Causality between Technological Innovation and Economic Growth: Evidence from the Economies of Developing Countries

Abstract

:1. Introduction

- It is considered an important applied research design in studying the relationship between technological innovation and economic growth.

- It intensifies the research and development process for the purpose of changing the traditional structures in developing countries, and thus provides new goods that would improve the financial conditions and consequently the economic growth of countries.

- It highlights the transition from that of the traditional economy to the innovative one, by acquiring various skills that enable countries to improve their financial performance.

- The researcher expects, through this study, to motivate researchers to conduct more research in the field of technological innovation, especially on the relationship between innovation, sustainable development, and competitiveness.

- −

- There is a long-term causal relationship between economic growth and technological innovation in both directions for the group of developing countries under study.

- −

- Our study contributes to the literature in the following ways. First, to our knowledge, this is the first study to find a systematic relationship between technological innovation and growth in the economy of developing countries. There are many studies that discuss the relationship between innovation in general and economic growth; our study focused on technological innovation because it is considered one of the most important types of innovation in addition to being one of the basic and important activities of contemporary institutions, as the main reason for the existence of institutions is to provide distinguished products and services. In order for it to survive and grow, it must adapt to changes in the external environment and find the necessary methods and processes to enable it to offer all new or improved products and services to achieve superiority over competitors, especially in the developing economy. Second, we document this through the results of the study, where the technological innovation index represented by the percentage of spending on education is generally expected to have a positive impact on countries, our results were completely different. We found a negative and moral impact of 1% and this does not fit with the various theoretical analyses that considered spending on education as a driver of economic growth. This is because developing countries still need to spend more on education infrastructure for innovation to deliver its expected results.

2. Theoretical Background

- Throughout history, nations seeking a successful future have relied on the discovery of the next “great idea,” which often follows the accidental discovery of a great idea that propelled the country forward. Nevertheless, for the country to succeed in competition, and for its growth to continue in the current and ever-changing business environment, it must learn how to develop a thriving innovation culture—that is, a continuous ability to generate, accept, and implement creative ideas—within the country, as can be seen in Figure 2.

3. Research Model

3.1. Economic Methodology

3.2. Standard Methodology

- () Study variable vectors.

- Panel data cross-sectional directions (i = 1, …, N),

- (N) represents the number of units (people, companies, industries, countries... etc.),

- (t = 1, …, T) time direction.

- −

- The stability of their average values over time, i.e., E (xt) = μ

- −

- The stability of the variability of their values over time, i.e., V (Xt) = E (Xt − μ) 2 = σ2

- −

- The covariance between two values of the same variable depends on the time gap between the two values and not on the actual value of time i.e., cove (x t, xt + k) = E [(Xt − μ). (Xt − k − μ)] = γK

3.3. Availability of Data and Material

4. Estimating and Analyzing Results

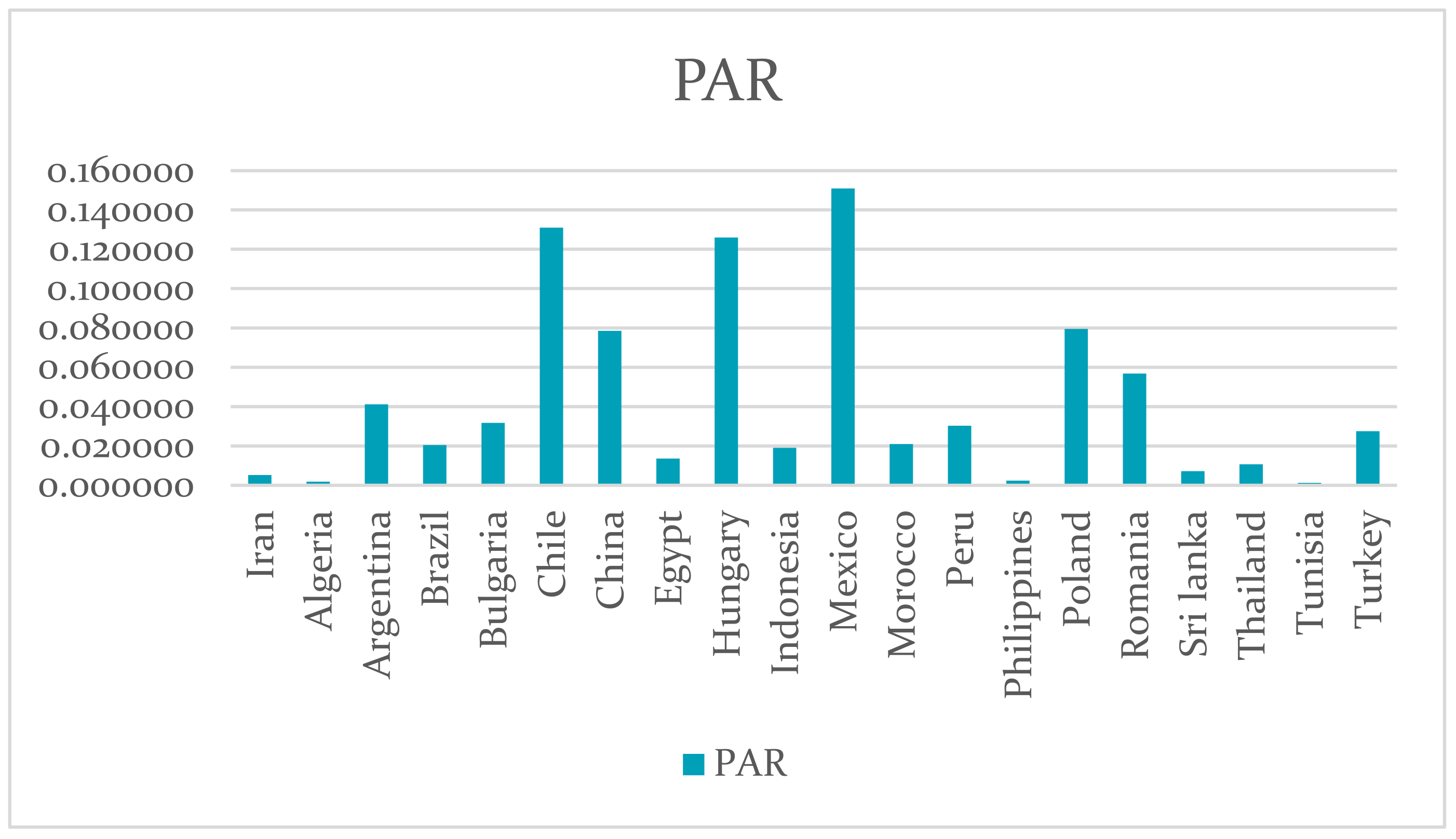

- The minimum value of the PAR over all the sample is 0.23 while the maximum is 1233, with average = 42.8 and standard deviation = 85.4.

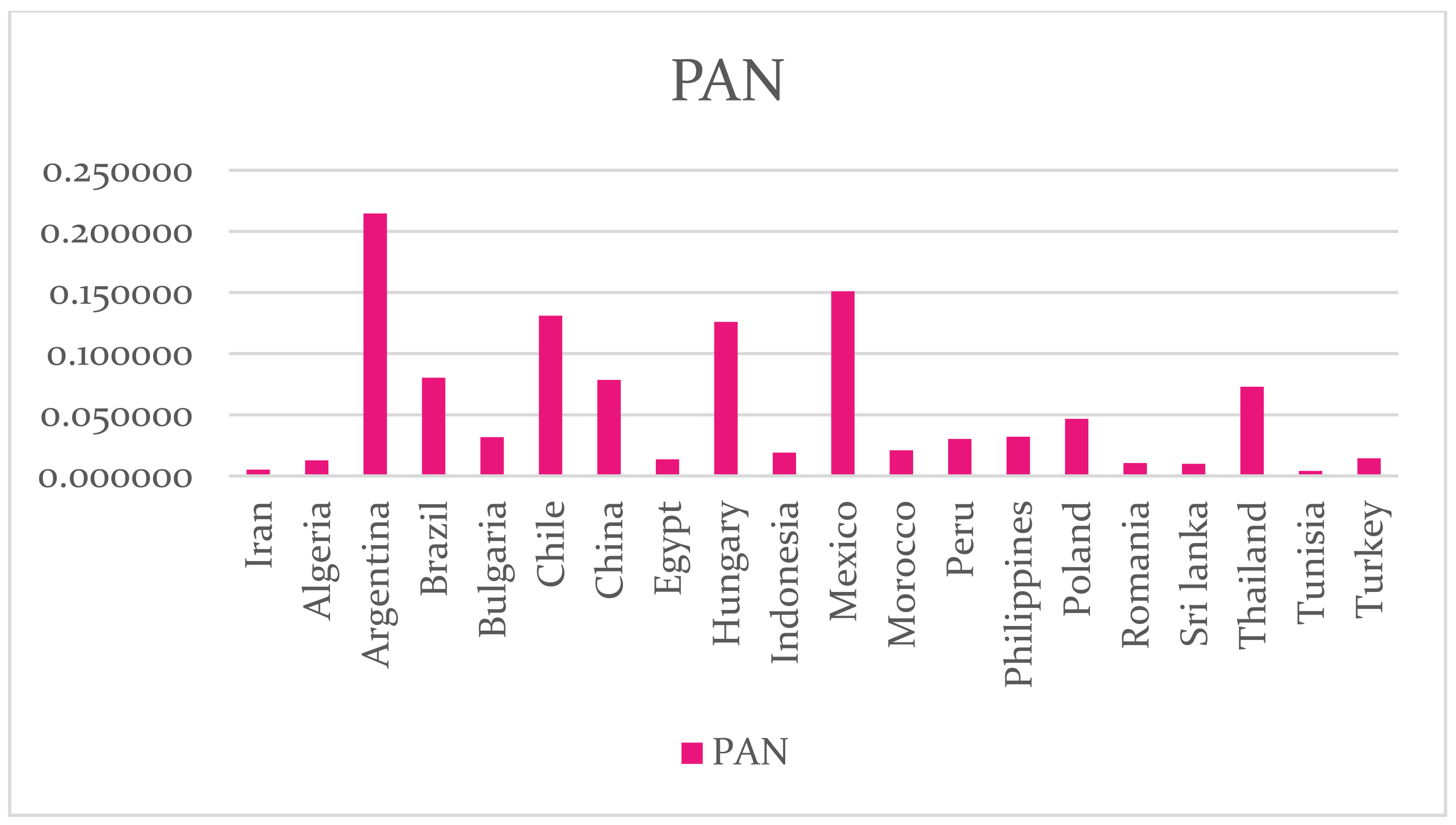

- The minimum value of the PAN over all the sample is 0.91 while the maximum is 1524, with average = 55.3 and standard deviation = 121.7

