Improving Circular Supply Chain Performance through Green Innovations: The Moderating Role of Economic Policy Uncertainty

Abstract

1. Introduction

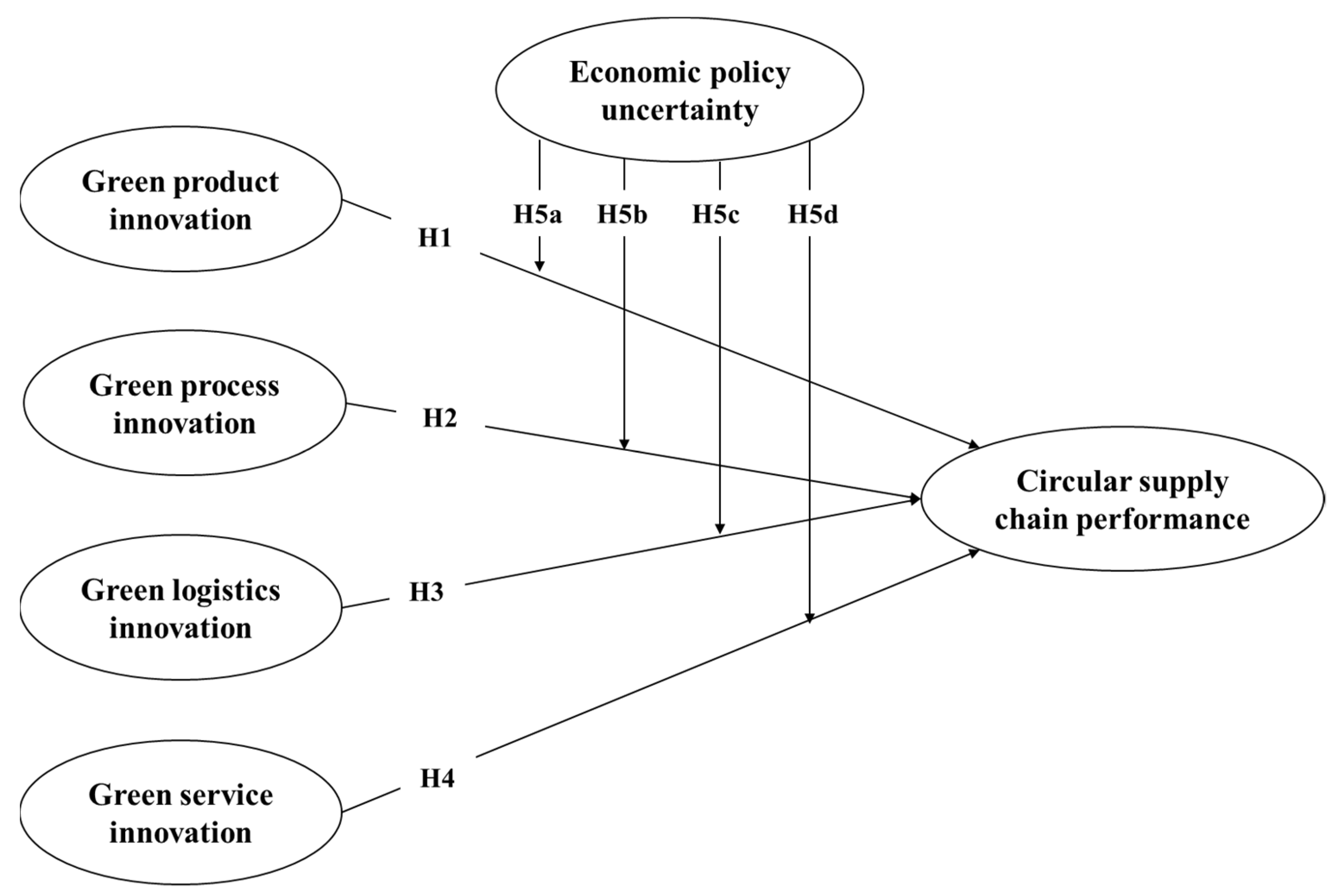

2. Literature Review and Hypothesis Development

2.1. Green Product Innovation and Circular Supply Chain Performance

2.2. Green Process Innovation and Circular Supply Chain Performance

2.3. Green Logistics Innovation and Circular Supply Chain Performance

2.4. Green Service Innovation and Circular Supply Chain Performance

2.5. The Moderating Effect of Economic Policy Uncertainty

