Green Credit Policy and Enterprise Green M&As: An Empirical Test from China

Abstract

1. Introduction

2. Literature Review and Research Hypotheses

2.1. Literature Review

2.1.1. Implementation Effect of Green Credit Policy

2.1.2. Influence Factors and Economic Consequences of Green M&As

2.2. Research Hypotheses

2.2.1. Green Credit Policy and Enterprise Green M&As

2.2.2. The Heterogeneity of Green Technology Innovation Capability

2.2.3. Heterogeneity of the Level of Marketization in the Location of the Enterprise

3. Empirical Design

3.1. Data Sources

- Kept the sample of the listed company as the acquirer;

- Removed the samples whose transactions failed;

- Excluded the samples whose M&A type is divestiture, asset replacement, debt restructuring or share repurchase;

- Excluded samples whose acquisition target is not equity;

- Excluded samples with an equity acquisition amount less than CNY 1 million or an equity acquisition proportion less than 30%;

- Excluded samples that held more than 30% of the equity of the target before the acquisition; and

- For multiple M&A transactions initiated by the same enterprise in the same year, those with the same subject matter were merged, whereas those with different subject matter only retained the transaction sample with the largest transaction amount.

3.2. Variable Definition

3.2.1. Definition and Judgment Method of Green M&As

3.2.2. Definition of Control Variables

3.3. Econometric Model

3.4. Descriptive Statistics

4. Empirical Results

4.1. The Impact of Green Credit Policy on Enterprise Green M&A

4.2. Robustness Test

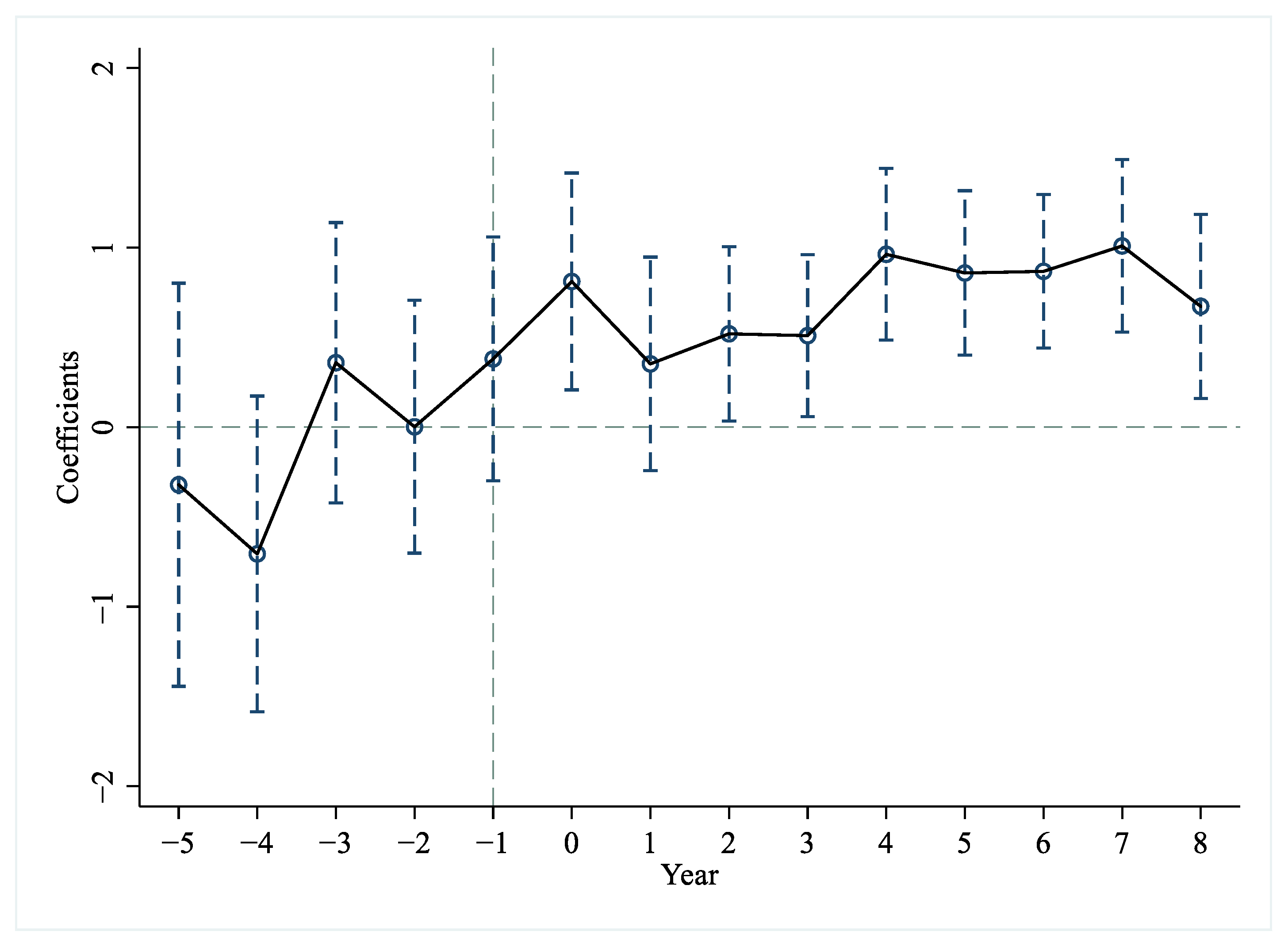

4.2.1. Parallel Trend Test

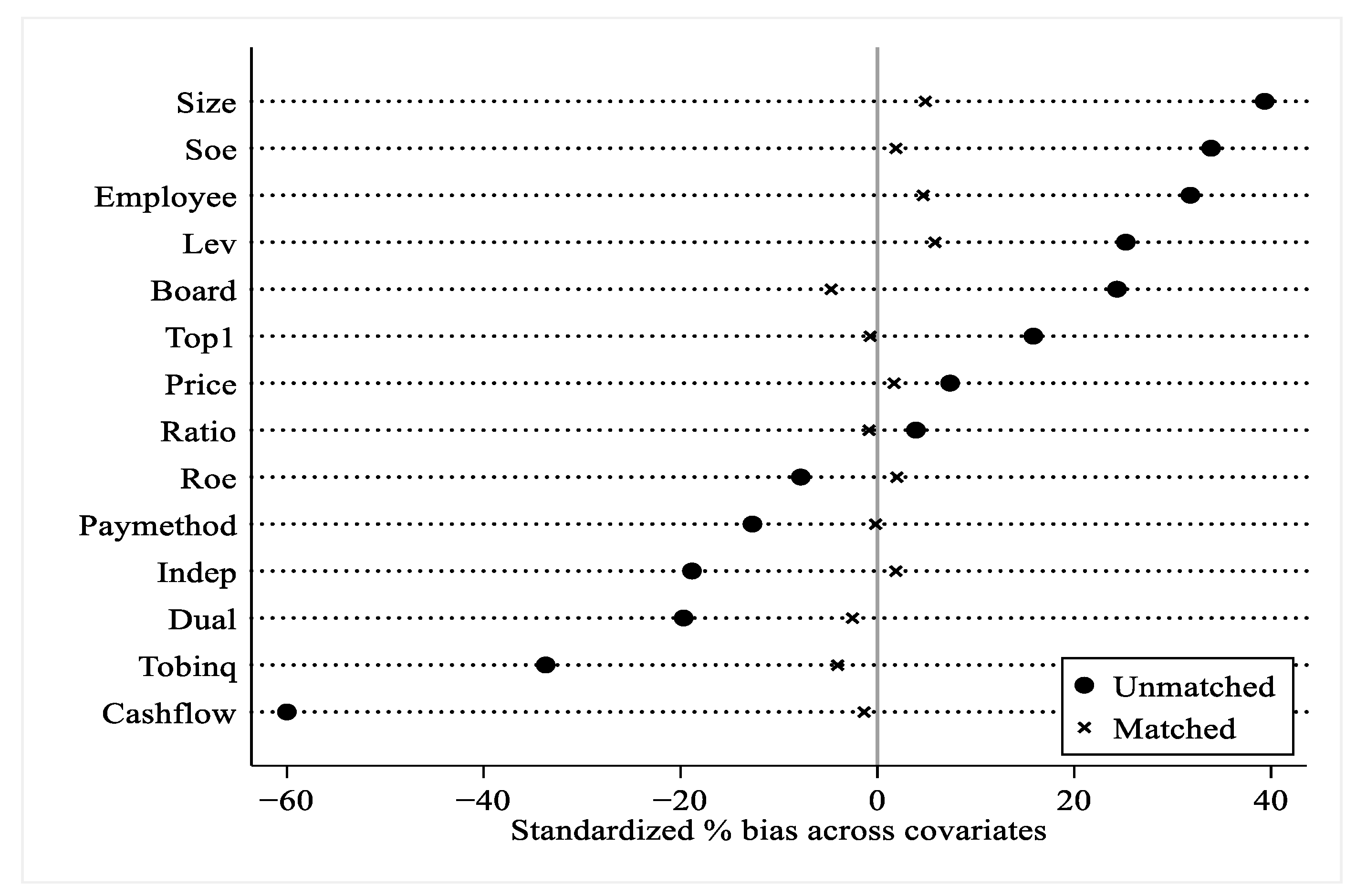

4.2.2. PSM-DID

4.2.3. Change in the Industry Definition Standard

4.2.4. Excluding the Interference of Other Policies

4.2.5. Control over Regional and Industry Characteristics

4.3. Heterogeneity Analysis

4.3.1. Analysis of the Heterogeneity of Green Technology Innovation Capability

4.3.2. Analysis of Heterogeneity of Marketization Level

4.4. Further Analysis

Green Innovation Performance Test for Green M&As

5. Discussion

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Greenma | 1 | 0.08 *** | 0.11 *** | 0.06 *** | 0.03 ** | −0.06 *** | −0.03 ** | 0.08 *** | 0.03 * | −0.01 | −0.03 * | −0.04 ** | −0.07 *** | −0.04 *** | 0.00 | −0.02 | 0.02 |

