Abstract

Due to a lack of focus on China’s financial decentralization system, the existing research does not pay attention to the beneficial contribution of Chinese local governments to carbon emission reduction through their actions in the financial field. In this study, we collected 16 years of data from 30 provinces in China and utilized a two-way fixed-effects model to empirically test the impact of China’s financial decentralization on carbon emission reduction. The regression results show that China’s financial decentralization system has a significant carbon-emission reduction effect. A heterogeneity analysis shows that this effect is common in different regions of China and that fiscal decentralization will negatively moderate it. A mechanism analysis shows that under China’s financial decentralization system, the active intervention of local governments in local finance will significantly upgrade the energy consumption structure and ease the financing constraints of enterprises. The regression results of the spatial econometric model show that the carbon emission reduction effect of China’s financial decentralization still has a spatial spillover effect. Finally, we put forward corresponding policy recommendations.

1. Introduction

Since the 18th National Congress of the Communist Party of China (CPC), China has implemented a new concept of development, putting the response to climate change in a more prominent position in national governance. In recent years, the Chinese government has launched a series of fiscal, tax, and financial policies by which to achieve carbon emission reduction goals. In terms of financial policy, in August 2016, seven ministries and commissions, including the People’s Bank of China and the Ministry of Finance, jointly issued guiding opinions on building a green financial system, which emphasized accelerating the development of green funds and green bond markets and supporting green project financing [1]. The empirical results of most studies show that the implementation of China’s green finance policy has significantly promoted carbon emission reduction [2,3]. However, the existing research is limited to the top-down policy implementation of the central government and neglects the influence and initiatives of local governments in the financial field. This is mainly because it fails to consider financial decentralization in China. In recent years, with the reform of the financial system, the influence of China’s local governments in the financial sector has become more prominent, significantly affecting the development of local finance and the allocation of financial resources. Considering the above, the purpose of this study is to assess the impact that financial decentralization in China has on the volume of carbon emissions.

The contributions of this study are as follows:

First of all, there is little research on the impact of China’s financial decentralization system on the reduction of carbon emissions. Based on a two-way fixed-effects model, in this study, we empirically discuss the impact of China’s financial decentralization on carbon emission reduction and its mechanism. When developing a low-carbon economy became a national goal, to reduce carbon emissions, the central government issued a series of policies, such as the green finance policy in the financial sector to vigorously promote economic transformation. However, green finance is implemented from top to bottom under the control of the central government. Focusing only on this neglects the role played by local governments. In fact, China’s financial decentralization has given local governments the ability to intervene in bank lending, thus providing significant support for carbon emission reduction. This is an institutional phenomenon that has not been observed in the previous literature.

Second, studies have mainly analyzed heterogeneity from the perspective of regional differences. Unlike past research, in this paper we analyze heterogeneity from the perspective of fiscal decentralization. After the 1994 tax sharing reform, the fiscal decentralization system between central and local governments was gradually established in China. Although this reform has greatly alleviated the fiscal pressure on the central government, it has caused increasing local fiscal pressure. In recent years, to ease this pressure, local governments have obtained financing from local financial institutions directly or indirectly, which has crowded out corporate loans, hindered the improvement of low-carbon technology and equipment, and ultimately obstructed low-carbon development. Therefore, in this paper, we use the moderating effect model to empirically analyze the role of fiscal decentralization. In addition, the traditional analysis of regional heterogeneity often takes the perspective of the development gap between the east and the west. In contrast, we analyze regional heterogeneity based on the increasingly stark gap between northern and southern China.

Finally, we further explore the spatial spillover effect. On the one hand, under financial decentralization, a significant reduction in a region’s carbon emissions will put pressure on officials in surrounding regions to achieve similar results. This pressure will make surrounding areas increase carbon emission reduction efforts. On the other hand, due to more frequent exchanges and learning between officials in neighboring regions, each region may imitate carbon emission reduction measures, which will bring about more space spillover effects. The conclusions of this study can provide an empirical basis for promoting intergovernmental exchange and linkage mechanisms.

The remainder of this paper is divided into several parts. Section 2 reviews the related studies. Section 3 presents the theoretical analysis and research hypotheses. The research methodology is presented in Section 4. Section 5 presents the results of the empirical test. Section 6 provides conclusions and corresponding policy recommendations.

2. Literature Review

2.1. Financial Decentralization

Exploring the political roots of China’s economic growth miracle, Montinola et al. [4] noted that China’s local governments have considerable influence on the banking system. The concept of financial decentralization was first proposed by Qian and Weingast [5], who studied the characteristics of China’s market-preserving Federalism system. They found that with the localization of the professional banking system, many local governments used administrative means to intervene in it and obtain extensive financial resources. Qian and Weingast’s proposal of the financial decentralization concept is considered the beginning of research in this area. Its specific meaning was clearly expressed for the first time by Hong and Hu [6]: to promote a country’s long-term economic growth and stimulate local economic development, it is a series of explicit and implicit institutional arrangements to delineate and distribute financial resource allocation and control rights between different levels of government and between the government and the market.

Financial decentralization is simply a system by which the central government delegates part of the administrative control over the financial sector to local governments in an effort to promote economic growth. The central government first delegated some power to provincial governments. Later, while preserving the authority to approve access and significant issues, the provincial government went on to transfer its daily supervision, market exit, and other administrative powers to lower-level governments [7]. This is the product of competing interests between the central government and local governments [6]. According to the organizational decentralization theory, optimal organizational decentralization reflects the trade-off between the loss of the principal’s control right and the use of the agent’s information [8]. Poitevin [9] studied organizational decentralization from the perspective of incentive theory. He believed that because subordinates have information advantages, superiors benefit from granting decision-making power to subordinates but also face loss of control. The optimal organizational structure or degree of decentralization depends on the trade-off between communication costs and loss of control. Local governments are more familiar with the resource endowments of their jurisdictions and the production and operation of local enterprises, so they have investment information advantages compared with the central government [6]. To stimulate the enthusiasm of local governments to promote economic growth, the central government in China began to recognize local interests, give local governments certain financial approval and supervision rights, and allow local commercial banks to develop rapidly. While stimulating the enthusiasm of local governments for economic development, this enables local governments to exert sufficient influence on local financial institutions to intervene in the allocation of credit resources and trigger potential economic and financial risks [10].

The advantages of the decentralized financial system are mainly reflected in the ability to reduce information asymmetry, improve the efficiency of resource allocation, expand the scale of short-term project investment, and promote economic growth [11,12]. On the one hand, financial decentralization helps give play to the information advantages of local governments in the allocation of local financial resources [13], and on the other hand, it helps improve the information advantages of local financial institutions in the allocation of financial resources [14]. However, financial decentralization may create some financial risks. Agarwal et al. [15] noted that local financial regulators cannot strictly supervise all local governments. More tolerant states have often had higher bad bank-debt rates. This may be due to the soft budget constraints of banks caused by lax supervision. Miao [16] found that the local government intervened in credit resources by becoming the major shareholder of the Rural Commercial Bank and the Urban Commercial Bank, which led to increased bank credit risk and exacerbated local financial fluctuations.