3. Methodology

3.1. Sampling and Data Collection

3.2. Bias Testing

3.3. Variables and Measurement

4. Analyses and Results

4.1. Measurement Reliability and Validity

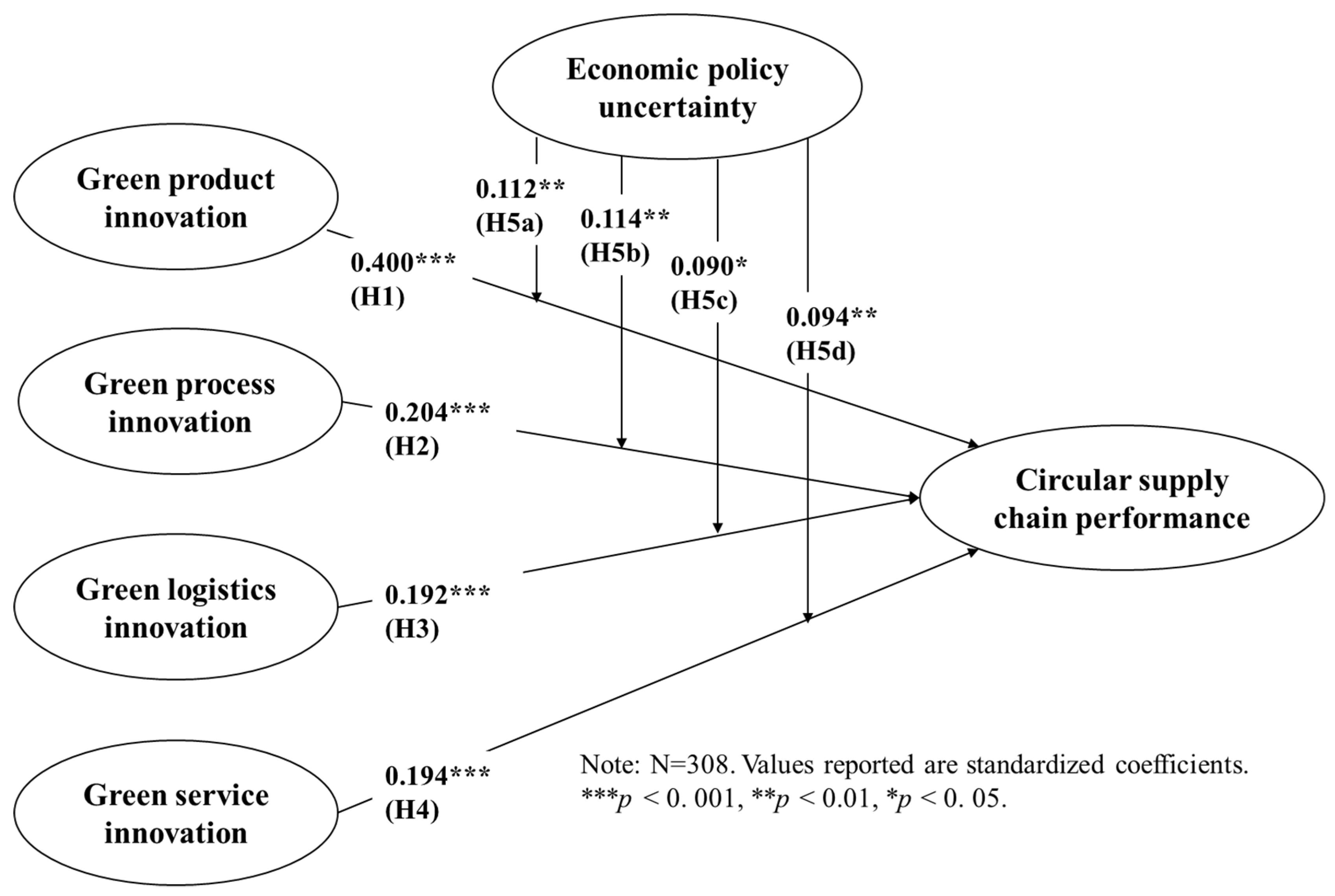

4.2. Hypothesis Testing

4.3. Robustness Checks

5. Discussion and Conclusions

6. Limitations and Future Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Batista, L.; Bourlakis, M.; Smart, P.; Maull, R.S. In search of a circular supply chain archetype–a content-analysis-based literature review. Prod. Plan. Control 2018, 29, 438–451. [Google Scholar] [CrossRef]