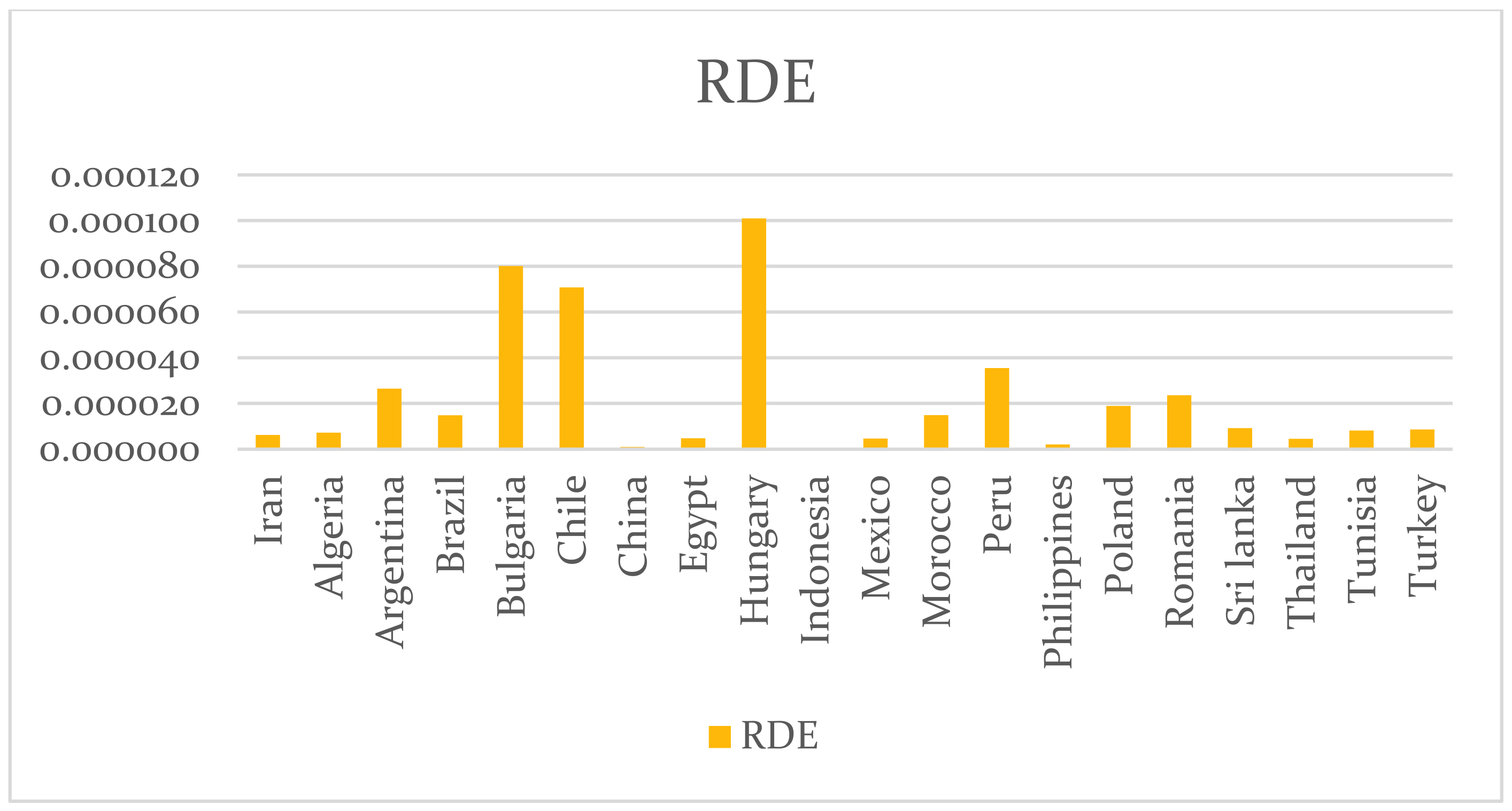

- The minimum value of the RDE over all the samples is 0 while the maximum is 0.534, with average = 0.022 and standard deviation = 0.041.

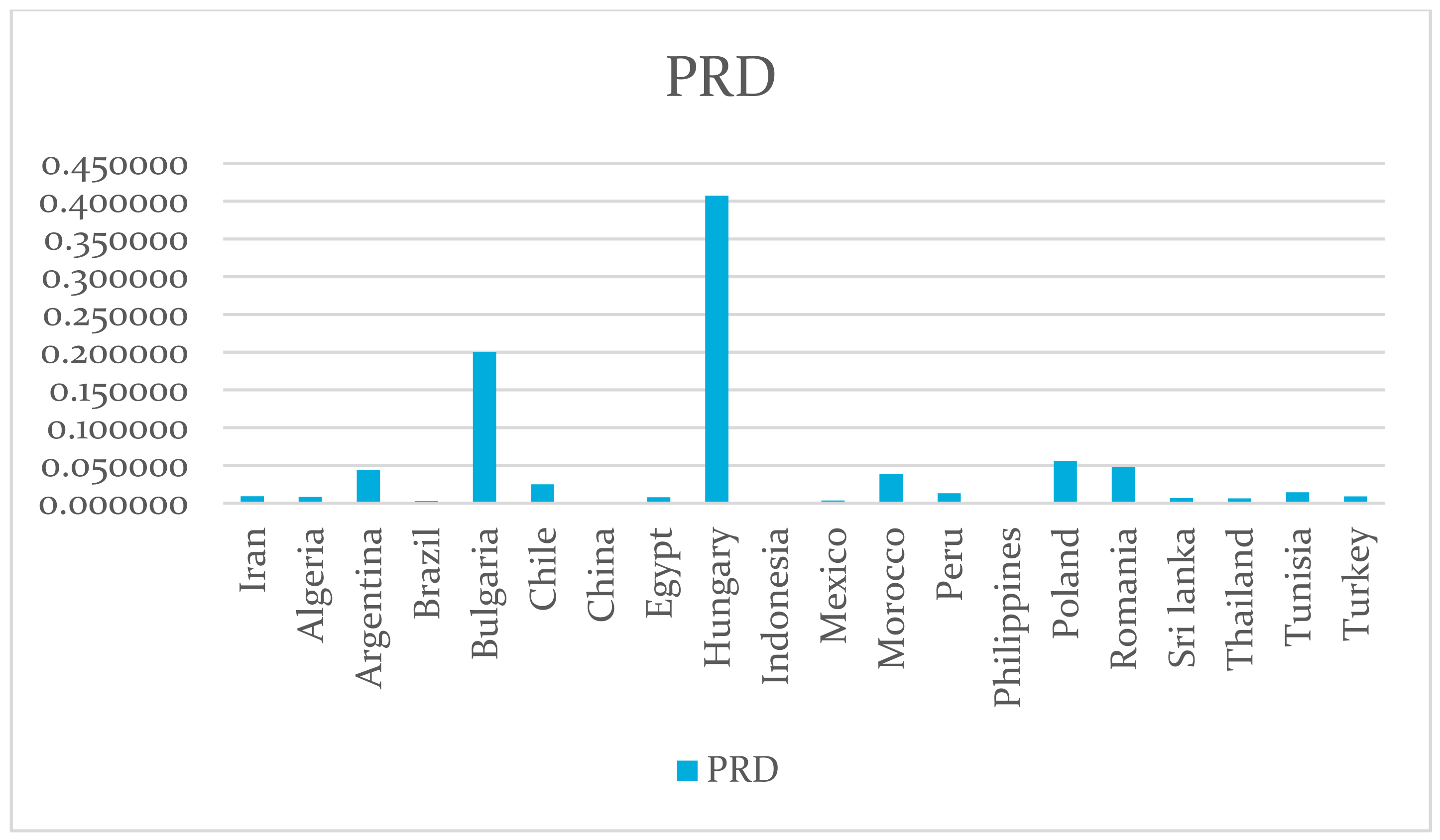

- The minimum value of the PRD over all the samples is 0.28 while the maximum is 660.3, with average = 45.2 and standard deviation = 103.6.

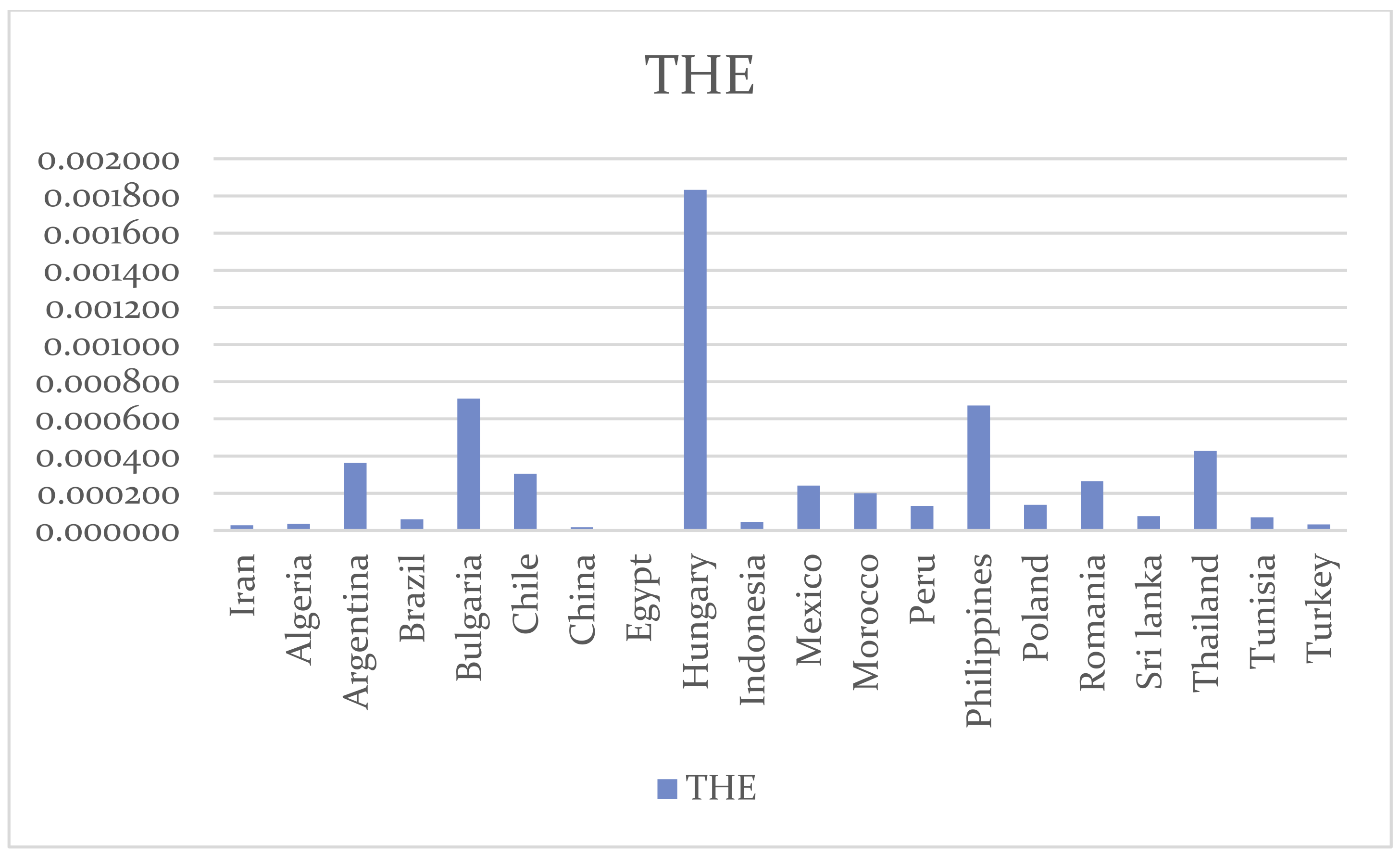

- The minimum value of the THE overall the sample is 0.0016 while the maximum is 2.9, with average = 0.28 and standard deviation = 0.48.

