Time–Cost Schedules and Project–Threats Indication

Abstract

:1. Introduction

1.1. Publication Frequency

- (a)

- Parametric methods;

- (b)

- Simulation on the basis of classical input–output observations;

- (c)

- Simulations on the basis of the Monte Carlo method and pseudo-random numbers, the presented paper extends this scheme;

- (d)

- Identification of build-in deterministic chaos in the structure of a model.

1.2. Article Contributions

2. Methods

- POutputs(A)—is time and resource schedule of all activities,

- D = (D1, D2, …, Dm), and Di > 0, ∀i ∈ m are durations of activities Di = fD(Qi, Qi′),

- tStart = (, , …, ), where ≥0, and = fS(GOrg(A), D), for ∀i ∈ m, are activity starting time,

- tEnd = (, ,…, ), where . ≥0, and = fE(GOrg(A), D), for ∀i ∈ m, are activity ending time.

- {Qt}—is sum of project time series cumulative quantities for all project activities Ai where ∀i ∈ m. Values are positioned in time, like results produced by differential equations in [22],

- {Qi}—time series quantities of individual activities, where t > 0 ∀t ∈ n.

- {Qt} or as {Ct′} … time series for ∀t ∈ n of resources-flow, or cash-flow during production time t needed for each activity Ai for ∀i ∈ m,

- {Qt′} or as {Ct′} … time series for ∀t ∈ n of resources-flow, or cash-flow during production time t needed for the project activities A as a whole,

- {Qt″} alias {Ct″} … time series for ∀t ∈ n of resources-flow or cash-flow changes (acceleration) created in time t for each activity Ai for ∀i ∈ m,

- {Qt″} alias {Ct″} … time series for ∀t ∈ n of resources-flow or cash-flow changes (acceleration) created in time t for the all A of project as a whole,

- {Qt‴} alias {Ct‴} … time series for ∀t ∈ n of changes of acceleration (impulses) in t for project activities Ai,

- {Qt‴} alias {Ct‴} … changes of accelerations (impulses) in time t for ∀t ∈ n for project as a whole A.

- (1)

- Concentration of information content from the description of project activities as a whole and decomposition of A to A1, A2, …, Am. Decomposition defines the context and obligations such as technical drawings, reports, norms, standards, environment, environmental, legal, economic, moral, and more, than the contemplate into PInputs, see Table 2.

- (2)

- Creating a singular form of time and cost schedule of resources:

- for individual activities Ai while respecting the links of GOrg,

- for aggregation of time series of resources and indicators of the project as a whole.

