Abstract

An overview of the adoption extent of the energy business models around the world was undertaken by considering both the developed and developing countries, with the emphasis on the customer-side renewable energy business models. The developed countries have widely adopted energy business initiatives to advance the distributed generation of electricity from renewable energy sources, while developing countries are struggling and/or have failed to record significant success. Additionally, developing countries are shifting from customer-owned energy business initiatives to the community-shared energy business initiatives to enhance prosumer-generated energy self-consumption. Furthermore, the existent billing schemes as well as the store-on grid scheme applicable to the energy business initiatives are discussed in this paper. The virtual net metering scheme category is the main billing scheme used for the community-shared energy business initiatives. In addition, this study depicts how the store-on grid scheme addresses the shortfalls of the existent billing schemes. Finally, the study gives policy recommendations that the decision makers in the developing countries could use as a foundation to foster the solar PV technology deployment through energy business models, especially by the adoption of the store-on grid scheme as the billing scheme.

1. Introduction

The emergence of distributed power generation in recent decades has globally transformed the energy industry, bringing about a shift from the entirely centralised systems to the networks that incorporate both distributed and centralised elements [1]. The concept of distributed power generation at small-scale level is highly desirable due to its sustainable development factors, namely, environmental, techno-economic, and socio-political factors [1,2]. By the nature of their sizes, distributed power generation systems are characterised by a range of advantages, such as scalability, proximity to demand, and being less costly to implement [1,3].

Renewable energy can simply be defined as energy from sources that can be naturally replenished at a higher rate than they are consumed. These sources include, among others, the sun and wind [1]. Renewable energy sources (RES)-based distributed power generation systems are at the centre of the efforts and strategies adopted to mitigate climate change globally [4]. To efficiently exploit the distributed renewable energy resources, energy business models have been proposed and/or adopted to foster the energy transition from conventional sources to renewable energy sources. However, these efforts have encountered challenges, especially from the participating stakeholders. Literature reveals that the billing scheme to adopt is the greatest challenge faced by the stakeholders during the energy business-model designing process [5,6,7]. Likewise, an assertion has been made that in addition to enhancing the access to reliable, clean and affordable energy (that is, sustainable development goal seven (SDG7)), energy business models ought to foster other SDGs to maximise the social and economic benefits of electricity [8,9]. Thus, novel and self-sustaining energy business models for renewable energy technologies (RET) remain a crucial necessity for the energy sector [4,10,11,12]. Although several energy business models exist, there is no record in the literature that has investigated their successes and/or failures as well as their uniqueness over the others on the global scale. Thus, this study makes the following contributions to knowledge:

- Examines the existent billing schemes for energy business models and the reasons for opposition to them from the stakeholders.

- Discusses the uniqueness of the store-on grid scheme from the existent billing schemes and its suitability to replace the existing billing schemes.

- Discusses appropriate approaches that developing countries could adopt to succeed in the adoption of energy business models.

2. Energy Business Models for Solar PV

Generally, a business model could be defined as the mechanism through which an organisation conveys value to clients, attracts clients to renumerate for value, and transforms those renumerations to profits [2]. In principle, a business model should comprise four compulsory elements: key organisation resources, value concept for clients, organisation profit form, and organisation processes [3]. A business model’s success is assessed based on its ability to establish a conciliation between the organisation’s technology and its economic value formation [4].

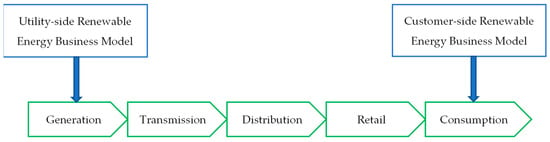

The energy sector mainly uses two general energy business models, namely, utility-side renewable energy business models (UREBM) and customer-side renewable energy business models (CREBM) [2]. UREBM constitute large-scale capacity projects that generate bulk electricity and feed it into the grid, which delivers it to customers via the conventional power system. Thus, the generation and transmission of the electricity from the RES follows a similar pattern to the centralised conventional power plants [2]. CREBM constitute small-scale systems that are installed close to the end-users, referred to as distributed generation (DG). Small-scale electricity generation systems, however, have a different integration position in the power system, that is, they are located at the consumption position. Thus, the generation and transmission of the electricity follows a very different pattern from the utility-side projects, as shown in Figure 1 [2]. Since the emphasis of this study is on distributed generation, UREBM are not discussed in this study. Interested readers may refer to [2,5] for an extended discussion about UREBM and how they compare with CREBM.

Figure 1.

Two general energy business models and their location in the power system.

Literature reveals that CREBM are further categorised as customer-owned, community-shared, and third-party ownership business-model initiatives [3,4,6]. The customer-owned energy business (COEB) initiatives are the widely spread systems operated under the customer-side renewable energy models, while the community-shared energy business (CSEB) initiatives have only been recently introduced for adoption [3,7]. Under the community-shared energy business, customers might own two solar modules or an agreed-upon share of the solar plant’s generated energy [3,6,7]. The CSEB initiatives are relatively new, and consequently have not been widely adopted; thus, they are under-investigated by researchers to date [7,8]. Recently, third-party ownership energy business (TPOEB) initiatives have emerged, where the energy company owns and operates customer-sited energy systems and either leases the equipment or sells the generated electricity to the site occupants [3,6]. Table 1 shows some of the reviewed studies identifying the customer-side renewable energy models adopted for the solar photovoltaic systems at a considered location.

Table 1.

Some of the reviewed studies on energy business models for solar PV technology.

The developed countries have widely adopted energy business initiatives to advance the distributed generation of electricity from renewable energy sources as a means of addressing the multiple challenges of global sustainability, energy security and socio-economic development, in which the transformative change of energy systems towards a broad portfolio of low-carbon technologies was inevitable [12]. In turn, developed countries opted for the development of distributed generation from renewable energy sources over the generation and importation of energy from fossil fuels [23,24]. Renewable energy technologies, particularly photovoltaics, are unique in the sense that they allow homeowners to produce and self-consume electricity at even small capacity ratings, with minimal maintenance and no fuel costs [12].

The adoption of business initiative policies has been successful in addressing the energy end-user’s quest for a secure and affordable electricity supply [25,26]. For instance, in the United Kingdom and other developed countries, the electricity sector was radically reformed to incorporate modern retail electricity markets [25]. The reforms were a consequence of the liberalisation that commenced in the late 1990s, which oversaw monopolies dissociated into constituent parts, enabling free competition amongst energy retailers and amongst wholesale generators. This increased the number of market actors, because vertically integrated utilities were divided to create individual entities, which are typically owned and operated by different companies [25].

2.1. Customer-Owned Energy Business

The customer-owned energy business, also known as self-investment, is defined as a project whereby the companies or individual households invest in clean energy technologies and own the systems individually [9,10,27,28]. In the COEB project, the main beneficiary of the generated energy is the building owner or property where the solar PV system is installed. Since the COEB projects render the possibility of individually installing the solar PV systems, these business models are the most widespread businesses globally [3]. The COEB initiative can be designed on terms such as “all electricity is fed into the grid network” or “self-consumed and the surplus electricity is fed into the grid network”. Thus, the prosumer benefits from every unit of energy that is fed into the grid network under both designs of the COEB initiative [10,27,28]. The main market segment for COEB projects is the residential sector, as along with small and medium enterprises that normally have appropriate property space that fits the solar PV systems, especially the building rooftops [10,27,28].

Generally, COEB projects have high up-front investment costs as well as long payback time, which hinder their deployment [10,27,28]. The low deployment by markets of RET, especially solar PV, brought about the development of energy business schemes (policies), such as feed-in tariff (FiT), carbon taxes, net-metering (NM), cap-and-trade schemes, net billing (NB), performance standards, and the creation of niche markets intended to enhance the diffusion of RET and their valuation [29,30]. COEB projects have significantly benefited from these schemes, especially the FiT and NM schemes [3,27,28].

Germany is one of the countries that have successfully implemented the COEB initiative for solar PV technology [28,31]. In addition to offering attractive FiT scheme rates, Germany also established a low interest loan rate scheme especially for RET [28]. Other countries that have implemented the COEB initiatives that consider rooftop-mounted solar PV systems in the FiT scheme include, among others, Portugal, Turkey, Greece, Ukraine, Switzerland, Luxemburg, Kosovo, China, Indonesia, Japan, Taiwan, Canada, US, Israel, and Iran [32,33]. The NM scheme is widely adopted in the US, Germany, India, and China [18,32], while the NB scheme is common in Mexico, Finland, New York, and Arizona [30]. Incorporation of self-consumption with schemes such as FiT, NM, and NB has been adopted in the US, Germany, Japan, China, Mexico, Finland, and in 25 of the 29 states of India [30,31,32,34].