2.2. Finance and Carbon Emission Reduction

Concern about climate change and commitment to carbon emission reduction are important topics of academic research. The existing research fully discusses the impact of the population, technology, and the economy on carbon emissions and asserts that population density, economic growth rate, foreign direct investment, technological progress, economic structure, and other factors significantly affect regional carbon emissions [17,18,19,20]. In addition, due to the policy exchange between governments, the demonstration effect of leading enterprises and the interaction of individual environmental awareness, the level of carbon emissions among regions shows some spatial correlation [21,22,23]. Ghazala et al. [24] used a spatial econometric model to decompose the impact of forest investment on China’s carbon emission reduction and found that China’s interprovincial carbon emissions have a spatial spillover effect.

In recent years, with deepening research, an increasing number of scholars have begun to pay attention to the impact of financial factors on carbon emission reduction. The relevant research mainly focuses on financial development and financial policy.

First, the carbon emission reduction’s effect of financial development is not clear. Financial development can stimulate consumption and investment by easing the financing constraints of consumers and enterprises, thereby expanding the economy and energy consumption and significantly increasing carbon emissions [25]. Sadorsky [26] found that financial development makes it easier for consumers to obtain credit, thus stimulating them to buy large, energy-consuming products, thereby increasing carbon emissions. Similarly, financial development can encourage enterprises to purchase large-scale equipment, build new production lines, and expand the production scale, which will inevitably increase carbon emissions. However, Shahbaz et al. [27] noted that financial development can guide changes to economic and energy structures by promoting technological innovation by enterprises and providing financial support for R&D, the implementation of environmental protection industrial projects, and cleaner production technologies to spur low-carbon economic development and reduce carbon emissions.

Second, research on how financial policies affect carbon emission reduction mainly focuses on green finance, which encompasses green credit, bonds, funds, and insurance and other green financial products and services [28,29]. In the early stages of this research, scholars paid more attention to the connotations, functional effects, and development path of green finance, emphasizing the important role of its development in bank risk control, environmental problem-solving, green economic development, and the green transformation of developing countries [30]. With the deepening of the implementation of the green finance policy, research on the policy’s effect began to appear. Most scholars have fully affirmed the carbon emission reduction effect of green finance, but there have also been some criticisms.

On the one hand, the green finance policy with green credit at its core can not only affect enterprises’ green investment, but also promote carbon emission reduction through changes in the industrial structure. Such empirical research methods include, but are not limited to, the CGE model, the double difference model, and the panel threshold model. By building a nonlinear threshold panel model, Xiu et al. [31] found that green credit moderating measures are conducive to energy conservation and emission reduction under the constraint of industrial growth. Liu et al. [32] found that the green credit policy is effective in restraining investment in energy-intensive industries and has significant financing punishment and investment inhibition effects. Alonso-Conde et al. [33] noted that, compared with bank loans, the internal rate of return of shareholders issuing green bonds was higher, and green bond financing provided strong financial incentives for sponsors. Observing the V4 countries, Hadaś-Dyduch et al. [34] found that the issuance of green government bonds can promote capital mobilization, spur the development of green financial markets, and enhance investors’ demand and reputation interests.

On the other hand, some scholars believe that as a result of its inaccurate details and asymmetric information, the green finance policy has failed to meet expectations. Zhang et al. [35] asserted that the effects of green finance policies in various countries fall below expectations. The main problems are the imperfect environmental protection information possessed by banks in the implementation process and the lack of clear implementation standards in practice, which have made green finance policies ineffective in suppressing emissions in high-emission industries. In their study on China’s green credit policy, Wang et al. [36] observed that the environmental information disclosure system has not evolved into a decision-making tool for bank risk management.

2.3. Fiscal Decentralization and Carbon Emission Reduction

The first generation of fiscal decentralization theory attaches importance to the efficiency of public goods provision. For example, Tiebout [37] and Oates [38] asserted that local governments have more information advantages than the central government in providing public goods. The second generation of property decentralization theory relaxed the hypothesis of a benevolent government and revealed the important contribution of fiscal decentralization to China’s rapid economic growth [4,5].

With societal development, fiscal decentralization has some drawbacks. In terms of environmental governance, theories indicate that it may lead to corruption and rent-seeking behavior, a race to the bottom, and lack of cooperation with intergovernmental governance [39,40,41]. Obviously, these government actions are not conducive to carbon emission reduction. The corresponding empirical analysis shows that fiscal decentralization is not conducive to strengthening environmental regulation and has a certain inhibitory effect on carbon emission reduction [42]. This is mainly because it has triggered a series of short-sighted behaviors by local governments and produced negative environmental protection effects: rent-seeking and corruption inhibit enterprises’ green technology innovation, lax environmental regulation methods increase taxes, and highly polluting enterprises are introduced for economic growth [39,43,44,45]. Furthermore, financial and fiscal decentralization have significant interaction effects, which have a significant impact on China’s social governance [10]. Unfortunately, little research has examined how this interaction affects the reduction of carbon emissions, which is also the focus of this paper.

In summary, the literature fully explores the impact of fiscal decentralization and green financial policies on carbon emission reduction. China’s obvious institutional characteristics are “political centralization and economic decentralization”, and financial decentralization is an important aspect of economic decentralization. However, few studies have focused on the impact of China’s financial decentralization on carbon emission reduction. The rest of this paper primarily explores the impact of this special financial decentralization system on carbon emission reduction.

3. A Preliminary Analysis of the Practice of Financial Decentralization in China in the Context of Reducing Carbon Emissions

China seeks to achieve a carbon peak by 2030 and carbon neutrality by 2060. This is a grand strategic goal of “pulling one hair and moving the whole body”, which will entail the transformation from an industrial civilization to an ecological civilization. China is still a developing country that is in the process of institutional change. Macrocontrol is hugely significant in China, with its socialist market economy. After the central government has determined its objectives in line with social interests, it will implement them from top to bottom through a series of policies. State-owned enterprises often become the specific carriers of policies and play an important social demonstration role. Regarding carbon emission reduction, after the central government implements its policies according to the national will, the cost of economic operations will increase somewhat. Enterprises will need extensive funds to purchase new production equipment, install emission reduction equipment, and increase their relevant R&D investment. To protect the economic interests of the jurisdiction, expand employment, and promote the steady growth of GDP, the local government will vigorously intervene in the jurisdiction’s banking system, promote the flow of funds to the enterprises there (in particular, local governments will strive to ensure that state-owned enterprises obtain sufficient loans), and support the enterprises’ survival and development.

A question that arises is why local governments have the ability to intervene in the banking system. The answer is that this ability originates from China’s financial decentralization system. China’s financial system reform began with the reform and opening up in 1978. During the planned economy period, the system was “unified”. To a large extent, the fiscal government assumed responsibility for finance, and local governments struggled to have a role in this area. After 1978, driven by the “decentralization and interest concessions”, the financial sector saw a wave of decentralization. Various financial institutions restarted one after another, nonbank financial institutions arose, various financial markets emerged, and the actual financial management power moved down. Local governments’ ability to intervene in local finance comes from two aspects: the “capture” of the central bank branches by local governments and the rapid development of local finance. These financial institutions have interests that are inextricably linked with those of local governments.