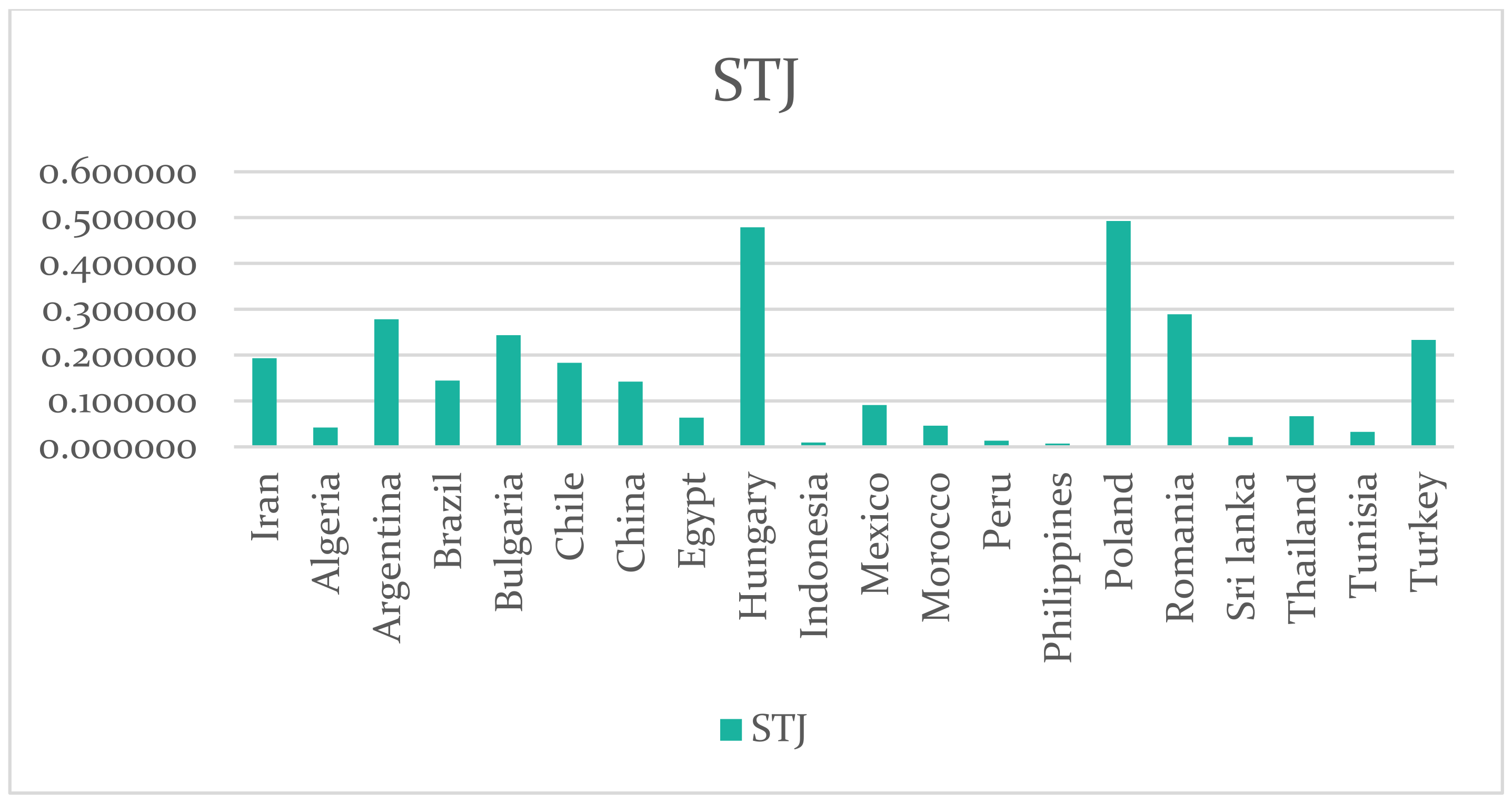

- The minimum value of the STJ over all the sample is 0.69 while the maximum is 1966, with average = 153.5 and standard deviation = 207.8.

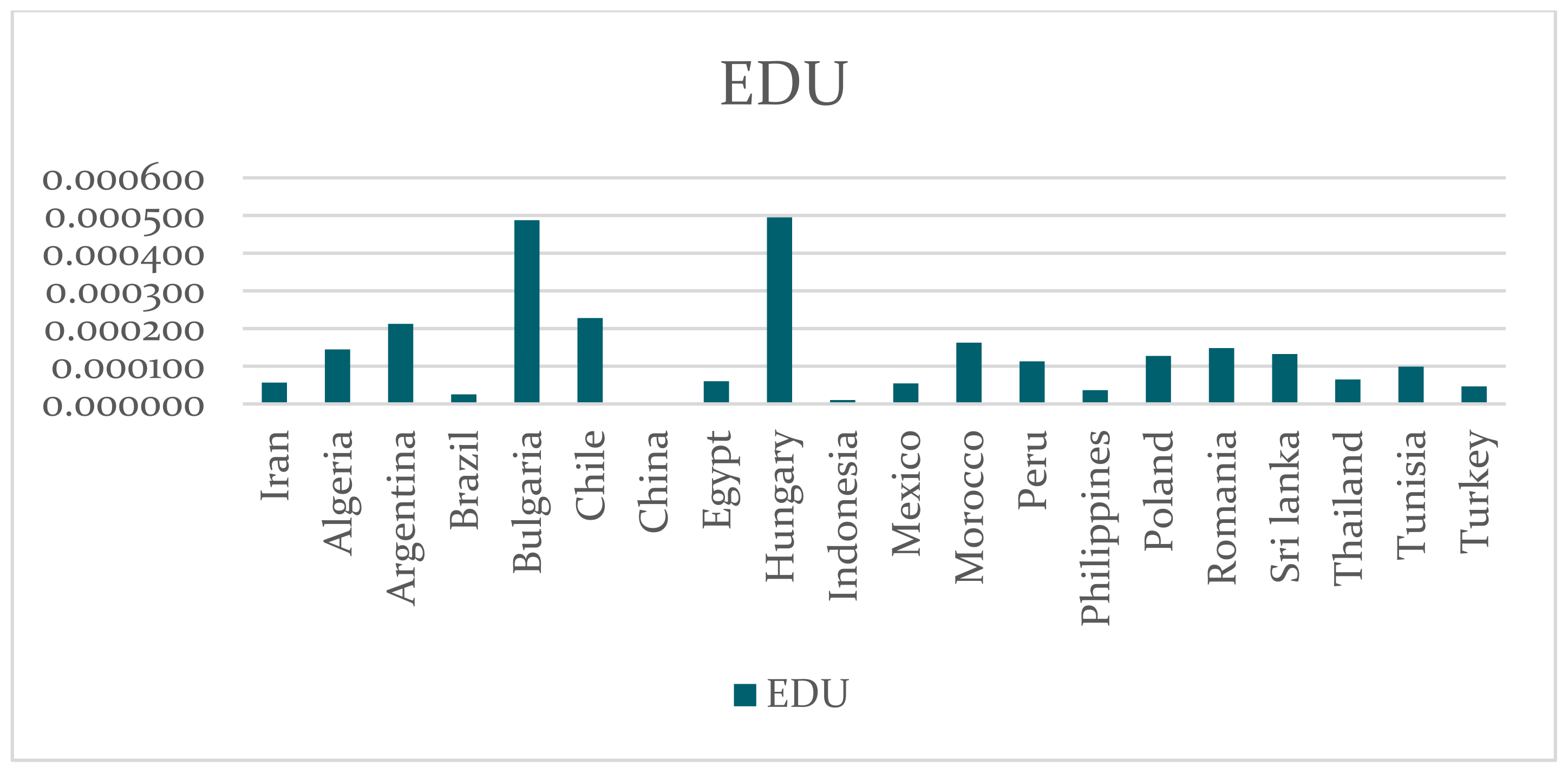

- The minimum value of the EDU over all the sample is 0 while the maximum is 1.27, with average = 0.135 and standard deviation = 0.157.

