1. Introduction

According to the latest version of the Climate Bond Standard issued by the Climate Bond Initiative (CBI), green bonds refer to a bond where the proceeds will be exclusively applied to finance or re-finance, in part or in full, new or existing eligible green projects, which are aligned with the four core components of the Green Bond Principles (Check the Climate Bond Standard for details of the four core components.

https://www.climatebonds.net/files/files/climate-bonds-standard-v3-20191210.pdf (accessed on 10 December 2022)). Similar to traditional fixed-income securities, enterprises can raise capital through green bonds. In addition, green bonds need to report, in detail, the use of the raised funds in green projects and the “green” nature of the projects [

1]. Moreover, green bonds aim to produce positive environmental benefits. Previous studies have shown that green bonds play a role in reducing carbon dioxide emissions [

2], improving air quality [

3], and improving environmental performance [

4], although there are some greenwashing behaviors in the green bond market [

5].

In 2007, the European Investment Bank (EIB) issued the first “Climate Awareness Bond”, which marked the rise of the green bond market [

6]. After this, the green bond market developed slowly until 2013, when the market began to grow rapidly and entered an “exciting period” [

7]. Although the green bond market has developed rapidly in recent years, due to its late start, the issuance of green bonds is less than 1% of the global cumulative bond issuance [

8]. In addition, the statistical results of this research sample show that only 63 non-financial listed companies in China have successfully issued green bonds by the end of 2020, which is less than 1.5% of the total number of listed companies in China. Therefore, it is important to ask, how can such a small amount of green bonds promote overall environmental improvement? A reasonable explanation is that the issuance of green bonds not only affects the pro-environmental behavior of the issuer [

2] but also drives peer firms to take more measures that are beneficial to environmental protection [

3], thus resulting in better overall environmental performance and social welfare.

Throughout the existing literature, scholars mainly study green bonds from two aspects: issue pricing and market reaction. Regarding green bond issuance pricing, most studies believe that green bonds can signal enterprises’ ecologically sustainable development to the market and enhance the ESG value of issuers. Investors who are concerned about environmental protection may be willing to sacrifice a certain expected income to buy green bonds, resulting in green premium [

5,

9,

10,

11,

12,

13]. In research on the market reaction of green bonds, scholars have found that the stock market has a positive response to green bonds issuers by using the event study method [

2,

14,

15,

16]. One stream of research has also confirmed that green bonds can produce a positive environmental performance [

2,

4] and financial performance [

17]. At the present stage of the development of the green bond market, the corporate green bonds issuers have explored new financing ways for other enterprises; they are the “pioneers” of the green bond market, and their successful practices will inevitably be learned and referenced by peer firms, thus affecting the behavior of peer companies. Wu et al. (2022) [

3] found that enterprises issuing green bonds will drive the same industry companies to take more actions that benefit environmental protection. These behaviors are recognized by investors, thus reducing the bond financing costs of other enterprises in the same industry. However, up to now, there is no article to explore the impact of green bonds issued by enterprises on the green innovation behavior of peer companies. This paper will make a supplement in this field.

