Governing Value Creation in a Major Infrastructure Project Client Organization: The Case of Beijing Daxing International Airport

Abstract

:1. Introduction

2. Literature Review

2.1. Project Value

2.2. Value and Value Creation in MIPs

2.3. Project Client and Governance in MIPs

3. Methodology

3.1. Research Design

3.2. Data Collection

3.3. Data Analysis

4. Case analysis

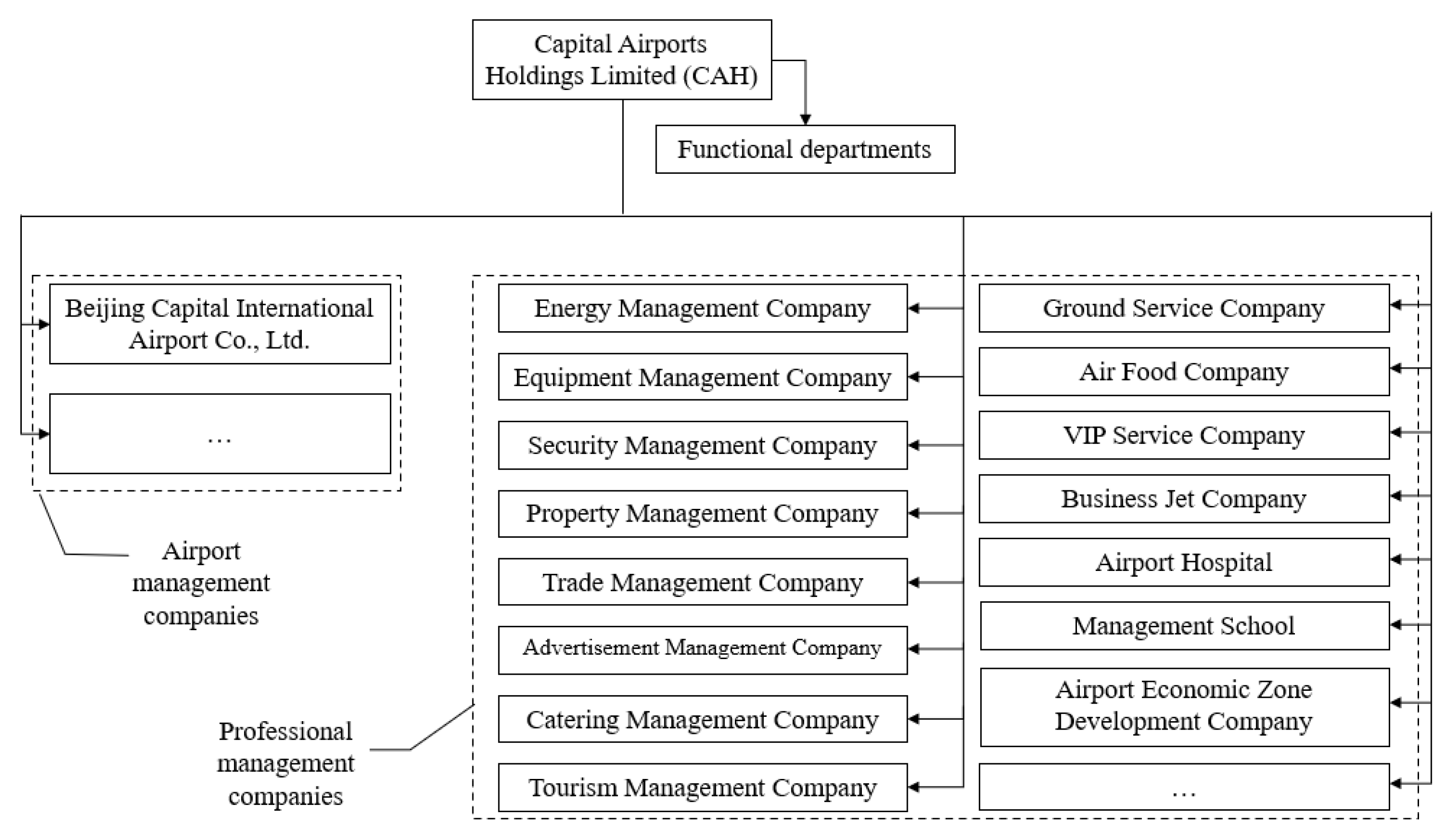

4.1. Brief Introduction of the Client: CAH

4.2. Governance Dimensions and Value Creation of BDIA

4.2.1. Governance of Project Activities: Vertical Blended Integration

- Capable project organization

- 2.

