The Impact of Financial Development and FDI on Renewable Energy in the UAE: A Path towards Sustainable Development

Abstract

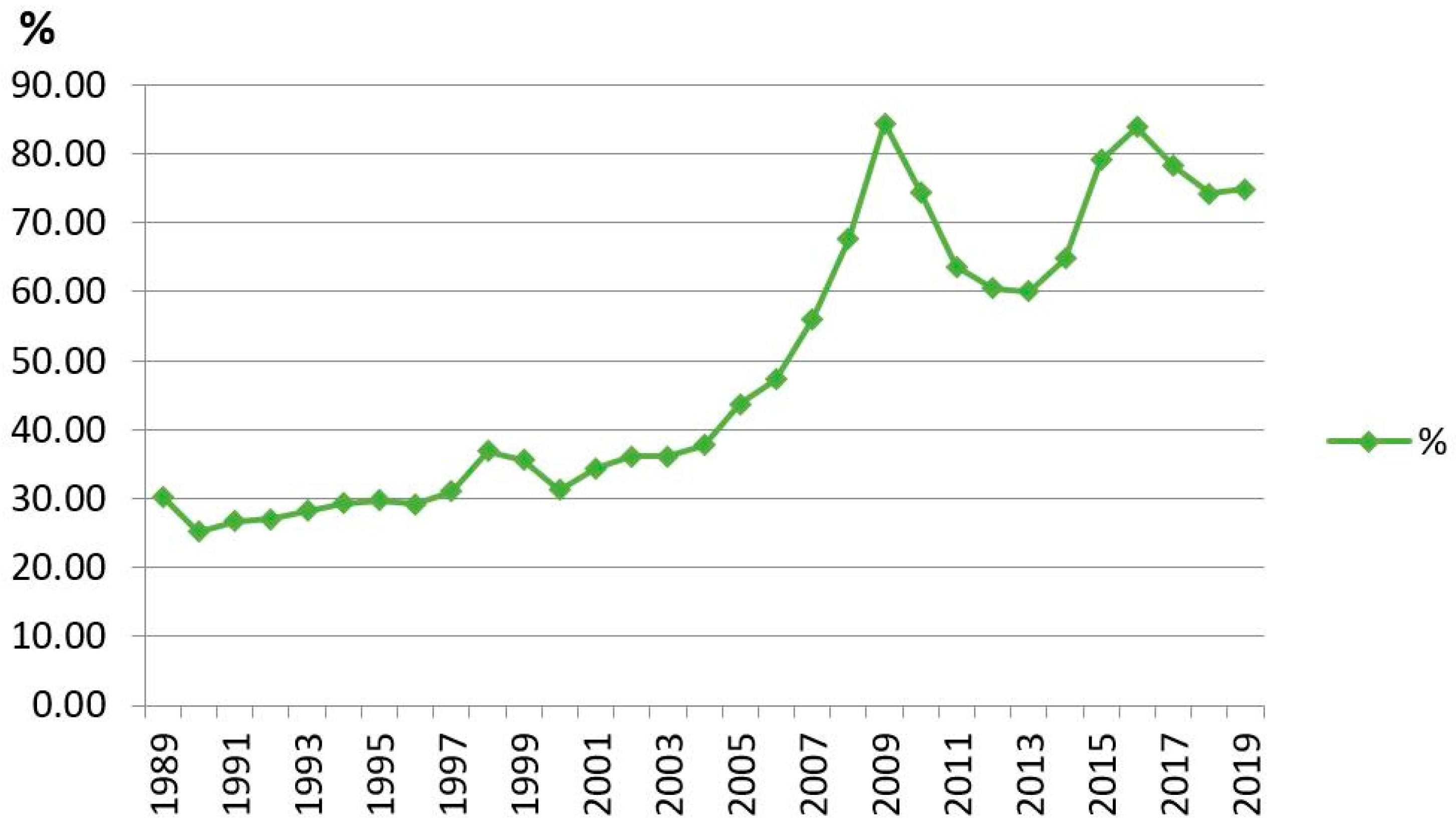

:1. Introduction

2. Review of Literature

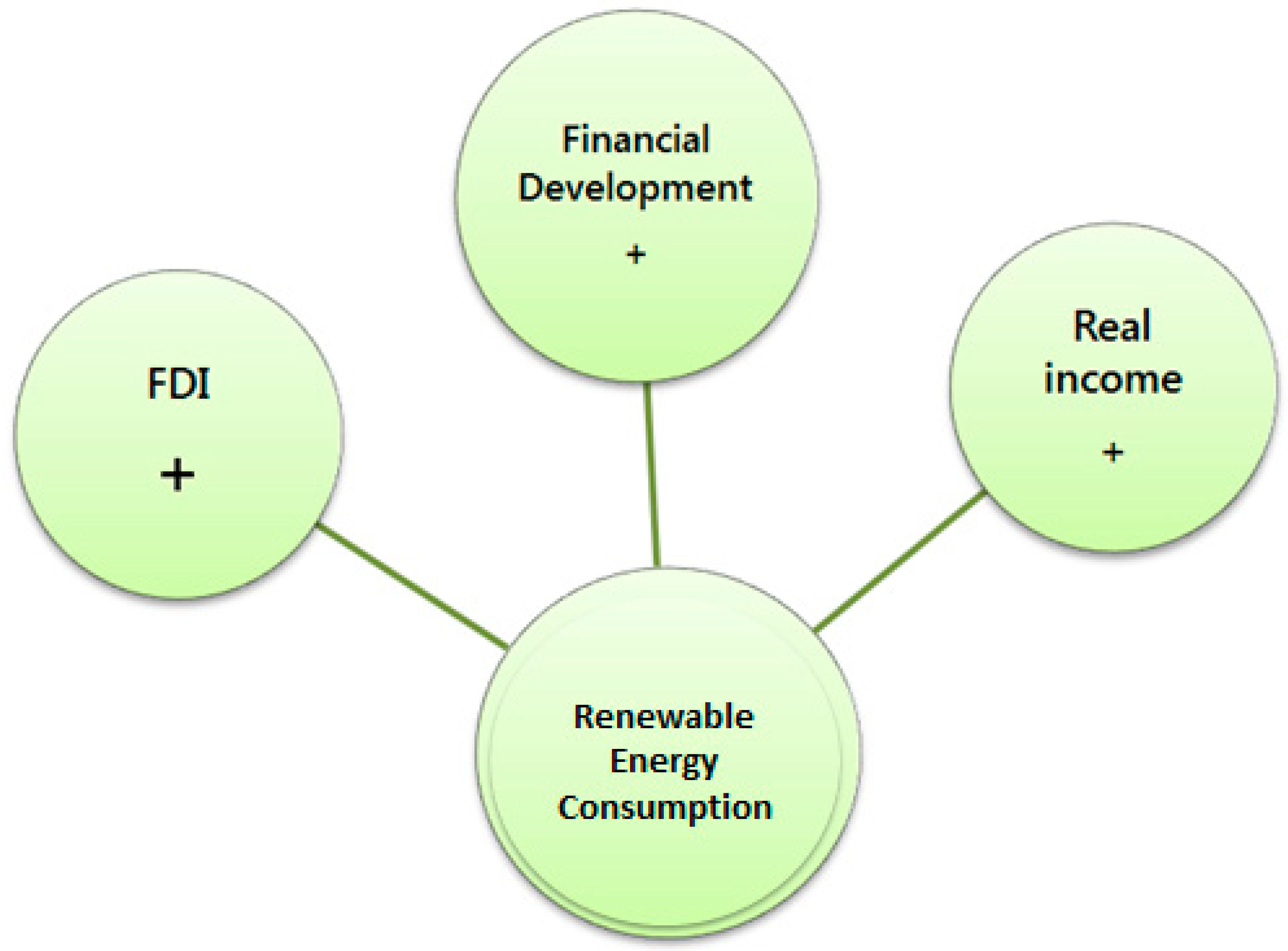

2.1. Real Income and Renewable Energy Consumption

2.2. FDI and Renewable Energy Consumption

2.3. Financial Development and the Consumption of Renewable Energy