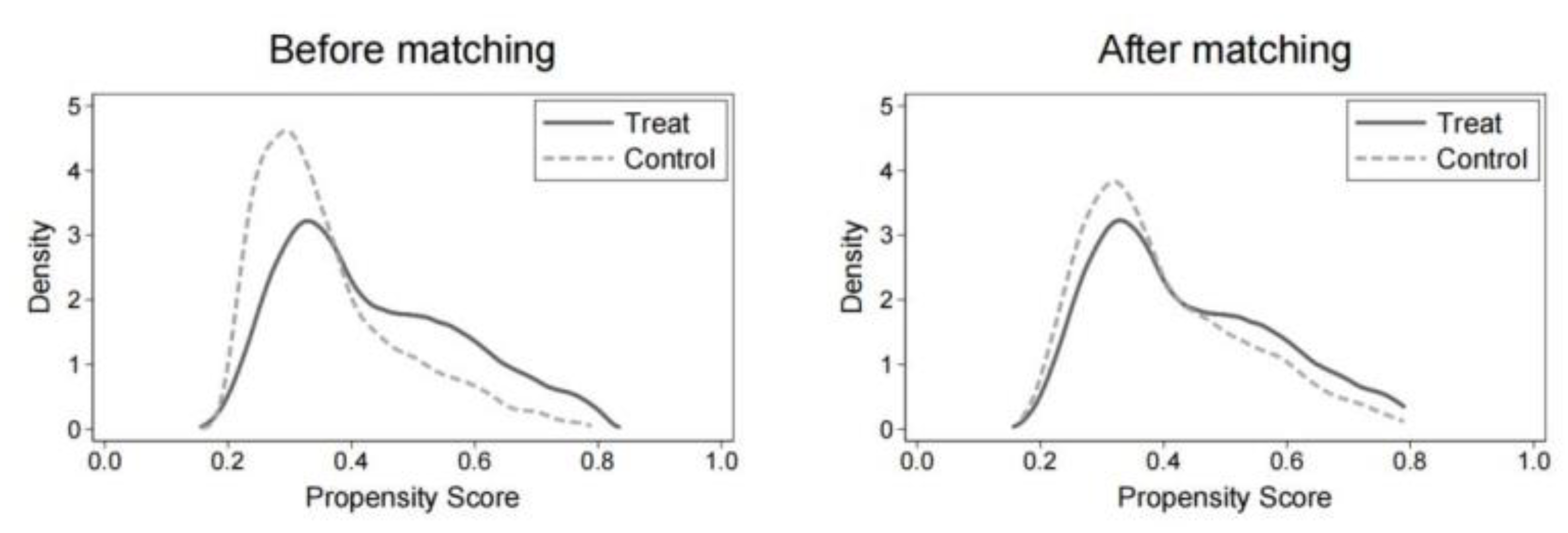

We use the non-financial listed companies in China from 2010 to 2020 as samples to test the impact of green bonds on the green innovation of peer firms. Since the Green Bond Issuance Guidelines were released in 2015, China’s green bond market has developed rapidly. By the end of 2020, China has issued a total of USD 258.8 billion of green bonds in domestic and overseas markets and has become the second largest green bond issuer (The data come from the China Green Bond Market Report 2021. You can access