In 1983 and 1986, the State Council issued documents to clarify the responsibilities of the People’s Bank of China as the central bank and the financial moderating authority, nominally forming a unified supervision and management system. However, by “capturing” or “colluding” with the local branches of the central bank, local governments have gained most of the power of local financial resource allocation and financial management. There are at least two factors that enabled local governments to “erode” the central bank’s financial management power. First, the central bank’s organization and management system, which established branches according to administrative divisions, had insufficient vertical control and was vulnerable to local government intervention. Second, to increase the enthusiasm of local branches, the central bank’s head office delegated the right to adjust the loan scale, the right to finance, and the power to approve local financial institutions and financial markets to local branches from the beginning, and local governments have a greater influence on the local branches.

In recent years, China’s local financial institutions have also developed rapidly. Urban commercial banks with obvious marks of local government influence have accelerated their restructuring and listing, and their asset scale and business scope have expanded. Rural credit cooperatives are also actively reforming shareholding, and some have been transformed into agricultural commercial banks. Local financial institutions, such as village and town banks, small loan companies, and mutual fund cooperatives, have developed rapidly. At the same time, to promote local economic development, local governments have adopted local financial development and management as important strategic measures, from optimizing the local financial ecology to establishing a local financial holding group and finally building a regional or even national financial center, prompting fierce competition to attract the inflow of financial resources. In terms of financial management authority, the central government has successively delegated the financial supervision authority of nondeposit quasi-financial institutions, such as small loan companies, pawn banks, and financing guarantee companies, to local governments. In 2013, based on strengthening local responsibilities, the central government delegated the prequalification right to issue bonds to local governments. The decentralization of financial resource allocation and financial management has greatly stimulated the enthusiasm of local governments in developing finance. Local governments have a considerable influence on large-scale, state-owned commercial banks, urban commercial banks, rural commercial banks, and other banks in their jurisdictions. They can directly interfere with these banks in issuing loans, increasing financial efficiency. They also have interests that are inextricably linked to those of some non-bank financial institutions and can influence the flow of funds from these institutions to the construction of government-supported projects.

As local governments can intervene in local finance, we ask what local governments’ motivation is for intervening in local finance to support carbon emission reduction. One aspect is that environmental factors have been linked to the performance assessment of officials. From economic and political perspectives, China can be characterized as having “economic decentralization and political centralization” [46], and under this special system, local officials compete for political achievements, which ultimately helps them obtain individual promotions. Carbon emission reduction constitutes the official performance evaluation standard. (In 2013, the CPC Central Committee’s Organization Department released the Notice on Improving the Performance Assessment of Local Party and Government Leading Groups and Leading Cadres, which clearly states that the weight of environmental preservation in official evaluations should be enhanced. In 2014, China’s National Development and Reform Commission announced Measures for Assessment and Assessment of Responsibility for the Reduction of Carbon Dioxide Emission Target of Unit GDP, which calls for an enhancement in the target responsibility assessment system for carbon emission reduction). Since the beginning of the 21st century, the Chinese government has attached great importance to environmental indicators in performance assessment. In some areas, a “one vote veto” system for ecological and environmental protection has even emerged [47]. To reach carbon emission reduction targets, local officials have a strong incentive to intervene in local financial institutions and grant loans to carbon emission reduction projects. With strong financial support, local enterprises can quickly update their production equipment, increase research and development, and make green technological progress. Rapid building of the infrastructure related to carbon emission reduction, especially the energy supply system, has also begun, which has greatly improved the local energy consumption structure and promoted carbon emission reduction.

This intervention is also motivated by the desire to protect jurisdictions’ economic interests. The “promotion tournament” theory asserts that officials will vigorously develop the local economy and promote the rapid growth of GDP to receive job promotions. Carbon emission reduction will undoubtedly exert cost pressure on enterprises’ production and operation. To relieve this pressure and boost the local economy, local governments will intervene in financial institutions to lend funds to enterprises under their jurisdiction, especially state-owned enterprises, to support low-carbon production.

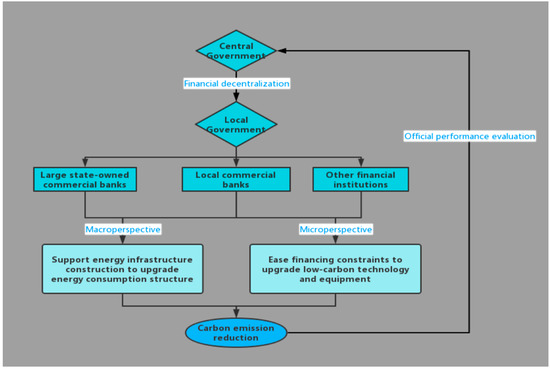

In summary, local governments have the ability and motivation to intervene in local finance to promote carbon emission reduction. China’s financial system is dominated by the banking industry. Large state-owned commercial banks, local commercial banks, and other financial institutions constitute most of China’s local financial institutions. By “capturing” the branches of the People’s Bank of China, local governments can intervene in the credit business of large state-owned commercial banks. Local commercial banks, local governments, and even the actual shareholders of urban and rural commercial banks have considerable influence on credit allocation. Local governments also have some influence over other types of financial institutions, such as small loan companies, because they have the power of approval and some financial supervision authority. Due to environmental regulations, enterprises need ample funds to update their technology and production equipment. To protect the economic interests of their jurisdictions, especially the interests of state-owned enterprises, local governments can make a large amount of credit funds flow to these enterprises through active intervention in the above financial institutions, easing financing constraints and ensuring the upgrading of low-carbon technology and equipment. In addition, local governments bear direct and indirect responsibility for the construction of energy infrastructure. Due to increasing fiscal pressure, local governments will obtain part of the credit funds directly or indirectly to ensure the construction of energy infrastructure, which is conducive to the upgrading of the energy consumption structure in the areas under their jurisdiction. Figure 1 shows the impact mechanism of local government intervention in local finance on carbon emission reduction under the financial decentralization system.

Figure 1.

Impact mechanism of financial decentralization on carbon emission reduction.

It can be seen from the above that under the special institutional arrangement of financial decentralization, local governments will actively intervene in local financial institutions to provide financial support for carbon emission reduction in their jurisdictions. Therefore, we propose the following hypothesis.

Hypothesis 1.

The institutional arrangement effected by China’s financial decentralization is conducive to significantly reducing carbon emissions.

4. Research Design

4.1. Model Setting

4.1.1. Benchmark Regression Model Setting

To empirically test the impact of China’s financial decentralization on carbon emission reduction, we establish the following model for benchmark regression analysis:

We establish the above two-way fixed effects model for empirical analysis, where is the carbon emission intensity of a region, is the degree of financial decentralization of a region, is a series of control variables, is the time fixed effect, is the regional fixed effect, and is the random perturbation term. In this paper, time and regional fixed effects are controlled to capture interference factors that do or do not change with time.

We focus on the coefficient of and its significance level. We construct the t statistic to be used in the significance test:

where stands for the calculated coefficient, denotes the assumed value, and is the sample standard error of . Here, we formulate a null hypothesis and an alternative hypothesis using the general format in economic research:

A critical number can be found by checking the t distribution table given a significance level u (1%, 5%, or 10%), together with the sample size n utilized in the regression. The significance test is passed if , which means that the null hypothesis is rejected at the significance level of u. The significance test is failed if this criterion is not met. This method is also used to conduct the significance test in the following sections of this paper.

