Abstract

Based on a resource-based view, we explore the relationship between ambidextrous innovation human capital and the efficiency of technological innovation and its stage efficiency in big data enterprises. We divide their technological innovation into two stages: technological development and the commercialization of technological achievements. For a more reasonable efficiency measurement, we construct an efficiency evaluation index system based on the entropy value method (EVM) and the analytical hierarchy process (AHP), and we measure and evaluate their technological innovation efficiency from both static and dynamic perspectives. We conduct an empirical analysis with a sample of Chinese big data listed companies from 2014–2017. After regression analysis and its robustness test, we find that ambidextrous innovation human capital has a significant impact on the technological innovation efficiency of big data enterprises, that incremental innovation human capital and radical innovation human capital have opposite impact relationships in the technological development stage and that radical innovation human capital may have a more significant economic significance on the efficiency of commercializing technological achievements of big data enterprises. In the course of our analysis, we also find some other relevant findings. Finally, we formulate some relevant management suggestions.

1. Introduction

The world’s leading big data development countries have introduced a series of policies to promote big data development with the aim of enhancing national productivity and competitiveness and addressing the challenges of the fourth industrial revolution. The EU released the Data Driven Economy Strategy in 2014, the US introduced the Federal Big Data R&D Strategic Plan in 2016 and the UK issued the Digital Strategy 2017 in 2017. China’s General Secretary Xi Jinping indicated that the globalization of the digital economy is a major trend, and promoting the integration of the digital economy with the real economy is an important task for us. In September 2015, the State Council issued the Action Plan for Promoting the Development of Big Data, marking the rise of big data to the height of China’s national strategy. Improving the technological innovation efficiency of big data enterprises is conducive to the development of the big data industry and to the construction of the national digital economy, thus helping enhance comprehensive national strength and realizing the transformation of the “Made in China” production mode. Although big data have a broad market prospect and huge development potential, there are still some problems in China’s big data industry, such as lagging technological innovation, a lack of professional and technical talents, insufficient application of big data, etc. Zhao et al. (2017) [1] found that the total factor productivity of big data enterprises showed negative growth during the survey period, mainly due to the insufficient contribution of technical efficiency and technological progress. Through a literature review, it was found that there is not much literature that analyzes the improvement of the technological innovation efficiency of big data enterprises through a stage-by-stage internal perspective (i.e., analyzing each internal sequential stage of technological innovation activities) to improve the technological innovation efficiency of big data enterprises more comprehensively. According to Cruz-Cázares et al. (2013) [2], technological innovation efficiency is defined as the relative ability of enterprises to maximize relevant innovation output through various innovation inputs in technological innovation activities.

Based on a resource-based view [3,4], the positive impact of human capital on technological innovation in firms has been demonstrated [5,6]. However, not much of the literature explores the relationship between human capital and technological innovation efficiency of enterprises from the perspective of ambidextrous innovation theory. Based on the ambidextrous innovation theory proposed by March (1991) [7], innovation activities can be divided into incremental innovation and radical innovation according to the degree of innovation. This paper discusses different types of human capital from this perspective. Current related research in this field mainly concerns the relationship between other aspects of human capital heterogeneity and firm innovation performance [8,9], or the relationship between human capital heterogeneity and firm innovation performance [10]. In addition, the concept of ambidextrous innovation human capital proposed in this paper is derived from the concept of heterogeneous innovation human capital [10], which is a more intuitive definition of human capital heterogeneity based on the perspective of ambidextrous innovation theory. From the perspective of ambidextrous innovation theory, discussing the relationship between human capital (i.e., incremental innovation human capital and radical innovation human capital) and the efficiency of technological innovation of enterprises is conducive to optimizing the allocation of human resources and giving full play to the positive effects of the human resources of different natures on the efficiency of the technological innovation of enterprises. Incremental innovation human capital emphasizes the accumulation of knowledge and technology by means of “learning by doing”, which is closely related to the incremental innovation of products or services. Radical innovation human capital emphasizes that employees learn in research and development to obtain subversive technology or knowledge, thus helping achieve radical innovation for products or services.

Based on the above research background, this paper intends to solve the following research problems: First, we systematically and reasonably construct an evaluation index of the technological innovation efficiency of big data enterprises. Because the current construction process of the evaluation index system of enterprise technological innovation efficiency is relatively simple and lacks a systematic manner, we integrate the application of the literature research method, AHP and the entropy value method to construct the efficiency evaluation index system more systematically and reasonably. Second, we evaluate the technological innovation efficiency of big data enterprises during the investigation period and the dynamic trend and average level of their efficiency at different stages. Third, we conduct an empirical comparative analysis of the heterogeneous impact of ambidextrous innovation human capital (i.e., incremental innovation human capital and radical innovation human capital) on technological innovation efficiency and its stage efficiency (technological R&D efficiency and technological achievement commercialization efficiency) of big data enterprises.

Through the analysis of the above issues, the research contributions of this paper are mainly reflected in the following points: (1) more reasonable identification of the key input–output indicators that affect the technological innovation efficiency of big data enterprises; (2) a more in-depth and comprehensive understanding of the status quo and dynamic trends of the technological innovation efficiency and stage efficiency of big data enterprises during the investigation period; (3) the exploration of the heterogeneous impact of human capital on the relation between enterprise technological innovation efficiency and stage efficiency from a new theoretical perspective (the ambidextrous innovation theory).

The research framework of this paper is as follows: Section 2 conducts a literature review, Section 3 constructs an efficiency evaluation index system for the two stages of technological innovation in big data enterprises, Section 4 conducts a measurement of technological innovation efficiency, Section 5 analyzes the impact of ambidextrous innovation human capital on the overall efficiency of technological innovation and its stage efficiency in big data enterprises, Section 6 comprises a discussion and the research significance, Section 7 contains the conclusion and Section 8 discusses research limitations and future prospects.

2. Literature Review

Our research of the literature on the issue of the “technological innovation efficiency of big data enterprises and its influencing factors” is summarized in the following six aspects:

First, in terms of research objects, there are few empirical studies on the efficiency or performance of big data enterprises and big data industry. In an empirical study of big data enterprises, Zhao et al. (2017) [1] found the total factor productivity of big data enterprises; Cha et al. (2017) [11] studied the innovation performance of big data enterprises; and Zhang and Deng (2016) [12] indicated the direct relationship between R&D investment and the business performance of big data enterprises. In a study of the big data industry, Han and Hui (2016) suggested the technical efficiency and influencing factors of the big data industry.

Second, in terms of research perspectives, there is not much research on the internal operating mechanism of the technological innovation efficiency of big data enterprises in China, but research on the internal operating mechanism of technological innovation is reflected in other fields. Liu et al. (2018) conducted a two-stage study on China’s financial support for technological innovation, divided into a scientific and technological stage and an economic stage, and Xiao and Jiang (2017) divided technological innovation in high-tech industries into a basic innovation stage, an applied innovation stage and a revenue innovation stage to study the efficiency of the three stages.