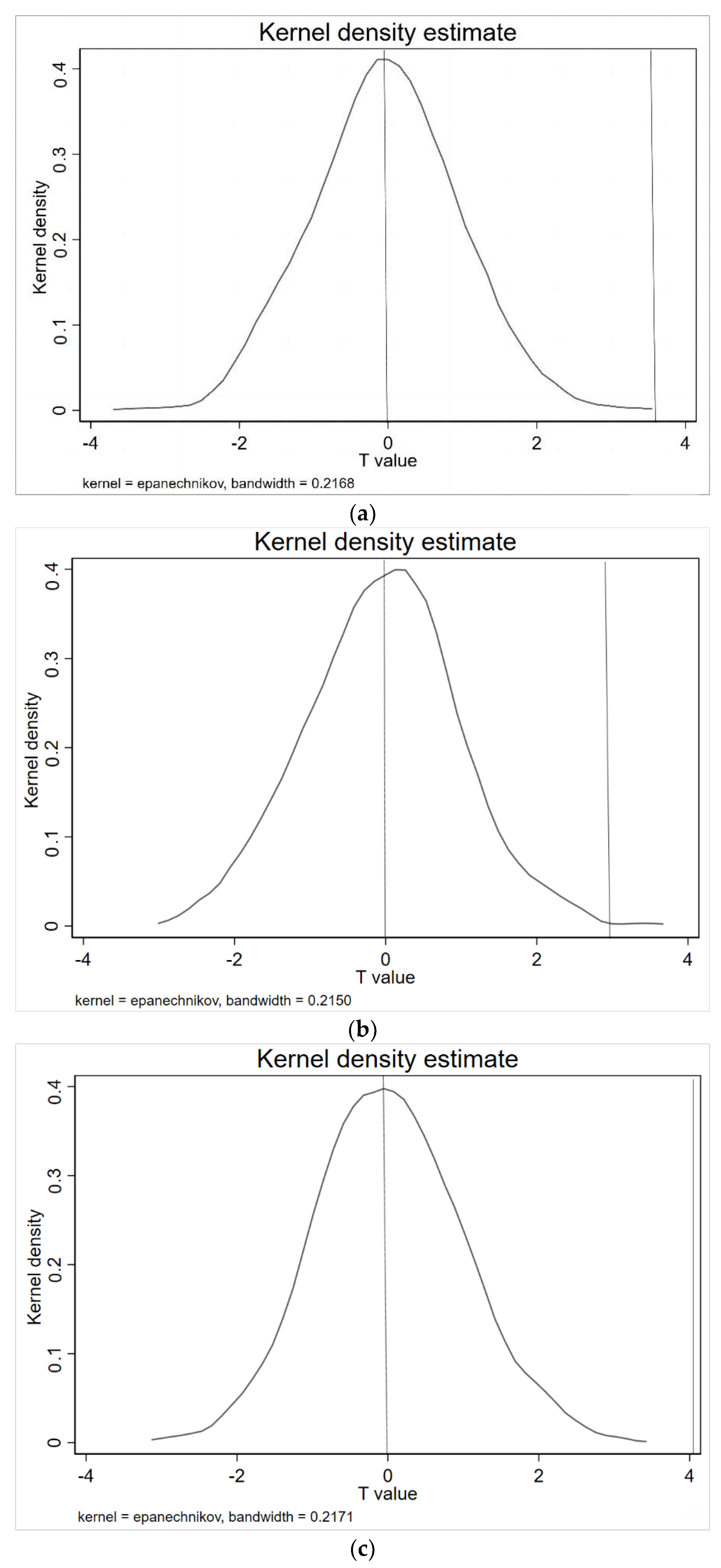

https://www.chinabond.com.cn/cb/cn/yjfx/zzfx/nb/20220704/160692668.shtml (accessed on 10 December 2022) for the original text). The Wind database is the largest, most complete, and most widely used financial database in China. It contains all the announcements of listed companies, stock funds, bond data, financial laws, and regulations in the China stock market. The Wind database comprehensively includes the announcement date, circulation, issue price, basic information of issuers, and other data on green bonds issued by China enterprises, which meets the data requirements of this study. Suppose enterprises in an industry have successfully issued green bonds. In that case, we take the companies that have not issued green bonds in this industry as the treatment group and use the propensity score matching (PSM) method to match the appropriate control groups in other industries. Then, we build a difference-in-difference (DID) model to test the impact of green bonds on the green innovation of peer firms. Whether enterprises issue green bonds is not random, and PSM can alleviate the problem of selectivity deviation in the model. The DID model can effectively evaluate the implementation effect of green bonds, thus alleviating the endogenous problem of the model. From this data set, we find that the issuance of corporate green bonds can significantly improve the quantity and quality of peer firms’ green innovation, which is manifested in the significant increase in the total number of green patent applications, green invention patent applications, and green patent citations of peer firms. This result is robust in several different specifications, including, but not limited to, changing the PSM matching method, the explained variables being delayed by one period, using the Tobit model to re-estimate the results, conducting a placebo test, and excluding the influence of industry policies. The results from these specifications are similar to the baseline.

The premise that the DID model is effective is that the enterprises in the treatment group and the control group have a parallel trend before the policy impact, which we have confirmed. We find that the green bond has a dynamic and sustained role in promoting the green innovation of peer firms.

Next, we are interested in what kind of green bond issuers can produce better green innovation spillover effects. We find that when the green bond issuer is an industry leader or the issuer is highly concerned by the media, the green innovation promotion effect of peer firms is more significant. Similarly, when the issuer and the peer firm are close competitors or in the same board network, the peer firm has a higher level of green innovation.

We further explored whether the green innovation behavior adopted by the peer firms can produce positive environmental performance. We found that the green innovation behavior of peer firms can significantly increase their probability of obtaining environmental recognition or other positive evaluation, improve their environmental responsibility scores, and promote them to pass the ISO14001 certification. Generally speaking, our research shows that peer firms improve their environmental performance by upgrading the quantity and quality of green innovation after enterprises issue green bonds.

