The Influencing Mechanisms on Global Industrial Value Chains Embedded in Trade Implied Carbon Emissions from a Higher-Order Networks Perspective

Abstract

1. Introduction

2. Literature Review

2.1. The Embeddedness of Global Industrial Value Chains

2.2. Global Trade Implied Carbon Emissions

2.3. Environmental Effects of Industry Value Chains Embedded

3. Measurement of Indicators

3.1. Measurement of Global Industry Value Chain Index

- Ratio of foreign value added in exportswhere denotes the industry, r denotes the country, denotes the foreign value added included in the country’s export, and denotes the total export of industry in country r.

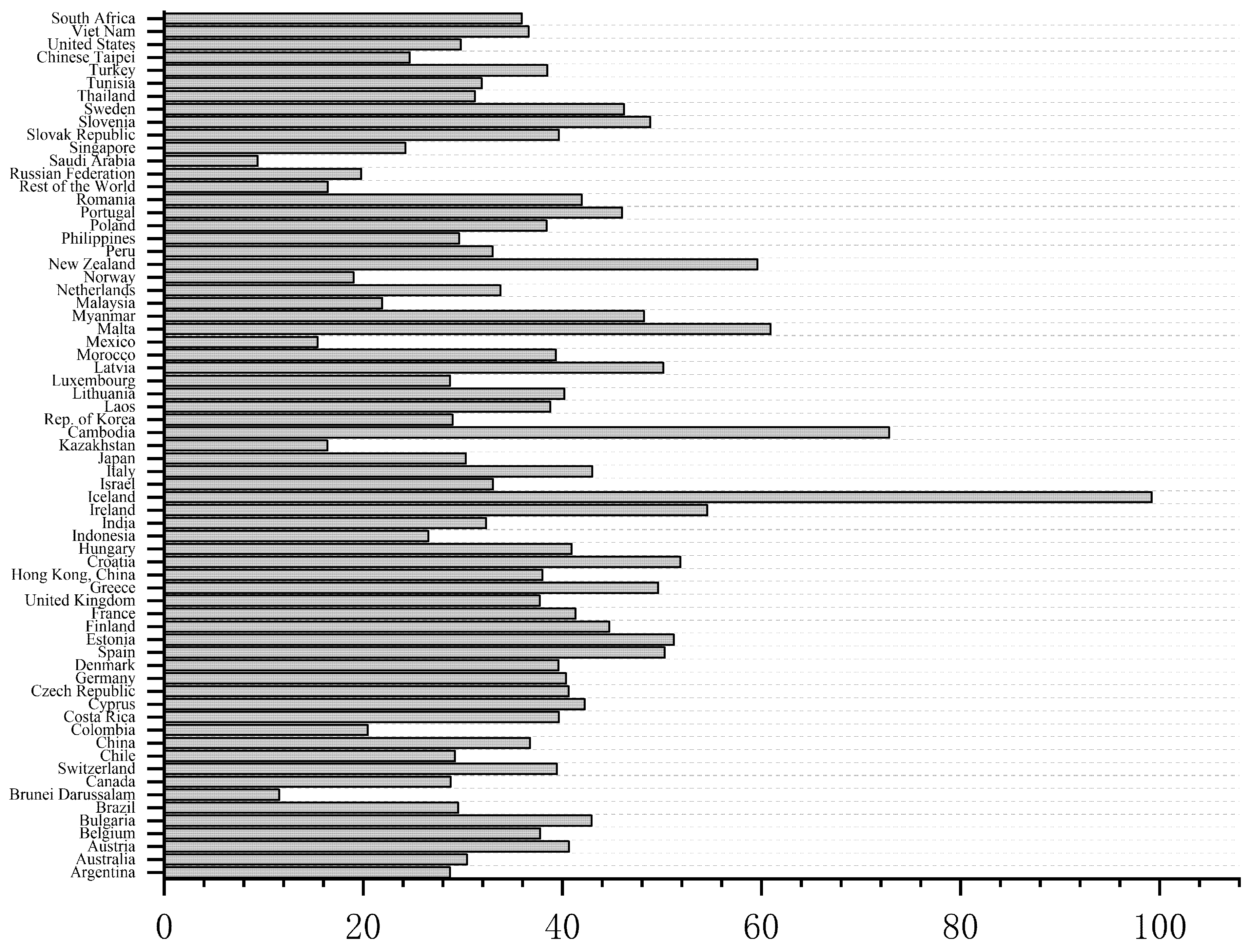

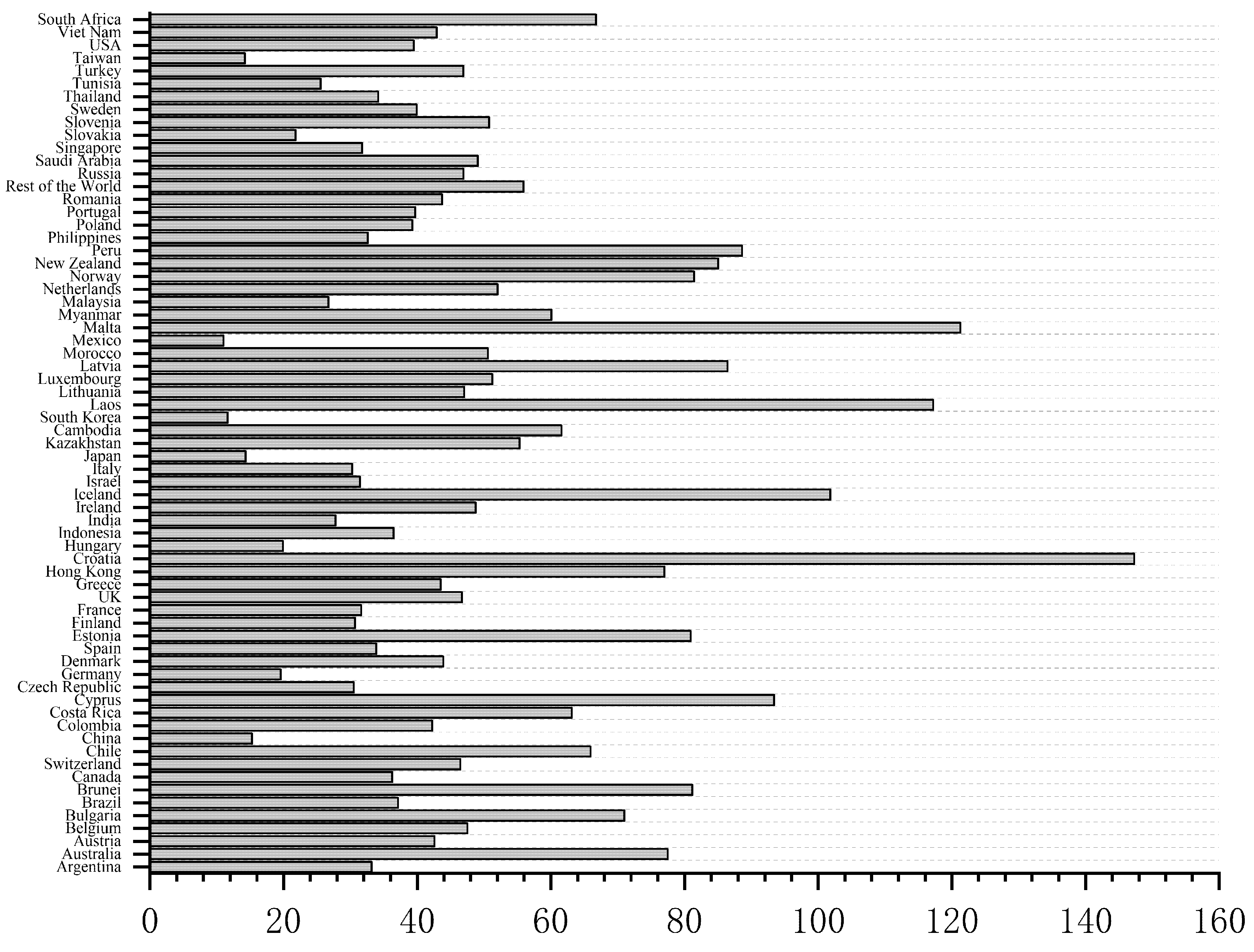

- Global industry value chain embedded participation index:is the indirect value-added exports of industry in country r. It measures the value-added of intermediate products exported from industry in country r and processed in another country for exporting to the third country. is the forward industry value chain embedded index, and a higher index indicates that country r is more upstream in the global industry value chain. is the backward industry value chain embedded index, and a higher index indicates that country r is more downstream in the global industry value chain.

