Maintenance Prioritisation of Irrigation Infrastructure Using a Multi-Criteria Decision-Making Methodology under a Fuzzy Environment

Abstract

1. Introduction

- Determining relevant criteria;

- Attaching numerical measures to the criteria’s relative importance and the alternative’s impacts;

- Processing the numerical values to determine the ranking of alternatives.

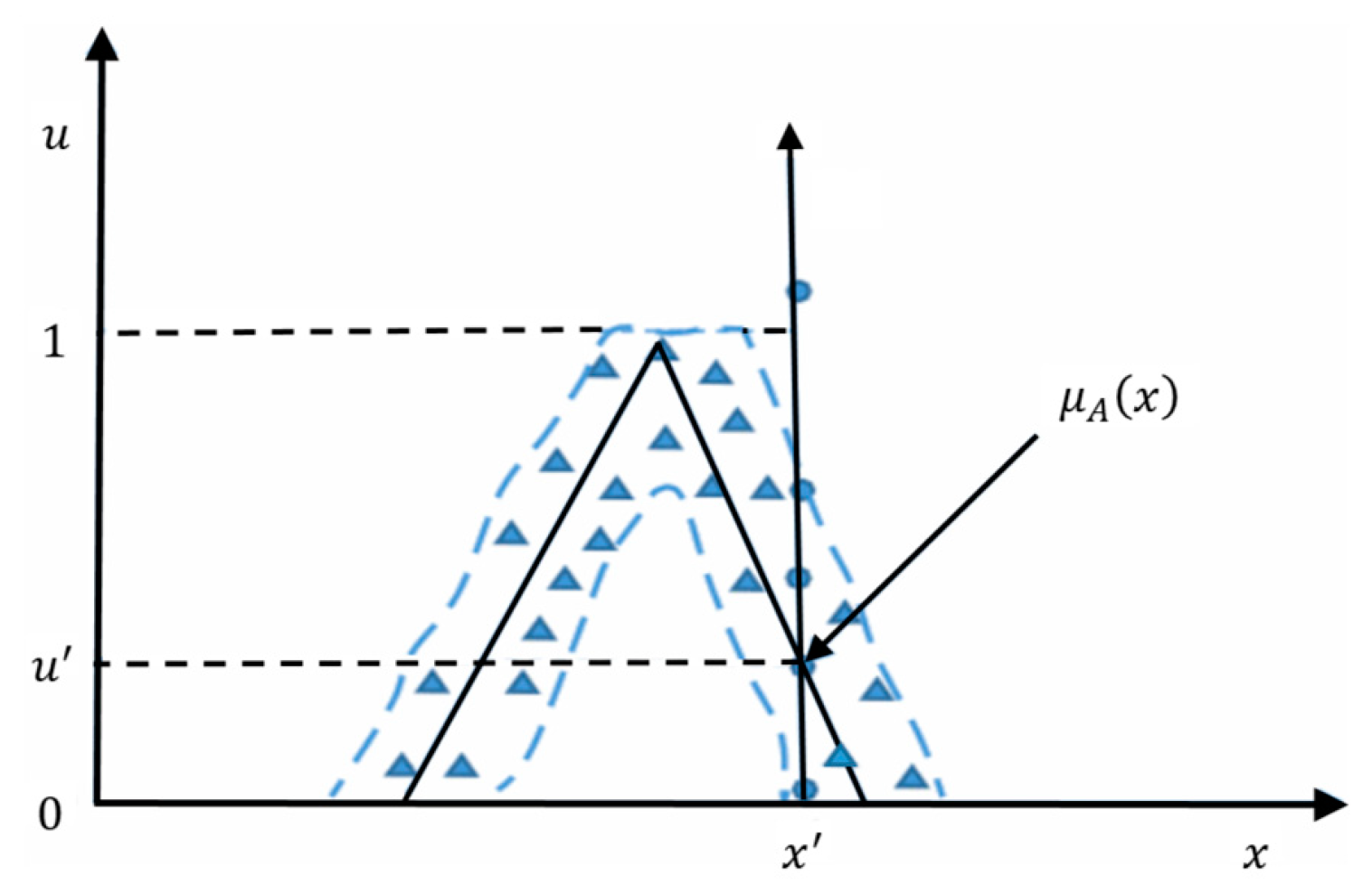

2. Fuzzy Sets

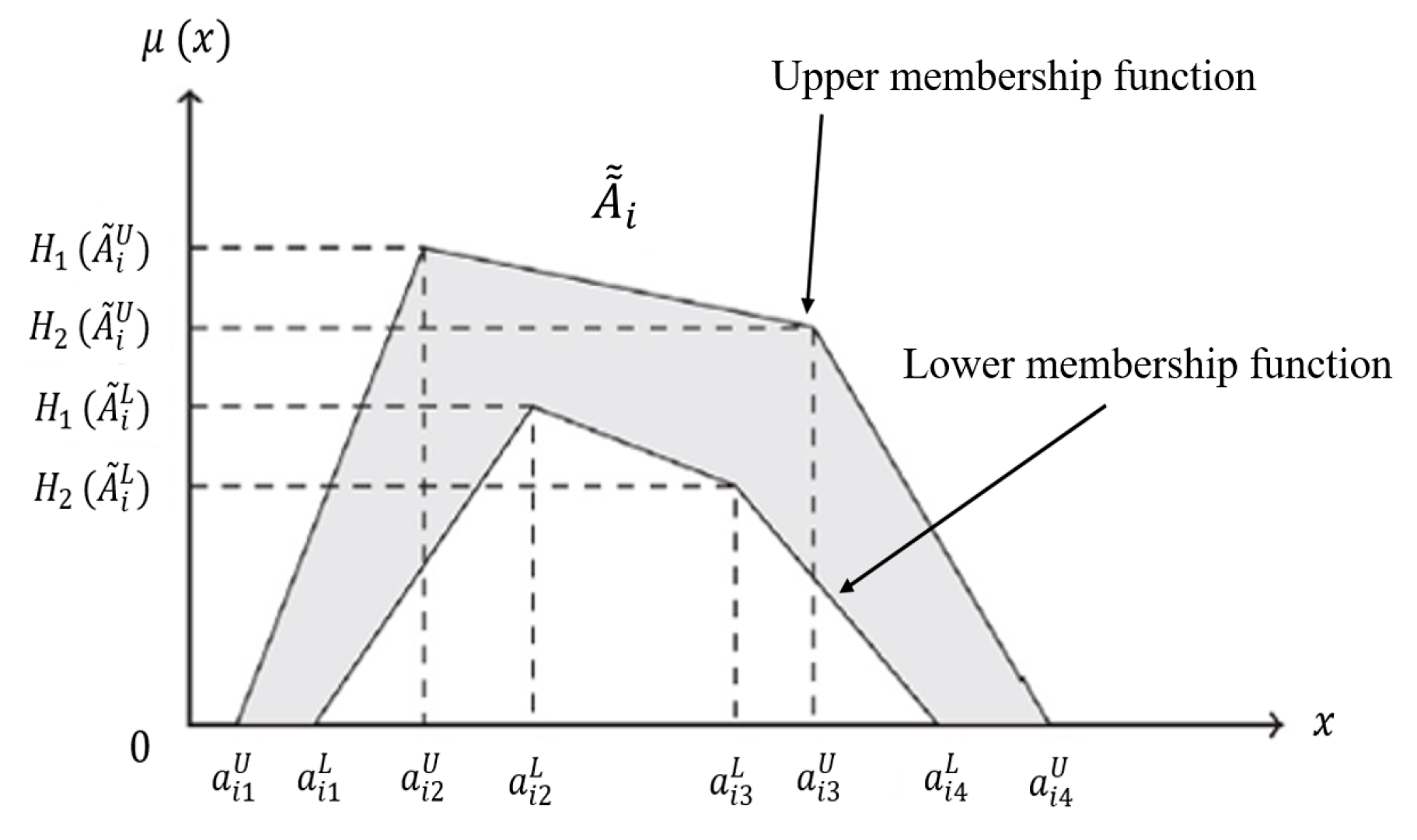

2.1. Operations on Trapezoidal Interval Type-2 Fuzzy Sets

2.2. Linguistic Variables

3. Determining Factors in Selecting an MCDM Methodology

3.1. Problem Structure

3.2. The Core Process of Methods

3.3. Determining the Weight of Criteria

3.4. Cost and Benefit Criteria

4. The Proposed Methodology

4.1. Determining Decision Criteria and Computing Criteria Weights

4.2. Consistency Check

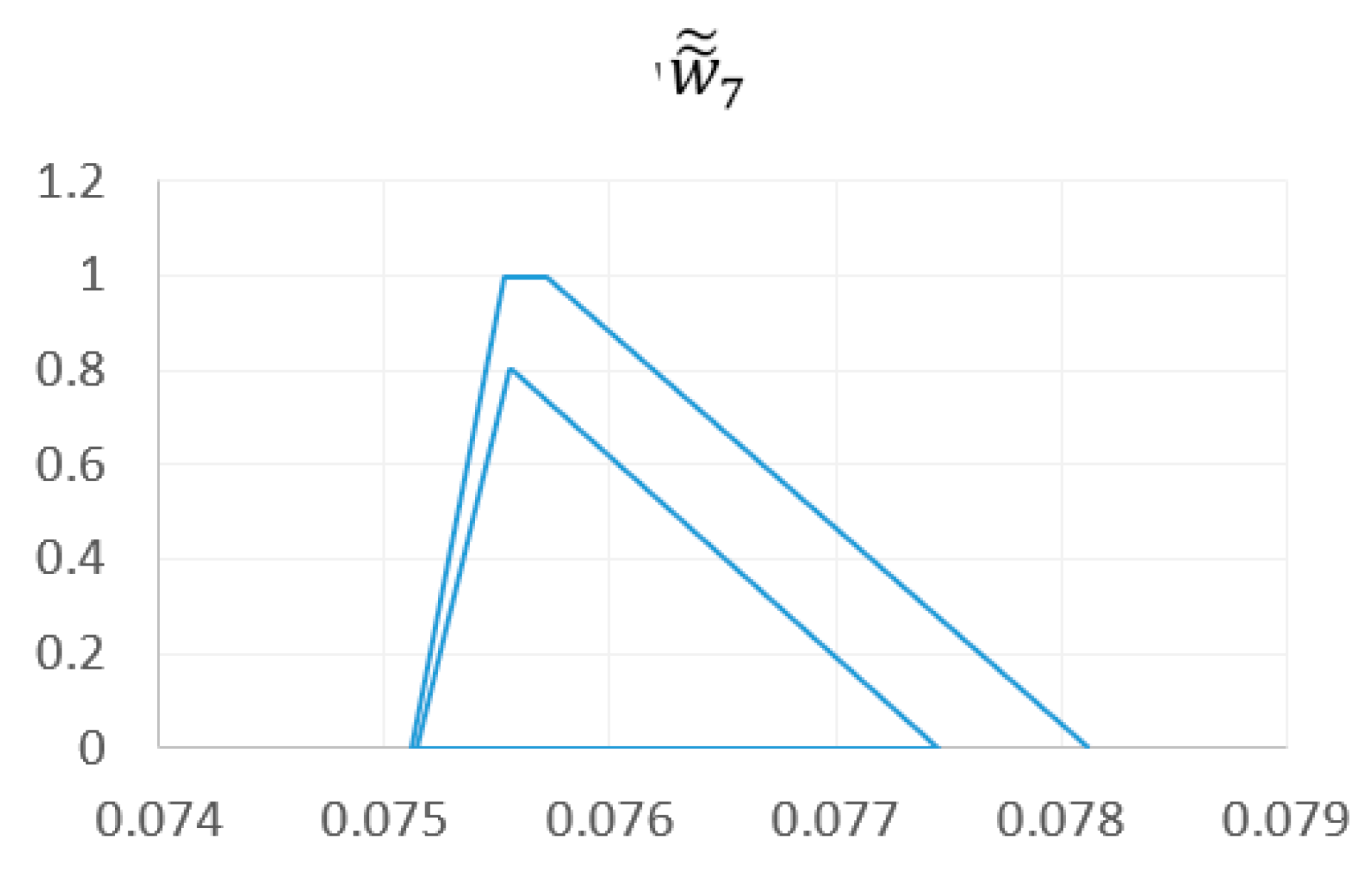

4.3. Defuzzification

4.4. Ranking the Alternatives Using Fuzzy TOPSIS

- The logic behind the method’s concept is considered rational and reasonable to decision-makers.

- The method is capable of representing quantitative values accounting for the best and worst performers among the decision alternatives.

- The method’s calculation procedure is straightforward and easily programmable.

- The alternatives’ performance measures can be visually presented in a two-dimensional space on a polyhedron (Figure 7).

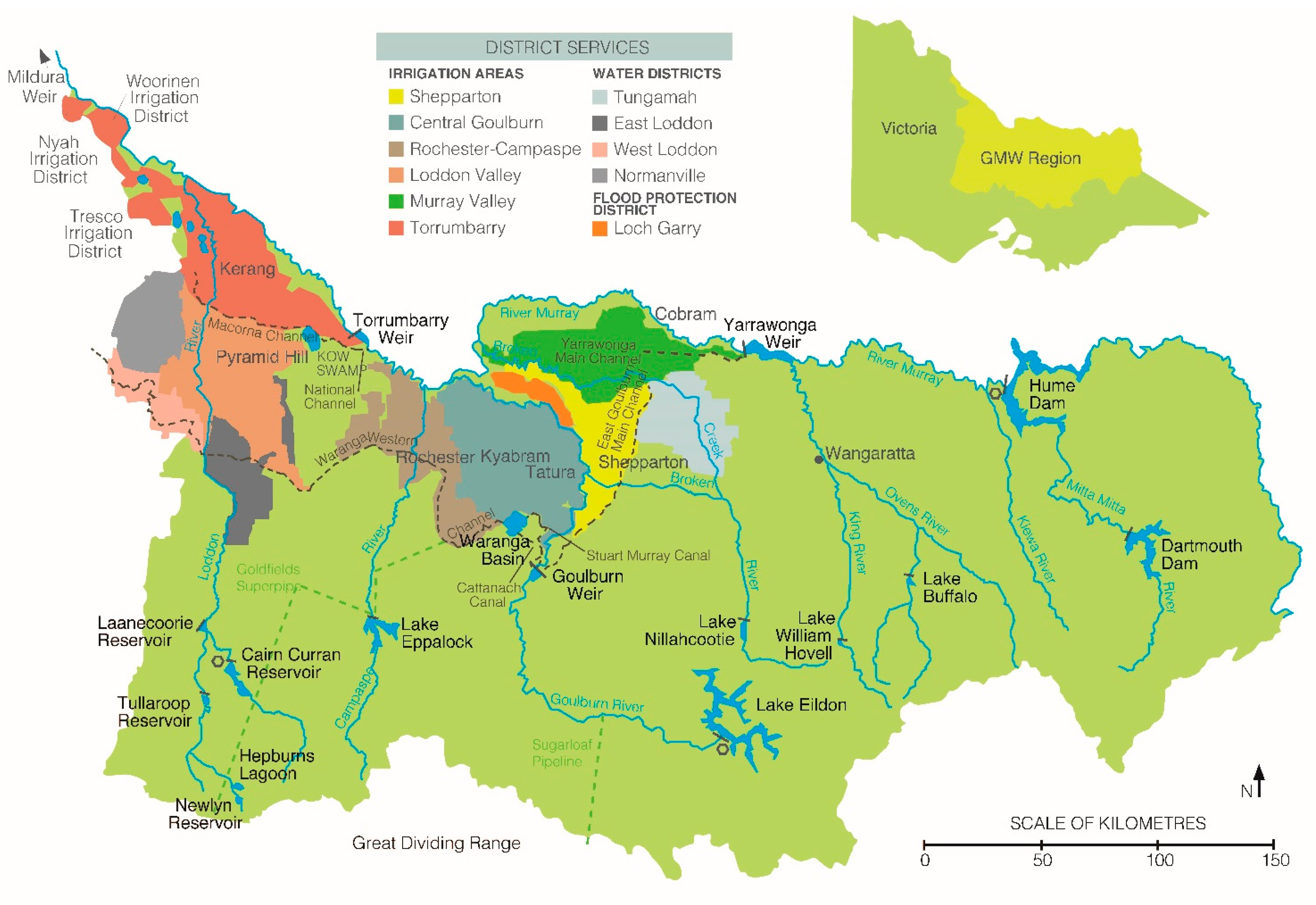

5. Application of the Method to Maintenance Prioritisation of Irrigation Infrastructure