| 2 | Treat | 0.08 *** | 1 | −0.06 *** | 0.08 *** | −0.17 *** | 0.05 *** | 0.11 *** | −0.12 *** | −0.03 ** | −0.09 *** | −0.15 *** | 0.06 *** | 0.04 ** | 0.01 | 0.20 *** | 0.01 | 0.13 *** |

| 3 | Post | 0.11 *** | −0.06 *** | 1 | 0.15 *** | 0.14 *** | −0.25 *** | −0.08 *** | 0.11 *** | 0.10 *** | 0.07 *** | −0.05 *** | −0.07 *** | −0.17 *** | 0.12 *** | 0.03 * | 0.01 | −0.05 *** |

| 4 | Size | 0.06 *** | 0.08 *** | 0.17 *** | 1 | 0.35 *** | −0.37 *** | −0.17 *** | 0.52 *** | 0.22 *** | 0.17 *** | 0.10 *** | −0.06 *** | −0.52 *** | 0.67 *** | 0.26 *** | −0.01 | −0.11 *** |

| 5 | Soe | 0.03 ** | −0.17 *** | 0.14 *** | 0.37 *** | 1 | −0.26 *** | −0.26 *** | 0.29 *** | 0.26 *** | 0.22 *** | −0.03 ** | −0.11 *** | −0.26 *** | 0.27 *** | 0.07 *** | −0.00 | −0.03 ** |

| 6 | Cashflow | −0.05 *** | 0.04 ** | −0.25 *** | −0.37 *** | −0.27 *** | 1 | 0.13 *** | −0.60 *** | −0.10 *** | −0.04 *** | 0.14 *** | 0.07 *** | 0.27 *** | −0.35 *** | −0.14 *** | −0.01 | 0.05 *** |

| 7 | Dual | −0.03 ** | 0.11 *** | −0.08 *** | −0.16 *** | −0.26 *** | 0.13 *** | 1 | −0.16 *** | −0.14 *** | −0.05 *** | −0.02 | 0.07 *** | 0.12 *** | −0.13 *** | −0.03 ** | −0.01 | 0.01 |

| 8 | Lev | 0.08 *** | −0.12 *** | 0.11 *** | 0.51 *** | 0.30 *** | −0.62 *** | −0.16 *** | 1 | 0.11 *** | 0.07 *** | −0.02 | −0.06 *** | −0.39 *** | 0.34 *** | 0.11 *** | 0.01 | −0.08 *** |

| 9 | Board | 0.02* | −0.02 * | 0.10 *** | 0.24 *** | 0.27 *** | −0.12 *** | −0.13 *** | 0.12 *** | 1 | 0.03* | 0.01 | −0.28 *** | −0.12 *** | 0.20 *** | 0.05 *** | −0.00 | −0.03 ** |

| 10 | Top1 | −0.00 | −0.09 *** | 0.07 *** | 0.21 *** | 0.22 *** | −0.04 *** | −0.05 *** | 0.08 *** | 0.04 *** | 1 | 0.17 *** | 0.00 | −0.17 *** | 0.16 *** | 0.01 | 0.04 *** | −0.07 *** |

| 11 | Roe | −0.02* | −0.15 *** | −0.03 ** | 0.09 *** | −0.02* | 0.15 *** | −0.00 | −0.07 *** | 0.00 | 0.16 *** | 1 | 0.00 | 0.13 *** | 0.15 *** | −0.04 *** | −0.02 | −0.10 *** |

| 12 | Indep | −0.03 ** | 0.06 *** | −0.08 *** | −0.05 *** | −0.11 *** | 0.07 *** | 0.09 *** | −0.06 *** | −0.21 *** | 0.01 | 0.00 | 1 | 0.08 *** | −0.06 *** | −0.01 | 0.02 | 0.02 |

| 13 | Tobinq | −0.07 *** | 0.03 ** | −0.13 *** | −0.41 *** | −0.17 *** | 0.19 *** | 0.07 *** | −0.29 *** | −0.08 *** | −0.14 *** | 0.09 *** | 0.06 *** | 1 | −0.32 *** | −0.03 ** | 0.01 | 0.17 *** |

| 14 | Employee | −0.03 ** | 0.02* | 0.13 *** | 0.68 *** | 0.26 *** | −0.34 *** | −0.11 *** | 0.31 *** | 0.21 *** | 0.19 *** | 0.14 *** | −0.04 *** | −0.27 *** | 1 | 0.11 *** | 0.01 | −0.12 *** |

| 15 | Price | 0.00 | 0.19 *** | 0.03 ** | 0.28 *** | 0.08 *** | −0.15 *** | −0.03 ** | 0.11 *** | 0.07 *** | 0.03 ** | −0.03 * | −0.01 | 0.02 | 0.13 *** | 1 | 0.25 *** | 0.55 *** |

| 16 | Ratio | −0.02 | 0.01 | 0.02 | −0.00 | −0.00 | −0.03 * | −0.01 | 0.01 | −0.00 | 0.04 ** | −0.00 | 0.02 | 0.03 ** | 0.02 | 0.25 *** | 1 | 0.30 *** |

| 17 | Paymethod | 0.02 | 0.13 *** | −0.05 *** | −0.11 *** | −0.03 ** | 0.04 *** | 0.01 | −0.08 *** | −0.03 ** | −0.07 *** | −0.07 *** | 0.02 | 0.15 *** | −0.12 *** | 0.53 *** | 0.31 *** | 1 |