- The global value chain status index:

3.2. Measurement of Trade-Implied Carbon Emissions

4. Networks Construction

4.1. Higher-Order Networks Theory

- (1)

- Line graphs [46]: Note that the hypergraph , then the line graph of is a common graph whose nodes are contractions of hyper-edges. If there is a common node between two hyperedges, the two nodes representing hyperedges are considered to have connected edges between them, and the set of nodes is denoted as , and the set of edges is denoted as .

- (2)

- s-linear graph [46]: The s-linear graph strengthens the condition of the number of common nodes between hyperedges. An s-linear graph is denoted as with the set of nodes denoted as and the set of edges denoted as .

4.2. Higher-Order Networks Analysis of Global Industry Value Chain

4.2.1. Node-Based Indicators Analysis

Node-Based Degree Centrality

Node-Based Closeness Centrality

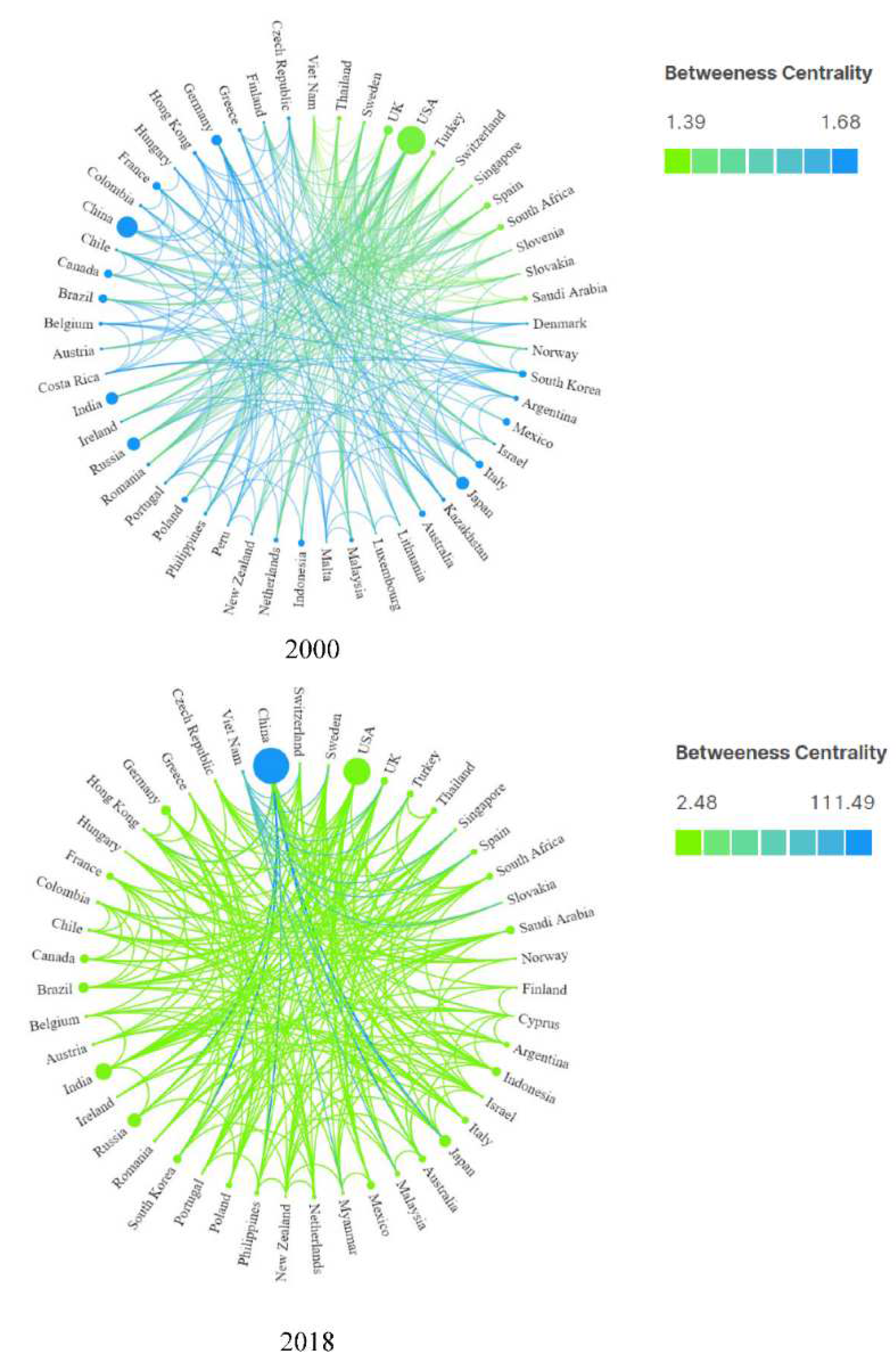

Node-Based Betweenness Centrality

Node-Based Eigenvector Centrality

Node-Based Cycle Ratio

4.2.2. Hyperedges-Based Indicators Analysis

Hyperedges-Based Importance Analysis

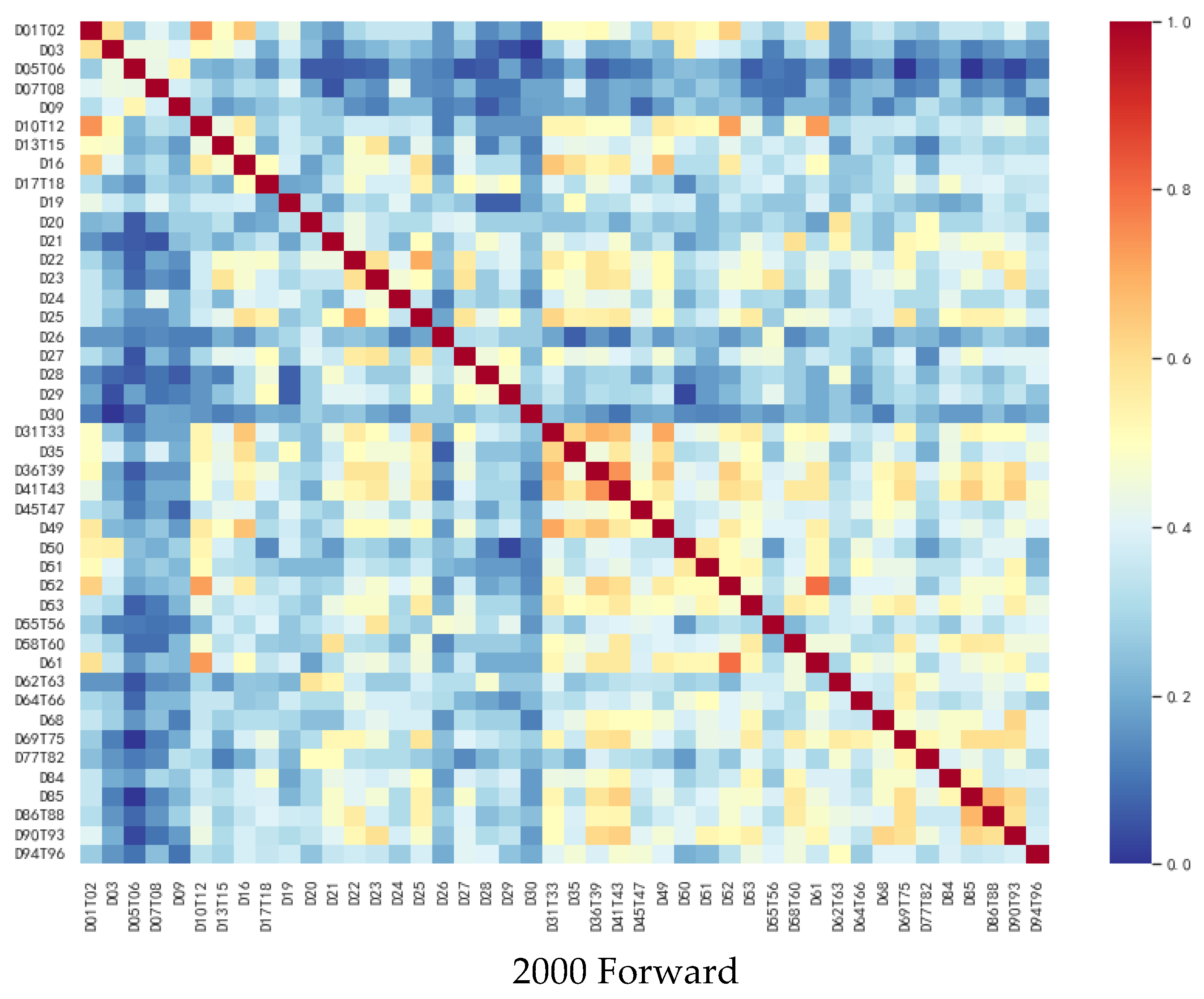

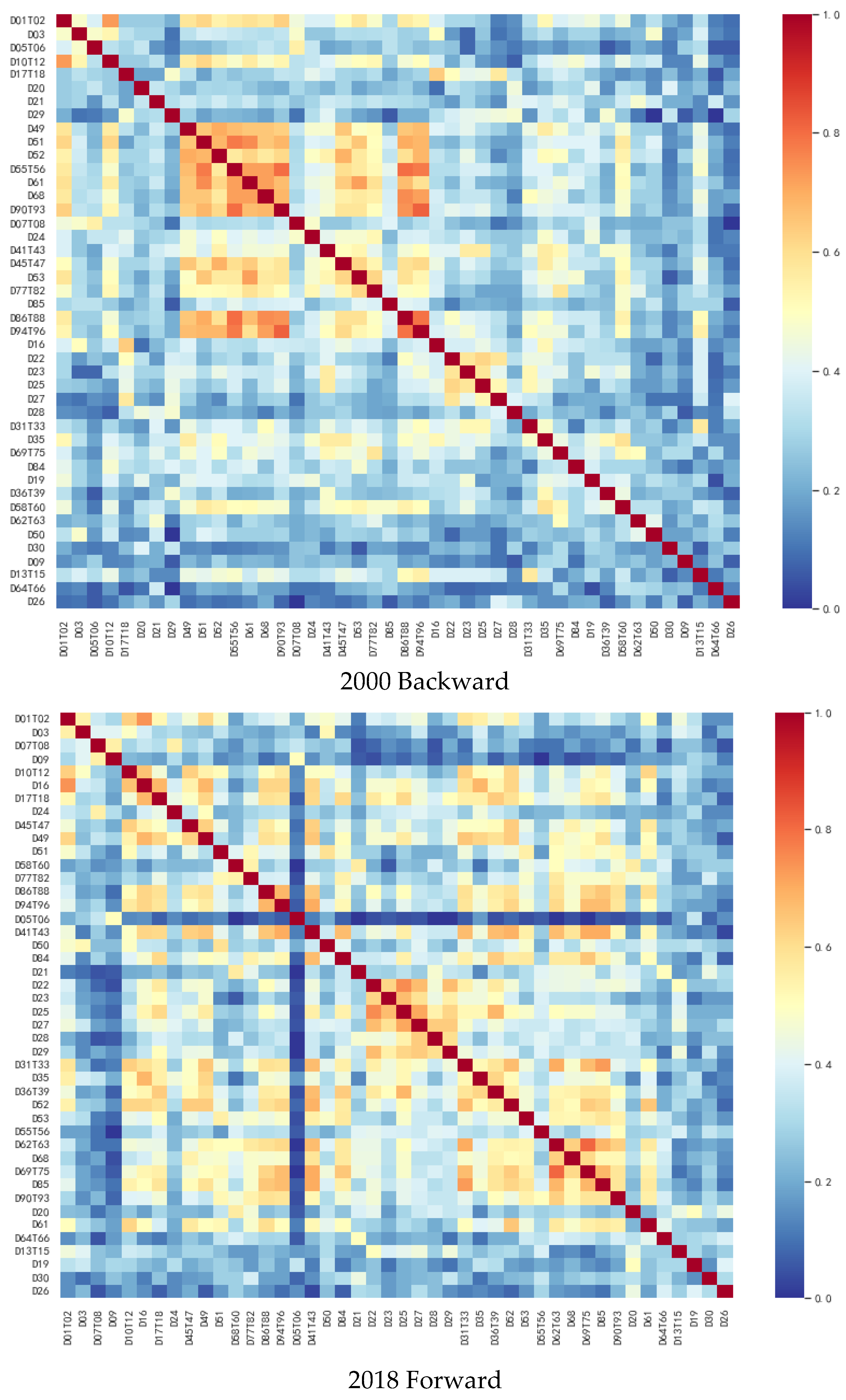

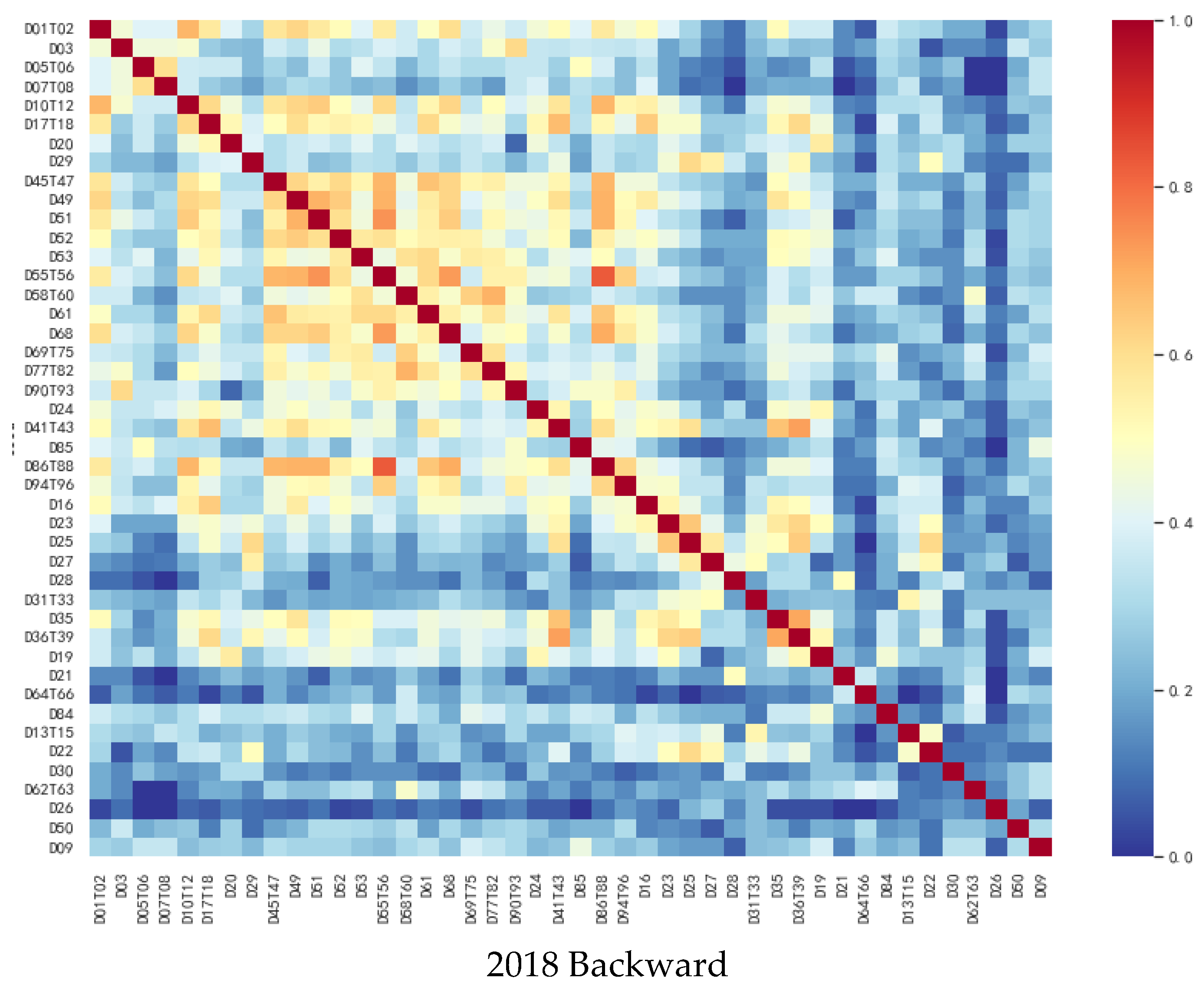

Hyperedges-Based Similarity Analysis

4.3. Networks Analysis of Global Trade Implied Carbon Emissions

5. Methods, Data Source and Hypotheses

5.1. Methods

5.2. Data Source

5.3. Hypoyheses

5.3.1. A Hypothesis of the Factors Influencing Trade Implied Carbon Emissions Based on industry Perspective

5.3.2. A Hypothesis on the Impact of Industrial Value Chains Embedded in Trade Implied Carbon Emissions Based on Industry Perspective

6. An Industry Perspective on the Factors Influencing Implied Carbon Emissions from Global Trade

6.1. LMDI Model Construction

6.2. Empirical Analysis of the LMDI

7. Influence Mechanism of Global Industry Value Chain Embedded in Trade Implied Carbon Emissions

7.1. Variable Selection