This research clarified the mechanism of green bonds on the green innovation behavior of peer companies, explored the specific path of green bonds to produce environmental performance, and answered an important question in practice, that is, how does the green bond market support the sustainable development of economy and ecology in the initial stage of development?

Moreover, this study expands and enriches the related literature on green bonds. The existing research mainly focuses on the issues of the pricing of green bonds [

9,

10,

11,

13,

18], stock market reflection [

2,

16], environmental performance [

2,

4], financial performance [

17], links with other financial products [

19,

20], and factors affecting green bonds [

21,

22]. So far, there is no literature that studies the innovation spillover effect of green bonds. We supplement this research system by studying the impact of green bond issuance on the green innovation of peer firms.

Furthermore, this study also contributes to the literature on the influencing factors of green innovation. The driving factors of green innovation have been widely considered in academic circles. The existing research mainly focuses on the following aspects: First, environmental regulation, mainly including environmental tax collection, government subsidies, emission trading, environmental information disclosure, environmental decentralization, environmental interview, environmental policy uncertainty, carbon emission regulation, government environmental expenditure, central environmental protection inspector, and other factors [

23,

24,

25,

26]. Second, the enterprise’s organizational structure, mainly including factors, such as company resources, corporate governance mechanism, and senior management characteristics [

27,

28,

29,

30,

31]. Third, the external environment, mainly including the digital economy, intellectual property protection, air pollution, Internet development, media attention, and other factors [

32,

33]. At present, the research on the promotion path of green innovation lacks the realistic consideration of the support of financial instruments. Although a few pieces of literature have studied the promotion of green finance to green innovation from the perspective of green credit, the research on other green financial instruments represented by green bonds is lacking.

In addition, this study also adds to the literature on the role of peers in firms’ decision making. Previous literature has studied the influence of executive compensation [

34], stock split [

35], dividend policy [

36], M&A decision [

37], investment decision [

38,

39], etc., on peers’ decision making, and we have supplemented the literature on the influence of financing decisions on peers’ investment behavior.

6. Conclusions

Faced with global environmental problems, such as environmental pollution, resource depletion, and deterioration of the ecological environment, human beings have realized the harm of past production and consumption patterns to the environment. In order to better coordinate the relationship between economic development and ecological protection, sustainable development and green development have become the mainstream strategies of future economic development. Green development needs a lot of capital investment, but government funds can only cover a small part. Therefore, it is important to build a green financial system and guide social capital to participate in environmental governance. As a new financing tool with both “green” and “financial” characteristics, green bonds are an effective way to help the green development strategy break through the capital shackles [

6,

10]. However, whether and how green bonds can play an active role in promoting the sustainable development of the environment has not been answered consistently. Against this background, we studied green bonds’ industrial technology spillover effect, mechanism, and environmental performance. We find that after enterprises issue green bonds, peer companies will improve the quantity and quality of their green innovations based on the motivation of seeking benefits and avoiding harm, and this improvement effect is dynamic and sustainable. This conclusion is consistent with the research conclusion of [

