Foreign Shareholders’ Social Responsibility, R&D Innovation, and International Competitiveness of Chinese SOEs

Abstract

:1. Introduction

2. Theoretical Analysis and Research Hypotheses

2.1. Foreign Shareholders’ Social Responsibility and Enterprises’ International Competitiveness

2.2. Foreign Shareholders’ Social Responsibility, R&D Innovation, and Enterprises’ International Competitiveness

3. Study Design

3.1. Variable Design

3.1.1. Dependent Variable: International competitiveness

3.1.2. Independent Variable: Social Responsibility of Foreign Shareholders

3.1.3. Moderating Variable: R&D innovation

3.1.4. Controlled Variables

3.2. Empirical Model Design

3.2.1. Baseline Regression Test Model Design

3.2.2. Endogeneity Test Model Design

3.3. Data Selection and Description

4. Results and Analysis of Empirical Tests

4.1. Descriptive Statistical Results and Analysis

4.2. Correlation Test Results and Analysis

4.3. Baseline Regression Test Results and Analysis

4.4. Endogeneity Regression Test Results and Analysis

4.5. Heterogeneity Grouping Regression Test Results and Analysis

4.5.1. Grouping Test between Central SOEs and Local SOEs

4.5.2. Grouping Test of Commercial SOEs and Public Welfare SOEs

4.5.3. Grouping Test of Manufacturing SOEs and Non-Manufacturing SOEs

5. Conclusions

Limitations and Avenues for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jiang, X.J. On the Transformation of Models of Use of Foreign Capital versus the Transformation of Economic Growth Models. Manag. World 1999, 15, 7–15. [Google Scholar]