- Farooque, M.; Zhang, A.; Thürer, M.; Qu, T.; Huisingh, D. Circular supply chain management: A definition and structured literature review. J. Clean. Prod. 2019, 228, 882–900. [Google Scholar] [CrossRef]

- Henry, M.A.; Bauwens, T.; Hekkert, M.P.; Kirchherr, J. A typology of circular start-ups: An Analysis of 128 circular business models. J. Clean. Prod. 2020, 245, 118528. [Google Scholar] [CrossRef]

- Burke, H.; Zhang, A.; Wang, J.X. Integrating product design and supply chain management for a circular economy. Prod. Plan. Control 2021, 1–17. [Google Scholar] [CrossRef]

- Schiederig, T.; Tietze, F.; Herstatt, C. Green innovation in technology and innovation management—An exploratory literature review. R D Manag. 2012, 42, 180–192. [Google Scholar] [CrossRef]

- Mu, Z.; Zheng, Y.; Sun, H. Cooperative green technology innovation of an e-commerce sales channel in a two-stage supply chain. Sustainability 2021, 13, 7499. [Google Scholar] [CrossRef]

- Arfi, B.W.; Hikkerova, L.; Sahut, J.M. External knowledge sources, green innovation and performance. Technol. Forecast. Soc. Chang. 2018, 129, 210–220. [Google Scholar] [CrossRef]

- Chen, J.; Cheng, J.; Dai, S. Regional eco-innovation in China: An analysis of eco-innovation levels and influencing factors. J. Clean. Prod. 2017, 153, 1–14. [Google Scholar] [CrossRef]

- Wang, M.M.; Liu, Z.Q. How do green innovation strategies contribute to firm performance under supply chain risk? evidence from China’s manufacturing sector. Front. Psychol. 2022, 13, 894766. [Google Scholar] [CrossRef]

- Xie, X.; Huo, J.; Zou, H. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Lee, K.H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lin, Y.H.; Lin, C.Y.; Chang, C.W. Enhancing green absorptive capacity, green dynamic capacities and green service innovation to improve firm performance: An analysis of structural equation modeling (SEM). Sustainability 2015, 7, 15674–15692. [Google Scholar] [CrossRef]

- Lin, Y.H.; Chen, Y.S. Determinants of green competitive advantage: The roles of green knowledge sharing, green dynamic capabilities, and green service innovation. Quality 2017, 51, 1663–1685. [Google Scholar] [CrossRef]

- Liu, C.; Ma, T. Green logistics management and supply chain system construction based on internet of things technology. Sustain. Comput. 2022, 35, 100773. [Google Scholar] [CrossRef]

- Agyabeng-Mensah, Y.; Afum, E.; Ahenkorah, E. Exploring financial performance and green logistics management practices: Examining the mediating influences of market, environmental and social performances. J. Clean. Prod. 2020, 258, 120613. [Google Scholar] [CrossRef]

- Zhu, Y.; Sun, Z.; Zhang, S.; Wang, X. Economic policy uncertainty, environmental regulation, and green innovation—An empirical study based on chinese high-tech enterprises. Int. J. Environ. Res. Public Health 2020, 18, 9503. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy uncertainty and corporate investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- Li, X.; Hu, Z.; Zhang, Q. Environmental regulation, economic policy uncertainty, and green technology innovation. Clean Technol. Environ. Policy 2021, 23, 2975–2988. [Google Scholar] [CrossRef]

- Pearce, D.W.; Turner, K. Economics of Natural Resources and the Environment; John Hopkins Press: Baltimore, MD, USA, 1990. [Google Scholar]