4.1.2. Heterogeneity Test Model Setting

China’s financial and fiscal sectors are closely linked. During the planned economy, state-owned firms’ investment funds were mostly derived from fiscal allocation. The fiscal government assumed most financial responsibilities. In 1985, China experienced a comprehensive reform of “government appropriations being replaced by loans”. Ever since, the banking system has provided the majority of the investment money for state-owned enterprises, and the financial function has started to be separated from the national budget. However, the boundary between the two is still ambiguous.

In 1994, China reformed the tax distribution system and gradually shifted to fiscal decentralization. This greatly alleviated the pressure of central fiscal power but also caused a mismatch between local fiscal and administrative power, which increased local fiscal pressure and debt problems. Since local governments have considerable influence on local finance, to ease fiscal pressure, the trend of local fiscal risk financialization is becoming starker. For instance, local governments established city investment companies and funded them with land capital, and a substantial portion of credit funds flowed into these companies. Clearly, there is an evident interaction between China’s fiscal and financial sectors, which will have an important impact on carbon emission reduction. To explore the role of fiscal decentralization in the process of financial decentralization affecting carbon emission reduction, we use the following moderating effect model for a regression analysis:

where represents fiscal decentralization and represents the interaction term between financial decentralization and fiscal decentralization. To measure fiscal decentralization on the expenditure side, we divide the regional fiscal expenditure per capita by the sum of the regional fiscal expenditure per capita and the central fiscal expenditure per capita (The literature mainly measures fiscal decentralization from both fiscal revenue and fiscal expenditure decentralization and determines the measurement method according to the research focus. We assert that fiscal decentralization will cause local fiscal pressure and eventually suppress the carbon emission reduction effect of financial decentralization. This fiscal pressure mainly comes from fiscal expenditure decentralization). We focus on the value of and its significance level.

We further divide the total sample into two subsamples of the south and the north for the regional heterogeneity test. The regression model used in this part is still that presented in Formula (1).

4.1.3. Mechanism Analysis Model Setting

According to the previous theoretical analysis, financial decentralization will reduce carbon emissions through two channels: easing corporate finance constraints and upgrading the jurisdiction’s energy consumption structure. The following two mechanism analysis models are used in this study to conduct corresponding empirical tests (Because the mediating effect model is controversial due to the endogenous nature of the mediating variable, we chose the mechanism analysis method commonly used in economic empirical research to discuss the channel mechanism).

First, financial decentralization will have an impact on carbon emission reduction by easing corporate financing constraints. We selected 3487 A-share-listed companies in China as research samples for this section and matched them with the original provincial panel data using provinces and years as matching marks, obtaining 32,644 research samples (First, we excluded companies in the tertiary industry from the sample. Second, we did not include the companies marked ST and * ST. Finally, we removed companies with significant missing statistical values for variables. 3487 enterprise samples were obtained after the above screening). We used the newly obtained panel data for the regression analysis and the mechanism analysis in this section adopts the following model:

where subscript k represents the k-th enterprise, control includes both enterprise-level and provincial-level control variables, and is the industry fixed effect. SA is the absolute value of the SA index, representing the degree of financing constraints of enterprises (We take the absolute value of the calculated SA index. The greater the absolute value, the stronger the enterprises’ financing constraints). The SA index is constructed from two relatively exogenous indicators, namely, the total assets of enterprises and the age of enterprises [48]. Its calculation is not affected by endogenous characteristic variables such as financing methods and operating conditions, which are more stable and reliable.

Second, financial decentralization will reduce carbon emissions by upgrading the energy consumption structure. For the mechanism analysis in this part, we establish the following model:

where Coal is the proportion of regional coal consumption. We divide the regional coal consumption according to the unified standard by the total regional energy consumption to measure the regional energy consumption structure. The higher its value, the lower the regional carbon emission reduction.

4.1.4. Spatial Analytical Model Setting

When studying regional problems, it is often necessary to pay attention to the spatial dependence in spatial data; that is, certain attributes of geospatial units and of adjacent spatial units interact with each other and tend to show the same or similar attribute values. This reflects Tobler’s first law of geography: everything is related, but similar things are more closely related [49]. For this article, the carbon emission reduction effect of financial decentralization on the region will, on the one hand, exert pressure on officials in surrounding areas, which will force local governments there to strive to reduce carbon emissions. On the other hand, considering the government governance factors, the ways and means of carbon emission reduction in one region will spill over to other regions through the communication of local officials, which will further contribute to carbon emission reduction. The above suggests that there is a spatial correlation among regional carbon emissions and that under the financial decentralization system, the active intervention of local governments in local finance has a certain spatial spillover effect on carbon emissions. Therefore, we establish a spatial lag model (SAR) to further explore the carbon emission reduction effect of China’s financial decentralization based on considering spatial dependence, and we decompose the direct and indirect effects through this model. The regression formula is as follows:

where W is the spatial weight matrix, and and are the related parameters. The spatial adjacency matrix is used in this part of the regression, and its specific form is as follows:

where the elements on the main diagonal are 0, and if province i and province j have a common border, then . Otherwise, .

The effect of decomposition of the spatial lag model can be described as follows. In the general form , the marginal effect of explanatory variable X on y is not β because the explained variables of different provinces affect each other until they return to the equilibrium level.

First, we convert the general form into matrix equation form:

Because

Then,

where is an matrix. We expand Equation (9) as

where is the element of matrix . From Equation (10), we obtain

Therefore, the independent variable of a province will have an impact on the explained variable of any province. In particular, when

where represents the influence of the r-th explanatory variable of province j on province i, which is generally called the indirect effect; represents the influence of the r-th explanatory variable of province i on itself, which is generally called the direct effect; and the sum of the indirect and direct effects is called the total effect.

4.2. Indicators of Main Variables

4.2.1. Indicators of Carbon Emissions

Since the carbon emission data provided by the Carbon Emission Accounts and Datasets for emerging economies (CEADs) database are in line with the reality of China’s carbon emissions and are generally recognized as such, we used this data and divided them by the GDP of each region to measure the explained variables in the benchmark regression.

Some scholars also use the IPCC method to manually calculate a region’s carbon emissions [45]. Therefore, we used the carbon emission coefficient published by the IPCC and divided the final energy consumption into nine categories to estimate carbon dioxide emissions. We used the data measured using this method to test the robustness, and the specific calculation formula is as follows:

where C represents the total carbon emissions, k is the energy variety, E is the energy consumption, SC is the conversion coefficient of standard coal, and CF is the carbon emission coefficient. According to the China Energy Statistics Yearbook, the final energy consumption was divided into the nine categories of raw coal, coke, crude oil, gasoline, kerosene, diesel, fuel oil, natural gas, and electricity.

4.2.2. Indicators of Financial Decentralization

Since China’s financial system is dominated by banks, most of the literature measures the degree of financial decentralization by the proportion of regional bank deposits or loans in the country. He and Miao [50] noted that bank loans are the most important financial resources and have an obvious positive correlation with other financial indicators. Local governments can intervene in large state-owned banks and national joint-stock banks within their jurisdictions. Therefore, they used the ratio of regional bank loans to the total amount of national loans to measure financial decentralization. However, Wang et al. [51] showed that the proportion of bank deposits can better reflect the degree of decentralization of local finance than the proportion of bank loans. In the benchmark regression, in one region, we used the proportion of deposits to national deposits to measure the degree of financial decentralization and the ratio of loans to national loans to test the robustness.

