Sustainable Entrepreneurship: Good Deeds, Business, Social and Environmental Responsibility in a Market Experiment

Abstract

1. Introduction

2. Experimental Design and Procedures

2.1. Design

2.1.1. Market Shares

2.2. Recruitment

2.3. Implementation

3. Theory Predictions and Hypotheses

4. Results and Discussion

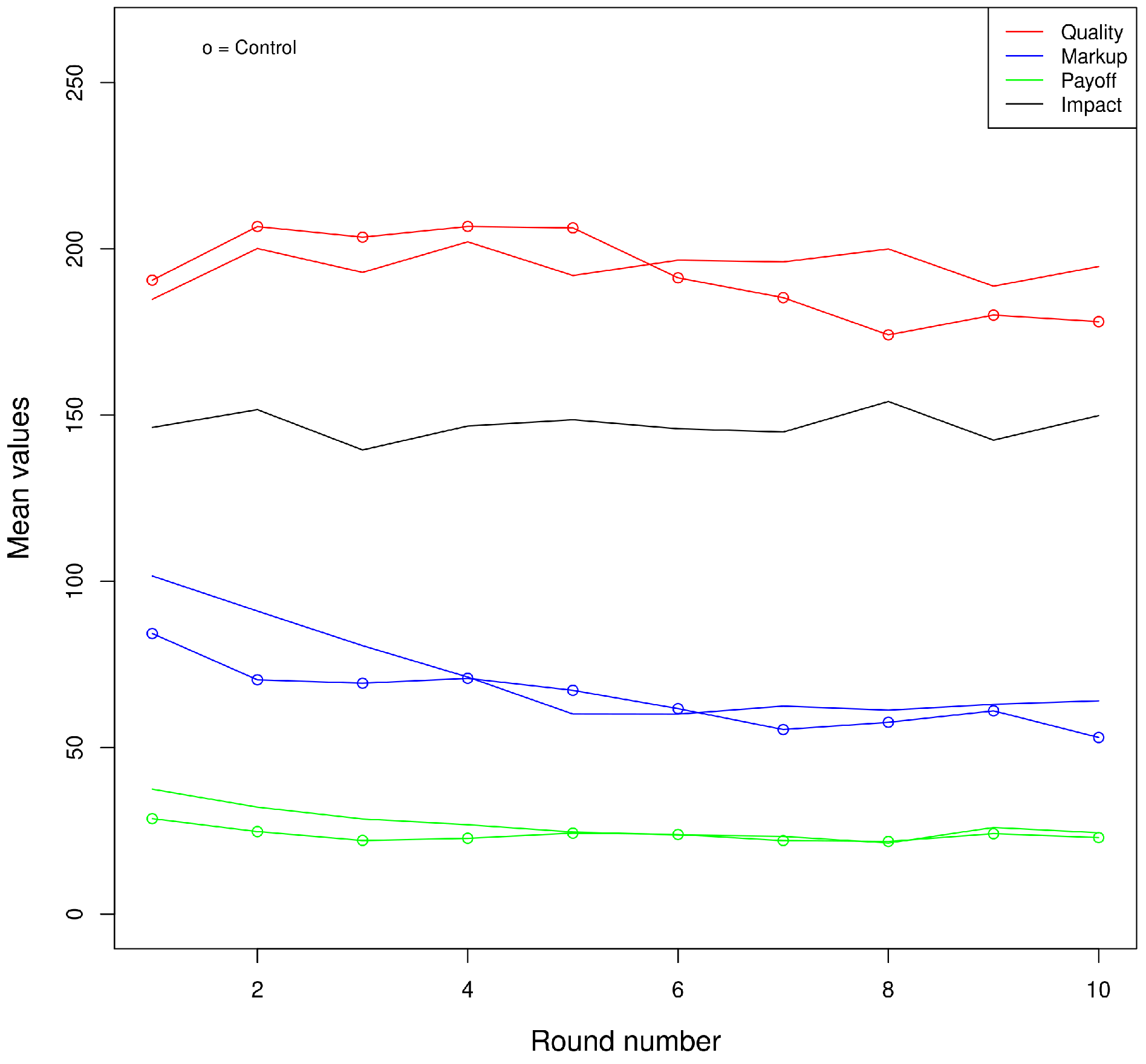

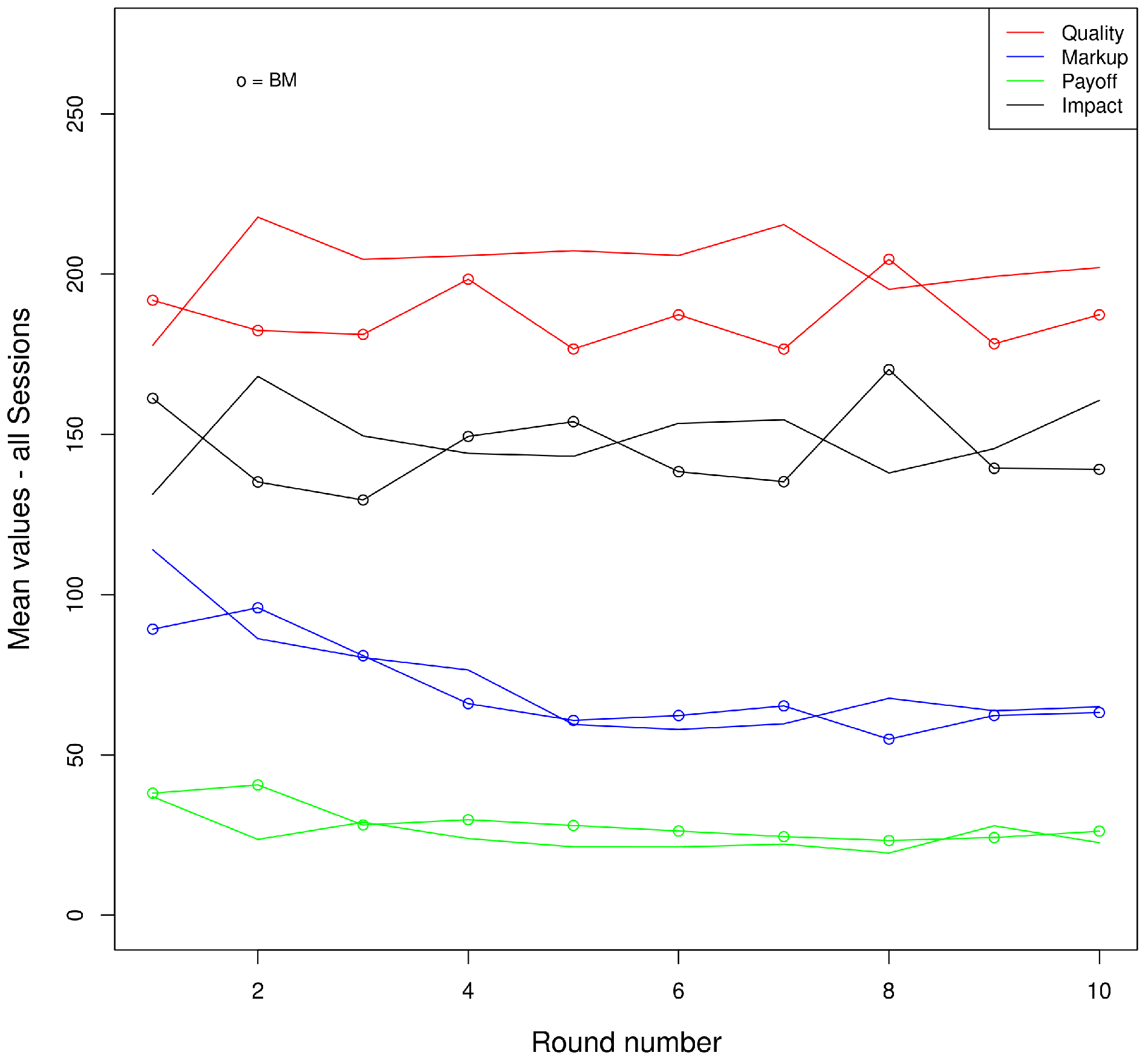

4.1. Learning and Adjustment

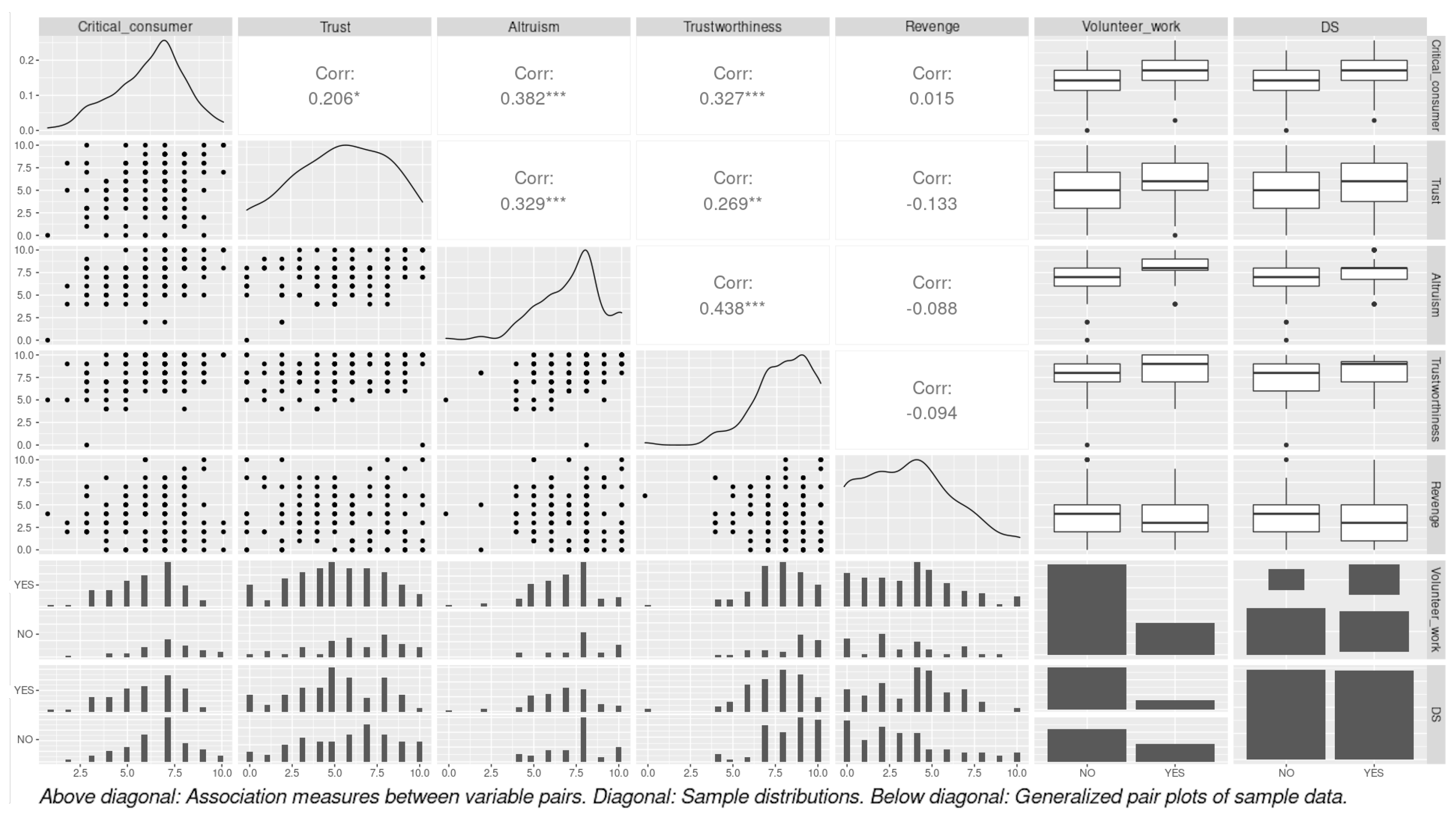

4.2. Evidence from the Questionnaire on Sustainability Attitudes

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Terán-Yépez, E.; Marín-Carrillo, G.M.; del Pilar Casado-Belmonte, M.; de las Mercedes Capobianco-Uriarte, M. Sustainable entrepreneurship: Review of its evolution and new trends. J. Clean. Prod. 2020, 252, 119742. [Google Scholar] [CrossRef]

- Foster, W.; Bradach, J. Should nonprofits seek profits? Harv. Bus. Rev. 2005, 83, 92–100. [Google Scholar] [PubMed]

- Ali, M. A systematic literature review of sustainable entrepreneurship with thematic analysis. World J. Entrep. Manag. Sustain. Dev. 2021, 17, 742–764. [Google Scholar] [CrossRef]