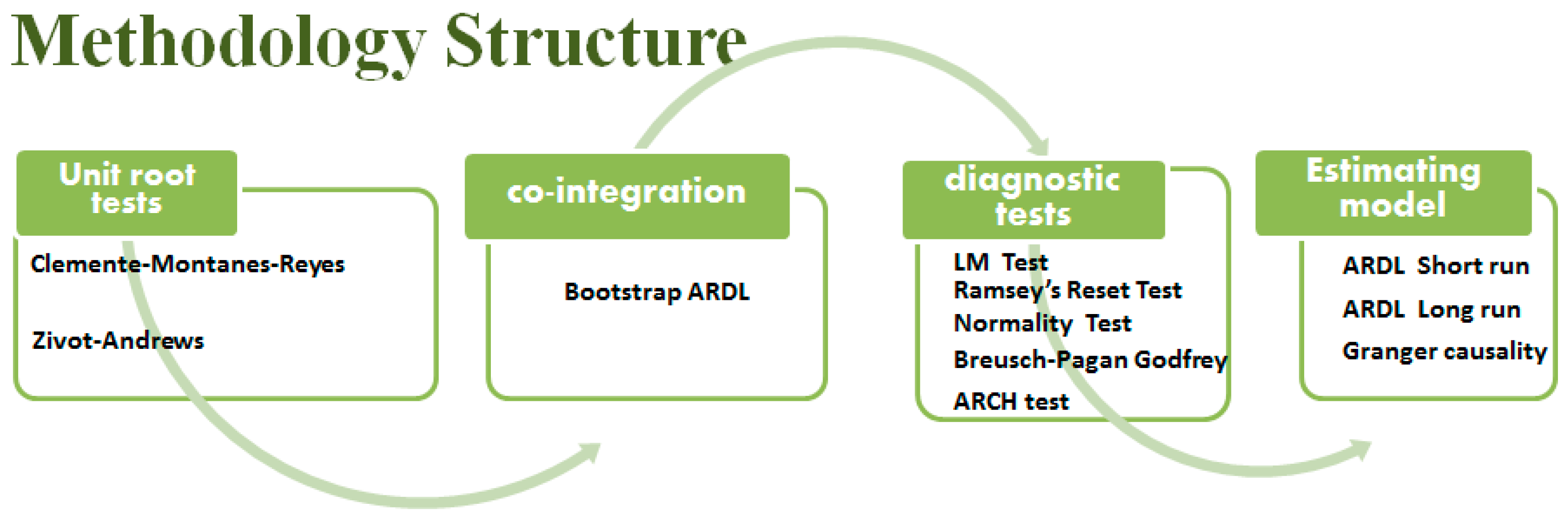

3. Research Methodology and Data Sources

Unit Root and Cointegration Tests

4. Results and Discussion

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abumunshar, M.; Aga, M.; Samour, A. Oil Price, Energy Consumption, and CO2 Emissions in Turkey. New Evidence from a Bootstrap ARDL Test. Energies 2020, 13, 5588. [Google Scholar] [CrossRef]

- Shahzad, U.; Hussain, M.; Qin, F.; Amir, M. Reinvestigating the Role of Coal Consumption in Indian Economy: An ARDL and Causality Analysis. Eur. Online J. Nat. Soc. Sci. 2018, 7, 348. [Google Scholar]

- Chishti, M.Z.; Ahmad, M.; Rehman, A.; Khan, M.K. Mitigations pathways towards sustainable development: Assessing the influence of fiscal and monetary policies on carbon emissions in BRICS economies. J. Clean. Prod. 2021, 292, 126035. [Google Scholar] [CrossRef]