7.2. Model Construction

7.3. Analysis of Empirical Results

7.3.1. Empirical Analysis of the TERGM

7.3.2. Multicollinearity Test

7.3.3. Robustness Test

Extrapolation from an Out-of-Sample

Great Likelihood Estimation Using Markov Monte Carlo

8. Discussion

9. Conclusions and Implications

9.1. Conclusions

9.2. Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Porter’s, V.C.M. What Is Value Chain; The Free Press: New York, NY, USA, 1985; pp. 1–13. [Google Scholar]

- Du, Y.S.; Peng, D.D. The servitization of manufacturing and the upgrading of global value-added trade network status-based on the world input-output tables from 2000–2014. Financ. Trade Econ. 2018, 39, 102–117. [Google Scholar]

- Grossman, G.M.; Rossi-Hansberg, E. Trading tasks: A simple theory of offshoring. Am. Econ. Rev. 2008, 98, 1978–1997. [Google Scholar]

- Hummels, D.; Ishii, J.; Yi, K.M. The Nature and Growth of Vertical Specialization in World Trade. J. Int. Econ. 2001, 54, 75–96. [Google Scholar]

- Zeng, Z.; Zhang, L.L. Defining the distribution of trade benefits between China and the United States under the global production network system—A study on the value added of China’s manufacturing trade. World Econ. Stud. 2008, 1, 36–43. [Google Scholar]

- Johnson, R.C.; Noguera, G. Accounting for Intermediates: Production Sharing and Trade in Value Added. J. Int. Econ. 2012, 86, 224–236. [Google Scholar] [CrossRef]

- Koopman, R.; Powers, W.; Wang, Z.; Wei, S.J. Give Credit Where Credit is Due: Tracing Value Added in Global Production Chains; NBER Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2010. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, S.J.; Zhu, K. Quantifying International Production Sharing at the Bilateral and Sector Levels; NBER Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2013. [Google Scholar] [CrossRef]

- Koopman, R.; Wang, Z.; Wei, S.J. Tracing Value—Added and Double Counting in Gross Exports. Am. Econ. Rev. 2014, 104, 459–494. [Google Scholar]