- Geissdoerfer, M.; Morioka, S.N.; de Carvalho, M.M.; Evans, S. Business models and supply chains for the circular economy. J. Clean. Prod. 2018, 190, 712–721. [Google Scholar] [CrossRef]

- Kuzma, E.; Sehnem, S. Validation of the Measurement Scale for the Circular Economy: A proposal based on the precepts of innovation. Int. J. Prof. Bus. Rev. 2022, 7, e0278. [Google Scholar] [CrossRef]

- Batista, L.; Bourlakis, M.; Smart, P.; Maull, R. Business models in the circular economy and the enabling role of circular supply chains. In Operations Management and Sustainability; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 105–134. [Google Scholar]

- Zheng, S.; Zhang, W.; Du, J. Knowledge-based dynamic capabilities and innovation in networked environments. J. Knowl. Manag. 2011, 15, 1035–1051. [Google Scholar] [CrossRef]

- Zotoo, I.K.; Lu, Z.; Liu, G. Big data management capabilities and librarians’ innovative performance: The role of value perception using the theory of knowledge-based dynamic capability. J. Acad. Libr. 2021, 47, 102272. [Google Scholar] [CrossRef]

- Muna, N.; Yasa, N.; Ekawati, N.; Wibawa, I. A dynamic capability theory perspective: Borderless media breakthrough to enhance SMEs performance. Int. J. Data Netw. Sci. 2022, 6, 363–374. [Google Scholar] [CrossRef]

- Lahane, S.; Kant, R.; Shankar, R. Circular supply chain management: A state-of-art review and future opportunities. J. Clean. Prod. 2020, 258, 120859. [Google Scholar] [CrossRef]

- Govindan, K.; Rajeev, A.; Padhi, S.S.; Pati, R.K. Supply chain sustainability and performance of firms: A meta-analysis of the literature. Transp. Res. E Logist. Transp. Rev. 2020, 137, 101923. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Atasu, A.; Van Wassenhovec, L.N. New opportunities for operations management research in sustainability. M&SOM-Manuf. Serv. Oper. Manag. 2019, 21, 1–12. [Google Scholar] [CrossRef]

- Dev, N.K.; Shankar, R.; Zacharia, Z.G.; Swami, S. Supply chain resilience for managing the ripple effect in Industry 4.0 for green product diffusion. Int. J. Phys. Distrib. Logist. Manag. 2021, 51, 897–930. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Dangelico, R.M. Green product innovation: Where we are and where we are going. Bus. Strategy Environ. 2016, 25, 560–576. [Google Scholar] [CrossRef]

- Lopes de Sousa Jabbour, A.B.; Jabbour, C.J.C.; Godinho Filho, M.; Roubaud, D. Industry 4.0 and the circular economy: A proposed research agenda and original roadmap for sustainable operations. Ann. Oper. Res. 2018, 270, 273–286. [Google Scholar] [CrossRef]

- Sabahi, S.; Parast, M.M. Firm innovation and supply chain resilience: A dynamic capability perspective. Int. J. Logist. Res. Appl. 2020, 23, 254–269. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Li, J.; Wang, Z. Green process innovation, green product innovation and its economic performance improvement paths: A survey and structural model. J. Environ. Manag. 2021, 297, 113282. [Google Scholar] [CrossRef] [PubMed]

- Wei, Z.; Sun, L. How to leverage manufacturing digitalization for green process innovation: An information processing perspective. Ind. Manag. Data Syst. 2021, 121, 1026–1044. [Google Scholar] [CrossRef]

- Seroka-Stolka, O. The development of green logistics for implementation sustainable development strategy in companies. Procedia Soc. Behav. Sci. 2014, 151, 302–309. [Google Scholar] [CrossRef]

- Baah, C.; Opoku-Agyeman, D.; Acquah, I.S.K.; Agyabeng-Mensah, Y.; Afum, E.; Faibil, D.; Abdoulaye, F.A.M. Examining the correlations between stakeholder pressures, green production practices, firm reputation, environmental and financial performance: Evidence from manufacturing SMEs. Sustain. Prod. Consum. 2021, 27, 100–114. [Google Scholar] [CrossRef]