Appendix B

| Variable | VIF | SQRT VIF | Tolerance | R-Squared | Variable | VIF | SQRT VIF | Tolerance | R-Squared |

|---|---|---|---|---|---|---|---|---|---|

| Post | 1.56 | 1.25 | 0.6398 | 0.3602 | Top1 | 1.13 | 1.06 | 0.8886 | 0.1114 |

| Treat | 4.33 | 2.08 | 0.2312 | 0.7688 | Roe | 1.16 | 1.08 | 0.8649 | 0.1351 |

| Post Treat | 4.43 | 2.11 | 0.2255 | 0.7745 | Indep | 1.06 | 1.03 | 0.9418 | 0.0582 |

| Size | 3.12 | 1.77 | 0.3208 | 0.6792 | Tobinq | 1.29 | 1.14 | 0.7757 | 0.2243 |

| Soe | 1.38 | 1.18 | 0.7234 | 0.2766 | Employee | 2.05 | 1.43 | 0.487 | 0.513 |

| Cashflow | 1.86 | 1.36 | 0.5377 | 0.4623 | Price | 1.76 | 1.33 | 0.5685 | 0.4315 |

| Dual | 1.09 | 1.05 | 0.9133 | 0.0867 | Ratio | 1.13 | 1.06 | 0.8841 | 0.1159 |

| Lev | 2.07 | 1.44 | 0.4821 | 0.5179 | Paymethod | 1.65 | 1.28 | 0.6069 | 0.3931 |

| Board | 1.16 | 1.08 | 0.8596 | 0.1404 |

References

- Du, M.; Zhang, R.; Chai, S.; Li, Q.; Sun, R.; Chu, W. Can Green Finance Policies Stimulate Technological Innovation and Financial Performance? Evidence from Chinese Listed Green Enterprises. Sustainability 2022, 14, 9287. [Google Scholar] [CrossRef]

- Liang, X.; Li, S.; Luo, P.; Li, Z. Green mergers and acquisitions and green innovation: An empirical study on heavily polluting enterprises. Environ. Sci. Pollut. Res. 2022, 29, 48937–48952. [Google Scholar] [CrossRef] [PubMed]

- Salvi, A.; Petruzzella, F.; Giakoumelou, A. Green M&A Deals and Bidders’ Value Creation: The Role of Sustainability in Post-Acquisition Performance. Int. Bus. Res. 2018, 11, 96–105. [Google Scholar]

- Zhang, D.; Kong, Q. Credit policy, uncertainty, and firm R&D investment: A quasi-natural experiment based on the Green Credit Guidelines. Pac. Basin Financ. J. 2022, 73, 101751. [Google Scholar]

- Wang, H.; Qi, S.; Zhou, C.; Zhou, J.; Huang, X. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X.; Xing, C. How does China’s green credit policy affect the green innovation of high polluting enterprises? The perspective of radical and incremental innovations. J. Clean. Prod. 2022, 336, 130387. [Google Scholar] [CrossRef]

- Zhang, Z.; Duan, H.; Shan, S.; Liu, Q.; Geng, W. The impact of green credit on the green innovation level of heavy-polluting enterprises—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 650. [Google Scholar] [CrossRef]

- Yao, S.; Pan, Y.; Sensoy, A.; Uddin, G.S.; Cheng, F. Green credit policy and firm performance: What we learn from China. Energy Econ. 2021, 101, 105415. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Janeway, W.H. Doing Capitalism in the Innovation Economy: Markets, Speculation and the State; Cambridge University Press: Cambridge, UK, 2012; pp. 232–254. [Google Scholar]

- Nandy, M.; Lodh, S. Do banks value the eco-friendliness of firms in their corporate lending decision? Some empirical evidence. Int. Rev. Financ. Anal. 2012, 25, 83–93. [Google Scholar] [CrossRef]

- Salazar, J. Environmental finance: Linking two world: A Workshop on Financial Innovations for Biodiversity Bratislava. Sci. Res. 1998, 1, 2–18. [Google Scholar]

- Zhang, K.; Li, Y.; Qi, Y.; Shao, S. Can green credit policy improve environmental quality? Evidence from China. J. Environ. Manag. 2021, 298, 113445. [Google Scholar] [CrossRef] [PubMed]

- Soundarrajan, P.; Vivek, N. Green finance for sustainable green economic growth in India. Agric. Econ. 2016, 62, 35–44. [Google Scholar] [CrossRef]

- Nenavath, S. Impact of fintech and green finance on environmental quality protection in India: By applying the semi-parametric difference-in-differences (SDID). Renew. Energy 2022, 193, 913–919. [Google Scholar] [CrossRef]

- Liu, X.; Wang, E.; Cai, D. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Wu, S.; Wu, L.; Zhao, X. Impact of the green credit policy on external financing, economic growth and energy consumption of the manufacturing industry. Chin. J. Popul. Resour. Environ. 2022, 20, 59–68. [Google Scholar] [CrossRef]

