The Impact of the Low-Carbon Energy Concept and Green Transition on Corporate Behaviour—A Perspective Based on a Contagion Model

Abstract

1. Introduction

2. Literature Review

2.1. China under the Goal of Carbon Neutrality

2.2. Enterprises under the Goal of Carbon Neutrality

2.3. Herd Effect

2.4. The Significance of the Infectious Disease Model for the Spread of Green Low-Carbon Beliefs

3. Methodology

3.1. Basic Assumptions

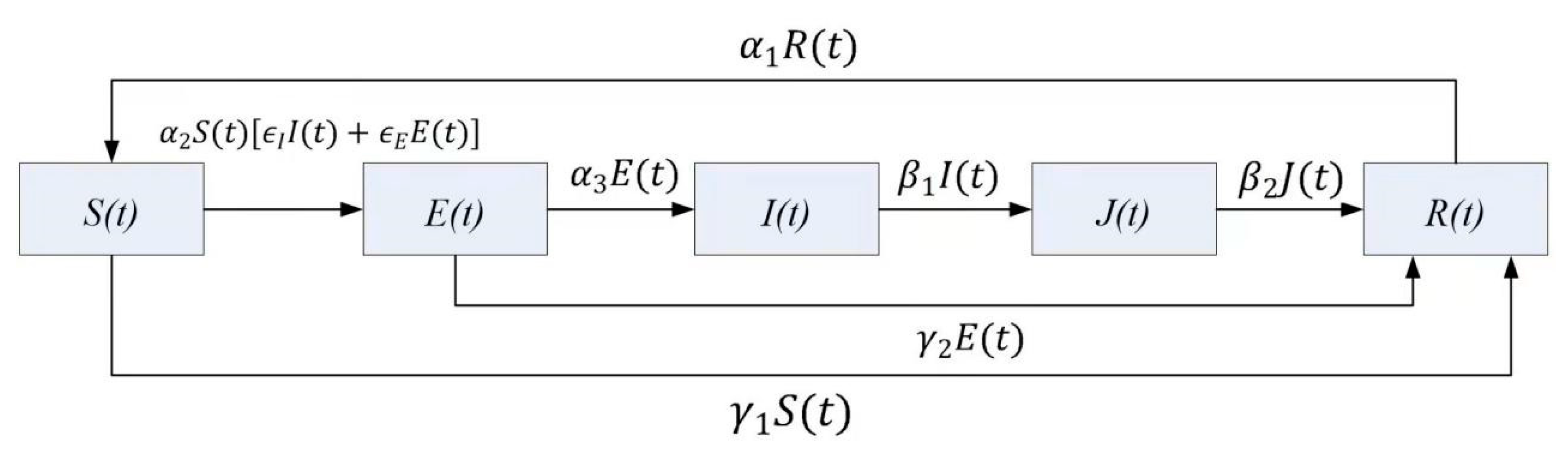

3.2. Model Building

3.3. Model Analysis

4. The Optimal Control Problem

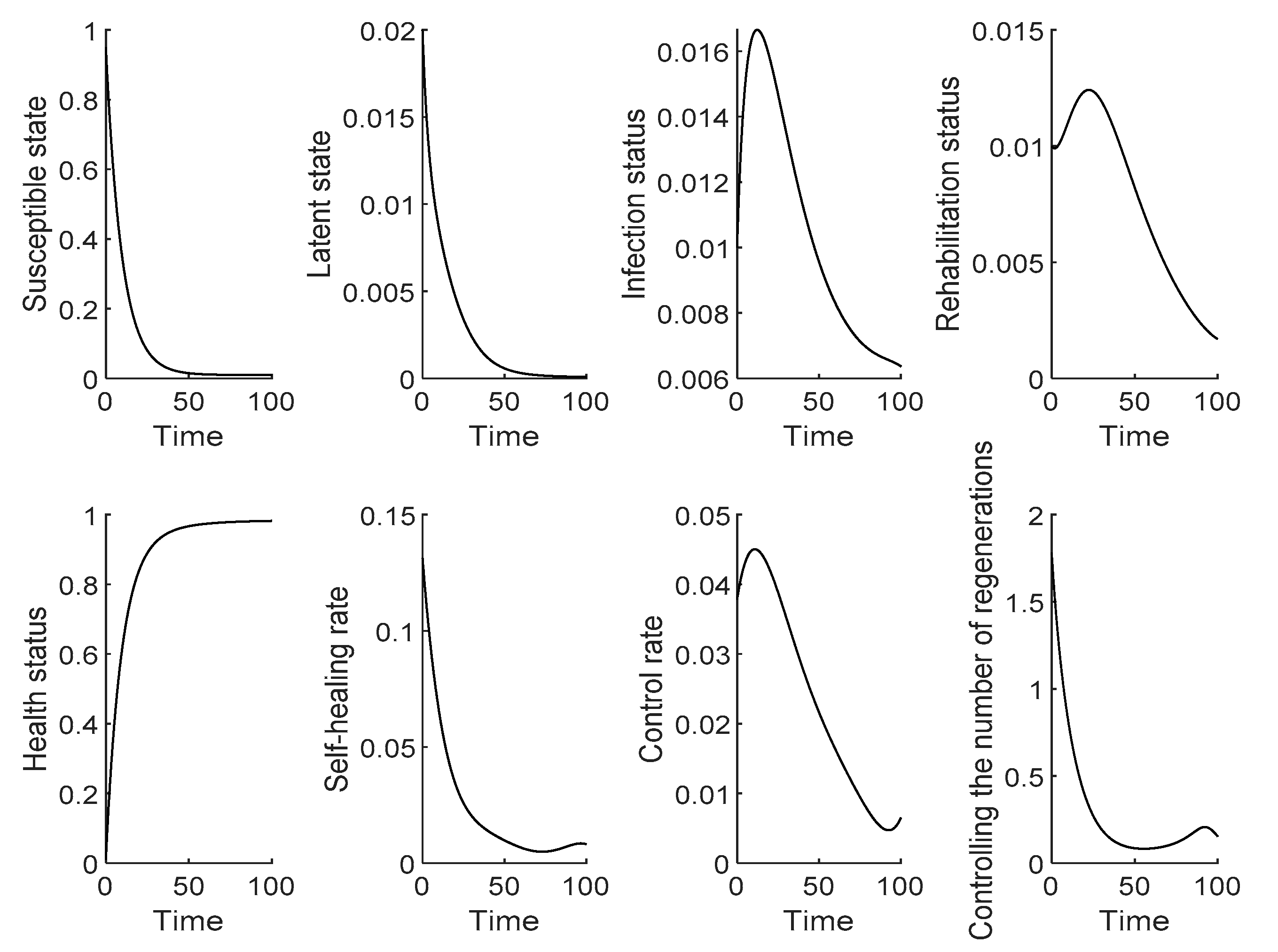

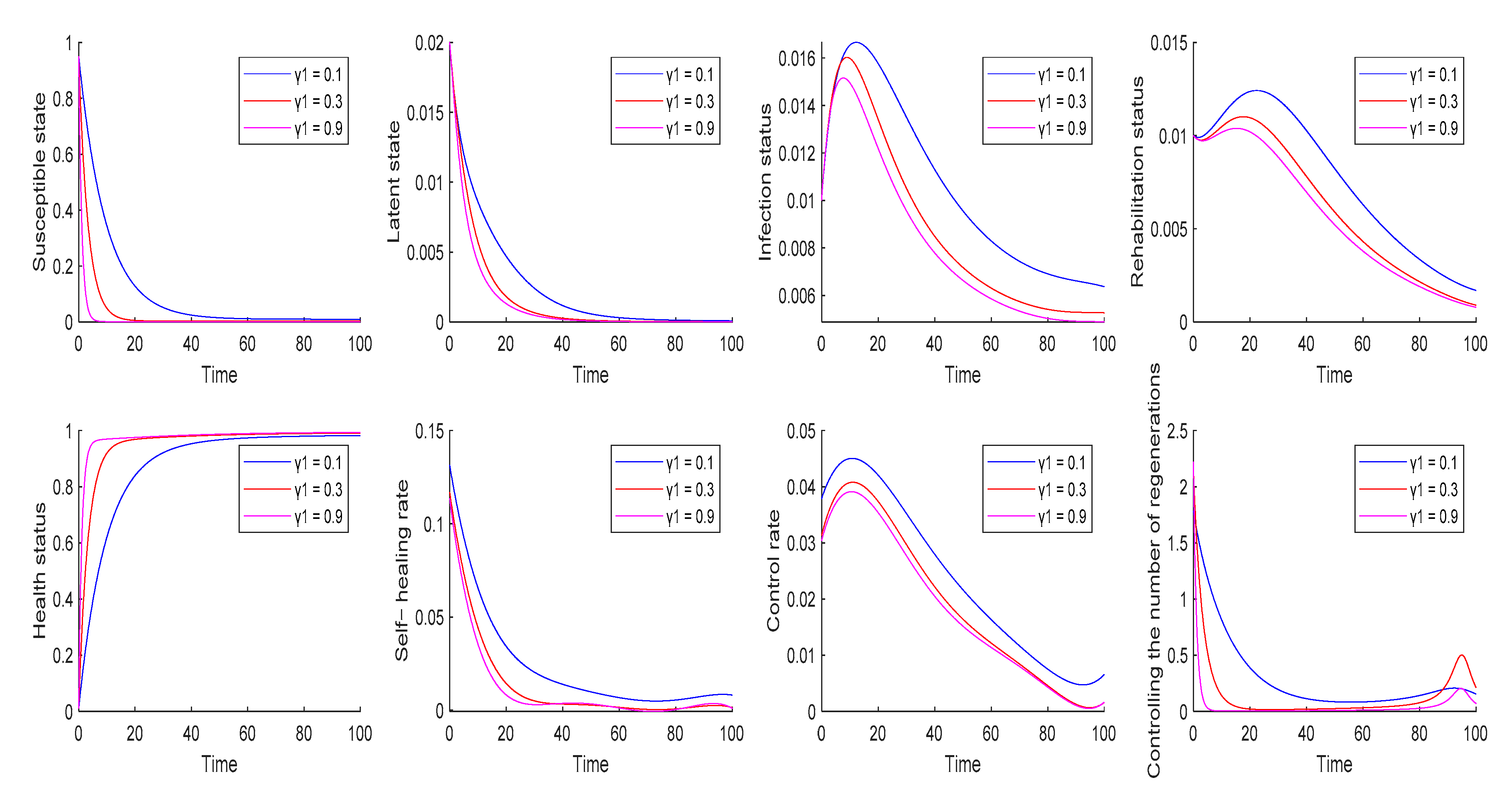

5. The Numerical Simulation