- Wang, Z.; Wei, S.J.; YU, X.; Zhu, K. Measures of participation in global value chains and global business cycles. Natl. Bur. Econ. Res. 2017. [Google Scholar] [CrossRef]

- Matthew, C.; Mahutga, M.C. When do value chains go global? A theory of the spatialization of global value chains. Glob. Netw. 2012, 12, 1–21. [Google Scholar] [CrossRef]

- Hipp, A.; Binz, C. Firm Survival in Complex Value Chains and Global Innovation Systems: Evidence from Solar Photovoltaics. Res. Policy 2019, 49, 103876. [Google Scholar] [CrossRef]

- Knez, K.; Jaklič, A.; Stare, M. An extended approach to value chain analysis. J. Econ. Struct. 2021, 10, 1–37. [Google Scholar] [CrossRef] [PubMed]

- Wyckoff, A.W.; Roop, J.M. The Embodiment Carbon in Imports of Manufactured Products: Implements for International Agreements on Greenhouse Gas Emissions. Energy Policy 1994, 22, 187–194. [Google Scholar]

- Mäenpää, I.; Siikavirta, H. Greenhouse Gases Embodied in the International Trade and Final Consumption of Finland: An Input-Output Analysis. Energy Policy 2007, 35, 128–143. [Google Scholar]

- Wiedmann, T.; Minx, J.; Barrett, J.; Wackernagel, M. Allocating Ecological Footprints to Final Consumption Categories with Input-Output Analysis. Energy Policy 2008, 25, 245–258. [Google Scholar]

- Liu, X.; Ishikawa, M.; Wang, C.; Dong, Y.; Liu, W. Analyses of CO2 Emissions Embodied in Japan-China Trade. Energy Policy 2010, 38, 1510–1518. [Google Scholar]

- Du, H.; Guo, J.; Mao, G.; Smith, A.M.; Wang, X.; Wang, Y. CO2 Emissions Embodied in China-US Trade: Input-Output Analysis Based on Energy/Dollar Ratio. Energy Policy 2011, 39, 5980–5987. [Google Scholar]

- Li, H.M.; Qi, Y. Carbon Embodied in International Trade of China and its Emission Responsibility. Chin. J. Popul. Resour. Environ. 2010, 8, 24–31. [Google Scholar]

- Lin, B.Q.; Sun, C.W. Evaluating Carbon Dioxide Emissions in International Trade of China. Energy Policy 2010, 38, 613–621. [Google Scholar]