2.1. The Basic Time-Scheduling Outputs

2.2. Comment on the Structure GOrg(A)

2.3. Extension of Interpretation

2.4. Time Series of Production Speeds-Simulation

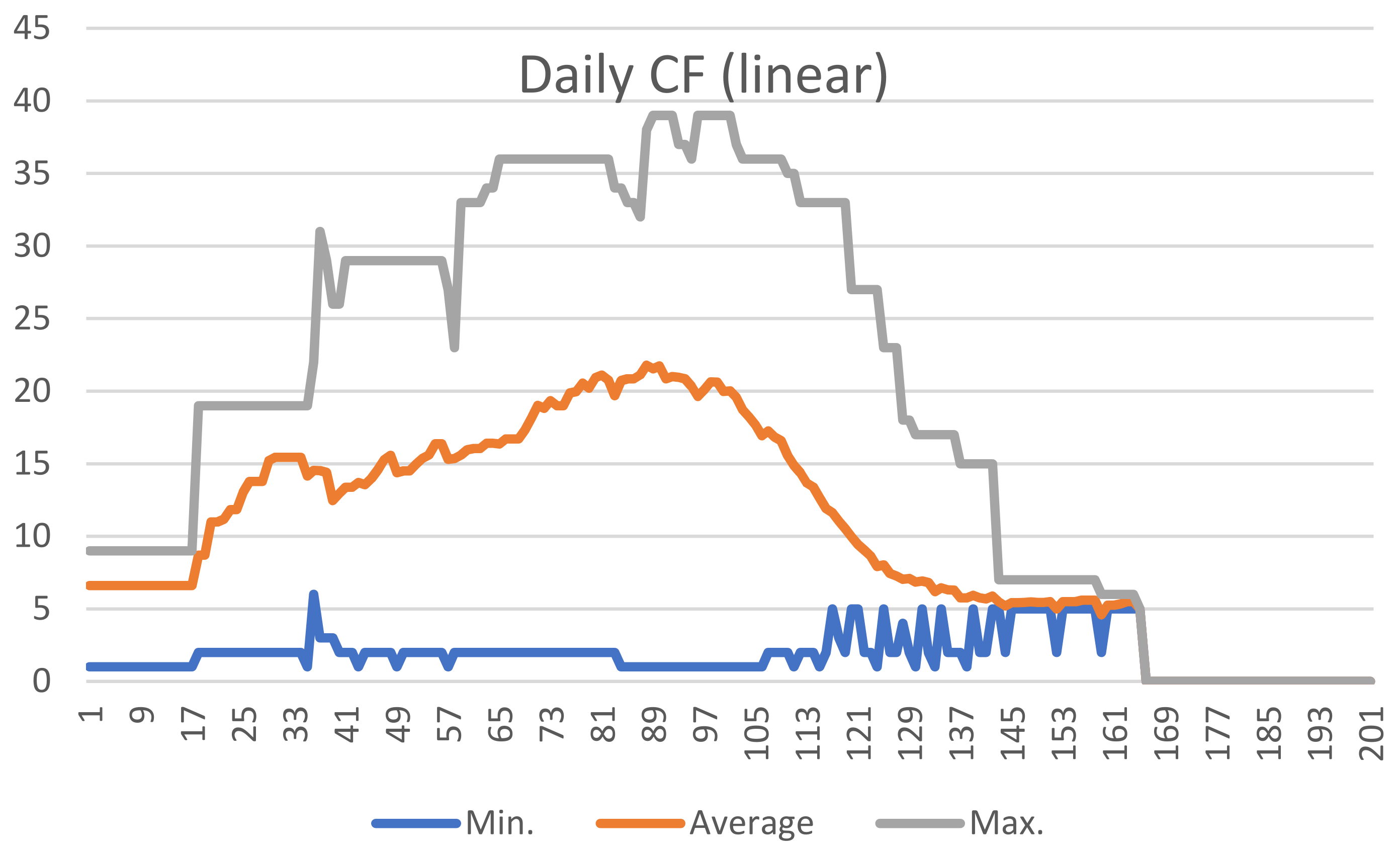

separately, and further supplemented by comments (a) Com 1–6, (b) Com 1–4. A visual comparison between the 2 parts of Figure 3 indicate significant differences between the linear distribution of resources (financial resources Q in terms of costs C) and the use of logistics functions of the distribution of resources C.

separately, and further supplemented by comments (a) Com 1–6, (b) Com 1–4. A visual comparison between the 2 parts of Figure 3 indicate significant differences between the linear distribution of resources (financial resources Q in terms of costs C) and the use of logistics functions of the distribution of resources C.2.4.1. Linear Resource Drawing Schedule—Comment

- Com 1: The start of the project assumes a jump in production capacity. The jump increase does not correspond to the practice of implementation.

- Com 2: The onset of follow-up activities Ai misses the follow-up to the ongoing start-up activities; changes are needed in GOrg(A).

- Com 3: Some follow-up activities do not continue in parallel with ongoing activities. For some activities, the production speed decreases. The opportunity to increase production speed steadily is wasted.

- Com 4: Organizational and technological continuity of activities lead to disturbances in the flow of production speeds. A decrease to the level of the start of implementation can be expected with the concurrence of some external influences. Increasing production speed seems unworkable.

- Com 5: The consequences of the missed opportunities commented on in points 1 to 4 lead to congestion of activities. The expected consequences are chaotic states of coordination of activities, space constraints during implementation, defects in the quality of execution, and more.

- Com 6: A wide range of project completion dates, the completion slippages represent about 1/3 of the total project duration.

