Measuring Financial Sustainability and Social Adequacy of the Italian NDC Pension System under the COVID-19 Pandemic

Abstract

1. Introduction

- The presence of a fixed contribution rate that stabilizes the weight of pension expenditure on gross domestic product (GDP) between generations;

- The recognition of a rate of return that is adjusted periodically to ensure the financial sustainability of the system;

- The link between the level of initial pension and the residual life expectancy at retirement, which limits the negative effect of longevity risk on the pension balance;

- The recognition of an economic incentive to postpone the moment of retirement by applying an actuarially fair annuity rate.

2. Methodology

2.1. NDC Schemes

- is the total population in the state i at time t, and it is given by , where is the number of lives in state i at age x at time t. The latter depends on the new entrants in state i aged x in year t, and the previous-year population who have survived by time t: for , where is the probability for an individual aged in year to remain in state i for one year (for the equations of new entrants for see [20]. Regarding the unemployed, we assume that , where is the relative age distribution of the new unemployed and is the total new entrants in the unemployed state at time t. We suppose the same relative age distribution for the new unemployed population and the new actives: , and , with depending on the total active population growth rate that equally influences contributors).

- is the contribution rate of the pension system at time t. Note that in an NDC system, the contribution rate is set constant over time: for all t.

- is the average wage at time t, which is given by , where is the total wage at time t, and is the individual wage depending on the growth rate of individual wage from to t, .

- is the average pension paid to retirees in year t. It is given by , where is the amount of total pensions paid to retirees at time t. It is given by , where is the total pensions paid to all retirees aged x at time t, which depends on the pension indexation rate and the total benefits paid to the new retirees in the year t, ( is a function of the notional rate that is the rate of return remunerated on the individual notional account, the expected indexation rate for , and the expected rate of return, for (see [20] for further details)).

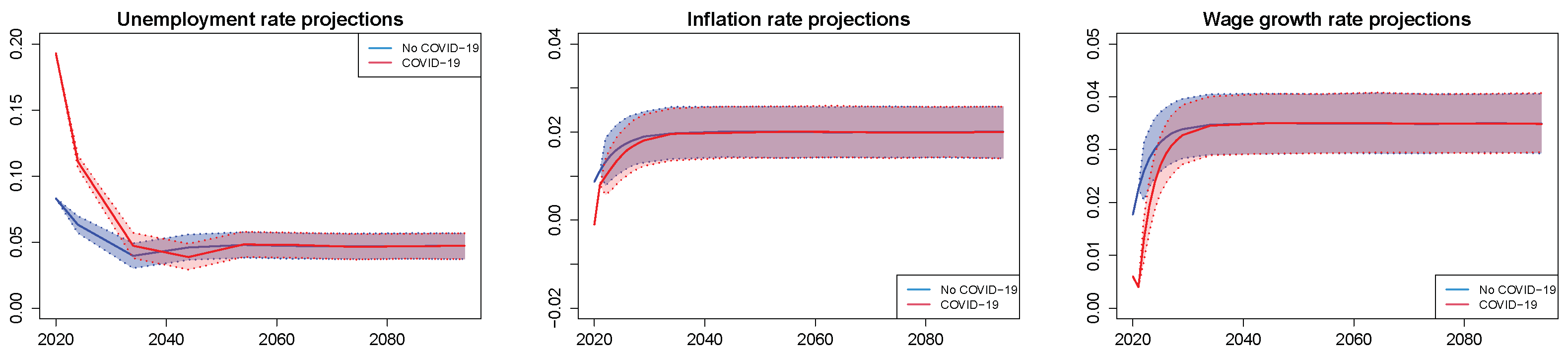

2.2. Macroeconomic Variables Modeling

- The unemployment rate of the male population aged 25–75 in the years 1983–2015; the rates for the residual period (2016–2019) are estimated by regression using the unemployment rate of the male population aged 15–64. These data provide values of .

- The wage growth rate in the years 1983–2015, and the gross contractual hourly remuneration of employees for the last four years, which are used to estimate .

- The consumer price index for blue and white-collar worker households (FOI) in the years 1983–2019, which are used to estimate .