4.2.3. Indicators of Control Variables

In the benchmark regression, we selected the following control variables based on our own research focus and the literature. (1) Industrial structure was selected, since a region’s level of industrialization and economic development will significantly affect the intensity of its carbon emissions. Therefore, we controlled for the proportion of the secondary and tertiary industries in a region to measure its industrialization and industrial upgrading. (2) Demographic factors were used, and we further divided a region’s resident population by the administrative area to control for the important factor of population density. (3) For environmental regulation, we used the methods of Morgenstern et al. [52] for reference to measure and control for the degree of environmental regulation in a region. (4) Technological innovation was selected as a variable that must be controlled, as it significantly affects carbon emissions [53,54,55]. We divided a region’s R&D input cost by its GDP to control its R&D intensity. (5) Economic growth undoubtedly affects a region’s carbon emission level [56]. For the control variable of economic growth, we used the GDP growth rate to control the regional economic growth rate. (6) Opening up was selected; since China is a developing country, its opening up will often affect a region’s technological level and industrial structure [57,58]. We used the level of FDI to measure the level of openness. (7) The degree of government intervention was used, measured by the ratio of local government fiscal expenditure to GDP. The corresponding variable symbols and measurement methods are shown in Table 1.

Table 1.

Indicators of main variables.

4.3. Data Source and Sample Selection

Financial decentralization involves the relationship between the central and local governments. The central government has delegated the financial supervision power, examination, and approval power, and other relevant rights to the provincial governments. While retaining some of these rights, provincial governments have further delegated some powers and responsibilities to lower-level governments. Provincial governments are not only the central link point of the financial decentralization system but also have core rights related to local finance. Therefore, we conducted empirical tests based on provincial panel data, whose selection also conforms to the mainstream data selection method for financial decentralization. We collected data from 30 provinces in mainland China, excluding Tibet. Since low-carbon development has been highly valued by local governments at all levels since the scientific outlook on development was put forward, we set the data time interval as 2004–2019 based on data availability (The scientific outlook on development was put forward by Comrade Hu Jintao in July 2003 and has prompted a widespread response from local governments in all parts of China. Since the formulation and implementation of government policies have a certain lag, we set the data time starting point as 2004).

For carbon emission data, the benchmark regression in this paper used the open- source data released by CEADs (The relevant data are available at the following link: https://www.ceads.net.cn/data/province/ (accessed on 1 June 2020)). We have two main reasons for doing so: first, considering the uncertainties, such as the rapid change in China’s energy structure and the large differences in coal combustion efficiency, CEADs’ data measure the carbon emission factors based on the IPCC accounting method to recalculate the carbon emissions of energy consumption. This can scientifically and accurately reflect China’s carbon emissions. Second, CEADs’ carbon emission measurement results have been published in important international journals [59,60,61,62]. In the robustness test, we use the method introduced by the IPCC to measure carbon emissions and conduct the regression analysis again.

The data for financial decentralization and related control variables mainly came from the EPS database. We supplemented missing values based on the statistical database of the China economic network and cross-checked them. The enterprise-level variables in the mechanism analysis were derived from the CSMAR database. All the regression analyses in this paper were conducted in Stata 16.0.

5. Empirical Analysis

5.1. Variable Descriptive Statistics

The descriptive statistical results of the main variables in this paper are shown in Table 2. They show that for carbon emission intensity and financial decentralization, the measurement results used in the benchmark regression and robustness test are somewhat different. From the perspective of industrial structure, the proportions of secondary and tertiary industry in each region differ greatly, which indicates obvious differences in the industrialization process and the degree of industrial upgrading in different regions of China, reflecting the characteristics of unbalanced economic development. The population density, the intensity of environmental regulation, the level of foreign direct investment, and the degree of government intervention all have some variability. This reflects the fact that China is a vast country with different environmental and cultural characteristics in each region, which will affect the intensity of regional carbon emissions. Finally, we controlled the GDP growth rate, the average of which is 0.134. This indicates that China’s economy maintains a rapid growth rate, which will inevitably affect carbon emissions.

Table 2.

Descriptive statistical results.

5.2. Benchmark Regression Analysis

The benchmark regression results in this paper are shown in Columns 1–4 of Table 3. First, we conducted a regression without controlling for any variables. We found that the coefficient of financial decentralization was negative and significant at the 1% level. Second, we controlled regional fixed effects to capture the unobserved factors that do not change with time, and we carried out the regression analysis. The results show that the sign and significance level of the financial decentralization coefficient have not changed substantially. Third, we controlled the time-fixed effect to capture the interference factors that changed with time, and we conducted the regression analysis. The results also did not change substantially. Finally, we added the corresponding control variables for the regression analysis, and the coefficient of financial decentralization was still significantly negative at the 1% level. This preliminary outcome shows that the empirical results of this paper have a certain robustness. These results indicate that China’s financial decentralization has resulted in a positive institutional arrangement for reducing carbon emissions. Our primary hypothesis is confirmed.

Table 3.

Benchmark regression results.

5.3. Robustness Test

The explained variable and the explanatory variable were remeasured for robustness testing, and the results are shown in Table 4.

Table 4.

Robustness test results.

First, we used the method recommended by the IPCC to remeasure carbon emissions and used the newly obtained explained variable to reperform the regression analysis on Formula (1). The results after re-regression in Column 1 show that the coefficient of financial decentralization is still significantly negative at the 1% level.

Second, we changed the measurement method of the core explanatory variable and used the newly obtained core explanatory variable to reperform the regression analysis on Formula (1). Since some scholars use the ratio of the total loans of each province to the total loans of the whole country as the proxy variable of financial decentralization, we used this method to remeasure financial decentralization and conduct a regression test. We found that the financial decentralization coefficient in Column 2 is significantly negative at the 5% level, and the regression results have not changed substantially. This further shows that the empirical results of this paper have a certain robustness.

5.4. Heterogeneity Test

China is a country in transition with vast territory and uneven development. Different regions have different economic conditions and institutional characteristics. First, as China’s institutional arrangement has been transformed from a unified planned economic system, financial and fiscal decentralization are inextricably linked, and local fiscal pressure has a far-reaching impact on local finance. We explored the moderating effect of financial decentralization on carbon emission reduction in various places. Second, as the Chinese economy shows a clear trend of north–south differentiation, and the North–South gap is gradually replacing the east–west gap, we conducted a further empirical study based on the regional differences between the north and the south.

5.4.1. Heterogeneity Test Based on Fiscal Decentralizaion

Based on the different characteristics of fiscal decentralization in different regions, we constructed an interaction term between fiscal and financial decentralization and empirically discussed the moderating effect. We performed a regression analysis on Formula (4), and the results are displayed in the first column of Table 5.

Table 5.

Heterogeneity test results.

From the regression results, we can see that the interaction term between fiscal decentralization and financial decentralization is significantly positive, which indicates that fiscal decentralization produces a negative moderating effect on the process of reducing carbon emission intensity by financial decentralization. This is because the higher the degree of fiscal decentralization, the greater the mismatch between administrative and financial powers. To ease the fiscal pressure, local governments turn to the local financial system to obtain funds in direct or indirect ways, which largely crowds out corporate loans, inhibiting the improvement of low-carbon production technology and related equipment and hampering carbon emission reduction.

5.4.2. Heterogeneity Test Based on Regional Differences

Based on the characteristics of the north–south gap, we empirically tested the regional heterogeneity of the impact of financial decentralization on carbon emission reduction. We divided the total sample into two component samples, the south and the north, and regressed Formula (1). The regression results are shown in columns two and three of Table 5.