2.4.2. Comment for the Schedule of Drawing Resources by the Logistics Function

- Com 1: The achieved pace of implementation is not used to establish follow-up activities. The dynamics of implementation speeds are lost.

- Com 2: Individual activities start with a time delay. The achieved realization speeds are not linked in such a way that there is an effect of increasing the realization speed.

- Com 3: Activities that are supposed to create a precondition for the rapid completion of project implementation start with a time delay.

- Com 4: The finishing process is disorganized and extensive.

2.5. Simulation of the Duration of the Project as a Whole DA

3. Analysis of Time Series Outputs

3.1. Information Potential

- More realistic dynamics of monitored processes with the distribution of resources based on the logistics function;

- The limits of high implementation speeds {maxQ′t}Sim, and their economic complexity;

- The limits of low implementation speeds {minQ′t}Sim; accompanying phenomena are slowing down or interrupting the implementation, organizational complexity of the project, errors in the preparation of the implementation, and more;

- Alternating cycles of the increase and slowdown of implementation with economic consequences;

- The unresolved continuity of implementation activities, especially {maxQ′t}Sim; their limiting manifestation may be both interruptions of project implementation and cycles in implementation speeds.

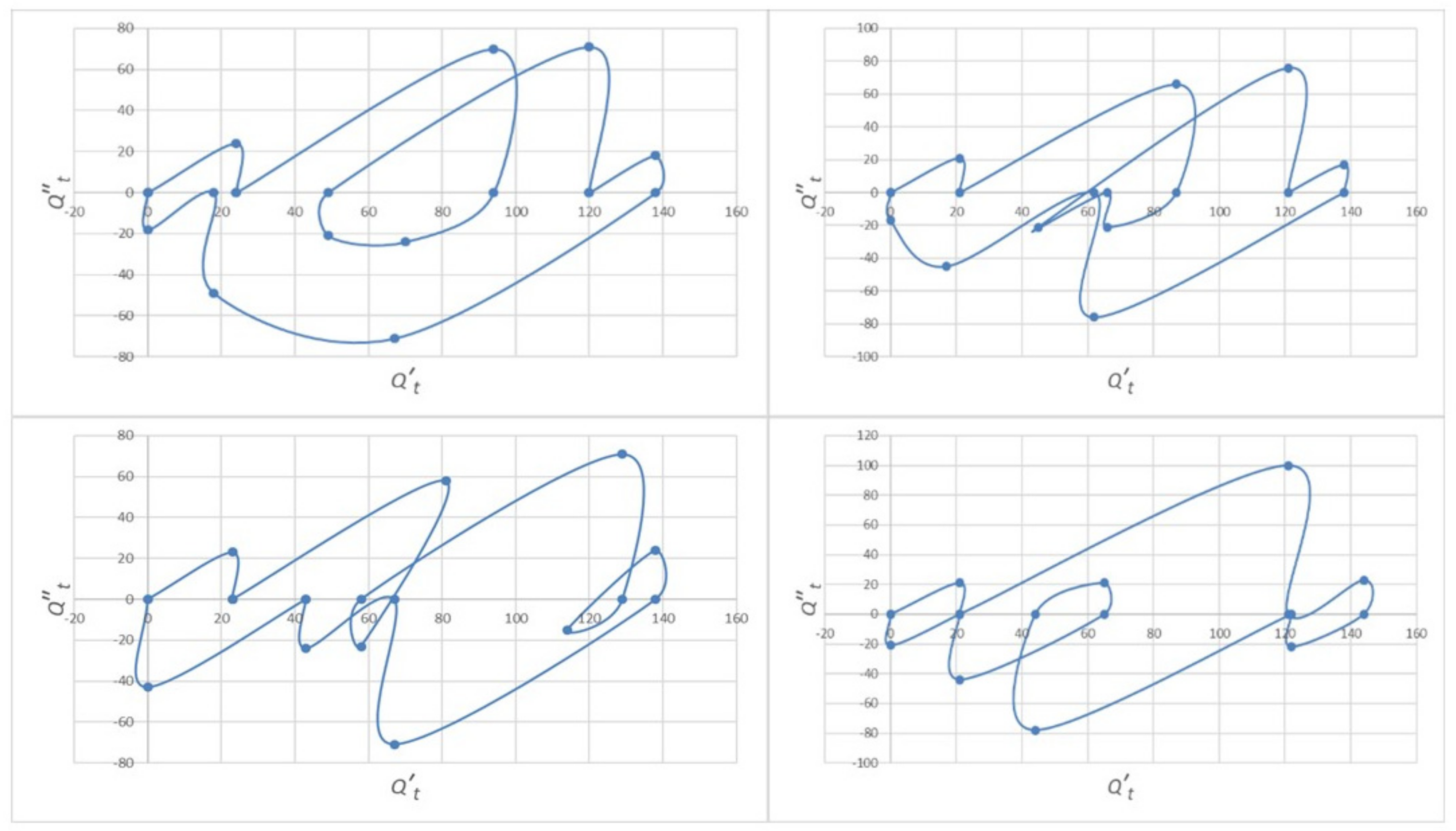

3.2. Phase Portrait Speed and Acceleration

3.3. Application Potential

- revitalization, here a new design of the excavated space;

- potential, use of giant mining mechanisms on alternative projects;

- analysis, time and cost schedules of investments;

- life cycle projects, new investment projects.

4. Conclusions

- (a)

- factual specifications of the proposal (for example, technical, economic, legal, ecological or technological, and other errors);

- (b)

- misleading specifications of time and resource preparation of project activities (engineering of multiple works, project weaknesses, responsibility for risks, etc.);

- (c)