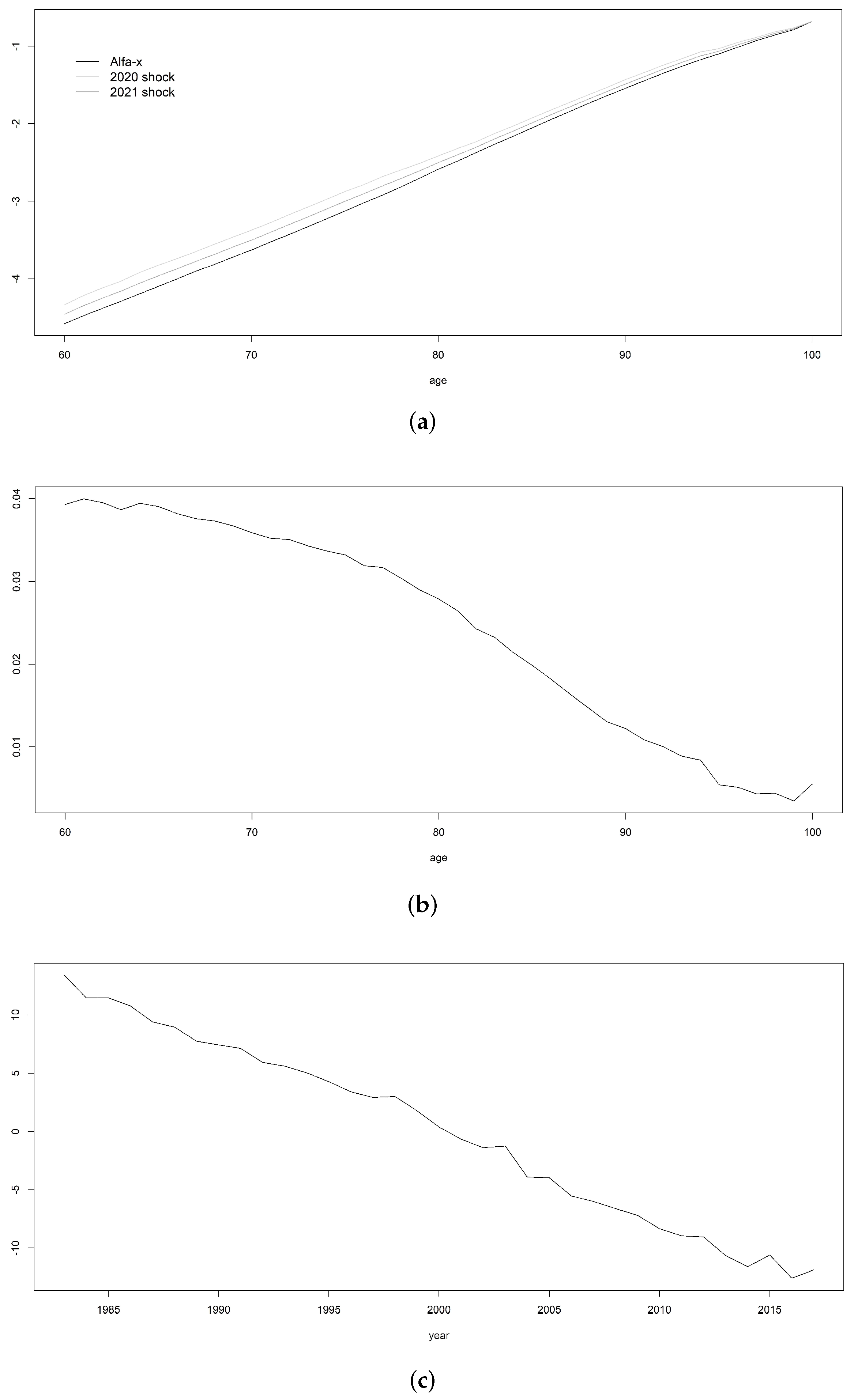

2.3. Mortality Modeling

2.4. The COVID-19 Macroeconomic and Demographic Scenario

3. Numerical Application

3.1. Main Assumptions

- The initial age distribution of both actives and pensioners, the initial wage distribution by age, and the initial pension benefits distribution by age derive from the corresponding observed distribution of the FPLD pension scheme.

- The new actives’ age distribution comes from the observed age distribution of actives with a past service duration of less than 2 years in 2019.

- Analogously for the new unemployed population’s age distribution, , which we supposed to be equal to the new actives’ age distribution.

- and are assumed constant over time.

- , which is the initial active population, includes 1000 males.

- The initial number of pensioners is fixed by the dependency ratio of the FPLD pension scheme, i.e., with .

- We assume that all the actives retire at age 63; therefore, and . Age 63 has been chosen consistently with the average retirement age of Italian employees in 2019.

- We assume that all the unemployed retire at age 63 ( and ).

- We set aside the mortality of the active population due to the characteristics of the Italian NDC scheme that does not consider the distribution of inheritance gains from people who die before the earliest possible retirement age. Hence, for all ages and time.

- We make the same assumption for the unemployed, .

- The death probabilities of pensioners, , are assumed equal to the probabilities for the general Italian population.

- The term in Equation (18) is estimated from the difference between the observed and expected death rates in 2020.

- Coherently with the macroeconomic assumptions of the Ministry of Finance for the long-term projection of the national pension expenditure [45], we suppose that the GDP growth rate equals the sum of the active population’s growth rate, growth rate of labor productivity and inflation rate.

- Following the structure of the Italian pension scheme, the notional rate is set equal to the GDP growth rate, and the pension indexation rate equals the inflation rate .

- As specified in Section 3, to deal with the influence of COVID-19 on the Italian system, we include a shock in and on the inflation rate , the wage growth rate , and the unemployment rate .