- Anand, A.; Argade, P.; Barkemeyer, R.; Salignac, F. Trends and patterns in sustainable entrepreneurship research: A bibliometric review and research agenda. J. Bus. Ventur. 2021, 36, 106092. [Google Scholar] [CrossRef]

- Fellnhofer, K.; Kraus, S.; Bouncken, R.B. The Current State of Research on Sustainable Entrepreneurship. Int. J. Bus. Res. 2014, 14, 163–172. [Google Scholar] [CrossRef]

- Greco, A.; de Jong, G. Sustainable entrepreneurship: Definitions, themes and research gaps. In Working Paper Series Rijksuniversiteit Groningen; University of Groningen: Groningen, The Netherlands, 2017; Volume 6. [Google Scholar]

- Kummitha, H.; Kummitha, R. Sustainable entrepreneurship training: A study of motivational factors. Int. J. Manag. Educ. 2021, 19, 100449. [Google Scholar] [CrossRef]

- Muñoz, P.; Cohen, B. Entrepreneurship Research: Taking Stock and Looking Ahead. Bus. Strategy Environ. 2018, 27, 300–322. [Google Scholar] [CrossRef]

- Parrish, B. Sustainability-Driven Entrepreneurship: A Literature Review; SRI PAPERS Sustainability Research Institute, School of Earth and Environment, University of Leeds: Leeds, UK, 2008; Volume 9, ISSN 1753-1330. [Google Scholar]

- Ran, B.; Weller, S. An Exit Strategy for the Definitional Elusiveness: A Three-Dimensional Framework for Social Entrepreneurship. Sustainability 2021, 13, 563. [Google Scholar] [CrossRef]

- Volkmann, C.; Fichter, K.; Klofsten, M.; Audretsch, D.B. Sustainable entrepreneurial ecosystems: An emerging field of research. Small Bus. Econ. 2019, 56, 1–9. [Google Scholar] [CrossRef]

- Jolink, A.; Niesten, E. Sustainable Development and Business Models of Entrepreneurs in the Organic Food Industry. Bus. Strategy Environ. 2015, 24, 386–401. [Google Scholar] [CrossRef]

- Cohen, B.; Smith, B.B.; Mitchell, R. Toward a sustainable conceptualization of dependent variables in entrepreneurship research. Bus. Strategy Environ. 2008, 17, 107–119. [Google Scholar] [CrossRef]

- Weller, S.; Ran, B. Social Entrepreneurship: The Logic of Paradox. Sustainability 2020, 12, 10642. [Google Scholar] [CrossRef]