- Xu, X.; Li, J. Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Zhang, B.; Yang, Y.; Bi, J. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. J. Environ. Manag. 2011, 92, 1321–1327. [Google Scholar] [CrossRef]

- Wang, Y.; Lei, X.; Long, R.; Zhao, J. Green Credit, Financial Constraint, and Capital Investment: Evidence from China’s Energy-intensive Enterprises. Environ. Manag. 2020, 66, 1059–1071. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, Y.; Wang, H.; Ouyang, X.; Xie, Y. Can green credit policy promote low-carbon technology innovation? J. Clean. Prod. 2022, 359, 132061. [Google Scholar] [CrossRef]

- Cui, X.; Wang, P.; Sensoy, A.; Nguyen, D.K.; Pan, Y. Green Credit Policy and Corporate Productivity: Evidence from a Quasi-natural Experiment in China. Technol. Forecast. Soc. Change 2022, 177, 121516. [Google Scholar] [CrossRef]

- Tian, C.; Li, X.; Xiao, L.; Zhu, B. Exploring the impact of green credit policy on green transformation of heavy polluting industries. J. Clean. Prod. 2022, 335, 130257. [Google Scholar] [CrossRef]

- Wen, H.; Lee, C.; Zhou, F. Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 2021, 94, 105099. [Google Scholar] [CrossRef]

- Huang, W.N.; Yuan, T.R. Substantive Transformation and Upgrading or Strategic Policy Arbitrage—Research on the Impact of Green Industry Policy on Green M&As of Industrial Enterprises. J. Shanxi Univ. Financ. Econ. 2021, 43, 56–67. [Google Scholar]

- Pan, A.; Liu, X.; Qiu, J.; Shen, Y. Can green M&A of heavy polluting enterprises achieve substantial transformation under the pressure of media. China Ind. Econ. 2019, 2, 174–192. [Google Scholar]

- Dicu, R.M.; Robu, I.; Aevoae, G.; Mardiros, D. Rethinking the Role of M&As in Promoting Sustainable Development: Empirical Evidence Regarding the Relation Between the Audit Opinion and the Sustainable Performance of the Romanian Target Companies. Sustainability 2020, 12, 8622. [Google Scholar]

- Li, B.; Xu, L.; McIver, R.; Wu, Q.; Pan, A. Green M&A, legitimacy and risk-taking: Evidence from China’s heavy polluters. Account. Financ. 2020, 60, 97–127. [Google Scholar]

- Zhou, L.; Li, W.; Teo, B.S.X.; Yusoff, S.K.M. The Effect of Green Transformation on the Operating Efficiency of Green M&A Enterprises: Evidence from China. J. Asian Financ. Econ. Bus. 2022, 9, 299–310. [Google Scholar]

- Bettinazzi, E.L.M.; Zollo, M. Stakeholder Orientation and Acquisition Performance. Strateg. Manag. J. 2017, 38, 2465–2485. [Google Scholar] [CrossRef]

- Huang, W.; Yuan, T. Green innovation of Chinese industrial enterprises to achieve the ‘dual carbon’ goal–based on the perspective of green M&A. Appl. Econ. Lett. 2022, 1–5. [Google Scholar] [CrossRef]

- Lu, J. Can the green merger and acquisition strategy improve the environmental protection investment of listed company? Environ. Impact Assess. Rev. 2021, 86, 106470. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990; pp. 73–82. [Google Scholar]

- Arikan, A.M.; Stulz, R.M. Corporate acquisitions, diversification, and the firm’s life cycle. J. Financ. 2016, 71, 139–194. [Google Scholar] [CrossRef]

- Cornaggia, J.; Li, J.Y. The value of access to finance: Evidence from M&As. J. Financ. Econ. 2018, 131, 232–250. [Google Scholar]

- Dierickx, I.; Cool, K.O. Asset Stock Accumulation and Sustainability of Competitive Advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strateg. Manag. J. 2001, 22, 197–220. [Google Scholar] [CrossRef]

- Bresman, H.; Birkinshaw, J.; Nobel, R. Knowledge transfer in international acquisitions. J. Int. Bus. Stud. 1999, 30, 439–462. [Google Scholar] [CrossRef]

- Zhao, X.; Jia, M. Sincerity or hypocrisy: Can green M&A achieve corporate environmental governance? Environ. Sci. Pollut. Res. 2022, 29, 27339–27351. [Google Scholar]

- Iacobucci, D. Mediation analysis and categorical variables: The final frontier. J. Consum. Psychol. 2012, 22, 582–594. [Google Scholar] [CrossRef]