5.1. Evaluation Criteria and Channel Remodeling Candidates

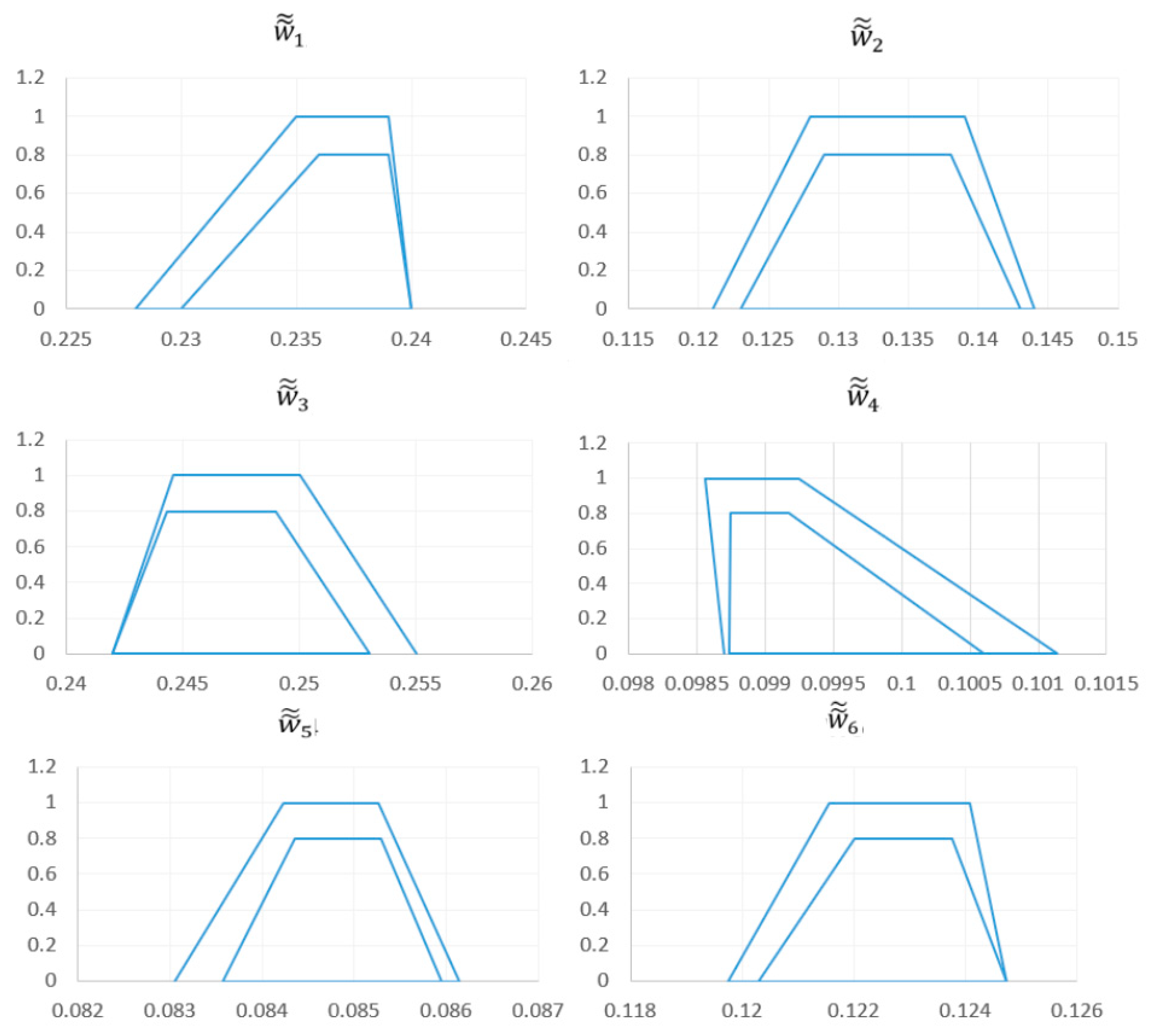

5.2. Conducting Fuzzy AHP Computations

5.3. Evaluating the Channels with Type-2 Fuzzy TOPSIS and Determining the Maintenance Ranking

6. Discussion

- Since irrigation channels could run along bends or paddocks (which can expedite deterioration due to livestock movement, especially if banks are not protected by fences), their physical condition can vary along their length. The existing prioritisation method utilises the highest-evaluated ACR as the likelihood of failure of an irrigation channel. This makes the assessment inaccurate, as a channel might have 20% of its length in ACR5 but most of its length in good condition yet still be prioritised for maintenance over another channel (with the same capacity but with, for example, 50% of its length with ACR5 and the rest in much worse condition compared to the first channel). Despite having the same risk score, if not investigated in more detail, the second channel could be easily overlooked by the current practice. Given the length of channel infrastructure, mistakes such as this can result in inefficient operation and cause reputational damage to the irrigation infrastructure owner. The research methodology suggests considering different percentages of different asset condition ratings when assessing an irrigation channel for maintenance, which would yield more accurate maintenance prioritisation rankings compared to the existing method.

