The Stance, Factors, and Composition of Competitiveness of SMEs in Poland

Abstract

1. Introduction

- Measurement of the impact, directions, and intensity of competitiveness changes and their factors;

- Identification of the characteristics of the analysed group of companies, an analysis of the relocation of objects and their classification;

- Comparative analysis of the profiles of the analysed structures.

- In the context of great similarities between small and medium enterprise profiles in terms of their normative competitiveness patterns, the results of the analysis of the existing differences are in favour of medium entities.

- Despite belonging to the same sector (SME), small and medium enterprises represent different levels of competitiveness, and the intensity of changes varies in the course of time;

- Increased competitiveness in both groups of companies results from export activities rather than an increase in labour productivity;

- Changes in meso- and micro-structures are characterised by a greater density of objects and their increasing stability in ranking positions.

2. Literature Review

- Competitiveness is characterized by a multiplicity of definitions and multidimensionality, and the most infrequent research is undertaken at the meso-economic level;

- Various changes and processes have changed the conditions of competition, so that the new centre and measure of competitive advantage are now not the value chain but its module;

- The theoretical measures of competitiveness are much broader than the possibilities of their application in practice;

- Measuring competitiveness in financial terms facilitates the broadening of analysis, their comparability, and universal application.

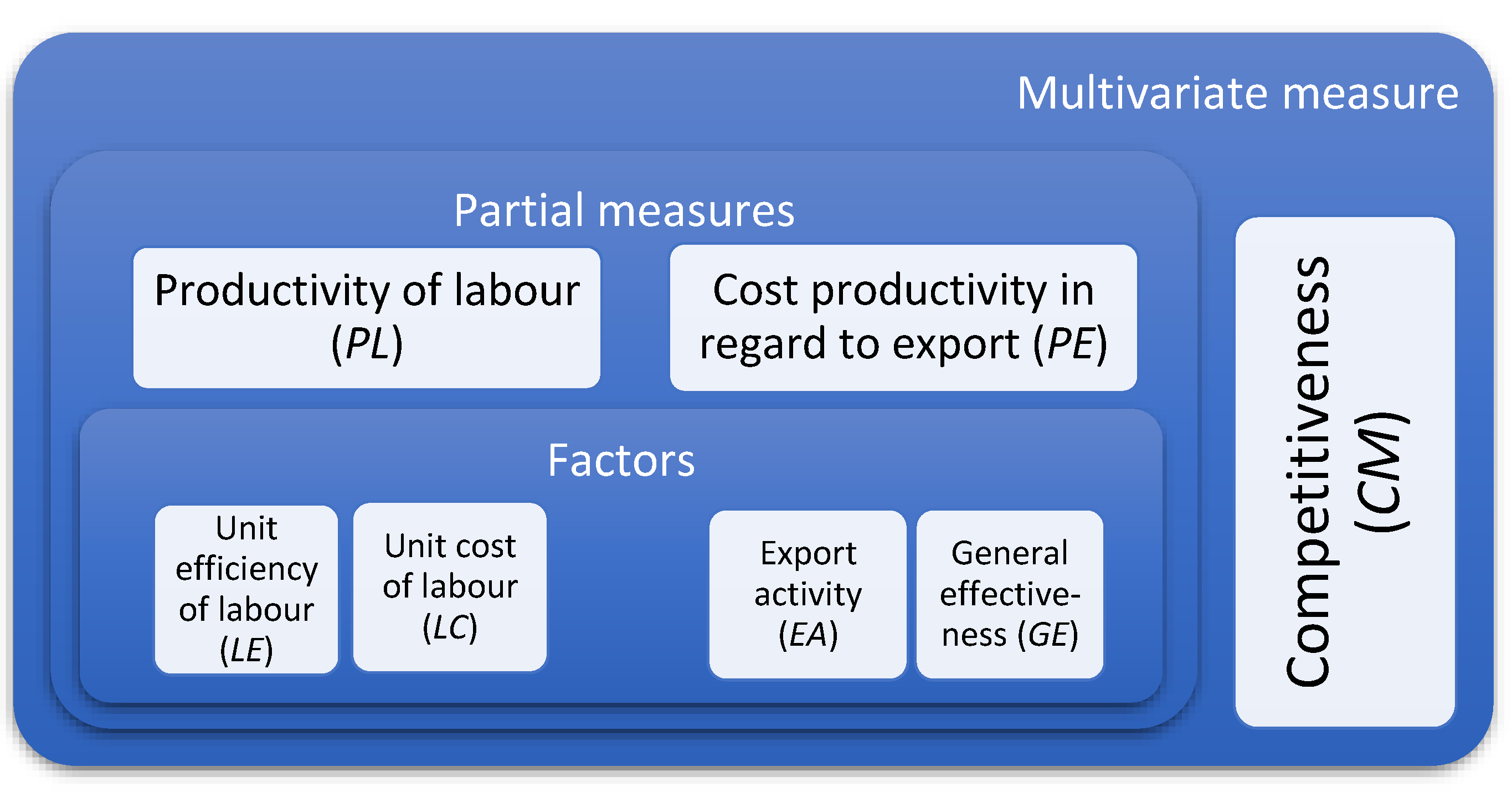

3. The Methodology of Research

- PL: Productivity of labour cost;

- LE: Unit efficiency of labour;

- LC: Unit cost of labour;

- PE: Cost productivity in regard to export;

- EA: Export activity;

- GE: Overall cost productivity;

- GS: Gross revenues from sales;

- EMP: Number of employees;

- TS: Labour costs (remuneration, social insurance, and other benefits);

- EX: Revenues from export;

- TC: Total costs;

- X0 = (0, …, 0)K;

- K—Number of multivariate measure components (j = 1, …, K).

- s2x, s2y: Variance of determinant x, variance of determinant y;

- r2xy: Pearson linear correlation factor between x and y.

- Pattern I: High and stable position;

- Pattern II: High and considerably changeable position;

- Pattern III: Low and stable position;

- Pattern IV: Low and considerably changeable position.

- pij, pik: Share of the i-th object in structure j, k;

- N: Number of objects.