Rooftop-mounted solar PV systems account for about 50% of the cumulative installed solar PV capacity globally [35]. In most developed solar PV markets, such as Europe, the US, Australia, and Japan, rooftop-mounted solar PV systems have contributed a significant share of cumulative installed solar PV capacity [31,32]. In Europe, about 46% of the cumulative installed solar PV capacity was from rooftop-mounted solar PV systems (residential and commercial sectors) in 2017 [36]. The feasibility of both the on-grid and off-grid connected rooftop-mounted solar PV systems has been widely investigated around the world; for instance, in India [31], Uganda [35], Turkey [32], Thailand [37], Switzerland [38], Oman [39], Europe [36], and United Arab Emirates [40]. However, some rooftop owners do not have or are not willing to meet the up-front investment costs for the solar PV systems. Thus, to utilise their rooftop spaces, building owners lease out their rooftop spaces for solar PV installation to the developers, known as third-party developers [31].

2.2. Third-Party Ownership Energy Business

Third-party ownership energy business is defined as an energy project launched by a developer to generate electricity based on RES in which all the costs and benefits are directed toward the developer [41,42]. Under this arrangement, the customers, normally the building owners or tenants, can benefit from the energy-generating system without necessarily paying the system’s upfront costs [3,5]. Under the TPOEB, the third-party developer deals with all the concerns, such as financing the designing, installation, and maintenance of the rooftop-mounted solar PV system on the host customer’s building [5,42,43,44]. TPOEB initiatives offer an attractive alternative to electricity customers who are not willing to handle the risks related to owning a solar PV system by making high upfront payments, but rather prefer to make low upfront payments for solar PV systems [14]. Under the TPOEB initiative, the third-party developer could be the utility, or another individual (company) [31]. Where the utility is not the third-party developer, it plays a more active role for the TPOEB initiatives by acting as the project facilitator [6].

The TPOEB project could be designed such that the rooftop-mounted solar PV system does not have to feed any of the system’s produced energy into the grid network; in this case, the host customer consumes all the generated energy. Otherwise, the TPOEB project could be designed such that the rooftop-mounted solar PV system feeds the surplus generated energy into the grid network and the utility operator transacts with the third-party developer [31]. The third-party developer and the host customer are governed by a power purchase agreement (PPA) or lease for a period of 10–25 years to buy some or all the energy generated from the installed system [3,5,31,44]. Under both PPA and lease contracts, the host customer makes a one-time low deposit payment to the developer and thereafter continues to make periodic payments as agreed upon. That is, after the upfront down payment is made, for the lease contract, the host customer pays an agreed-upon amount on a monthly basis ($/month), while for the PPA contract, the host customer pays an agreed-upon amount per unit ($/kWh) for the energy generated in a month [14,42,44]. For further discussion on the PPA and lease contracts for the TPOEB initiatives, refer to [44].

Notably, TPOEB initiatives have been adopted not only in the residential sector, but rather, they have also been extended to the community-shared solar PV initiatives in the developed countries. Ownership of some CSEB projects is reported to be based on third-party ownership arrangements [41,45,46]. Community-shared solar PV projects with capacities that range widely in size connected to the distribution grid networks that are operated by the utility or the third-party entity permitting several clients to participate are reported to offer a middle ground for achieving stakeholders’ interests [15]. Under third-party ownership of the community-shared solar PV projects, developers collaborate with utility operators to develop, manage, and maintain solar PV systems; that is, developers sell their generated energy to utility operators through PPAs. Thus, utility operators are mandated to facilitate the billing process, interconnection services, and management of the electricity distribution system [45,46].

2.3. Community-Shared Energy Business

A community-shared energy business is defined as an energy project launched by a group of community members united by their proximity, and/or identify with similar interests, such that some or all of the costs incurred and benefits related to the project are directed toward the same group of people [8,47]. CSEB initiatives necessitate the development of robust conceptual frameworks that render opportunities for advancement in empowerment and equity to enhance transparency and urge engagement in community initiatives amongst the citizens [8]. Literature highlights positive outcomes of CSEB initiatives, especially for solar PV technology, that include, among others, financial rewards in the form of annual energy cost saving and shorter payback periods, and sustainability goal setting as well as marketing rewards in the form of energy security and energy independence [16,19,45].

CSEB projects could be owned by utility operators, third-party developers, a group of customers, or a charitable non-profit corporation [41,45,46]. The ownership of CSEB projects directly affects how they are financed and operated [45,46]. CSEB initiatives involve professional organisations, primarily partnerships established between the public and private sectors that involve the public authorities assuming a coordinating role to strengthen the private sector engagement and investment in the energy projects [48]. The role of prosumers under CSEB initiatives is to maximise the personal utility; that is, the power network established in the local and non-local areas. The primary purpose of CSEB initiatives is to foster economic growth and wellbeing by creating jobs and upskilling people, by investing in RET [48]. On the other hand, the CSEB initiatives could be constituted from voluntary non-profit third-party actors [48,49,50]. An extensive review on CSEB initiatives for a sustainable energy future is covered in [45,46,47,51].

CSEB initiatives are operated in various sizes worldwide, ranging from small-rooftop solar to mini-grids [52]. The underlying principles of CSEB initiatives are to foresee sustainable community development and energy democracy, thus ensuring energy security for communities [49,52]. Community cohesion is pivotal to CSEB initiatives. Communal collaboration and unity are crucial in mobilising communal members toward a shared purpose, and are often achieved through interactions and engagements within the community [7,53,54]. Generally, CSEB initiatives are considered to contribute to a reduction in greenhouse gases emissions and to overall community solidarity [53,55]. The achievement of the sustainable development intentions of CSEB initiatives, namely, environmental, economic and social community benefits, relies on government motivation, wider community engagement, and the deployment of business model design in addition to other characteristics [48,49]. CSEB initiatives have so far been adopted in developed countries, such as Australia, Scotland, Germany, Italy, The Netherlands, New Zealand, UK, Denmark, and US [43,49,50,52]. Notably, most of the existent literature reveals that CSEB initiatives have largely been studied and/or adopted in the developed countries [22,43,47]. The concept of CSEB has not yet been embraced by governments in developing countries to install solar PV systems for both on-grid and off-grid connections. Community-shared energy business models are still in the early stages of development, with only a few dedicated projects and studies [3]. In Sub-Saharan Africa, for instance, energy communities have received less attention from both the government and the private sector, partly due to the nascent energy systems in many emerging SSA countries [56]. However, developing countries have mainly adopted the stand-alone microgrid systems of the CSEB program for rural electrification.

General barriers to RET based business models are discussed in [3,10,57]. Possible barriers for CSEB initiatives are the billing scheme requirements, regulatory constraints, and tax incentives that vary from one country (state) to another [41,58]. Without appealing payment structures as well as access to tax incentives by the stakeholders, CSEB initiatives might fail to attract enough participation from potential investors [41,46,58]. Overall, the adoption of CSEB initiatives is considered to result in significant elimination of solar PV technology barriers [3]. Literature asserts that the main barriers to solar PV technology diffusion are significantly minimised when the CSEB initiative is adopted. Additionally, the TPOEB initiatives are reported to minimise some of the barriers that are common for the case of the COEB initiatives [3,10,11].

Overall, the three customer-side renewable energy models adopted have advantages and disadvantages. Table 2 shows the comparison of these models [3].

Table 2.

Comparison of the customer-side renewable energy business models.

3. Energy Billing Schemes

Several requirements are set under individual energy business model initiatives that should be followed by the adopting group members. For instance, some CSEB programs might require the energy project and prosumers to be in the locality that is served by the utility that buys the project’s generated energy [43,46]. Some of the other set prerequisites include a cap on the project capacity, project ownership by the members, and a category of ratepayers that are eligible for the program. Furthermore, billing schemes used by CSEB initiatives differ; for instance, some CSEB initiatives use an aggregate billing scheme to bill project members [42,43,46]. Which billing scheme to adopt is the greatest dilemma faced by stakeholders during the energy business-model designing process [43,51,59]. A billing scheme is required to track and apply the prosumers’ electricity purchased from the utility (kWh) and bill credits or payments for the surplus energy, which is fed to the grid network by prosumers (kWh or dollars) from the energy business project. Likewise, such a billing system ought to render the prosumer an opportunity to visualise the benefits from their energy project investment on the bill in a simpler way. Thus, the concern about the billing scheme used should not be overlooked by the policy developers; hence, it should be assessed prior to enacting the initiative [58]. The various existent billing schemes that are widely utilised by the energy business models, namely, FiT policy, net metering policy, and net billing policy, are discussed in this section.