- Integrated management strategy

- 3.

- Full empowerment

4.2.2. Governance of Operational Preparation Activities: Dynamic Matrix Integration

- Knowledge support

- 2.

- Parallel planning

- 3.

- Gradual integration

4.2.3. Governance of the Interplay between Project Activities and Operational Preparation Activities: Continuous Coupling

- Top integration and coordination

- 2.

- Organizational and staff overlap

- 3.

- Whole-process interaction

4.2.4. Hybrid Value Creation

- Project management value

- 2.

- Business value

- 3.

- Public value

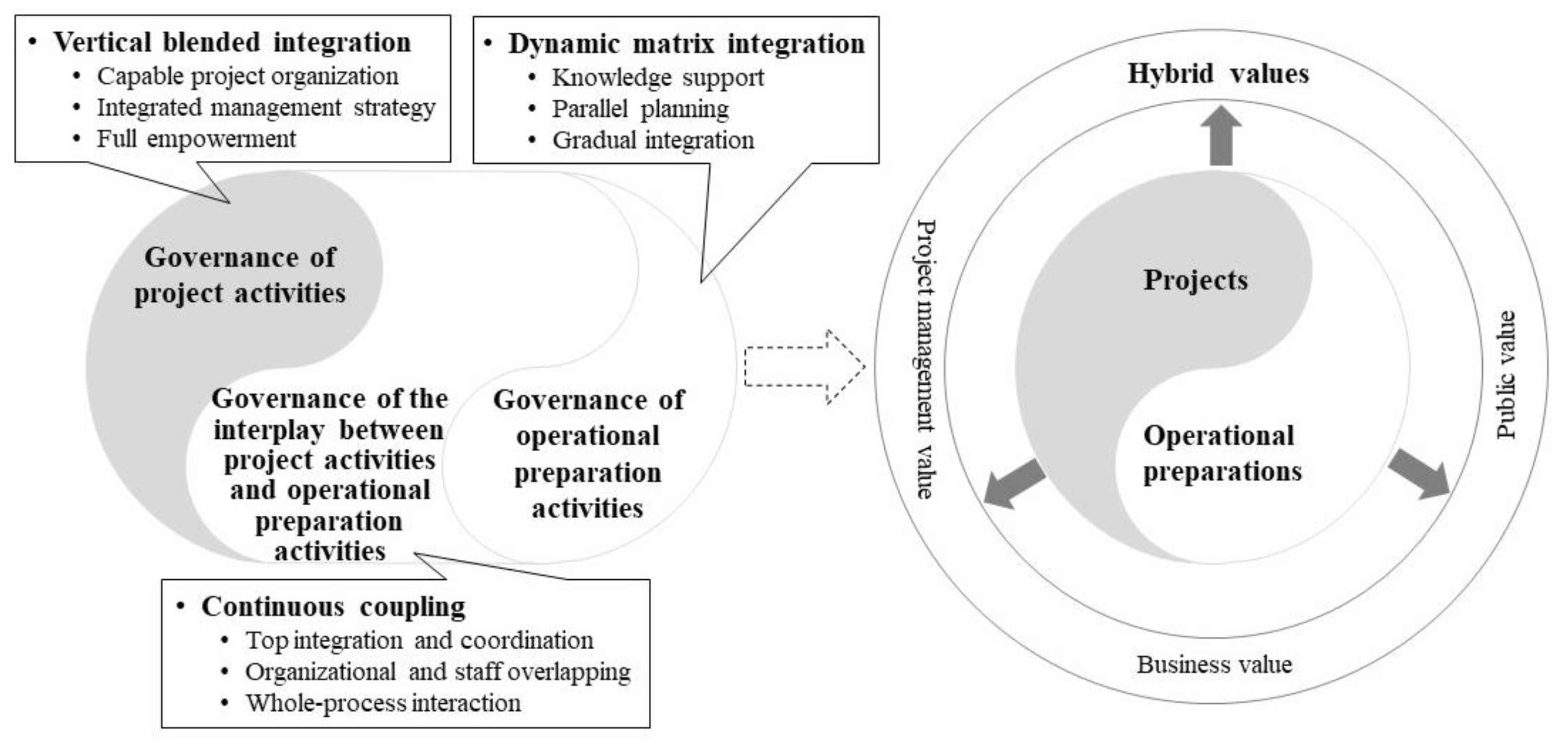

5. Conceptual Framework

5.1. Vertical Blended Integration vs. Dynamic Matrix Integration

5.2. Continuous Coupling

5.3. Hybrid Value Creation

6. Conclusions and Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Flyvbjerg, B. What You Should Know about Megaprojects and Why: An Overview. Proj. Manag. J. 2014, 45, 6–19. [Google Scholar] [CrossRef] [Green Version]

- Wang, G.; Wu, P.; Wu, X.; Zhang, H.; Guo, Q.; Cai, Y. Mapping global research on sustainability of megaproject management: A scientometric review. J. Clean. Prod. 2020, 259, 120831. [Google Scholar] [CrossRef]

- Jia, G.; Yang, F.; Wang, G.; Hong, B.; You, R. A study of mega project from a perspective of social conflict theory. Int. J. Proj. Manag. 2011, 29, 817–827. [Google Scholar] [CrossRef]

- Vidal, L.-A.; Marle, F.; Dernis, M. Modeling and Estimating Host Country Values in International Projects to Facilitate In-Country Value Creation. Sustainability 2021, 13, 5592. [Google Scholar] [CrossRef]

