1. Introduction

The Fifth Plenary session of the 19th CPC Central Committee further stressed that, in order to promote high-quality development as the theme of economic and social development during the 14th five-year plan period, we must put the quality of development in a more prominent position and strive to improve the quality and efficiency of development. At the same time, the new round of scientific and technological revolution and industrial reform represented by the digital economy are reconstructing the global innovation map and reshaping the global economic structure, which is a historical opportunity for China to promote high-quality development. Developing the digital economy vigorously, promoting digital industrialization and industrial digitization, accelerating innovative breakthroughs in new-generation information and communication technologies, such as 5G, Internet of Things, cloud computing, big data, and artificial intelligence, and promoting the deep integration of the digital economy and the real economy will help to transform and upgrade traditional industries and promote the upgrading of the industrial foundation and modernization of the industrial chain, and are the strategic choices and key support for constructing a new development pattern to achieve high-quality development.

China’s economic development is in a new normal period of transformation from an investment-driven, high-speed growth model to an innovation-driven, high-quality development model. In the face of multiple pressures, such as the impact of the epidemic, the global economic downturn, and the lack of effective demand, the platform economy represented by the Internet, cloud computing, and big data has played an inestimable role. According to the report of the China Academy of Information and Communications, the added value of China’s digital economy increased from 9.5 trillion yuan in 2011 to 39.2 trillion yuan in 2020, accounting for 38.6 percent of GDP from 20.3 percent. Under the superimposed influence of the impact of the epidemic and the global economic downturn in 2020, China’s digital economy still maintained a trend of vigorous development, with a scale of 392 trillion yuan, of which the scale of digital industrialization reached 7.5 trillion yuan, accounting for 19.1 percent of the digital economy and 7.3 percent of GDP. The scale of industrial digitization reached 31.7 trillion yuan, accounting for 80.9 percent of the digital economy and 31.2 percent of GDP. The platform economy, which is based on data as the factor of production and driven by intelligence, will become a new engine and provide key momentum for the high-quality development of China’s economy. Therefore, it is of great practical significance to explore the relationship between the platform economy and high-quality development to effectively release the new momentum of the platform economy to achieve high-quality economic development.

The possible contributions and innovations of this paper are as follows: first, the existing research on the platform economy and high-quality development is mainly focused on theoretical analysis, and empirical analysis is mostly based on linear discussion. Different from the existing research, this paper comprehensively measures the high-quality development index based on the new development concept and comprehensively discusses the nonlinear relationship between the platform economy and high-quality development and its underlying mechanism, which makes up for the research gap of this topic and enriches the relevant research theory. Second, this paper takes the allocation of factor resources as mechanism variables to construct a theoretical analysis framework to explore the adjustment mechanism between platform economy and high-quality economic development, which provides a new insight for a deeper understanding of the role of the platform economy in high-quality development. Third, based on the “double-edged sword” characteristics of the platform economy, this paper discusses the heterogeneity of the impact of the platform economy on high-quality economic development in multiple dimensions and can evaluate the conditionality and effectiveness of platform economic development more comprehensively than previous studies. It provides detailed evidence for supporting and guiding the healthy development of the platform economy.

2. Literature Review

Previous studies have been carried out from both theoretical and empirical aspects: theoretical studies believe that the platform economy, represented by big data, the Internet, and artificial intelligence, mainly affects the high-quality development of the economy from micro and macro dimensions. Microscopically, digital technology is widely used in various fields, and the application scenarios are constantly being expanded and enriched, promoting the innovation and development of technology, business, and models in different fields, and creating an economic environment with economies of scale and scope. On this basis, new economic forms, such as the sharing economy and platform economy, are being produced to better match supply and demand, form a more perfect price mechanism, and improve the efficiency of economic operation as a whole [

1,

2,

3]. Macroscopically, the platform economy promotes high-quality economic development mainly by improving the efficiency of resource allocation and total factor productivity [

4,

5]. Empirical research shows that the platform economy can improve entrepreneurial activity [