Third, in terms of the efficiency evaluation content of big data enterprises, scholars Zhao and Cha used DEA to study the total factor productivity and innovation performance of big data enterprises, respectively, but did not cover the technological innovation efficiency of big data enterprises and their internal operation mechanism.

Fourth, in terms of efficiency evaluation methods, through literature research, the current methods for evaluating technological innovation efficiency were found to include the numerical proportional method, the stochastic frontier method with parameters (SFA) (e.g., Fan Chao (2019) used SFA to evaluate the innovation efficiency of the high-tech industry) and data envelopment analysis (DEA) without parameters. Due to the strong objectivity of DEA in relative efficiency evaluation and without considering the indicator dimension problem, it is suitable for use in the relative efficiency evaluation of multiple inputs and outputs and thus is widely used in current efficiency evaluations [13]. Yuan Chen (2016) applied a three-stage DEA to evaluate the energy efficiency of China’s regional construction industry. Related scholars applied DEA to the comprehensive measure of agro-ecological efficiency, the input–output efficiency of agricultural products for e-commerce and evaluation of the efficiency of Chinese commercial banks, respectively (Ren, 2019; Nian, 2019; Duan et al., 2019).

Fifth, the literature discusses the influencing factors of the efficiency of enterprise technological innovation. There is not much literature examining the relationship between ambidextrous innovation human capital and the efficiency of firms’ technological innovation. Relevant papers in foreign journals argue that the efficiency of firms’ technological innovation is mainly influenced by factors such as government support, R&D investment density, industry environment and foreign technology spillover [14,15]. Xiao et al. (2015) and Fan and Zhao (2019) concluded through an empirical analysis that there is a positive relationship between enterprise size and technological innovation efficiency. Fan (2019) empirically analyzed and concluded that government subsidies effectively enhance the innovation efficiency of high-tech enterprises. Tao and Gong (2014) concluded that human capital has an important supporting role for technological innovation efficiency. Song and Su (2017) empirically concluded that there is a positive relationship between enterprise R&D investment and technological innovation efficiency; e.g., Han (2016) found that the factors influencing the technical efficiency of the big data industry include profitability level, earnings quality, capital structure, capital utilization ability and growth ability. Fan and Zhao (2019) studied the effects of enterprise size, government support, financial support and ownership on the innovation efficiency of high-tech industries. Fang (2016) concluded that there is a positive relationship between innovation efficiency and market structure, industry profit and enterprise size.

Sixth, the literature provides definitions for big data enterprises. According to literature combing, there is no unified definition of big data enterprises, and there are few scholars who directly mention the concept of big data enterprises. Scholars Cha and Cai (2017) [11] believed that a big data enterprise is an enterprise that arises in the context of relevant national policies, that calls from relevant government and industrial sectors and that has data collection, storage, analysis and application as its main business. Guo (2015) indicated that the connotation of a big data enterprise is that the enterprise should have a big data mindset and should reconstruct the organizational form and operational paradigm of the enterprise based on the “integration of business information resources with social media and the integration of internal and external data of the enterprise”. Anxin Securities believes that big data enterprises have the advantages of big data resources and related technology, and they use these in their services. According to Zhou (2013), big data enterprises can be divided into two types: “data storage, processing and analysis” and “data operation and maintenance”. The above-mentioned scholars’ or institutions’ understanding of big data enterprises illustrate the background, main business and data sources of big data enterprises. According to these results, this paper attempts to give the following broad definition of big data enterprises: all enterprises related to big data can be called big data enterprises in a broad sense, and such enterprises have certain big data resources, big data management thinking, big-data-related application technology, etc. In a narrow sense, the definition of big data enterprises can be understood as follows: it is an information service enterprise that collects, processes, stores, analyzes and applies all kinds of internal and external data of the enterprise with the aid of big data thinking, and it provides its labor achievements to users, e.g., Baidu, Alibaba and Tencent.

Through the above literature combing, it was found that there is not much literature on constructing a more rigorous technological innovation efficiency evaluation index system through empirical methods, and there is not much literature on evaluating the technological innovation efficiency of big data enterprises from both static and dynamic perspectives. (The static perspective refers to the overall average level of the efficiency value of technological innovation during the review period, and the dynamic perspective refers to the dynamic change in the increase and decrease in the efficiency value each year during the review period.) Most importantly, it was found that there is not much research in the current literature on the internal operation mechanism of the technological innovation efficiency of big data enterprises and its relationship with ambidextrous innovation human capital. In addition, to analyze the reasons for the technological innovation efficiency of big data enterprises from the perspective of internal stages, this paper argues that, as an emerging information service enterprise in the digital economy era, the purpose of technological innovation in big data enterprises is to enhance the core technological capabilities of big data, thus creating more big data products with competitive advantages. Due to the uniqueness and complexity of big data enterprise products, big data enterprises in different data service areas may differ significantly in the stages of technological development and the commercialization of technological achievements (e.g., new data product development), so it is necessary to study their technological innovation efficiency in stages. Through a phased study on the technological innovation efficiency of big data enterprises, our understanding of the efficiency differences in different stages and the influencing factors of their heterogeneity can be deepened, and a reference for later related research can be provided.

3. The Evaluation Index System of Technological Innovation Efficiency

First, the evaluation indices are initially selected through qualitative research methods, such as literature research, technological innovation theory and expert interviews, and then the evaluation index system of the two-stage efficiency of the technological innovation of big data enterprises is constructed by integrating the application of hierarchical analysis and the entropy value method.

3.1. Selecting Input–Output Evaluation Indices

According to the definition of technological innovation and the technological innovation theory of the new Schumpeterian school, this paper divides the technological innovation of big data enterprises into two stages: the technology research and development stage and the commercialization of technological achievements. The technological innovation efficiency of big data enterprises can be regarded as being composed of technology R&D efficiency and the technological achievement of commercialization efficiency. The technology R&D stage mainly involves the input of human, financial and material resources for the determination of certain technological results, whereas the commercialization stage of technological achievements mainly refers to the process of transforming technological results into new products or ownership. The input–output index system of the technological innovation efficiency evaluation of big data enterprises is initially constructed according to the technological innovation theory, literature research and expert interview method, and in order to simplify the data envelopment analysis (DEA) model, the entropy value method and hierarchical analysis method are integrated to further rationalize the construction of the input–output index system. In the technology R&D stage, the number of R&D personnel, R&D input expenses, the number of valid patents in the previous period, the number of valid inventions in the previous period and fixed assets are initially selected as input indicators, and the number of patent applications, the number of patent licenses and the number of invention applications are taken as output indicators in the technology R&D stage of big data enterprises. In the commercialization stage of technological achievements, the number of sales personnel, the number of valid patents in the current year, the number of valid inventions, the number of technical personnel and R&D input costs are input indicators, and the total operating income, net profit and operating profit margin are output indicators.