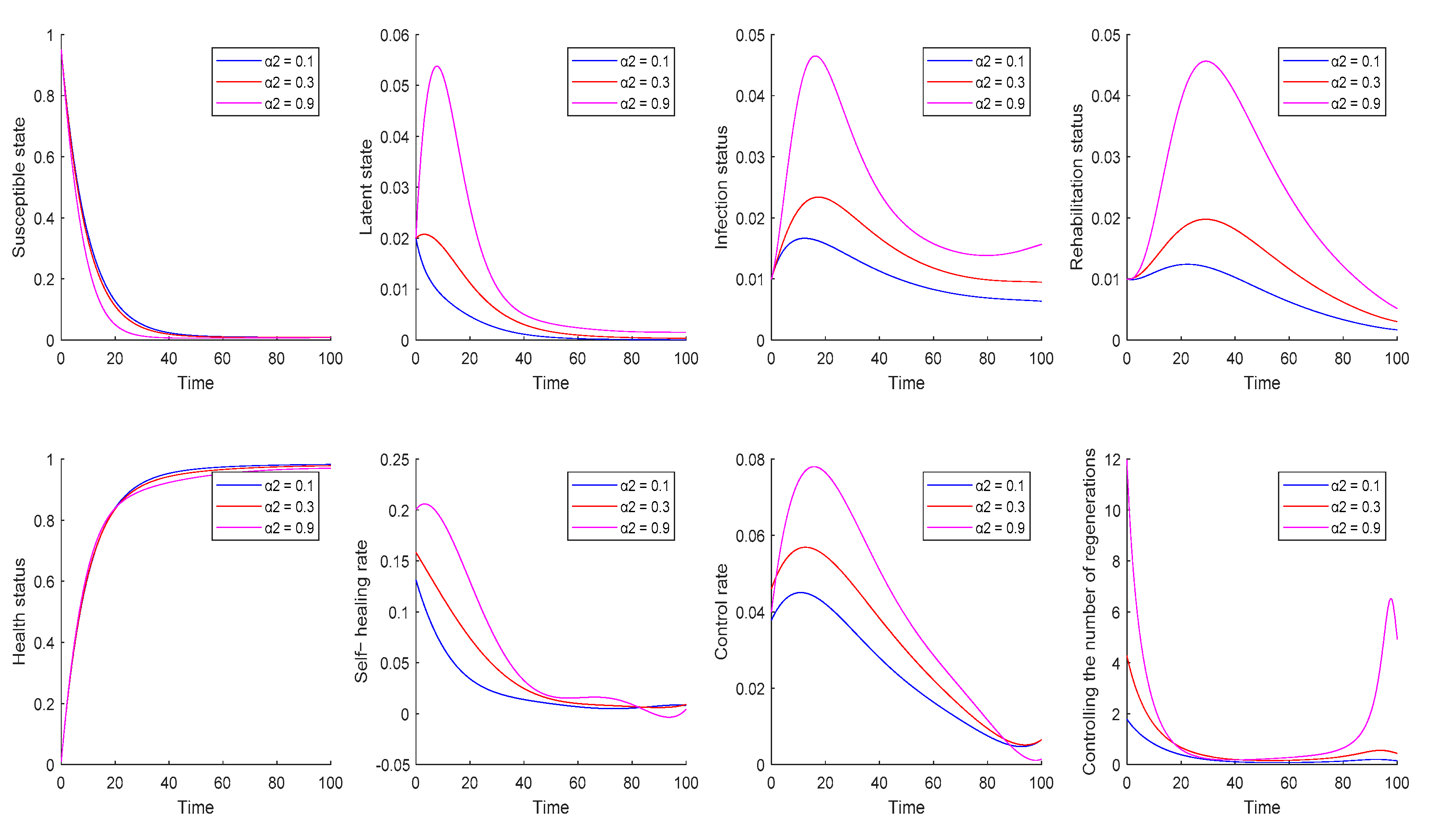

5.1. Influence of Contagion Rate on Optimal Control Strategies

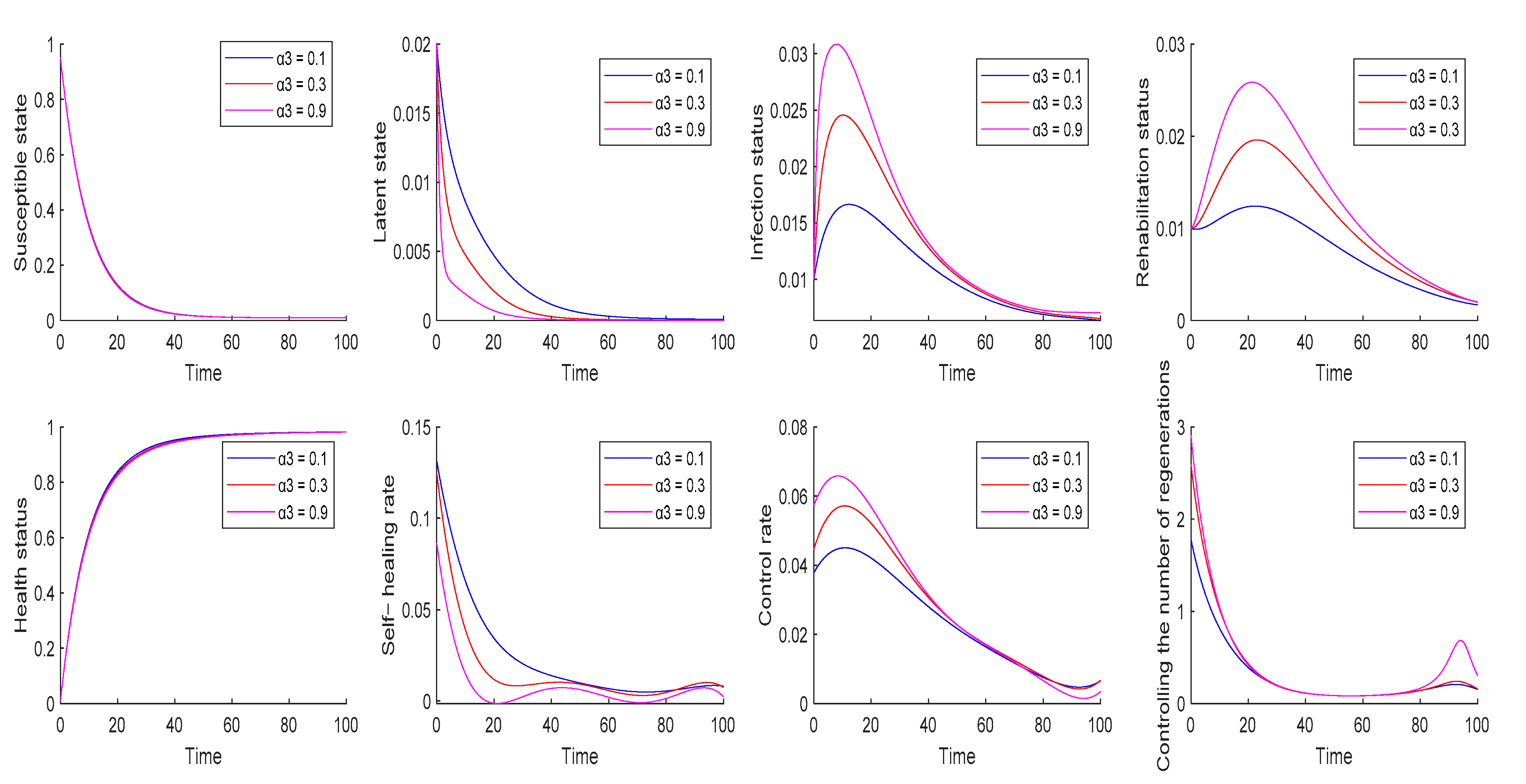

5.2. The Impact of Infection Rates in Latent-State Firms on Optimal Control Strategies

5.3. The Effect of Direct Immunity Rates on Optimal Control Strategies

6. Conclusions and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ciscar, J.-C.; Iglesias, A.; Perry, M.; van Regemorter, D. Agriculture, climate change and the global economy. In Proceedings of the Macroeconomics and Climate Change, Cowles Foundation for Research in Economics, New Haven, CT, USA, 15 March 2012; pp. 11–12. [Google Scholar]