The results show that the financial decentralization coefficient is negative in both the south and the north. The significance level of financial decentralization in the south is below 1%, and the coefficient of financial decentralization in the North also passes the significance test at the 5% level. This further shows that the carbon emission reduction effect of financial decentralization is widespread in mainland China.

5.5. Mechanism Analysis Based on Corporate Financing Constraints and Regional Energy Consumption Structure

Based on the perspective of corporate financing constraints and the regional energy consumption structure, we empirically tested whether the impact channel mechanisms exist.

First, we performed regression analysis on Formula (5), and the results are shown in column one of Table 6. The coefficient of financial decentralization is negative at the significance level of 1%, which indicates that local governments’ intervention in local finance has improved financial efficiency, effectively reduced enterprises’ financing constraints, and thus guaranteed the transformation and upgrading of regional low-carbon production technology and equipment.

Table 6.

Mechanism analysis results.

Second, we performed regression analysis on Formula (6). The results, shown in Column 2 of Table 6, show that the coefficient of financial decentralization is negative and passes the significance test at the 1% level. The Chinese government attaches great importance to the development of a low-carbon economy and actively promotes the construction of a low-carbon-related infrastructure. In particular, local governments have provided strong financial support for the construction of the energy supply system by intervening in local finance, which has effectively promoted carbon emission reduction by improving the energy consumption structure.

5.6. Analysis of the Spatial Spillover Effect

We used the SAR model for empirical analysis and decomposed the direct and indirect effects. The regression results are shown in Table 7. They show that is significantly positive, and the spatial correlation coefficient passes the significance test at the 1% level. This shows that the carbon emission intensity of each province shows a certain spatial dependence.

Table 7.

Spatial econometric regression results.

The first column of Table 7 shows that the coefficient of financial decentralization is negative and passes the significance test at the 1% level. Since the direct effect can be regarded as the spillover effect within the region, under China’s financial decentralization system, the local government can be viewed as having effectively promoted carbon emission reduction through active intervention in local finance. The second column of Table 7 shows that the coefficient of financial decentralization is negative and passes the significance test at the 1% level. Since the indirect effect is an interregional spillover effect, the carbon emission reduction effect of financial decentralization in one region can be viewed as having a spillover effect on carbon emission reduction in other regions. This shows that under the financial decentralization system, the efforts of the government of one region to promote carbon emission reduction have a demonstration effect on other regions and that the mechanism of horizontal competition among governments forces other regions to learn and imitate, thus causing this spatial spillover effect.

In this section, we conducted a benchmark regression analysis using empirical data and tested the robustness of the regression results using a variety of methods. Furthermore, we performed a heterogeneity analysis based on regional differences and fiscal decentralization, as well as discussing the impact mechanisms. Finally, we examined the spatial spillover effect of this impact using a SAR model. The empirical results of this study clearly prove that China’s financial decentralization has a positive impact on carbon emission reduction.

6. Conclusions and Recommendations

6.1. Conclusions

With the proposal of China’s “double carbon” goal, the academic community has paid close attention to the impact of financial development and financial policies on carbon emission reduction. However, few studies have analyzed how local governments influence carbon emission reduction through positive actions in the financial sector from the perspective of the financial decentralization system. We focused on this special institutional arrangement, specifically analyzed how China’s local governments’ intervention in the local financial system has promoted carbon emission reduction, and conducted corresponding empirical tests, which somewhat fill the gap in existing research. This study also emphasizes the little-studied moderating effect that fiscal decentralization has on this process. The empirical findings of this work can offer new perspectives for further research in the field. The interaction of financial and fiscal decentralization will affect low-carbon development and enable development of relevant theoretical frameworks.

Many countries in transition, like China, face difficulties due to ambiguous borders between the government and the market. The government has a significant influence on economic development, and the delegation of power by the central government to local governments has enabled local governments to intervene considerably in the market. It is important to pay attention to local government intervention in the financial system in various countries’ financial decentralization systems and guide these behaviors to integrate them with the trend of low-carbon development around the world. Furthermore, the empirical results of this study indicate that we should pay attention to the spatial spillover effect of the financial decentralization system on carbon emission reduction, which might provide empirical evidence for promoting the establishment of linkage mechanisms between local governments. In respect to this aspect, this paper has some practical significance.

Based on panel data from 30 provinces in China, we conducted an empirical analysis, and our main conclusions are as follows:

- The results of the benchmark regression show that China’s financial decentralization system has a significant carbon emission reduction effect, which does not change substantially after a series of robustness tests. This shows that the empirical results of this paper are somewhat reliable. The existing research indicates that green financial policies, especially green credit, can significantly support the reduction of carbon emissions [2,3]. The results of this study further show that the financial decentralization system has stimulated the enthusiasm of local governments in China to participate in low-carbon development in the financial sector and has effectively promoted carbon emission reduction.

- Fiscal decentralization will negatively moderate this carbon emission reduction effect. According to the research currently available, fiscal decentralization will cause local governments to act in a number of ways that are not beneficial for reducing carbon emissions [39,43,44,45]. Based on this, the results of our study further indicate that the fiscal decentralization system has created significant local fiscal pressure, making local governments directly or indirectly obtain financing from local financial institutions, which has squeezed out enterprise loans. This is not conducive to the upgrading of low-carbon equipment and technology.

- The regional heterogeneity test shows that the carbon emission reduction effect of the financial decentralization system is widespread in both southern and northern China.

- The mechanism analysis shows that financial decentralization promotes carbon emission reduction by optimizing the energy consumption structure in jurisdictions and easing enterprises’ financing constraints. Optimizing the energy consumption structure can reduce carbon emissions per unit energy consumption, and easing corporate financing constraints is effective in upgrading low-carbon technologies and production equipment, which will ultimately help reduce carbon emissions.

- Considering the spatial dependence, we also used the SAR model to explore the spatial spillover effect. The regression results of the spatial econometric model show that under China’s financial decentralization system, the positive actions of local governments not only significantly reduce carbon emissions within their jurisdictions, but also have a spatial spillover effect on other regions, thus reducing these other regions’ carbon emission intensities.

6.2. Policy Recommendations

Based on the research results, we make the following suggestions from both positive and negative experiences. Some of the policy recommendations (Recommendations 1, 2, 4, and 5) apply not only to China but also to other countries, especially those in transition.

First, people should fully understand the behavior characteristics of local governments under the financial decentralization system, pay attention to the important role played by local governments in promoting carbon emission reduction, and gradually standardize and institutionalize these behaviors.

Second, most transitioning countries should pay special attention to the distortion of government conduct produced by financial pressure on local governments. To avoid government financing constricting the funding sources for low-carbon development of market players, transitioning countries should accelerate the implementation of a preventative mechanism. In particular, it is critical for China to deepen fiscal and tax reform, promote the matching of fiscal and administrative powers of local governments, and alleviate local fiscal pressure.

Third, China should accelerate the construction of a modern fiscal, tax, and financial system; clarify the responsibilities of all government departments; accelerate the introduction of relevant laws and regulations; increase the independence and coordination of financial supervision; and prevent local governments from extending the “grabbing hands” caused by fiscal pressure.