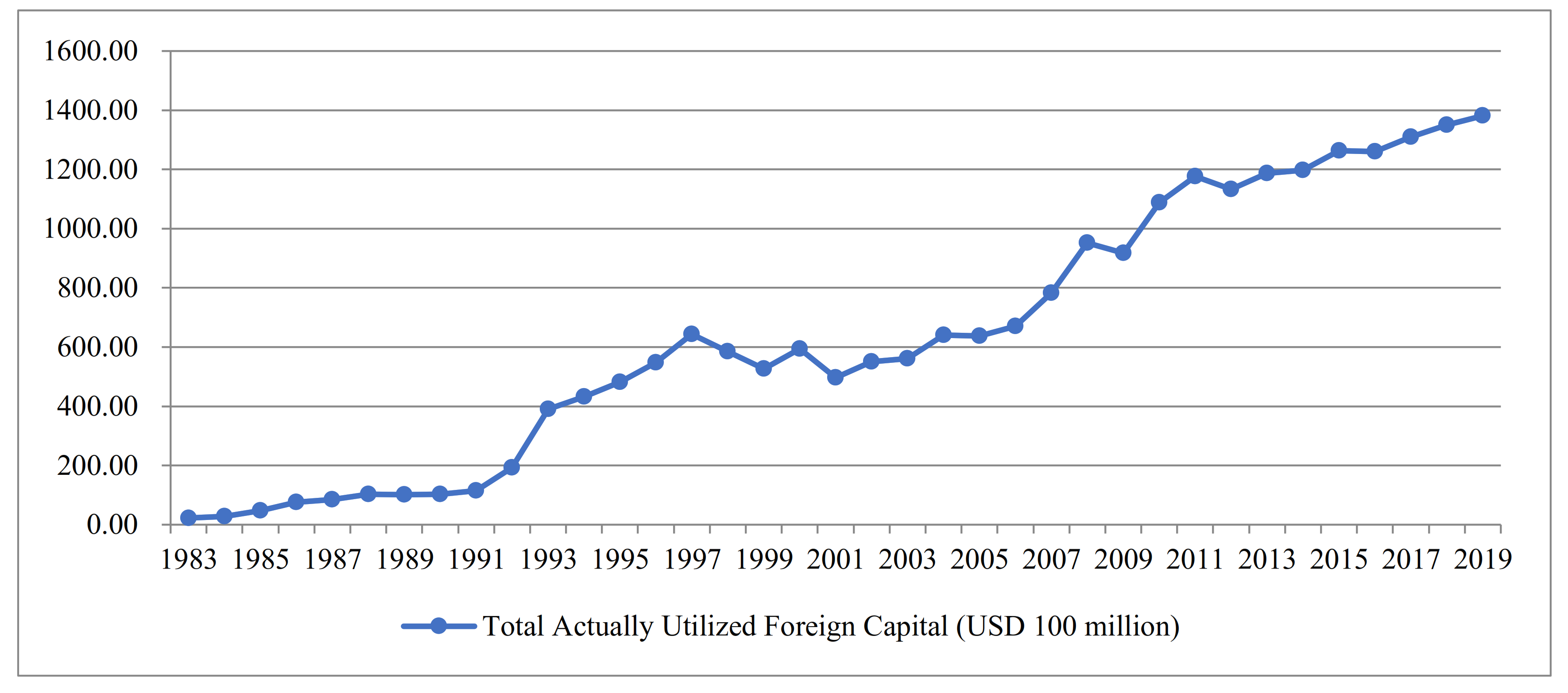

- Li, Z.C.; Ma, X.M.; Chen, Y. Practice, Effect, Experience and Countermeasures of China’s Utilization of Foreign Capital Since the Reform and Open Up. Intertrade 2019, 38, 58–67. [Google Scholar]

- Wu, C.Q.; Lv, Z.Y. Privatization, Foreign Shareholder and Embeddedness: Evidence from China. Bus. Manag. J. 2011, 33, 51–58. [Google Scholar]

- Deng, Z.L.; Chen, Y. The Influence of Foreign Direct Investment on the Survival of State-owned Enterprises: A Study based on the Heterogeneity of Enterprises. J. World Econ. 2013, 36, 53–69. [Google Scholar]

- Ma, L.F.; Wang, L.L.; Zhang, Q. Pecking Order of Mixed Ownership: The Logic of Market. China Ind. Econ. 2015, 33, 5–20. [Google Scholar]

- Letchumanan, R.; Kodama, F. Reconciling the Conflict Between the ‘Pollution-Haven’ Hypothesis and an Emerging Trajectory of International Technology Transfer. Res. Policy 2000, 29, 59–79. [Google Scholar] [CrossRef]

- Shao, M.; Bao, Q. The Influence of FDI on China’s Domestic Labor Rights and Interests. Manag. World 2013, 29, 32–43. [Google Scholar]

- Wang, H.M.; Lv, X.J.; Lin, W.F. The Effect of Foreign Equity Participation,Executive Ownership,Institutional Ownership on Corporate Social Responsibility. Account. Res. 2014, 35, 81–87. [Google Scholar]

- Huang, W.; Chen, Z. Foreign Capital Entry, Supply Chain Pressure and Chinese Corporate Social Responsibility. Manag. World 2015, 31, 91–100. [Google Scholar]

- Bu, D.L.; He, C.; Wen, C.H. How does Foreign Shareholder Affect Corporate Social Responsibility. Account. Res. 2021, 42, 86–101. [Google Scholar]

- Aggarwal, R.; Ere, I.; Ferreira, M.; Matos, P. Does Governance Travel around the World: Evidence from Institutional Investors. J. Financ. Econ. 2011, 100, 154–181. [Google Scholar] [CrossRef]

- Gangi, F.; Mustilli, M.; Varrone, N. The Impact of Corporate Social Responsibility (CSR) Knowledge on Corporate Financial Performance: Evidence from the European Banking Industry. J. Knowl. Manag. 2019, 23, 110–134. [Google Scholar] [CrossRef]

- Child, J. A Foreign Perspective on the Management of People in China. Int. J. Hum. Resour. Manag. 1991, 2, 93–107. [Google Scholar] [CrossRef]

- Chapple, W.; Moon, J. Corporate Social Responsibility (CSR) in Asia: A Seven-Country Study of CSR Web Site Reporting. Bus. Soc. 2005, 44, 415–441. [Google Scholar] [CrossRef] [Green Version]

- Barako, D.G.; Hancock, P.; Izan, H.Y. Factors Influencing Voluntary Corporate Disclosure by Kenyan Companies. Corp. Gov. Int. Rev. 2006, 14, 107–125. [Google Scholar] [CrossRef]

- In, F.; Kim, M.; Park, R.J. Competition of Socially Responsible and Conventional Mutual Funds and Its Impact on Fund Performance. J. Bank. Financ. 2014, 44, 160–176. [Google Scholar] [CrossRef]

- Ma, L.L. Research on the Influence Mechanism of Corporate Social Responsibility on Consumers’ Purchase Intention. Manag. World 2011, 27, 120–126. [Google Scholar]