3.1. Feed-in Tariff Scheme

The FiT scheme is a mechanism that permits consumers of the utility to also generate energy by establishing a RET project and feeding the excess generated energy into the grid network. The scheme offers the prosumer a FiT rate that is used to monetise the energy fed into the grid. Thus, prosumers benefit financially, in addition to recording a reduction in periodic energy bills from the utility. The FiT rate offered under the scheme is either facilitated by the utility operator through ratepayers or the government through taxpayers [60]. The FiT scheme is intended to foster the deployment of RET projects through long-term PPA contracts offered to prosumers for the sale of the energy generated by the RET system to the utility operators [60,61]. In recent decades, the FiT policy was widely implemented in European countries to foster solar PV technology deployment. For instance, about 61% of the total solar PV technologies in European countries in 2012 were from the FiT policy [62,63]. FiT schemes recorded significant success in the developed countries, but by contrast, they struggled in the developing countries due to different factors [64,65,66,67]. The FiT scheme has struggled and/or failed in the Caribbean and Latin American countries [66,67,68]. FiT schemes have likewise failed in African countries, mainly due to factors such as poor institutional design, very low FiT scheme tariffs offered, and political hindrances encountered in the operations of the scheme [64,65].

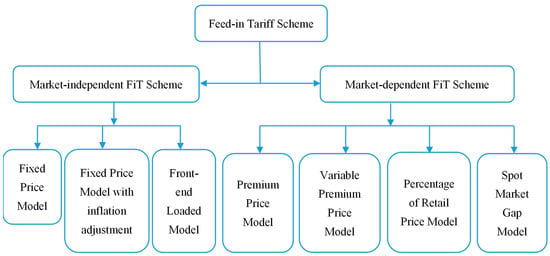

FiT schemes can be categorised into two groups. The first FiT category is the market-independent FiT scheme, where remuneration is determined by the regulatory authority independently of the electricity market retail rate. The market-independent FiT scheme is also known as the fixed-price FiT scheme. The second FiT category is the market-dependent FiT scheme, in which a premium payment, which serves as a top-up, is added to the electricity market retail rate. The market-dependent FiT scheme is also known as the premium-price FiT scheme [61,69]. Figure 2 shows the two categories of feed-in payment design, including further subdivision categories [69]. Table 3 shows a brief description of the FiT scheme models.

Figure 2.

FiT scheme payment design categories.

Table 3.

Brief description of the FiT scheme models.

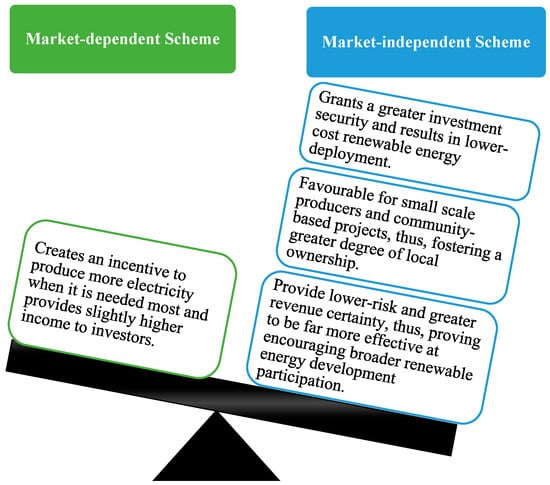

Overall, market-independent fixed price FiT schemes are currently the most widely utilised of all the FiT scheme designs. Globally, market-independent fixed price FiT schemes have been used in over 50 countries. Based on these countries’ experiences, in terms of cost efficiency of the Fit schemes, market-independent fixed price FiT payments have exhibited a higher level of cost efficiency in comparison to the market-dependent premium price FiT payments [69,71]. Figure 3 shows a comparison of the FiT payment schemes, depicting the strength of the market-independent schemes over the market-dependent schemes [61,69].

Figure 3.

Strength comparison between market-independent and market-dependent FiT payment schemes.

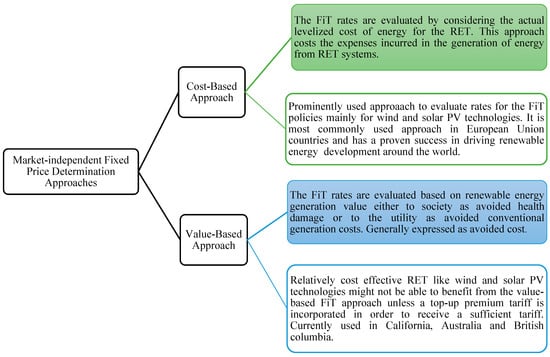

The market-independent fixed rate can be evaluated based on two approaches, namely, cost-based methods and value-based FiT calculation methods. Figure 4 shows the different approaches for determining market-independent fixed prices and how they have been used worldwide [69,71].

Figure 4.

Market-independent fixed price determination approaches.

Generally, FiT schemes are perceived to be expensive policies to be implemented by governments, even in the developed countries [33,72]. This perception is mainly attributed to the general assertion made about FiT scheme rates that they are normally above electricity market retail prices [73,74]. Notably, the FiT scheme approach offering above-market rates has recorded success in fostering energy transition to RET, particularly in the developed countries [62,63,73]. In contrast, FiT schemes that offer above-market rates payments to prosumers do not guarantee the schemes’ success if they are not well-designed [74]. FiT schemes have been crucial in the adoption of solar PV technology through COEB initiatives, especially rooftop-mounted systems. In developed countries, certain electricity markets have already achieved grid parity in the case of solar PV technology [75,76]. As a result, several developing countries have simultaneously shifted from the FiT schemes, especially for the COEB initiatives and have adopted energy initiatives that emphasise self-consumption of the generated electricity [36,77]. Since July 2017, a programme in support of the prosumer self-consumption of energy generated from the residential rooftop-mounted solar PV systems has been enacted in Germany, offering tariffs well below the average electricity market retail rates [31,77]. The new FiT scheme in Germany requires utilities to buy only 80% of the energy generated by a prosumer, while the prosumer self-consumes the remaining 20% of the energy generated from the rooftop-mounted solar PV system under the COEB project [31].

Although some developed countries are so far at grid parity in the case of solar PV technology [75,76], they still wish to sustain the same level of solar PV deployment growth; thus, alternative schemes for furthering solar PV deployment are being proposed and investigated [59,75]. One of the key aspects to be considered in the alternative schemes is the clear definition of the revenue streams in the energy business initiative for new market agents, such as the prosumers and the utilities [59,75]. An example of the emerging COEB initiatives is peer-to-peer energy trading [78]. Peer-to-peer trading provides a platform through which energy customers and producers can directly transact with each other without the involvement of the utility operator [78].

3.2. Net Metering Scheme

The net metering scheme is the billing approach that compensates prosumers for the energy fed into the grid network from their installed systems. During the billing period, prosumers’ bills are normally credited with kilowatt-hours of energy fed into the grid network. If the prosumers’ installed systems generate more electricity than the prosumers’ demand, the electric meters “run backwards” as the surplus generated energy is being fed to the grid network; thus, the prosumers purchase less electricity from the utility [30,41,42,46]. The net metering scheme could involve: simple net metering, where the prosumers who generate more than they consume do not receive credits from the utility, and likewise are not paid for the surplus energy that is fed to the grid at the end of the billing period; net metering with buy-pack, where the prosumers are paid by the utility operator for the excess generated energy during the billing period at a rate below the electricity market retail rate, equal to the electricity market retail rate, or above the electricity market retail rate; net metering with rolling credit, where the excess energy generated by the prosumers in one billing period is considered as credits to reduce the grid electricity consumption expenditure of the prosumers in the following billing period; or net metering with rolling credit and buy-back, where the prosumers receive monetary credit for any surplus generated energy fed into the grid network at the end of the banking period (in this case, the banking period is considered to be greater than one billing period) [79]. Net metering schemes could adopt different compensation approaches to meet the value of the energy generated and fed into the grid by the prosumers’ systems. The existent compensation approaches for net metering schemes are discussed in Section 3.2.1.

3.2.1. Net Metering Scheme Compensation Rates

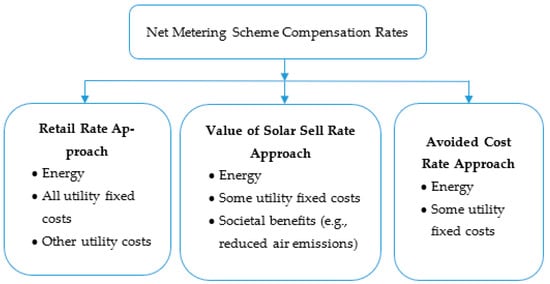

Under the net metering scheme, the energy generated and fed into the grid network by the prosumer is valued at the electricity market retail price,; this system is referred to as the traditional net metering (TNM) scheme [46]. In addition to the retail rate approach, the net metering scheme compensation rates could also be evaluated based on the value of the solar rate, or avoided cost rate, as shown in Figure 5 [80].

Figure 5.

Methods for evaluating the net metering scheme compensation rates.