- Koondhar, M.A.; Shahbaz, M.; Ozturk, I.; Randhawa, A.A.; Kong, R. Revisiting the relationship between carbon emission, renewable energy consumption, forestry, and agricultural financial development for China. Environ. Sci. Pollut. Res. 2021, 28, 45459–45473. [Google Scholar] [CrossRef]

- Al Naqbi, S.; Tsai, I.; Mezher, T. Market design for successful implementation of UAE 2050 energy strategy. Renew. Sustain. Energy Rev. 2019, 116, 109429. [Google Scholar] [CrossRef]

- Altarhouni, A.; Danju, D.; Samour, A. Insurance Market Development, Energy Consumption, and Turkey’s CO2 Emissions. New Perspectives from a Bootstrap ARDL Test. Energies 2021, 14, 7830. [Google Scholar] [CrossRef]

- Jiang, C.; Ma, X. The Impact of Financial Development on Carbon Emissions: A Global Perspective. Sustainability 2019, 11, 5241. [Google Scholar] [CrossRef] [Green Version]

- Godil, D.I.; Sharif, A.; Ali, M.I.; Ozturk, I.; Usman, R. The role of financial development, R&D expenditure, globalization and institutional quality in energy consumption in India: New evidence from the QARDL approach. J. Environ. Manag. 2021, 285, 112208. [Google Scholar]

- Fatima, T.; Mentel, G.; Doğan, B.; Hashim, Z.; Shahzad, U. Investigating the role of export product diversification for renewable, and non-renewable energy consumption in GCC (gulf cooperation council) countries: Does the Kuznets hypothesis exist? Environ. Dev. Sustain. 2021, 9, 1–21. [Google Scholar] [CrossRef]

- Ozturk, I.; Aslan, A.; Kalyoncu, H. Energy consumption and economic growth relationship: Evidence from panel data for low and middle income countries. Energy Policy 2010, 38, 4422–4428. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable and non-renewable electricity consumption–growth nexus: Evidence from emerging market economies. Appl. Energy 2011, 88, 5226–5230. [Google Scholar] [CrossRef]

- Sebri, M.; Ben-Salha, O. On the causal dynamics between economic growth, renewable energy consumption, CO2 emissions and trade openness: Fresh evidence from BRICS countries. Renew. Sustain. Energy Rev. 2014, 39, 14–23. [Google Scholar] [CrossRef] [Green Version]

- Ajmi, A.N.; Hammoudeh, S.; Nguyen, D.K.; Sato, J.R. On the relationships between CO 2 emissions, energy consumption and income: The importance of time variation. Energy Econ. 2015, 49, 629–638. [Google Scholar] [CrossRef]

- Kahia, M.; Ben Aïssa, M.S.; Lanouar, C. Renewable and non-renewable energy use-economic growth nexus: The case of MENA Net Oil Importing Countries. Renew. Sustain. Energy Rev. 2017, 71, 127–140. [Google Scholar] [CrossRef]

- Bulut, U.; Inglesi-Lotz, R. Which type of energy drove industrial growth in the US from 2000 to 2018? Energy Rep. 2019, 5, 425–430. [Google Scholar] [CrossRef]

- Tugcu, C.T.; Topcu, M. Total, renewable and non-renewable energy consumption and economic growth: Revisiting the issue with an asymmetric point of view. Energy 2018, 152, 64–74. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, C.K.M.; Lu, Z. Energy consumption and economic growth: New evidence from the OECD countries. Energy 2018, 153, 27–34. [Google Scholar] [CrossRef] [Green Version]

- Adams, S.; Klobodu, E.K.M.; Apio, A. Renewable and non-renewable energy, regime type and economic growth. Renew. Energy 2018, 125, 755–767. [Google Scholar] [CrossRef]

- Zivkovic, A.; Fosic, I.; Starcevic, D.P. Employee Turnover Trends in Croatia. Econ. Soc. Dev. Book Proc. 2020, 16, 155–162. [Google Scholar]

- Asiedu, B.A.; Hassan, A.A.; Bein, M.A. Renewable energy, non-renewable energy, and economic growth: Evidence from 26 European countries. Environ. Sci. Pollut. Res. 2021, 28, 11119–11128. [Google Scholar] [CrossRef]