- MacKinnon, D.P.; Cox, M.G. Commentary on “Mediation analysis and categorical variables: The final frontier” by Dawn Iacobucci. J. Consum. Psychol. 2012, 22, 600–602. [Google Scholar] [CrossRef]

| Variable | Meaning | Variable Definition |

|---|---|---|

| Greenma | Green M&A | Green M&A is recorded as 1; otherwise, it is 0. |

| Post | Time dummy variable | Post is recorded as 0 for 2007–2011, and 1 for 2012 and later. |

| Treat | Group dummy variable | Treat is recorded as 1; otherwise, it is 0. |

| Treat Post | Policy effect of the GCGs | Multiplicative term of Treat and Post. |

| Size | Enterprise size | The natural logarithm of the total assets of the enterprise. |

| Lev | Financial leverage | End-of-period liabilities/end-of-period total assets. |

| Roe | Return on equity | Net profit/average balance of shareholder equity. |

| Cashflow | Cash flow ratio | Net cash flow from operating activities/total assets. |

| Board | Board size | The logarithm of the number of directors after adding 1. |

| Indep | The proportion of independent directors | Number of independent directors/number of all directors. |

| Dual | Combined title of Board Chair and CEO | If the chairman and the general manager positions are held by the same individual, it is equal to 1; otherwise, it is equal to 0. |

| Top1 | Ownership concentration | Shareholding proportion of the largest shareholder |

| Tobinq | Tobin’s Q ratio | (Market value of tradable shares + face value of non-tradable shares)/total assets. |

| Soe | Property rights nature | 1 for state-owned enterprises and 0 for others. |

| Employee | Employee size | The logarithm of the number of employees after adding 1. |

| Price | Transaction consideration | The natural logarithm of the M&A transaction price. |

| Ratio | Proportion of acquired equity | Proportion of acquired equity. |

| Paymethod | Payment method | Equal to 1 when the payment method is share-based payment; otherwise, it is equal to 0. |