The electricity retail rate approach provides relatively high compensations compared to the other approaches of determining the compensation rates. The retail rate-based compensation rate considers all the costs incurred in generating electricity and in operating, and maintaining the grid network, as well as other utility-related expenses, while the avoided cost rate-based compensation rate primarily reflects the costs incurred in generating electricity. Avoided cost rates are usually referred to as wholesale electricity rates [80]. The value of the solar rate approach reflects more or less the same considerations as the avoided cost rate approach with an addition of the evaluated societal benefits recorded with adoption of distributed solar PV, such as the reduction in air emissions, as shown in Figure 5 [80]. Table 4 shows a brief description of the different net metering scheme compensation rate approaches.

Table 4.

Brief description of the different net metering scheme compensation rate approaches.

3.2.2. Net Metering Scheme Categories

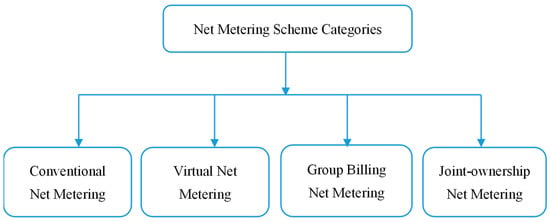

The application of the net metering scheme to energy business initiatives can be achieved by different methods. These methods are conventional net metering (CNM), virtual net metering (VNM), group billing (aggregate) net metering, and joint-ownership (remote) net metering [15,46,80], as shown in Figure 6. The conventional net metering scheme is the most frequently applied scheme for the COEB and TPOEB initiatives, while the virtual net metering, group billing net metering, and joint-ownership net metering schemes are applied to the CSEB initiatives. Table 5 shows a summarised description of the different net metering scheme categories.

Figure 6.

Net metering scheme categories.

Table 5.

Summarised description of the net metering scheme categories.

The adoption of VNM scheme for CSEB initiatives has not occurred without conflicts being registered between the utility operators and prosumers. For instance, in California and New York, the adoption of community net-metering provision for the CSEB initiative was opposed by the utility operators on the principle argument that the cost incurred by the utility for the net metering scheme payments should be endured by the non-scheme-participating utility customers, which jeopardises equity of energy access, and likewise causes a cost burden for the utility operators and non-scheme-participating utility customers [17]. It is asserted that utility operators were never excited about the adoption of a net metering scheme that further proposed a reduction in the effects of the CSEB projects on their business goal of sustaining steady revenue inflows with limited operational risks. After its authorisation in New York in 2015, the program was so widely embraced by the developers that it faced challenges caused by a flood of CSEB project proposals from developers, which resulted in a backlash in some communities. In 2017, the VNM scheme was temporarily terminated, and the initiative was adopted with the new VoS scheme. However, the VoS scheme was highly opposed by the developers, resulting in about 175 solar PV projects being cancelled by the developers, which was estimated to represent approximately a $1 billion investment loss. In 2019, the virtual net metering policy was revised and reactivated in New York, ensuring pricing stability, access to community credit by developers, and capped projects under the net metering scheme to 750 kW capacity [17].

3.3. Net Billing Scheme

The net billing scheme utilises two meters; one to records the grid energy consumed by the utility customer, while the other records the energy fed into the grid network by the prosumer for every billing period. The net billing scheme permits the utility operator to bill the prosumer for all the energy supplied by the grid network, while the prosumer obtains payment for all the energy fed into the grid network [79,87]. The net billing scheme may adopt any of the following approaches: net billing with buy-back, where the prosumers are not allowed to bank any surplus energy fed into the grid network between the billing periods, such that the utility operator pays the prosumers using the contracted buy-back plan at the end of every billing period; net billing with rolling credit, where the prosumers are allowed to bank the gained credits and use them to reduce the energy consumption charges in the following billing period, but the prosumer receives no compensation for the excess credits at the end of the banking period; or net billing with rolling credit and buy-back, where the prosumers are allowed to bank gained credits between billing periods and the utility pays for the excess credits at the end of the banking period using the contracted buy-back plan [79,87].

The possible buy-back plans for the net billing scheme are: the below-retail-rate buy-back plan, where the prosumer is paid by the utility at a value less than the electricity market retail rate for all the electricity fed into the grid; the retail rate buy-back plan, where the prosumer is paid by the utility at a value equivalent to the electricity market retail rate for the energy fed into the grid network; and the premium buy-back plan, where the prosumer is paid by the utility at a value greater than the electricity market retail rate for all the energy fed into the grid network [79]. Notably, the below-retail-rate buy-back plan is the commonly used plan for net billing schemes. Thus, the net billing scheme compensates the prosumers at the wholesale electricity market price, reflecting more accurately the value of the energy fed into the grid network [30,34]. The invoice sent by the utility operator to the prosumer is based on the value of the energy consumption from the grid network after subtracting the value of the energy fed into the grid network [34]. The net billing scheme is enacted in places such as Indonesia, Australia, Italy, Mexico, Portugal, Arizona, and New York [30]. Table 6 shows some of the other methods used to determine the compensation tariffs for excess electricity fed to the grid under the net billing scheme [30].

Table 6.

Methods used to determine the compensation tariffs for surplus energy for the net billing scheme.

The net billing scheme is an alternative approach that is used to address some of the limitations of the net metering and FiT schemes’ compensation mechanisms applicable to the prosumers, as well as to foster self-consumption amongst the prosumers [30]. The net billing scheme avoids the “death spiral” phenomenon for utility operators that can emerge in the case of net metering and FiT schemes. For instance, prosumers participating in the net metering and FiT schemes are most likely to generate energy at levels that are not optimal for the grid, due to overcompensation for the energy fed into the grid network. This overfeeding of energy into the grid network could result in revenue losses for utility operators and an increase in electricity market retail rates in order to stabilise the utilities’ revenue flows. Consequently, this makes the grid more expensive for customers who rely entirely on the grid network for their energy supply. However, the likelihood of the “death spiral” occurring is very low when the net billing scheme is enacted, since it prevents undue overcompensation by the prosumers [30].

The below-retail-rate buy-back plan, also known as the wholesale rate, is the widely used compensation strategy for net billing schemes [34,88]. However, the dynamic buy-back method, as described in Table 5, is asserted to be the most suitable net billing scheme for regulating solar PV electricity self-consumption [30,88]. Generally, the net billing schemes are widely considered to give lower compensation tariffs in comparison to the electricity market retail rates to the prosumers for the surplus energy generated and fed into the grid network, while net metering schemes are considered to give compensation tariffs equivalent to the electricity market retail rates [34,88]. Thus, net billing schemes foster the maximisation of self-consumption amongst the prosumers. Overall, the net billing scheme has similar issues to the net metering scheme, although is more easily controlled through the setting of the feed-in rate of the surplus energy into the grid network by the prosumer [89]. In both schemes, the compensation rates are intrinsically linked to the electricity market retail rates. Thus, it is very important to understand how the electricity market retail rate designs are changing to comprehend the impact of solar PV electricity compensation [89].

Generally, as discussed in this section, all the existent billing schemes for the energy business initiatives have faced some form of opposition from the involved stakeholders, especially based on their compensation rates. Furthermore, it has been revealed herein that these billing schemes have been widely adopted and have succeeded in the developed countries, but they have either been ignored or struggled and failed in the developing countries. Thus, to address such imbalances in energy business initiative implementation around the world, with the emphasis on the developing countries, the necessity for other scheme frameworks for the energy business models was pointed out [90]. Therefore, Section 4 discusses the novel billing scheme known as the store-on grid scheme, and how it addresses some of the shortfalls of the existent billing schemes for energy business initiatives.

4. Store-on Grid Scheme

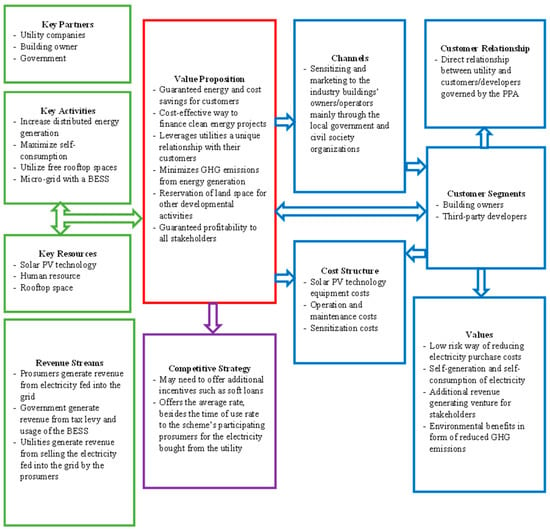

For the success of energy business initiatives, a stable and transparent billing scheme with an appropriate tariff that lowers the financial risk of the stakeholders is crucial in the design and development process of the initiative [41,45,51]. The selection of a suitable and powerful billing design is considered the most crucial aspect of the design of energy business initiatives [51]. Therefore, developing self-sustaining energy business models for RET was recommended in [2,6,57,91], particularly for developing countries [90]. The store-on grid (SoG) scheme for the grid-connected rooftop-mounted solar PV systems was presented in [33,85] for the CSEB initiative. Thus, this section discusses some of the details of the SoG scheme that are generally applicable to CSEB initiatives.