3.2. Sample Selection and Data Sources

According to the sample collection, the sample of this paper was selected from 31 listed big data enterprises that meet the empirical requirements. The relevant sample index data were collated from the CCER database (i.e., CCER China Economic and Financial Database) and CSMAR database (i.e., China Stock Market and Accounting Research Database), and the data type is the panel data from 2014–2017. For missing values in a relatively small part of the sample data, this paper uses the multiple interpolation method to deal with them.

3.3. Calculation of Index Weights Based on the EVM and AHP

In this paper, the entropy value method of objective assignment and the analytical hierarchical process (AHP) method of subjective assignment are used to determine the appropriate indicators for the two stages of input and output of the technological innovation of big data enterprises.

3.3.1. Calculation of Indicator Weights Based on the Entropy Value Method

In this paper, the entropy value method is first used to calculate the weight of indicators, and the relatively more important indicators are selected as the candidate input–output indicators of the technological innovation efficiency of big data enterprises based on the real information of the indicators. The calculation process can be divided into five steps. The detailed process is shown in the Appendix A.

3.3.2. Calculation of Index Weights Based on the Analytical Hierarchy Process (AHP)

Although the EVM has strong objectivity, it is completely dependent on the fixed sample data value. Due to the limited sample data in this paper, in order to reduce the error and further derive more reasonable index weights, this paper also uses the analytical hierarchy process (AHP) with certain systematicity to judge the index weights, and then it takes the combined weight of the entropy value method and hierarchical analysis method as the final weight of the index. The calculation process of the analytical hierarchy process is as follows.

- (1)

- First, the recursive hierarchical structure model is constructed. According to the input–output index system of the two-stage efficiency evaluation of the technological innovation of big data enterprises constructed in this paper, a recursive hierarchical structure model consisting of a target layer, a criterion layer and an element layer is constructed, as shown in Table 1.

- (2)

- According to the recursive hierarchy model, a judgment matrix is established to measure the relative importance of each element index. The values of each judgment matrix are compiled according to the expert interview method and the expert scoring method, and the judgment matrix constructed therein needs to pass the consistency test before it can be established. Combining the characteristics of the recursive hierarchy model, the following five judgment matrices are constructed in this paper (see the Appendix A for details of the judgment matrix).

- (3)

- A consistency test of the judgment matrix is performed, and index weights are calculated. The purpose of the consistency test is to judge the reasonableness of the construction of the judgment matrix, and its standard is to make the consistency ratio CR less than 0.1. Otherwise, the judgment matrix needs to be reconstructed until the matrix passes the test. After calculation, all judgment matrices pass the consistency test.

Table 1.

Recursive hierarchical model of the evaluation index of technological innovation efficiency of big data enterprises.

Table 1.

Recursive hierarchical model of the evaluation index of technological innovation efficiency of big data enterprises.

| Target Layer | Guideline Layer | Element Layer |

|---|---|---|

| Evaluation of two-stage efficiency of technological innovation in big data enterprises(A) | Input indicators for the technological development phase (B1) | Number of R&D staff (C1) |

| R&D investment funds (C2) | ||

| Number of valid patents (C3) | ||

| Number of valid inventions (C4) | ||

| Fixed assets (C5) | ||

| Output indicators for the technological development phase (B2) | Number of patent applications (C6) | |

| Number of patents granted (C7) | ||

| Number of invention applications (C8) | ||

| Input indicators for the results of the technological commercialization phase (B3) | Number of sales staff (C9) | |

| Number of valid patents (C10) | ||

| Number of valid inventions (C11) | ||

| Number of technical staff (C12) | ||

| R&D investment fees (C13) | ||

| Output indicators for results of the technological commercialization phase (B4) | Total operating revenue (C14) | |

| Net profit (C15) | ||

| Operating margin (C16) |

3.3.3. Final Weighting Calculation Results

Based on the weighting results of the entropy value method and hierarchical analysis method, the average value of the two represents the weighting of the two-stage input–output index of the technological innovation of big data enterprises, and the weighting values are shown in Table 2.

Table 2.

Combined weighting results of preliminary selection indicators.

According to the results of the index weights calculated by the entropy value method, among the input indices in the technology R&D stage, fixed assets have the greatest weight (0.095), indicating that hardware such as infrastructure has a greater influence on the technology R&D of big data enterprises. The second most influential is the number of valid inventions (0.079), indicating that valid inventions play a more obvious role in technology R&D than other types of patents. In addition, the number of R&D personnel (0.05) and R&D investment funds (0.046) have a small impact on technology R&D according to the entropy value method. Among the output indicators in the technology R&D stage, the number of patents granted (0.079) has a greater impact on technology R&D and is more representative than the number of patent applications (0.07) and invention applications (0.078) in technology R&D results and technological innovation. Among the input indicators in the commercialization stage, the number of sales staff (0.112) has a more significant impact on the successful commercialization of technological achievements, likely because, as a new type of enterprise, big data enterprises have social application value that is still in the rising stage. Society needs a process to adapt and accept the socio-economic value of big data enterprises, so in this process, sales staff are continuously needed. Secondly, the number of effective inventions (0.082) is more important in the commercialization of technological achievements, and the R&D input fees (0.046) have lower impacts in the commercialization stage of technological achievements than those of effective inventions and sales personnel. Among the output indicators in the commercialization stage of technological achievements, gross operating income has the largest weight value (0.068), indicating that gross operating income can better reflect whether technological achievements can truly realize market value compared with net profit (0.026) and operating profit margin (0.01).