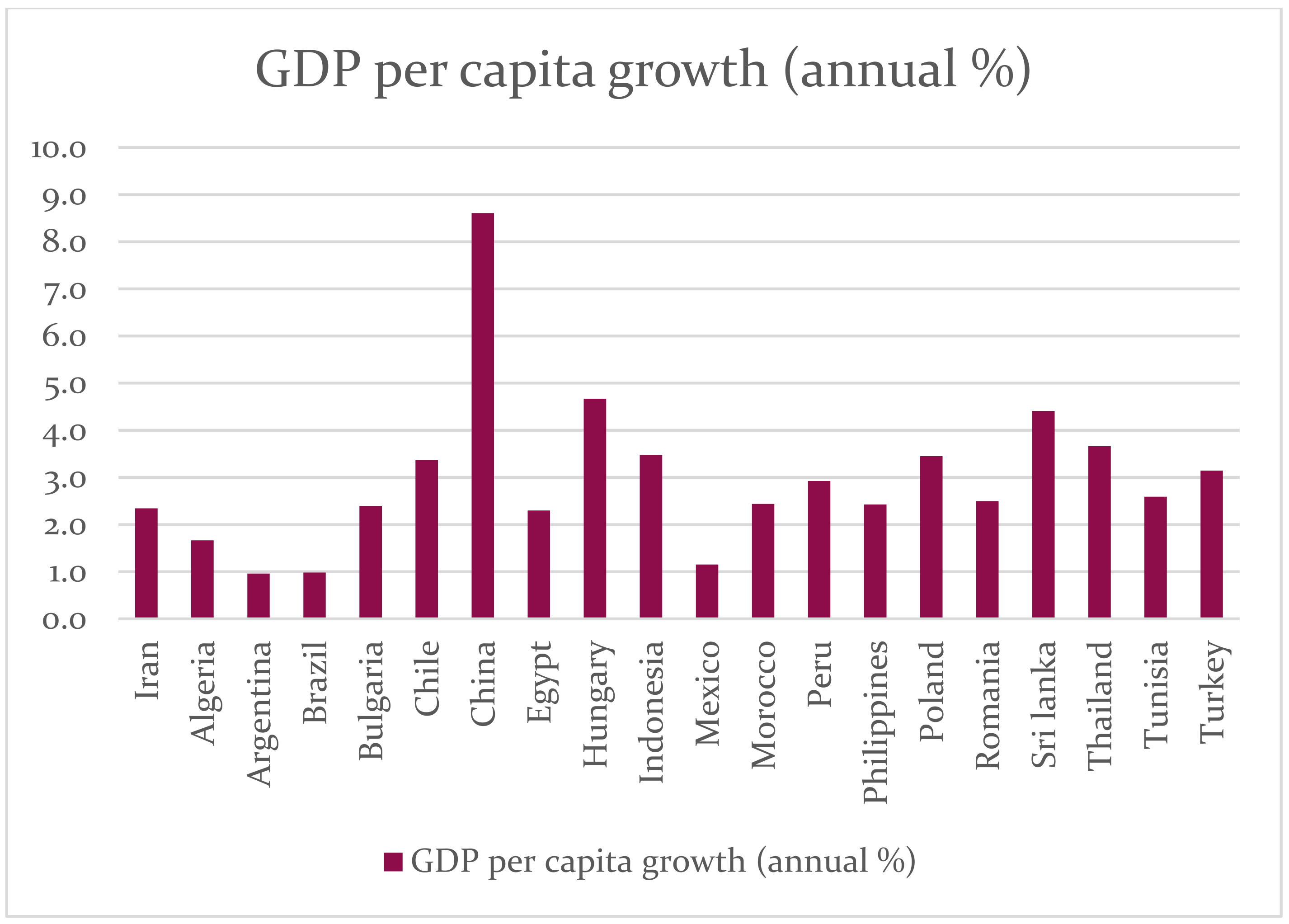

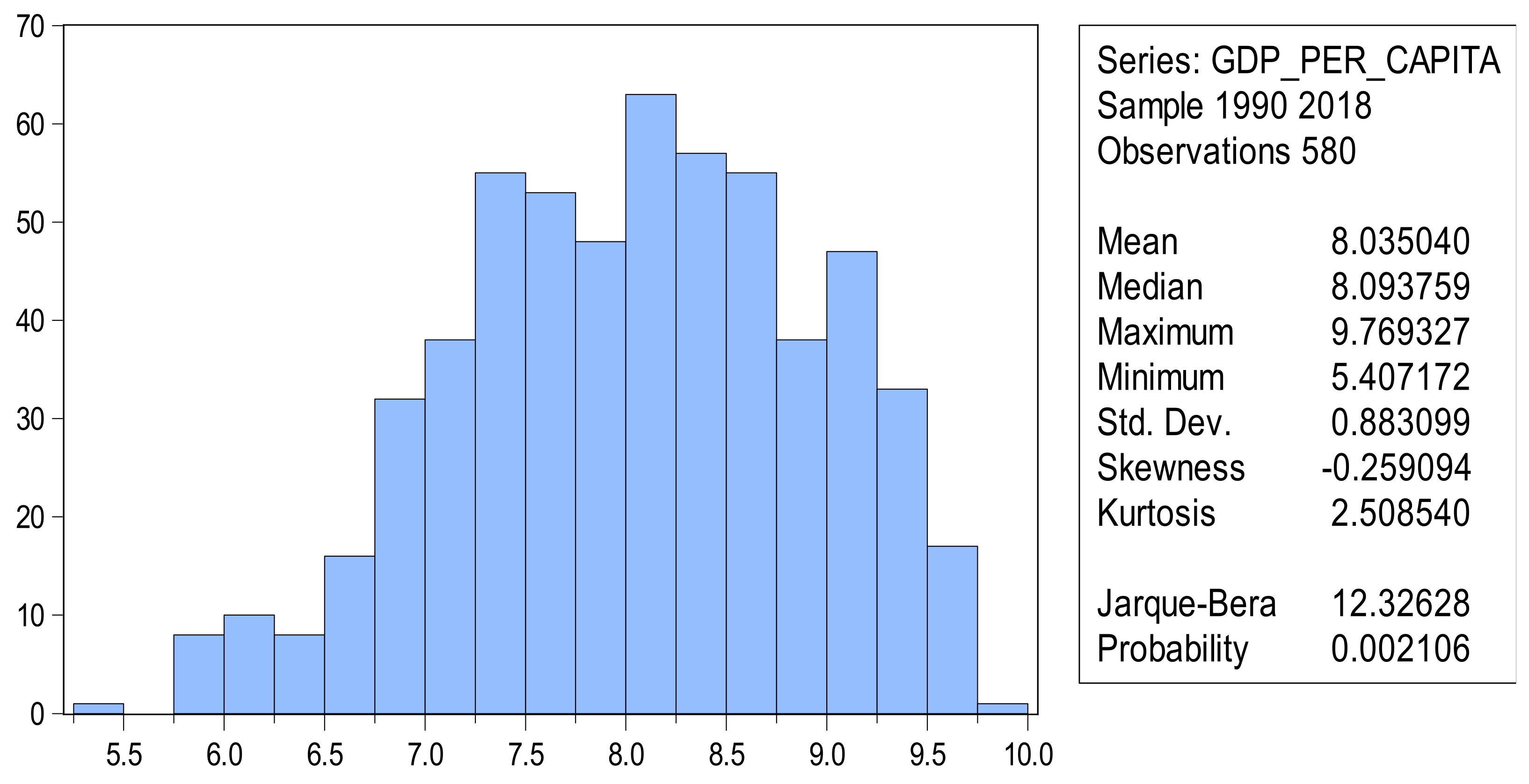

- The minimum value of the GDP per capita growth overall the samples is −14.351 while the maximum is 13.636, with average = 2.974 and standard deviation = 3.841. The following figures show the highest and lowest averages of innovation variables for all developing countries during the period 1990–2018, shown in Figure 3, Figure 4, Figure 5, Figure 6, Figure 7, Figure 8, Figure 9 and Figure 10. We can conclude the following: Mexico has the highest average PAR, followed by Hungary, while Tunisia has the lowest one (Figure 3). The lowest. Figure 4 shows that Argentina had the highest average for PAN. Regarding Figure 5, Hungary has the highest average RDE, while China and Indonesia have the lowest averages. Figure 6 shows that Hungary has the highest PRD average, while China, Indonesia, and the Philippines have the lowest averages. According to Figure 7 and Figure 8, Hungary has the highest average for THE and DUE., While China has the lowest average of these two variables. Figure 9 shows that Poland had the highest average for STJ, while the Philippines had the lowest average. China recorded the highest average per capita GDP, while Argentina had the lowest (Figure 10).

- Sargan-Hansen test or Sargan‘s test is a statistical test used in the statistical model to assess over-identifying limitations. In other words, it checks whether the instrument variables used are correct. This test’s null hypothesis is, “no over-identification.” If the null hypothesis is not dismissed, the model is correct.

- The Arellano-Bond method tests whether the errors are correlated. This test’s null hypothesis is “no self-correlation”. If the null hypothesis is not dismissed, the model is correct. The findings are provided in Table 7 and Table 8 and it is possible to infer that there is a significant negative impact of education (percent of expenditure in GDP) on GDP per capita growth, and this effect = −3.5, with 95% confidence, as the p-value of the coefficient is less than 5%. Moreover, findings show a significant positive impact of research development and expenditure on GDP per capita growth, with an effect = 0.00269, and with a 95% confidence as the p-value of the coefficient is less than 5%. While there is a significant positive impact of scientific and technical journal articles on GDP per capita growth, and this effect = 0.004503, with 95% confidence as the p-value of the coefficient is less than 5%. However, there is a significant positive impact of high technology exports on GDP per capita growth, and this effect = 0.740, with 95% confidence as the p-value of the coefficient is less than 5%. Finally, there is an insignificant impact of each of PAN, PAR, and RDE on GDP per capita, with 95% confidence as the p-value for these coefficients are greater than 5%. Regarding the goodness of fit of the model and analysis of the results of the dynamic model estimation for GMM, the empirical results from estimating the dynamic models of panel data by GMM are good if the estimated values of the regression coefficients of these models by this method are consistent and consistency is achieved with the actual values of the regression coefficients. This can be illustrated by the graph in Figure 12 showing the consistency of the actual, estimated, and residual values with each other. Additionally, to determine the validity of these variables, Sargan’s statistical test was used, and it was greater than 5%. Therefore, the null hypothesis was accepted, which states the quality and suitability of the tools used in the model and the validity of the moment conditions used in the estimation. It was also clear through Sargan’s test that the delay variables were valid and that the first-degree differences were statistically acceptable. On the other hand, the statistical value of the Arellano-Bond test for second-order serial correlation between the estimated errors with the first step indicates that the null hypothesis of this test is not rejected, which is the absence of this correlation. This means that the original error term is not sequentially related. This is because the estimation results in Table 7 show that the probability of this test statistic is greater than 5%, equal to (0.9907) that is, accepting the null hypothesis that there is no second-order serial correlation to the random error, and this indicates the validity of the moment constraints used in the estimation.

5. Discussion

6. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Pairwise Granger Causality Tests. | |||

|---|---|---|---|

| Sample: 1990 2018 IF COUNTRY1 = 1 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 3.45139 | 0.0497 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.65959 | 0.5270 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.28866 | 0.7521 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.54733 | 0.5862 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.41770 | 0.6637 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.35729 | 0.2781 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.19865 | 0.8213 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.11666 | 0.8904 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.88593 | 0.4265 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.72180 | 0.4970 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 5.55960 | 0.0111 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.87955 | 0.4291 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.06448 | 0.9377 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.08922 | 0.9150 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 2 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 1.85640 | 0.1713 |

| GDP_PER_CAPITA does not Granger Cause PAN | 1.20757 | 0.3340 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 2.75374 | 0.0709 |

| GDP_PER_CAPITA does not Granger Cause PAR | 1.69911 | 0.2010 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 3.75307 | 0.0285 |

| GDP_PER_CAPITA does not Granger Cause PRD | 2.52407 | 0.0884 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 3.80148 | 0.0273 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.31620 | 0.2983 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 3.80122 | 0.0273 |

| GDP_PER_CAPITA does not Granger Cause STJ | 2.78491 | 0.0689 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 2.11193 | 0.1325 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.21826 | 0.3303 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 2.50999 | 0.0896 |

| GDP_PER_CAPITA does not Granger Cause EDU | 1.46903 | 0.2547 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 3 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.02088 | 0.9794 |

| GDP_PER_CAPITA does not Granger Cause PAN | 3.50598 | 0.0477 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 1.05750 | 0.3643 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.92123 | 0.4128 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.61420 | 0.5501 |

| GDP_PER_CAPITA does not Granger Cause PRD | 3.58595 | 0.0449 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.93278 | 0.4085 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.57160 | 0.2302 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 3.85557 | 0.0367 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.82624 | 0.4508 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.48506 | 0.6221 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.26147 | 0.7723 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 3.45232 | 0.0497 |

| GDP_PER_CAPITA does not Granger Cause EDU | 3.39050 | 0.0521 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 4 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.55365 | 0.4638 |

| GDP_PER_CAPITA does not Granger Cause PAN | 4.24517 | 0.0499 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.55365 | 0.4638 |

| GDP_PER_CAPITA does not Granger Cause PAR | 4.24517 | 0.0499 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 2.08852 | 0.1608 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.31153 | 0.2630 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 2.25745 | 0.1455 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.08045 | 0.3085 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 24.2234 | 5.E-05 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.47384 | 0.4976 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 9.65160 | 0.0047 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.68544 | 0.2061 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.17195 | 0.6819 |

| GDP_PER_CAPITA does not Granger Cause EDU | 2.04251 | 0.1653 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 5 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 6.42670 | 0.0179 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.16010 | 0.6925 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 6.42670 | 0.0179 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.16010 | 0.6925 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.93974 | 0.3416 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.70005 | 0.4107 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.25433 | 0.6185 |

| GDP_PER_CAPITA does not Granger Cause RDE | 4.69006 | 0.0401 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.70643 | 0.4086 |

| GDP_PER_CAPITA does not Granger Cause STJ | 8.69955 | 0.0068 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 2.18918 | 0.1515 |

| GDP_PER_CAPITA does not Granger Cause THE | 5.95758 | 0.0221 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.54776 | 0.4661 |

| GDP_PER_CAPITA does not Granger Cause EDU | 4.74801 | 0.0390 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 6 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.07652 | 0.9266 |

| GDP_PER_CAPITA does not Granger Cause PAN | 4.13486 | 0.0299 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.07652 | 0.9266 |

| GDP_PER_CAPITA does not Granger Cause PAR | 4.13486 | 0.0299 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.59115 | 0.2263 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.71315 | 0.2035 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.63068 | 0.5416 |

| GDP_PER_CAPITA does not Granger Cause RDE | 6.14284 | 0.0076 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 4.29613 | 0.0266 |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.72200 | 0.2019 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 5.98152 | 0.0084 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.04888 | 0.9524 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.08946 | 0.9148 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.13876 | 0.8712 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 7 | |||

| Lags: 1 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 7.85133 | 0.0097 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.05001 | 0.8249 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 7.85133 | 0.0097 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.05001 | 0.8249 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.01360 | 0.3237 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.50835 | 0.4825 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.12053 | 0.7314 |

| GDP_PER_CAPITA does not Granger Cause RDE | 6.87595 | 0.0147 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.02424 | 0.8775 |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.20223 | 0.2833 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.06169 | 0.8059 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.60651 | 0.2167 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 18.0285 | 0.0003 |

| GDP_PER_CAPITA does not Granger Cause EDU | 6.94753 | 0.0142 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 8 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.11664 | 0.7356 |

| GDP_PER_CAPITA does not Granger Cause PAN | 1.36300 | 0.2540 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.11664 | 0.7356 |

| GDP_PER_CAPITA does not Granger Cause PAR | 1.36300 | 0.2540 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.23194 | 0.2776 |

| GDP_PER_CAPITA does not Granger Cause PRD | 6.58574 | 0.0167 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 4.35234 | 0.0473 |

| GDP_PER_CAPITA does not Granger Cause RDE | 53.1925 | 1.E-07 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 4.47252 | 0.0446 |