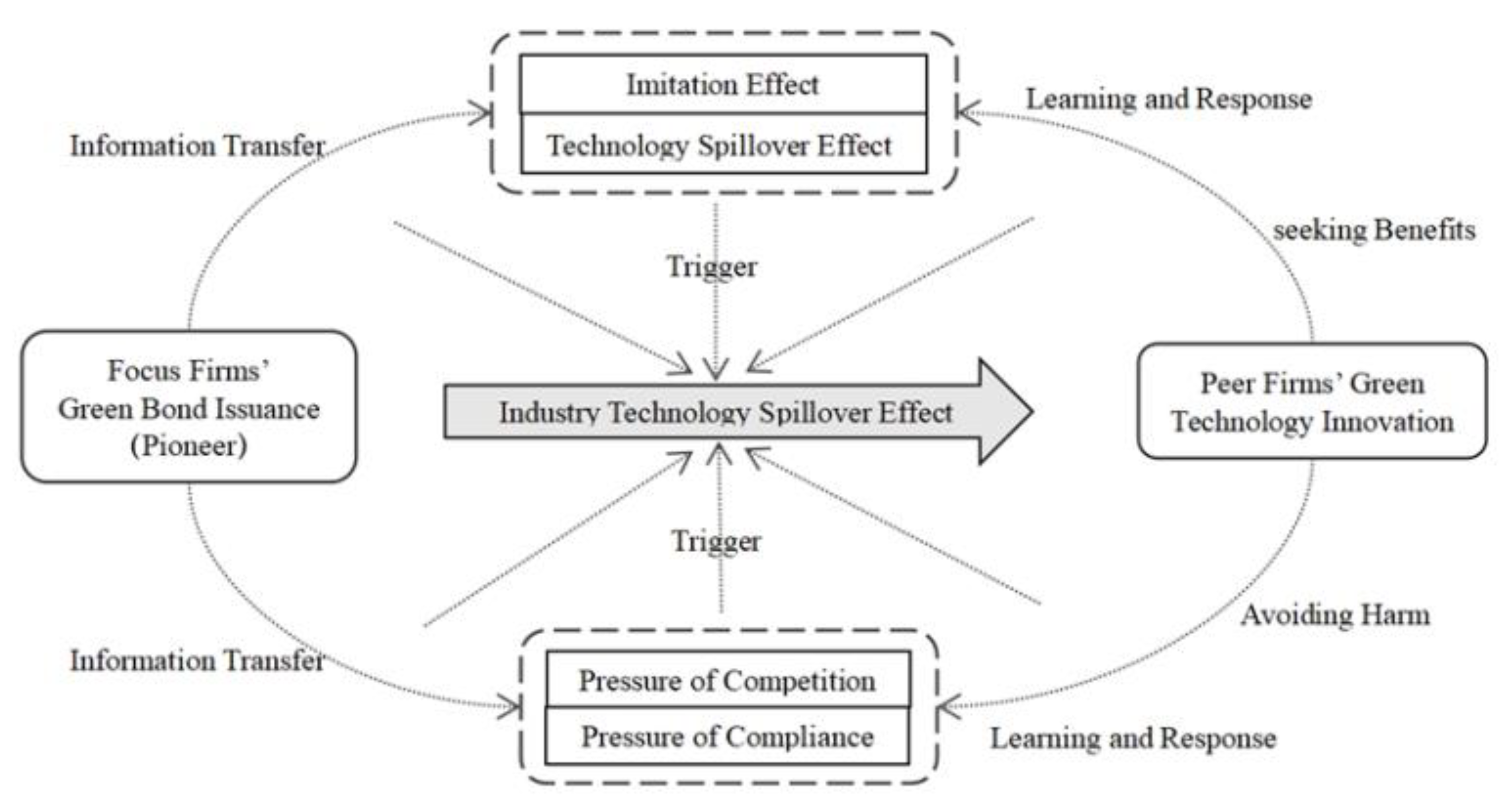

44], which states that corporate behavior motivated by organizational learning and reputation acquisition will be influenced by other corporate behaviors in the group. Different from the literature that suggests green bonds promote the green innovation of issuers, our research found another transmission path in which green bonds play a positive environmental role.

Then, we are curious about what kind of enterprises issuing green bonds can produce greater industry spillover effects. Industry leaders are the benchmark enterprises in the industry, and their behavior is often more considered and studied by other enterprises in the same industry. Therefore, when industry leaders issue green bonds, the information about green bonds issued by them is more likely to spread to peer enterprises, and it is also easier to cause peer companies to learn and imitate, resulting in greater industry spillover effect. At the same time, media reports are the main method of information diffusion and dissemination. Therefore, when enterprises issue green bonds with more media attention and publicity, it will naturally bring more industry spillover effects. In addition, enterprises tend to pay more attention to the behavior of close competitors. When competitors adopt new means or methods to obtain resources, enterprises will try to imitate or even surpass them. Therefore, the industry spillover effect will be more significant when the issuer of green bonds is a close competitor with its peer company. In addition, the board network is also an effective channel for information exchange. Therefore, when the issuer of green bonds is in the same board network as the peer company, the peer company’s green innovation level is higher. These findings make us better understand the industry spillover effect of green bonds.