- Chen, Y.S.; Chang, T.W.; Lin, C.Y.; Lai, P.Y.; Wang, K.H. The influence of proactive green innovation and reactive green innovation on green product development performance: The mediation role of green creativity. Sustainability 2016, 8, 966. [Google Scholar] [CrossRef]

- Lin, Y.H.; Chen, H.C. Critical factors for enhancing green service innovation: Linking green relationship quality and green entrepreneurial orientation. J. Hosp. Tour. Technol. 2018, 9, 188–203. [Google Scholar] [CrossRef]

- Liu, Y.; Li, J.; Liu, G.; Lee, C.C. Economic policy uncertainty and firm’s cash holding in China: The key role of asset reversibility. J. Asian Econ. 2021, 74, 101318. [Google Scholar] [CrossRef]

- Al-Thaqeb, S.A.; Algharabali, B.G.; Alabdulghafour, K.T. The pandemic and economic policy uncertainty. Int. J. Financ. Econ. 2020, 27, 2784–2794. [Google Scholar] [CrossRef]

- Kuo, Y.C.; Lin, J.C. The impact of supply chain strategy and integration on supply chain performance: Supply Chain vulnerability as a moderator. Int. J. Econ. Manag. Eng. 2018, 12, 1089–1093. [Google Scholar] [CrossRef]

- Chen, J.; Tsou, H.T. Information technology adoption for service innovation practices and competitive advantage: The case of financial firms. Inf. Res. 2006, 12, 314–324. [Google Scholar]

- Hosseini, S.; Ivanov, D.; Dolgui, A. Review of quantitative methods for supply chain resilience analysis. Transp. Res. Part E 2019, 125, 285–307. [Google Scholar] [CrossRef]

- World Bank. China’s transition to a low-carbon economy and climate resilience needs shifts in resources and technologies. World Bank, 12 October 2022. Available online: https://www.worldbank.org/en/news/press-release/2022/10/12/china-s-transition-to-a-low-carbon-economy-and-climate-resilience-needs-shifts-in-resources-and-technologies (accessed on 16 October 2022).

- Chinadaily. China to investment 2.37t yuan in energy-saving projects. Chinadaily, 22 August 2012. Available online: https://www.chinadaily.com.cn/bizchina/2012-08/22/content_15694761.htm (accessed on 12 October 2022).

- Qi, X. China cuts carbon intensity by 34% in past decade, will further boost green development. Global Times, 12 May 2022. Available online: https://www.globaltimes.cn/page/202205/1265510.shtml (accessed on 15 October 2022).

- Yu, C. Consumption, infrastructure get green tinge. Chinadaily, 29 August 2022. Available online: https://global.chinadaily.com.cn/a/202208/29/WS630bfcb4a310fd2b29e74a4f.html (accessed on 12 October 2022).

- Hoskisson, R.E.; Eden, L.; Lau, C.M.; Wright, M. Strategy in emerging economies. Acad. Manag. J. 2000, 43, 249–267. [Google Scholar] [CrossRef]

- Xiao, S.S.; Lew, Y.K.; Park, B.I. International Network Searching, Learning, and Explorative Capability: Small and medium-sized Enterprises from China. Manag. Int. Rev. 2020, 60, 597–621. [Google Scholar] [CrossRef]

- Peng, M.W.; Luo, Y. Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Acad Manag. J. 2000, 43, 486–501. [Google Scholar] [CrossRef]

- Roy, A.; Walters, P.G.P.; Luk, S.T.K. Chinese puzzles and paradoxes conducting business research in China. J. Bus. Res. 2001, 52, 203–210. [Google Scholar] [CrossRef]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Chang, S.J.; Van Witteloostuijn, A.; Eden, L. From the editors: Common method variance in international business research. J. Int. Bus. Stud. 2010, 41, 178–184. [Google Scholar] [CrossRef]

- Johnson, R.E.; Rosen, C.C.; Djurdjevic, E. Assessing the impact of common method variance on higher order multidimensional constructs. J. Appl. Psychol. 2011, 96, 744. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879. [Google Scholar] [CrossRef]

- Lin, R.; Tan, K.; Yong, G. Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. J. Clean. Prod. 2013, 40, 101–107. [Google Scholar] [CrossRef]