- Wagner, M. Effects of innovativeness and long-term orientation on entrepreneurial intentions: A comparison of business and engineering students. Int. J. Entrep. Small Bus. 2011, 12, 300. [Google Scholar] [CrossRef]

- Meier, S. A survey of economic theories and field evidence on pro-social behavior. In Economics and Psychology: A Promising New Cross-Disciplinary Field; Frey, B.S., Stutzer, A., Eds.; MIT Press: Cambridge, MA, USA, 2007; pp. 51–87. [Google Scholar]

- Baron, D.P. Corporate social responsibility and social entrepreneurship. J. Econ. Manag. Strategy 2007, 16, 683–717. [Google Scholar] [CrossRef]

- Doni, N.; Ricchiuti, G. Market equilibrium in the presence of green consumers and responsible firms: A comparative statics analysis. Resour. Energy Econ. 2013, 35, 380–395. [Google Scholar] [CrossRef]

- Devinney, T.M.; Auger, P.; Eckhardt, G. The Myth of the Ethical Consumer; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Schmitz, J.; Schrader, J. Corporate social responsibility: A microeconomic review of the literature. J. Econ. Surv. 2015, 29, 27–45. [Google Scholar] [CrossRef]

- Normann, H.-T.; Ruffle, B. Introduction to the special issue on experiments in industrial organization. Int. J. Ind. Organ. 2011, 29, 1–3. [Google Scholar] [CrossRef]

- Potters, J.; Suetens, S. Oligopoly experiments in the current millennium. J. Econ. Surv. 2013, 27, 439–460. [Google Scholar] [CrossRef]

- Horiuchi, Y.; Markovich, Z.; Yamamoto, T. Does Conjoint Analysis Mitigate Social Desirability Bias? Political Anal. 2021, 1–15. [Google Scholar] [CrossRef]

- Shepherd, D.A.; Zacharakis, A. Venture capitalists’ expertise: A call for research into decision aids and cognitive feedback. J. Bus. Ventur. 2002, 17, 1–20. [Google Scholar] [CrossRef]

- Bartling, B.; Weber, R.A.; Yao, L. Do markets erode social responsibility? Q. J. Econ. 2015, 130, 219–266. [Google Scholar] [CrossRef]

- Georgantzis, N.; Vasileiou, E. An experiment on energy saving competition with socially responsible consumers: Opening the black box. J. Behav. Exp. Econ. 2015, 58, 1–10. [Google Scholar]

- Pigors, M.; Rockenbach, B. Consumer social responsibility. Manag. Sci. 2016, 62, 3123–3137. [Google Scholar] [CrossRef]

- Rode, J.; Hogarth, R.M.; Le Menestrel, M. Ethical differentiation and market behavior: An experimental approach. J. Econ. Behav. Organ. 2008, 66, 265–280. [Google Scholar] [CrossRef]

- Valente, M. Ethical differentiation and consumption in an incentivized market experiment. Rev. Ind. Organ. 2015, 47, 51–69. [Google Scholar] [CrossRef]

- Danz, D.; Engelmann, D.; Kübler, D. Do Legal Standards Affect Ethical Concerns of Consumers? An Experiment on Minimum Wages; Discussion Paper: Collaborative Research Center Transregio 190; Ludwig-Maximilians-Universität München: Munich, Germany; Humboldt-Universität zu Berlin: Berlin, Germany, 2020; Volume 234. [Google Scholar]

- Feicht, R.; Grimm, V.; Seebauer, M. An experimental study of corporate social responsibility through charitable giving in Bertrand markets. J. Econ. Behav. Organ. 2016, 124, 88–101. [Google Scholar] [CrossRef]

- Etilé, F.; Teyssier, S. Signaling corporate social responsibility: Third-party certification vs. brands. Scand. J. Econ. 2016, 118, 397–432. [Google Scholar] [CrossRef]

- Gabszewicz, J.; Thisse, J.F. Price competition, quality and income disparities. J. Econ. Theory 1979, 20, 340–359. [Google Scholar] [CrossRef]

- Mussa, M.; Rosen, S. Monopoly and product quality. J. Econ. Theory 1978, 18, 301–317. [Google Scholar] [CrossRef]

- Bansal, S.; Gangopadhyay, S. Tax/subsidy policies in the presence of environmentally aware consumers. J. Environ. Econ. Manag. 2003, 45, 333–355. [Google Scholar] [CrossRef]

- Eriksson, C. Can green consumerism replace environmental regulation? A differentiated-products examples. Resour. Energy Econ. 2004, 26, 281–293. [Google Scholar] [CrossRef]

- Garcia-Gallego, A.; Georgantzis, N. Market effects of changes in consumers’ social responsibility. J. Econ. Manag. Strategy 2009, 18, 235–262. [Google Scholar] [CrossRef]

- Lombardini-Riipinen, C. Optimal tax policy under environmental quality competition. Environ. Resour. Econ. 2005, 32, 317–336. [Google Scholar] [CrossRef]