| Variable | Observation | Mean | Max | Min | Std. Dev | |

|---|---|---|---|---|---|---|

| Treatment group | Greenma | 1122 | 0.290 | 1 | 0 | 0.454 |

| Post | 1122 | 0.742 | 1 | 0 | 0.438 | |

| Size | 1122 | 22.58 | 25.89 | 19.53 | 1.424 | |

| Soe | 1122 | 0.481 | 1 | 0 | 0.500 | |

| Cashflow | 1122 | 0.088 | 0.761 | −0.415 | 0.231 | |

| Dual | 1122 | 0.215 | 1 | 0 | 0.411 | |

| Lev | 1122 | 0.480 | 0.925 | 0.0591 | 0.198 | |

| Board | 1122 | 9.798 | 17 | 5 | 2.398 | |

| Top1 | 1122 | 37.14 | 73.01 | 8.975 | 15.40 | |

| Roe | 1122 | 0.082 | 0.383 | −0.358 | 0.109 | |

| Indep | 1122 | 0.368 | 0.600 | 0.250 | 0.059 | |

| Tobinq | 1122 | 1.776 | 8.954 | 0.888 | 1.032 | |

| Employee | 1122 | 7.999 | 10.86 | 4.127 | 1.304 | |

| Price | 1122 | 19.01 | 23.15 | 14.56 | 1.883 | |

| Ratio | 1122 | 80.56 | 100 | 30 | 22.97 | |

| Paymethod | 1122 | 0.183 | 1 | 0 | 0.387 | |

| Control group | Greenma | 3805 | 0.182 | 1 | 0 | 0.386 |

| Post | 3805 | 0.803 | 1 | 0 | 0.398 | |

| Size | 3805 | 22.07 | 25.89 | 19.53 | 1.166 | |

| Soe | 3805 | 0.315 | 1 | 0 | 0.465 | |

| Cashflow | 3805 | 0.226 | 0.761 | −0.415 | 0.223 | |

| Dual | 3805 | 0.302 | 1 | 0 | 0.459 | |

| Lev | 3805 | 0.429 | 0.925 | 0.059 | 0.198 | |

| Board | 3805 | 9.234 | 17 | 5 | 2.180 | |

| Top1 | 3805 | 34.72 | 73.01 | 8.975 | 14.83 | |

| Roe | 3805 | 0.090 | 0.383 | −0.358 | 0.094 | |

| Indep | 3805 | 0.380 | 0.600 | 0.250 | 0.065 | |

| Tobinq | 3805 | 2.191 | 8.954 | 0.888 | 1.405 | |

| Employee | 3805 | 7.595 | 10.86 | 4.127 | 1.216 | |

| Price | 3805 | 18.87 | 23.15 | 14.56 | 1.805 | |

| Ratio | 3805 | 79.66 | 100 | 30 | 23.29 | |

| Paymethod | 3805 | 0.235 | 1 | 0 | 0.424 |

| Variable | Greenma | |

|---|---|---|

| (1) | (2) | |

| Treat Post | 0.785 *** (0.233) | 0.708 *** (0.238) |

| Post | 0.827 ** (0.324) | 0.990 *** (0.336) |

| Treat | −0.007 (0.217) | 0.031 (0.223) |

| Size | 0.114 * (0.062) | |

| Soe | 0.050 (0.098) | |

| Cashflow | 0.556 ** (0.257) | |

| Dual | −0.063 (−0.090) | |

| Lev | 1.094 *** (0.322) | |

| Board | −0.001 (−0.018) | |

| Top1 | −0.001 (−0.003) | |

| Roe | 0.842 * (0.449) | |

| Indep | −1.168 * (0.624) | |

| Tobinq | −0.116 *** (0.042) | |

| Employee | −0.241 *** (0.054) | |

| Price | −0.072 *** (0.027) | |

| Ratio | −0.003 * (0.002) | |

| Paymethod | 0.331 *** (0.119) | |

| Constant | −3.366 *** (0.585) | −2.473 ** (1.234) |

| Industry FE | Y | Y |

| Year FE | Y | Y |

| Pseudo R2 | 0.1288 | 0.1414 |

| LR | 646.463 (p = 0.000) | 709.855 (p = 0.0000) |

| N | 4927 | 4927 |

| Variable | Greenma | |

|---|---|---|

| (1) | (2) | |

| Treat Post2007 | −0.315 (0.681) | |

| Treat Post2008 | −0.696 (0.532) | |

| Treat Post2009 | 0.373 (0.473) | |

| Treat Post2010 | 0.015 (0.427) | |

| Treat Post2011 | 0.391 (0.411) | |

| Treat Post | 0.742 *** (0.114) | |

| Controls | Y | |

| Year FE | Y | |

| Industry FE | Y | |

| Pseudo R2 | 0.1422 | |

| N | 4927 | |

| Variable | Unmatched Matched | Mean | Bias | t-Test | |||

|---|---|---|---|---|---|---|---|

| Treatment Group | Control Group | %bias | Reduction (%) | t Value | p > |t| | ||