- Baah, C.; Jin, Z.; Tang, L. Organizational and regulatory stakeholder pressures friends or foes to green logistics practices and financial performance: Investigating corporate reputation as a missing link. J. Clean. Prod. 2020, 247, 119125. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Sreedevi, R.; Saranga, H. Uncertainty and supply chain risk: The moderating role of supply chain flexibility in risk mitigation. Int. J. Prod. Econ. 2017, 193, 332–342. [Google Scholar] [CrossRef]

- Wong, C.Y.; Boon-Itt, S.; Wong, C.W.Y. The contingency effects of environmental uncertainty on the relationship between supply chain integration and operational performance. J. Oper. Manag. 2011, 29, 604–615. [Google Scholar] [CrossRef]

- Kazancoglu, Y.; Kazancoglu, I.; Sagnak, M. A new holistic conceptual framework for green supply chain management performance assessment based on the circular economy. J. Clean. Prod. 2018, 195, 1282–1299. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Aiken, L.S.; West, S.G. Multiple Regression: Testing and Interpreting Interactions; Sage: Newbury Park, CA, USA, 1991. [Google Scholar] [CrossRef]

- Hendayani, R.; Rahmadina, E.; Anggadwita, G.; Pasaribu, R.D. Analysis of the house of risk (HOR) model for risk mitigation of the supply chain management process (case study: KPBS pangalengan bandung, Indonesia). In Proceedings of the 2021 9th International Conference on Information and Communication Technology, Yogyakarta, Indonesia, 3–5 August 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 13–18. [Google Scholar] [CrossRef]

| Construct and Indicators | SFL | Cronbach’s Alpha | CR | AVE |

|---|---|---|---|---|

| Green product innovation (GTI) | 0.935 | 0.935 | 0.642 | |

| GTI1 | 0.846 | |||

| GTI2 | 0.805 | |||

| GTI3 | 0.801 | |||

| GTI4 | 0.797 | |||

| GTI5 | 0.786 | |||

| GTI6 | 0.794 | |||

| GTI7 | 0.790 | |||

| GTI8 | 0.792 | |||

| Green process innovation (GSI) | 0.918 | 0.918 | 0.616 | |

| GSI1 | 0.755 | |||

| GSI2 | 0.777 | |||

| GSI3 | 0.794 | |||

| GSI4 | 0.781 | |||

| GSI5 | 0.821 | |||

| GSI6 | 0.778 | |||

| GSI7 | 0.785 | |||

| Green logistics innovation (GLI) | 0.926 | 0.927 | 0.612 | |

| GLI1 | 0.761 | |||

| GLI2 | 0.802 | |||

| GLI3 | 0.798 | |||

| GLI4 | 0.771 | |||

| GLI5 | 0.790 | |||

| GLI6 | 0.785 | |||

| GLI7 | 0.760 | |||

| GLI8 | 0.792 | |||

| Green service innovation (GEI) | 0.887 | 0.888 | 0.613 | |

| GEI1 | 0.778 | |||

| GEI2 | 0.761 | |||

| GEI3 | 0.822 | |||

| GEI4 | 0.777 | |||

| GEI5 | 0.774 | |||

| Economic policy uncertainty (EPU) | 0.885 | 0.887 | 0.663 | |

| EPU1 | 0.723 | |||

| EPU2 | 0.796 | |||

| EPU3 | 0.862 | |||

| EPU4 | 0.869 | |||

| Circular supply chain performance (CSCP) | 0.941 | 0.941 | 0.639 | |

| CSCP1 | 0.809 | |||

| CSCP2 | 0.827 | |||

| CSCP3 | 0.801 | |||

| CSCP4 | 0.777 | |||

| CSCP5 | 0.799 | |||

| CSCP6 | 0.756 | |||

| CSCP7 | 0.832 | |||

| CSCP8 | 0.774 | |||

| CSCP9 | 0.817 |

| Variable | Mean | STD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 5.162 | 1.598 | |||||||||