- Shui, B.; Harriss, R.C. The role of CO2 embodiment in US–China trade. Energy Policy 2006, 34, 4063–4068. [Google Scholar]

- Wang, Y.Y.; Yan, Y.Y.; Li, L. Implicit carbon emission flows in the international trade of computer products. China Popul.-Resour. Environ. 2015, 25, 37–40. [Google Scholar]

- GrossmanGM, K. Environmental Impacts of the North American Free Trade Agreement; NBER Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar] [CrossRef]

- Dong, Y.L.; Ishikawa, M.; Liu, X.B. An Analysis of the Driving Forces of CO2 Emissions Embodied in Japan-China Trade. Energy Policy 2010, 38, 6784–6792. [Google Scholar]

- Xu, Y.; Dietzenbacher, E. A Structural Decomposition Analysis of the Emissions Embodied in Trade. Ecol. Econ. 2014, 101, 10–20. [Google Scholar]

- Jiang, H. Measurement and comparison of implied carbon in foreign trade of BRICS countries-an empirical analysis based on input-output model and structural decomposition. Resour. Sci. 2016, 38, 2326–2337. [Google Scholar]

- Li, X.X.; Zhang, T. An empirical analysis of the impact of export growth on China’s environment. Int. Trade Issues 2004, 7, 9–12. (In Chinese) [Google Scholar]

- Pang, J.; Zhang, J.Z. Implied carbon emissions of China-Europe trade and its influencing factors-analysis based on MRIO model and LMDI method. Int. Econ. Trade Explor. 2014, 30, 51–65. [Google Scholar]

- Kagawa, S.; Suh, S.; Hubacek, K.; Wiedmann, T.; Nansai, K.; Minx, J. CO2 emission clusters within global supply chain networks:Implications for climate change mitigation. Glob. Environ. Chang. 2015, 35, 486–496. [Google Scholar]

- Du, P.L.; Wang, A.G. Global carbon transfer pattern and China’s transit status: An empirical analysis based on network governance. World Econ. Res. 2018, 7, 95–107+137. [Google Scholar] [CrossRef]

- Zhang, T.B.; Sun, J. Research on the structural characteristics and transmission path of “international trade-carbon emission” network. Financ. Econ. Res. 2019, 45, 114–126. [Google Scholar]

- Wang, M.J. Study on the Evolution of the Implicit Carbon Emission Network Pattern of International Trade and its Influencing Factors. J. Xinyang Norm. Coll. (Philos. Soc. Sci. Ed.) 2020, 40, 19–26. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement. Soc. Sci. Electron. Publ. 1993, 8, 223–250. [Google Scholar]

- Lv, Y.F.; Cui, X.H.; Wang, D. Global value chain participation and trade implied carbon. Quant. Econ. Tech. Econ. Res. 2019, 2, 45–65. [Google Scholar] [CrossRef]

- Yang, F.; Sun, W.Y.; Zhang, S.L. Global value chain embedding, technological progress and pollution emissions-an empirical study based on Chinese sub-sector data. World Econ. Res. 2017, 2, 126-134+137. [Google Scholar] [CrossRef]

- Wang, J.; Wan, G.; Wang, C. Participation in GVCs and CO2 Emissions. Energy Econ. 2019, 84, 1–11. [Google Scholar] [CrossRef]

- Zhang, H.; Wei, X. Green paradox or forced emission reduction: The double effect of environmental regulation on carbon emissions. China Popul.-Resour. Environ. 2014, 24, 21–29. [Google Scholar]

- Gao, P.; Yue, S.J. Does global value chain embedding reduce the implied carbon in China’s industrial sector—And the moderating effect of industrial digitization. Int. Trade Issues 2022, 7, 53–67. [Google Scholar] [CrossRef]

- He, R.Y. Research on Low Carbon Economy and the International Division of Labor Status of Manufacturing Industry. Master’s Thesis, Xiamen University, Xiamen, China, 2017. [Google Scholar]

- Sun, C.; Li, Z.; Ma, T.; He, R. Carbon Efficiency and International Specialization Position: Evidence from Global Value Chain Position Index of Manufacture. Energy Policy 2019, 128, 235–242. [Google Scholar]

- Xie, H.Q.; Huang, L.Y.; Liu, D.D. Does global value chain embedding improve carbon productivity in China’s manufacturing industry. Int. Trade Issues 2018, 12, 109–121. [Google Scholar] [CrossRef]

- Sun, H.P.; Du, X.M. The impact of global value chain embedding degree and status on industrial carbon productivity. China Popul.-Resour. Environ. 2020, 30, 27–37. [Google Scholar]

- Hou, F.M.; Cai, T.; Yang, Y.X. Mechanism and empirical study of the impact of embedding in global value chain on China’s trade implied carbon emissions. J. Nanjing Univ. Financ. Econ. 2018, 6, 28–40. [Google Scholar]

- Battiston, F.; Cencetti, G.; Iacopini, I.; Latora, V.; Lucas, M.; Patania, A.; Young, J.-G.; Petri, G. Networks beyond pairwise interactions: Structure and dynamics. Phys. Rep. 2020, 874, 1–92. [Google Scholar]

- Hidalgo, C.A.; Klinger, B.; Barabási, A.-L.; Hausmann, R. The Product Space Conditions the Development of Nations. Science 2007, 317, 482–487. [Google Scholar]

- Aksoy, S.G.; Joslyn, C.; Marrero, C.O.; Praggastis, B.; Purvine, E. Hypernetwork science via high-order hypergraph walks. EPJ Data Sci. 2020, 9, 16. [Google Scholar]

- Fan, T.; Lü, L.; Shi, D.; Zhou, T. Characterizing cycle structure in complex networks. Commun. Phys. 2021, 4, 1–9. [Google Scholar]

- Ang, B.W. The LMDI approach to decomposition analysis: A practical guide. Energy policy 2005, 33, 867–871. [Google Scholar]

- Corsatea, T.D.; Lindner, S.; Arto, I.; Román, M.V.; Rueda-Cantuche, J.M.; Velázquez Afonso, A.; Amores, A.F.; Neuwahl, F. World Input-Output Database Environmental Accounts, Update 2000–2016; EUR 29727 EN; Publications Office of the European Union: Luxembourg, 2019; p. 54. ISBN 978-92-76-02068-4. [Google Scholar]

- Wang, Z.; Li, Y.; Cai, H.; Yang, Y.; Wang, B. Regional difference and drivers in China’s carbon emissions embodied in internal trade. Energy Econ. 2019, 83, 217–228. [Google Scholar]

- Shen, Y.; Liu, J.; Tian, W. Interaction between international trade and logistics carbon emissions. Energy Rep. 2022, 8, 10334–10345. [Google Scholar]

- Liu, C.; Ma, C.; Xie, R. Structural, innovation and efficiency effects of environmental regulation: Evidence from China’s carbon emissions trading pilot. Environ. Resour. Econ. 2020, 75, 741–768. [Google Scholar] [CrossRef]

- Huang, H.P.; Yi, M.T.; Cao, J.W.; Zou, Y.F.; Huang, X.M. Spatial and temporal variation of implied carbon emissions from regional trade and its impact effects: The Yangtze River Economic Belt as an example. Econ. Geogr. 2021, 41, 49–57. [Google Scholar]

- Wang, B.Q.; Chen, P.; Du, G.; Jiang, X.H. A study on the structural decomposition of implied carbon emissions of China’s export trade—A comparative analysis based on carbon emissions data of China’s trade with its trade partners by industry. Price Theory Pract. 2018, 1, 134–137. [Google Scholar] [CrossRef]