The SoG scheme emphasises self-consumption of the generated energy amongst CSEB project members. To achieve maximum self-consumption, a battery energy storage system (BESS) was introduced in this scheme to be collectively used by the participating members of the microgrid to store their surplus generated electricity before feeding any excess electricity into the grid. The SoG scheme comprises three actors, namely, the prosumers, the utility, and the government, who are governed by the PPA contract. The individual prosumers under the PPA contract are obliged to buy and install the solar PV system on their rooftops, while the government is mandated with the acquisition and installation of the BESS. The utility is mandated to buy the excess energy generated by the prosumers that is fed into the grid network, as well as supplying energy to the individual prosumers whenever there is insufficient or no energy generation from the installed solar PV system and BESS [85]. To monetise the energy transactions amongst the SoG scheme actors, the governing expressions for evaluating the charging rates are well stipulated in [33,85], and their brief descriptions are shown in Table 7.

Table 7.

Brief description of SoG scheme entities.

To depict the high-level strategic details appropriate for the success of an energy business initiative using the SoG scheme model, the energy business model canvas in Figure 7 was developed to depict how the energy business initiative using the SoG scheme could create and deliver value, make money, and visualise its structure. The store-on grid scheme has been investigated for its viability by consideration of the industrial sector in comparison to the time-of-use rating scheme used by the utility in Uganda [33,85]. The investigation results revealed that the industrial prosumer could record about a 12.5% decrease in the prosumer’s annual electricity purchase cost. Additionally, about 80% of the annual energy demand could be supplied by the solar PV system (which is about 84% of the annual solar PV generated energy), while only 20% is supplied by the utility [85]. Furthermore, the utility would record more profits annually by using this scheme in comparison to the currently utilised time-of-use rating scheme to bill the industrial customers. Likewise, through the scheme, both the government and prosumers would record significant revenue collection annually from generated energy sold to the utility operator [33]. Furthermore, the scheme has been compared with other billing schemes, namely, the FiT scheme and the NM scheme, to demonstrate its strength and applicability [85]. An interested reader could find more details about the SoG scheme model in [33,85].

Figure 7.

Store-on grid model canvas for the energy business initiative.

The SoG scheme was further investigated for its viability across selected Sub-Saharan African (SSA) countries [92]. The SSA countries considered were Namibia, Kenya, Madagascar, Mali, Niger, Cote d’Ivoire, Senegal, Togo, Cameroon, Eswatini, Zimbabwe, Rwanda, and Burkina Faso. Each individual country’s datasets applicable to the SoG scheme and a typical industrial building as a baseline prosumer were considered while assessing the scheme’s viability. Two SoG scheme scenarios (A and B) based on the solar PV module prices, that is, module prices for scenario A and scenario B of 40 c$/W and 65 c$/W, respectively, were used in the analysis. Under scenario A, the SoG scheme was found to be viable in nine out of the thirteen considered SSA countries, namely, Namibia, Senegal, Burkina Faso, Mali, Niger, Togo, Eswatini, Rwanda, and Cameroon. Furthermore, under scenario B, the SoG scheme was established to be viable in only four out of the thirteen considered SSA countries, namely, Namibia, Senegal, Togo, and Burkina Faso. For both scenarios, the SoG scheme was not viable in Kenya, Madagascar, Cote d’Ivoire and Zimbabwe, due either to low electricity market retail rates or high lending interest rates [92]. Likewise, the electricity market retail rates in most of the SSA countries did not reflect the cost of electricity services due to the under-pricing of the electricity because of government subsidies [93]. However, it is asserted that with the availability of soft loans with lower lending interest rates dedicated to renewable energy initiatives, the SoG scheme could be viable in all the selected SSA countries [92].

Overall, by considering the developing countries, the African continent is endowed with vast solar PV potential estimated at 10,000 GW, with an annual technical potential of solar PV energy estimated at about 6500 TWh [94,95]. Limited energy consumption, grid reliability challenges, repressive electricity retail rates, and financial constrain for the utility operators are some of the factors that describe the energy sector in the SSA region [96]. The grid reliability concern in the SSA region is a major constraint due to the common occurrences of grid outages across most of the SSA countries [96]. The frequent grid outages are mainly attributed to the insufficient electricity generating capacities in the region and/or the poor states of the transmission and distribution infrastructures in these countries [97]. The sector most affected by such grid outages is the industrial sector, which often opts for backup diesel generators, which are costlier than grid electricity [97]. The cost of electricity disruptions across SSA is estimated to result in about a 2.1% GDP reduction and a 4.9% reduction in the total sales recorded by firms in the SSA regions compared to situations of dependable electricity supply [98]. Thus, the discussion and policy recommendations in this study are mainly directed toward how decision and policy makers in developing countries, especially in the SSA region, can benefit from the abundant solar resource by adopting rooftop solar PV systems and CSEB initiatives that use the SoG scheme, with an emphasis on the industrial sector.

5. Recommendations

This overview study of the customer-side renewable energy business models made the following recommendations for the betterment of the operationalisation of different business initiatives. Some of the key deductions of this study are as follows:

- Although most of the developed countries have been successful at implementing the FiT scheme, most of the developing countries have struggled and/or failed to achieve the scheme’s set targets. Aspects such as unattractive low rates and unfavourable institutional designs for FiT policies were prominent amongst the developing countries, especially in the SSA countries. Additionally, the developed countries incorporated their FiT schemes with other incentives, such as soft loans with low lending interest rates, which was not the case in the developing countries. Therefore, for developing countries to jumpstart the implementation of FiT policies, these policies should be well domesticated and incentivised to facilitate project profitability.

- The virtual net metering scheme is the most frequently used net metering scheme category for community-shared energy business initiatives in the developed countries. Other scheme categories, namely, joint-ownership and group billing, are enacted in some states in the US. Generally, all the existent billing schemes have met opposition from the stakeholders for different reasons. Even the widely adopted virtual net metering scheme is highly contested, especially by the utility operators, who describe it as the cause of the cost burden on the utility operators and non-scheme-participating utility customers under the virtual net metering scheme. It is appropriate that all stakeholders are involved in the scheme planning and developing stages to accommodate their views as well as to establish a buy-in to facilitate scheme success at its implementation.

- The store-on grid scheme shows potential for addressing most of the highlighted shortfalls of the existent billing schemes for community-shared energy business initiatives. The SoG scheme defines all revenue streams for the stakeholders participating in the community-shared energy business project, and presents options for evaluating the revenue for each of the stakeholders, which addresses the shortfall of the VoS compensation approach, which has no widely utilisable methodology to evaluate its rate. Likewise, the SoG scheme addresses the shortfalls for the FiT scheme and VNM scheme categories by guaranteeing profitability to all the stakeholders through its governing constraint. The SoG scheme should be further studied and piloted to ascertain its strength over the other schemes.

- The developing countries could foster solar PV technology, especially in rooftop-mounted form, by utilising the SoG scheme for community-shared energy business initiatives. The developing countries should start with the industrial sector in rolling out the community-shared energy business initiatives, since it is the most highly affected sector due to the grid outages. Furthermore, because industrial buildings have large rooftop spaces that can accommodate solar PV systems of considerable size, they could be used for solar PV installation, rather than ground-mounted solar PV installation, which necessitates clearing and/or acquiring of land. Thus, land could be reserved for other purposes, such as agriculture, and rooftops utilised for solar PV energy-generation purposes.

In this study, the policy recommendations made for energy business initiatives are mainly focused on the developing countries, since they are the most under-electrified areas and frequently experience grid outages. However, some of the recommendations can also be adopted in the developed countries. In the future, the suitability of the SoG scheme as a billing scheme for community-shared energy business projects will be examined for developed countries, and the appropriate policy recommendations shall be made.

6. Conclusions

An overview of customer-side renewable energy business models based on their categorisation is presented in this study. The extent of adoption of energy business models worldwide is reviewed, highlighting where they are a success and/or a failure. The study further presents a discussion on the existent billing schemes that have so far been adopted by developers for the different categories of energy business models. Likewise, the successes and/or failures of these billing schemes are discussed. Furthermore, the study reviews the store-on grid scheme and its potential as an alternative billing scheme to address the shortfalls of the existent billing schemes. Finally, the study presents a policy discussion on how the developing countries can foster solar PV technology deployment through energy business models, especially by adopting the store-on grid scheme as a billing scheme. The study gives recommendations on the appropriate approaches that policy makers in the developing countries could take into consideration to overcome some of the hindrances that were noted under other schemes, such as the FiT scheme.