- Salari, M.; Kelly, I.; Doytch, N.; Javid, R.J. Economic Growth and Renewable and Non-Renewable Energy Consumption: Evidence from the U.S. States. Renew. Energy 2021, 178, 50–65. [Google Scholar] [CrossRef]

- Freidin, M.; Burakov, D. Economic growth, electricity consumption and internet usage nexus: Evidence from a panel of commonwealth of independent states. Int. J. Energy Econ. Policy 2018, 8, 267. [Google Scholar]

- Kutn, A.M.; Paramati, S.R.; Ummalla, M.; Zakari, A. Financing renewable energy projects in major emerging market economies: Evidence in the perspective of sustainable economic development. Emerg. Mark. Financ. Trade 2018, 54, 1761–1777. [Google Scholar] [CrossRef] [Green Version]

- Wang, J.; Zhang, S.; Zhang, Q. The relationship of renewable energy consumption to financial development and economic growth in China. Renew. Energy 2021, 170, 897–904. [Google Scholar] [CrossRef]

- Anton, S.G.; Nucu, A.E.A. The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 2020, 147, 330–338. [Google Scholar] [CrossRef]

- Lahiani, A.; Mefteh-Wali, S.; Shahbaz, M.; Vo, X.V. Does financial development influence renewable energy consumption to achieve carbon neutrality in the USA? Energy Policy 2021, 158, 112524. [Google Scholar] [CrossRef]

- McNown, R.; Sam, C.Y.; Goh, S.K. Bootstrapping the autoregressive distributed lag test for cointegration. Appl. Econ. 2018, 50, 1509–1521. [Google Scholar] [CrossRef]

- Ikram, M.; Xia, W.; Fareed, Z.; Shahzad, U.; Rafique, M.Z. Exploring the nexus between economic complexity, economic growth and ecological footprint: Contextual evidences from Japan. Sustain. Energy Technol. Assess. 2021, 47, 101460. [Google Scholar] [CrossRef]

- Erdal, G.; Erdal, H.; Esengün, K. The causality between energy consumption and economic growth in Turkey. Energy Policy 2008, 36, 3838–3842. [Google Scholar] [CrossRef]

- Rafique, M.Z.; Doğan, B.; Husain, S.; Huang, S.; Shahzad, U. Role of economic complexity to induce renewable energy: Contextual evidence from G7 and E7 countries. Int. J. Green Energy 2021, 18, 745–754. [Google Scholar] [CrossRef]

- Mielnik, O.; Goldemberg, J. Foreign direct investment and decoupling between energy and gross domestic product in developing countries. Energy Policy 2002, 30, 87–89. [Google Scholar] [CrossRef]

- Salim, R.; Yao, Y.; Chen, G.; Zhang, L. Can foreign direct investment harness energy consumption in China? A time series investigation. Energy Econ. 2017, 66, 43–53. [Google Scholar] [CrossRef]

- Adom, P.K.; Opoku, E.E.O.; Yan, I.K.-M. Energy demand–FDI nexus in Africa: Do FDIs induce dichotomous paths? Energy Econ. 2019, 81, 928–941. [Google Scholar] [CrossRef]

- Sbia, R.; Shahbaz, M.; Hamdi, H. A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ. Model. 2014, 36, 191–197. [Google Scholar] [CrossRef] [Green Version]

- Paramati, S.R.; Ummalla, M.; Apergis, N. The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ. 2016, 56, 29–41. [Google Scholar] [CrossRef]

- Kilicarslan, Z. The Relationship between Foreign Direct Investment and Renewable Energy Production: Evidence from Brazil, Russia, India, China, South Africa and Turkey. Int. J. Energy Econ. Policy 2019, 9, 291–297. [Google Scholar] [CrossRef]

- Fan, W.; Hao, Y. An empirical research on the relationship amongst renewable energy consumption, economic growth and foreign direct investment in China. Renew. Energy 2020, 146, 598–609. [Google Scholar] [CrossRef]