4. Results

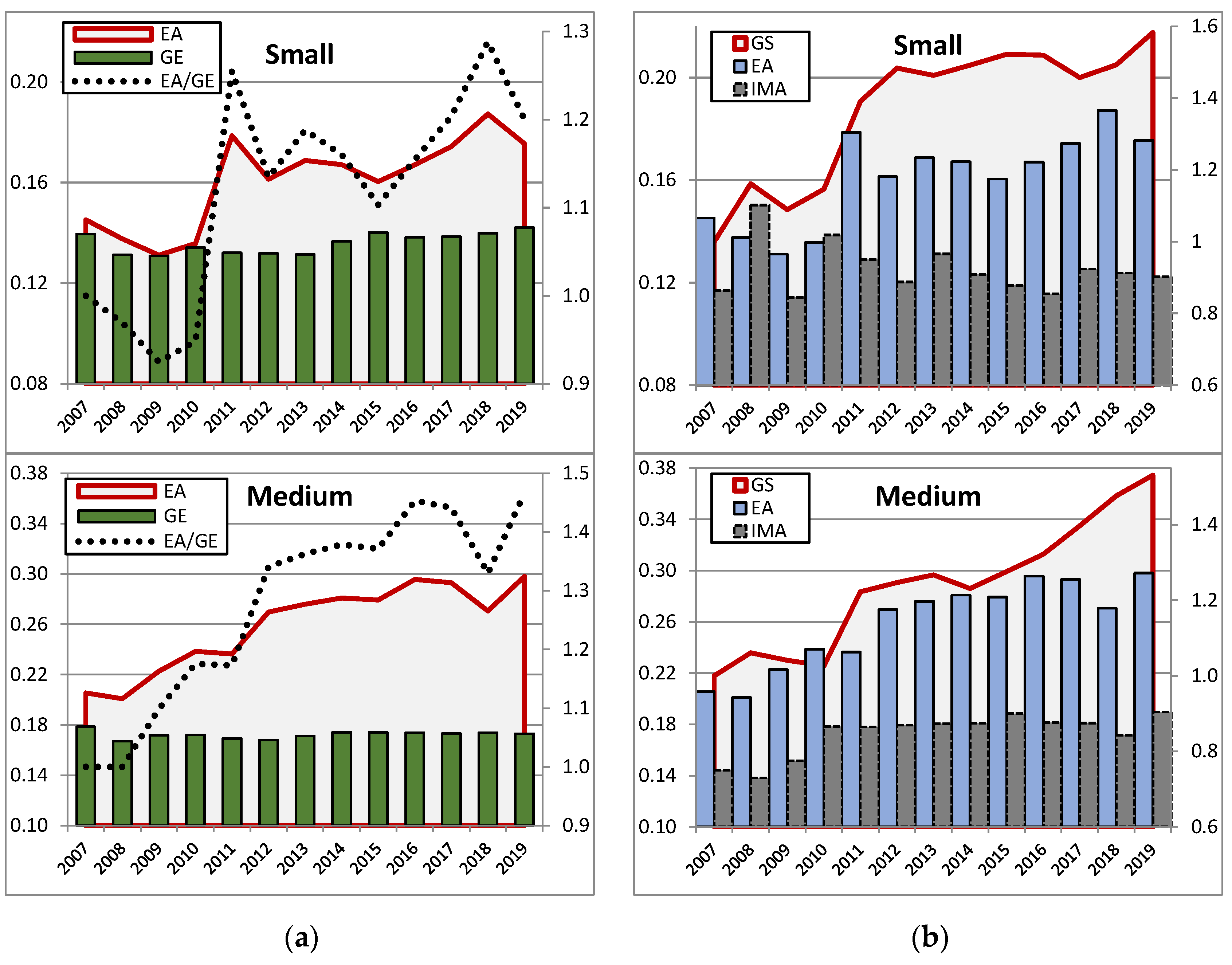

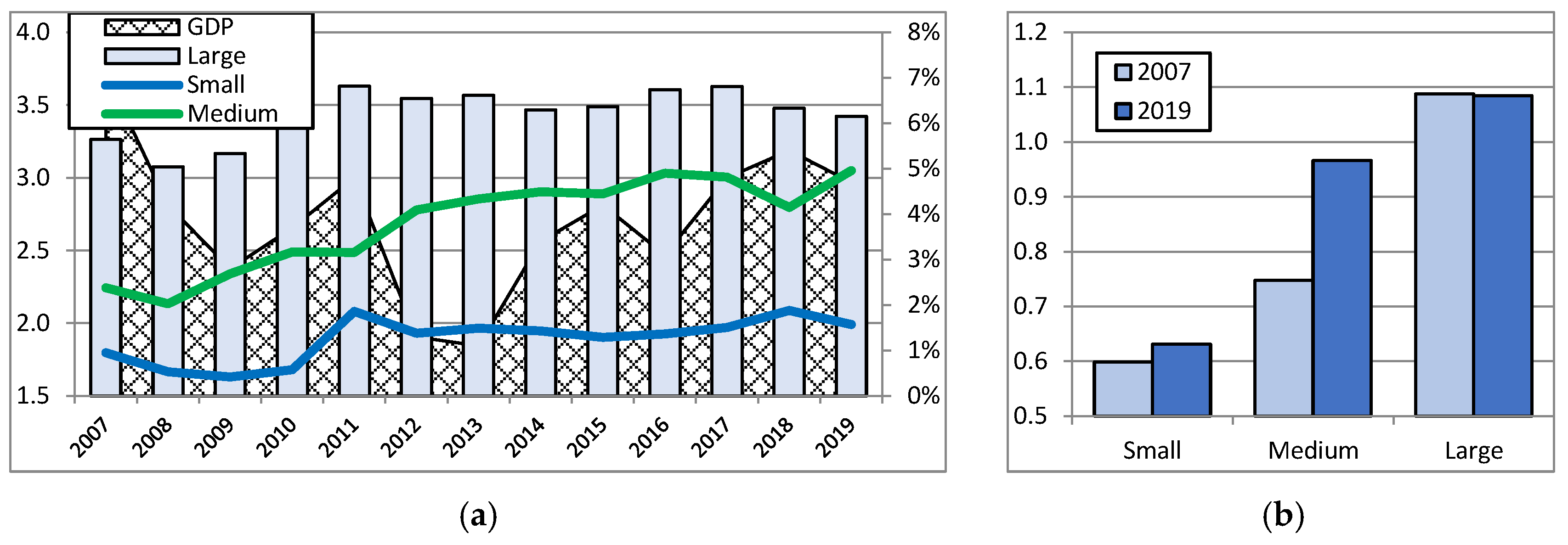

4.1. Competitiveness Factors

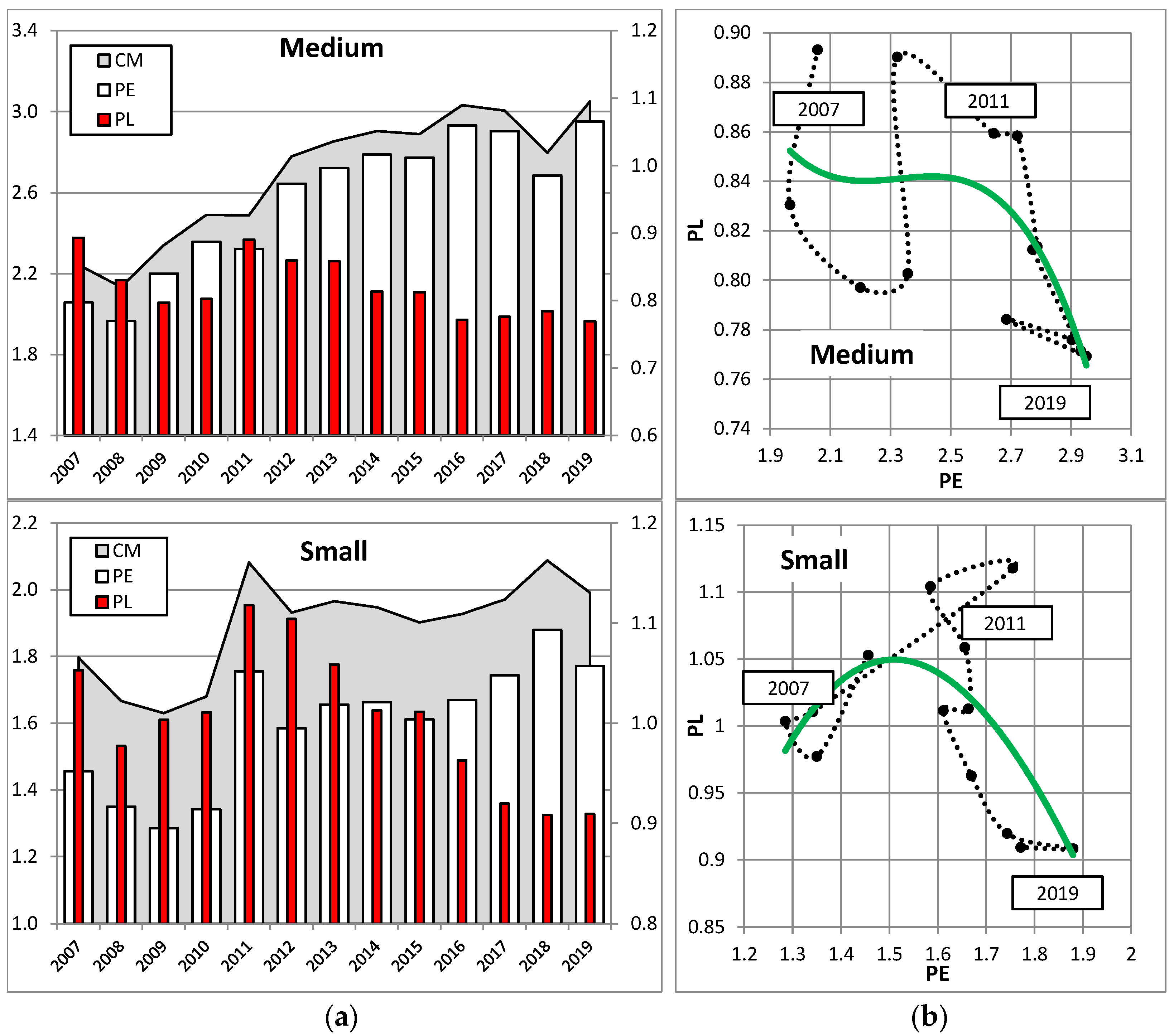

4.2. Multivariate Competitiveness Measure

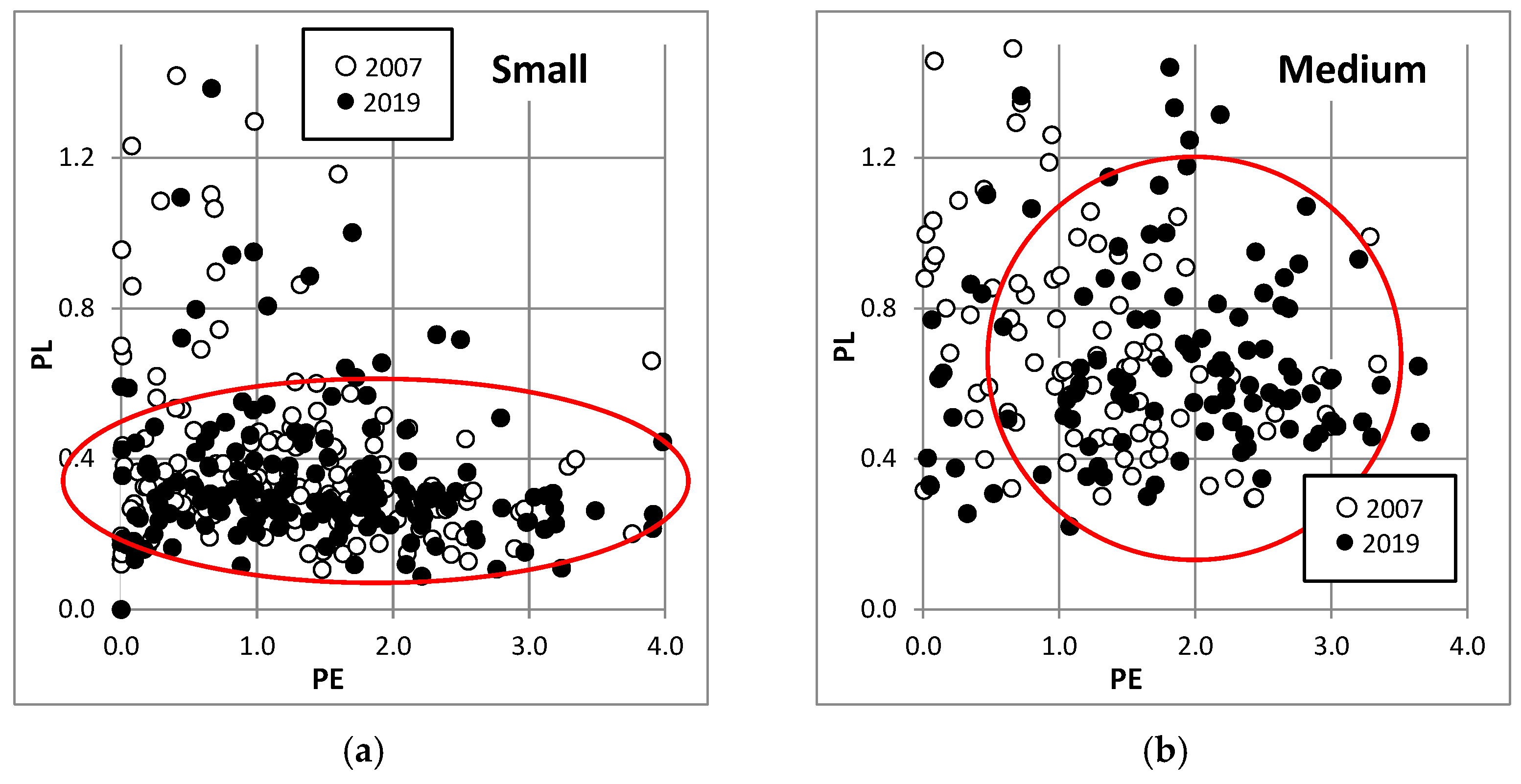

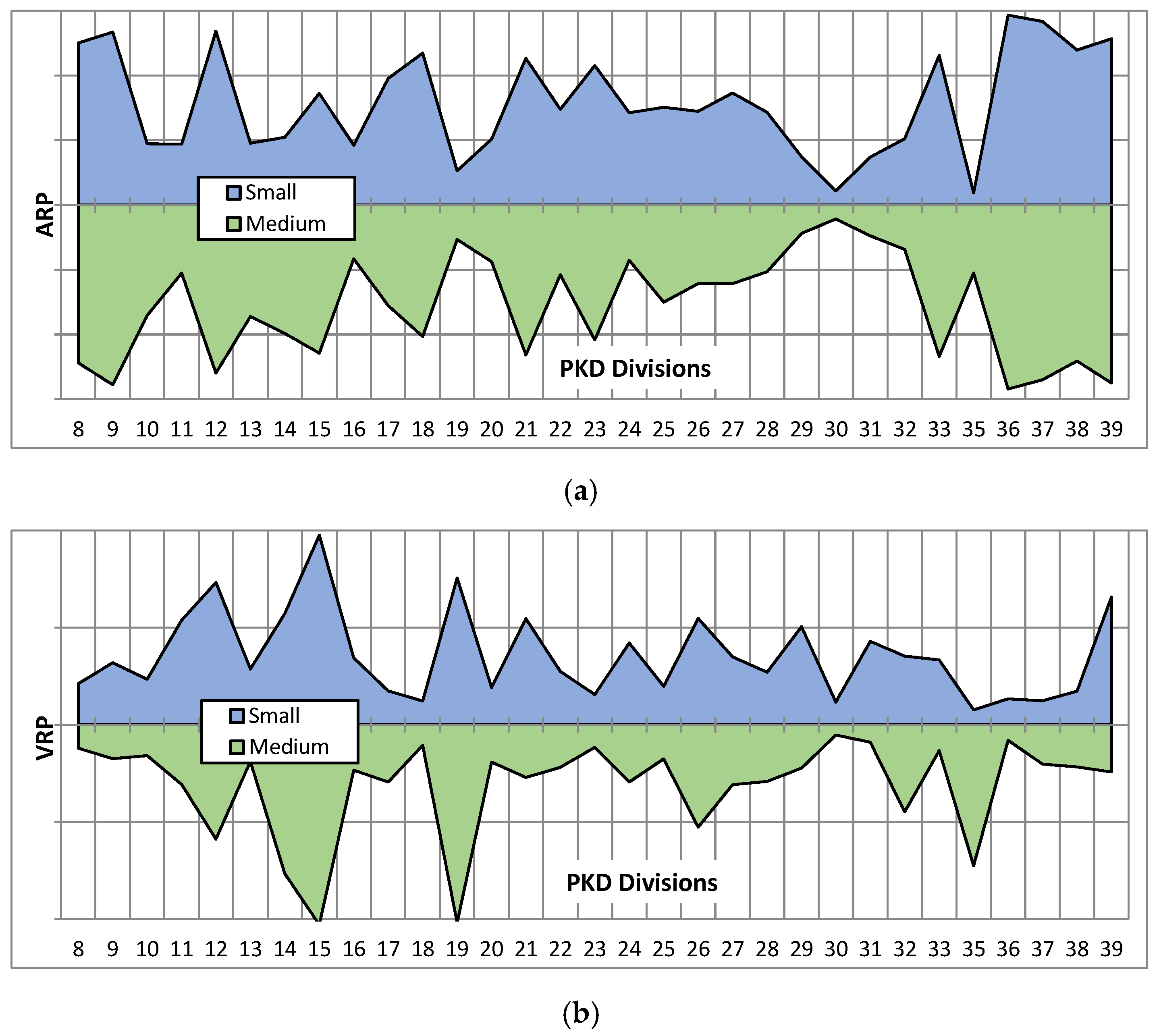

4.3. Changes in Structures (Macro, Meso, and Micro)

| Small Enterprises | Medium Enterprises |

|

|

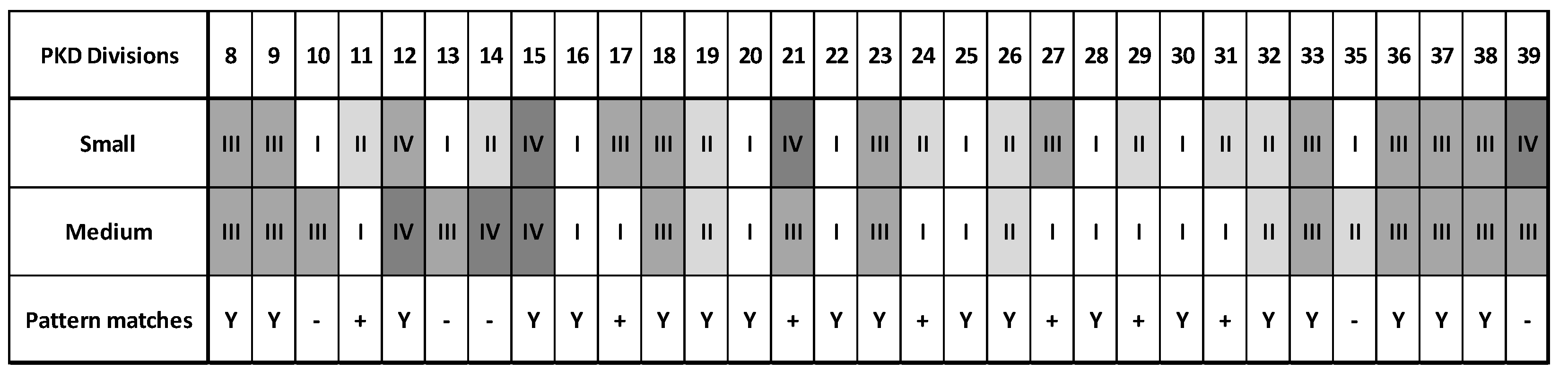

4.4. Competitiveness Profiles

5. Discussion

5.1. Primary Factors

5.2. Major Factors

5.3. Structures

5.4. Profiles

6. Conclusions

- Despite belonging to the same sector (SME), small and medium enterprises represent different levels of competitiveness, and the intensity of changes varies in the course of time:

- −

- Based on this characteristic, the more advantageous position was obtained by medium-sized enterprises;

- Increased competitiveness in both groups of companies results from export activities rather than an increase in labour productivity:

- −

- Based on this characteristic, the more advantageous position was obtained by medium-sized enterprises;

- Changes in meso- and micro-structures are characterised by a greater density of objects and their increasing stability in ranking positions:

- −

- Based on this characteristic, the more advantageous position was obtained by medium-sized enterprises.