- misleading dispositions with available project resources (substitution of design, certification, durability, energy intensity, emissions, and more).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hilton, B.C. A History of Planning and Production Control 1750 to 2000; Book Guild Ltd.: Lewes, UK, 2005; p. 296. ISBN 1857769961. [Google Scholar]

- Dasović, B.; Klanšek, U. Integration of mixed-integer nonlinear program and project management tool to support sustainable cost-optimal construction scheduling. Sustainability 2021, 13, 12173. [Google Scholar] [CrossRef]

- Zlatanovic, M.; Matejevic, B. Usage of dynamic plans in civil engineering of Serbia. Facta Univ.-Ser. Arch. Civ. Eng. 2011, 9, 57–75. [Google Scholar] [CrossRef]

- Holton, G.A. Defining risk. Financ. Anal. J. 2004, 60, 19–25. [Google Scholar] [CrossRef] [Green Version]

- Burch, H.A. Basic Social Policy and Planning: Strategies and Practice Method; The Haworth Press, Inc.: Binghamton, NY, USA, 1996. [Google Scholar]

- Samuels, L.K. Chaos Gets a Bad Rap: Importance of Chaology to Liberty. Strike-The-Root. 18 February 2015. Available online: http://www.strike-the-root.com/chaos-gets-bad-rap-importance-of-chaology-to-liberty (accessed on 25 November 2021).

- Crouhy, M.; Gaqlai, D.; Mark, R. Risk Management; McGraw-Hill: New York, NY, USA, 2001. [Google Scholar]

- Bareiša, E.; Karčiauskas, E.; Mačikénas, E.; Motiejunas, K. Research and development of teaching software engineering processes. In CompSysTech ’07: Proceedings of the International Conference on Computer Systems and Technologies, Ruse, Bulgaria, 14–15 June 2007; ACM Press: New York, NY, USA, 2007; ISBN 9789549641509. [Google Scholar] [CrossRef]

- Koulinas, G.K.; Demesouka, O.E.; Sidas, K.A.; Koulouriotis, D.E. A TOPSIS—Risk Matrix and Monte Carlo Expert System for Risk Assessment in Engineering Projects. Sustainability 2021, 13, 11277. [Google Scholar] [CrossRef]

- Flemming, C.; Netzker, M.; Schöttle, A. Probabilistic consideration of cost and quantity risks in a detailed estimate. Bautechnik 2011, 88, 94–101. [Google Scholar] [CrossRef]

- Jorion, P. Value at Risk: The New Benchmark for Managing Financial Risk, 2nd ed.; McGraw-Hill: New York, NY, USA, 2001. [Google Scholar]