- The current irrigation asset maintenance prioritisation method utilises a category-based approach to determine the consequence score and subsequent maintenance ranking for assets; that is, channels with <500 ML/D capacity have a consequence score of 14, and channels with 500–2000 ML/D capacity have a consequence score of 16. Considering existing budget restrictions, this approach is too generalised and could overlook the subtle differences between irrigation channels with similar characteristics. Thus, changing this approach could make a significant difference in (more accurately) identifying the riskiest assets to maintain, which in turn improves asset maintenance efficiency in the long term.

- The existing method for measuring the criteria weights and alternative performance values is subjective. Therefore, uncertainty attached to asset management experts’ thinking (in measuring the criteria weight and deciding on asset condition ratings, which ultimately result in the evaluation of maintenance prioritisation) can add to the inaccuracy of the maintenance prioritisation assessment. The literature suggests employing the fuzzy theory to capture the uncertainty associated with the subjective decision-making and thus result in more accurate rankings. This is the core and most important suggestion of this study, as no existing irrigation asset maintenance prioritisation methods consider the issue of subjectivity in assessment.

- Another shortcoming of the existing prioritisation method is the lack of a procedure to check consistency when measuring criteria weights. As the number of criteria is considerable and the evaluation scale is subjective (with linguistic variables such as more important, less important, equally important), irrigation infrastructure management experts could easily lose track while evaluating. In other words, the process of measuring the criteria importance index does not have any controlling stage to make sure that judgments are not random and reflect realistic and accurate assessments by irrigation infrastructure management experts. To put this in an easier context, when an asset decision-maker decides service delivery is twice as important as safety, which is in turn three times more important than financial loss, currently, there is no procedure to assure service delivery is assessed as six times more important compared to financial loss. Inconsistent judgments while undertaking trade-offs create inaccuracy in the criteria weight determination and consequently asset maintenance prioritisation. The methodologies, such as AHP, enable detecting such inconsistencies in the decision-making process.

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A

| Channel No.1 | Channel No.2 | Channel No.3 | Channel No.4 | Channel No.5 | Channel No.6 | |

|---|---|---|---|---|---|---|

| C11 | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.1; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C12 | ((0.233, 0.333, 0.333, 0.467; 1, 1), (0.283, 0.333, 0.333, 0.400; 0.9, 0.9)) | ((0.300, 0.367, 0.367, 0.467; 1, 1), (0.333, 0.367, 0.367, 0.417; 0.9, 0.9)) | ((0.167, 0.267, 0.267, 0.433; 1, 1), (0.217, 0.267, 0.267, 0.350; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) |

| C13 | ((0.300, 0.500, 0.500, 0.700; 1, 1), (0.400, 0.500, 0.500, 0.600; 0.9, 0.9)) | ((0.433, 0.600, 0.600, 0.733; 1, 1), (0.517, 0.600, 0.600, 0.667; 0.9, 0.9)) | ((0.367, 0.567, 0.567, 0.733; 1, 1), (0.467, 0.567, 0.567, 0.650; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0.133, 0.300, 0.300, 0.500; 1, 1), (0.217, 0.300, 0.300, 0.400; 0.9, 0.9)) |

| C14 | ((0.833, 0.967, 0.967, 1; 1, 1), (0.900, 0.967, 0.967, 0.983; 0.9, 0.9)) | ((0.700, 0.867, 0.867, 0.967; 1, 1), (0.783, 0.867, 0.867, 0.917; 0.9, 0.9)) | ((0.633, 0.800, 0.800, 0.933; 1, 1), (0.717, 0.800, 0.800, 0.867; 0.9, 0.9)) | ((0.367, 0.567, 0.567, 0.733; 1, 1), (0.467, 0.567, 0.567, 0.650; 0.9, 0.9)) | ((0.200, 0.367, 0.367, 0.567; 1, 1), (0.283, 0.367, 0.367, 0.467; 0.9, 0.9)) | ((0.633, 0.833, 0.833, 0.967; 1, 1), (0.733, 0.833, 0.833, 0.9; 0.9, 0.9)) |

| C15 * | ((0.900, 1, 1, 1; 1, 1), (0.950, 1, 1, 1; 0.9, 0.9)) | ((0.767, 0.900, 0.900, 0.967; 1, 1), (0.833, 0.900, 0.900, 0.933; 0.9, 0.9)) | ((0.767, 0.900, 0.900, 0.967; 1, 1), (0.833, 0.900, 0.900, 0.933; 0.9, 0.9)) | ((0.633, 0.800, 0.800, 0.933; 1, 1), (0.717, 0.800, 0.800, 0.867; 0.9, 0.9)) | ((0.567, 0.733, 0.733, 0.867; 1, 1), (0.650, 0.733, 0.733, 0.800; 0.9, 0.9)) | ((0.767, 0.900, 0.900, 0.967; 1, 1), (0.833, 0.900, 0.900, 0.933; 0.9, 0.9)) |

| C21 | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C22 | ((0.167, 0.233, 0.233, 0.367; 1, 1), (0.200, 0.233, 0.233, 0.300; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C23 | ((0.167, 0.233, 0.233, 0.367; 1, 1), (0.200, 0.233, 0.233, 0.300; 0.9, 0.9)) | ((0.233, 0.333, 0.333, 0.467; 1, 1), (0.283, 0.333, 0.333, 0.400; 0.9, 0.9)) | ((0.200, 0.333, 0.333, 0.500; 1, 1), (0.267, 0.333, 0.333, 0.417; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) |

| C24 | ((0.500, 0.700, 0.700, 0.833; 1, 1), (0.600, 0.700, 0.700, 0.767; 0.9, 0.9)) | ((0.300, 0.500, 0.500, 0.667; 1, 1), (0.400, 0.500, 0.500, 0.583; 0.9, 0.9)) | ((0.333, 0.467, 0.467, 0.600; 1, 1), (0.400, 0.467, 0.467, 0.533; 0.9, 0.9)) | ((0.200, 0.367, 0.367, 0.567; 1, 1), (0.283, 0.367, 0.367, 0.467; 0.9, 0.9)) | ((0.200, 0.333, 0.333, 0.500; 1, 1), (0.267, 0.333, 0.333, 0.417; 0.9, 0.9)) | ((0.367, 0.533, 0.533, 0.667; 1, 1), (0.450, 0.533, 0.533, 0.600; 0.9, 0.9)) |

| C25 * | ((0.833, 0.967, 0.967, 1; 1, 1), (0.900, 0.967, 0.967, 0.983; 0.9, 0.9)) | ((0.700, 0.867, 0.867, 0.967; 1, 1), (0.783, 0.867, 0.867, 0.917; 0.9, 0.9)) | ((0.500, 0.667, 0.667, 0.800; 1, 1), (0.583, 0.667, 0.667, 0.733; 0.9, 0.9)) | ((0.500, 0.667, 0.667, 0.800; 1, 1), (0.583, 0.667, 0.667, 0.733; 0.9, 0.9)) | ((0.533, 0.667, 0.667, 0.767; 1, 1), (0.600, 0.667, 0.667, 0.717; 0.9, 0.9)) | ((0.700, 0.867, 0.867, 0.967; 1, 1), (0.783, 0.867, 0.867, 0.917; 0.9, 0.9)) |

| C31 | ((0.233, 0.333, 0.333, 0.467; 1, 1), (0.283, 0.333, 0.333, 0.400; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0.167, 0.233, 0.233, 0.367; 1, 1), (0.200, 0.233, 0.233, 0.300; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C32 | ((0.467, 0.567, 0.567, 0.667; 1, 1), (0.517, 0.567, 0.567, 0.617; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0.233, 0.333, 0.333, 0.467; 1, 1), (0.283, 0.333, 0.333, 0.400; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C33 | ((0.467, 0.567, 0.567, 0.667; 1, 1), (0.517, 0.567, 0.567, 0.617; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.1; 0.9, 0.9)) | ((0.033, 0.100, 0.100, 0.233; 1, 1), (0.067, 0.100, 0.100, 0.167; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0.400, 0.500, 0.500, 0.600; 1, 1), (0.450, 0.500, 0.500, 0.550; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) |

| C34 | ((0.467, 0.567, 0.567, 0.667; 1, 1), (0.517, 0.567, 0.567, 0.617; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) | ((0.467, 0.567, 0.567, 0.667; 1, 1), (0.517, 0.567, 0.567, 0.617; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) |

| C35 | ((0.533, 0.633, 0.633, 0.7; 1, 1), (0.583, 0.633, 0.633, 0.667; 0.9, 0.9)) | ((0.100, 0.200, 0.200, 0.367; 1, 1), (0.150, 0.200, 0.200, 0.283; 0.9, 0.9)) | ((0.100, 0.200, 0.200, 0.367; 1, 1), (0.150, 0.200, 0.200, 0.283; 0.9, 0.9)) | ((0.100, 0.200, 0.200, 0.367; 1, 1), (0.150, 0.200, 0.200, 0.283; 0.9, 0.9)) | ((0.533, 0.633, 0.633, 0.700; 1, 1), (0.583, 0.633, 0.633, 0.667; 0.9, 0.9)) | ((0.100, 0.200, 0.200, 0.367; 1, 1), (0.150, 0.200, 0.200, 0.283; 0.9, 0.9)) |

| C41 | ((0.100, 0.167, 0.167, 0.300; 1, 1), (0.133, 0.167, 0.167, 0.233; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0.167, 0.233, 0.233, 0.367; 1, 1), (0.200, 0.233, 0.233, 0.300; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C42 | ((0.267, 0.400, 0.400, 0.533; 1, 1), (0.333, 0.400, 0.400, 0.467; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.0500; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.0500; 0.9, 0.9)) | ((0.233, 0.300, 0.300, 0.400; 1, 1), (0.267, 0.300, 0.300, 0.350; 0.9, 0.9)) | ((0.100, 0.167, 0.167, 0.300; 1, 1), (0.133, 0.167, 0.167, 0.233; 0.9, 0.9)) |