- In the context of great similarities between small and medium enterprise profiles in terms of their normative competitiveness patterns, the results of the analysis of the existing differences are in favour of medium enterprises.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kaczmarek, J. Mezostruktura Gospodarki Polski w Okresie Transformacji. Uwarunkowania, Procesy, Efektywność (Mesostructure of the Polish Economy during Transformation. Determinants, Processes, Efficiency); Difin Press: Warszawa, Poland, 2012; pp. 81–91, 103–126. [Google Scholar]

- Pech, M.; Vrchota, J. Classification of Small- and Medium-Sized Enterprises Based on the Level of Industry 4.0 Implementation. Appl. Sci. 2020, 10, 5150. [Google Scholar] [CrossRef]

- Aguilar-Fernández, M.E.; Otegi-Olaso, J.R. Firm Size and the Business Model for Sustainable Innovation. Sustainability 2018, 10, 4785. [Google Scholar] [CrossRef]

- Kim, S. Sustainable Growth Variables by Industry Sectors and Their Influence on Changes in Business Models of SMEs in the Era of Digital Transformation. Sustainability 2021, 13, 7114. [Google Scholar] [CrossRef]

- Gherghina, Ș.C.; Botezatu, M.A.; Hosszu, A.; Simionescu, L.N. Small and Medium-Sized Enterprises (SMEs): The Engine of Economic Growth through Investments and Innovation. Sustainability 2020, 12, 347. [Google Scholar] [CrossRef]