- Carleton, T.A.; Hsiang, S.M. Social and economic impacts of climate. Science 2016, 353, aad9837. [Google Scholar] [CrossRef] [PubMed]

- UNFCCC. Decision 1/CP.21. Available online: https://unfccc.int/files/home/application/pdf/decision1cp21.pdf (accessed on 4 October 2022).

- Levin, K.; Rich, D. Turning Point: Which Countries’ GHG Emissions Have Peaked? Which Will in the Future? Available online: https://www.wri.org/insights/turning-point-which-countries-ghg-emissions-have-peaked-which-will-future?utm_source=miragenews&utm_medium=miragenews&utm_campaign=news (accessed on 4 October 2022).

- Bagchi, B.; Chatterjee, S.; Ghosh, R.; Dandapat, D. Impact of COVID-19 on Global Economy. In Coronavirus Outbreak and the Great Lockdown: Impact on Oil Prices and Major Stock Markets Across the Globe; Bagchi, B., Chatterjee, S., Ghosh, R., Dandapat, D., Eds.; Springer: Singapore, 2020; pp. 15–26. [Google Scholar]

- Tian, J.; Yu, L.; Xue, R.; Zhuang, S.; Shan, Y. Global low-carbon energy transition in the post-COVID-19 era. Appl. Energ. 2022, 307, 118205. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.; Zhou, W.; Liu, M. Driving factors of enterprise energy-saving and emission reduction behaviors. Energy 2022, 256, 124685. [Google Scholar] [CrossRef]

- Li, L.; Wang, J.; Tan, Z.; Ge, X.; Zhang, J.; Yun, X. Policies for eliminating low-efficiency production capacities and improving energy efficiency of energy-intensive industries in China. Renew. Sustain. Energy Rev. 2014, 39, 312–326. [Google Scholar] [CrossRef]

- Ates, S.A.; Durakbasa, N.M. Evaluation of corporate energy management practices of energy intensive industries in Turkey. Energy 2012, 45, 81–91. [Google Scholar] [CrossRef]

- Ea, I. CO2 Emissions from Fuel Combustion: A New Basis for Comparing Emissions of a Major Greenhouse Gas; OECD/IEA: Paris, France, 1997. [Google Scholar]

- Friedlingstein, P.; O’sullivan, M.; Jones, M.W.; Andrew, R.M.; Hauck, J.; Olsen, A.; Zaehle, S. Global carbon budget 2020. Earth Syst. Sci. Data 2020, 12, 3269–3340. [Google Scholar] [CrossRef]