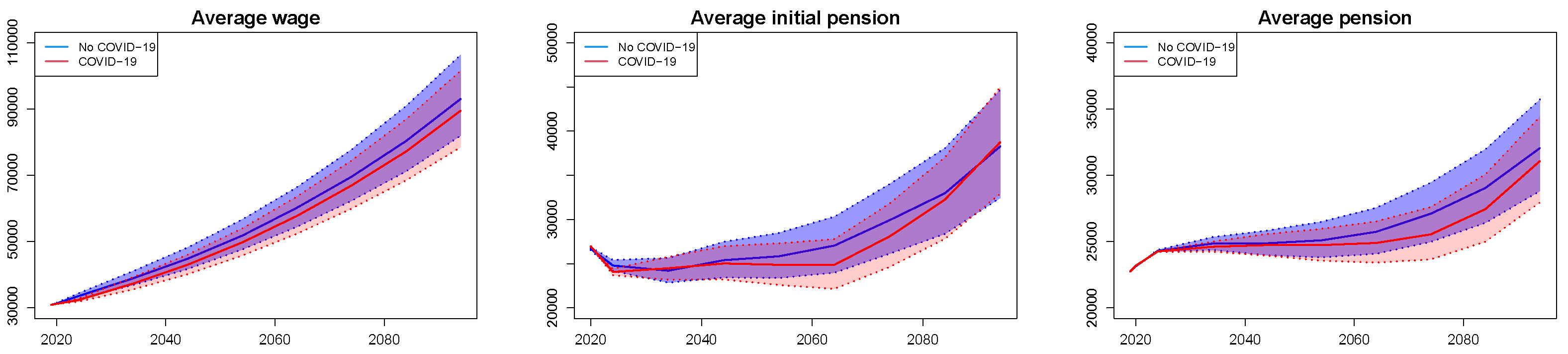

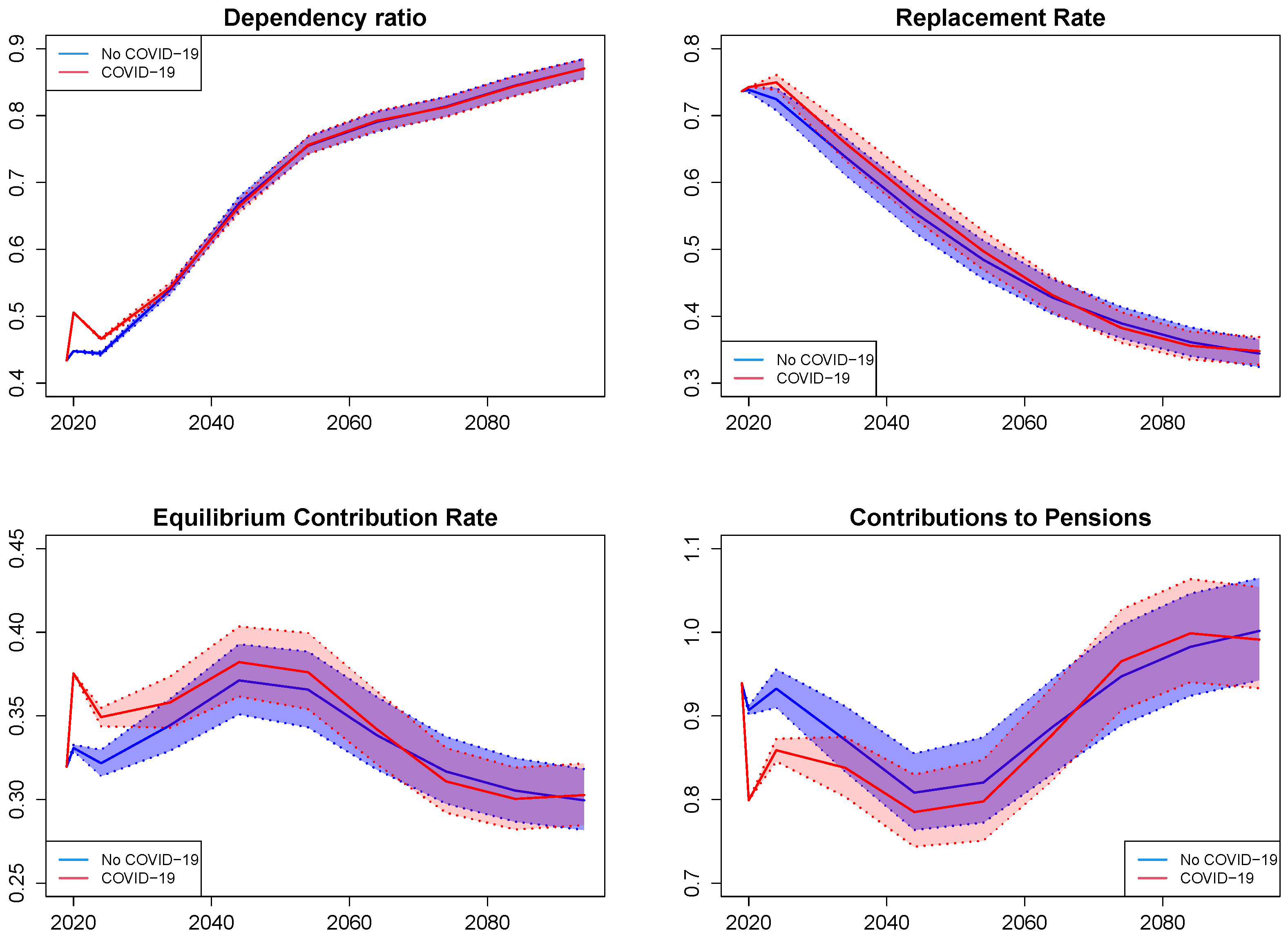

3.2. Baseline Results with and without COVID-19

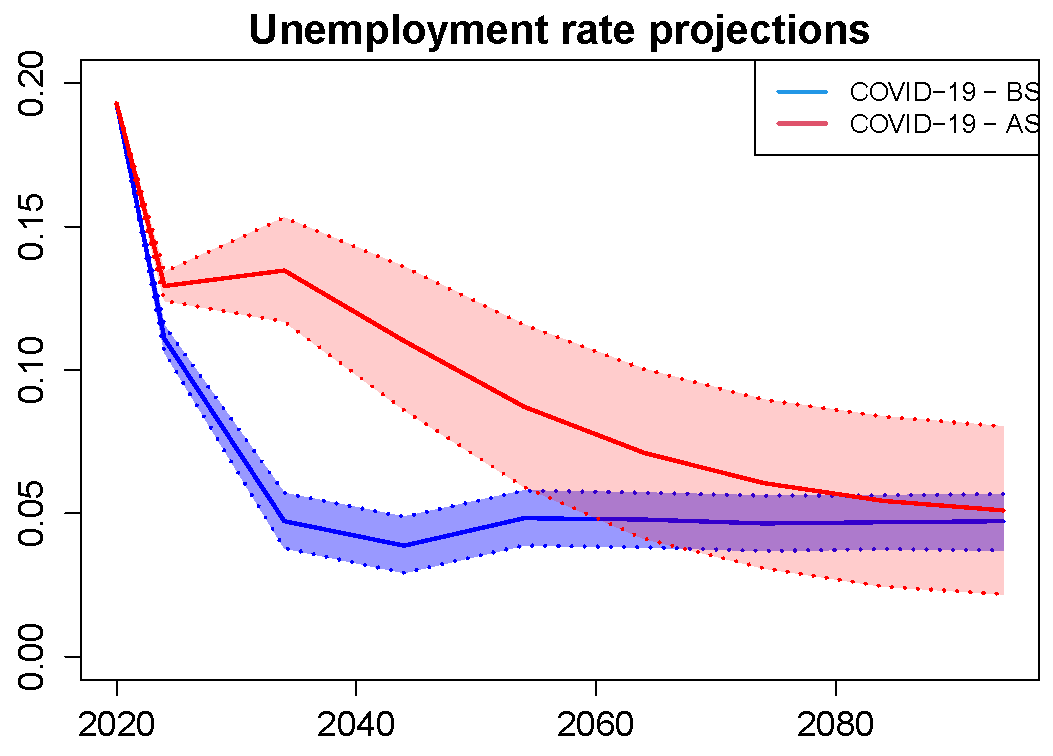

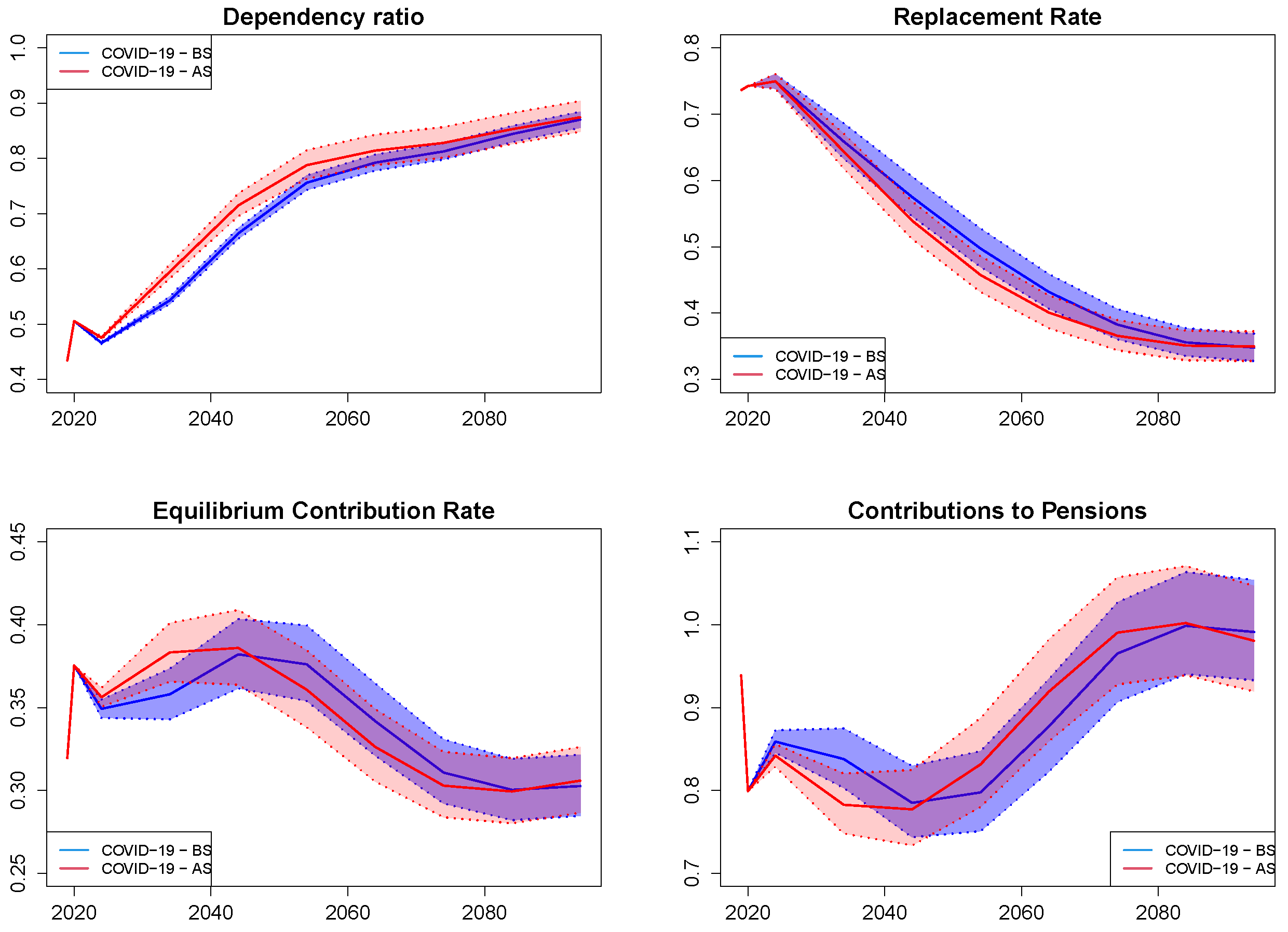

3.3. Unemployment Rate Sensitivity Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

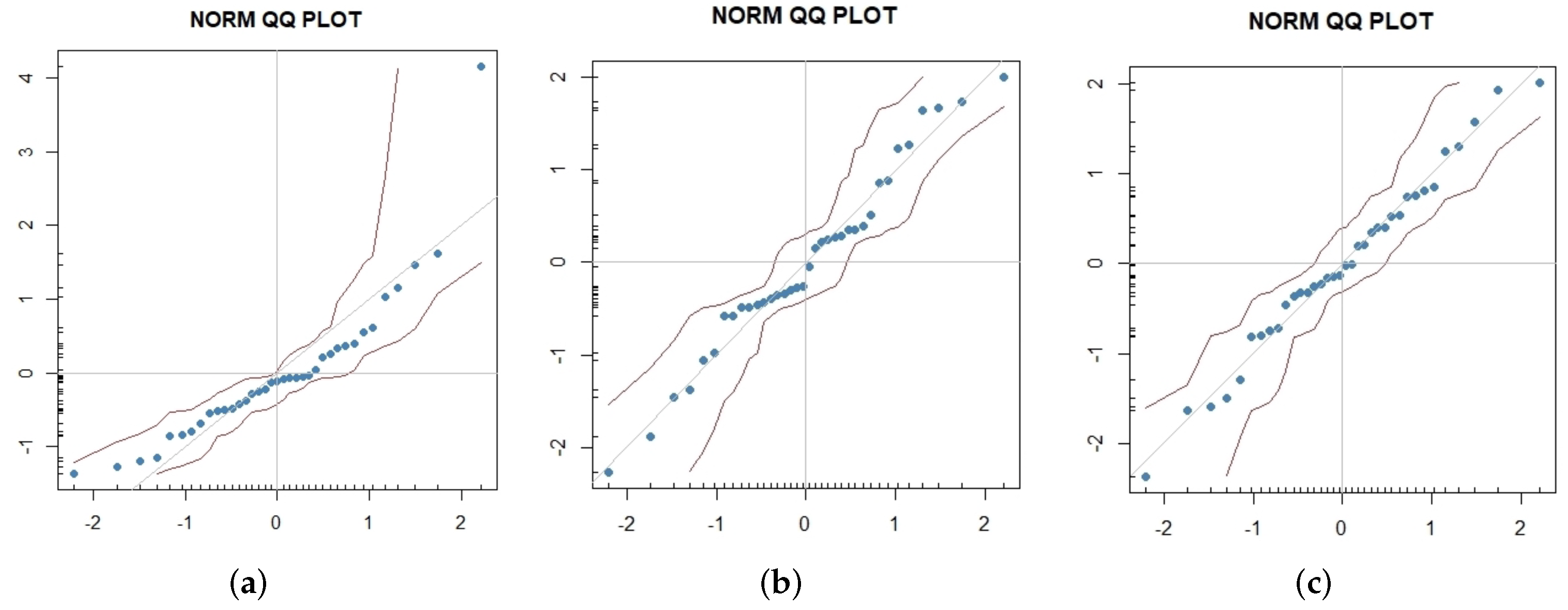

Appendix A.1

| ARMA(1,1) | AR(2) | AR(4) | |

|---|---|---|---|

| AIC | 51.087 | 55.624 | 50.442 |

| LLR p-value | 0.0101 * | ||

| Estimate | Std. Error | z Value | Pr (>|z|) | |

|---|---|---|---|---|

| AR(1) | 1.88591 | 0.14714 | 12.8176 | <2.2 *** |

| AR(2) | −1.52345 | 0.30476 | −4.9989 | 5.767 *** |

| AR(3) | 0.99499 | 0.30350 | 3.2784 | 0.0010439 ** |

| AR(4) | −0.41209 | 0.15188 | −2.7133 | 0.0066611 ** |

Appendix A.2

References

- WHO. Virtual Press Conference on COVID-19. 11 March 2020. Available online: https://www.who.int/docs/default-source/coronaviruse/transcripts/who-audioemergencies-coronavirus-press-conference-fulland-final-11mar2020.pdf?sfvrsn=cb432bb3_2 (accessed on 20 March 2020).