6], technology utilization efficiency [

7], and other paths to promote the high-quality development of regional economies. However, a small number of scholars have found that there are risks and problems in the development of the platform economy [

8,

9]. For example, excessive use of artificial intelligence may lead to a mismatch between capital and labor factors [

10], inappropriate competition [

11], and disorderly development of the platform economy, leading to technological risks and market monopolies [

12], and other problems are not conducive to the healthy development of the economy. The platform economy has gradually become an important part of today’s social and economic development, but there is a lack of empirical research to comprehensively evaluate the relationship between the platform economy and high-quality economic development. The only relevant literature focused on how artificial intelligence affects economic and social transformation [

13], economic growth and sustainable development [

11,

14,

15], total factor productivity and employment [

16], and the impact of the platform economy on economic growth and income equity [

17,

18] and other high-quality development sub-topics. By combing the existing literature, we found that the effect of the platform economy on high-quality economic development may not just be a simple linear relationship. Some scholars have discussed the threshold effect of the platform economy on high-quality development [

17]. However, it does not give its non-linear mechanism, nor does it evaluate the regional differences in the current high-quality development level of regional economies in China.

According to the summary, the existing research has the following shortcomings: first, from the perspective of the platform economy paradox, it is rare to explore the nonlinear relationship between the platform economy and regional high-quality development. As far as the actual platform economy is concerned, some platform organizations use digital technology to carry out price monopolies; market monopolies destroy the market order and are not conducive to the healthy development of the national economy [

12,

19]. The existing research is not enough to fully assess the economic effects of the platform economy. Second, the existing literature on the relationship between the platform economy and high-quality development only focuses on related sub-topics, such as artificial intelligence and employment [

20,

21], ICT, and economic growth [

22]. A few studies tried to combine the platform economy with economic growth [

23]. However, it is not very good to measure the platform economy and solve endogenous problems. Third, there is still a lot of room for discussion of the relationship and mechanism between the platform economy and high-quality development. Therefore, this paper attempts to explore the non-linear relationship between the platform economy and high-quality development level and its mechanism on the basis of the comprehensive measurement of the platform economy and high-quality development level. The questions to be answered in this paper are as follows: Is there a non-linear impact of the platform economy on high-quality economic development? If so, what is the mechanism behind it? What is the non-linear relationship between the two and is it affected by the location and the degree of marketization? In order to answer the above questions, we need to analyze the regional characteristics on the basis of combing the relevant theories. This paper selects 30 provinces in China as research samples, and empirically tests the influence and mechanism of the platform economy on high-quality development.

3. Theoretical Analysis and Research Hypotheses

High-quality development is development that can well meet the growing needs of people for a better life, and embodies the new development concept of “innovation, coordination, green, openness, and sharing” [

24]. The platform economy and sharing economy spawned by the platform economy not only break through physical time and space constraints and realize the real-time development of large-scale supply and demand activities, but also help to reduce production operation costs and transaction costs. It has not only become an important carrier to promote resource integration and value creation in the development of the platform economy [

25], but also represents a new way of resource allocation with an emphasis on matching and connection. It has effectively solved the problems of high-quality economic development, such as the contradiction between the supply and demand of factor resources, space limitation of economic activities, efficiency, and fairness, etc. [

22]. This paper holds that the platform economy can create conditions for high-quality economic development by improving the efficiency of resource allocation of talent, capital, and technology.

In terms of the allocation of technological elements, many scholars have proved that the digital economy can promote the improvement of total factor productivity and economic growth [

26,

27,

28]. Platform enterprise productivity is a comprehensive function of enterprise technology upgrading, management mode improvement, product quality improvement, and enterprise structure upgrading. We believe that any realistic productivity is actually total factor productivity, and there is a positive correlation between technological innovation and enterprise total factor productivity. The higher the level of technological innovation, the higher the efficiency of technological factor resource allocation. Therefore, this paper focuses on the use of total factor productivity representation as a kind of technological progress brought about by the platform economy. We believe that the platform economy affects technological innovation from the following four aspects: first, the platform economy has the characteristics of versatility and high permeability, and the integration of the platform economy and real economy expands from the field of consumption to the field of production. It accelerates the new trend of the integration of production and consumption and the integration of industrial collaborative innovation, promotes the application and upgrading of new technologies in traditional industries, and accelerates the networking and intellectualization of traditional industries [