- Rodriguez-Ibeas, R. Environmental product differentiation and environmental awareness. Environ. Resour. Econ. 2007, 36, 237–254. [Google Scholar] [CrossRef]

- Sana, H.A.; Alkhalaf, S.; Zulfiqar, S.; Al-Rahmi, W.M.; Al-Adwan, A.S.; AlSoud, A.R. Upshots of Intrinsic Traits on Social Entrepreneurship Intentions among Young Business Graduates: An Investigation through Moderated-Mediation Model. Sustainability 2021, 13, 5192. [Google Scholar] [CrossRef]

- Tu, B.; Bhowmik, R.; Hasan, M.K.; Asheq, A.A.; Rahaman, M.A.; Chen, X. Graduate Students’ Behavioral Intention towards Social Entrepreneurship: Role of Social Vision, Innovativeness, Social Proactiveness, and Risk Taking. Sustainability 2021, 13, 6386. [Google Scholar] [CrossRef]

- Ham, J.C.; Kagel, J.H.; Lehrer, S.F. Randomization, endogeneity, and laboratory experiments: The role of cash balances in private value auctions. J. Econom. 2005, 125, 175–205. [Google Scholar] [CrossRef][Green Version]

- Schmidt, B.; Hewig, J. Paying out one or all trials: A behavioral economic evaluation of payment methods in a prototypical risky decision study. Psychol. Rec. 2015, 65, 245–250. [Google Scholar] [CrossRef]

- Charness, G.; Gneezy, U.; Halladay, B. Experimental methods: Pay one or pay all. J. Econ. Behav. Organ. 2016, 131, 141–150. [Google Scholar] [CrossRef]

- Moorthy, K.S. Product and price competition in a duopoly. Mark. Sci. 1988, 7, 141–168. [Google Scholar] [CrossRef]

- Wauthy, X. Quality choice in models of vertical differentiation. J. Ind. Econ. 1996, 44, 345–352. [Google Scholar] [CrossRef]

- Hughes, C.T.; Gibson, M.L. Students as surrogates for managers in a decision-making environment: An experimental study. J. Manag. Inf. Syst. 1991, 8, 153–166. [Google Scholar] [CrossRef]

- Ashton, R.H.; Kramer, S.S. Students as surrogates in behavioral accounting research: Some evidence. J. Account. Res. 1980, 18, 1–15. [Google Scholar] [CrossRef]

- Remus, W. Will behavioral research on managerial decision making generalize to managers? Manag. Decis. Econ. 1996, 17, 93–101. [Google Scholar] [CrossRef]

- Song, Y.; Arnott, D.; Gao, S. Graduate students as surrogates for managers in business intelligence and analytics research: A preliminary study. J. Decis. Syst. 2020. [Google Scholar] [CrossRef]

- Trottier, K.; Gordon, I.M. Students as surrogates for managers: Evidence from a replicated experiment. Can. J. Adm. Sci. 2018, 35, 146–161. [Google Scholar] [CrossRef]

- Gordon, M.E.; Slade, L.A.; Schmitt, N. The “Science of the Sophomore” revisited: From conjecture to empiricism. Acad. Manag. Rev. 1986, 11, 191–207. [Google Scholar]

- Gordon, M.E.; Slade, L.A.; Schmitt, N. Student guinea pigs: Porcine predictors and particularistic phenomena. Acad. Manag. Rev. 1987, 12, 160–163. [Google Scholar] [CrossRef]

- Greenberg, J. The college sophomore as guinea pig: Setting the record straight. Acad. Manag. Rev. 1987, 12, 157–159. [Google Scholar] [CrossRef]

- Chen, D.L.; Schonger, M.; Wickens, C. oTree—An open-source platform for laboratory, online, and field experiments. J. Behav. Exp. Financ. 2016, 9, 88–97. [Google Scholar] [CrossRef]

- Stokey, N. Job Differentiation and Wages. Q. J. Econ. 1980, 95, 431–449. [Google Scholar] [CrossRef][Green Version]

- Bigoni, M.; Fort, M. Information and learning in oligopoly: An experiment. Games Econ. Behav. 2013, 81, 192–214. [Google Scholar] [CrossRef][Green Version]

- Huck, S.; Normann, H.T.; Oechssler, J. Learning in Cournot oligopoly—An experiment. Econ. J. 1999, 109, 80–95. [Google Scholar] [CrossRef]

- Offerman, T.; Potters, J.; Sonnemans, J. Imitation and Belief Learning in an Oligopoly Experiment. Rev. Econ. Stud. 2002, 69, 973–997. [Google Scholar] [CrossRef]

- Skatova, A.; Ferguson, E. Why do different people choose different university degrees? Motivation and the choice of degree. Front. Psychol. 2014, 5, 1244. [Google Scholar] [CrossRef] [PubMed]

- Falk, A.; Becker, A.; Dohmen, T.; Huffman, D.; Sunde, U. The Preference Survey Module: A Validated Instrument for Measuring Risk, Time, and Social Preferences; IZA Discussion Paper; Forschungsinstitut zur Zukunft der Arbeit: Bonn, Germany, 2016; Volume 9674. [Google Scholar]