| C43 | ((0.500, 0.667, 0.667, 0.800; 1, 1), (0.583, 0.667, 0.667, 0.733; 0.9, 0.9)) | ((0.133, 0.300, 0.300, 0.500; 1, 1), (0.217, 0.300, 0.300, 0.400; 0.9, 0.9)) | ((0.367, 0.567, 0.567, 0.767; 1, 1), (0.467, 0.567, 0.567, 0.667; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) | ((0.400, 0.500, 0.500, 0.600; 1, 1), (0.450, 0.500, 0.500, 0.550; 0.9, 0.9)) | ((0.133, 0.300, 0.300, 0.500; 1, 1), (0.217, 0.300, 0.300, 0.400; 0.9, 0.9)) |

| C44 | ((0.833, 0.967, 0.967, 1; 1, 1), (0.900, 0.967, 0.967, 0.983; 0.9, 0.9)) | ((0.300, 0.500, 0.500, 0.667; 1, 1), (0.400, 0.500, 0.500, 0.583; 0.9, 0.9)) | ((0.433, 0.633, 0.633, 0.800; 1, 1), (0.533, 0.633, 0.633, 0.717; 0.9, 0.9)) | ((0.133, 0.267, 0.267, 0.433; 1, 1), (0.200, 0.267, 0.267, 0.350; 0.9, 0.9)) | ((0.467, 0.567, 0.567, 0.667; 1, 1), (0.517, 0.567, 0.567, 0.617; 0.9, 0.9)) | ((0.367, 0.567, 0.567, 0.733; 1, 1), (0.467, 0.567, 0.567, 0.650; 0.9, 0.9)) |

| C45 | ((0.767, 0.900, 0.900, 0.967; 1, 1), (0.833, 0.900, 0.900, 0.933; 0.9, 0.9)) | ((0.633, 0.800, 0.800, 0.933; 1, 1), (0.717, 0.800, 0.800, 0.867; 0.9, 0.9)) | ((0.767, 0.900, 0.900, 0.967; 1, 1), (0.833, 0.900, 0.900, 0.933; 0.9, 0.9)) | ((0.433, 0.600, 0.600, 0.733; 1, 1), (0.517, 0.600, 0.600, 0.667; 0.9, 0.9)) | ((0.567, 0.733, 0.733, 0.833; 1, 1), (0.650, 0.733, 0.733, 0.783; 0.9, 0.9)) | ((0.700, 0.867, 0.867, 0.967; 1, 1), (0.783, 0.867, 0.867, 0.917; 0.9, 0.9)) |

| C51 | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C52 | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C53 | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C54 | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) |

| C55 * | ((0.467, 0.600, 0.600, 0.700; 1, 1), (0.533, 0.600, 0.600, 0.650; 0.9, 0.9)) | ((0.467, 0.600, 0.600, 0.700; 1, 1), (0.533, 0.600, 0.600, 0.650; 0.9, 0.9)) | ((0.467, 0.600, 0.600, 0.700; 1, 1), (0.533, 0.600, 0.600, 0.650; 0.9, 0.9)) | ((0.267, 0.400, 0.400, 0.533; 1, 1), (0.333, 0.400, 0.400, 0.467; 0.9, 0.9)) | ((0.333, 0.467, 0.467, 0.600; 1, 1), (0.400, 0.467, 0.467, 0.533; 0.9, 0.9)) | ((0.467, 0.600, 0.600, 0.700; 1, 1), (0.533, 0.600, 0.600, 0.650; 0.9, 0.9)) |

| C61 | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) | ((0, 0, 0, 0.100; 1, 1), (0, 0, 0, 0.050; 0.9, 0.9)) |

| C62 | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) |

| C63 | ((0.133, 0.267, 0.267, 0.433; 1, 1), (0.200, 0.267, 0.267, 0.350; 0.9, 0.9)) | ((0, 0.033, 0.033, 0.167; 1, 1), (0.017, 0.033, 0.033, 0.100; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0, 0.067, 0.067, 0.233; 1, 1), (0.033, 0.067, 0.067, 0.150; 0.9, 0.9)) | ((0.133, 0.267, 0.267, 0.433; 1, 1), (0.200, 0.267, 0.267, 0.350; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) |

| C64 | ((0.267, 0.400, 0.400, 0.567; 1, 1), (0.333, 0.400, 0.400, 0.483; 0.9, 0.9)) | ((0.033, 0.133, 0.133, 0.300; 1, 1), (0.083, 0.133, 0.133, 0.217; 0.9, 0.9)) | ((0.267, 0.400, 0.400, 0.567; 1, 1), (0.333, 0.400, 0.400, 0.483; 0.9, 0.9)) | ((0.067, 0.200, 0.200, 0.367; 1, 1), (0.133, 0.200, 0.200, 0.283; 0.9, 0.9)) | ((0.200, 0.333, 0.333, 0.500; 1, 1), (0.267, 0.333, 0.333, 0.417; 0.9, 0.9)) | ((0.200, 0.333, 0.333, 0.500; 1, 1), (0.267, 0.333, 0.333, 0.417; 0.9, 0.9)) |

| C65 * | ((0.467, 0.600, 0.600, 0.700; 1, 1), (0.533, 0.600, 0.600, 0.650; 0.9, 0.9)) | ((0.400, 0.533, 0.533, 0.667; 1, 1), (0.467, 0.533, 0.533, 0.600; 0.9, 0.9)) | ((0.400, 0.533, 0.533, 0.667; 1, 1), (0.467, 0.533, 0.533, 0.600; 0.9, 0.9)) | ((0.333, 0.467, 0.467, 0.600; 1, 1), (0.400, 0.467, 0.467, 0.533; 0.9, 0.9)) | ((0.333, 0.467, 0.467, 0.600; 1, 1), (0.400, 0.467, 0.467, 0.533; 0.9, 0.9)) | ((0.467, 0.600, 0.600, 0.700; 1, 1), (0.533, 0.600, 0.600, 0.650; 0.9, 0.9)) |

| C71 * | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0001 |

| C72 * | 0.1000 | 0.0001 | 0.0001 | 0.5500 | 0.0001 | 0.0500 |

| C73 | 0.3500 | 0.2500 | 0.7500 | 0.4500 | 0.0001 | 0.0750 |

| C74 | 0.1000 | 0.3750 | 0.0001 | 0.0001 | 0.3500 | 0.7000 |

| C75 | 0.4500 | 0.3750 | 0.2500 | 0.0001 | 0.6500 | 0.1750 |

| C76 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0001 |

Appendix B

| Rating | General Risk Categorisation as per Corporate Risk Framework | Major Channels | Non-Major Channels | |

|---|---|---|---|---|

| Interruption to service delivery resulting in | 5 | C11, catastrophic outcomes for many customers. | ||

| 4 | C12, service impacts to many customers. | 4 | ||

| 3 | C13, major impact to a significant number of customers. | |||

| 2 | C14, moderate impact to a small group of customers. | 2 | ||

| 1 | C15, impacts a small number of customers and has minimal impact on their operations. | |||

| Business financial loss is | 5 | C21, greater than $12 million loss. | ||

| 4 | C22, between $8 and $12 million loss. | 4 | ||

| 5 | C23, between $4 and $8 million loss. | |||

| 2 | C24, between $and $4 million loss. | 2 | ||

| 1 | C25, smaller than $1 million. | |||

| Safety incident results in | 5 | C31, multiple fatalities. | ||

| 4 | C32, a permanent injury or a single fatality. | |||

| 3 | C33, recoverable injuries. | 3 | ||

| 2 | C34, medical treatment. | 2 | ||

| 1 | C35, minor first aid injuries. | |||

| Credibility | 5 | C41, local and national public outage resulting in loss of key stakeholder support. External intervention required. | ||

| 4 | C42, substantial active criticism from key stakeholders, resulting in national media coverage. | 4 | ||

| 3 | C43, criticism from stakeholders, involving local community public reactions. | |||

| 2 | C44, criticism from local community segment, resulting in negative local press coverage. | 2 | ||

| 1 | C45, internal dissent/isolated external criticism. No external impact to reputation. | |||

| Environment | 5 | C51, impacts to the biological or physical environment that cause indigenous species extinction and/or irretrievable loss of habitat and/or cultural heritage. | ||

| 4 | C52, impacts to the environment that cause multiple indigenous species damage | 4 | ||

| 3 | C53, impacts to the environment that cause multiple indigenous species damage within a local area | |||

| 2 | C54, impacts to the environment that cause single indigenous species damage or result in damage or loss of species, habitat and/or cultural heritage. | |||

| 1 | C55, impacts on the environment that cause no indigenous species damage and/or cause damage to species, habitat and/or cultural heritage. | 1 | ||

| Compliance | 5 | C61, multiple breaches of requirements. Prolonged breaches of multiple legal and regulatory obligations. Potential loss of operating license. | ||

| 4 | C62, single breach of requirements or multiple breaches of legal and regulatory obligations. Regulator issues a corrective notice | |||

| 3 | C63, single breach of legal or regulatory obligations. Cooperate risk issues corrective actions notice. | 3 | ||

| 2 | C64, partial breach of legal or regulatory obligations. | 2 | ||

| 1 | C65, no breach of legal or regulatory obligations detected; however, improvements to the manner in which compliance is attained can be made. | |||

| Total | 22 | 11 | ||

| Legend | ||||

| Rare—low (1) | ||||

| Unlikely—low (2) | ||||

| Possible—medium (3) | ||||

| Likely—significant (4) | ||||

| Almost certain—extreme (5) | ||||

References

- Vicroads. Department of Transport Open Data; Vicroads: Melbourne, Australia, 2017; Available online: https://vicroadsopendata-vicroadsmaps.opendata.arcgis.com/search?tags=Road%20Assets%20Open%20Data (accessed on 2 June 2020).

- Sydney Water. Annual Report 2018–19; Sydney Water: Parramatta, Australia, 2019. [Google Scholar]

- V/Line. Annual Report 2018-2019; V/Line: Melbourne, Australia, 2019. [Google Scholar]

- Melbourne Water. Melbourne Water Annual Report 2018/19; Melbourne Water: Melbourne, Australia, 2019. [Google Scholar]

- Goulburn-Murray Water’s Maximo Asset Management Information System (AMIS); IBM: New York, NY, USA, 2019.

- Water NSW. Water Availability; Water NSW: Parramatta, Australia, 2020; Available online: https://www.waternsw.com.au/supply/regional-nsw/availability (accessed on 2 June 2020).