- Grabara, J.; Tleppayev, A.; Dabylova, M.; Mihardjo, L.W.W.; Dacko-Pikiewicz, Z. Empirical Research on the Relationship Amongst Renewable Energy Consumption, Economic Growth and Foreign Direct Investment in Kazakhstan and Uzbekistan. Energies 2021, 14, 332. [Google Scholar] [CrossRef]

- Song, C.-Q.; Chang, C.-P.; Gong, Q. Economic growth, corruption, and financial development: Global evidence. Econ. Model. 2021, 94, 822–830. [Google Scholar] [CrossRef]

- Ekanayake, E.M.; Thaver, R. The Nexus between Financial Development and Economic Growth: Panel Data Evidence from Developing Countries. J. Risk Financial Manag. 2021, 14, 489. [Google Scholar] [CrossRef]

- Cheng, C.-Y.; Chien, M.-S.; Lee, C.-C. ICT diffusion, financial development, and economic growth: An international cross-country analysis. Econ. Model. 2021, 94, 662–671. [Google Scholar] [CrossRef]

- Islam, F.; Shahbaz, M.; Ahmed, A.U.; Alam, M. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Econ. Model. 2013, 30, 435–441. [Google Scholar] [CrossRef] [Green Version]

- Çoban, S.; Topcu, M. The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ. 2013, 39, 81–88. [Google Scholar] [CrossRef]

- Shahbaz, M.; Van Hoang, T.H.; Mahalik, M.K.; Roubaud, D. Energy consumption, financial development and economic growth in India: New evidence from a nonlinear and asymmetric analysis. Energy Econ. 2017, 63, 199–212. [Google Scholar] [CrossRef] [Green Version]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Chiu, Y.-B.; Lee, C.-C. Effects of financial development on energy consumption: The role of country risks. Energy Econ. 2020, 90, 104833. [Google Scholar] [CrossRef]

- Omri, A.; Kahouli, B. Causal relationships between energy consumption, foreign direct investment and economic growth: Fresh evidence from dynamic simultaneous-equations models. Energy Policy 2014, 67, 913–922. [Google Scholar] [CrossRef] [Green Version]

- Wu, L.; Broadstock, D.C. Does economic, financial and institutional development matter for renewable energy consumption? Evidence from emerging economies. Int. J. Econ. Policy Emerg. Econ. 2015, 8, 20–39. [Google Scholar] [CrossRef]

- Kim, J.; Park, K. Financial development and deployment of renewable energy technologies. Energy Econ. 2016, 59, 238–250. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W. Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J. Bus. Econ. Stat. 2002, 20, 25–44. [Google Scholar] [CrossRef]

- Clemente, J.; Montañés, A.; Reyes, M. Testing for a unit root in variables with a double change in the mean. Econ. Lett. 1998, 59, 175–182. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Goh, S.K.; McNown, R.; Wong, K.N. Macroeconomic implications of population aging: Evidence from Japan. J. Asian Econ. 2020, 68, 101198. [Google Scholar] [CrossRef]

- Alhodiry, A.; Rjoub, H.; Samour, A. Impact of oil prices, the U.S interest rates on Turkey’s real estate market. New evidence from combined co-integration and bootstrap ARDL tests. PLoS ONE 2021, 16, e0242672. [Google Scholar] [CrossRef]

- Moyo, D.; Samour, A.; Tursoy, T. The Nexus Between Taxation, Government Expenditure and Economic Growth in South Africa. A fresh evidence from combined cointegration test. Stud. Appl. Econ. 2021, 39. [Google Scholar] [CrossRef]

- Hashmi, S.M.; Bhowmik, R.; Inglesi-Lotz, R.; Syed, Q.R. Investigating the Environmental Kuznets Curve hypothesis amidst geopolitical risk: Global evidence using bootstrap ARDL approach. Environ. Sci. Pollut. Res. 2021, 1–14. [Google Scholar] [CrossRef]