- Feher, C.; de Bidegain, I. Pension Schemes in the COVID-19 Crisis: Impact and Policy Considerations. Special Series on COVID-19. International Monetary Fund, Fiscal Affairs. 2020. Available online: https://www.imf.org/en/Publications/SPROLLs/covid19-special-notes (accessed on 12 October 2022).

- Biggs, A.G. How the COVID-19 pandemic could reduce near-retirees’ Social Security benefits. J. Pension Econ. Financ. 2021, 20, 1–8. [Google Scholar] [CrossRef]

- OECD. Retirement savings and old-age pensions in the time of COVID-19. In OECD Pensions Outlook 2020; OECD Publishing: Paris, France, 2020. [Google Scholar]

- Rust, S. Macron Suspends Pension Reform Given Coronavirus Demands. 17 March 2020. Investment and Pensions Europe (IPE). 2020. Available online: https://www.ipe.com/news/macron-suspends-pension-reform-given-coronavirus-demands/10044357.article (accessed on 12 October 2022).

- Sutcliffe, C. The implications of the COVID-19 pandemic for pensions. In A New World Post COVID-19: Lessons for Business, the Finance Industry and Policy Makers; Billio, M., Varotto, S., Eds.; Ca’ Foscari University Press: Venice, Italy, 2020; pp. 235–244. [Google Scholar]

- Mitchell, O. Building Better Retirement Systems in the Wake of the Global Pandemic; NBER Working Paper No. 27261; NBER: Cambridge, MA, USA, 2020. [Google Scholar]

- Natali, D. Pensions in the Age of COVID-19: Recent Changes and Future Challenges. ETUI Research Paper—Policy Brief 13/2020, 12 November 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3729359 (accessed on 12 October 2022).

- Grech, A.G. What Makes Pension Reforms Sustainable? Sustainability 2018, 10, 2891. [Google Scholar] [CrossRef]

- European Commission. European Economic Forecast. Autumn 2020; European Economy Institutional Paper 136; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- American Academy of Actuaries. Impact of COVID-19 on Pension Plan Actuarial Experience and Assumptions, Including Mortality. Issue Brief, September 2020. Available online: https://www.actuary.org/node/13887 (accessed on 12 October 2022).

- Cairns, A.J.G.; Blake, D.; Kessler, A.R.; Kessler, M. The Impact of COVID-19 on Future Higher-Age Mortality. The Pensions Institute, Cass Business School. May 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3606988 (accessed on 12 October 2022).