- Tichý, T.; Brož, J.; Bělinová, Z.; Pirník, R. Analysis of predictive maintenance for tunnel systems. Sustainability 2021, 13, 3977. [Google Scholar] [CrossRef]

- Eash-Gates, P.; Klemun, M.M.; Kavlak, G.; McNerney, J.; Buongiorno, J.; Trancik, J.E. Sources of cost overrun in nuclear power plant construction call for a new approach to engineering design. Joule 2020, 4, 2348–2373. [Google Scholar] [CrossRef]

- Mohamed, H.H.; Ibrahim, A.H.; Soliman, A.A. Toward reducing construction project delivery time under limited resources. Sustainability 2021, 13, 11035. [Google Scholar] [CrossRef]

- Bush, T.A.; Girmscheid, G. Projektrisikomanagement in der Bauwirtschaft; Beuth: Berlin, Germany, 2014; p. 242. ISBN 9783410223153. (In German) [Google Scholar]

- Beran, J.; Feng, Y.; Grosh, S.; Kulik, R. Long-Memory Processes, Probabilistic Properties and Statistical Methods; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Rychlik, K. The Theory of Real Numbers in Bolzano’s Handwritten Papers; Publishing House of the Czechoslovak Academy of Sciences: Prague, Czech Republic, 1962. (In Czech) [Google Scholar]

- Harrod, F.R. An essay in dynamic theory. In The Economic Journal; Palgrave Macmillan: London, UK, 1939; pp. 14–33. [Google Scholar]

- Beran, V.; Dlask, P.; Eaton, D.; Hromada, E.; Zindulka, O. Mapping of synchronous activities through virtual management momentum simulation. Constr. Innov. Inf. Process Manag. 2011, 11, 190–211. [Google Scholar] [CrossRef]

- Beran, V.; Teichmann, M.; Kuda, F. Decision-making rules and the influence of memory data. Sustainability 2021, 13, 1396. [Google Scholar] [CrossRef]

- Beran, V.; Teichmann, M.; Kuda, F.; Zdarilova, R. Dynamics of regional development in regional and municipal economy. Sustainability 2020, 12, 9234. [Google Scholar] [CrossRef]

- Kuda, F.; Teichmann, M. Maintenance of infrastructural constructions with use of modern technologies. Vytap. Vetr. Instal. 2017, 26, 18–21. (In Czech) [Google Scholar]

- Awad, T.; Guardiola, J.; Fraíz, D. Sustainable construction: Improving productivity through lean construction. Sustainability 2021, 13, 13877. [Google Scholar] [CrossRef]

- Rosłon, J.; Książek-Nowak, M.; Nowak, P.; Zawistowski, J. Cash-flow schedules optimization within life cycle costing (LCC). Sustainability 2020, 12, 8201. [Google Scholar] [CrossRef]

- Fulcher, B.D.; Little, M.A.; Jones, N.S. Highly comparative time-series analysis: The empirical structure of time series and their methods. J. R. Soc. Interface 2013, 10, 20130048. [Google Scholar] [CrossRef]

- Tichý, T.; Brož, J.; Bělinová, Z.; Kouba, P. Predictive diagnostics usage for telematic systems maintenance. In 2020 Smart City Symposium Prague; IEEE Press: New York, NY, USA, 2020; ISBN 978-1-7281-6821-0. [Google Scholar] [CrossRef]

- Flyvbjerg, B.; Bruzelius, N.; Rothengatter, W. Megaprojects and Risk—An Anatomy of Ambition; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Flyvbjerg, B.; Steward, A. Olympic Proportions: Cost and Cost Overrun at the Olympics 1960–2012; Said Business School Working Paper; University of Oxford: Oxford, UK, 2012. [Google Scholar]

- Marwan, N.; Romano, M.C.; Thiel, M.; Kurths, J. Recurrence plots for the analysis of complex systems. Phys. Rep. 2007, 438, 237–329. [Google Scholar] [CrossRef]

- Prigogine, I.; Stengers, I. Order out of Chaos, Man’s New Dialogue with Nature; Bantam Books: New York, NY, USA, 1984. [Google Scholar]