Overall, the billing scheme remains the greatest challenge faced by stakeholders during the design process of the energy business models. The existent billing schemes, such as net metering categories for CSEB initiatives, have been widely opposed in the developed countries by the stakeholders, as discussed in Section 3, while the FiT scheme has failed in the developing countries for the COEB initiatives. However, the policy makers in the developing countries could utilise the SoG scheme for CSOEB initiatives. The SoG scheme addresses challenges such as the insufficient levels of compensation rates that were encountered under the FIT scheme, and the cost burden on the utility operators and non-scheme participating utility customers that were experienced under the net metering scheme, by presenting a method that can be utilised to evaluate the compensation rate at which the prosumer feeds the surplus generated energy into the grid network. Additionally, the SoG scheme is constrained in such a way that the feed-in grid rate is always slightly higher than the LCOE of solar PV systems but lower than the average utility electricity market retail rate, to guarantee the profitability of the energy transaction to all the stakeholders. Likewise, the SoG scheme addresses the challenge of nonexistent methodology for evaluating the value of solar energy under the VoS compensation approach for the net metering scheme. The SoG scheme presents well-stipulated expressions for the evaluation of every monetary exchange involved in the energy transactions under the scheme amongst the stakeholders.

Furthermore, it is appropriate that the policy makers specify the target community group as well as the goals for the CSEB initiative. For instance, in the SSA region, the industrial sector could be considered as the target community grouping for the CSEB initiatives. In most of the countries, industries are found in industrial and business parks. Likewise, industrial buildings often have large rooftop spaces that can accommodate a considerable size of the solar PV arrays. The industrial sector is equally the most affected by grid outages in the developing countries. Therefore, goals such as environmental mandates, access to clean electricity, and creation of economic value for stakeholders should be highlighted, and appropriate communication channels should be adopted to raise awareness as well as to gather feedback from the target community grouping by the policy makers. This approach would foster a clearer comprehension of the communities that are being served (or not) by the CSEB initiatives. This is crucial in establishing whether CSEB initiatives enhance the sense of community belonging for the stakeholders as well as for the evaluation of the tangible community benefits of the CSEB initiative for sustainable development. Notably, such energy business initiatives advocating for the deployment of RET have significant impacts on the sustainable development of the communities implementing them.

As reported in some developed countries, particularly in Germany, the success of energy business models was supported by other incentives, such as soft loans with low lending interest rates. Policy makers could revise existing government subsidies on fossil-fuel-based electricity generation in the developing countries and direct them toward the deployment of solar PV technology. Likewise, policy makers should devise means of establishing soft loans with low lending interest rates dedicated to fostering the deployment of solar PV technology. Furthermore, policy makers could lobby funds from international funders, such as the clean development mechanism based on the carbon emissions avoided by adopting the solar PV technology. Generally, international funding sources rely on the carbon emissions avoided as a criterion for supporting an initiative. Therefore, based on the sustainable development benefits of RET on the communities, policy makers should ensure that a conducive environment is established for target community groups to adopt the energy business initiatives being advocated for. This can be achieved by the government rendering all possible assistance to the potential participants, such as soft loans, awareness, and sensitisation regarding energy business initiatives.

Author Contributions

The authors contributed to this manuscript as follows: conceptualization, methodology and formal analysis were done by N.M. and R.Z.; writing—original draft preparation was done by N.M.; writing—review and editing were done by N.M., R.Z. and T.T.L.; supervision was done by R.Z. and T.T.L. All authors have read and agreed to the published version of the manuscript.

Funding

There was no direct funding for completing this manuscript.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors would like to acknowledge the Ministry of Foreign Affairs and Trade, New Zealand, in the form of a PhD scholarship under the Commonwealth Aid Development Programme and Auckland University of Technology for the conducive research environment that enabled the undertaking of this research.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Nomenclature

| BESS | Battery energy storage system |

| COEB | Customer-owned energy business |

| CREBM | Customer-side renewable energy business model |

| CSEB | Community-shared energy business |

| DG | Distributed generation |

| FiT | Feed-in tariff |

| NB | Net billing |

| NM | Net metering |

| SDG | Sustainable development goal |

| RES | Renewable energy sources |

| SSA | Sub-Saharan Africa |

| TPOEB | Third-party ownership energy business |

| SoG | Store-on grid |

| PPA | Power purchase agreement |

| UREBM | Utility-side renewable energy business model |

| UK | United Kingdom |

| PV | Photovoltaic |

| CNM | Conventional net metering |

| VoS | Value-of-solar |

| VNM | Virtual net metering |

| US | United States |

| RET | Renewable energy technologies |

| GDP | Gross domestic product |

| TNM | Traditional net metering |

References

- Onyi-Ogelle, O.H.; Nwosu, D. Exploration and Production of Shale Oil as a Renewable Energy for Sustainable Development in Nigeria: Need for Legal Alignment. Int. J. Comp. Law Leg. Philos. 2020, 2, 2. [Google Scholar]

- Richter, M. Business model innovation for sustainable energy: German utilities and renewable energy. Energy Policy 2013, 62, 1226–1237. [Google Scholar] [CrossRef]

- Horváth, D.; Szabó, R.Z. Evolution of photovoltaic business models: Overcoming the main barriers of distributed energy deployment. Renew. Sustain. Energy Rev. 2018, 90, 623–635. [Google Scholar] [CrossRef]

- Karakaya, E.; Nuur, C.; Hidalgo, A. Business model challenge: Lessons from a local solar company. Renew. Energy 2016, 85, 1026–1035. [Google Scholar] [CrossRef]

- Burger, S.P.; Luke, M. Business models for distributed energy resources: A review and empirical analysis. Energy Policy 2017, 109, 230–248. [Google Scholar] [CrossRef]

- Huijben, J.C.C.M.; Verbong, G.P.J. Breakthrough without subsidies? PV business model experiments in the Netherlands. Energy Policy 2013, 56, 362–370. [Google Scholar] [CrossRef]

- Bomberg, E.; McEwen, N. Mobilizing community energy. Energy Policy 2012, 51, 435–444. [Google Scholar] [CrossRef]

- Ptak, T.; Nagel, A.; Radil, S.M.; Phayre, D. Rethinking community: Analyzing the landscape of community solar through the community-place nexus. Electr. J. 2018, 31, 46–51. [Google Scholar] [CrossRef]

- Vasileiadou, E.; Huijben, J.C.C.M.; Raven, R.P.J.M. Three is a crowd? Exploring the potential of crowdfunding for renewable energy in the Netherlands. J. Clean. Prod. 2016, 128, 142–155. [Google Scholar] [CrossRef]

- Cai, X.; Xie, M.; Zhang, H.; Xu, Z.; Cheng, F. Business Models of Distributed Solar Photovoltaic Power of China: The Business Model Canvas Perspective. Sustainability 2019, 11, 4322. [Google Scholar] [CrossRef]

- Dóci, G.; Vasileiadou, E. “Let’s do it ourselves” Individual motivations for investing in renewables at community level. Renew. Sustain. Energy Rev. 2015, 49, 41–50. [Google Scholar] [CrossRef]

- Strupeit, L.; Palm, A. Overcoming barriers to renewable energy diffusion: Business models for customer-sited solar photovoltaics in Japan, Germany and the United States. J. Clean. Prod. 2016, 123, 124–136. [Google Scholar] [CrossRef]

- Seel, J.; Barbose, G.L.; Wiser, R.H. An analysis of residential PV system price differences between the United States and Germany. Energy Policy 2014, 69, 216–226. [Google Scholar] [CrossRef]

- Davidson, C.; Steinberg, D.; Margolis, R. Exploring the market for third-party-owned residential photovoltaic systems: Insights from lease and power-purchase agreement contract structures and costs in California. Environ. Res. Lett. 2015, 10, 024006. [Google Scholar] [CrossRef]

- Funkhouser, E.; Blackburn, G.; Magee, C.; Rai, V. Business model innovations for deploying distributed generation: The emerging landscape of community solar in the U.S. Energy Res. Soc. Sci. 2015, 10, 90–101. [Google Scholar] [CrossRef]

- Peters, M.; Fudge, S.; High-Pippert, A.; Carragher, V.; Hoffman, S.M. Community solar initiatives in the United States of America: Comparisons with—And lessons for—The UK and other European countries. Energy Policy 2018, 121, 355–364. [Google Scholar] [CrossRef]

- Hess, D.J.; Lee, D. Energy decentralization in California and New York: Conflicts in the politics of shared solar and community choice. Renew. Sustain. Energy Rev. 2020, 121, 109716. [Google Scholar] [CrossRef]

- Soto, E.A.; Bosman, L.B.; Wollega, E.; Leon-Salas, W.D. Peer-to-peer energy trading: A review of the literature. Appl. Energy 2021, 283, 116268. [Google Scholar] [CrossRef]

- Hsueh, S.-L. Assessing the effectiveness of community-promoted environmental protection policy by using a Delphi-fuzzy method: A case study on solar power and plain afforestation in Taiwan. Renew. Sustain. Energy Rev. 2015, 49, 1286–1295. [Google Scholar] [CrossRef]