- Palmer, E. What’s ndc? In Pension Reform: Issues and Prospects for Non-Financial Defined Contribution (NDC) Schemes; Holzmann, R., Palmer, E., Eds.; The World Bank: Washington, DC, USA, 2006; Chapter 2; pp. 17–35. [Google Scholar]

- Holzmann, R. The ABCs of nonfinancial defined contribution (NDC) schemes. Int. Soc. Secur. Rev. 2017, 70, 53–77. [Google Scholar] [CrossRef]

- Izekenova, A.K.; Rakhmatullina, A.T.; Izekenova, A.K.; Tolegenova, A.; Yermekbayeva, D.D. Impact of COVID-19 on Ageing and Retirement System: Key Policy Considerations. Econ. Strategy Pract. 2021, 16, 167–176. [Google Scholar] [CrossRef]

- Lörincz, A. Forecasts regarding on the sustainability of the Romanian pension system. In Challenges in the Carpathian Basin; Sapientia-Hungarian University of Transylvania: Cluj-Napoca, Romania, 2021; pp. 335–348. ISBN 978-973-53-2752-1. [Google Scholar]

- Mielczarek, B. A Simulation Study of the Delayed Effect of COVID-19 Pandemic on Pensions and Welfare of the Elderly: Evidence from Poland. In Computational Science—ICCS 2022; Lecture Notes in Computer, Science; Groen, D., de Mulatier, C., Paszynski, M., Krzhizhanovskaya, V.V., Dongarra, J.J., Sloot, P.M.A., Eds.; Springer: Cham, Switzerland, 2022; Volume 13352. [Google Scholar]

- Olivera, J.; Valderrama, J. The Impact of the COVID-19 Pandemic on the Future Pensions of the Peruvian Pension System. IADB: Inter-American Development Bank. 2022. Available online: https://policycommons.net/artifacts/3136512/the-impact-of-the-covid-19-pandemic-on-the-future-pensions-of-the-peruvian-pension-system/3929803/ (accessed on 10 November 2022).

- Chlon-Dominczak, A.; Franco, D.; Palmer, E. The first wave of NDC reforms: The experiences of Italy, Latvia, Poland and Sweden. In NDC Pension Schemes in a Changing Pension World. Volume 1: Progress, Lessons, and Implementation; Holzmann, R., Palmer, E., Robalino, D., Eds.; World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Devolder, P.; Levantesi, S.; Menzietti, M. Automatic Balance Mechanisms for Notional Defined Contribution pension systems guaranteeing social adequacy and financial sustainability: An application to the Italian pension system. Ann. Oper. Res. 2021, 299, 765–795. [Google Scholar] [CrossRef]

- He, L.; Liang, Z.; Song, Y.; Ye, Q. Optimal contribution rate of PAYGO pension. Scand. Actuar. J. 2021, 6, 505–531. [Google Scholar] [CrossRef]

- Godinez-Olivares, H.; Boado-Penas, M.C.; Haberman, S. Optimal strategies for pay-as-you-go finance: A sustainability framework. Insur. Math. Econ. 2016, 69, 117–126. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Terry, S.J. COVID-Induced Economic Uncertainty; NBER Working Paper No. 26983; NBER: Cambridge, MA, USA, 2020. [Google Scholar]

- Foroni, C.; Marcellino, M.; Stevanović, D. Forecasting the COVID-19 recession and recovery: Lessons from the financial crisis. Int. J. Forecast. 2022, 38, 596–612. [Google Scholar] [CrossRef]

- Choi, S.-Y. Analysis of stock market efficiency during crisis periods in the US stock market: Differences between the global financial crisis and COVID-19 pandemic. Phys. A 2021, 574, 125988. [Google Scholar] [CrossRef]

- Li, Z.; Farmanesh, P.; Kirikkaleli, D.; Itani, R. A comparative analysis of COVID-19 and global financial crises: Evidence from US economy. Econ.-Res.-Ekon. Istraživanja 2021, 35, 2427–2441. [Google Scholar] [CrossRef]

- Montgomery, A.L.; Zarnowitz, V.; Tsay, R.S.; Tiao, G.C. Forecasting the U.S. Unemployment Rate. J. Am. Stat. Assoc. 1998, 93, 478–493. [Google Scholar] [CrossRef]

- Lee, R.; Anderson, M.W.; Tuljapurkar, S. Stochastic Forecasts of the Social Security Trust Fund. Report Prepared for the Social Security Administration; Working Paper 2003-043; Michigan Retirement Research Center: Ann Arbor, MI, USA, 2003. [Google Scholar]

- Marcellino, M.; Stock, J.H.; Watson, M.W. Macroeconomic forecasting in the Euro area: Country specific versus area-wide information. Eur. Econ. Rev. 2003, 47, 1–18. [Google Scholar] [CrossRef]

- Hubrich, K. Forecasting euro area inflation: Does aggregating forecasts by HICP component improve forecast accuracy? Int. J. Forecast. 2005, 21, 119–136. [Google Scholar] [CrossRef]

- Lack, C. Forecasting Swiss Inflation Using VAR Models; Economic Studies 2; Swiss National Bank: Zurich, Switzerland, 2006. [Google Scholar]

- Moser, G.; Rumler, F.; Scharler, J. Forecasting Austrian inflation. Econ. Model. 2007, 24, 470–480. [Google Scholar] [CrossRef]

- Marcellino, M.; Stock, J.H.; Watson, M.W. A comparison of direct and iterated multistep AR methods for forecasting macroeconomic time series. J. Econom. 2006, 135, 499–526. [Google Scholar] [CrossRef]

- Kishor, N.K.; Koenig, E.F. VAR estimation and forecasting when data are subject to revision. J. Bus. Econ. Stat. 2012, 30, 181–190. [Google Scholar] [CrossRef]

- D’Agostino, A.; Gambetti, L.; Giannone, D. Macroeconomic forecasting and structural change. J. Appl. Econom. 2013, 28, 82–101. [Google Scholar] [CrossRef]