Fourth, in view of the significant space spillover effect of financial decentralization in reducing carbon emissions, local governments in China and other countries should strengthen regional cooperation and exchange and form a normalized linkage mechanism between governments as soon as possible. This could involve, for example, exchanging cadres in different places, promoting learning exchanges among officials and promoting policy information-sharing.

Finally, although the government has played an important role in reducing carbon emissions, it should pay more attention to the market’s decisive position in resource allocation. Countries in transition, including China, should speed up the development of a service-oriented government so that the government can provide “services” instead of leading the process when the market moves towards a low-carbon path. Low-carbon development should pay attention to the combination of social and economic benefits. Not only should there be policy guidance but the concept of low-carbon development should also be internalized in the market itself. Government intervention may produce significant carbon emission reduction effects in the short-term. However, in the long-term, too much government intervention will produce high transformation costs, which is not conducive to the long-term low-carbon development of the economy. Under the general policy direction of low-carbon development, market players should be guided to actively participate, and a corresponding industrial ecology should be formed as soon as possible. Only when driven by both the low-carbon concept and a profit focus can the economy maintain the long-term motivation to smoothly transition to a low-carbon development mode.

6.3. Research Prospects

The impact of the financial decentralization system on the decreasing of carbon emissions is a crucial issue. The following three aspects can be explored further in the future. First, the issue of property rights is typically one that transitioning nations have to deal with. The power of local governments to control the financial sector has expanded as a result of financial decentralization. We need to conduct more research to see whether this will impact different interest groups differently and ultimately have an influence on the reduction of carbon emissions. For instance, it is important to consider whether local government intervention will lead to substantial financial resources flowing into state-owned companies, making it difficult for private companies to obtain financing and ultimately limiting their ability to upgrade their low-carbon technologies. Second, financial decentralization will increase regional competition for financial resources. It is crucial to conduct more research to see whether financial competition among local governments would result in a significant outflow of funds from underdeveloped areas, which would be detrimental to efforts to finance low-carbon development in these areas. Finally, financial decentralization presents governance issues for governments. This needs to be further explored if the expansion of local governments’ rights will lead to rent-seeking, corruption, or even collusion between the government and corporations, which is ultimately detrimental to regional sustainable development.

Author Contributions

Conceptualization, Y.L.; methodology, F.Z.; software, F.Z.; writing—original draft preparation, F.Z.; writing—review and editing, Y.L.; visualization, F.Z.; supervision, Y.L.; project administration, Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Building a Green Financial System: Guiding Opinions Was Published by Seven Ministries and Commissions. Available online: http://www.gov.cn/xinwen/2016-09/01/content_5104132.htm (accessed on 1 September 2016).

- Zhou, G.; Zhu, J.; Luo, S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 2022, 193, 107308. [Google Scholar] [CrossRef]

- Li, Z.-Z.; Li, R.Y.M.; Malik, M.Y.; Murshed, M.; Khan, Z.; Umar, M. Determinants of Carbon Emission in China: How Good is Green Investment? Sustain. Prod. Consum. 2021, 27, 392–401. [Google Scholar] [CrossRef]

- Montinola, G.; Qian, Y.Y.; Weingast, B.R. Federalism, Chinese Style—The Political Basis for Economic Success in China. World Politics 1995, 48, 50–81. [Google Scholar] [CrossRef]

- Qian, Y.; Weingast, B.R. Federalism as a Commitment to Preserving Market Incentives. J. Econ. Perspect. 1997, 11, 83–92. [Google Scholar] [CrossRef]

- Hong, Z.; Hu, Y. China’s financial decentralization. China Econ. Q. 2017, 16, 545–567. [Google Scholar]

- Meng, F. The Logic of Financial Decentralization between Central and Local Governments: Administrative Subcontract Model and Its Effect. Shanghai J. Econ. 2017, 12, 85–97. [Google Scholar] [CrossRef]

- Pistor, K. The Governance of China’s Finance. In Capitalizing China; Fan, J.P.H., Morck, R., Eds.; University of Chicago Press: Chicago, IL, USA, 2012; pp. 35–60. [Google Scholar]

- Poitevin, M. Can the theory of incentives explain decentralization? Can. J. Econ. Rev. Can. D’économique 2000, 33, 878–906. [Google Scholar] [CrossRef]

- He, D.; Miao, W. Fiscal and Financial Decentralization and Macroeconomic Governance. Soc. Sci. China 2021, 7, 163–185, 207–208. [Google Scholar]

- Park, A.; Shen, M. Refinancing and decentralization: Evidence from China. J. Econ. Behav. Organ. Sci. 2008, 66, 703–730. [Google Scholar] [CrossRef]

- Dewatripont, M.; Maskin, E. Credit and Efficiency in Centralized and Decentralized Economies. Rev. Econ. Stud. 1995, 62, 541–555. [Google Scholar] [CrossRef]

- Fu, Y.; Li, L. The logic of Financial Decentralization: From the perspective of local intervention and central concentration. Shanghai Financ. 2015, 10, 47–53. [Google Scholar]

- Xiong, H.; Shen, K. The Impact of Financial Decentralization on the Efficiency of Corporate Investment. Res. Econ. Manag. 2019, 40, 27–46. [Google Scholar] [CrossRef]

- Agarwal, S.; Lucca, D.; Seru, A.; Trebbi, F. Inconsistent Regulators: Evidence from Banking. Q. J. Econ. 2014, 129, 889–938. [Google Scholar] [CrossRef]

- Miao, W. National Assistance, Local Financial Decentralization and Financial Fluctuations. Contemp. Financ. Econ. 2019, 5, 47–60. [Google Scholar]

- Haroldo, V.R.; Diego, R.; Jürgen, P.K. Effects of changing population or density on urban carbon dioxide emissions. Nat. Commun. 2019, 10, 3204. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, W.; Zhao, M.; Wang, B. Analysis of the influencing factors on CO2 emissions at different urbanization levels: Regional difference in China based on panel estimation. Nat. Hazards 2019, 96, 627–645. [Google Scholar] [CrossRef]

- Hasan, M.M.; Wu, C.J.E.S.R. Estimating energy-related CO2 emission growth in Bangladesh: The LMDI decomposition method approach. Energy Strategy Rev. 2020, 32, 100565. [Google Scholar] [CrossRef]

- Knight, K.W.; Schor, J.B. Economic Growth and Climate Change: A Cross-National Analysis of Territorial and Consumption-Based Carbon Emissions in High-Income Countries. Sustainability 2014, 6, 3722–3731. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Okubo, T.; Zhou, Y. The carbon dioxide emissions of firms: A spatial analysis. J. Environ. Econ. Manag. 2013, 65, 290–309. [Google Scholar] [CrossRef]

- Cees, W.; Alex, H. Tax competition leading to strict environmental policy. Int. Tax Public Financ. 2013, 20, 434–449. [Google Scholar] [CrossRef][Green Version]

- Liu, Z.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Aziz, G.; Mighri, Z. Carbon Dioxide Emissions and Forestry in China: A Spatial Panel Data Approach. Sustainability 2022, 14, 12862. [Google Scholar] [CrossRef]

- Tamazian, A.; Pineiro Chousa, J.; Chaitanya Vadlamannati, K. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Shahbaz, M.; Solarin, S.A.; Mahmood, H. Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ. Model. 2013, 35, 145–152. [Google Scholar] [CrossRef]