| GDP_PER_CAPITA does not Granger Cause STJ | 2.96970 | 0.0972 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 3.48594 | 0.0737 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.65908 | 0.2095 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 1.07799 | 0.3091 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.00019 | 0.9892 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 9 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.60294 | 0.5560 |

| GDP_PER_CAPITA does not Granger Cause PAN | 5.20243 | 0.0141 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.60294 | 0.5560 |

| GDP_PER_CAPITA does not Granger Cause PAR | 5.20243 | 0.0141 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 4.82837 | 0.0183 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.11963 | 0.8878 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.01557 | 0.9846 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.51660 | 0.6036 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.02185 | 0.9784 |

| GDP_PER_CAPITA does not Granger Cause STJ | 2.43003 | 0.1113 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 1.54441 | 0.2357 |

| GDP_PER_CAPITA does not Granger Cause THE | 6.48804 | 0.0061 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 1.45638 | 0.2547 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.39204 | 0.6803 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 10 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 3.28536 | 0.0819 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.25676 | 0.6168 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 3.28536 | 0.0819 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.25676 | 0.6168 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 8.85677 | 0.0064 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.09699 | 0.7581 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 9.04547 | 0.0059 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.07771 | 0.7827 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 3.93442 | 0.0584 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.50925 | 0.4821 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 4.39407 | 0.0463 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.07888 | 0.7811 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 2.43955 | 0.1309 |

| GDP_PER_CAPITA does not Granger Cause EDU | 3.25965 | 0.0831 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 11 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.33389 | 0.7197 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.11052 | 0.8959 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.33389 | 0.7197 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.11052 | 0.8959 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.28754 | 0.7529 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.09579 | 0.9090 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.31281 | 0.7346 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.18231 | 0.8346 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.26862 | 0.7669 |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.67510 | 0.2103 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.29089 | 0.7504 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.01289 | 0.9872 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.32060 | 0.7290 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.02119 | 0.9791 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 12 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 26 | 0.89077 | 0.4638 |

| GDP_PER_CAPITA does not Granger Cause PAN | 3.30388 | 0.0425 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 26 | 0.89077 | 0.4638 |

| GDP_PER_CAPITA does not Granger Cause PAR | 3.30388 | 0.0425 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 26 | 0.45675 | 0.7157 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.24709 | 0.3205 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 26 | 3.90725 | 0.0249 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.69901 | 0.5642 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 26 | 0.74834 | 0.5367 |

| GDP_PER_CAPITA does not Granger Cause STJ | 3.48123 | 0.0363 | |

| THE does not Granger Cause GDP_PER_CAPITA | 26 | 1.98610 | 0.1503 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.64873 | 0.2117 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 26 | 0.59479 | 0.6261 |

| GDP_PER_CAPITA does not Granger Cause EDU | 1.69819 | 0.2012 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 13 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.97908 | 0.3914 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.66307 | 0.5253 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.97908 | 0.3914 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.66307 | 0.5253 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.27895 | 0.7592 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.45400 | 0.6409 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.91969 | 0.4134 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.36466 | 0.6986 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.09426 | 0.9104 |

| GDP_PER_CAPITA does not Granger Cause STJ | 5.11692 | 0.0150 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.93801 | 0.4065 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.91330 | 0.4159 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.03313 | 0.9675 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.17291 | 0.8423 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 14 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 1.32599 | 0.2859 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.14147 | 0.8689 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 1.37618 | 0.2734 |

| GDP_PER_CAPITA does not Granger Cause PAR | 1.62187 | 0.2203 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.33509 | 0.7189 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.69119 | 0.5115 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 4.55742 | 0.0221 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.67502 | 0.5194 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.15912 | 0.8539 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.41448 | 0.6657 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 1.78683 | 0.1910 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.26876 | 0.7668 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 3.61820 | 0.0438 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.98913 | 0.3878 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 15 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 3.94050 | 0.0242 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.95690 | 0.4332 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.58816 | 0.6302 |

| GDP_PER_CAPITA does not Granger Cause PAR | 2.94843 | 0.0590 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.26065 | 0.8528 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.80394 | 0.5071 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 1.05090 | 0.3930 |

| GDP_PER_CAPITA does not Granger Cause RDE | 3.07919 | 0.0523 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 2.19014 | 0.1226 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.18275 | 0.9068 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.81335 | 0.5022 |

| GDP_PER_CAPITA does not Granger Cause THE | 4.74172 | 0.0124 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.04317 | 0.9877 |

| GDP_PER_CAPITA does not Granger Cause EDU | 1.17654 | 0.3449 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 16 | |||

| Lags: 2 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 2.56142 | 0.1000 |

| GDP_PER_CAPITA does not Granger Cause PAN | 6.73806 | 0.0052 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 2.40498 | 0.1136 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.14059 | 0.8696 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.85992 | 0.4369 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.29628 | 0.7465 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 1.02146 | 0.3765 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.13856 | 0.8714 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 9.11119 | 0.0013 |

| GDP_PER_CAPITA does not Granger Cause STJ | 19.9675 | 1.E-05 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.35056 | 0.7082 |

| GDP_PER_CAPITA does not Granger Cause THE | 11.8021 | 0.0003 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 2.68070 | 0.0908 |

| GDP_PER_CAPITA does not Granger Cause EDU | 2.94423 | 0.0736 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 17 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.13404 | 0.8753 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.34464 | 0.7122 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 1.79948 | 0.1889 |

| GDP_PER_CAPITA does not Granger Cause PAR | 9.57892 | 0.0010 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.56537 | 0.2314 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.02108 | 0.3767 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.27437 | 0.7626 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.95295 | 0.1657 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.98285 | 0.3901 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.50109 | 0.6126 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 1.00865 | 0.3810 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.46224 | 0.2534 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.59774 | 0.5587 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.34051 | 0.7151 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 18 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 4.52198 | 0.0226 |

| GDP_PER_CAPITA does not Granger Cause PAN | 1.67446 | 0.2104 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 1.14622 | 0.3361 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.80727 | 0.4589 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.54357 | 0.2359 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.21407 | 0.3161 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.76778 | 0.4761 |

| GDP_PER_CAPITA does not Granger Cause RDE | 2.69477 | 0.0898 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 6.39219 | 0.0065 |

| GDP_PER_CAPITA does not Granger Cause STJ | 4.38578 | 0.0249 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 8.52687 | 0.0018 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.56740 | 0.5751 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 5.85179 | 0.0092 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.02474 | 0.9756 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 19 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.25761 | 0.6162 |

| GDP_PER_CAPITA does not Granger Cause PAN | 7.66646 | 0.0104 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 3.59486 | 0.0696 |

| GDP_PER_CAPITA does not Granger Cause PAR | 6.67297 | 0.0160 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.04494 | 0.8338 |

| GDP_PER_CAPITA does not Granger Cause PRD | 2.59188 | 0.1200 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 9.86050 | 0.0043 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.16887 | 0.2900 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 2.20958 | 0.1497 |

| GDP_PER_CAPITA does not Granger Cause STJ | 16.5676 | 0.0004 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.10476 | 0.7489 |

| GDP_PER_CAPITA does not Granger Cause THE | 15.6075 | 0.0006 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.00675 | 0.9352 |

| GDP_PER_CAPITA does not Granger Cause EDU | 7.53871 | 0.0110 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 19 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.25761 | 0.6162 |

| GDP_PER_CAPITA does not Granger Cause PAN | 7.66646 | 0.0104 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 3.59486 | 0.0696 |

| GDP_PER_CAPITA does not Granger Cause PAR | 6.67297 | 0.0160 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.04494 | 0.8338 |

| GDP_PER_CAPITA does not Granger Cause PRD | 2.59188 | 0.1200 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 9.86050 | 0.0043 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.16887 | 0.2900 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 2.20958 | 0.1497 |

| GDP_PER_CAPITA does not Granger Cause STJ | 16.5676 | 0.0004 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.10476 | 0.7489 |

| GDP_PER_CAPITA does not Granger Cause THE | 15.6075 | 0.0006 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.00675 | 0.9352 |

| GDP_PER_CAPITA does not Granger Cause EDU | 7.53871 | 0.0110 | |

References

- Grossman, G.M.; Helpman, E. Endogenous innovation in the theory of growth. J. Econ. Perspect. 1994, 8, 23–44. [Google Scholar] [CrossRef] [Green Version]

- Tew, J.H.; Lee, K.J.X.; Lau, H.C.; Hoh, Y.C.; Woon, S.P. Linkage between the Role of Knowledge and Economic Growth: A Panel Data Analysis. Ph.D. Thesis, UTAR, Kampar, Malaysia, 2017. [Google Scholar]

- Hussaini, N. Economic Growth and Higher Education in South Asian Countries: Evidence from Econometrics. Int. J. High. Educ. 2020, 9, 118–125. [Google Scholar] [CrossRef]

- Dusange, P.; Ramanantsoa, B. Technologie Et Stratégie D’entreprise, Édition International; Ediscience International: Paris, France, 1994; Volume 1, p. 248. [Google Scholar]

- Millier, P. Stratégie Et Marketing De L’innovation Technologique-3ème Édition: Lancer Avec Succès Des Produits Qui N’existent Pas Sur Des Marchés Qui N’existent Pas Encore; Dunod: Paris, France, 2011; Available online: https://www.dunod.com (accessed on 10 January 2022).

- Diaconu, M. Technological innovation: Concept, process, typology and implications in the economy. Theor. Appl. Econ. 2011, 18. [Google Scholar]

- Dodgson, M.; Gann, D.M.; Salter, A. The Management of Technological Innovation: Strategy and Practice; Oxford University Press on Demand: Oxford, UK, 2008; Available online: https://www.researchgate.net/publication/43478333 (accessed on 10 January 2022).

- Şener, S.; Sarıdoğan, E. The effects of science-technology-innovation on competitiveness and economic growth. Procedia-Soc. Behav. Sci. 2011, 24, 815–828. [Google Scholar] [CrossRef] [Green Version]

- Tidd, J.; Bessant, J.; Pavitt, K. Management De L’innovation: Intégration Du Changement Technologique, Commercial Et Organisationnel; De Boeck Supérieur: Paris, France, 2006; Available online: https://www.lavoisier.fr/livre/economie/management-de-l-innovation-integration-du-changement-technologique-commercial-et-organisationnel/tidd/descriptif_2157630 (accessed on 10 January 2022).

- Atalay, M.; Anafarta, N.; Sarvan, F. The relationship between innovation and firm performance: An empirical evidence from Turkish automotive supplier industry. Procedia-Soc. Behav. Sci. 2013, 75, 226–235. [Google Scholar] [CrossRef] [Green Version]

- Zorrilla, D.M.N.; Gracia, T.J.H.; Velazquez, M.D.R.G.; Gracia, J.F.H.; Duran, J.G.I.; Sevilla, J.A.C. Relevance of technological innovation in the business competitiveness of medium enterprises in Hidalgo State. Eur. Sci. J. 2014, 10. Available online: https://eujournal.org/index.php/esj/article/view/3532 (accessed on 10 January 2022).

- Rice, C.F.; Yayboke, E. Innovation-Led Economic Growth: Transforming Tomorrow’s Developing Economies through Technology and Innovation; Rowman & Littlefield: Washington, DC, USA, 2017; Available online: https://www.amazon.com/Innovation-Led-Economic-Growth-Transforming-Developing (accessed on 10 January 2022).

- Mohamed, M.; Liu, P.; Nie, G. Are technological innovation and foreign direct investment a way to boost economic growth? an egyptian case study using the autoregressive distributed lag (ardl) model. Sustainability 2021, 13, 3265. [Google Scholar] [CrossRef]

- Dincer, O. Does corruption slow down innovation? Evidence from a cointegrated panel of US states. Eur. J. Political Econ. 2019, 56, 1–10. [Google Scholar] [CrossRef]

- Broughel, J.; Thierer, A.D. Technological innovation and economic growth: A brief report on the evidence. Mercatus Res. Pap. 2019. [Google Scholar]

- Smith, K.; Estibals, A. Innovation and Research Strategy for Growth. 2011. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/32445/11-1386-economics-innovation-and-research-strategy-for-growth.pdf (accessed on 10 January 2022).