- Mclennan, M. The Global Risks Report 2022; World Economic Forum: Geneva, Switzerland, 2021. [Google Scholar]

- Cheng, M.; Shao, Z.; Yang, C.; Tang, X. Analysis of Coordinated Development of Energy and Environment in China’s Manufacturing Industry under Environmental Regulation: A Comparative Study of Sub-Industries. Sustainability 2019, 11, 6510. [Google Scholar] [CrossRef]

- Wang, T.; Song, Z.; Zhou, J.; Sun, H.; Liu, F. Low-Carbon Transition and Green Innovation: Evidence from Pilot Cities in China. Sustainability 2022, 14, 7264. [Google Scholar] [CrossRef]

- Ramanathan, R. A multi-factor efficiency perspective to the relationships among world GDP, energy consumption and carbon dioxide emissions. Technol. Forecast. Soc. Change 2006, 73, 483–494. [Google Scholar] [CrossRef]

- Bonsu, N.O. Towards a circular and low-carbon economy: Insights from the transitioning to electric vehicles and net zero economy—ScienceDirect. J. Clean. Prod. 2020, 256, 120659. [Google Scholar] [CrossRef]

- Hafeznia, H.; Pourfayaz, F.; Maleki, A. An assessment of Iran’s natural gas potential for transition toward low-carbon economy. Renew. Sust. Energy Rev. 2017, 79, 71–81. [Google Scholar] [CrossRef]

- Tang, W.Q.; Meng, B.; Wu, L.B. The impact of regulatory and financial discrimination on China’s low-carbon development: Considering firm heterogeneity. Adv. Climate Change Res. 2020, 11, 72–84. [Google Scholar] [CrossRef]

- Qian, H.; Xu, S.; Cao, J.; Ren, F.; Wei, W.; Meng, J.; Wu, L. Air pollution reduction and climate co-benefits in China’s industries. Nat. Sust. 2021, 4, 417–425. [Google Scholar] [CrossRef]

- Pinkse, K.J. Business responses to climate change: Identifying emergent strategies. Calif. Manage. Rev. 2005, 47, 6–20. [Google Scholar] [CrossRef]

- Kim, Y. Corporate Responses to Climate Change: The Resource-Based View; Institute for Economy and the Environment: Sankt Gallen, Switzerland, 2008. [Google Scholar]

- Zhou, P.; Wen, W.A. Carbon-constrained firm decisions: From business strategies to operations modeling. Eur. J. Opera. Res. 2020, 281, 1–15. [Google Scholar] [CrossRef]

- Wang, D.; Feng, T.; Lawton, A. Linking ethical leadership with firm performance: A multi-dimensional perspective. J. Bus. Ethics. 2017, 145, 95–109. [Google Scholar] [CrossRef]

- Mi, W.; Zhao, K.; Zhang, P. Spatio-Temporal Evolution and Driving Mechanism of Green Innovation in China. Sustainability 2022, 14, 5121. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. The moderating effects of institutional pressures on emergent green supply chain practices and performance. Int. J. Prod. Res. 2007, 45, 4333–4355. [Google Scholar] [CrossRef]

- Sharma, S. Managerial interpretations and organizational context as predictors of corporate choice of environmental strategy. Acad. Manage. J. 2000, 43, 681–697. [Google Scholar] [CrossRef]

- Banerjee, A.V. A simple model of herd behavior. Q. J. Econ. 1992, 107, 797–817. [Google Scholar] [CrossRef]

- Keynes, J.M. The General Theory of Employment, Interest, and Money; Harcourt Brace and Co.: New York, NY, USA, 1936. [Google Scholar]

- Allen, L.; Bali, T.G.; Tang, Y. Does systemic risk in the financial sector predict future economic downturns? Rev. Financial Stud. 2012, 25, 3000–3036. [Google Scholar] [CrossRef]

- Bikhchandani, S.; Hirshleifer, D.; Welch, I. A theory of fads, fashion, custom, and cultural change as informational cascades. J. Polit. Econ. 1992, 100, 992–1026. [Google Scholar] [CrossRef]

- Manski, C.F. Endogenous social effects: The reflect problem. Rev. Econ. Stud. 1993, 60, 531–542. [Google Scholar] [CrossRef]