- South Australian Water. 2018–19 SA Water Corporation Annual Report; SA Water: Adelaide, Australia, 2019. [Google Scholar]

- City of Melbourne. Guide to Parks; City of Melbourne: Melbourne, Australia, 2020. Available online: https://www.melbourne.vic.gov.au/community/parks-open-spaces/guide-to-parks/Pages/guide-to-parks.aspx (accessed on 12 June 2020).

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Kilic, M.; Kaya, I. Investment project evaluation by a decision making methodology based on type-2 fuzzy sets. Appl. Soft Comput. 2015, 27, 399–410. [Google Scholar] [CrossRef]

- Ozcan, T.; Celebi, N.; Esnaf, S. Comparative analysis of multi-criteria decision making methodologies and implementation of a warehouse location selection problem. Expert Syst. Appl. 2011, 38, 9773–9779. [Google Scholar] [CrossRef]

- Paksoy, T.; Pehlivan, N.Y.; Kahraman, C. Organizational strategy development in distribution channel management using fuzzy AHP and hierarchical fuzzy TOPSIS. Expert Syst. Appl. 2012, 39, 2822–2841. [Google Scholar] [CrossRef]

- Uçal Sarý, I.; Öztayşi, B.; Kahraman, C. Fuzzy Analytic Hierarchy Process Using Type-2 Fuzzy Sets: An Application to Warehouse Location Selection. In Multicriteria Decision Aid and Artificial Intelligence: Links, Theory and Applications; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar] [CrossRef]

- Kilic, M.; Kaya, I. The prioritisation of provinces for public grants allocation by a decision-making methodology based on type-2 fuzzy sets. Urban Stud. 2016, 53, 755–774. [Google Scholar] [CrossRef]

- Vasiliki, B.; Christos, T.; Christos, E. Multi-Criteria Decision Making Using TOPSIS Method Under Fuzzy Environment. Appl. Spillway Sel. 2018, 2, 637. [Google Scholar] [CrossRef]

- Chen, S.-M.; Lee, L.-W. Fuzzy multiple criteria hierarchical group decision-making based on interval type-2 fuzzy sets. IEEE Trans. Syst. Man Cybern.-Syst. Hum. 2010, 40, 1120–1128. [Google Scholar] [CrossRef]

- Triantaphyllou, E.; Parlos, P.M. Multi-Criteria Decision Making Methods: A Comparative Study; Kluwer Academic Publishers: Alphen, The Netherlands, 2010. [Google Scholar]

- Bagga, P.; Joshi, A.; Hans, R. QoS based web service selection and multi-criteria decision making methods. Int. J. Interact. Multimed. Artif. Intell. 2019, 5, 113–121. [Google Scholar] [CrossRef]

- Mulliner, E.; Malys, N.; Maliene, V. Comparative analysis of MCDM methods for the assessment of sustainable housing affordability. Omega-Int. J. Manag. Sci. 2016, 59, 146–156. [Google Scholar] [CrossRef]

- Dun, R.W.; Wicks, J.M. Canal breach risk assessment for improved asset management. Proc. Inst. Civ. Eng. Water Manag. 2014, 167, 5–16. [Google Scholar] [CrossRef]

- Ika, K. Cost-Effective Asset Management Planning for the Sustainable Future of Rural Irrigation Systems. Ph.D. Thesis, Curtin University, Perth, Australia, 2014. [Google Scholar]

- Chaira, T. Fuzzy Set and Its Extension: The Intuitionistic Fuzzy Set; John Wiley & Sons: Hoboken, NJ, USA, 2019. [Google Scholar]

- Wang, W.; Liu, X.; Qin, Y. Multi-attribute group decision making models under interval type-2 fuzzy environment. Knowl.-Based Syst. 2012, 30, 121–128. [Google Scholar] [CrossRef]

- Acuña-Soto, C.; Liern, V.; Pérez-Gladish, B. Normalization in TOPSIS-based approaches with data of different nature: Application to the ranking of mathematical videos. Ann. Oper. Res. 2018, 296, 541–569. [Google Scholar] [CrossRef]

- Saaty, T.L. How to make a decision: The analytic hierarchy process. Eur. J. Oper. Res. 1990, 48, 9–26. [Google Scholar] [CrossRef]

- Suh, Y.; Park, Y.; Kang, D. Evaluating mobile services using integrated weighting approach and fuzzy VIKOR. PLoS ONE 2019, 14, e0222312. [Google Scholar] [CrossRef]

- Shahrivar, F.; Li, C.Q.; Mahmoodian, M. Comparative analysis of Fuzzy Multi Criteria Decision Making methods in maintenance prioritization of infrastructure assets. Int. J. Crit. Infrastruct. 2022, 18, 172–195. [Google Scholar] [CrossRef]

- Akpan, U.; Morimoto, R. An application of Multi-Attribute Utility Theory (MAUT) to the prioritization of rural roads to improve rural accessibility in Nigeria. Socio-Econ. Plan. Sci. 2022, 82, 101256. [Google Scholar] [CrossRef]

- Figueira, J.R.; Greco, S.; Roy, B. Electre-Score: A first outranking based method for scoring actions. Eur. J. Oper. Res. 2022, 297, 986–1005. [Google Scholar] [CrossRef]

- Saaty, T.L. What is the analytic hierarchy process? In Mathematical Models for Decision Support; Mitra, G., Greenberg, H.J., Lootsma, F.A., Rijkaert, M.J., Zimmermann, H.J., Eds.; Springer: Berlin/Heidelberg, Germany, 1988; Volume 48, pp. 109–121. [Google Scholar]

- Buckley, J.J. Fuzzy hierarchical analysis. Fuzzy Sets Syst. 1985, 17, 233–247. [Google Scholar] [CrossRef]

- Kahraman, C.; Kaya, İ.; Cebi, S. A comparative analysis for multiattribute selection among renewable energy alternatives using fuzzy axiomatic design and fuzzy analytic hierarchy process. Energy 2009, 34, 1603–1616. [Google Scholar] [CrossRef]

- Kahraman, C.; Oztaysi, B.; Sari, I.U.; Turanoglu, E. Fuzzy analytic hierarchy process with interval type-2 fuzzy sets. Knowl.-Based Syst. 2014, 59, 48–57. [Google Scholar] [CrossRef]

- Mu, E.; Pereyra-Rojas, M. Practical Decision Making an Introduction to the Analytic Hierarchy Process (AHP) Using Super Decisions V2; Springer International Publishing: Cham, Switzerland, 2017. [Google Scholar]

- Saaty, T.L.; Vargas, L.G. Models, Methods, Concepts and Applications of the Analytic Hierarchy Process; Springer: Berlin/Heidelberg, Germany, 2012. [Google Scholar] [CrossRef]

- Contreras-Nieto, C.; Shan, Y.; Lewis, P.; Hartell, J.A. Bridge maintenance prioritization using analytic hierarchy process and fusion tables. Autom. Constr. 2019, 101, 99–110. [Google Scholar] [CrossRef]

- Chang, T.; Wang, T. Using the fuzzy multi-criteria decision making approach for measuring the possibility of successful knowledge management. Inf. Sci. 2009, 179, 355–370. [Google Scholar] [CrossRef]

- Niewiadomski, A.; Ochelska-Mierzejewska, J.; Szczepaniak, P. Interval-valued linguistic summaries of databases. Control Cybern. 2006, 35, 415–444. [Google Scholar]

- Celik, E.; Akyuz, E. An interval type-2 fuzzy AHP and TOPSIS methods for decision-making problems in maritime transportation engineering: The case of ship loader. Ocean Eng. 2018, 155, 371–381. [Google Scholar] [CrossRef]

- Yoon, K.P.; Hwang, C.-L. Multiple Attribute Decision Making: An Introduction; SAGE Publications: Southend Oaks, CA, USA, 1995. [Google Scholar] [CrossRef]

- Jun, K.-S.; Chung, E.-S.; Kim, Y.-G.; Kim, Y. A fuzzy multi-criteria approach to flood risk vulnerability in South Korea by considering climate change impacts. Expert Syst. Appl. 2013, 40, 1003–1013. [Google Scholar] [CrossRef]

- Tzeng, G.-H.; Huang, J.-J. Multiple Attribute Decision Making Methods and Applications; CRC Press: Boca Raton, FL, USA, 2011. [Google Scholar] [CrossRef]

- Goulburn-Murray Water. Goulburn-Murray Water Region Map; Goulburn-Murray Water: Tatura, Australia, 2020; Available online: https://www.g-mwater.com.au/about/regionalmap (accessed on 21 June 2020).

- Goulburn-Murray Water. Asset Management Irrigation and Drainage Asset Priority & Decision Manual, version 3722113v2; Goulburn-Murray Water: Tatura, Australia, 2018. [Google Scholar]

| Asset Owner | Asset Type | Asset Length (km) | Number of Assets |

|---|---|---|---|

| VicRoads [1] | bridge and major culvert | 6353 | |

| freeway and arterial road | 23,000 | ||

| electrical asset | 8235 | ||

| sign structure | 1082 | ||

| Sydney Water [2] | reservoir | 249 | |

| water main | 22,342 | ||

| wastewater main | 26,169 | ||

| wastewater pumping station | 689 | ||

| V/Line [3] | rail track | 3520 | |

| stations | 94 | ||

| Melbourne Water [4] | water main | 1067 | |

| drainage line | 1491 | ||

| aqueduct | 221 | ||

| storage and service reservoir | 47 | ||

| GMW [5] | earthen channel bank | 6000 | |

| surface drain | 3162 | ||

| pipeline | 1479 | ||

| bridge | 2874 | ||

| culvert | 10,553 | ||

| footbridge | 383 | ||

| regulator | 5007 | ||

| weir | 208 | ||

| flume and fish ladder | 39 | ||

| subways and syphons | 2857 | ||

| Water New South Wales [6] | storage dam | 42 | |

| South Australia Water [7] | water main | 27,066 | |

| sewerage main | 8977 | ||

| City of Melbourne [8] | open spaces including parks and gardens | 114 |

| Decision-Making Method | Core Process | Accommodating Cost and Benefit Criteria | Limitation |

|---|---|---|---|

| Risk score-based prioritisation (RSBP) | Calculating failure risk of each alternative | Only cost criteria | Cannot accommodate multi-criteria and multi-dimensional attributes. |

| Cost–benefit analysis (CBA) | Monetising the impact of criteria in terms of alternatives | Cost and benefit criteria | Uncertainty attached to the estimations and approximations. |

| Asset renewal strategy | Identifying and choosing optimum asset via a comprehensive optimisation of both the technical, operational and financial options | Cost and benefit criteria | Difficult to agree with an objective assessment of multi-criteria from an asset renewal perspective. Estimating gains or losses resulting from asset renewals includes assumptions. |