- Wang, W.; Fu, Y.; Gao, J.; Shang, K.; Gao, S.; Xing, J.; Ni, G.; Yuan, Z.; Qiao, Y.; Mi, L. How the COVID-19 Outbreak Affected Organizational Citizenship Behavior in Emergency Construction Megaprojects: Case Study from Two Emergency Hospital Projects in Wuhan, China. J. Manag. Eng. 2021, 37, 04021008. [Google Scholar] [CrossRef]

- Thounaojam, N.; Laishram, B. Issues in promoting sustainability in mega infrastructure projects: A systematic review. J. Environ. Plan. Manag. 2021; 1–24, in press. [Google Scholar] [CrossRef]

- Sturup, S.; Low, N. Sustainable development and mega infrastructure: An overview of the issues. J. Mega Infrastruct. Sustain. Dev. 2019, 1, 8–26. [Google Scholar] [CrossRef]

- Winter, M.; Smith, C.; Morris, P.; Cicmil, S. Directions for future research in project management: The main findings of a UK government-funded research network. Int. J. Proj. Manag. 2006, 24, 638–649. [Google Scholar] [CrossRef]

- Winter, M.; Szczepanek, T. Projects and programmes as value creation processes: A new perspective and some practical implications. Int. J. Proj. Manag. 2008, 26, 95–103. [Google Scholar] [CrossRef]

- Zwikael, O.; Smyrk, J. A General Framework for Gauging the Performance of Initiatives to Enhance Organizational Value. Brit. J. Manag. 2012, 23, S6–S22. [Google Scholar] [CrossRef]

- Laursen, M.; Svejvig, P. Taking stock of project value creation: A structured literature review with future directions for research and practice. Int. J. Proj. Manag. 2016, 34, 736–747. [Google Scholar] [CrossRef]

- Martinsuo, M.; Klakegg, O.J.; van Marrewijk, A. Editorial: Delivering value in projects and project-based business. Int. J. Proj. Manag. 2019, 37, 631–635. [Google Scholar] [CrossRef]