- Zoephel, M.; Zapf, M. Michael Porter’s Competitive Advantage Theory: Focus Strategy for SMEs; GRIN Verlag: Munchen, Germany, 2011; pp. 1–40. [Google Scholar]

- Jalagat, R. The Impact of Change and Change Management in Achieving Corporate Goals and Objectives: Organizational Perspective. Int. J. Sci. Res. 2016, 5, 1233–1239. Available online: https://www.ijsr.net/get_abstract.php?paper_id=ART20163105 (accessed on 1 January 2022).

- Asikhia, O.; Nneji, N.; Olafenwa, A.; Owoeye, O. Change Management and Organisational Performance: A Review of Literature. Int. J. Adv. Eng. Manag. 2021, 3, 67–69. [Google Scholar] [CrossRef]

- Clarke, L. The Essence of Change; Prentice Hall: Hoboken, NJ, USA, 1994; pp. 20–35. [Google Scholar]

- Waverman, L. A critical analysis of Porter’s framework on the competitive advantage of nations. In Beyond the Diamond; Rugman, A.M., Van Den Broec, J., Verbeke, A., Eds.; Emerald Group Publishing Limited: Bingley, UK, 1995; pp. 67–95. [Google Scholar] [CrossRef]

- Nazarczuk, J.M. Wybrane aspekty konkurencyjności polskiej gospodarki (Some Aspects of Competitiveness of the Polish Economy). In Konkurencyjność Gospodarki Polski (Competitiveness of the Polish Economy); Balcerzak, A.P., Rogalska, E., Eds.; Wydawnictwo A. Marszałek: Toruń, Poland, 2008; pp. 25–35. [Google Scholar]