- Lall, S. Vertical Inter-Firm Linkages in LDCs: An Empirical Study. Oxf. Bull. Econ. Stat. 1980, 42, 203–226. [Google Scholar] [CrossRef]

- Zheng, S.F.; Huang, L.Y. Impact of Foreign Direct Investment Entry on Corporate Social Responsibility: Based on Intra-industry and Inter-industry Spillover Effects. J. Int. Trade 2018, 44, 116–129. [Google Scholar]

- Ruf, B.M.; Muralidhar, K.; Brown, R.M.; Janney, J.J.; Paul, K. An Empirical Investigate of the Relationship between Change in Corporate Social Performance and Financial Performance: A Stakeholder Theory Perspective. J. Bus. Ethics 2001, 32, 143–156. [Google Scholar] [CrossRef]

- Petersen, H.L.; Vredenburg, H. Morals or Economics: Institutional Investor Preferences for Corporate Social Responsibility. J. Bus. Ethics 2009, 90, 1–14. [Google Scholar] [CrossRef]

- Lin, B.; Rao, J. Why do Listed Companies Disclose the Auditor’s Internal Control Reports Voluntarily: An Empirical Study Based on Signaling Theory in China. Account. Res. 2009, 30, 45–52. [Google Scholar]

- Friedman, M. The Social Responsibility of Business is to Increase its Profit. N. Y. Times Mag. 1970, 13, 122–126. [Google Scholar]

- Du, W.J.; Li, M.J. A Research on Enterprise Innovation-Driven Mechanism in the Open Economy. Sci. Res. Manag. 2018, 39, 91–98. [Google Scholar]

- Küçükoglu, M.T.; Pınar, R.İ. Positive Influences of Green Innovation on Company Performance. Procedia-Soc. Behav. Sci. 2015, 195, 1232–1237. [Google Scholar] [CrossRef] [Green Version]

- Zheng, S.L.; Zhang, M.C. Estimating the Contribution of China’s Scientific and Technological Progress to Economic Growth: 1990–2017. J. World Econ. 2019, 42, 73–97. [Google Scholar]

- Li, X.H.; Wang, Y.F. Data Value Chain and the Mechanism of Value Creation. Econ. Rev. J. 2020, 36, 54–62. [Google Scholar]

- Cheng, K.Y.; Lin, P. Spillover Effects of FDI on Innovation in China: Evidence from Provincial Data. China Econ. Rev. 2004, 15, 25–44. [Google Scholar] [CrossRef] [Green Version]

- Ortas, E.; Gallego-Alvarez, I.; Etxeberria, I.A. Financial Factors Influencing the Quality of Corporate Social Responsibility and Environmental Management Disclosure: A Quantile Regression Approach. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 362–380. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A. Corporate Reputation and Philanthropy: An Empirical Analysis. J. Bus. Ethics 2005, 61, 29–44. [Google Scholar] [CrossRef]

- Carrasco, I.; Buendia, M. Corporate Social Responsibility: A Crossroad between Changing Values, Innovation and Internationalization. Eur. J. Int. Manag. 2013, 7, 295–314. [Google Scholar]

- Luong, H.; Moshirian, F.; Nguyen, L.; Tian, X.; Zhang, B. How do Foreign Institutional Investors Enhance Firm Innovation. J. Financ. Quant. Anal. 2017, 52, 1449–1490. [Google Scholar] [CrossRef] [Green Version]

- Iyer, D.N.; Miller, K.D. Performance Feedback, Slack, and the Timing of Acquisitions. Acad. Manag. J. 2008, 51, 808–822. [Google Scholar]

- Chen, H.; Xu, R. Research on the International Competitiveness of Chinese and American Listed Companies: An Empirical Analysis Based on High-end Manufacturing and Information Technology Industry. Stud. Int. Financ. 2016, 33, 49–61. [Google Scholar]

- Long, W.; Li, S.; Wu, H.; Song, X. Corporate social responsibility and financial performance: The roles of government intervention and market competition. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 525–541. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef] [Green Version]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Buckley, P.J.; Pass, C.L.; Prescott, K. Measures of international competitiveness: A critical survey. J. Mark. Manag. 1988, 4, 175–200. [Google Scholar] [CrossRef]