According to the weight calculation results of hierarchical analysis, among the input indicators of the technology R&D stage, the number of R&D personnel (0.124) has the largest weight value, indicating that R&D human resources have a significant impact on technological innovation in knowledge-intensive big data enterprises. This is followed by R&D investment funds (0.058), which have a significant impact on the efficiency of technology R&D, revealing that technological innovation is an enterprise activity that requires sufficient financial support. The numbers of effective patents (0.032), effective inventions (0.020) and fixed assets (0.016) are somewhat weaker in their relative importance to technology R&D. Among the output indicators in the technological R&D stage, the number of granted patents (0.169) has the greatest relative importance, which reflects that technological achievement has good value and is recognized by the patent office. The numbers of patent applications (0.056) and invention applications (0.025) reflect a certain number of technological achievements, but they do not guarantee that all patented inventions that were applied for have sufficient gold content. Among the input indicators in the commercialization stage of technological achievements, the number of sales personnel (0.128) has the greatest weight, and the successful commercialization of the technological achievements of big data enterprises needs sales personnel for marketing to slowly enter various industries. Second, the number of effective patents (0.049) has a greater role in promoting the commercialization of technological achievements, and effective patents can help improve the quality of new products and further promote their market value. The number of valid inventions (0.029), the number of technicians (0.016) and R&D investment fees (0.027) are relatively weak in the commercialization stage of the technological achievements of big data enterprises. Among the output indicators of the commercialization stage, operating profit margin (0.171) is the most important, and as an indicator of the overall operating efficiency of enterprise activities, operating profit margin can better reflect the technological innovation performance of big data enterprises. Net profit (0.055) can better reflect the sales of new products and commercialization efficiency compared with gross operating income (0.023) by removing the cost and tax factors. Net profit (0.055) can better reflect the sales and commercialization efficiency of new products compared with gross operating income (0.023).

In order to simplify the technological innovation efficiency measurement model of big data enterprises and to reduce the interference between variables on a reasonable basis as much as possible, therefore, according to the results in Table 2, this paper selects indicators with larger comprehensive weights as the technological innovation efficiency measurement indicators, and it selects the number of R&D personnel, R&D input funds and fixed assets as input indicators and the number of patents granted as output indicators in the technology R&D stage. In the commercialization stage of technological achievements, the number of sales personnel and the number of effective inventions are selected as input indicators, and the operating profit margin is selected as the output indicator.

4. Measurement of Technological Innovation Efficiency

In this paper, the two-stage efficiency of the technological innovation of the sample of big data enterprises in the period under examination is evaluated statically and dynamically using data envelopment analysis with variable payoffs of scale (BCC–DEA) and the DEA model with the Malmquist index, respectively.

4.1. Constructing the DEA Model

DEA is commonly used in the efficiency evaluation problem of multiple inputs and multiple outputs. According to the research needs of this paper, the BCC–DEA model and the DEA model with the Malmquist index are constructed.

4.1.1. Constructing the BCC–DEA Model

The number of decision making units (DMUs) is n ( = 1, 2…), the number of input indicators of each DMU is r (a = 1, 2…r), the output indicators of each DMU are s (b = 1, 2…s) and their indicator weights are V and U. denotes the value of the a-th input indicator of the i-th DMU, and denotes the value of the b-th output indicator of the i-th DMU. The model expressions are as follows.

In Equation (1), and denote the weight values of the a-th input indicator and the b-th output indicator, respectively, and denotes the payoff of the scale for the i-th decision unit, where denotes the technical efficiency of the DMU.

4.1.2. Construction of the Malmquist Index–DEA Model

The Malmquist index represents the change in total factor productivity (tfpch) in two adjacent periods and consists of the technical efficiency change index (EC) and the technological progress change index (techch). In the case of variable returns to scale, the technical efficiency change index is further divided into the scale efficiency change index (sech) and the pure technical efficiency change index (pech), so the Malmquist index is calculated as follows: tfpch = techch ∗ EC = techch ∗ sech ∗ pech, whose corresponding mathematical expression is:

In Equation (2), and denote the values of input indicators in periods t + 1 and t, and denote the values of output indicators in periods t + 1 and t, the index of total factor productivity change is on the left side of the equal sign and and denote the efficiency distance functions with reference to the technology level in periods t and t + 1, respectively. c and v in the subscripts represent the cases under constant and changing returns to scale, respectively.

4.2. Static Evaluation of Technological Innovation Efficiency of Big Data Enterprises

Based on the stage division of technological innovation, BCC–DEA is used to measure the efficiency of technological R&D, the efficiency of the commercialization of technological achievements of big data enterprises in 2014–2017 and finally the overall efficiency of technological innovation. Because BCC–DEA is generally used for cross-sectional data, the overall efficiency evaluation results are expressed as mean values in this paper. To ensure that DEAP2.1 software can properly measure the efficiency results, the data with negative or zero original values are modified to 0.001. The input-oriented BCC–DEA model is used in the technology R&D stage, and the output-oriented BCC–DEA model is used in the commercialization stage of technological achievements.

According to the technology R&D efficiency measurement results of big data enterprises in Table 3, the comprehensive technical efficiency of the sample big data enterprises in the period under study is low (0.307), which indicates that the overall resource allocation ability of big data enterprises in the R&D stage is relatively insufficient, and the input resources are not fully utilized. The pure technical efficiency of big data enterprises in the technology R&D stage in the period under study is at a medium level (0.65), which indicates that the management level and technical level of big data enterprises in the process of technology R&D are at a medium level, and there is still more room and potential for improvement. The scale efficiency of the sample of big data enterprises is low (0.425), which indicates that there is a large gap between the actual scale and the optimal scale of big data enterprises as a whole. According to the relationship between comprehensive technical efficiency, pure technical efficiency and scale efficiency, the comprehensive technical efficiency of the technology R&D stage of big data enterprises is mainly influenced by the lower scale efficiency, which makes the R&D efficiency of big data enterprises low.

Table 3.

Static evaluation of technological innovation efficiency of big data enterprises.

According to the measurement results of the commercialization efficiency of the technological achievements of big data enterprises in Table 3, the comprehensive technical efficiency is low (0.296), which indicates that big data enterprises need to further improve resource allocation and the degree of resource utilization in the commercialization stage of technological achievements. The pure technical efficiency of the sample big data enterprises in the examination period is in the middle to upper level (0.512), which indicates that the big data enterprises are in the commercialization stage of technological achievements. In terms of the scale efficiency in the commercialization stage of technological achievements, big data enterprises as a whole are in the middle (0.530), which reveals that the gap between the actual scale and the optimal scale of big data enterprises is in the middle. A comprehensive analysis of the relationship among comprehensive technical efficiency, pure technical efficiency and scale efficiency shows that the reason for the low comprehensive technical efficiency of big data enterprises in the commercialization stage of technological achievements is mainly due to the low pure technical efficiency.

According to the calculation results in Table 3, the comprehensive technical efficiency value of the overall technological innovation of the sample of big data enterprises in the period under investigation is low (0.302), which indicates that the overall resource allocation and the full utilization of resources of big data enterprises are low and need to be further improved. The pure technical efficiency of the overall technological innovation of the sample of big data enterprises in the period under investigation is at a medium level (0.581), which indicates that the management level and technical level of big data enterprises are at a medium level. In terms of scale efficiency, the scale efficiency of big data enterprises is low (0.478) during the period under investigation, indicating that there is a large gap between the actual scale and the optimal scale of big data enterprises. According to the relationship among comprehensive technical efficiency, pure technical efficiency and scale efficiency, the low technological innovation efficiency of big data enterprises as a whole is mainly influenced by scale efficiency.