- Krugman, P.R.; Obstfeld, M.; Melitz, M. International Economics; Prentice Hall: New York, NY, USA, 2014; pp. 122–150. [Google Scholar]

- Kaczmarek, J. Intensywność i efekty transformacji gospodarczej (Intensity and Effects of Economic Transformation). Przegląd Organ. 2016, 10, 62–71. Available online: http://www.przegladorganizacji.pl/przeglad-organizacji-102016/m/78 (accessed on 10 November 2021). [CrossRef]

- Reynauld, A.; Vidal, J.P. Labour Standards and International Competitiveness: A Comparative Analysis of Developing and Industrialized Countries; E. Elgar Publishing: Cheltenham, UK, 1998; p. 59. [Google Scholar]

- Frischtak, C. Manufacturing, Competitiveness: Concept, Measurement Policies. In Competition and the World Economy UNIDO; Sercovich, F., Ahn, C.-Y., Frischtak, C., Mrak, M., Muegge, H., Peres, W., Eds.; E. Elgar Publishing: Northampton, UK, 1999; pp. 85–95. [Google Scholar]

- Stankiewicz, M.J. Istota i sposoby oceny konkurencyjności przedsiębiorstwa (Essence and Methods of Evaluation of Enterprise Competitiveness). Gospod. Nar. 2000, 7–8, 95–111. Available online: https://gnpje.sgh.waw.pl/Istota-i-sposoby-oceny-konkurencyjnosci-przedsiebiorstwa,113968,0,2.html (accessed on 10 November 2021). [CrossRef]