- Qiu, Q.; Li, Q.Q. A study on the measurement of implied carbon emissions in China’s import and export trade and the driving factors. Econ. Manag. 2012, 34, 10–18. [Google Scholar]

- Liu, L.Q.; Yan, X.F.; Yang, L.; Song, M. Research on the evolution and endogenous mechanism of international trade dependence network. China Ind. Econ. 2021, 2, 98–116. [Google Scholar] [CrossRef]

- Ben Kheder, S.; Zugravu, N. The Pollution Haven Hypothesis: A Geographic Economy Model in a Comparative Study. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Leifeld, P.; Cranmer, S.J.; Desmarais, B.A. Temporal exponential random graph models with btergm: Estimation and bootstrap confidence intervals. J. Stat. Softw. 2018, 83, 1–36. [Google Scholar]

- Lusher, D.; Koskinen, J.; Robins, G. Exponential Random Graph Models for Social Networks: Theory, Methods, and Applications; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Qu, C.; Shao, J.; Cheng, Z. Can embedding in global value chain drive green growth in China’s manufacturing industry? J. Clean. Prod. 2020, 268, 121962. [Google Scholar]

- Liu, C.; Zhao, G. Can global value chain participation affect embodied carbon emission intensity? J. Clean. Prod. 2020, 287, 125069. [Google Scholar]

- Wang, Y.; Wang, Z.; Zameer, H. Structural characteristics and evolution of the “international trade-carbon emissions” network in equipment manufacturing industry: International evidence in the perspective of global value chains. Environ. Sci. Pollut. Res. 2021, 28, 25886–25905. [Google Scholar]

- Wu, K.; Yang, T.; Wei, X. Does the structure of intersectoral embedded carbon flow network matter to carbon reduction in China? J. Clean. Prod. 2019, 233, 1061–1074. [Google Scholar] [CrossRef]

- Bianconi, G. Higher-Order Networks (Elements in Structure and Dynamics of Complex Networks); Cambridge University Press: Cambridge, UK, 2021. [Google Scholar] [CrossRef]

- Cai, L.H.; Zhang, Z.; Zhu, L. Global value chain embedding and carbon dioxide emissions-an empirical study from Chinese industrial panel data. Int. Trade Issues 2020, 4, 86–104. [Google Scholar] [CrossRef]

- Hu, D.; Jiao, J.; Tang, Y.; Han, X.; Sun, H. The effect of global value chain position on green technology innovation efficiency: From the perspective of environmental regulation. Ecol. Indic. 2020, 121, 107195. [Google Scholar]

- Wang, S.; He, Y.; Song, M. Global value chains, technological progress, and environmental pollution: Inequality towards developing countries. J. Environ. Manag. 2020, 277, 110999. [Google Scholar]

- Yang, B.; Liu, B.; Peng, J.; Liu, X. The impact of the embedded global value chain position on energy-biased technology progress: Evidence from China’s manufacturing. Technol. Soc. 2022, 71, 102065. [Google Scholar]

- Meng, B.; Wang, Z.; Koopman, R. How Are Global Value Chains Fragmented and Extended in China’s Domestic Production Networks; IDE Discussion Papers 424; Institute of Developing Economies, Japan External Trade Organization (JETRO): Tokyo, Japan, 2013. [Google Scholar]

- Morris, M.; Kaplinsky, R.; Kaplan, D. “One thing leads to another”—Commodities, linkages and industrial development. Resour. Policy 2012, 37, 408–416. [Google Scholar]

- Ji, C.Y.; Yang, H.Q. Progress of research on implied carbon emissions in international trade: A review of the literature. J. Univ. Int. Bus. Econ. 2011, 6, 64–71. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, C.; Wang, Q.; Zhou, D. Does emission trading lead to carbon leakage in China? Direction and channel identifications. Renew. Sustain. Energy Rev. 2020, 132, 110090. [Google Scholar]

- Zhang, W.; Tang, X.; Yang, G.; Zha, D. Decomposition of CO2 emission intensity in Chinese MIs through a development mode extended LMDI method combined with a production-theoretical approach. Sci. Total Environ. 2019, 702, 134787. [Google Scholar]

| Forward | Backward | |||

|---|---|---|---|---|

| 2000 | 2018 | 2000 | 2018 | |

| China | 4.577 | 5.143 | 2.604 | 2.362 |

| America | 2.626 | 2.473 | 2.663 | 3.797 |

| Germany | 3.454 | 3.665 | 2.199 | 2.758 |

| England | 3.279 | 3.085 | 2.879 | 3.280 |

| France | 3.999 | 4.074 | 3.438 | 2.784 |

| Japan | 2.451 | 2.345 | 1.741 | 1.856 |

| Korea | 2.450 | 2.433 | 1.479 | 1.823 |

| Russia | 2.330 | 2.344 | 3.649 | 3.332 |

| India | 3.232 | 2.613 | 1.590 | 1.916 |

| Forward | Backward | |||

|---|---|---|---|---|

| 2000 | 2018 | 2000 | 2018 | |

| D01T02 | 4.258 | 7.578 | 28.101 | 30.501 |

| D21 | 31.610 | 27.775 | 3.903 | 2.048 |

| D25 | 2.461 | 3.491 | 3.706 | 4.023 |

| D26 | 3.401 | 3.368 | 2.218 | 1.591 |

| D52 | 2.241 | 2.199 | 4.593 | 5.257 |

| D64T66 | 8.150 | 6.069 | 1.849 | 1.905 |

| D69T75 | 3.594 | 2.792 | 4.012 | 3.884 |

| D84 | 3.372 | 4.497 | 2.774 | 2.813 |

| D85 | 2.899 | 3.311 | 2.218 | 2.326 |

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 2000 | USA | China | Japan | Russia | India | Germany | UK | Brazil | France | Italy |

| 2006 | USA | China | Japan | Russia | India | Germany | UK | Brazil | France | Italy |

| 2012 | China | USA | India | Russia | Japan | Brazil | Germany | UK | Canada | Iran |

| 2018 | China | USA | India | Russia | Japan | Brazil | Germany | Indonesia | Iran | Saudi Arabia |

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 2000 | USA | China | Russia | India | Japan | Germany | Brazil | Canada | UK | Italy |

| 2006 | China | USA | Russia | India | Japan | Germany | Brazil | Canada | Iran | UK |

| 2012 | China | USA | India | Russia | Japan | Brazil | Germany | Indonesia | Iran | Canada |

| 2018 | China | USA | India | Russia | Japan | Brazil | Germany | Iran | Indonesia | Korea |

| Year | Country |

|---|---|

| 2000 | USA, UK |

| 2006 | USA, UK |

| 2012 | USA, UK |

| 2018 | USA, UK, India, Russia, Japan, Brazil, Germany, Iran, Indonesia, Korea, Canada, France, Italy |

| Decomposition Results | Carbon Intensity Effect | Industrial Structure Effect | Output Scale Effect | Total Effect |