4.3. Dynamic Evaluation of the Technological Innovation Efficiency of Big Data Enterprises

In this part, a dynamic evaluation of the efficiency of the technology R&D stage and the commercialization stage of technological achievements is first conducted, and then a dynamic evaluation of the overall technological innovation efficiency is conducted based on the dynamic evaluation results of the two stages of efficiency.

4.3.1. Dynamic Evaluation of the Two-Stage Efficiency of the Technological Innovation of Big Data Enterprises

Malmquist–DEA is used to dynamically evaluate the two-stage efficiency of the technological innovation of big data enterprises, and the results are measured with the help of DEAP2.1 software, as shown in Table 4.

Table 4.

Dynamic evaluation of technological innovation efficiency of big data enterprises.

According to the results measured in Table 4, the technical efficiency change index of the technology R&D stage of the sample of big data enterprises in the examination period is 0.737, indicating that the technical efficiency of big data enterprises overall in the technology R&D stage has decreased by 26.3%. According to the technological progress change index, big data enterprises overall in the examination period are undergoing a growth trend, with a growth rate of 25.6%. According to the pure technical efficiency change index, the. According to the overall scale efficiency change index, big data enterprises overall showed a decreasing trend during the examination period, with a decline rate of 15.7%. According to the overall total factor productivity (TFP) change index, big data enterprises overall showed a decreasing trend during the examination period, with a decline rate of 12.6%. According to the total factor productivity (TFP), big data enterprises showed a decreasing trend during the technological development stage, with a decline rate of 7.5%. According to the internal structure of the total factor productivity change index, the total factor productivity change index of big data enterprises shows a downward trend, mainly influenced by the pure technical efficiency change index and the scale efficiency change index in the technical efficiency change index, and it is more influenced by the pure technical efficiency change index.

According to the overall level and the measurement results in Table 4, the commercialization efficiency of the technological achievements of big data enterprises in the examination period shows a decreasing trend as a whole, with a decline rate of 16.8%, and the reason for its decline is mainly influenced by the decline of technical progress, which is 35%. The technical efficiency of big data enterprises in the commercialization stage of technological achievements has an upward trend, with an overall growth rate of 27.9%, among which the growth rate of pure technology is 6.5% and the growth rate of scale efficiency is 20.1%. In technological progress, the technological progress index of the sample of big data enterprises has a decreasing trend, which indicates that big data enterprises have achieved fewer new technologies and products in the examination period, and technological innovation ability needs to be further improved.

4.3.2. Dynamic Evaluation of the Technological Innovation Efficiency of Big Data Enterprises as a Whole

Based on the results of dynamic evaluation in Table 4, the mean value of the dynamic evaluation of efficiency in two stages indicates the dynamic evaluation results of the technological innovation efficiency of big data enterprises as a whole, as shown in Table 5.

Table 5.

Dynamic evaluation of the overall technological innovation efficiency of big data enterprises.

According to the summary results in Table 5, the overall technological innovation efficiency of big data enterprises showed a downward trend during the period under investigation, with a decline rate of 12.1%, which was mainly influenced by the decline of technological progress and pure technical efficiency, of which the decline rates were 4.7% and 4.6%, respectively. The scale efficiency of the technological innovation of big data enterprises as a whole showed a growing trend with a growth rate of 3.8%, and technical efficiency showed a growing trend with a growth rate of 0.8%.

5. Ambidextrous Innovation Human Capital and Firm Technological Innovation Segment Efficiency

Based on the efficiency measurement, this paper uses the Tobit regression model to further analyze the impact of ambidextrous innovation human capital on the technological innovation efficiency of big data enterprises and their stage efficiency.

5.1. Constructing Tobit Regression Models

According to the research needs of this paper, and taking into account the availability of data, several Tobit regression models are constructed in this paper, with the following dependent variables: overall technological innovation integrated efficiency (Y0) and its pure technical efficiency (Y01) and scale efficiency (Y02) of big data enterprises; technology R&D integrated efficiency (Y1) and its pure technical efficiency (Y11) and scale efficiency (Y12); and the commercialization of technological achievements combined efficiency (Y2) and its pure technical efficiency (Y21) and scale efficiency (Y22). To eliminate the effects of other important factors, the model uses firm size (ln_zzc), government subsidies (ln_zfbt) and R&D input costs (ln_yffy) as control variables. Ambidextrous innovation human capital is used as the independent variable, which is divided into radical innovation human capital (sbryzb) and incremental innovation human capital (bkryzb).

In model (3) denotes the nine dependent variables, and denote the corresponding regression coefficients in the Tobit regression model, denotes ambidextrous innovation human capital, denotes the random disturbance term and denotes the constant term.

5.2. Description of Independent Variables and Theoretical Hypotheses

Ambidextrous innovation human capital, as the core explanatory variable of the regression model, is based on the perspective of ambidextrous innovation theory, which divides innovation human capital heterogeneity into incremental innovation human capital and radical innovation human capital. Drawing on the practice of relevant scholars, this paper takes the proportion of undergraduate personnel as a measure of incremental innovation human capital and the proportion of employees with master’s or higher degrees as an indicator of radical innovation human capital [10]. The control variables are as follows (the three control variables are logged to eliminate heteroskedasticity): The first is the size of the enterprise, which is represented in this paper by total assets. According to Schumpeter’s innovation theory, there is a positive correlation between firm size and innovation capability. The second is government subsidies. Government subsidies have an impact on the efficiency of technological innovation (Huang et al., 2016). The third is R&D investment costs, which were shown to significantly affect the efficiency of technological innovation [16].

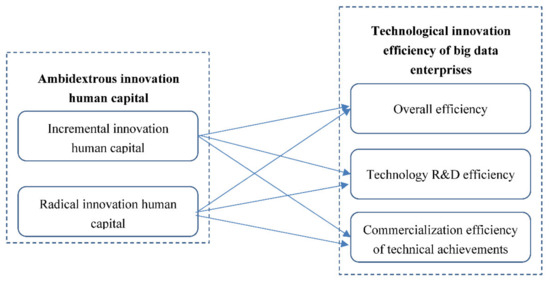

Based on a resource-based view, innovative human capital, as a core resource of enterprises, has positive significance on the efficiency of enterprise technological innovation and the enhancement of competitive advantage. However, considering that March (2006) [7] indicated that the characteristics of enterprise incremental innovation and radical innovation cannot coexist, and that big data enterprises are still emerging enterprises, incremental innovative human capital should be more suitable at present. The following hypotheses are thus proposed. The corresponding research conceptual model is shown in Figure 1. Descriptive analysis and correlation analysis of variables in the regression model are shown in Table 6.

Figure 1.

Research model.

Table 6.

Descriptive statistics and correlation analysis (N = 124).