- Naccarato, A.; Falorsi, S.; Loriga, S.; Pierini, A. Combining official and Google Trends data to forecast the Italian youth unemployment rate. Technol. Forecast. Soc. Chang. 2018, 130, 114–122. [Google Scholar] [CrossRef]

- Teräsvirta, T.; Van Dijk, D.; Medeiros, M.C. Linear models, smooth transition autoregressions, and neural networks for forecasting macroeconomic time series: A re-examination. Int. J. Forecast. 2005, 21, 755–774. [Google Scholar] [CrossRef]

- Ahmad, M.; Khan, M.A.; Jiang, C.; Kazmi, S.J.H.; Abbas, S.Z. The impact of COVID-19 on unemployment rate: An intelligent based unemployment rate prediction in selected countries of Europe. Int. J. Financ. Econ. 2021, 1–16. [Google Scholar] [CrossRef]

- Lai, H.; Khan, Y.A.; Thaljaoui, A.; Chammam, W.; Abbas, S.Z. COVID-19 pandemic and unemployment rate: A hybrid unemployment rate prediction approach for developed and developing countries of Asia. Soft Comput. 2021, 1–16. [Google Scholar] [CrossRef]

- Šestanović, T.; Arnerić, J. Neural network structure identification in inflation forecasting. J. Forecast. 2021, 40, 62–79. [Google Scholar] [CrossRef]

- Lee, R.; Tuljapurkar, S. Stochastic forecasts for social security. In Frontiers in the Economics of Aging; National Bureau of Economic Research: Cambridge, MA, USA, 1998; pp. 393–428. [Google Scholar]

- Belloni, M.; Maccheroni, C. Actuarial Fairness When Longevity Increases: An Evaluation of the Italian Pension System. Geneva Pap. Risk Insur. Issues Pract. 2013, 38, 638–674. [Google Scholar] [CrossRef]

- Zhao, Y.; Bai, M.; Liu, Y.; Hao, J. Quantitative Analyses of Transition Pension Liabilities and Solvency Sustainability in China. Sustainability 2017, 9, 2252. [Google Scholar] [CrossRef]

- Bisetti, E.; Favero, A. Measuring the Impact of Longevity Risk on Pension Systems: The Case of Italy. N. Am. Actuar. J. 2014, 18, 87–103. [Google Scholar] [CrossRef]

- Ragioneria Generale dello Stato (RGS). Mid-Long Term Trends for the Pension, Health and Long Term Care Systems 2020; Update of the Report n. 21; Ragioneria Generale dello Stato (RGS): Rome, Italy, 2020.

- Lee, R.; Carter, L.R. Modeling and forecasting U.S. mortality. J. Am. Stat. Assoc. 1992, 87, 659–675. [Google Scholar] [CrossRef]

- Cox, S.H.; Lin, Y.; Wang, S. Multivariate exponential tilting and pricing implications for mortality securitization. J. Risk Insur. 2006, 73, 113–136. [Google Scholar] [CrossRef]

- Chen, H.; Cox, S.H. Modeling mortality with jumps: Application to mortality securitization. J. Risk Insur. 2009, 76, 727–751. [Google Scholar] [CrossRef]

- Deng, Y.; Brockett, P.L.; MacMinn, R.D. Longevity/mortality risk modeling and securities pricing. J. Risk Insur. 2012, 79, 697–721. [Google Scholar] [CrossRef]

- Özen, S.; Şahin, Ş. Transitory Mortality Jump Modeling with Renewal Process and Its Impact on Pricing of Catastrophic Bonds. J. Comput. Appl. Math. 2020, 376, 112829. [Google Scholar] [CrossRef]

- Cox, S.H.; Lin, Y.; Pedersen, H. Mortality risk modeling: Applications to insurance securitization. Insur. Math. Econ. 2010, 46, 242–253. [Google Scholar] [CrossRef]

- Liu, Y.; Li, J.S.H. The age pattern of transitory mortality jumps and its impact on the pricing of catastrophic mortality bonds. Insur. Math. Econ. 2015, 64, 135–150. [Google Scholar] [CrossRef]

- HMD. Human Mortality Database. Max Planck Institute for Demographic Research (Germany), University of California, Berkeley (USA), and French Institute for Demographic Studies (France). Available online: www.mortality.org (accessed on 31 October 2022).

- Heckman, J.; Robb, R. Using longitudinal data to estimate age, period and cohort effects in earnings equations. In Cohort Analysis in Social Research: Beyond the Identification Problem; Mason, W., Fienberg, S., Eds.; Springer: New York, NY, USA, 1985. [Google Scholar]

- Kapteyn, A.; Alessie, R.; Lusardi, A. Explaining the wealth holdings of different cohorts: Productivity growth and Social Security. Eur. Econ. Rev. 2005, 49, 1361–1391. [Google Scholar] [CrossRef]

- Blake, D.; Mayhew, L. On the Sustainability of the UK State Pension System in the Light of Population Ageing and Declining Fertility. Econ. J. 2006, 116, 286–305. [Google Scholar] [CrossRef]

- European Commission. European Economic Forecast, Winter 2021; Institutional Paper 144; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- Istituto Nazionale di Statistica (ISTAT). Le Prospettive per l’Economia Italiana nel 2020–2021; Istituto Nazionale di Statistica (ISTAT): Rome, Italy, 2020.