- Chen, S.H.; Lu, C.C. Can the Governance Participation of Party Organizations in State-owned Enterprises Effectively Curb the ‘Loss of State-owned Assets’ in Mergers and Acquisitions. Manag. World 2014, 30, 106–120. [Google Scholar]

- Xie, L.Y. The Boundary between Government and Market in the Classification Reform of State-owned Enterprises. Dyn. Soc. Sci. 2017, 40, 35–39. [Google Scholar]

- Feng, D.L. Trends and Problems of China’s Manufacturing Large Enterprises Outward Internationalization and Its Countermeasures. Intertrade 2020, 39, 31–37. [Google Scholar]

- Sueyoshi, T.; Wang, D. Radial and Non-Radial Approaches for Environmental Assessment by Data Envelopment Analysis: Corporate Sustainability and Effective Investment for Technology Innovation. Energy Econ. 2014, 45, 537–551. [Google Scholar] [CrossRef]

| First Level Indicators | Second Level Indicators | Third Level Indicators | Attribute |

|---|---|---|---|

| Management ability | Market scale | Market value per share, net profit per share, net assets per share | Positive indicators |

| Ownership concentration | Shareholding ratio of the first largest shareholder, concentration of shares held by top ten shareholders | Positive indicators | |

| Insider incentive | Executive compensation level, executive shareholding ratio | Positive indicators | |

| Financial Status | Viability | Liquidity ratio, quick ratio, total asset turnover | Positive indicators |

| Asset-liability ratio | Negative indicators | ||

| Profitability | Net profit margin, return on total assets, return on equity, return on invested capital | Positive indicators | |

| Ratio of sales to cost | Negative indicators | ||

| Developing ability | Total assets growth rate, increase rate of main business revenue, net profit growth rate, equity multiplier | Positive indicators | |

| Investment performance | Market performance | Alpha, Beta, Sharpe | Positive indicators |

| Valuation ability | Price earnings ratio, price-to-book ratio | Moderation indicators | |

| Dividend yield ratio, earnings per share, free cash flow per share | Positive indicators | ||

| Development potential | Growth potential | Proportion of intangible assets to total assets, proportion of fixed assets to total assets | Positive indicators |

| R&D ability | proportion of R&D expenses to total assets | Positive indicators | |

| Degree of internationalization | Proportion of overseas revenue to operating revenue | Positive indicators |

| Variable | Mean | Median | Standard Deviation | 5% | 25% | 75% | 95% |

|---|---|---|---|---|---|---|---|

| ICi,t | 0.190 | 0.176 | 0.065 | 0.125 | 0.152 | 0.216 | 0.297 |

| SRFSi,t | 0.367 | 0.000 | 1.241 | 0.000 | 0.000 | 0.119 | 2.306 |

| R&Di,t | 15.858 | 17.982 | 6.250 | 0.000 | 16.416 | 19.237 | 20.757 |

| EAi,t | 0.286 | 0.000 | 0.452 | 0.000 | 0.000 | 1.000 | 1.000 |

| TAi,t | 22.728 | 22.570 | 1.292 | 20.821 | 21.786 | 23.735 | 24.965 |

| ALRi,t | 0.522 | 0.532 | 0.198 | 0.184 | 0.371 | 0.689 | 0.826 |

| ROAi,t | 0.043 | 0.041 | 0.058 | -0.043 | 0.023 | 0.070 | 0.128 |

| OCi,t | 0.180 | 0.155 | 0.123 | 0.034 | 0.090 | 0.264 | 0.407 |

| PIDi,t | 0.372 | 0.357 | 0.080 | 0.286 | 0.333 | 0.429 | 0.500 |

| Variable | High SRFSi,t | Low SRFSi,t | T Test | Wilcoxon Z | ||||

|---|---|---|---|---|---|---|---|---|

| N | Mean | Median | N | Mean | Median | |||

| ICi,t | 777 | 0.208 | 0.188 | 2253 | 0.183 | 0.172 | 9.358 *** | 8.882 *** |

| Variable | High R&Di,t | Low R&Di,t | T test | Wilcoxon Z | ||||

| N | Mean | Median | N | Mean | Median | |||

| ICi,t | 1515 | 0.198 | 0.181 | 1515 | 0.182 | 0.170 | 6.765 *** | 7.262 *** |

| ICi,t | SRFSi,t | R&Di,t | EAi,t | TAi,t | ALRi,t | ROAi,t | OCi,t | PIDi,t | |