| 2.619 | 0.726 | 0.399 | ||||||||

| 0.269 | 0.444 | 0.345 | 0.079 | |||||||

| 5.573 | 1.130 | 0.266 | 0.070 | 0.290 | 0.801 | |||||

| 5.492 | 1.112 | 0.186 | −0.036 | 0.284 | 0.566 | 0.785 | ||||

| 5.423 | 1.126 | 0.202 | 0.040 | 0.231 | 0.565 | 0.569 | 0.782 | |||

| 5.501 | 1.082 | 0.190 | −0.047 | 0.250 | 0.533 | 0.529 | 0.499 | 0.783 | ||

| 3.876 | 1.506 | 0.159 | 0.173 | −0.005 | −0.051 | −0.075 | 0.010 | −0.052 | 0.814 | |

| 5.429 | 1.169 | 0.190 | −0.008 | 0.211 | 0.715 | 0.633 | 0.618 | 0.602 | −0.113 | 0.799 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| Firm size | 0.170 ** | 0.005 | −0.010 | 0.001 | 0.002 | 0.003 |

| (2.641) | (0.121) | (−0.247) | (0.035) | (0.052) | (0.072) | |

| Firm age | −0.089 | −0.013 | −0.024 | −0.026 | −0.025 | −0.012 |

| (−1.463) | (−0.333) | (−0.632) | (−0.687) | (−0.668) | (−0.327) | |

| Industry | 0.160 ** | −0.056 | −0.050 | −0.054 | −0.054 | −0.056 |

| (2.701) | (−1.486) | (−1.342) | (−1.437) | (−1.436) | (−1.480) | |

| Green product innovation (GTI) | 0.400 *** | 0.409 *** | 0.414 *** | 0.413 *** | 0.396 *** | |

| (8.505) | (8.816) | (8.919) | (8.818) | (8.505) | ||

| Green process innovation (GSI) | 0.204 *** | 0.207 *** | 0.191 *** | 0.196 *** | 0.211 *** | |

| (4.374) | (4.495) | (4.127) | (4.217) | (4.562) | ||

| Green logistics innovation (GLI) | 0.192 *** | 0.204 *** | 0.190 *** | 0.192*** | 0.201 *** | |

| (4.209) | (4.514) | (4.237) | (4.243) | (4.442) | ||

| Green service innovation (GEI) | 0.194 *** | 0.190 *** | 0.207 *** | 0.202 *** | 0.197 *** | |

| (4.397) | (4.385) | (4.750) | (4.608) | (4.528) | ||

| Economic policy uncertainty (EPU) | −0.069 † | −0.056 | −0.067 † | −0.063 † | −0.064 † | |

| (−1.944) | (−1.600) | (−1.936) | (−1.811) | (−1.832) | ||

| GTI × EPU | 0.112 | |||||

| (3.219) ** | ||||||

| GSI × EPU | 0.114 ** | |||||

| (3.308) | ||||||

| GLI × EPU | 0.090 * | |||||

| (2.577) | ||||||

| GEI × EPU | 0.094 ** | |||||

| (2.748) | ||||||

| R2 | 0.067 | 0.648 | 0.660 | 0.660 | 0.655 | 0.656 |

| ΔR2 | 0.581 *** | 0.012 ** | 0.012 ** | 0.008 * | 0.009 ** | |

| F statistics | 7.245 *** | 68.725 *** | 64.152 *** | 64.336 *** | 62.980 *** | 63.267 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Z.; Wang, M. Improving Circular Supply Chain Performance through Green Innovations: The Moderating Role of Economic Policy Uncertainty. Sustainability 2022, 14, 16888. https://doi.org/10.3390/su142416888

Liu Z, Wang M. Improving Circular Supply Chain Performance through Green Innovations: The Moderating Role of Economic Policy Uncertainty. Sustainability. 2022; 14(24):16888. https://doi.org/10.3390/su142416888

Chicago/Turabian StyleLiu, Zhaoqian, and Mengmeng Wang. 2022. "Improving Circular Supply Chain Performance through Green Innovations: The Moderating Role of Economic Policy Uncertainty" Sustainability 14, no. 24: 16888. https://doi.org/10.3390/su142416888

APA StyleLiu, Z., & Wang, M. (2022). Improving Circular Supply Chain Performance through Green Innovations: The Moderating Role of Economic Policy Uncertainty. Sustainability, 14(24), 16888. https://doi.org/10.3390/su142416888