- Nolden, C. Governing community energy—Feed-in tariffs and the development of community wind energy schemes in the United Kingdom and Germany. Energy Policy 2013, 63, 543–552. [Google Scholar] [CrossRef]

- Mah, D.N.-Y. Community solar energy initiatives in urban energy transitions: A comparative study of Foshan, China and Seoul, South Korea. Energy Res. Soc. Sci. 2019, 50, 129–142. [Google Scholar] [CrossRef]

- Joshi, G.; Yenneti, K. Community solar energy initiatives in India: A pathway for addressing energy poverty and sustainability? Energy Build. 2020, 210, 109736. [Google Scholar] [CrossRef]

- Heirani, H.; Moghaddam, N.B.; Labbafi, S.; Sina, S. A Business Model for Developing Distributed Photovoltaic Systems in Iran. Sustainability 2022, 14, 11194. [Google Scholar] [CrossRef]

- Baranyai, N.H.; Zsiborács, H.; Vincze, A.; Rodek, N.; Makai, M.; Pintér, G. Correlation analysis of the spread of household-sized photovoltaic power plants and various district indicators: A case study. Sustainability 2021, 13, 482. [Google Scholar] [CrossRef]

- Hampton, H.; Foley, A.M.; del Rio, D.F.; Sovacool, B. Developing future retail electricity markets with a customer-centric focus. Energy Policy 2022, 168, 113147. [Google Scholar] [CrossRef]

- Haar, L. The competitive disadvantages facing British assetless electricity retailers. Energy Policy 2021, 155, 112323. [Google Scholar] [CrossRef]

- Pang, Y.; He, Y.; Cai, H. Business model of distributed photovoltaic energy integrating investment and consulting services in China. J. Clean. Prod. 2019, 218, 943–965. [Google Scholar] [CrossRef]

- Hamwi, M.; Lizarralde, I. A Review of Business Models towards Service-Oriented Electricity Systems. Procedia CIRP 2017, 64, 109–114. [Google Scholar] [CrossRef]

- Tsikintikou, M. Improving Feed-In Tariff Policy Design for Solar PV: Learning Lessons from the Experiences of Greece, Spain and Germany. Master’s Thesis, Faculty of Applied Sciences, Delft University of Technology, Delft, The Netherlands, 2015. [Google Scholar]

- IRENA. Innovation Landscape Brief: Net Billing Schemes; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Garg, A.; Sinha, P. Harnessing Energy from the Sun: Empowering Rooftop Owners; World Bank: New Delhi, India, 2014. [Google Scholar]

- Bhattacharjee, U.; Goyal, R.K.; Nagpal, A.; Chauhan, S.; Alam, S.; Lise, W.; Kocaoglu, M.; Tosun, G.; Kucukbahar-Beygo, D.; Ozdamar, I.; et al. Turkey-Rooftop Solar Market Assessment: Summary Note; The World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Mukisa, N.; Zamora, R.; Lie, T.T. Store-on grid scheme model for grid-tied solar photovoltaic systems for industrial sector application: Benefits analysis. Renew. Energy 2021, 171, 1257–1275. [Google Scholar] [CrossRef]

- Energy Community. Policy Guidelines by the Energy Community Secretariat on the Grid Integration of Prosumers; Energy Community: Vienna, Austria, 2018. [Google Scholar]

- Mukisa, N.; Zamora, R.; Lie, T.T. Feasibility assessment of grid-tied rooftop solar photovoltaic systems for industrial sector application in Uganda. Sustain. Energy Technol. Assess. 2019, 32, 83–91. [Google Scholar] [CrossRef]

- Bódis, K.; Kougias, I.; Jäger-Waldau, A.; Taylor, N.; Szabó, S. A high-resolution geospatial assessment of the rooftop solar photovoltaic potential in the European Union. Renew. Sustain. Energy Rev. 2019, 114, 109309. [Google Scholar] [CrossRef]

- Yoomak, S.; Patcharoen, T.; Ngaopitakkul, A. Performance and economic evaluation of solar rooftop systems in different regions of Thailand. Sustainability 2019, 11, 6647. [Google Scholar] [CrossRef]

- Assouline, D.; Mohajeri, N.; Scartezzini, J.-L. Large-scale rooftop solar photovoltaic technical potential estimation using Random Forests. Appl. Energy 2018, 217, 189–211. [Google Scholar] [CrossRef]

- Al-Saqlawi, J.; Madani, K.; Dowell, N.M. Techno-economic feasibility of grid-independent residential roof-top solar PV systems in Muscat, Oman. Energy Convers. Manag. 2018, 178, 322–334. [Google Scholar] [CrossRef]

- Griffiths, S.; Mills, R. Potential of rooftop solar photovoltaics in the energy system evolution of the United Arab Emirates. Energy Strategy Rev. 2016, 9, 1–7. [Google Scholar] [CrossRef]

- Augustine, P.; McGavisk, E. The next big thing in renewable energy: Shared solar. Electr. J. 2016, 29, 36–42. [Google Scholar] [CrossRef]

- Zhang, S. Innovative business models and financing mechanisms for distributed solar PV (DSPV) deployment in China. Energy Policy 2016, 95, 458–467. [Google Scholar] [CrossRef]

- Klein, S.J.W.; Hargreaves, A.; Coffey, S. A financial benefit-cost analysis of different community solar approaches in the Northeastern US. Sol. Energy 2021, 213, 225–245. [Google Scholar] [CrossRef]

- Speer, B. Residential Solar Photovoltaics: Comparison of Financing Benefits, Innovations, and Options; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2012. [Google Scholar]

- Chan, G.; Evans, I.; Grimley, M.; Ihde, B.; Mazumder, P. Design choices and equity implications of community shared solar. Electr. J. 2017, 30, 37–41. [Google Scholar] [CrossRef]

- Coughlin, J.; Grove, J.; Irvine, L.; Jacobs, J.F.; Phillips, S.J.; Moynihan, L.; Wiedman, J. Guide to Community Solar: Utility, Private, and Non-Profit Project Development; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2011. [Google Scholar]

- Klein, S.J.; Coffey, S. Building a sustainable energy future, one community at a time. Renew. Sustain. Energy Rev. 2016, 60, 867–880. [Google Scholar] [CrossRef]

- Devine-Wright, P. Community versus local energy in a context of climate emergency. Nat. Energy 2019, 4, 894–896. [Google Scholar] [CrossRef]

- Berka, A.L.; MacArthur, J.L.; Gonnelli, C. Explaining inclusivity in energy transitions: Local and community energy in Aotearoa New Zealand. Environ. Innov. Soc. Transit. 2020, 34, 165–182. [Google Scholar] [CrossRef]

- Moroni, S.; Antoniucci, V.; Bisello, A. Local Energy Communities and Distributed Generation: Contrasting Perspectives, and Inevitable Policy Trade-Offs, beyond the Apparent Global Consensus. Sustainability 2019, 11, 3493. [Google Scholar] [CrossRef]

- Chang, V.; Goldenberg, C.; Hoskins, J.; Lassiter, S.; Li, Z.; Nakatani, E.; Oluwafemi, S.; Safford, H. Solar Gardens in the Garden State: Community Solar Recommendations for New Jersey; Princeton University: Princeton, NJ, USA, 2017. [Google Scholar]

- Hicks, J.; Ison, N. An exploration of the boundaries of ‘community’ in community renewable energy projects: Navigating between motivations and context. Energy Policy 2018, 113, 523–534. [Google Scholar] [CrossRef]

- Michaud, G. Perspectives on community solar policy adoption across the United States. Renew. Energy Focus 2020, 33, 1–15. [Google Scholar] [CrossRef]

- Pitt, D.; Michaud, G.; Duggan, A. Analyzing the costs and benefits of distributed solar energy in Virginia (USA): A case study of collaborative energy planning. J. Environ. Plan. Manag. 2018, 61, 2032–2049. [Google Scholar] [CrossRef]

- Hoffman, S.M.; High-Pippert, A. From private lives to collective action: Recruitment and participation incentives for a community energy program. Energy Policy 2010, 38, 7567–7574. [Google Scholar] [CrossRef]

- Ambole, A.; Koranteng, K.; Njoroge, P.; Luhangala, D.L. A Review of Energy Communities in Sub-Saharan Africa as a Transition Pathway to Energy Democracy. Sustainability 2021, 13, 2128. [Google Scholar] [CrossRef]

- Engelken, M.; Römer, B.; Drescher, M.; Welpe, I.M.; Picot, A. Comparing drivers, barriers, and opportunities of business models for renewable energies: A review. Renew. Sustain. Energy Rev. 2016, 60, 795–809. [Google Scholar] [CrossRef]

- Siegrist, C.R.; Barth, B.; Campbell, B.; Krishnamoorthy, B.; Taylor, M. Utility Community Solar Handbook: Understanding and Supporting Utility Program Development; Solar Electric Power Association: Washington, DC, USA, 2013; pp. 1–25. [Google Scholar]