|---|---|---|---|---|---|---|---|---|---|

| ICi,t | 1 | ||||||||

| SRFSi,t | 0.169 *** | 1 | |||||||

| R&Di,t | 0.078 *** | 0.036 ** | 1 | ||||||

| EAi,t | 0.067 *** | −0.018 | 0.062 *** | 1 | |||||

| TAi,t | 0.079 *** | 0.115 *** | 0.154 *** | −0.003 | 1 | ||||

| ALRi,t | −0.164 *** | −0.081 *** | -0.024 | −0.032 * | 0.426 *** | 1 | |||

| ROAi,t | 0.418 *** | 0.219 *** | 0.046 ** | −0.047 ** | 0.089 *** | −0.287 *** | 1 | ||

| OCi,t | 0.102 *** | 0.058 *** | 0.021 | 0.029 * | 0.284 *** | 0.024 | 0.119 *** | 1 | |

| PIDi,t | −0.023 | −0.031* | 0.018 | −0.011 | 0.139 *** | 0.037 ** | −0.006 | 0.083 *** | 1 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| SRFSi,t | 0.089 *** (0.010) | 0.078 *** (0.014) | 0.382 *** (0.089) | 0.330 *** (0.022) | ||

| SRFSi,t × R&Di,t | 0.006 *** (0.001) | 0.042 *** (0.012) | ||||

| R&Di,t | 0.081 *** (0.019) | 0.073 *** (0.019) | 0.454 *** (0.174) | 0.438 ** (0.180) | ||

| EAi,t | 0.012 *** | 0.011 *** | 0.012 *** | |||

| TAi,t | 0.003 *** | 0.003 *** | 0.003 *** | |||

| ALRi,t | −0.025 *** | −0.025 *** | −0.023 *** | |||

| ROAi,t | 0.422 *** | 0.436 *** | 0.422 *** | |||

| OCi,t | 0.020 ** | 0.021 ** | 0.021 ** | |||

| PIDi,t | −0.021 * | −0.024* | −0.021 * | |||

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.187 *** | 0.177 *** | 0.175 *** | 0.112 *** | 0.105 *** | 0.114 *** |

| Adj R2 | 0.028 | 0.006 | 0.033 | 0.194 | 0.191 | 0.196 |

| F-statistics | 89.083 *** | 18.424 *** | 35.277 *** | 105.370 *** | 103.302 *** | 82.831 *** |

| 1st Stage | 2nd-Stage Dependent Variable | ||||

|---|---|---|---|---|---|

| SRFSi,t | ICi,t | ICi,t | ICi,t | ICi,t | |

| (1) | (2) | (3) | (4) | (5) | |

| TPAi,t | 0.206 *** (0.088) | ||||

| SRFSi,t | 0.057 *** (0.011) | 0.010 *** (0.001) | 0.083 *** (0.022) | 0.044 ***(0.003) | |

| SRFSi,t × R&Di,t | 0.099 *** (0.019) | 0.079 *** (0.017) | |||

| R&Di,t | 0.035 *** (0.004) | 0.020 *** (0.003) | |||

| Control_Variable | Yes | No | Yes | No | Yes |

| Year | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.392 *** | 0.186 *** | 0.130 *** | 0.180 *** | 0.130 *** |

| Adj R2 | 0.014 | 0.056 | 0.189 | 0.056 | 0.188 |

| F-statistics | 19.989 *** | 80.006 *** | 45.386 *** | 27.237 *** | 35.358 *** |

| J-statistics | — | 0.444 | 0.708 | 0.582 | 0.726 |

| Sample of Central SOEs | Sample of Local SOEs | |||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| SRFSi,t | 0.023 *** (0.002) | 0.005 *** (0.002) | 0.015 *** (0.003) | 0.008 ** (0.003) | 0.041 *** (0.001) | 0.010 *** (0.001) | 0.022 *** (0.003) | 0.010 *** (0.002) |

| SRFSi,t × R&Di,t | 0.020 *** (0.002) | 0.022 *** (0.002) | 0.013 *** (0.001) | 0.011 *** (0.002) | ||||

| R&Di,t | 0.013 *** (0.003) | 0.028 *** (0.008) | 0.049 ** (0.023) | 0.043 ** (0.020) | ||||