- Bhowmik, R.; Syed, Q.R.; Apergis, N.; Alola, A.A.; Gai, Z. Applying a dynamic ARDL approach to the Environmental Phillips Curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environ. Sci. Pollut. Res. 2021, 1–15. [Google Scholar] [CrossRef]

- Syed, Q.R.; Bouri, E. Impact of economic policy uncertainty on CO2 emissions in the US: Evidence from bootstrap ARDL approach. J. Public Aff. 2021, e2595. [Google Scholar] [CrossRef]

- Mahi, M.; Phoong, S.W.; Ismail, I.; Isa, C.R. Energy–finance–growth nexus in ASEAN-5 countries: An ARDL bounds test approach. Sustainability 2020, 12, 5. [Google Scholar] [CrossRef] [Green Version]

| Level | First Differences | ||||

|---|---|---|---|---|---|

| Tested Variable | Variables | ||||

| −1.250 | 1990 | −6.410 ** | 2001 | ||

| −1.466 | 2010 | −5.991 ** | 2001 | ||

| −2.679 | 1994 | −6.401 ** | 2006 | ||

| −1.2510 | 1996 | −6.001 ** | 2019 | ||

| Level | First Differences | ||||||

|---|---|---|---|---|---|---|---|

| Tested Variable | Variables | ||||||

| −2.001 | 1997 | 2004 | −6.310 ** | 2001 | 2011 | ||

| −1.345 | 1999 | 1996 | −7.661 ** | 1994 | 2018 | ||

| −1.441 | 2001 | 2012 | −8.010 ** | 1998 | 2011 | ||

| −2.661 | 2014 | 2016 | −8.331 ** | 2011 | 2018 | ||

| Bootstrap ARDL Results | Diagnostic Tests Results | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| ARDL(0,1,1,0) | Break Date | ||||||||

| (REC, EG, FDI, and FD) | 2001 | 6.85 ** | −4.95 ** | 5.88 ** | |||||

| Bootstrap-based table CV 5% | 2.9 | −3.39 | 4.41 | ||||||

| Variable | Coefficient | T-Statistic | p-Value |

|---|---|---|---|

| 0.021 | 0.163 | 0.551 | |

| 0.091 *** | 0.651 | 0.00 | |

| 0.031 *** | 0.451 | 0.00 | |

| 0.280 *** | 1.22 | 0.00 | |

| 0.009 ** | 0.179 | 0.01 | |

| 0.033 *** | 0.441 | 0.00 | |

| D2001 | −0.091 *** | −1.210 | 0.00 |

| −0.113 *** | −2.510 | 0.00 |

| ECTt−1 | |||||

|---|---|---|---|---|---|

| - | 7.961 ** | 7.447 ** | 8.6794 ** | −0.711 ** | |

| 1.310 | - | 6.934 * | 6.346 * | −0.441 | |

| 0.909 | 1.374 | 2.114 | 7.661 ** | −0.322 | |

| 0.826 | 1.115 | 1.554 | - | −0.114 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Samour, A.; Baskaya, M.M.; Tursoy, T. The Impact of Financial Development and FDI on Renewable Energy in the UAE: A Path towards Sustainable Development. Sustainability 2022, 14, 1208. https://doi.org/10.3390/su14031208

Samour A, Baskaya MM, Tursoy T. The Impact of Financial Development and FDI on Renewable Energy in the UAE: A Path towards Sustainable Development. Sustainability. 2022; 14(3):1208. https://doi.org/10.3390/su14031208

Chicago/Turabian StyleSamour, Ahmed, M. Mine Baskaya, and Turgut Tursoy. 2022. "The Impact of Financial Development and FDI on Renewable Energy in the UAE: A Path towards Sustainable Development" Sustainability 14, no. 3: 1208. https://doi.org/10.3390/su14031208

APA StyleSamour, A., Baskaya, M. M., & Tursoy, T. (2022). The Impact of Financial Development and FDI on Renewable Energy in the UAE: A Path towards Sustainable Development. Sustainability, 14(3), 1208. https://doi.org/10.3390/su14031208