| Size | Unmatched | 22.58 | 22.07 | 39.4 | 87.7 | 12.27 | 0.000 |

| Matched | 22.45 | 22.38 | 4.9 | 1.140 | 0.256 | ||

| Soe | Unmatched | 0.481 | 0.317 | 33.9 | 94.5 | 10.19 | 0.000 |

| Matched | 0.452 | 0.443 | 1.9 | 0.420 | 0.678 | ||

| Cashflow | Unmatched | 0.0881 | 0.225 | −60.0 | 97.7 | −17.83 | 0.000 |

| Matched | 0.106 | 0.109 | −1.4 | −0.320 | 0.748 | ||

| Dual | Unmatched | 0.215 | 0.301 | −19.7 | 87.1 | −5.630 | 0.000 |

| Matched | 0.224 | 0.235 | −2.5 | −0.600 | 0.546 | ||

| Lev | Unmatched | 0.480 | 0.430 | 25.2 | 76.9 | 7.430 | 0.000 |

| Matched | 0.470 | 0.459 | 5.8 | 1.370 | 0.171 | ||

| Board | Unmatched | 9.798 | 9.239 | 24.4 | 80.7 | 7.370 | 0.000 |

| Matched | 9.679 | 9.787 | −4.7 | −1.040 | 0.298 | ||

| Top1 | Unmatched | 37.14 | 34.74 | 15.9 | 95.3 | 4.720 | 0.000 |

| Matched | 36.42 | 36.53 | −0.7 | −0.170 | 0.867 | ||

| Roe | Unmatched | 0.0822 | 0.0901 | −7.8 | 74.8 | −2.400 | 0.0170 |

| Matched | 0.0843 | 0.0823 | 2.0 | 0.460 | 0.644 | ||

| Indep | Unmatched | 0.369 | 0.380 | −18.8 | 90.1 | −5.400 | 0.000 |

| Matched | 0.370 | 0.369 | 1.9 | 0.440 | 0.659 | ||

| Tobinq | Unmatched | 1.776 | 2.191 | −33.7 | 88.0 | −9.210 | 0.000 |

| Matched | 1.815 | 1.865 | −4.1 | −1.070 | 0.285 | ||

| Employee | Unmatched | 7.999 | 7.598 | 31.8 | 85.4 | 9.550 | 0.000 |

| Matched | 7.911 | 7.852 | 4.6 | 1.080 | 0.278 | ||

| Price | Unmatched | 19.01 | 18.87 | 7.4 | 77.2 | 2.200 | 0.028 |

| Matched | 18.95 | 18.92 | 1.7 | 0.380 | 0.701 | ||

| Ratio | Unmatched | 80.56 | 79.65 | 3.9 | 77.9 | 1.150 | 0.251 |

| Matched | 80.34 | 80.55 | −0.9 | −0.200 | 0.843 | ||

| Paymethod | Unmatched | 0.183 | 0.234 | −12.7 | 98.4 | −3.650 | 0.000 |

| Matched | 0.193 | 0.194 | −0.2 | −0.050 | 0.963 | ||

| Variable | Greenma |

|---|---|

| Treat Post | 0.732 *** (0.247) |

| Post | 1.049 *** (0.344) |

| Treat | 0.038 (0.230) |

| constant | −2.590 ** (1.264) |

| Controls | Y |

| Industry FE | Y |

| Year FE | Y |

| N | 4747 |

| Pseudo R2 | 0.1416 |

| Variable | Greenma |

|---|---|

| Treat Post2 | 0.529 ** (0.227) |

| Post | 0.974 *** (0.341) |

| Treat2 | −0.216 (0.220) |

| Constant | −2.829 ** (1.224) |

| Controls | Y |

| Industry FE | Y |

| Year FE | Y |

| N | 4927 |

| Pseudo R2 | 0.1355 |

| Variable | Greenma | |

|---|---|---|

| (1) | (2) | |

| Treat Post | 0.683 *** (0.236) | 0.562 ** (0.276) |

| Post | −0.021 (0.188) | 1.097 *** (0.385) |

| Treat | 0.044 (0.222) | 0.075 (0.258) |

| EPL | −0.428 *** (0.155) | |

| constant | −222.166 *** (60.832) | −2.222 (1.565) |

| Controls | Y | Y |

| Industry FE | Y | Y |

| Year FE | Y | Y |

| N | 4927 | 3324 |

| Pseudo R2 | 0.1375 | 0.1485 |

| Variable | Greenma | |

|---|---|---|

| (1) | (2) | |

| Treat Post | 0.687 *** (0.242) | 0.611 ** (0.243) |

| Post | 0.800 ** (0.348) | 1.749 *** (0.477) |

| Treat | −0.029 (0.231) | 0.111 (0.231) |

| HHI | −0.135 (0.222) | |

| IndROE | 0.414 (0.646) | |

| IndGrowth | −0.056 * (0.033) | |

| IndTQ | −0.119 ** (0.047) | |

| ProvinceGDP | −0.00001 ** (5.43 × 10−6) | |

| Constant | −1.965 (1.262) | −2.319 (1.410) |

| Controls | Y | Y |

| Province FE | N | Y |

| Industry FE | Y | Y |

| Year FE | Y | Y |

| N | 4835 | 4927 |

| Pseudo R2 | 0.1417 | 0.1520 |

| Variable | Greenma | |

|---|---|---|

| Strong Green Innovation Capability | Weak Green Innovation Capability | |

| (1) | (2) | |

| Treat Post | −0.015 (0.393) | 1.142 *** (0.313) |

| Post | 0.889 (0.677) | 0.607 (0.448) |

| Treat | 0.684 * (0.380) | −0.249 (0.286) |

| Constant | −2.719 (1.797) | −0.819 (1.871) |

| Controls | Y | Y |

| Industry FE | Y | Y |

| Year FE | Y | Y |

| N | 2162 | 2756 |

| Pseudo R2 | 0.1343 | 0.1511 |

| Fisher’s Permutation test | 0.010 | |

| Variable | Greenma | |

|---|---|---|

| High Degree of Marketization | Low Degree of Marketization | |

| (1) | (2) | |

| Treat Post | 0.167 (0.379) | 1.058 *** (0.308) |

| Post | 1.062 * (0.583) | 1.094 *** (0.419) |

| Treat | 0.689 * (0.355) | −0.323 (0.293) |

| Constant | −1.880 (1.755) | −2.431 (1.819) |

| Controls | Y | Y |

| Industry FE | Y | Y |

| Year FE | Y | Y |

| N | 2732 | 2184 |

| Pseudo R2 | 0.1603 | 0.1374 |

| Fisher’s Permutation test | 0.035 | |

| Variable | t + 1 | t + 2 | ||

|---|---|---|---|---|

| ∆GPatent1 | ∆GPatent2 | |||

| (1) | (2) | (3) | (4) | |

| Treat × Post | 2.011 * | 1.713 | 2.474 ** | 2.080 * |

| (1.112) | (1.135) | (1.123) | (1.149) | |

| Greenma | 2.135 *** | 2.897 *** | ||

| (0.733) | (1.093) | |||

| Post | −5.438 *** | −5.640 *** | −5.500 *** | −5.806 *** |

| (0.884) | (0.852) | (0.952) | (0.995) | |

| Treat | −2.072 ** | −2.045 ** | −3.334 *** | −3.264 *** |

| (1.042) | (1.041) | (1.111) | (1.106) | |

| Constant | −40.580 *** | −40.926 *** | −48.917 *** | −49.280 *** |

| (7.828) | (7.837) | (13.713) | (13.772) | |

| Controls | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Industry FE | Y | Y | Y | Y |

| R2 | 0.0592 | 0.0626 | 0.0612 | 0.0651 |

| N | 4426 | 4426 | 4062 | 4062 |

| The proportion of the mediation effect | 0.1477738 | 0.15937114 | ||

| Sobel-Z | 0.29710182 *** | 0.39435868 *** | ||

| 95%CI | 0.30334−3.19622 | 0.33608−4.47078 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Y.; Liu, L. Green Credit Policy and Enterprise Green M&As: An Empirical Test from China. Sustainability 2022, 14, 15692. https://doi.org/10.3390/su142315692

Sun Y, Liu L. Green Credit Policy and Enterprise Green M&As: An Empirical Test from China. Sustainability. 2022; 14(23):15692. https://doi.org/10.3390/su142315692

Chicago/Turabian StyleSun, Ying, and Li Liu. 2022. "Green Credit Policy and Enterprise Green M&As: An Empirical Test from China" Sustainability 14, no. 23: 15692. https://doi.org/10.3390/su142315692

APA StyleSun, Y., & Liu, L. (2022). Green Credit Policy and Enterprise Green M&As: An Empirical Test from China. Sustainability, 14(23), 15692. https://doi.org/10.3390/su142315692