- Salazar, J. Environmental Finance: Linking Two World. In Proceedings of the Workshop on Finance Innovations for Biodiversity, Bratislava, Slovakia, 1–3 May 1998; pp. 2–18. [Google Scholar]

- Cowan, E. Topical Issues in Environmental Finance. In Research Paper Was Commissioned by the Asia Branch of the Canadian International Development Agency (CIDA); International Development Research Centre: Ottawa, ON, Canada, 1999; pp. 1–20. [Google Scholar]

- Li, W.; Hu, M. An overview of the environmental finance policies in China: Retrofitting an integrated mechanism for environmental management. Front. Environ. Sci. Eng. 2014, 8, 316–328. [Google Scholar] [CrossRef]

- Xiu, J.; Liu, H.Y.; Zang, X.Q. The Industrial Growth and Prediction under the Background of Green Credit and Energy Saving and Emission Reduction. Mod. Econ. Sci. 2015, 37, 55–62. [Google Scholar]

- Liu, J.; Xia, Y.; Fan, Y.; Lin, S.; Wu, J. Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J. Clean. Prod. 2017, 163, 293–302. [Google Scholar] [CrossRef]

- Alonso-Conde, A.-B.; Rojo-Suárez, J. On the Effect of Green Bonds on the Profitability and Credit Quality of Project Financing. Sustainability 2020, 12, 6695. [Google Scholar] [CrossRef]

- Hadaś-Dyduch, M.; Puszer, B.; Czech, M.; Cichy, J. Green Bonds as an Instrument for Financing Ecological Investments in the V4 Countries. Sustainability 2022, 14, 12188. [Google Scholar] [CrossRef]

- Zhang, B.; Yang, Y.; Bi, J. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. J. Environ. Manag. 2011, 92, 1321–1327. [Google Scholar] [CrossRef] [PubMed]

- Wang, F.; Yang, S.; Reisner, A.; Liu, N. Does Green Credit Policy Work in China? The Correlation between Green Credit and Corporate Environmental Information Disclosure Quality. Sustainability 2019, 11, 733. [Google Scholar] [CrossRef]

- Charles, M.T. Exports and Regional Economic Growth: Rejoinder. J. Political Econ. 1956, 64, 169. [Google Scholar] [CrossRef]

- Oates, W.E.; Schwab, R.M. Economic competition among jurisdictions: Efficiency enhancing or distortion inducing? J. Public Econ. 1988, 35, 333–354. [Google Scholar] [CrossRef]

- Lopez, R.; Mitra, S. Corruption, Pollution, and the Kuznets Environment Curve. J. Environ. Econ. Manag. 2000, 40, 137–150. [Google Scholar] [CrossRef]

- Keen, M.; Marchand, M. Fiscal competition and the pattern of public spending. J. Public Econ. 1997, 66, 33–53. [Google Scholar] [CrossRef]

- Maoliang, B.; Marcus, W. Racing to the bottom and racing to the top: The crucial role of firm characteristics in foreign direct investment choices. J. Int. Bus. Stud. 2016, 47, 1032–1057. [Google Scholar] [CrossRef]

- You, D.; Zhang, Y.; Yuan, B. Environmental regulation and firm eco-innovation: Evidence of moderating effects of fiscal decentralization and political competition from listed Chinese industrial companies. J. Clean. Prod. 2019, 207, 1072–1083. [Google Scholar] [CrossRef]

- Kunce, M.; Shogren, J.F. Destructive interjurisdictional competition: Firm, capital and labor mobility in a model of direct emission control. Ecol. Econ. 2007, 60, 543–549. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; List, J.A.; Millimet, D.L. Bureaucratic corruption, environmental policy and inbound US FDI: Theory and evidence. J. Public Econ. 2003, 87, 1407–1430. [Google Scholar] [CrossRef]

- Zhang, K.; Wang, J.; Cui, X. Fiscal Decentralization and Environmental Pollution: From the Perspective of Carbon Emission. China Ind. Econ. 2011, 10, 65–75. [Google Scholar]

- Blanchard, O.; Shleifer, A. Federalism with and without Political Centralization: China versus Russia. IMF Staff Pap. 2001, 48, 171–179. [Google Scholar]

- Lin, T.; Shen, R. Green Performance Assessment and Local Environmental Governance:Empirical Evidence from the Environmental Protection One-vote Veto System. J. Huazhong Univ. Sci. Technol. Soc. Sci. Ed. 2021, 35, 74–84. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Tobler, W.R. A Computer Movie Simulating Urban Growth in the Detroit Region. Econ. Geogr. 1970, 46, 234–240. [Google Scholar] [CrossRef]

- He, D.; Miao, W. Does the Fiscal Decentralization Impact the Financial Decentralization? Econ. Res. J. 2016, 51, 42–55. [Google Scholar]

- Wang, M.; Chen, H.; Chen, D. Research on the Spatial Spillover Effect of Financial Decentralization on Chinese Private Investment. J. Shanxi Financ. Econ. Univ. 2017, 39, 40–54. [Google Scholar]

- Morgenstern, R.D.; Pizer, W.A.; Shih, J.S. Jobs versus the environment: An industry-level perspective. J. Environ. Econ. Manag. 2002, 43, 412–436. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Buonanno, P.; Carraro, C.; Galeotti, M. Endogenous induced technical change and the costs of Kyoto. Resour. Energy Econ. 2003, 25, 11–34. [Google Scholar] [CrossRef]

- Popp, D. ENTICE: Endogenous technological change in the DICE model of global warming. J. Environ. Econ. Manag. 2004, 48, 742–768. [Google Scholar] [CrossRef]

- Dindaa, S.; Coondoob, D. Income and emission: A panel data-based cointegration analysis. Ecol. Econ. 2006, 57, 167–181. [Google Scholar] [CrossRef]

- Jorgenson, A.K. Does foreign investment harm the air we breathe and the water we drink? A cross-national study of carbon dioxide emissions and organic water pollution in less-developed countries, 1975 to 2000. Organ. Environ. 2007, 20, 137–156. [Google Scholar] [CrossRef]

- Acharyya, J. FDI, Growth and the Environment: Evidence from India on CO2 Emission during the Last Two Decades. J. Econ. Dev. 2009, 34, 43–58. [Google Scholar] [CrossRef]

- Shan, Y.; Liu, J.; Liu, Z.; Xu, X.; Shao, S.; Wang, P.; Guan, D. New provincial CO2 emission inventories in China based on apparent energy consumption data and updated emission factors. Appl. Energy 2016, 184, 742–750. [Google Scholar] [CrossRef]

- Shan, Y.; Guan, D.; Zheng, H.; Ou, J.; Li, Y.; Meng, J.; Mi, Z.; Liu, Z.; Zhang, Q. Data Descriptor: China CO2 emission accounts 1997–2015. Sci. Data 2018, 5, 170201. [Google Scholar] [CrossRef]

- Shan, Y.; Huang, Q.; Guan, D.; Hubacek, K. China CO2 emission accounts 2016–2017. Sci. Data 2020, 7, 54. [Google Scholar] [CrossRef]

- Guan, Y.; Shan, Y.; Huang, Q.; Chen, H.; Wang, D.; Hubacek, K. Assessment to China’s Recent Emission Pattern Shifts. Earths Future 2021, 9, e2021EF002241. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).