou, C.N.; Katsikeas, C.S.; Morgan, N.A. “Greening” the marketing mix: Do firms do it and does it pay off? J. Acad. Mark. Sci. 2013, 41, 151–170. [Google Scholar]

- Tsoutsoura, M. Corporate social responsibility and financial performance. J. Cent. Responsible Bus. 2004, 1, 1–24. [Google Scholar]

- Wang, Z.; Sarkis, J. Corporate social responsibility governance, outcomes, and financial performance. Clean. Prod. 2017, 162, 1607–1616. [Google Scholar]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate social responsibility: Strategic implications. J. Manag. Stud. 2006, 43, 1–18. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010; pp. 47–279. [Google Scholar]

- Giddings, B.; Hopwood, B.; O’brien, G. Environment, economy and society: Fitting them together into sustainable development. J. Sustain. Dev. 2002, 10, 187–196. [Google Scholar]

- Kotler, P.; Lee, N. Best of breed: When it comes to gaining a market edge while supporting a social cause, “corporate social marketing” leads the pack. Soc. Mark. Q. 2005, 11, 91–103. [Google Scholar]

- Singh, R.K.; Murty, H.R.; Gupta, S.K.; Dikshit, A.K. An overview of sustainability assessment methodologies. J. Ecol. Indic 2009, 9, 189–212. [Google Scholar]

- Chung, K.C. Green marketing orientation: Achieving sustainable development in green hotel management. J. Hosp. Mark. Manag. 2020, 29, 722–738. [Google Scholar]

- Papadas, K.K.; Avlonitis, G.J.; Carrigan, M.; Piha, L. The interplay of strategic and internal green marketing orientation on competitive advantage. J. Bus. Res. 2019, 104, 632–643. [Google Scholar]

- Cho, S.J.; Chung, C.Y.; Young, J. Study on the Relationship between CSR and Financial Performance. Sustainability 2019, 11, 343. [Google Scholar]

- Samy, M.; Odemilin, G.; Bampton, R. Corporate social responsibility: A strategy for sustainable business success. An analysis of 20 selected British companies. Int. J. Bus. Soc. 2010, 10, 203–217. [Google Scholar]

- Statman, M.; Glushkov, D. Equity investments: Research sources; investment theory: Efficient market theory; Portfolio management: Equity strategies. Financ. Anal. J. 2009, 65, 1–23. [Google Scholar]

- Rodgers, W.; Choy, H.L.; Guiral, A. Do investors value a firm’s commitment to social activities? J. Bus. Ethics 2013, 114, 607–623. [Google Scholar]

- Jackson, L.A.; Singh, D. Environmental rankings and financial performance: An analysis of firms in the US food and beverage supply chain. J. Tour Manag. 2015, 14, 25–33. [Google Scholar]

- Munoz, F.; Vagas, M.; Marco, I. Environmental mutual funds. Financial performance and managerial abilities. J. Bus. Ethics 2014, 37, 551–569. [Google Scholar]

- Chariri, A.; Bukit, G.R.S.B.; Eklesia, O.B.; Christi, B.U.; Tarigan, D.M. Does Green Investment Increase Financial Performance? Empirical Evidence from Indonesian Companies. In Proceedings of the EDP Science Web of Conferences; EDP Sciences: Les Ulis, France, 2018; Volume 31, p. 09001. [Google Scholar]

- Tang, M.; Walsh, G.; Lerner, D.; Fitza, M.A.; Li, Q. Green innovation, managerial concern and firm performance: An em-pirical study. J. Bus. Strategy Environ. 2018, 27, 39–51. [Google Scholar]

- Maxwell, J.W.; Decker, C.S. Voluntary environmental investment and responsive regulation. Environ. Resour. Econ. 2006, 33, 425–439. [Google Scholar]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J. Account. Public Policy 2011, 30, 122–144. [Google Scholar]

- Moravcikova, D.; Krizanova, A.; Kliestikova, J.; Rypakova, M. Green Marketing as the Source of the Competitive Advantage of the Business. Sustainability 2017, 9, 2218. [Google Scholar]

- Eneizan, B.M.; Wahab, K.A.; Zainon, M.S.; Obaid, T.F. Prior research on green marketing and green marketing strategy: Critical analysis. Singap. J. Bus. Econ. Manag. Stud. 2016, 51, 1–19. [Google Scholar]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar]