- Holton, G.A. Time: The Second Dimension of Risk. Financ. Anal. J. 1992, 48, 38–45. [Google Scholar] [CrossRef]

- Samuels, L.K. In Defense of Chaos: The Chaology of Politics, Economics and Human Action; Cobden Press: London, UK, 2014. [Google Scholar]

- Mindlin, G.B.; Gilmore, R. Topological analysis and synthesis of chaotic time series. Physica D 1992, 58, 229–242. [Google Scholar] [CrossRef]

- Kong, Q.; Lee, C.-Y.; Teo, C.-P.; Zheng, Z. Scheduling arrivals to a stochastic service delivery system using copositive cones. Oper. Res. 2013, 61, 711–726. [Google Scholar] [CrossRef] [Green Version]

- Shvetsova, O.A.; Lee, J.H. Minimizing the environmental impact of industrial production: Evidence from South Korean waste treatment investment projects. Appl. Sci. 2020, 10, 3489. [Google Scholar] [CrossRef]

- Liu, Z. Chaotic time series analysis. Math. Probl. Eng. 2010, 2010, 720190. [Google Scholar] [CrossRef] [Green Version]

- Gu, Z.; Xu, Y. Chaotic dynamics analysis based on financial time series. Complexity 2021, 2021, 2373423. [Google Scholar] [CrossRef]

- Teichmann, M.; Kuta, D.; Endel, S.; Szeligova, N. Modeling and optimization of the drinking water supply network—A system case study from the Czech Republic. Sustainability 2020, 12, 9984. [Google Scholar] [CrossRef]

- Rodionova, E.A.; Shvetsova, O.A.; Epstein, M.Z. Multicriterial approach to investment project’s estimation under risk conditions. Rev. Espac. 2018, 39, 28–44. [Google Scholar]

- Lehtonen, J.-M.; Appelqvist, P.; Ruohala, T.; Mattila, I. Factory scheduling: Simulation-based finite scheduling at Albany International. In Proceedings of the 2003 Winter Simulation Conference, New Orleans, LA, USA, 7–10 December 2003; pp. 1449–1455. [Google Scholar]

- Szeligova, N.; Teichmann, M.; Kuda, F. Research of the disparities in the process of revitalization of brownfields in small towns and cities. Sustainability 2021, 13, 1232. [Google Scholar] [CrossRef]

- Jíšová, J.; Tichý, T.; Filip, J.; Navrátilová, K.; Thomayer, L. The application of the latest territorial components for sustainable mobility in district cities. IOP Conf. Ser. Earth Environ. Sci. 2021, 900, 012012. [Google Scholar] [CrossRef]

| Record Count 100% = 25,752; Selection for >5.00% | Records | % |

|---|---|---|

| engineering electrical electronic | 5822 | 22.61 |

| operations research management science | 4347 | 16.88 |

| computer science theory methods | 3308 | 12.85 |

| engineering industrial | 2603 | 10.11 |

| computer science information systems | 2364 | 9.18 |

| telecommunications | 2086 | 8.10 |

| computer science interdisciplinary applications | 2069 | 8.03 |

| computer science hardware architecture | 1768 | 6.86 |

| computer science artificial intelligence | 1686 | 6.55 |

| management | 1610 | 6.25 |

| engineering manufacturing | 1542 | 5.99 |

| automation control systems | 1473 | 5.72 |

| energy fuels | 1450 | 5.63 |

| engineering civil | 1425 | 5.53 |

| computer science software engineering | 1328 | 5.16 |

| Dynamic Schedule Inputs | ||||

|---|---|---|---|---|

| Simulation 100× | ||||

| Inputs | Inputs | Inputs | Calculation | Inputs |

| Activity A | Quantity QA inputs (*) | Price π per QA unit | Costs CA = πA QA | Speed (**) Q′A |

| Activity A1 | 20 | 5 | 100.00 | 19.00 |

| Activity A2 | 7.5 | 10 | 75.00 | 12.00 |

| Activity A3 | 10 | 55 | 550.00 | 87.00 |

| Activity A4 | 20 | 20 | 400.00 | 48.00 |

| Activity A5 | 5 | 20 | 100.00 | 25.00 |

| Total Costs (TC) | 1225.00 | |||

| Dynamic Schedule: Costs | Dynamic Schedule: Durations | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| External Data Inputs | Calculation | |||||||||||||||||||