- Dunford, M.; Smith, A.; Tsoukalis, L.; Hall, R.; Louri, H.; Rosenstock, M. Competition, Competitiveness and Enterprise Policies. In Competitiveness and Cohesion in EU Policies; Hall, R., Smith, A., Tsoukalis, L., Eds.; Oxford University Press: Oxford, UK, 2001; pp. 109–146. [Google Scholar]

- Obłój, K. Strategia Organizacji. W Poszukiwaniu Trwałej Przewagi Konkurencyjnej (Strategy of Organization. In Search of Permanent Competitive Advantage); PWE Press: Warszawa, Poland, 1998; p. 58. [Google Scholar]

- Feenstra, R.C. (Ed.) Trade Policies for International Competitiveness; The University of Chicago Press: Chicago, IL, USA; London, UK, 1989; pp. 1–2. [Google Scholar]

- Capobianco-Uriarte, M.; Casado-Belmonte, M.; Marín-Carrillo, G.; Terán-Yépez, E. Bibliometric Analysis of International Competitiveness (1983–2017). Sustainability 2019, 11, 1877. [Google Scholar] [CrossRef]

- Klenow, P.J.; Rodríguez-Clare, A. Economic growth: A review essay. J. Monet. Econ. 1997, 40, 597–617. [Google Scholar] [CrossRef]

- Sen, S. International Trade Theory and Policy: A Review of the Literature. Levy Econ. Inst. Work. Pap. Ser. 2010, 635, 1–24. [Google Scholar] [CrossRef]

- Krafft, J. The Process of Competition; p. 1. Available online: https://hal.archives-ouvertes.fr/hal-00212278/document (accessed on 10 November 2021).

- Skoorka, B. Measuring Market Distortion: International Comparisons, Policy and Competitiveness. Appl. Econ. 2000, 32, 253–264. [Google Scholar] [CrossRef]

- Stonehouse, G.; Snowdon, B. Competitive Advantage Revisited: Michael Porter on Strategy and Competitiveness. J. Manag. Inq. 2007, 16, 256–273. [Google Scholar] [CrossRef]

- Sołoducho-Pelc, L.; Sulich, A. Between Sustainable and Temporary Competitive Advantages in the Unstable Business Environment. Sustainability 2020, 12, 8832. [Google Scholar] [CrossRef]

- Huggins, R.; Izushi, H. Competition, Competitive Advantage, and Clusters: The Ideas of Michael Porter; Oxford University Press: Oxford, UK, 2012; pp. 32–47. [Google Scholar] [CrossRef]

- Dzemydaitė, G. The Impact of Economic Specialization on Regional Economic Development in the European Union: Insights for Formation of Smart Specialization Strategy. Economies 2021, 9, 76. [Google Scholar] [CrossRef]

- Cooper, R.N. Industrial Policy and Trade Distortion: A Policy Perspective. In Protection, Cooperation, Integration and Development; El-Agraa, A.M., Ed.; Palgrave Macmillan: London, UK, 1987; pp. 37–69. [Google Scholar] [CrossRef]

- Costinot, A.; Donaldson, D. Ricardo’s Theory of Comparative Advantage: Old Idea, New Evidence. Am. Econ. Rev. 2012, 102, 453–458. [Google Scholar] [CrossRef]

- Lebert, D.; El Younsi, H. International Specialization Dynamics; Wiley-ISTE: London, UK, 2017; pp. 120–131. [Google Scholar]

- Amable, B. International specialisation and growth. Struct. Change Econ. Dyn. 2000, 11, 413–431. [Google Scholar] [CrossRef]

- Corsi, M. Division of Labour. Technical Change and Economic Growth; Gower Publishing: Brookfield, WI, USA, 1991; p. 138. [Google Scholar]

- Mosley, H.; Smith, G. Public Services and Competitiveness. In European Competitiveness; Hughes, K.S., Ed.; Cambridge University Press: Cambridge, UK, 1993; pp. 200–231. [Google Scholar] [CrossRef]

- Balassa, B. Economic Integration. In The World of Economics; Eatwell, J., Milgate, M., Newman, P., Eds.; The New Palgrave. Palgrave Macmillan: London, UK, 1991; pp. 176–186. [Google Scholar] [CrossRef]

- Jensen, C.A. The Staged Competition Innovation Theory. J. Open Innov. Technol. Mark. Complex. 2021, 7, 201. [Google Scholar] [CrossRef]

- Klepper, G.; Weiss, F.D. Protection and International Competitiveness: A View from West Germany. In International Productivity and Competitiveness; Hickman, B.G., Ed.; Oxford University Press: New York, NY, USA, 1992; pp. 362–369. [Google Scholar]

- Feng, Z.; Luo, N.; Liu, Y. Trade-in Strategy and Competition between Two Independent Remanufacturers. Int. J. Environ. Res. Public Health 2021, 18, 6745. [Google Scholar] [CrossRef]

- Lall, S. Competitiveness Indices and Developing Countries: An Economic Evaluation of the Global Competitiveness Report. World Dev. 2001, 29, 1501–1525. [Google Scholar] [CrossRef]

- Berger, T.; Bristow, G. Competitiveness and the Benchmarking of Nations? A Critical Reflection. Int. Adv. Econ. Res. 2009, 15, 378–392. [Google Scholar] [CrossRef]

- Belton, P. An Analysis of Michael E. Porter’s Competitive Strategy; Macat Library: London, UK, 2017; pp. 44–62. [Google Scholar]

- Wu, Y.; Wang, J.; Chen, L. Optimization and Decision of Supply Chain Considering Negative Spillover Effect and Service Competition. Sustainability 2021, 13, 2320. [Google Scholar] [CrossRef]

- Xia, R.; Liang, T.; Zhang, Y.; Wu, S. Is Global Competitive Index a Good Standard to Measure Economic Growth? A Suggestion for Improvement. Int. J. Serv. Stand. 2012, 8, 45–57. [Google Scholar] [CrossRef]

- Boltho, A. The assessment: International competitiveness. Oxf. Rev. Econ. Policy 1996, 12, 1–16. [Google Scholar] [CrossRef]

- Dziembała, M. The Enhancement of Sustainable Competitiveness of the CEE Regions at the Time of the COVID-19 Pandemic Instability. Sustainability 2021, 13, 12958. [Google Scholar] [CrossRef]

- Širá, E.; Vavrek, R.; Kravčáková, V.I.; Kotulič, R. Knowledge Economy Indicators and Their Impact on the Sustainable Competitiveness of the EU Countries. Sustainability 2020, 12, 4172. [Google Scholar] [CrossRef]

- Dzikowska, M.; Gorynia, M. Teoretyczne aspekty konkurencyjności przedsiębiorstwa-w kierunku koncepcji eklektycznej (Theoretical Aspects of Enterprise Competitiveness-Towards an Eclectic Concept). Gospod. Nar. 2012, 4, 4–13. Available online: http://gospodarkanarodowa.sgh.waw.pl/p/gospodarka_narodowa_2012_04_01.pdf (accessed on 10 November 2021).