|---|---|---|---|---|

| 2000–2001 | −73,829.161 | 1,061,657.994 | −726,021.657 | 261,807.200 |

| 2001–2002 | −459,122.422 | −135,572.369 | 927,053.464 | 332,358.700 |

| 2002–2003 | −3,121,006.316 | 863,505.950 | 3,371,033.064 | 1,113,533 |

| 2003–2004 | −3,787,544.259 | 348,993.065 | 458,4290.446 | 1,145,739 |

| 2004–2005 | −2,869,250.837 | 985,462.706 | 3,036,935.963 | 1,153,148 |

| 2005–2006 | −2,536,938.215 | 131,182.793 | 3,369,665.775 | 963,910.400 |

| 2006–2007 | −2,056,612.819 | −945,665.700 | 4,231,205.859 | 1,228,927 |

| 2007–2008 | −580,8231.105 | 1,994,754.896 | 3,791,545.573 | −21,930.600 |

| 2008–2009 | 6,335,941.657 | −171,800.983 | −648,0871.526 | −31,6731 |

| 2009–2010 | −1,711,930.717 | −1,392,234.989 | 4,903,457.528 | 1,799,292 |

| 2010–2011 | −4,388,350.725 | 417,369.907 | 5,001,958.384 | 1,030,978 |

| 2011–2012 | 1,337,354.530 | −1,245,181.575 | 299,006.948 | 391,179.900 |

| 2012–2013 | 813,157.783 | −1,002,984.844 | 717,527.757 | 527,700.700 |

| 2013–2014 | 1,676,778.679 | −1,946,462.717 | 709,721.570 | 440,037.500 |

| 2014–2015 | 3,320,028.628 | −408,040.3052 | −3,408,984.098 | −496,996 |

| 2015–2016 | 2,191,325.161 | −1,647,892.727 | −861,325.6748 | −317,893 |

| 2016–2017 | −2,977,756.207 | 495,530.7062 | 285,9819.586 | 377,594.1 |

| 2017–2018 | −2,822,500.756 | −526,70.83295 | 2,729,406.612 | −145,765 |

| Contribution Rate | Carbon Intensity Effect | Industrial Structure Effect | Output Scale Effect | Sum |

|---|---|---|---|---|

| 2000–2001 | −0.282 | 4.055 | −2.773 | 1 |

| 2001–2002 | −1.381 | −0.408 | 2.789 | 1 |

| 2002–2003 | −2.803 | 0.775 | 3.027 | 1 |

| 2003–2004 | −3.306 | 0.305 | 4.001 | 1 |

| 2004–2005 | −2.488 | 0.855 | 2.634 | 1 |

| 2005–2006 | −2.632 | 0.136 | 3.496 | 1 |

| 2006–2007 | −1.674 | −0.770 | 3.443 | 1 |

| 2007–2008 | 264.846 | −90.958 | −172.888 | 1 |

| 2008–2009 | −20.004 | 0.542 | 20.462 | 1 |

| 2009–2010 | −0.952 | −0.774 | 2.723 | 1 |

| 2010–2011 | −4.256 | 0.405 | 4.852 | 1 |

| 2011–2012 | 3.419 | −3.183 | 0.764 | 1 |

| 2012–2013 | 1.541 | −1.901 | 1.360 | 1 |

| 2013–2014 | 3.811 | −4.423 | 1.613 | 1 |

| 2014–2015 | −6.680 | 0.821 | 6.859 | 1 |

| 2015–2016 | −6.893 | 5.184 | 2.709 | 1 |

| 2016–2017 | −7.886 | 1.312 | 7.574 | 1 |

| 2017–2018 | 19.363 | 0.361 | −18.725 | 1 |

| System Variable | Subsystem Variable | Variable Name | Variable Symbol | Indicator Sender(S) Receiver(R) |

|---|---|---|---|---|

| Dependent variable | — | Global trade implies a carbon emissions relationship | Y | — |

| Independent variable | Core explanatory variable | Degree of forward industry value chain embedded | GVC_IV | S & R |

| Degree of backward industry value chain embedded | GVC_FV | S & R | ||

| Network Structure Variable | edges | edges | — | |

| Forward industrial embedded network centrality | q_eig | S & R | ||

| Backward industrial embedded network centrality | h_eig | S & R | ||

| Control variable | GDP per capita (USD) | lnGDP | S & R | |

| Percentage of manufacturing value added (%) | structure | S & R | ||

| R&D expenditure share (%) | tec | S & R | ||

| GDP energy consumption per unit (USD/kg oil) | energy | S & R | ||

| Other covariate | Geographical proximity | geo | — | |

| Time-dependent variable | stability | stability | — | |

| Transferability | auto | — | ||

| Dischargeability | loss | — | ||

| Updatability | innovation | — |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| Structure-dependent | |||||

| edges | 5.39 *** (0.47) | 7.62 *** (0.70) | 3.60 *** (0.69) | 3.68 *** (0.69) | 11.61 *** (0.75) |

| Receiver Properties | |||||

| Core explanatory | |||||

| GVC_IV | −1.89 *** (0.54) | −3.20 *** (0.70) | −3.78 *** (0.71) | −3.08 *** (0.69) | −3.33 *** (0.70) |

| High-order structural | |||||

| q_eig | 6.35 *** (0.26) | 9.32 *** (0.44) | 9.35 *** (0.45) | 9.07 *** (0.45) | 9.08 *** (0.45) |

| Control | |||||

| lnGDP | 0.62 *** (0.06) | 0.33 *** (0.10) | 0.39 *** (0.10) | 0.29 *** (0.10) | 0.33 *** (0.10) |

| structure | 0.01 (0.01) | 0.03 *** (0.01) | 0.04 *** (0.01) | 0.03 *** (0.01) | 0.03 *** (0.01) |

| tec | 0.24 *** (0.04) | 0.35 *** (0.06) | 0.36 *** (0.06) | 0.40 *** (0.06) | 0.44 *** (0.06) |

| energy | −0.29 *** (0.05) | −1.02 *** (0.07) | −1.07 *** (0.07) | −1.14 *** (0.07) | −1.15 *** (0.07) |

| Sender Properties | |||||

| Core explanatory | |||||

| GVC_IV | −1.89 *** (0.47) | −1.00 (0.64) | −0.82 (0.65) | −0.75 (0.65) | −1.21 (0.65) |

| High-order structural | |||||

| q_eig | −1.70 *** (0.36) | 0.14 (0.51) | 0.70 (0.50) | −0.07 (0.52) | 0.32 (0.52) |

| Control | |||||

| lnGDP | −0.70 *** (0.08) | −0.52 *** (0.12) | −0.58 *** (0.12) | −0.62 *** (0.12) | −0.48 *** (0.12) |

| structure | 0.04 *** (0.01) | 0.07 *** (0.01) | 0.06 *** (0.01) | 0.06 *** (0.01) | 0.07 *** (0.01) |

| tec | 0.56 *** (0.05) | 0.73 *** (0.08) | 0.77 *** (0.08) | 0.72 *** (0.08) | 0.70 *** (0.08) |

| energy | 0.26 *** (0.05) | −0.15 ** (0.07) | −0.10 (0.08) | 0.01 (0.07) | −0.00 (0.07) |

| Covariates | |||||

| geo | 2.22 *** (0.47) | 1.81 *** (0.55) | 1.79 *** (0.55) | 1.68 *** (0.51) | 2.27 *** (0.66) |

| Time-dependent | |||||

| stability | 4.18 *** (0.11) | ||||

| auto | 8.45 *** (0.23) | ||||

| loss | −8.46 *** (0.23) | ||||

| innovation | −8.38 *** (0.23) | ||||

| Num | 79,040 | 74,880 | 74,880 | 74,880 | 74,880 |

| AIC | 2,011,966.99 | 1,796,770.08 | 1,796,625.22 | 1,796,655.59 | 1,796,659.82 |

| BIC | 2,012,138.31 | 1,796,952.01 | 1,796,807.15 | 1,796,837.52 | 1,796,841.75 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| Structure-dependent | |||||

| edges | 3.23 *** (0.49) | 4.45 *** (0.70) | 0.75 (0.70) | 0.38 (0.70) | 8.22 *** (0.75) |