- Jaumotte, F.; Pain, N. Innovation in the Business Sector. 2005. Available online: https://ideas.repec.org/p/oec/ecoaaa/459-en.html (accessed on 10 January 2022).

- Asheim, B. Localised learning, innovation and regional clusters. Clust. Policies–Clust. Dev. 2001, 39–58. Available online: https://www.sv.uio.no (accessed on 10 January 2022).

- Bhuiyan, A.A.M. Financing education: A route to the development of a country. J. Educ. Dev. 2019, 7, 209–217. [Google Scholar]

- Porter, M.E. The competitive advantage of nations harvard business review. Harv. Bus. Rev. 1990, 91. [Google Scholar]

- Cooper, R.G. From experience: The invisible success factors in product innovation. J. Prod. Innov. Manag. 1999, 16, 115–133. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef] [Green Version]

- Aghion, P.; Harmgart, H.; Weisshaar, N. Fostering growth in CEE countries: A country-tailored approach to growth policy. In Challenges for European Innovation Policy; Edward Elgar Publishing: Cheltenham, UK, 2011; Available online: https://www.ebrd.com/downloads/research/economics/workingpapers/wp0118.pdf (accessed on 10 January 2022).

- Aubert, J.-E. Promoting Innovation in Developing Countries: A Conceptual Framework; World Bank Publications: Washington, DC, USA, 2005; Volume 3554, Available online: https://openknowledge.worldbank.org/handle/10986/8965 (accessed on 10 January 2022).

- Maradana, R.P.; Pradhan, R.P.; Dash, S.; Gaurav, K.; Jayakumar, M.; Chatterjee, D. Does innovation promote economic growth? Evidence from European countries. J. Innov. Entrep. 2017, 6, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Sylwester, K. R&D and economic growth. Knowl. Technol. Policy 2001, 13, 71–84. [Google Scholar]

- Pala, A. Innovation and economic growth in developing countries: Empirical implication of Swamy’s random coefficient model (RCM). Procedia Comput. Sci. 2019, 158, 1122–1130. [Google Scholar] [CrossRef]

- Sadraoui, T.; Ali, T.B.; Deguachi, B. testing for panel granger causality relationship between international R&D cooperation and economic growth. Int. J. Econom. Financ. Manag. 2014, 2, 7–21. [Google Scholar]

- Freimane, R.; Bāliņa, S. Research and development expenditures and economic growth in the EU: A panel data analysis. Econ. Bus. 2016, 29, 5–11. [Google Scholar] [CrossRef] [Green Version]

- Schumpeter, J.A.; Redvers, O. Theorie Der Wirtschaftlichen Entwicklung. The Theory of Economic Development. An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Redvers Opie. 1934. Available online: https://www.hup.harvard.edu/catalog.php?isbn=9780674879904 (accessed on 10 January 2022).

- ÇETİN, M. The hypothesis of innovation-based economic growth: A causal relationship. Uluslararası İktisadi ve İdari İncelemeler Dergisi 2013, 1–16. [Google Scholar]

- Antonelli, C. The economics of innovation: From the classical legacies to the economics of complexity. Econ. Innov. New Technol. 2009, 18, 611–646. [Google Scholar] [CrossRef]

- Conte, A. The Evolution of the Literature on Technological Change over Time: A Survey. 2006. Available online: https://www.researchgate.net/publication/5018301 (accessed on 10 January 2022).

- Solow, R.M. Technical change and the aggregate production function. Rev. Econ. Stat. 1957, 39, 312–320. [Google Scholar] [CrossRef] [Green Version]

- Sofuoğlu, E.; Kizilkaya, O.; Koçak, E. Assessing the impact of high-technology exports on the growth of the turkish economy. J. Econ. Policy Res. 2022, 9, 205–229. [Google Scholar] [CrossRef]

- Idris, J.; Yusop, Z.; Habibullah, M.S. Trade openness and economic growth: A causality test in panel perspective. Int. J. Bus. Soc. 2016, 17. [Google Scholar] [CrossRef]

- Zahonogo, P. Trade and economic growth in developing countries: Evidence from sub-Saharan Africa. J. Afr. Trade 2016, 3, 41–56. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing returns and long-run growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef] [Green Version]

- Lucas, R.E., Jr. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Guloglu, B.; Tekin, R.B. A panel causality analysis of the relationship among research and development, innovation, and economic growth in high-income OECD countries. Eurasian Econ. Rev. 2012, 2, 32–47. [Google Scholar]

- Romer, P.M. The origins of endogenous growth. J. Econ. Perspect. 1994, 8, 3–22. [Google Scholar] [CrossRef] [Green Version]

- Jones, C.I. Paul Romer: Ideas, nonrivalry, and endogenous growth. Scand. J. Econ. 2019, 121, 859–883. [Google Scholar] [CrossRef]

- Aghion, P.; Ljungqvist, L.; Howitt, P.; Howitt, P.W.; Brant-Collett, M.; García-Peñalosa, C. Endogenous Growth Theory; MIT Press: Cambridge, MA, USA, 1998; Available online: https://mitpress.mit.edu/books/endogenous-growth-theory (accessed on 10 January 2022).

- Zeng, J. Reexamining the interaction between innovation and capital accumulation. J. Macroecon. 2003, 25, 541–560. [Google Scholar] [CrossRef]

- Chu, S.-Y. Internet, economic growth and recession. Sci. Res. 2013, 4, 3A. [Google Scholar] [CrossRef] [Green Version]

- Nelson, R.R. Why do firms differ, and how does it matter? Strateg. Manag. J. 1991, 12, 61–74. [Google Scholar] [CrossRef]

- Kim, L. Imitation to Innovation: The Dynamics of Korea’s Technological Learning; Harvard Bus School Press: Boston, MA, USA, 1997. [Google Scholar]

- Nelson, R.R. National Innovation Systems: A Comparative Analysis; Oxford University Press on Demand: Oxford, UK, 1993; Available online: https://www.academia.edu/28567904 (accessed on 10 January 2022).

- Carlo, P.P.; Vandana, C.; Deniz, E. Innovation and Growth Chasing a Moving Frontier: Chasing a Moving Frontier; OECD Publishing: Washington, DC, USA, 2009; Available online: https://www.oecd.org/innovation/innovationandgrowthchasingamovingfrontier.htm (accessed on 10 January 2022).

- Hargadon, A.; Sutton, R.I. Technology brokering and innovation in a product development firm. Adm. Sci. Q. 1997, 716–749. [Google Scholar] [CrossRef]

- Fagerberg, J.; Srholec, M. National innovation systems, capabilities and economic development. Res. Policy 2008, 37, 1417–1435. [Google Scholar] [CrossRef]

- Arocena, R.; Sutz, J. Research and innovation policies for social inclusion: An opportunity for developing countries. Innov. Dev. 2012, 2, 147–158. [Google Scholar] [CrossRef]

- Freeman, C. Continental, national and sub-national innovation systems—Complementarity and economic growth. Res. Policy 2002, 31, 191–211. [Google Scholar] [CrossRef]

- Castellacci, F.; Natera, J.M. The dynamics of national innovation systems: A panel cointegration analysis of the coevolution between innovative capability and absorptive capacity. Res. Policy 2013, 42, 579–594. [Google Scholar] [CrossRef] [Green Version]

- Wu, Y. Innovation and Economic Growth in China. Business School the University of Western Australia. DISCUSSION PAPER 10.10. VAL. TECH. 2012. Available online: https://econpapers.repec.org/paper/uwawpaper/10-10.htm (accessed on 10 January 2022).

- Tuna, K.; Kayacan, E.; Bektaş, H. The relationship between research & development expenditures and economic growth: The case of Turkey. Procedia-Soc. Behav. Sci. 2015, 195, 501–507. [Google Scholar]

- Abdelaoui, T.M.L.; Abdelaoui, O. The impact of innovation on economic development in Arab countries: The Case of Selected Arab Countries from 2007 to 2016. J.N. Afr. Econ. 2020, 16, 33–54. [Google Scholar]

- Lomachynska, I.; Podgorna, I. Innovation potential: Impact on the national economy’s competitiveness of the EU developed countries. Balt. J. Econ. Stud. 2018, 4, 262–270. [Google Scholar] [CrossRef]

- Pece, A.M.; Simona, O.E.O.; Salisteanu, F. Innovation and economic growth: An empirical analysis for CEE countries. Procedia Econ. Financ. 2015, 26, 461–467. [Google Scholar] [CrossRef] [Green Version]

- Solomon, O.; Samuel, J.; Samuel, A. Study of the relationship between economic growth, volatility and innovation for the Eu-27 and ceec countries. J. Inf. Syst. Oper. Manag. 2011, 5, 82–90. [Google Scholar]

- Economists Understand Little about the Causes of Growth, 2 April 2018. Available online: https://www.economist.com/finance-and-economics/2018/04/12/economists-understand-little-about-the-causes-of-growth (accessed on 12 April 2018).

- Yang, C.-H. Is innovation the story of Taiwan’s economic growth? J. Asian Econ. 2006, 17, 867–878. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Hall, J.H.; Nair, M. Innovation, financial development and economic growth in Eurozone countries. Appl. Econ. Lett. 2016, 23, 1141–1144. [Google Scholar] [CrossRef]

- Sinha, D. Patents, Innovations and economic Growth in Japan and South Korea: Evidence from individual country and Panel Data. Appl. Econom. Int. Dev. 2008, 8. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1308261 (accessed on 12 April 2018).

- Sadraoui, T.; Ali, T.B.; Deguachi, B. Economic growth and international R&D cooperation: A panel granger causality analysis. Int. J. Econom. Financ. Manag. 2014, 2, 7–21. [Google Scholar]

- Fagerberg, J.; Srholec, M.; Knell, M. The competitiveness of nations: Why some countries prosper while others fall behind. World Dev. 2007, 35, 1595–1620. [Google Scholar] [CrossRef]

- Kuo, H.-C.; Tseng, Y.-C.; Yang, Y.-T.C. Promoting college student’s learning motivation and creativity through a STEM interdisciplinary PBL human-computer interaction system design and development course. Think. Ski. Creat. 2019, 31, 1–10. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. A Model of Growth through Creative Destruction; National Bureau of Economic Research: Cambridge, MA, USA, 1990; pp. 898–2937. Available online: https://dash.harvard.edu/bitstream/handle/1/12490578/A%20Model%20of%20Growth%20through%20Creative%20Destruction.pdf (accessed on 12 April 2018).

- Silva, M.A.P.M.d. Teaching Aghion and Howitt’s model of schumpeterian growth to graduate students: A diagrammatic approach. Australas. J. Econ. Educ. 2012, 9, 15–36. [Google Scholar]

- Stiglitz, J.E. Capital-market liberalization, globalization, and the IMF. Oxf. Rev. Econ. Policy 2004, 20, 57–71. [Google Scholar] [CrossRef]

- Hsiao, C. Analysis of Panel Data; Cambridge University Press: Cambridge, UK, 2014; Available online: https://doi.org/10.1017/CBO9781139839327 (accessed on 12 April 2018).