| Life-cycle cost methods | Quantifies the risk losses and gains attached to an alternative | Cost and benefit | Do not allow for consideration of an operator’s level of experience (which can result in uncertainty) in the assessment. |

| Pros and cons method | Identifies, lists and compares the pros and cons of each alternative | Cost and benefit | Cannot computationally consider uncertainty in assessment. |

| Maximin and maximax | Maximising the minimal performing criterion | Cost and benefit | Suitable for problems with single-dimensional criteria. |

| Conjunctive and disjunctive method | Defines minimum and maximum performance thresholds | Cost and benefit | More advanced methods such as ESM provide more structure to the problem. |

| Lexicographic | Prioritises the decision criteria and ranks the alternatives based on their importance | Cost and benefit | More advanced methods such as MCDM can be more comprehensive in analysis as they consider all criteria, not just the important ones. |

| Hierarchical decision modelling | Uses pairwise comparison for calculating the relative importance of criteria | Cost and benefit | More advanced methods such as AHP can consider inconsistencies in assessment and address subjectivity. |

| Multi-criteria decision-making (MCDM) method | Calculating performance values of alternatives | Cost and benefit | Subjectivity in qualitative assessment, though subjectivity can be addressed by using fuzzy logic. |

| Researcher | Application |

|---|---|

| Ozcan et al. [11] | Used compensatory and non-compensatory MCDM methods for warehouse location selection. |

| Paksoy et al. [12] | Organisational strategy development in distribution channel management for an edible vegetable oils manufacturer firm operating in Turkey. |

| Uçal Sarý et al. [13] | Warehouse location selection application. |

| Kilic and Kaya [10] | Evaluation of investment projects. |

| Kilic and Kaya [14] | Grant allocation system of regional development agencies in Turkey. |

| Vasiliki et al. [15] | Spillway selection for a dam in the district of Kilkis in Northern Greece. |

| Linguistic Variable | Trapezoidal Interval Type-2 Fuzzy Scales |

|---|---|

| Very low—VL | ((0, 0, 0, 0.1; 1, 1), (0, 0, 0, 0.05; 1, 1)) |

| Low—L | ((0, 0.1, 0.1, 0.3; 1, 1), (0.05, 0.1, 0.1, 0.2; 0.9, 0.9)) |

| Medium low—ML | ((0.1, 0.3, 0.3, 0.5; 1, 1), (0.2, 0.3, 0.3, 0.4; 0.9, 0.9)) |

| Medium—M | ((0.3, 0.5, 0.5, 0.7; 1, 1)), (0.4, 0.5, 0.5, 0.6; 0.9, 0.9)) |

| Medium high—MH | ((0.5, 0.7, 0.7, 0.9; 1, 1)), (0.6, 0.7, 0.7, 0.8; 0.9, 0.9)) |

| High—H | ((0.7, 0.9, 0.9, 1; 1, 1), (0.8, 0.9, 0.9, 0.95; 0.9, 0.9)) |

| Very high—VH | ((0.9, 1, 1, 1; 1, 1), (0.95, 1, 1, 1; 0.9, 0.9)) |

| Linguistic Variables | Trapezoidal Interval Type-2 Fuzzy Scales |

|---|---|

| Absolutely strong—AS | ((7, 8, 9, 9; 1, 1), (7.2, 8.2, 8.8, 9; 0.8, 0.8)) |

| Very strong—VS | ((5, 6, 8, 9; 1, 1), (5.2, 6.2, 7.8, 8.8; 0.8, 0.8)) |

| Fairly strong—FS | ((3, 4, 6, 7; 1, 1), (3.2, 4.2, 5.8, 6.8; 0.8, 0.8)) |

| Slightly strong—SS | ((1, 2, 4, 5; 1, 1), (1.2, 2.2, 3.8, 4.8; 0.8, 0.8)) |

| Exactly equal—EE | ((1, 1, 1, 1; 1, 1), (1, 1, 1, 1; 1, 1)) |

| n | 3 | 4 | 5 | 6 | 7 |

| RI | 0.58 | 0.90 | 1.12 | 1.24 | 1.32 |

| Period Constructed/Rehabilitated | Average Age Years | Bank Length | |

|---|---|---|---|

| Meter | % of the Total Length | ||

| 1896–1905 | 104 | 3912 | 0.6% |

| 1906–1915 | 94 | 694 | 0.0% |

| 1916–1925 | 84 | 322,383 | 5.3% |

| 1926–1935 | 74 | 2,849,011 | 46.6% |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | |

|---|---|---|---|---|---|---|---|

| C1 | EE, EE, EE | EE, SS, SS | 1/FS, AS, 1/AS | 1/SS, VS, FS | 1/SS, FS, AS | EE, FS, FS | EE, VS, VS |

| C2 | EE, 1/SS, | EE, EE, EE | 1/FS, VS, 1/AS | 1/FS, FS, SS | 1/FS, SS, VS | 1/FS, SS, SS | 1/FS, FS, FS |

| C3 | FS, 1/AS, AS | FS, 1/VS, AS | EE, EE, EE | FS, 1/SS, AS | FS, 1/SS, AS | FS, 1/FS, AS | FS, 1/SS, AS |

| C4 | SS, 1/VS, 1/FS | FS, 1/FS, 1/SS | 1/FS, SS, 1/AS | EE, EE, EE | EE, 1/SS, FS | EE, 1/SS, EE | EE, EE, SS |

| C5 | SS, 1/FS, 1/AS | FS, 1/SS, 1/VS | 1/FS, SS, 1/AS | EE, SS, 1/FS | EE, EE, EE | EE, EE, 1/FS | EE, SS, 1/SS |

| C6 | EE, 1/FS, 1/FS | FS, 1/SS, 1/SS | 1/FS, FS, 1/AS | EE, SS, EE | EE, EE, FS | EE, EE, EE | EE, SS, SS |

| C7 | EE, 1/VS, 1/VS | FS, 1/FS, 1/FS | 1/FS, SS, 1/AS | EE, 1/EE, 1/SS | EE, 1/SS, 1/SS | EE, 1/SS, 1/SS | EE, EE, EE |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | |

|---|---|---|---|---|---|---|---|

| C1 | ((1.0, 1.0, 1.0, 1.0; 1, 1), (1.0, 1.0, 1.0, 1.0; 1, 1)) | ((1.0, 1.587, 2.52, 2.924; 1, 1), (1.129, 1.692, 2.435, 2.846; 0.8, 0.8)) | ((0.481, 0.529, 0.655, 0.754; 1, 1), (0.49, 0.544, 0.635, 0.732; 0.8, 0.8)) | ((1.442, 1.817, 2.884, 3.979; 1, 1), (1.513, 1.899, 2.741, 3.68; 0.8, 0.8)) | ((1.613, 2.0, 3.0, 3.979; 1, 1), (1.686, 2.085, 2.853, 3.708; 0.8, 0.8)) | ((2.08, 2.52, 3.302, 3.659; 1, 1), (2.172, 2.603, 3.228, 3.589; 0.8, 0.8)) | ((2.924, 3.302, 4.0, 4.327; 1, 1), (3.001, 3.375, 3.933, 4.262; 0.8, 0.8)) |

| C2 | ((0.342, 0.397, 0.63, 1.0; 1, 1), (0.351, 0.41, 0.592, 0.885; 0.8, 0.8)) | ((1.0, 1.0, 1.0, 1.0; 1, 1), (1.0, 1.0, 1.0, 1.0; 1, 1)) | ((0.43, 0.481, 0.63, 0.754; 1, 1), (0.439, 0.495, 0.61, 0.726; 0.8, 0.8)) | ((0.754, 1.101, 1.817, 2.267; 1, 1), (0.826, 1.167, 1.738, 2.17; 0.8, 0.8)) | ((0.894, 1.261, 2.0, 2.465; 1, 1), (0.972, 1.329, 1.918, 2.365; 0.8, 0.8)) | ((0.523, 0.874, 1.587, 2.027; 1, 1), (0.596, 0.941, 1.509, 1.932; 0.8, 0.8)) | ((1.088, 1.388, 2.08, 2.536; 1, 1), (1.146, 1.448, 2.001, 2.437; 0.8, 0.8)) |

| C3 | ((1.326, 1.526, 1.89, 2.081; 1, 1), (1.368, 1.578, 1.84, 2.041; 0.8, 0.8)) | ((1.326, 1.587, 2.081, 2.327; 1, 1), (1.38, 1.64, 2.018, 2.273; 0.8, 0.8)) | ((1.0, 1.0, 1.0, 1.0; 1, 1), (1.0, 1.0, 1.0, 1.0; 1, 1)) | ((1.613, 2.0, 3.0, 3.979; 1, 1), (1.686, 2.085, 2.853, 3.708; 0.8, 0.8)) | ((1.613, 2.0, 3.0, 3.979; 1, 1), (1.686, 2.085, 2.853, 3.708; 0.8, 0.8)) | ((1.443, 1.748, 2.381, 2.758; 1, 1), (1.502, 1.809, 2.299, 2.676; 0.8, 0.8)) | ((1.613, 2.0, 3.0, 3.979; 1, 1), (1.686, 2.085, 2.853, 3.708; 0.8, 0.8)) |

| C4 | ((0.894, 1.261, 2.0, 2.465; 1, 1), (0.972, 1.329, 1.918, 2.365; 0.8, 0.8)) | ((0.441, 0.551, 0.909, 1.326; 1, 1), (0.461, 0.575, 0.856, 1.21; 0.8, 0.8)) | ((0.251, 0.333, 0.5, 0.62; 1, 1), (0.27, 0.351, 0.48, 0.593; 0.8, 0.8)) | ((1.0, 1.0, 1.0, 1.0; 1, 1), (1.0, 1.0, 1.0, 1.0; 1, 1)) | ((0.843, 1.0, 1.442, 1.913; 1, 1), (0.873, 1.034, 1.382, 1.783; 0.8, 0.8)) | ((0.585, 0.63, 0.794, 1.0; 1, 1), (0.592, 0.641, 0.769, 0.941; 0.8, 0.8)) | ((1.0, 1.26, 1.587, 1.71; 1, 1), (1.063, 1.301, 1.56, 1.687; 0.8, 0.8)) |