H1:

Incremental innovation human capital facilitates the efficiency of technological innovation and its stage efficiency in big data enterprises.

H2:

Radical innovation human capital is not conducive to the efficiency of technological innovation in current big data enterprises.

5.3. Regression Results

Stata14 software was used to measure the regression results, as shown in Table 7.

Table 7.

Results of regression.

In Table 7, one economically significant result that needs to be highlighted [17,18,19], due to the small sample size in this paper (N = 124), is as follows: independent variables that have a p-value less than 0.2 for the statistical results (i.e., t-values around 1.64) but that have a large regression coefficient (e.g., the ratio of the regression coefficient to its extreme difference is greater than 0.3) are considered to be marginally significant, and an asterisk is marked for it in Table 7.

5.4. Endogeneity Tests and Robustness Tests

In order to test the stability of the model regression results, as well as to consider the endogeneity of the model, this paper treats the independent variable (ambidextrous innovation human capital) with a one-period lag, i.e., incremental innovation human capital (*bkryzb) and radical innovation human capital (*sbryzb) with asterisks in Table 7 are obtained. Based on the regression results, the robustness tests show that incremental human capital positively affects the pure technical efficiency of R&D in big data enterprises, whereas radical innovation human capital has a greater negative impact on the pure technical efficiency of R&D in big data enterprises. Based on the regression results in Table 7, the empirical results validate parts of Hypothesis 1 and Hypothesis 2. Moreover, the development of radical innovation human capital has an occasional negative impact on the scale efficiency of technology R&D.

6. Discussion and Research Implications

6.1. Discussion

In order to better answer the research questions in the introduction, we carried out relevant research and found that incremental innovation human capital and radical innovation human capital have the opposite effect on the technical level and management level of big data enterprises at the technology research and development stage. Moreover, it was found that incremental innovation has many positive impacts on the technological innovation efficiency of big data enterprises, which reflects the positive impact of incremental innovation human capital on short-term technological innovation efficiency. However, radical innovation human capital even has a certain negative impact on short-term technological innovation efficiency, which conforms to the basic connotation of ambidextrous innovation human capital [10]. In addition, by analyzing the relationship between human capital and the technological innovation efficiency of big data enterprises (including technology R&D efficiency and the commercialization efficiency of technological achievements) from the perspective of ambidextrous innovation, we can more clearly understand the different effects of different types of human capital on technological innovation efficiency, and we can more reasonably allocate different types of human resources in technological innovation activities. Thus, it not only realizes the sustainable development of human capital [20] but also facilitates the optimization and improvement of enterprises’ technological innovation efficiency. Compared with other studies, this paper analyzes the heterogeneity of human capital from the perspective of ambidextrous innovation theory [10]. Moreover, this study also expands the research scope of human capital and innovation performance [21].

6.2. Theoretical Implications

Based on the ambidextrous innovation perspective, this paper discusses the relationship between human capital and technological innovation and its stage efficiency, enriching the research perspective and content in this field. In addition, this paper reconstructs a more systematic and reasonable evaluation index system of technological innovation efficiency, providing a certain reference value for subsequent scholars in building an evaluation index system of technological innovation and its stage efficiency and in exploring important influencing factors of technological innovation efficiency.

6.3. Practical Implications

The practical significance of this paper is mainly reflected in two aspects. First, it helps managers of big data enterprises to more accurately understand the level of technological innovation and its stage efficiency, and it provides reference information for them to make reasonable enterprise decisions or strategies. Secondly, the results of this study provide a reference for managers to reasonably arrange human resources in technological innovation activities to effectively improve the efficiency of enterprise technological innovation. In addition, this article proposes the following relevant management suggestions:

First, according to relevant research results, big data enterprises should strive to use incremental innovation human capital to play a positive role in their recent technological innovation activities in order to effectively enhance the technical and managerial level of technological R&D. As emerging companies, big data enterprises are in an early stage of growth, and incremental innovation for technology accumulation is more suitable for them. It is possible to introduce advanced technology to allow incremental innovation human capital to have a “learning by doing” effect, but it is important to move towards radical innovation as soon as possible. In addition, based on economic salience analysis, it is recommended that radical innovation human capital be increased during the commercialization phase of technological achievements to take advantage of radical innovation to penetrate the market and to stimulate the potential purchase desire of the market. Through the reasonable allocation of ambidextrous innovation human capital, the “human capital accumulation paradox” of big data enterprises can be avoided.

Second, big data enterprises should speed up the development of new technologies or new products in the commercialization phase of the technological achievements. Based on research results, it is recommended that big data enterprises establish awareness of market-demand-oriented new products or new technological development, and technical personnel and marketing personnel can mutually participate in the process of market research and new product development to reduce the number of demand changes and reworking new products. They should adopt a cross-functional form of organizational management and apply it to new product project creation and R&D to shorten the R&D cycle of new products or new technologies. Big data enterprises should establish a shared technology platform that meets their own new product or technology R&D needs to improve resource sharing and R&D efficiency. They should enhance the scale efficiency of overall technological innovation and improve the efficiency of the main body of each stage within technological innovation. Big data enterprises should pay attention to the improvement of their own scale efficiency and strive to achieve an optimal enterprise scale for conducting technology R&D. Moreover, they should focus on improving their management capacity and technical level in the process of transforming technological achievements, intensifying resources and improving the capacity of resource allocation and effective use.

Third, big data enterprises should reasonably accept government subsidies. Based on research results, considering that government subsidies may have a crowding-out effect on technological innovation, it is suggested that big data enterprises take into account their actual location and make reasonable use of support resources provided by the government. It should be noted that the crowding-out effect of government subsidies on the efficiency of the commercialization of technological achievements of big data enterprises is more obvious.

Fourth, the conversion rate of technology R&D expenses in the R&D stage of big data enterprises should be improved. There is a need to reasonably apply R&D expenses to various R&D stages to ensure smooth R&D chain flow. They should appropriately increase R&D expenses in the commercialization stage of technological achievement to help improve commercialization efficiency, and through the commercialization of technological achievements, they should let technological achievements bring tangible economic benefits to the enterprise, thus feeding sustainable R&D in later stages.

Fifth, because the number of granted patents has a particularly strong impact on the technological innovation performance of big data enterprises, big data enterprises can give this factor priority in the process of technological innovation activities, and it can be reasonably adjusted according to the scale status and actual locations in which the enterprises themselves are located.

7. Conclusions

This paper applies a combination of the entropy value method, hierarchical analysis, BCC–DEA, Malmquist–DEA and Tobit regression analysis to evaluate the technological innovation stage efficiency of big data enterprises from 2014–2017, and it analyzes the impact of ambidextrous innovation human capital on technological innovation efficiency and its stage efficiency, drawing the following conclusions.