- Yunus, M.; Biggeri, M.; Testi, E. Social Economy and Social Business Supporting Policies for Sustainable Human Development in a Post-COVID-19 World. Sustainability 2021, 13, 12155. [Google Scholar] [CrossRef]

- Biggeri, M.; Colucci, D.; Doni, N.; Valori, V. Incentivized market experiment with vertical differentiation and positive externalities. Mendeley Data 2022, 1. [Google Scholar] [CrossRef]

| Subjects | Groups | |||||

|---|---|---|---|---|---|---|

| Totals | BM | DS | BM-BM | BM-DS | DS-DS | |

| T | 82 | 41 | 41 | 12 | 17 | 12 |

| C | 64 | 32 | 32 | 10 | 12 | 10 |

| Total | 146 | 73 | 73 | 22 | 29 | 22 |

| (a) | |||

|---|---|---|---|

| Statistics | N | Mean | St. Dev. |

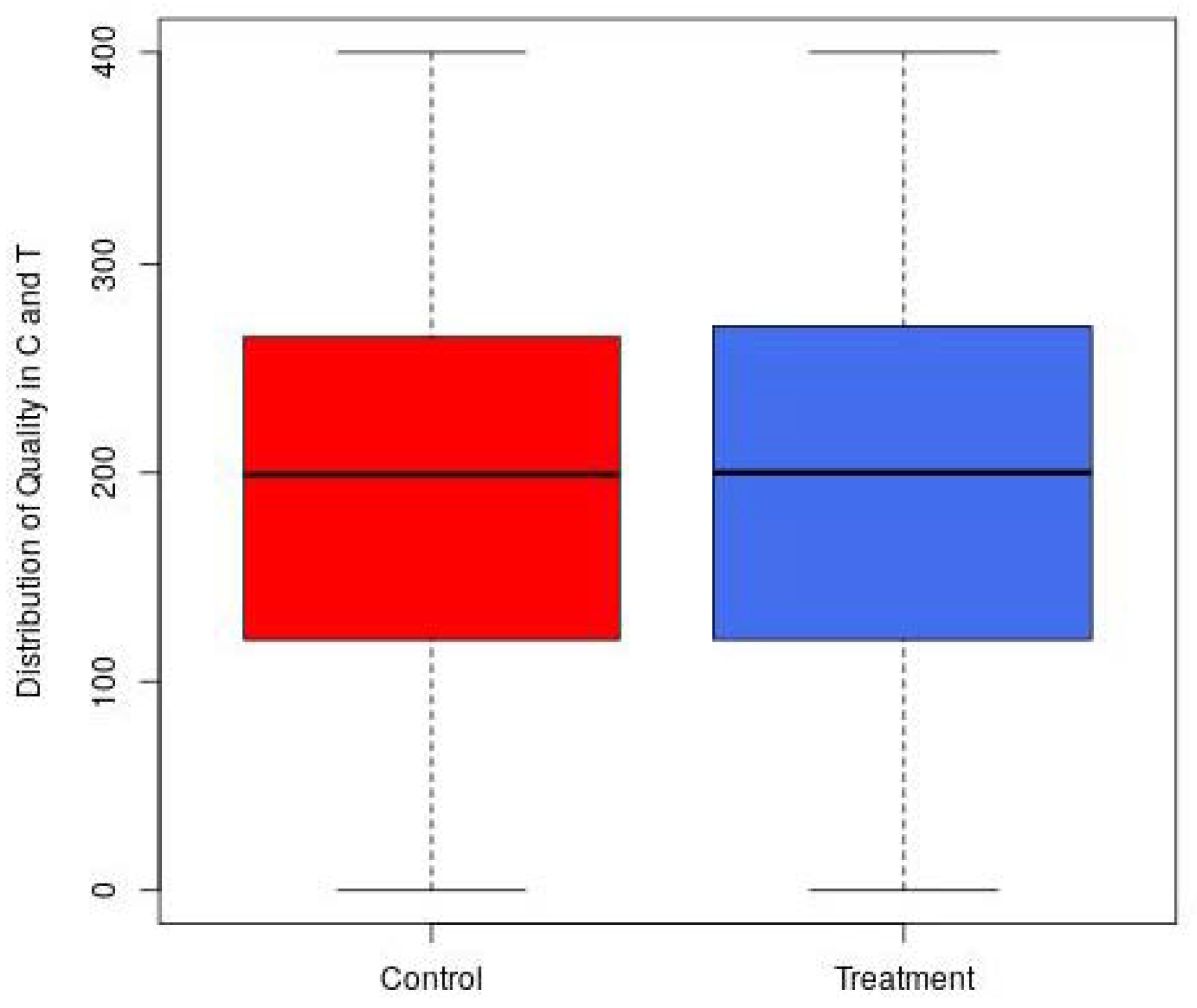

| Quality | 738 | 195.6 | 101.2 |

| Markup | 738 | 68.2 | 68.6 |

| Profit | 738 | 25.6 | 34.2 |

| Impact | 738 | 147.0 | 134.6 |

| (b) | |||

| Statistic | N | Mean | St. Dev. |

| Quality | 576 | 192.4 | 97.1 |

| Markup | 576 | 62.9 | 61.0 |

| Profit | 576 | 23.2 | 27.5 |

| Variable | Estimate | p-Value |

|---|---|---|

| Quality-C | −4.514 | 0.008 |

| Quality-T | −0.571 | 0.669 |

| Price-C | −6.722 | 0.00004 |

| Price-T | −3.543 | 0.01 |

| Profit-C | −0.088 | 0.836 |

| Profit-T | −0.847 | 0.06 |

| Markup-C | −2.208 | 0.011 |

| Markup-T | −2.973 | 0.00004 |

| Impact-T | 0.214 | 0.904 |

| Dependent Variable | |||||||

|---|---|---|---|---|---|---|---|

| Quality | Markup | Profit | Impact | ||||

| T | C | T | C | T | C | T | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| DS | 34.361 | −12.582 | −0.356 | 3.754 | −8.411 | −2.905 | 4.573 |

| (14.026) | (8.291) | (9.248) | (6.104) | (5.245) | (2.363) | (17.713) | |

| p = 0.015 | p = 0.130 | p = 0.970 | p = 0.539 | p = 0.109 | p = 0.219 | p = 0.797 | |

| female | 8.362 | 9.189 | −1.467 | 1.759 | −7.081 | −4.943 | −0.303 |

| (8.796) | (5.871) | (4.849) | (7.517) | (2.744) | (2.895) | (14.783) | |

| p = 0.342 | p = 0.118 | p = 0.763 | p = 0.815 | p = 0.010 | p = 0.088 | p = 0.984 | |

| age | −1.755 | −9.169 | 0.580 | 2.991 | 0.058 | −1.538 | 1.108 |