| Activity A | Quantity Inputs (*) | Price per Q Unit | Costs [t. €] | Speed (**) of Production | Start [Weeks] | Duration [Weeks] | End [Weeks] | End [Weeks] | ||||||||||||

| Activity A1 | 20 | 5 | 100.00 | 15.00 | 1.00 | 7.00 | 8.00 | 8.00 | ||||||||||||

| Activity A2 | 7.5 | 10 | 75.00 | 12.00 | 6.00 | 7.00 | 13.00 | 13.00 | ||||||||||||

| Activity A3 | 10 | 55 | 550.00 | 70.00 | 9.00 | 8.00 | 16.00 | 16.00 | ||||||||||||

| Activity A4 | 20 | 20 | 400.00 | 60.00 | 11.00 | 7.00 | 18.00 | 18.00 | ||||||||||||

| Activity A5 | 5 | 20 | 100.00 | 20.00 | 16.00 | 5.00 | 21.00 | 21.00 | ||||||||||||

| Total Costs TC… | 1225.00 | |||||||||||||||||||

| Dynamic Network: Production Speed. Acceleration. Prod. Cumulated | ||||||||||||||||||||

| Activity A | 8.1 | 9.1 | 10.1 | 11.1 | 12.1 | 13.1 | 14.1 | 15.1 | 16.1 | 17.1 | 18.1 | 19.1 | 20.1 | 21.1 | 22.1 | 23.1 | 24.1 | 25.1 | 26.1 | 27.1 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | |

| Activity A1 | 15 | 15 | 15 | 15 | 15 | 15 | 10 | |||||||||||||

| Activity A2 | 12 | 12 | 12 | 12 | 12 | 12 | 3 | |||||||||||||

| Activity A3 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 60 | ||||||||||||

| Activity A4 | 60 | 60 | 60 | 60 | 60 | 60 | 40 | |||||||||||||

| Activity A5 | 20 | 20 | 20 | 20 | 20 | |||||||||||||||

| Cash Flow{Q´t} | 15 | 15 | 15 | 15 | 15 | 27 | 22 | 12 | 82 | 82 | 142 | 133 | 130 | 130 | 130 | 140 | 60 | 20 | 20 | 20 |

| Accel. {Q´´t} | 15 | 0 | 0 | 0 | 0 | 12 | −5 | −10 | 70 | 0 | 60 | −9 | −3 | 0 | 0 | 10 | −80 | −40 | 0 | 0 |

| Impuls {Q´´´t} | 15 | −15 | 0 | 0 | 0 | 12 | −17 | −5 | 80 | −70 | 60 | −69 | 6 | 3 | 0 | 10 | −90 | 40 | 40 | 0 |

| Cumul. prod {Qt} | 15 | 30 | 45 | 60 | 75 | 102 | 124 | 136 | 218 | 300 | 442 | 575 | 705 | 835 | 965 | 1105 | 1165 | 1185 | 1205 | 1225 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kuda, F.; Dlask, P.; Teichmann, M.; Beran, V. Time–Cost Schedules and Project–Threats Indication. Sustainability 2022, 14, 2828. https://doi.org/10.3390/su14052828

Kuda F, Dlask P, Teichmann M, Beran V. Time–Cost Schedules and Project–Threats Indication. Sustainability. 2022; 14(5):2828. https://doi.org/10.3390/su14052828

Chicago/Turabian StyleKuda, Frantisek, Petr Dlask, Marek Teichmann, and Vaclav Beran. 2022. "Time–Cost Schedules and Project–Threats Indication" Sustainability 14, no. 5: 2828. https://doi.org/10.3390/su14052828

APA StyleKuda, F., Dlask, P., Teichmann, M., & Beran, V. (2022). Time–Cost Schedules and Project–Threats Indication. Sustainability, 14(5), 2828. https://doi.org/10.3390/su14052828