First, based on the entropy value method and hierarchical analysis, the number of R&D personnel, R&D input costs, fixed assets, the number of patents granted, the number of sales staff, the number of valid inventions and the operating profit margin in the input–output index system have a significant impact on the technological innovation efficiency of big data enterprises.

Second, based on BCC–DEA, resource allocation capacity and the full utilization of resources in the overall technological innovation activities of big data enterprises are low, mainly due to a large gap between the actual scale and the ideal scale of big data enterprises. In terms of stage impact, the under-allocation of resources and the under-utilization of resources in the commercialization stage of technological achievements significantly reduces the overall technological innovation efficiency level. The technical level and management level of the overall technological innovation process of big data enterprises are mainly limited by the pure technical efficiency of the commercialization stage of technological achievements. Scale efficiency in the technology R&D stage widens the distance between the actual scale and the optimal scale of big data enterprises as a whole. In the technology R&D stage, a lower scale efficiency lowers the resource allocation ability and the effective utilization of resources in the technology R&D process. In the commercialization stage of the technological achievements of big data enterprises, the technical level and management level in the commercialization process of technological achievements, in terms of resource allocation and other capabilities, limit the commercialization of technological achievements. According to the differences between the technological development stage and the technological achievement commercialization stage, the technological development stage of big data enterprises is better than the technological achievement commercialization stage in terms of resource allocation ability, the degree of the full utilization of resources, management level, technology level and distance from the optimal scale, but the differences between the two stages are smaller.

Third, based on Malmquist–DEA, the total factor productivity of technological innovation, the total factor productivity of technological R&D and the total factor productivity of the commercialization of technological achievements of big data enterprises had an overall downward trend during the period under examination. The slower pace of new technological development or new product production was the main reason for an overall decline in the total factor productivity of technological innovation in big data enterprises. The total factor productivity of both technology R&D and the commercialization of technology outcomes had a downward trend during the period under examination, with the total factor productivity of the commercialization stage of technology outcomes declining more rapidly. The decline in the technology level and management level of big data enterprises in the technology R&D process was the main reason for slow improvement in technology upgrading and the management model in the technology R&D process, and the slow pace of new technological development and new product development was the main factor leading to a rapid decline in product quality improvement in the commercialization of technological achievement activities. From the perspective of the technological innovation stage of big data, the decline in the total factor productivity of overall technological innovation was mainly influenced by the commercialization stage of technological achievements. The limited management level and technology level of overall technological innovation was mainly dragged down by the technological development stage, and the growth of the scale efficiency of overall technological innovation was mainly influenced by the driving effect of the commercialization stage of technological achievements. The slow development of new technologies or the slow production of new products in overall technological innovation was mainly affected by a decline in technological progress in the commercialization stage of technological achievements. Growth in the technical efficiency of overall technological innovation was mainly driven by the commercialization stage of technological achievements. The differences between the technological development stage and the commercialization stage of technological achievements show that there is a large gap between the two in terms of technical efficiency (especially scale efficiency) and technological progress, and in terms of technological upgrading capability and the management model, the gap is smaller and better in the technological development stage.

Fourth, there is a significant positive impact of incremental innovation human capital on the R&D efficiency of big data enterprises and their pure technical efficiency, and there is a significant negative impact of radical innovation human capital on the technological innovation efficiency of big data enterprises and the pure technical efficiency of R&D. Considering the issue of economic significance (Mccloskey and Ziliak, 2008), and based on the results of the robustness tests, it was found that radical innovation human capital may have a robust positive impact on the scale efficiency of the commercialization of the technological achievements of big data enterprises (with a large value of its regression coefficient, this paper concludes that this variable has some economic significance) (Zhou, 2009), which, in turn, positively affects the efficiency of the commercialization of the technological achievements of big data enterprises. Regarding the impact of the control variables on technological innovation efficiency, government subsidies have a significant negative impact on the technological innovation efficiency of big data enterprises, revealing that there is a crowding-out effect of government subsidies on the technological innovation of big data enterprises. R&D expenses have a significant negative impact on the R&D efficiency of big data enterprises and on their pure technical efficiency and scale efficiency, but they positively affect the scale efficiency of the commercialization stage of technological achievements, indicating that the conversion rate of the R&D expenses of big data enterprises is low. The size of the big data enterprise has a significant negative impact on their technological innovation and on their pure technical efficiency in two stages, but it has a facilitating effect on the scale efficiency of technological innovation. This reveals that a larger big data enterprise size is not better, and a larger size leads to lower efficiency in technological management. It is necessary to find the optimal size of technological innovation for big data enterprises to form economies of scale.

8. Research Limitations and Future Prospects

Although this study has some research significance, it still has limitations. First, the number of suitable samples selected in this paper is small, which has a certain adverse impact on the statistical significance level. Second, this paper only takes big data enterprises as the research object, and the universality of the research results needs further research. For future research, we can increase the sample size and examine the specific impact of ambidextrous innovation human capital on the efficiency of enterprise technological innovation in other industries. In addition, a more systematic and reasonable method can be adopted to conduct multi-dimensional comprehensive measurements of explanatory variables (ambidextrous innovation human capital) in later stages. Moreover, it can also be used to further analyze the moderating effect of the internal and external innovation environment and other factors (e.g., knowledge hiding, team cohesion, etc.) on the relationship between the two, and it can be used to deeply explore the potential mediating impact mechanism (e.g., knowledge accumulation, knowledge creation and organizational dynamic capability) of the relationship between the two.

Author Contributions

Conceptualization, C.L.; methodology, C.L.; software, C.L.; validation, C.L.; formal analysis, C.L.; investigation, C.L.; resources, C.L.; data curation, C.L.; writing—original draft preparation, C.L.; writing—review and editing, C.L.; visualization, C.L.; supervision, H.-L.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. The Process of Calculating Index Weights Using the Entropy Value Method and Hierarchical Analysis Method

1. The process of calculating index weights based on the entropy value method

- (1)

- First, the input–output indicator data are standardized. Since the units of each indicator are different, standardization is used to eliminate the adverse effects of the dimensionality. In this paper, the deviation standardization method is used, and as all indicators in this paper are positive indicators, their standardization formula is

In the above formula, the original value of the indicator is indicated. The left side of the equation indicates the standardized value of the indicator, and the right side of the equation indicates the value of the j-th indicator of the i-th sample (i = 1, 2 − n; j = 1, 2 − m).