- Baltagi, B.H.; Song, S.H.; Koh, W. Testing panel data regression models with spatial error correlation. J. Econom. 2003, 117, 123–150. [Google Scholar] [CrossRef]

- Narayan, P.K.; Smyth, R. Energy consumption and real GDP in G7 countries: New evidence from panel cointegration with structural breaks. Energy Econ. 2008, 30, 2331–2341. [Google Scholar] [CrossRef]

- Dimitrios, A.; Stephen, G. Hall, Applied Econometrics: A Modern Approach, Revised; Palgrave Macmillan: London, UK, 2007; Available online: https://www.pdfdrive.com/applied-econometrics-a-modern-approach-using-eviews-and-microfit-revised-edition-d157033339.html (accessed on 12 April 2018).

- MacKinnon, J.G. Numerical distribution functions for unit root and cointegration tests. J. Appl. Econom. 1996, 11, 601–618. [Google Scholar] [CrossRef] [Green Version]

- Han, L.; Cui, W.; Zhang, W. A Relevance Study of Economic Time Series Data. In Proceedings of the LISS 2020: The 10th International Conference on Logistics, Informatics and Service Sciences; Springer: Berlin/Heidelberg, Germany, 2021; p. 405. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econom. J. Econom. Soc. 1981, 83, 1057–1072. Available online: https://econpapers.repec.org/article/ecmemetrp/v_3a49_3ay_3a1981_3ai_3a4_3ap_3a1057-72.htm (accessed on 12 April 2018). [CrossRef]

- Yaya, O.S.; Ogbonna, A.E.; Furuoka, F.; Gil-Alana, L.A. A New Unit Root Test for Unemployment Hysteresis Based on the Autoregressive Neural Network. Oxf. Bull. Econ. Stat. 2021, 83, 960–981. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-integration and Error Correction: Representation, Estimation, and Testing. Econom. J. Econom. Soc. 1987, 55, 176–251. [Google Scholar] [CrossRef]

- Padder, A.H.; Mathavan, B. The Relationship between Unemployment and Economic Growth in India: Granger Causality Approach. NVEO-Nat. Volatiles Essent. Oils J. NVEO 2021, 8, 1265–1271. [Google Scholar]

- Naimoğlu, M. Impact on Economic Growth of Energy Consumption and Foreign Direct Investment: The Case of Turkey, Conference: 7. In Proceedings of the International Conference on Economics (IceTea2021): Unpacking the Economic Impacts of COVID-1; Available online: https://teacongress.com/ (accessed on 10 January 2022).

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Damodar, N.G. Basic Econometrics; The Mc-Graw Hill: New York, NY, USA, 2004; Available online: https://www.academia.edu/40263427/BASIC_ECONOMETRICS_FOURTH_EDITION (accessed on 12 April 2018).

- Husain, F.; Abbas, K. Money, Income, Prices, and Causality in Pakistan. A Trivariate Analysis. PIDE-Working Papers 2000:178, Pakistan Institute of Development Economics. 2020. Available online: https://ideas.repec.org/p/pid/wpaper/2000178.html (accessed on 10 January 2022).

- Gujarati, D.N. Basic Econometrics, 4th ed.; McGraw-Hill: Singapore, 2003; Available online: http://zalamsyah.staff.unja.ac.id/wp-content/uploads/sites/286/2019/11/7-Basic-Econometrics-4th-Ed.-Gujarati.pdf (accessed on 12 April 2018).

- Liang, Z. Financial development and income distribution: A system GMM panel analysis with application to urban China. J. Econ. Dev. 2006, 31, 1. [Google Scholar]

- Pham, T.T.; Dao, L.K.O.; Nguyen, V.C. The determinants of bank’s stability: A system GMM panel analysis. Cogent Bus. Manag. 2021, 8, 1963390. [Google Scholar] [CrossRef]

- Oppong, G.K.; Pattanayak, J.K.; Irfan, M. Impact of intellectual capital on productivity of insurance companies in Ghana: A panel data analysis with system GMM estimation. J. Intellect. Cap. 2019, 20, 763–783. [Google Scholar] [CrossRef]

| Indices | PAR | PAN | EDU | RDE | PRD | STJ | THE | GDP_PER_CAPITA_GROWT |

|---|---|---|---|---|---|---|---|---|

| Mean | 42.79799 | 55.28742 | 0.135374 | 0.022152 | 45.21019 | 153.5121 | 0.282907 | 2.974121 |

| Median | 15.97560 | 21.55963 | 0.097227 | 0.007254 | 9.439463 | 73.27613 | 0.104898 | 3.253375 |

| Maximum | 1232.796 | 1524.110 | 1.269957 | 0.533769 | 660.2663 | 1966.061 | 2.879151 | 13.63634 |

| Minimum | 0.227269 | 0.905273 | 0.000000 | 4.14 × 10−5 | 0.281453 | 0.689034 | 0.001584 | −14.35055 |

| Std. Dev. | 85.36316 | 120.7277 | 0.157449 | 0.041215 | 103.6293 | 206.7747 | 0.483565 | 3.840783 |

| Skewness | 7.890280 | 7.811967 | 2.788900 | 5.492087 | 3.643645 | 2.860077 | 3.270931 | −0.767087 |

| Kurtosis | 93.38687 | 77.77401 | 14.05681 | 54.31703 | 17.32591 | 16.78431 | 14.29189 | 4.782198 |

| Jarque-Bera | 203454.6 | 141018.8 | 3706.320 | 66557.17 | 6243.125 | 5382.580 | 4115.652 | 133.6397 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Sum | 24822.83 | 32066.70 | 78.51690 | 12.84793 | 26221.91 | 89037.02 | 164.0861 | 1724.990 |

| Sum Sq. Dev. | 4219097. | 8439034. | 14.35357 | 0.983534 | 6217899. | 24755592 | 135.3906 | 8541.184 |

| Observations | 580 | 580 | 580 | 580 | 580 | 580 | 580 | 580 |

| Items | GDP_PER_CAPITA_GROWTH__A | PAR | PAN | RDE | PRD | STJ | THE | EDU |

|---|---|---|---|---|---|---|---|---|

| GDP_PER_CAPITA_GROWT | 1.000000 | −0.004692 | −0.047889 | 0.011245 | 0.061354 | 0.038487 | 0.056533 | −0.009516 |

| PAR | −0.004692 | 1.000000 | 0.746965 | 0.204002 | 0.149051 | 0.324532 | 0.311667 | 0.277678 |

| PAN | −0.047889 | 0.746965 | 1.000000 | 0.217452 | 0.142241 | 0.402496 | 0.367943 | 0.441065 |

| RDE | 0.011245 | 0.204002 | 0.217452 | 1.000000 | 0.583682 | 0.389245 | 0.494083 | 0.635408 |

| PRD | 0.061354 | 0.149051 | 0.142241 | 0.583682 | 1.000000 | 0.539553 | 0.797042 | 0.739735 |

| STJ | 0.038487 | 0.324532 | 0.402496 | 0.389245 | 0.539553 | 1.000000 | 0.501469 | 0.552201 |

| THE | 0.056533 | 0.311667 | 0.367943 | 0.494083 | 0.797042 | 0.501469 | 1.000000 | 0.685608 |

| EDU | −0.009516 | 0.277678 | 0.441065 | 0.635408 | 0.739735 | 0.552201 | 0.685608 | 1.000000 |

| Country | PARLV (FD) | PANLV (FD) | RDELV (FD) | PRDLV (FD) | THELV (FD) | STJLV (FD) | EDULV (FD) | GDP per Capita Growth (Annual %) LV (FD) |

|---|---|---|---|---|---|---|---|---|

| Algeria | 2.158 (20.7 ***) | 2.206 (24.03 ***) | 22.12 *** | 0.217 (34.836) | 8.37 ** | 5.7 × 10−5 15.7 *** | 12.17 *** | 1.798 (17.034 ***) |

| Argentina | 18.42 *** | 18.42 *** | 20.12 *** | 18.79 *** | 19.445 *** | 18.42 *** | 18.46 *** | 0.289 (14.99 ***) |

| Brazil | 6.373 ** | 1.127 (13.05 ***) | 1.17 (23.2 ***) | 1.287 (31.22 ***) | 5.298 * (8.62 ***) | 0.00784 (16.87 ***) | 5.64 * (26.29 ***) | 0.573 (8.63 **) |

| Bulgaria | 0.911 (17.6 ***) | 0.911 (17.6 ***) | 2.503 (22.9 ***) | 0.031 (14.86 ***) | 0.0237 (15.06 ***) | 0.02188 (20.067 ***) | 1.535 (24.89 ***) | 0.99145 (7.67 **) |

| Chile | 7.498 ** | 7.498 ** | 0.212 (15.9 ****) | 1.59 (34.1 ***) | 1.813 (25.85 ***) | 0.0025 (18.42 ***) | 1.36 (7.22 ***) | 0.7916 (6.304 **) |

| China | (13.6 ***) | 13.63 *** | 0.036 (19.8 ***) | 0.319 (16.9 ***) | 1.9007 (6.3 ***) | 0.0011 (14.085 ***) | 7.43 ** | 0.3077 (15.12 ***) |

| Egypt | 2.52 (16.96 ***) | 5.52 (16.97 ***) | 9.553 *** | 3.96 (18.95 ***) | 12.8 *** | 0.01555 (33.65 ***) | 4.826 * (18.42 ***) | 2.2902 (21.65 ***) |

| Hungary | 0.9131 (8.27 **) | 2.37 (8.27 **) | 2.5 (14.47 ***) | 0.227 (19.47 ***) | 2.05 (13.25 ***) | 1.83 (23.47 ***) | 1.79 (9.62 ***) | 0.02018 (19.29 ***) |

| Indonesia | 3.011 (23.8 ***) | 3.011 (26.5 ***) | 1.39 (32.5 ***) | 2.9 (29.86 ***) | 2.33 (18.86 ***) | 0.0039 (24.82 ***) | 3.0074 (25.9 ***) | 0.40005 (18.42 ***) |

| Iran | 0.544 (19.3 ***) | 0.544 (19.3 ***) | 17.08 *** | 4.97 * (17.47 ***) | 2.24 (21.17 ***) | 0.01927 (6.911 **) | 1.039 (20.83 ***) | 4.568 (11.74 ***) |

| Mexico | 16.57 *** | 16.57 *** | 1.79 (22.4 ***) | 17.025 *** | 16.0697 *** | 15.74 *** | 16.56 *** | 2.839 (15.006 ***) |

| Morocco | 0.00061 (6.66**) | 0.00061 (6.66 **) | 18.4 *** | 0.00053 (15.73 ***) | 1.56 (11.16 ***) | 2.0E-05 (31.9 ***) | 9.016 ** | 0.233 (11.956 ***) |

| Peru | 4.08 (15.9 ***) | 5.212 * (16.18 ***) | 8.1 ** | 3.34 (13.67 ***) | 5.11 * (18.74 ***) | 3.1E09 (34.064 ***) | 5.234 * (30.51 ***) | 0.17077 (9.222 ***) |

| Philippines | 0.13564 (8.71 ***) | 9.708 ** | 0.143 8.4 ** | 1.37 (17.6 ***) | 1.28 (9.38 ***) | 5.4E-08 (24.77 ***) | 2.799 (15.55 ***) | 0.1331 (13.0118 ***) |

| Poland | 0.5878 (12.94 ***) | 0.859 (12.78 ***) | 0.143 (8.4 ***) | 13.22 *** | 0.0338 (10.33 ***) | 0.024 (16.76 ***) | 5.83 * (11.42 ***) | 2.9957 (13.548 ***) |

| Romania | 14.93 *** | 0.45044 (22.47 ***) | 5.62 * (27.7 ***) | 40.25 *** | 1.288 (10.96 ***) | 0.44 (12.8 ***) | 5.38 * (31.14 ***) | 0.10418 (11.128 ***) |

| Sri Lanka | 0.816 (33.47 ***) | 2.433 (20.9 ***) | 3.22 (13.8 ***) | 0.618 (13.98 ***) | 4.37 (10.6 ***) | 6.2E-07 (7.06 **) | 1.88 (22.42 ***) | 0.03594 (6.326 **) |