29,

30]. Second, platform technology is widely used in various economic and social fields, giving birth to a large number of emerging intelligent industries with a high technical level and production efficiency, such as network offices, the sharing economy, intelligent manufacturing, and so on. The increasing proportion of knowledge-intensive industries helps to promote the optimization and upgrading of the industrial structure and the improvement of production efficiency [

31]. Third, in the process of deepening the integration of the platform economy and the traditional industry, it has effectively improved the original leading technology of the traditional industry and reshaped the traditional production organization mode [

32]. Through the intelligent transformation of procurement, production, circulation, and other links, optimize the business process, effectively improve the production efficiency and profitability of enterprises, and then contribute to the technological innovation of enterprises [

33]. Fourth, the platform economy is conducive to the birth of economies of scale and knowledge agglomeration, while the effects of economies of scale and agglomeration can promote technological innovation through technology spillover, labor costs, intermediate goods sharing, cooperation, and exchange among enterprises, reducing production costs and other aspects [

34]. Therefore, we believe that the platform economy can affect high-quality economic development by improving the allocation level of technical elements.

Secondly, in terms of the allocation of talent elements, the integration of the platform economy and different industries and fields will help to give birth to new industries, new business types, and new models, on the basis of which a shared economy and a platform economy will be formed to better match supply and demand and form a more perfect price mechanism. In addition, through platform organization, enterprises improve the efficiency of information searching, break the information asymmetry barrier between the supply and demand of human resources, reduce the market transaction cost, and improve the efficiency of economic operation [

35]. The platform economy is a new economic form based on information technology and data as elements. In the era of the platform economy, talents are the core elements of digital innovation. In the process of platform economy agglomeration, the infrastructure is more perfect, the policy environment is more favorable, the attraction to investment is enhanced, and more and more high-quality enterprises are attracted. With the expansion of the industrial agglomeration around the digital industry, the spatial agglomeration of digital technology, talents, and capital is conducive to the flow of new knowledge and technology between enterprises and industries, and provides intellectual and dynamic support for the innovation and development of regional economies [

30]. When the saving of transaction costs further expands the scope of the market and promotes the development of division of labor, enterprises can carry out division of labor and cooperation on a global scale, and quickly adjust the industrial chain and match better partners according to changes in demand so as to improve the efficiency of resource allocation and promote high-quality economic development [

33].

Finally, in the allocation of capital elements. The platform economy accelerates the flow of resources. Under the condition of market competition, the mechanism of survival of the fittest helps to optimize the allocation of resources and improve the efficiency of capital utilization. The development of digital industrialization helps to promote the formation of a wider integration of the digital economy and real economy. In the environment of economies of scale and economies of scope, the reduction of production and transaction costs attracts more factors of production. In particular, the free flow of capital factors between industries and regions is more rapid, which helps to optimize the efficiency of spatial capital allocation and improve the rate of return on capital and labor productivity [

36,

37], and promote the high-quality development of regional economies. In addition, due to information asymmetry, capital utilization efficiency and market efficiency are reduced. The platform organization makes use of its strong data advantages to provide online evaluation, comparison, and feedback systems, which saves search costs and negotiation costs for consumers to choose goods, reduces the information asymmetry between buyers and sellers, and improves market competition and capital utilization efficiency [

38]. Therefore, the rapid development of the digital economy breaks down the distance barriers between regions, improves the degree of competition between regions and industries, and improves the efficiency of capital factor resource allocation, which is conducive to high-quality economic development.