- Faulkner, D.; Bowman, C. Elements of Competitive Strategy; Teora: Bucharest, Romania, 2000; pp. 35–40, 44. [Google Scholar]

- Galli, G.; Pelkmans, J. (Eds.) Regulatory Reform and Competitiveness in Europe; E. Elgar Publishing: Cheltenham, UK, 2000; p. 20. [Google Scholar]

- Krugman, P.R. Import Protection as Export Promotion: International Competititionin the Presence of Oligopoly and Economies of Scale. In Rethinking International Trade; Krugman, P.R., Ed.; MIT Press: Cambridge, UK, 2000; pp. 185–198. [Google Scholar]

- Foss, N.J.; Mahnke, V. Strategy and the Market Process Perspective. Process of Competition; Edward Elgar: Aldershot, UK, 2002; pp. 1–30. [Google Scholar]

- Krafft, J. Introduction to the process of competition. In The Process of Competition; Krafft, J., Ed.; E. Elgar Publishing: Cheltenham, UK, 2000; pp. 4–5. [Google Scholar]

- McKiernan, P. (Ed.) Historical Evolution of Strategic Management; Taylor & Francis: London, UK; New York, NY, USA, 2017; p. 328. [Google Scholar]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors; Simon and Schuster: New York, NY, USA, 2008; pp. 300–323. [Google Scholar]

- Magretta, J. Fast, Global and Entrepreneurial: Supply Chain Management, Hong Kong Style. Harv. Bus. Rev. 1998, 9–10, 103–114. Available online: https://hbr.org/1998/09/fast-global-and-entrepreneurial-supply-chain-management-hong-kong-style (accessed on 14 November 2019).

- Hamel, G.; Prahalad, C.K. The Core Competence of the Corporation. In Strategic Learning in a Knowledge Economy; Cross, R.L., Jr., Israelit, S.B., Eds.; Routledge: London, UK, 2011; pp. 3–22. [Google Scholar]

- Naisbitt, D.; Naisbitt, J. Mastering Megatrends: Understanding and Leveraging the Evolving New World; World Scientific: London, UK, 2017; pp. 84–179. [Google Scholar]

- De Vet, J.M.; Edwards, J.H.; Bocci, M. Blue Growth and Smart Specialisation: How to catch maritime growth through ‘Value Nets’. Jt. Res. Cent. Work. Pap. S3 Policy Brief Ser. 2016, 17, 2–25. Available online: https://s3platform.jrc.ec.europa.eu/documents/20182/154989/Blue+Growth+and+Smart+Specialisation.+How+to+catch+maritime+growth+through+%27Value+Nets%27/17053ed6-705f-4905-9963-c63a78df26bc (accessed on 14 November 2021).

- Best, M.H. Greater Boston׳s industrial ecosystem: A manufactory of sectors. Technovation 2015, 39–40, 4–13. [Google Scholar] [CrossRef]

- Hitt, M.A.; Ireland, R.D.; Sirmon, D.G. Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef]

- Cirik, K.; Makadok, R. First-Mover Advantages Versus First-Mover Benefits in Network-Based Industries. Acad. Manag. Annu. Meet. Proc. 2017, 1, 115–158. [Google Scholar] [CrossRef]

- Zinnes, C.; Eilat, Y.; Sachs, J. Benchmarking Competitiveness in Transition Economies. Econ. Transit. 2001, 9, 315–353. [Google Scholar] [CrossRef]

- Marsh, I.W.; Tokarick, S.P. Competitiveness Indicators. A Theoretical and Empirical Assessment. Int. Monet. Fund 1994, 29, 700–722. [Google Scholar] [CrossRef]

- Aiginger, K. Unit Value to Signal the Quality Position of CEECs (The Competitiveness of Transition Economies). OECD Proc. 1998, 93–121. Available online: http://ecsocman.hse.ru/data/944/674/1219/chap34.pdf (accessed on 20 November 2021).

- Zhang, D. Energy Finance: Background, Concept, and Recent Developments. Emerg. Mark. Financ. Trade 2018, 54, 1687–1692. [Google Scholar] [CrossRef]

- Lamont, O. Cash flow and investment: Evidence from internal capital markets. J. Financ. 1997, 52, 83–109. [Google Scholar] [CrossRef]

- Cheng, I.-H.; Xiong, W. The financialization of commodity markets. Rev. Financ. Econ. 2014, 6, 419–441. [Google Scholar] [CrossRef]

- Kweon, Y. Economic Competitiveness and Social Policy in Open Economies. Int. Interact. 2018, 44, 537–558. [Google Scholar] [CrossRef]

- Bartelsman, E.; Scarpetta, S.; Schivardi, F. Comparative analysis of firm demographics and survival: Micro-level evidence for the OECD countries. OECD Econ. Dep. Work. Pap. 2003, 348, 1–61. [Google Scholar] [CrossRef]

- SME Competitiveness Outlook 2020; International Trade Centre: Geneve, Switzerland, 2020. [CrossRef]

- Martin, R.L. A Study on the Factors of Regional Competitiveness; University of Cambridge: Cambridge, UK, 2004; Available online: http://ec.europa.eu/regional_policy/sources/docgener/studies/pdf/3cr/competitiveness.pdf (accessed on 14 November 2021).