- Goldsmith, H.; Boeuf, P. Digging beneath the iron triangle: The Chunnel with 2020 hindsight. J. Mega Infrastruct. Sustain. Dev. 2019, 1, 79–93. [Google Scholar] [CrossRef]

- Davies, A.; Dodgson, M.; Gann, D.M.; MacAulay, S.C. Five Rules for Managing Large, Complex Projects. MIT Sloan Manag. Rev. 2017, 59, 73–78. [Google Scholar]

- Geraldi, J.; Maylor, H.; Williams, T. Now, let’s make it really complex (complicated). Int. J. Oper. Prod. Manag. 2011, 31, 966–990. [Google Scholar] [CrossRef]

- Abu Aisheh, Y.I. Lessons Learned, Barriers, and Improvement Factors for Mega Building Construction Projects in Developing Countries: Review Study. Sustainability 2021, 13, 10678. [Google Scholar] [CrossRef]

- Gil, N.; Fu, Y. Megaproject Performance, Value Creation and Value Distribution: An Organizational Governance Perspective. Acad. Manag. Discov. 2021; in press. [Google Scholar] [CrossRef]

- Montrimas, A.; Bruneckienė, J.; Gaidelys, V. Beyond the Socio-Economic Impact of Transport Megaprojects. Sustainability 2021, 13, 8547. [Google Scholar] [CrossRef]

- Biesenthal, C.; Clegg, S.; Mahalingam, A.; Sankaran, S. Applying institutional theories to managing megaprojects. Int. J. Proj. Manag. 2018, 36, 43–54. [Google Scholar] [CrossRef]

- Miterev, M.; Jerbrant, A.; Feldmann, A. Exploring the alignment between organization designs and value processes over the program lifecycle. Int. J. Proj. Manag. 2020, 38, 112–123. [Google Scholar] [CrossRef]

- Vuorinen, L.; Martinsuo, M. Value-oriented stakeholder influence on infrastructure projects. Int. J. Proj. Manag. 2019, 37, 750–766. [Google Scholar] [CrossRef]

- Chang, A.; Chih, Y.-Y.; Chew, E.; Pisarski, A. Reconceptualising mega project success in Australian Defence: Recognising the importance of value co-creation. Int. J. Proj. Manag. 2013, 31, 1139–1153. [Google Scholar] [CrossRef]

- Fuentes, M.; Smyth, H.; Davies, A. Co-creation of value outcomes: A client perspective on service provision in projects. Int. J. Proj. Manag. 2019, 37, 696–715. [Google Scholar] [CrossRef]

- Winch, G.M. Three domains of project organising. Int. J. Proj. Manag. 2014, 32, 721–731. [Google Scholar] [CrossRef]

- Zerjav, V.; Edkins, A.; Davies, A. Project capabilities for operational outcomes in inter-organisational settings: The case of London Heathrow Terminal 2. Int. J. Proj. Manag. 2018, 36, 444–459. [Google Scholar] [CrossRef]

- Liu, H.; Jia, G.; Zhao, Z. Research on Operational Preparations Work Schedule of the Airport Reconstruction and Expansion Project. Eng. Econ. 2016, 26, 23–26. (In Chinese) [Google Scholar]

- Zerjav, V.; McArthur, J.; Edkins, A. The multiplicity of value in the front-end of projects: The case of London transportation infrastructure. Int. J. Proj. Manag. 2021, 39, 507–519. [Google Scholar] [CrossRef]

- Martinsuo, M.M.; Vuorinen, L.; Killen, C. Lifecycle-oriented framing of value at the front end of infrastructure projects. Int. J. Manag. Proj. Bus. 2019, 12, 617–643. [Google Scholar] [CrossRef]

- Lehtinen, J.; Peltokorpi, A.; Artto, K. Megaprojects as organizational platforms and technology platforms for value creation. Int. J. Proj. Manag. 2019, 37, 43–58. [Google Scholar] [CrossRef]

- Davies, A. Projects: A Very Short Introduction; Oxford University Press: Oxford, UK, 2017. [Google Scholar]