| C5 | ((0.251, 0.333, 0.5, 0.62; 1, 1), (0.27, 0.351, 0.48, 0.593; 0.8, 0.8)) | ((0.405, 0.5, 0.794, 1.119; 1, 1), (0.423, 0.521, 0.752, 1.028; 0.8, 0.8)) | ((0.251, 0.333, 0.5, 0.62; 1, 1), (0.27, 0.351, 0.48, 0.593; 0.8, 0.8)) | ((0.523, 0.694, 1.0, 1.185; 1, 1), (0.561, 0.723, 0.967, 1.145; 0.8, 0.8)) | ((1.0, 1.0, 1.0, 1.0; 1, 1), (1.0, 1.0, 1.0, 1.0; 1, 1)) | ((0.523, 0.551, 0.63, 0.693; 1, 1), (0.528, 0.556, 0.62, 0.679; 0.8, 0.8)) | ((0.585, 0.794, 1.26, 1.71; 1, 1), (0.63, 0.833, 1.2, 1.587; 0.8, 0.8)) |

| C6 | ((0.273, 0.303, 0.397, 0.48; 1, 1), (0.279, 0.309, 0.384, 0.461; 0.8, 0.8)) | ((0.493, 0.63, 1.145, 1.913; 1, 1), (0.517, 0.662, 1.063, 1.677; 0.8, 0.8)) | ((0.362, 0.42, 0.572, 0.693; 1, 1), (0.374, 0.435, 0.552, 0.666; 0.8, 0.8)) | ((1.0, 1.26, 1.587, 1.71; 1, 1), (1.063, 1.301, 1.56, 1.687; 0.8, 0.8)) | ((1.442, 1.587, 1.817, 1.913; 1, 1), (1.474, 1.613, 1.797, 1.895; 0.8, 0.8)) | ((1.0, 1.0, 1.0, 1.0; 1, 1), (1.0, 1.0, 1.0, 1.0; 1, 1)) | ((1.0, 1.587, 2.52, 2.924; 1, 1), (1.129, 1.692, 2.435, 2.846; 0.8, 0.8)) |

| C7 | ((0.231, 0.25, 0.303, 0.342; 1, 1), (0.235, 0.254, 0.296, 0.333; 0.8, 0.8)) | ((0.394, 0.481, 0.721, 0.919; 1, 1), (0.41, 0.499, 0.69, 0.873; 0.8, 0.8)) | ((0.251, 0.333, 0.5, 0.62; 1, 1), (0.27, 0.351, 0.48, 0.593; 0.8, 0.8)) | ((0.585, 0.63, 0.794, 1.0; 1, 1), (0.592, 0.641, 0.769, 0.941; 0.8, 0.8)) | ((0.342, 0.397, 0.63, 1.0; 1, 1), (0.351, 0.41, 0.592, 0.885; 0.8, 0.8)) | ((0.342, 0.397, 0.63, 1.0; 1, 1), (0.351, 0.41, 0.592, 0.885; 0.8, 0.8)) | ((1.0, 1.0, 1.0, 1.0; 1, 1), (1.0, 1.0, 1.0, 1.0; 1, 1)) |

| 1. Service delivery interruption resulting in: | |

| C11, Catastrophic outcomes for many customers. C12, Impacting service to many customers. C13, Major impact on significant number of customers. | C14, Moderate impact on a small group of customers. C15, Impacting a small number of customers. |

| 2. Business financial loss is: | |

| C21, Greater than $12 million loss. C22, Between 8 and $12 million loss. C23, Between 4 and $8 million loss. | C24, Between 1 and $4 million loss. C25, Smaller than $1 million. |

| 3. Safety incident results in: | |

| C31, Multiple fatalities. C32, A permanent injury or a single fatality. C33, Recoverable injuries. | C34, Medical treatment. C35, Minor first aid injuries. |

| 4. Credibility: | |

| C41, Local and national public outage resulting in loss of key stakeholder support. External intervention required. C42, Substantial active criticism from key stakeholders, resulting in national media coverage. C43, Criticism from stakeholders, involving local community public reactions. | C44, Criticism from the local community segment, resulting in negative local press coverage. C45, Internal dissent/isolated external criticism. No external impact on reputation. |

| 5. Environment: Impacts that | |

| C51, Cause indigenous species extinction and/or cause irretrievable loss of habitat and or cultural heritage. C52, Multiple indigenous species damage across a regional area. C53, Multiple indigenous species damage within a local area. | C54, Single indigenous species damage or result in damage or loss of species, habitat and/or cultural heritage. C55, No indigenous species damage and/or cause damage to species, habitat and/or cultural heritage. |

| 6. Compliance: | |

| C61, Multiple breaches of requirements/prolonged breaches of multiple legal and regulatory obligations. The potential loss of operating license. C62, Single breach of requirements or multiple breaches of legal and regulatory obligations. | C63, Single breach of legal or regulatory obligations. C64, Partial breach of legal or regulatory obligations. C65, No breach of legal or regulatory obligations |

| 7. Asset Condition Rating (ACR): Channel has | |

| C71, 89 % average remaining life and 80 % minimum remaining life. C72, 58 % average remaining life and 39 % minimum remaining life. C73, 32 % average remaining life and 27 % minimum remaining life. | C74, 20 % average remaining life and 15 % minimum remaining life. C75, 8 % average remaining life and 3 % minimum remaining life. C76, 1 % average remaining life and 0 % minimum remaining life. |

| Channel No.1 | Channel No.2 | Channel No.3 | Channel No.4 | Channel No.5 | Channel No.6 | |

|---|---|---|---|---|---|---|

| C11 | VL, VL, VL | L, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL |

| C12 | H, L, VL | VH, L, VL | MH, L, VL | VL, VL, VL | VL, VL, VL | VL, L, VL |

| C13 | VH, ML, MH | VH, ML, M | H, ML, M | L, VL, ML | VL, VL, VL | L, ML, M |

| C14 | VH, H, VH | VH, H, MH | VH, MH, MH | H, M, ML | M, M, L | H, H, MH |

| C15 | VH, VH, VH | VH, VH, MH | VH, VH, MH | VH, MH, MH | VH, MH, M | VH, VH, MH |

| C21 | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL |

| C22 | VL, VL, MH | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL |

| C23 | VL, VL, MH | H, VL, L | MH, VL, ML | L, VL, L | L, VL, ML | VL, VL, L |

| C24 | H, ML, H | H, ML, ML | VH, L, ML | MH, L, ML | MH, VL, ML | VH, ML, ML |

| C25 | VH, H, VH | VH, H, MH | VH, ML, MH | VH, ML, MH | VH, L, H | VH, H, MH |

| C31 | H, VL, L | VL, VL, VL | VL, VL, VL | VL, VL, VL | MH, VL, VL | VL, VL, VL |

| C32 | VH, VL, MH | VL, VL, VL | VL, VL, VL | VL, VL, VL | H, VL, L | VL, VL, VL |

| C33 | VH, VL, MH | VL, VL, L | VL, VL, ML | L, VL, L | VH, VL, M | L, VL, L |

| C34 | VH, VL, MH | L, VL, ML | L, VL, ML | L, VL, ML | VH, VL, MH | L, VL, ML |

| C35 | VH, VL, H | L, VL, M | L, VL, M | L, VL, M | VH, VL, H | L, VL, M |

| C41 | M, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | MH, VL, VL | VL, VL, VL |

| C42 | H, VL, ML | L, VL, VL | VL, VL, VL | VL, VL, VL | H, VL, VL | M, VL, VL |

| C43 | VH, ML, MH | M, L, ML | MH, M, M | ML, VL, L | VH, VL, M | M, L, ML |

| C44 | VH, H, VH | H, ML, ML | H, ML, MH | M, VL, ML | VH, VL, MH | H, ML, M |

| C45 | VH, MH, VH | VH, MH, MH | VH, MH, VH | VH, ML, M | VH, ML, H | VH, H, MH |

| C51 | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL |

| C52 | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL |

| C53 | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL |

| C54 | L, VL, ML | VL, VL, VL | VL, VL, L | VL, VL, L | VL, VL, L | VL, VL, L |

| C55 | H, VL, H | H, VL, H | H, VL, H | H, VL, ML | H, VL, M | H, VL, H |

| C61 | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL | VL, VL, VL |

| C62 | L, VL, L | L, VL, L | L, VL, L | L, VL, L | L, VL, L | VL, VL, L |

| C63 | M, VL, ML | VL, VL, L | L, VL, L | L, VL, L | M, VL, ML | L, VL, ML |

| C64 | M, VL, MH | L, VL, ML | MH, VL, M | ML, VL, ML | M, VL, M | ML, VL, MH |

| C65 | H, VL, H | H, VL, MH | H, VL, MH | H, VL, M | H, VL, M | H, VL, H |

| C71, ACR1 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0001 |

| C72, ACR2 | 0.1 | 0.0001 | 0.0001 | 0.55 | 0.0001 | 0.05 |

| C73, ACR3 | 0.35 | 0.25 | 0.75 | 0.45 | 0.0001 | 0.075 |

| C74, ACR4 | 0.1 | 0.375 | 0.0001 | 0.0001 | 0.35 | 0.7 |

| C75, ACR5 | 0.45 | 0.375 | 0.25 | 0.0001 | 0.65 | 0.175 |

| C76, ACR6 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0001 | 0.0001 |

| Channel No.1 | Channel No.2 | Channel No.3 | Channel No.4 | Channel No.5 | Channel No.6 | |