The above analysis shows that technology, human resources, capital, and other factor resources play a positive role in regulating the relationship between the platform economy and high-quality development. However, due to psychological reactions and behavioral inertia, under certain conditions, once the economic advantage of the platform appears and reaches a certain extent, there will be a monopoly situation of "the stronger is stronger". Therefore, when the platform economy exceeds a certain threshold, it may have a negative impact and reduce the efficiency of factor resource allocation, because, when the market is monopolized by several large platform organizations, the free flow of technology, manpower, and capital may be disturbed by monopoly behavior. For example, in the past two years, some large Internet giants in China have been involved in platform monopoly events to varying degrees. Therefore, there is a double-edged sword effect in the platform economy, such as unreasonable guidance and standardization, which is ultimately not conducive to the high-quality development of the socialist market economy [

12].

To sum up, the platform economy is a double-edged sword, which plays a positive role in promoting high-quality economic development at the initial stage of development, but, without reasonable supervision and guidance, the negative externalities brought about by the later development of the platform economy exceed its positive externalities, which will hinder the high-quality development of the economy. Based on the above analysis, this paper puts forward the following assumptions.

Hypothesis 1 (H1). The platform economy has an inverted U-shaped impact on the high-quality development of regional economy. Specifically, on the left side of the inflection point, the platform economy promotes high-quality economic development, while, on the right side of the inflection point, the platform economy suppresses high-quality economic development.

Hypothesis 2 (H2). The platform economy mainly affects the high-quality development of regional economies through labor, capital, and technology.

7. Conclusions and Revelations

This paper empirically analyzes the influence and mechanism of the platform economy on high-quality economic development by using Chinese provincial panel data.