- de Wit, A. Measurement of project success. Int. J. Proj. Manag. 1988, 6, 164–170. [Google Scholar] [CrossRef]

- Pinto, J.K.; Slevin, D.P. Project success: Definitions and measurement techniques. Proj. Manag. J. 1988, XIX, 67–72. [Google Scholar]

- Kerzner, H. Project Management 2.0: Leveraging Tools, Distributed Collaboration, and Metrics for Project Success; John Wiley & Sons: New York, NY, USA, 2015. [Google Scholar]

- Cabral, S.; Mahoney, J.T.; McGahan, A.M.; Potoski, M. Value creation and value appropriation in public and nonprofit organizations. Strateg. Manag. J. 2019, 40, 465–475. [Google Scholar] [CrossRef]

- Lepak, D.P.; Smith, K.G.; Taylor, M.S. Value creation and value capture: A multilevel perspective. Acad. Manag. Rev. 2007, 32, 180–194. [Google Scholar] [CrossRef] [Green Version]

- Bowman, C.; Ambrosini, V. Value Creation Versus Value Capture: Towards a Coherent Definition of Value in Strategy. Brit. J. Manag. 2000, 11, 1–15. [Google Scholar] [CrossRef]

- Hamidi, F.; Shams Gharneh, N.; Khajeheian, D. A Conceptual Framework for Value Co-Creation in Service Enterprises (Case of Tourism Agencies). Sustainability 2019, 12, 213. [Google Scholar] [CrossRef] [Green Version]

- Liu, Y.; van Marrewijk, A.; Houwing, E.-J.; Hertogh, M. The co-creation of values-in-use at the front end of infrastructure development programs. Int. J. Proj. Manag. 2019, 37, 684–695. [Google Scholar] [CrossRef]

- Martinsuo, M.; Killen, C.P. Value Management in Project Portfolios: Identifying and Assessing Strategic Value. Proj. Manag. J. 2014, 45, 56–70. [Google Scholar] [CrossRef]

- Eskerod, P.; Ang, K. Stakeholder Value Constructs in Megaprojects: A Long-Term Assessment Case Study. Proj. Manag. J. 2017, 48, 60–75. [Google Scholar] [CrossRef]

- Ang, K.; Sankaran, S.; Killen, C. ‘Value for Whom, by Whom’: Investigating Value Constructs in Non-Profit Project Portfolios. Proj. Manag. Res. Pract. 2016, 3, 1–21. [Google Scholar] [CrossRef] [Green Version]

- Brady, T.; Davies, A. From hero to hubris—Reconsidering the project management of Heathrow’s Terminal 5. Int. J. Proj. Manag. 2010, 28, 151–157. [Google Scholar] [CrossRef]

- Kivleniece, I.; Quelin, B.V. Creating and Capturing Value in Public-Private Ties: A Private Actor’s Perspective. Acad. Manag. Rev. 2012, 37, 272–299. [Google Scholar] [CrossRef]

- Schulze, W.; Zellweger, T. Property Rights, Owner-Management, and Value Creation. Acad. Manag. Rev. 2021, 46, 489–511. [Google Scholar] [CrossRef]

- Too, E.G.; Weaver, P. The management of project management: A conceptual framework for project governance. Int. J. Proj. Manag. 2014, 32, 1382–1394. [Google Scholar] [CrossRef]

- Müller, R. Governance and Governmentality for Projects: Enablers, Practices and Consequences; Routledge: New York, NY, USA, 2017. [Google Scholar]

- Whyte, J.; Lindkvist, C.; Jaradat, S. Passing the baton? Handing over digital data from the project to operations. Eng. Proj. Organ. J. 2016, 6, 2–14. [Google Scholar] [CrossRef] [Green Version]

- Whyte, J.; Nussbaum, T. Transition and Temporalities: Spanning Temporal Boundaries as Projects End and Operations Begin. Proj. Manag. J. 2020, 51, 505–521. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 3rd ed.; SAGE Publications: Thousand Oaks, CA, USA, 2003. [Google Scholar]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef] [Green Version]