- Hasan, Z.; Ali, N.A. The impact of green marketing strategy on the firm’s performance in Malaysia. J. Procedia Soc. Behav. Sci. 2015, 172, 463–470. [Google Scholar]

- Eneizan, B.M.; Abd Wahab, K.; Obaid, T.F. Effects of green marketing strategies on sales volume of green cars. J. Singap. J. Bus. Econ. Manag. Stud. 2016, 51, 1–14. [Google Scholar]

- Carroll, A.B. A three-dimensional conceptual model of corporate performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar]

- Clarkson, M.B. A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance; University of Toronto Press: Toronto, ON, Canada, 2016. [Google Scholar]

- Bhardwaj, B.R. Role of green policy on sustainable supply chain management: A model for implementing corporate social responsibility (CSR). Benchmark. Int. J. 2016, 23, 456–468. [Google Scholar]

- Razzaq, A.; Ajaz, T.; Li, J.C.; Irfan, M.; Suksatan, W. investigating the asymmetric linkages between infrastructure development, green innovation, and consumption-based material footprint: Novel empirical estimations from highly resource-consuming economies. J. Res. Policy 2021, 74, 102302. [Google Scholar]

- Han, S.R.; Li, P.; Xiang, J.J.; Luo, X.H.; Chen, C.Y. Does the institutional environment influence corporate social responsibility? Consideration of green investment of enterprises evidence from China. J. Environ. Sci. Pollut. Res. 2020, 29, 12722–12739. [Google Scholar]

- Martin, P.R.; Moser, D.V. Managers’ green investment disclosures and investors’ reaction. J. Account. Econ. 2016, 61, 239–254. [Google Scholar]

- Seth, S.; Khan, M.S. Green marketing: Solving dual purpose of marketing and corporate social responsibility. J. Manag. Stud. Econ. Syst. 2015, 1, 181–188. [Google Scholar]

- Shahzad, M.; Qu, Y.; Ur Rehman, S.; Zafar, A.U.; Ding, X.; Abbas, J. Impact of knowledge absorptive capacity on corporate sustainability with mediating role of CSR: Analysis from the Asian context. J. Environ. Plan. Manag. 2020, 63, 148–174. [Google Scholar]

- Bashir, M.; Yousaf, A.; Wani, A.A. Green Marketing & CSR: A Proactive & Innovative Tool to Gain Competitive Excellence. J. Supply Chain Manag. Syst. 2016, 5, 1–11. [Google Scholar]

- Park, Y.; Park, Y.; Hong, P.C.; Yang, S. Clarity of CSR orientation and firm performance: Case of Japanese SMEs. Benchmark. Int. J. 2017, 24, 1581–1596. [Google Scholar]

- Jones, T.M.; Harrison, J.S.; Felps, W. How applying instrumental stakeholder theory can provide sustainable competitive advantage. J. Acad. Manag. Rev. 2018, 43, 371–391. [Google Scholar]

- Wang, Z.; Hsieh, T.S.; Sarkis, J. CSR performance and the readability of CSR reports: Too good to be true? Corp. Soc. Responsib. Environ. Manag. 2018, 25, 66–79. [Google Scholar]

- Stojanovic, A.; Milosevic, I.; Arsic, S.; Urosevic, S.; Mihajlovic, I. Corporate social responsibility as a determinant of employee loyalty and business performance. J. Compet. 2020, 12, 149. [Google Scholar]

- Babalola, Y.A. The impact of corporate social responsibility on firms’ profitability in Nigeria. Eur. J. Econ. Financ. Adm. Sci. 2012, 45, 39–50. [Google Scholar]

- Bokhari, H.W.; Khan, M.A. The impact of capital structure on firm’s performance (A case of non-financial sector of Pakistan). J. Eur. J. Bus. Manag. 2013, 5, 111–137. [Google Scholar]

- Selcuk, E.A.; Kiymaz, H. Corporate social responsibility and firm performance: Evidence from an emerging market. J. Account. Financ. Res. 2017, 6, 42. [Google Scholar]

- Maldonado-Guzman, G.; Pinzon-Castro, S.Y.; Lopez-Torres, G.C. Corporate social responsibility and business performance: The role of Mexican SMEs. Int. Asian Soc. Sci. 2016, 6, 568–579. [Google Scholar]

- Kumar, R. Research Methodology a Step-by-Step Guide for Beginners, 3rd ed.; SAGE Publications Ltd.: New Delhi, India, 2011. [Google Scholar]

- Taherdoost, H. Sampling Methods in Research Methodology; How to Choose A Sampling Technique for Research. 2016. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3205035 (accessed on 22 March 2022).