- (2)

- After standardizing the indicator data, the weight of each indicator is calculated. The calculation formula is

- (3)

- Then, the entropy of each indicator is calculated, which is also the reflection of the validity of each indicator. Entropy is negatively related to the amount of information carried by each indicator. The entropy value is calculated with the following formula:

- (4)

- The redundancy of information entropy is then derived, and the formula is expressed as

- (5)

- Finally, the weight value of each indicator is calculated, which is expressed by the following formula:

The above entropy value method process was used to calculate the sample data of this paper. As the data type of this paper is panel data, we calculated the indicator weight results for each year separately, and finally, the final weight results of each indicator were obtained by using the mean value method.

2. The specific values of the five judgment matrices in this paper.

| A-B | B1 | B2 | B3 | B4 | |

| B1 | 1 | 1 | 1 | 1 | |

| B2 | 1 | 1 | 1 | 1 | |

| B3 | 1 | 1 | 1 | 1 | |

| B4 | 1 | 1 | 1 | 1 | |

| B1-C | C3 | C4 | C5 | C2 | C1 |

| C3 | 1 | 3 | 2 | 1/3 | 1/5 |

| C4 | 1/3 | 1 | 2 | 1/3 | 1/5 |

| C5 | 1/2 | 1/2 | 1 | 1/3 | 1/6 |

| C2 | 3 | 3 | 3 | 1 | 1/3 |

| C1 | 5 | 5 | 6 | 3 | 1 |

| B2-C | C6 | C8 | C7 | ||

| C6 | 1 | 3 | 1/4 | ||

| C8 | 1/3 | 1 | 1/5 | ||

| C7 | 4 | 5 | 1 | ||

| B3-C | C10 | C11 | C13 | C9 | C12 |

| C10 | 1 | 3 | 2 | 1/5 | 3 |

| C11 | 1/3 | 1 | 2 | 1/5 | 2 |

| C13 | 1/2 | 1/2 | 1 | 1/4 | 3 |

| C9 | 5 | 5 | 4 | 1 | 4 |

| C12 | 1/3 | 1/2 | 1/3 | 1/4 | 1 |

| B4-C | C15 | C14 | C16 | ||

| C15 | 1 | 3 | 1/4 | ||

| C14 | 1/3 | 1 | 1/6 | ||

| C16 | 4 | 6 | 1 |

References

- Zhao, C.R.; Dai, J.L. The Total Factor Productivity Growth and Convergence Analysis For China Big-data Enterprise. J. Northwest Univ. Philos. Soc. Sci. Ed. 2017, 47, 60–66. [Google Scholar]

- Cruz-Cázares, C.; Bayona-Sáez, C.; García-Marco, T. You can’t manage right what you can’t measure well: Technological innovation efficiency. Res. Policy 2013, 42, 1239–1250. [Google Scholar] [CrossRef]

- Barney, J.; Wright, M.; Ketchen, D.J. The resource-based view of the firm: Ten years after 1991. J. Manag. 2001, 27, 625–641. [Google Scholar] [CrossRef]

- Wernerfelt, B. A Resource-Based View of the Firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Jimenez-Jimenez, D.; Sanz-Valle, R. Studying the relationships among human capital, technological capabilities, and innovation in Spanish manufacturing firms. Int. J. Technol. Manag. 2020, 82, 227–243. [Google Scholar] [CrossRef]

- Xi, X.; Xi, B.; Miao, C.; Yu, R.; Xie, J.; Xiang, R.; Hu, F. Factors influencing technological innovation efficiency in the Chinese video game industry: Applying the meta-frontier approach. Technol. Forecast. Soc. Change 2022, 178, 1–11. [Google Scholar] [CrossRef]

- March, J.G. Exploration and Exploitation in Organizational Learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Li, H.J.; Liu, P.S. A study on the impact of diversity in human capital structure on firm innovation. Stud. Sci. Sci. 2018, 36, 1694–1707. [Google Scholar]

- Wang, M.; Xu, M.; Ma, S.J. The effect of the spatial heterogeneity of human capital structure on regional green total factor productivity. Struct. Change Econ. D 2021, 59, 427–441. [Google Scholar] [CrossRef]

- Peng, W.H. The Influence of Heterogeneity Innovation Human Capital on Enterprise Value Chain: An Empirical Study Based on the Listed Companies in China’s Manufacturing Industry. Financ. Econ. 2019, 4, 120–132. [Google Scholar]

- Cha, H.W.; Cai, G.L. Evaluation of Innovation Efficiency of Big Data Enterprises in China: Based on DEA Method. J. Beijing Univ. Posts Telecommun. Soc. Sci. Ed. 2017, 19, 71–78. [Google Scholar]

- Zhang, T.S.; Deng, X.C. Research on the Relationship between Operating Performance and R & D Investment Based on the Listed Big Data Companies. J. Ind. Technol. Econ. 2016, 9, 77–84. [Google Scholar]

- Tsolas, I.E. Firm credit risk evaluation: A series two-stage DEA modeling framework. Ann. Oper. Res. 2015, 233, 483–500. [Google Scholar] [CrossRef]

- Chen, H.X.; Lin, H.; Zou, W.J. Research on the Regional Differences and Influencing Factors of the Innovation Efficiency of China’s High-Tech Industries: Based on a Shared Inputs Two-Stage Network DEA. Sustainability 2020, 12, 3284. [Google Scholar] [CrossRef]

- Zhang, Y.L. The regional disparity of influencing factors of technological innovation in China: Evidence from high-tech industry. Technol. Econ. Dev. Econ. 2021, 27, 811–832. [Google Scholar] [CrossRef]

- Zhao, M.; Sun, T.; Feng, Q. Capital allocation efficiency, technological innovation and vehicle carbon emissions: Evidence from a panel threshold model of Chinese new energy vehicles enterprises. Sci. Total Environ. 2021, 784, 147104. [Google Scholar] [CrossRef] [PubMed]

- Gill, J. The Insignificance of Null Hypothesis Significance Testing. Political Res. Q. 1999, 52, 647–674. [Google Scholar] [CrossRef]

- Mccloskey, D.N.; Ziliak, S. The Cult of Statistical Significance: How the Standard Error Costs Us Jobs, Justice, and Lives; University of Michigan Press: Ann Arbor, MI, USA, 2008. [Google Scholar]

- Zhou, X.; Stephen, T.; Ziliak Deirdre, N. McCloskey: The Cult of Statistical Significance: How the Standard Error Costs Us Jobs, Justice, and Lives. Adm. Sci. Q. 2009, 54, 361–363. [Google Scholar] [CrossRef]

- Dai, X.; Wu, J.; Yan, L. A Spatial Evolutionary Study of Technological Innovation Talents’ Sticky Wages and Technological Innovation Efficiency Based on the Perspective of Sustainable Development. Sustainability 2018, 10, 4201. [Google Scholar] [CrossRef]

- Fonseca, T.; de Faria, P.; Lima, F. Human capital and innovation: The importance of the optimal organizational task structure. Res. Policy 2019, 48, 616–627. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).