| (1.141) | (1.813) | (0.719) | (2.832) | (0.402) | (0.937) | (1.978) | |

| p = 0.124 | p = 0.00000 | p = 0.420 | p = 0.291 | p = 0.885 | p = 0.101 | p = 0.576 | |

| Constant | 270.257 | 350.490 | 80.192 | 53.625 | 37.925 | 95.947 | 160.628 |

| (28.868) | (48.450) | (20.912) | (66.582) | (10.675) | (22.396) | (83.391) | |

| p = 0.000 | p = 0.000 | p = 0.0002 | p = 0.421 | p = 0.0004 | p = 0.00002 | p = 0.055 | |

| Observations | 738 | 576 | 738 | 576 | 738 | 576 | 738 |

| R | 0.513 | 0.471 | 0.510 | 0.435 | 0.363 | 0.299 | 0.178 |

| Adjusted R | 0.483 | 0.437 | 0.480 | 0.399 | 0.323 | 0.255 | 0.127 |

| F Statistic | 17.009 *** (df = 43; 694) | 14.143 *** (df = 34; 541) | 16.819 *** (df = 43; 694) | 12.238 *** (df = 34; 541) | 9.186 *** (df = 43; 694) | 6.785 *** (df = 34; 541) | 3.487 *** (df = 43; 694) |

| Dependent variable | ||||||||

|---|---|---|---|---|---|---|---|---|

| Quality | Markup | Profit | Impact | |||||

| (H) | (M) | (H) | (M) | (H) | (M) | (H) | (M) | |

| DS | −41.964 | 31.087 | −83.908 | 0.567 | −30.675 | −9.439 | −65.380 | 6.450 |

| (26.197) | (14.031) | (17.580) | (9.696) | (7.830) | (5.571) | (76.715) | (17.923) | |

| p = 0.110 | p = 0.027 | p = 0.00001 | p = 0.954 | p = 0.0001 | p = 0.091 | p = 0.395 | p = 0.719 | |

| female | 20.032 | −47.403 | −5.183 | 16.909 | −6.751 | −3.812 | 5.294 | −44.895 |

| (8.983) | (14.994) | (5.423) | (5.011) | (2.961) | (2.629) | (16.574) | (25.013) | |

| p = 0.026 | p = 0.002 | p = 0.340 | p = 0.001 | p = 0.023 | p = 0.148 | p = 0.750 | p = 0.073 | |

| age | −2.404 | −1.759 | 0.684 | 0.692 | −0.768 | 0.922 | 3.774 | −2.080 |

| (2.031) | (1.096) | (1.112) | (0.907) | (0.564) | (0.444) | (3.049) | (1.486) | |

| p = 0.237 | p = 0.109 | p = 0.539 | p = 0.446 | p = 0.174 | p = 0.038 | p = 0.216 | p = 0.162 | |

| Constant | 278.707 | 227.282 | 79.769 | −5.862 | 55.933 | −6.124 | 99.177 | 192.202 |

| (47.485) | (25.061) | (28.686) | (19.716) | (14.205) | (7.929) | (98.261) | (42.478) | |

| p = 0.000 | p = 0.000 | p = 0.006 | p = 0.767 | p = 0.0001 | p = 0.440 | p = 0.313 | p = 0.00001 | |