- Michas, S.; Stavrakas, V.; Spyridaki, N.-A.; Flamos, A. Identifying Research Priorities for the further development and deployment of Solar Photovoltaics. Int. J. Sustain. Energy 2019, 38, 276–296. [Google Scholar] [CrossRef]

- Radomes, A.A.; Arango, S. Renewable energy technology diffusion: An analysis of photovoltaic-system support schemes in Medellín, Colombia. J. Clean. Prod. 2015, 92, 152–161. [Google Scholar] [CrossRef]

- Barbosa, L.; Ferrão, P.; Rodrigues, A.; Sardinha, A. Feed-in tariffs with minimum price guarantees and regulatory uncertainty. Energy Econ. 2018, 72, 517–541. [Google Scholar] [CrossRef]

- Milanés-Montero, P.; Arroyo-Farrona, A.; Pérez-Calderón, E. Assessment of the Influence of Feed-In Tariffs on the Profitability of European Photovoltaic Companies. Sustainability 2018, 10, 3427. [Google Scholar] [CrossRef]

- IEA. Trends 2013. In Photovoltaic Applications; International Energy Agency: Paris, France, 2013. [Google Scholar]

- Meyer-Renschhausen, M. Evaluation of feed-in tariff-schemes in African countries. J. Energy S. Afr. 2013, 24, 56–66. [Google Scholar] [CrossRef]

- Quansah, D.A.; Adaramola, M.S.; Mensah, L.D. Solar photovoltaics in sub-Saharan Africa–addressing barriers, unlocking potential. Energy Procedia 2016, 106, 97–110. [Google Scholar] [CrossRef]

- Jacobs, D.; Marzolf, N.; Paredes, J.R.; Rickerson, W.; Flynn, H.; Becker-Birck, C.; Solano-Peralta, M. Analysis of renewable energy incentives in the Latin America and Caribbean region: The feed-in tariff case. Energy Policy 2013, 60, 601–610. [Google Scholar] [CrossRef]

- Viana, A.G.; Ramos, D.S. Outcomes from the first large-scale solar PV auction in Brazil. Renew. Sustain. Energy Rev. 2018, 91, 219–228. [Google Scholar] [CrossRef]

- Washburn, C.; Pablo-Romero, M. Measures to promote renewable energies for electricity generation in Latin American countries. Energy Policy 2019, 128, 212–222. [Google Scholar] [CrossRef]

- Couture, T.; Gagnon, Y. An Analysis of feed-in tariff remuneration models: Implications for renewable energy investment. Energy Policy 2010, 38, 955–965. [Google Scholar] [CrossRef]

- Infomoby. Oscar Industries. 2018. Available online: http://www.infomoby.co.ug/en/profile/oscar_industries/15574 (accessed on 8 November 2022).

- Klein, A.; Held, A.; Ragwitz, M.; Resch, G.; Faber, T. Evaluation of Different Feed-In Tariff Design Options: Best Practice Paper for the International Feed-In Cooperation; Energy Economics Group & Fraunhofer Institute Systems and Innovation Research: Munich, Germany, 2008. [Google Scholar]

- Saidmamatov, O.; Salaev, S.; Eshchanov, B. Challenges and Optimization strategy for Feed-in tariffs of Renewable Energy in CIS countries. Balt. J. Real Estate Econ. Constr. Manag. 2015, 3, 6–13. [Google Scholar] [CrossRef][Green Version]

- Gerhardt, C. Germany’s renewable energy shift: Addressing climate change. Capital. Nat. Social. 2017, 28, 103–119. [Google Scholar] [CrossRef]

- Guild, J. Feed-in-tariffs and the politics of renewable energy in Indonesia and the Philippines. Asia Pac. Policy Stud. 2019, 6, 417–431. [Google Scholar] [CrossRef]

- Stauch, A.; Vuichard, P. Community solar as an innovative business model for building-integrated photovoltaics: An experimental analysis with Swiss electricity consumers. Energy Build. 2019, 204, 109526. [Google Scholar] [CrossRef]

- Karneyeva, Y.; Wüstenhagen, R. Solar feed-in tariffs in a post-grid parity world: The role of risk, investor diversity and business models. Energy Policy 2017, 106, 445–456. [Google Scholar] [CrossRef]

- Jäger-Waldau, A. PV Status Report 2019; Publications Office of the European Union: Luxembourg, 2019. [Google Scholar]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Hughes, L.; Bell, J. Compensating customer-generators: A taxonomy describing methods of compensating customer-generators for electricity supplied to the grid. Energy Policy 2006, 34, 1532–1539. [Google Scholar] [CrossRef]

- Lawson, A.J. Net Metering: In Brief; Congressional Research Service: Washington, DC, USA, 2019. [Google Scholar]

- Schelly, C.; Louie, E.P.; Pearce, J.M. Examining interconnection and net metering policy for distributed generation in the United States. Renew. Energy Focus 2017, 22–23, 10–19. [Google Scholar] [CrossRef]

- USSI. Avoided Cost. 2018. Available online: https://www.myussi.com/glossary/avoided-cost/#:~:text=An%20avoided%20cost%20(also%20known,than%20the%20retail%20price%20charged (accessed on 8 November 2022).

- Pitt, D.; Michaud, G. Assessing the Value of Distributed Solar Energy Generation. Curr. Sustain. Renew. Energy Rep. 2015, 2, 105–113. [Google Scholar] [CrossRef]

- Taylor, M.; McLaren, J.; Cory, K.; Davidovich, T.; Sterling, J.; Makhyoun, M. Value of Solar. Program Design and Implementation Considerations; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2015. [Google Scholar]

- Mukisa, N.; Zamora, R.; Lie, T.T. Store-on grid scheme model for grid-tied solar photovoltaic systems for industrial sector application: Costs analysis. Sustain. Energy Technol. Assess. 2020, 41, 100797. [Google Scholar] [CrossRef]

- Azimoh, C.L.; Dzobo, O.; Mbohwa, C. Investigation of net metering as a tool for increasing electricity access in developing countries. In Proceedings of the 2017 IEEE Electrical Power and Energy Conference (EPEC), Saskatoon, SK, Canada, 22–25 October 2017; pp. 1–6. [Google Scholar]

- Zinaman, O.; Aznar, A.; Linvill, C.; Darghouth, N.; Dubbeling, T.; Bianco, E. Grid-Connected Distributed Generation: Compensation Mechanism Basics; National Renewable Energy Laboratory: Golden, CO, USA, 2017. [Google Scholar]

- Prol, J.L.; Steininger, K.W. Photovoltaic self-consumption regulation in Spain: Profitability analysis and alternative regulation schemes. Energy Policy 2017, 108, 742–754. [Google Scholar] [CrossRef]

- Darghouth, N.R. Compensation Mechanisms for Distributed PV—Types and Trends; Lawrence Berkeley National Laboratory: Jharkand, India, 2019. [Google Scholar]

- World Bank. Tracking SDG 7: The Energy Progress Report 2020; World Bank: Washington, DC, USA, 2020; Available online: https://www.irena.org/publications/2020/May/Tracking-SDG7-The-Energy-Progress-Report-2020 (accessed on 8 November 2022).

- Brown, D.; Kivimaa, P.; Sorrell, S. An energy leap? Business model innovation and intermediation in the ‘Energiesprong’ retrofit initiative. Energy Res. Soc. Sci. 2019, 58, 101253. [Google Scholar] [CrossRef]

- Mukisa, N.; Zamora, R.; Lie, T.T. Viability of the store-on grid scheme model for grid-tied rooftop solar photovoltaic systems in sub Saharan African countries. Renew. Energy 2021, 178, 845–863. [Google Scholar] [CrossRef]

- Trimble, C.; Kojima, M.; Arroyo, I.P.; Mohammadzadeh, F. Financial Viability of Electricity Sectors in Sub-Saharan Africa: Quasi-Fiscal Deficits and Hidden Costs; Energy and Extractives Global Practice Group, World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Cartwright, A. Better Growth, Better Cities: Rethinking and Redirecting Urbanisation in Africa; The New Climate Economy Working: Washington, DC, USA, 2015. [Google Scholar]

- Avila, N.; Carvallo, J.P.; Shaw, B.; Kammen, D.M. The energy challenge in sub-Saharan Africa: A guide for advocates and policy makers. In Part 1: Generating Energy for Sustainable and Equitable Development; Oxfam Research Backgrounder Series: Nairobi, Kenya, 2017. [Google Scholar]

- Blimpo, M.P.; Cosgrove-Davies, M. Electricity Access in Sub-Saharan Africa; The World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Farquharson, D.; Jaramillo, P.; Samaras, C. Sustainability implications of electricity outages in sub-Saharan Africa. Nat. Sustain. 2018, 1, 589–597. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Occhiali, G.; Strobl, E. Power outages and firm performance in Sub-Saharan Africa. J. Dev. Econ. 2018, 134, 150–159. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).