|---|---|---|---|---|---|---|

| C11 | 0.01875 | 0.05118 | 0.01875 | 0.01875 | 0.01875 | 0.01875 |

| C12 | 0.33105 | 0.36395 | 0.27270 | 0.01875 | 0.01875 | 0.05118 |

| C13 | 0.48750 | 0.57875 | 0.54645 | 0.14230 | 0.01875 | 0.29875 |

| C14 | 0.92383 | 0.83270 | 0.77375 | 0.54645 | 0.36395 | 0.79980 |

| C15 | 0.95625 | 0.86500 | 0.86500 | 0.77375 | 0.70868 | 0.86500 |

| C21 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 |

| C22 | 0.23993 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 |

| C23 | 0.23993 | 0.33105 | 0.33118 | 0.08383 | 0.14230 | 0.05118 |

| C24 | 0.67000 | 0.48125 | 0.45508 | 0.36395 | 0.33118 | 0.51368 |

| C25 | 0.92383 | 0.83270 | 0.64383 | 0.64383 | 0.64395 | 0.83270 |

| C31 | 0.33105 | 0.01875 | 0.01875 | 0.01875 | 0.23993 | 0.01875 |

| C32 | 0.55283 | 0.01875 | 0.01875 | 0.01875 | 0.33105 | 0.01875 |

| C33 | 0.55283 | 0.05118 | 0.11000 | 0.08383 | 0.48750 | 0.08383 |

| C34 | 0.55283 | 0.14230 | 0.14230 | 0.14230 | 0.55283 | 0.14230 |

| C35 | 0.61105 | 0.20750 | 0.20750 | 0.20750 | 0.61105 | 0.20750 |

| C41 | 0.17508 | 0.01875 | 0.01875 | 0.01875 | 0.23993 | 0.01875 |

| C42 | 0.39000 | 0.05118 | 0.01875 | 0.01875 | 0.29875 | 0.17508 |

| C43 | 0.64383 | 0.29875 | 0.55283 | 0.14230 | 0.48750 | 0.29875 |

| C44 | 0.92383 | 0.48125 | 0.61105 | 0.26633 | 0.55283 | 0.54645 |

| C45 | 0.86500 | 0.77375 | 0.86500 | 0.57875 | 0.70230 | 0.83270 |

| C51 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 |

| C52 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 |

| C53 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 |

| C54 | 0.14230 | 0.01875 | 0.05118 | 0.05118 | 0.05118 | 0.05118 |

| C55 | 0.57875 | 0.57875 | 0.57875 | 0.39000 | 0.45508 | 0.57875 |

| C61 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 | 0.01875 |

| C62 | 0.08383 | 0.08383 | 0.08383 | 0.08383 | 0.08383 | 0.05118 |

| C63 | 0.26633 | 0.05118 | 0.08383 | 0.08383 | 0.26633 | 0.14230 |

| C64 | 0.39625 | 0.14230 | 0.39625 | 0.20125 | 0.33118 | 0.33118 |

| C65 | 0.57875 | 0.51993 | 0.51993 | 0.45508 | 0.45508 | 0.57875 |

| C71 | 0.00010 | 0.00010 | 0.00010 | 0.00010 | 0.00010 | 0.00010 |

| C72 | 0.10000 | 0.00010 | 0.00010 | 0.55000 | 0.00010 | 0.05000 |

| C73 | 0.35000 | 0.25000 | 0.75000 | 0.45000 | 0.00010 | 0.07500 |

| C74 | 0.10000 | 0.37500 | 0.00010 | 0.00010 | 0.35000 | 0.70000 |

| C75 | 0.45000 | 0.37500 | 0.25000 | 0.00010 | 0.65000 | 0.17500 |

| C76 | 0.00010 | 0.00010 | 0.00010 | 0.00010 | 0.00010 | 0.00010 |

| Criteria | Channel No.1 | Channel No.2 | Channel No.3 | Channel No.4 | Channel No.5 | Channel No.6 | ||

|---|---|---|---|---|---|---|---|---|

| C11 | 0.145 | 0.000 | 0.145 | 0.145 | 0.145 | 0.145 | 0.145 | 0.000 |

| C12 | 0.023 | 0.000 | 0.058 | 0.219 | 0.219 | 0.199 | 0.219 | 0.000 |

| C13 | 0.000 | 0.023 | 0.035 | 0.180 | 0.224 | 0.124 | 0.224 | 0.000 |

| C14 | 0.000 | 0.023 | 0.038 | 0.095 | 0.133 | 0.031 | 0.133 | 0.000 |

| C15 | 0.231 | 0.209 | 0.209 | 0.187 | 0.171 | 0.209 | 0.171 | 0.231 |

| C21 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| C22 | 0.000 | 0.121 | 0.121 | 0.121 | 0.121 | 0.121 | 0.121 | 0.000 |

| C23 | 0.036 | 0.000 | 0.000 | 0.099 | 0.075 | 0.118 | 0.118 | 0.000 |

| C24 | 0.000 | 0.037 | 0.042 | 0.060 | 0.066 | 0.031 | 0.066 | 0.000 |

| C25 | 0.131 | 0.118 | 0.091 | 0.091 | 0.091 | 0.118 | 0.091 | 0.131 |

| C31 | 0.000 | 0.226 | 0.226 | 0.226 | 0.066 | 0.226 | 0.226 | 0.000 |

| C32 | 0.096 | 0.235 | 0.235 | 0.235 | 0.000 | 0.235 | 0.235 | 0.000 |

| C33 | 0.000 | 0.226 | 0.192 | 0.204 | 0.028 | 0.204 | 0.226 | 0.000 |

| C34 | 0.000 | 0.178 | 0.178 | 0.178 | 0.000 | 0.178 | 0.178 | 0.000 |

| C35 | 0.000 | 0.158 | 0.158 | 0.158 | 0.000 | 0.158 | 0.158 | 0.000 |

| C41 | 0.033 | 0.111 | 0.111 | 0.111 | 0.000 | 0.111 | 0.111 | 0.000 |

| C42 | 0.000 | 0.110 | 0.114 | 0.114 | 0.028 | 0.066 | 0.114 | 0.000 |

| C43 | 0.000 | 0.064 | 0.017 | 0.094 | 0.029 | 0.064 | 0.094 | 0.000 |

| C44 | 0.000 | 0.058 | 0.041 | 0.085 | 0.048 | 0.049 | 0.085 | 0.000 |

| C45 | 0.000 | 0.013 | 0.000 | 0.040 | 0.027 | 0.004 | 0.040 | 0.000 |

| C51 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| C52 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| C53 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| C54 | 0.000 | 0.069 | 0.062 | 0.062 | 0.062 | 0.062 | 0.069 | 0.000 |

| C55 | 0.080 | 0.080 | 0.080 | 0.054 | 0.063 | 0.080 | 0.054 | 0.080 |

| C61 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| C62 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.073 | 0.073 | 0.000 |

| C63 | 0.000 | 0.106 | 0.083 | 0.083 | 0.000 | 0.056 | 0.106 | 0.000 |

| C64 | 0.000 | 0.077 | 0.000 | 0.059 | 0.020 | 0.020 | 0.077 | 0.000 |

| C65 | 0.120 | 0.108 | 0.108 | 0.094 | 0.094 | 0.120 | 0.094 | 0.120 |

| C71, ACR1 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 |

| C72, ACR2 | 0.013 | 0.000 | 0.000 | 0.070 | 0.000 | 0.006 | 0.000 | 0.070 |

| C73, ACR3 | 0.037 | 0.046 | 0.000 | 0.028 | 0.069 | 0.063 | 0.070 | 0.000 |

| C74, ACR4 | 0.060 | 0.032 | 0.069 | 0.069 | 0.035 | 0.000 | 0.070 | 0.000 |

| C75, ACR5 | 0.021 | 0.029 | 0.043 | 0.069 | 0.000 | 0.051 | 0.070 | 0.000 |

| C76, ACR6 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Channel No.1 | Channel No.2 | Channel No.3 | Channel No.4 | Channel No.5 | Channel No.6 | |

|---|---|---|---|---|---|---|

| 0.204 | 0.543 | 0.543 | 0.644 | 0.437 | 0.598 | |

| 0.619 | 0.386 | 0.339 | 0.132 | 0.480 | 0.207 | |

| 0.751 | 0.422 | 0.388 | 0.176 | 0.518 | 0.257 | |

| Preference for maintenance | 1st | 3rd | 4th | 6th | 2nd | 5th |

| Consequence Category | Underlying Values | Description |

|---|---|---|

| Service delivery | Resource stewardship, core service delivery and customer prosperity | (What impact interruption to service delivery will have on how many customers.) |

| Business financial loss | Business viability and sustainability | (What is the range of business financial loss as a result.) |

| Safety | Individual health and wellbeing | (What impact an incident due to failure has on how many individuals.) |

| Credibility | Relationships and credibility | (What level of criticism a failure causes and what impacts it has on GMW’s reputation.) |

| Environment | Cultural heritage, native vegetation, water quality and fauna | (What the impacts and causes to the environment and cultural heritage are and what the extent area-wise is.) |

| Compliance | Legal and regulatory compliance obligations | (What level of breaches of requirements and legal and regulatory obligations and their level of consequences.) |

| Channel | Asset Condition Rating (ACR) | Design Capacity (ML/day) | 1st Asset Expert Preferred Ranking | 2nd Asset Expert Preferred Ranking | 3rd Asset Expert Preferred Ranking | Results of the Developed Method | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | ||||||

| No.1 | 200 | 1st | 2nd | 1st | 1st | ||||||

| LB * | 0.2 | 0.2 | 0.6 | ||||||||

| RB * | 0.2 | 0.5 | 0.3 | ||||||||

| No.2 | 180 | 2nd | 3rd | 4th | 3rd | ||||||

| LB | 0.3 | 0.25 | 0.45 | ||||||||

| RB | 0.2 | 0.5 | 0.3 | ||||||||

| No.3 | 135 | 3rd | 4th | 3rd | 4th | ||||||

| LB | 0.7 | 0.3 | |||||||||

| RB | 0.8 | 0.2 | |||||||||

| No.4 | 70 | 6th | 6th | 6th | 6th | ||||||

| LB | 0.55 | 0.45 | |||||||||

| RB | 0.55 | 0.45 | |||||||||

| No.5 | 35 | 5th | 1st | 5th | 2nd | ||||||

| LB | 0.6 | 0.4 | |||||||||

| RB | 0.1 | 0.9 | |||||||||

| No.6 | 190 | 4th | 5th | 2nd | 5th | ||||||

| LB | 0.05 | 0.15 | 0.8 | ||||||||

| RB | 0.05 | 0.6 | 0.35 | ||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mahmoodian, M.; Shahrivar, F.; Li, C. Maintenance Prioritisation of Irrigation Infrastructure Using a Multi-Criteria Decision-Making Methodology under a Fuzzy Environment. Sustainability 2022, 14, 14791. https://doi.org/10.3390/su142214791

Mahmoodian M, Shahrivar F, Li C. Maintenance Prioritisation of Irrigation Infrastructure Using a Multi-Criteria Decision-Making Methodology under a Fuzzy Environment. Sustainability. 2022; 14(22):14791. https://doi.org/10.3390/su142214791

Chicago/Turabian StyleMahmoodian, Mojtaba, Farham Shahrivar, and Chunqing Li. 2022. "Maintenance Prioritisation of Irrigation Infrastructure Using a Multi-Criteria Decision-Making Methodology under a Fuzzy Environment" Sustainability 14, no. 22: 14791. https://doi.org/10.3390/su142214791

APA StyleMahmoodian, M., Shahrivar, F., & Li, C. (2022). Maintenance Prioritisation of Irrigation Infrastructure Using a Multi-Criteria Decision-Making Methodology under a Fuzzy Environment. Sustainability, 14(22), 14791. https://doi.org/10.3390/su142214791