Finally, we are interested in whether peer enterprises’ green innovation impacts their environmental performance. The answer to this question can echo the question we put forward in the introduction: at the early stage of the development of the green bond market, how can green bonds produce overall environmental performance when the number and coverage of green bonds issued are meager? We found that the green innovation behavior of peer enterprises promoted by green bonds can significantly improve their environmental performance, which is manifested in the higher probability of peer enterprises receiving environmental recognition or other positive evaluation, higher environmental responsibility score, and higher probability of passing ISO14001 certification. This makes us believe that the issuance of green bonds not only affects the pro-environmental behavior of the issuer [

2] but also drives the peer enterprises to take more measures that are beneficial to environmental protection [

3], resulting in overall environmental performance and social welfare.

In general, our research shows that the issuance of corporate green bonds can produce a good spillover effect of green innovation in the industry, and then produce positive environmental benefits, which is conducive to China’s strategic goal of “carbon neutrality, carbon emission peak”.

9. Suggestions

Green bond is a fixed-income tool that aims to provide financing for environmental and sustainable development projects, and it is attracting issuers and investors in various fields [

1]. This article found the positive industrial spillover effect of green bonds, which showed that it was feasible to develop a green bond market, guide social capital to flow into green fields, and build a sustainable economy together. However, compared with the mission of green bonds, the scale of the green bond market is still tiny. Therefore, government departments should speed up the cultivation and construction of the green bond market and promote the orderly growth of green bond issuance. Future improvements can be made in the following aspects.

First, we agree with [

1] and we recommend that government departments pursue the standardization of issuance by developing a standard green bond framework. At the same time, we recommend promoting the international convergence of this standard to attract more international capital to invest in Chinese green bonds.

Second, we suggest taking measures to encourage institutional investors, such as commercial banks, insurance companies, and securities companies, to invest in green bonds. For example, increasing the proportion of green bonds in financial institutions’ green financial evaluation schemes, giving priority to selecting green bonds that meet the standards and include them in the central bank’s pledge pool, making use of small tax spillovers to improve the return rate of investing in green bonds [

71], and enriching and improving the diversified green bond product system to attract investors’ attention and participation in the green bond market.

Third, we recommend enhancing green bond issuers’ information transparency and promoting information circulation among enterprises. On the one hand, the relevant departments should establish a complete and transparent information disclosure framework for green bonds, standardize the information disclosure behavior of issuers, and promote the standardization and digitization of environmental benefit information disclosure of green bonds. On the other hand, China should further improve the third-party certification system, promote the healthy and orderly development of the external certification market, provide full access to the supervisory role of the third-party certification, and reasonably guarantee the quality of information disclosure.

Fourth, because of the media’s attention to promoting the industrial spillover effect of the green bond, we suggest guiding the media to publicize the green bond and provide full access to the media’s supervision and information diffusion. For example, we can choose typical green bond issuers to focus on tracking and reporting so that more enterprises and investors can know about green bonds. In addition, in view of the fact that the issuance of green bonds by industry leaders can produce greater industry spillover effects, qualified leading enterprises should be encouraged and guided to issue green bonds.

10. Limitations and Future Research

This study has three main limitations, which can be optimized in future research. Firstly, limited by data, this paper only considers the green patent for measuring an enterprise’s green technology innovation, while green innovation is a systematic process. In the future, we can participate in collecting relevant data and bringing green innovation input, efficiency, performance, and other factors into the research framework. Secondly, as a few samples of enterprises successfully issue green bonds at present, this paper does not subdivide the types of green bonds. In the future, we can further explore the influence of the heterogeneity of green bonds on the green technology innovation of peer enterprises. Thirdly, this paper does not consider the synergy mechanism of green bonds, that is, which factors can enhance the industry spillover effect of green bonds. In the future, we can supplement this vacancy from the perspectives of environmental regulation, good legal systems for intellectual property protection, and effective internal control environment. This paper also fails to consider the alternative mechanism of green bonds, that is, which factors can replace green bonds and produce the same positive effect as green bonds. In the future, we can further investigate whether other green financial products, such as green insurance, green funds, and green credit, can promote the green technological innovation of enterprises.