- Gioia, D.A.; Corley, K.G.; Hamilton, A.L. Seeking Qualitative Rigor in Inductive Research: Notes on the Gioia Methodology. Organ. Res. Methods 2013, 16, 15–31. [Google Scholar] [CrossRef]

- Tracey, P.; Phillips, N.; Jarvis, O. Bridging Institutional Entrepreneurship and the Creation of New Organizational Forms: A Multilevel Model. Organ. Sci. 2011, 22, 60–80. [Google Scholar] [CrossRef]

- Gumusay, A.A.; Smets, M.; Morris, T. ‘God at Work’: Engaging Central and Incompatible Institutional Logics Through Elastic Hybridity. Acad. Manage. J. 2020, 63, 124–154. [Google Scholar] [CrossRef]

- Qiu, Y.; Chen, H.; Sheng, Z.; Zhang, J.; Cheng, S. Institutional Entrepreneurship and Megaproject: A Case of the Hong Kong–Zhuhai–Macau Bridge. IEEE Trans. Eng. Manag. 2020; in press. [Google Scholar] [CrossRef]

- Brady, T.; Davies, A.; Gann, D.M. Creating value by delivering integrated solutions. Int. J. Proj. Manag. 2005, 23, 360–365. [Google Scholar] [CrossRef]

- Davies, A.; Mackenzie, I. Project complexity and systems integration: Constructing the London 2012 Olympics and Paralympics Games. Int. J. Proj. Manag. 2014, 32, 773–790. [Google Scholar] [CrossRef] [Green Version]

- Winch, G.; Leiringer, R. Owner project capabilities for infrastructure development: A review and development of the “strong owner” concept. Int. J. Proj. Manag. 2016, 34, 271–281. [Google Scholar] [CrossRef] [Green Version]

- Morris, P.W.G.; Hough, G.H. The Anatomy of Major Projects: A Study of the Reality of Project Management; John Wiley & Sons: Wiltshire, UK, 1987. [Google Scholar]

- Davies, A.; Brady, T. Explicating the dynamics of project capabilities. Int. J. Proj. Manag. 2016, 34, 314–327. [Google Scholar] [CrossRef]

- Yiu, D.W.; Lu, Y.; Bruton, G.D.; Hoskisson, R.E. Business Groups: An Integrated Model to Focus Future Research. J. Manag. Stud. 2007, 44, 1551–1579. [Google Scholar] [CrossRef]

- Hobday, M. The project-based organisation: An ideal form for managing complex products and systems? Res. Policy 2000, 29, 871–893. [Google Scholar] [CrossRef]

- Locatelli, G.; Mancini, M.; Romano, E. Systems Engineering to improve the governance in complex project environments. Int. J. Proj. Manag. 2014, 32, 1395–1410. [Google Scholar] [CrossRef]

| Data Type | Data Items | Number of Data Points | Descriptions |

|---|---|---|---|

| Project documents | Feasibility study report | 1012 pages | — |

| Approved documents of preliminary design | 17 documents | Involving the schemes, key technical parameters, and investment arrangements of each subproject of BDIA | |

| Project pocketbook | 390 pages | A detailed summary of BDIA, from site selection to project opening | |

| Manual of airport operation | 1060 pages | A detailed manual to guide airport operation | |

| Project summary report | 138 pages | An official summary about the values, processes, achievements, experiences, and implications of BDIA | |

| Other documents | 58 documents | Involving organizations, institutions, schemes, etc. | |

| Minutes of meetings | Minutes at the Group level: General manager meetings of CAH | 30 meetings | The time ranged from 2011 to 2018 |

| Minutes at the Group level: Steering committee of BDIA in CAH | 47 meetings | A total of 47 meetings were held by this committee from November 2014 to September 2019 | |

| Minutes related to project activities: The commander-in-chief meetings at the Headquarters | 234 meetings | A total of 234 meetings were held from 2010 to 2019 | |

| Minutes related to operational preparation activities: Meetings hosted by various operational organizations within CAH | 86 meetings | Involving airport management companies and professional management companies | |