- Krejcie, R.V.; Morgan, D.W. Determining sample size for research activities. J. Educ. Psychol. Meas. 1970, 30, 607–610. [Google Scholar]

- Amenc, N.; Goltz, F.; Tang, L. Adoption of Green Investing by Institutional Investors; An EDHEC-Risk Institute: Paris, France, 2010. [Google Scholar]

- Langerak, F.; Peelen, E.; van der Veen, M. Exploratory results on the antecedents and consequences of green marketing. J. Mark. Res. Soc. 1998, 40, 1–12. [Google Scholar]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar]

- Turker, D. How corporate social responsibility influences organizational commitment. J. Bus. Ethics 2009, 89, 189–204. [Google Scholar]

- Tian, Q.; Liu, Y.; Fan, J. The effects of external stakeholder pressure and ethical leadership on corporate social responsibility in China. J. Manag. Organ. 2015, 21, 388–410. [Google Scholar]

- Gray, D.E. Doing Research in the Real World, 1st ed.; SAGE Publications, Inc.: London, UK, 2004. [Google Scholar]

- Brusset, X. Does supply chain visibility enhance agility? Int. J. Prod. Econ. 2016, 171, 46–59. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar]

- Grace, J.B.; Bollen, K.A. Interpreting the results from multiple regression and structural equation models. J. Bull. Ecol. Soc. Am. 2005, 86, 283–295. [Google Scholar]

- Kang, H.; Ahn, J.-W. Model Setting and Interpretation of Results in Research Using Structural Equation Modeling: A Checklist with Guiding Questions for Reporting. J. Asian Nurs. Res. 2021, 15, 157–162. [Google Scholar]

- Shi, D.; Lee, T.; Maydeu-Olivares, A. Understanding the model size effect on SEM fit indices. J. Educ. Psychol. Meas. 2019, 79, 310–334. [Google Scholar]

- Yay, M. The mediation analysis with the Sobel test and the percentile bootstrap. Int. J. Manag. Appl. Sci. 2017, 3, 123–125. [Google Scholar]

- Hadi, N.U.; Abdullah, N.; Sentosa, I. Making sense of mediating analysis: A marketing perspective. J. Rev. Integr. Bus. Econ. Res. 2016, 5, 62–76. [Google Scholar]

- Chauhan, S. A relational study of firm’s characteristics and CSR expenditure. J. Procedia Econ. Financ. 2014, 11, 23–32. [Google Scholar]

| Demographic Variables | Frequency | % | |

|---|---|---|---|

| Gender | Male | 166 | 70 |

| Female | 71 | 30 | |

| Age | 20–29 | 47 | 19.8 |

| 30–39 | 82 | 34.6 | |

| 40–49 | 72 | 30.4 | |

| ≥50 | 36 | 15.2 | |

| Education | Doctorate | 14 | 5.9 |

| Masters | 85 | 35.9 | |

| Bachelor | 72 | 30.4 | |

| Others | 66 | 27.8 | |

| Experiences (Year) | 1–5 | 17 | 7.2 |

| 6–10 | 66 | 27.8 | |

| 11–15 | 117 | 49.4 | |

| 16–20 | 32 | 13.5 | |

| >20 | 5 | 2.1 | |

| Managerial Level | General Managers | 57 | 24.1 |

| Production Managers | 71 | 30 | |

| Financial and Marketing Managers | 45 | 19 | |

| Regulatory Chief | 64 | 27 |

| Constructs | Items | Factor Loading | Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) |

|---|---|---|---|---|---|

| Business Performance | BP1 | 0.868 | |||

| BP2 | 0.772 | ||||

| BP3 | 0.831 | 0.875 | 0.909 | 0.669 | |

| BP4 | 0.727 | ||||

| BP5 | 0.879 | ||||

| Green Investment | GI1 | 0.859 | |||

| GI2 | 0.715 | ||||

| GI3 | 0.716 | 0.821 | 0.871 | 0.576 | |

| GI4 | 0.747 | ||||

| GI5 | 0.75 | ||||

| Green Marketing | GM1 | 0.849 | |||

| GM2 | 0.869 | 0.891 | 0.92 | 0.696 | |

| GM3 | 0.87 | ||||

| GM4 | 0.776 | ||||

| GM5 | 0.804 | ||||

| Corporate Social Responsibility | CSR1 | 0.755 | |||

| CSR2 | 0.742 | ||||

| CSR3 | 0.786 | 0.813 | 0.869 | 0.57 | |

| CSR4 | 0.75 | ||||

| CSR5 | 0.742 |

| BP | CSR | GI | GM | |

|---|---|---|---|---|

| BP | 0.812 | |||

| CSR | 0.569 | 0.820 | ||

| GI | 0.127 | 0.321 | 0.803 | |

| GM | 0.406 | 0.241 | 0.241 | 0.819 |

| Latent Variables | Path | Measurement Variables | Standardized Estimate (β) | SE. | CR. | Sig. |