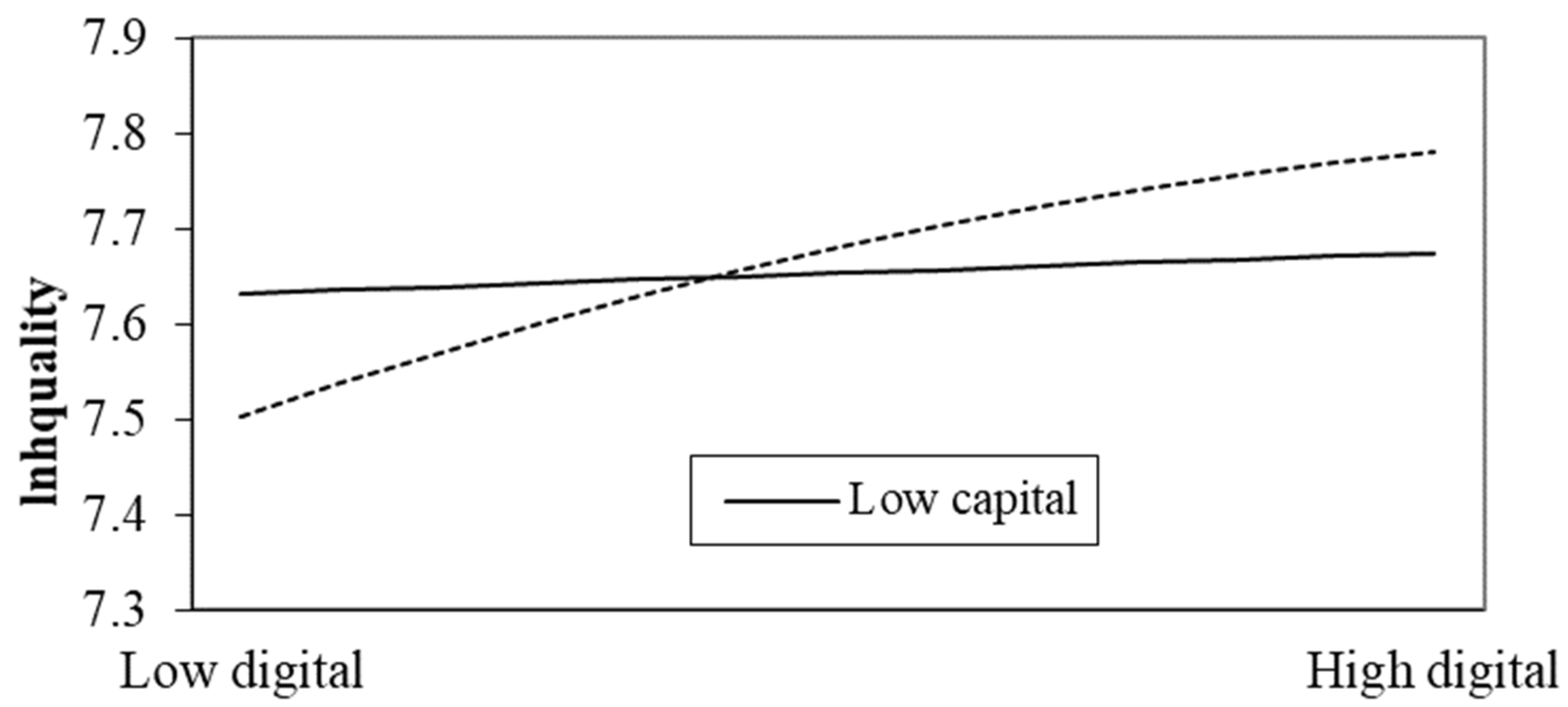

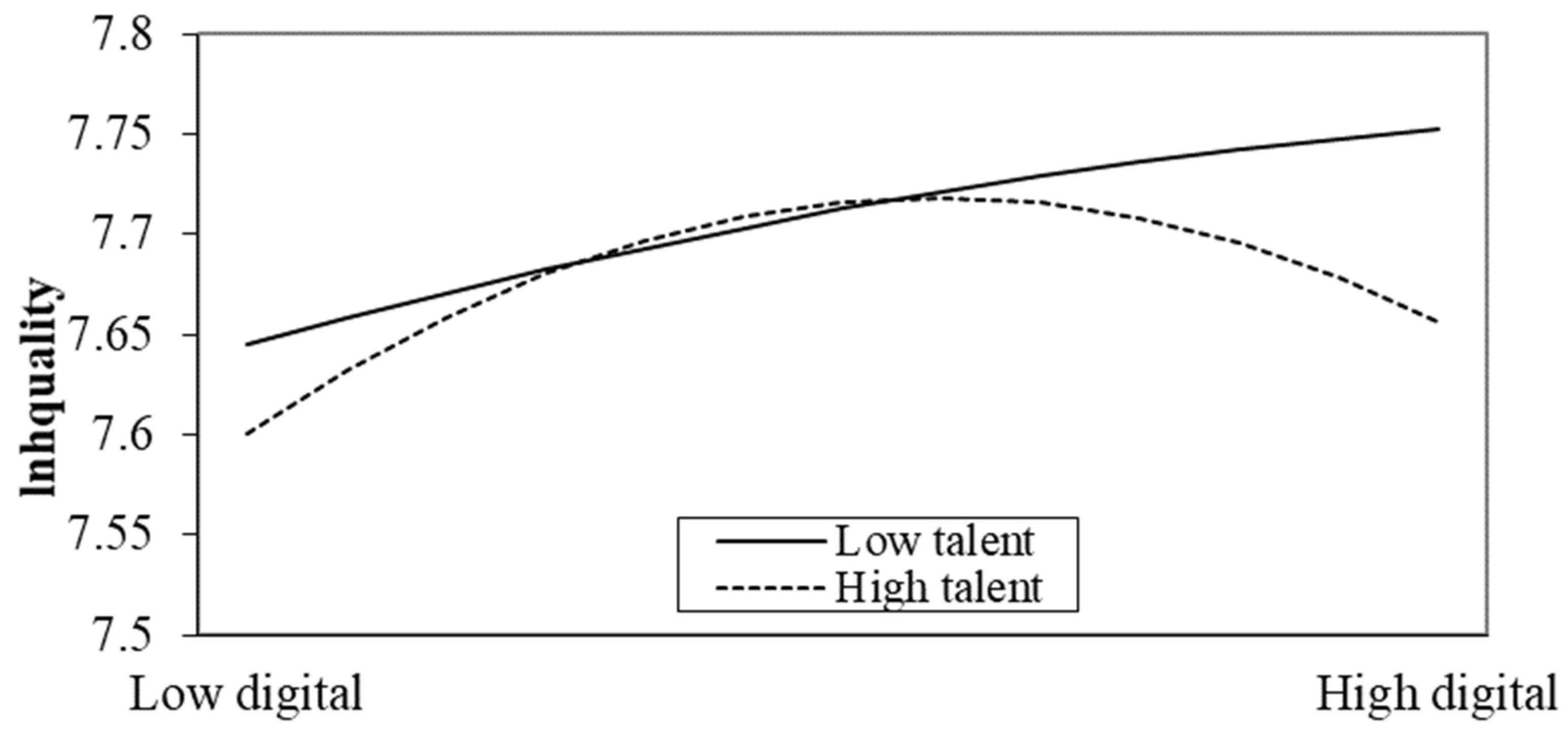

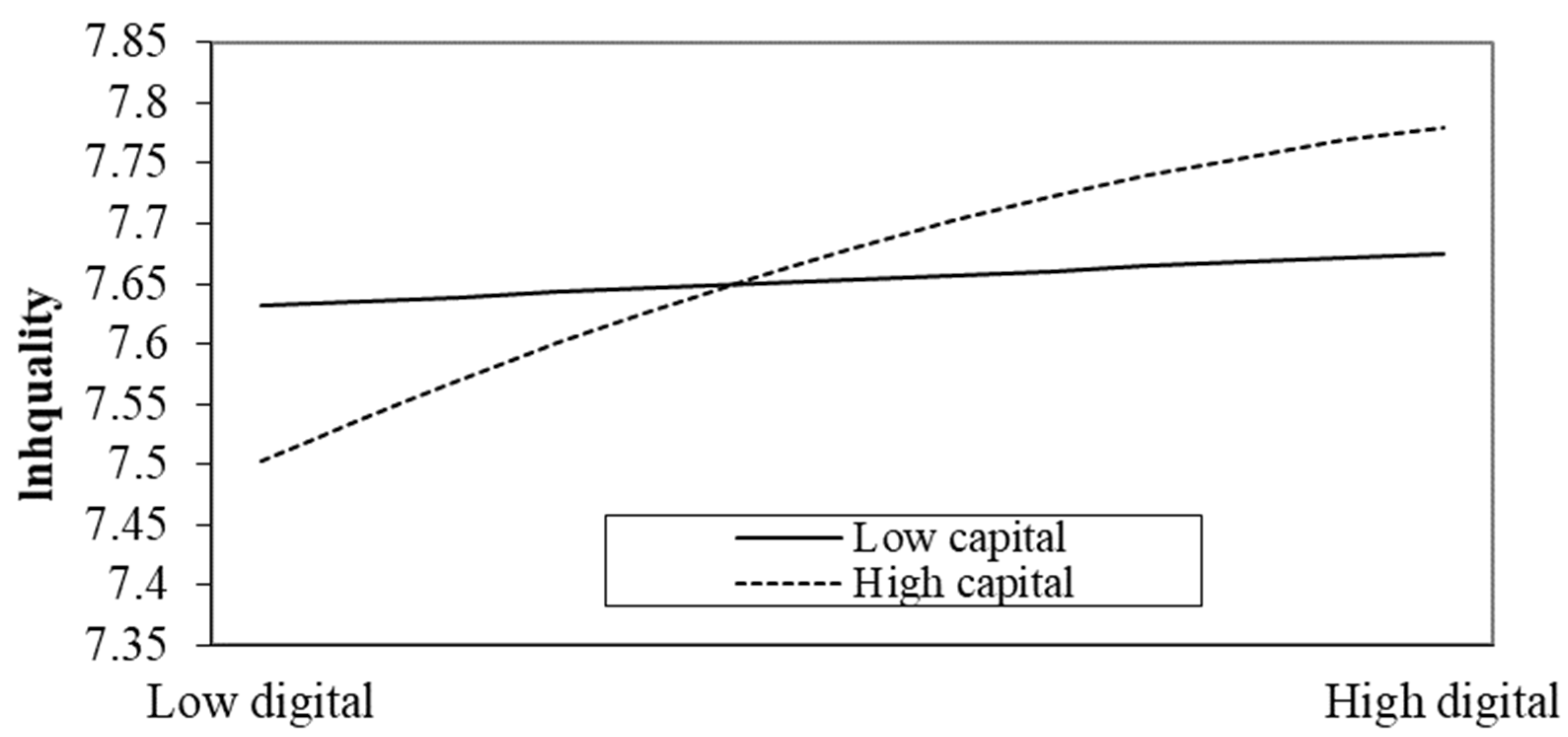

The conclusions are as follows: first, the platform economy has an inverted U-shaped influence on the high-quality economic development. On the left side of the inverted U-shaped inflection point, the platform economy has an obvious promoting effect on the regional high-quality development. On the right side of the inflection point, the platform economy has an inhibitory effect on the regional high-quality development. Second, compared with areas with stronger government intervention, the platform economy has a more significant inverted U-shaped effect on high-quality development in areas with weaker intervention. Compared with areas with a higher-quality market system, the promotion effect of the platform economy on high-quality development in areas with lower institutional quality is more obvious on the left side of the inflection point and the inhibitory effect on the right side of the inflection point. Compared with the eastern and central regions, on the left side of the inflection point, the platform economy plays a greater role in promoting the high-quality development of the northeastern and western regions, while, on the right side of the inflection point, the platform economy has an inhibitory effect on the high-quality development of each region. Third, the agglomeration of factors plays a regulatory role between the platform economy and high-quality development, in which talent and technology elements play a positive regulatory role on the left side of the inflection point and a negative regulatory role on the right side of the inflection point; meanwhile, capital elements only play a positive regulatory role, and the negative regulatory role is not significant.