| Thailand | 2.05 (26.26 ***) | 6.65 ** | 1.46 (6.003 **) | 3.5E-06 (18.97 ***) | 6.11573** | 0.0002 (13.32 ***) | 11.55 ** | 0.2262 (7.845 ***) |

| Tunisia | 0.823 (22.3 ***) | 0.76 (8.196 ***) | 1.066 (9.85 ***) | 0.13077 (11.196 ***) | 0.583 (23.55 ***) | 0.00112 (28.24 ***) | 3.68 (27.87 ***) | 2.050 (11.174 ***) |

| Turkey | 0.0064 (12.72**) | 2.841 (7.123 **) | 1.137 (22.7 ***) | 0.01690 (15.05 ***) | 6.077 ** | 0.313 (30.084 ***) | 2.66 (30.33 ***) | 0.528 (16.75 ***) |

| Variables | PAR | PAN | RDE | PRD | THE | STJ | EDU | GDP |

|---|---|---|---|---|---|---|---|---|

| Degree of integration | I (1) | I (1) | I (1) | I (1) | I (1) | I (1) | I (1) | I (1) |

| Null Hypothesis: | Algeria | Argentina | Brazil | Bulgaria | Chile | |

|---|---|---|---|---|---|---|

| PAN | PAN does not Granger Cause GDP_PER_CAPITA | 3.45139 ** | 1.85640 | 0.02088 | 0.55365 | 6.42670 ** |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.65959 | 1.20757 | 3.50598 ** | 4.24517 ** | 0.16010 | |

| PAR | PAR does not Granger Cause GDP_PER_CAPITA | 0.28866 | 2.75374 * | 1.05750 | 0.55365 | 6.42670 ** |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.54733 | 1.69911 | 0.92123 | 4.24517 ** | 0.16010 | |

| PRD | PRD does not Granger Cause GDP_PER_CAPITA | 0.41770 | 3.75307 ** | 0.61420 | 2.08852 | 0.93974 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.35729 | 2.52407 * | 3.58595 ** | 1.31153 | 0.70005 | |

| RDE | RDE does not Granger Cause GDP_PER_CAPITA | 0.19865 | 3.80148 ** | 0.93278 | 2.25745 | 0.25433 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.11666 | 1.31620 | 1.57160 | 1.08045 | 4.69006 ** | |

| STJ | STJ does not Granger Cause GDP_PER_CAPITA | 0.88593 | 3.80122 ** | 3.85557 ** | 24.2234 *** | 0.70643 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.72180 | 2.78491* | 0.82624 | 0.47384 | 8.69955 *** | |

| THE | THE does not Granger Cause GDP_PER_CAPITA | 5.55960 ** | 2.11193 | 0.48506 | 9.65160 *** | 2.18918 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.87955 | 1.21826 | 0.26147 | 1.68544 | 5.95758 ** | |

| EDU | EDU does not Granger Cause GDP_PER_CAPITA | 0.06448 | 2.50999 * | 3.45232 ** | 0.17195 | 0.54776 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.08922 | 1.46903 | 3.39050 * | 2.04251 | 4.74801 ** | |

| Null Hypothesis: | China | Egypt | Hungary | Indonesia | Iran | |

| PAN | PAN does not Granger Cause GDP_PER_CAPITA | 0.07652 | 7.85133 *** | 0.11664 | 0.60294 | 3.28536 * |

| GDP_PER_CAPITA does not Granger Cause PAN | 4.13486 ** | 0.05001 | 1.36300 | 5.20243 ** | 0.25676 | |

| PAR | PAR does not Granger Cause GDP_PER_CAPITA | 0.07652 | 7.85133 *** | 0.11664 | 0.60294 | 3.28536 * |

| GDP_PER_CAPITA does not Granger Cause PAR | 4.13486 ** | 0.05001 | 1.36300 | 5.20243 ** | 0.25676 | |

| PRD | PRD does not Granger Cause GDP_PER_CAPITA | 1.59115 | 1.01360 | 1.23194 | 4.82837 ** | 8.85677 *** |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.71315 | 0.50835 | 6.58574 ** | 0.11963 | 0.09699 | |

| RDE | RDE does not Granger Cause GDP_PER_CAPITA | 0.63068 | 0.12053 | 4.35234 ** | 0.01557 | 9.04547 *** |

| GDP_PER_CAPITA does not Granger Cause RDE | 6.14284 *** | 6.87595 ** | 53.1925 *** | 0.51660 | 0.07771 | |

| STJ | STJ does not Granger Cause GDP_PER_CAPITA | 4.29613 ** | 0.02424 | 4.47252 ** | 0.02185 | 3.93442 * |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.72200 | 1.20223 | 2.96970 * | 2.43003 | 0.50925 | |

| THE | THE does not Granger Cause GDP_PER_CAPITA | 5.98152 ** | 0.06169 | 3.48594 * | 1.54441 | 4.39407 ** |

| GDP_PER_CAPITA does not Granger Cause THE | 0.04888 | 1.60651 | 1.65908 | 6.48804 *** | 0.07888 | |

| EDU | EDU does not Granger Cause GDP_PER_CAPITA | 0.08946 | 18.0285 *** | 1.07799 | 1.45638 | 2.43955 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.13876 | 6.94753 ** | 0.00019 | 0.39204 | 3.25965 * | |

| Null Hypothesis: | Mexico | Morocco | Peru | Philippines | Poland | |

| PAN | PAN does not Granger Cause GDP_PER_CAPITA | 0.33389 | 0.89077 | 0.97908 | 1.32599 | 3.94050 ** |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.11052 | 3.30388 ** | 0.66307 | 0.14147 | 0.95690 | |

| PAR | PAR does not Granger Cause GDP_PER_CAPITA | 0.33389 | 0.89077 | 0.97908 | 1.37618 | 0.58816 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.11052 | 3.30388 ** | 0.66307 | 1.62187 | 2.94843 * | |

| PRD | PRD does not Granger Cause GDP_PER_CAPITA | 0.28754 | 0.45675 | 0.27895 | 0.33509 | 0.26065 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.09579 | 1.24709 | 0.45400 | 0.69119 | 0.80394 | |

| RDE | RDE does not Granger Cause GDP_PER_CAPITA | 0.31281 | 3.90725 ** | 0.91969 | 4.55742 ** | 1.05090 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.18231 | 0.69901 | 0.36466 | 0.67502 | 3.07919 * | |

| STJ | STJ does not Granger Cause GDP_PER_CAPITA | 0.26862 | 0.74834 | 0.09426 | 0.15912 | 2.19014 |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.67510 | 3.48123 ** | 5.11692 ** | 0.41448 | 0.18275 | |

| THE | THE does not Granger Cause GDP_PER_CAPITA | 0.29089 | 1.98610 | 0.93801 | 1.78683 | 0.81335 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.01289 | 1.64873 | 0.91330 | 0.26876 | 4.74172 ** | |

| EDU | EDU does not Granger Cause GDP_PER_CAPITA | 0.32060 | 0.59479 | 0.03313 | 3.61820 ** | 0.04317 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.02119 | 1.69819 | 0.17291 | 0.98913 | 1.17654 | |

| Null Hypothesis: | Romania | Sri Lanka | Thailand | Tunisia | Turkey | |

| PAN | PAN does not Granger Cause GDP_PER_CAPITA | 2.56142 | 0.13404 | 4.52198 ** | 0.25761 | 5.64758 ** |

| GDP_PER_CAPITA does not Granger Cause PAN | 6.73806 *** | 0.34464 | 1.67446 | 7.66646 *** | 1.47880 | |

| PAR | PAR does not Granger Cause GDP_PER_CAPITA | 2.40498 | 1.79948 | 1.14622 | 3.5948 * | 0.36393 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.14059 | 9.57892 *** | 0.80727 | 6.67297 ** | 2.40591 | |

| PRD | PRD does not Granger Cause GDP_PER_CAPITA | 0.85992 | 1.56537 | 1.54357 | 0.04494 | 0.77162 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.29628 | 1.02108 | 1.21407 | 2.59188 | 1.20477 | |

| RDE | RDE does not Granger Cause GDP_PER_CAPITA | 1.02146 | 0.27437 | 0.76778 | 9.86050 *** | 0.29961 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.13856 | 1.95295 | 2.69477 * | 1.16887 | 4.26462 ** | |

| STJ | STJ does not Granger Cause GDP_PER_CAPITA | 9.11119 *** | 0.98285 | 6.39219 *** | 2.20958 | 8.52400 *** |

| GDP_PER_CAPITA does not Granger Cause STJ | 19.9675 *** | 0.50109 | 4.38578 ** | 16.5676 *** | 0.25703 | |

| THE | THE does not Granger Cause GDP_PER_CAPITA | 0.35056 | 1.00865 | 8.52687 *** | 0.10476 | 1.62364 |

| GDP_PER_CAPITA does not Granger Cause THE | 11.8021 *** | 1.46224 | 0.56740 | 15.6075 *** | 1.12907 | |

| EDU | EDU does not Granger Cause GDP_PER_CAPITA | 2.68070 | 0.59774 | 5.85179 *** | 0.00675 | 0.41114 |

| GDP_PER_CAPITA does not Granger Cause EDU | 2.94423 | 0.34051 | 0.02474 | 7.53871 ** | 1.06322 |

| Variable | Statistic | Asymp. Sig. (Two-Tailed) |

|---|---|---|

| GDP per capita growth | 12.326 | 0.0021 |

| Variable | Coefficient | Standard Error | t-Statistic | Probability |

|---|---|---|---|---|

| EDU | −3.500127 | 0.390585 | −8.961248 | 0.0000 |

| PAN | −0.000345 | 0.001832 | −0.188131 | 0.8508 |

| PAR | 0.000147 | 0.001754 | 0.084037 | 0.9331 |

| PRD | 0.002690 | 0.001332 | 2.019151 | 0.0440 |

| RDE | −0.686891 | 1.316314 | −0.521829 | 0.6020 |

| STJ | 0.004503 | 0.001514 | 2.974776 | 0.0031 |

| THE | 0.740715 | 0.245014 | 3.023156 | 0.0026 |

| Effects Specification | ||||

| Cross-section fixed (first differences) | ||||

| Mean dependent var | 0.047455 | S.D. dependent var | 0.206800 | |

| S.E. of regression | 0.501957 | Sum squared resid | 139.3344 | |

| J-statistic | 13.90493 | Instrument rank | 21 | |

| Prob (J-statistic) | 0.456818 | |||

| Test order | m-Statistic | rho | SE (rho) | Prob. |

|---|---|---|---|---|

| AR (2) | −0.011694 | −0.320535 | 27.409643 | 0.9907 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohamed, M.M.A.; Liu, P.; Nie, G. Causality between Technological Innovation and Economic Growth: Evidence from the Economies of Developing Countries. Sustainability 2022, 14, 3586. https://doi.org/10.3390/su14063586

Mohamed MMA, Liu P, Nie G. Causality between Technological Innovation and Economic Growth: Evidence from the Economies of Developing Countries. Sustainability. 2022; 14(6):3586. https://doi.org/10.3390/su14063586

Chicago/Turabian StyleMohamed, Maha Mohamed Alsebai, Pingfeng Liu, and Guihua Nie. 2022. "Causality between Technological Innovation and Economic Growth: Evidence from the Economies of Developing Countries" Sustainability 14, no. 6: 3586. https://doi.org/10.3390/su14063586

APA StyleMohamed, M. M. A., Liu, P., & Nie, G. (2022). Causality between Technological Innovation and Economic Growth: Evidence from the Economies of Developing Countries. Sustainability, 14(6), 3586. https://doi.org/10.3390/su14063586