| Control_Variable | No | Yes | No | Yes | No | Yes | No | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.195 *** | 0.145 *** | 0.174 *** | 0.139 *** | 0.183 *** | 0.102 *** | 0.175 *** | 0.106 *** |

| N | 867 | 867 | 867 | 867 | 2163 | 2163 | 2163 | 2163 |

| Adj R2 | 0.011 | 0.126 | 0.026 | 0.132 | 0.035 | 0.211 | 0.037 | 0.212 |

| F-statistics | 10.627 *** | 21.787 *** | 8.700 *** | 17.430 *** | 79.137 *** | 97.381 *** | 28.504 *** | 73.534 *** |

| Sample of Commercial SOEs | Sample of Public Welfare SOES | |||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| SRFSi,t | 0.040 *** (0.001) | 0.011 *** (0.001) | 0.080 *** (0.003) | 0.015 *** (0.004) | 0.032 *** (0.001) | 0.006 *** (0.001) | 0.031 *** (0.002) | 0.006 *** (0.001) |

| SRFSi,t × R&Di,t | 0.026 *** (0.002) | 0.025 *** (0.002) | 0.043 *** (0.002) | 0.041 *** (0.001) | ||||

| R&Di,t | 0.093 *** (0.002) | 0.056 *** (0.002) | 0.036 *** (0.003) | 0.029 *** (0.003) | ||||

| Control_Variable | No | Yes | No | Yes | No | Yes | No | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.191 *** | 0.022 *** | 0.176 *** | 0.025 *** | 0.178 *** | 0.245 *** | 0.172 *** | 0.252 *** |

| N | 2019 | 2019 | 2019 | 2019 | 1011 | 1011 | 1011 | 1011 |

| Adj R2 | 0.031 | 0.224 | 0.037 | 0.225 | 0.028 | 0.186 | 0.037 | 0.193 |

| F-statistics | 65.790 *** | 83.992 *** | 26.808 *** | 66.237 *** | 30.334 *** | 34.017 *** | 14.014 *** | 27.922 *** |

| Sample of Manufacturing SOEs | Sample of Non-Manufacturing SOEs | |||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| SRFSi,t | 0.049 *** (0.012) | 0.012 *** (0.001) | 0.064 *** (0.005) | 0.017 *** (0.006) | 0.042 *** (0.012) | 0.008 *** (0.001) | 0.046 *** (0.002) | 0.004 * (0.002) |

| SRFSi,t × R&Di,t | 0.083 *** (0.028) | 0.030 *** (0.003) | 0.019 *** (0.005) | 0.016 *** (0.001) | ||||

| R&Di,t | 0.050 *** (0.003) | 0.015 *** (0.003) | 0.032 *** (0.002) | 0.025 *** (0.002) | ||||

| Control_Variable | No | Yes | No | Yes | No | Yes | No | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.187 *** | 0.091 *** | 0.161 *** | 0.092 *** | 0.185 *** | 0.131 *** | 0.181 *** | 0.135 *** |

| N | 2130 | 2130 | 2130 | 2130 | 900 | 900 | 900 | 900 |

| Adj R2 | 0.038 | 0.213 | 0.046 | 0.213 | 0.012 | 0.151 | 0.013 | 0.151 |

| F-statistics | 85.850 *** | 83.399 *** | 34.912 *** | 65.143 *** | 11.942 *** | 23.847 *** | 4.982 *** | 18.787 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, Y.; Lei, C.; Jiménez, A. Foreign Shareholders’ Social Responsibility, R&D Innovation, and International Competitiveness of Chinese SOEs. Sustainability 2022, 14, 1746. https://doi.org/10.3390/su14031746

Zhou Y, Lei C, Jiménez A. Foreign Shareholders’ Social Responsibility, R&D Innovation, and International Competitiveness of Chinese SOEs. Sustainability. 2022; 14(3):1746. https://doi.org/10.3390/su14031746

Chicago/Turabian StyleZhou, Yuying, Chu Lei, and Alfredo Jiménez. 2022. "Foreign Shareholders’ Social Responsibility, R&D Innovation, and International Competitiveness of Chinese SOEs" Sustainability 14, no. 3: 1746. https://doi.org/10.3390/su14031746

APA StyleZhou, Y., Lei, C., & Jiménez, A. (2022). Foreign Shareholders’ Social Responsibility, R&D Innovation, and International Competitiveness of Chinese SOEs. Sustainability, 14(3), 1746. https://doi.org/10.3390/su14031746