|---|---|---|---|---|---|---|

| CSR | <--- | Green Marketing | 0.552 | 0.054 | 9.694 | *** |

| CSR | <--- | Green Investment | 0.375 | 0.060 | 6.592 | *** |

| BP | <--- | Corporate social responsibility | 0.350 | 0.072 | 5.619 | *** |

| BP | <--- | Green Investment | 0.160 | 0.072 | 2.700 | 0.007 |

| BP | <--- | Green Marketing | 0.390 | 0.070 | 6.060 | *** |

| Model Fit Indices | Recommended Value | Structured Model |

|---|---|---|

| Chi-Square (x2) | Low | 32.357 |

| Degree of Freedom | >0.0 | 12 |

| x2/df | <3.0 | 2.696 |

| Goodness-of-Fit Index (GFI) | ≥0.90 | 0.931 |

| Adjusted Goodness of Fit (AGFI) | ≥0.90 | 0.934 |

| Normed Fit Index (NFI) | >0.90 | 0.912 |

| Incremental Fit Index (IFI) | >0.90 | 0.948 |

| Tucker–Lewis Index (TLI) | ≥0.90 | 0.939 |

| Comparative Fit Index (CFI) | ≥0.90 | 0.913 |

| RMSEA | <0.08 | 0.036 |

| Hypotheses | Direction and Structural Paths | Β | T-Value | p-Value | Decision |

|---|---|---|---|---|---|

| H1 (+) | GI → BP | 0.160 | 2.700 | 0.007 | Supported |

| H2 (+) | GM → BP | 0.39 | 6.06 | 0.000 | Supported |

| H3 (+) | GI → CSR | 0.38 | 6.592 | 0.000 | Supported |

| H4 (+) | GM → CSR | 0.552 | 9.694 | 0.000 | Supported |

| H5 (+) | CSR → BP | 0.35 | 5.619 | 0.000 | Supported |

| Mediating Effects | Coefficient | Standard Error | Sobel Test (Z-Score) | p-Value |

|---|---|---|---|---|

| GI → CSR → BP | 0.375 0.350 | 0.060 0.072 | 3.837 | 0.000 *** |

| GM → CSR → BP | 0.552 0.350 | 0.054 0.072 | 4.390 | 0.000 *** |

| Variables | Green Investment | Green Marketing | CSR | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | |

| CSR | 0.375 | 0.000 | 0.375 | 0.552 | 0.000 | 0.552 | 0.000 | 0.000 | 0.000 |

| BP | 0.160 | 0.131 | 0.291 | 0.390 | 0.193 | 0.583 | 0.350 | 0.000 | 0.350 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Berhe, H.M. The Impact of Green Investment and Green Marketing on Business Performance: The Mediation Role of Corporate Social Responsibility in Ethiopia’s Chinese Textile Companies. Sustainability 2022, 14, 3883. https://doi.org/10.3390/su14073883

Zhang Y, Berhe HM. The Impact of Green Investment and Green Marketing on Business Performance: The Mediation Role of Corporate Social Responsibility in Ethiopia’s Chinese Textile Companies. Sustainability. 2022; 14(7):3883. https://doi.org/10.3390/su14073883

Chicago/Turabian StyleZhang, Youtang, and Hagos Mesfin Berhe. 2022. "The Impact of Green Investment and Green Marketing on Business Performance: The Mediation Role of Corporate Social Responsibility in Ethiopia’s Chinese Textile Companies" Sustainability 14, no. 7: 3883. https://doi.org/10.3390/su14073883

APA StyleZhang, Y., & Berhe, H. M. (2022). The Impact of Green Investment and Green Marketing on Business Performance: The Mediation Role of Corporate Social Responsibility in Ethiopia’s Chinese Textile Companies. Sustainability, 14(7), 3883. https://doi.org/10.3390/su14073883