- Choudhri, E.U.; Schembri, L.L. Productivity Performance and International Competitiveness: An Old Test Reconsidered. Can. J. Econ./Rev. Can. D’Economique 2002, 35, 341–362. Available online: http://www.jstor.org/stable/3131950 (accessed on 20 November 2021). [CrossRef]

- Taçoğlu, C.; Ceylan, C.; Kazançoğlu, Y. Analysis of variables affecting competitiveness of SMEs in the textile industry. J. Bus. Econ. Manag. 2019, 20, 648–673. [Google Scholar] [CrossRef]

- Wisenthige, K.; Guoping, C. Firm Level Competitiveness of Small and Medium Enterprises (SMEs): Analytical Framework Based on Pillars of Competitiveness Model. Int. Res. J. Manag. IT Soc. Sci. 2016, 2, 51–56. [Google Scholar] [CrossRef]

- Hall, B.H. The Relationship Between Firm Size and Firm Growth in the US Manufacturing Sector. J. Ind. Econ. 1987, 35, 583–606. [Google Scholar] [CrossRef]

- Elston, J. An Examination of the Relationship Between Firm Size, Growth and Liquidity in the Neuer Markt. SSRN Electron. J. 2002, 2, 1–25. [Google Scholar] [CrossRef]

- Sipa, M.; Gorzeń-Mitka, I.; Skibiński, A. Determinants of Competitiveness of Small Enterprises: Polish Perspective. Procedia Econ. Financ. 2015, 27, 445–453. [Google Scholar] [CrossRef]

- Aiginger, K.; Bärenthaler-Sieber, S.; Vogel, J. Competitiveness under New Perspectives. WWW Eur. Work. Pap. 2013, 44, 1–97. [Google Scholar] [CrossRef]

- Piatkowski, M. Factors Strengthening the Competitive Position of SME Sector Enterprises. An Example for Poland. Procedia-Soc. Behav. Sci. 2012, 58, 269–278. [Google Scholar] [CrossRef][Green Version]

- Raport o Stanie Sektora Małych i Średnich Przedsiębiorstw w Polsce w 2019 Roku (Report on the Condition of the Small and Medium Enterprise Sector in Poland in 2019); PARP: Warszawa, Poland, 2019. Available online: https://www.parp.gov.pl/component/publications/publication/raport-o-stanie-sektora-malych-i-srednich-przedsiebiorstw-w-polsce-1 (accessed on 10 December 2021).

- Oslo Manual. The Measurement of Scientific and Technological Activities. Proposed Guidelines for Collecting and Interpreting Technological Innovation Data, 3rd ed.; OECD: Paris, France; Eurostat: Luxemburg, 2005; p. 39.

- Prasanna, R.; Jayasundara, J.; Gamage, S.K.N.; Ekanayake, E.; Rajapakshe, P.; Abeyrathn, G. Sustainability of SMEs in the Competition: A Systemic Review on Technological Challenges and SME Performance. J. Open Innov. Technol. Mark. Complex. 2019, 5, 100. [Google Scholar] [CrossRef]

- Kaczmarek, J. The Mechanisms of Creating Value vs. Financial Security of Going Concern-Sustainable Management. Sustainability 2019, 11, 2278. [Google Scholar] [CrossRef]

- Sobczyk, E.J.; Kaczmarek, J.; Fijorek, K.; Kopacz, M. Efficiency and Financial Standing of Coal Mining Enterprises in Poland in Terms of Restructuring Course and Effects. Miner. Resour. Manag. 2020, 36, 127–152. [Google Scholar] [CrossRef]

- Kaczmarek, J. The concept and Measurement of Creating Excess Value in Listed Companies. Eng. Econ. 2018, 29, 1392–2785. [Google Scholar] [CrossRef]

- Fijorek, K.; Denkowska, S.; Kaczmarek, J.; Náñez Alonso, S.L.; Sokołowski, A. Financial threat profiles of industrial enterprises in Poland. Oeconomia Copernic. 2021, 12, 463–498. [Google Scholar] [CrossRef]

- Adian, I.; Doumbia, D.; Gregory, N.; Ragoussis, A.; Reddy, A.; Timmis, J. Small and Medium Enterprises in the Pandemic: Impact, Responses and the Role of Development Finance. Policy Res. Work. Pap. World Bank 2020, 9414, 1–33. Available online: https://documents1.worldbank.org/curated/en/729451600968236270/pdf/Small-and-Medium-Enterprises-in-the-Pandemic-Impact-Responses-and-the-Role-of-Development-Finance.pdf (accessed on 10 December 2021).

| Items | Pattern I | Pattern II | Pattern III | Pattern IV |

|---|---|---|---|---|

| Small enterprises | 23.3% | 32.1% | 28.2% | 16.4% |

| Cut-off points | ARP = 131.0; VRP = 25.2 | |||

| Medium enterprises | 31.7% | 21.5% | 36.0% | 10.8% |

| Cut-off points | ARP = 131.0; VRP = 13.1 | |||

| “Leaders” by Pattern | “Outsiders” by Pattern | Variability of Rank Position (Divisions) | Variability of Rank Position (Classes) | |

| Small < Medium (+36.1%) | Small > Medium (+51.9%) | Small > Medium (+22.4%) | Small > Medium (+92.3%) | |

| Density measure rate | Small (61.5% extension along PL) | Medium (19.1% balanced position PL/PE) | ||

| Position in sector (CM) | Small (63.0% of average) | Medium (96.5% of average) | ||

| Multivariate measure | CM (competitiveness level) | |||

| Small < Medium (+42.3%) | ||||

| Partial measures | PL (productivity of labour cost) | PE (cost productivity in regard to export) | ||

| Small > Medium (+22.4%) | Small < Medium (+60.3%) | |||

| Factors | LE (unit efficiency of labour) | LC (unit cost of labour) | EA (export activity) | GE (overall cost productivity) |

| Small > Medium (+10.1%) | Small < Medium (+11.1%) | Small < Medium (+60.9%) | Small ≈ Medium | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kaczmarek, J. The Stance, Factors, and Composition of Competitiveness of SMEs in Poland. Sustainability 2022, 14, 1788. https://doi.org/10.3390/su14031788

Kaczmarek J. The Stance, Factors, and Composition of Competitiveness of SMEs in Poland. Sustainability. 2022; 14(3):1788. https://doi.org/10.3390/su14031788

Chicago/Turabian StyleKaczmarek, Jarosław. 2022. "The Stance, Factors, and Composition of Competitiveness of SMEs in Poland" Sustainability 14, no. 3: 1788. https://doi.org/10.3390/su14031788

APA StyleKaczmarek, J. (2022). The Stance, Factors, and Composition of Competitiveness of SMEs in Poland. Sustainability, 14(3), 1788. https://doi.org/10.3390/su14031788