| Interviews | Stage 1: Department leaders and staff | 18 interviews | The number of people in each interview ranged from 1 to 3 |

| Stage 2: Senior leaders, department leaders, and staff | 44 interviews | The number of people in each interview ranged from 1 to 4 | |

| Stage 3: Senior leaders | 4 people | 473 minutes |

| 1st-Order Categories | 2nd-Order Themes | 3rd-Order Aggregate Dimensions |

|---|---|---|

| Selecting elite leaders from the whole Group to form the leadership of the Headquarters | Capable project organization | Governance of project activities: vertical blended integration |

| Hybridizing different people with project experience and airport operation experience | ||

| Maintaining the stability of the Headquarters’ core leaderships | ||

| Responsible for all project activities within CAH | Integrated management strategy | |

| Coordinating other projects and external stakeholders | ||

| Collaborating with many internal operational organizations | ||

| Only major issues needed to be reported to the Group | Full empowerment | |

| The Headquarters had a high degree of discretion on project activities | ||

| A combination strategy to manage contract interfaces | ||

| Capital Airport Management Company utilized its rich airport operation experience to help the Headquarters carry out the front-end study of BDIA | Knowledge support | Governance of operational preparation activities: dynamic matrix integration |

| Professional management companies provided professional suggestions for the formulation of project schemes and the feasibility study report | ||

| Professional management companies parallelly intervened in BDIA to deepen the operational schemes of respective businesses | Parallel planning | |

| Professional management companies parallelly conducted respective operational preparation activities related to organizations, institutions, and people | ||

| Operational Readiness Office only integrated non-aviation businesses | Gradual integration | |

| Daxing Airport Management Company integrated all the businesses and operational preparation activities of professional management companies | ||

| General Manager meeting acting as the top integration and coordination platform in the front end | Top integration and coordination | Governance of the interplay between project activities and operational preparation activities: continuous coupling |

| Establishing a steering committee led by the General Manager of CAH to integrate and coordinate all issues of BDIA in the construction and close-out phases | ||

| Functional departments integrated and coordinated special issues | ||

| The two organizations, the Operational Readiness Office and the Headquarters, were overlapped as “one organization with two titles” | Organizational and staff overlap | |

| The staff of the Daxing Airport Management Company and the Headquarters were overlapped | ||

| Front end: the Headquarters interacted with the Capital Airport Management Company and several professional management companies | Whole-process interaction | |

| Construction: the Headquarters interacted and collaborated with all professional management companies | ||

| Close-out: the Headquarters interacted and collaborated with the Daxing Airport Management Company | ||

| Constraints of cost and schedule | Project management value | Hybrid value creation |

| Quality and safety requirements | ||

| Operational value: maximizing operational income and minimizing operational costs | Business value | |

| Enterprise development value: building brands and innovating management modes | ||

| Economic and social value | Public value | |

| Ecological value | ||

| Industry value |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, Q.; Jia, G.; Wang, X.; Chen, Y. Governing Value Creation in a Major Infrastructure Project Client Organization: The Case of Beijing Daxing International Airport. Sustainability 2022, 14, 3001. https://doi.org/10.3390/su14053001

Xu Q, Jia G, Wang X, Chen Y. Governing Value Creation in a Major Infrastructure Project Client Organization: The Case of Beijing Daxing International Airport. Sustainability. 2022; 14(5):3001. https://doi.org/10.3390/su14053001

Chicago/Turabian StyleXu, Qixiong, Guangshe Jia, Xueying Wang, and Yuting Chen. 2022. "Governing Value Creation in a Major Infrastructure Project Client Organization: The Case of Beijing Daxing International Airport" Sustainability 14, no. 5: 3001. https://doi.org/10.3390/su14053001

APA StyleXu, Q., Jia, G., Wang, X., & Chen, Y. (2022). Governing Value Creation in a Major Infrastructure Project Client Organization: The Case of Beijing Daxing International Airport. Sustainability, 14(5), 3001. https://doi.org/10.3390/su14053001

_Chen.png)