| Observations | 432 | 306 | 432 | 306 | 432 | 306 | 432 | 306 |

| R | 0.540 | 0.493 | 0.357 | 0.611 | 0.255 | 0.437 | 0.162 | 0.218 |

| Adjusted R | 0.511 | 0.459 | 0.317 | 0.585 | 0.209 | 0.399 | 0.110 | 0.166 |

| F Statistic | 19.050 *** (df = 25; 406) | 14.622 *** (df = 19; 286) | 9.016 *** (df = 25; 406) | 23.658 *** (df = 19; 286) | 5.567 *** (df = 25; 406) | 11.676 *** (df = 19; 286) | 3.130 *** (df = 25; 406) | 4.204 *** (df = 19; 286) |

| Dependent Variable | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| 31.553 | 46.643 | |||

| (5.539) | (4.945) | |||

| p = 0.000 | p = 0.000 | |||

| 6.163 | −16.660 | |||

| (7.582) | (6.592) | |||

| p = 0.417 | p = 0.012 | |||

| 4.943 | 14.384 | |||

| (5.757) | (5.400) | |||

| p = 0.391 | p = 0.008 | |||

| 5.836 | −6.251 | |||

| (7.784) | (7.243) | |||

| p = 0.454 | p = 0.389 | |||

| 19.132 | 24.254 | |||

| (3.027) | (3.125) | |||

| p = 0.000 | p = 0.000 | |||

| 0.063 | −3.764 | |||

| (5.072) | (4.887) | |||

| p = 0.991 | p = 0.442 | |||

| 8.006 | 7.521 | |||

| (2.928) | (3.162) | |||

| p = 0.007 | p = 0.018 | |||

| 1.526 | 0.321 | |||

| (4.811) | (5.139) | |||

| p = 0.752 | p = 0.951 | |||

| Constant | −1.795 | 0.583 | −1.265 | −3.359 |

| (3.669) | (3.140) | (2.300) | (2.238) | |

| p = 0.625 | p = 0.853 | p = 0.583 | p = 0.134 | |

| Observations | 512 | 656 | 512 | 656 |

| R | 0.149 | 0.196 | 0.140 | 0.139 |

| Adjusted R | 0.143 | 0.191 | 0.134 | 0.134 |

| Residual Std. Error | 81.487 (df = 507) | 79.082 (df = 651) | 51.353 (df = 507) | 57.320 (df = 651) |

| F Statistic | 22.270 *** (df = 4; 507) | 39.654 *** (df = 4; 651) | 20.694 *** (df = 4; 507) | 26.360 *** (df = 4; 651) |

| Where Would You Like to Work in 10 Years? | DS | BM |

|---|---|---|

| In the public administration (health or social sector) | 12.3% | 1.4% |

| In the public administration (other sectors) | 16.4% | 8.2% |

| As a freelance | 9.6% | 16.4% |

| In a private enterprise | 8.2% | 63% |

| In a nonprofit organization | 43.8% | 2.7% |

| I do not wish to answer | 19.2% | 9.6% |

| Questions | Label |

|---|---|

| How well does the statement “As long as I am not convinced otherwise I always assume that people have only the best intentions” describe you as a person? | Trust |

| How willing are you to give to good causes without expecting anything in return? | Altruism |

| How would you rate your willingness to return a favor to a stranger? | Trustworthiness |

| How well does the following statement describe you as a person: “If I am treated very unjustly, I will take revenge at the first opportunity, even if there is a cost to do so”? | Revenge |

| A critical consumer makes consumption choices based on predefined criteria, such as environmental and social sustainability, which have the same importance of price and quality of the products/services. Given this definition, define your own level of criticality as a consumer. | Critical consumer |

| Are you currently a voluntary member of an organisation or association? | Volunteer work |

| Median DS | Median BM | p-Value | |

|---|---|---|---|

| Trust | 6 | 5 | 0.07075 |

| Altruism | 8 | 7 | 0.00213 |

| Trustworthiness | 9 | 8 | 0.001231 |

| Revenge | 3 | 4 | 0.03132 |

| Critical consumer | 7 | 6 | 0.05419 |

| Odds DS | Odds BM | p-Value | |

| Volunteer work | 0.54 | 0.23 | 0.02041 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Biggeri, M.; Colucci, D.; Doni, N.; Valori, V. Sustainable Entrepreneurship: Good Deeds, Business, Social and Environmental Responsibility in a Market Experiment. Sustainability 2022, 14, 3577. https://doi.org/10.3390/su14063577

Biggeri M, Colucci D, Doni N, Valori V. Sustainable Entrepreneurship: Good Deeds, Business, Social and Environmental Responsibility in a Market Experiment. Sustainability. 2022; 14(6):3577. https://doi.org/10.3390/su14063577

Chicago/Turabian StyleBiggeri, Mario, Domenico Colucci, Nicola Doni, and Vincenzo Valori. 2022. "Sustainable Entrepreneurship: Good Deeds, Business, Social and Environmental Responsibility in a Market Experiment" Sustainability 14, no. 6: 3577. https://doi.org/10.3390/su14063577

APA StyleBiggeri, M., Colucci, D., Doni, N., & Valori, V. (2022). Sustainable Entrepreneurship: Good Deeds, Business, Social and Environmental Responsibility in a Market Experiment. Sustainability, 14(6), 3577. https://doi.org/10.3390/su14063577