- Banca d’Italia. Proiezioni Macroeconomiche per l’Economia Italiana, 11 Dicembre 2020; Banca d’Italia: Rome, Italy, 2020. [Google Scholar]

- Gronchi, S.; Nisticò, S. Theoretical Foundations of Pay-as-You-Go Defined-Contribution Pension Schemes. Metroeconomica 2008, 50, 131–159. [Google Scholar] [CrossRef]

| Year | 2019 | 2020 | 2024 | 2034 | 2044 | 2054 | 2064 | 2074 | 2084 | 2094 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DR | No COVID-19 | 0.434 | 0.448 | 0.444 | 0.539 | 0.669 | 0.755 | 0.791 | 0.813 | 0.845 | 0.870 |

| COVID-19 | 0.506 | 0.466 | 0.543 | 0.664 | 0.756 | 0.792 | 0.813 | 0.844 | 0.870 | ||

| COVID-19 | 12.9% | 4.9% | 0.7% | −0.7% | 0.1% | 0.2% | −0.1% | −0.1% | 0.0% | ||

| RR | No COVID-19 | 0.736 | 0.738 | 0.724 | 0.639 | 0.556 | 0.485 | 0.429 | 0.390 | 0.362 | 0.345 |

| COVID-19 | 0.743 | 0.750 | 0.659 | 0.576 | 0.498 | 0.432 | 0.383 | 0.356 | 0.348 | ||

| COVID-19 | 0.5% | 3.5% | 3.2% | 3.6% | 2.7% | 0.8% | −1.8% | −1.6% | 1.0% | ||

| ECR | No COVID-19 | 0.320 | 0.331 | 0.322 | 0.345 | 0.372 | 0.366 | 0.339 | 0.317 | 0.305 | 0.300 |

| COVID-19 | 0.375 | 0.349 | 0.358 | 0.382 | 0.376 | 0.342 | 0.311 | 0.301 | 0.303 | ||

| COVID-19 | 13.5% | 8.6% | 3.9% | 2.9% | 2.9% | 1.0% | −1.9% | −1.6% | 1.1% | ||

| CP | No COVID-19 | 0.939 | 0.907 | 0.933 | 0.872 | 0.809 | 0.822 | 0.887 | 0.948 | 0.984 | 1.003 |

| COVID-19 | 0.799 | 0.859 | 0.839 | 0.786 | 0.799 | 0.878 | 0.966 | 1.001 | 0.993 | ||

| COVID-19 | −11.9% | −7.9% | −3.8% | −2.9% | −2.8% | −1.0% | 2.0% | 1.6% | −1.0% | ||

| Scenario | ||

|---|---|---|

| No COVID-19 | −1,028,956,271 | −1,529,673,097 |

| COVID-19 | −1,160,895,524 | −1,620,110,175 |

| COVID-19 | −131,939,253 | −90,437,078 |

| Year | 2019 | 2020 | 2024 | 2034 | 2044 | 2054 | 2064 | 2074 | 2084 | 2094 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DR | COVID-19—BS | 0.434 | 0.506 | 0.466 | 0.543 | 0.664 | 0.756 | 0.792 | 0.813 | 0.844 | 0.870 |

| COVID-19—AS | 0.506 | 0.475 | 0.595 | 0.715 | 0.788 | 0.815 | 0.829 | 0.854 | 0.875 | ||

| AS | 0.0% | 2.0% | 9.6% | 7.7% | 4.3% | 2.8% | 2.0% | 1.1% | 0.6% | ||

| RR | COVID-19—BS | 0.736 | 0.743 | 0.750 | 0.659 | 0.576 | 0.498 | 0.432 | 0.383 | 0.356 | 0.348 |

| COVID-19—AS | 0.743 | 0.750 | 0.644 | 0.540 | 0.458 | 0.401 | 0.366 | 0.351 | 0.350 | ||

| AS | 0.0% | 0.0% | −2.3% | −6.2% | −8.0% | −7.1% | −4.4% | −1.4% | 0.5% | ||

| ECR | COVID-19—BS | 0.320 | 0.375 | 0.349 | 0.358 | 0.382 | 0.376 | 0.342 | 0.311 | 0.301 | 0.303 |

| COVID-19—AS | 0.375 | 0.356 | 0.383 | 0.386 | 0.361 | 0.327 | 0.303 | 0.300 | 0.306 | ||

| AS | 0.0% | 2.0% | 7.1% | 1.0% | −4.1% | −4.5% | −2.5% | −0.3% | 1.1% | ||

| CP | COVID-19—BS | 0.939 | 0.799 | 0.859 | 0.839 | 0.786 | 0.799 | 0.878 | 0.966 | 1.001 | 0.993 |

| COVID-19—AS | 0.799 | 0.842 | 0.783 | 0.778 | 0.833 | 0.920 | 0.992 | 1.004 | 0.982 | ||

| AS | 0.0% | −2.0% | −6.6% | −1.0% | 4.3% | 4.8% | 2.6% | 0.3% | −1.0% | ||

| Scenario | ||

|---|---|---|

| COVID-19—BS | −1,160,895,524 | −1,620,110,175 |

| COVID-19—AS | −1,146,928,808 | −1,600,542,927 |

| AS | −13,966,716 | −19,567,248 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fratoni, L.; Levantesi, S.; Menzietti, M. Measuring Financial Sustainability and Social Adequacy of the Italian NDC Pension System under the COVID-19 Pandemic. Sustainability 2022, 14, 16274. https://doi.org/10.3390/su142316274

Fratoni L, Levantesi S, Menzietti M. Measuring Financial Sustainability and Social Adequacy of the Italian NDC Pension System under the COVID-19 Pandemic. Sustainability. 2022; 14(23):16274. https://doi.org/10.3390/su142316274

Chicago/Turabian StyleFratoni, Lorenzo, Susanna Levantesi, and Massimiliano Menzietti. 2022. "Measuring Financial Sustainability and Social Adequacy of the Italian NDC Pension System under the COVID-19 Pandemic" Sustainability 14, no. 23: 16274. https://doi.org/10.3390/su142316274

APA StyleFratoni, L., Levantesi, S., & Menzietti, M. (2022). Measuring Financial Sustainability and Social Adequacy of the Italian NDC Pension System under the COVID-19 Pandemic. Sustainability, 14(23), 16274. https://doi.org/10.3390/su142316274