According to the research conclusions, several policy implications are obtained: first of all, according to the statistical analysis, 85% of the observations fell on the left side of the inverted U shape, indicating that the overall development of China’s platform economy is in its infancy. Vigorously developing the platform economy will help to promote the high-quality development of the regional economy. Therefore, the government will promote the construction of platform infrastructure, especially by accelerating the application of technology in the fields of big data, artificial intelligence, 5G, and the Internet of things, further promote the integration of the platform economy with the real economy, and speed up the in-depth development of platform technology, making the platform organization innovation vitality and potential continue to burst out, and providing new momentum for achieving high-quality economic development. Secondly, attach importance to regional coordinated development, according to regional resource endowment, improve the resource utilization rate of regional technology, talent, and capital advantages, and vigorously develop the platform economy and scope economy to make full use of agglomeration advantages to promote regional high-quality development. At the same time, the government needs to pay attention to the economic support and guidance of the platform, especially in the areas where the degree of government intervention is weak, to strengthen the reasonable guidance and supervision of the platform economy. In the eastern region, there is a high degree of market and there is a great possibility of monopoly risk. Therefore, it is necessary to strengthen the supervision of largescale platform organizations in the east, and to encourage and support the platform economy in the central and western regions and underdeveloped areas. The government should appropriately relax the market access threshold for platform enterprises and release the economic vitality of platform enterprises in backward areas. Finally, improve the supervision and management system and mechanism of platform enterprises, provide an institutional guarantee for the healthy development of the platform economy, make full use of the agglomeration advantage of the platform economy to promote high-quality economic development, and attach importance to the double-edged sword effect of the platform economy.

The article also has the following shortcomings: first, compared with the existing research, the comprehensive index of the platform economy has made great progress, but, with the continuous extension and development of digital technology in recent years, the connotation of the platform economy is becoming richer. This study is mainly based on the Internet-based comprehensive index, and index diversification is still lacking. Second, from the actual situation in China, the study found that 15% of the sample observations, such as Guangdong, Beijing, Shanghai, and other areas, fell on the right side of the inverted U shape, which does not mean that the development of the platform economy in this region should be stagnated or restrained across the board, because there is still an imbalance in the development between prefecture-level cities and counties; however, the provincial panel data cannot capture these details very well. This is also an important direction for the author to study in the next step.