- Cha, B.; Oh, S. The relationship between developed equity markets and the Pacific Basin’s emerging equity markets. Int. Rev. Econ. Financ. 2000, 9, 299–322. [Google Scholar] [CrossRef]

- Bae, K.-H.; Karolyi, G.A.; Stulz, R.M. A new approach to measuring financial contagion. Rev. Financ. Stud. 2003, 16, 717–763. [Google Scholar] [CrossRef]

- Kermack, W.O.; McKendrick, A.G. A contribution to the mathematical theory of epidemics. Proc. Royal Soc. 1927, 115, 700–721. [Google Scholar] [CrossRef]

- King, M.A.; Wadhwani, S. Transmission of volatility between stock markets. Rev. Financial Stud. 1990, 3, 5–33. [Google Scholar] [CrossRef]

- May, R.; Levin, S.; Sugihara, G. Ecology for bankers. Nature 2008, 451, 893–894. [Google Scholar] [CrossRef]

- Garas, A.; Argyrakis, P.; Rozenblat, C.; Tomassini, M.; Havlin, S. Worldwide spreading of economic crisis. N. J. Phys. 2010, 12, 113043. [Google Scholar] [CrossRef]

- Zhao, L.; Cui, H.; Qiu, X.; Wang, X.; Wang, J. SIR rumor spreading model in the new media age. Phys. A 2013, 392, 995–1003. [Google Scholar] [CrossRef]

- Ma, Y.; Li, L. Crisis spreading model of the shareholding networks of listed companies and their main holders and their controllability. Complexity 2018, 2018, 1–6946234. [Google Scholar] [CrossRef]

- Chen, T.; Wang, J.; Liu, H.; He, Y. Contagion model on counterparty credit risk in the CRT market by considering the heterogeneity of counterparties and preferential-random mixing attachment. Phys. A 2019, 520, 458–480. [Google Scholar] [CrossRef]

- Qian, Q.; Yang, Y.; Gu, J.; Feng, H. Information authenticity, spreading willingness and credit risk contagion-A dual-layer network perspective. Phys. A 2019, 536, 122519. [Google Scholar] [CrossRef]

| Parameters | Definition |

|---|---|

| Probability of a business returning from a healthy state to a susceptible state | |

| Infection rate | |

| The probability of a business being infected in a latent state | |

| Correction factor relating to transmission from latent-state enterprises | |

| Correction factor related to transmission from infected-state enterprises | |

| The probability of an infected company being controlled | |

| The probability of an infected company being infected | |

| Direct immunisation rate | |

| Self-cure rate |

| Parameter | Parameter Value | Parameter | Parameter Value | Parameter | Parameter Value | Parameter | Parameter Value |

|---|---|---|---|---|---|---|---|

| 0.1 | 0.5 | 0.05 | 0.8 | ||||

| 0.1 | 0.8 | 0.1 | 0.2 | ||||

| 0.1 | 0.4 | 6 | 3 |

| Situation | Optimal Control Strategy |

|---|---|

| Increased transmission rate | Increased self-cure rates and increased control rates |

| Increased infection rates in latent-state businesses | Decrease in self-cure rates and increase in control rates |

| Increased direct immunisation rates | Decrease in both self-cure and control rates |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wen, S.; Cui, W.; Wei, G. The Impact of the Low-Carbon Energy Concept and Green Transition on Corporate Behaviour—A Perspective Based on a Contagion Model. Sustainability 2022, 14, 16600. https://doi.org/10.3390/su142416600

Wen S, Cui W, Wei G. The Impact of the Low-Carbon Energy Concept and Green Transition on Corporate Behaviour—A Perspective Based on a Contagion Model. Sustainability. 2022; 14(24):16600. https://doi.org/10.3390/su142416600

Chicago/Turabian StyleWen, Shuran, Wei Cui, and Guiying Wei. 2022. "The Impact of the Low-Carbon Energy Concept and Green Transition on Corporate Behaviour—A Perspective Based on a Contagion Model" Sustainability 14, no. 24: 16600. https://doi.org/10.3390/su142416600

APA StyleWen, S., Cui, W., & Wei, G. (2022). The Impact of the Low-Carbon Energy Concept and Green Transition on Corporate Behaviour—A Perspective Based on a Contagion Model. Sustainability, 14(24), 16600. https://doi.org/10.3390/su142416600