| Receiver Properties | |||||

| Core explanatory | |||||

| GVC_IV | −1.93 *** (0.25) | −0.75 ** (0.36) | −0.76 ** (0.37) | −0.53 (0.37) | −0.85 ** (0.37) |

| High-order structural | |||||

| q_eig | −2.32 *** (0.26) | −2.07 *** (0.44) | −1.97 *** (0.45) | −2.01 *** (0.45) | −1.88 *** (0.45) |

| Control | |||||

| lnGDP | 0.27 *** (0.06) | −0.14 (0.09) | −0.21 ** (0.09) | −0.09 (0.09) | −0.15 (0.09) |

| structure | −0.00 (0.01) | 0.01 (0.01) | −0.00 (0.01) | 0.00 (0.01) | −0.00 (0.01) |

| tec | 0.18 *** (0.04) | 0.28 *** (0.05) | 0.32 *** (0.06) | 0.27 *** (0.05) | 0.34 *** (0.06) |

| energy | −0.04 (0.04) | −0.87 *** (0.07) | −0.91 *** (0.07) | −0.89 *** (0.07) | −0.92 *** (0.07) |

| Sender Properties | |||||

| Core explanatory | |||||

| GVC_IV | 1.17 *** (0.29) | 0.33 (0.36) | 0.47 (0.36) | 0.42 (0.37) | 0.87 ** (0.37) |

| High-order structural | |||||

| q_eig | −1.38 *** (0.24) | −2.32 *** (0.34) | −2.36 *** (0.34) | −2.24 *** (0.34) | −2.44 *** (0.34) |

| Control | |||||

| lnGDP | −0.77 *** (0.08) | −0.55 *** (0.10) | −0.54 *** (0.11) | −0.57 *** (0.11) | −0.50 *** (0.11) |

| structure | 0.05 *** (0.01) | 0.05 *** (0.01) | 0.06 *** (0.01) | 0.05 *** (0.01) | 0.05 *** (0.01) |

| tec | 0.60 *** (0.05) | 0.63 *** (0.07) | 0.56 *** (0.07) | 0.59 *** (0.07) | 0.54 *** (0.07) |

| energy | 0.28 *** (0.04) | 0.07 (0.07) | 0.06 (0.07) | 0.10 (0.07) | 0.13 ** (0.07) |

| Covariates | |||||

| geo | 2.02 *** (0.47) | 1.63 *** (0.52) | 1.78 *** (0.54) | 1.59 *** (0.53) | 1.78 *** (0.54) |

| Time-dependent | |||||

| stability | 3.98 *** (0.11) | ||||

| auto | 8.14 *** (0.23) | ||||

| loss | −7.98 *** (0.22) | ||||

| innovation | −7.98 *** (0.22) | ||||

| Num | 79,040 | 74,880 | 74,880 | 74,880 | 74,880 |

| AIC | 2,012,021.45 | 1,797,254.39 | 1,797,126.04 | 1,797,109.47 | 1,797,091.35 |

| BIC | 2,012,192.76 | 1,797,436.32 | 1,797,307.96 | 1,797,291.40 | 1,797,273.28 |

| Variables | Model 1 | Variables | Model 2 |

|---|---|---|---|

| Structure-dependent | Structure-dependent | ||

| edges | 3.91 *** (0.51) | edges | 2.35 *** (0.51) |

| Receiver Properties | Receiver Properties | ||

| Core explanatory | Core explanatory | ||

| GVC_IV | −2.45 *** (0.57) | GVC_IV | −1.61 *** (0.27) |

| High-order structural | High-order structural | ||

| q_eig | 4.46 *** (0.26) | q_eig | −2.16 *** (0.28) |

| Control | Control | ||

| lnGDP | 0.69 *** (0.07) | lnGDP | 0.35 *** (0.07) |

| structure | 0.01 (0.01) | structure | −0.00 (0.01) |

| tec | 0.12 *** (0.05) | tec | 0.13 *** (0.04) |

| energy | 0.02 (0.05) | energy | 0.14 *** (0.05) |

| Sender Properties | Sender Properties | ||

| Core explanatory | Core explanatory | ||

| GVC_IV | −1.48 *** (0.50) | GVC_IV | 1.20 *** (0.31) |

| High-order structural | High-order structural | ||

| q_eig | −2.32 *** (0.35) | q_eig | −1.21 *** (0.26) |

| Control | Control | ||

| lnGDP | −0.80 *** (0.09) | lnGDP | −0.80 *** (0.08) |

| structure | 0.03 *** (0.01) | structure | 0.04 *** (0.01) |

| tec | 0.51 *** (0.05) | tec | 0.51 *** (0.05) |

| energy | 0.37 *** (0.05) | energy | 0.38 *** (0.05) |

| Covariates | Covariates | ||

| geo | 2.18 *** (0.50) | geo | 2.06 *** (0.50) |

| Variables | Model 1 | Variables | Model 2 |

| Structure-dependent | Structure-dependent | ||

| edges | 4.01 *** (0.49) | edges | 2.16 *** (0.49) |

| Receiver Properties | Receiver Properties | ||

| Core explanatory | Core explanatory | ||

| GVC_IV | −2.27 *** (0.54) | GVC_IV | −1.71 *** (0.54) |

| High-order structural | High-order structural | ||

| q_eig | 5.18 *** (0.23) | q_eig | −2.15 *** (0.23) |

| Control | Control | ||

| lnGDP | 0.72 *** (0.07) | lnGDP | 0.50 *** (0.07) |

| structure | 0.00 (0.01) | structure | −0.00 (0.01) |

| tec | 0.18 *** (0.04) | tec | 0.20 *** (0.04) |

| energy | −0.00 (0.05) | energy | 0.17 *** (0.05) |

| Sender Properties | Sender Properties | ||

| Core explanatory | Core explanatory | ||

| GVC_IV | −1.45 *** (0.64) | GVC_IV | 0.96 *** (0.64) |

| High-order structural | High-order structural | ||

| q_eig | −2.32 *** (0.33) | q_eig | −1.18 *** (0.33) |

| Control | Control | ||

| lnGDP | −0.75 *** (0.08) | lnGDP | −0.75 *** (0.08) |

| structure | 0.03 *** (0.01) | structure | 0.03 *** (0.01) |

| tec | 0.52 *** (0.05) | tec | 0.52 *** (0.05) |

| energy | 0.35 *** (0.05) | energy | 0.28 *** (0.05) |

| Covariates | Covariates | ||

| geo | 2.20 *** (0.48) | geo | 2.31 *** (0.58) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, C.; Zhang, X. The Influencing Mechanisms on Global Industrial Value Chains Embedded in Trade Implied Carbon Emissions from a Higher-Order Networks Perspective. Sustainability 2022, 14, 15138. https://doi.org/10.3390/su142215138

Li C, Zhang X. The Influencing Mechanisms on Global Industrial Value Chains Embedded in Trade Implied Carbon Emissions from a Higher-Order Networks Perspective. Sustainability. 2022; 14(22):15138. https://doi.org/10.3390/su142215138

Chicago/Turabian StyleLi, Congxin, and Xu Zhang. 2022. "The Influencing Mechanisms on Global Industrial Value Chains Embedded in Trade Implied Carbon Emissions from a Higher-Order Networks Perspective" Sustainability 14, no. 22: 15138. https://doi.org/10.3390/su142215138

APA StyleLi, C., & Zhang, X. (2022). The Influencing Mechanisms on Global Industrial Value Chains Embedded in Trade Implied Carbon Emissions from a Higher-Order Networks Perspective. Sustainability, 14(22), 15138. https://doi.org/10.3390/su142215138